Form 8-K NextPlay Technologies For: May 24

Exhibit 99.1

The Next Global Technology Play H.C. Wainwright Fintech Conference Presentation - May 2022 NASDAQ: NXTP

2 This presentation includes “forward - looking statements” within the meaning of, and within the safe harbor provided by the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995 , Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . Forward - looking statements give our current expectations, opinions, belief or forecasts of future events and performance . A statement identified by the use of forward - looking words including “will,” “may,” “expects,” “projects,” “anticipates,” “plans,” “believes,” “estimate,” “should,” and certain of the other foregoing statements may be deemed forward - looking statements .. Although the Company believes that the expectations reflected in such forward - looking statements are reasonable, these statements involve risks and uncertainties that may cause actual future activities and results to be materially different from those suggested or described in this presentation . Factors that may cause such a difference include risks and uncertainties related to our need for additional capital which may not be available on commercially acceptable terms, if at all, which raises questions about our ability to continue as a going concern ; the fact that the COVID - 19 pandemic has had, and is expected to continue to have, a significant material adverse impact on the travel industry and our business, operating results and liquidity ; amounts owed to us by third parties which may not be paid timely, if at all ; certain amounts we owe under outstanding indebtedness which are secured by substantially all of our assets and penalties we may incur in connection therewith ; the fact that we have significant indebtedness, which could adversely affect our business and financial condition ; uncertainty and illiquidity in credit and capital markets which may impair our ability to obtain credit and financing on acceptable terms and may adversely affect the financial strength of our business partners ; the officers and directors of the Company have the ability to exercise significant influence over the Company ; stockholders may be diluted significantly through our efforts to obtain financing, satisfy obligations and complete acquisitions through the issuance of additional shares of our common or preferred stock ; if we are unable to adapt to changes in technology, our business could be harmed ; if we do not adequately protect our intellectual property, our ability to compete could be impaired ; our long - term travel business success depends, in part, on our ability to expand our property owner, manager and traveler bases outside of the United States and, as a result, our travel business is susceptible to risks associated with international operations ; unfavorable changes in, or interpretations of, government regulations or taxation of the evolving Alternative Lodging Rentals, Internet and e - commerce industries which could harm our operating results ; risks associated with the operations of, the business of, and the regulation of, Longroot and IFEB ; the Axion lawsuits ; the market in which we participate being highly competitive, and because of that we may be unable to compete successfully with our current or future competitors ; our potential inability to adapt to changes in technology, which could harm our business ; the volatility of our stock price ; the fact that we may be subject to liability for the activities of our property owners and managers, which could harm our reputation and increase our operating costs ; and that we have incurred significant losses to date and require additional capital which may not be available on commercially acceptable terms, if at all . More information about the risks and uncertainties faced by the Company are detailed from time to time in the Company’s periodic reports filed with the SEC, including its most recent Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q, under the headings “Risk Factors” . These reports are available at www . sec .. gov . Other unknown or unpredictable factors also could have material adverse effects on the Company’s future results and/or could cause our actual results and financial condition to differ materially from those indicated in the forward - looking statements .. Investors are cautioned that any forward - looking statements are not guarantees of future performance and actual results or developments may differ materially from those projected . The forward - looking statements in this press release are made only as of the date hereof .. The Company takes no obligation to update or correct its own forward - looking presentations and statements, except as required by law, or those prepared by third parties that are not paid for by the Company . If we update one or more forward - looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward - looking statements . Disclosures & Important Cautions Regarding Forward - Looking Statements © Copyright 2019 - 2021 NextPlay Technologies, Inc. All Rights Reserved.

3 Puerto Rican International Financial Entity Crypto Investment Bank Next Shield Primary Insurance ReInsurance Next FinTech NextPlay’s partner and major shareholders include DTGO , led by Founder & Chairman, Ms . Thippaporn Ahriyavraromp and her husband, Dr . Jwanwat Ahriyavararomp, via T&B Media Global . Ms . Thippaporn is a member of the Chearavanont family that owns CP Group , one of Asia’s largest conglomerates . Smart Complaint Tokens Operating Units Core Technologies

