Form 8-K PennyMac Mortgage Invest For: Feb 07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 7, 2019

PennyMac Mortgage Investment Trust

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Maryland |

001-34416 |

27-0186273 |

|

(State or other jurisdiction |

(Commission |

(IRS Employer |

|

of incorporation) |

File Number) |

Identification No.) |

|

|

|

|

|

3043 Townsgate Road, Westlake Village, California |

91361 |

|

(Address of principal executive offices) |

(Zip Code) |

(818) 224‑7442

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 7, 2019, PennyMac Mortgage Investment Trust (the “Company”) issued a press release announcing its unaudited financial results for the fiscal quarter and year ended December 31, 2018. A copy of the press release and the slide presentation used in connection with the Company’s recorded presentation of financial results were made available on February 7, 2019 and are furnished as Exhibit 99.1 and Exhibit 99.2, respectively.

The information in Item 2.02 of this report, including the exhibits hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of Section 18, nor shall it be deemed incorporated by reference into any disclosure document relating to the Company, except to the extent, if any, expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No. |

Description |

|

|

|

|

99.1 |

|

|

|

|

|

99.2 |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

PENNYMAC MORTGAGE INVESTMENT TRUST |

|

|

|

|

Dated: February 8, 2019 |

/s/ Andrew S. Chang |

|

|

Andrew S. Chang Senior Managing Director and Chief Financial Officer |

Exhibit 99.1

|

|

|

|

|

|

Media |

|

Investors |

|

|

Stephen Hagey |

|

Christopher Oltmann |

|

|

(805) 530-5817 |

|

(818) 224-7028 |

PennyMac Mortgage Investment Trust Reports

Fourth Quarter and Full-Year 2018 Results

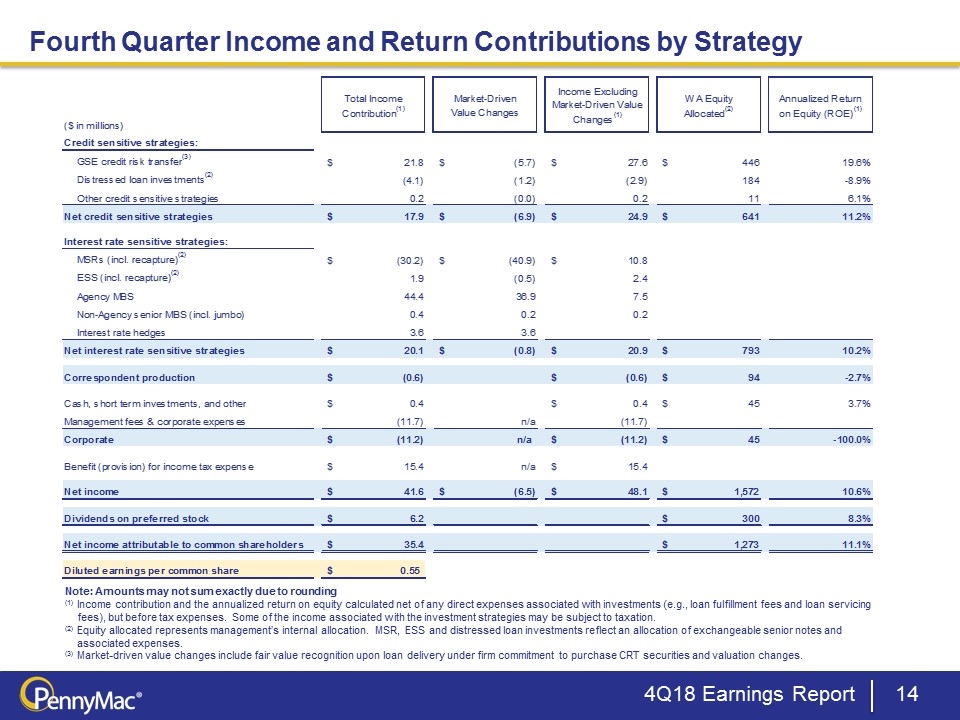

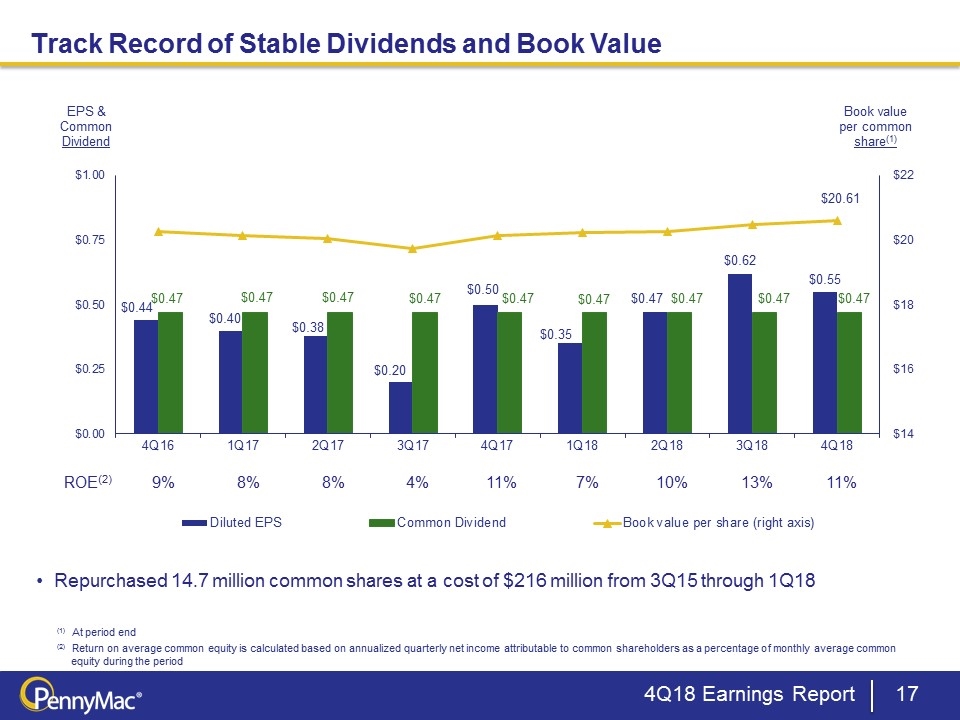

Westlake Village, CA, February 7, 2019 – PennyMac Mortgage Investment Trust (NYSE: PMT) today reported net income attributable to common shareholders of $35.4 million, or $0.55 per common share on a diluted basis for the fourth quarter of 2018, on net investment income of $83.9 million. PMT previously announced a cash dividend for the fourth quarter of 2018 of $0.47 per common share of beneficial interest, which was declared on December 21, 2018, and paid on January 28, 2019.

Fourth Quarter 2018 Highlights

Financial results:

|

|

• |

Net income attributable to common shareholders of $35.4 million, down from $40.3 million in the prior quarter |

|

|

o |

Results reflect solid contributions from Government-sponsored enterprise (GSE) credit risk transfer (CRT) investments and Interest Rate Sensitive strategies |

|

|

o |

Fair value declines in CRT and mortgage servicing right (MSR) investments held in PMT’s taxable subsidiary drove $15.4 million benefit for income tax expense |

|

|

• |

Diluted earnings per common share of $0.55, down 11 percent from the prior quarter |

|

|

prior quarter1 |

|

|

• |

Book value per common share of $20.61 at December 31, 2018, up from $20.48 at |

Investment and operating highlights:

|

|

• |

Continued investment in GSE CRT and MSRs resulting from PMT’s mortgage acquisitions |

|

|

o |

Correspondent production from nonaffiliates related to conventional conforming and jumbo loans totaled $9.1 billion in unpaid principal balance (UPB), up 21 percent from the prior quarter |

|

|

o |

Loan acquisitions from PennyMac Financial Services, Inc. (NYSE: PFSI) totaled $0.9 billion in UPB, down 2 percent from the prior quarter |

|

|

o |

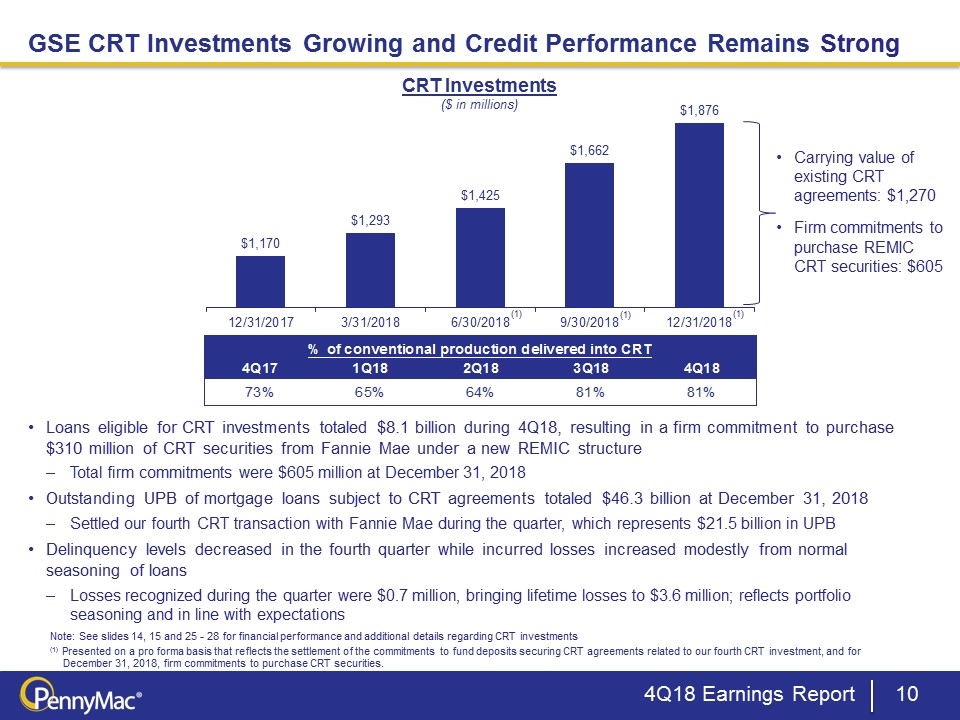

Loans eligible for CRT investments totaled $8.1 billion, resulting in a firm commitment to purchase $310 million of CRT securities |

|

|

o |

New MSR investments totaled $128 million |

|

|

• |

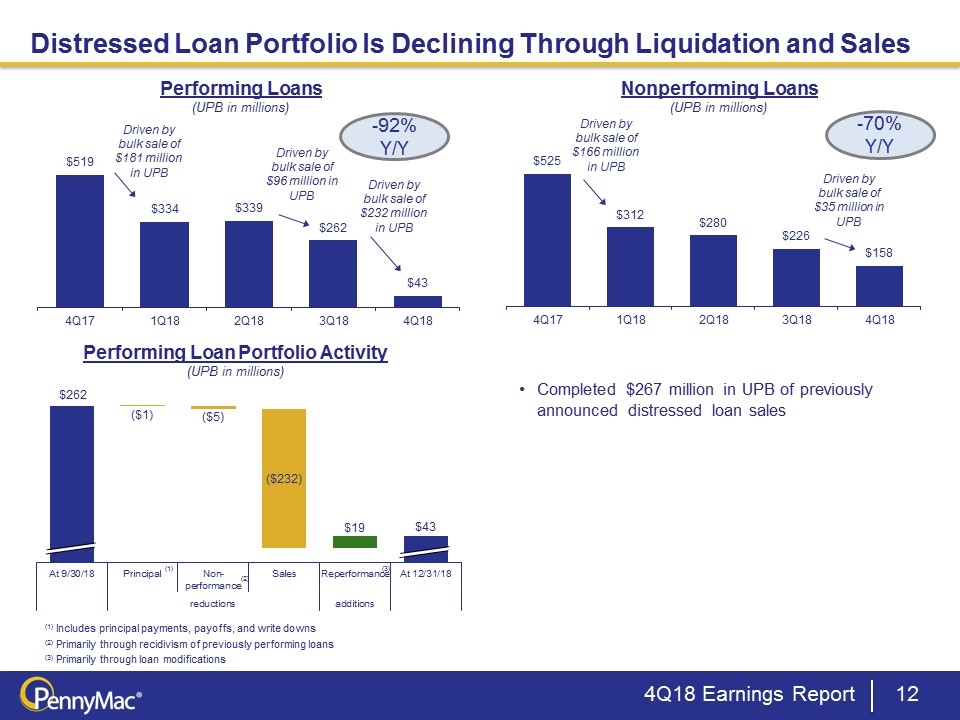

Completed $267 million in UPB of previously announced distressed loan sales |

Full-Year 2018 Highlights

Financial results:

|

|

• |

Net income attributable to common shareholders of $127.9 million, up 25 percent from the prior year |

|

|

• |

Diluted earnings per common share of $1.99, up 34 percent from the prior year |

|

|

• |

Net investment income of $351.1 million, up 10 percent from the prior year |

|

|

• |

Return on average common equity of 10 percent, up from 8 percent in the prior year1 |

