Form 8-K OMNICOM GROUP INC. For: Jul 20

Exhibit 99.1

Omnicom Group Reports Second Quarter and Year-to-Date

2021 Results

NEW YORK, July 20, 2021 - Omnicom Group Inc. (NYSE: OMC) today announced net income - Omnicom Group Inc. for the second quarter of 2021 of $348.2 million as compared to a net loss - Omnicom Group Inc. of $24.2 million in the second quarter of 2020. Diluted net income per share for the second quarter of 2021 was $1.60 per share compared to a diluted net loss per share of $0.11 in the second quarter of 2020. Net income - Omnicom Group Inc. and diluted net income per share for the second quarter of 2021 include the gain on a disposition of a subsidiary and a loss on the early retirement of our 2022 Senior Notes, of $31.0 million and $0.14 per share, respectively, as discussed below.

Net loss - Omnicom Group Inc. and diluted net loss per share - Omnicom Group Inc. in the second quarter of 2020 included a net after-tax decrease of $223.1 million and $1.03 per share, respectively, as a result of COVID-19 repositioning costs.

Omnicom’s worldwide revenue in the second quarter of 2021, which continued to improve from the negative effects of the COVID-19 pandemic, increased 27.5% to $3,571.6 million from $2,800.7 million in the second quarter of 2020. The components of the change in revenue included an increase in revenue from the positive impact of foreign currency translation of 5.4%, a decrease in acquisition revenue, net of disposition revenue of 2.2% and an increase in revenue from organic growth of 24.4%. Since the onset of the COVID-19 pandemic, the second quarter of 2020 had the most significant negative impact on our revenue.

Organic growth in the second quarter of 2021 as compared to the second quarter of 2020 increased across all of our fundamental disciplines. The percentage increases were as follows: 29.8% for Advertising, 25.0% for CRM Precision Marketing, 15.2% for CRM Commerce and Brand Consulting, 53.0% for CRM Experiential, 22.7% for CRM Execution & Support, 15.1% for Public Relations and 4.5% for Healthcare.

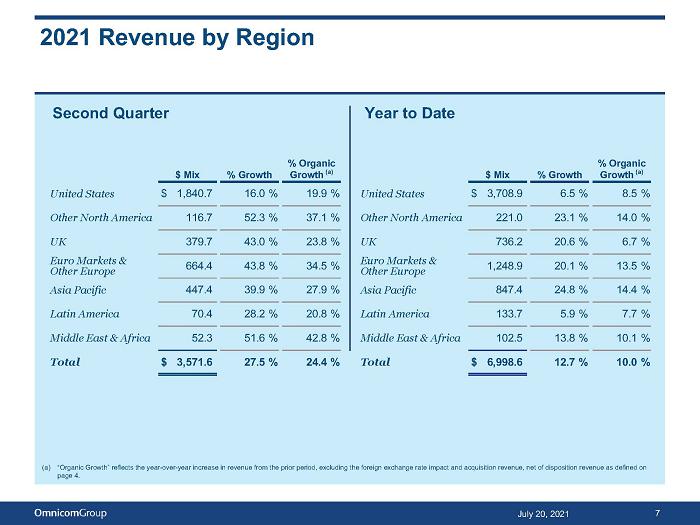

Across all of our regional markets, organic growth in the second quarter of 2021 as compared to the second quarter of 2020 was as follows: 19.9% for the United States, 37.1% for Other North America, 23.8% for the United Kingdom, 34.5% for

280 Park Avenue, New York, New York 10017 (212) 415-3672 Fax (212) 415-3000

Omnicom Group Inc.

the Euro Markets & Other Europe, 27.9% for Asia Pacific, 20.8% for Latin America and 42.8% for the Middle East & Africa.

Operating profit increased $505.9 million to $568.4 million compared to $62.5 million during the second quarter of 2020. Our operating margin for the second quarter of 2021 increased to 15.9% versus 2.2% for the second quarter of 2020.

Operating profit in the second quarter of 2021 reflects a pre-tax increase of $50.5 million arising from the gain on disposition of ICON,

a specialty media business, during the quarter. The sale of ICON is part of our continuing realignment of our portfolio of businesses

and is consistent with our strategic plan and investment priorities. The disposition is not expected to have a material impact on our

ongoing results of operations or financial position.

Operating profit in the second quarter of 2020 included a pre-tax decrease of $277.9 million due to COVID-19 repositioning costs, comprised of incremental severance charges, right-of-use asset impairments and other costs.

Interest expense in the second quarter of 2021 increased $26.6 million due to the early retirement of our 2022 Senior Notes. The retirement reduced our leverage, which had increased from the issuance of $600 million of Senior Notes due 2030 in the second quarter of 2020 to increase our liquidity in response to the pandemic.

For the second quarter of 2021, our effective income tax rate decreased period-over-period to 24.9%. The lower rate for the second quarter of 2021 was predominantly the result of a nominal tax applied against the book gain on the disposal of ICON that resulted from excess tax over book basis. Additionally, the prior year effective tax rate reflects the non-deductibility in certain jurisdictions of a portion of the COVID-19 repositioning charges recorded in the second quarter of 2020, which increased our rate.

Year-to-Date

Net income - Omnicom Group Inc. for the six months ended June 30, 2021 increased $402.0 million to $636.0 million compared to $234.0 million in the same period in 2020. Diluted net income per share - Omnicom Group Inc. for the six months ended June 30, 2021 increased $1.85 to $2.93 per share compared to $1.08 per share for the six months ended June 30, 2020. Net income - Omnicom Group Inc. and diluted net income per share for the six months ended June 30, 2021 include the gain on a disposition of a subsidiary and a loss on the early retirement

Page 2

Omnicom Group Inc.

of our 2022 Senior Notes, of $31.0 million and $0.14 per share, respectively, as discussed below.

Net income - Omnicom Group Inc. and diluted net income per share - Omnicom Group Inc. for the six months ended June 30, 2020 included a net after-tax decrease of $223.1 million and $1.03 per share, respectively, as a result of COVID-19 repositioning costs incurred during the second quarter of 2020, as previously discussed above.

Omnicom's worldwide revenue for the six months ended June 30, 2021 increased 12.7% to $6,998.6 million from $6,207.6 million in the same period of 2020. The components of the change in revenue included an increase in revenue from the positive impact of foreign currency translation of 4.0%, a decrease in acquisition revenue, net of disposition revenue of 1.2% and an increase in revenue from organic growth of 10.0% when compared to the same period of 2020.

Organic growth for the six months ended June 30, 2021 compared to the same period in 2020 in our fundamental disciplines was as follows: Advertising increased 13.9%, CRM Precision Marketing increased 15.8%, CRM Commerce and Brand Consulting increased 4.7%, CRM Experiential decreased 1.0%, CRM Execution & Support increased 1.6%, Public Relations increased 5.3% and Healthcare increased 2.3%.

Across all of our regional markets, organic growth in the six months ended June 30, 2021 as compared to the same period of 2020 was as follows: 8.5% for the United States, 14.0% for Other North America, 6.7% for the United Kingdom, 13.5% for the Euro Markets & Other Europe, 14.4% for Asia Pacific, 7.7% for Latin America and 10.1% for the Middle East & Africa.

