Form 8-K LINDSAY CORP For: Jul 01

Exhibit 99.1

|

|

18135 BURKE ST. OMAHA, NE 68022 TEL: 402-829-6800 FAX: 402-829-6836 |

For further information, contact:

| LINDSAY CORPORATION: | THREE PART ADVISORS: | |

| Brian Ketcham | Hala Elsherbini | |

| Senior Vice President & Chief Financial Officer | 214-442-0016 | |

| 402-827-6579 | ||

Lindsay Corporation Reports Fiscal 2021 Third Quarter Results

| • | Third quarter consolidated revenues increase 32 percent to $161.9 million with EPS of $1.61 |

| • | Higher agriculture commodity prices drive improved demand for irrigation equipment across all geographies |

| • | Irrigation revenues increase 39 percent in North America and 62 percent in international markets |

| • | Infrastructure revenues decrease 21 percent due to coronavirus-related project delays |

OMAHA, Neb., July 1, 2021—Lindsay Corporation (NYSE: LNN), a leading global manufacturer and distributor of irrigation and infrastructure equipment and technology, today announced results for its third quarter of fiscal 2021, which ended on May 31, 2021.

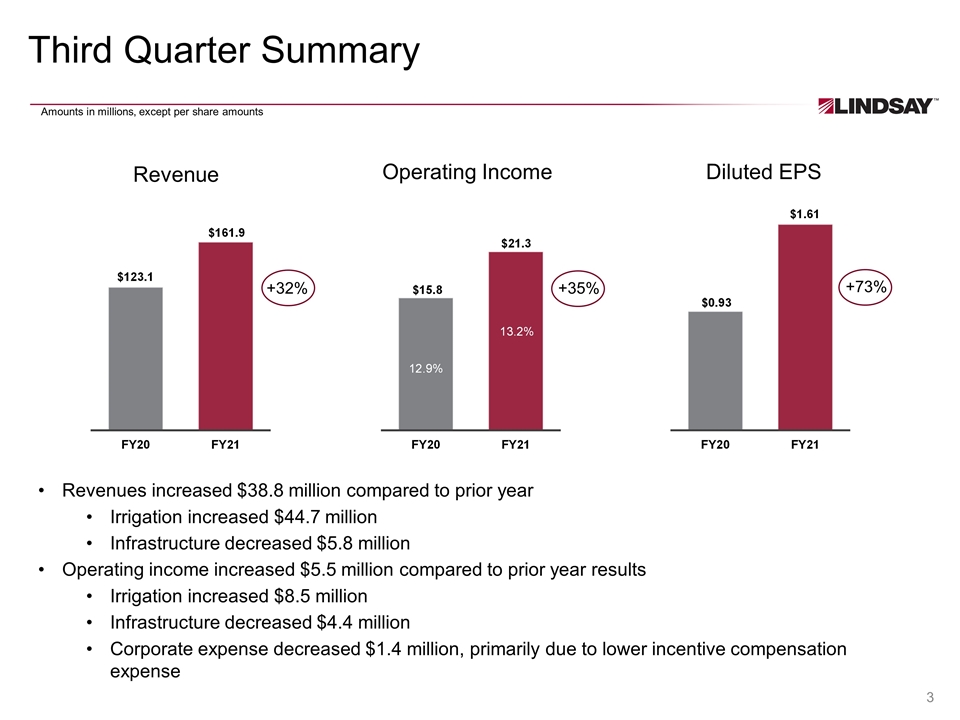

Third Quarter Summary

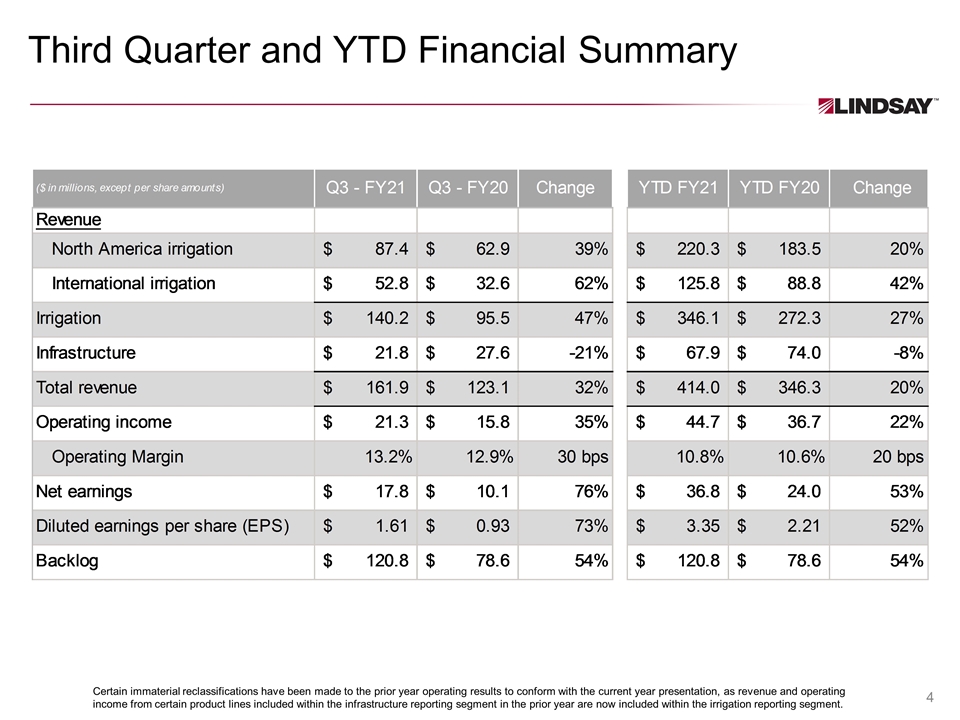

Revenues for the third quarter of fiscal 2021 were $161.9 million, an increase of $38.8 million, or 32 percent, compared to revenues of $123.1 million in the prior year third quarter. Net earnings for the quarter were $17.8 million, or $1.61 per diluted share, compared with net earnings of $10.1 million, or $0.93 per diluted share, for the prior year third quarter.

“Healthy agricultural market fundamentals and positive grower sentiment continue to drive increased global demand for irrigation equipment,” said Randy Wood, President and Chief Executive Officer. “At the same time, raw material inflation and other supply chain issues continue to create challenges and margin headwinds. Our teams have responded well and effectively managed through these dynamic market conditions in order to support our customers.”

Third Quarter Segment Results

Irrigation segment revenues for the third quarter of fiscal 2021 increased $44.7 million, or 47 percent, to $140.2 million, compared to $95.5 million in the prior year third quarter. North America irrigation revenues increased $24.5 million, or 39 percent, to $87.4 million compared to the prior year third quarter. The increase resulted from a combination of higher irrigation equipment unit sales volume and higher average selling prices. The increase was partially offset by lower engineering services revenue. International irrigation revenues of $52.8 million increased $20.2 million, or 62 percent, compared to the prior year third quarter. The increase resulted from higher unit sales volumes in most international markets, higher prices, and favorable foreign currency translation impact of $2.3 million.

Irrigation segment operating income was $23.9 million, an increase of $8.5 million, or 55 percent, compared to the prior year third quarter. Operating margin was 17.1 percent of sales, compared to 16.1 percent of sales in the prior year third quarter. The increase resulted primarily from the impact of higher irrigation system unit volume and was partially offset by the impact of higher raw material and other costs.

