Form 8-K Leidos Holdings, Inc. For: Oct 07

CONRAD MIDTOWN October 7, 2021 2021 Investor Day

Certain statements in this presentation contain or are based on "forward-looking" information within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by words such as "expects," "intends," "plans," "anticipates," "believes," "estimates," "guidance" and similar words or phrases. Forward-looking statements in this presentation include, among others, estimates of our future growth and financial and operating performance, including future revenues, adjusted EBITDA and cash flows provided by operating activities, as well as statements about our strategy, planned investments, sustainability goals and our future dividends, share repurchases, capital expenditures, debt repayments, acquisitions, dispositions, addressable markets, and cash flow conversion. These statements reflect our belief and assumptions as to future events that may not prove to be accurate. Actual performance and results may differ materially from those results anticipated by our guidance and other forward-looking statements made in this presentation depending on a variety of factors, including, but not limited to: changes to our reputation and relationships with government agencies, developments in the U.S. government defense budget, including budget reductions, implementation of spending limits (sequestration) or changes in budgetary priorities; delays in the U.S. government budget process or approval of raises to the debt ceiling; delays in the U.S. government contract procurement process or the award of contracts; delays or loss of contracts as a result of competitor protests; changes in U.S. government procurement rules, regulations and practices; changes in interest rates and other market factors out of our control, including general economic and political conditions and the COVID-19 pandemic; our compliance with various U.S. government and other government procurement rules and regulations; governmental reviews, audits and investigations of our Company; our ability to effectively compete for and win contracts with the U.S. government and other customers; our reliance on information technology spending by hospitals/healthcare organizations; our reliance on infrastructure investments by industrial and natural resources organizations; energy efficiency and alternative energy sourcing investments; investments by the U.S. government and commercial organizations in environmental impact and remediation projects; our ability to attract, train and retain skilled employees, including our management team, and to obtain security clearances for our employees; the mix of our contracts and our ability to accurately estimate costs associated with our firm-fixed-price and other contracts; our ability to realize as revenues the full amount of our backlog; cybersecurity, data security or other security threats, systems failures or other disruptions of our business; resolution of legal and other disputes with our customers and others or legal or regulatory compliance issues; our ability to effectively acquire businesses and make investments; our ability to maintain relationships with prime contractors, subcontractors and joint venture partners; our ability to manage performance and other risks related to customer contracts, including complex engineering projects; our ability to obtain necessary components and materials to perform our contracts, including semiconductors and related equipment, on reasonable terms or at all; the failure of our inspection or detection systems to detect threats; the adequacy of our insurance programs designed to protect us from significant product or other liability claims; our ability to manage risks associated with our international business; exposure to lawsuits and contingencies associated with any acquired businesses; our ability to declare future dividends or repurchase our stock based on our earnings, financial condition, capital requirements and other factors, including compliance with applicable laws and contractual agreements; our ability to grow our commercial health and infrastructure businesses, which could be negatively affected by budgetary constraints faced by hospitals and by developers of energy and infrastructure projects; and our ability to execute our business plan and long-term management initiatives effectively and to overcome these and other known and unknown risks that we face. These are only some of the factors that may affect the forward-looking statements contained in this presentation. For further information concerning risks and uncertainties associated with our business, please refer to the filings we make from time to time with the U.S. Securities and Exchange Commission ("SEC"), including the "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Legal Proceedings" sections of our latest Annual report on Form 10-K and quarterly reports on Form 10-Q, all of which may be viewed or obtained through the Investor Relations section of our website at www.leidos.com. All information in this presentation is as of October 7, 2021. The Company expressly disclaims any duty to update the guidance or any other forward-looking statement provided in this presentation to reflect subsequent events, actual results or changes in the Company’s expectations. The Company also disclaims any duty to comment upon or correct information that may be contained in reports published by investment analysts or others. Forward-Looking Statements 2 Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Agenda 3 8:00 – 8:30 Registration and Breakfast 8:30 – 8:35 Stuart Davis, Investor Relations Opening Remarks 8:35 – 9:05 Roger Krone, Chairman & CEO Strategy & Investment Thesis 9:05 – 9:20 Jim Carlini, Chief Technology Officer Technology Differentiation 9:20 – 9:55 Dave King, Dynetics Group President Group Overview and Outlook Gerry Fasano, Defense Group President 9:55 – 10:10 Break 10:10 – 11:05 Roy Stevens, Intelligence Group President Group Overview & OutlookLiz Porter, Health Group President Jim Moos, Civil Group President 11:05 – 11:30 Chris Cage, Chief Financial Officer Financial Outlook 11:30 – 11:40 Break 11:40 – 12:25 Q&A 12:25 – 1:00 Lunch

Strategy and Investment Thesis ROGER KRONE, CHAIRMAN AND CEO 4

Building the Leader in the Government Technology Services Market 5 Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Motivated by Our Mission, Vision & Values 6 Vision Become the global leader in the development and application of technology to solve our customers’ most demanding challenges. Engage, develop and empower our diverse and valued people to foster a culture of creativity and growth. Strengthen our communities through volunteerism, sustainable operations, and the advancement of equality. Values … through technology, engineering, and science Mission Make the world… Safer Healthier More Efficient Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Living Our Values Through Commitment to ESG 7 2030 Sustainability Goals ADVANCE ENVIRONMENTAL SUSTAINABILITY • Reduce GHG emissions 25% • Reduce waste by 50% in Leidos facilities • Increase renewable energy to 25% of total electricity use PROMOTE HEALTHIER LIVES • Source 20 of Leidos’ biggest commodities more sustainably • Increase investment by 60% in initiatives aimed at enhancing employee health and well-being CULTIVATE INCLUSION • Increase representation of women and ethnically diverse employees by 10% • Award 16% of supplier contracts to diverse suppliers • Hire 15,000 veterans and military spouses Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

On Track to Exceed 2019 – 2021 Financial Targets 8 * Reconciliations of non-GAAP measures to the most comparable GAAP measures are included in the Appendix Metric 2019 – 2021 Targets 2019 – Q2 2021 Results Organic Revenue Growth CAGR:* 5% 6.6% (12.1% Total) Adjusted EBITDA Margin:* 10.0%+ 10.7% Cash Flow Conversion:* >100% 108% Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

$7.7B 12/20 $6.5B 04/20 $4.0B 04/20 $2.9B 08/20 $2.9B 06/19 Next Generation Enterprise Network Service Management, Integration, & Transport Global Solutions Management Operations II Hanford Mission Integration Solution Singlelock NASA End-user Services and Technologies Winning in the Market 9 $2.0B 01/21 $1.1B 11/19 $1.0B 06/21 $1.0B 05/20 $0.9B 04/20 Military Family Life Counseling Future Flight Services Program Reserve Health Readiness Program Traveler Processing and Vetting Software Pathfinder Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction Note: Amounts reflect Total Contract Value.

Building the Foundation for a Stronger Future 10 $21.5 $21.7 $23.9 $24.1 $28.2 $30.7 $31.7 $31.9 $32.6 $33.5 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 +56% Ba ck lo g (B ) Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Our business model will continue to differentiate us in the marketplace and lead to above market revenue, adjusted EBITDA, and cash generation growth based on our: Scale • Largest government technology services provider • Drives differentiation from peers Positioning • Three complementary segments of scale • Diversified portfolio aligned with the market Talented People • Focus on employee growth and development • Investing to be an employer of choice Strategic Focus 11 Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Increasing Our Leadership Position 12 $10.2 $8.3 $6.6 $6.5 $6.9 $4.6 $4.4 $3.5 $2.0 $1.5 $13.3 $8.2 $7.9 $7.2 $7.0 $6.0 $5.2 $4.4 $2.6 $1.8 LDOS GDIT BAH SAIC Perspecta, NGIT, Peraton CACI Jacobs ATN KBR Government Solutions MANT Parsons Federal Solutions Q4 2018 Q2 2021 Note: Revenues shown for trailing twelve months for each period. Q4 2018 figures for GDIT, Jacobs ATN, and SAIC shown on a pro-forma basis. All figures for Perspecta, NG, Peraton and the Q2 2021 figures for GDIT reflect the most contemporaneous publicly available data; other figures are from public filings. Revenues (B) Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Reaping the Benefits of Scale Technical Differentiation Greater investment in differentiation & repeatable solutions Leidos Innovation Center (LInC) incubates advanced technologies Strategic supplier alliances and university partnerships augment internal capabilities Customer Relationship Broadest set of relationships in the industry Commitment to customer mission strengthens partnerships Deep mission understanding provides foundation for differentiation Key Personnel Dedicated recruiting engine — 4,500+ external hires Q2 YTD Greater career mobility and investments in our people, aiding recruitment and retention Dedicated technical career track increases retention of key technical staff Past Performance Industry’s broadest set of past performance credentials Unique combination of demonstrated performance Commitment to program excellence & executive-level focus on customer success drives strong reputation and award fees 13 Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