Operating profit increased $551.1 million, or 114.2%, to $1,033.8 million from $482.7 million for the six months ended June 30, 2020. Our operating margin for the six months ended June 30, 2021 increased to 14.8% versus 7.8% for the same period of 2020.

Operating profit for the six months ended June 30, 2021 reflects a pre-tax increase of $50.5 million arising from the gain on disposition

of ICON during the second quarter of 2021.

Page 3

Omnicom Group Inc.

Operating profit for the six months ended June 30, 2020 included a pre-tax decrease of $277.9 million due to COVID-19 repositioning costs, as discussed previously.

Interest expense for the six months ended June 30, 2021 increased $26.6 million due to the early retirement of our 2022 Senior Notes, as discussed previously.

Our effective tax rate for the six months ended June 30, 2021 decreased period-over-period to 25.8% from 30.6%. In connection with the sale of ICON in 2021, we recorded a gain of $50.5 million. The lower rate for 2021 was predominantly the result of a nominal tax applied against the book gain on the disposal of ICON that resulted from excess tax over book basis. Additionally, the prior year effective tax rate reflects the non-deductibility in certain jurisdictions of a portion of the COVID-19 repositioning charges recorded in the second quarter of 2020, which increased our rate. Our effective tax rate for the six months ended June 30, 2021 would have been in line with our expectations except for the nominal tax on the pre-tax ICON gain of $50.5 million.

Non-GAAP Financial Measures

We use certain non-GAAP financial measures in describing our performance. We use EBITA (defined as earnings before interest, taxes and amortization of intangible assets) and EBITA Margin (defined as EBITA divided by revenue) as additional operating performance measures, which exclude the non-cash amortization expense of intangible assets (primarily consisting of amortization of intangible assets arising from acquisitions). Accordingly, we believe EBITA and EBITA Margin are useful measures for investors to evaluate the performance of our business.

For the second quarter of 2021, EBITA increased $505.7 million, or 602.7%, to $589.6 million from $83.9 million in the second quarter of 2020. Our EBITA margin increased to 16.5% for the second quarter of 2021 versus 3.0% in the second quarter of 2020.

For the six months ended June 30, 2021, EBITA increased 104.8%, or $550.0 million, to $1,074.9 million from $524.9 million for the same period in 2020. Our EBITA margin increased to 15.4% for the six months ended June 30, 2021 versus 8.5% when compared to the six months ended June 30, 2020.

Page 4

Omnicom Group Inc.

EBITA for the second quarter and six months ended June 30, 2021 reflects a pre-tax increase of $50.5 million arising from the gain on disposition of ICON. EBITA for the second quarter and six months ended June 30, 2020 reflects a pre-tax decrease of $277.9 million due to COVID-19 repositioning costs, comprised of incremental severance charges, right-of-use asset impairments and other costs.

Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with U.S. GAAP. Non-GAAP financial measures reported by us may not be comparable to similarly titled amounts reported by other companies.

COVID-19 Business Update

We experienced an improvement in our business in the second quarter of 2021 as compared to the second quarter of 2020, primarily because the recovery from the COVID-19 pandemic that began in the first quarter 2021 continued into the second quarter. The second quarter of 2020 reflected the most negative impact on our businesses since the onset of the pandemic. The COVID-19 pandemic did not significantly impact our major markets and businesses until late in the first quarter of 2020 and the improvement from the pandemic in 2021 compared to the prior year, was significantly greater in the second quarter.

Global economic conditions will continue to be volatile as long as the COVID-19 pandemic remains a public health threat, including as a result of new information concerning the severity of the pandemic, government actions to mitigate the effects of the pandemic in the near-term, and the resulting impact on our clients' spending plans. We expect global economic performance and the performance of our businesses to vary by geography and discipline until the impact of the COVID-19 pandemic on the global economy subsides.

Definitions - Components of Revenue Change

We use certain terms in describing the components of the change in revenue above.

Foreign exchange rate impact: calculated by translating the current period’s local currency revenue using the prior period average exchange rates to derive current period constant currency revenue. The foreign exchange rate impact is the difference between the current period revenue in U.S. Dollars and the current period constant currency revenue.

Page 5

Omnicom Group Inc.

Acquisition revenue, net of disposition revenue: Acquisition revenue is calculated as if the acquisition occurred twelve months prior to the acquisition date by aggregating the comparable prior period revenue of acquisitions through the acquisition date. As a result, acquisition revenue excludes the positive or negative difference between our current period revenue subsequent to the acquisition date and the comparable prior period revenue and the positive or negative growth after the acquisition date is attributed to organic growth. Disposition revenue is calculated as if the disposition occurred twelve months prior to the disposition date by aggregating the comparable prior period revenue of disposals through the disposition date. The acquisition revenue and disposition revenue amounts are netted in the description above.

Organic growth: calculated by subtracting the foreign exchange rate impact component and the acquisition revenue, net of disposition revenue component from total revenue growth.

Revenue by Discipline

Effective January 1, 2021, we realigned the classification of certain services primarily within our CRM Consumer Experience discipline. As a result, our CRM discipline is now grouped into four categories: CRM Precision Marketing which includes our precision marketing and digital/direct marketing agencies; CRM Commerce and Brand Consulting that is primarily comprised of Omnicom Commerce Group, including our shopper marketing businesses, and Omnicom Brand Consulting agencies; CRM Experiential, which includes our experiential marketing agencies and events businesses; and CRM Execution & Support, which includes field marketing, merchandising and point of sale, as well as other specialized marketing and custom communications services.

Forward-looking Statements

Certain statements in this press release including those related to COVID-19 constitute forward-looking statements, including statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements may discuss goals, intentions and expectations as to future plans, trends, events, results of operations or financial condition, based on current beliefs of the Company’s management as well as assumptions made by, and information currently available to, the Company’s management. Forward-looking statements may be accompanied

Page 6

Omnicom Group Inc.

by words such as “aim,” “anticipate,” “believe,” “plan,” “could,” “should,” “would,” “estimate,” “expect,” “forecast,” “future,” “guidance,” “intend,” “may,” “will,” “possible,” “potential,” “predict,” “project” or similar words, phrases or expressions.

Forward-looking statements are subject to various risks and uncertainties, many of which are outside the Company’s control. Therefore, you should not place undue reliance on such statements. You should carefully consider this and the other risks and uncertainties that may affect the Company’s business, including those described in Item 1A, “Risk Factors” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recent Annual Report on Form 10-K and other documents filed from time to time with the Securities and Exchange Commission. Except as required under applicable law, the Company does not assume any obligation to update these forward-looking statements.

Conference Call

Omnicom will host a conference call to review the second quarter 2021 financial results on Tuesday, July 20, 2021 at 8:30 a.m. EDT. Participants can listen to the conference call by dialing (844) 291-6362 (domestic) or (234) 720-6995 (international), along with access code 1468163. The call will also be simulcast and archived on our website at: http://investor.omnicomgroup.com/investor-relations/news-events-and-filings.

About Omnicom Group Inc.

Omnicom Group Inc. (NYSE: OMC) (www.omnicomgroup.com) is a leading global marketing and corporate communications company. Omnicom’s branded networks and numerous specialty firms provide advertising, strategic media planning and buying, digital and interactive marketing, direct and promotional marketing, public relations and other specialty communications services to over 5,000 clients in more than 70 countries. Follow us on Twitter for the latest news.

