Form 8-K JETBLUE AIRWAYS CORP For: Aug 02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 2, 2022

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | |||||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||||

(718 ) 286-7900

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 2, 2022 we issued a press release announcing our financial results for the second quarter ended June 30, 2022. A copy of the press release is attached to this report as Exhibit 99.1 and is incorporated herein by reference.

The information included under Item 2.02 of this report (including the exhibits) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933.

Item 7.01 Regulation FD Disclosure.

On August 2, 2022 we provided an update for investors presenting information relating to our financial outlook for the third quarter ending September 30, 2022 and full year 2022, and other information regarding our business. The update and materials to be used in conjunction with the presentation are furnished herewith as Exhibit 99.2 and Exhibit 99.3 and are incorporated herein by reference.

The information included under Item 7.01 of this report (including the exhibits) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit Number | Description | |||||||

Press Release dated August 2, 2022 of JetBlue Airways Corporation announcing financial results for the second quarter ended June 30, 2022. | ||||||||

Investor Update dated August 2, 2022 of JetBlue Airways Corporation. | ||||||||

Earnings Presentation dated August 2, 2022. | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| JETBLUE AIRWAYS CORPORATION | |||||||||||||||||

| (Registrant) | |||||||||||||||||

| Date: | August 2, 2022 | By: | /s/ Al Spencer | ||||||||||||||

| Al Spencer | |||||||||||||||||

| Vice President, Controller and Principal Accounting Officer | |||||||||||||||||

Earnings Release

Earnings ReleaseJETBLUE ANNOUNCES SECOND QUARTER 2022 RESULTS

NEW YORK (August 2, 2022) -- JetBlue Airways Corporation (NASDAQ: JBLU) today reported its results for the second quarter of 2022:

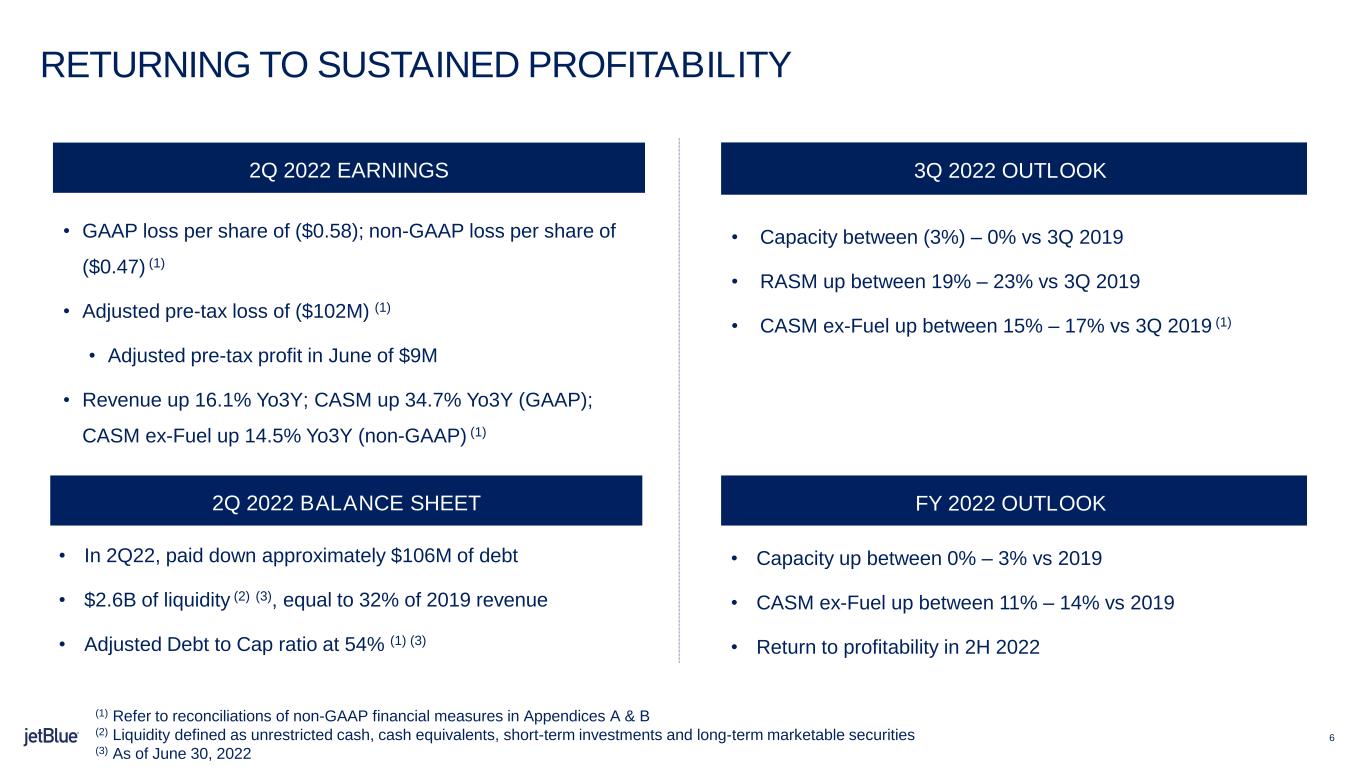

•Reported GAAP loss per share of ($0.58) in the second quarter of 2022 compared to diluted earnings per share of $0.59 in the second quarter of 2019. Adjusted loss per share was ($0.47)(1) in the second quarter of 2022 versus adjusted diluted earnings per share of $0.60(1) in the second quarter of 2019.

•GAAP pre-tax loss of ($151) million in the second quarter of 2022, compared to a pre-tax income of $236 million in the second quarter of 2019. Excluding one-time items, adjusted pre-tax loss of ($102) million(1) in the second quarter of 2022 versus adjusted pre-tax income of $238 million(1) in the second quarter of 2019.

Operational and Financial Highlights from the Second Quarter

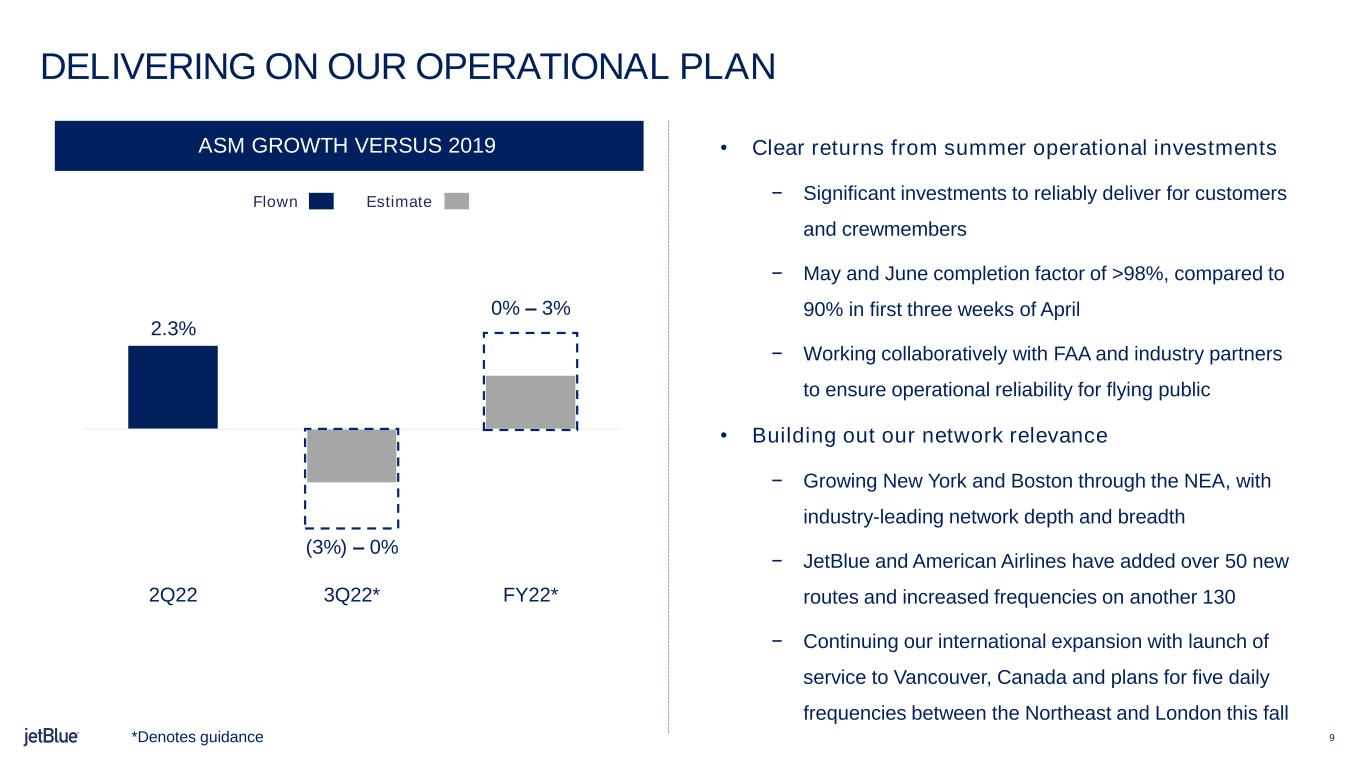

•Capacity increased by 2.3% year over three, compared to our guidance for capacity to increase 2% to 3% year over three.

•Revenue increased 16.1% year over three, compared to our guidance of an increase of 16% or above, year over three. Revenue was better than the high-end of our initial outlook as a result of robust demand across the network with a record number of Customers.

•Operating expenses per available seat mile increased 34.7% year over three. Operating expenses per available seat mile, excluding fuel and special items (CASM ex-fuel) (1) increased 14.5%(1) year over three, compared to our guidance of a 15% to 17% increase year over three.

