Form 8-K KINDRED HEALTHCARE, INC For: Feb 05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 5, 2018

KINDRED HEALTHCARE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-14057 | 61-1323993 | ||

| (State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(IRS Employer Identification No.) |

680 South Fourth Street

Louisville, Kentucky

(Address of principal executive offices)

40202

(Zip Code)

Registrant’s telephone number, including area code: (502) 596-7300

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. | Regulation FD Disclosure. |

As previously announced, on December 19, 2017, Kindred Healthcare, Inc. (“Kindred” or the “Company”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Kentucky Hospital Holdings, LLC, a Delaware limited liability company, Kentucky Homecare Holdings, Inc., a Delaware corporation, and Kentucky Homecare Merger Sub, Inc. On February 5, 2018, Kindred made available an investor presentation regarding the transactions contemplated by the Merger Agreement (the “Investor Presentation”). A copy of the Investor Presentation is attached hereto as Exhibit 99.1. Exhibit 99.1 is being furnished under Item 7.01 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of such section, nor shall this information be deemed incorporated by reference into any filing made by the Company under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| Item 8.01. | Other Events. |

On February 5, 2018, Kindred made available the Investor Presentation.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit |

Description | |

| 99.1 | Investor Presentation made available by Kindred Healthcare, Inc. on February 5, 2018 | |

***********

Forward Looking Statements

Certain statements contained herein includes “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act. These forward-looking statements are often identified by words such as “anticipate,” “approximate,” “believe,” “plan,” “estimate,” “expect,” “project,” “could,” “would,” “should,” “will,” “intend,” “hope,” “may,” “potential,” “upside,” “seek,” “continue” and other similar expressions.

Such forward-looking statements are inherently uncertain, and stockholders and other potential investors must recognize that actual results may differ materially from the Company’s expectations as a result of a variety of factors. Such forward-looking statements are based upon management’s current expectations and include known and unknown risks, uncertainties and other factors, many of which the Company is unable to predict or control, that may cause the Company’s actual results, performance, or plans to differ materially from any future results, performance or plans expressed or implied by such forward-looking statements. Risks and uncertainties related to the proposed transactions include, but are not limited to, the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement; the failure of the parties to satisfy conditions to completion of the proposed merger, including the failure of the Company’s stockholders to approve the proposed merger or the failure of the parties to obtain required regulatory approvals; the risk that regulatory or other approvals are delayed or are subject to terms and conditions that are not anticipated; changes in the business or operating prospects of the Company or its businesses; changes in health care and other laws and regulations; the impact of the announcement of, or failure to complete, the proposed merger on our relationships with employees, customers, vendors and other business partners; and potential or actual litigation. In addition, these statements involve risks, uncertainties, and other factors detailed from time to time in the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the Securities and Exchange Commission (the “SEC”).

Many of these factors are beyond the Company’s control. The Company cautions investors that any forward-looking statements made by the Company are not guarantees of future performance. The Company disclaims any obligation to update any such factors or to announce publicly the results of any revisions to any of the forward-looking statements to reflect future events or developments.

Additional Information and Where to Find It

The Company has filed with the SEC a preliminary proxy statement and will file with the SEC and mail to its stockholders a definitive proxy statement in connection with the proposed merger. We urge investors and security holders to read the proxy statement when it becomes available because it will contain important information regarding the proposed merger. You may obtain a free copy of the proxy statement (when available) and other related documents filed by the Company with the SEC at the SEC’s website at www.sec.gov. You also may obtain the proxy statement (when it is available) and other documents filed by the Company with the SEC relating to the proposed merger for free by accessing the Company’s website at www.kindredhealthcare.com by clicking on the link for “Investors”, then clicking on the link for “SEC Filings.”

Participants in the Solicitation

The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection with the proposed merger. Information regarding the interests of these directors and executive officers in the proposed merger will be included in the proxy statement when it is filed with the SEC. You may find additional information about the Company’s directors and executive officers in the Company’s preliminary proxy statement, which was filed with the SEC on February 5, 2018. You can obtain free copies of these documents from the Company using the contact information above.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Kindred Healthcare, Inc. | ||||||

| February 5, 2018 | By: | /s/ Joseph L. Landenwich | ||||

| Name: | Joseph L. Landenwich | |||||

| Title: | General Counsel and Corporate Secretary | |||||

| Exhibit 99.1

|

Investor Presentation February 2018

|

Forward Looking Statements

This presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking statements are often identified by words such as “anticipate,” “approximate,” “believe,” “plan,” “estimate,” “expect,”

“project,” “could,” “would,” “should,” “will,” “intend,” “hope,” “may,” “potential,” “upside,” “seek,” “continue,” and other

similar expressions.

Such forward-looking statements are inherently uncertain, and stockholders and other potential investors must recognize that actual results

may differ materially from the Company’s expectations as a result of a variety of factors. Such forward-looking statements are based upon management’s current expectations and include known and unknown risks, uncertainties and other

factors, many of which the Company is unable to predict or control, that may cause the Company’s actual results, performance, or plans to differ materially from any future results, performance or plans expressed or implied by such

forward-looking statements. Risks and uncertainties related to the proposed transactions include, but are not limited to, the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement; the

failure of the parties to satisfy conditions to completion of the proposed Merger, including the failure of the Company’s stockholders to approve the proposed Merger or the failure of the parties to obtain required regulatory approvals; the

risk that regulatory or other approvals are delayed or are subject to terms and conditions that are not anticipated; changes in the business or operating prospects of the Company or its businesses; changes in health care and other laws and

regulations; the impact of the announcement of, or failure to complete, the proposed Merger on our relationships with employees, customers, vendors and other business partners; and potential or actual litigation. In addition, these statements

involve risks, uncertainties, and other factors detailed from time to time in the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K filed with the Securities and Exchange Commission (the “SEC”).

Many of these factors are

beyond the Company’s control. The Company cautions investors that any forward-looking statements made by the Company are not guarantees of future performance. The Company disclaims any obligation to update any such factors or to announce

publicly the results of any revisions to any of the forward-looking statements to reflect future events or developments.

Additional Information and Where to Find

It

The Company has filed with the SEC a preliminary proxy statement and will file with the SEC and mail to its stockholders a definitive proxy statement in

connection with the proposed Merger. We urge investors and security holders to read the proxy statement when it becomes available because it will contain important information regarding the proposed Merger. You may obtain a free copy of the proxy

statement (when available) and other related documents filed by the Company with the SEC at the SEC’s website at www.sec.gov. You also may obtain the proxy statement (when it is available) and other documents filed by the Company with the SEC

relating to the proposed Merger for free by accessing the Company’s website at www.kindredhealthcare.com by clicking on the link for “Investors”, then clicking on the link for “SEC Filings.”

Participants in the Solicitation

The Company and its directors and executive officers may be

deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection with the proposed Merger. Information regarding the interests of these directors and executive officers in the proposed Merger will be

included in the proxy statement when it is filed with the SEC. You may find additional information about the Company’s directors and executive officers in the Company’s preliminary proxy statement, which was filed with the SEC on

February 5, 2018. You can obtain free copies of these documents from the Company using the contact information above.