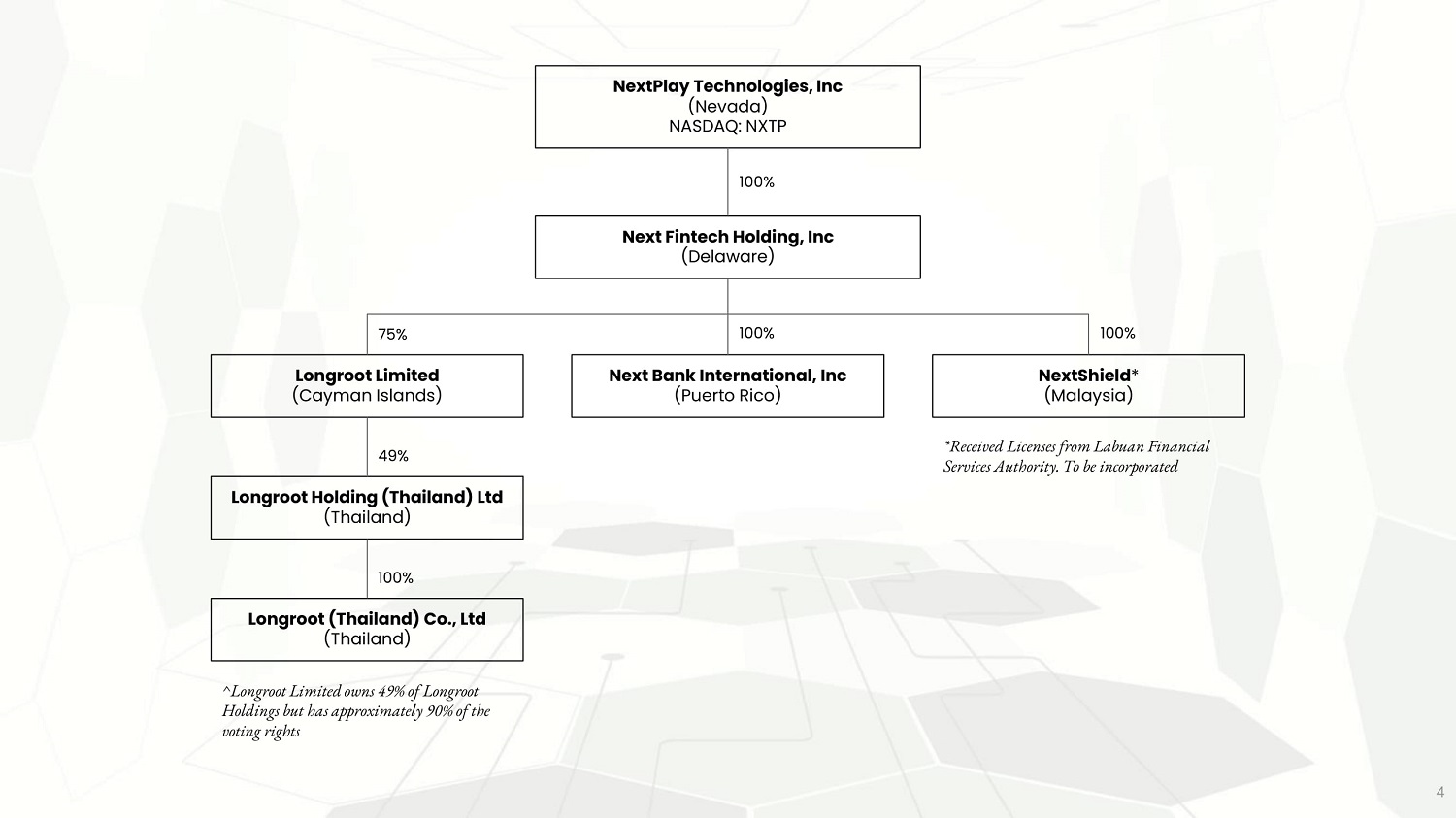

4 NextPlay Technologies, Inc (Nevada) NASDAQ: NXTP Next Fintech Holding, Inc (Delaware) Longroot Limited (Cayman Islands) Longroot Holding (Thailand) Ltd (Thailand) Longroot (Thailand) Co., Ltd (Thailand) Next Bank International, Inc (Puerto Rico) NextShield * (Malaysia) *Received Licenses from Labuan Financial Services Authority. To be incorporated 100% 49% 100% ^Longroot Limited owns 49% of Longroot Holdings but has approximately 90% of the voting rights 75% 100% 100%

In August 2021, NextPlay formed NextFin to oversee the Longroot, NextBank and TokenIQ businesses and manage the company’s overall fintech strategy. Current activities include planning insurance and alternative asset management in a blockchain crypto securitized form. Products & Solutions ● Alternative assets designed to be more resistant to market declines. ● Insurance products, engineered to protect the wealth of banking clients. ● NextBank International charter is broad, allowing it to offer a range of services (subject to licensing): ○ Asset banking ○ Asset management ○ Investment banking services ○ Insurance products Licenses NextFin has been approved by the Labuan FSA for licenses to offer an array of protection products and assets for customer’s wealth protection strategies. A consolidation of financial services, Fintech, and Insurtech operations. NextFin 5 FINTECH Next Shield

