Form 8-K People's United Financia For: Apr 18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) April 19, 2019 (April 18, 2019)

People’s United Financial, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-33326 | 20-8447891 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) | ||

| 850 Main Street, Bridgeport, CT | 06604 | |||

| (Address of principal executive offices) | (Zip Code) | |||

Registrant’s telephone number, including area code (203) 338-7171

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02. | Results of Operations and Financial Condition. |

On April 18, 2019, People’s United Financial, Inc. (the “Company”) issued a press release announcing its results of operations for the three-month period ended March 31, 2019. A copy of that press release is being furnished herewith as Exhibit 99.1.

The information contained in and accompanying this Form 8-K with respect to Item 2.02 (including Exhibit 99.1 hereto) is being furnished to, and not filed with, the Securities and Exchange Commission in accordance with General Instruction B.2 to Form 8-K.

| Item 7.01. | Regulation FD Disclosure. |

The Company hereby furnishes the Investor Presentation attached hereto as Exhibit 99.2.

The information contained in and accompanying this Form 8-K with respect to Item 7.01 (including Exhibit 99.2 hereto) is being furnished to, and not filed with, the Securities and Exchange Commission in accordance with General Instruction B.2 to Form 8-K.

| Item 9.01. | Financial Statements and Exhibits |

| (d) | The following Exhibits are submitted herewith. |

| Exhibit No. |

Description | |

| 99.1 | Earnings Press Release dated April 18, 2019 | |

| 99.2 | Investor Presentation dated April 18, 2019 | |

EXHIBIT INDEX

| Exhibit No. |

Description |

Page |

||||

| 99.1 |

Earnings Press Release dated April 18, 2019 | 99.1-1 | ||||

| 99.2 |

Investor Presentation dated April 18, 2019 | 99.2-1 | ||||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| People’s United Financial, Inc. | ||||||

| (Registrant) | ||||||

| Date: April 19, 2019 | By: | /s/ Andrew S. Hersom | ||||

| (Signature) | ||||||

| Name: | Andrew S. Hersom | |||||

| Title: | Senior Vice President, Investor Relations | |||||

EXHIBIT 99.1

Earnings Press Release dated April 18, 2019

People’s United Financial Reports First Quarter Net Income of $114.6 Million, or $0.30 per Common Share

Operating Earnings of $0.33 per Common Share

Announces Increase in the Common Dividend to an Annual Rate of $0.71 Per Share

| • | Completed the acquisition of BSB Bancorp on April 1st. |

| • | Results include merger-related expenses of $15.0 million ($11.9 million after-tax), or $0.03 per common share. |

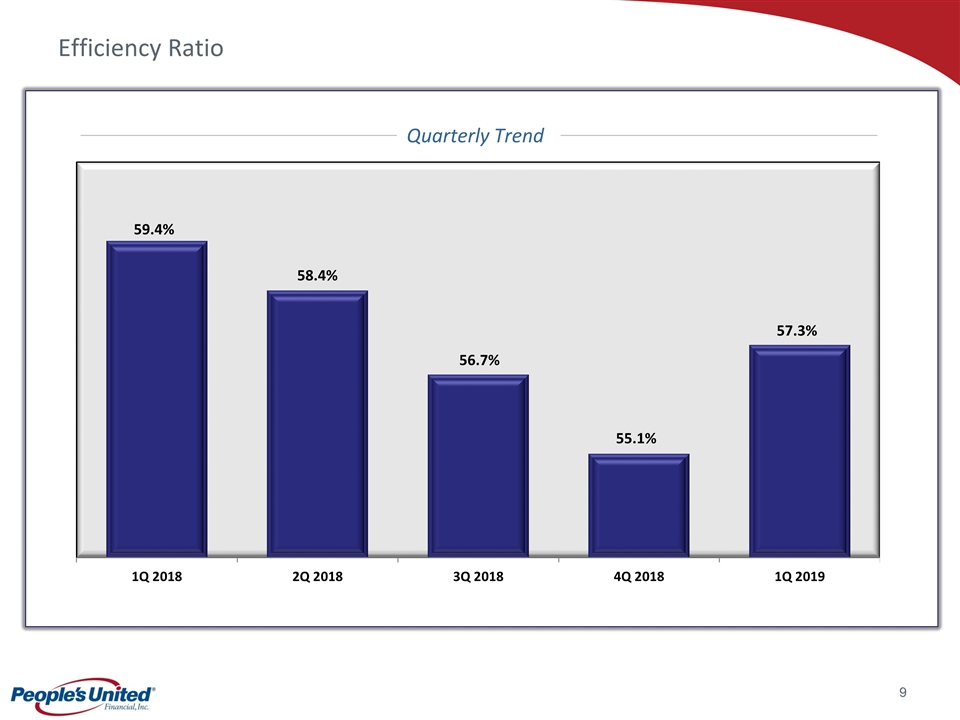

| • | Efficiency ratio of 57.3 percent, an improvement of 210 basis points from a year ago, reflecting higher revenues and well-controlled expenses. |

| • | Net interest margin of 3.20 percent, expanded three basis points linked-quarter. |

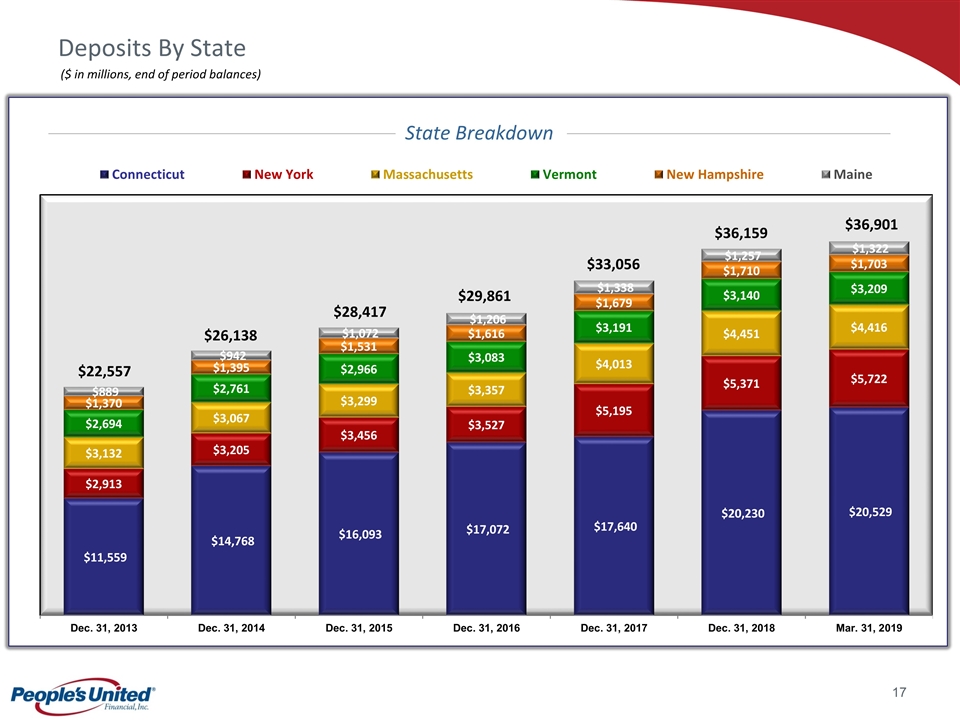

| • | Strong deposit growth as period-end balances increased $742 million or two percent from year-end. |

BRIDGEPORT, CT., April 18, 2019 – People’s United Financial, Inc. (NASDAQ: PBCT) today reported results for the first quarter 2019. These results along with comparison periods are summarized below:

| ($ in millions, except per common share data) | ||||||||||||

| Three Months Ended | ||||||||||||

| Mar. 31, 2019 | Dec. 31, 2018 | Mar. 31, 2018 | ||||||||||

| Net income |

$ | 114.6 | $ | 132.9 | $ | 107.9 | ||||||

| Net income available to common shareholders |

111.1 | 129.4 | 104.4 | |||||||||

| Per common share |

0.30 | 0.35 | 0.30 | |||||||||

| Operating earnings1 |

123.0 | 134.2 | 104.4 | |||||||||

| Per common share |

0.33 | 0.36 | 0.30 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net interest income |

$ | 332.8 | $ | 332.6 | $ | 295.8 | ||||||

| Net interest margin |

3.20 | % | 3.17 | % | 3.05 | % | ||||||

| Non-interest income1 |

94.6 | 88.7 | 90.4 | |||||||||

|

|

|

|

|

|

|

|||||||

| Non-interest expense |

$ | 277.2 | $ | 262.7 | $ | 243.5 | ||||||

| Operating non-interest expense1 |

262.2 | 254.7 | 243.5 | |||||||||

| Efficiency ratio |

57.3 | % | 55.1 | % | 59.4 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Average balances |

||||||||||||

| Loans |

$ | 35,046 | $ | 35,016 | $ | 32,096 | ||||||

| Deposits |

36,450 | 35,959 | 32,824 | |||||||||

| Period-end balances |

||||||||||||

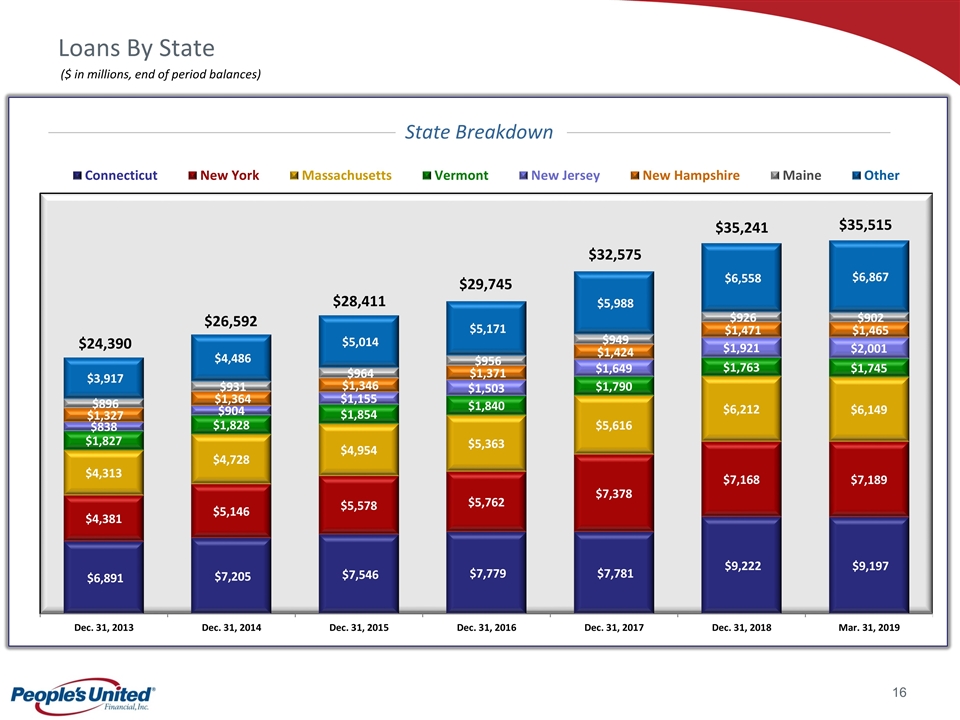

| Loans |

35,515 | 35,241 | 32,104 | |||||||||

| Deposits |

36,901 | 36,159 | 32,894 | |||||||||

| 1 | See Non-GAAP Financial Measures and Reconciliation to GAAP beginning on page 13. |