|

|

• |

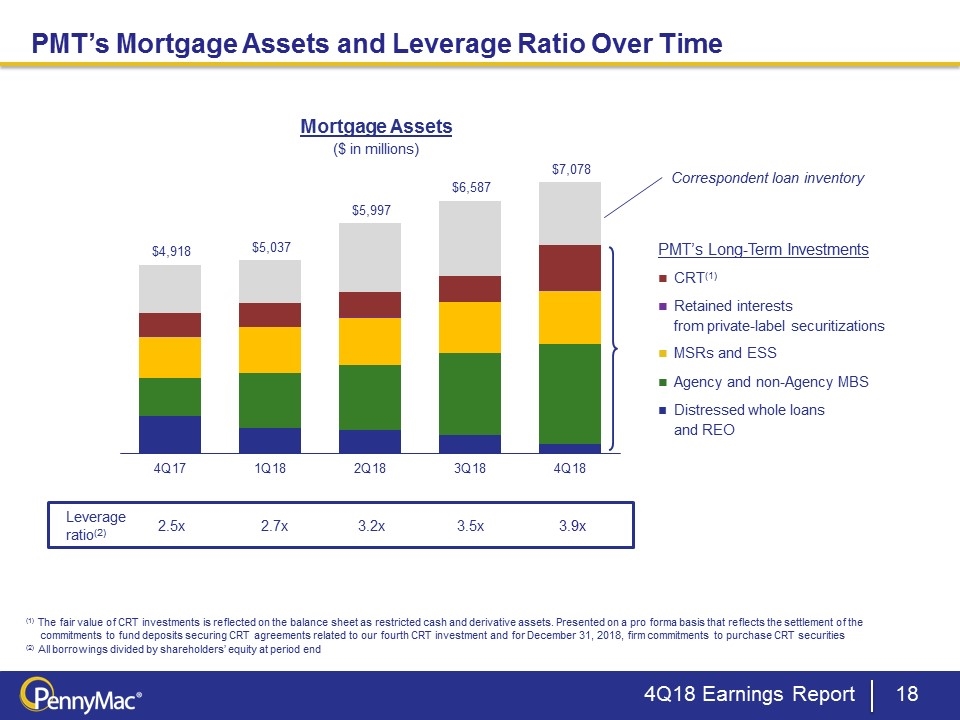

PMT’s equity allocation to CRT, MSRs and excess servicing spread (ESS) grew to 70 percent of total equity at December 31, 2018, from 66 percent at the end of 2017 |

|

|

1 Annualized return on average common equity is calculated based on annualized quarterly net income attributable to common shareholders as a percentage of monthly average common equity during the period. |

2

“Our results reflect solid performance in a volatile market environment during the fourth quarter,” said President and CEO David Spector. “PMT’s unique credit risk transfer investments, while somewhat impacted by credit spread widening, continued to deliver solid results and the returns on our Interest Rate Sensitive strategies reflect our disciplined focus on hedging through this period. Our correspondent production activities delivered strong volume growth as a result of our unique execution capabilities, driving continued growth in our CRT and MSR investment strategies.”

The following table presents the contributions of PMT’s segments, consisting of Correspondent Production, Credit Sensitive Strategies, Interest Rate Sensitive Strategies and Corporate:

3

|

|

|

Quarter ended December 31, 2018 |

|

|||||||||||||||||

|

|

|

|

|

|

|

Credit |

|

|

Interest rate |

|

|

|

|

|

|

|

|

|

||

|

|

|

Correspondent production |

|

|

sensitive stratgies |

|

|

sensitive strategies |

|

|

Corporate |

|

|

Consolidated |

|

|||||

|

|

|

(in thousands) |

|

|||||||||||||||||

|

Net gain (loss) on investments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgage loans at fair value |

|

$ |

- |

|

|

$ |

2,505 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

2,505 |

|

|

Mortgage loans held by variable interest entity net of asset-backed secured financing |

|

|

- |

|

|

|

- |

|

|

|

445 |

|

|

|

- |

|

|

|

445 |

|

|

Mortgage-backed securities |

|

|

- |

|

|

|

(120 |

) |

|

|

39,146 |

|

|

|

- |

|

|

|

39,026 |

|

|

CRT investments |

|

|

- |

|

|

|

9,814 |

|

|

|

- |

|

|

|

- |

|

|

|

9,814 |

|

|

Hedging derivatives |

|

|

- |

|

|

|

- |

|

|

|

(5,181 |

) |

|

|

- |

|

|

|

(5,181 |

) |

|

Excess servicing spread investments |

|

|

- |

|

|

|

- |

|

|

|

107 |

|

|

|

- |

|

|

|

107 |

|

|

|

|

|

- |

|

|

|

12,199 |

|

|

|

34,517 |

|

|

|

- |

|

|

|

46,716 |

|

|

Net gain on mortgage loans acquired for sale |

|

|

3,635 |

|

|

|

13,971 |

|

|

|

- |

|

|

|

- |

|

|

|

17,606 |

|

|

Net mortgage loan servicing fees |

|

|

- |

|

|

|

- |

|

|

|

(7,548 |

) |

|

|

- |

|

|

|

(7,548 |

) |

|

Net interest income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

23,611 |

|

|

|

10,152 |

|

|

|

32,944 |

|

|

|

417 |

|

|

|

67,124 |

|

|

Interest expense |

|

|

(11,315 |

) |

|

|

(12,624 |

) |

|

|

(29,742 |

) |

|

|

- |

|

|

|

(53,681 |

) |

|

|

|

|

12,296 |

|

|

|

(2,472 |

) |

|

|

3,202 |

|

|

|

417 |

|

|

|

13,443 |

|

|

Other income (loss) |

|

|

15,038 |

|

|

|

(1,353 |

) |

|

|

- |

|

|

|

- |

|

|

|

13,685 |

|

|

|

|

|

30,969 |

|

|

|

22,345 |

|

|

|

30,171 |

|

|

|

417 |

|

|

|

83,902 |

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgage loan fulfillment and servicing fees payable to PennyMac Financial Services, Inc. |

|

|

28,591 |

|

|

|

2,032 |

|

|

|

9,492 |

|

|

|

- |

|

|

|

40,115 |

|

|

Management fees payable to PennyMac Financial Services, Inc. |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

6,559 |

|

|

|

6,559 |

|

|

Other |

|

|

3,006 |

|

|

|

2,382 |

|

|

|

531 |

|

|

|

5,107 |

|

|

|

11,026 |

|

|

|

|

|

31,597 |

|

|

|

4,414 |

|

|

|

10,023 |

|

|

|

11,666 |

|

|

|

57,700 |

|

|

Pretax income (loss) |

|

$ |

(628 |

) |

|

$ |

17,931 |

|

|

$ |

20,148 |

|

|

$ |

(11,249 |

) |

|

$ |

26,202 |

|

Credit Sensitive Strategies Segment

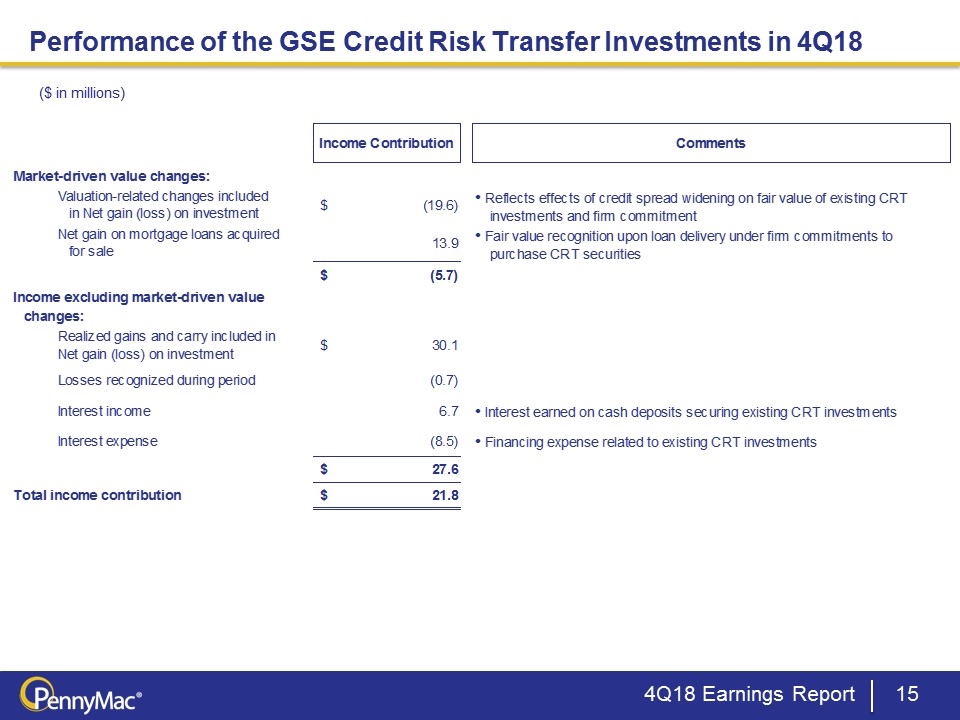

The Credit Sensitive Strategies segment primarily includes results from CRT, distressed mortgage loans and non-Agency subordinated bonds. Pretax income for the segment was $17.9 million on revenues of $22.3 million, compared to pretax income of $33.1 million on revenues of $40.0 million in the prior quarter.

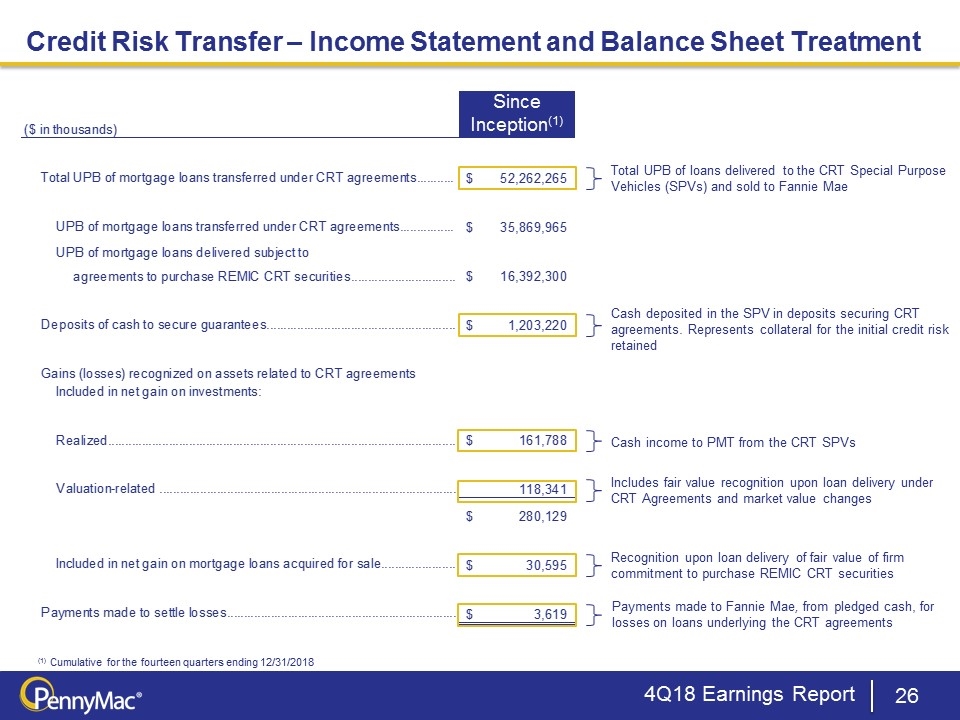

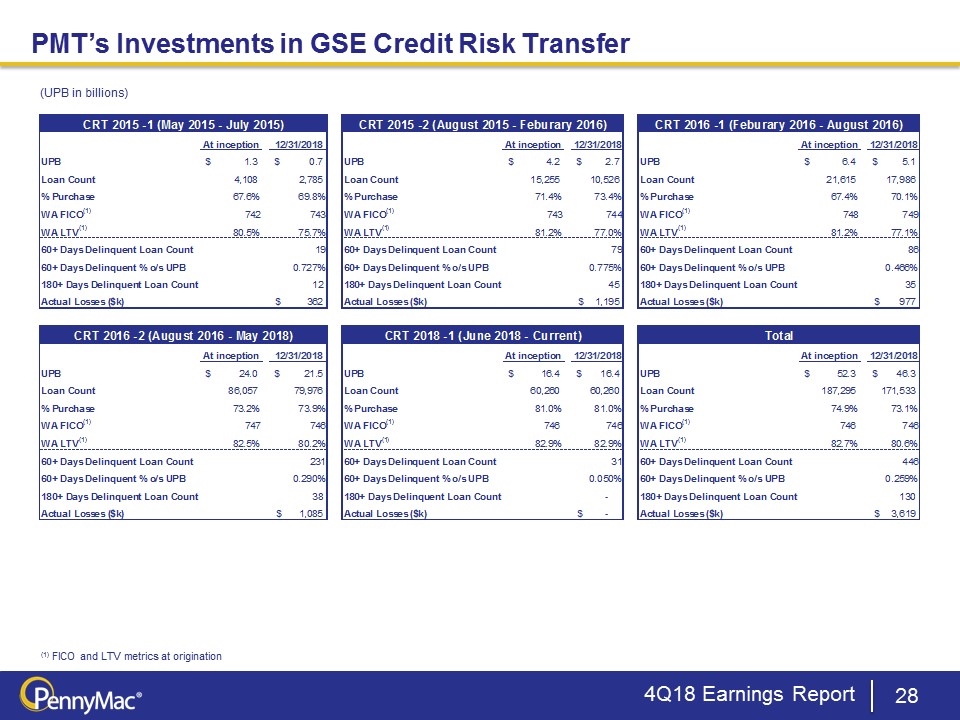

During the quarter, PMT continued to deliver to Fannie Mae loans eligible for CRT investments under a new REMIC structure. The Company also settled its fourth CRT transaction with Fannie Mae in the quarter.