Balance Sheet and Liquidity

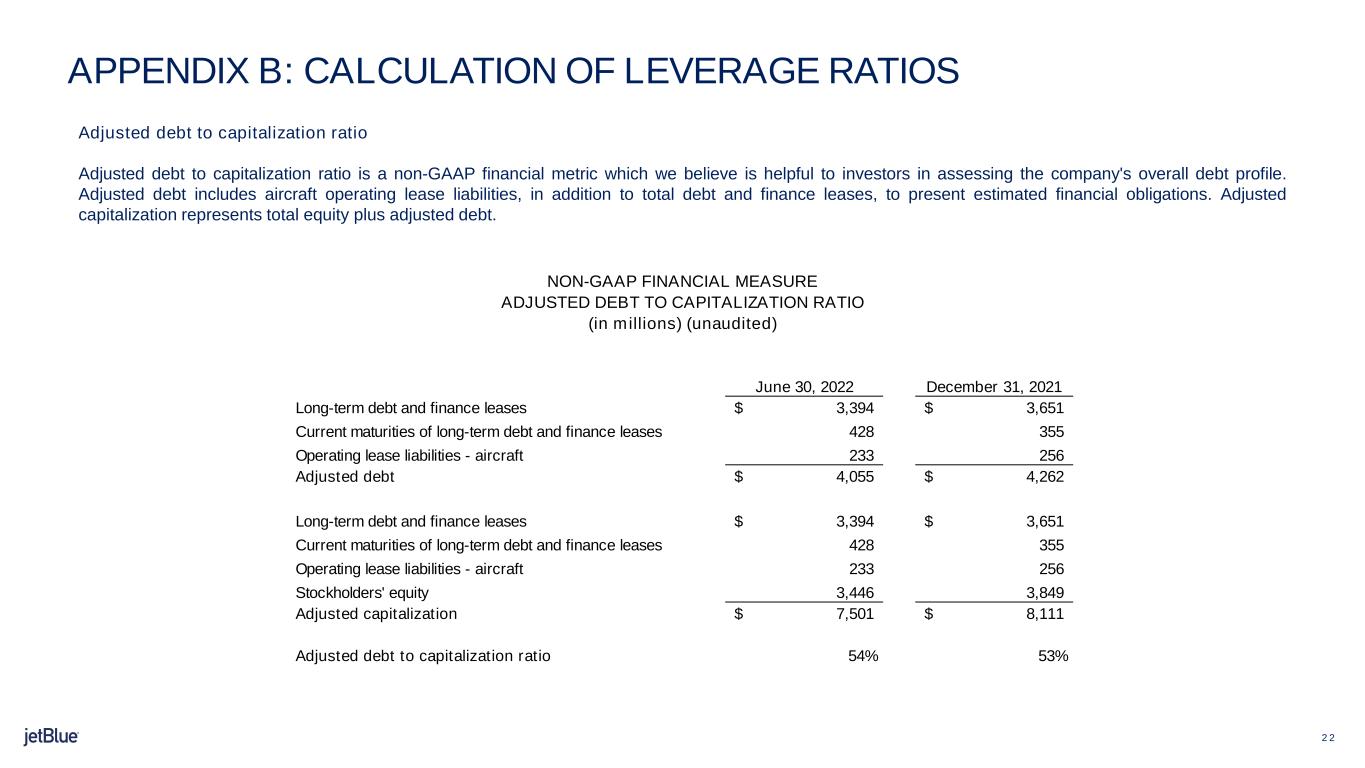

•As of June 30, 2022, JetBlue’s adjusted debt to capital ratio was 54%(1).

•JetBlue ended the second quarter of 2022 with approximately $2.6 billion in unrestricted cash, cash equivalents, short-term investments, and long-term marketable securities, or 32% of 2019 revenue. This excludes our $550 million undrawn revolving credit facility.

•JetBlue paid down approximately $106 million in regularly scheduled debt and finance lease obligations during the second quarter of 2022.

Fuel Expense and Hedging

•The realized fuel price in the second quarter 2022 was $4.24 per gallon, a 97% increase versus second quarter 2019 realized fuel price of $2.16.

- 1 -

•As of August 2, 2022, JetBlue has not entered into forward fuel derivative contracts to hedge its fuel consumption for the third quarter of 2022. Based on the forward curve as of July 22, 2022, JetBlue expects an average all-in price per gallon of fuel of $3.68 in the third quarter of 2022.

Creating a National Low-Fare Challenger to the Dominant Big Four Airlines

•On July 28, 2022, JetBlue and Spirit Airlines, Inc. (“Spirit”) announced that their boards of directors approved a definitive merger agreement under which JetBlue will acquire Spirit for $33.50 per share in cash, including a prepayment of $2.50 per share in cash payable upon Spirit stockholders’ approval of the transaction and a ticking fee of $0.10 per month starting in January 2023 through closing, for an aggregate fully diluted equity value of $3.8 billion(2) and an adjusted enterprise value of $7.6 billion(3).

•This combination increases JetBlue’s relevance and offers consumers more choices by leveraging the airlines’ complementary networks and fleets. The airline will offer its combined 77 million customers more options and choices and will accelerate JetBlue’s organic growth plan with 1,700+ daily flights to more than 125 destinations in 30 countries based on December 2022 schedules. The combined airline will have a fleet of 458 aircraft on a pro forma basis and an order book of over 300 Airbus aircraft.

•JetBlue expects to achieve $600-700 million in net annual synergies once integration is complete, driven in large part by expanded customer offerings resulting from the greater breadth and depth of the combined network. JetBlue expects the transaction to be significantly accretive to earnings per share in the first full year following closing. The company also expects to maintain balance sheet flexibility with post-transaction leverage of 3.0-3.5x, well inside historical levels, and to continue its deleveraging trajectory as it captures synergies.

Delivering Significant Growth and Consumer Benefits Through the Northeast Alliance

•While the industry has yet to return capacity to 2019 levels, the Northeast Alliance (NEA) is growing well in excess of the U.S. market. The NEA added over 50 new routes, and increased frequencies on another 130 routes. Collectively with American, JetBlue is now offering more service in New York than the other two legacy carriers.

•The NEA growth is delivering tremendous consumer benefits, enabling JetBlue to offer more customers an award-winning combination of low fares and great service, while simultaneously eliciting a strong competitive response from other carriers.

•Through the NEA, JetBlue is able to serve a broader set of customers, including business travelers, fly to more markets, and create thousands of jobs in the process.

Accelerating Retirement of E190 Fleet and Pulling Forward Fleet Modernization Plans

•When we reset our medium-term capacity plan back in the spring to reflect our industry’s output constraints, we highlighted some potential mitigating actions to optimize our footprint for this new reality. Today, JetBlue announced the acceleration of its E190 retirement

- 2 -

schedule, pulling it forward by over a year to mid 2025 versus prior plans to exit the fleet by year-end 2026.

•JetBlue currently has a sizable A220 orderbook, with 100 total A220s either in the airline’s fleet or on order following a recently revised agreement announced earlier this year.

•Expediting the transition towards A220s and our fleet modernization plans will result in meaningful cost avoidance. We expect to save at least $75 million in maintenance expense alone, and we expect to benefit from reallocating flying to more CASM efficient A220s which burn up to 35% less fuel per seat. We do not expect any impact to our near-term capacity plans as a result of the updated fleet transition plan.

•A220s enable greater flexibility with efficiency across different range profiles, supporting our network strategy, as well as our leadership in reducing carbon emissions.

Setting a New Foundation for Long-Term Costs

•Following a review of JetBlue’s optimal long-term cost structure, we announced the launch of a new program focused on operational and planning efficiencies. During the second quarter, we announced the creation of a new Enterprise Planning team to help unlock structural efficiencies across the airline longer-term.

•JetBlue is also investing in automation across the business, particularly in support of end-of-life maintenance planning as we begin to retire aircraft for the first time in our history.

•We expect this new program to deliver run-rate cost savings of approximately $150 million to $200 million by 2024, supporting our objective of a flattish CASM ex-Fuel trajectory over a multi-year period and margin expansion beyond pre-pandemic levels.

•The structural cost program and the accelerated E190 retirements is expected to drive a total of approximately $250 million of cost savings through 2024.

Building Back to Sustained Profitability

“I’m very pleased we found a path forward with Spirit, and we can’t wait to welcome their incredible 10,000 Team Members to JetBlue as we create a true, national low-fare challenger to the dominant ‘Big Four’ airlines. Together we will expand our uniquely disruptive combination of award-winning service and competitive low fares to more customers across the country as we combine the best of both airlines,” said Robin Hayes, JetBlue’s Chief Executive Officer.

“We reported a record-breaking revenue result for the second quarter, and we’re on pace to top it again here in the third quarter and drive our first quarterly profit since the start of the pandemic.

I’m proud to say that our operational performance improved significantly through the quarter, and we capitalized on the strong demand environment to deliver revenue growth above the top-end of our original guidance range. We’ve entered the third quarter with some solid momentum that we expect to carry through to a sustained profit inflection.

- 3 -

While high fuel prices and our short-term operational investments are weighing on our margins this summer, we’re making steady underlying progress on our long-term initiatives to structurally improve our profitability and enhance our long-term earnings power.”

Revenue and Capacity

“We took decisive action last quarter to reduce our full-year capacity plan by 10 points and build greater resiliency into the operation, and we have seen good returns – we closed May and June with a completion factor above 98%, compared to approximately 90% during the first three weeks of April. In our congested geography where more than two-thirds of our flights touch the Northeast, we have completed more flights versus our peers in May and June,” said Joanna Geraghty, JetBlue’s President and Chief Operating Officer.

“For the third quarter, we expect capacity to be flat to negative 3 percent year over three, which remains above legacy carriers yet more cautious compared to ULCC growth. For the full-year 2022, we are tightening our forecast for capacity to grow between 0 and 3 percent versus 2019.

For the third quarter, we expect unit revenue to increase between 19 and 23 percent, to the highest absolute levels in our history as strong demand combined with a tight supply backdrop help offset the high price of fuel. Revenue is tracking well to help deliver a profitable quarter, and early bookings keep us cautiously optimistic about the fall.”

Financial Performance and Outlook

“I’m very pleased with the team’s execution this quarter to position us to return to sustained profitability in the back half of the year. Despite the operational headwinds in April, the subsequent operational investments we made, and the sharp rise in fuel prices throughout the quarter, we exited Q2 with an adjusted pre-tax profit for the month of June, and we look forward to carrying this momentum into Q3 and beyond,” said Ursula Hurley, JetBlue’s Chief Financial Officer.

“For the third quarter, we are forecasting CASM ex-Fuel(4) to increase 15 to 17 percent. We’re also tightening our forecast for full-year 2022 CASM ex-Fuel(4) to increase in the range of 11 to 14 percent versus 2019. We expect the heightened level of operational investments to normalize once we get beyond the summer peak. As a result, we expect to see some productivity improvement into the fourth quarter and 2023.

We’re embarking on a new plan to keep our costs low, focused on cross-functional costs and applying best practices with respect to operational and planning efficiencies. Through the strong underlying momentum in the business and the continued execution of our various strategic initiatives – from the Northeast Alliance to the evolution of our Loyalty program to scaling JetBlue Travel Products, and now our new structural cost program as well – we are setting a foundation to structurally improve our long-term earnings potential.”

Earnings Call Details

JetBlue will conduct a conference call to discuss its quarterly earnings today, August 2, 2022 at 10:00 a.m. Eastern Time. A live broadcast of the conference call will also be available via the internet at http://investor.jetblue.com. The webcast replay and presentation materials will be archived on the company’s website.

