Form 8-K Osmotica Pharmaceuticals For: Jun 01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 1, 2021

Osmotica Pharmaceuticals plc

(Exact name of registrant as specified in its charter)

| Ireland | 001-38709 | Not Applicable | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

| 400 Crossing Boulevard Bridgewater, NJ |

08807 | |

| (Address of principal executive offices) | (Zip Code) |

(Registrant’s telephone number, including area code): (908) 809-1300

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Ordinary Shares | OSMT | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

| Item 7.01 | Regulation FD Disclosure. |

Beginning on June 1, 2021, Osmotica Pharmaceuticals plc intends to use the presentation furnished herewith, or portions thereof, in one or more meetings or presentations with investors. A copy of the presentation is furnished as Exhibit 99.1.

The information contained in this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. |

Description | |

| 99.1 | Investor Presentation, dated June 2021 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| OSMOTICA PHARMACEUTICALS PLC | ||

| By: | /s/ Brian Markison | |

| Brian Markison Chief Executive Officer |

Date: June 1, 2021

Exhibit 99.1

Jefferies Healthcare Conference June 2021

Forward Looking Statements 1 This presentation contains forward - looking statements. You should not rely upon forward - looking statements as predictions of future events . These forward - looking statements generally can be identified by the use of words such as “anticipate,” “expect,” “plan,” “could, ” “may,” “will,” “believe,” “estimate,” “forecast,” “goal,” “project,” and other words of similar meaning. These forward - looking statemen ts address various matters including information concerning the timing of our commercial development and launch plans with respect to our products and product candidates; information concerning the commercial opportunity for UPNEEQ, including our ability to build an addressable patient audience for UPNEEQ, our ability to reach this patient audience through RVL Pharmacy, and our estimates regarding the pr oportion of the U.S. patient population that self identifies as having droopy eyelid or would otherwise purchase Upneeq ; our beliefs regarding the market opportunity for Upneeq ; estimates regarding the likelihood that eye care providers would recommend Upneeq to patients; information concerning our commercial strategy for UPNEEQ, including planned enhancements to our sales and marketing efforts and our launch into the aesthetic market and planned consumer outreach; and information concerning our strategic process and planned div estiture of our legacy business. Each forward - looking statement contained in this presentation is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statement. Applicable risks and uncertainties inclu de, among others: that our estimates regarding the commercial opportunity and addressable patient audience for UPNEEQ are inaccurate; t hat the intended effects of UPNEEQ are not experienced by patients or consumers; that we are unable to realize our planned sales and mar keting enhancements in order execute on our commercial strategy for UPNEEQ, as well as the other factors that are described in the “Risk Factors” section of our Annual Report on Form 10 - K for the year ended December 31, 2020, and in our other filings with the Securities and Exchange or Commission . We caution investors not to place considerable reliance on the forward - looking statements contained in this presentation. You are encouraged to read our filings with the SEC, available at www.sec.gov , for a discussion of these and other risks and uncertainties. The forward - looking statements in this presentation speak only as of the date of this document, and we undertake no obligation to update or revise any of these statements. Our business is subject to substantial risks and uncertainties, including those referenced abov e. Investors, potential investors, and others should give careful consideration to these risks and uncertainties . JS1