1

|

Table of Contents

1 Overview of Transaction

2 Robust 18-Month Strategic

Review and Exploration of Interest

3 Operating, Regulatory and Reimbursement Headwinds and Risks

|

Overview of Transaction

|

Transaction Delivers Superior Risk-Adjusted Value to

Kindred Stockholders

TPG Capital (“TPG”), Welsh, Carson, Anderson & Stowe (“WCAS”) and Humana Inc.

(“Humana”) (collectively the “Consortium”), to acquire Kindred for $9.00 per share in cash

All cash offer at a significant 27% premium to Kindred’s 90-day volume weighted average price

(“VWAP”)(1)

Concludes robust strategic review process to maximize

value, involving 15 financial sponsors and 3 strategic parties

Results in superior risk-adjusted value and certainty to all other evaluated

opportunities including the standalone plan

Provides certain cash value in a challenging operating, regulatory and reimbursement environment

compounded by Kindred’s high financial leverage

Unanimous approval from Kindred’s Board of Directors(2)

Note: 1. VWAP as of December 15, 2017, the last trading day prior to news reports regarding a potential transaction.

2. Sharad Mansukani recused himself from this process due to existing relationship with TPG.

2

|

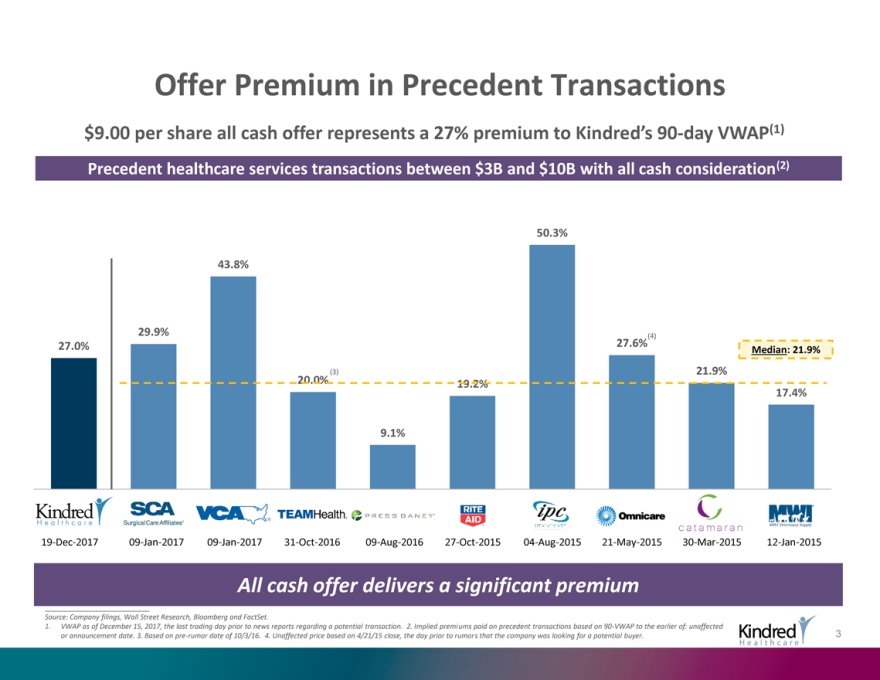

Offer Premium in Precedent Transactions

$9.00 per share all cash offer represents a 27% premium to Kindred’s 90-day VWAP(1)

Precedent healthcare services transactions between $3B and $10B with all cash consideration(2)

50.3%

43.8%

29.9% (4) 27.0% 27.6%

Median: 21.9%

20.0%(3) 21.9%

19.2% 17.4%

9.1%

19-Dec-2017

09-Jan-2017 09-Jan-2017

31-Oct-2016 09-Aug-2016

27-Oct-2015 04-Aug-2015

21-May-2015 30-Mar-2015

12-Jan-2015

All cash offer delivers a significant premium

Source: Company filings, Wall Street Research, Bloomberg and FactSet.

1. VWAP as of

December 15, 2017, the last trading day prior to news reports regarding a potential transaction. 2. Implied premiums paid on precedent transactions based on 90-VWAP to the earlier of: unaffected 3 or

announcement date. 3. Based on pre-rumor date of 10/3/16. 4. Unaffected price based on 4/21/15 close, the day prior to rumors that the company was looking for a potential buyer.

|

Now Is the Right Time to Enter into a Transaction to

Maximize Stockholder Value

Transaction removes risk and volatility from stockholders related to:

• Reimbursement uncertainty

— Further headwinds from potential Medicare rate

reductions as “pay-for” for tax cuts

• Financial leverage

• Challenging operating environment

Transaction monetizes home health and hospice assets

during a period of record valuations

• These valuation levels are exposed to possible downward revision given reimbursement changes signaled with the HHGM

proposal and tax reform

Significant near- to intermediate-term debt maturities that require refinancing, potentially in a rising interest rate environment

• Transaction eliminates this overhang for stockholders

4

|

Now Is the Right Time to Enter into a Transaction to

Maximize Stockholder Value (continued)

Restructuring essentially complete, benefits included in Company’s 2018 guidance, and impact already reflected in

Kindred’s pre-transaction valuation

• Skilled nursing divestiture, cost reductions, as well as lease and

insurance restructurings

Kindred faces persistent labor cost pressure, especially in a full-employment environment

Kindred’s high leverage:

• Amplifies impact of reimbursement and operational

headwinds and risks

• Significantly constrains ability of Kindred to pursue opportunities

• Negates near-term benefits from federal tax reform

Uncertain reimbursement environment

due to federal budget deficits from tax reform

5

|

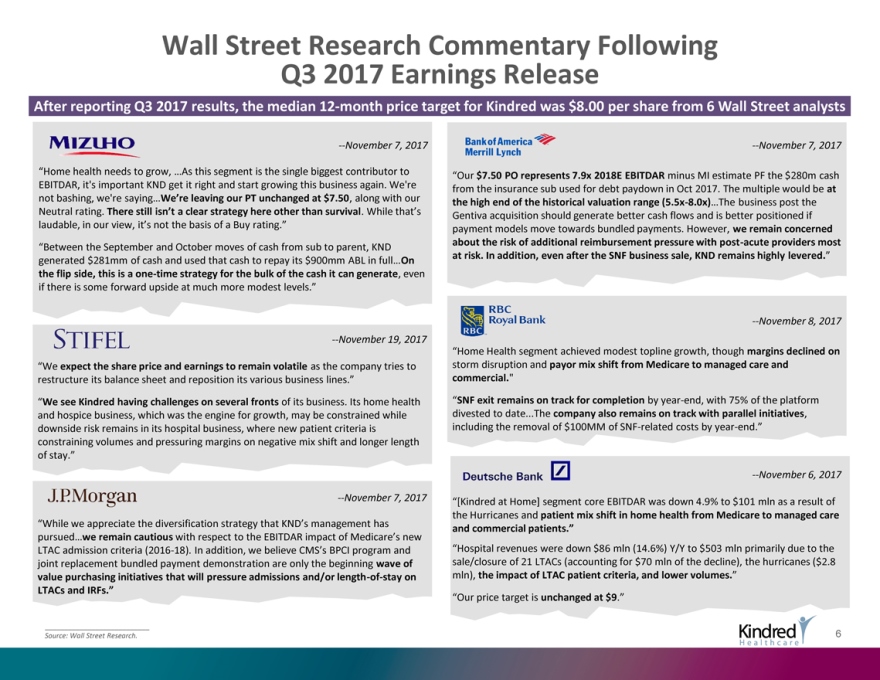

Wall Street Research Commentary Following Q3 2017

Earnings Release

After reporting Q3 2017 results, the median 12-month price target for Kindred was $8.00 per share from 6