For further details see the Second Quarter 2022 Earnings Presentation available via the internet at http://investor.jetblue.com.

- 4 -

About JetBlue

JetBlue is New York's Hometown Airline®, and a leading carrier in Boston, Fort Lauderdale-Hollywood, Los Angeles, Orlando, and San Juan. JetBlue carries customers to more than 100 cities throughout the United States, Latin America, Caribbean, Canada, and United Kingdom. For more information and the best fares, visit jetblue.com.

Notes

a.Non-GAAP financial measure; Note A provides a reconciliation of non-GAAP financial measures used in this release and explains the reasons management believes that presentation of these non-GAAP financial measure provides useful information to investors regarding JetBlue's financial condition and results of operations.

a.Based on total consideration of $33.50 per Spirit share assuming closing in December 2023, and approximately 112.4 million fully diluted shares outstanding, per the merger agreement.

a.Includes adjusted net debt of $3.8 billion including operating leases of $2.0 billion (as of March 31, 2022, based on Spirit’s Q1 2022 10-Q).

a.With respect to JetBlue’s CASM ex-fuel guidance, JetBlue is unable to provide a reconciliation of the non-GAAP financial measure to GAAP because the excluded items have not yet occurred and cannot be reasonably predicted. The reconciling information that is unavailable would include a forward-looking range of financial performance measures beyond our control, such as fuel costs, which are subject to many economic and political factors. Accordingly, a reconciliation to CASM is not available without unreasonable effort.

Forward-Looking Statements

This Earnings Release (or otherwise made by JetBlue or on JetBlue’s behalf) contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which represent our management’s beliefs and assumptions concerning future events. These statements are intended to qualify for the “safe harbor” from liability established by the Private Securities Litigation Reform Act of 1995. When used in this document and in documents incorporated herein by reference, the words “expects,” “plans,” “intends,” “anticipates,” “indicates,” “remains,” “believes,” “estimates,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “goals,” “targets” and similar expressions are intended to identify forward-looking statements. Additionally, forward-looking statements include statements that do not relate solely to historical facts, such as statements which identify uncertainties or trends, discuss the possible future effects of current known trends or uncertainties, or which indicate that the future effects of known trends or uncertainties cannot be predicted, guaranteed, or assured. Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, the COVID-19 pandemic including existing and new variants, and the outbreak of any other disease or similar public health threat that affects travel demand or behavior; restrictions on our business related to the financing we accepted under various federal government support programs such as the Coronavirus Aid, Relief, and Economic Security Act, the Consolidated Appropriations Act, and the American Rescue Plan Act; our significant fixed obligations and substantial indebtedness; risk associated with execution of our strategic operating plans in the near-term and long-term; the recording of a material impairment loss of tangible or intangible assets; our extremely competitive industry; volatility in financial and credit markets which could affect our ability to obtain debt and/or lease financing or to raise funds through debt or equity issuances; volatility in fuel prices, maintenance costs and interest rates; our reliance on high daily aircraft utilization; our ability to implement our growth strategy; our ability to attract and retain qualified personnel and maintain our culture as we grow; our reliance on a limited number of suppliers, including for aircraft, aircraft engines and parts and vulnerability to delays by those suppliers; our dependence on the New York and Boston

- 5 -

metropolitan markets and the effect of increased congestion in these markets; our reliance on automated systems and technology; the outcome of the lawsuit filed by the Department of Justice and certain state Attorneys General against us related to our Northeast Alliance entered into with American Airlines, our being subject to potential unionization, work stoppages, slowdowns or increased labor costs; our presence in some international emerging markets that may experience political or economic instability or may subject us to legal risk; reputational and business risk from information security breaches or cyber-attacks; changes in or additional domestic or foreign government regulation, including new or increased tariffs; changes in our industry due to other airlines’ financial condition; acts of war or terrorism; global economic conditions or an economic downturn leading to a continuing or accelerated decrease in demand for air travel; adverse weather conditions or natural disasters; external geopolitical events and conditions; the occurrence of any event, change or other circumstances that could give rise to the right of JetBlue or Spirit or both of them to terminate the Merger Agreement; failure to obtain applicable regulatory or Spirit stockholder approval in a timely manner or otherwise and the potential financial consequences thereof; failure to satisfy other closing conditions to the proposed transactions with Spirit; failure of the parties to consummate the proposed transaction; JetBlue’s ability to finance the proposed transaction with Spirit and the indebtedness JetBlue expects to incur in connection with the proposed transaction; the possibility that JetBlue may be unable to achieve expected synergies and operating efficiencies within the expected timeframes or at all and to successfully integrate Spirit’s operations with those of JetBlue; the possibility that such integration may be more difficult, time-consuming or costly than expected or that operating costs and business disruption (including, without limitation, disruptions in relationships with employees, customers or suppliers) may be greater than expected in connection with the proposed transaction with Spirit; failure to realize anticipated benefits of the combined operations; demand for the combined company’s services; the growth, change and competitive landscape of the markets in which the combined company participates; expected seasonality trends; diversion of managements’ attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the proposed transaction with Spirit; risks related to investor and rating agency perceptions of each of the parties and their respective business, operations, financial condition and the industry in which they operate; risks related to the potential impact of general economic, political and market factors on the companies or the proposed transaction with Spirit; and ongoing and increase in costs related to IT network security. It is routine for our internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it should be clearly understood that the internal projections, beliefs, and assumptions upon which we base our expectations may change prior to the end of each quarter or year. Any outlook or forecasts in this document have been prepared without taking into account or consideration the proposed transaction with Spirit.

Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. You should understand that many important factors, in addition to those discussed or incorporated by reference in this Earnings Release, could cause our results to differ materially from those expressed in the forward-looking statements. In light of these risks and uncertainties, the forward-looking events discussed in this Earnings Release might not occur. Our forward-looking statements speak only as of the date of this Earnings Release. Other than as required by law, we undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

This Earnings Release also includes certain “non-GAAP financial measures” as defined under the Exchange Act and in accordance with Regulation G. We have included reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated and provided in accordance with U.S. GAAP within this Earnings Release.

Additional Information and Where to Find It

JetBlue has made a proposal for a business combination transaction with Spirit. In furtherance of this proposal and subject to future developments, JetBlue (and, if a negotiated transaction is agreed to, Spirit) may file one or more proxy statements or other documents with the Securities and Exchange Commission, or SEC. This communication is not a substitute for any proxy statement or other document JetBlue and/or Spirit may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF JETBLUE AND SPIRIT ARE URGED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE POSSIBLE TRANSACTION. Any definitive

- 6 -

proxy statement (if and when available) will be mailed to stockholders of Spirit. Investors and security holders of Spirit and JetBlue will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by JetBlue and Spirit through the web site maintained by the SEC at http://www.sec.gov.

Participants in the Solicitation

This Earnings Release is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC. Nonetheless, JetBlue and certain of its directors and executive officers may be deemed to be participants in any solicitation with respect to the proposed transaction under the rules of the SEC. Information regarding the interests of these participants in any such proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be included in any proxy statement and other relevant materials to be filed with the SEC if and when they become available. These documents can be obtained free of charge as described in the preceding paragraph.

No Offer or Solicitation

This Earnings Release shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

- 7 -

| JETBLUE AIRWAYS CORPORATION | ||||||||||||||||||||||||||||||||||||||

| CONSOLIDATED STATEMENTS OF OPERATIONS | ||||||||||||||||||||||||||||||||||||||

| (in millions, except per share amounts) | ||||||||||||||||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | Percent Change | 2022 | 2021 | Percent Change | |||||||||||||||||||||||||||||||||

| OPERATING REVENUES | ||||||||||||||||||||||||||||||||||||||

| Passenger | $ | 2,302 | $ | 1,388 | 65.8 | $ | 3,904 | 2,058 | 89.7 | |||||||||||||||||||||||||||||

| Other | 143 | 111 | 29.6 | 277 | 174 | 59.2 | ||||||||||||||||||||||||||||||||

| Total operating revenues | 2,445 | 1,499 | 63.1 | 4,181 | 2,232 | 87.4 | ||||||||||||||||||||||||||||||||

| OPERATING EXPENSES | ||||||||||||||||||||||||||||||||||||||

| Aircraft fuel and related taxes | 910 | 336 | 170.7 | 1,481 | 530 | 179.6 | ||||||||||||||||||||||||||||||||

| Salaries, wages and benefits | 695 | 577 | 20.4 | 1,383 | 1,098 | 25.9 | ||||||||||||||||||||||||||||||||

| Landing fees and other rents | 149 | 174 | (14.4) | 281 | 289 | (2.8) | ||||||||||||||||||||||||||||||||

| Depreciation and amortization | 145 | 133 | 8.4 | 288 | 258 | 11.6 | ||||||||||||||||||||||||||||||||

| Aircraft rent | 27 | 26 | 5.0 | 53 | 50 | 4.6 | ||||||||||||||||||||||||||||||||

| Sales and marketing | 78 | 47 | 65.1 | 135 | 70 | 93.4 | ||||||||||||||||||||||||||||||||

| Maintenance, materials and repairs | 162 | 164 | (1.3) | 313 | 268 | 17.0 | ||||||||||||||||||||||||||||||||

| Other operating expenses | 348 | 261 | 33.6 | 683 | 471 | 45.0 | ||||||||||||||||||||||||||||||||

| Special items | 44 | (366) | (112.1) | 44 | (655) | 106.8 | ||||||||||||||||||||||||||||||||

| Total operating expenses | 2,558 | 1,352 | 89.2 | 4,661 | 2,379 | 95.9 | ||||||||||||||||||||||||||||||||

| OPERATING (LOSS) INCOME | (113) | 147 | (176.7) | (480) | (147) | 226.3 | ||||||||||||||||||||||||||||||||

| Operating margin | -4.6 | % | 9.8 | % | (14.4) | pts. | -11.5 | % | -6.6 | % | (4.9) | pts. | ||||||||||||||||||||||||||

| OTHER INCOME (EXPENSE) | ||||||||||||||||||||||||||||||||||||||

| Interest expense | (40) | (54) | (26.2) | (77) | (112) | (31.1) | ||||||||||||||||||||||||||||||||

| Interest income | 8 | 4 | 85.6 | 12 | 8 | 51.3 | ||||||||||||||||||||||||||||||||

| Gain on investments, net | (5) | — | 374.4 | (4) | 4 | (222.9) | ||||||||||||||||||||||||||||||||

| Other | (1) | (40) | (97.1) | — | (43) | (99.8) | ||||||||||||||||||||||||||||||||

| Total other income (expense) | (38) | (90) | (58.0) | (69) | (143) | (51.8) | ||||||||||||||||||||||||||||||||

