Form 8-K MULESOFT, INC For: Mar 20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

March 20, 2018

MuleSoft, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-38031 | 20-5158650 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

77 Geary Street, Suite 400

San Francisco, California 94108

(Address of principal executive offices, including zip code)

(415) 229-2009

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2 below):

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) of Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

| Item 8.01. | Other Events. |

On March 20, 2018, MuleSoft, Inc., a Delaware corporation (“MuleSoft”), and salesforce.com, inc., a Delaware corporation (“salesforce”), issued a joint press release announcing the execution of an Agreement and Plan of Merger, by and among MuleSoft, salesforce and Malbec Acquisition Corp., a wholly owned subsidiary of salesforce (the “Merger Agreement”).

A copy of the press release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference. On March 20, 2018, in connection with announcement of the Merger Agreement, salesforce and MuleSoft will hold a conference call available to investors and the public. A presentation (the “Investor Presentation”) for reference during such call is furnished as Exhibit 99.2 hereto and is incorporated herein by reference.

Additional Information and Where to Find It

The exchange offer referenced in this communication has not yet commenced. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares, nor is it a substitute for any offer materials that MuleSoft will file with the U.S. Securities and Exchange Commission (the “SEC”). At the time the exchange offer is commenced, salesforce and its acquisition subsidiary will file a tender offer statement on Schedule TO, salesforce will file a registration statement on Form S-4 and MuleSoft will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the exchange offer. THE EXCHANGE OFFER MATERIALS (INCLUDING AN OFFER TO EXCHANGE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER EXCHANGE OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT WILL CONTAIN IMPORTANT INFORMATION. MULESOFT STOCKHOLDERS ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS OF MULESOFT SECURITIES SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING EXCHANGING THEIR SECURITIES. The Solicitation/Recommendation Statement, the Offer to Exchange, the related Letter of Transmittal and certain other exchange offer documents will be made available to all MuleSoft stockholders at no expense to them. The exchange offer materials and the Solicitation/Recommendation Statement will be made available for free on the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by salesforce will be available free of charge under the Financials heading of the Investor Relations section of salesforce’s website at www.salesforce.com/investor. Copies of the documents filed with the SEC by MuleSoft will be available free of charge under the SEC filings heading of the Investors section of MuleSoft’s website at investors.mulesoft.com.

Forward-Looking Statements

This communication contains forward-looking information related to MuleSoft and the acquisition of MuleSoft by salesforce that involves substantial risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed or implied by such statements. Forward-looking statements in this release include, among other things, statements about the potential benefits of the proposed transaction, MuleSoft’s plans, objectives, expectations and intentions, the financial condition, results of operations and business of MuleSoft, and the anticipated timing of closing of the proposed transaction. Risks and uncertainties include, among other things, risks related to the ability of MuleSoft to consummate the proposed transaction on a timely basis or at all; the satisfaction of the conditions precedent to consummation of the proposed transaction, including having a sufficient number of MuleSoft’s shares being validly tendered into the exchange offer to meet the minimum condition; MuleSoft’s ability to secure regulatory approvals on the terms expected in a timely manner or at all; the ability to realize the anticipated benefits of the proposed transaction, including the possibility that the expected benefits from the proposed transaction will not be realized or will not be realized within the expected time period; disruption from the transaction making it more difficult to maintain business and operational relationships; significant transaction costs; unknown liabilities; the risk of litigation and/or regulatory actions related to the proposed transaction; the pace of change and innovation in enterprise cloud computing services; the competitive nature of the market in which MuleSoft participates; MuleSoft’s service performance and security, including the resources and costs required to prevent, detect and remediate potential security breaches; the expenses associated with new data centers and third-party infrastructure providers; additional data center capacity; MuleSoft’s ability to protect its intellectual property rights and develop its brand; dependency on the development and maintenance of the infrastructure of the Internet; the ability to develop new services and product features; other business effects, including the effects of industry, market, economic, political or

regulatory conditions; future exchange and interest rates; changes in tax and other laws, regulations, rates and policies, including those related to the provision of services on the Internet, those related to accessing the Internet and those addressing data privacy and import and export controls; future business combinations or disposals; the uncertainties inherent in research and development; competitive developments and climate change.