Infrastructure segment revenues for the third quarter of fiscal 2021 decreased $5.8 million, or 21 percent, to $21.8 million, compared to $27.6 million in the prior year third quarter. The decrease resulted from lower Road Zipper System® sales, which were partially offset by higher Road Zipper System lease revenue and increased sales of road safety products. Road construction activity and the timing of certain projects continues to be impacted by coronavirus-related delays.

Infrastructure segment operating income was $3.8 million, a decrease of $4.4 million, or 54 percent, compared to the prior year third quarter. Operating margin was 17.3 percent of sales, compared to 29.5 percent of sales in the prior year third quarter. Current year results reflect lower revenues and a less favorable margin mix of revenues compared to the prior year.

The backlog of unfilled orders at May 31, 2021 was $120.8 million compared with $78.6 million at May 31, 2020. The irrigation backlog is higher compared to the prior year while the infrastructure backlog is lower due to two large orders in the prior year that did not repeat.

Outlook

“Market conditions support continued robust demand for irrigation equipment, and we also expect raw material inflation and supply chain challenges to persist through the balance of our fiscal year,” said Mr. Wood. “We remain optimistic about the outlook for our infrastructure business, particularly as coronavirus restrictions are lifted and road construction activity returns to more normal levels.”

Mr. Wood continued, “Our financial position remains strong, providing support for our innovation growth strategy across our businesses that address global megatrends and provide solutions that improve customer profitability and assist in their sustainability efforts.”

Third Quarter Conference Call

Lindsay’s fiscal 2021 third quarter investor conference call is scheduled for 11:00 a.m. Eastern Time today. Interested investors may participate in the call by dialing (833) 535-2202 in the U.S., or (412) 902-6745 internationally, and requesting the Lindsay Corporation call. Additionally, the conference call will be simulcast live on the Internet and can be accessed via the investor relations section of the Company’s Web site, www.lindsay.com. Replays of the conference call will remain on our Web site through the next quarterly earnings release. The Company will have a slide presentation available to augment management’s formal presentation, which will also be accessible via the Company’s Web site.

About the Company

Lindsay Corporation (NYSE: LNN) is a leading global manufacturer and distributor of irrigation and infrastructure equipment and technology. Established in 1955, the company has been at the forefront of research and development of innovative solutions to meet the food, fuel, fiber and transportation needs of the world’s rapidly growing population. The Lindsay family of irrigation brands includes Zimmatic® center pivot and lateral move agricultural irrigation systems and FieldNET® remote irrigation management and scheduling technology, as well as irrigation consulting and design and industrial IoT solutions. Also a global leader in the transportation industry, Lindsay Transportation Solutions manufactures equipment to improve road safety and keep traffic moving on the world’s roads, bridges and tunnels, through the Barrier Systems®, Road Zipper® and Snoline™ brands. For more information about Lindsay Corporation, visit www.lindsay.com.