Wall Street analysts

—November 7, 2017 —November 7, 2017

“Home

health needs to grow, …As this segment is the single biggest contributor to “Our $7.50 PO represents 7.9x 2018E EBITDAR minus MI estimate PF the $280m cash

EBITDAR, it’s important KND get it right and start growing this business again. We’re from the insurance sub used for debt paydown in Oct 2017. The

multiple would be at not bashing, we’re saying…We’re leaving our PT unchanged at $7.50, along with our the high end of the historical valuation range (5.5x-8.0x)…The business post the

Neutral rating. There still isn’t a clear strategy here other than survival. While that’s Gentiva acquisition should generate better cash flows and is

better positioned if laudable, in our view, it’s not the basis of a Buy rating.” payment models move towards bundled payments. However, we remain concerned about the risk of additional reimbursement pressure with post-acute providers most

“Between the September and October moves of cash from sub to parent, KND at risk. In addition, even after the SNF business sale, KND remains highly levered.” generated $281mm of cash and used that cash to repay its $900mm ABL in

full…On the flip side, this is a one-time strategy for the bulk of the cash it can generate, even if there is some forward upside at much more modest levels.”

—November 8, 2017 —November 19, 2017

“Home Health segment achieved modest

topline growth, though margins declined on

“We expect the share price and earnings to remain volatile as the company tries to storm disruption and payor mix

shift from Medicare to managed care and restructure its balance sheet and reposition its various business lines.” commercial.”

“We see Kindred

having challenges on several fronts of its business. Its home health “SNF exit remains on track for completion by year-end, with 75% of the platform and hospice business, which was the engine for growth,

may be constrained while divested to date...The company also remains on track with parallel initiatives, downside risk remains in its hospital business, where new patient criteria is including the removal of $100MM of

SNF-related costs by year-end.” constraining volumes and pressuring margins on negative mix shift and longer length of stay.”

—November 6, 2017

—November 7, 2017 “[Kindred at Home] segment core EBITDAR was

down 4.9% to $101 mln as a result of “While we appreciate the diversification strategy that KND’s management has the Hurricanes and patient mix shift in home health from Medicare to managed care pursued…we remain cautious with respect

to the EBITDAR impact of Medicare’s new and commercial patients.”

LTAC admission criteria (2016-18). In addition,

we believe CMS’s BPCI program and “Hospital revenues were down $86 mln (14.6%) Y/Y to $503 mln primarily due to the joint replacement bundled payment demonstration are only the beginning wave of sale/closure of 21 LTACs (accounting for $70

mln of the decline), the hurricanes ($2.8 value purchasing initiatives that will pressure admissions and/or length-of-stay on mln), the impact of LTAC patient criteria,

and lower volumes.”

LTACs and IRFs.”

“Our price target is

unchanged at $9.”

___________________________ 6 Source: Wall Street Research.

|

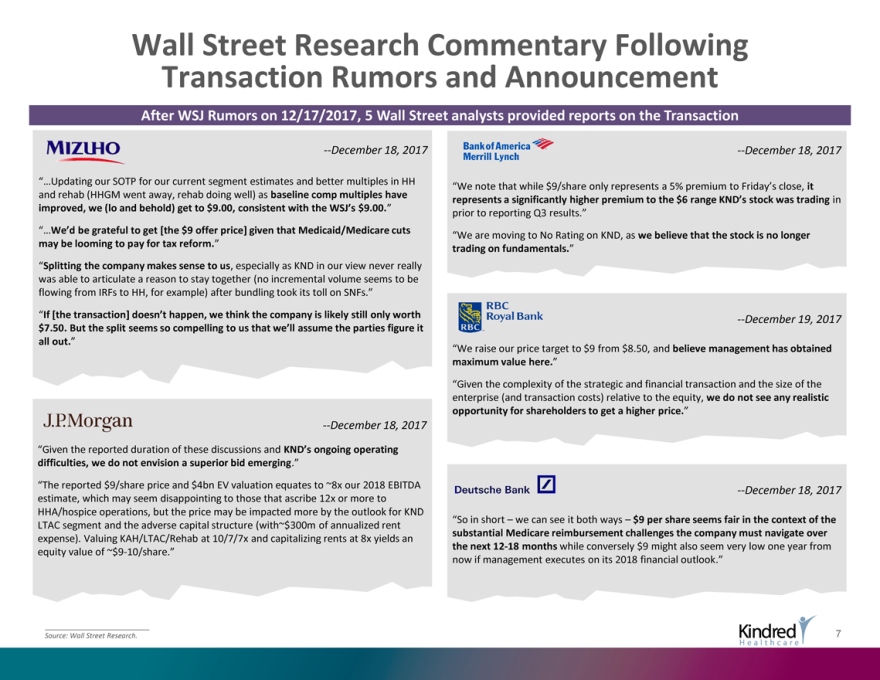

Wall Street Research Commentary Following

Transaction Rumors and Announcement

After WSJ Rumors on 12/17/2017, 5 Wall Street analysts provided reports on the Transaction

—December 18, 2017 —December 18, 2017

“…Updating our SOTP for our current

segment estimates and better multiples in HH and rehab (HHGM went away, rehab doing well) as baseline comp multiples have “We note that while $9/share only represents a 5% premium to Friday’s close, it improved, we (lo and behold) get to

$9.00, consistent with the WSJ’s $9.00.” represents a significantly higher premium to the $6 range KND’s stock was trading in prior to reporting Q3 results.” “…We’d be grateful to get [the $9 offer price] given

that Medicaid/Medicare cuts may be looming to pay for tax reform.” “We are moving to No Rating on KND, as we believe that the stock is no longer trading on fundamentals.”

“Splitting the company makes sense to us, especially as KND in our view never really was able to articulate a reason to stay together (no incremental volume seems to be

flowing from IRFs to HH, for example) after bundling took its toll on SNFs.”

“If [the transaction] doesn’t happen, we think the company is likely

still only worth —December 19, 2017 $7.50. But the split seems so compelling to us that we’ll assume the parties figure it all out.”

“We raise

our price target to $9 from $8.50, and believe management has obtained maximum value here.”

“Given the complexity of the strategic and financial

transaction and the size of the enterprise (and transaction costs) relative to the equity, we do not see any realistic opportunity for shareholders to get a higher price.”

—December 18, 2017

“Given the reported duration of these discussions and KND’s

ongoing operating difficulties, we do not envision a superior bid emerging.”

“The reported $9/share price and $4bn EV valuation equates to ~8x our 2018

EBITDA estimate, which may seem disappointing to those that ascribe 12x or more to —December 18, 2017 HHA/hospice operations, but the price may be impacted more by the outlook for KND “So in short – we can see it both ways – $9

per share seems fair in the context of the

LTAC segment and the adverse capital structure (with~$300m of annualized rent substantial Medicare reimbursement

challenges the company must navigate over expense). Valuing KAH/LTAC/Rehab at 10/7/7x and capitalizing rents at 8x yields an the next 12-18 months while conversely $9 might also seem very low one year from

equity value of ~$9-10/share.” now if management executes on its 2018 financial outlook.”