Further information on these and other risk and uncertainties relating to MuleSoft can be found in its reports on Forms 10-K, 10-Q and 8-K and in other filings MuleSoft makes with the SEC from time to time and available at www.sec.gov. These documents are available under the SEC filings heading of the Investors section of MuleSoft’s website at investors.mulesoft.com.

The forward-looking statements included in this communication are made only as of the date hereof. MuleSoft assumes no obligation and does not intend to update these forward-looking statements, except as required by law.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit Number |

Description | |

| 99.1 | Joint Press Release issued by MuleSoft, Inc. and salesforce.com, inc., dated March 20, 2018 | |

| 99.2 | Investor Presentation | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| MULESOFT, INC. | ||

| By: | /s/ Matt Langdon | |

| Matt Langdon Chief Financial Officer | ||

Date: March 20, 2018

Exhibit 99.1

John Cummings

Salesforce

Investor Relations

415-778-4188

Gina Sheibley

Salesforce

Public Relations

917-297-8988

Melissa Czapiga

MuleSoft

Public Relations

415-294-0161

Carla Cooper

MuleSoft

Investor Relations

415-229-2009

Salesforce Signs Definitive Agreement to Acquire MuleSoft

MuleSoft provides one of the world’s leading platforms for building application networks that connect

enterprise apps, data and devices, across any cloud and on-premise

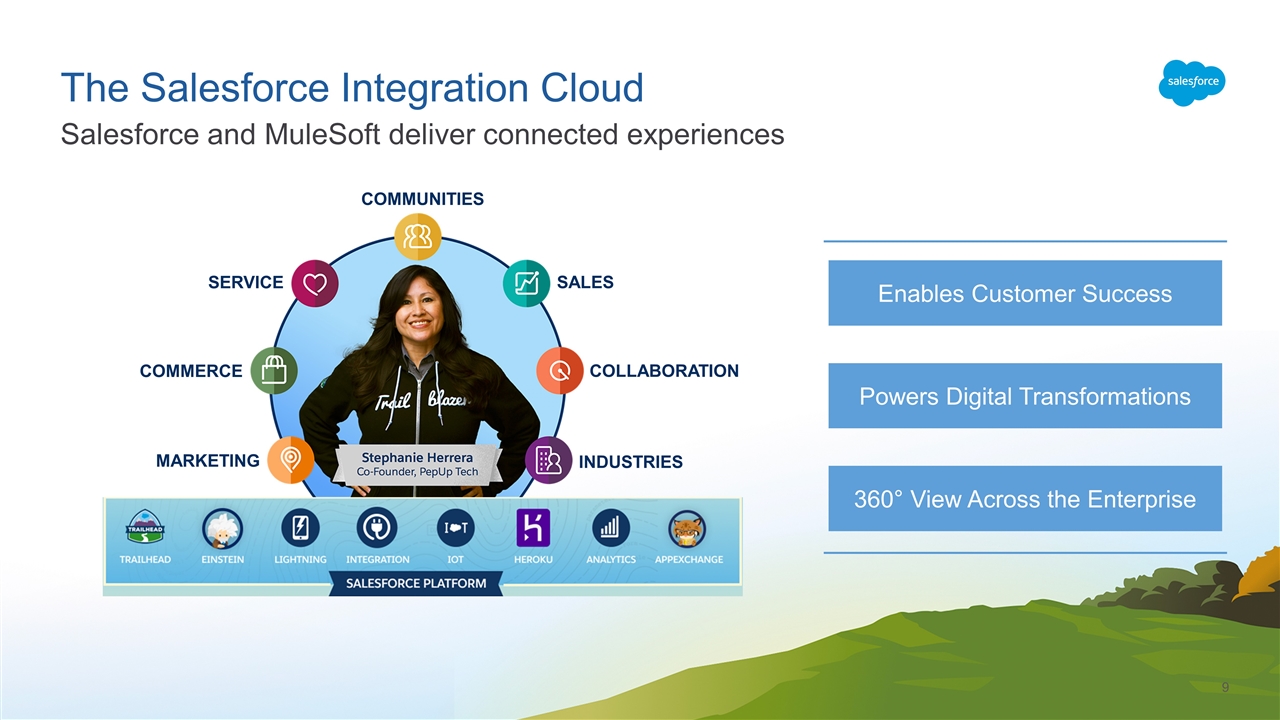

MuleSoft will power the new Salesforce Integration Cloud, which will enable all enterprises to surface any data—regardless of where it resides—to drive deep and intelligent customer experiences throughout a personalized 1:1 journey