Concerning Forward-looking Statements

This release contains forward-looking statements that are subject to risks and uncertainties and which reflect management’s current beliefs and estimates of future economic circumstances, industry conditions, Company performance and financial results. You can find a discussion of many of these risks and uncertainties in the annual, quarterly and current reports that the Company files with the Securities and Exchange Commission. Forward-looking statements include information concerning possible or assumed future results of operations and planned financing of the Company and those statements preceded by, followed by or including the words “anticipate,” “estimate,” “believe,” “intend,” “expect,” “outlook,” “could,” “may,” “should,” “will,” or similar expressions. For these statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The Company undertakes no obligation to update any forward-looking information contained in this press release.

2

LINDSAY CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS

(Unaudited)

| Three months ended | Nine months ended | |||||||||||||||

| (in thousands, except per share amounts) |

May 31, 2021 |

May 31, 2020 |

May 31, 2021 |

May 31, 2020 |

||||||||||||

| Operating revenues |

$ | 161,936 | $ | 123,106 | $ | 413,998 | $ | 346,287 | ||||||||

| Cost of operating revenues |

117,880 | 83,410 | 297,360 | 239,111 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

44,056 | 39,696 | 116,638 | 107,176 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating expenses: |

||||||||||||||||

| Selling expense |

7,570 | 7,417 | 22,680 | 22,101 | ||||||||||||

| General and administrative expense |

12,043 | 13,055 | 39,770 | 38,026 | ||||||||||||

| Engineering and research expense |

3,102 | 3,396 | 9,504 | 10,303 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

22,715 | 23,868 | 71,954 | 70,430 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income |

21,341 | 15,828 | 44,684 | 36,746 | ||||||||||||

| Other (expense) income: |

||||||||||||||||

| Interest expense |

(1,178 | ) | (1,197 | ) | (3,584 | ) | (3,574 | ) | ||||||||

| Interest income |

227 | 408 | 798 | 1,412 | ||||||||||||

| Other expense, net |

764 | (2,774 | ) | 699 | (4,197 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other (expense) income |

(187 | ) | (3,563 | ) | (2,087 | ) | (6,359 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings before income taxes |

21,154 | 12,265 | 42,597 | 30,387 | ||||||||||||

| Income tax expense |

3,357 | 2,171 | 5,829 | 6,432 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net earnings |

$ | 17,797 | $ | 10,094 | $ | 36,768 | $ | 23,955 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings per share: |

||||||||||||||||

| Basic |

$ | 1.63 | $ | 0.93 | $ | 3.38 | $ | 2.21 | ||||||||

| Diluted |

$ | 1.61 | $ | 0.93 | $ | 3.35 | $ | 2.21 | ||||||||

| Shares used in computing earnings per share: |

||||||||||||||||

| Basic |

10,907 | 10,835 | 10,879 | 10,818 | ||||||||||||

| Diluted |

11,033 | 10,877 | 10,967 | 10,854 | ||||||||||||

| Cash dividends declared per share |

$ | 0.33 | $ | 0.32 | $ | 0.97 | $ | 0.94 | ||||||||

3

LINDSAY CORPORATION AND SUBSIDIARIES

SUMMARY OPERATING RESULTS

(Unaudited)

| Three months ended | Nine months ended | |||||||||||||||

| (in thousands) |

May 31, 2021 |

May 31, 2020 |

May 31, 2021 |

May 31, 2020 |

||||||||||||

| Operating revenues: |

||||||||||||||||

| Irrigation: |

||||||||||||||||

| North America |

$ | 87,364 | $ | 62,895 | 220,332 | $ | 183,570 | |||||||||

| International |

52,812 | 32,606 | 125,772 | 88,751 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Irrigation segment |

140,176 | 95,501 | $ | 346,104 | $ | 272,321 | ||||||||||

| Infrastructure segment |

21,760 | 27,605 | 67,894 | 73,966 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating revenues |

$ | 161,936 | $ | 123,106 | $ | 413,998 | $ | 346,287 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income (loss): |

||||||||||||||||

| Irrigation segment |

$ | 23,925 | $ | 15,417 | $ | 52,603 | $ | 35,282 | ||||||||

| Infrastructure segment |

3,767 | 8,157 | 14,364 | 22,788 | ||||||||||||

| Corporate |

(6,351 | ) | (7,746 | ) | (22,283 | ) | (21,324 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating income |

$ | 21,341 | $ | 15,828 | $ | 44,684 | $ | 36,746 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The Company manages its business activities in two reportable segments as follows:

Irrigation - This reporting segment includes the manufacture and marketing of center pivot, lateral move and hose reel irrigation systems and large diameter steel tubing as well as various innovative technology solutions such as GPS positioning and guidance, variable rate irrigation, remote irrigation management and scheduling technology, irrigation consulting and design and industrial IoT solutions.

Infrastructure – This reporting segment includes the manufacture and marketing of moveable barriers, specialty barriers, crash cushions and end terminals, and road marking and road safety equipment.

Certain immaterial reclassifications have been made to the prior year operating results to conform with current year presentation, as revenues and operating income from certain product lines previously included within the Infrastructure reporting segment are now included within the Irrigation reporting segment.