| (LOSS) INCOME BEFORE INCOME TAXES | (151) | 57 | (367.0) | (480) | (290) | 89.1 | ||||||||||||||||||||||||||||||||

| Pre-tax margin | -6.2 | % | 3.8 | % | (10.0) | pts. | -13.1 | % | -13.0 | % | (0.1) | pts. | ||||||||||||||||||||||||||

| Income tax (benefit) expense | 37 | (7) | (638.9) | (106) | (107) | (1.1) | ||||||||||||||||||||||||||||||||

| NET INCOME (LOSS) | $ | (188) | $ | 64 | (396.5) | $ | (443) | (183) | 141.8 | |||||||||||||||||||||||||||||

| EARNINGS (LOSS) PER COMMON SHARE: | ||||||||||||||||||||||||||||||||||||||

| Basic | $ | (0.58) | $ | 0.20 | $ | (1.38) | $ | (0.58) | ||||||||||||||||||||||||||||||

| Diluted | $ | (0.58) | $ | 0.20 | $ | (1.38) | $ | (0.58) | ||||||||||||||||||||||||||||||

| WEIGHTED AVERAGE SHARES OUTSTANDING: | ||||||||||||||||||||||||||||||||||||||

| Basic | 323.1 | 317.7 | 321.9 | 317.0 | ||||||||||||||||||||||||||||||||||

| Diluted | 323.1 | 321.5 | 321.9 | 317.0 | ||||||||||||||||||||||||||||||||||

- 8 -

| JETBLUE AIRWAYS CORPORATION | ||||||||||||||||||||||||||||||||||||||

| COMPARATIVE OPERATING STATISTICS | ||||||||||||||||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | Percent Change | 2022 | 2021 | Percent Change | |||||||||||||||||||||||||||||||||

| Revenue passengers (thousands) | 10,396 | 7,938 | 31.0 | 18,573 | 12,401 | 49.8 | ||||||||||||||||||||||||||||||||

| Revenue passenger miles (RPMs) (millions) | 13,967 | 10,804 | 29.3 | 24,893 | 16,611 | 49.9 | ||||||||||||||||||||||||||||||||

| Available seat miles (ASMs) (millions) | 16,405 | 13,645 | 20.2 | 31,788 | 22,734 | 39.8 | ||||||||||||||||||||||||||||||||

| Load factor | 85.1 | % | 79.2 | % | 5.9 | pts. | 78.3 | % | 73.1 | % | 5.2 | pts. | ||||||||||||||||||||||||||

| Aircraft utilization (hours per day) | 10.4 | 8.8 | 18.2 | 10.2 | 7.4 | 37.8 | ||||||||||||||||||||||||||||||||

| Average fare | $ | 221.38 | $ | 174.90 | 26.6 | $ | 210.20 | $ | 165.93 | 26.7 | ||||||||||||||||||||||||||||

| Yield per passenger mile (cents) | 16.48 | 12.82 | 28.5 | 15.68 | 12.39 | 26.6 | ||||||||||||||||||||||||||||||||

| Passenger revenue per ASM (cents) | 14.03 | 10.18 | 37.9 | 12.28 | 9.05 | 35.7 | ||||||||||||||||||||||||||||||||

| Revenue per ASM (cents) | 14.90 | 10.99 | 35.7 | 13.15 | 9.82 | 34.0 | ||||||||||||||||||||||||||||||||

| Operating expense per ASM (cents) | 15.59 | 9.91 | 57.4 | 14.66 | 10.46 | 40.1 | ||||||||||||||||||||||||||||||||

Operating expense per ASM, excluding fuel (cents)(1) | 9.69 | 10.05 | (3.5) | 9.77 | 10.92 | (10.5) | ||||||||||||||||||||||||||||||||

| Departures | 83,455 | 67,253 | 24.1 | 161,848 | 111,302 | 45.4 | ||||||||||||||||||||||||||||||||

| Average stage length (miles) | 1,233 | 1,279 | (3.6) | 1,232 | 1,278 | (3.6) | ||||||||||||||||||||||||||||||||

| Average number of operating aircraft during period | 221.4 | 269.0 | 5.3 | 282.6 | 268.0 | 5.4 | ||||||||||||||||||||||||||||||||

| Average fuel cost per gallon, including fuel taxes | $ | 4.24 | $ | 1.91 | 121.6 | $ | 3.60 | $ | 1.84 | 95.7 | ||||||||||||||||||||||||||||

| Fuel gallons consumed (millions) | 215 | 176 | 22.2 | 411 | 288 | 42.8 | ||||||||||||||||||||||||||||||||

| Average number of full-time equivalent crewmembers | 19,868 | 15,416 | 28.9 | |||||||||||||||||||||||||||||||||||

| (1) Refer to Note A at the end of our Earnings Release for more information on this non-GAAP financial measure. Operating expense per available seat mile, excluding fuel (“CASM Ex-Fuel”) excludes fuel and related taxes, other non-airline operating expenses, and special items. | ||||||||||||||||||||||||||||||||||||||

- 9 -

| JETBLUE AIRWAYS CORPORATION | |||||||||||

| SELECTED CONSOLIDATED BALANCE SHEET DATA | |||||||||||

| (in millions) | |||||||||||

| June 30, | December 31, | ||||||||||

| 2022 | 2021 | ||||||||||

| (unaudited) | |||||||||||

| Cash and cash equivalents | $ | 1,611 | $ | 2,018 | |||||||

| Total investment securities | 993 | 863 | |||||||||

| Total assets | 13,543 | 13,642 | |||||||||

| Total debt | 3,822 | 4,006 | |||||||||

| Stockholders' equity | 3,446 | 3,849 | |||||||||

- 10 -

Note A - Non-GAAP Financial Measures

JetBlue uses non-GAAP financial measures in this press release. Non-GAAP financial measures are financial measures that are derived from the consolidated financial statements, but that are not presented in accordance with generally accepted accounting principles in the United States, or GAAP. We believe these non-GAAP financial measures provide a meaningful comparison of our results to others in the airline industry and our prior year results. Investors should consider these non-GAAP financial measures in addition to, and not as a substitute for, our financial performance measures prepared in accordance with GAAP. Further, our non-GAAP information may be different from the non-GAAP information provided by other companies. The information below provides an explanation of each non-GAAP financial measure and shows a reconciliation of non-GAAP financial measures used in this press release to the most directly comparable GAAP financial measures.

- 11 -

Operating expense per available seat mile, excluding fuel and related taxes, other non-airline operating expenses, and special items (“CASM ex-fuel”)

Operating expenses per available seat mile, or CASM, is a common metric used in the airline industry. We exclude aircraft fuel and related taxes, operating expenses related to other non-airline businesses, such as JetBlue Technology Ventures and JetBlue Travel Products, and special items from operating expenses to determine CASM ex-fuel, which is a non-GAAP financial measure.

For the three and six months ended June 30, 2022, special items include an impairment on our E190 fleet, the ALPA ratification bonus, expenses related to our takeover bid of Spirit airlines, and expenses related to implementation of our flight attendants' collective bargaining agreement.

Special items for the three and six months ended June 30, 2019 include one-time costs related to the Embraer E190 fleet transition as well as one-time costs related to the implementation of our pilots' collective bargaining agreement.

We believe that CASM ex-fuel is useful for investors because it provides investors the ability to measure financial performance excluding items beyond our control, such as fuel costs, which are subject to many economic and political factors, or not related to the generation of an available seat mile, such as operating expense related to certain non-airline businesses. We believe this non-GAAP measure is more indicative of our ability to manage airline costs and is more comparable to measures reported by other major airlines.

With respect to JetBlue’s CASM ex-fuel guidance, JetBlue is unable to provide a reconciliation of the non-GAAP financial measure to GAAP because the excluded items have not yet occurred and cannot be reasonably predicted. The reconciling information that is unavailable would include a forward-looking range of financial performance measures beyond our control, such as fuel costs, which are subject to many economic and political factors. Accordingly, a reconciliation to CASM is not available without unreasonable effort.

| NON-GAAP FINANCIAL MEASURE | |||||||||||||||||||||||||||||||||||||||||||||||

| RECONCILIATION OF OPERATING EXPENSE PER ASM, EXCLUDING FUEL | |||||||||||||||||||||||||||||||||||||||||||||||

| ($ in millions, per ASM data in cents) | |||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2019 | 2022 | 2019 | ||||||||||||||||||||||||||||||||||||||||||||

| $ | per ASM | $ | per ASM | $ | per ASM | $ | per ASM | ||||||||||||||||||||||||||||||||||||||||

| Total operating expenses | $ | 2,558 | $ | 15.59 | $ | 1,855 | $ | 11.58 | $ | 4,661 | $ | 14.66 | $ | 3,652 | $ | 11.60 | |||||||||||||||||||||||||||||||

| Less: | |||||||||||||||||||||||||||||||||||||||||||||||

| Aircraft fuel and related taxes | 910 | 5.55 | 484 | 3.02 | 1,481 | 4.66 | 921 | 2.93 | |||||||||||||||||||||||||||||||||||||||

| Other non-airline expenses | 14 | 0.08 | 12 | 0.09 | 29 | 0.09 | 23 | 0.07 | |||||||||||||||||||||||||||||||||||||||

| Special items | 44 | 0.27 | 2 | 0.01 | 44 | 0.14 | 14 | 0.04 | |||||||||||||||||||||||||||||||||||||||

| Operating expenses, excluding fuel | $ | 1,590 | $ | 9.69 | $ | 1,357 | $ | 8.46 | $ | 3,107 | $ | 9.77 | $ | 2,694 | $ | 8.56 | |||||||||||||||||||||||||||||||

Operating expense, (loss) income before taxes, net (loss) income and (loss) earnings per share, excluding special items and net gain on investments

Our GAAP results in the applicable periods were impacted by charges that are deemed special items.

- 12 -

For the three and six months ended June 30, 2022, special items include an impairment on our E190 fleet, the ALPA ratification bonus, expenses related to our takeover bid of Spirit airlines, and expenses related to implementation of our flight attendants' collective bargaining agreement.

Special items for the three and six months ended June 30, 2019 include one-time costs related to the Embraer E190 fleet transition as well as one-time costs related to the implementation of our pilots' collective bargaining agreement.

Mark-to-market and certain gains and losses on our investments were also excluded from our 2022 GAAP results.

We believe the impact of these items distort our overall trends and that our metrics are more comparable with the presentation of our results excluding the impact of these items. The table below provides a reconciliation of our GAAP reported amounts to the non-GAAP amounts excluding the impact of these items.

