Form 8-K Invitation Homes Inc. For: Jun 06

Investor Presentation Together with you, we make a house a home. June 2022

Las Vegas 2 I. Executive Summary

3 We remain strategically positioned to pursue growth opportunities and enhance the resident experience Key Takeaways and Updates Our strong Same Store results continued in May: New lease rate growth accelerated to 16.5% (+240 bps YoY) in May, up from 15.5% in April and 14.8% in 1Q22 Renewal rate growth accelerated to 10.3% (+450 bps YoY) in May, consistent with April and up from 9.7% in 1Q22 Blended rate growth accelerated to 11.8% (+380 bps YoY) in May, up from 11.5% in April and 10.9% in 1Q22 Average occupancy of 98.0% in May Charlotte Our prudent capital sourcing and multi-channel acquisition strategy help us to achieve our growth goals, including an expanded pipeline of new homes from our builder relationships and our new, premier-product JV with Rockpoint Our best-in-class resident experience focuses on choice and flexibility, which we continue to enhance in new ways such as through our investment in Pathway Homes and in providing a worry-free leasing lifestyle Our builder relationships are helping to bring new supply of housing to the marketplace

4 We believe our business and proven strategy position us well against economic uncertainty A Business Model For All Seasons Atlanta The location and quality of our homes attracts a higher-end SFR customer Average annual income of new residents nearly $130,000, with an income to rent ratio of 5.4x as of 1Q22 Resident turnover the lowest in our history, with average tenure nearly 32 months as of 1Q22 Our loss to lease offers an expected sizable runway for future growth, as market rents have accelerated higher than renewals in recent years Our investment-grade rated balance sheet provides us with $1.5 billion of liquidity as of March 31, 2022, with no debt maturing prior to 2025 and the majority of our debt unsecured and at fixed or swapped to fixed rates We believe our emphasis on location, scale and eyes in markets is important in good times and critical in more challenging times, with our 16 unique markets offering geographic and economic diversity Supply and demand fundamentals for SFR housing expected to remain favorable, with the millennial population just beginning to reach our average resident age of 40 years old Single-family rental homes with shorter duration leases should provide an effective hedge in an inflationary environment

5 Our Most Recent Growth Opportunities Pathway Homes Announced February 2022 as a $750M (including debt) platform, backed by Regis Group, Fifth Wall, and INVH Pathway provides unique housing solutions that allow residents to first lease and then buy the home outright at a future date INVH investing in homes and technology platform, and will earn property management fee Acquired 46 homes as of 3/31/22 Rockpoint “Premier-Product” JV Announced March 2022 as a $750M (including debt) premier-product joint venture with Rockpoint Group Targets homes in premium locations and at price points and rents that average 30%-60% higher than traditional strategy INVH to earn asset management and property management fees, along with promote opportunity We expect to begin buying homes soon Our new investments offer additional housing solutions around flexibility and choice PulteGroup, Inc. (NYSE: PHM) Announced July 2021 as a strategic relationship with PulteGroup Inc., the nation’s third largest homebuilder INVH expects to buy approximately 7,500 new homes over a five-year timeframe that Pulte will design and build The companies are under contract on over 1,500 homes as of 3/31/22, which will start to deliver toward the end of 2022

Differentiated Portfolio and Platform We are strategically positioned around three pillars that enhance growth and the resident experience 6 Location • 95% of portfolio in Western U.S., Sunbelt, and Florida • In-fill neighborhoods • High barriers to homeownership • Outsized LT growth drivers • We believe infill locations create insulation from new supply Track Record of Sector-Leading Growth and High-Quality Resident Experience Eyes in Markets • 20 in-house investment professionals in markets • ~800 operations personnel across 33 local home pods • Proactive “ProCare” service visits by in-house techs • Local, in-house control of the resident experience Scale • Over 5,000 homes per market on average • Over 98% of revenue from markets with >1,800 homes • Density drives service efficiency and revenue management intel