4

LINDSAY CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| (in thousands) |

May 31, 2021 |

May 31, 2020 |

August 31, 2020 |

|||||||||

| ASSETS |

||||||||||||

| Current assets: |

||||||||||||

| Cash and cash equivalents |

$ | 120,801 | $ | 102,474 | $ | 121,403 | ||||||

| Marketable securities |

19,663 | 19,012 | 19,511 | |||||||||

| Receivables, net |

107,713 | 84,931 | 84,604 | |||||||||

| Inventories, net |

136,601 | 113,301 | 104,792 | |||||||||

| Other current assets, net |

32,947 | 19,469 | 17,625 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total current assets |

417,725 | 339,187 | 347,935 | |||||||||

|

|

|

|

|

|

|

|||||||

| Property, plant, and equipment, net |

92,517 | 72,827 | 79,581 | |||||||||

| Intangibles, net |

21,893 | 24,053 | 23,477 | |||||||||

| Goodwill |

68,134 | 67,635 | 68,004 | |||||||||

| Operating lease right-of-use assets |

19,360 | 27,663 | 27,457 | |||||||||

| Deferred income tax assets |

10,247 | 11,118 | 9,935 | |||||||||

| Other noncurrent assets, net |

12,341 | 15,003 | 14,137 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total assets |

$ | 642,217 | $ | 557,486 | $ | 570,526 | ||||||

|

|

|

|

|

|

|

|||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

||||||||||||

| Current liabilities: |

||||||||||||

| Accounts payable |

$ | 49,351 | $ | 35,310 | $ | 29,554 | ||||||

| Current portion of long-term debt |

216 | 195 | 195 | |||||||||

| Other current liabilities |

94,589 | 71,712 | 72,646 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total current liabilities |

144,156 | 107,217 | 102,395 | |||||||||

|

|

|

|

|

|

|

|||||||

| Pension benefits liabilities |

6,086 | 5,787 | 6,374 | |||||||||

| Long-term debt |

115,557 | 115,723 | 115,682 | |||||||||

| Operating lease liabilities |

19,369 | 26,333 | 25,862 | |||||||||

| Deferred income tax liabilities |

881 | 835 | 889 | |||||||||

| Other noncurrent liabilities |

19,995 | 18,633 | 20,806 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total liabilities |

306,044 | 274,528 | 272,008 | |||||||||

|

|

|

|

|

|

|

|||||||

| Shareholders’ equity: |

||||||||||||

| Preferred stock |

— | — | — | |||||||||

| Common stock |

18,991 | 18,918 | 18,918 | |||||||||

| Capital in excess of stated value |

85,257 | 76,188 | 77,686 | |||||||||

| Retained earnings |

525,926 | 488,518 | 499,724 | |||||||||

| Less treasury stock - at cost |

(277,238 | ) | (277,238 | ) | (277,238 | ) | ||||||

| Accumulated other comprehensive loss, net |

(16,763 | ) | (23,428 | ) | (20,572 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total shareholders’ equity |

336,173 | 282,958 | 298,518 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total liabilities and shareholders’ equity |

$ | 642,217 | $ | 557,486 | $ | 570,526 | ||||||

|

|

|

|

|

|

|

|||||||

5

LINDSAY CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| Nine months ended | ||||||||

| (in thousands) |

May 31, 2021 |

May 31, 2020 |

||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: |

||||||||

| Net earnings |

$ | 36,768 | $ | 23,955 | ||||

| Adjustments to reconcile net earnings to net cash provided by operating activities: |

||||||||

| Depreciation and amortization |

14,688 | 14,146 | ||||||

| Gain on sale of assets held-for-sale |

— | (1,191 | ) | |||||

| Provision for uncollectible accounts receivable |

304 | 466 | ||||||

| Deferred income taxes |

205 | 27 | ||||||

| Share-based compensation expense |

5,021 | 4,118 | ||||||

| Unrealized foreign currency transaction (gain) loss |

(1,934 | ) | 3,632 | |||||

| Other, net |

(2,123 | ) | 1,575 | |||||

| Changes in assets and liabilities: |

||||||||

| Receivables |

(22,934 | ) | (11,379 | ) | ||||

| Inventories |

(28,612 | ) | (23,765 | ) | ||||

| Other current assets |

(14,025 | ) | (6,681 | ) | ||||

| Accounts payable |

20,828 | 5,385 | ||||||

| Other current liabilities |

20,149 | 14,485 | ||||||

| Other noncurrent assets and liabilities |

2,325 | (8,810 | ) | |||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

30,660 | 15,963 | ||||||

|

|

|

|

|

|||||

| CASH FLOWS FROM INVESTING ACTIVITIES: |

||||||||

| Purchases of property, plant, and equipment |

(22,532 | ) | (12,268 | ) | ||||

| Proceeds from sale of property and equipment held-for-sale |

— | 3,955 | ||||||

| Purchases of marketable securities available-for-sale |

(13,067 | ) | (23,389 | ) | ||||

| Proceeds from maturities of marketable securities available-for-sale |

12,592 | 4,320 | ||||||

| Acquisition of business, net of cash acquired |

— | (3,034 | ) | |||||

| Other investing activities, net |

(1,960 | ) | 1,503 | |||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(24,967 | ) | (28,913 | ) | ||||

|

|

|

|

|

|||||

| CASH FLOWS FROM FINANCING ACTIVITIES: |

||||||||

| Proceeds from exercise of stock options |

3,892 | 1,545 | ||||||

| Common stock withheld for payroll tax obligations |

(1,269 | ) | (1,111 | ) | ||||

| Principal payments on long-term debt |

(141 | ) | (174 | ) | ||||

| Dividends paid |

(10,566 | ) | (10,177 | ) | ||||

|

|

|

|

|

|||||

| Net cash used in financing activities |

(8,084 | ) | (9,917 | ) | ||||

|

|

|

|

|

|||||

| Effect of exchange rate changes on cash and cash equivalents |

1,789 | (1,863 | ) | |||||

|

|

|

|

|

|||||

| Net change in cash and cash equivalents |

(602 | ) | (24,730 | ) | ||||

| Cash and cash equivalents, beginning of period |

121,403 | 127,204 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents, end of period |