- 13 -

| NON-GAAP FINANCIAL MEASURE | |||||||||||||||||||||||

| RECONCILIATION OF OPERATING EXPENSE, (LOSS) INCOME BEFORE TAXES, NET (LOSS) INCOME AND (LOSS) EARNINGS PER SHARE EXCLUDING SPECIAL ITEMS AND NET GAIN (LOSS) ON INVESTMENTS | |||||||||||||||||||||||

| (in millions, except per share amounts) | |||||||||||||||||||||||

| (unaudited) | |||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2022 | 2019 | 2022 | 2019 | ||||||||||||||||||||

| Total operating revenues | $ | 2,445 | $ | 2,105 | $ | 4,181 | $ | 3,977 | |||||||||||||||

| Total operating expenses | $ | 2,558 | $ | 1,855 | $ | 4,661 | $ | 3,652 | |||||||||||||||

| Less: Special items | 44 | 2 | 44 | 14 | |||||||||||||||||||

| Total operating expenses excluding special items | $ | 2,514 | $ | 1,853 | $ | 4,617 | $ | 3,638 | |||||||||||||||

| Operating (loss) income | $ | (113) | $ | 250 | $ | (480) | $ | 325 | |||||||||||||||

| Add back: Special items | 44 | 2 | 44 | 14 | |||||||||||||||||||

| Operating (loss) income excluding special items | $ | (69) | $ | 252 | $ | (436) | $ | 339 | |||||||||||||||

| Operating margin excluding special items | -2.8 | % | 12.0 | % | (10.4) | % | 8.5 | % | |||||||||||||||

| (Loss) income before income taxes | $ | (151) | $ | 236 | $ | (549) | $ | 294 | |||||||||||||||

| Add back: Special items | 44 | 2 | 44 | 14 | |||||||||||||||||||

| Less: Net gain (loss) on investments | $ | (5) | — | $ | (4) | — | |||||||||||||||||

| (Loss) income before income taxes excluding special items and net gain (loss) on investments | $ | (102) | $ | 238 | $ | (501) | $ | 308 | |||||||||||||||

| Pre-tax margin excluding special items and net gain (loss) on investments | -4.2 | % | 11.3 | % | (12.0) | % | 7.7 | % | |||||||||||||||

| Net (loss) income | $ | (188) | $ | 179 | $ | (443) | $ | 221 | |||||||||||||||

| Add back: Special items | 44 | 2 | 44 | 14 | |||||||||||||||||||

| Less: Income tax (expense) benefit related to special items | 12 | 1 | 12 | 3 | |||||||||||||||||||

| Less: Net gain (loss) on investments | (5) | — | $ | (4) | — | ||||||||||||||||||

| Less: Income tax (expense) benefit related to net gain (loss) on investment | 2 | — | $ | 1 | — | ||||||||||||||||||

| Net (loss) income excluding special items and net gain (loss) on investments | $ | (153) | $ | 180 | $ | (408) | $ | 232 | |||||||||||||||

| (Loss) earnings per common share: | |||||||||||||||||||||||

| Basic | $ | (0.58) | $ | 0.60 | $ | (1.38) | $ | 0.73 | |||||||||||||||

| Add back: Special items, net of tax | 0.10 | — | 0.10 | 0.03 | |||||||||||||||||||

| Less: Net gain (loss) on investments, net of tax | $ | (0.01) | — | $ | (0.01) | — | |||||||||||||||||

| Basic excluding special items and net gain (loss) on investments | $ | (0.47) | $ | 0.60 | $ | (1.27) | $ | 0.76 | |||||||||||||||

| Diluted | $ | (0.58) | $ | 0.59 | $ | (1.38) | $ | 0.73 | |||||||||||||||

| Add back: Special items, net of tax | 0.10 | 0.01 | 0.10 | 0.03 | |||||||||||||||||||

| Less: Net gain on investment, net of tax | $ | (0.01) | — | $ | (0.01) | — | |||||||||||||||||

| Diluted excluding special items | $ | (0.47) | $ | 0.60 | $ | (1.27) | $ | 0.76 | |||||||||||||||

Adjusted debt to capitalization ratio

Adjusted debt to capitalization ratio is a non-GAAP financial metric which we believe is helpful to investors in assessing the company's overall debt profile. Adjusted debt includes aircraft operating lease liabilities, in addition to total debt and finance leases, to present estimated financial obligations. Adjusted capitalization represents total equity plus adjusted debt.

- 14 -

| NON-GAAP FINANCIAL MEASURE | |||||||||||

| ADJUSTED DEBT TO CAPITALIZATION RATIO | |||||||||||

| (in millions) (unaudited) | |||||||||||

| June 30, 2022 | December 31, 2021 | ||||||||||

| (unaudited) | |||||||||||

| Long-term debt and finance leases | $ | 3,394 | $ | 3,651 | |||||||

| Current maturities of long-term debt and finance leases | 428 | 355 | |||||||||

| Operating lease liabilities - aircraft | 233 | 256 | |||||||||

| Adjusted debt | $ | 4,055 | $ | 4,262 | |||||||

| Long-term debt and finance leases | $ | 3,394 | $ | 3,652 | |||||||

| Current maturities of long-term debt and finance leases | 428 | 355 | |||||||||

| Operating lease liabilities - aircraft | 233 | 256 | |||||||||

| Stockholders' equity | 3,446 | 3,849 | |||||||||

| Adjusted capitalization | $ | 7,501 | $ | 8,111 | |||||||

| Adjusted debt to capitalization ratio | 54 | % | 53 | % | |||||||

- 15 -

CONTACTS

JetBlue Investor Relations

Tel: +1 718 709 2202

ir@jetblue.com

JetBlue Corporate Communications

Tel: +1 718 709 3089

corpcomm@jetblue.com

- 16 -

Investor Update

Investor UpdateInvestor Update: August 2, 2022

This update provides JetBlue’s investor guidance for the third quarter ending September 30, 2022 and full year 2022.

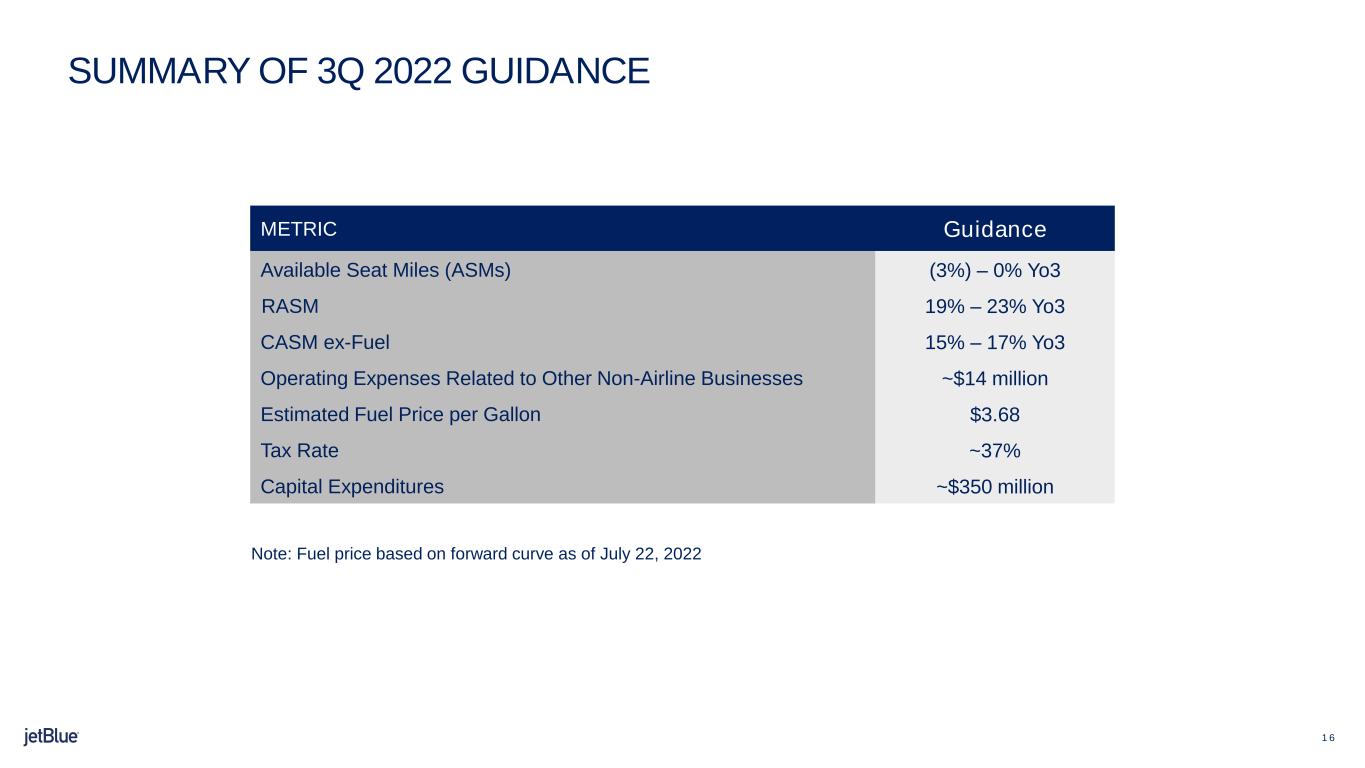

Third Quarter and Full-Year 2022 Outlook | Estimated 3Q 2022 | Estimated FY 2022 | ||||||

Capacity and Revenue | ||||||||

Available Seat Miles (ASMs) vs 2019 | (3%) – 0% | 0% – 3% | ||||||

Revenue per Available Seat Mile vs 2019 | 19% – 23% | N/A | ||||||

Expense | ||||||||

CASM Ex-Fuel1 (Non-GAAP) vs 2019 | 15% – 17% | 11% – 14% | ||||||

Operating Expenses Related to Other Non-Airline Businesses | $14 million | $50 – $60 million | ||||||

Estimated Fuel Price per Gallon, Net of Hedges2 | $3.683 | N/A | ||||||

Interest Expense | $40 – $50 million | $160 – $170 million | ||||||

Tax Rate | ~37% | ~15% | ||||||

Diluted Share Count4 | ~325 million | ~324 million | ||||||

Capital Expenditures | ~$350 million | ~$1 billion | ||||||

1 CASM Ex-Fuel excludes fuel and related taxes, special items and operating expenses related to non-airline businesses. With respect to JetBlue’s CASM Ex-Fuel and guidance, JetBlue is not able to provide a reconciliation of the non-GAAP financial measure to GAAP because the excluded items have not yet occurred and cannot be reasonably predicted. The reconciling information that is unavailable would include a forward-looking range of financial performance measures beyond our control, such as fuel costs, which are subject to many economic and political factors beyond our control.