Our Commitment to ESG 7 SOCIAL Top-ranked governance(1) 89% of directors independent Quarterly ESG board updates Robust risk management Opted out of MUTA Genuine Care commitment to our residents Associates’ pay linked to resident service & ESG Employee Resource Groups and training foster DE&I $250 million investment in Pathway Homes Coordinated philanthropy and volunteer efforts ENVIRONMENTAL We are committed to strong corporate citizenship and raising the bar for ESG 2021 GRESB Score ________________________________________________ (1) Ranked #6 out of all 89 REITs (and #1 out of 12 residential REITs) in Green Street Advisors’ corporate governance rankings. GOVERNANCE 13% increase from prior year Resident education on energy-efficiency ENERGY STAR® certified appliances & durable, energy-efficient materials Smart Home technology & HVAC filter delivery program Water-saving landscape designs Anchor investment in Fifth Wall Climate Tech Fund

34.3% 24.2% 11.8% -3.1% Invitation Homes American Homes 4 Rent National Multifamily Coastal Multifamily Cumulative SS-NOI Growth (2017-2021) Track Record of Consistency and Sector-Leading Growth Differentiated locations, scale, and local expertise have driven consistent outperformance in organic growth 8 ________________________________________________ (1) National Multifamily represents simple average of CPT, MAA, and UDR. Coastal Multifamily represents simple average of AVB, EQR, and ESS. Data, including non-GAAP measures, is from public filings. There can be no assurance that our basis for computing this non-GAAP measure is comparable with that of other companies, including those mentioned above. 7.4% 5.1% 2.9% 2.8% Invitation Homes American Homes 4 Rent Coastal Multifamily National Multifamily 2017 SS-NOI Growth 4.4% 2.9% 2.8% 2.3% Invitation Homes National Multifamily American Homes 4 Rent Coastal Multifamily 2018 SS-NOI Growth 5.6% 4.2% 3.7% 3.3% Invitation Homes National Multifamily American Homes 4 Rent Coastal Multifamily 2019 SS-NOI Growth 3.7% 2.0% -1.5% -6.1% Invitation Homes American Homes 4 Rent National Multifamily Coastal Multifamily 2020 SS-NOI Growth 9.4% 8.7% 2.9% -5.1% Invitation Homes American Homes 4 Rent National Multifamily Coastal Multifamily 2021 SS-NOI Growth $87M incremental IH SS-NOI $195M incremental IH SS-NOI $323M incremental IH SS-NOI

Tampa II. Location & Scale 9

Location: High-Growth Markets We focus on high-growth markets and in-fill neighborhoods with proximity to jobs, transportation, and schools 10 >95% of revenue from Western U.S., Sunbelt, and Florida 6.1% avg annual SS-NOI growth from 2017 to 2021 38% more home price appreciation than U.S. avg since 2012 (1) Percent of 1Q22 revenue Seattle 6% Minne- apolis 1% Denver 4% Dallas 3% Phoenix 9% Atlanta 13% Tampa 10% Southern California 12% Las Vegas 4% South Florida 12% Northern California 6% Carolinas 6% Jacksonville 2% Orlando 7%Houston 2% Chicago 3% ________________________________________________ (1) Sources: John Burns Real Estate Consulting, S&P CoreLogic Case-Shiller® Home Price Indices, March 2022. Growth rates are for the entire market in which IH owns homes, weighted by IH home count, and represent market-level data for the entire market rather than IH home-specific data. 2.0x more job growth than U.S. avg since 2012 (1)