___________________________ 7 Source: Wall Street Research.

|

Robust 18-Month Strategic Review and Exploration of Interest

|

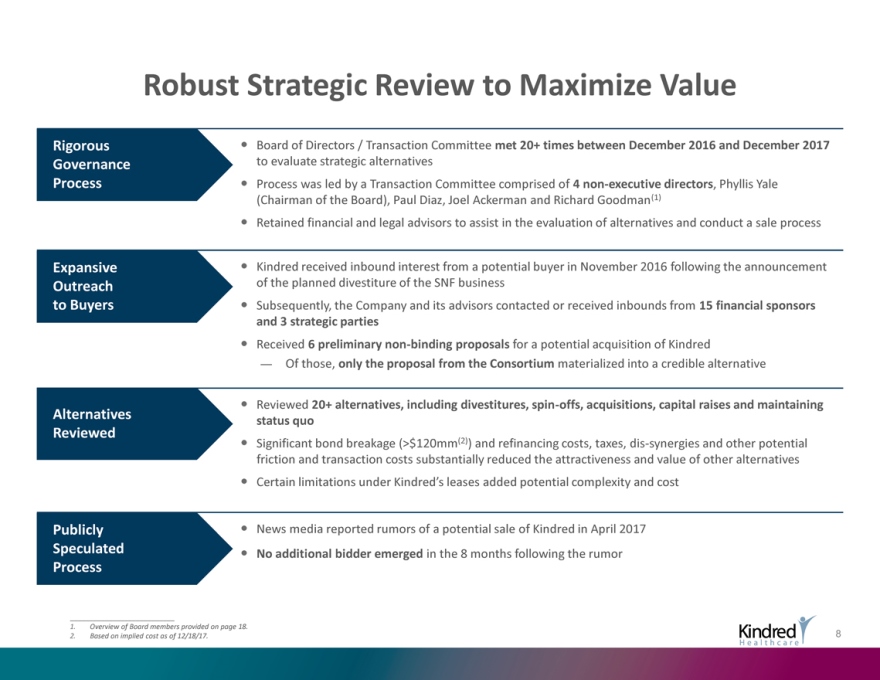

Robust Strategic Review to Maximize Value

Rigorous ï,— Board of Directors / Transaction Committee met 20+ times between December 2016 and December 2017

Governance to evaluate strategic alternatives

Processï,— Process was led by a

Transaction Committee comprised of 4 non-executive directors, Phyllis Yale (Chairman of the Board), Paul Diaz, Joel Ackerman and Richard Goodman(1)ï,— Retained financial and legal advisors to assist

in the evaluation of alternatives and conduct a sale process

Expansive ï,— Kindred received inbound interest from a potential buyer in November 2016

following the announcement Outreach of the planned divestiture of the SNF business to Buyersï,— Subsequently, the Company and its advisors contacted or received inbounds from 15 financial sponsors and 3 strategic parties

ï,— Received 6 preliminary non-binding proposals for a potential acquisition of Kindred

— Of those, only the proposal from the Consortium materialized into a credible alternative

ï,— Reviewed 20+ alternatives, including divestitures, spin-offs, acquisitions, capital raises and maintaining

Alternatives

status quo

Reviewed

ï,— Significant bond breakage (>$120mm(2)) and refinancing costs, taxes,

dis-synergies and other potential friction and transaction costs substantially reduced the attractiveness and value of other alternatives

ï,— Certain limitations under Kindred’s leases added potential complexity and cost

Publicly ï,— News media reported rumors of a potential sale of Kindred in April 2017 Speculated ï,— No additional bidder emerged in the 8 months following the

rumor

Process

1. Overview of Board members provided on page 18.

2. Based on implied cost as of 12/18/17. 8

|

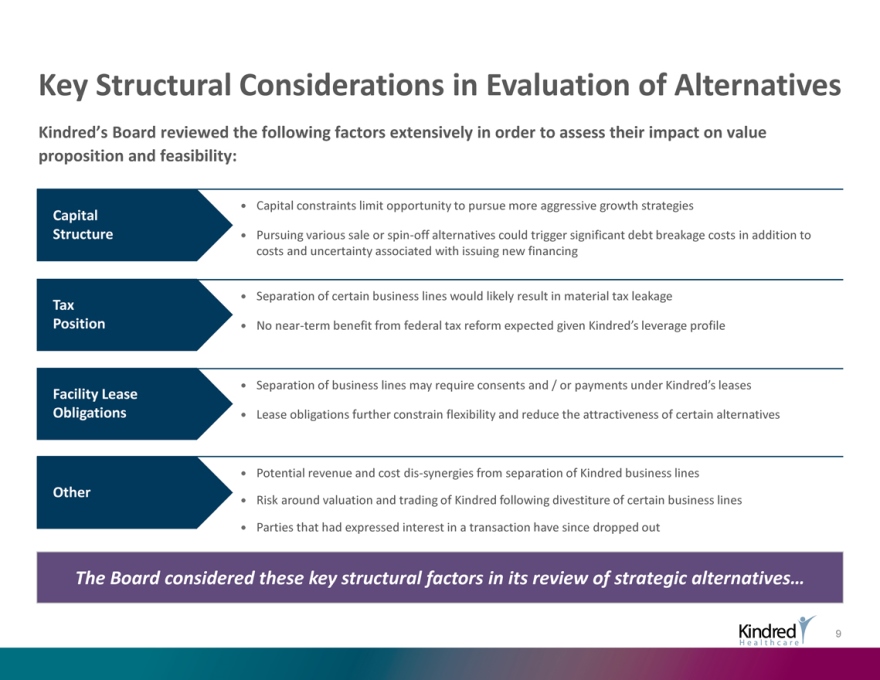

Key Structural Considerations in Evaluation of

Alternatives

Kindred’s Board reviewed the following factors extensively in order to assess their impact on value proposition and feasibility:

ï,— Capital constraints limit opportunity to pursue more aggressive growth strategies

Capital

Structureï,— Pursuing various sale or spin-off alternatives could trigger significant debt breakage costs in addition to costs and uncertainty associated with issuing new financing

ï,— Separation of certain business lines would likely result in material tax leakage

Tax

Positionï,— No near-term benefit from federal tax reform

expected given Kindred’s leverage profile

ï,— Separation of business lines may require consents and / or payments under Kindred’s leases

Facility Lease

Obligationsï,— Lease obligations further constrain

flexibility and reduce the attractiveness of certain alternatives

ï,— Potential revenue and cost dis-synergies

from separation of Kindred business lines

Other

ï,— Risk around

valuation and trading of Kindred following divestiture of certain business lines

ï,— Parties that had expressed interest in a transaction have since

dropped out

The Board considered these key structural factors in its review of strategic alternatives…