2 Includes fuel taxes.

3 JetBlue utilizes the forward Brent crude curve and the forward Brent crude to heating oil crack spread to calculate the unhedged portion of its prompt quarter. As of July 22, 2022, the forward Brent crude per barrel price was $100 and the crack spread averaged $45 per barrel for the third quarter of 2022.

4 Average share count for the period. The number of shares used in JetBlue’s actual earnings per share will likely be different than those stated above.

Fuel Hedges

As of August 2, 2022 JetBlue has not entered into any advanced fuel derivative contracts.

Order Book

As of June 30, 2022 JetBlue’s fleet was comprised of 130 Airbus A320 aircraft, 84 Airbus A321, 11 Airbus A220 and 60 EMBRAER E190 aircraft, for a total of 285 aircraft.

1

JetBlue Airways Investor Relations • (718) 709-2202 • ir@jetblue.com

Investor Update

Investor UpdateJetBlue’s contractual order book for the full-year 2022 and 2023 as of June 30, 2022:

Year | A220 | A321NEO | A321NEO LR | Total | ||||||||||

2022 | 10 | - | 3 | 13 | ||||||||||

2023 | 21 | 6 | 5 | 32 | ||||||||||

Forward-Looking Statements

This Investor Update (or otherwise made by JetBlue or on JetBlue’s behalf) contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which represent our management’s beliefs and assumptions concerning future events. These statements are intended to qualify for the “safe harbor” from liability established by the Private Securities Litigation Reform Act of 1995. When used in this document and in documents incorporated herein by reference, the words “expects,” “plans,” “intends,” “anticipates,” “indicates,” “remains,” “believes,” “estimates,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “goals,” “targets” and similar expressions are intended to identify forward-looking statements. Additionally, forward-looking statements include statements that do not relate solely to historical facts, such as statements which identify uncertainties or trends, discuss the possible future effects of current known trends or uncertainties, or which indicate that the future effects of known trends or uncertainties cannot be predicted, guaranteed, or assured. Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, the COVID-19 pandemic including existing and new variants, and the outbreak of any other disease or similar public health threat that affects travel demand or behavior; restrictions on our business related to the financing we accepted under various federal government support programs such as the Coronavirus Aid, Relief, and Economic Security Act, the Consolidated Appropriations Act, and the American Rescue Plan Act; our significant fixed obligations and substantial indebtedness; risk associated with execution of our strategic operating plans in the near-term and long-term; the recording of a material impairment loss of tangible or intangible assets; our extremely competitive industry; volatility in financial and credit markets which could affect our ability to obtain debt and/or lease financing or to raise funds through debt or equity issuances; volatility in fuel prices, maintenance costs and interest rates; our reliance on high daily aircraft utilization; our ability to implement our growth strategy; our ability to attract and retain qualified personnel and maintain our culture as we grow; our reliance on a limited number of suppliers, including for aircraft, aircraft engines and parts and vulnerability to delays by those suppliers; our dependence on the New York and Boston metropolitan markets and the effect of increased congestion in these markets; our reliance on automated systems and technology; the outcome of the lawsuit filed by the Department of Justice and certain state Attorneys General against us related to our Northeast Alliance entered into with American Airlines, our being subject to potential unionization, work stoppages, slowdowns or increased labor costs; our presence in some international emerging markets that may experience political or economic instability or may subject us to legal risk; reputational and business risk from information security breaches or cyber-attacks; changes in or additional domestic or foreign government regulation, including new or increased tariffs; changes in our industry due to other airlines’ financial condition; acts of war or terrorism; global economic conditions or an economic downturn leading to a continuing or accelerated decrease in demand for air travel; adverse weather conditions or natural disasters; external geopolitical events and conditions; the occurrence of any event, change or other circumstances that could give rise to the right of JetBlue or Spirit or both of them to terminate the Merger Agreement; failure to obtain applicable regulatory or Spirit stockholder approval in a timely manner or otherwise and the potential financial consequences thereof; failure to satisfy other closing conditions to the proposed transactions with Spirit; failure of the parties to consummate the proposed transaction; JetBlue’s ability to finance the proposed transaction with Spirit and the indebtedness JetBlue expects to incur in connection with the proposed transaction; the possibility that JetBlue may be unable to achieve expected synergies and operating efficiencies within the expected timeframes or at all and to successfully integrate Spirit’s operations with those of JetBlue; the possibility that such integration may be more difficult, time-consuming or costly than expected or that operating costs and business disruption (including, without limitation, disruptions in relationships with employees, customers or suppliers) may be greater than expected in connection with the proposed transaction with Spirit; failure to realize anticipated benefits of the combined operations; demand for the combined company’s services; the growth, change and competitive landscape of the markets in which the combined company participates; expected seasonality trends; diversion of managements’ attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the proposed transaction with Spirit; risks related to investor and rating agency perceptions of each of the parties and their respective business, operations, financial condition and the industry in which they operate; risks related to the potential impact of general economic, political and market factors on the companies or the proposed transaction with Spirit; and ongoing and increase in

2

JetBlue Airways Investor Relations • (718) 709-2202 • ir@jetblue.com

Investor Update

Investor Updatecosts related to IT network security. It is routine for our internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it should be clearly understood that the internal projections, beliefs, and assumptions upon which we base our expectations may change prior to the end of each quarter or year. Any outlook or forecasts in this document have been prepared without taking into account or consideration the proposed transaction with Spirit.

Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. You should understand that many important factors, in addition to those discussed or incorporated by reference in this Investor Update, could cause our results to differ materially from those expressed in the forward-looking statements. In light of these risks and uncertainties, the forward-looking events discussed in this Investor Update might not occur. Our forward-looking statements speak only as of the date of this Investor Update. Other than as required by law, we undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

3

JetBlue Airways Investor Relations • (718) 709-2202 • ir@jetblue.com

2Q22 EARNINGS PRESENTATION AUGUST 2, 2022

2 SAFE HARBOR This Presentation (or otherwise made by JetBlue or on JetBlue’s behalf) contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which represent our management’s beliefs and assumptions concerning future events. These statements are intended to qualify for the “safe harbor” from liability established by the Private Securities Litigation Reform Act of 1995. When used in this document and in documents incorporated herein by reference, the words “expects,” “plans,” “intends,” “anticipates,” “indicates,” “remains,” “believes,” “estimates,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “goals,” “targets” and similar expressions are intended to identify forward-looking statements. Additionally, forward-looking statements include statements that do not relate solely to historical facts, such as statements which identify uncertainties or trends, discuss the possible future effects of current known trends or uncertainties, or which indicate that the future effects of known trends or uncertainties cannot be predicted, guaranteed, or assured. Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, the coronavirus (“COVID-19”) pandemic including new and existing variants, and the outbreak of any other disease or similar public health threat that affects travel demand or behavior; restrictions on our business related to the financing we accepted under various federal government support programs such as the Coronavirus Aid, Relief, and Economic Security Act, the Consolidated Appropriations Act, and the American Rescue Plan Act; our significant fixed obligations and substantial indebtedness; risk associated with execution of our strategic operating plans in the near-term and long-term; the recording of a material impairment loss of tangible or intangible assets; our extremely competitive industry; volatility in financial and credit markets which could affect our ability to obtain debt and/or lease financing or to raise funds through debt or equity issuances; volatility in fuel prices, maintenance costs and interest rates; our reliance on high daily aircraft utilization; our ability to implement our growth strategy; our ability to attract and retain qualified personnel and maintain our culture as we grow; our reliance on a limited number of suppliers, including for aircraft, aircraft engines and parts and vulnerability to delays by those suppliers; our dependence on the New York and Boston metropolitan markets and the effect of increased congestion in these markets; our reliance on automated systems and technology; the outcome of the lawsuit filed by the Department of Justice and certain state Attorneys General against us related to our Northeast Alliance entered into with American Airlines, our being subject to potential unionization, work stoppages, slowdowns or increased labor costs; our presence in some international emerging markets that may experience political or economic instability or may subject us to legal risk; reputational and business risk from information security breaches or cyber-attacks; changes in or additional domestic or foreign government regulation, including new or increased tariffs; changes in our industry due to other airlines’ financial condition; acts of war or terrorism; global economic conditions or an economic downturn leading to a continuing or accelerated decrease in demand for air travel; adverse weather conditions or natural disasters; external geopolitical events and conditions; the occurrence of any event, change or other circumstances that could give rise to the right of JetBlue or Spirit Airlines, Inc. (“Spirit”) or both of them to terminate the merger agreement; failure to obtain applicable regulatory or Spirit stockholder approval in a timely manner or otherwise and the potential financial consequences thereof; failure to satisfy other closing conditions to the proposed transactions with Spirit; failure of the parties to consummate the proposed transaction; JetBlue’s ability to finance the proposed transaction with Spirit and the indebtedness JetBlue expects to incur in connection with the proposed transaction; the possibility that JetBlue may be unable to achieve expected synergies and operating efficiencies within the expected timeframes or at all and to successfully integrate Spirit’s operations with those of JetBlue; the possibility that such integration may be more difficult, time-consuming or costly than expected or that operating costs and business disruption (including, without limitation, disruptions in relationships with employees, customers or suppliers) may be greater than expected in connection with the proposed transaction with Spirit; failure to realize anticipated benefits of the combined operations; demand for the combined company’s services; the growth, change and competitive landscape of the markets in which the combined company participates; expected seasonality trends; diversion of managements’ attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the proposed transaction with Spirit; risks related to investor and rating agency perceptions of each of the parties and their respective business, operations, financial condition and the industry in which they operate; risks related to the potential impact of general economic, political and market factors on the companies or the proposed transaction with Spirit; and ongoing and increase in costs related to IT network security. It is routine for our internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it should be clearly understood that the internal projections, beliefs, and assumptions upon which we base our expectations may change prior to the end of each quarter or year. Any outlook or forecasts in this document have been prepared without taking into account or consideration the proposed transaction with Spirit. Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. You should understand that many important factors, in addition to those discussed in this Presentation, could cause our results to differ materially from those expressed in the forward-looking statements. Further information concerning these and other factors is contained in JetBlue’s and filings with the Securities and Exchange Commission, or SEC, including but not limited to, JetBlue’s 2021 Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. In light of these risks and uncertainties, the forward-looking events discussed in this Presentation might not occur. Our forward-looking statements speak only as of the date of this Presentation. Other than as required by law, we undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise. This Presentation also includes certain “non-GAAP financial measures” as defined under the Exchange Act and in accordance with Regulation G. We have included reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated and provided in accordance with U.S. GAAP within this Presentation.