$ | 120,801 | $ | 102,474 | ||||

|

|

|

|

|

|||||

6

3rd Quarter Fiscal 2021 Earnings Slide Deck Exhibit 99.2

Safe-Harbor Statement This presentation contains forward-looking statements that are subject to risks and uncertainties, and which reflect management’s current beliefs and estimates of future economic circumstances, industry conditions, Company performance, financial results and planned financing. You can find a discussion of many of these risks and uncertainties in the annual, quarterly and current reports that the Company files with the Securities and Exchange Commission. Investors should understand that a number of factors (including but not limited to the lingering effects of the COVID-19 pandemic and related public health measures on plant operations, workforce availability, supply chain availability, and product demand) could cause future economic and industry conditions and the Company’s actual financial condition and results of operations to differ materially from management’s beliefs expressed in the forward-looking statements contained in this presentation. These factors include those outlined in the “Risk Factors” section of the Company’s most recent annual report on Form 10-K filed with the Securities and Exchange Commission, and investors are urged to review these factors when considering the forward-looking statements contained in this presentation. For these statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. For full financial statement information, please see the Company’s earnings release dated July 1, 2021.

Third Quarter Summary Revenues increased $38.8 million compared to prior year Irrigation increased $44.7 million Infrastructure decreased $5.8 million Operating income increased $5.5 million compared to prior year results Irrigation increased $8.5 million Infrastructure decreased $4.4 million Corporate expense decreased $1.4 million, primarily due to lower incentive compensation expense Amounts in millions, except per share amounts Revenue Operating Income Diluted EPS +32% +73% +35%

Third Quarter and YTD Financial Summary 4 Certain immaterial reclassifications have been made to the prior year operating results to conform with the current year presentation, as revenue and operating income from certain product lines included within the infrastructure reporting segment in the prior year are now included within the irrigation reporting segment.