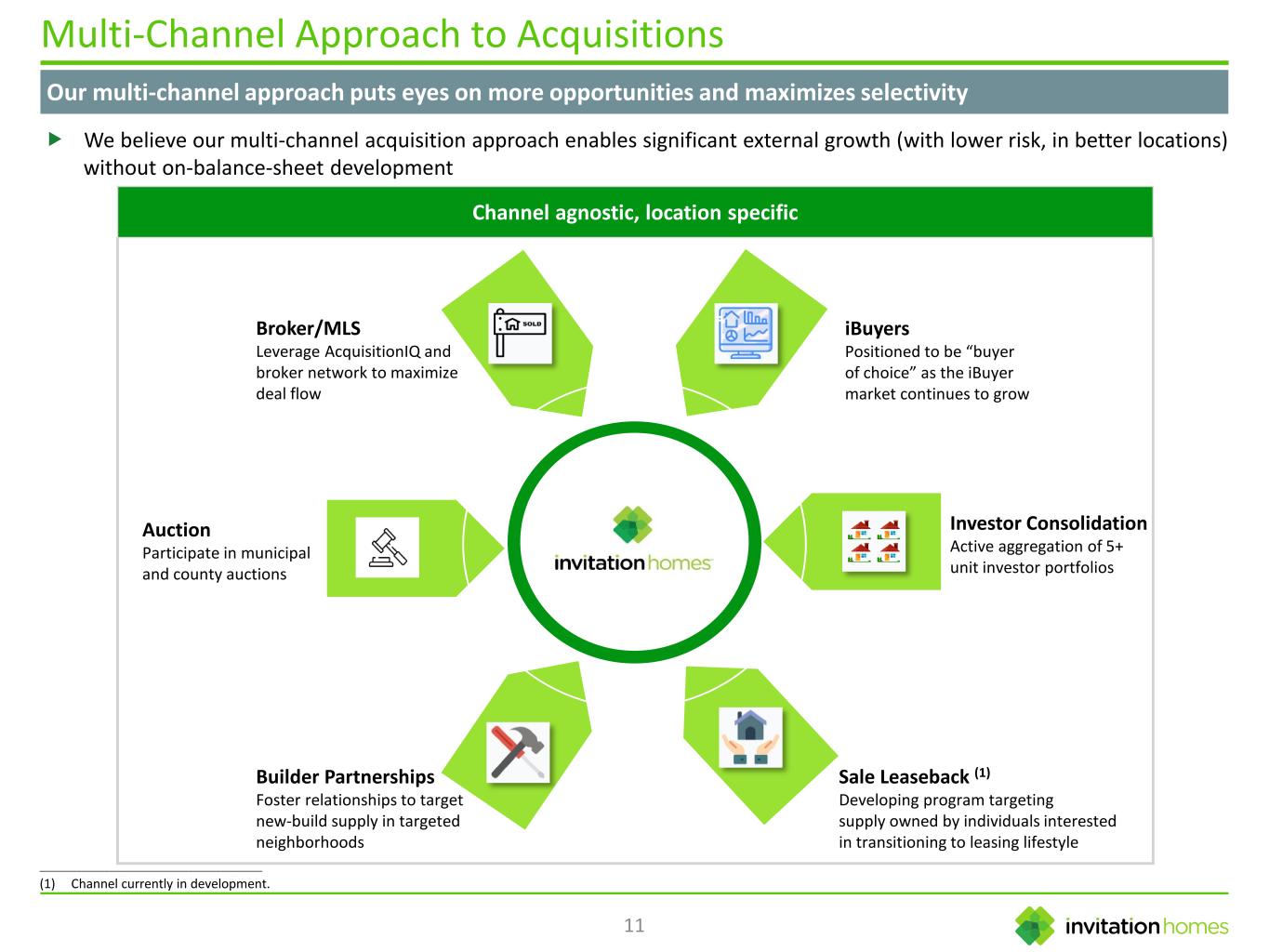

Channel agnostic, location specific 11 Multi-Channel Approach to Acquisitions Our multi-channel approach puts eyes on more opportunities and maximizes selectivity Broker/MLS Leverage AcquisitionIQ and broker network to maximize deal flow Builder Partnerships Foster relationships to target new-build supply in targeted neighborhoods Sale Leaseback (1) Developing program targeting supply owned by individuals interested in transitioning to leasing lifestyle Investor Consolidation Active aggregation of 5+ unit investor portfolios iBuyers Positioned to be “buyer of choice” as the iBuyer market continues to grow Auction Participate in municipal and county auctions We believe our multi-channel acquisition approach enables significant external growth (with lower risk, in better locations) without on-balance-sheet development ________________________________________________ (1) Channel currently in development.