More than 1,200 customers, including Coca-Cola, Barclays, Unilever and Mount Sinai, rely on MuleSoft to change and innovate faster, deliver differentiated customer experiences and increase operational efficiency

SAN FRANCISCO, March 20, 2018 Salesforce (NYSE: CRM), the global leader in CRM, and MuleSoft (NYSE: MULE), the provider of one of the world’s leading platforms for building application networks, have entered into a definitive agreement under which Salesforce will acquire MuleSoft for an enterprise value of approximately $6.5 billion.

Comments on the News:

| • | “Every digital transformation starts and ends with the customer,” said Marc Benioff, Chairman and CEO, Salesforce. “Together, Salesforce and MuleSoft will enable customers to connect all of the information throughout their enterprise across all public and private clouds and data sources—radically enhancing innovation. I am thrilled to welcome MuleSoft to the Salesforce Ohana.” |

| • | “With the full power of Salesforce behind us, we have a tremendous opportunity to realize our vision of the application network even faster and at scale,” said Greg Schott, MuleSoft Chairman and CEO. “Together, Salesforce and MuleSoft will accelerate our customers’ digital transformations enabling them to unlock their data across any application or endpoint.” |

MuleSoft: One of the World’s Leading Application Network Platforms

MuleSoft provides one of the world’s leading platforms for building application networks that connect enterprise apps, data and devices, across any cloud and on-premise. More than 1,200 customers, including Coca-Cola, Barclays, Unilever and Mount Sinai, rely on MuleSoft to change and innovate faster, deliver differentiated customer experiences, and increase operational efficiency.

Acquisition to Accelerate Customers’ Digital Transformations

Together, Salesforce and MuleSoft will accelerate customers’ digital transformations, enabling them to unlock data across legacy systems, cloud apps and devices to make smarter, faster decisions and create highly differentiated, connected customer experiences.

MuleSoft will continue to build toward the company’s vision of the application network with Anypoint Platform, and MuleSoft will power the new Salesforce Integration Cloud, which will enable all enterprises to surface any data—regardless of where it resides—to drive deep and intelligent customer experiences throughout a personalized 1:1 journey.

As part of the world’s #1 CRM company and fastest growing top 5 enterprise software company, MuleSoft will be able to accelerate its growth and deliver even more innovation to its customers at scale.

Details Regarding the Proposed MuleSoft Acquisition

The boards of directors of Salesforce and MuleSoft have unanimously approved the transaction.

Under the terms of the transaction, the MuleSoft acquisition consideration will be composed of $36.00 in cash and 0.0711 shares of Salesforce common stock per MuleSoft Class A and Class B common share, which represents a per share price for MuleSoft common shares of $44.89 based on the closing price of Salesforce common stock on March 19, 2018. The per share price represents a 36% premium over MuleSoft’s closing share price on March 19, 2018.

Under the terms of the transaction, Salesforce will commence an exchange offer to acquire all of the outstanding shares of MuleSoft. The transaction is expected to close in the second quarter of Salesforce’s fiscal year 2019, ending July 31, 2018, subject to the satisfaction of customary closing conditions, including the tender by MuleSoft stockholders of shares representing a majority of the MuleSoft common stock voting power, on a one-vote per share basis, and the expiration of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act. Stockholders of MuleSoft owning approximately 30% of the outstanding shares have entered into tender and support agreements with Salesforce, pursuant to which they have agreed, among other things, and subject to the terms and conditions of the agreements, to tender their shares of MuleSoft common stock in the exchange offer. Following the successful completion of the exchange offer, MuleSoft shares not tendered in the exchange offer will be converted in a second step merger into the right to receive the same $36.00 in cash and 0.0711 shares of Salesforce common stock, paid in the exchange offer, per MuleSoft share.

Salesforce expects to fund the cash consideration with cash from its balance sheet and approximately $3.0 billion of proceeds from a combination of term loans and/or the issuance of debt securities. The relative mix of each will depend on prevailing market conditions. Salesforce has obtained a commitment from BofA Merrill Lynch for a $3.0 billion bridge loan facility, subject to customary conditions. This transaction is not subject to any financing condition.