Contact

| Joanne Trout | [email protected] |

Page 7

Omnicom Group Inc.

Consolidated Statements of Income

Three Months Ended June 30

(Unaudited)

(Dollars in Millions, Except Per Share Data)

| 2021 (a) | 2020 (b) (c) | |||||||

| Revenue | $ | 3,571.6 | $ | 2,800.7 | ||||

| Operating Expenses: | ||||||||

| Salary and service costs | 2,603.1 | 2,031.1 | ||||||

| Occupancy and other costs | 293.9 | 290.0 | ||||||

| Gain on disposition of subsidiary | (50.5) | — | ||||||

| COVID-19 repositioning costs | — | 277.9 | ||||||

| Costs of services | 2,846.5 | 2,599.0 | ||||||

| Selling, general and administrative expenses | 103.2 | 82.1 | ||||||

| Depreciation and amortization | 53.5 | 57.1 | ||||||

| 3,003.2 | 2,738.2 | |||||||

| Operating Profit | 568.4 | 62.5 | ||||||

| Interest Expense | 80.3 | 53.7 | ||||||

| Interest Income | 6.8 | 6.5 | ||||||

| Income Before Income Taxes | 494.9 | 15.3 | ||||||

| Income Tax Expense | 123.2 | 21.9 | ||||||

| Loss From Equity Method Investments | (0.1) | (7.8) | ||||||

| Net Income (Loss) | 371.6 | (14.4) | ||||||

| Net Income Attributed To Noncontrolling Interests | 23.4 | 9.8 | ||||||

| Net Income (Loss) - Omnicom Group Inc. | $ | 348.2 | $ | (24.2) | ||||

| Net Income (Loss) Per Share - Omnicom Group Inc. | ||||||||

| Basic | $ | 1.62 | $ | (0.11) | ||||

| Diluted | $ | 1.60 | $ | (0.11) | ||||

| Weighted average shares (in millions) | ||||||||

| Basic | 215.4 | 214.9 | ||||||

| Diluted | 217.1 | 215.4 | ||||||

| Dividends Declared Per Common Share | $ | 0.70 | $ | 0.65 | ||||

| (a) | During the second quarter of 2021, we recorded a gain on the disposition of subsidiaries, which increased Operating Profit and Net Income - Omnicom Group Inc. by $50.5 million for the three months ended June 30, 2021. Additionally, Net Interest Expense during the second quarter of 2021 included a $26.6 million charge related to the early extinguishment of our 2022 Senior Notes, which decreased Net Income - Omnicom Group Inc. by $19.5 million for the three months ended June 30, 2021. The net impact of these items increased Earnings per Share - Diluted by $0.14 per share for the three months ended June 30, 2021. |

| (b) | During the second quarter of 2020, we recorded expenses for certain repositioning actions related to the realignment of our businesses in reaction to the COVID-19 pandemic. The impact of these items decreased Operating Profit by $277.9 million, Net Income - Omnicom Group Inc. by $223.1 million and Earnings per Share - Diluted by $1.03 per share for the three months ended June 30, 2020. |

| (c) | Salary and service costs for the second quarter of 2020 includes the reduction of $49.2 million in operating expenses related to reimbursements and tax credits under government programs in several countries where we have operations. |

Page 8

Omnicom Group Inc.

Consolidated Statements of Income

Six Months Ended June 30

(Unaudited)

(Dollars in Millions, Except Per Share Data)

| 2021 (a) | 2020 (b) (c) | ||||||

| Revenue | $ | 6,998.6 | $ | 6,207.6 | |||

| Operating Expenses: | |||||||

| Salary and service costs | 5,148.1 | 4,564.4 | |||||

| Occupancy and other costs | 585.5 | 599.6 | |||||

| Gain on disposition of subsidiary | (50.5) | — | |||||

| COVID-19 repositioning costs | — | 277.9 | |||||

| Costs of services | 5,683.1 | 5,441.9 | |||||

| Selling, general and administrative expenses | 174.9 | 168.9 | |||||

| Depreciation and amortization | 106.8 | 114.1 | |||||

| 5,964.8 | 5,724.9 | ||||||

| Operating Profit | 1,033.8 | 482.7 | |||||

| Interest Expense | 134.1 | 112.2 | |||||

| Interest Income | 13.1 | 19.2 | |||||

| Income Before Income Taxes | 912.8 | 389.7 | |||||

| Income Tax Expense | 235.2 | 119.3 | |||||

| Loss From Equity Method Investments | (0.1) | (13.0) | |||||

| Net Income | 677.5 | 257.4 | |||||

| Net Income Attributed To Noncontrolling Interests | 41.5 | 23.4 | |||||

| Net Income - Omnicom Group Inc. | $ | 636.0 | $ | 234.0 | |||

| Net Income Per Share - Omnicom Group Inc. | |||||||

| Basic | $ | 2.95 | $ | 1.08 | |||

| Diluted | $ | 2.93 | $ | 1.08 | |||

| Weighted average shares (in millions) | |||||||

| Basic | 215.5 | 215.8 | |||||

| Diluted | 217.0 | 216.5 | |||||

| Dividends Declared Per Common Share | $ | 1.40 | $ | 1.30 | |||

| (a) | During the second quarter of 2021, we recorded a gain on the disposition of subsidiaries, which increased Operating Profit and Net Income - Omnicom Group Inc. by $50.5 million for the six months ended June 30, 2021. Additionally, Net Interest Expense during the second quarter of 2021 included a $26.6 million charge related to the early extinguishment of our 2022 Senior Notes, which decreased Net Income - Omnicom Group Inc. by $19.5 million for the six months ended June 30, 2021. The net impact of these items increased Earnings per Share - Diluted by $0.14 per share for the six months ended June 30, 2021. |

| (b) | During the second quarter of 2020, we recorded expenses for certain repositioning actions related to the realignment of our businesses in reaction to the COVID-19 pandemic. The impact of these items decreased Operating Profit by $277.9 million, Net Income - Omnicom Group Inc. by $223.1 million and Earnings per Share - Diluted by $1.03 per share for the six months ended June 30, 2020. |

| (c) | Salary and service costs for the six months ended June 30, 2020 includes the reduction of $49.2 million in operating expenses related to reimbursements and tax credits under government programs in several countries where we have operations. |

Page 9

Omnicom Group Inc.

Detail of Operating Expenses

Three Months Ended June 30

(Unaudited)

(Dollars in Millions)

| 2021 | 2020 | ||||||

| Operating Expenses: | |||||||

| Salary and service costs | |||||||

| Salary and related service costs | $ | 1,721.7 | $ | 1,424.7 | |||

| Third-party service costs | 881.4 | 606.4 | |||||

| Occupancy and other costs | 293.9 | 290.0 | |||||

| Gain on disposition of subsidiary | (50.5) | — | |||||

| COVID-19 repositioning costs | — | 277.9 | |||||

| Costs of services | 2,846.5 | 2,599.0 | |||||

| Selling, general and administrative expenses | 103.2 | 82.1 | |||||

| Depreciation and amortization | 53.5 | 57.1 | |||||

| Total Operating Expenses | $ | 3,003.2 | $ | 2,738.2 | |||

Page 10

Omnicom Group Inc.