9

|

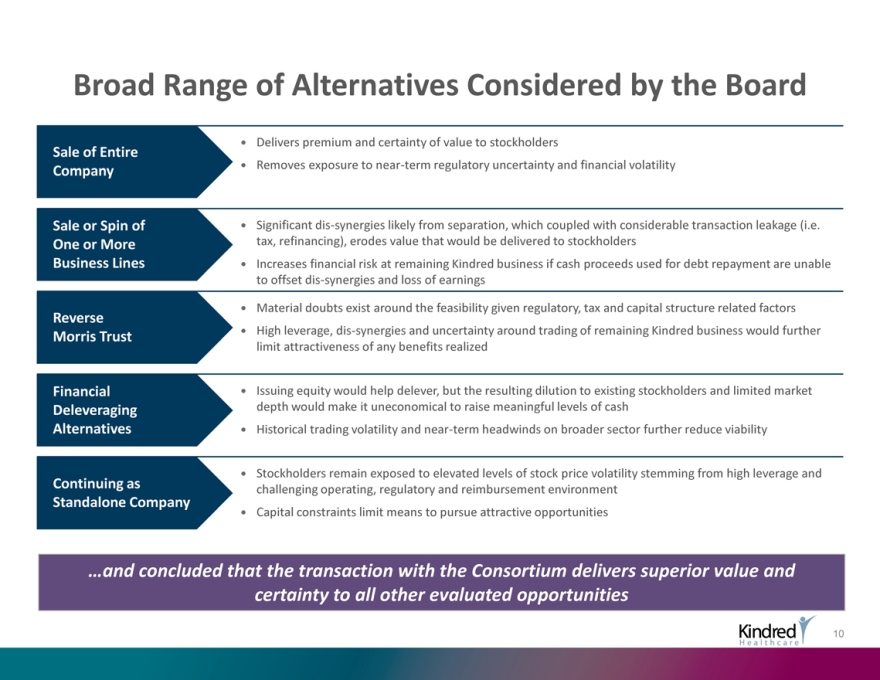

Broad Range of Alternatives Considered by the Board

ï,— Delivers premium and certainty of value to stockholders

Sale of

Entire

Companyï,— Removes exposure to near-term regulatory uncertainty and financial volatility

Sale or Spin of ï,— Significant dis-synergies likely from separation, which coupled with considerable transaction leakage (i.e.

One or More tax, refinancing), erodes value that would be delivered to stockholders

Business Linesï,— Increases financial risk at remaining Kindred business if cash proceeds used for debt repayment are unable to offset

dis-synergies and loss of earnings

ï,— Material doubts exist around the feasibility given regulatory, tax and

capital structure related factors

Reverse

ï,— High leverage, dis-synergies and uncertainty around trading of remaining Kindred business would further

Morris Trust

limit attractiveness of any benefits realized

Financial wï,— Issuing equity would

help delever, but the resulting dilution to existing stockholders and limited market Deleveraging depth would make it uneconomical to raise meaningful levels of cash Alternativesï,— Historical trading volatility and near-term headwinds on

broader sector further reduce viability

ï,— Stockholders remain exposed to elevated levels of stock price volatility stemming from high leverage and

Continuing as

challenging operating, regulatory and reimbursement environment

Standalone Company

ï,— Capital constraints limit means to pursue

attractive opportunities

…and concluded that the transaction with the Consortium delivers superior value and certainty to all other evaluated opportunities

10

|

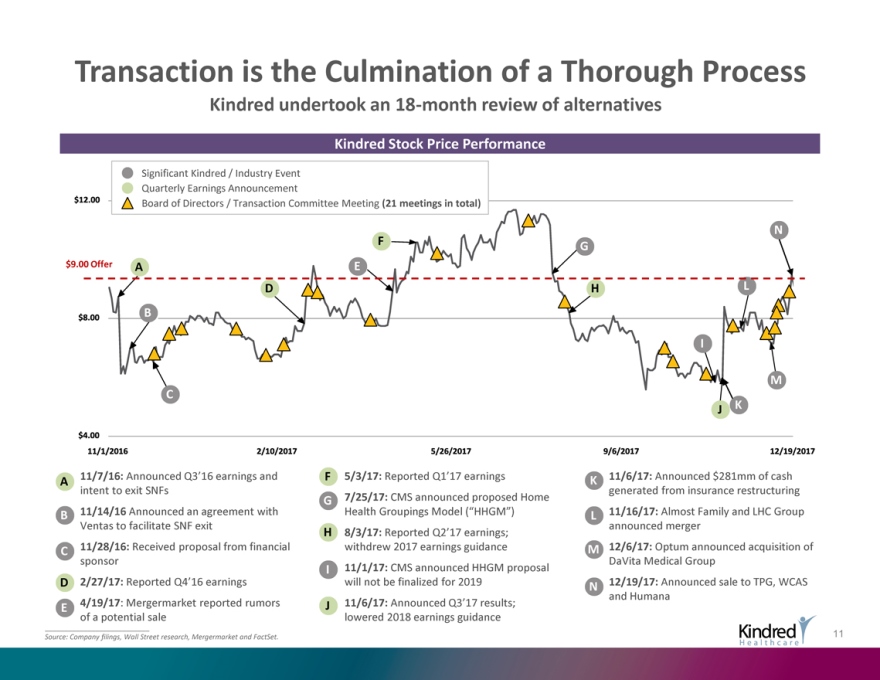

Transaction is the Culmination of a Thorough Process

Kindred undertook an 18-month review of alternatives

Kindred Stock Price Performance

Significant Kindred / Industry Event Quarterly Earnings

Announcement

Board of Directors / Transaction Committee Meeting (21 meetings in total)

N F

G

$9.00 Offer A E

D H L B

I

M C

J

K

ï,— 11/7/16: Announced Q3’16 earnings and ï,— F 5/3/17: Reported Q1’17 earningsï,— K 11/6/17: Announced $281mm of cash

A intent to exit SNFs generated from insurance restructuring Gï,— 7/25/17: CMS announced proposed Home ï,— B 11/14/16 Announced an agreement

with Health Groupings Model (“HHGM”)ï,—L 11/16/17: Almost Family and LHC Group Ventas to facilitate SNF exit announced merger

Hï,—

8/3/17: Reported Q2’17 earnings;

ï,— C 11/28/16: Received proposal from financial withdrew 2017 earnings guidance Mï,— 12/6/17: Optum

announced acquisition of sponsor DaVita Medical Groupï,— I 11/1/17: CMS announced HHGM proposal Dï,— 2/27/17: Reported Q4’16 earnings will not be finalized for 2019ï,— 12/19/17: Announced sale to TPG, WCAS

N and Humanaï,— E 4/19/17: Mergermarket reported rumors ï,— J 11/6/17: Announced Q3’17 results; of a potential sale lowered 2018 earnings