4

The Credit Sensitive Strategies segment recorded net gain on mortgage loans acquired for sale of $14.0 million, up from $12.3 million in the prior quarter, which represents the recognition of the fair value of firm commitments to acquire CRT securities under the REMIC structure. The quarter-over-quarter increase in net gain on mortgage loans acquired for sale was driven by the higher volume of loans delivered into CRT investments resulting from increased loan production activity.

Net gain on investments was $12.2 million, down 54 percent from the prior quarter.

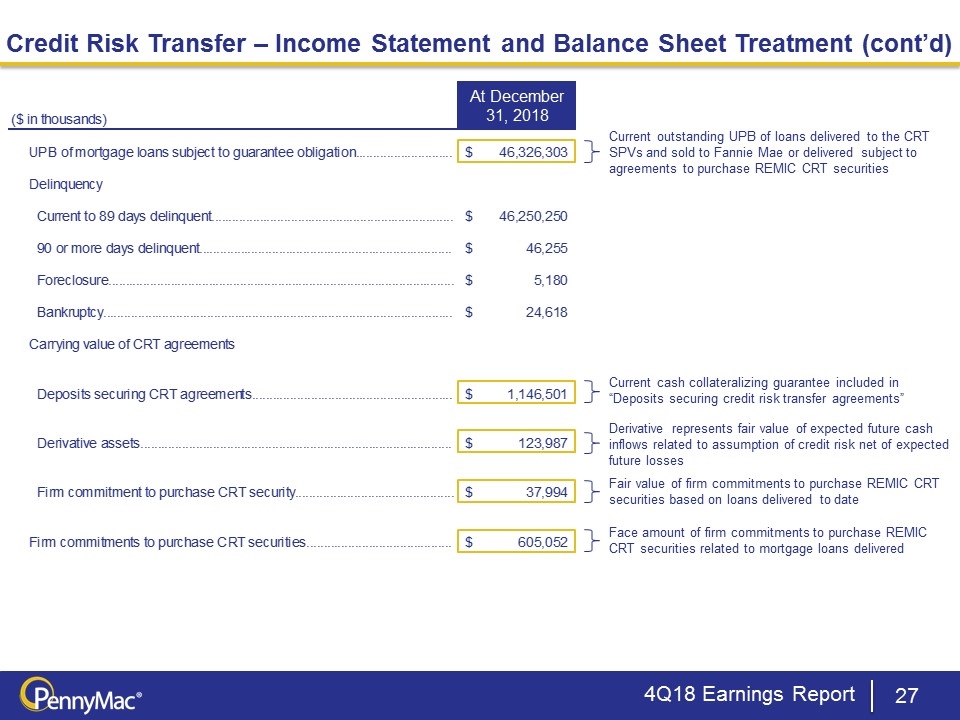

Net gain on CRT investments was $9.8 million, compared to $29.5 million in the prior quarter. Net gain on CRT investments included $19.6 million in valuation-related losses, driven by declines in fair value from credit spread widening and increased market volatility. Net gain on CRT investments also included $30.1 million in realized gains and carry on CRT investments, up from $27.0 million in the prior quarter, as well as losses recognized during the quarter of $0.7 million, up from $0.4 million in the prior quarter, reflecting portfolio seasoning and in line with expectations.

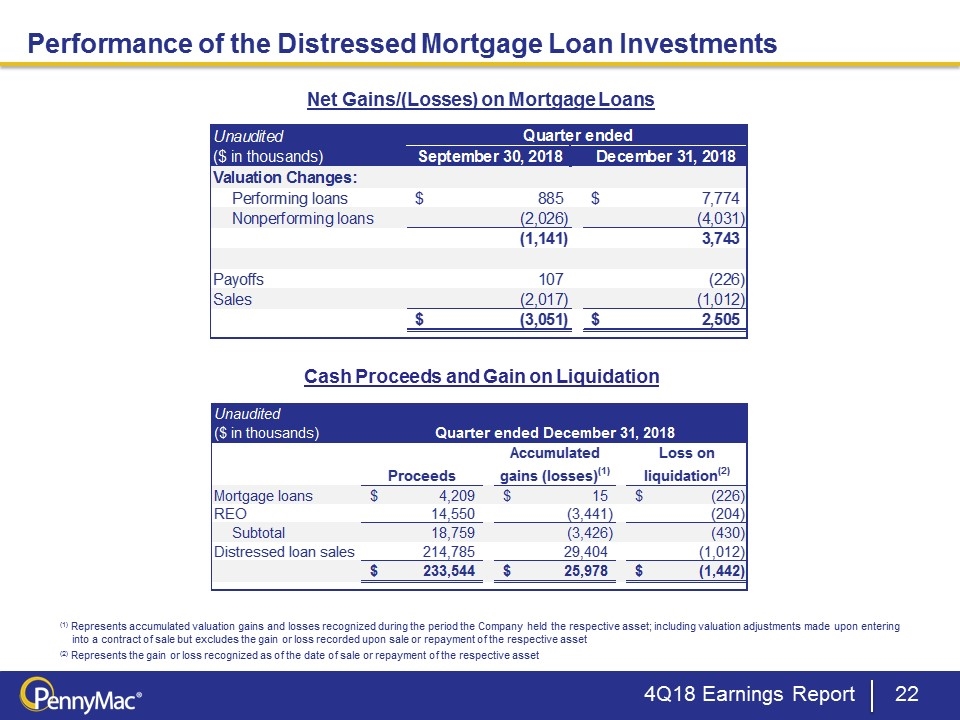

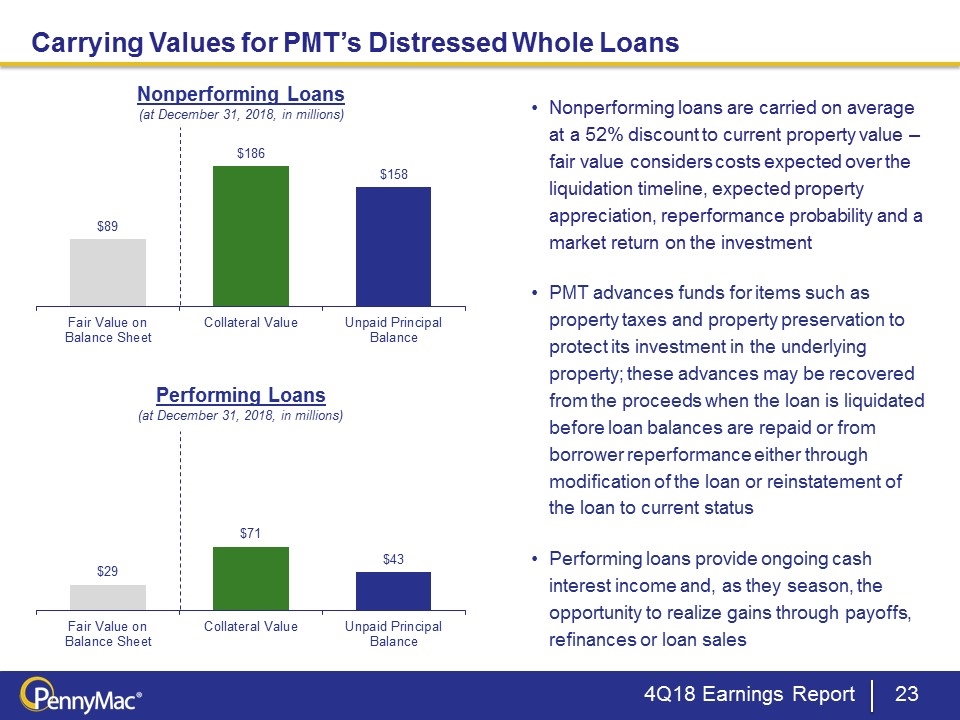

PMT’s distressed mortgage loan portfolio generated realized and unrealized gains totaling $2.5 million, compared to a loss of $3.1 million in the prior quarter. Fair value gains on performing loans in the distressed portfolio were $7.7 million, while fair value losses on nonperforming loans were $4.0 million.

Net interest expense for the segment totaled $2.5 million, compared to $0.1 million in the prior quarter. Interest income totaled $10.2 million, a 17 percent increase from the prior quarter, driven by an increase in deposits securing CRT agreements resulting from the settlement of our fourth CRT transaction during the quarter. Interest expense totaled $12.7 million, up from $8.8 million in the prior quarter, resulting from the growth in CRT investments subject to financing arrangements.

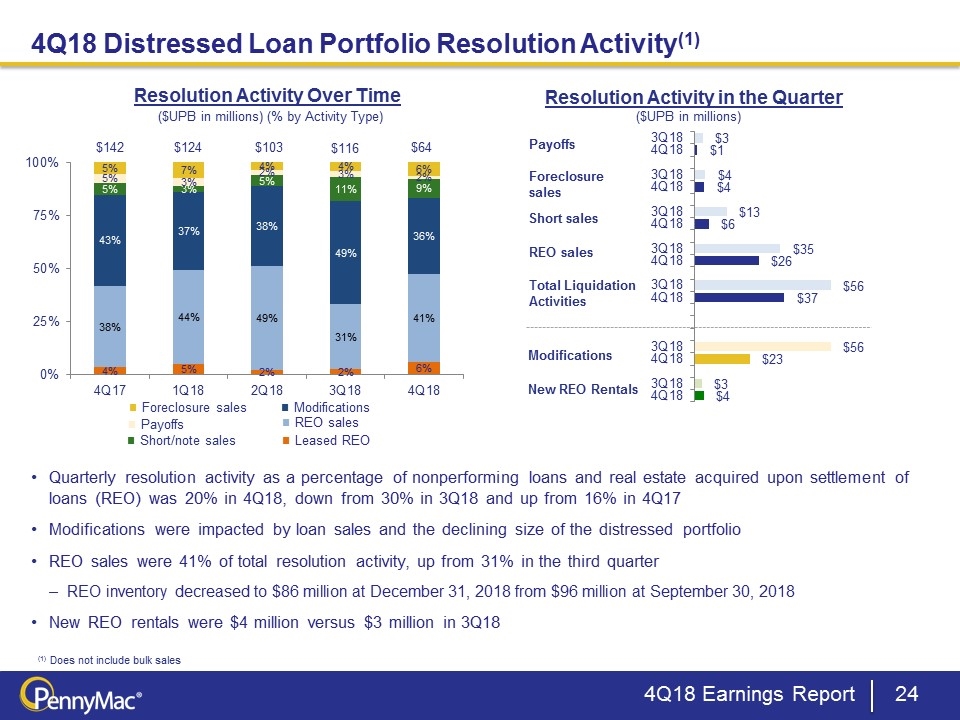

Other investment losses were $1.4 million, compared to a gain of $1.5 million in the prior quarter, driven by costs related to ongoing reduction of the real estate acquired in the settlement of loans (REO) portfolio. At quarter end, PMT’s inventory of REO properties totaled $85.7 million, down from $95.6 million at September 30, 2018.

5

Segment expenses were $4.4 million, down 36 percent from the prior quarter driven by servicing advance recoveries and lower professional services expense.