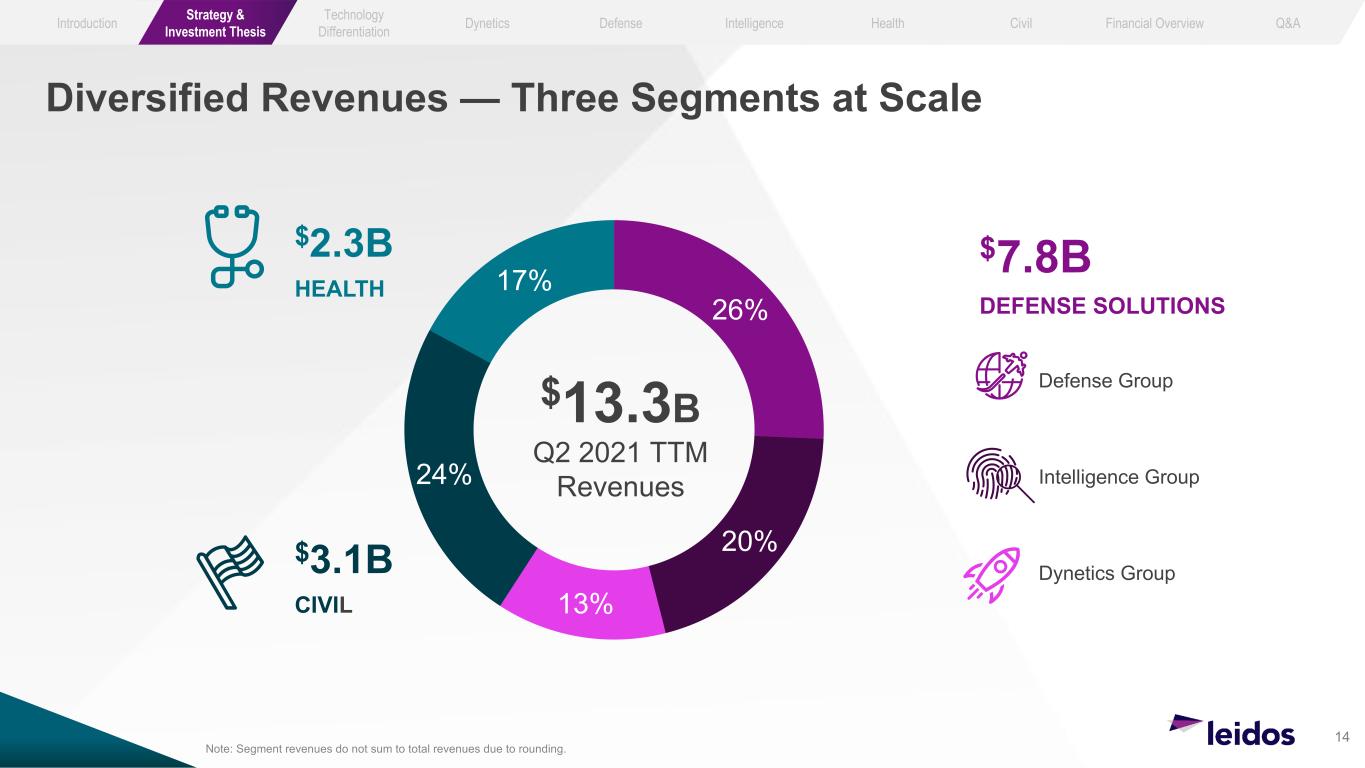

Diversified Revenues — Three Segments at Scale 14 26% 20% 13% 24% 17% $13.3B Q2 2021 TTM Revenues $2.3B HEALTH $3.1B CIVIL Defense Group Dynetics Group Intelligence Group $7.8B DEFENSE SOLUTIONS Note: Segment revenues do not sum to total revenues due to rounding.Note: Segment revenues do not sum to total revenues due to rounding. Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Focusing on Attractive Markets We Can Lead 15 2020 2021 2022 2023 2024 Civil Defense Dynetics Health Intelligence $333B $351B $365B $384B $398B CAGR ‘20 – ’24 3.3% 6.2% 4.1% 3.4% 4.9% ~4.6% ’20-’24 CAGR Attractive end markets • Civil & Health market leadership • Non-defense supplemental would provide opportunities • Focus on cyber and AI/ML • Emphasis on RDT&E / advanced capabilities Proven ability to take market share • 14th consecutive quarter B2B³1.0 • $49B proposals submitted awaiting award • Above market win rates • Investing to improve competitive position Ample white space for future growth Addressable Market Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction Source: Management’s estimates

Respected Leadership Team 16 Roger Krone Chairman & Chief Executive Officer Paul Engola EVP, National Security Space Kamal Dua Chief Audit Executive Jim Carlini Chief Technology Officer Chris Cage Chief Financial Officer Vicki Schmanske EVP, Corporate Operations Gerry Fasano President, Defense Group Roy Stevens President, Intelligence Group Liz Porter President, Health Group Jim Moos President, Civil Group Dave King President, Dynetics Group Steve Hull Chief Information Officer Groups Functions Debbie Opiekun Chief Business Development Officer George Reiter Chief Human Resources Officer, Acting Jerry Howe General Counsel Presenters Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

• Increased headcount by 35% since Q1 2019 • Leadership development & rotational opportunities • Building out software development centers near universities to attract technical talent • Upskilling initiatives in AI/ML, Data Science and Digital Engineering • Diversity and inclusion training and policies Investing in Our People 17 20% MILITARY VETERANS 20K CLEARED EMPLOYEES 9K ADVANCED DEGREES 43K EMPLOYEES WORLDWIDE 34% FEMALE 33% ETHNICALLY DIVERSE Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction Note: All figures except total headcount refer to the U.S. employee population of 39K.

Compelling Investment Thesis 18 Cultivate a portfolio which offers resiliency across the cycles through presence in diverse, yet complementary end-markets. Operate an asset-light business with a high Return on Invested Capital while investing to improve competitive position. Drive market share gains and revenue growth by meeting customers’ emerging needs, while growing margins. Balance capital deployment to drive sustained value for all stakeholders, leveraging inorganic investments to accelerate the strategy. Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Technology Differentiation JIM CARLINI, CHIEF TECHNOLOGY OFFICER 19

Strategic Anticipation, Differentiation, and Scale 20 Speed, Security, and Scale Core capabilities and technologies Demos at scale Leverage external tech Culture of innovation New Administration Priorities and Spending New Technologies New Threats and Mission Needs Commercial Innovation Increasing Debt and Budget Pressures Accelerating Pace of Change Key Trends Impacting Our Customers… ….Drive Our Technology Strategy Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Core Capabilities and Technologies — Making the World Safer, Healthier, and More Efficient 21 Through our customer facing organizations • Dynetics • Defense • Intelligence • Health • Civil By Delivering Our Differentiated Capabilities (Speed, Security, and Scale) • Digital Modernization • Cyber Operations • Mission Software Systems • Integrated Systems • Mission Operations Powered By Our Enabling Technology • Secure, Rapid Software • Trusted AI/ML • Full-spectrum Cyber • Digital Engineering Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Accelerators AI/ML Cyber Software Digital Modernization Demos at Scale Air Defense Launcher Zero Trust AIOps Modeling and Simulation Our Partners Commercial Industry Labs and FFRDCs Universities Technical Talent & Culture Upskilling Innovation Council Differentiating at Scale 22 Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Trusted AI/ML 23 Driving Trusted AI/ML into all core capabilities using unique algorithms and deployment methodologies Digital Modernization Cyber Operations Mission Software Systems Integrated Systems Mission Operations Increased IT operations efficiency and security for large networks via Smarter Anomaly Detection Adaptive detection and countering of advanced cyber threats via Machine Learning Data collection, discovery, and enrichment at massive scale via secure AI/ML microservices Automated detection of threats to transportation and critical infrastructure via Computer Vision Medical examination efficiencies and better outcomes via Natural Language Processing Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Digital Modernization Cyber Operations Mission Software Systems Integrated Systems Mission Operations Secure current IT and cloud environments; migrate to future resilient architectures Counter advanced cyber threats through prevention, detection, and response Defend software integrity through secure coding methods, tools, and continuous testing Mitigate risks to weapon, detection, and industrial control systems Assure missions through secure supply chains, information assurance, and tradecraft Full-Spectrum Cyber — Beyond Compliance 24 Pushing the frontiers through AI/ML-enabled cyber and resilient architectures Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Driving the Business in 2021 and Beyond 25 Technical differentiation to help our customers achieve speed, security, and scale Rapidly Fielded Capabilities for Great Power Competition Secure, Modernized, Large-scale Enterprise Infrastructure Transformed Mission Operations Better Health Outcomes Secure, Efficient Ports/Borders/Infrastructure Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Dynetics Group DAVE KING, GROUP PRESIDENT Dynetics is the applied research and technology accelerator for the corporation, focused on transitioning innovative prototypes to fielded solutions. We solve the toughest scientific and engineering problems for our customers and deliver high-technology, mission-critical services and solutions from seafloor to space. 26 Key Customers