BofA Merrill Lynch is serving as exclusive financial advisor to Salesforce. Goldman, Sachs & Co. is serving as exclusive financial advisor to MuleSoft.

Management Conference Call

Salesforce and MuleSoft will host a conference call to discuss this transaction at 2:30 p.m. (PT) / 5:30 p.m. (ET) on March 20, 2018. A live dial-in is available domestically at 866-901-SFDC or 866-901-7332 and internationally at 706-902-1764, passcode 6797006. A live audiocast of the event will be available on the Salesforce Investor Relations website at http://www.salesforce.com/investor and on MuleSoft’s website at https://investor.mulesoft.com. A replay will be available at 800-585-8367 or 855-859-2056 until midnight (ET) April 19, 2018.

Additional Information and Where to Find It

The exchange offer referenced in this communication has not yet commenced. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares, nor is it a substitute for any offer materials that Salesforce, its acquisition subsidiary and MuleSoft will file with the U.S. Securities and Exchange Commission (the “SEC”). At the time the exchange offer is commenced, Salesforce and its acquisition subsidiary will file a tender offer statement on Schedule TO, Salesforce will file a registration statement on Form S-4 and MuleSoft will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the exchange offer. THE EXCHANGE OFFER MATERIALS (INCLUDING AN OFFER TO EXCHANGE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER EXCHANGE OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT WILL CONTAIN IMPORTANT INFORMATION. MULESOFT STOCKHOLDERS ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS OF MULESOFT SECURITIES SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING EXCHANGING THEIR SECURITIES. The Solicitation/Recommendation Statement, the Offer to Exchange, the related Letter of Transmittal and certain other exchange offer documents will be made available to all MuleSoft stockholders at no expense to them. The exchange offer materials and the Solicitation/Recommendation Statement will be made available for free on the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by Salesforce will be available free of charge under the Financials heading of the Investor Relations section of Salesforce’s website at www.salesforce.com/investor or by contacting Salesforce’s Investor Relations department at [email protected]. Copies of the documents filed with the SEC by MuleSoft will be available free of charge under the SEC filings heading of the Investor section of MuleSoft’s website at https://investors.mulesoft.com or by contacting MuleSoft’s Investor Relations department at [email protected].

In addition to the Solicitation/Recommendation Statement, the Offer to Exchange, the related Letter of Transmittal and certain other exchange offer documents, Salesforce and MuleSoft file annual, quarterly and current reports and other information with the SEC. You may read and copy any reports or other information filed by Salesforce and MuleSoft at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. Salesforce’s and MuleSoft’s filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at http://www.sec.gov.

Forward-Looking Statements

This communication contains forward-looking information related to the Company, MuleSoft and the acquisition of MuleSoft by the Company that involves substantial risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed or implied by such statements. Forward-looking statements in this communication include, among other things, statements about the potential benefits of the proposed transaction, the Company’s plans, objectives, expectations and

intentions, the financial condition, results of operations and business of the Company, and the anticipated timing of closing of the proposed transaction. Risks and uncertainties include, among other things, risks related to the ability of the Company to consummate the proposed transaction on a timely basis or at all, including due to complexities resulting from the adoption of new accounting pronouncements and associated system implementations; the satisfaction of the conditions precedent to consummation of the proposed transaction, including having a sufficient number of MuleSoft’s shares being validly tendered into the exchange offer to meet the minimum condition; the Company’s ability to secure regulatory approvals on the terms expected, in a timely manner or at all; the Company’s ability to successfully integrate MuleSoft’s operations; the Company’s ability to implement its plans, forecasts and other expectations with respect to MuleSoft’s business after the completion of the transaction and realize expected synergies; the ability to realize the anticipated benefits of the proposed transaction, including the possibility that the expected benefits from the proposed transaction will not be realized or will not be realized within the expected time period; disruption from the transaction making it more difficult to maintain business and operational relationships; the negative effects of the announcement or the consummation of the proposed transaction on the market price of the Company’s common stock or on the Company’s operating results; significant transaction costs; unknown liabilities; the risk of litigation or regulatory actions related to the proposed transaction; the pace of change and innovation in enterprise cloud computing services; the competitive nature of the market in which the Company participates; the Company’s service performance and security, including the resources and costs required to prevent, detect and remediate potential security breaches; the expenses associated with new data centers and third-party infrastructure providers; additional data center capacity; the Company’s ability to protect its intellectual property rights and develop its brands; dependency on the development and maintenance of the infrastructure of the Internet; the ability to develop new services and product features; other business effects, including the effects of industry, market, economic, political or regulatory conditions; future exchange and interest rates; changes in tax and other laws, regulations, rates and policies, including those related to the provision of services on the Internet, those related to accessing the Internet and those addressing data privacy and import and export controls; future business combinations or disposals; the uncertainties inherent in research and development; competitive developments and climate change.