Detail of Operating Expenses

Six Months Ended June 30

(Unaudited)

(Dollars in Millions)

| 2021 | 2020 | ||||||

| Operating Expenses: | |||||||

| Salary and service costs | |||||||

| Salary and related service costs | $ | 3,370.9 | $ | 3,067.1 | |||

| Third-party service costs | 1,777.2 | 1,497.3 | |||||

| Occupancy and other costs | 585.5 | 599.6 | |||||

| Gain on disposition of subsidiary | (50.5) | — | |||||

| COVID-19 repositioning costs | — | 277.9 | |||||

| Costs of services | 5,683.1 | 5,441.9 | |||||

| Selling, general and administrative expenses | 174.9 | 168.9 | |||||

| Depreciation and amortization | 106.8 | 114.1 | |||||

| Total Operating Expenses | $ | 5,964.8 | $ | 5,724.9 | |||

Page 11

Omnicom Group Inc.

Reconciliation of Non-GAAP Financial Measures - EBITA

Three Months Ended June 30

(Unaudited)

(Dollars in Millions)

| 2021 | 2020 | ||||||

| Net Income (Loss) - Omnicom Group Inc. | $ | 348.2 | $ | (24.2) | |||

| Net Income Attributed To Noncontrolling Interests | 23.4 | 9.8 | |||||

| Net Income (Loss) | 371.6 | (14.4) | |||||

| Loss From Equity Method Investments | (0.1) | (7.8) | |||||

| Income Tax Expense | 123.2 | 21.9 | |||||

| Income Before Income Taxes | 494.9 | 15.3 | |||||

| Interest Income | 6.8 | 6.5 | |||||

| Interest Expense | 80.3 | 53.7 | |||||

| Operating Profit | 568.4 | 62.5 | |||||

| Add back: Amortization of intangible assets | 21.2 | 21.4 | |||||

| Earnings before interest, taxes and amortization of intangible assets ("EBITA") | $ | 589.6 | $ | 83.9 | |||

| Revenue | $ | 3,571.6 | $ | 2,800.7 | |||

| EBITA | $ | 589.6 | $ | 83.9 | |||

| EBITA Margin % | 16.5 | % | 3.0 | % | |||

The above table reconciles the U.S. GAAP financial measure of Net Income - Omnicom Group Inc. to EBITA (defined as earnings before interest, taxes and amortization of intangible assets) and EBITA Margin (defined as EBITA divided by revenue) for the periods presented. We use EBITA and EBITA Margin as additional operating performance measures, which exclude the non-cash amortization expense of intangible assets (primarily consisting of amortization of intangible assets arising from acquisitions). Accordingly, we believe EBITA and EBITA Margin are useful measures for investors to evaluate the performance of our business. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with U.S. GAAP. Non-GAAP financial measures reported by us may not be comparable to similarly titled amounts reported by other companies.

Page 12

Omnicom Group Inc.

Reconciliation of Non-GAAP Financial Measures - EBITA

Six Months Ended June 30

(Unaudited)

(Dollars in Millions)

| 2021 | 2020 | ||||||

| Net Income - Omnicom Group Inc. | $ | 636.0 | $ | 234.0 | |||

| Net Income Attributed To Noncontrolling Interests | 41.5 | 23.4 | |||||

| Net Income | 677.5 | 257.4 | |||||

| Loss From Equity Method Investments | (0.1) | (13.0) | |||||

| Income Tax Expense | 235.2 | 119.3 | |||||

| Income Before Income Taxes | 912.8 | 389.7 | |||||

| Interest Income | 13.1 | 19.2 | |||||

| Interest Expense | 134.1 | 112.2 | |||||

| Operating Profit | 1,033.8 | 482.7 | |||||

| Add back: Amortization of intangible assets | 41.1 | 42.2 | |||||

| Earnings before interest, taxes and amortization of intangible assets ("EBITA") | $ | 1,074.9 | $ | 524.9 | |||

| Revenue | $ | 6,998.6 | $ | 6,207.6 | |||

| EBITA | $ | 1,074.9 | $ | 524.9 | |||

| EBITA Margin % | 15.4 | % | 8.5 | % | |||

The above table reconciles the U.S. GAAP financial measure of Net Income - Omnicom Group Inc. to EBITA (defined as earnings before interest, taxes and amortization of intangible assets) and EBITA Margin (defined as EBITA divided by revenue) for the periods presented. We use EBITA and EBITA Margin as additional operating performance measures, which exclude the non-cash amortization expense of intangible assets (primarily consisting of amortization of intangible assets arising from acquisitions). Accordingly, we believe EBITA and EBITA Margin are useful measures for investors to evaluate the performance of our business. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with U.S. GAAP. Non-GAAP financial measures reported by us may not be comparable to similarly titled amounts reported by other companies.

Page 13

Second Quarter 2021 Results July 20, 2021 Investor Presentation Exhibit 99.2

Second Quarter 2021 Results July 20, 2021 Investor Presentation Exhibit 99.2

Second Quarter 2021 Results July 20, 2021 Investor Presentation Exhibit 99.2

July 20, 2021 Operating Expense Detail 3 Second Quarter Year to Date 2021 % of Rev 2020 (a)(b) % of Rev 2021 % of Rev 2020 (a)(b) % of Rev Revenue $ 3,571.6 $ 2,800.7 $ 6,998.6 $ 6,207.6 Operating expenses: Salary and service costs: Salary and related service costs 1,721.7 48.2 % 1,424.7 50.9 % 3,370.9 48.2 % 3,067.1 49.4 % Third-party service costs (c) 881.4 24.7 % 606.4 21.7 % 1,777.2 25.4 % 1,497.3 24.1 % Occupancy and other costs 293.9 8.2 % 290.0 10.4 % 585.5 8.4 % 599.6 9.7 % Gain on disposition of subsidiary (50.5) (1.4) % — n/a (50.5) (0.7) % — n/a COVID-19 repositioning costs — n/a 277.9 9.9 % — n/a 277.9 4.5 % Cost of services 2,846.5 2,599.0 5,683.1 5,441.9 Selling, general and administrative expenses 103.2 2.9 % 82.1 2.9 % 174.9 2.5 % 168.9 2.7 % Depreciation and amortization 53.5 1.5 % 57.1 2.0 % 106.8 1.5 % 114.1 1.8 % Total operating expenses 3,003.2 84.1 % 2,738.2 97.8 % 5,964.8 85.2 % 5,724.9 92.2 % Operating Profit $ 568.4 $ 62.5 $ 1,033.8 $ 482.7 (a) COVID-19 repositioning costs for the second quarter and year to date 2020 periods include expenses for certain repositioning actions related to the realignment of our businesses in reaction to the COVID-19 pandemic. The impact of these items increased operating expenses by $277.9 million for the three months and six months ended June 30, 2020. (b) Salary and service costs for the second quarter and year to date 2020 periods include the reduction $49.2 million in operating expenses related to reimbursements and tax credits under government programs in several countries where we have operations. (c) Third-party service costs are expenses paid to third-party vendors incurred primarily in connection with performance obligations for our services where we have determined that we are acting as principal. These third-party expenses also include incidental costs incurred in the performance of our services including airfare, mileage, hotel and out-of-town expenses, etc.