Strategic Focus 27 2020 2021 2022 2023 2024 Tactical Weapons Hypersonic Systems Integrated Force Protection Sensors Cyber - Physical Systems Airborne Autonomy Human Space Exploration E&T Services and Prototyping Maritime Systems CAGR ’20-’24$51B$50B $46B $44B $45B 6.1% 0.8% 4.8% 4.2% 3.9% 3.5% 13.3% 3.6% -5.4% Market Drivers: • Move to great power competition • Defense modernization programs • Emphasis on rapid, innovative solutions for new threats Growth Vectors: • Disruptive provider of − Air Defense Products − Maritime Autonomy − Hypersonic Systems • New capabilities in all domains, Seafloor to Space Addressable Market (B) ~4.1% ’20-’24 CAGR Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction Source: Management’s estimates

What We Do 28 Aerospace, Defense, & Civil Maritime Systems Advanced Science & Technology Center Weapons Technology & Manufacturing Description Advanced engineering, disruptive integration, agile development, technology and advanced materials solutions Deep engineering talent across naval architecture, maritime engineering, maritime autonomy, undersea sensors and systems LInC, our applied R&D engine for affordable multi-mission platforms, AI/ML, data analytics, advanced RF Systems, signal processing and space overhead persistent infrared discriminating capabilities leading to Programs of Record Research, development, system design engineering, rapid, agile, and affordable prototyping, and manufacturing of new weapons technology in areas such as hypersonics, high-energy lasers Key Programs • Small Glide Munition (USAF) • Universal Stage Adapter (NASA) • FFG-62 Constellation Class Design Services (Navy) • Program Office and Engineering Support (Navy) • Document and Media Exploitation Data Discovery Platform (DIA) • Wide Area Surveillance (SDA) • Common Hypersonics Glide Body (Army) • Enduring Indirect Fire Protection Capability (Army) Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Key Programs 29 $750M POR potential 35 Employees 4 U.S. Sites Positioned for: Tranche 1 & beyond refresh growing to 100’s of SV’s Positioned for: Low rate initial production leading to Program of Record Common Hypersonic Glide Body Tranche 0 Tracking Layer Wide Field of View (WFOV) Mission Need: Enable responsive, long-range, strike options against distant, defended, and/or time-critical threats Challenge detection and defense due to their speed, maneuverability, and low altitude of flight Leidos Response: Navy Conventional Prompt Strike contract served as a precursor to this effort Transitioned Sandia National Lab design into a production ready Technical Data Package Potential follow-on production contract for 124 glide bodies valued at ~$1B Mission Need: Detect and track conventional and hypersonic missiles Close kill chains precisely and at a currently unattainable pace Tech refresh every 2-3 years (Tranches) to counter evolving threats Leidos Response: Deliver 4 LEO WFOV payloads and mission unique software to Prime Integrator to meet a 09/2022 launch Unique staring optical sensor with state of art sensitivity On-board processing for real-time detection and tracking Bus agnostic, fast schedule, low risk, affordable payload $342M base over 48 months, $485M w/Option 14 Glide Bodies, option for 18 Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Key Takeaways 30 As an innovation engine for Leidos, we deliver technology-enabled solutions to address the highest priorities of our national security strategy Will benefit from increasing requirement to field platform agnostic, open solutions that integrate the best capabilities from any supplier Well positioned in our customers most important new priorities, including hypersonics, directed energy, and force protection We excel at rapidly delivering innovative prototypes and transitioning the capability to fielded solutions Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Defense Group GERRY FASANO, GROUP PRESIDENT The Defense Group is the proven trusted partner who delivers digital modernization, integrated decision support solutions and mission-critical operational services across land, sea, air, space and cyber domains for DoD, UK and select strategic international governments. 31 Key Customers

Strategic Focus 32 CAGR ’20-’24 2020 2021 2022 2023 2024 UK C4ISR Logistics Digital Modernization Airborne Simulation and Training Force Protection $95B$94B$92B$90B $84B 5.6% 5.1% 3.9% 1.8% 4.8% 2.1% 2.3% Market Drivers: • Pivot to Great Power Competition as Counter-Insurgency operations wane • DoD Services seek Multi-domain command and control solutions • Heavy emphasis on Digital Modernization and Cloud Computing • New Business Models actively sought – COCO and Managed Services Growth Vectors: • Digital modernization with unified architectures and ‘as a service’ delivery • Frictionless JADC2 for seamless data and C2 integration at machine speed • Zero-trust Cyber solutions for modular integration of best technologies • Trusted AI/ML to augment soldiers and decrease cognitive load • Digital engineering to accelerate and adapt technology insertions Addressable Market (B): ~3.4% ’20-’24 CAGR Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction Source: Management’s estimates

Airborne Solutions C4ISR Digital Modernization Logistics & Mission Support UK & Europe Description Design, integrate, operate, and sustain technically advanced manned and unmanned aerial ISR platforms Secure all domain C2 mission software systems, simulation and training, Intel analysis and data analytics Nation scale digital modernization, cyber operations, cloud migration and AIOps managed services Resilient logistics solutions, digital engineering, integrated force protection systems and product support Deliver Leidos technical core capabilities focused on digital modernization, agile software, cyber and mission support Key Programs • Army Geospatial ISR (HR3DGI) • SOCOM Tactical Aircraft ISR (STAMP II) • USAF Intel analysis (ACC-ISR) • Army Fires Software Modernization (AFATDS) • Navy Network Services (NGEN SMIT) • DISA GSM-O II • Army Force Protection (AIE-3) • Logistics Commodities & Services Transformation (LCST) • National Air Traffic Software & Services (UK NATS) • Home Office Biometrics (UK HOB) What We Do 33 Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Key Programs 34 $604M Contract Value 2.4M km2 of High-Resolution Data Collected 31 Countries in Which Data Has Been Collected $7.7B IDIQ Ceiling Value 670K Navy and Marine Corps Users 2.5K Worldwide Sites Positioned for: FEDSIM SENTINEL (sensor integration and operations)Positioned for: DISA Defense Enclave Services (DES) Next Generation Enterprise Network Service Management, Integration, and Transport (NGEN SMIT) High Resolution Three-Dimensional Geospatial Information (HR3DGI) Mission Need: Modernize and operate the USN and USMC CONUS and OCONUS Enterprise networks, data centers, and end user devices Support mission critical communications services Leidos Response: Transitioned contract in 6 months (33% faster than 9-month requirement) with no mission failure Advanced Model-based Systems Engineering (MBSE) to deliver precision engineering, repeatability, and data consistency Mission-focused AI/ML to accelerate incident resolution and reduce costs Mission Need: High resolution, color, unclassified imagery and 3D elevation data that can be shared among interagency and international partners Improved accuracy and precision for situational awareness and detailed mission analysis, including understanding of the terrain and features at the tactical and urban level Leidos Response: Modernized the fleet by purchasing 7 King Air 350 aircraft and integrating multiple combinations of LIDAR and electro-optical sensors capable of collecting 10cm geo-registered, ortho-rectified, color imagery and 1m resolution elevation data Converted to a contractor-owned / contractor operated business model resulting in reduced customer costs while growing margin Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Key Takeaways 35 Market leadership at scale with repeatable solutions—we execute industry’s franchise programs, including NGEN, GSMO, ACC-ISR and UK Logistics (LCST) Well positioned in Multi-Domain Operations / JADC2 with focus on resilient infrastructure, trusted AI/ML, and easily-deployed C2 software solutions Enhanced margins and customer experience by leveraging ‘as a service’ platform from 1901 Group acquisition Exceeding customer expectations through differentiated Leidos offerings that leverage our scale and financial strength Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Intelligence Group ROY STEVENS, GROUP PRESIDENT The Intelligence Group provides a full range of intelligence capabilities, digital modernization and mission critical software for the 17 members of the US Intelligence Agencies and the Commonwealth of Australia. 36 Key Customers