Interest Rate Sensitive Strategies Segment

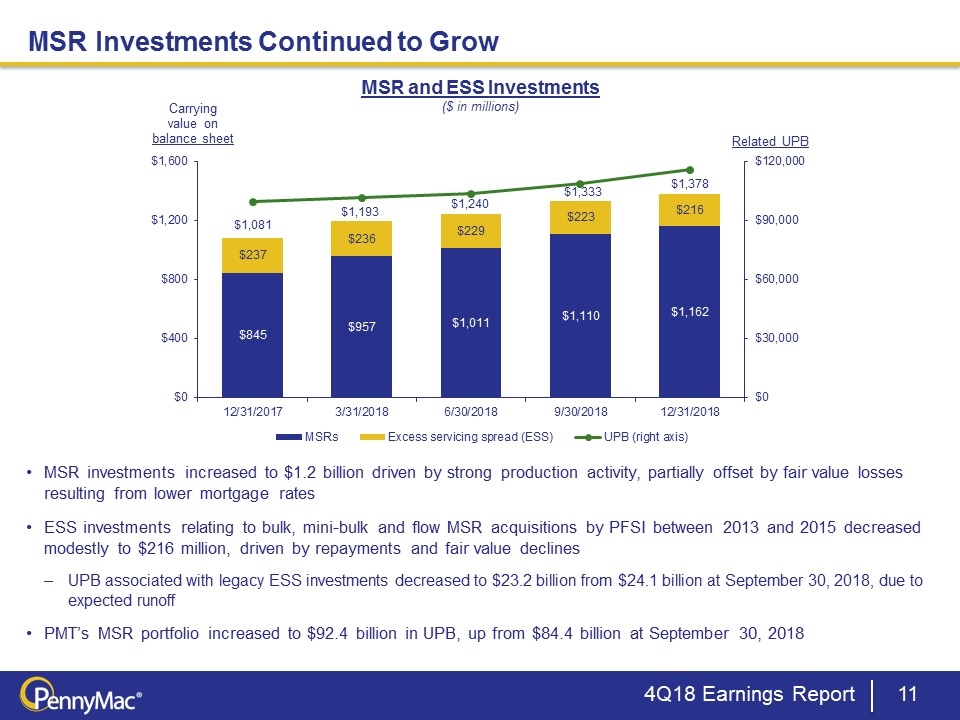

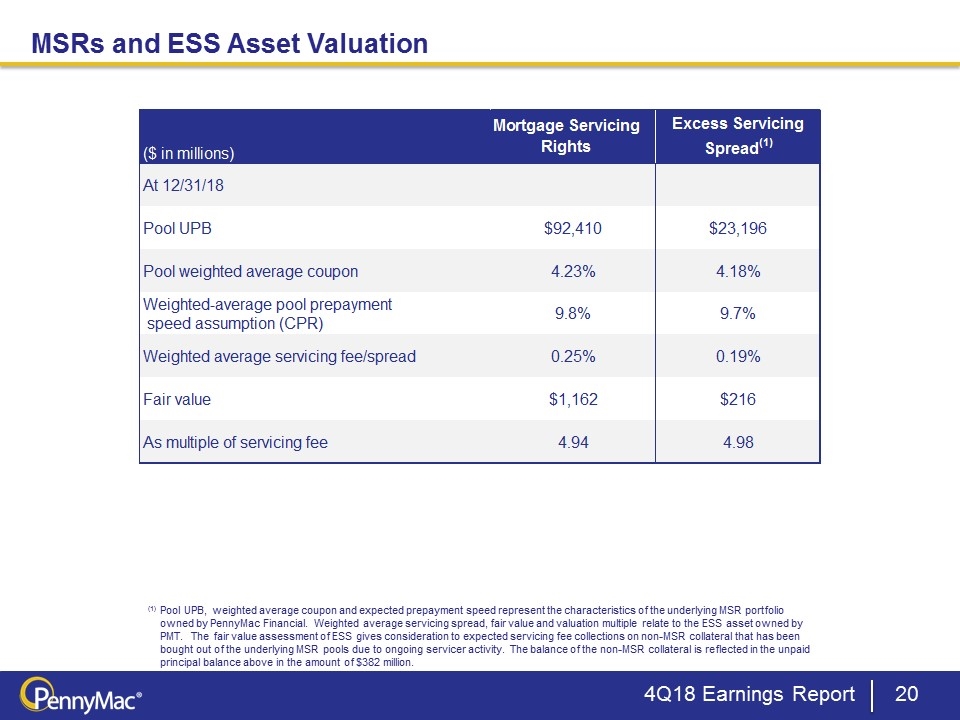

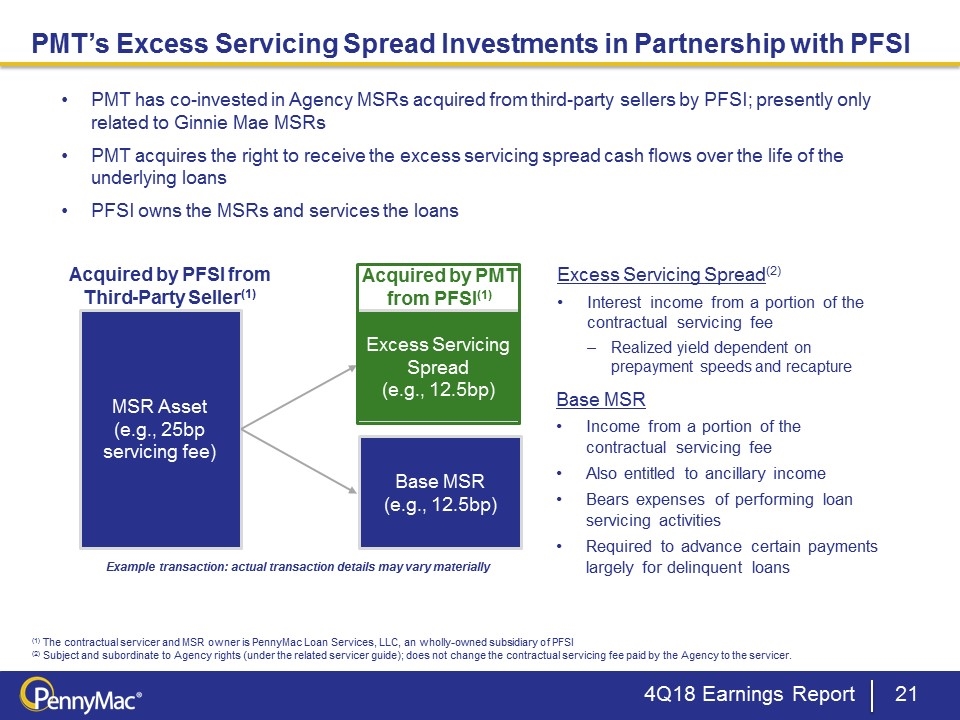

The Interest Rate Sensitive Strategies segment includes results from investments in MSRs, ESS, Agency mortgage-backed securities (MBS), non-Agency senior MBS and interest rate hedges. Pretax income for the segment was $20.1 million on revenues of $30.2 million, compared to pretax income of $24.1 million on revenues of $33.2 million in the prior quarter. The segment includes investments that typically have offsetting fair value exposures to changes in interest rates. For example, in a period with increasing interest rates, MSRs and ESS typically increase in fair value whereas Agency MBS typically decrease in value.

The results in the Interest Rate Sensitive Strategies segment consist of net gains and losses on investments, net interest income and net loan servicing fees, as well as associated expenses.

Net gain on investments for the segment totaled $34.5 million, primarily consisting of $39.1 million of gains on MBS, partially offset by a $5.2 million loss in the value of hedging derivatives.

Net interest income for the segment was $3.2 million compared to $5.5 million in the prior quarter. Interest income totaled $32.9 million, up from $30.6 million in the prior quarter primarily driven by growth in the MBS portfolio. Interest expense totaled $29.7 million, up from $25.1 million in the prior quarter, driven by increased financing costs from higher short-term interest rates and a larger MSR asset.

Net mortgage loan servicing fees resulted in a loss of $7.5 million, compared to a gain of $44.4 million in the prior quarter. Net mortgage loan servicing fees included $57.4 million in servicing fees and $1.4 million in ancillary and other fees, reduced by $34.9 million in realization of MSR cash flows. Net mortgage loan servicing fees also included a $40.9 million decrease in the fair value of MSRs, $8.8 million of related hedging gains and $0.6 million of MSR recapture income. PMT’s hedging activities are intended to manage the Company’s net exposure across all interest rate-sensitive strategies, which include MSRs, ESS and MBS.

6

The following schedule details net mortgage loan servicing fees:

|

|

Quarter ended |

|

|||||||||

|

|

December 31, 2018 |

|

|

September 30, 2018 |

|

|

December 31, 2017 |

|

|||

|

|

(in thousands) |

|

|||||||||

|

From non-affiliates: |

|

|

|

|

|

|

|

|

|

|

|

|

Servicing fees (1) |

$ |

57,400 |

|

|

$ |

49,864 |

|

|

$ |

45,553 |

|

|

Ancillary and other fees |

|

1,388 |

|

|

|

3,111 |

|

|

|

1,877 |

|

|

Effect of MSRs: |

|

|

|

|

|

|

|

|

|

|

|

|

Carried at fair value—change in fair value |

|

|

|

|

|

|

|

|

|

|

|

|

Realization of cashflows |

|

(34,863 |

) |

|

|

(30,053 |

) |

|

|

(2,806 |

) |

|

Other |

|

(40,927 |

) |

|

|

33,004 |

|

|

|

(959 |

) |

|

|

|

(75,790 |

) |

|

|

2,951 |

|

|

|

(3,765 |

) |

|

Gain on sale |

|

- |

|

|

|

- |

|

|

|

660 |

|

|

Carried at lower of amortized cost or fair value: |

|

|

|

|

|

|

|

|

|

|

|

|

Amortization |

|

- |

|

|

|

- |

|

|

|

(22,609 |

) |

|

Additions to impairment valuation allowance |

|

- |

|

|

|

- |

|

|

|

(1,589 |

) |

|

Gains (losses) on hedging derivatives |

|

8,830 |

|

|

|

(12,093 |

) |

|

|

(782 |

) |

|

|

|

(66,960 |

) |

|

|

(9,142 |

) |

|

|

(28,085 |

) |

|

|

|

(8,172 |

) |

|

|

43,833 |

|

|

|

19,345 |

|

|

From PFSI-MSR recapture income |

|

624 |

|

|

|

561 |

|

|

|

570 |

|

|

Net mortgage loan servicing fees |

$ |

(7,548 |

) |

|

$ |

44,394 |

|

|

$ |

19,915 |

|

(1) Includes contractually specified servicing and ancillary fees

Before January 1, 2018, PMT carried the majority of its MSRs at the lower of amortized cost or fair value. Beginning January 1, 2018, and prospectively, the Company accounts for all MSRs at fair value.

MSR valuation losses were primarily driven by a decrease in mortgage rates at quarter end, resulting in expectations for higher prepayment activity in the future. ESS investments also declined in value from a decrease in mortgage rates; however, the valuation losses were more than offset by higher recapture income from PFSI for prepayment activity during the quarter. PMT generally benefits from recapture income when the prepayment of a loan underlying PMT’s ESS results from refinancing by PFSI.

Segment expenses were $10.0 million, a 10 percent increase from the prior quarter, primarily driven by higher servicing expenses on a growing MSR portfolio.

7

Correspondent Production Segment

PMT acquires newly originated mortgage loans from correspondent sellers and typically sells or securitizes the loans, resulting in current-period income and ongoing investments in MSRs and CRT related to a portion of its production. PMT’s Correspondent Production segment generated a pretax loss of $0.6 million, compared to a profit of $6.0 million in the prior quarter.

Through its correspondent production activities, PMT acquired $18.1 billion in UPB of loans and issued interest rate lock commitments totaling $19.1 billion in the fourth quarter, compared to $16.6 billion and $17.9 billion, respectively, in the third quarter. Of the correspondent acquisitions, conventional conforming and jumbo acquisitions from nonaffiliates totaled $9.1 billion and government-insured or guaranteed acquisitions totaled $8.9 billion, compared to $7.5 billion and $9.0 billion, respectively, in the prior quarter.

Segment revenues were $31.0 million, an 11 percent decrease from the prior quarter and included a net gain on mortgage loans of $3.6 million, other income of $15.0 million, which primarily consists of volume-based origination fees, and net interest income of $12.3 million. Net gain on mortgage loans acquired for sale in the quarter decreased by $8.9 million from the prior quarter, driven by heightened competition for conventional loans during the quarter. Net interest income increased $2.5 million from the prior quarter, primarily driven by production volume growth and the corresponding recognition of incentives the Company is currently entitled to receive under one of its master repurchase agreements to finance mortgage loans that satisfy certain consumer relief characteristics. These incentives totaled $8.7 million, up from $5.0 million in the third quarter. The Company expects that it will cease to accrue incentives under this repurchase agreement beginning in the second quarter of 2019. While there can be no assurance, the Company expects that the loss of any such incentives could be partially offset by an improvement in pricing margins.

Segment expenses were $31.6 million, up 10 percent from the prior quarter from increased production activity, partially offset by a reduction in the weighted average fulfillment fee during the quarter. The weighted average fulfillment fee rate in the fourth quarter was 32 basis points, down from 35 basis points in the prior quarter, reflecting discretionary reductions made by PFSI to facilitate successful loan acquisitions by PMT.

8

The Corporate segment includes interest income from cash and short-term investments, management fees and corporate expenses.

Segment revenues were $417,000, down from $611,000 in the prior quarter.

Management fees were $6.6 million, up 1 percent from the prior quarter primarily driven by a 10 percent increase in incentive fees paid to PFSI in the fourth quarter based on PMT’s profitability.

Other segment expenses were $5.1 million, down from $5.6 million in the prior quarter.

Taxes

PMT recorded an income tax benefit of $15.4 million compared to a $5.1 million expense in the prior quarter, resulting from net losses driven by fair value declines in PMT’s taxable subsidiary.

***

Executive Chairman Stanford L. Kurland concluded, “PMT’s partnership with PFSI and exclusive access to unique investments in GSE CRT and MSRs from its own conventional correspondent production have delivered strong results, placing PMT among the top performing residential mortgage REIT stocks in 2018. We remain focused on prudently growing PMT’s core investments in CRT and MSRs while continuing to seek attractive new opportunities in the dynamic U.S. mortgage market. The recent launch of HELOC and prime non-QM loan products by our manager and service provider, PennyMac Financial, is expected to leverage PMT’s ability to securitize and retain credit risk investments from securitizations while further diversifying its investment portfolio.”