guidance

Source: Company filings, Wall Street research, Mergermarket and FactSet. 11

|

Operating, Regulatory and Reimbursement Headwinds and Risks

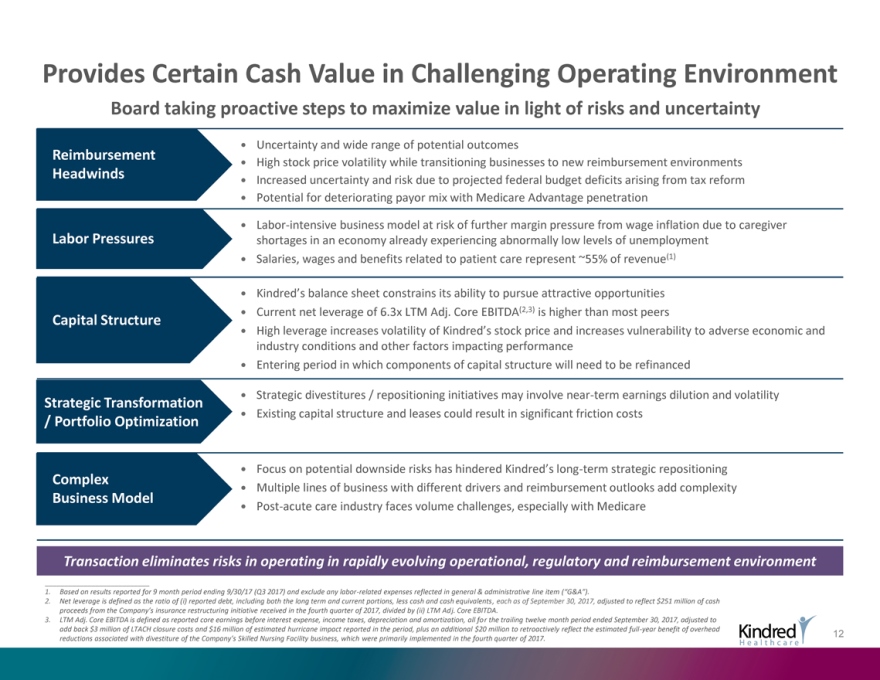

Provides Certain Cash Value in

Challenging Operating Environment

Board taking proactive steps to maximize value in light of risks and uncertainty

ï,— Uncertainty and wide range of potential outcomes

Reimbursement

Headwindsï,— High stock price volatility while transitioning businesses to new reimbursement environmentsï,— Increased uncertainty and risk due to projected

federal budget deficits arising from tax reformï,— Potential for deteriorating payor mix with Medicare Advantage penetration

ï,—

Labor-intensive business model at risk of further margin pressure from wage inflation due to caregiver Labor Pressures shortages in an economy already experiencing abnormally low levels of unemploymentï,— Salaries, wages and benefits

related to patient care represent ~55% of revenue(1)

ï,— Kindred’s balance sheet constrains its ability to pursue attractive opportunities

ï,— Current net leverage of 6.3x LTM Adj. Core EBITDA(2,3) is higher than most peers

Capital Structure

ï,— High leverage increases volatility of Kindred’s stock

price and increases vulnerability to adverse economic and industry conditions and other factors impacting performanceï,— Entering period in which components of capital structure will need to be refinanced

ï,— Strategic divestitures / repositioning initiatives may involve near-term earnings dilution and volatility Strategic Transformation Existing capital structure and

leases could result in significant friction costs

ï,—

/ Portfolio

Optimization

Complex ï,— Focus on potential downside risks has hindered Kindred’s long-term strategic repositioning

Business Modelï,— Multiple lines of business with different drivers and reimbursement outlooks add complexityï,— Post-acute care industry faces volume

challenges, especially with Medicare

Transaction eliminates risks in operating in rapidly evolving operational, regulatory and reimbursement environment

1. Based on results reported for 9 month period ending 9/30/17 (Q3 2017) and exclude any labor-related expenses reflected in general & administrative line

item (“G&A”).

2. Net leverage is defined as the ratio of (i) reported debt, including both the long term and current portions, less cash and

cash equivalents, each as of September 30, 2017, adjusted to reflect $251 million of cash proceeds from the Company’s insurance restructuring initiative received in the fourth quarter of 2017, divided by (ii) LTM Adj. Core

EBITDA.

3. LTM Adj. Core EBITDA is defined as reported core earnings before interest expense, income taxes, depreciation and amortization, all for the trailing

twelve month period ended September 30, 2017, adjusted to add back $3 million of LTACH closure costs and $16 million of estimated hurricane impact reported in the period, plus an additional $20 million to retroactively reflect

the estimated full-year benefit of overhead 12 reductions associated with divestiture of the Company’s Skilled Nursing Facility business, which were primarily implemented in the fourth quarter of 2017.

|

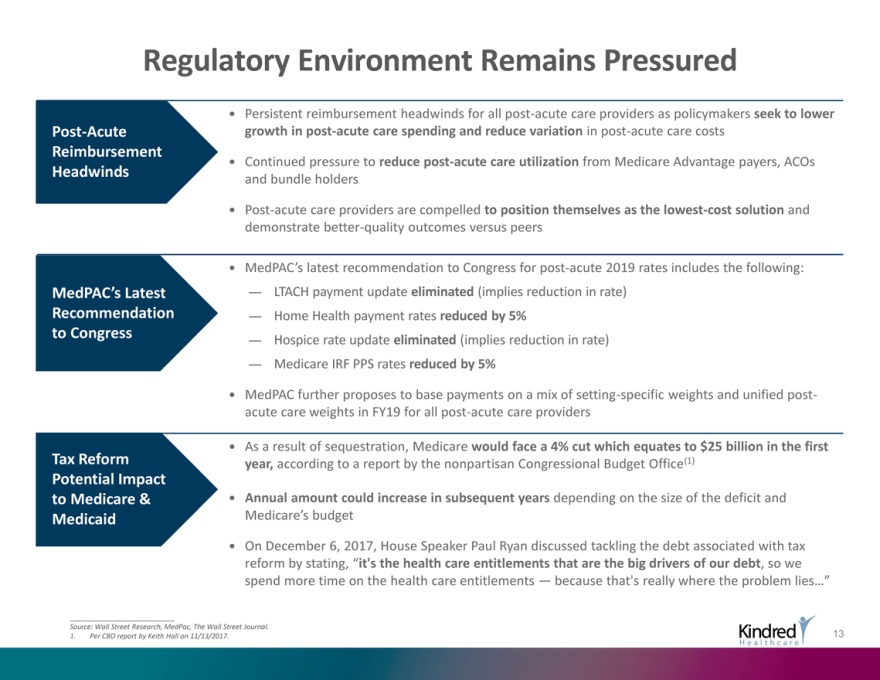

Regulatory Environment Remains Pressured

ï,— Persistent reimbursement headwinds for all post-acute care providers as policymakers seek to lower

Post-Acute growth in post-acute care spending and reduce variation in post-acute care costs

Reimbursement

ï,— Continued pressure to reduce post-acute care

utilization from Medicare Advantage payers, ACOs

Headwinds

and bundle holders

ï,— Post-acute care providers are compelled to position themselves as the lowest-cost solution and demonstrate better-quality outcomes versus peers

ï,— MedPAC’s latest recommendation to Congress for post-acute 2019 rates includes the following: MedPAC’s Latest — LTACH payment update

eliminated (implies reduction in rate) Recommendation — Home Health payment rates reduced by 5%

to Congress

— Hospice rate update eliminated (implies reduction in rate)

— Medicare IRF PPS

rates reduced by 5%

ï,— MedPAC further proposes to base payments on a mix of setting-specific weights and unified post-acute care weights in FY19 for all

post-acute care providers

ï,— As a result of sequestration, Medicare would face a 4% cut which equates to $25 billion in the first

Tax Reform year, according to a report by the nonpartisan Congressional Budget Office(1)

Potential Impact

to Medicare & ï,— Annual amount could

increase in subsequent years depending on the size of the deficit and

Medicaid Medicare’s budget

ï,— On December 6, 2017, House Speaker Paul Ryan discussed tackling the debt associated with tax reform by stating, “it’s the health care entitlements that

are the big drivers of our debt, so we spend more time on the health care entitlements — because that’s really where the problem lies…”

Source:

Wall Street Research, MedPac, The Wall Street Journal.