~3.3% ’20-’24 CAGR Strategic Focus 2020 2021 2022 2023 2024 Intel Tradecraft Digital Modernization Logistics Cyber Mission Software Systems Intel ISR $48B CAGR ’20-’24 $42B $43B $45B $46B 4.3% 3.8% 5.6% 2.4% 2.6% 1.0% Market Drivers: • Increasing prevalence of cyber and space as contested domains by near peer competitors • Ability of AI/ML & automation to synthesize, contextualize, and validate massive data sets • Evolution of digital/cloud infrastructure • Cyber and software capabilities span markets and provide key differentiation Growth Vectors: • Mission software leveraging data analytics and AI/ML to increase decision speed • Trusted, secure, full-spectrum cyber • Large scale, digital modernization which leverages our partners and investments Addressable Market (B): Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction 37 Source: Management’s estimates

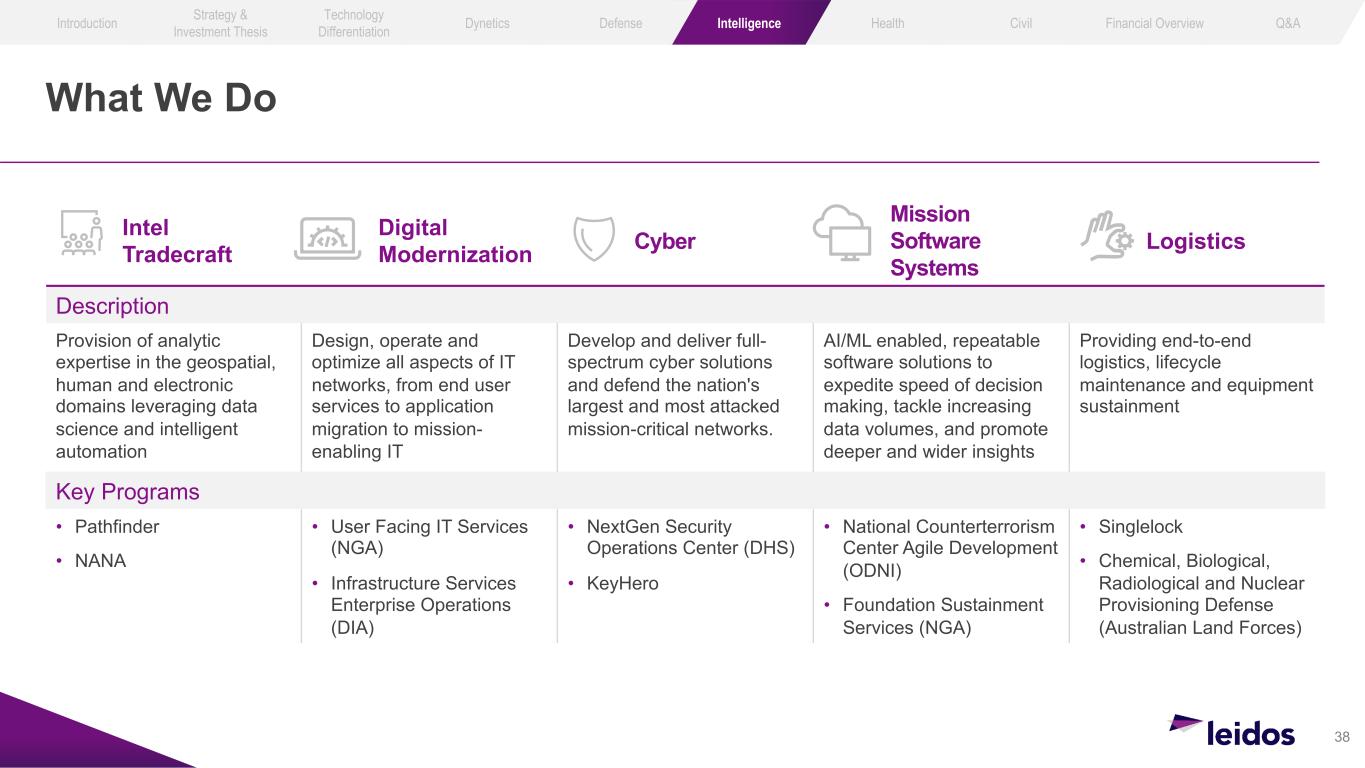

What We Do 38 Intel Tradecraft Digital Modernization Cyber Mission Software Systems Logistics Description Provision of analytic expertise in the geospatial, human and electronic domains leveraging data science and intelligent automation Design, operate and optimize all aspects of IT networks, from end user services to application migration to mission- enabling IT Develop and deliver full- spectrum cyber solutions and defend the nation's largest and most attacked mission-critical networks. AI/ML enabled, repeatable software solutions to expedite speed of decision making, tackle increasing data volumes, and promote deeper and wider insights Providing end-to-end logistics, lifecycle maintenance and equipment sustainment Key Programs • Pathfinder • NANA • User Facing IT Services (NGA) • Infrastructure Services Enterprise Operations (DIA) • NextGen Security Operations Center (DHS) • KeyHero • National Counterterrorism Center Agile Development (ODNI) • Foundation Sustainment Services (NGA) • Singlelock • Chemical, Biological, Radiological and Nuclear Provisioning Defense (Australian Land Forces) Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Key Programs 39 $1.3B Contract Value 110K+ Defense and Government Users 15 Locations (Australia + International) Positioned for: JP2060 (Defense Health Transformation)Positioned for: CBP Integrated Traveler Initiatives CBP — Traveler Processing and Vetting Software Application Services (TPVS) Australian Ministry of Defense Centralized Processing Mission Need: Build and Operate a Private Cloud supporting MoD operations across three security domains Modernization and continuous transformation of infrastructure, applications and services Leidos Response: Consolidated over 200 data centers to 15, delivering PaaS, IaaS, DBaaS and SaaS services Application transformation, rehosting and rationalization of 300 mission systems Ongoing operations and new projects (data center to the desktop), Providing significant cost efficiencies and improved network performance $960M Ceiling Value 650K/187K Daily Travelers/Vehicles 328 Ports of Entry Mission Need: Developing, modernizing and supporting software applications and specialized hardware to verify identities for people transiting our international ports of entry and exit Rapidly and continuously adapting to evolving technologies, threats, world events 24/7/365 Leidos Response: Implemented agile software approach to migrate to cloud, expand use of biometrics and mobile solutions Utilized Automation and AI/ML to improve performance and reduce costs Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Key Takeaways 40 We are a leader in providing services to the US intelligence community and the Commonwealth of Australia While continuing to deliver mission operations, we will expand our market positions in mission software, full-spectrum cyber, digital modernization We will improve margins by changing our portfolio mix and leveraging our technology investments We execute franchise programs focused on the IC’s most important technical domains: AI/ML, full-spectrum cyber, data analytics Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Health Group LIZ PORTER, GROUP PRESIDENT Leidos Health Group is a leading provider of healthcare solutions for federal agencies. We deliver secure, whole health solutions, across ever-changing sites of care, to improve patient outcomes and system efficiencies. 41 Key Customers

Strategic Focus 42 2020 2021 2022 2023 2024 Digital Modernization (Federal) Digital Modernization (Commercial) Managed Health Services Life Sciences Mission Software Systems $87B $97B $111B $104B $93B 8.9% -6.4% 6.1% 7.5% 3.0% CAGR ’20-’24 Market Drivers: • Shifting care to alternative sites driving secure technology needs • Increased supplemental services – behavioral health, non-medical counseling for military readiness and services to address social determinants of health • Significant benefit expansion (e.g., Medicare and Medicaid) emphasizing need for enterprise-wide solutions Growth Vectors: • Secure clinical managed services delivered anywhere (mobile and/or virtual) • Data analytics and EHR optimization, increasing scale and efficiency of health services • Mission-focused modernization and cyber Addressable Market (B): ~6.2% ’20-’24 CAGR Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction Source: Management’s estimates