Management’s slide presentation will be available in the Investor Relations section of the Company’s website at www.pennymac-REIT.com beginning at 1:30 p.m. (Pacific Standard Time) on Thursday, February 7, 2019.

9

About PennyMac Mortgage Investment Trust

PennyMac Mortgage Investment Trust is a mortgage real estate investment trust (REIT) that invests primarily in residential mortgage loans and mortgage-related assets. PMT is externally managed by PNMAC Capital Management, LLC, a wholly-owned subsidiary of PennyMac Financial Services, Inc. (NYSE: PFSI). Additional information about PennyMac Mortgage Investment Trust is available at www.PennyMac-REIT.com.

This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, regarding management’s beliefs, estimates, projections and assumptions with respect to, among other things, the Company’s financial results, future operations, business plans and investment strategies, as well as industry and market conditions, all of which are subject to change. Words like “believe,” “expect,” “anticipate,” “promise,” “plan,” and other expressions or words of similar meanings, as well as future or conditional verbs such as “will,” “would,” “should,” “could,” or “may” are generally intended to identify forward-looking statements. Actual results and operations for any future period may vary materially from those projected herein and from past results discussed herein. Factors which could cause actual results to differ materially from historical results or those anticipated include, but are not limited to: changes in our investment objectives or investment or operational strategies, including any new lines of business or new products and services that may subject us to additional risks; volatility in our industry, the debt or equity markets, the general economy or the real estate finance and real estate markets specifically; events or circumstances which undermine confidence in the financial markets or otherwise have a broad impact on financial markets; changes in general business, economic, market, employment and political conditions, or in consumer confidence and spending habits from those expected; declines in real estate or significant changes in U.S. housing prices or activity in the U.S. housing market; the availability of, and level of competition for, attractive risk-adjusted investment opportunities in mortgage loans and mortgage-related assets that satisfy our investment objectives; the inherent difficulty in winning bids to acquire mortgage loans, and our success in doing so; the concentration of credit risks to which we are exposed; the degree and nature of our competition; the availability, terms and deployment of short-term and long-term capital; the adequacy of our cash reserves and working capital; our ability to maintain the

10

desired relationship between our financing and the interest rates and maturities of our assets; the timing and amount of cash flows, if any, from our investments; unanticipated increases or volatility in financing and other costs, including a rise in interest rates; the performance, financial condition and liquidity of borrowers; incomplete or inaccurate information or documentation provided by customers or counterparties, or adverse changes in the financial condition of our customers and counterparties; changes in the number of investor repurchases or indemnifications and our ability to obtain indemnification or demand repurchase from our correspondent sellers; increased rates of delinquency, default and/or decreased recovery rates on our investments; increased prepayments of the mortgages and other loans underlying our mortgage-backed securities or relating to our mortgage servicing rights, excess servicing spread and other investments; our exposure to market risk and declines in credit quality and credit spreads; the degree to which our hedging strategies may or may not protect us from interest rate volatility; the effect of the accuracy of or changes in the estimates we make about uncertainties, contingencies and asset and liability valuations when measuring and reporting upon our financial condition and results of operations; changes in regulations or the occurrence of other events that impact the business, operation or prospects of government sponsored enterprises; changes in government support of homeownership; changes in governmental regulations, accounting treatment, tax rates and similar matters; our ability to mitigate cybersecurity risks and cyber incidents; our exposure to risks of loss with real estate investments resulting from adverse weather conditions and man-made or natural disasters; our ability to satisfy complex rules in order to qualify as a REIT for U.S. federal income tax purposes; our ability to make distributions to our shareholders in the future; and our organizational structure and certain requirements in our charter documents. You should not place undue reliance on any forward-looking statement and should consider all of the uncertainties and risks described above, as well as those more fully discussed in reports and other documents filed by the Company with the Securities and Exchange Commission from time to time. The Company undertakes no obligation to publicly update or revise any forward-looking statements or any other information contained herein, and the statements made in this press release are current as of the date of this release only.

11

PENNYMAC MORTGAGE INVESTMENT TRUST AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

|

|

December 31, 2018 |

|

|

September 30, 2018 |

|

|

December 31, 2017 |

|

|||

|

|

(in thousands except share amounts) |

|

|||||||||

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

Cash |

$ |

59,845 |

|

|

$ |

88,929 |

|

|

$ |

77,647 |

|

|

Short-term investments |

|

74,850 |

|

|

|

26,736 |

|

|

|

18,398 |

|

|

Mortgage-backed securities at fair value |

|

2,610,422 |

|

|

|

2,126,507 |

|

|

|

989,461 |

|

|

Mortgage loans acquired for sale at fair value |

|

1,643,957 |

|

|

|

1,949,432 |

|

|

|

1,269,515 |

|

|

Mortgage loans at fair value |

|

408,305 |

|

|

|

633,168 |

|

|

|

1,089,473 |

|

|

Excess servicing spread purchased from PennyMac Financial Services, Inc. |

|

216,110 |

|

|

|

223,275 |

|

|

|

236,534 |

|

|

Firm commitment to purchase credit risk transfer security at fair value |

|

37,994 |

|

|

|

18,749 |

|

|

|

- |

|

|

Derivative assets |

|

167,165 |

|

|

|

143,577 |

|

|

|

113,881 |

|

|

Real estate acquired in settlement of loans |

|

85,681 |

|

|

|

95,605 |

|

|

|

162,865 |

|

|

Real estate held for investment |

|

43,110 |

|

|

|

45,971 |

|

|

|

44,224 |

|

|

Mortgage servicing rights |

|

1,162,369 |

|

|

|

1,109,741 |

|

|

|

844,781 |

|

|

Servicing advances |

|

67,666 |

|

|

|

48,056 |

|

|

|

77,158 |

|

|

Deposits securing credit risk transfer agreements |

|

1,146,501 |

|

|

|

662,624 |

|

|

|

588,867 |

|

|

Due from PennyMac Financial Services, Inc. |

|

4,077 |

|

|

|

2,351 |

|

|

|

4,154 |

|

|

Other assets |

|

85,309 |

|

|

|

92,857 |

|

|

|

87,975 |

|

|

Total assets |

$ |

7,813,361 |

|

|

$ |

7,267,578 |

|

|

$ |

5,604,933 |

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

Assets sold under agreements to repurchase |

$ |

4,777,027 |

|

|

$ |

4,394,500 |

|

|

$ |

3,180,886 |

|

|

Mortgage loan participation and sale agreements |

|

178,639 |

|

|

|

31,578 |

|

|

|

44,488 |

|

|

Notes payable |

|

445,573 |

|

|

|

445,318 |

|

|

|

- |

|

|

Asset-backed financing of a variable interest entity at fair value |

|

276,499 |

|

|

|

278,113 |

|

|

|

307,419 |

|

|

Exchangeable senior notes |

|

248,350 |

|

|

|

248,053 |

|

|

|

247,186 |

|

|

Assets sold to PennyMac Financial Services, Inc. under agreement to repurchase |

|

131,025 |

|

|

|

133,128 |

|

|

|

144,128 |

|

|

Interest-only security payable at fair value |

|

36,011 |

|

|

|

8,821 |

|

|

|

7,070 |

|

|

Derivative liabilities |

|

5,914 |

|

|

|

11,880 |

|

|

|

1,306 |

|

|

Accounts payable and accrued liabilities |

|

70,687 |

|

|

|

70,362 |

|

|

|

64,751 |

|

|

Due to PennyMac Financial Services, Inc. |

|

33,464 |

|

|

|

27,467 |

|

|

|

27,119 |

|

|

Income taxes payable |

|

36,526 |

|

|

|

52,382 |

|

|

|

27,317 |

|

|

Liability for losses under representations and warranties |

|

7,514 |

|

|

|

7,413 |

|

|

|

8,678 |

|

|

Total liabilities |

|

6,247,229 |

|

|

|

5,709,015 |

|

|

|

4,060,348 |

|

|

SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

Preferred shares of beneficial interest |

|

299,707 |

|

|

|

299,707 |

|

|

|

299,707 |

|

|

Common shares of beneficial interest—authorized, 500,000,000 common shares of $0.01 par value; issued and outstanding 60,951,444, 60,951,444, and 61,334,087 common shares, respectively |

|

610 |

|

|

|

610 |

|

|

|

613 |

|

|

Additional paid-in capital |

|

1,285,533 |

|

|

|

1,284,537 |

|

|

|

1,290,931 |

|

|

Accumulated deficit |

|

(19,718 |

) |

|

|

(26,291 |

) |

|

|

(46,666 |

) |

|

Total shareholders' equity |

|

1,566,132 |

|

|

|

1,558,563 |

|

|

|

1,544,585 |

|

|

Total liabilities and shareholders' equity |

$ |

7,813,361 |

|

|

$ |

7,267,578 |

|

|

$ |

5,604,933 |

|

12

PENNYMAC MORTGAGE INVESTMENT TRUST AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

|

|

For the Quarterly Periods ended |

|

|||||||||

|

|

December 31, 2018 |

|

|

September 30, 2018 |

|

|

December 31, 2017 |

|

|||

|

|

(in thousands, expect per share amounts) |

|

|||||||||

|

Investment Income |

|

|

|

|

|

|

|

|

|

|

|

|

Net mortgage loan servicing fees: |

|

|

|

|

|

|

|

|

|

|

|

|

From nonaffiliates |

$ |

(8,172 |

) |

|

$ |

43,833 |

|

|

$ |

19,345 |

|

|

From PennyMac Financial Services, Inc. |

|

624 |

|

|

|

561 |

|

|

|

570 |

|

|

|

|

(7,548 |

) |

|

|

44,394 |

|

|

|

19,915 |

|

|

Net gain on mortgage loans acquired for sale: |

|

|

|

|

|

|

|

|

|

|

|

|

From nonaffiliates |

|

14,902 |

|

|

|

22,121 |

|

|

|

17,488 |

|

|

From PennyMac Financial Services, Inc. |

|

2,704 |

|

|

|

2,689 |

|

|

|

2,744 |

|

|

|

|

17,606 |

|

|

|

24,810 |

|

|

|

20,232 |

|

|

Mortgage loan origination fees |

|

15,010 |

|

|

|

12,424 |

|

|

|

9,683 |

|

|

Net gain (loss) on investments: |

|

|

|

|

|

|

|

|

|

|

|

|

From nonaffiliates |

|

46,609 |

|

|

|

7,977 |

|

|

|

41,847 |

|

|

From PennyMac Financial Services, Inc. |

|

107 |

|

|

|

1,706 |

|

|

|

(3,610 |

) |

|

|

|

46,716 |

|

|

|

9,683 |

|

|

|

38,237 |

|

|

Interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

From nonaffiliates |

|

63,570 |

|

|

|

58,584 |

|

|

|

39,173 |

|

|

From PennyMac Financial Services, Inc. |

|

3,554 |

|

|

|

3,740 |

|

|

|

3,940 |

|

|

|

|

67,124 |

|

|

|

62,324 |

|

|

|

43,113 |

|

|

Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

To nonaffiliates |

|

51,905 |

|

|

|

44,797 |

|

|

|

33,397 |

|

|

To PennyMac Financial Services, Inc. |

|

1,776 |

|

|

|

1,812 |

|

|

|

2,092 |

|

|

|

|

53,681 |

|

|

|

46,609 |

|

|

|

35,489 |

|

|

Net interest income |

|

13,443 |

|

|

|

15,715 |

|

|

|

7,624 |

|

|

Results of real estate acquired in settlement of loans |

|

(2,953 |

) |

|

|

(310 |

) |

|

|

(4,101 |

) |

|

Other |

|

1,628 |

|

|

|

1,785 |

|

|

|

2,113 |

|

|

Net investment income |

|

83,902 |

|

|

|

108,501 |

|

|

|

93,703 |

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Earned by PennyMac Financial Services, Inc.: |

|

|

|

|

|

|

|

|

|

|

|

|

Mortgage loan fulfillment fees |

|

28,591 |

|

|

|

26,256 |

|

|

|

19,175 |

|

|

Mortgage loan servicing fees (1) |

|

11,524 |

|

|

|

10,071 |

|

|

|

11,077 |

|

|

Management fees |

|

6,559 |

|

|

|

6,482 |

|

|

|

5,900 |

|

|

Mortgage loan collection and liquidation |

|

953 |

|

|

|

2,747 |

|

|

|

1,507 |

|

|

Compensation |

|

1,369 |

|

|

|

1,924 |

|

|

|

1,404 |

|

|

Mortgage loan origination |

|

2,582 |

|

|

|

2,136 |

|

|

|

1,786 |

|

|

Professional services |

|

688 |

|

|

|

2,616 |

|

|

|

1,374 |

|

|

Real estate held for investment |

|

1,799 |

|

|

|

1,713 |

|

|

|

2,037 |

|

|

Other |

|

3,635 |

|

|

|

2,894 |

|

|

|

3,496 |

|

|

Total expenses |

|

57,700 |

|

|

|

56,839 |

|

|

|

47,756 |

|

|

Income before (benefit from) provision for income taxes |

|

26,202 |

|

|

|

51,662 |

|

|

|

45,947 |

|

|

(Benefit from) provision for income taxes |

|

(15,423 |

) |

|

|

5,100 |

|

|

|

5,109 |

|

|

Net income |

|

41,625 |

|

|

|

46,562 |

|

|

|

40,838 |

|

|

Dividends on preferred shares |

|

6,235 |

|

|

|

6,235 |

|

|

|

6,235 |

|

|

Net income attributable to common shareholders |

$ |

35,390 |

|

|

$ |

40,327 |

|

|

$ |

34,603 |

|

|

Earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.58 |

|

|

$ |

0.66 |

|

|

$ |

0.53 |

|

|

Diluted |

$ |

0.55 |

|

|

$ |

0.62 |

|

|

$ |

0.50 |

|

|

Weighted average shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

60,951 |

|

|

|

60,950 |

|

|

|

64,485 |

|

|

Diluted |

|

69,418 |

|

|

|

69,417 |

|

|

|

72,952 |

|

|

Dividends declared per common share |

$ |

0.47 |

|

|

$ |

0.47 |

|

|

$ |

0.47 |

|

1 Mortgage loan servicing fees expense includes both special servicing for PMT’s distressed portfolio and subservicing for its mortgage servicing rights