1. Per CBO report by Keith Hall on 11/13/2017. 13

|

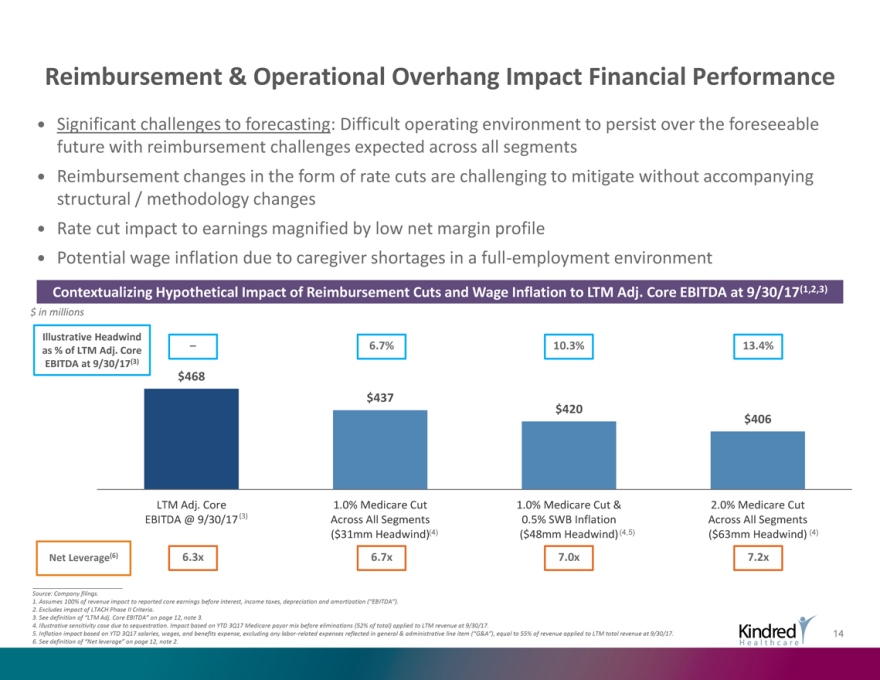

Reimbursement & Operational Overhang Impact

Financial Performance

ï,— Significant challenges to forecasting: Difficult operating environment to persist over the foreseeable future with

reimbursement challenges expected across all segments ï,— Reimbursement changes in the form of rate cuts are challenging to mitigate without accompanying structural / methodology changesï,— Rate cut impact to earnings magnified

by low net margin profileï,— Potential wage inflation due to caregiver shortages in a full-employment environment

Contextualizing Hypothetical Impact of

Reimbursement Cuts and Wage Inflation to LTM Adj. Core EBITDA at 9/30/17(1,2,3)

$ in millions

Illustrative Headwind – 6.7% 10.3% 13.4% as % of LTM Adj. Core EBITDA at 9/30/17(3) $468 $437 $420 $406

LTM Adj. Core 1.0% Medicare Cut 1.0% Medicare Cut & 2.0% Medicare Cut EBITDA @ 9/30/17(3) Across All Segments 0.5% SWB Inflation Across All Segments

($31mm Headwind)(4) ($48mm Headwind)(4,5) ($63mm Headwind) (4)

Net Leverage(6) 6.3x 6.7x 7.0x

7.2x

___________________________ Source: Company filings.

1. Assumes 100% of

revenue impact to reported core earnings before interest, income taxes, depreciation and amortization (“EBITDA”).

2. Excludes impact of LTACH Phase II

Criteria.

3. See definition of “LTM Adj. Core EBITDA” on page 12, note 3.

4. Illustrative sensitivity case due to sequestration. Impact based on YTD 3Q17 Medicare payor mix before eliminations (52% of total) applied to LTM revenue at 9/30/17.

5. Inflation impact based on YTD 3Q17 salaries, wages, and benefits expense, excluding any labor-related expenses reflected in general & administrative line item

(“G&A”), equal to 55% of revenue applied to LTM total revenue at 9/30/17. 14

6. See definition of “Net leverage” on page 12, note 2.

|

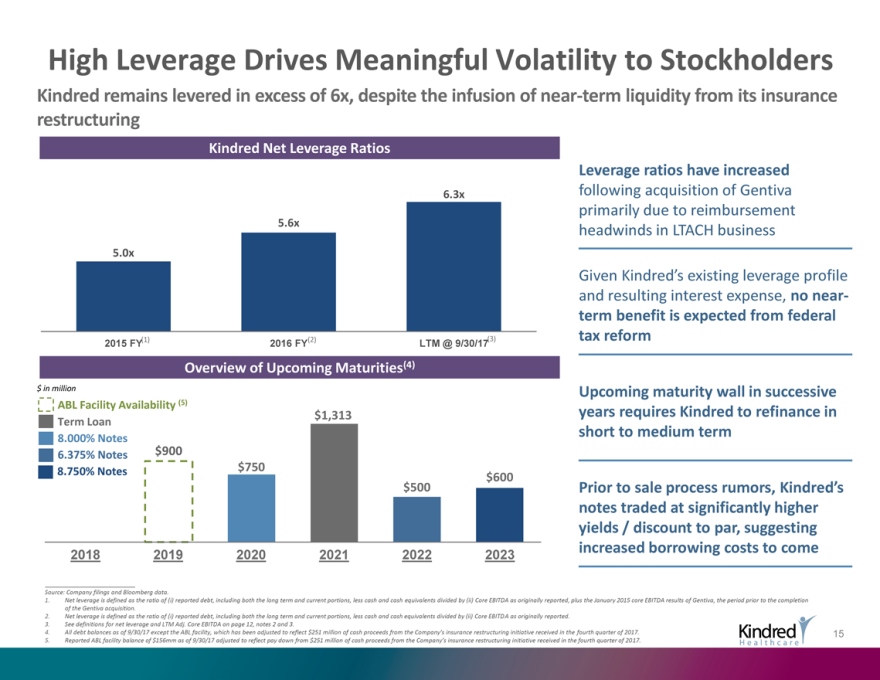

High Leverage Drives Meaningful Volatility to

Stockholders

Kindred remains levered in excess of 6x, despite the infusion of near-term liquidity from its insurance restructuring

Kindred Net Leverage Ratios

Leverage ratios have increased

6.3x following acquisition of Gentiva primarily due to reimbursement

5.6x

headwinds in LTACH business

5.0x

Given Kindred’s existing leverage profile and resulting interest expense, no near-term benefit is expected from federal (1) (2) (3) tax reform

2015 FY 2016 FY LTM @ 9/30/17

Overview of Upcoming Maturities(4) $ in million Upcoming

maturity wall in successive

ABL Facility Availability (5)

Term Loan $1,313

years requires Kindred to refinance in short to medium term

8.000% Notes

6.375% Notes $900

8.750% Notes $750 $600

$500 Prior to sale process rumors, Kindred’s notes traded at significantly higher yields / discount to par, suggesting increased borrowing costs to come

2018 2019 2020 2021 2022 2023

Source: Company filings and Bloomberg data.

1. Net leverage is defined as the ratio of (i) reported debt, including both the long term and current portions, less cash and cash equivalents divided by (ii) Core

EBITDA as originally reported, plus the January 2015 core EBITDA results of Gentiva, the period prior to the completion of the Gentiva acquisition.