Further information on these and other risk and uncertainties relating to Salesforce and MuleSoft can be found in their respective reports on Forms 10-K, 10-Q and 8-K and in other filings Salesforce and MuleSoft make with the SEC from time to time and available at www.sec.gov. These documents are available on the SEC Filings section of the Investor Information section of Salesforce’s website at www.salesforce.com/investor and the Investor section of MuleSoft’s website at https://investors.mulesoft.com/.

The forward-looking statements included in this communication are made only as of the date hereof. Salesforce and MuleSoft assumes no obligation and does not intend to update these forward-looking statements, except as required by law.

About MuleSoft

MuleSoft’s mission is to help organizations change and innovate faster by making it easy to connect the world’s applications, data and devices. With its API-led approach to connectivity, MuleSoft’s industry-leading Anypoint Platform™ is enabling more than 1,200 organizations in approximately 60 countries to build application networks. For more information, visit https://www.mulesoft.com.

About Salesforce

Salesforce, the global leader in CRM, empowers companies to connect with their customers in a whole new way. For more information about Salesforce (NYSE: CRM), visit http://www.salesforce.com.

Salesforce Announces Agreement to Acquire MuleSoft March 20, 2018 Exhibit 99.2

Call Participants Greg Schott Chairman & Chief Executive Officer, MuleSoft Mark Hawkins President & Chief Financial Officer, Salesforce Keith Block Vice Chairman, President & Chief Operating Officer, Salesforce Bret Taylor President & Chief Product Officer, Salesforce

Forward-Looking Statements This presentation contains forward-looking information related to Salesforce, MuleSoft and the acquisition of MuleSoft by Salesforce that involves substantial risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed or implied by such statements. Forward-looking statements in this presentation include, among other things, statements about the potential benefits of the proposed transaction, Salesforce and MuleSoft's plans, objectives, expectations and intentions, the financial condition, results of operations and business of Salesforce and MuleSoft, and the anticipated timing of closing of the proposed transaction. Risks and uncertainties include, among other things, risks related the ability of Salesforce and MuleSoft to consummate the proposed transaction on a timely basis or at all, including due to complexities resulting from the adoption of new accounting pronouncements and associated system implementations; the satisfaction of the conditions precedent to consummation of the proposed transaction, including having a sufficient number of MuleSoft's shares being validly tendered into the exchange offer to meet the minimum condition; Salesforce’s and MuleSoft’s ability to secure regulatory approvals on the terms expected, in a timely manner or at all; Salesforce’s ability to successfully integrate MuleSoft's operations; Salesforce’s ability to implement its plans, forecasts and other expectations with respect to MuleSoft's business after the completion of the transaction and realize expected synergies; risks related to the ability to realize the anticipated benefits of the proposed transaction, including the possibility that the expected benefits from the proposed transaction will not be realized or will not be realized within the expected time period; disruption from the transaction making it more difficult to maintain business and operational relationships; negative effects of the announcement or the consummation of the proposed transaction on the market price of Salesforce’s common stock or on Salesforce's operating results; significant transaction costs; unknown liabilities; the risk of litigation and/or regulatory actions related to the proposed transaction; the pace of change and innovation in enterprise cloud computing services; the competitive nature of the market in which Salesforce and MuleSoft participate; Salesforce’s and MuleSoft’s service performance and security, including the resources and costs required to prevent, detect and remediate potential security breaches; the expenses associated with new data centers and third-party infrastructure providers; additional data center capacity; Salesforce and MuleSoft’s ability to protect their intellectual property rights and develop their brands; dependency on the development and maintenance of the infrastructure of the Internet; the ability to develop new services and product features; other business effects, including the effects of industry, market, economic, political or regulatory conditions; future exchange and interest rates; changes in tax and other laws, regulations, rates and policies, including those related to the provision of services on the Internet, those related to accessing the Internet, and those addressing data privacy and import and export controls; future business combinations or disposals; the uncertainties inherent in research and development; competitive developments and climate change. Further information on these and other risk and uncertainties relating to Salesforce and MuleSoft can be found in their respective reports on Forms 10-K, 10-Q and 8-K and in other filings Salesforce and MuleSoft make with the SEC from time to time and available at www.sec.gov. These documents are available on the SEC Filings section of the Investor Information section of the Salesforce’s website at www.salesforce.com/investor and the Investor section of MuleSoft’s website at https://investors.mulesoft.com/. The forward-looking statements included in this communication are made only as of the date hereof. Salesforce and MuleSoft assume no obligation and do not intend to update these forward-looking statements, except as required by law. Financial metrics are based on ASC605 standard throughout this presentation. Statement under the Private Securities Litigation Reform Act of 1995 3