● NextBank online & mobile banking services provide customers convenience and easy access to accounts anytime, anywhere in the world. ● Supports NextPlay ecosystem by providing access to merchant services solutions for our gaming, and other business verticals. ● Also supports plans to expand Longroot’s capabilities to potentially include: ○ Access to cryptocurrency exchanges ○ Digital wallet, mobile payments and banking - thereby creating a diversified Fintech Solutions company. NextFin Fintech Solutions for the Global Citizen NextPlay completed its acquisition for 100% ownership of IFEB and rebranded to NextBank in fall 2021 6 IFEB is licensed as an Act 273 - 2012 international financial entity, incorporated in Puerto Rico. IFEB Current Financial Services Concierge Banking Mobile Banking (IFEB Mobile on Apple Store & Google Play) Deposit Loan Products Escrow

7 Crypto Exchange Solutions (currently offered or in development) ● Providing bank accounts for Exchange users’ fiat deposits ● Providing cards solutions ○ Prepaid Cards ○ Payment Cards that offer credit against users’ crypto deposits, allowing users to access fiat without having to liquidate their crypto holdings ○ Exchange shall put reserves in NextBank thereby reducing NextBank’s risk Porta Stable Coin ● Stable coins that are backed 1 to 1 by Account Holder’s deposits of any currency ○ E.g. User shall receive 100 Porta - USD in exchange for depositing U.S $100 ○ Represents a digital ‘bank book’ for account holders ○ Provides low - cost remittance solutions through cross border transfer of Porta ○ Access to investment products issued by Longroot Digital Asset Solutions for Exchanges and Consumers

8 Selected to Provide Deposit Accounts and Payment Cards ✔ February 2022, Signed agreement with Alphabit Consulting Pte. Ltd., to provide deposit accounts and payment cards for members of its ABCC cryptocurrency exchange . Partners with TruCash Group of Companies to Launch Worldwide Payments Platform and offer International Banking Services ✔ March 2022, signed agreement to launch NextBank Payments, which will include (but not be limited to) Mobile Wallets, Mobile Payments, Credit cards, Debit Cards, and Prepaid products. In addition, NextBank will have the opportunity to offer NextBank's international banking services to TruCash's millions of account holders worldwide. Recent NextBank Contracts

9 ● Focused on creating regulated digital assets, available to both retail and institutional investors, backed by alternative assets that are designed to be more resistant to market declines . ● Provides fully regulated and licensed financing and investment services for companies via the issuance of digital assets. ● Thai subsidiary is licensed by the Thai Securities & Exchange Commission. Alternative Assets more Resistant to Market Declines

10 Alternative Assets more Resistant to Market Declines Traditional Loans Portfolio of traditional loans that have high yield and a low risk of default Insurance Linked Securities Portfolio of nano - reinsurance of a diversified range of insurance policies Prime Real Estate Global Portfolio of Marquee Real Estate developed by highly reputable companies Video Games Portfolio of A - AAA Games that distribute returns to investors Precious Metals Portfolio of Precious Metals limited in supply and high in demand such as Nickel and Cobalt (required for Electric Vehicle batteries)

11 Next Shield Machine Learning and Blockchain Powered Insurance Licensed by the Labuan Financial Services Authority to operate as a general insurance and reinsurance business, NextShield will offer: Primary Insurance ● Bank Deposit Insurance cover up to $10 mil per policyholders per bank account ● Everything Everywhere Insurance - Highly Customisable, Machine Learning Priced Travel Insurance, where policyholders can ○ Design their own product ○ Select and deselect payout triggers ○ Determine policy duration ○ Set own deductibles and coverage limits Insurance Linked Securities ● NextShield shall package insurance policies into separate pools and sell the economic interest of the policies to Investors as Insurance Linked Securities (“ILS”) ● Regression analysis suggest almost 0 correlation between insurance underwriting profits and the general market