July 20, 2021 2021 Total Revenue Change 4 Second Quarter Year to Date $ % Ä $ % Ä Prior Period Revenue $ 2,800.7 $ 6,207.6 Foreign exchange rate impact (a) 150.8 5.4 % 246.5 4.0 % Acquisition revenue, net of disposition revenue (b) (62.0) (2.2) % (77.0) (1.2) % Organic growth (c) 682.1 24.4 % 621.5 10.0 % Current Period Revenue $ 3,571.6 27.5 % $ 6,998.6 12.7 % (a) Foreign exchange rate impact: calculated by translating the current period’s local currency revenue using the prior period average exchange rates to derive current period constant currency revenue. The foreign exchange rate impact is the difference between the current period revenue in U.S. Dollars and the current period constant currency revenue. (b) Acquisition revenue, net of disposition revenue: Acquisition revenue is calculated as if the acquisition occurred twelve months prior to the acquisition date by aggregating the comparable prior period revenue of acquisitions through the acquisition date. As a result, acquisition revenue excludes the positive or negative difference between our current period revenue subsequent to the acquisition date and the comparable prior period revenue and the positive or negative growth after the acquisition date is attributed to organic growth. Disposition revenue is calculated as if the disposition occurred twelve months prior to the disposition date by aggregating the comparable prior period revenue of disposals through the disposition date. The acquisition revenue and disposition revenue amounts are netted in the presentation above. (c) Organic growth: calculated by subtracting the foreign exchange rate impact, and the acquisition revenue, net of disposition revenue components from total revenue growth.

July 20, 2021 Advertising 56.4% CRM Precision Marketing 8.2% CRM Commerce and Brand Consulting 6.2% CRM Experiential 3.5% CRM Execution & Support 7.0% PR 9.7% Healthcare 9.0% 2021 Revenue by Discipline 5 Advertising 57.4% CRM Precision Marketing 8.1% CRM Commerce and Brand Consulting 6.2% CRM Experiential 3.0% CRM Execution & Support PR 7.1% 9.5% Healthcare 8.7% Second Quarter Year to Date $ Mix % Growth % Organic Growth (a) Advertising $ 2,014.5 31.7 % 29.8 % CRM Precision Marketing 293.6 37.2 % 25.0 % CRM Commerce and Brand Consulting 221.5 18.0 % 15.2 % CRM Experiential 124.0 58.0 % 53.0 % CRM Execution & Support 250.9 30.1 % 22.7 % PR 345.9 16.0 % 15.1 % Healthcare 321.2 7.2 % 4.5 % Total $ 3,571.6 27.5 % 24.4 % $ Mix % Growth % Organic Growth (a) Advertising $ 4,018.2 16.0 % 13.9 % CRM Precision Marketing 563.0 26.2 % 15.8 % CRM Commerce and Brand Consulting 436.1 6.7 % 4.7 % CRM Experiential 212.4 1.2 % (1.0) % CRM Execution & Support 497.5 6.6 % 1.6 % PR 663.4 5.0 % 5.3 % Healthcare 608.0 4.6 % 2.3 % Total $ 6,998.6 12.7 % 10.0 % (a) “Organic Growth” reflects the year-over-year increase or decrease in revenue from the prior period, excluding the foreign exchange rate impact and acquisition revenue, net of disposition revenue as defined on page 4.

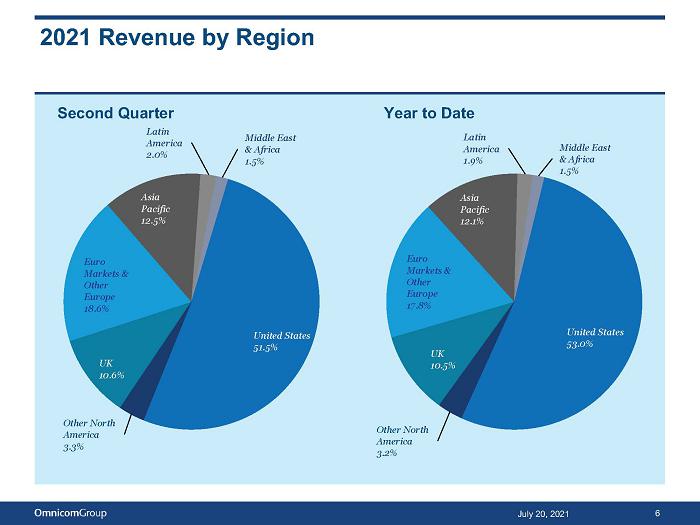

July 20, 2021 UK 10.5% Euro Markets & Other Europe 17.8% Asia Pacific 12.1% Latin America 1.9% Middle East & Africa 1.5% United States 53.0% Other North America 3.2% Second Quarter UK 10.6% Euro Markets & Other Europe 18.6% Asia Pacific 12.5% Latin America 2.0% Middle East & Africa 1.5% United States 51.5% Other North America 3.3% 2021 Revenue by Region 6 Year to Date

July 20, 2021 2021 Revenue by Region 7 Second Quarter Year to Date $ Mix % Growth % Organic Growth (a) United States $ 1,840.7 16.0 % 19.9 % Other North America 116.7 52.3 % 37.1 % UK 379.7 43.0 % 23.8 % Euro Markets & Other Europe 664.4 43.8 % 34.5 % Asia Pacific 447.4 39.9 % 27.9 % Latin America 70.4 28.2 % 20.8 % Middle East & Africa 52.3 51.6 % 42.8 % Total $ 3,571.6 27.5 % 24.4 % $ Mix % Growth % Organic Growth (a) United States $ 3,708.9 6.5 % 8.5 % Other North America 221.0 23.1 % 14.0 % UK 736.2 20.6 % 6.7 % Euro Markets & Other Europe 1,248.9 20.1 % 13.5 % Asia Pacific 847.4 24.8 % 14.4 % Latin America 133.7 5.9 % 7.7 % Middle East & Africa 102.5 13.8 % 10.1 % Total $ 6,998.6 12.7 % 10.0 % (a) “Organic Growth” reflects the year-over-year increase in revenue from the prior period, excluding the foreign exchange rate impact and acquisition revenue, net of disposition revenue as defined on page 4.

July 20, 2021 Other 7% Services 2% Oil, Gas & Utilities Not-for-Profit 1% 1% Government 3% Education 1% Pharma & Health 16% Retail 7% Tech 9% Telcom 5% T& E 9% Auto 10% Consumer Products 8% Financial Services 7% Food & Beverage 14% Revenue by Industry 8 Year to Date – 2021 Other 7% Services 2% Oil, Gas & Utilities Not-for-Profit 2% 1% Government 3% Education 1% Pharma & Health 16% Retail 6% Tech 8% Telcom 6% T& E 8% Auto 10% Consumer Products 8% Financial Services 8% Food & Beverage 14% Year to Date – 2020

July 20, 2021 Cash Flow Performance 9 Six Months Ended June 30 2021 2020 Net Income $ 677.5 $ 257.4 Depreciation and Amortization of Intangible Assets 106.8 114.1 Share-Based Compensation 39.1 34.9 Gain on disposition of subsidiary (50.5) — COVID-19 Repositioning Costs — 277.9 Other Items to Reconcile to Net Cash Used in Operating Activities, net 22.6 39.3 Free Cash Flow (a) $ 795.5 $ 723.6 Additional information regarding our cash flows can be found in our condensed cash flow statement on page 18. (a) The Free Cash Flow amounts presented above are non-GAAP liquidity measures. See page 24 for the definition of this measure and page 21 for the reconciliation of the non-GAAP financial measures, which reconciles Free Cash Flow to the Net Cash Used in Operating Activities for the periods presented above.