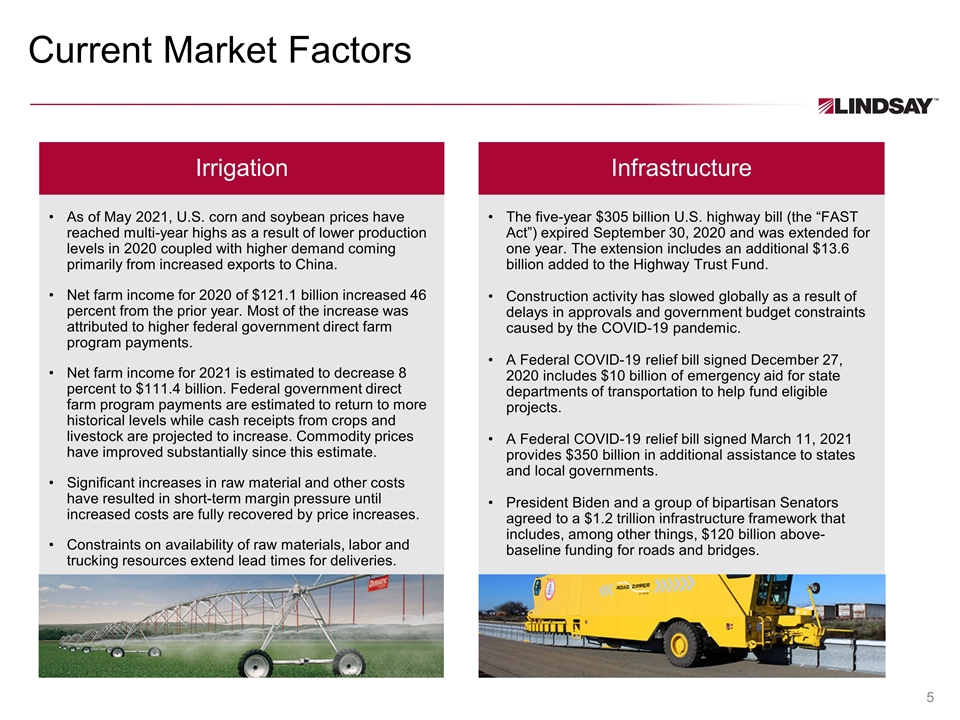

Current Market Factors 5 As of May 2021, U.S. corn and soybean prices have reached multi-year highs as a result of lower production levels in 2020 coupled with higher demand coming primarily from increased exports to China. Net farm income for 2020 of $121.1 billion increased 46 percent from the prior year. Most of the increase was attributed to higher federal government direct farm program payments. Net farm income for 2021 is estimated to decrease 8 percent to $111.4 billion. Federal government direct farm program payments are estimated to return to more historical levels while cash receipts from crops and livestock are projected to increase. Commodity prices have improved substantially since this estimate. Significant increases in raw material and other costs have resulted in short-term margin pressure until increased costs are fully recovered by price increases. Constraints on availability of raw materials, labor and trucking resources extend lead times for deliveries. Irrigation Infrastructure The five-year $305 billion U.S. highway bill (the “FAST Act”) expired September 30, 2020 and was extended for one year. The extension includes an additional $13.6 billion added to the Highway Trust Fund. Construction activity has slowed globally as a result of delays in approvals and government budget constraints caused by the COVID-19 pandemic. A Federal COVID-19 relief bill signed December 27, 2020 includes $10 billion of emergency aid for state departments of transportation to help fund eligible projects. A Federal COVID-19 relief bill signed March 11, 2021 provides $350 billion in additional assistance to states and local governments. President Biden and a group of bipartisan Senators agreed to a $1.2 trillion infrastructure framework that includes, among other things, $120 billion above-baseline funding for roads and bridges.

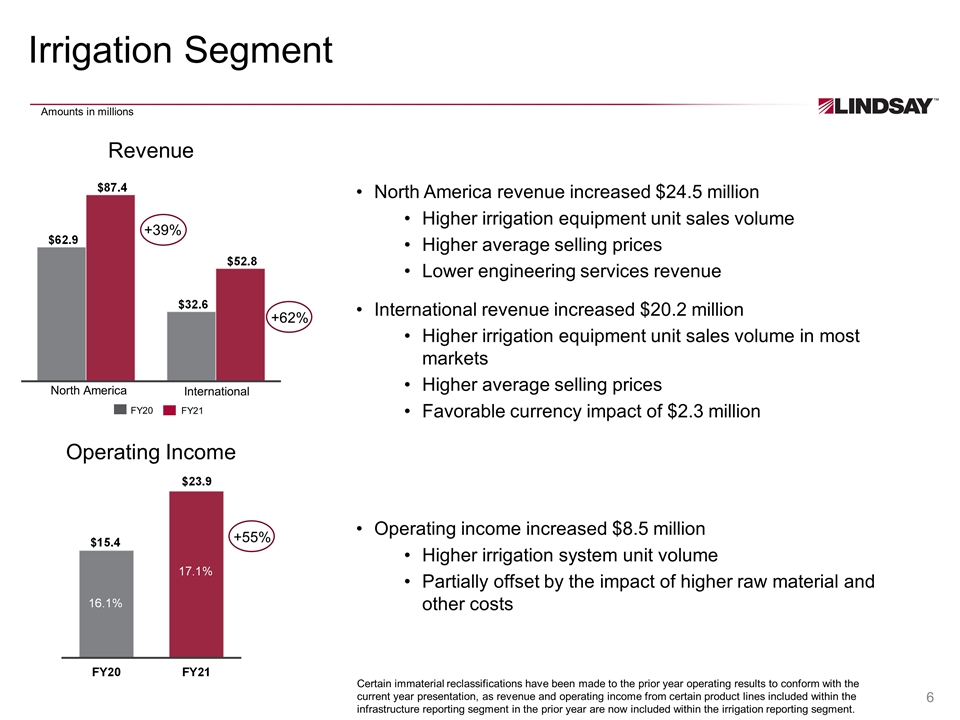

Irrigation Segment North America revenue increased $24.5 million Higher irrigation equipment unit sales volume Higher average selling prices Lower engineering services revenue International revenue increased $20.2 million Higher irrigation equipment unit sales volume in most markets Higher average selling prices Favorable currency impact of $2.3 million Operating income increased $8.5 million Higher irrigation system unit volume Partially offset by the impact of higher raw material and other costs Revenue Operating Income North America International FY20 FY21 Amounts in millions Certain immaterial reclassifications have been made to the prior year operating results to conform with the current year presentation, as revenue and operating income from certain product lines included within the infrastructure reporting segment in the prior year are now included within the irrigation reporting segment. +62% +55% +39%