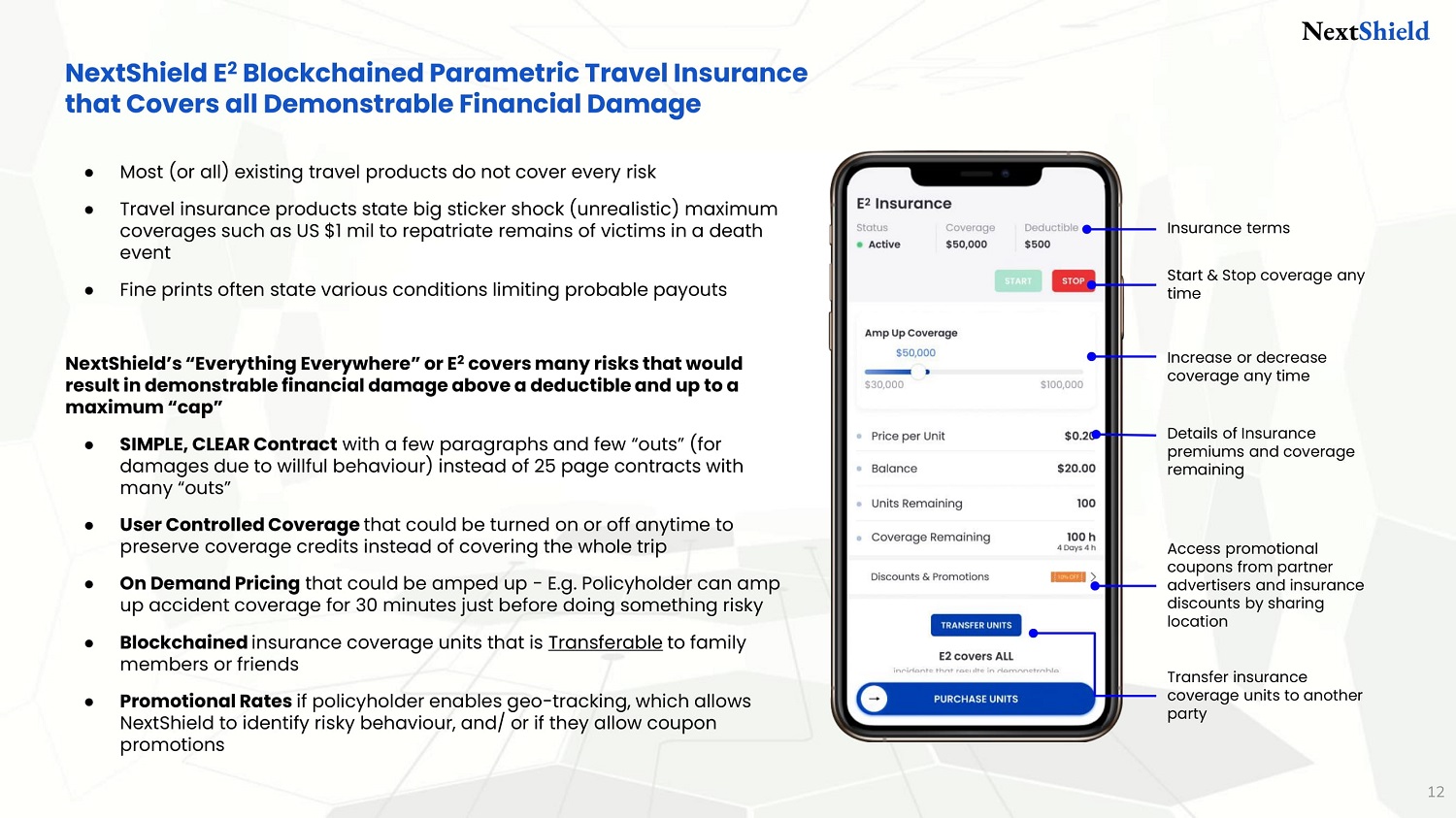

12 NextShield E 2 Blockchained Parametric Travel Insurance that Covers all Demonstrable Financial Damage ● Most (or all) existing travel products do not cover every risk ● Travel insurance products state big sticker shock (unrealistic) maximum coverages such as US $1 mil to repatriate remains of victims in a death event ● Fine prints often state various conditions limiting probable payouts NextShield’s “Everything Everywhere” or E 2 covers many risks that would result in demonstrable financial damage above a deductible and up to a maximum “cap” ● SIMPLE, CLEAR Contract with a few paragraphs and few “outs” (for damages due to willful behaviour ) instead of 25 page contracts with many “outs” ● User Controlled Coverage that could be turned on or off anytime to preserve coverage credits instead of covering the whole trip ● On Demand Pricing that could be amped up - E.g. Policyholder can amp up accident coverage for 30 minutes just before doing something risky ● Blockchained insurance coverage units that is Transferable to family members or friends ● Promotional Rates if policyholder enables geo - tracking, which allows NextShield to identify risky behaviour , and/ or if they allow coupon promotions Insurance terms Start & Stop coverage any time Increase or decrease coverage any time Details of Insurance premiums and coverage remaining Access promotional coupons from partner advertisers and insurance discounts by sharing location Transfer insurance coverage units to another party Next Shield