Additional Information and Where to Find it The exchange offer referenced in this communication has not yet commenced. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares, nor is it a substitute for any offer materials that Salesforce and its acquisition subsidiary will file with the U.S. Securities and Exchange Commission (the “SEC”). At the time the exchange offer is commenced, Salesforce and its acquisition subsidiary will file a tender offer statement on Schedule TO, Salesforce will file a registration statement on Form S-4 and MuleSoft will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the exchange offer. THE EXCHANGE OFFER MATERIALS (INCLUDING AN OFFER TO EXCHANGE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER EXCHANGE OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT WILL CONTAIN IMPORTANT INFORMATION. MULESOFT STOCKHOLDERS ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS OF MULESOFT SECURITIES SHOULD CONSIDER BEFORE M AKING ANY DECISION REGARDING EXCHANGING THEIR SECURITIES. The Offer to Exchange, the related Letter of Transmittal and certain other exchange offer documents, as well as the Solicitation/Recommendation Statement, will be made available to all holders of MuleSoft stock at no expense to them. The exchange offer materials and the Solicitation/Recommendation Statement will be made available for free at the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by Salesforce will be available free of charge on the SEC Filings section of the Investor Information section of Salesforce’s website at www.salesforce.com/investor or by contacting Salesforce’s Investor Relations department at [email protected]. Copies of the documents filed with the SEC by MuleSoft will be available free of charge on the Investor section of MuleSoft's website at https://investors.mulesoft.com or by contacting MuleSoft’s Investor Relations department at [email protected]. In addition to the Offer to Exchange, the related Letter of Transmittal and certain other exchange offer documents, as well as the Solicitation/Recommendation Statement, Salesforce and MuleSoft file annual, quarterly and current reports and other information with the SEC. You may read and copy any reports or other information filed by Salesforce and MuleSoft at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. Salesforce’s and MuleSoft’s filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at http://www.sec.gov. 3

Transaction Overview Purchase price of $6.5 billion, net of cash acquired $36.00 per share in cash; and 0.0711 shares of Salesforce common stock for each share of MuleSoft common stock Purchase price to be supported by approximately $3.0 billion of committed debt financing Pending ASC 606 and ASC 340-40, updated management guidance to be provided on or before April 3, 2018, excluding MuleSoft. 4 Expected to close in Q2 FY19 Subject to completion of exchange offer, regulatory approval and customary closing conditions Salesforce and MuleSoft will accelerate digital transformation for our customers, enabling them to unlock data across their legacy systems, cloud apps and devices to create highly differentiated, connected experiences at every touchpoint Transaction Consideration Financing Financial Impact Expected Closing Strategic Rationale Management & Governance Greg Schott will remain CEO of MuleSoft, reporting to Keith Block.

Driving Digital Transformation Together Two industry-leading companies sharing a common mission The #1 CRM enabling companies to connect with their customers in whole new ways Connecting in New Ways To Enable Customer Success, Speed & Innovation Enables organizations to change and innovate faster by making it easy to connect to the world’s applications, data, and devices 5