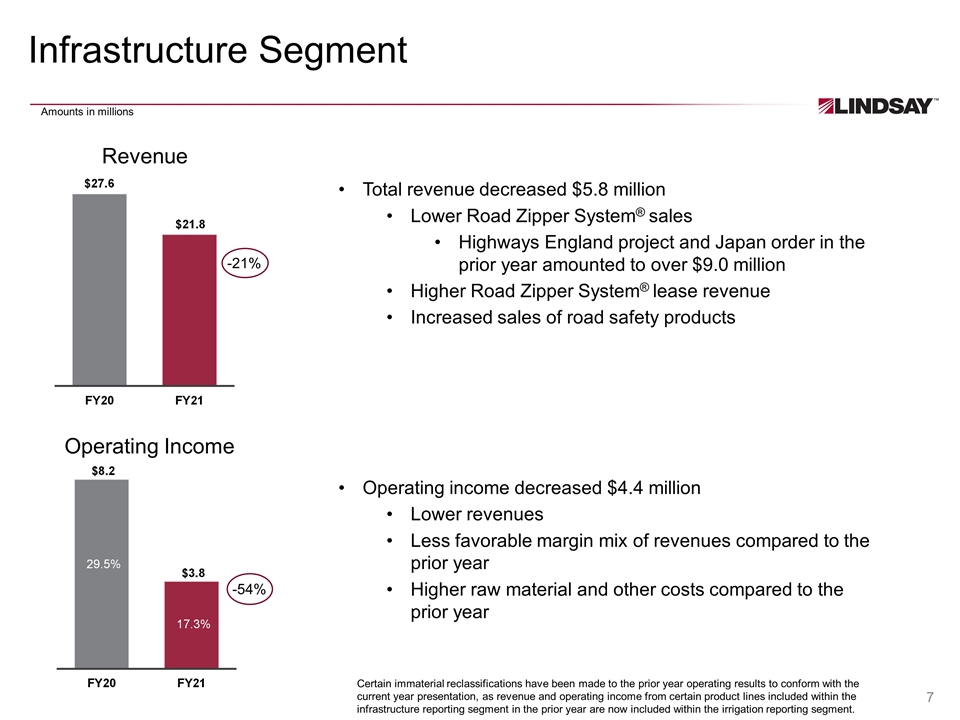

Infrastructure Segment Total revenue decreased $5.8 million Lower Road Zipper System® sales Highways England project and Japan order in the prior year amounted to over $9.0 million Higher Road Zipper System® lease revenue Increased sales of road safety products Operating income decreased $4.4 million Lower revenues Less favorable margin mix of revenues compared to the prior year Higher raw material and other costs compared to the prior year Revenue Operating Income Amounts in millions Certain immaterial reclassifications have been made to the prior year operating results to conform with the current year presentation, as revenue and operating income from certain product lines included within the infrastructure reporting segment in the prior year are now included within the irrigation reporting segment. -21% -54%

Innovation Leadership: Addressing Global Megatrends Capitalizing on global megatrends Key Trends Food Security Water Scarcity Land Availability Mobility Safety Reducing Emissions Labor Savings

Strong Commitment to Sustainable Practices Our mission is to provide solutions that conserve natural resources, enhance the quality of life for people, and expand our world’s potential. Investing in sustainable technologies Improving our operational footprint Empowering and protecting our people Engaging in our local communities Operating with integrity 1 2 3 4 5

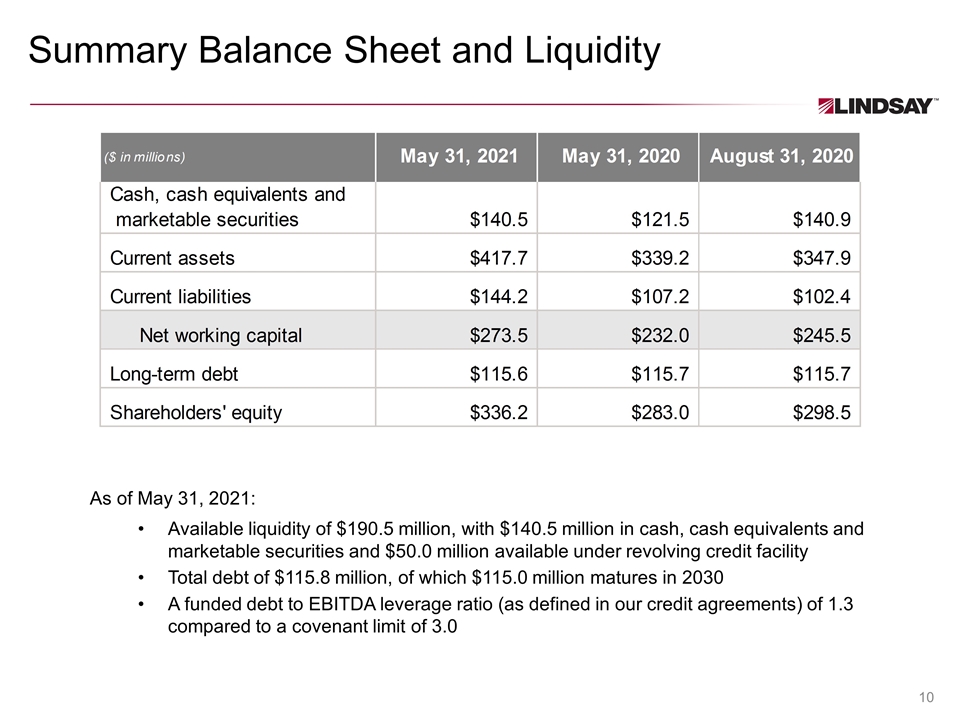

Summary Balance Sheet and Liquidity As of May 31, 2021: Available liquidity of $190.5 million, with $140.5 million in cash, cash equivalents and marketable securities and $50.0 million available under revolving credit facility Total debt of $115.8 million, of which $115.0 million matures in 2030 A funded debt to EBITDA leverage ratio (as defined in our credit agreements) of 1.3 compared to a covenant limit of 3.0