July 20, 2021 Cash Flow Performance 10 Six Months Ended June 30 2021 2020 Free Cash Flow (a) $ 795.5 $ 723.6 Primary Uses of Cash: Dividends paid to Common Shareholders 292.4 282.9 Dividends paid to Noncontrolling Interest Shareholders 38.6 35.2 Capital Expenditures 22.9 33.6 Acquisition of Businesses and Affiliates, Acquisition of Additional Noncontrolling Interests and Contingent Purchase Price Payments, net of Proceeds from Sale of Investments and other 35.9 26.0 Stock Repurchases, net of Proceeds from Stock Plans 94.7 202.9 Primary Uses of Cash (a) 484.5 580.6 Net Free Cash Flow (a) $ 311.0 $ 143.0 Additional information regarding our cash flows can be found in our condensed cash flow statement on page 18. (a) The Free Cash Flow, Primary Uses of Cash and Net Free Cash Flow amounts presented above are non-GAAP liquidity measures. See page 24 for the definition of these measures and page 21 for the reconciliation of non-GAAP financial measures, which reconciles Free Cash Flow to the Net Cash Used in Operating Activities and Net Free Cash Flow to the Net Decrease in Cash and Cash Equivalents for the periods presented above.

July 20, 2021 Current Credit Picture 11 Twelve Months Ended June 30 2021 2020 EBITDA (a) $ 2,365.2 $ 1,830.6 Total Debt / EBITDA 2.2 x 3.1 x Net Debt (b) / EBITDA 0.4 x 1.3 x Debt Bank Loans (Due Less Than 1 Year) $ 9.3 $ 6.4 CP & Borrowings Issued Under Revolver — — USD-denominated Senior Notes (c) 4,150.0 4,600.0 EUR-denominated Senior Notes (c) 1,188.4 1,124.4 Other Debt (37.7) (10.3) Total Debt $ 5,310.0 $ 5,720.5 Cash, Cash Equivalents and Short-Term Investments 4,388.1 3,281.0 Net Debt (b) $ 921.9 $ 2,439.5 (a) EBITDA is a non-GAAP performance measure. See page 24 for the definition of this measure and page 20 for the reconciliation of non-GAAP financial measures. (b) Net Debt is a non-GAAP liquidity measure. See page 24 for the definition of this measure, which is reconciled in the table above. (c) See page 14 for additional information on our Senior Notes.

July 20, 2021 Historical Returns 12 Return on Invested Capital (ROIC) (a): Twelve months ended June 30, 2021 25.9 % Twelve months ended June 30, 2020 17.8 % Return on Equity (b): Twelve months ended June 30, 2021 46.8 % Twelve months ended June 30, 2020 38.9 % (a) Return on Invested Capital is After Tax Reported Operating Profit (a non-GAAP performance measure – see page 24 for the definition of this measure and page 21 for the reconciliation of non-GAAP financial measures) divided by the average of Invested Capital at the beginning and the end of the period (book value of all long-term liabilities, including those related to operating leases, short-term interest bearing debt, the short-term liability related to operating leases plus shareholders’ equity less cash, cash equivalents, short-term investments and operating lease right of use assets). (b) Return on Equity is Reported Net Income for the given period divided by the average of shareholders’ equity at the beginning and end of the period.

July 20, 2021 Supplemental Financial Information 13

July 20, 2021 Omnicom Debt Maturity Profile 14 Jun-21 Dec-21 Jun-22 Dec-22 Jun-23 Dec-23 Jun-24 Dec-24 Jun-25 Dec-25 Jun-26 Dec-26 Jun-27 Dec-27 Jun-28 Dec-28 Jun-29 Dec-29 Jun-30 Dec-30 Jun-31 Dec -31 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 Other Borrowings 2024 Senior Notes 2026 Senior Notes Other borrowings at June 30, 2021 include bank loans of $9.3 million, which are due in less than one year. For purposes of this presentation we have included these borrowings as outstanding through February 14, 2025, the date of expiration of our five-year credit facility. 2027 Euro Senior Notes 2031 Euro Senior Notes 2030 Senior Notes 2031 Senior Notes

July 20, 2021 Operating Expense Detail - Constant $ 15 Second Quarter Year to Date 2021 2021 C$ (a) 2020 (b)(c) 2021 2021 C$ (a) 2020 (b)(c) Operating expenses: Salary and service costs: Salary and related service costs $ 1,721.7 $ 1,645.4 $ 1,424.7 $ 3,370.9 $ 3,244.3 $ 3,067.1 Third-party service costs (d) 881.4 848.1 606.4 1,777.2 1,724.8 1,497.3 Occupancy and other costs 293.9 280.0 290.0 585.5 561.9 599.6 Gain on disposition of subsidiary (50.5) (50.5) — (50.5) (50.5) — COVID-19 repositioning costs — — 277.9 — — 277.9 Cost of services 2,846.5 2,723.0 2,599.0 5,683.1 5,480.5 5,441.9 Selling, general and administrative expenses 103.2 99.8 82.1 174.9 169.6 168.9 Depreciation and amortization 53.5 51.4 57.1 106.8 103.2 114.1 Total operating expenses $ 3,003.2 $ 2,874.2 $ 2,738.2 $ 5,964.8 $ 5,753.3 $ 5,724.9 (a) Constant Dollar ("C$") expense is calculated by translating the current period’s local currency expense using the prior period average exchange rates to derive current period C$ expense. The foreign exchange rate impact is the difference between the current period expense in U.S. Dollars and the current period C$ expense. (b) COVID-19 repositioning costs for the second quarter and year to date 2020 periods include expenses for certain repositioning actions related to the realignment of our businesses in reaction to the COVID-19 pandemic. The impact of these items increased operating expenses by $277.9 million for the three months and six months ended June 30, 2020. (c) Salary and service costs for the second quarter and year to date 2020 periods include the reduction $49.2 million in operating expenses related to reimbursements and tax credits under government programs in several countries where we have operations. (d) Third-party service costs are expenses paid to third-party vendors incurred primarily in connection with performance obligations for our services where we have determined that we are acting as principal. These third-party expenses also include incidental costs incurred in the performance of our services including airfare, mileage, hotel and out-of-town expenses, etc.

July 20, 2021 Net Interest Expense Detail 16 Second Quarter Year to Date 2021 2020 2021 2020 Net Interest expense: Interest expense (a) $ 80.3 $ 53.7 $ 134.1 $ 112.2 Interest income 6.8 6.5 13.1 19.2 Net Interest Expense $ 73.5 $ 47.2 $ 121.0 $ 93.0 (a) Interest Expense during the second quarter of 2021 included a $26.6 million charge related to the early extinguishment of our 2022 Senior Notes.