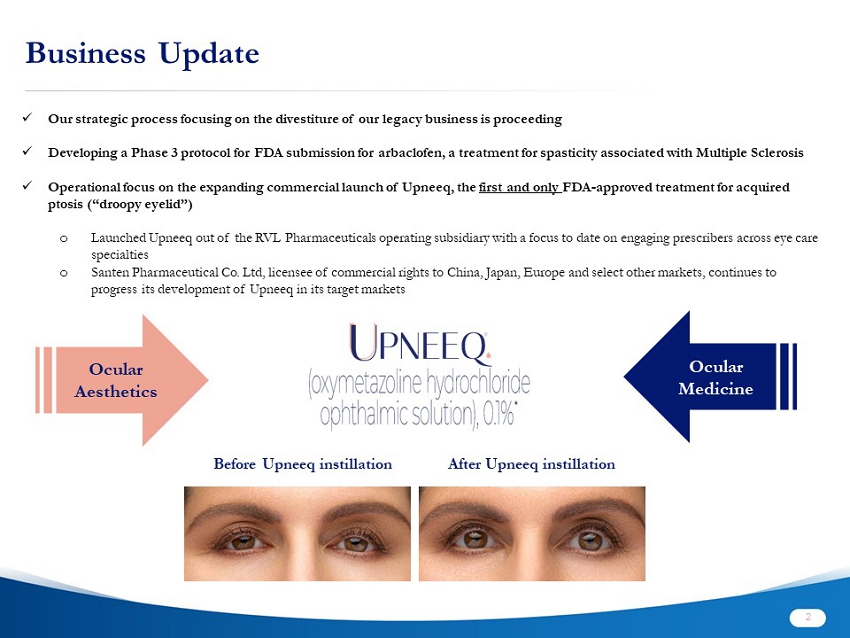

x Our strategic process focusing on the divestiture of our legacy business is proceeding x Developing a Phase 3 protocol for FDA submission for arbaclofen, a treatment for spasticity associated with Multiple Sclerosi s x Operational focus on the expanding commercial launch of Upneeq, the first and only FDA - approved treatment for acquired ptosis (“droopy eyelid”) o Launched Upneeq out of the RVL Pharmaceuticals operating subsidiary with a focus to date on engaging prescribers across eye care specialties o Santen Pharmaceutical Co. Ltd, licensee of commercial rights to China, Japan, Europe and select other markets, continues to progress its development of Upneeq in its target markets Business Update 2 Ocular Aesthetics Ocular Medicine Before Upneeq instillation After Upneeq instillation

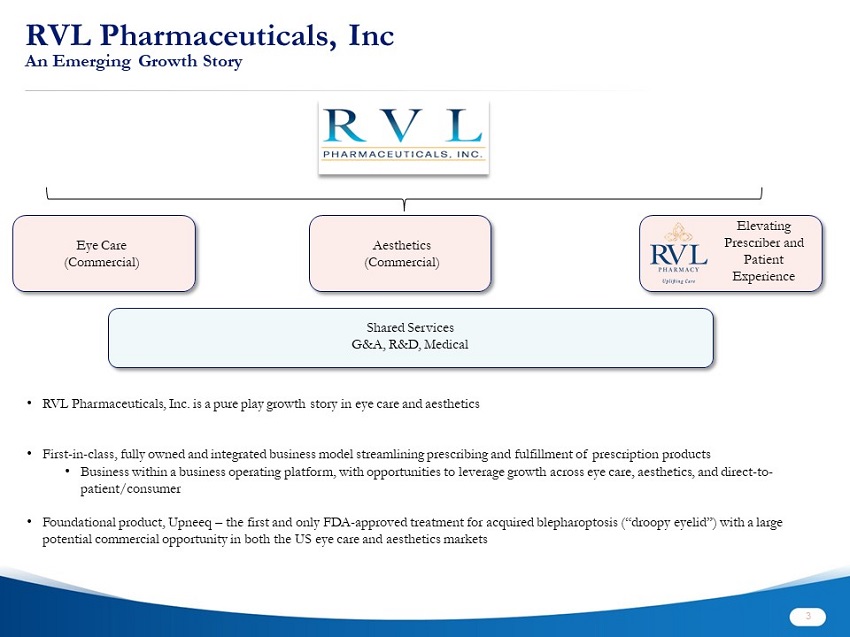

RVL Pharmaceuticals, Inc An Emerging Growth Story 3 Eye Care (Commercial) Aesthetics (Commercial) Shared Services G&A, R&D, Medical Elevating Prescriber and Patient Experience • RVL Pharmaceuticals, Inc. is a pure play growth story in eye care and aesthetics • First - in - class, fully owned and integrated business model streamlining prescribing and fulfillment of prescription products • Business within a business operating platform, with opportunities to leverage growth across eye care, aesthetics, and direct - to - patient/consumer • Foundational product, Upneeq – the first and only FDA - approved treatment for acquired blepharoptosis (“droopy eyelid ”) with a large potential commercial opportunity in both the US eye care and aesthetics markets