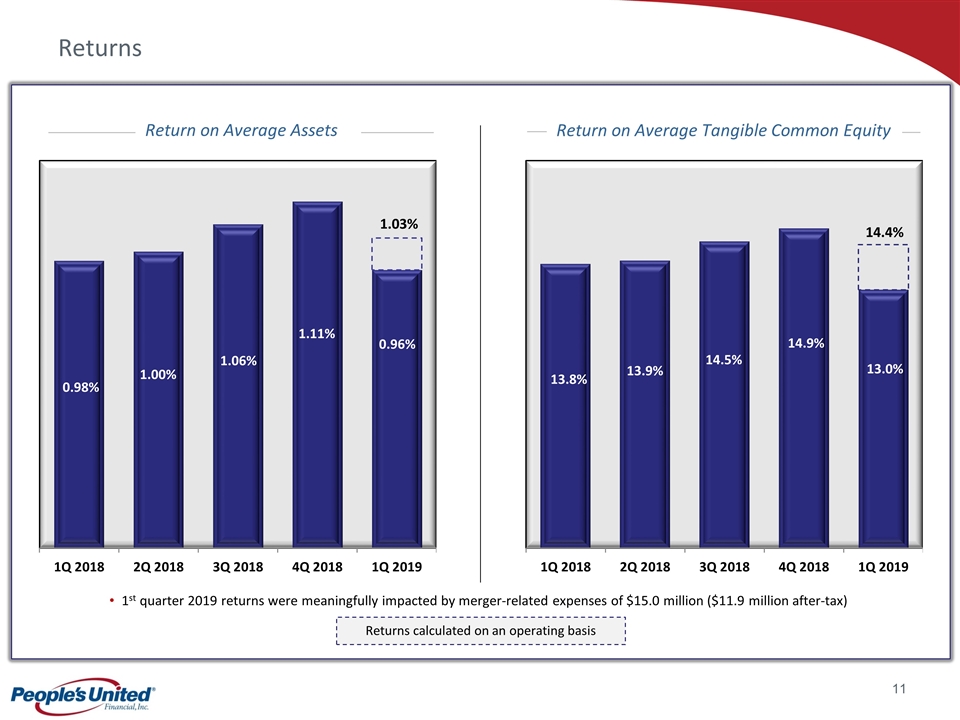

“We are pleased with our first quarter performance and continued success enhancing profitability,” said Jack Barnes, Chairman and Chief Executive Officer. “Operating earnings of $123 million grew 18 percent from a year ago and operating return on average tangible common equity of 14.4 percent improved 60 basis points. Total revenues increased 11 percent year-over-year due to both higher net interest income and non-interest income. The quarter benefited from the First Connecticut acquisition and further net interest margin expansion primarily resulting from higher yields on new business. With the acquisition of BSB Bancorp complete, we are excited to leverage our

expanded customer and employee base to build upon our strong organic growth in Massachusetts, particularly in the Greater Boston area. Integration has gone very well, core systems conversion will take place in the third quarter, and we remain confident in achieving the transaction’s attractive financial returns. In addition, we are proud to announce an increase to our common dividend for the 26th consecutive year, which demonstrates our commitment to deliver shareholder value through a consistent return of capital.”

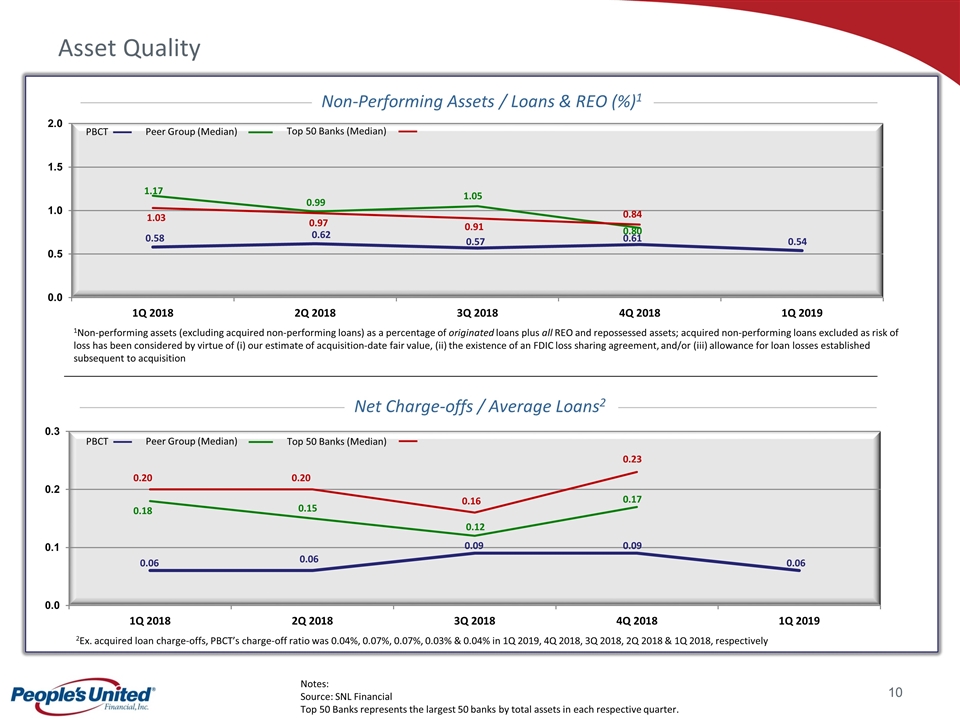

“In what is typically a seasonally slower quarter for loan growth, total period-end loans increased one percent from year-end,” said David Rosato, Senior Executive Vice President and Chief Financial Officer. “Solid results across C&I businesses and equipment finance more than offset lower commercial real estate balances, reflecting the importance of our portfolio’s diversification. We are encouraged with our ongoing success gathering deposits as period-end balances were up two percent during the quarter, lowering the loan-to-deposit ratio to 96 percent. Asset quality was once again exceptional in each of our portfolios as net charge-offs of six basis points improved linked-quarter from an already low level. While the credit environment has continued to be benign for an extended period, we remain committed to our conservative and well-defined approach to underwriting that has served us well for many years.”

| As of and for the Three Months Ended | ||||||||||||

| Mar. 31, 2019 | Dec. 31, 2018 | Mar. 31, 2018 | ||||||||||

| Asset Quality |

||||||||||||

| Net loan charge-offs to average total loans |

0.06 | % | 0.09 | % | 0.06 | % | ||||||

| Originated non-performing loans as a percentage of originated loans |

0.49 | % | 0.55 | % | 0.52 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Returns |

||||||||||||

| Return on average assets1 |

0.96 | % | 1.11 | % | 0.98 | % | ||||||

| Return on average tangible common equity1 |

13.0 | % | 14.9 | % | 13.8 | % | ||||||

|

|

|

|

|

|

|

|||||||

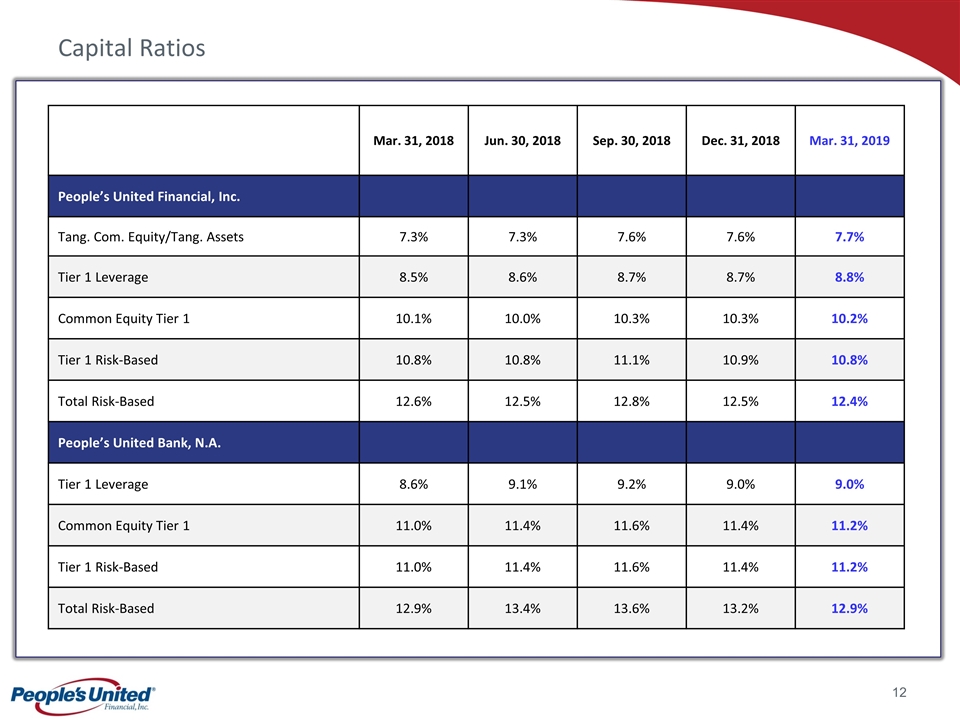

| Capital Ratios |

||||||||||||

| People’s United Financial, Inc. |

||||||||||||

| Tangible common equity / tangible assets |

7.7 | % | 7.6 | % | 7.3 | % | ||||||

| Tier 1 leverage |

8.8 | % | 8.7 | % | 8.5 | % | ||||||

| Common equity tier 1 |

10.2 | % | 10.3 | % | 10.1 | % | ||||||

| Tier 1 risk-based |

10.8 | % | 10.9 | % | 10.8 | % | ||||||

| Total risk-based |

12.4 | % | 12.5 | % | 12.6 | % | ||||||

| People’s United Bank, N.A. |

||||||||||||

| Tier 1 leverage |

9.0 | % | 9.0 | % | 8.6 | % | ||||||

| Common equity tier 1 |

11.2 | % | 11.4 | % | 11.0 | % | ||||||

| Tier 1 risk-based |

11.2 | % | 11.4 | % | 11.0 | % | ||||||

| Total risk-based |

12.9 | % | 13.2 | % | 12.9 | % | ||||||

| 1 | See Non-GAAP Financial Measures and Reconciliation to GAAP beginning on page 13 |

The Company’s Board of Directors voted to increase the common stock dividend to an annual rate of $0.71 per share. Based on the closing stock price on April 17, 2019, the dividend yield on People’s United Financial common stock is 4.1 percent. The quarterly dividend of $0.1775 per share is payable May 15, 2019 to shareholders of record on May 1, 2019

People’s United Bank, N.A. is a subsidiary of People’s United Financial, Inc., a diversified, community-focused financial services company headquartered in the Northeast with more than $48 billion in assets. Founded in 1842, People’s United Bank offers commercial and retail banking through a network of over 400 retail locations in Connecticut, New York, Massachusetts, Vermont, New Hampshire and Maine, as well as wealth management and insurance solutions. The company also provides specialized commercial services to customers nationwide.

Page 2

1Q 2019 Financial Highlights

Summary

| • | Net income totaled $114.6 million, or $0.30 per common share. |

| • | Net income available to common shareholders totaled $111.1 million. |

| • | Operating earnings totaled $123.0 million, or $0.33 per common share (see page 13). |

| • | Net interest income totaled $332.8 million in 1Q19 compared to $332.6 million in 4Q18. |