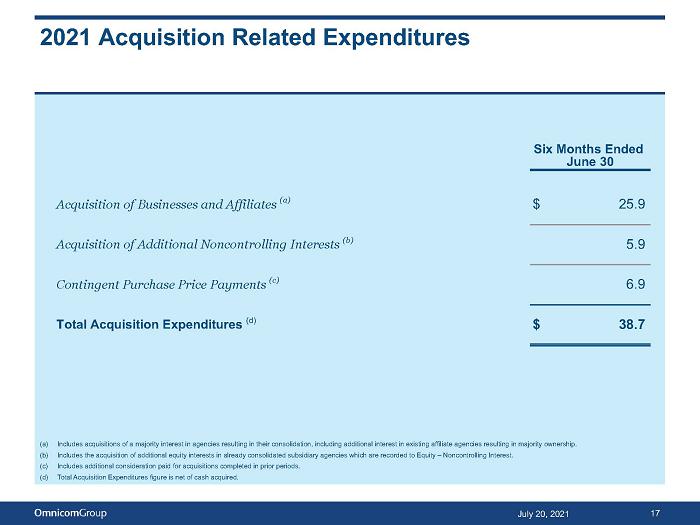

July 20, 2021 2021 Acquisition Related Expenditures 17 Six Months Ended June 30 Acquisition of Businesses and Affiliates (a) $ 25.9 Acquisition of Additional Noncontrolling Interests (b) 5.9 Contingent Purchase Price Payments (c) 6.9 Total Acquisition Expenditures (d) $ 38.7 (a) Includes acquisitions of a majority interest in agencies resulting in their consolidation, including additional interest in existing affiliate agencies resulting in majority ownership. (b) Includes the acquisition of additional equity interests in already consolidated subsidiary agencies which are recorded to Equity – Noncontrolling Interest. (c) Includes additional consideration paid for acquisitions completed in prior periods. (d) Total Acquisition Expenditures figure is net of cash acquired.

July 20, 2021 Condensed Cash Flow 18 Six Months Ended June 30 2021 2020 Net Income $ 677.5 $ 257.4 Share-Based Compensation 39.1 34.9 Depreciation and Amortization of Intangible Assets 106.8 114.1 Other Items to Reconcile to Net Cash Used in Operating Activities, net 22.6 39.3 Gain on disposition of subsidiary (50.5) — COVID-19 Repositioning Costs — 277.9 Changes in Operating Capital (1,091.2) (1,585.8) Net Cash Used in Operating Activities (295.7) (862.2) Capital Expenditures (22.9) (33.6) Proceeds from Sale of Investments and other 2.8 3.5 Acquisition of Businesses and Interest in Affiliates, net of cash acquired (25.9) — Proceeds from Dispositions of Subsidiaries 114.1 0.2 Net Cash Provided by (Used in) Investing Activities 68.1 (29.9) Dividends paid to Common Shareholders (292.4) (282.9) Dividends paid to Noncontrolling Interest Shareholders (38.6) (35.2) Changes in Short-term Debt, net 5.7 (3.1) Proceeds from Long-term Borrowings 791.7 1,186.6 Repayment of Long-term Debt (1,250.0) (600.0) Stock Repurchases, net of Proceeds from Stock Plans (94.7) (202.9) Acquisition of Additional Noncontrolling Interests (5.9) (16.7) Payment of Contingent Purchase Price Obligations (6.9) (12.8) Other Financing Activities, net (70.1) (38.7) Net Cash Used in Financing Activities (961.2) (5.7) Effect of foreign exchange rate changes on cash and cash equivalents (23.6) (126.9) Net Decrease in Cash and Cash Equivalents $ (1,212.4) $ (1,024.7)

July 20, 2021 2021 vs. 2020 Non-GAAP Financial Measures – EBITA 19 (a) Additional information regarding our operating expenses can be found on page 3. (b) EBITA is a non-GAAP financial performance measure. Please see page 24 for the definition of this measure and page 20 for the reconciliation of non-GAAP financial measures, which reconciles the EBITA figures presented above to Net Income - Omnicom Group Inc. for the periods presented above. (c) EBITA Margin is a non-GAAP financial performance measure, which is calculated by dividing EBITA (please see page 24 for the definition of this measure) by revenue for the periods presented. Second Quarter Year to Date 2021 2020 2021 2020 Revenue $ 3,571.6 $ 2,800.7 $ 6,998.6 $ 6,207.6 Operating expenses (a) 3,003.2 2,738.2 5,964.8 5,724.9 Operating Profit 568.4 62.5 1,033.8 482.7 Operating Profit Margin % 15.9 % 2.2 % 14.8 % 7.8 % Add back: Amortization of intangible assets 21.2 21.4 41.1 42.2 EBITA (b) $ 589.6 $ 83.9 $ 1,074.9 $ 524.9 EBITA Margin % (c) 16.5 % 3.0 % 15.4 % 8.5 %

July 20, 2021 Reconciliation of Non-GAAP Financial Measures – EBITA and EBITDA Three Months Ended Six Months Ended Twelve Months Ended June 30 June 30 June 30 2021 2020 2020 2019 2021 2020 Net Income (Loss) - Omnicom Group Inc. $ 348.2 $ (24.2) $ 636.0 $ 234.0 $ 1,347.4 $ 939.2 Net Income Attributed to Noncontrolling Interests 23.4 9.8 41.5 23.4 93.5 80.2 Net Income (Loss) 371.6 (14.4) 677.5 257.4 1,440.9 1,019.4 Income (Loss) From Equity Method Investments (0.1) (7.8) (0.1) (13.0) 6.1 (11.7) Income Tax Expense 123.2 21.9 235.2 119.3 497.6 390.5 Income Before Income Taxes 494.9 15.3 912.8 389.7 1,932.4 1,421.6 Net Interest Expense 73.5 47.2 121.0 93.0 217.5 180.8 Operating Profit 568.4 62.5 1,033.8 482.7 2,149.9 1,602.4 Amortization of Intangible Assets 21.2 21.4 41.1 42.2 82.0 83.2 EBITA 589.6 83.9 1,074.9 524.9 2,231.9 1,685.6 Depreciation 32.3 35.7 65.7 71.9 133.3 145.0 EBITDA $ 621.9 $ 119.6 $ 1,140.6 $ 596.8 $ 2,365.2 $ 1,830.6 20 The above table reconciles the GAAP financial measure of Net Income (Loss) – Omnicom Group Inc. to the non-GAAP financial measures of EBITDA and EBITA for the periods presented. EBITDA and EBITA, which are defined on page 24, are non-GAAP financial measures within the meaning of applicable SEC rules and regulations. Our credit facility defines EBITDA as earnings before deducting interest expense, income taxes, depreciation and amortization. Our credit facility uses EBITDA to measure our compliance with covenants, such as our leverage ratios, as presented on page 11 of this presentation.