Upneeq: The First & Only Approved Treatment for Droopy Eyelid Administration 1 One drop administered topically to the ptotic eye(s) once daily Patients should not touch the tip of the single patient - use container to their eye or to any surface, in order to avoid eye injury or contamination of the solution 1 Description 1 Oxymetazoline hydrochloride ophthalmic solution, 0.1% Preservative - free; formulated with a balanced salt solution and the hydrophilic polymer hypromellose – Hypromellose crosslinks upon contact with the surface of the eye, acting to coat and protect the ocular surface 2 Indication 1 Upneeq is indicated for the treatment of acquired blepharoptosis (“droopy eyelid”) in adults * Patients should discard the single patient - use container immediately after dosing; contact lenses should be removed prior to installation of Upneeq and may be reinserted 15 minutes after administration; if more than one topical ophthalmic drug is being used, the drugs should be administered at least 15 minutes before applications. 1. Upneeq Œ (oxymetazoline hydrochloride ophthalmic solution), 0.1%. RVL Pharmaceuticals, Inc. 2020. 2. Larson T. Artificial tears: a primer. Available at: http://webeye.ophth.uiowa.edu/eyeforum/tutorials/artificial - tears.htm. Ac cessed October 22, 2020. November 23, 2016 . BEFORE AFTER Upneeq lifts the upper eyelid(s) and improves superior field of vision 4

Ptosis Impacts a Patient’s Vision, Appearance and Overall Daily Well - Being 1. Ho SF, Morawski A, Sampath R, Burns J. Modified visual field test for ptosis surgery (Leicester Peripheral Field Test). Eye. 2011;25:365 - 369. 2. Meyer DR, Stern JH, Jarvis JM, Lininger LL. Evaluating the visual field effects of blepharoptosis using automated static p eri metry. Ophthalmology. 1993;100:651 - 658. 3. Alniemi ST, Pang NK, Woog JJ, Bradley EA. Comparison of automated and manual perimetry in patients with blepharoptosis. Ophthal Plast Reconstr Surg. 2013;29:361 - 363. 4. Fowler BT, Pegram TA, Cutler - Peck C, et al. Contrast sensitivity testing in functional ptosis and dermatochalasis surgery. Op hthalmic Plast Reconstr Surg. 2015;31(4):272 - 274. 5. Zheng X, Yamada H, Mitani A, et al. Improvement of visual function and ocular and systemic symptoms following blepharoptosis surgery. Orbit. 2020; Epub ahead of print. 6. Finsterer J. Ptosis: causes, presentation, and management. Aesthetic Plast Surg. 2003;27:193 - 204. 7. Zoumalan CI, Lisman RD. Evaluation and management of unilateral ptosis and avoiding contralateral ptosis. Aesthet Surg J. 2010;30:320 - 328. 8. Cahill KV, Bradley EA, Meyer DR, et al. Functional indications for upper eyelid ptosis and blepharoplasty surgery: a repor t b y the American Academy of Ophthalmology. Ophthalmol . 2011;118(12):2510 - 2517. 9. Richards, HS, Jenkinson E, Rumsey N, et al. The psychological well - being and appearance concerns of patients presenting with ptosis. Eye. 2014;28(3):296 - 302. 10. McKean - Cowdin R, Varma R, Wu J, et al. Severity of visual field loss and health - related quality of life. Am J Ophthalmol . 2007;143:1013 - 1023. Ptosis can have broad negative effects across a patient’s life: Visual function ▪ Eyelid droop can cause pupil obstruction, superior peripheral visual field deficits 1 - 3 ▪ Impairs vision quality by reducing contrast sensitivity and increasing higher - order aberrations 4,5 Appearance ▪ Asymmetric or sleepy look 6,7 Activities of daily living and psychosocial well - being ▪ Reduced independence, increased appearance - related distress, anxiety, and depression, similar to levels in patients with other appearance - altering ocular conditions (e.g., strabismus) 8 - 10 5