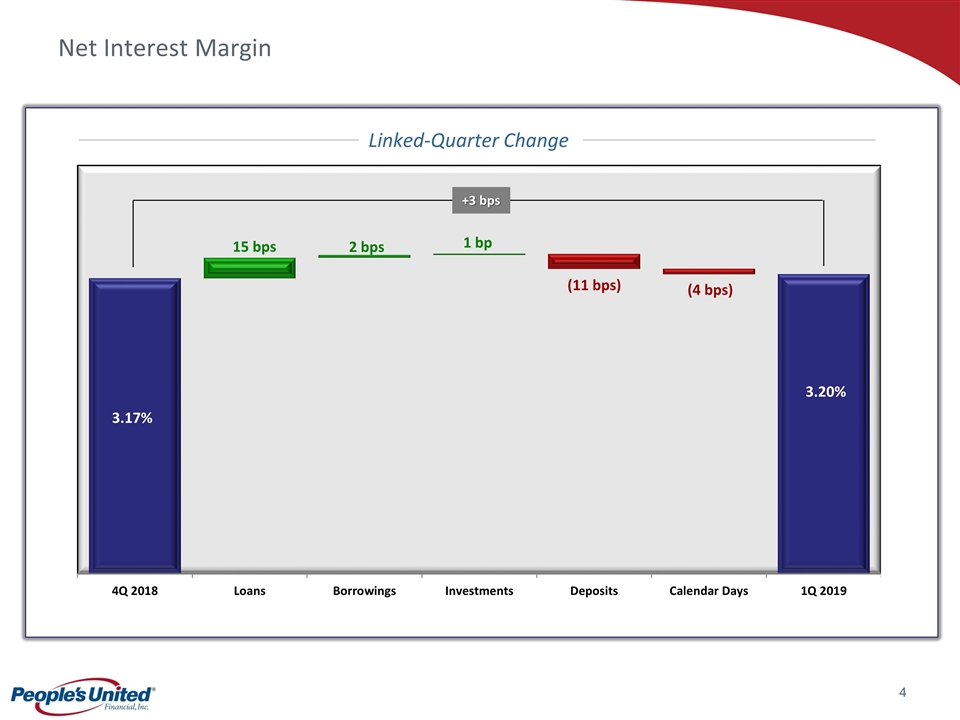

| • | Net interest margin increased three basis points from 4Q18 to 3.20% reflecting: |

| • | Higher yields on the loan portfolio (increase of 15 basis points). |

| • | Higher yields on the securities portfolio (increase of one basis point). |

| • | Higher rates on deposits and borrowings (net decrease of nine basis points). |

| • | Two fewer calendar days in 1Q19 (decrease of four basis points). |

| • | Provision for loan losses totaled $5.6 million. |

| • | Net loan charge-offs totaled $5.1 million. |

| • | Net loan charge-off ratio of 0.06% in 1Q19. |

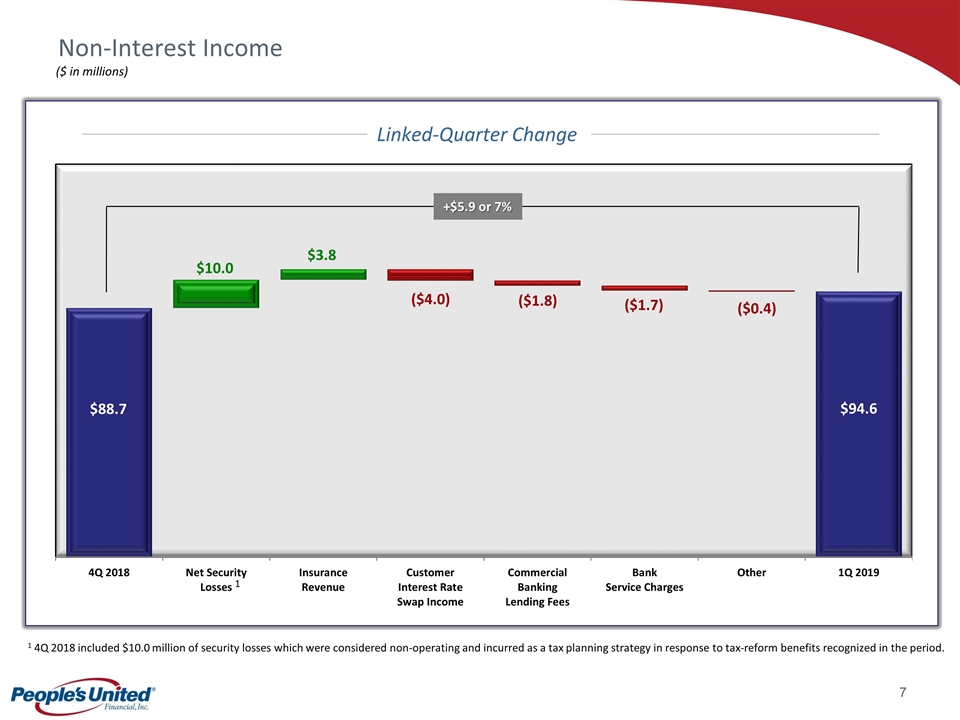

| • | Non-interest income totaled $94.6 million in 1Q19 compared to $88.7 million in 4Q18. |

| • | Insurance revenue increased $3.8 million. |

| • | Customer interest rate swap income decreased $4.0 million. |

| • | Commercial banking lending fees decreased $1.8 million. |

| • | Bank service charges decreased $1.7 million. |

| • | Net security losses of $10.0 million in 4Q18 incurred in response to a tax reform-related benefit recognized in the period (see page 13). |

| • | At March 31, 2019, assets under administration totaled $25.5 billion, of which $9.3 billion are under discretionary management, compared to $23.3 billion and $8.6 billion, respectively, at December 31, 2018. |

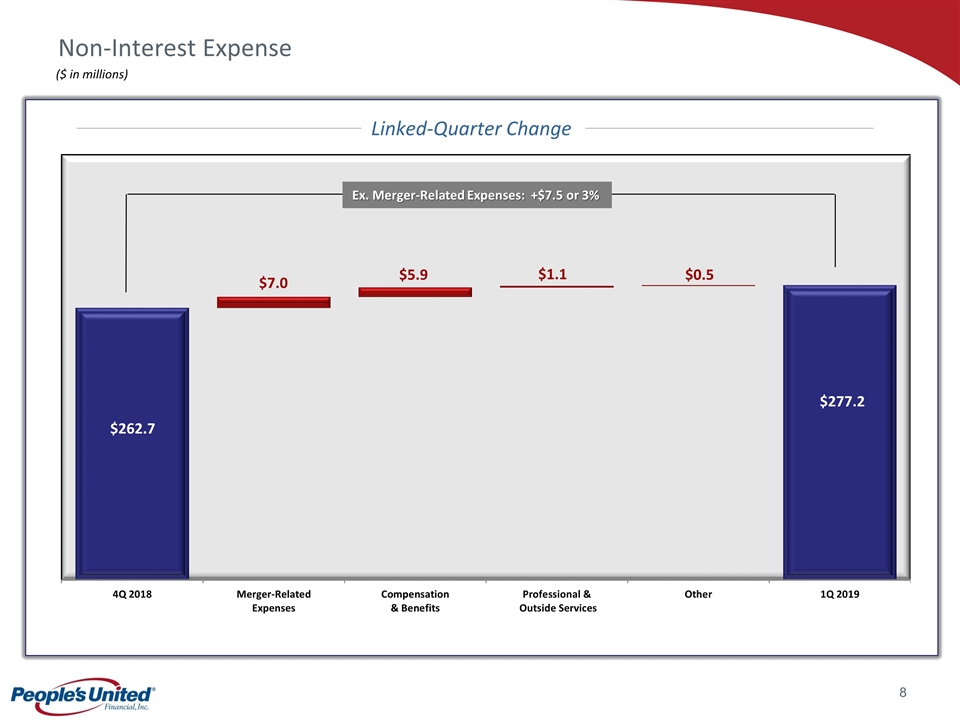

| • | Non-interest expense totaled $277.2 million in 1Q19 compared to $262.7 million in 4Q18. |

| • | Operating non-interest expense totaled $262.2 million in 1Q19 (see page 13). |

| • | Compensation and benefits expense, excluding $1.5 million and $3.5 million of merger-related expenses in 1Q19 and 4Q 18, respectively, increased $5.9 million, primarily reflecting seasonally higher payroll and benefit-related costs in 1Q19. |

| • | Professional and outside services expense, excluding $1.2 million and $3.7 million of merger-related expenses in 1Q19 and 4Q18, respectively, increased $1.1 million. |

| • | Other non-interest expense includes merger-related expenses of $11.9 million and $0.2 million in 1Q19 and 4Q18, respectively. |

| • | The efficiency ratio was 57.3% for 1Q19 compared to 55.1% for 4Q18 and 59.4% for 1Q18 (see page 13). |

| • | The effective income tax rate was 20.8% for 1Q19 and 18.8% for the full-year of 2018. |

| • | The rate in 2018 reflects a $9.2 million benefit recognized in connection with tax reform. |

Page 3

Commercial Banking

| • | Commercial loans totaled $25.4 billion at March 31, 2019, an increase of $334 million from December 31, 2018. |

| • | The equipment financing portfolio increased $127 million. |

| • | The mortgage warehouse portfolio increased $93 million. |

| • | The New York multifamily portfolio decreased $27 million. |

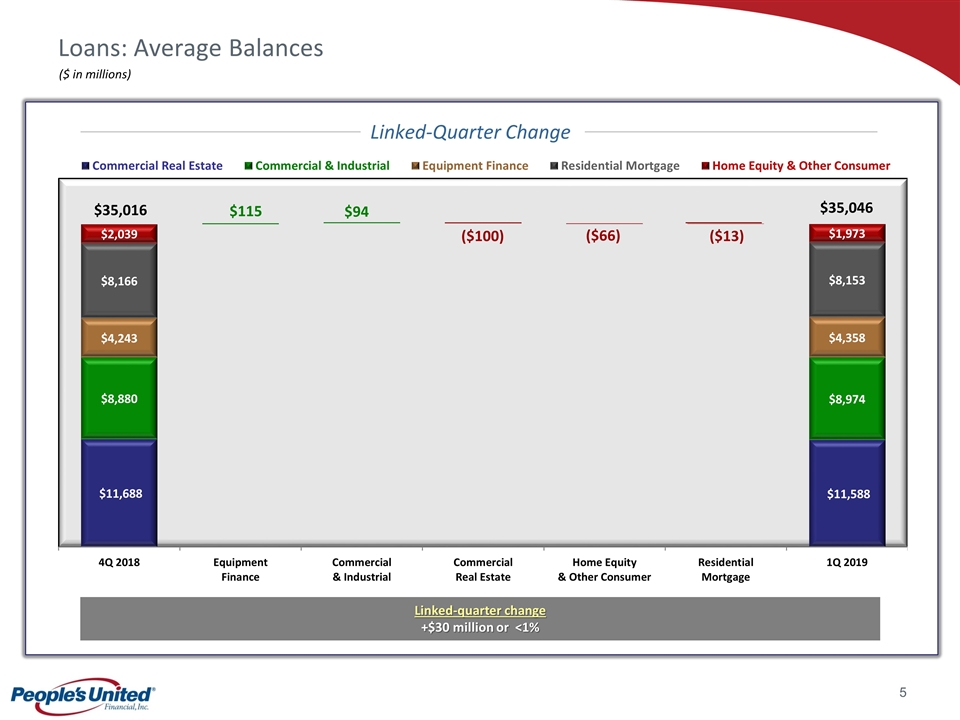

| • | Average commercial loans totaled $24.9 billion in 1Q19, an increase of $108 million from 4Q18. |

| • | The average equipment financing portfolio increased $115 million. |

| • | The average mortgage warehouse portfolio decreased $91 million. |

| • | The average New York multifamily portfolio decreased $48 million. |

| • | Commercial deposits totaled $13.5 billion at March 31, 2019 compared to $13.1 billion at December 31, 2018. |

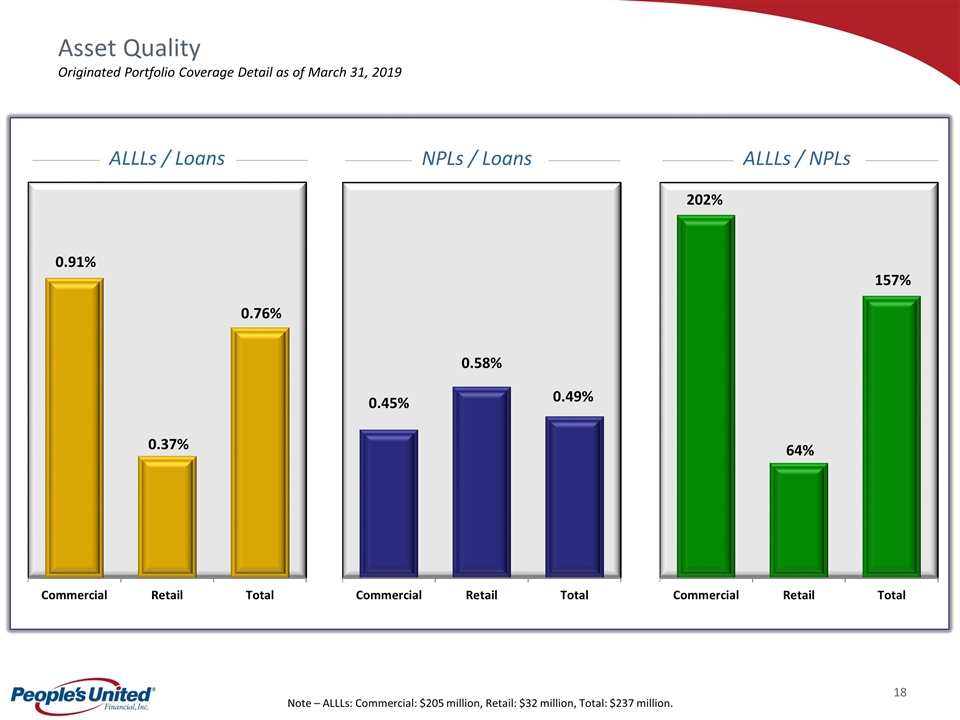

| • | The ratio of originated non-performing commercial loans to originated commercial loans was 0.45% at March 31, 2019 compared to 0.52% at December 31, 2018. |

| • | Non-performing commercial assets, excluding acquired non-performing loans, totaled $111.1 million at March 31, 2019 compared to $126.1 million at December 31, 2018. |

| • | For the originated commercial loan portfolio, the allowance for loan losses as a percentage of loans was 0.91% at March 31, 2019 compared to 0.93% at December 31, 2018. |

| • | The originated commercial allowance for loan losses represented 202% of originated non-performing commercial loans at March 31, 2019 compared to 181% at December 31, 2018. |