July 20, 2021 Reconciliation of Non-GAAP Financial Measures 21 Six Months Ended June 30 2021 2020 Net Cash Used in Operating Activities $ (295.7) $ (862.2) Operating Activities items excluded from Free Cash Flow: Changes in Operating Capital (1,091.2) (1,585.8) Free Cash Flow $ 795.5 $ 723.6 Six Months Ended June 30 2021 2020 Net Decrease in Cash and Cash Equivalents $ (1,212.4) $ (1,024.7) Cash Flow items excluded from Net Free Cash Flow: Changes in Operating Capital (1,091.2) (1,585.8) Proceeds from Dispositions of Subsidiaries 114.1 0.2 Changes in Short-term Debt, net 5.7 (3.1) Proceeds from Long-term Borrowings 791.7 1,186.6 Repayment of Long-term Debt (1,250.0) (600.0) Other Financing Activities, net (70.1) (38.7) Effect of foreign exchange rate changes on cash and cash equivalents (23.6) (126.9) Net Free Cash Flow $ 311.0 $ 143.0 Twelve Months Ended June 30 2021 2020 Reported Operating Profit 2,149.9 1,602.4 Effective Tax Rate for the applicable period 25.8 % 27.5 % Income Taxes on Reported Operating Profit 554.7 440.7 After Tax Reported Operating Profit $ 1,595.2 $ 1,161.7

July 20, 2021 22 Second Quarter Acquisition Archbow Consulting helps pharmaceutical and biotech companies design, build, and optimize market access operations, product distribution, and patient support hubs. Established in 2017, Archbow's services focus on assisting clients’ commercial planning with offerings such as: developing and optimizing product distribution strategy and contracts, improving patient outreach efforts and revamping patient services departments. With offices in Orlando, Florida and Zug, Switzerland, Archbow will operate as part of Entrée Health network within the Omnicom Health Group.

July 20, 2021 23 Second Quarter Acquisition Credera acquired a majority stake in Areteans, a leading global services and solutions company, to extend its depth in digital transformation, digital marketing and e-commerce capabilities. Areteans specializes in the design, delivery, and implementation of real-time interaction management and digital customer relationship management. The company serves some of world's biggest brands across the banking, insurance, consumer products, telecom, and government industries. Based in Hyderabad, India with additional offices in India, Australia and the United Kingdom, Areteans will operate as part of Credera within the Omnicom Precision Marketing Group.

July 20, 2021 Disclosure 24 The preceding materials have been prepared for use in the July 20, 2021 conference call on Omnicom’s results of operations for the three and six months ended June 30, 2021. The call will be archived on the Internet at http://investor.omnicomgroup.com/investor-relations/news-events-and-filings/. Forward-Looking Statements Certain statements in this presentation constitute forward-looking statements, including statements within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, from time to time, Omnicom Group Inc. ("Omnicom" or the "Company") or its representatives have made, or may make, forward-looking statements, orally or in writing. These statements may discuss goals, intentions and expectations as to future plans, trends, events, results of operations or financial condition, based on current beliefs of the Company’s management as well as assumptions made by, and information currently available to, the Company’s management. Forward-looking statements may be accompanied by words such as “aim,” “anticipate,” “believe,” “plan,” “could,” “should,” “would,” “estimate,” “expect,” “forecast,” “future,” “guidance,” “intend,” “may,” “will,” “possible,” “potential,” “predict,” “project” or similar words, phrases or expressions. These forward-looking statements are subject to various risks and uncertainties, many of which are outside the Company’s control. Therefore, you should not place undue reliance on such statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include: the impact of the COVID-19 pandemic, international, national or local economic conditions that could adversely affect the Company or its clients; losses on media purchases and production costs incurred on behalf of clients; reductions in client spending, a slowdown in client payments and a deterioration in the credit markets; the ability to attract new clients and retain existing clients in the manner anticipated; changes in client advertising, marketing and corporate communications requirements; failure to manage potential conflicts of interest between or among clients; unanticipated changes relating to competitive factors in the advertising, marketing and corporate communications industries; the ability to hire and retain key personnel; currency exchange rate fluctuations; reliance on information technology systems; changes in legislation or governmental regulations affecting the Company or its clients; risks associated with assumptions the Company makes in connection with its critical accounting estimates and legal proceedings; and the Company’s international operations, which are subject to the risks of currency repatriation restrictions, social or political conditions and regulatory actions. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that may affect the Company’s business, including those described in Item 1A, “Risk Factors” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2020 and other documents filed from time to time with the Securities and Exchange Commission. Except as required under applicable law, the Company does not assume any obligation to update these forward-looking statements. Non-GAAP Financial Measures We present financial measures determined in accordance with generally accepted accounting principles in the United States (“GAAP”) and adjustments to the GAAP presentation (“Non-GAAP”), which we believe are meaningful for understanding our performance. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with GAAP. Non-GAAP financial measures as reported by us may not be comparable to similarly titled amounts reported by other companies. We provide a reconciliation of non-GAAP measures to the comparable GAAP measures on pages 20 and 21. The Non-GAAP measures used in this presentation include the following: Free Cash Flow, defined as net income plus depreciation, amortization, share based compensation expense plus/(less) other items to reconcile to net cash used in operating activities. We believe Free Cash Flow is a useful measure of liquidity to evaluate our ability to generate excess cash from our operations. Primary Uses of Cash, defined as dividends to common shareholders, dividends paid to non-controlling interest shareholders, capital expenditures, cash paid on acquisitions, payments for additional interest in controlled subsidiaries and stock repurchases, net of the proceeds from our stock plans, and excludes changes in operating capital and other investing and financing activities, including commercial paper issuances and redemptions used to fund working capital changes. We believe this liquidity measure is useful in identifying the significant uses of our cash. Net Free Cash Flow, defined as Free Cash Flow less the Primary Uses of Cash. Net Free Cash Flow is one of the metrics used by us to assess our sources and uses of cash and was derived from our consolidated statements of cash flows. We believe that this liquidity measure is meaningful for understanding our primary sources and primary uses of that cash flow. EBITDA, defined as operating profit before interest, taxes, depreciation and amortization of intangible assets. We believe EBITDA is a meaningful operating performance measure because the financial covenants in our credit facilities are based on EBITDA. EBITA, defined as operating profit before interest, taxes and amortization of intangible assets and EBITA margin, defined as EBITA divided by revenue. We use EBITA and EBITA margin as additional operating performance measures, which excludes the non-cash amortization expense of intangible assets (primarily consisting of amortization arising from acquisitions). Accordingly, we believe it is a useful measure for investors to evaluate the performance of our business. Net Debt, defined as total debt less cash, cash equivalents and short-term investments. We believe net debt, together with the comparable GAAP measures, reflects one of the liquidity metrics used by us to assess our cash management. After Tax Reported Operating Profit, defined as reported operating profit less income taxes calculated using the effective tax rate for the applicable period. Management uses after tax operating profit as a measure of after tax operating performance as it excludes the after tax effects of financing and investing activities on results of operations. Other Information All dollar amounts are in millions except for per share figures on pages 1 and 2. The information contained in this document has not been audited, although some data has been derived from Omnicom’s historical financial statements, including its audited financial statements. In addition, industry, operational and other non-financial data contained in this document have been derived from sources that we believe to be reliable, but we have not independently verified such information, and we do not, nor does any other person, assume responsibility for the accuracy or completeness of that information. Certain amounts in prior periods have been reclassified to conform to our current presentation. The inclusion of information in this presentation does not mean that such information is material or that disclosure of such information is required.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Wells Fargo Upgrades Omnicom Group (OMC) to Overweight

- Hamad International Airport Recognised as the "World's Best Airport" at the 2024 Skytrax World Airport Awards

- Madison Metals Outlines Priority Uranium Drill Targets at Khan Project in Namibia, Africa

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share