13

PENNYMAC MORTGAGE INVESTMENT TRUST AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

|

|

|

Year ended December 31, |

|

|||||||||

|

|

|

2018 |

|

|

2017 |

|

|

2016 |

|

|||

|

|

|

(in thousands, except per share amounts) |

|

|||||||||

|

Net investment income |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net mortgage loan servicing fees: |

|

|

|

|

|

|

|

|

|

|

|

|

|

From nonaffiliates |

|

$ |

118,395 |

|

|

$ |

67,812 |

|

|

$ |

53,216 |

|

|

From PennyMac Financial Services, Inc. |

|

|

2,192 |

|

|

|

1,428 |

|

|

|

1,573 |

|

|

|

|

|

120,587 |

|

|

|

69,240 |

|

|

|

54,789 |

|

|

Net gain on mortgage loans acquired for sale: |

|

|

|

|

|

|

|

|

|

|

|

|

|

From nonaffiliates |

|

|

48,260 |

|

|

|

62,432 |

|

|

|

97,218 |

|

|

From PennyMac Financial Services, Inc. |

|

|

10,925 |

|

|

|

12,084 |

|

|

|

9,224 |

|

|

|

|

|

59,185 |

|

|

|

74,516 |

|

|

|

106,442 |

|

|

Mortgage loan origination fees |

|

|

43,321 |

|

|

|

40,184 |

|

|

|

41,993 |

|

|

Net gain (loss) on investments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

From nonaffiliates |

|

|

70,842 |

|

|

|

110,914 |

|

|

|

24,569 |

|

|

From PennyMac Financial Services, Inc. |

|

|

11,084 |

|

|

|

(14,530 |

) |

|

|

(17,394 |

) |

|

|

|

|

81,926 |

|

|

|

96,384 |

|

|

|

7,175 |

|

|

Interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

From nonaffiliates |

|

|

207,634 |

|

|

|

178,225 |

|

|

|

199,521 |

|

|

From PennyMac Financial Services, Inc. |

|

|

15,138 |

|

|

|

16,951 |

|

|

|

22,601 |

|

|

|

|

|

222,772 |

|

|

|

195,176 |

|

|

|

222,122 |

|

|

Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

To nonaffiliates |

|

|

167,709 |

|

|

|

143,333 |

|

|

|

141,938 |

|

|

To PennyMac Financial Services, Inc. |

|

|

7,462 |

|

|

|

8,038 |

|

|

|

7,830 |

|

|

|

|

|

175,171 |

|

|

|

151,371 |

|

|

|

149,768 |

|

|

Net interest income |

|

|

47,601 |

|

|

|

43,805 |

|

|

|

72,354 |

|

|

Results of real estate acquired in settlement of loans |

|

|

(8,786 |

) |

|

|

(14,955 |

) |

|

|

(19,118 |

) |

|

Other |

|

|

7,233 |

|

|

|

8,766 |

|

|

|

8,453 |

|

|

Net investment income |

|

|

351,067 |

|

|

|

317,940 |

|

|

|

272,088 |

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earned by PennyMac Financial Services, Inc.: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgage loan fulfillment fees |

|

|

81,350 |

|

|

|

80,359 |

|

|

|

86,465 |

|

|

Mortgage loan servicing fees |

|

|

42,045 |

|

|

|

43,064 |

|

|

|

50,615 |

|

|

Management fees |

|

|

24,465 |

|

|

|

22,584 |

|

|

|

20,657 |

|

|

Mortgage loan collection and liquidation |

|

|

7,852 |

|

|

|

6,063 |

|

|

|

13,436 |

|

|

Compensation |

|

|

6,781 |

|

|

|

6,322 |

|

|

|

7,000 |

|

|

Mortgage loan origination |

|

|

6,562 |

|

|

|

7,521 |

|

|

|

7,108 |

|

|

Professional services |

|

|

6,380 |

|

|

|

6,905 |

|

|

|

6,819 |

|

|

Real estate held for investment |

|

|

6,251 |

|

|

|

6,376 |

|

|

|

3,213 |

|

|

Other |

|

|

11,393 |

|

|

|

14,200 |

|

|

|

15,012 |

|

|

Total expenses |

|

|

193,079 |

|

|

|

193,394 |

|

|

|

210,325 |

|

|

Income before provision for (benefit from) income taxes |

|

|

157,988 |

|

|

|

124,546 |

|

|

|

61,763 |

|

|

Provision for (benefit from) income taxes |

|

|

5,190 |

|

|

|

6,797 |

|

|

|

(14,047 |

) |

|

Net income |

|

|

152,798 |

|

|

|

117,749 |

|

|

|

75,810 |

|

|

Dividends on preferred stock |

|

|

24,938 |

|

|

|

15,267 |

|

|

|

— |

|

|

Net income attributable to common shareholders |

|

$ |

127,860 |

|

|

$ |

102,482 |

|

|

$ |

75,810 |

|

|

Earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

2.09 |

|

|

$ |

1.53 |

|

|

$ |

1.09 |

|

|

Diluted |

|

$ |

1.99 |

|

|

$ |

1.48 |

|

|

$ |

1.08 |

|

|

Weighted average shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

60,898 |

|

|

|

66,144 |

|

|

|

68,642 |

|

|

Diluted |

|

|

69,365 |

|

|

|

74,611 |

|

|

|

77,109 |

|

|

Dividends declared per share |

|

$ |

1.88 |

|

|

$ |

1.88 |

|

|

$ |

1.88 |

|

14

PennyMac Mortgage Investment Trust February 7, 2019 Fourth Quarter 2018 Earnings Report Exhibit 99.2

4Q18 Earnings Report This presentation contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, regarding management’s beliefs, estimates, projections and assumptions with respect to, among other things, the Company’s financial results, future operations, business plans and investment strategies, as well as industry and market conditions, all of which are subject to change. Words like “believe,” “expect,” “anticipate,” “promise,” “plan,” and other expressions or words of similar meanings, as well as future or conditional verbs such as “will,” “would,” “should,” “could,” or “may” are generally intended to identify forward-looking statements. Actual results and operations for any future period may vary materially from those projected herein, from past results discussed herein, or illustrative examples provided herein. Factors which could cause actual results to differ materially from historical results or those anticipated include, but are not limited to: changes in our investment objectives or investment or operational strategies, including any new lines of business or new products and services that may subject us to additional risks; volatility in our industry, the debt or equity markets, the general economy or the real estate finance and real estate markets specifically, whether the result of market events or otherwise; events or circumstances which undermine confidence in the financial markets or otherwise have a broad impact on financial markets, such as the sudden instability or collapse of large depository institutions or other significant corporations, terrorist attacks, natural or man-made disasters, or threatened or actual armed conflicts; changes in general business, economic, market, employment and political conditions, or in consumer confidence and spending habits from those expected; declines in real estate or significant changes in U.S. housing prices or activity in the U.S. housing market; the availability of, and level of competition for, attractive risk-adjusted investment opportunities in mortgage loans and mortgage-related assets that satisfy our investment objectives; the inherent difficulty in winning bids to acquire mortgage loans, and our success in doing so; the concentration of credit risks to which we are exposed; the degree and nature of our competition; our dependence on our manager and servicer, potential conflicts of interest with such entities and their affiliates, and the performance of such entities; changes in personnel and lack of availability of qualified personnel at our manager, servicer or their affiliates; the availability, terms and deployment of short-term and long-term capital; the adequacy of our cash reserves and working capital; our ability to maintain the desired relationship between our financing and the interest rates and maturities of our assets; the timing and amount of cash flows, if any, from our investments; unanticipated increases or volatility in financing and other costs, including a rise in interest rates; the performance, financial condition and liquidity of borrowers; the ability of our servicer, which also provides us with fulfillment services, to approve and monitor correspondent sellers and underwrite loans to investor standards; incomplete or inaccurate information or documentation provided by customers or counterparties, or adverse changes in the financial condition of our customers and counterparties; our indemnification and repurchase obligations in connection with mortgage loans we purchase and later sell or securitize; the quality and enforceability of the collateral documentation evidencing our ownership and rights in the assets in which we invest; increased rates of delinquency, default and/or decreased recovery rates on our investments; our ability to foreclose on our investments in a timely manner or at all; increased prepayments of the mortgages and other loans underlying our mortgage-backed securities or relating to our mortgage servicing rights , excess servicing spread and other investments; the degree to which our hedging strategies may or may not protect us from interest rate volatility; the effect of the accuracy of or changes in the estimates we make about uncertainties, contingencies and asset and liability valuations when measuring and reporting upon our financial condition and results of income; our failure to maintain appropriate internal controls over financial reporting; technologies for loans and our ability to mitigate security risks and cyber intrusions; our ability to obtain and/or maintain licenses and other approvals in those jurisdictions where required to conduct our business; our ability to detect misconduct and fraud; our ability to comply with various federal, state and local laws and regulations that govern our business; developments in the secondary markets for our mortgage loan products; legislative and regulatory changes that impact the mortgage loan industry or housing market; changes in regulations or the occurrence of other events that impact the business, operations or prospects of government agencies or government-sponsored entities, or such changes that increase the cost of doing business with such entities; the Dodd-Frank Wall Street Reform and Consumer Protection Act and its implementing regulations and regulatory agencies, and any other legislative and regulatory changes that impact the business, operations or governance of mortgage lenders and/or publicly-traded companies; the Consumer Financial Protection Bureau and its issued and future rules and the enforcement thereof; changes in government support of homeownership; changes in government or government-sponsored home affordability programs; limitations imposed on our business and our ability to satisfy complex rules for us to qualify as a real estate investment trust (REIT) for U.S. federal income tax purposes and qualify for an exclusion from the Investment Company Act of 1940 and the ability of certain of our subsidiaries to qualify as REITs or as taxable REIT subsidiaries for U.S. federal income tax purposes, as applicable, and our ability and the ability of our subsidiaries to operate effectively within the limitations imposed by these rules; changes in governmental regulations, accounting treatment, tax rates and similar matters (including changes to laws governing the taxation of REITs, or the exclusions from registration as an investment company); the effect of public opinion on our reputation; the occurrence of natural disasters or other events or circumstances that could impact our operations; and our organizational structure and certain requirements in our charter documents. You should not place undue reliance on any forward-looking statement and should consider all of the uncertainties and risks described above, as well as those more fully discussed in reports and other documents filed by the Company with the Securities and Exchange Commission from time to time. The Company undertakes no obligation to publicly update or revise any forward-looking statements or any other information contained herein, and the statements made in this presentation are current as of the date of this presentation only. Forward-Looking Statements