Retail Banking

| • | Residential mortgage loans totaled $8.2 billion at March 31, 2019, an increase of $9 million from December 31, 2018. |

| • | Average residential mortgage loans totaled $8.2 billion in 1Q19, a decrease of $12 million from 4Q18. |

| • | Home equity loans totaled $1.9 billion at March 31, 2019, a decrease of $67 million from December 31, 2018. |

| • | Average home equity loans totaled $1.9 billion in 1Q19, a decrease of $66 million from 4Q18. |

| • | Retail deposits totaled $23.4 billion at March 31, 2019 compared to $23.1 billion at December 31, 2018. |

| • | The ratio of originated non-performing residential mortgage loans to originated residential mortgage loans was 0.52% at March 31, 2019 compared to 0.57% at December 31, 2018. |

| • | The ratio of originated non-performing home equity loans to originated home equity loans was 0.81% at March 31, 2019 compared to 0.85% at December 31, 2018. |

Page 4

Conference Call

On April 18, 2019, at 5 p.m., Eastern Time, People’s United Financial will host a conference call to discuss this earnings announcement. The call may be heard through www.peoples.com by selecting “Investor Relations” in the “About Us” section on the home page, and then selecting “Conference Calls” in the “News and Events” section. Additional materials relating to the call may also be accessed at People’s United Bank’s web site. The call will be archived on the web site and available for approximately 90 days.

Certain statements contained in this release are forward-looking in nature. These include all statements about People’s United Financial’s plans, objectives, expectations and other statements that are not historical facts, and usually use words such as “expect,” “anticipate,” “believe,” “should” and similar expressions. Such statements represent management’s current beliefs, based upon information available at the time the statements are made, with regard to the matters addressed. All forward-looking statements are subject to risks and uncertainties that could cause People’s United Financial’s actual results or financial condition to differ materially from those expressed in or implied by such statements. Factors of particular importance to People’s United Financial include, but are not limited to: (1) changes in general, international, national or regional economic conditions; (2) changes in interest rates; (3) changes in loan default and charge-off rates; (4) changes in deposit levels; (5) changes in levels of income and expense in non-interest income and expense related activities; (6) changes in accounting and regulatory guidance applicable to banks; (7) price levels and conditions in the public securities markets generally; (8) competition and its effect on pricing, spending, third-party relationships and revenues; (9) the successful integration of acquisitions; and (10) changes in regulation resulting from or relating to financial reform legislation. People’s United Financial does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

###

Access Information About People’s United Financial at www.peoples.com.

INVESTOR CONTACT:

Andrew S. Hersom

Investor Relations

203.338.4581

MEDIA CONTACT:

Steven Bodakowski

Corporate Communications

203.338.4202

Page 5

People’s United Financial, Inc.

FINANCIAL HIGHLIGHTS

| Three Months Ended | ||||||||||||||||||||

| (dollars in millions, except per common share data) |

March 31, 2019 |

Dec. 31, 2018 |

Sept. 30, 2018 |

June 30, 2018 |

March 31, 2018 |

|||||||||||||||

| Earnings Data: |

||||||||||||||||||||

| Net interest income (fully taxable equivalent) |

$ | 340.0 | $ | 339.5 | $ | 313.0 | $ | 307.8 | $ | 302.1 | ||||||||||

| Net interest income |

332.8 | 332.6 | 306.4 | 301.2 | 295.8 | |||||||||||||||

| Provision for loan losses |

5.6 | 9.9 | 8.2 | 6.5 | 5.4 | |||||||||||||||

| Non-interest income (1) |

94.6 | 88.7 | 92.3 | 94.9 | 90.4 | |||||||||||||||

| Non-interest expense (1) |

277.2 | 262.7 | 241.3 | 248.6 | 243.5 | |||||||||||||||

| Income before income tax expense |

144.6 | 148.7 | 149.2 | 141.0 | 137.3 | |||||||||||||||

| Net income |

114.6 | 132.9 | 117.0 | 110.2 | 107.9 | |||||||||||||||

| Net income available to common shareholders (1) |

111.1 | 129.4 | 113.5 | 106.7 | 104.4 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Selected Statistical Data: |

||||||||||||||||||||

| Net interest margin (2) |

3.20 | % | 3.17 | % | 3.15 | % | 3.10 | % | 3.05 | % | ||||||||||

| Return on average assets (1), (2) |

0.96 | 1.11 | 1.06 | 1.00 | 0.98 | |||||||||||||||

| Return on average common equity (2) |

7.0 | 8.3 | 8.0 | 7.6 | 7.5 | |||||||||||||||

| Return on average tangible common equity (1), (2) |

13.0 | 14.9 | 14.5 | 13.9 | 13.8 | |||||||||||||||

| Efficiency ratio (1) |

57.3 | 55.1 | 56.7 | 58.4 | 59.4 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Common Share Data: |

||||||||||||||||||||

| Earnings per common share: |

||||||||||||||||||||

| Basic |

$ | 0.30 | $ | 0.35 | $ | 0.33 | $ | 0.31 | $ | 0.31 | ||||||||||

| Diluted (1) |

0.30 | 0.35 | 0.33 | 0.31 | 0.30 | |||||||||||||||

| Dividends paid per common share |

0.1750 | 0.1750 | 0.1750 | 0.1750 | 0.1725 | |||||||||||||||

| Common dividend payout ratio (1) |

58.6 | % | 50.3 | % | 52.9 | % | 56.2 | % | 56.3 | % | ||||||||||

| Book value per common share (end of period) |

$ | 17.13 | $ | 16.95 | $ | 16.69 | $ | 16.56 | $ | 16.43 | ||||||||||

| Tangible book value per common share (end of period) (1) |

9.35 | 9.23 | 9.19 | 9.02 | 8.93 | |||||||||||||||

| Stock price: |

||||||||||||||||||||

| High |

18.03 | 17.46 | 19.00 | 19.37 | 20.26 | |||||||||||||||

| Low |

14.25 | 13.66 | 16.95 | 18.00 | 18.18 | |||||||||||||||

| Close (end of period) |

16.44 | 14.43 | 17.12 | 18.09 | 18.66 | |||||||||||||||

| Common shares (end of period) (in millions) |

372.18 | 371.02 | 342.36 | 341.59 | 341.01 | |||||||||||||||

| Weighted average diluted common shares (in millions) |

374.09 | 372.83 | 345.04 | 344.47 | 344.00 | |||||||||||||||

| (1) | See Non-GAAP Financial Measures and Reconciliation to GAAP beginning on page 13. |

| (2) | Annualized. |

6

People’s United Financial, Inc.

FINANCIAL HIGHLIGHTS - Continued

| As of and for the Three Months Ended | ||||||||||||||||||||

| (dollars in millions) |

March 31, 2019 |

Dec. 31, 2018 |

Sept. 30, 2018 |

June 30, 2018 |

March 31, 2018 |

|||||||||||||||

| Financial Condition Data: |

||||||||||||||||||||

| Total assets |

$ | 48,092 | $ | 47,877 | $ | 44,133 | $ | 44,575 | $ | 44,101 | ||||||||||

| Loans |

35,515 | 35,241 | 32,199 | 32,512 | 32,104 | |||||||||||||||

| Securities |

7,175 | 7,233 | 7,385 | 7,324 | 7,173 | |||||||||||||||

| Short-term investments |

106 | 266 | 128 | 253 | 470 | |||||||||||||||

| Allowance for loan losses |

241 | 240 | 238 | 237 | 235 | |||||||||||||||

| Goodwill and other acquisition-related intangible assets |

2,896 | 2,866 | 2,569 | 2,574 | 2,555 | |||||||||||||||

| Deposits |

36,901 | 36,159 | 33,210 | 32,468 | 32,894 | |||||||||||||||

| Borrowings |

2,860 | 3,593 | 3,392 | 4,639 | 3,877 | |||||||||||||||

| Notes and debentures |

902 | 896 | 886 | 889 | 892 | |||||||||||||||

| Stockholders’ equity |

6,621 | 6,534 | 5,959 | 5,900 | 5,845 | |||||||||||||||

| Total risk-weighted assets (1): |

||||||||||||||||||||

| People’s United Financial, Inc. |

36,479 | 35,910 | 33,181 | 33,369 | 32,833 | |||||||||||||||

| People’s United Bank, N.A. |

36,461 | 35,875 | 33,132 | 33,317 | 32,784 | |||||||||||||||

| Non-performing assets (2) |

167 | 186 | 173 | 187 | 174 | |||||||||||||||

| Net loan charge-offs |

5.1 | 7.5 | 7.0 | 5.0 | 4.5 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Average Balances: |

||||||||||||||||||||

| Loans |

$ | 35,046 | $ | 35,016 | $ | 32,166 | $ | 32,116 | $ | 32,096 | ||||||||||

| Securities (3) |

7,311 | 7,479 | 7,404 | 7,302 | 7,186 | |||||||||||||||

| Short-term investments |

203 | 292 | 193 | 267 | 366 | |||||||||||||||

| Total earning assets |

42,560 | 42,786 | 39,763 | 39,685 | 39,648 | |||||||||||||||

| Total assets |

47,800 | 47,721 | 44,245 | 44,110 | 44,011 | |||||||||||||||

| Deposits |

36,450 | 35,959 | 33,058 | 32,535 | 32,824 | |||||||||||||||

| Borrowings |

2,937 | 3,456 | 3,539 | 4,031 | 3,752 | |||||||||||||||

| Notes and debentures |

896 | 886 | 888 | 890 | 895 | |||||||||||||||

| Total funding liabilities |

40,284 | 40,302 | 37,485 | 37,456 | 37,471 | |||||||||||||||

| Stockholders’ equity |

6,562 | 6,515 | 5,937 | 5,870 | 5,820 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Ratios: |

||||||||||||||||||||

| Net loan charge-offs to average total loans (annualized) |

0.06 | % | 0.09 | % | 0.09 | % | 0.06 | % | 0.06 | % | ||||||||||

| Non-performing assets to originated loans, real estate owned and repossessed assets (2) |

0.54 | 0.61 | 0.57 | 0.62 | 0.58 | |||||||||||||||

| Originated allowance for loan losses to: |

||||||||||||||||||||

| Originated loans (2) |

0.76 | 0.77 | 0.78 | 0.77 | 0.78 | |||||||||||||||

| Originated non-performing loans (2) |

157.0 | 140.9 | 147.9 | 138.4 | 149.3 | |||||||||||||||

| Average stockholders’ equity to average total assets |

13.7 | 13.7 | 13.4 | 13.3 | 13.2 | |||||||||||||||

| Stockholders’ equity to total assets |

13.8 | 13.6 | 13.5 | 13.2 | 13.3 | |||||||||||||||

| Tangible common equity to tangible assets (4) |

7.7 | 7.6 | 7.6 | 7.3 | 7.3 | |||||||||||||||

| Total risk-based capital (1): |

||||||||||||||||||||

| People’s United Financial, Inc. |

12.4 | 12.5 | 12.8 | 12.5 | 12.6 | |||||||||||||||

| People’s United Bank, N.A. |

12.9 | 13.2 | 13.6 | 13.4 | 12.9 | |||||||||||||||

| (1) | March 31, 2019 amounts and ratios are preliminary. |

| (2) | Excludes acquired loans. |

| (3) | Average balances for securities are based on amortized cost. |

| (4) | See Non-GAAP Financial Measures and Reconciliation to GAAP beginning on page 13. |

7

People’s United Financial, Inc.