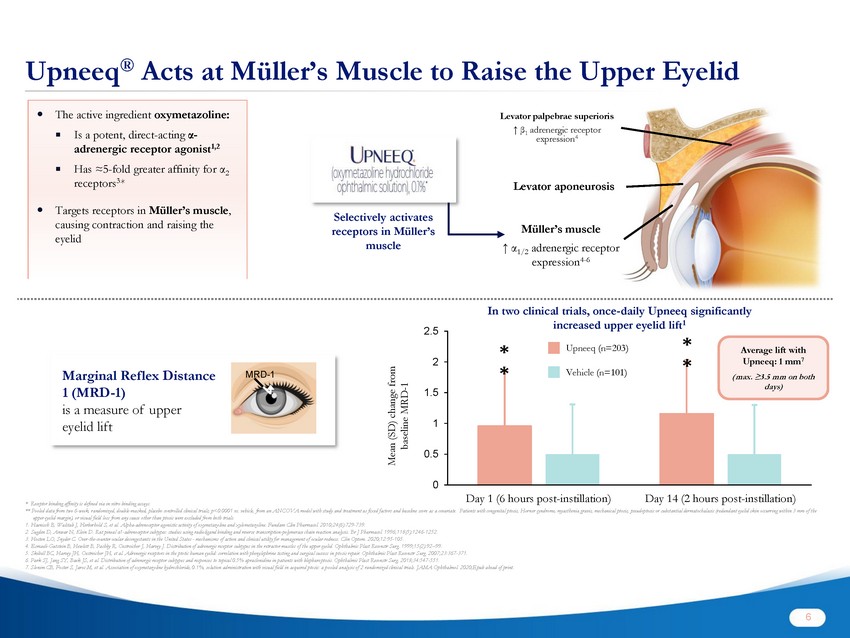

Upneeq ® Acts at Müller’s Muscle to Raise the Upper Eyelid * Receptor binding affinity is defined via in vitro binding assays. ** Pooled data from two 6 - week, randomized, double - masked, placebo controlled clinical trials; p<0.0001 vs. vehicle, from an ANC OVA model with study and treatment as fixed factors and baseline score as a covariate. Patients with congenital ptosis, Horn er syndrome, myasthenia gravis, mechanical ptosis, pseudoptosis or substantial dermatochalasis (redundant eyelid skin occurring wit hin 3 mm of the upper eyelid margin), or visual field loss from any cause other than ptosis were excluded from both trials. 1. Haenisch B, Walstab J, Herberhold S, et al. Alpha - adrenoceptor agonistic activity of oxymetazoline and xylometazoline. Fundam Clin Pharmacol . 2010;24(6):729 - 739. 2. Sugden D, Anwar N, Klein D. Rat pineal α1 - adrenoceptor subtypes: studies using radioligand binding and reverse transcription - polymerase chain reaction analysis. Br J Pharmacol . 1996;118(5):1246 - 1252. 3. Hosten LO, Snyder C. Over - the - counter ocular decongestants in the United States - mechanisms of action and clinical utility for manage ment of ocular redness. Clin Optom . 2020;12:95 - 105. 4. Esmaeli - Gutstein B, Hewlett B, Pashby R, Oestreicher J, Harvey J. Distribution of adrenergic receptor subtypes in the retractor muscles of the upper eyelid. Ophthalmic Plast Reconstr Surg. 1999;15(2):92 – 99. 5. Skibell BC, Harvey JH, Oestreicher JH, et al. Adrenergic receptors in the ptotic human eyelid: correlation with phenylephrine testing and surgical success in pt os is repair. Ophthalmic Plast Reconstr Surg. 2007;23:367 - 371. 6. Park SJ, Jang SY, Baek JS, et al. Distribution of adrenergic receptor subtypes and responses to topical 0.5% apraclonidine in patients with blepharo pt osis. Ophthalmic Plast Reconstr Surg. 2018;34:547 - 551. 7. Slonim CB, Foster S, Jaros M, et al. Association of oxymetazoline hydrochloride, 0.1%, solution administration with visual field in acquired ptosis: a p oo led analysis of 2 randomized clinical trials. JAMA Ophthalmol . 2020;Epub ahead of print. The active ingredient oxymetazoline: Is a potent, direct - acting α - adrenergic receptor agonist 1,2 Has ≈5 - fold greater affinity for α 2 receptors 3 * Targets receptors in Müller’s muscle , causing contraction and raising the eyelid Levator palpebrae superioris ↑ β 1 adrenergic receptor expression 4 Levator aponeurosis Müller’s muscle ↑ α 1/2 adrenergic receptor expression 4 - 6 Selectively activates receptors in Müller’s muscle 0 0.5 1 1.5 2 2.5 Day 1 (6 hours post-instillation) Day 14 (2 hours post-instillation) * * * * Mean (SD) change from baseline MRD - 1 Upneeq (n=203) Vehicle (n=101) Marginal Reflex Distance 1 (MRD - 1) is a measure of upper eyelid lift In two clinical trials, once - daily Upneeq significantly increased upper eyelid lift 1 MRD - 1 Average lift with Upneeq: 1 mm 7 (max. ≥3.5 mm on both days) 6