12 Our Homebuilder Relationships Offer Many Advantages Preferred partnership with PulteGroup, but also work with other national, regional and local builders Allows us to partner with, instead of competing against, the best homebuilders Lower initial upfront investment Projected to deliver stabilized yields favorable to one-off acquisitions More flexible with regards to what is acquired, e.g. partial or full communities No land bank, builder G&A load, direct supply-chain concerns, or developer risks 1,932 homes under contract from various homebuilders as of 3/31/22, with deliveries in 2022, 2023 and beyond Pulte Rendering

Scale: Atlanta Example Our industry-leading scale enables us to operate efficiently with significant local presence in markets 13 NW POD Team 3,484 Homes NE POD Team 3,332 Homes SE POD Team 2,933 Homes SW POD Team 2,936 Homes Atlanta - 12,685 Homes (1) ________________________________________________ (1) In addition to the 12,685 wholly owned homes in Atlanta, there are 228 homes owned by the 2020 Rockpoint JV and 40 homes owned by the Pathway Homes JV that are managed by Invitation Homes; home counts as of March 31, 2022. • 1 Vice President of Operations • 1 Director of Operations • 1 Rehab/Turn/R&M Director • 3 Portfolio Directors (POD) • 7 Portfolio Mgmt. Personnel • 21 Leasing Personnel • 22 Customer Care Reps • 73 Maintenance Techs/RTM Personnel

Orlando 14 III. Eyes in Markets

Best-in-Class, Local Approach to Operations and Investing Local, high-touch service with eyes in markets enhances control over asset quality and the resident experience Differentiated Approach Superior Results Local resident service, leasing, and investment/asset management, with centralized oversight and tools Proactive resident care and asset preservation Collaboration between operations, investment, and asset mgmt teams to identify opportunities and drive consistency In-house accountability for every step of the resident journey and life of the home Home-by-home asset management decision making Scale in markets to enhance efficiency and intel Resident satisfaction scores in high-4’s / 5 in TTM Better Business Bureau accredited with an A+ rating TTM Same Store turnover rate of 22.3% at 1Q22 Same Store average occupancy 98.1% at 1Q22 Residential sector-leading SS-NOI growth in each of the last five years (6.1% per year on average); 9.4% in FY2021 15 85,582 homes1 20 Field investment personnel ~1,000 Field ops personnel covering 33 home pods Central strategy, tools, and oversight Collaboration ________________________________________________ (1) Includes 82,758 wholly owned homes and 2,824 homes owned through joint ventures that are managed by Invitation Homes, as of March 31, 2022.

Proactive Resident Service and Asset Management ProCare proactive maintenance program designed to optimize each touch point with our residents and homes Initial Showing / Leasing Interaction ProCare Resident Orientation (RO) ProCare 45-Day Maintenance Visit Work Order General Property Condition Assessment Program ProCare 6-Month Maintenance Visit ProCare Pre-Move Out Visit (PMOV) Move Out Inspection / Budget Creation Move-in 16 Move-out Educate Residents Make Repairs Check Home Condition ProCare is our differentiated approach to service that leverages proactive engagement with residents and homes to maximize resident satisfaction and the quality and efficiency of asset preservation In-house personnel own every step of the resident journey and visit residents in their homes at least 2x per year Proactive resident education and “eyes on assets” are critical to homes’ condition and cost to maintain; the ProCare cycle is designed to maximize touchpoints that facilitate this, and resident feedback is collected throughout Emergency repairs are addressed immediately, while minor repairs can be bundled into ProCare visits for efficiency Our mobile maintenance app, launched in 2021, allows residents to make camera-enabled maintenance requests on their own terms, and allows us to diagnose the problem before we arrive and reduce the number of return trips