CONSOLIDATED STATEMENTS OF CONDITION

| (in millions) |

March 31, 2019 |

Dec. 31, 2018 |

March 31, 2018 |

|||||||||

| Assets |

||||||||||||

| Cash and due from banks |

$ | 508.5 | $ | 665.7 | $ | 402.2 | ||||||

| Short-term investments |

106.0 | 266.3 | 470.3 | |||||||||

| Securities: |

||||||||||||

| Trading debt securities, at fair value |

8.3 | 8.4 | 8.2 | |||||||||

| Equity securities, at fair value |

8.2 | 8.1 | 9.5 | |||||||||

| Debt securities available-for-sale, at fair value |

3,060.0 | 3,121.0 | 3,153.8 | |||||||||

| Debt securities held-to-maturity, at amortized cost |

3,823.4 | 3,792.3 | 3,696.3 | |||||||||

| Federal Home Loan Bank and Federal Reserve Bank stock, at cost |

275.6 | 303.4 | 305.2 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total securities |

7,175.5 | 7,233.2 | 7,173.0 | |||||||||

|

|

|

|

|

|

|

|||||||

| Loans held-for-sale |

7.8 | 19.5 | 10.4 | |||||||||

|

|

|

|

|

|

|

|||||||

| Loans: |

||||||||||||

| Commercial real estate |

11,591.2 | 11,649.6 | 10,810.4 | |||||||||

| Commercial and industrial |

9,354.7 | 9,088.9 | 8,574.1 | |||||||||

| Equipment financing |

4,466.1 | 4,339.2 | 3,887.9 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Commercial Portfolio |

25,412.0 | 25,077.7 | 23,272.4 | |||||||||

|

|

|

|

|

|

|

|||||||

| Residential mortgage |

8,163.1 | 8,154.2 | 6,834.2 | |||||||||

| Home equity and other consumer |

1,940.1 | 2,009.5 | 1,997.8 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Retail Portfolio |

10,103.2 | 10,163.7 | 8,832.0 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total loans |

35,515.2 | 35,241.4 | 32,104.4 | |||||||||

| Less allowance for loan losses |

(240.9 | ) | (240.4 | ) | (235.3 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total loans, net |

35,274.3 | 35,001.0 | 31,869.1 | |||||||||

|

|

|

|

|

|

|

|||||||

| Goodwill and other acquisition-related intangible assets |

2,896.5 | 2,865.7 | 2,554.9 | |||||||||

| Bank-owned life insurance |

467.8 | 467.0 | 406.0 | |||||||||

| Premises and equipment, net |

255.8 | 267.3 | 250.0 | |||||||||

| Other assets |

1,399.7 | 1,091.6 | 964.6 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total assets |

$ | 48,091.9 | $ | 47,877.3 | $ | 44,100.5 | ||||||

|

|

|

|

|

|

|

|||||||

| Liabilities |

||||||||||||

| Deposits: |

||||||||||||

| Non-interest-bearing |

$ | 8,315.6 | $ | 8,543.0 | $ | 7,938.6 | ||||||

| Savings |

4,159.1 | 4,116.5 | 4,442.1 | |||||||||

| Interest-bearing checking and money market |

17,130.0 | 16,583.3 | 15,257.6 | |||||||||

| Time |

7,296.2 | 6,916.2 | 5,255.5 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total deposits |

36,900.9 | 36,159.0 | 32,893.8 | |||||||||

|

|

|

|

|

|

|

|||||||

| Borrowings: |

||||||||||||

| Federal Home Loan Bank advances |

1,573.2 | 2,404.5 | 2,610.7 | |||||||||

| Federal funds purchased |

1,020.0 | 845.0 | 805.0 | |||||||||

| Customer repurchase agreements |

264.8 | 332.9 | 265.8 | |||||||||

| Other borrowings |

1.6 | 11.0 | 195.4 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total borrowings |

2,859.6 | 3,593.4 | 3,876.9 | |||||||||

|

|

|

|

|

|

|

|||||||

| Notes and debentures |

901.6 | 895.8 | 891.9 | |||||||||

| Other liabilities |

808.6 | 695.2 | 592.4 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total liabilities |

41,470.7 | 41,343.4 | 38,255.0 | |||||||||

|

|

|

|

|

|

|

|||||||

| Stockholders’ Equity |

||||||||||||

| Preferred stock |

244.1 | 244.1 | 244.1 | |||||||||

| Common stock |

4.7 | 4.7 | 4.4 | |||||||||

| Additional paid-in capital |

6,558.8 | 6,549.3 | 6,029.0 | |||||||||

| Retained earnings |

1,328.6 | 1,284.8 | 1,121.4 | |||||||||

| Unallocated common stock of Employee Stock Ownership Plan, at cost |

(128.3 | ) | (130.1 | ) | (135.5 | ) | ||||||

| Accumulated other comprehensive loss |

(224.6 | ) | (256.8 | ) | (255.8 | ) | ||||||

| Treasury stock, at cost |

(1,162.1 | ) | (1,162.1 | ) | (1,162.1 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total stockholders’ equity |

6,621.2 | 6,533.9 | 5,845.5 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total liabilities and stockholders’ equity |

$ | 48,091.9 | $ | 47,877.3 | $ | 44,100.5 | ||||||

|

|

|

|

|

|

|

|||||||

8

People’s United Financial, Inc.

CONSOLIDATED STATEMENTS OF INCOME

| Three Months Ended | ||||||||||||||||||||

| (in millions, except per common share data) |

March 31, 2019 |

Dec. 31, 2018 |

Sept. 30, 2018 |

June 30, 2018 |

March 31, 2018 |

|||||||||||||||

| Interest and dividend income: |

||||||||||||||||||||

| Commercial real estate |

$ | 132.7 | $ | 130.2 | $ | 114.7 | $ | 111.5 | $ | 107.0 | ||||||||||

| Commercial and industrial |

103.9 | 100.1 | 93.2 | 90.1 | 82.3 | |||||||||||||||

| Equipment financing |

59.0 | 56.7 | 56.2 | 50.5 | 48.9 | |||||||||||||||

| Residential mortgage |

70.7 | 70.2 | 56.0 | 55.3 | 54.7 | |||||||||||||||

| Home equity and other consumer |

24.9 | 24.4 | 22.0 | 21.4 | 20.8 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total interest on loans |

391.2 | 381.6 | 342.1 | 328.8 | 313.7 | |||||||||||||||

| Securities |

47.8 | 48.5 | 46.6 | 45.1 | 44.0 | |||||||||||||||

| Short-term investments |

1.3 | 1.4 | 1.1 | 1.3 | 1.2 | |||||||||||||||

| Loans held-for-sale |

0.2 | 0.3 | 0.2 | 0.2 | 0.2 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total interest and dividend income |

440.5 | 431.8 | 390.0 | 375.4 | 359.1 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Interest expense: |

||||||||||||||||||||

| Deposits |

81.2 | 70.6 | 56.9 | 47.3 | 41.3 | |||||||||||||||

| Borrowings |

17.7 | 20.0 | 18.2 | 18.5 | 14.2 | |||||||||||||||

| Notes and debentures |

8.8 | 8.6 | 8.5 | 8.4 | 7.8 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total interest expense |

107.7 | 99.2 | 83.6 | 74.2 | 63.3 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income |

332.8 | 332.6 | 306.4 | 301.2 | 295.8 | |||||||||||||||

| Provision for loan losses |

5.6 | 9.9 | 8.2 | 6.5 | 5.4 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income after provision for loan losses |

327.2 | 322.7 | 298.2 | 294.7 | 290.4 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Non-interest income: |

||||||||||||||||||||

| Bank service charges |

25.2 | 26.9 | 24.9 | 24.3 | 23.8 | |||||||||||||||

| Investment management fees |

16.5 | 16.4 | 17.4 | 17.2 | 17.7 | |||||||||||||||

| Operating lease income |

12.7 | 12.0 | 11.0 | 11.2 | 10.7 | |||||||||||||||

| Insurance revenue |

10.5 | 6.7 | 9.8 | 8.3 | 9.8 | |||||||||||||||

| Commercial banking lending fees |

7.8 | 9.6 | 7.9 | 9.4 | 10.4 | |||||||||||||||

| Cash management fees |

6.8 | 6.6 | 7.0 | 7.0 | 6.6 | |||||||||||||||

| Brokerage commissions |

2.8 | 3.3 | 3.2 | 3.2 | 3.1 | |||||||||||||||

| Customer interest rate swap income, net |

2.3 | 6.3 | 2.8 | 4.0 | 1.5 | |||||||||||||||

| Net security (losses) gains (1) |

— | (10.0 | ) | 0.1 | — | 0.1 | ||||||||||||||

| Other non-interest income |

10.0 | 10.9 | 8.2 | 10.3 | 6.7 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total non-interest income |

94.6 | 88.7 | 92.3 | 94.9 | 90.4 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Non-interest expense: |

||||||||||||||||||||

| Compensation and benefits |

155.4 | 151.5 | 135.7 | 135.0 | 140.7 | |||||||||||||||

| Occupancy and equipment |

44.3 | 44.6 | 41.6 | 40.8 | 41.2 | |||||||||||||||

| Professional and outside services |

20.0 | 21.4 | 17.0 | 20.6 | 18.6 | |||||||||||||||

| Operating lease expense |

9.4 | 9.8 | 8.9 | 8.7 | 9.0 | |||||||||||||||

| Regulatory assessments |

7.0 | 7.4 | 10.0 | 9.9 | 10.6 | |||||||||||||||

| Amortization of other acquisition-related intangible assets |

6.7 | 6.9 | 4.9 | 4.9 | 5.1 | |||||||||||||||

| Other non-interest expense |

34.4 | 21.1 | 23.2 | 28.7 | 18.3 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total non-interest expense (1) |

277.2 | 262.7 | 241.3 | 248.6 | 243.5 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income tax expense |

144.6 | 148.7 | 149.2 | 141.0 | 137.3 | |||||||||||||||

| Income tax expense (1) |

30.0 | 15.8 | 32.2 | 30.8 | 29.4 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

114.6 | 132.9 | 117.0 | 110.2 | 107.9 | |||||||||||||||

| Preferred stock dividend |

3.5 | 3.5 | 3.5 | 3.5 | 3.5 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income available to common shareholders |

$ | 111.1 | $ | 129.4 | $ | 113.5 | $ | 106.7 | $ | 104.4 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Earnings per common share: |

||||||||||||||||||||

| Basic |

$ | 0.30 | $ | 0.35 | $ | 0.33 | $ | 0.31 | $ | 0.31 | ||||||||||

| Diluted |

0.30 | 0.35 | 0.33 | 0.31 | 0.30 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Includes $10.0 million of security losses for the three months ended December 31, 2018, which are considered non-operating, incurred as a tax planning strategy in response to tax reform-related benefits recognized in the period. Total non-interest expense includes $15.0 million, $8.0 million, $0.5 million and $2.9 million of non-operating expenses for the three months ended March 31, 2019, December 31, 2018, September 30, 2018 and June 30, 2018, respectively. Income tax expense includes a $9.2 million benefit recognized in connection with tax reform, which is considered non-operating, for the three months ended December 31, 2018. See Non-GAAP Financial Measures and Reconciliation to GAAP beginning on page 13. |

9

People’s United Financial, Inc.