Market Building Transformative Opportunity Lies in Upneeq’s Acceptance & Appeal 7 OPH / OPT < 5,000 ECP’s OPH / OPT ~ 50,000 ECP’s DERM / AEST ~20,000 HCP’s PATIENT POTENTIAL > 50 Million Today ptosis is perceived by ECP’s as a severe condition that predominantly affects the elderly with limited tools to treat ▪ Mild and moderate ptosis is most often overlooked and undiagnosed ▪ Misperception due to historical absence of available treatment options for early Ptosis Lid assessments, and ptosis treatment, as a daily part of eye care and aesthetic practice routines Step - wise approach that positions Upneeq for long term success ▪ Establish “buy - in” and medical foundation of efficacy and safety in eye care ▪ Educate and expand increasing breadth of prescriber specialties, in eye care and beyond ▪ Consumer Education and Activation Today Building Towards the Future OPH / OPT < 5,000 ECP’s

Launch Update – Executive Summary 8 Launch - to - Date Overview Controlled launch September 2020 – December 2020 focused on a small group of ECPs where product concept and messages were tested Response to Upneeq was positive from providers and patients alike Expanded commercial launch commenced Q121 Upgraded and upsized field force and eye care coverage (9,000 ECPs sampled year - to - date) Initiated broader marketing plan and tactics focused on HCP, digital Near - Term Focus Continuing to expand the field force (100 territory target Q221 ) Answering “what’s in it for me?” for the ECP – value share program(s) Piloting and executing key marketing initiatives include small - scale digital DTC Expanding, testing, adapting marketing mix to further elevate awareness and activation of both the HCP and patient Investing in the Brand Preparing to launch into aesthetics in 2022 Scaled DTC investments to further accelerate growth across both eye care and aesthetics channels Continuing to build out the RVL Pharmaceuticals platform Front - End & Back - End Technology (Consumer, Telehealth, Pharmacy, Prescriber, B2B Account Management/Service) The image part with relationship ID rId14 was not found in the file.

Launch Update – Prescriptions & Prescribers 9 0 100 200 300 400 500 600 700 800 900 Paid Rx Accelerating Growth – Full launch ramps up second - half of Q121 with ( i ) expanded sales team, (ii) marketing and medical initiatives 0 1,000 2,000 3,000 4,000 5,000 6,000 Cummulative Prescribers 5,701 unique prescribers launch - to - date Consistently adding ~250 new prescribers each week in eye care

Launch Strategy & Current Progress Stage 1 Stage 2 Stage 3 Stage 4 t - time <1M > 50M (1) Controlled launch with ~65 territories, 650 ECP’s; small fraction of ptosis population presenting to eye care Market research suggests that a significant proportion of the US female population self - identifies as having droopy eyelid, but hasn’t discussed with an HCP 1. Company estimate of addressable patient audience COMPLETE Q4 2020 – Q2 2021 2H 2021 + 10 • KOL/Market Development to drive awareness, uptake and advocacy • Execute UP (“Uncovering Ptosis”) early experience program with leading ECPs demonstrating PoC and Brand Potential • Introduce RVL Pharma, RVL Pharmacy, and develop sales relationships with customers • Expand eye care sales footprint to increase reach • Begin to incorporate practice protocols within early adopters driving depth • Enhance sales force talent with experienced eye care professionals • Initiate aesthetic channel expansion planning and KOL development • Explore additional clinical studies that may support broader consumer opportunity (aesthetic, QoL , etc.) • Rollout of expanded HCP marketing tactics to elevate awareness and share of voice • Optimize commercial footprint • Scaled - up DTC marketing investments • Initiate any clinical studies that will support broader consumer opportunity (aesthetic, QoL, etc.) • Finalize preparation for dermatology/aesthetics launch • Rollout of prescriber value - share programs (office - based dispensing and volume based rebates) • Build depth of prescribing within optimized ECP footprint • Full - scale DTC marketing campaign • Launch into aesthetic channel; office - dispensing • Begin leveraging any further clinical data to bolster messaging for broader audience