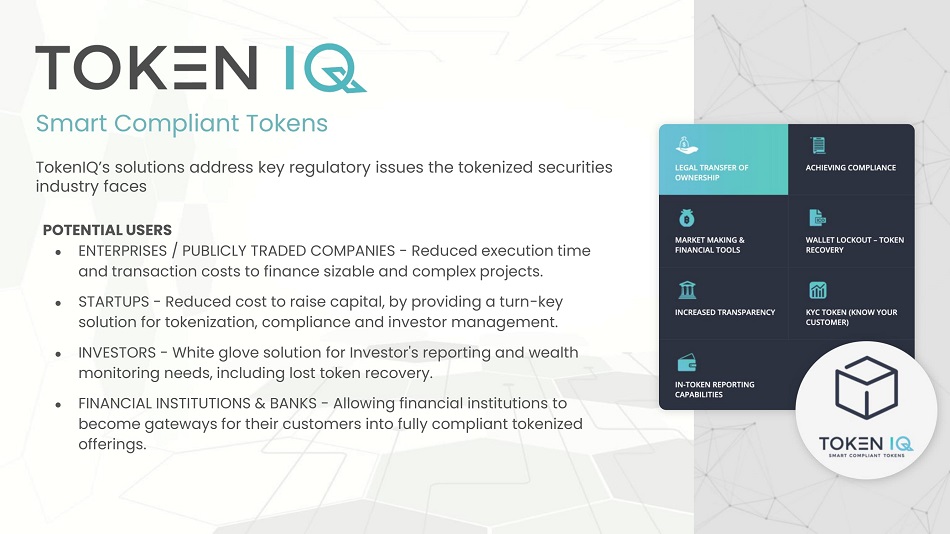

13 POTENTIAL USERS ● ENTERPRISES / PUBLICLY TRADED COMPANIES - Reduced execution time and transaction costs to finance sizable and complex projects. ● STARTUPS - Reduced cost to raise capital, by providing a turn - key solution for tokenization, compliance and investor management. ● INVESTORS - White glove solution for Investor's reporting and wealth monitoring needs, including lost token recovery. ● FINANCIAL INSTITUTIONS & BANKS - Allowing financial institutions to become gateways for their customers into fully compliant tokenized offerings. TokenIQ’s solutions address key regulatory issues the tokenized securities industry faces Smart Compliant Tokens

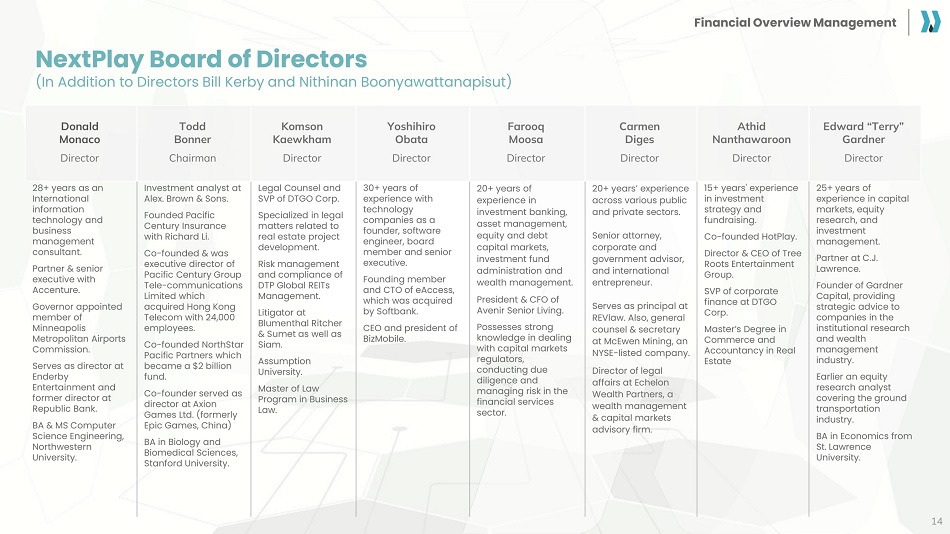

Donald Monaco Director Todd Bonner Chairman Komson Kaewkham Director Yoshihiro Obata Director Farooq Moosa Director Carmen Diges Director Athid Nanthawaroon Director Edward “Terry” Gardner Director 28+ years as an International information technology and business management consultant. Partner & senior executive with Accenture. Governor appointed member of Minneapolis Metropolitan Airports Commission. Serves as director at Enderby Entertainment and former director at Republic Bank. BA & MS Computer Science Engineering, Northwestern University. Investment analyst at Alex. Brown & Sons. Founded Pacific Century Insurance with Richard Li. Co - founded & was executive director of Pacific Century Group Tele - communications Limited which acquired Hong Kong Telecom with 24,000 employees. Co - founded NorthStar Pacific Partners which became a $2 billion fund. Co - founder served as director at Axion Games Ltd. (formerly Epic Games, China) BA in Biology and Biomedical Sciences, Stanford University. Legal Counsel and SVP of DTGO Corp. Specialized in legal matters related to real estate project development. Risk management and compliance of DTP Global REITs Management. Litigator at Blumenthal Ritcher & Sumet as well as Siam. Assumption University. Master of Law Program in Business Law. 30+ years of experience with technology companies as a founder, software engineer, board member and senior executive. Founding member and CTO of eAccess, which was acquired by Softbank. CEO and president of BizMobile. 20+ years of experience in investment banking, asset management, equity and debt capital markets, investment fund administration and wealth management. President & CFO of Avenir Senior Living. Possesses strong knowledge in dealing with capital markets regulators, conducting due diligence and managing risk in the financial services sector. 20+ years’ experience across various public and private sectors. Senior attorney, corporate and government advisor, and international entrepreneur. Serves as principal at REVlaw. Also, general counsel & secretary at McEwen Mining, an NYSE - listed company. Director of legal affairs at Echelon Wealth Partners, a wealth management & capital markets advisory firm. 15+ years' experience in investment strategy and fundraising. Co - founded HotPlay. Director & CEO of Tree Roots Entertainment Group. SVP of corporate finance at DTGO Corp. Master’s Degree in Commerce and Accountancy in Real Estate 25+ years of experience in capital markets, equity research, and investment management. Partner at C.J. Lawrence. Founder of Gardner Capital, providing strategic advice to companies in the institutional research and wealth management industry. Earlier an equity research analyst covering the ground transportation industry. BA in Economics from St. Lawrence University. 14 NextPlay Board of Directors (In Addition to Directors Bill Kerby and Nithinan Boonyawattanapisut) Financial Overview Management