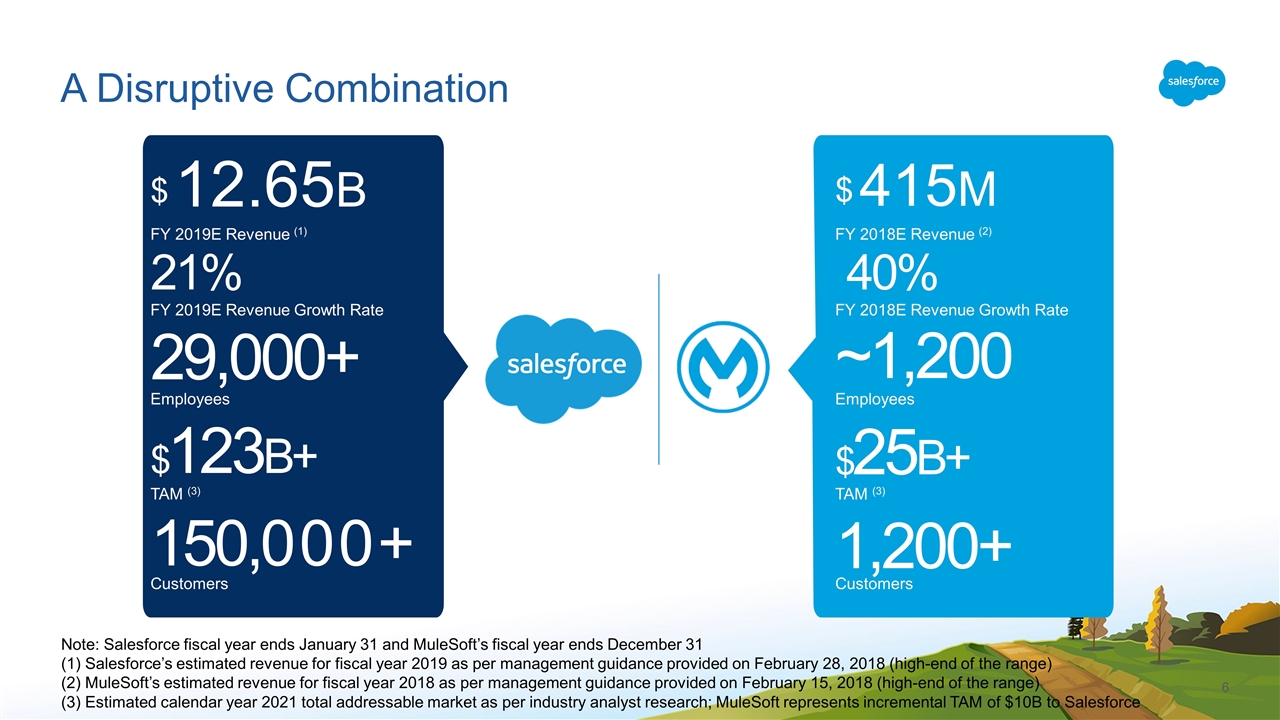

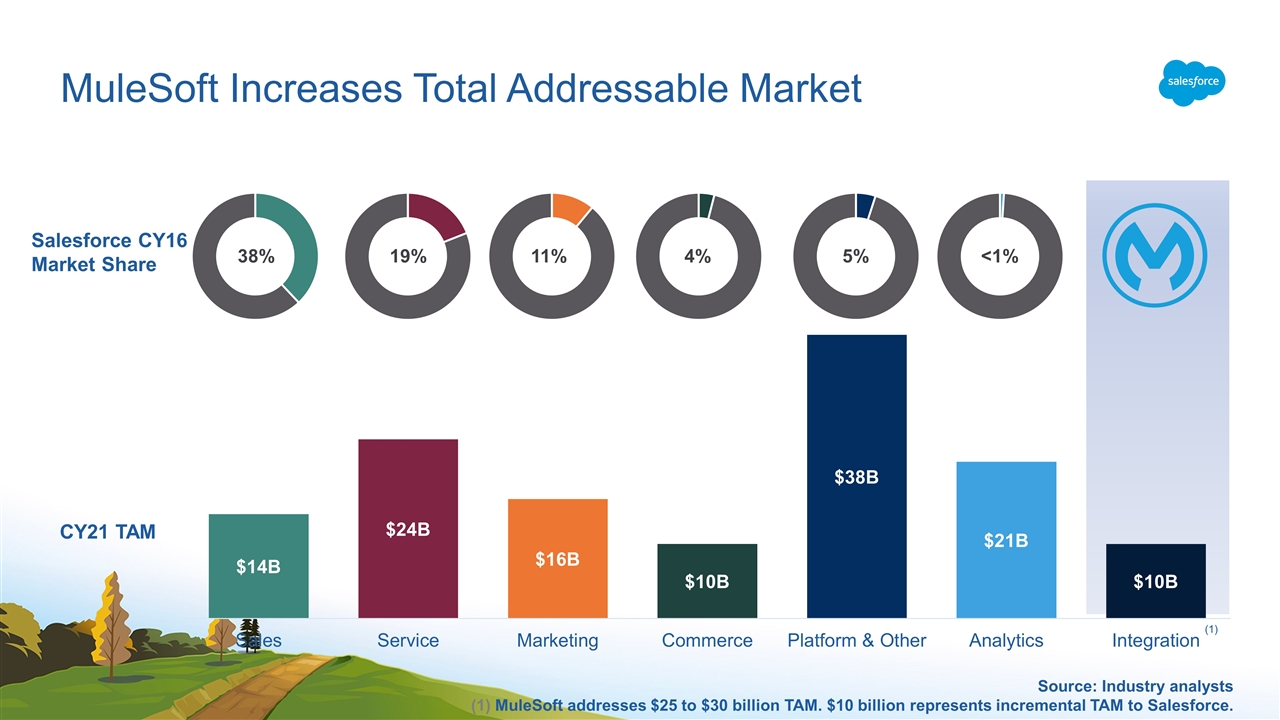

A Disruptive Combination Note: Salesforce fiscal year ends January 31 and MuleSoft’s fiscal year ends December 31 Salesforce’s estimated revenue for fiscal year 2019 as per management guidance provided on February 28, 2018 (high-end of the range) MuleSoft’s estimated revenue for fiscal year 2018 as per management guidance provided on February 15, 2018 (high-end of the range) Estimated calendar year 2021 total addressable market as per industry analyst research; MuleSoft represents incremental TAM of $10B to Salesforce 29,000+ Employees $ 12.65B FY 2019E Revenue (1) 150,000+ 21% FY 2019E Revenue Growth Rate Customers Employees $ 415M FY 2018E Revenue (2) 40% FY 2018E Revenue Growth Rate 1,200+ ~1,200 TAM (3) $123B+ $25B+ Customers TAM (3) 6

MuleSoft Enhances Industry Value Proposition Every industry has disparate systems critical to connected experiences Manufacturing Financial Services Retail Healthcare & Life Sciences Inventory POS ERP WFM Location Shipping Memberships Claims IoT Data Lakes Bureaus Credit Services Verification Practice Management Loyalty Standards Data Benefits ERP SCM/ Logistics PLM/ PIM Core Banking Portfolios Utilize an industry data model to ensure innovation and time to value Unlock value of data asset through cross and up-sell Create innovative applications and experiences with a complete view of the customer Single point of access for all patient/client interactions 7