What We Do 43 Digital Modernization Mission Software Systems Managed Health Services Life Sciences Description Delivering mission-focused, enterprise-scale digital modernization combined with our distinctive health IT capabilities, enhanced cybersecurity and cloud solutions Using mission expertise to create efficient, secure, and scalable software, combined with AI/ML and data analytics tools to improve care coordination, management and outcomes Providing clinical managed services through a network of medical and non-medical professionals across multiple sites of care, enabled by advanced analytics including NLP Executing science and technology enablement to support medical research, optimize business operations and expedite effective medical treatments Key Programs • Infrastructure Hosting and Centralized Connectivity Services (CMS) • IDIQ IT Support Services Contract (SSA) • DHMSM / MHS Genesis (DHA) • Scientific Computing and Bioinformatics Support Services (CDC) • Military Disability Exams (VA) • Military and Family Life Counseling (DOD) • Frederick National Laboratory for Cancer Research (NIH) • Clinical Trials of Repurposed Drugs for COVID-19 Therapeutic (DTRA) Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

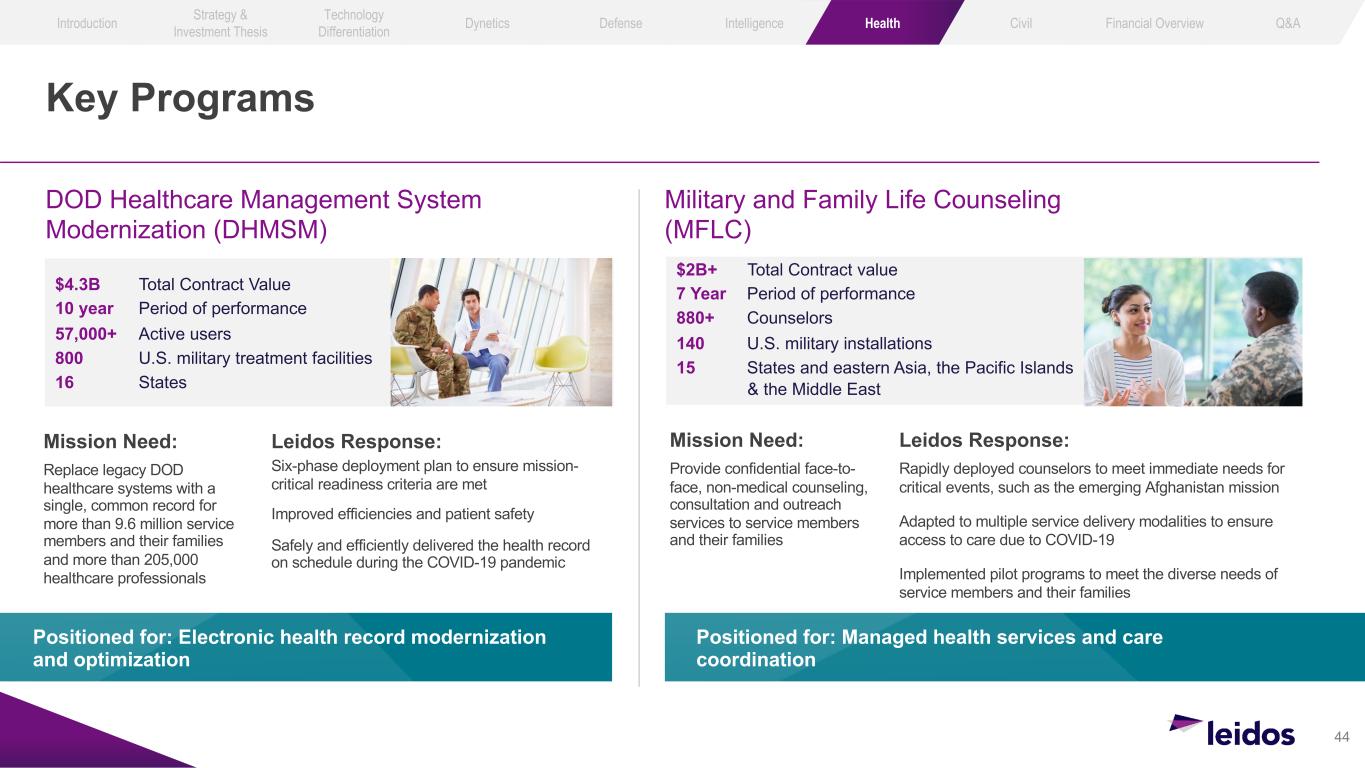

Key Programs 44 $2B+ Total Contract value 7 Year Period of performance 880+ Counselors 140 U.S. military installations 15 States and eastern Asia, the Pacific Islands & the Middle East Positioned for: Managed health services and care coordination Positioned for: Electronic health record modernization and optimization DOD Healthcare Management System Modernization (DHMSM) Military and Family Life Counseling (MFLC) Mission Need: Provide confidential face-to- face, non-medical counseling, consultation and outreach services to service members and their families Leidos Response: Rapidly deployed counselors to meet immediate needs for critical events, such as the emerging Afghanistan mission Adapted to multiple service delivery modalities to ensure access to care due to COVID-19 Implemented pilot programs to meet the diverse needs of service members and their families $4.3B Total Contract Value 10 year Period of performance 57,000+ Active users 800 U.S. military treatment facilities 16 States Mission Need: Replace legacy DOD healthcare systems with a single, common record for more than 9.6 million service members and their families and more than 205,000 healthcare professionals Leidos Response: Six-phase deployment plan to ensure mission- critical readiness criteria are met Improved efficiencies and patient safety Safely and efficiently delivered the health record on schedule during the COVID-19 pandemic Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Key Takeaways 45 Leading provider of data-driven, whole health solutions for federal healthcare agencies across the healthcare ecosystem Pursuing opportunities that leverage corporate capabilities in cyber, data analytics and digital modernization to deliver mission focused transformation Potential to expand our clinical managed services by building on our recent wins and ability to deliver services anywhere Making the world healthier by advancing basic, translational and clinical science with a focus on cancer, AIDS and infectious disease Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Civil Group JIM MOOS, GROUP PRESIDENT The Civil Group is modernizing global infrastructure, systems, and security for government agencies and commercial markets. 46 Key Customers

Strategic Focus 47 2020 2021 2022 2023 2024 Digital Modernization Mission Application Modernization Security Products & Services Logistics Mission Operations Energy Infrastructure CAGR ’20-’24 $85B $89B $93B $80B $77B 7.0% 5.6% 1.2% 5.4% 4.8% 3.3% Market Drivers: • Demand for U.S. civil agency IT consolidation, modernization and cybersecurity • Pressure to harden and modernize the U.S. electric energy grid against climate impacts and cyber threats • Recapitalization of airport screening technology globally (although near-term COVID impacted) • Deployment of more/newer border security screening technologies in U.S. and abroad Growth Vectors: • Large fed-civ agency full service/managed service IT contracts • Innovative electric grid efficiency, security, resiliency and modernization solutions • Cutting-edge screening technologies for people and baggage at airports • Advanced ports and borders security inspection solutions Addressable Market (B): ~4.9% ’20-’24 CAGR Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction Source: Management’s estimates