AVERAGE BALANCE SHEET, INTEREST AND YIELD/RATE ANALYSIS (1)

| March 31, 2019 | December 31, 2018 | March 31, 2018 | ||||||||||||||||||||||||||||||||||

| Three months ended (dollars in millions) |

Average Balance |

Interest | Yield/ Rate |

Average Balance |

Interest | Yield/ Rate |

Average Balance |

Interest | Yield/ Rate |

|||||||||||||||||||||||||||

| Assets: |

||||||||||||||||||||||||||||||||||||

| Short-term investments |

$ | 202.8 | $ | 1.3 | 2.60 | % | $ | 291.6 | $ | 1.4 | 2.02 | % | $ | 366.4 | $ | 1.2 | 1.35 | % | ||||||||||||||||||

| Securities (2) |

7,310.6 | 52.4 | 2.87 | 7,478.7 | 52.9 | 2.83 | 7,186.1 | 48.0 | 2.67 | |||||||||||||||||||||||||||

| Loans: |

||||||||||||||||||||||||||||||||||||

| Commercial real estate |

11,588.3 | 132.7 | 4.58 | 11,688.1 | 130.2 | 4.45 | 10,934.2 | 107.0 | 3.91 | |||||||||||||||||||||||||||

| Commercial and industrial |

8,974.0 | 106.5 | 4.74 | 8,880.3 | 102.6 | 4.62 | 8,418.6 | 84.6 | 4.02 | |||||||||||||||||||||||||||

| Equipment financing |

4,357.7 | 59.0 | 5.42 | 4,243.2 | 56.7 | 5.34 | 3,870.6 | 48.9 | 5.06 | |||||||||||||||||||||||||||

| Residential mortgage |

8,153.6 | 70.9 | 3.48 | 8,165.4 | 70.5 | 3.46 | 6,837.1 | 54.9 | 3.21 | |||||||||||||||||||||||||||

| Home equity and other consumer |

1,972.9 | 24.9 | 5.05 | 2,038.5 | 24.4 | 4.80 | 2,035.0 | 20.8 | 4.09 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total loans |

35,046.5 | 394.0 | 4.50 | 35,015.5 | 384.4 | 4.39 | 32,095.5 | 316.2 | 3.94 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total earning assets |

42,559.9 | $ | 447.7 | 4.21 | % | 42,785.8 | $ | 438.7 | 4.10 | % | 39,648.0 | $ | 365.4 | 3.69 | % | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Other assets |

5,240.3 | 4,935.3 | 4,363.3 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total assets |

$ | 47,800.2 | $ | 47,721.1 | $ | 44,011.3 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Liabilities and stockholders’ equity: |

||||||||||||||||||||||||||||||||||||

| Deposits: |

||||||||||||||||||||||||||||||||||||

| Non-interest-bearing |

$ | 8,301.3 | $ | — | — | % | $ | 8,576.4 | $ | — | — | % | $ | 7,796.7 | $ | — | — | % | ||||||||||||||||||

| Savings, interest-bearing checking and money market |

21,018.0 | 48.8 | 0.93 | 20,621.7 | 41.7 | 0.81 | 19,642.6 | 24.9 | 0.51 | |||||||||||||||||||||||||||

| Time |

7,130.8 | 32.4 | 1.82 | 6,761.1 | 28.9 | 1.71 | 5,384.5 | 16.4 | 1.22 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total deposits |

36,450.1 | 81.2 | 0.89 | 35,959.2 | 70.6 | 0.79 | 32,823.8 | 41.3 | 0.50 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Borrowings: |

||||||||||||||||||||||||||||||||||||

| Federal Home Loan Bank advances |

1,890.1 | 12.4 | 2.64 | 2,371.9 | 14.9 | 2.51 | 2,677.1 | 10.9 | 1.63 | |||||||||||||||||||||||||||

| Federal funds purchased |

751.9 | 4.7 | 2.52 | 761.4 | 4.5 | 2.38 | 608.3 | 2.3 | 1.53 | |||||||||||||||||||||||||||

| Customer repurchase agreements |

286.2 | 0.5 | 0.65 | 285.1 | 0.4 | 0.56 | 262.6 | 0.1 | 0.18 | |||||||||||||||||||||||||||

| Other borrowings |

9.0 | 0.1 | 2.43 | 37.5 | 0.2 | 2.26 | 203.7 | 0.9 | 1.65 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total borrowings |

2,937.2 | 17.7 | 2.41 | 3,455.9 | 20.0 | 2.32 | 3,751.7 | 14.2 | 1.51 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Notes and debentures |

896.3 | 8.8 | 3.93 | 886.4 | 8.6 | 3.90 | 895.2 | 7.8 | 3.48 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total funding liabilities |

40,283.6 | $ | 107.7 | 1.07 | % | 40,301.5 | $ | 99.2 | 0.99 | % | 37,470.7 | $ | 63.3 | 0.68 | % | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Other liabilities |

954.3 | 904.2 | 720.1 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total liabilities |

41,237.9 | 41,205.7 | 38,190.8 | |||||||||||||||||||||||||||||||||

| Stockholders’ equity |

6,562.3 | 6,515.4 | 5,820.5 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total liabilities and stockholders’ equity |

$ | 47,800.2 | $ | 47,721.1 | $ | 44,011.3 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Net interest income/spread (3) |

$ | 340.0 | 3.14 | % | $ | 339.5 | 3.11 | % | $ | 302.1 | 3.01 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Net interest margin |

3.20 | % | 3.17 | % | 3.05 | % | ||||||||||||||||||||||||||||||

| (1) | Average yields earned and rates paid are annualized. |

| (2) | Average balances and yields for securities are based on amortized cost. |

| (3) | The fully taxable equivalent adjustment was $7.2 million, $6.9 million and $6.3 million for the three months ended March 31, 2019, December 31, 2018 and March 31, 2018, respectively. |

10

People’s United Financial, Inc.

Loans acquired in a business combination are initially recorded at fair value with no carryover of an acquired entity’s previous established allowance for loan losses. Accordingly, selected asset quality metrics have been highlighted to distinguish between the ‘originated’ portfolio and the ‘acquired’ portfolio.

NON-PERFORMING ASSETS

| (dollars in millions) |

March 31, 2019 |

Dec. 31, 2018 |

Sept. 30, 2018 |

June 30, 2018 |

March 31, 2018 |

|||||||||||||||

| Originated non-performing loans: |

||||||||||||||||||||

| Commercial: |

||||||||||||||||||||

| Commercial real estate |

$ | 33.6 | $ | 33.5 | $ | 17.2 | $ | 20.3 | $ | 21.0 | ||||||||||

| Commercial and industrial |

30.3 | 38.0 | 44.9 | 50.1 | 34.6 | |||||||||||||||

| Equipment financing |

37.5 | 42.0 | 49.3 | 49.2 | 47.7 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

101.4 | 113.5 | 111.4 | 119.6 | 103.3 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Retail: |

||||||||||||||||||||

| Residential mortgage |

35.4 | 38.9 | 32.0 | 33.5 | 35.4 | |||||||||||||||

| Home equity |

14.1 | 15.3 | 14.6 | 15.1 | 16.1 | |||||||||||||||

| Other consumer |

— | — | 0.1 | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

49.5 | 54.2 | 46.7 | 48.6 | 51.5 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total originated non-performing loans (1) |

150.9 | 167.7 | 158.1 | 168.2 | 154.8 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| REO: |

||||||||||||||||||||

| Commercial |

4.1 | 8.7 | 8.7 | 9.3 | 10.6 | |||||||||||||||

| Residential |

6.9 | 5.5 | 4.4 | 5.8 | 6.8 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total REO |

11.0 | 14.2 | 13.1 | 15.1 | 17.4 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Repossessed assets |

5.6 | 3.9 | 2.0 | 3.7 | 1.8 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total non-performing assets |

$ | 167.5 | $ | 185.8 | $ | 173.2 | $ | 187.0 | $ | 174.0 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Acquired non-performing loans (contractual amount) |

$ | 42.6 | $ | 50.1 | $ | 32.3 | $ | 26.7 | $ | 30.1 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Originated non-performing loans as a percentage of originated loans |

0.49 | % | 0.55 | % | 0.53 | % | 0.56 | % | 0.52 | % | ||||||||||

| Non-performing assets as a percentage of: |

||||||||||||||||||||

| Originated loans, REO and repossessed assets |

0.54 | 0.61 | 0.57 | 0.62 | 0.58 | |||||||||||||||

| Tangible stockholders’ equity and originated allowance for loan losses |

4.23 | 4.76 | 4.78 | 5.25 | 4.94 | |||||||||||||||

| (1) | Reported net of government guarantees totaling $1.4 million at March 31, 2019, $1.9 million at December 31, 2018, $2.5 million at September 30, 2018, $2.6 million at June 30, 2018 and $3.0 million at March 31, 2018. |

11

People’s United Financial, Inc.

PROVISION AND ALLOWANCE FOR LOAN LOSSES

| Three Months Ended | ||||||||||||||||||||

| (dollars in millions) |

March 31, 2019 |

Dec. 31, 2018 |

Sept. 30, 2018 |

June 30, 2018 |

March 31, 2018 |

|||||||||||||||

| Allowance for loan losses on originated loans: |

||||||||||||||||||||

| Balance at beginning of period |

$ | 236.3 | $ | 233.9 | $ | 232.8 | $ | 231.3 | $ | 230.8 | ||||||||||

| Charge-offs |

(5.6 | ) | (7.3 | ) | (6.4 | ) | (4.7 | ) | (4.4 | ) | ||||||||||

| Recoveries |

2.2 | 1.3 | 1.0 | 1.9 | 1.4 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loan charge-offs |

(3.4 | ) | (6.0 | ) | (5.4 | ) | (2.8 | ) | (3.0 | ) | ||||||||||

| Provision for loan losses |

4.0 | 8.4 | 6.5 | 4.3 | 3.5 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance at end of period |

236.9 | 236.3 | 233.9 | 232.8 | 231.3 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Allowance for loan losses on acquired loans: |

||||||||||||||||||||

| Balance at beginning of period |

4.1 | 4.1 | 4.0 | 4.0 | 3.6 | |||||||||||||||

| Charge-offs |

(1.9 | ) | (1.8 | ) | (2.0 | ) | (2.5 | ) | (1.8 | ) | ||||||||||

| Recoveries |

0.2 | 0.3 | 0.4 | 0.3 | 0.3 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loan charge-offs |

(1.7 | ) | (1.5 | ) | (1.6 | ) | (2.2 | ) | (1.5 | ) | ||||||||||

| Provision for loan losses |

1.6 | 1.5 | 1.7 | 2.2 | 1.9 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance at end of period |

4.0 | 4.1 | 4.1 | 4.0 | 4.0 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total allowance for loan losses |

$ | 240.9 | $ | 240.4 | $ | 238.0 | $ | 236.8 | $ | 235.3 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Originated commercial allowance for loan losses as a percentage of originated commercial loans |

0.91 | % | 0.93 | % | 0.94 | % | 0.93 | % | 0.94 | % | ||||||||||

| Originated retail allowance for loan losses as a percentage of originated retail loans |

0.37 | 0.36 | 0.36 | 0.36 | 0.36 | |||||||||||||||

| Total originated allowance for loan losses as a percentage of: |

||||||||||||||||||||

| Originated loans |

0.76 | 0.77 | 0.78 | 0.77 | 0.78 | |||||||||||||||

| Originated non-performing loans |

157.0 | 140.9 | 147.9 | 138.4 | 149.3 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

NET LOAN CHARGE-OFFS (RECOVERIES)

| Three Months Ended | ||||||||||||||||||||

| (dollars in millions) |

March 31, 2019 |

Dec. 31, 2018 |

Sept. 30, 2018 |

June 30, 2018 |

March 31, 2018 |

|||||||||||||||

| Commercial: |

||||||||||||||||||||

| Commercial real estate |

$ | 1.1 | $ | 1.4 | $ | 1.7 | $ | 0.7 | $ | 0.5 | ||||||||||

| Commercial and industrial |

1.7 | 1.4 | 2.2 | 1.7 | 1.7 | |||||||||||||||

| Equipment financing |

2.2 | 4.4 | 2.9 | 2.6 | 1.6 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

5.0 | 7.2 | 6.8 | 5.0 | 3.8 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Retail: |

||||||||||||||||||||

| Residential mortgage |

0.1 | — | 0.1 | (0.1 | ) | 0.2 | ||||||||||||||

| Home equity |

(0.2 | ) | 0.1 | (0.1 | ) | — | 0.4 | |||||||||||||

| Other consumer |

0.2 | 0.2 | 0.2 | 0.1 | 0.1 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

0.1 | 0.3 | 0.2 | — | 0.7 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total net loan charge-offs |

$ | 5.1 | $ | 7.5 | $ | 7.0 | $ | 5.0 | $ | 4.5 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loan charge-offs to average total loans (annualized) |

0.06 | % | 0.09 | % | 0.09 | % | 0.06 | % | 0.06 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

12

People’s United Financial, Inc.