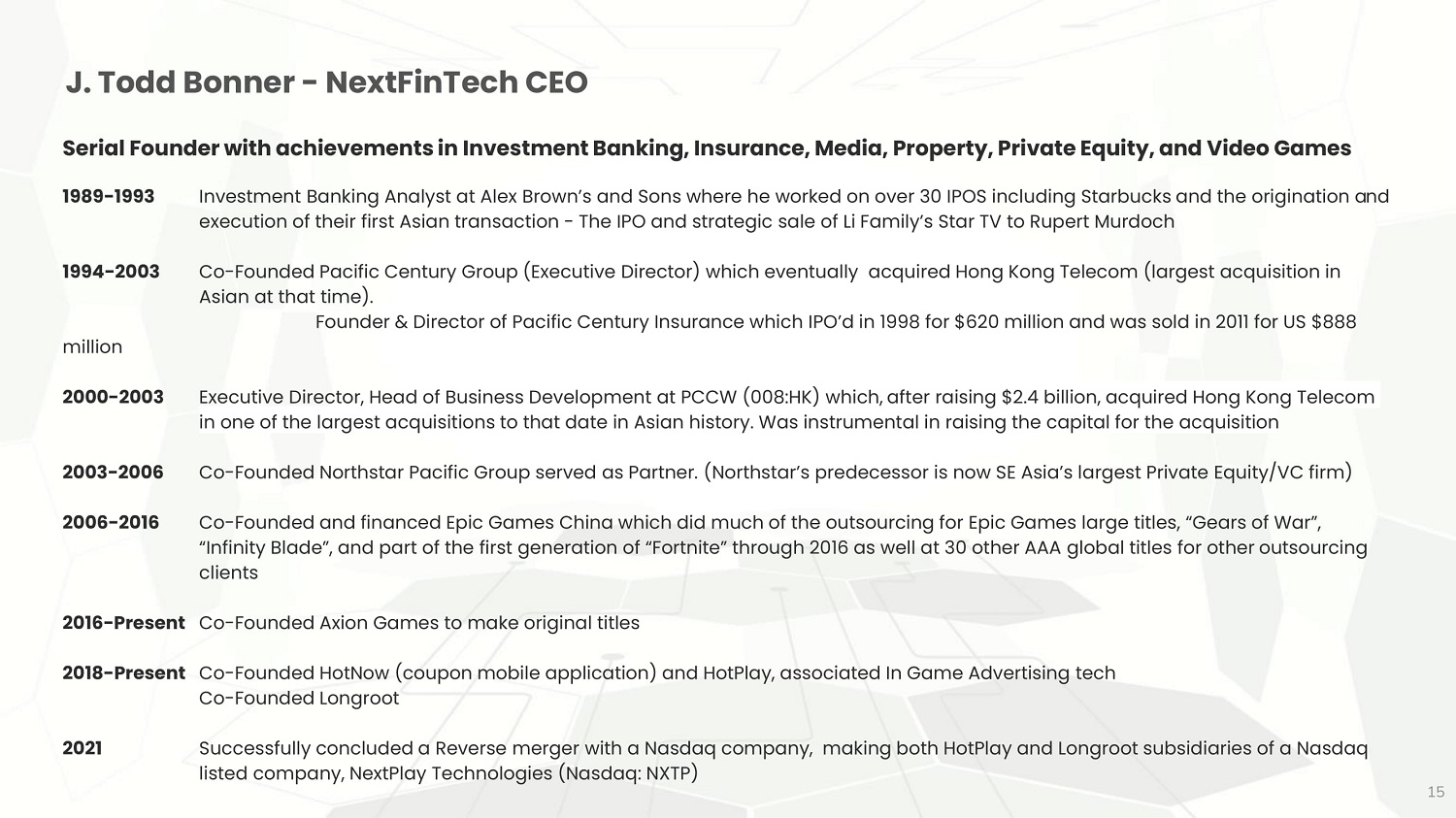

15 Serial Founder with achievements in Investment Banking, Insurance, Media, Property, Private Equity, and Video Games 1989 - 1993 Investment Banking Analyst at Alex Brown’s and Sons where he worked on over 30 IPOS including Starbucks and the origination a n d execution of their first Asian transaction - The IPO and strategic sale of Li Family’s Star TV to Rupert Murdoch 1994 - 2003 Co - Founded Pacific Century Group (Executive Director) which eventually acquired Hong Kong Telecom (largest acquisition in Asian at that time). Founder & Director of Pacific Century Insurance which IPO’d in 1998 for $620 million and was sold in 2011 for US $888 million 2000 - 2003 Executive Director, Head of Business Development at PCCW (008:HK) which, after raising $2.4 billion, acquired Hong Kong Telecom in one of the largest acquisitions to that date in Asian history. Was instrumental in raising the capital for the acquisition 2003 - 2006 Co - Founded Northstar Pacific Group served as Partner. ( Northstar’s predecessor is now SE Asia’s largest Private Equity/VC firm) 2006 - 2016 Co - Founded and financed Epic Games China which did much of the outsourcing for Epic Games large titles, “Gears of War”, “Infinity Blade”, and part of the first generation of “Fortnite” through 2016 as well at 30 other AAA global titles for other ou tsourcing clients 2016 - Present Co - Founded Axion Games to make original titles 2018 - Present Co - Founded HotNow (coupon mobile application) and HotPlay, associated In Game Advertising tech Co - Founded Longroot 2021 Successfully concluded a Reverse merger with a Nasdaq company, making both HotPlay and Longroot subsidiaries of a Nasdaq listed company, NextPlay Technologies (Nasdaq: NXTP) J. Todd Bonner - NextFinTech CEO