3 Additional Information and Where to Find It On July 28, 2022, JetBlue entered into a merger agreement with Spirit and Sundown Acquisition Corp. A meeting of the stockholders of Spirit will be announced as promptly as practicable to seek stockholder approval in connection with the proposed transaction. Spirit expects to file with the SEC a proxy statement and other relevant documents in connection with the proposed transaction. The definitive proxy statement will be sent or given to the stockholders of Spirit and will contain important information about the proposed transaction and related matters. STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ALL OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IN THEIR ENTIRETY CAREFULLY WHEN THEY BECOME AVAILABLE, INCLUDING ALL PROXY MATERIALS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Any definitive proxy statement (if and when available) will be mailed to stockholders of Spirit. Investors and stockholders may obtain a free copy of any proxy statement (when available) and other documents filed by JetBlue and Spirit at the SEC’s web site at https://www.sec.gov. In addition, investors and stockholders will be able to obtain free copies of any proxy statement (when available) and other documents filed by JetBlue and Spirit with the SEC on JetBlue’s Investor Relations website at http://investor.jetblue.com and on Spirit’s Investor Relations website at https://ir.spirit.com. Participants in the Solicitation This presentation is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC. JetBlue and Spirit, and certain of their respective directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders of Spirit common stock. Information regarding JetBlue’s directors and executive officers is contained in JetBlue’s Definitive Proxy Statement for its 2022 Annual Meeting of Stockholders filed with the SEC on April 7, 2022, and in JetBlue’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed with the SEC on February 22, 2022. Information regarding Spirit’s directors and executive officers is contained in Spirit’s Definitive Proxy Statement for its 2022 Annual Meeting of Stockholders filed with the SEC on March 30, 2022. Investors may obtain additional information regarding the interests of such participants by reading the proxy statement and other relevant materials regarding the proposed transaction when they become available. These documents can be obtained free of charge as described in the preceding paragraph. No Offer or Solicitation This presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. IMPORTANT INFORMATION FOR INVESTORS

4 2Q 2022 EARNINGS UPDATE ROBIN HAYES CHIEF EXECUTIVE OFFICER

5 Will Provide Significant Value for JetBlue and Spirit Shareholders Exhibits Strong Strategic Rationale Will Create a Compelling National Low-fare Challenger Will Accelerate Existing Growth Plan while Complementing JetBlue’s Northeast Alliance (NEA) Strategy Will Significantly Enhance JetBlue’s Long-term Financial Returns 5 CREATING LONG-TERM VALUE FOR ALL STAKEHOLDERS

6 RETURNING TO SUSTAINED PROFITABILITY FY 2022 OUTLOOK (1) Refer to reconciliations of non-GAAP financial measures in Appendices A & B (2) Liquidity defined as unrestricted cash, cash equivalents, short-term investments and long-term marketable securities (3) As of June 30, 2022 • GAAP loss per share of ($0.58); non-GAAP loss per share of ($0.47) (1) • Adjusted pre-tax loss of ($102M) (1) • Adjusted pre-tax profit in June of $9M • Revenue up 16.1% Yo3Y; CASM up 34.7% Yo3Y (GAAP); CASM ex-Fuel up 14.5% Yo3Y (non-GAAP) (1) 2Q 2022 EARNINGS • Capacity between (3%) – 0% vs 3Q 2019 • RASM up between 19% – 23% vs 3Q 2019 • CASM ex-Fuel up between 15% – 17% vs 3Q 2019 (1) 2Q 2021 PLANNING ASSUMPTIONS* • Capacity up between 0% – 3% vs 2019 • CASM ex-Fuel up between 11% – 14% vs 2019 • Return to profitability in 2H 2022 3Q 2022 OUTLOOK • In 2Q22, paid down approximately $106M of debt • $2.6B of liquidity (2) (3), equal to 32% of 2019 revenue • Adjusted Debt to Cap ratio at 54% (1) (3) 2Q 2022 BALANCE SHEET

7 ENHANCING LONG-TERM EARNINGS POWER Strategic initiatives to structurally improve our profitability • Strengthening relevance, boosting competition, and growing our two largest focus cities – New York and Boston – through the Northeast Alliance (NEA) • Broad product portfolio offers unique customer value proposition • Loyalty program growing double digits and contributing record cash flow, with spend at all-time high • Scaling our JetBlue Travel Products subsidiary and on track to deliver $100M in EBIT in 2022 • Setting new foundation for optimal long-term cost structure by targeting operational and planning efficiencies • Further accelerating fleet modernization efforts for margin-accretive growth with earlier retirement of E190 fleet • New structural cost program combined with accelerated E190 retirements to drive ~$250M of cost savings through 2024, supporting flattish CASM-ex trajectory Cost Revenue

8 COMMERCIAL UPDATE & OUTLOOK JOANNA GERAGHTY PRESIDENT & CHIEF OPERATING OFFICER

9 2.3% 2Q22 3Q22* FY22* DELIVERING ON OUR OPERATIONAL PLAN ASM GROWTH VERSUS 2019 EstimateFlown • Clear returns from summer operational investments − Significant investments to reliably deliver for customers and crewmembers − May and June completion factor of >98%, compared to 90% in first three weeks of April − Working collaboratively with FAA and industry partners to ensure operational reliability for flying public • Building out our network relevance − Growing New York and Boston through the NEA, with industry-leading network depth and breadth − JetBlue and American Airlines have added over 50 new routes and increased frequencies on another 130 − Continuing our international expansion with launch of service to Vancouver, Canada and plans for five daily frequencies between the Northeast and London this fall 0% – 3% (3%) – 0% *Denotes guidance

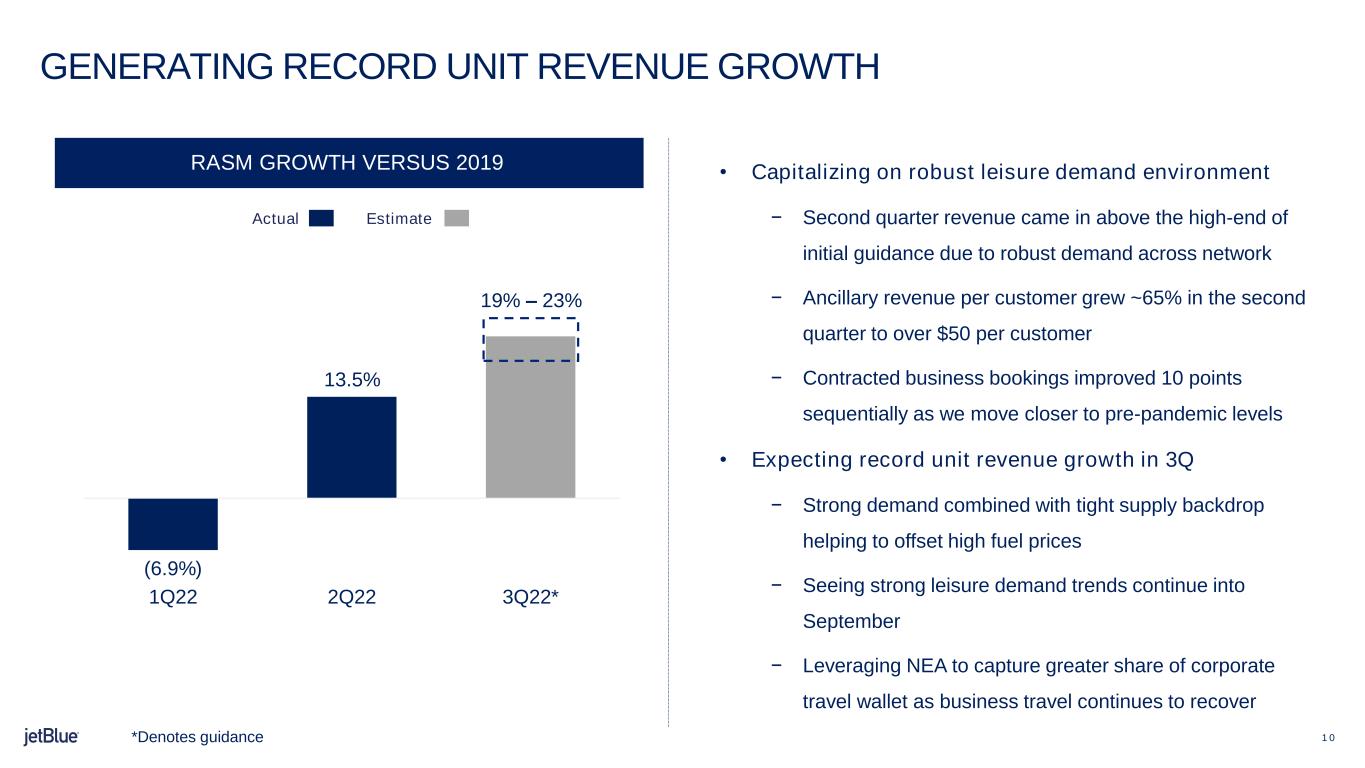

1 0 (6.9%) 13.5% 1Q22 2Q22 3Q22* GENERATING RECORD UNIT REVENUE GROWTH RASM GROWTH VERSUS 2019 • Capitalizing on robust leisure demand environment − Second quarter revenue came in above the high-end of initial guidance due to robust demand across network − Ancillary revenue per customer grew ~65% in the second quarter to over $50 per customer − Contracted business bookings improved 10 points sequentially as we move closer to pre-pandemic levels • Expecting record unit revenue growth in 3Q − Strong demand combined with tight supply backdrop helping to offset high fuel prices − Seeing strong leisure demand trends continue into September − Leveraging NEA to capture greater share of corporate travel wallet as business travel continues to recover EstimateActual *Denotes guidance 19% – 23%

1 1 FINANCIAL UPDATE & OUTLOOK URSULA HURLEY CHIEF FINANCIAL OFFICER

1 2 SUMMARY FINANCIALS 2Q 2022 US$ Millions 2Q 2022 2Q 2019 Change vs ‘19 Revenue 2,445 2,105 16% Operating Expenses 2,558 1,855 38% Adjusted Operating Expenses (1) 2,514 1,853 36% Adjusted Pre-Tax Income (Loss) (1) (102) 238 NM Earnings / (Loss) per Diluted Share (0.58) 0.59 NM Adjusted Earnings / (Loss) per Share(1) (0.47) 0.60 NM (1) Refer to reconciliations of non-GAAP financial measures in Appendix A