NON-GAAP FINANCIAL MEASURES AND RECONCILIATION TO GAAP

In addition to evaluating People’s United Financial Inc. (“People’s United”) results of operations in accordance with U.S. generally accepted accounting principles (“GAAP”), management routinely supplements its evaluation with an analysis of certain non-GAAP financial measures, such as the efficiency and tangible common equity ratios, tangible book value per common share and operating earnings metrics. Management believes these non-GAAP financial measures provide information useful to investors in understanding People’s United’s underlying operating performance and trends, and facilitates comparisons with the performance of other financial institutions. Further, the efficiency ratio and operating earnings metrics are used by management in its assessment of financial performance, including non-interest expense control, while the tangible common equity ratio and tangible book value per common share are used to analyze the relative strength of People’s United’s capital position.

The efficiency ratio, which represents an approximate measure of the cost required by People’s United to generate a dollar of revenue, is the ratio of (i) total non-interest expense (excluding operating lease expense, goodwill impairment charges, amortization of other acquisition-related intangible assets, losses on real estate assets and non-recurring expenses) (the numerator) to (ii) net interest income on a fully taxable equivalent (“FTE”) basis plus total non-interest income (including the FTE adjustment on bank-owned life insurance (“BOLI”) income, the netting of operating lease expense and excluding gains and losses on sales of assets other than residential mortgage loans and acquired loans, and non-recurring income) (the denominator). People’s United generally considers an item of income or expense to be non-recurring if it is not similar to an item of income or expense of a type incurred within the last two years and is not similar to an item of income or expense of a type reasonably expected to be incurred within the following two years.

Operating earnings exclude from net income available to common shareholders those items that management considers to be of such a non-recurring or infrequent nature that, by excluding such items (net of income taxes), People’s United’s results can be measured and assessed on a more consistent basis from period to period. Items excluded from operating earnings, which include, but are not limited to: (i) non-recurring gains/losses; (ii) merger-related expenses, including acquisition integration and other costs; (iii) writedowns of banking house assets and related lease termination costs; (iv) severance-related costs; and (v) charges related to executive-level management separation costs, are generally also excluded when calculating the efficiency ratio. Operating earnings per common share (“EPS”) is derived by determining the per common share impact of the respective adjustments to arrive at operating earnings and adding (subtracting) such amounts to (from) diluted EPS, as reported. Operating return on average assets is calculated by dividing operating earnings (annualized) by average total assets. Operating return on average tangible common equity is calculated by dividing operating earnings (annualized) by average tangible common equity. The operating common dividend payout ratio is calculated by dividing common dividends paid by operating earnings for the respective period.

The tangible common equity ratio is the ratio of (i) tangible common equity (total stockholders’ equity less preferred stock, goodwill and other acquisition-related intangible assets) (the numerator) to (ii) tangible assets (total assets less goodwill and other acquisition-related intangible assets) (the denominator). Tangible book value per common share is calculated by dividing tangible common equity by common shares (total common shares issued, less common shares classified as treasury shares and unallocated Employee Stock Ownership Plan (“ESOP”) common shares).

In light of diversity in presentation among financial institutions, the methodologies used by People’s United for determining the non-GAAP financial measures discussed above may differ from those used by other financial institutions.

13

People’s United Financial, Inc.

NON-GAAP FINANCIAL MEASURES AND RECONCILIATION TO GAAP - Continued

OPERATING NON-INTEREST EXPENSE AND EFFICIENCY RATIO

| Three Months Ended | ||||||||||||||||||||

| (dollars in millions) |

March 31, 2019 |

Dec. 31, 2018 |

Sept. 30, 2018 |

June 30, 2018 |

March 31, 2018 |

|||||||||||||||

| Total non-interest expense |

$ | 277.2 | $ | 262.7 | $ | 241.3 | $ | 248.6 | $ | 243.5 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjustments to arrive at operating non-interest expense: |

||||||||||||||||||||

| Merger-related expenses |

(15.0 | ) | (8.0 | ) | (0.5 | ) | (2.9 | ) | — | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

(15.0 | ) | (8.0 | ) | (0.5 | ) | (2.9 | ) | — | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating non-interest expense |

262.2 | 254.7 | 240.8 | 245.7 | 243.5 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating lease expense |

(9.4 | ) | (9.8 | ) | (8.9 | ) | (8.7 | ) | (9.0 | ) | ||||||||||

| Amortization of other acquisition-related intangible assets |

(6.7 | ) | (6.9 | ) | (4.9 | ) | (4.9 | ) | (5.1 | ) | ||||||||||

| Other (1) |

(1.8 | ) | (1.6 | ) | (1.8 | ) | (1.7 | ) | (1.3 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total non-interest expense for efficiency ratio |

$ | 244.3 | $ | 236.4 | $ | 225.2 | $ | 230.4 | $ | 228.1 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income (FTE basis) |

$ | 340.0 | $ | 339.5 | $ | 313.0 | $ | 307.8 | $ | 302.1 | ||||||||||

| Total non-interest income |

94.6 | 88.7 | 92.3 | 94.9 | 90.4 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenues |

434.6 | 428.2 | 405.3 | 402.7 | 392.5 | |||||||||||||||

| Adjustments: |

||||||||||||||||||||

| Operating lease expense |

(9.4 | ) | (9.8 | ) | (8.9 | ) | (8.7 | ) | (9.0 | ) | ||||||||||

| BOLI FTE adjustment |

0.6 | 0.5 | 0.6 | 0.4 | 0.4 | |||||||||||||||

| Net security losses (gains) |

— | 10.0 | (0.1 | ) | — | (0.1 | ) | |||||||||||||

| Other (2) |

0.3 | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenues for efficiency ratio |

$ | 426.1 | $ | 428.9 | $ | 396.9 | $ | 394.4 | $ | 383.8 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Efficiency ratio |

57.3 | % | 55.1 | % | 56.7 | % | 58.4 | % | 59.4 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Items classified as “other” and deducted from non-interest expense for purposes of calculating the efficiency ratio include certain franchise taxes and real estate owned expenses. |

| (2) | Items classified as “other” and deducted from total revenues for purposes of calculating the efficiency ratio include, as applicable, asset write-offs and gains associated with the sale of branch locations. |

14

People’s United Financial, Inc.

NON-GAAP FINANCIAL MEASURES AND RECONCILIATION TO GAAP - Continued

OPERATING EARNINGS

| Three Months Ended | ||||||||||||||||||||

| (dollars in millions, except per common share data) |

March 31, 2019 |

Dec. 31, 2018 |

Sept. 30, 2018 |

June 30, 2018 |

March 31, 2018 |

|||||||||||||||

| Net income available to common shareholders |

$ | 111.1 | $ | 129.4 | $ | 113.5 | $ | 106.7 | $ | 104.4 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjustments to arrive at operating earnings: |

||||||||||||||||||||

| Merger-related expenses |

15.0 | 8.0 | 0.5 | 2.9 | — | |||||||||||||||

| Security losses associated with tax reform (1) |

— | 10.0 | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total pre-tax adjustments |

15.0 | 18.0 | 0.5 | 2.9 | — | |||||||||||||||

| Tax effect (2) |

(3.1 | ) | (13.2 | ) | (0.2 | ) | (0.6 | ) | — | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total adjustments, net of tax |

11.9 | 4.8 | 0.3 | 2.3 | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating earnings |

$ | 123.0 | $ | 134.2 | $ | 113.8 | $ | 109.0 | $ | 104.4 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted EPS, as reported |

$ | 0.30 | $ | 0.35 | $ | 0.33 | $ | 0.31 | $ | 0.30 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjustments to arrive at operating EPS: |

||||||||||||||||||||

| Merger-related expenses |

0.03 | 0.01 | — | 0.01 | — | |||||||||||||||

| Security losses associated with tax reform |

— | 0.02 | — | — | — | |||||||||||||||

| Tax benefit associated with tax reform |

— | (0.02 | ) | — | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total adjustments per common share |

0.03 | 0.01 | — | 0.01 | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating EPS |

$ | 0.33 | $ | 0.36 | $ | 0.33 | $ | 0.32 | $ | 0.30 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Average total assets |

$ | 47,800 | $ | 47,721 | $ | 44,245 | $ | 44,110 | $ | 44,011 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating return on average assets (annualized) |

1.03 | % | 1.12 | % | 1.03 | % | 0.99 | % | 0.95 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Security losses incurred as a tax planning strategy in response to a tax reform-related benefit are considered non-operating. |

| (2) | Includes a $9.2 million benefit recognized in connection with tax reform for the three months ended December 31, 2018. |

OPERATING RETURN ON AVERAGE TANGIBLE COMMON EQUITY

| Three Months Ended | ||||||||||||||||||||

| (dollars in millions) |

March 31, 2019 |

Dec. 31, 2018 |

Sept. 30, 2018 |

June 30, 2018 |

March 31, 2018 |

|||||||||||||||

| Operating earnings |

$ | 123.0 | $ | 134.2 | $ | 113.8 | $ | 109.0 | $ | 104.4 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Average stockholders’ equity |

$ | 6,562 | $ | 6,515 | $ | 5,937 | $ | 5,870 | $ | 5,820 | ||||||||||

| Less: Average preferred stock |

244 | 244 | 244 | 244 | 244 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Average common equity |

6,318 | 6,271 | 5,693 | 5,626 | 5,576 | |||||||||||||||

| Less: Average goodwill and average other acquisition-related intangible assets |

2,900 | 2,807 | 2,572 | 2,554 | 2,558 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Average tangible common equity |

$ | 3,418 | $ | 3,464 | $ | 3,121 | $ | 3,072 | $ | 3,018 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating return on average tangible common equity (annualized) |

14.4 | % | 15.5 | % | 14.6 | % | 14.2 | % | 13.8 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

15

People’s United Financial, Inc.

NON-GAAP FINANCIAL MEASURES AND RECONCILIATION TO GAAP - Continued

OPERATING COMMON DIVIDEND PAYOUT RATIO

| Three Months Ended | ||||||||||||||||||||

| (dollars in millions) |

March 31, 2019 |

Dec. 31, 2018 |

Sept. 30, 2018 |

June 30, 2018 |

March 31, 2018 |

|||||||||||||||

| Common dividends paid |

$ | 65.2 | $ | 65.1 | $ | 60.0 | $ | 59.9 | $ | 58.8 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating earnings |

$ | 123.0 | $ | 134.2 | $ | 113.8 | $ | 109.0 | $ | 104.4 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating common dividend payout ratio |

53.0 | % | 48.5 | % | 52.7 | % | 55.0 | % | 56.3 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

TANGIBLE COMMON EQUITY RATIO

| (dollars in millions) |

March 31, 2019 |

Dec. 31, 2018 |

Sept. 30, 2018 |

June 30, 2018 |

March 31, 2018 |

|||||||||||||||

| Total stockholders’ equity |

$ | 6,621 | $ | 6,534 | $ | 5,959 | $ | 5,900 | $ | 5,845 | ||||||||||

| Less: Preferred stock |

244 | 244 | 244 | 244 | 244 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Common equity |

6,377 | 6,290 | 5,715 | 5,656 | 5,601 | |||||||||||||||

| Less: Goodwill and other acquisition-related intangible assets |

2,896 | 2,866 | 2,569 | 2,574 | 2,555 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Tangible common equity |

$ | 3,481 | $ | 3,424 | $ | 3,146 | $ | 3,082 | $ | 3,046 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

$ | 48,092 | $ | 47,877 | $ | 44,133 | $ | 44,575 | $ | 44,101 | ||||||||||

| Less: Goodwill and other acquisition-related intangible assets |

2,896 | 2,866 | 2,569 | 2,574 | 2,555 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Tangible assets |

$ | 45,196 | $ | 45,011 | $ | 41,564 | $ | 42,001 | $ | 41,546 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Tangible common equity ratio |

7.7 | % | 7.6 | % | 7.6 | % | 7.3 | % | 7.3 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

TANGIBLE BOOK VALUE PER COMMON SHARE

| (in millions, except per common share data) |

March 31, 2019 |

Dec. 31, 2018 |

Sept. 30, 2018 |

June 30, 2018 |

March 31, 2018 |

|||||||||||||||

| Tangible common equity |

$ | 3,481 | $ | 3,424 | $ | 3,146 | $ | 3,082 | $ | 3,046 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Common shares issued |