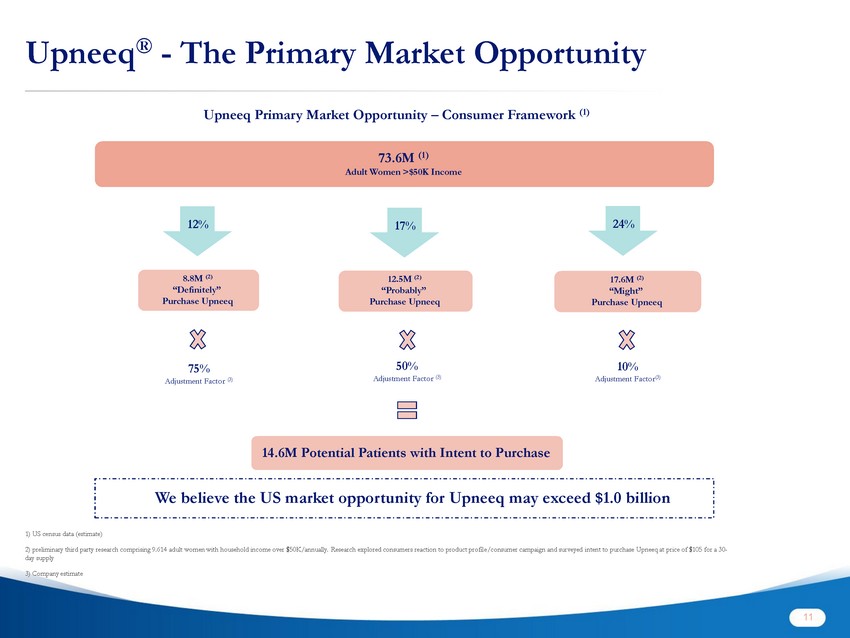

Upneeq ® - The Primary Market Opportunity 11 Upneeq Primary Market Opportunity – Consumer Framework (1) 73.6M (1) Adult Women >$50K Income 8.8M (2) “Definitely” Purchase Upneeq 12.5M (2) “Probably” Purchase Upneeq 12% 17% 17.6M (2) “Might” Purchase Upneeq 24 % 75% Adjustment Factor (3) 50% Adjustment Factor (3) 1 0% Adjustment Factor (3) 14.6M Potential Patients with Intent to Purchase 1 ) US census data (estimate) 2 ) p reliminary t hird p arty r esearch comprising 9.614 adult women with household income over $50K/annually. Research explored consumers reaction to product profil e/c onsumer campaign and surveyed intent to purchase Upneeq at price of $105 for a 30 - day supply 3) Company estimate We believe the US market opportunity for Upneeq may exceed $1.0 billion

12 Large Multi - Specialty Opportunity What percent of your patients either have eye droop / ptosis initially or acquire it from a surgery/procedure you or someone else performed? % of patients 19 28 25 22 22 39 32 24 14 18 11 20 15 18 19 15 9 8 4 11 7 14 10 7 58 45 61 46 56 30 39 55 Ophthalmologist - Cornea/Glaucoma specialist Optometrist Cosmetic - focused Dermatologist Ophthalmologist - Generalist Oculoplastic Surgeon Plastic Surgeon Aesthetics General Dermatologist Eye Care Dermatology & Aesthetics Mild Moderate Severe No Droop/Ptosis Source: HCP survey – 04/21 (N = 149)

Consumer - Activated Brand Potential (1) Potential to Amplify Demand Across Both Eye Care and Aesthetics Settings 13 58% Female consumers identifying as having a mild, moderate, or severely drooping eyelid 45% Female consumers bothered by the position of their upper eyelid 72% Female consumers that like the Upneeq product profile 75% Female consumers willing to try a free 5 - day sample of Upneeq 29% Female consumers who would “definitely” or “probably” purchase Upneeq at a price of $105 per 30 - day supply 1) Preliminary third p arty r esearch comprising 9,614 adult women with household income over $50K/annually.