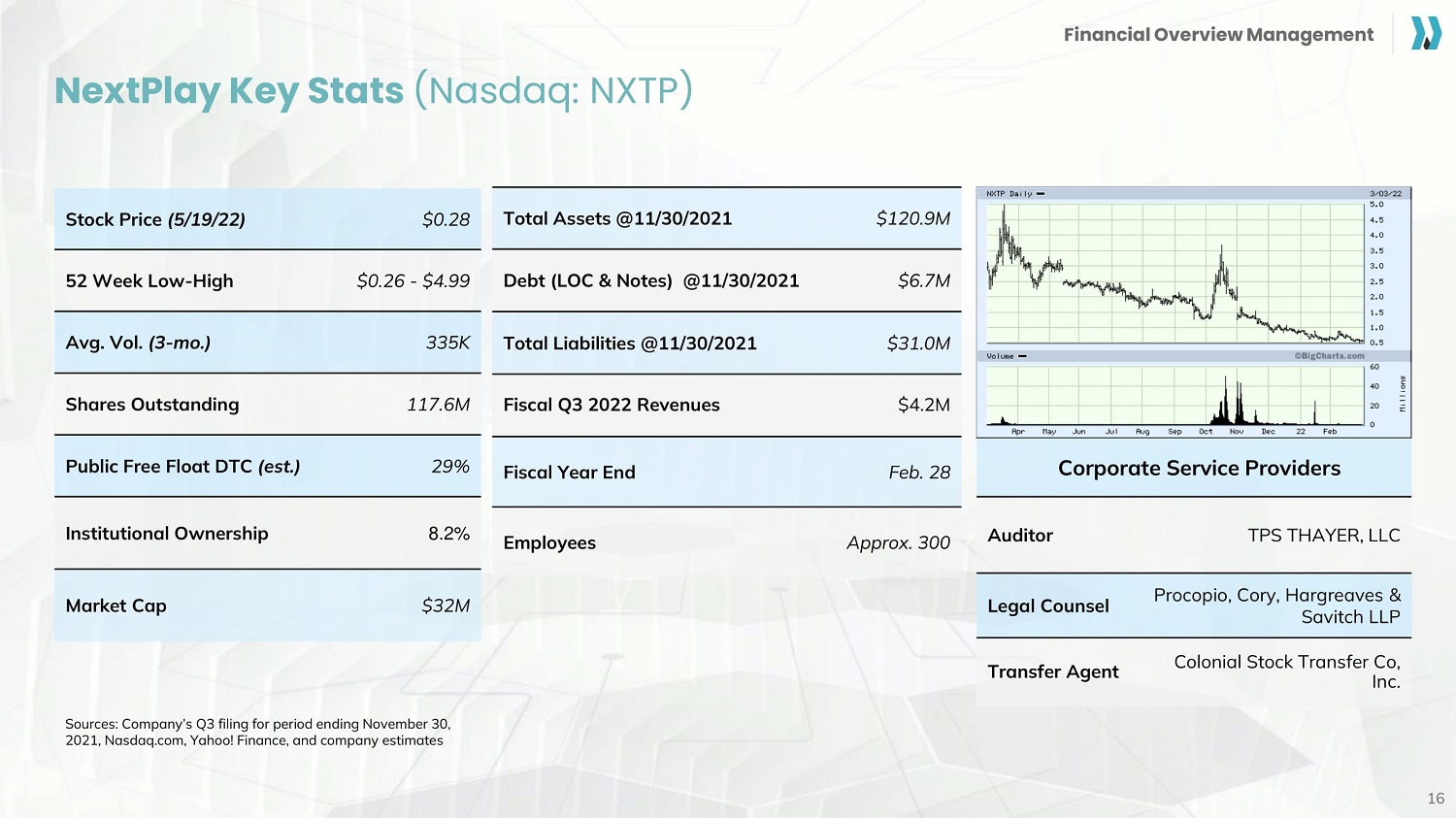

NextPlay Key Stats (Nasdaq: NXTP) Financial Overview Management 16 Stock Price ( 5/19/22 ) $ 0.28 52 Week Low - High $ 0.26 - $4.99 Avg. Vol. (3 - mo.) 335K Shares Outstanding 117.6M Public Free Float DTC (est.) 29% Institutional Ownership 8.2% Market Cap $ 32M Corporate Service Providers Auditor TPS THAYER, LLC Legal Counsel Procopio, Cory, Hargreaves & Savitch LLP Transfer Agent Colonial Stock Transfer Co, Inc. Sources: Company’s Q3 filing for period ending November 30, 2021, Nasdaq.com, Yahoo! Finance, and company estimates Total Assets @11/30/2021 $120.9M Debt (LOC & Notes) @11/30/2021 $6.7M Total Liabilities @11/30/2021 $31.0M Fiscal Q3 2022 Revenues $4.2M Fiscal Year End Feb. 28 Employees Approx. 300

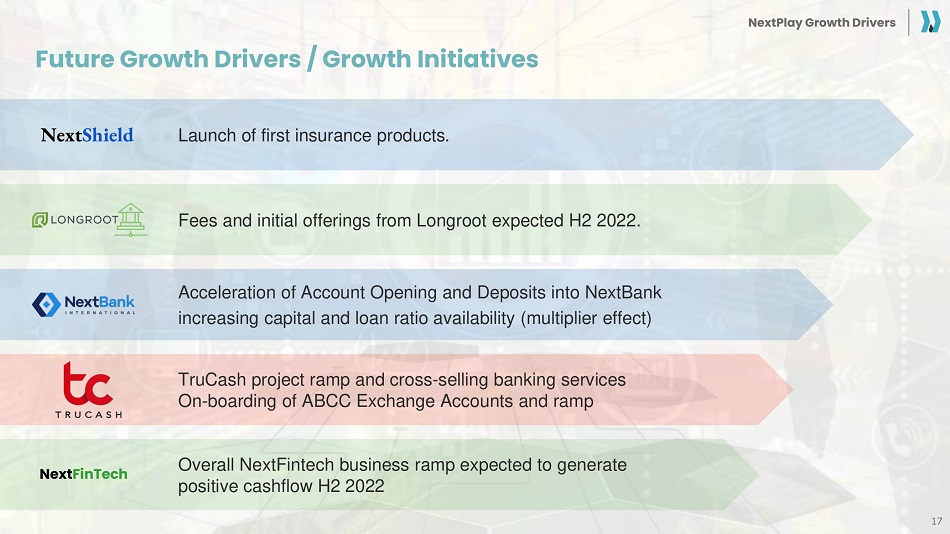

Fees and initial offerings from Longroot expected H2 2022. Launch of first insurance products . Overall NextFintech business ramp expected to generate positive cashflow H2 2022 Acceleration of Account Opening and Deposits into NextBank increasing capital and loan ratio availability (multiplier effect) 17 Future Growth Drivers / Growth Initiatives NextPlay Growth Drivers Next Shield TruCash project ramp and cross - selling banking services On - boarding of ABCC Exchange Accounts and ramp Next FinTech

1560 Sawgrass Corporate Parkway, Suite 130 Sunrise, Florida 33323 USA Main 954.888.9779 www.nextplaytechnologies.com Contact Us NextPlay Investor Contact: Richard Marshall Director of Corporate Development [email protected] Main 954.888.9779

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Rayonier Explores Forestry Career Paths: Discover the Role of a Timber Marketing Manager

- Healthcare Automation Market Size to Surpass USD 86.71 billion by 2030 with Highest CAGR of 8.11% by 2031

- Molecular Diagnostics Market to Reach USD 36.94 billion by 2031, North America to Hold 39% Share

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share