Growing Ancillary Services We remain on track with our multi-year plan to grow ancillary services to enhance the resident experience 17 Smart Home Update: Base Smart Home package recently expanded to include video doorbell along with smart lock and smart thermostat Upgraded Smart Home packages made available to residents who desire additional smart features New program structure increases our profit margin while enhancing benefits for residents HVAC Filter Program Update: Implemented program whereby HVAC filters are shipped by a 3rd party to all homes quarterly for a small fee to residents Reduces resident burden, improves energy efficiency, and reduces long-term HVAC maintenance costs Required for all new leases and all renewal leases We remain in the early innings of what the resident experience could look like We continue to see potential for significant growth in ancillary income New or proposed initiatives include pet programs, pest control, landscaping, insurance suite, and energy optimization

Dallas 18 IV. Industry Fundamentals

3% 17.0% 80.00% 1000+ units 10 to 999 units 1 to 9 units Meeting an Underserved Need in the Housing Market We provide a unique experience, but today serve only 0.5% of the growing demand for single-family rentals 19 U.S. Single-Family Rental Ownership (3) ________________________________________________ (1) Source: John Burns Real Estate Consulting, Burns US Housing Analysis and Forecast, published April 19, 2022. (2) Source: U.S. Census Bureau, as of July 2021. (3) Source: John Burns Real Estate Consulting, Burns Single-Family Rental Analysis and Forecast, published March 31, 2022. Current U.S. Population by Age Cohort (2) (millions of people) 20.9 21.5 22.7 23.2 21.9 20.7 19.5 18 19 20 21 22 23 24 15-19 20-24 25-29 30-34 35-39 40-44 45-49 Avg. Resident Age: 40 Potential Future Demand Single Unit Rentals: 36% (16M units) 2-9 Unit Rentals: 28% (13M units) 10+ Unit Rentals: 35% (16M units) Owned: 65% (84M units) Rented: 35% (45M units) U.S. Housing Summary (1) 129 Million Households 45 Million Rental Households