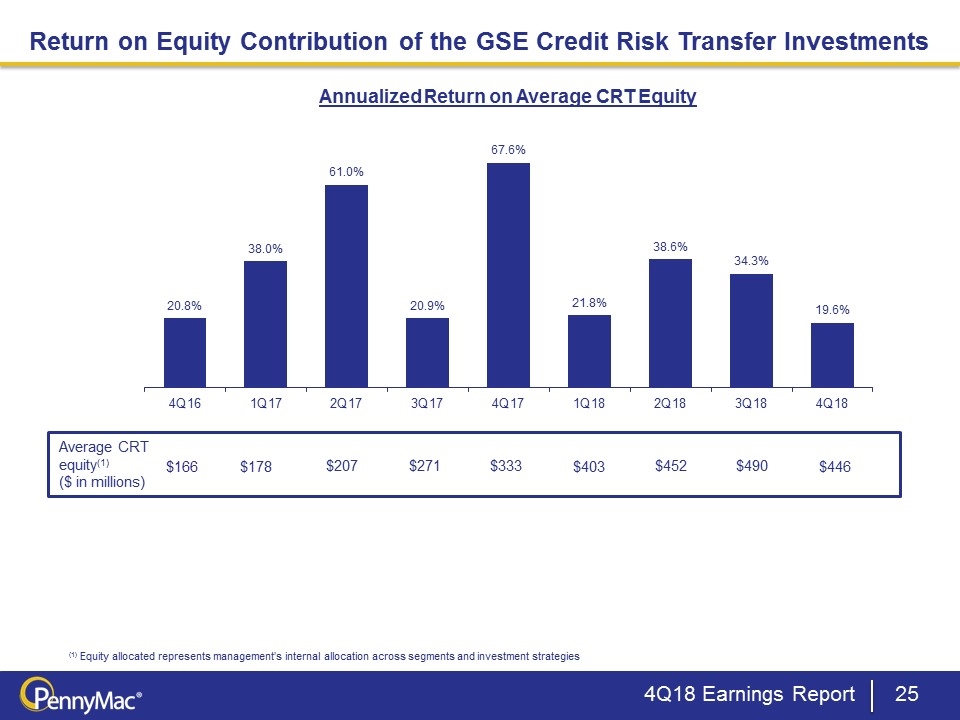

Fourth Quarter Highlights 4Q18 Earnings Report Net income attributable to common shareholders of $35.4 million; diluted earnings per common share of $0.55 Annualized return on average common equity of 11% Dividend of $0.47 per common share declared on December 21, 2018 and paid on January 28, 2019 Book value per common share increased to $20.61 from $20.48 at September 30, 2018 Results reflect solid contributions from Government-sponsored enterprise (GSE) credit risk transfer (CRT) investments and Interest Rate Sensitive strategies Fair value declines in CRT and mortgage servicing rights (MSR) investments held in PennyMac Mortgage Investment Trust’s (PMT’s) taxable subsidiary drove $15.4 million benefit for income tax expense Segment pretax results: Credit Sensitive Strategies: $17.9 million; Interest Rate Sensitive Strategies: $20.1 million; Correspondent Production: $(0.6) million; Corporate: $(11.2) million Continued investment in CRT and MSRs resulting from PMT’s correspondent production Conventional correspondent loan production from non-affiliates totaled $9.0 billion in unpaid principal balance (UPB), up 21% from the prior quarter, and conventional loan acquisitions from PennyMac Financial Services (NYSE: PFSI) totaled $0.9 billion, down 2% from the prior quarter Loans eligible for CRT investments totaled $8.1 billion in UPB, resulting in a firm commitment to purchase $310 million of CRT securities New MSR investments totaled $128 million Completed $267 million in UPB of previously announced distressed loan sales

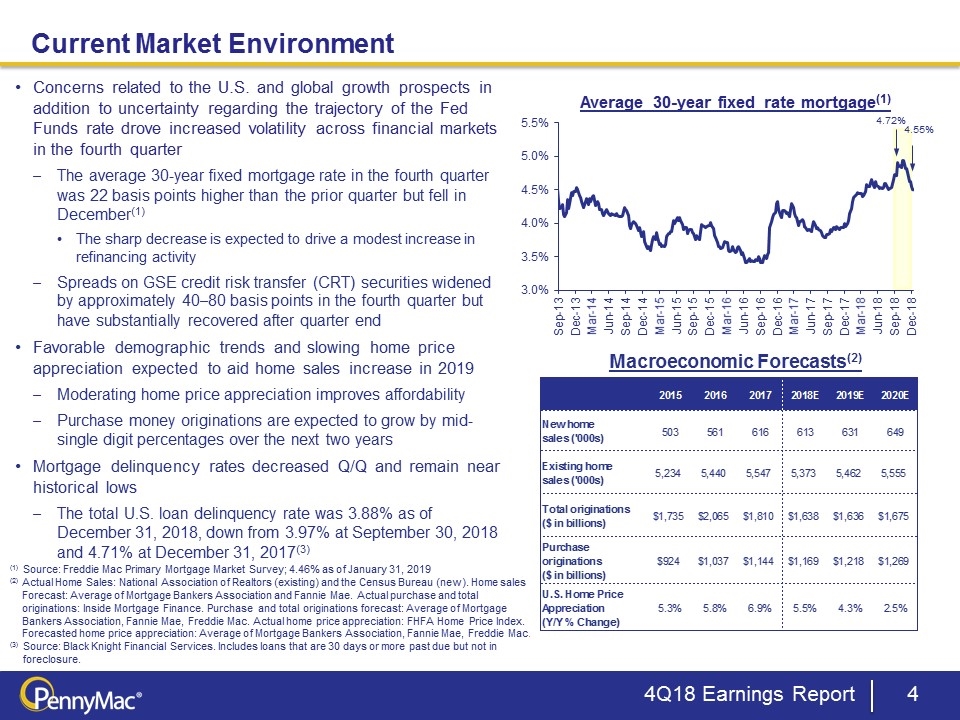

6 4 Current Market Environment 4Q18 Earnings Report Average 30-year fixed rate mortgage(1) Concerns related to the U.S. and global growth prospects in addition to uncertainty regarding the trajectory of the Fed Funds rate drove increased volatility across financial markets in the fourth quarter The average 30-year fixed mortgage rate in the fourth quarter was 22 basis points higher than the prior quarter but fell in December(1) The sharp decrease is expected to drive a modest increase in refinancing activity Spreads on GSE credit risk transfer (CRT) securities widened by approximately 40–80 basis points in the fourth quarter but have substantially recovered after quarter end Favorable demographic trends and slowing home price appreciation expected to aid home sales increase in 2019 Moderating home price appreciation improves affordability Purchase money originations are expected to grow by mid-single digit percentages over the next two years Mortgage delinquency rates decreased Q/Q and remain near historical lows The total U.S. loan delinquency rate was 3.88% as of December 31, 2018, down from 3.97% at September 30, 2018 and 4.71% at December 31, 2017(3) 4.72% 4.55% Macroeconomic Forecasts(2) (1) Source: Freddie Mac Primary Mortgage Market Survey; 4.46% as of January 31, 2019 (2) Actual Home Sales: National Association of Realtors (existing) and the Census Bureau (new). Home sales Forecast: Average of Mortgage Bankers Association and Fannie Mae. Actual purchase and total originations: Inside Mortgage Finance. Purchase and total originations forecast: Average of Mortgage Bankers Association, Fannie Mae, Freddie Mac. Actual home price appreciation: FHFA Home Price Index. Forecasted home price appreciation: Average of Mortgage Bankers Association, Fannie Mae, Freddie Mac. (3) Source: Black Knight Financial Services. Includes loans that are 30 days or more past due but not in foreclosure. 2015 2016 2017 2018E 2019E 2020E New home sales ('000s) 502.58 560.91666666666697 616.16666666666697 612.66666666666663 631 649.33333333333337 New Home Sales Existing Home Sales Total Average 30-yr Fixed Rate Mortgage Existing home sales ('000s) 5234 5440 5546.6666666666697 5373 5462 5555.333333333333 2015 0.501 5.25 5.7510000000000003 Total originations ($ in billions) $1,735 $2,065 $1,810 $1,638.3333333333333 $1,636 $1,675.3333333333333 Purchase originations ($ in billions) $924 $1,037 $1,144 $1,168.6666666666667 $1,218 $1,269 2016 0.56091666666666673 5.44 6.0009166666666669 3.6540384615384613E-2 U.S. Home Price Appreciation(Y/Y % Change) 5.3% 5.8% 6.9% 5.5% 4.3% 2.5% 2017 0.61616666666666664 5.5466666666666669 6.1628333333333334 3.9898076923076925E-2 ` 2018YTD 0.638625 5.43 6.0686249999999999 4.4707499999999997E-2 2019E 0.66300000000000003 5.5720000000000001 6.2350000000000003 4.9666666666666699E-2 2020E 0.67800000000000005 5.68 6.3579999999999997 5.1999999999999998E-2

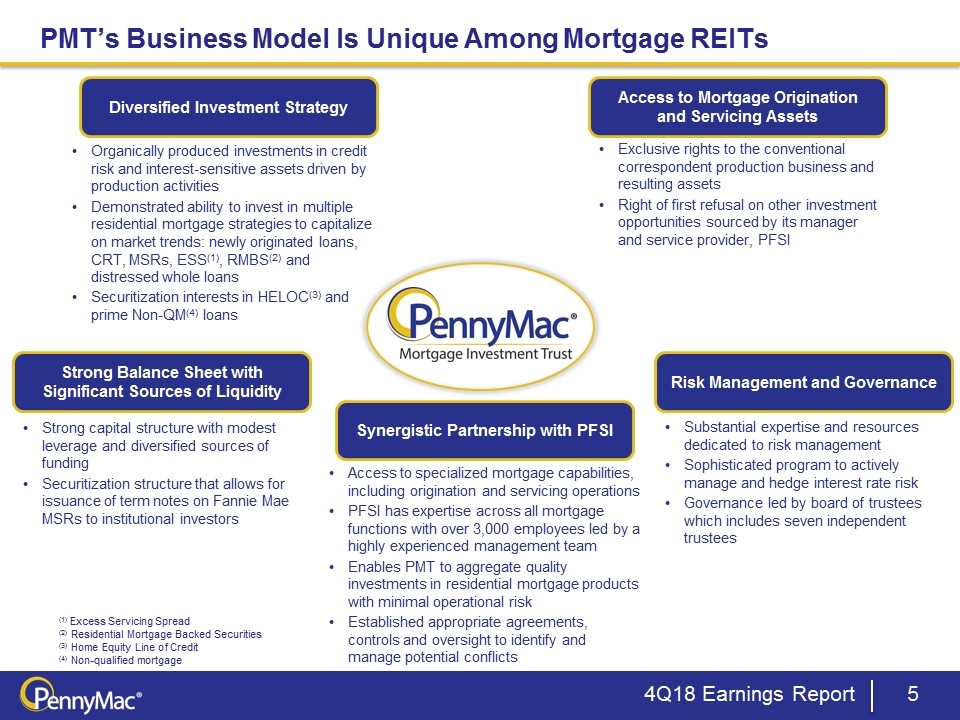

4Q18 Earnings Report PMT’s Business Model Is Unique Among Mortgage REITs Synergistic Partnership with PFSI Access to specialized mortgage capabilities, including origination and servicing operations PFSI has expertise across all mortgage functions with over 3,000 employees led by a highly experienced management team Enables PMT to aggregate quality investments in residential mortgage products with minimal operational risk Established appropriate agreements, controls and oversight to identify and manage potential conflicts Strong Balance Sheet with Significant Sources of Liquidity Strong capital structure with modest leverage and diversified sources of funding Securitization structure that allows for issuance of term notes on Fannie Mae MSRs to institutional investors Diversified Investment Strategy Access to Mortgage Origination and Servicing Assets Organically produced investments in credit risk and interest-sensitive assets driven by production activities Demonstrated ability to invest in multiple residential mortgage strategies to capitalize on market trends: newly originated loans, CRT, MSRs, ESS(1), RMBS(2) and distressed whole loans Securitization interests in HELOC(3) and prime Non-QM(4) loans Exclusive rights to the conventional correspondent production business and resulting assets Right of first refusal on other investment opportunities sourced by its manager and service provider, PFSI Risk Management and Governance Substantial expertise and resources dedicated to risk management Sophisticated program to actively manage and hedge interest rate risk Governance led by board of trustees which includes seven independent trustees (1) Excess Servicing Spread (2) Residential Mortgage Backed Securities (3) Home Equity Line of Credit (4) Non-qualified mortgage