Connecting Anything and Changing Everything SCM ERP Invoicing Inventory Management Field Service Employee Records Logistics Online Video Commerce CRM Blog Social Media Single Platform for All Use Cases Enterprise-Class Performance Vibrant Developer Community Security by Design 8

The Salesforce Integration Cloud Salesforce and MuleSoft deliver connected experiences Enables Customer Success Powers Digital Transformations 360° View Across the Enterprise MARKETING SERVICE SALES COMMERCE INDUSTRIES COMMUNITIES COLLABORATION 9

MuleSoft Increases Total Addressable Market CY21 TAM Salesforce CY16 Market Share 38% 19% 11% 4% 5% <1% (1) 10 Source: Industry analysts MuleSoft addresses $25 to $30 billion TAM. $10 billion represents incremental TAM to Salesforce. (1)

MuleSoft in the Enterprise Complements Salesforce’s enterprise success ~119% dollar-based net retention rate Average subscription & support rev. per customer of ~$185K in Q4 CY17, up 30% YoY 45 customers with >$1M+ in annual recurring revenue, up 50% from 30 customers at the IPO Key Highlights Source: MuleSoft November 2017 investor presentation and Q4 CY17 earnings call 11 1,200+ customers; approximately 60% overlap with Salesforce

13 +

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Patelco Credit Union selects the Empower LOS to streamline and bolster home loan and home-equity origination

- Mawson Infrastructure Group Inc. Announces Monthly Operational Update for March 2024

- Bacchus Capital Engaged as Strategic & Project Funding Adviser

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share