What We Do 48 Digital Modernization Energy Infrastructure Integrated Missions Transportation Applications Security Detection Description Modernizing and managing U.S. civilian agencies’ digital environments, from endpoints to networks to Cloud, leveraging automation, AI/ML, and continuous cybersecurity Solving energy resiliency, efficiency, and security (physical/cyber) through advanced engineering and technology services for U.S. electric utilities and commercial industry Delivering mission operations, logistics, advanced engineering, and environmental solutions that support U.S. civilian agencies Modernizing and developing mission-critical software systems and advanced engineering solutions for general aviation and national air traffic control Securing aviation, commercial infrastructure and borders around the globe with intelligently- integrated, cyber secured, AI/ML-powered screening solutions Key Programs • NASA End User Services Technologies • Enterprise Standard Architecture-V (DOJ) • Duke Power Up Program (Duke Energy) • Ameren Illinois Energy Efficiency (Ameren IL) • Hanford Mission Integration Solutions (DOE) • National Energy Technology Lab (DOE) • En Route Automation (FAA) • National Airspace System Integration Support Contract IV (FAA) • Non-Intrusive Inspection Multi-Energy Portal (CBP) • Schiphol Airport (Amsterdam Airport Schiphol) Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Key Programs 49 $480M IDIQ Ceiling Value +$1B Appropriated to CBP for NII Since 2016 15 Year Contract Positioned for: International Customs GrowthPositioned for: NASA Advanced Enterprise Global IT Solutions (AEGIS) NASA End-user Services & Technologies (NEST) Customs and Border Protection (CBP) Multi-Energy Portal (MEP) Mission Need: Increase border screenings to reach ultimate goal of 100% cargo screenings Expand non-intrusive inspection (NII) for all commercial vehicles at land and sea ports of entry Leidos Response: Provide critical non-intrusive inspection technology to CBP as they increase screening on 22M+ containers per year Help achieve CBP border screening goals of 72% of all cargo and 40% of privately- owned vehicles Implemented “Port of the Future” pilot at Brownsville, TX border crossing $2.9B IDIQ Ceiling Value 66K NASA Users 10 Year Contract Mission Need: Deliver IT managed services for 66K end users across 18 sites Manage personal computing hardware, software, print and mobility services, field service, and help-desk requirements Leidos Response: In response to COVID, Leidos migrated 35K+ end users from NASA facilities to home offices, within 14 days Developed an interactive situational awareness tool which resulted in 400+ enhancements and eliminated 75K vulnerabilities YTD Manage 100K+ IT assets and service requests annually Embraced the program vision of a connected, secure, and highly mobile workforce Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Key Takeaways 50 Sustained market leadership in fed-civ IT with franchise positions at NASA, FAA, DOJ Expanded pursuits in cyber, grid security/resiliency, and climate science Continued diversification into commercial and global markets Integrated suite of products and solutions across the security and detection market Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Financial Overview and Outlook CHRIS CAGE, CFO 51

Consistent performance above our previous financial targets Strong track record of deploying capital for shareholder value Continued growth momentum expected over the three-year horizon Long-term margin uplift and ability to generate substantial cash for value creation Key Messages 52 Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

• 6.6% organic growth CAGR since 2019 • Business development momentum driving strong revenue growth • Diversified portfolio offers resiliency and growth potential across administrations Strong Organic Growth 53* Excludes divested revenues as well as acquired revenues for twelve months; reconciliation to the most comparable GAAP measure is included in the Appendix Organic Revenue Growth Rate* 6.3% 9.5% 11.8% 13.5% 8.2% -3.0% 1.5% -3.1% 8.9% 16.3% Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Pandemic Effect Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Track Record of Margin Delivery 54 10.1% 10.0% 8.8% 11.0% 9.7% 11.1% 10.6% 11.5% 11.0% 10.4% Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 10% Target (5/19) * Excludes certain impacts (VirnetX, MSA, and Greek settlement gains) as well as the impact of COVID-19; reconciliation to the most comparable GAAP measure is included in the Appendix • Average normalized adjusted EBITDA margin of 10.4% since 2019 − 10.7% on an as reported basis with one- time gains and full COVID impacts • Sustaining margins while investing in R&D, talent development • Margin drivers − Disciplined bid approach for new business − Lean and flexible cost structure − Strong and consistent program execution Normalized Adjusted EBITDA Margin* Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Significant and Predictable Cash Flow 55 $288 $186 $290 $169 $175 $251 $541 $147 $145 $85 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 * Excludes certain impacts (VirnetX, MSA, and Greek settlement gains and CARES Act tax deferrals and employee retention credit) as well as the impact of accounts receivable sales; reconciliation to the most comparable GAAP measure is included in the Appendix • Average normalized OCF of $228M per quarter since 2019 • Capital light model—CapEx at 1.2% of revenues • 10 straight quarters w/ 3-year rolling FCF conversion > 100% Normalized Operating Cash Flow (M)* Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Capital Structure Provides Financial Flexibility 56 $48 $476 $668 $193 $1,349 $750 $1,000 $250 $161 $219 H2 '21 '22 '23 '24 '25 '26-'29 '30 '31 '32 '33 '34-'39 '40 • Maintain investment grade rating − Minimize WACC − 3x leverage ratio target • Balanced debt ladder—modest near-term maturities − 2022 $380M Gibbs & Cox loan − 3.6% weighted average cost of debt − 86% fixed rate including $1.1B swap • >$1B of liquidity − $338M Cash balance − $750M untapped Commercial Paper program, backstopped by $750M undrawn revolving line of credit Debt Maturity Profile (M) Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Disciplined and Balanced Past Capital Deployment 57 CapEx 7% M&A 69% Share Repurchase 14% Dividends 10% • 76% growth investments − M&A to strengthen foundation in integration, enter new markets, and expand long-term margins − Cap Ex to establish anchor facilities and drive profitable growth • 24% return to shareholders − Opportunistic share repurchases when price did not reflect business outlook − Increased dividends in 2021 as part of capital allocation review • Increased leverage ratio from 3.0 to 3.2 − Well within normal leverage range − Significant growth in adjusted EBITDA Allocation of $2.6B cash flow from operations and $2.3B incremental net debt since 2019 through Q2 2021 Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Providing Value through M&A 58 Strategic Fit Cultural Fit Deal Economics Capital Light Business Model Drive EBITDA • M&A has accelerated the differentiation from our near peers − Scale: IS&GS (2016) − Tailored, integrated solutions: Dynetics (2020), Gibbs & Cox (2021), and Security Detection & Automation (2020) − Disruptive Innovation: 1901 Group (2021) Disciplined process to filter M&A opportunities to those that will enable the most long-term shareholder value Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