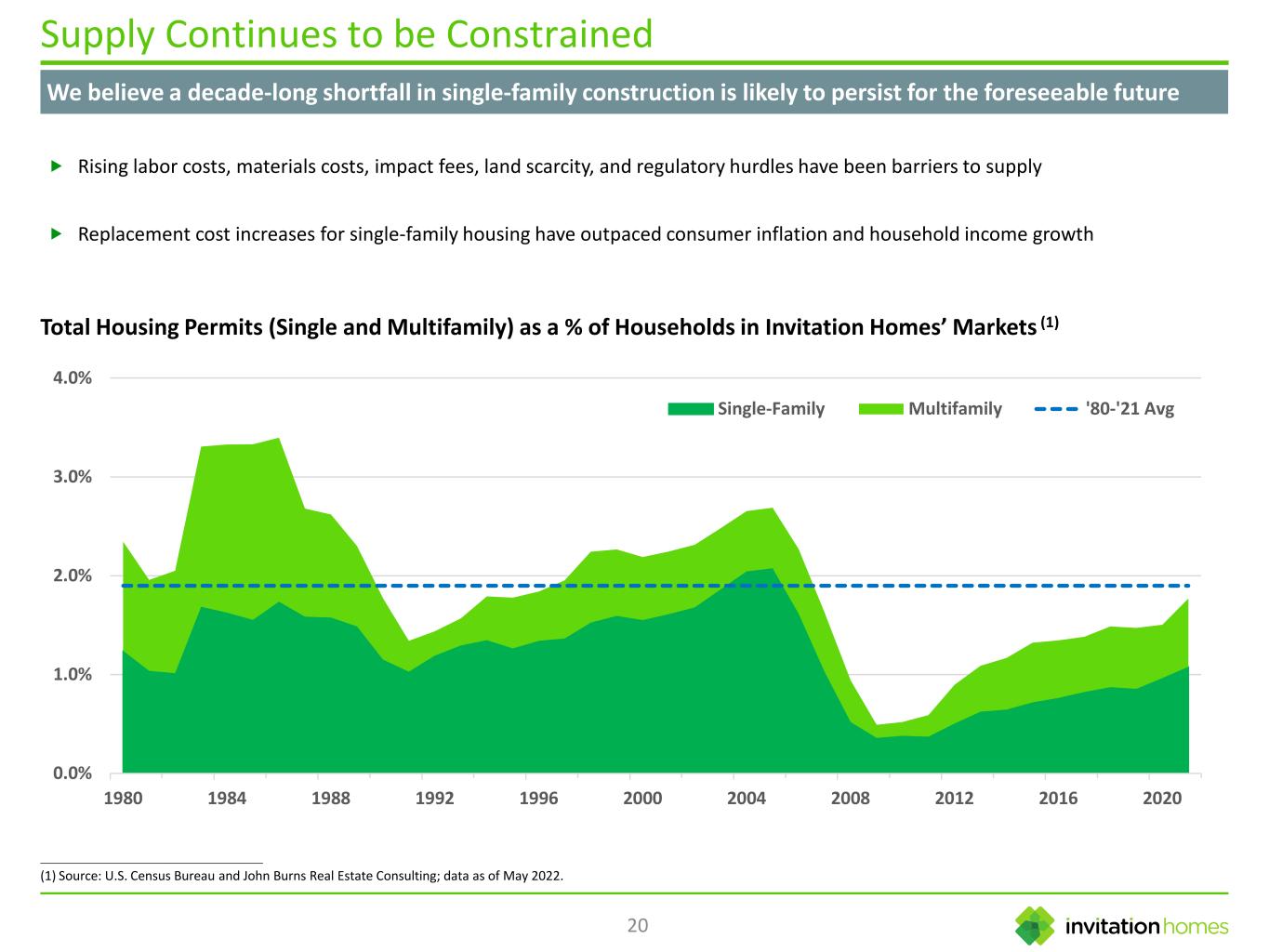

Supply Continues to be Constrained We believe a decade-long shortfall in single-family construction is likely to persist for the foreseeable future 20 Total Housing Permits (Single and Multifamily) as a % of Households in Invitation Homes’ Markets (1) 0.0% 1.0% 2.0% 3.0% 4.0% 1980 1984 1988 1992 1996 2000 2004 2008 2012 2016 2020 Single-Family Multifamily '80-'21 Avg Rising labor costs, materials costs, impact fees, land scarcity, and regulatory hurdles have been barriers to supply Replacement cost increases for single-family housing have outpaced consumer inflation and household income growth ________________________________________________ (1) Source: U.S. Census Bureau and John Burns Real Estate Consulting; data as of May 2022.

Disclaimer This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which include, but are not limited to, statements related to the Company’s expectations regarding the performance of the Company’s business, its financial results, its liquidity and capital resources and the use of the net proceeds from the offering, and other non-historical statements. In some cases, you can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties, including, among others, risks inherent to the single-family rental industry and the Company’s business model, macroeconomic factors beyond the Company’s control, competition in identifying and acquiring properties, competition in the leasing market for quality residents, increasing property taxes, homeowners’ association fees and insurance costs, the Company’s dependence on third parties for key services, risks related to the evaluation of properties, poor resident selection and defaults and non-renewals by the Company’s residents, performance of the Company’s information technology systems, risks related to the Company’s indebtedness, and risks related to the potential negative impact of the ongoing COVID-19 pandemic and geopolitical events on the Company’s financial condition, results of operations, cash flows, business, associates, and residents. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. The Company believes these factors include, but are not limited to, those described under Part I. Item 1A. “Risk Factors” of the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, as such factors may be updated from time to time in the Company’s periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this release and in the Company’s other periodic filings. The forward-looking statements speak only as of the date of this presentation, and the Company expressly disclaims any obligation or undertaking to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except to the extent otherwise required by law. [email protected] www.INVH.com

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Three From Lyons & Simmons Selected Among Best Lawyers in Dallas

- Four ONDA Partners Earn Placement on D Magazine’s Best Lawyers List

- Atlas Salt Inc. Announces Release with Conditions under the Environmental Protection Act for the Great Atlantic Salt Project

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share