467.38 | 466.32 | 437.74 | 437.06 | 436.56 | |||||||||||||||

| Less: Shares classified as treasury shares |

89.01 | 89.03 | 89.02 | 89.02 | 89.02 | |||||||||||||||

| Unallocated ESOP shares |

6.19 | 6.27 | 6.36 | 6.45 | 6.53 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Common shares |

372.18 | 371.02 | 342.36 | 341.59 | 341.01 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Tangible book value per common share |

$ | 9.35 | $ | 9.23 | $ | 9.19 | $ | 9.02 | $ | 8.93 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

16

First Quarter 2019 Results April 18, 2019 Exhibit 99.2 Investor Presentation dated April 18, 2019

Forward-Looking Statement Certain statements contained in this presentation are forward-looking in nature. These include all statements about People's United Financial, Inc. (“People’s United”) plans, objectives, expectations and other statements that are not historical facts, and usually use words such as "expect," "anticipate," "believe," "should" and similar expressions. Such statements represent management's current beliefs, based upon information available at the time the statements are made, with regard to the matters addressed. All forward-looking statements are subject to risks and uncertainties that could cause People's United’s actual results or financial condition to differ materially from those expressed in or implied by such statements. Factors of particular importance to People’s United include, but are not limited to: (1) changes in general, international, national or regional economic conditions; (2) changes in interest rates; (3) changes in loan default and charge-off rates; (4) changes in deposit levels; (5) changes in levels of income and expense in non-interest income and expense related activities; (6) changes in accounting and regulatory guidance applicable to banks; (7) price levels and conditions in the public securities markets generally; (8) competition and its effect on pricing, spending, third-party relationships and revenues; (9) the successful integration of acquisitions; and (10) changes in regulation resulting from or relating to financial reform legislation. People's United does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

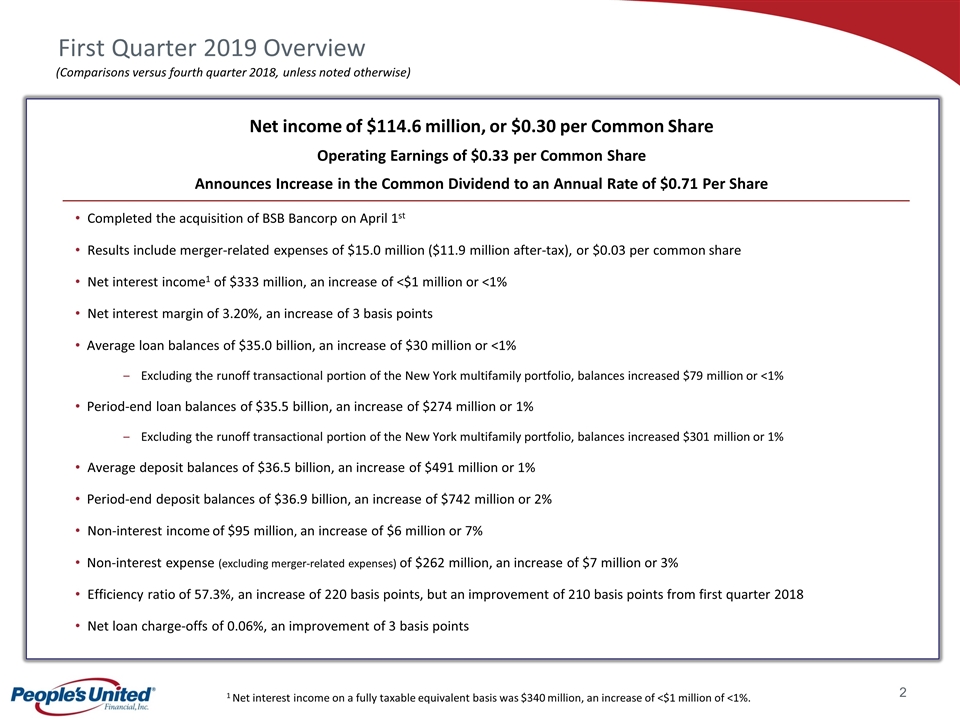

1 Net interest income on a fully taxable equivalent basis was $340 million, an increase of <$1 million of <1%. First Quarter 2019 Overview Net income of $114.6 million, or $0.30 per Common Share Operating Earnings of $0.33 per Common Share Announces Increase in the Common Dividend to an Annual Rate of $0.71 Per Share Completed the acquisition of BSB Bancorp on April 1st Results include merger-related expenses of $15.0 million ($11.9 million after-tax), or $0.03 per common share Net interest income1 of $333 million, an increase of <$1 million or <1% Net interest margin of 3.20%, an increase of 3 basis points Average loan balances of $35.0 billion, an increase of $30 million or <1% Excluding the runoff transactional portion of the New York multifamily portfolio, balances increased $79 million or <1% Period-end loan balances of $35.5 billion, an increase of $274 million or 1% Excluding the runoff transactional portion of the New York multifamily portfolio, balances increased $301 million or 1% Average deposit balances of $36.5 billion, an increase of $491 million or 1% Period-end deposit balances of $36.9 billion, an increase of $742 million or 2% Non-interest income of $95 million, an increase of $6 million or 7% Non-interest expense (excluding merger-related expenses) of $262 million, an increase of $7 million or 3% Efficiency ratio of 57.3%, an increase of 220 basis points, but an improvement of 210 basis points from first quarter 2018 Net loan charge-offs of 0.06%, an improvement of 3 basis points (Comparisons versus fourth quarter 2018, unless noted otherwise)

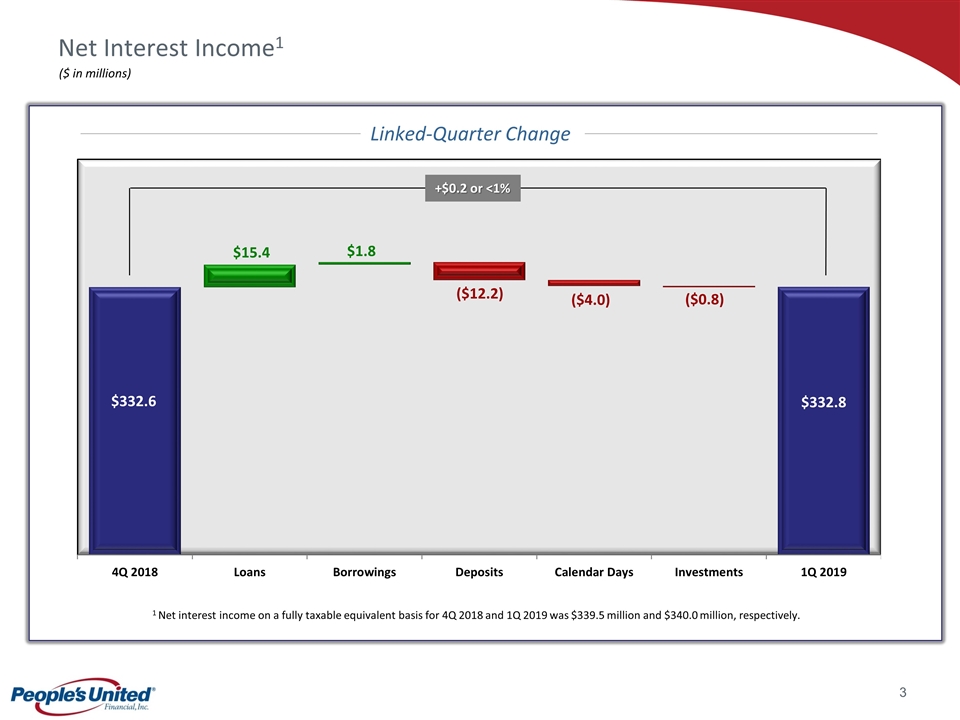

Net Interest Income1 ($ in millions) $332.6 $332.8 1 Net interest income on a fully taxable equivalent basis for 4Q 2018 and 1Q 2019 was $339.5 million and $340.0 million, respectively. +$0.2 or <1% Linked-Quarter Change $15.4 ($12.2) $1.8 ($4.0) ($0.8)

Net Interest Margin 3.17% 3.20% +3 bps Linked-Quarter Change 15 bps (11 bps) 2 bps 1 bp (4 bps)

Loans: Average Balances $35,046 ($ in millions) $35,016 Linked-Quarter Change Linked-quarter change +$30 million or <1% $115 $94 ($100) ($66) ($13)

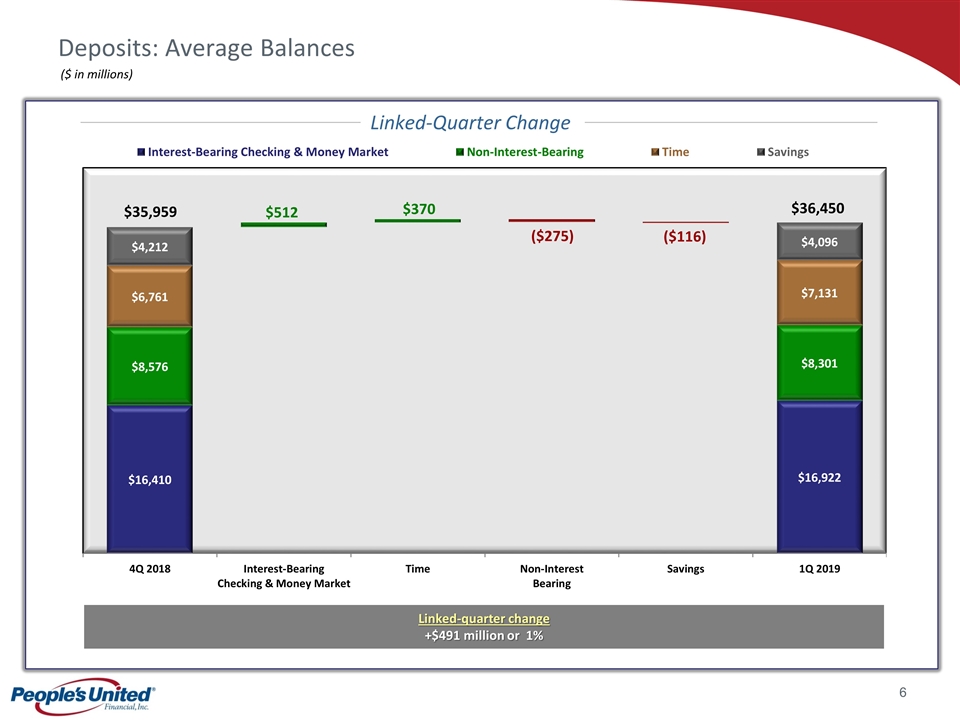

Deposits: Average Balances ($ in millions) $36,450 $35,959 Linked-Quarter Change Linked-quarter change +$491 million or 1% $512 ($275) $370 ($116)

Non-Interest Income ($ in millions) $88.7 $94.6 ($4.0) $10.0 +$5.9 or 7% Linked-Quarter Change 1 4Q 2018 included $10.0 million of security losses which were considered non-operating and incurred as a tax planning strategy in response to tax-reform benefits recognized in the period. 1 $3.8 ($1.8) ($1.7) ($0.4)

Non-Interest Expense ($ in millions) $277.2 $262.7 Ex. Merger-Related Expenses: +$7.5 or 3% Linked-Quarter Change $7.0 $5.9 $1.1 $0.5

Efficiency Ratio Quarterly Trend

Asset Quality 1Non-performing assets (excluding acquired non-performing loans) as a percentage of originated loans plus all REO and repossessed assets; acquired non-performing loans excluded as risk of loss has been considered by virtue of (i) our estimate of acquisition-date fair value, (ii) the existence of an FDIC loss sharing agreement, and/or (iii) allowance for loan losses established subsequent to acquisition Notes: Source: SNL Financial Top 50 Banks represents the largest 50 banks by total assets in each respective quarter. 2Ex. acquired loan charge-offs, PBCT’s charge-off ratio was 0.04%, 0.07%, 0.07%, 0.03% & 0.04% in 1Q 2019, 4Q 2018, 3Q 2018, 2Q 2018 & 1Q 2018, respectively PBCT Peer Group (Median) Top 50 Banks (Median) PBCT Peer Group (Median) Top 50 Banks (Median) Non-Performing Assets / Loans & REO (%)1 Net Charge-offs / Average Loans2