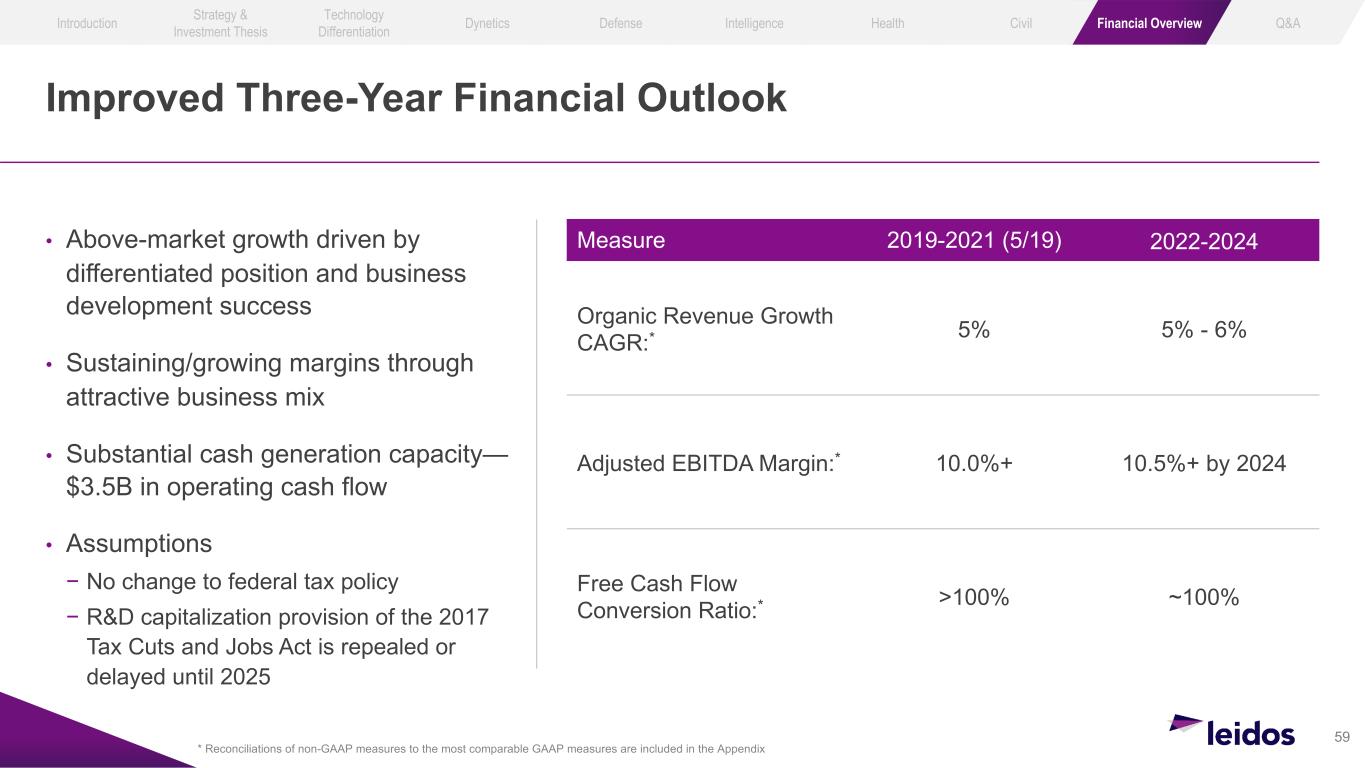

• Above-market growth driven by differentiated position and business development success • Sustaining/growing margins through attractive business mix • Substantial cash generation capacity— $3.5B in operating cash flow • Assumptions − No change to federal tax policy − R&D capitalization provision of the 2017 Tax Cuts and Jobs Act is repealed or delayed until 2025 Improved Three-Year Financial Outlook 59 Measure 2019-2021 (5/19) 2022-2024 Organic Revenue Growth CAGR:* 5% 5% - 6% Adjusted EBITDA Margin:* 10.0%+ 10.5%+ by 2024 Free Cash Flow Conversion Ratio:* >100% ~100% Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction * Reconciliations of non-GAAP measures to the most comparable GAAP measures are included in the Appendix

Strong Foundation Underlying Three-Year Outlook 60 Revenue Drivers + Build-out of recent wins + $49B submitted pipeline + $4B+ protested awards + Positioning in fast growing markets + Non-defense supplemental spending bill - Ramp downs: VA exam business (’22), DHMSM (’23) - Program ends: NASA HLS, Afghanistan support Margin Drivers + Mix shift from O&M to integration + Leveraging ‘as a service’ throughout portfolio + Real estate optimization + Holding the line on indirect cost growth + Return of airport screening market - Steady state margins in Health Advanced technology offerings drive win rates and better pricing Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

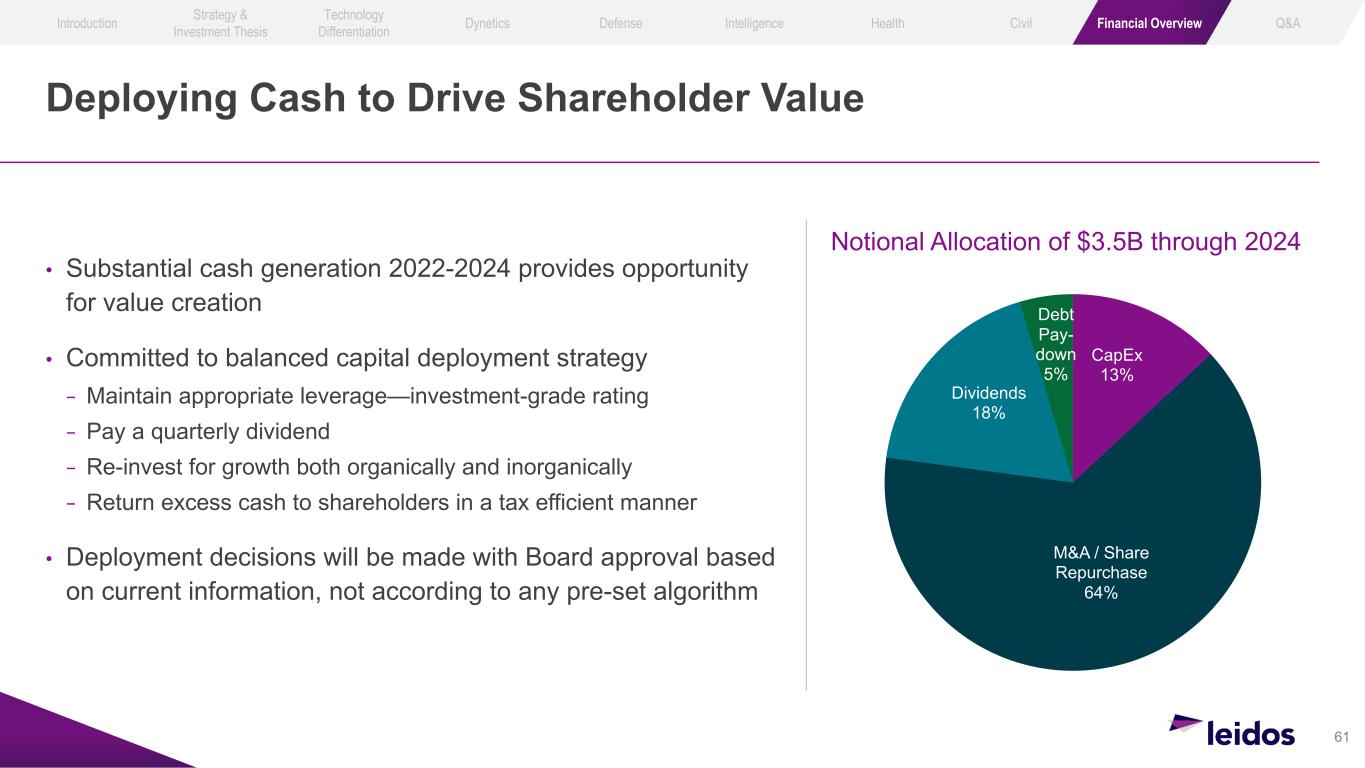

Deploying Cash to Drive Shareholder Value 61 CapEx 13% M&A / Share Repurchase 64% Dividends 18% Debt Pay- down 5% • Substantial cash generation 2022-2024 provides opportunity for value creation • Committed to balanced capital deployment strategy − Maintain appropriate leverage—investment-grade rating − Pay a quarterly dividend − Re-invest for growth both organically and inorganically − Return excess cash to shareholders in a tax efficient manner • Deployment decisions will be made with Board approval based on current information, not according to any pre-set algorithm Notional Allocation of $3.5B through 2024 Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Compelling Investment Thesis 62 Cultivate a portfolio which offers resiliency across the cycles through presence in diverse, yet complementary end-markets. Operate an asset-light business with a high Return on Invested Capital while investing to improve competitive position. Drive market share gains and revenue growth by meeting customers’ emerging needs, while growing margins. Balance capital deployment to drive sustained value for all stakeholders, leveraging inorganic investments to accelerate the strategy. Q&AFinancial OverviewCivilHealthIntelligenceDefenseDynetics Technology Differentiation Strategy & Investment Thesis Introduction

Appendix NON-GAAP RECONCILIATIONS LIST OF ACRONYMS 63

This presentation includes certain non-GAAP financial measures, such as organic growth; non-GAAP net income; adjusted earnings before interest, taxes, depreciation and amortization (EBITDA); adjusted EBITDA margin; normalized adjusted EBITDA margin, normalized operating cash flow, free cash flow, and free cash flow conversion ratio. These are not measures of financial performance under generally accepted accounting principles in the U.S. ("GAAP") and, accordingly, these measures should not be considered in isolation or as a substitute for the comparable GAAP measures and should be read in conjunction with the Company's consolidated financial statements prepared in accordance with GAAP. Management believes that these non-GAAP measures provide another measure of Leidos' results of operations and financial condition, including its ability to comply with financial covenants. These non-GAAP measures are frequently used by financial analysts covering Leidos and its peers. Leidos' computation of its non-GAAP measures may not be comparable to similarly titled measures reported by other companies, thus limiting their use for comparability. Leidos does not provide a reconciliation of forward-looking adjusted EBITDA margin, organic revenue growth, and cash flow conversion due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation without unreasonable effort. Because certain deductions for non-GAAP exclusions used to calculate projected net income may vary significantly based on actual events, Leidos is not able to forecast on a GAAP basis with reasonable certainty all deductions needed in order to provide a GAAP calculation of projected net income at this time. The amounts of these deductions may be material and, therefore, could result in projected GAAP net income being materially less than projected adjusted EBITDA margins. Non-GAAP Financial Measures 64