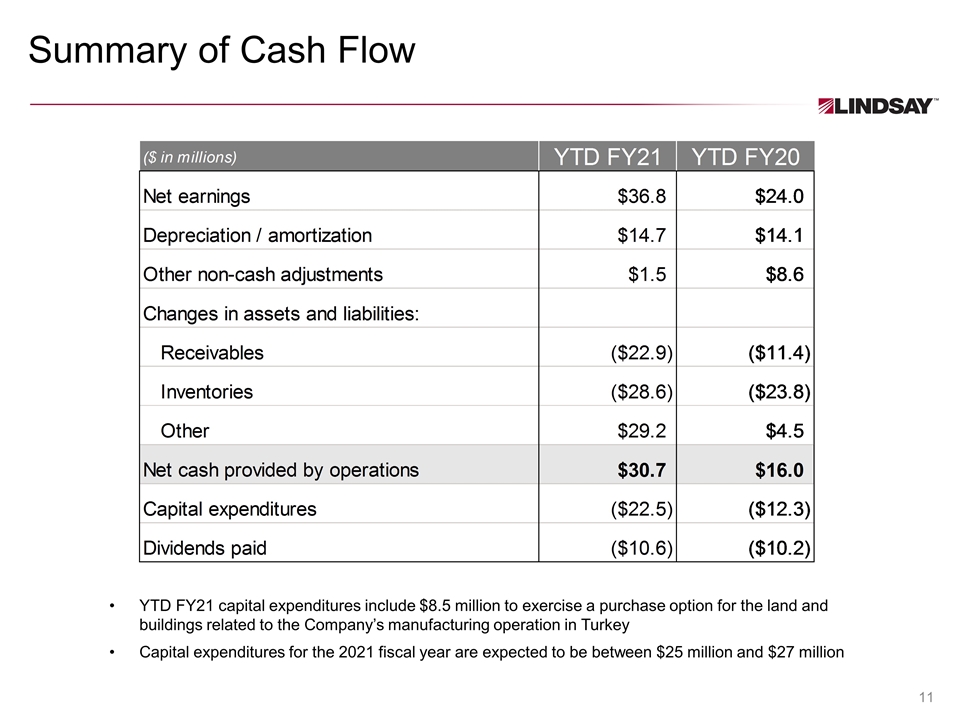

Summary of Cash Flow YTD FY21 capital expenditures include $8.5 million to exercise a purchase option for the land and buildings related to the Company’s manufacturing operation in Turkey Capital expenditures for the 2021 fiscal year are expected to be between $25 million and $27 million

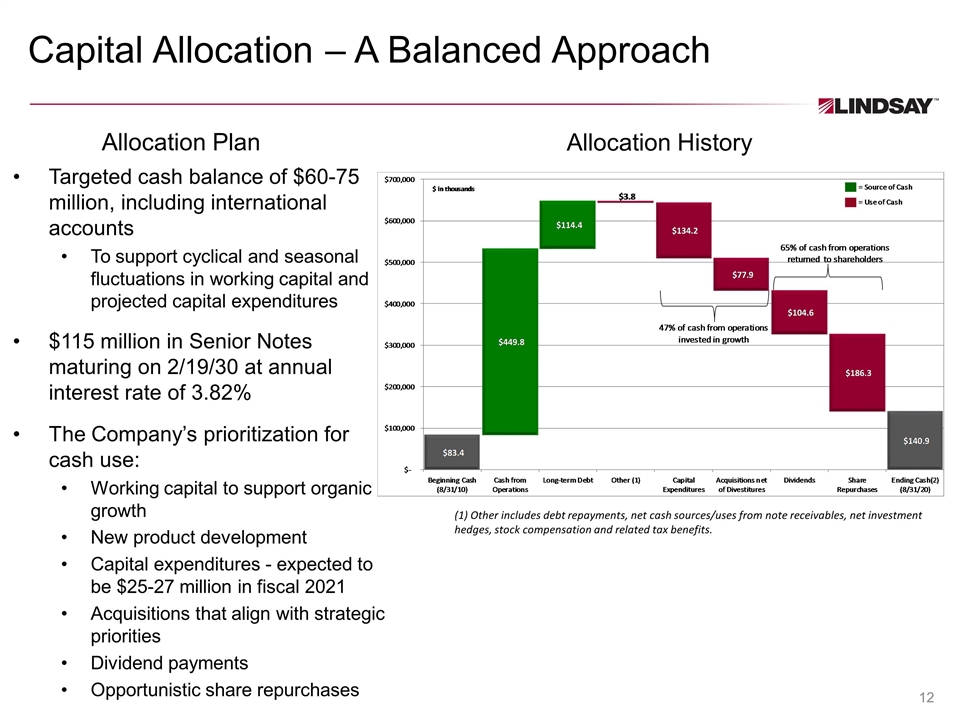

Capital Allocation – A Balanced Approach Allocation History (1) Other includes debt repayments, net cash sources/uses from note receivables, net investment hedges, stock compensation and related tax benefits. Targeted cash balance of $60-75 million, including international accounts To support cyclical and seasonal fluctuations in working capital and projected capital expenditures $115 million in Senior Notes maturing on 2/19/30 at annual interest rate of 3.82% The Company’s prioritization for cash use: Working capital to support organic growth New product development Capital expenditures - expected to be $25-27 million in fiscal 2021 Acquisitions that align with strategic priorities Dividend payments Opportunistic share repurchases Allocation Plan

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Tiger Aesthetics Medical, LLC Acquires Assets of Sientra, Inc.

- UGE Announces Financial Results Release Date and Webinar

- Vext Announces Delay of Annual Filings and Postponement of Conference Call

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share