1 3 2.3% 14.5% 34.7% ASM CASM ex-Fuel CASM CASM EX-FUEL VERSUS 2019 COST INITIATIVES Actual 2Q22 Estimate 3Q22* • Investing to operate reliably; expect productivity improvements into 2023 − 2Q22 CASM ex-Fuel better versus guidance, with slight benefit from better-than-expected completion factor − 3Q22 CASM ex-Fuel reflects a sequential step- down in capacity, timing of maintenance events, and continued operational investments − Expect improved productivity levels in 4Q22 and into 2023 as utilization recovers and we drive a more optimal staffing level KEEPING A DILIGENT FOCUS ON COSTS (3%) – 0% *Denotes guidance (1) Operating expenses excluding special items; refer to reconciliations of non-GAAP financial measures in Appendix A (1) 15% – 17% CASM

1 4 SETTING A NEW FOUNDATION FOR LONG-TERM COSTS Network Efficiency Crew Planning End-of-Life Maintenance Optimization Maximizing Asset Productivity Accelerated E190 Transition to A220s Total cost reduction opportunity of ~$250M through 2024, supporting a flattish multi-year CASM ex-Fuel trajectory Cumulative Cost Savings ~$45M ~$75M 2023 2024 E190 Savings Structural Cost $150M – $200M ~$250M ~$115M Run-rate cost savings $40M - $50M $35M - $50M $45M - $60M $75M Savings $60M – $80M $30M - $40M

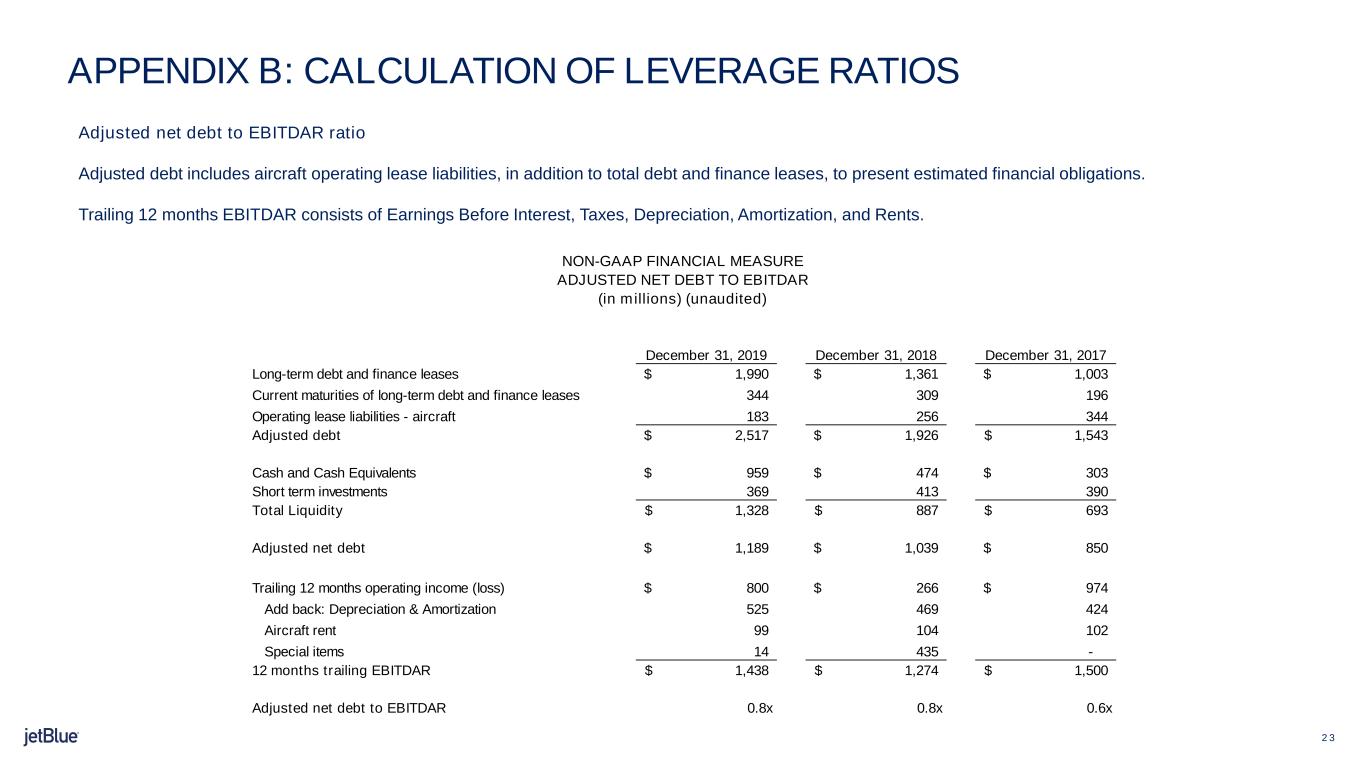

1 5 MAINTAINING RELATIVE BALANCE SHEET STRENGTH LEVERAGE Source: Management projections, historical financials, consensus estimates. Note: 2022E industry median excludes JetBlue and is based on consensus estimates as of July 19, 2022. Post-transaction net leverage is based on management projections for 2023E Adjusted Net Debt to 2023E EBITDAR and use leveragable EBITDAR where there is 50% synergy credit given to post-transaction figure and 100% synergy credit given to run-rate synergy capture figure. Leverage metric references adjusted net debt to EBITDAR, which is a non-GAAP metric. Refer to reconciliations of non-GAAP financial measures in Appendix B. Adjusted Net Debt to EBITDAR (1) • Paid down $106M in debt and funded $205M in CAPEX in 2Q22 • No significant near-term debt maturities; vast majority of pro-forma debt maturing beyond 2026 • Financing for Spirit acquisition expected to drive approximately $80M in financing costs (classified as interest expense) over 20 months 0.6x 0.8x 0.8x 5.5x 2017 2018 2019 2022E Post-transaction 2022E Industry Median 3.0x – 3.5x (2) (3) 3.5x – 4.0x

1 6 SUMMARY OF 3Q 2022 GUIDANCE METRIC Guidance Available Seat Miles (ASMs) (3%) – 0% Yo3 RASM 19% – 23% Yo3 CASM ex-Fuel 15% – 17% Yo3 Operating Expenses Related to Other Non-Airline Businesses ~$14 million Estimated Fuel Price per Gallon $3.68 Tax Rate ~37% Capital Expenditures ~$350 million Note: Fuel price based on forward curve as of July 22, 2022

1 7 QUESTIONS?

1 8 2Q 2022 FINANCIAL RESULTS US$ Millions 2Q 2022 2Q 2019 Change vs ’19 Total operating revenues 2,445 2,105 16% Aircraft fuel and related taxes 910 484 88% Salaries, wages and benefits 695 576 21% Landing fees and other rents 149 121 23% Depreciation and amortization 145 127 14% Aircraft rent 27 25 8% Sales and marketing 78 75 4% Maintenance, materials and repairs 162 168 (4%) Other operating expenses 348 277 26% Special items 44 2 NM Operating Income/(Loss) (113) 250 NM Other Income/(Expense) (38) (14) 171% Income/(Loss) before income taxes (151) 236 NM Income tax expense/(benefit) 37 57 (35%) NET INCOME/(LOSS) (188) 179 NM Pre-Tax Margin (6.2%) 11.2% (17.4) pts Earnings/(Loss) per Diluted Share (GAAP) ($0.58) $0.59 Adj. Pre-Tax Margin* (4.2%) 11.3% (15.5) pts Adj. Earnings/(Loss) per Diluted Share (Non-GAAP)* ($0.47) $0.60 * Refer to reconciliations of non-GAAP financial measures in this Appendix A

1 9 Non-GAAP Financial Measures JetBlue uses non-GAAP financial measures in this presentation. Non-GAAP financial measures are financial measures that are derived from the consolidated financial statements, but that are not presented in accordance with generally accepted accounting principles in the United States, or GAAP. We believe these non-GAAP financial measures provide a meaningful comparison of our results to others in the airline industry and our prior year results. Investors should consider these non-GAAP financial measures in addition to, and not as a substitute for, our financial performance measures prepared in accordance with GAAP. Further, our non-GAAP information may be different from the non-GAAP information provided by other companies. The information in Appendices A and B provides an explanation of each non-GAAP financial measure and shows a reconciliation of non-GAAP financial measures used in this presentation to the most directly comparable GAAP financial measures. APPENDIX A

2 0 Operating expense per available seat mile, excluding fuel and related taxes, other non-airline operating expenses, and special items (“CASM Ex-Fuel”) Operating expenses per available seat mile, or CASM, is a common metric used in the airline industry. We exclude aircraft fuel and related taxes, operating expenses related to other non- airline businesses, such as JetBlue Technology Ventures and JetBlue Travel Products, and special items from operating expenses to determine CASM ex-fuel, which is a non-GAAP financial measure. For the three and six months ended June 30, 2022, special items include an impairment on our E190 fleet, an ALPA ratification bonus and associated payroll taxes, expenses related to our takeover bid of Spirit airlines, and expenses related to implementation of our flight attendants' collective bargaining agreement. Special items for the three and six months ended June 30, 2019 include one-time costs related to the Embraer E190 fleet transition as well as one-time costs related to the implementation of our pilots' collective bargaining agreement. We believe that CASM ex-fuel is useful for investors because it provides investors the ability to measure financial performance excluding items beyond our control, such as fuel costs, which are subject to many economic and political factors, or not related to the generation of an available seat mile, such as operating expense related to certain non-airline businesses. We believe this non-GAAP measure is more indicative of our ability to manage airline costs and is more comparable to measures reported by other major airlines. With respect to JetBlue’s CASM ex-fuel guidance, JetBlue is unable to provide a reconciliation of the non-GAAP financial measure to GAAP because the excluded items have not yet occurred and cannot be reasonably predicted. The reconciling information that is unavailable would include a forward-looking range of financial performance measures beyond our control, such as fuel costs, which are subject to many economic and political factors. Accordingly, a reconciliation to CASM is not available without unreasonable effort. $ per ASM $ per ASM $ per ASM $ per ASM Total operating expenses 2,558$ 15.59$ 1,855$ 11.58$ 4,661$ 14.66$ 3,652$ 11.60$ Less: Aircraft fuel and related taxes 910 5.55 484 3.02 1,481 4.66 921 2.93 Other non-airline expenses 14 0.08 12 0.09 29 0.09 23 0.07 Special items 44 0.27 2 0.01 44 0.14 14 0.04 Operating expenses, excluding fuel 1,590$ 9.69$ 1,357$ 8.46$ 3,107$ 9.77$ 2,694$ 8.56$ 2019 Three Months Ended June 30, 20222022 2019 Six Months Ended June 30, NON-GAAP FINANCIAL MEASURE RECONCILIATION OF OPERATING EXPENSE PER ASM, EXCLUDING FUEL ($ in millions, per ASM data in cents) (unaudited)