Organic growth is computed as pro-forma revenues, post divestitures excluding acquired revenues 12 months since closing date divided by prior year pro-forma revenues, post divestitures. The organic revenue CAGR for the 10 quarters beginning FY19 Q1 is computed as: !"#$ %# &&' ()*+,*)-. )/0/12/3, (*35 670/35752)/3 /89:2671; .:: .9<27)/6 )/0/12/3 !"$= ()*+,*)-. )/0/12/3, (*35 670/35752)/3 ! ".$ - 1 Non-GAAP net income is computed by excluding the following discrete items and the related tax impacts from net income: Adjusted EBITDA is computed by excluding the following items from income before income taxes: (i) discrete items as identified above; (ii) interest expense; (iii) interest income; (iv) depreciation expense; and (v) amortization of internally developed intangible assets. Adjusted EBITDA margin is computed by dividing adjusted EBITDA by revenues. Adjusted EBITDA margin for the 10 quarters beginning FY19 Q1 is computed as adjusted EBITDA for the 10 quarters beginning FY19 Q1 divided by revenues for the 10 quarters beginning FY19 Q1. Normalized Adjusted EBITDA Margin is computed as by dividing adjusted EBITDA less non-recurring impacts (Greek settlement, VirnetX, and MSA gains and COVID impacts) by pro-forma revenues, excluding COVID impact. Normalized Operating Cash Flow is computed as operating cash flow less non-recurring impacts (Greek settlement, VirnetX, and MSA gains, accounts receivable sales, and CARES Act impacts). Free cash flow conversion ratio is computed by dividing free cash flow (cash flows from operations less payments for property, equipment and software) by non-GAAP net income. Free cash flow conversion ratio for the 10 quarters beginning FY19 Q1 is computed as free cash flow for the 10 quarters beginning FY19 Q1 divided by non- GAAP net income for the 10 quarters beginning FY19 Q1. Definition of Non-GAAP Financial Measures 65 • Acquisition, integration and restructuring costs • Amortization of acquired intangible assets • Acquisition related financing costs • Loss on debt modification • Amortization of equity method investment • Gain on sale of business • Asset impairment charges • Tax adjustments on assets held for sale • Other discrete tax adjustments Note: Normalized figures are not consistent with the Company’s normal non-GAAP disclosure practices but are included to capture the effect of disclosed non-recurring impacts to provide management’s view of true operating performance. Organic revenue CAGR, which is calculated specifically for the period FY21Q2 and FY19Q1, the start of the three-year targets provided at the 5/14/19 Leidos Investor Day, is not directly comparable to similarly titled metrics presented in the Company's consolidated financial statements prepared in accordance with GAAP.

Non-GAAP Financial Measures Reconciliation 66 1QFY18 2QFY18 3QFY18 4QFY18 1QFY19 2QFY19 3QFY19 4QFY19 1QFY20 2QFY20 3QFY20 4QFY20 1QFY21 2QFY21 (in millions) Revenues, as reported $2,443 $2,529 $2,575 $ 2,647 $2,577 $2,728 $2,835 $2,954 $2,889 $2,914 $3,242 $3,252 $3,315 $3,448 YoY revenue growth on reported revenues 5.5% 7.9% 10.1% 11.6% 12.1% 6.8% 14.4% 10.1% 14.7% 18.3% Divested revenues 53 63 63 56 36 27 21 Pro-forma revenues, post divestitures 2,390 2,466 2,512 2,591 2,541 2,701 2,814 2,954 2,889 2,914 3,242 3,252 3,315 3,448 Acquired revenues 12 months since closing date 6 12 140 293 387 389 168 58 Pro-forma revenues, post divestitures excluding acquired revenues 12 months since closing date 2,390 2,466 2,512 2,591 2,541 2,701 2,808 2,942 2,749 2,621 2,855 2,863 3,147 3,390 YoY organic growth 6.3% 9.5% 11.8% 13.5% 8.2% -3.0% 1.5% -3.1% 8.9% 16.3% Acquired revenues after 12 months since closing date 10 226 333 Pro-forma revenues, post divestitures excluding all acquired revenues 2,390 2,466 2,512 2,591 2,541 2,701 2,808 2,942 2,749 2,621 2,855 2,853 2,921 3,057 COVID-19 impact (21) (125) (40) (12) Pro-forma revenues, excluding COVID-19 impact 2,443 2,529 2,575 2,647 2,577 2,728 2,835 2,954 2,910 3,039 3,282 3,264 3,315 3,448 Net income, as reported 102 145 147 188 189 138 162 181 115 154 163 197 205 170 Less: net income attributable to non-controlling interest — 1 — — — — 1 — — 1 — — — 1 Net income attributable to Leidos common stockholders 102 144 147 188 189 136 161 181 115 153 163 197 205 169 Acquisition, integration and restructuring costs 12 7 5 4 1 1 — 2 9 12 4 4 4 8 Amortization of acquired intangibles 37 38 37 38 32 32 33 32 32 38 44 32 40 41 Acquisition related financing costs — — — — — — — 2 1 2 — — — — Loss on debt modification — — — — — — — — 14 9 — — — — Amortization of equity method investments 3 1 1 2 2 1 2 2 — — 1 — — — Gain on sale of business — — — — (65) — — (1) — — — — — — Asset impairment charges 5 — — — — — — — — 9 — 1 — — Tax adjustments on assets held for sale — (18) 1 1 — — — — — — — — — — Other tax adjustments — — (17) (68) 7 — 1 (1) — — — — — — Non-GAAP net income attributable to Leidos common stockholders 159 172 174 165 166 170 197 217 171 223 212 234 249 218 Depreciation expense (13) (15) (14) (14) (15) (14) (16) (16) (18) (20) (22) (24) (22) (25) Interest expense, net (34) (35) (35) (34) (38) (33) (28) (32) (46) (38) (44) (46) (45) (46) Income tax expense adjusted to reflect non-GAAP adjustments (43) (53) (55) (43) (39) (54) (62) (59) (34) (61) (68) (61) (72) (69) Amortization of internally developed intangible assets — — — — (1) — — (1) (1) — (1) (1) (1) — Adjusted EBITDA, as reported 249 276 278 256 259 273 304 325 270 343 347 366 389 359 Adjusted EBITDA margin, as reported 10.2% 10.9% 10.8% 9.7% 10.1% 10.0% 10.7% 11.0% 9.3% 11.8% 10.7% 11.3% 11.7% 10.4% Non-recurring impacts 54 (12) 7 (2) (8) 26 Normalized adjusted EBITDA margin 10.2% 10.9% 10.8% 9.7% 10.1% 10.0% 8.8% 11.0% 9.7% 11.1% 10.6% 11.5% 11.0% 10.4% Operating cash flow, as reported 22 271 371 104 288 186 349 169 372 422 592 (52) 239 17 Non-recurring impacts 59 197 171 51 (199) 94 (68) Normalized operating cash flow 22 271 371 104 288 186 290 169 175 251 541 147 145 85 Payments for property, equipment and software 15 13 25 20 30 16 21 54 44 46 30 63 26 21 Free cash flow 7 258 346 84 258 170 328 115 328 376 562 (115) 213 (4) Free cash flow conversion ratio 4% 150% 199% 51% 155% 100% 166% 53% 192% 169% 265% -49% 86% -2%

Acronym List 67 ACC-ISR Air Combat Command Intelligence Surveillance Reconnaissance AFATDS Advanced Field Artillery Tactical Data System AI/ML Artificial Intelligence/Machine Learning AIE-3 Automated Installation Entry - 3 AIOps Artificial Intelligence for IT Operations C2 Command and Control C4ISR Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance COCO Contractor Owned-Contractor Operated E&T Engineering & Test EHR Electronic Health Record FFG Frigate Freighter Class FFRDC Federally Funded Research and Development Centers HLS Human Landing System JADC2 Joint All-Domain Command and Control LEO Low Earth Orbit LIDAR Light Detection and Ranging MSA Mission Support Alliance NLP Natural Language Processing POR Program of Record RF Radio Frequency STAMP II SOCOM Tactical Airborne Multi-Sensor Platforms Follow-On SV Space Vehicles

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Leidos (LDOS) awarded $267 million Army C5ISR and COTS systems task order

- ROSEN, A LEADING LAW FIRM, Encourages VinFast Auto Ltd. f/k/a Black Spade Acquisition Co. Investors to Secure Counsel Before Important Deadline in Securities Class Action – VFS

- BioArctic and Eisai sign research evaluation agreement regarding BAN2802

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share