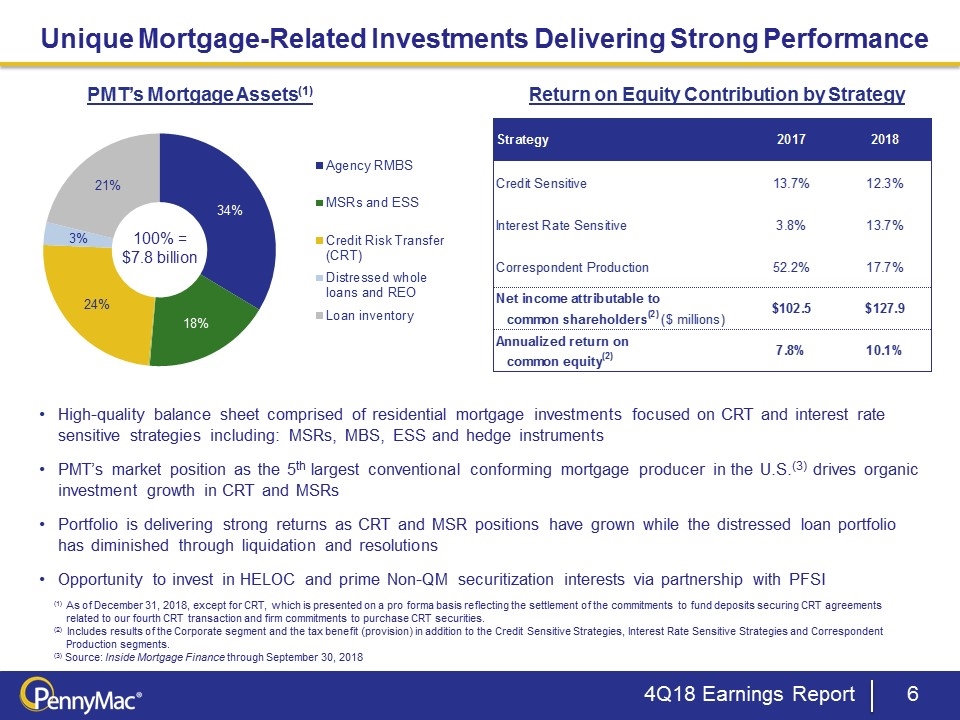

4Q18 Earnings Report PMT’s Mortgage Assets(1) (1) As of December 31, 2018, except for CRT, which is presented on a pro forma basis reflecting the settlement of the commitments to fund deposits securing CRT agreements related to our fourth CRT transaction and firm commitments to purchase CRT securities. (2) Includes results of the Corporate segment and the tax benefit (provision) in addition to the Credit Sensitive Strategies, Interest Rate Sensitive Strategies and Correspondent Production segments. (3) Source: Inside Mortgage Finance through September 30, 2018 Unique Mortgage-Related Investments Delivering Strong Performance 100% = $7.8 billion Return on Equity Contribution by Strategy High-quality balance sheet comprised of residential mortgage investments focused on CRT and interest rate sensitive strategies including: MSRs, MBS, ESS and hedge instruments PMT’s market position as the 5th largest conventional conforming mortgage producer in the U.S.(3) drives organic investment growth in CRT and MSRs Portfolio is delivering strong returns as CRT and MSR positions have grown while the distressed loan portfolio has diminished through liquidation and resolutions Opportunity to invest in HELOC and prime Non-QM securitization interests via partnership with PFSI Strategy 2017 2018 Credit Sensitive 0.13699675977905773 0.12344519566809332 Interest Rate Sensitive 3.8% 0.13671755478571881 Correspondent Production 0.5222068767292829 0.17655912422181616 Net income attributable to common shareholders(2) ($ millions) $102.4807513871 $127.85434710398999 Annualized return on common equity(2) 7.8% 0.10100072753858322

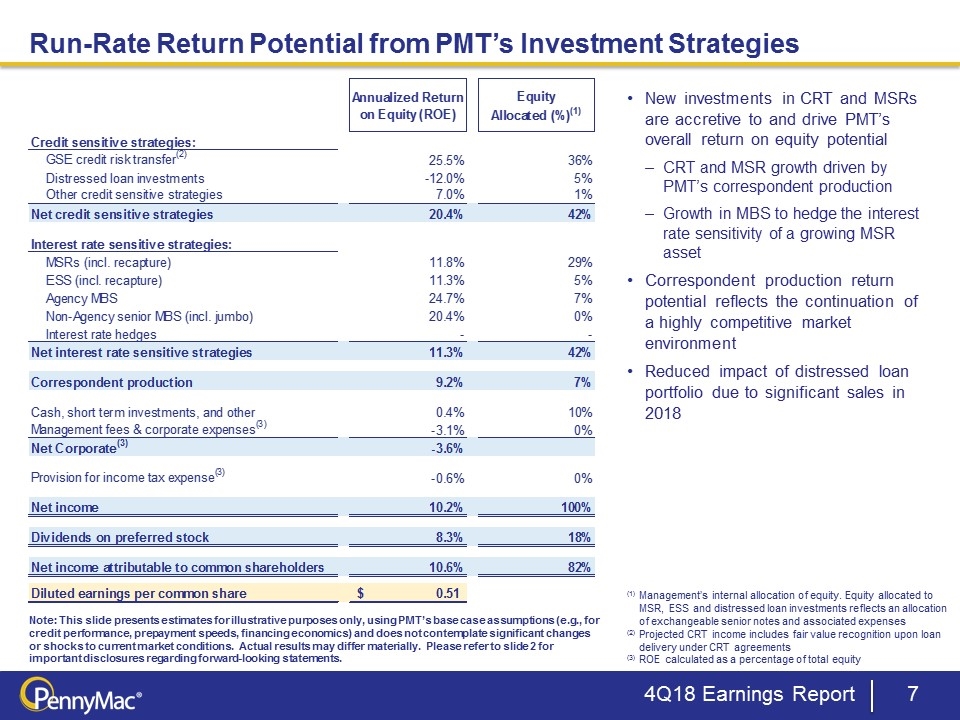

Note: This slide presents estimates for illustrative purposes only, using PMT’s base case assumptions (e.g., for credit performance, prepayment speeds, financing economics) and does not contemplate significant changes or shocks to current market conditions. Actual results may differ materially. Please refer to slide 2 for important disclosures regarding forward-looking statements. (1) Management’s internal allocation of equity. Equity allocated to MSR, ESS and distressed loan investments reflects an allocation of exchangeable senior notes and associated expenses (2) Projected CRT income includes fair value recognition upon loan delivery under CRT agreements (3) ROE calculated as a percentage of total equity Run-Rate Return Potential from PMT’s Investment Strategies 4Q18 Earnings Report New investments in CRT and MSRs are accretive to and drive PMT’s overall return on equity potential CRT and MSR growth driven by PMT’s correspondent production Growth in MBS to hedge the interest rate sensitivity of a growing MSR asset Correspondent production return potential reflects the continuation of a highly competitive market environment Reduced impact of distressed loan portfolio due to significant sales in 2018 Annualized Return on Equity (ROE) Equity Allocated (%)(1) Income Potential WA EquityAllocated Credit sensitive strategies: GSE credit risk transfer(2) 0.25536398086912793 0.35596746119225042 $37,751,451.565281868 $,591,335,574.21520925 Distressed loan investments -0.12011653094870607 5.3659365325922498E-2 $-2,676,775.9809238506 $89,139,303.633966148 Other credit sensitive strategies 6.9751518487213338 7.1637263222346726E-3 $,207,518.28362314258 $11,900,431.22798982 Net credit sensitive strategies 0.20383276766736988 0.41679055284040767 $35,282,193.867981158 $,692,375,308.87197447 Interest rate sensitive strategies: MSRs (incl. recapture) 0.11752202767412716 0.29467967751289526 $14,382,460.36550779 $,489,523,889.98703849 ESS (incl. recapture) 0.1134239698515709 4.9741358180450342E-2 $2,343,075.369210113 $82,630,683.443269029 Agency MBS 0.24685941996026184 7.135276249485871E-2 $7,315,166.4105686499 $,118,531,695.67920411 Non-Agency senior MBS (incl. jumbo) 0.2035462397541887 1.7690815265123383E-3 $,149,545.94632130093 $2,938,810.2969015613 Interest rate hedges - - $-4,618,225.7233506199 Net interest rate sensitive strategies 0.11286801638579942 0.41754287971471665 $19,572,021.707011119 $,693,625,079.4064132 Correspondent production 9.2% 6.519558509703717E-2 $2,481,110.2830245392 $,108,303,350.59426022 Cash, short term investments, and other .4% 0.10047098234783859 $,180,614.51689627167 $,166,903,081.8397049 Management fees & corporate expenses(3) -3.5% 0 $,-12,684,283.504991189 Net Corporate(3) -3.6% Provision for income tax expense(3) -0.6% 0 $-2,467,149.5445972765 Net income 0.10200898964869637 1 $42,364,507.325324625 $1,661,206,819.9566183 $0 Dividends on preferred stock 8.3% 0.18041551829038768 $6,235,937.5 $,299,707,489.41000003 Net income attributable to common shareholders 0.10614348171826021 0.81958448170961229 $36,128,569.825324625 $1,361,499,330.5466182 Diluted earnings per common share $0.51

Mortgage Investment Activities

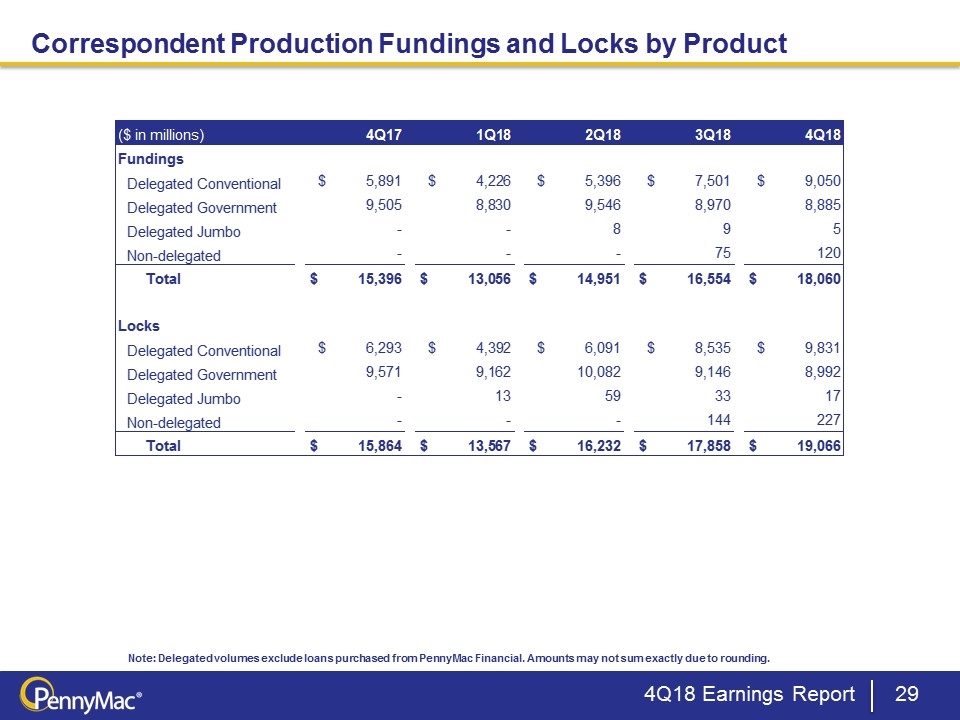

Correspondent Production Volume and Mix (UPB in billions) (1) For Government and non-delegated loans, PMT earns a sourcing fee and interest income for its holding period and does not pay a fulfillment fee (2) Conventional conforming and jumbo interest rate lock commitments (3) Based on funded loans subject to fulfillment fees. The fulfillment fee rate in 4Q18 reflects discretionary reductions made by PFSI to facilitate successful loan acquisitions. (1) Correspondent acquisitions from nonaffiliates by PMT in 4Q18 totaled $18.1 billion, up 9% Q/Q and 17% Y/Y 21% increase in conventional conforming acquisitions from 3Q18 and 54% Y/Y; 1% decrease in government acquisitions from 3Q18 and 7% Y/Y Purchase-money loans comprised 88% of total 4Q18 acquisition volume, up from 87% in 3Q18 Seller relationships growth driven by addition of non-delegated and community bank clients During 4Q18, PMT also acquired $879 million in UPB of conventional conforming loans originated by PFSI Increased conventional loan production drives additional investments in CRT and MSR January correspondent acquisitions totaled $5.2 billion; locks totaled $5.2 billion Have benefitted from incentives under a master repurchase agreement which are expected to cease starting in 2Q19; impact unclear but we expect partial offset from improvement in pricing margins Launched an innovative prime Non-QM loan product in January, offering a technology-based solution to streamline the underwriting process Plans to acquire HELOCs originated by PFSI Correspondent Production Highlights 4Q18 Earnings Report (1) (1) ($ in millions) 4Q17 1Q18 2Q18 3Q18 4Q18 QoQ YoY Fundings Delegated Conventional $5,891.1504007399999 $4,225.6310000000003 $5,396 $7,501 $9,049.7453661300024 0.20647185257032419 0.53615928138470959 Delegated Government 9504.8030605200001 8830.4058649199997 9546 8970.2080000000005 8885.1505081599989 -9.4822206842920531E-3 -6.5193623520075406E-2 Delegated Jumbo - - 8 8.6219370999999985 4.6743108199999996 -0.45785839472199341 #VALUE! Non-delegated - - - 74.54083249 119.93388573 Total(1) $15,395.95346126 $13,056.36864919999 $14,950 $16,554.370769590001 $18,059.504070839997 9.0920598686534904E-2 0.17300329052579588 Locks Delegated Conventional $6,293.2366228800001 $4,391.9986879999997 $6,091 $8,535 $9,830.61823 0.15180061277094326 0.56209257955744452 Delegated Government 9570.8870151197007 9162.2598610001005 10082 9146 8991.7640179997998 -1.6863763612530058E-2 -6.0508811378195748E-2 Delegated Jumbo - 12.89655 59 33 16.673044999999998 -0.49475621212121212 #VALUE! Non-delegated - - - 143.84402 227.10090400000001 Total $15,864.123637999701 $13,567.1550990001 $16,232 $17,857.84402 $19,066.156196999797 6.7662825123040671E-2 0.20184112479621596 Key Financial Metrics 3Q18 4Q18 Pretax income as a percentage of interest rate lock commitments(2) 6.9999999999999999E-4 0 Fulfillment Fee(3) 3.5000000000000001E-3 3.2000000000000002E-3 Selected Operational Metrics 3Q18 4Q18 Correspondent Seller Relationships 655 710 Purchase money loans, as a % of total acquisitions 0.87 0.88