Upneeq ® Raises the Upper Eyelids (as measured by MRD - 1)* Before Upneeq instillation After Upneeq instillation (2 hr) Mild ptosis *Individual results may vary. Images are of actual patients Moderate ptosis Severe ptosis 14

Near - Term Commercial Imperatives 15 Drive Eye Care Reach & Depth Consumer Awareness & Activation Frictionless Access and Distribution Strategy eg; B2B Business Model 1 3 4 Consumer Engagement Optimized Product Access ECP Engagement Aesthetics HCP Engagement Introduce Upneeq to Aesthetic Practices 2

Appendix

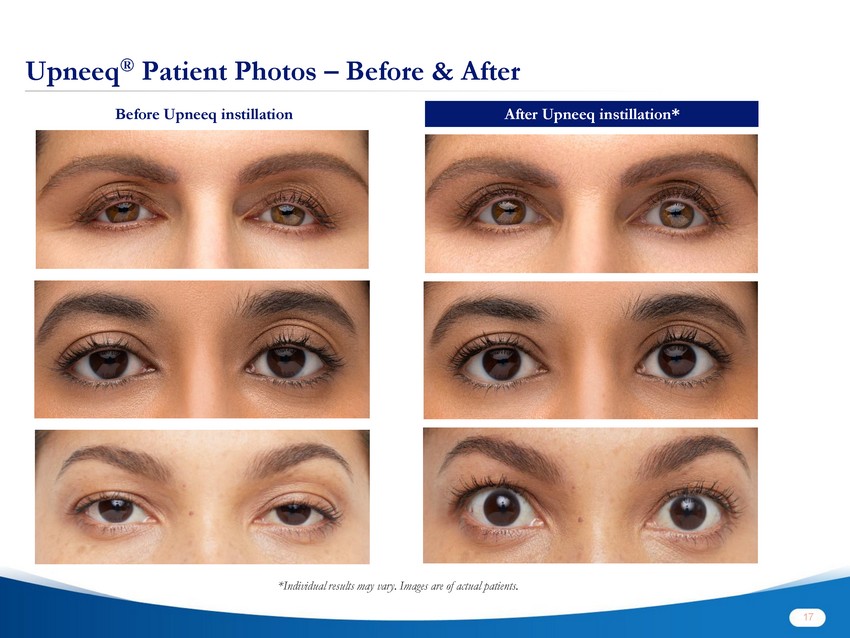

Upneeq ® Patient Photos – Before & After Before Upneeq instillation After Upneeq instillation* *Individual results may vary. Images are of actual patients. 17

Upneeq ® Patient Photos – Before & After Before Upneeq instillation After Upneeq instillation* *Individual results may vary. Images are of actual patients. 18

19 OPH / OPT < 5,000 ECP’s OPH / OPT < 5,000 ECP’s Upneeq ® Intellectual Property US Issued Method of Use (Expiry August 2031) US Issued Formulation (Expiry December 2039) Ptosis Aesthetic / Broad Treatment of ptosis with oxymetazoline without causing pupil dilation (any strength) Treatment of ptosis with 0.10% oxymetazoline (covers commercial formulation of RVL - 1201) Treatment with oxymetazoline to increase the vertical separation between eyelids without causing pupil dilation Latest Patent Expiry 2039 Latest Patent Expiry 2032 Additional IP protection in: Australia, Brazil, Canada, Korea, Mexico, New Zealand, Russia, Singapore, South Africa and Vietnam Aqueous pharmaceutically stable ophthalmic preservative - free comprising oxymetazoline 0.1% and other substances (1) Single use container comprising an aqueous pharmaceutically stable ophthalmic formulation containing oxymetazoline 0.1% and other substances (1) A n ophthalmic, sterile, preservative - free formulation comprising oxymetazoline 0.1% and other substances (1) (1) See issued patents 10,799,481 B1, 10,814,001 B1, and 10,898,573 B1 for further details Strong and growing IP portfolio with additional Orange Book patents pending

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- AEP DECLARES QUARTERLY DIVIDEND ON COMMON STOCK

- Midday movers: PepsiCo, JetBlue fall; GM, Danaher and UPS rise

- NHOA: Q1 2024 Trading and Operational update

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share