2. Net leverage

is defined as the ratio of (i) reported debt, including both the long term and current portions, less cash and cash equivalents divided by (ii) Core EBITDA as originally reported.

3. See definitions for net leverage and LTM Adj. Core EBITDA on page 12, notes 2 and 3.

4. All

debt balances as of 9/30/17 except the ABL facility, which has been adjusted to reflect $251 million of cash proceeds from the Company’s insurance restructuring initiative received in the fourth quarter of 2017. 15

5. Reported ABL facility balance of $156mm as of 9/30/17 adjusted to reflect pay down from $251 million of cash proceeds from the Company’s insurance restructuring

initiative received in the fourth quarter of 2017.

|

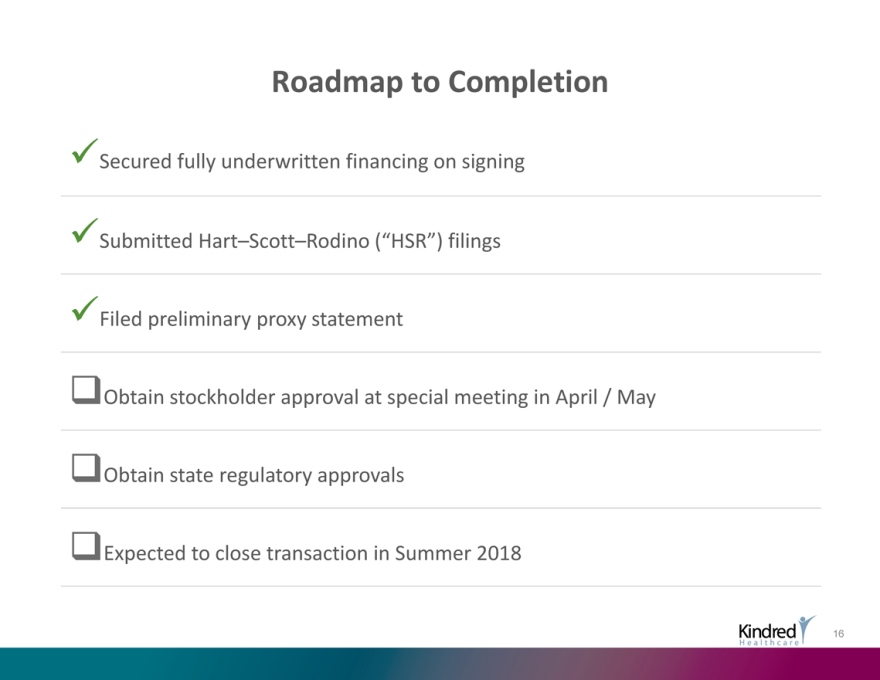

Roadmap to Completion

Secured fully underwritten financing on signing

Submitted

Hart–Scott–Rodino (“HSR”) filingsFiledpreliminary proxy statement

ï±Obtain stockholder approval at special

meeting in April / Mayï±Obtain state regulatory approvalsï±Expected to close transaction in Summer 2018

16

|

Transaction Delivers Superior Risk-Adjusted Value to

Kindred Stockholders

All cash offer at a significant 27% premium to Kindred’s 90-day VWAP(1)

Concludes robust strategic review process to maximize value, involving 15 financial sponsors and 3 strategic parties

Results in superior risk-adjusted value and certainty to all other evaluated opportunities including the standalone plan

Provides certain cash value in a challenging operating, regulatory and reimbursement environment compounded by Kindred’s high financial leverage

Unanimous approval from Kindred’s Board of Directors(2)

Note: 1. VWAP

as of December 15, 2017, the last trading day prior to news reports regarding a potential transaction.

2. Sharad Mansukani recused himself from this process

due to existing relationship with TPG.

17

|

Appendix

|

Kindred’s Board of Directors

Kindred has an experienced and diversified board of directors

Phyllis Yale* Joel Ackerman*

Paul Diaz Richard Goodman*

ï,— 8 years on Kindred’s Board, 3ï,— 9 years on Kindred’s Boardï,— 16 years on Kindred’s

Boardï,— 4 years on Kindred’s Board years as Chairï,— CFO, DaVitaï,— Former Executive Vice ï,— Director, Adient, The ï,— Advisory Partner, Bain & ï,— Chairman &

Former CEO of Chairman and CEO of Kindred Western Union Company, Company Champions Oncology ï,— Director, DaVita Toys ”R” Us ï,— Chairman, Blue Cross Blue ï,— Former Senior Portfolio Fellow ï,—

Partner, Cressey and Companyï,— Former EVP of Global Shield of Massachusetts with the Acumen Fundï,— Director, Performance Health Operations, PepsiCoï,— Director DaVitaï,— Former Managing Director and

ï,— Former CFO, PepsiCoï,— Former Director, ValueOptions, Head of Healthcare Services, ï,— Former Director, Johnson National Surgical Hospitals Warburg Pincus Controlsï,— Former Director, Coventry Health Care

Ben Breier Jonathan Blum* Heyward Donigan* Christopher Hjelm*

ï,— 9

years on Kindred’s Boardï,— 4 years on Kindred’s Board

ï,— 3 years on Kindred’s Boardï,— 6 years on Kindred’s

Board

ï,— Former Chief Global Nutrition ï,— President, CEO & Director,

ï,— President, CEO, Kindredï,— EVP & Chief Information Officer, Yum! Brands Vitalsï,— Former Chief Operating Officer, Officer, The Kroger Co.

Executive Vice President, ï,— Former SVP & Chief Public ï,— Director, NxStage Medicalï,— Director, Arcode Software President

of Hospital Division, Affairs Officer, Yum! Brandsï,— Former President, CEO &

ï,— Director, Thornton’s Solutions

Director, ValueOptions

President of Rehabilitation ï,— Former Director,

RehabCareï,— Former EVP & Chief Marketing Division, Kindred Officer, Premera Blue Cross Group

Fred Kleisner* Sharad Mansukani (1) Lynn

Simon*

ï,— 9 years on Kindred’s Board

ï,— Director,

Ashford Hospitality Trust, ï,— 2 years on Kindred’s Board year on Kindred’s ï,— 1 Board

Playtime LLC, Aimbridge Hospitality,

ï,— Senior Advisor, TPG

ï,— President, Clinical

Operations and Athora Holdings Bermudaï,— Director, Surgical Care Affiliates, ï,— Former President, CEO & Director, Chief Medical Officer, Community Immucor, IASIS Healthcare Morgans Hotel Group Health

Systemsï,— Former Director, Envision ï,— Former Director, Caesars Entertainment, ï,— Former President, Clinical Services Pharmaceutical Services, IMS Health Innkeepers USA Trust, Apollo Residential and Chief Quality

Officer, Community Holdings Mortgage Health Systems

Transaction Committee Members * Independent Director

1. Sharad Mansukani recused himself from this process due to existing relationship with TPG. 18

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Agile Introduces Competitive Electronic Bidding on Fourth Month TBA Mortgage-Backed Securities

- ASU economists share what's in store for next year at Annual Economic Outlook

- Caltrans Honors 193 Fallen Highway Workers at 34th Annual Memorial Ceremony, Highlighting Road Safety for All

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share