Form 8-K Inhibrx, Inc. For: May 16

Outcomes Focused Innovation Driven May 2022

2 This presentation contains forward-looking statements. In some cases, you can identify forward-looking statements by the words “will,” “expect,” “intend,” “plan,” “objective,” “believe,” “estimate,” “potential,” “continue” and “ongoing,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. These statements are based on management’s current beliefs and expectations. These statements include but are not limited to statements regarding Inhibrx, Inc.’s (the “Company”) business strategy, the Company’s plans to develop and commercialize its product candidates, the safety and efficacy of the Company’s product candidates, the Company’s plans and expected timing with respect to clinical trials and regulatory filings and approvals, manufacturing matters, strength of intellectual property protection, and the size and growth potential of the markets for the Company’s product candidates, and any implication that pre-clinical data or preliminary or topline results will be representative of the results of later trials. This presentation also contains certain projections and estimates regarding the Company’s future financial performance, namely potential future revenue for certain of the Company’s product candidates. This information also constitutes forward-looking information and is for illustrative purposes only and should not be relied upon as necessarily being indicative of any future results. The assumptions and estimates underlying this estimated financial information are inherently uncertain and subject to a wide variety of significant business, economic competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. These potential financial information and other forward-looking statements involve substantial known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. Additional information regarding the Company’s risks and uncertainties are described from time to time in the “Risk Factors” section of our Securities and Exchange Commission filings, including those described in our Annual Report on Form 10-K as well as our Quarterly Reports on Form 10-Q, and supplemented from time to time by our Current Reports on Form 8-K. The Company may not actually achieve the plans, intentions or expectations disclosed in its forward-looking statements, and you should not place undue reliance on the Company’s forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements the Company makes. The forward-looking statements in this presentation represent the Company’s views as of the date of this presentation. The Company anticipates that subsequent events and developments will cause its views to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company has no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward- looking statements as representing the Company’s views as of any date subsequent to the date of this presentation. The investigational product candidates discussed in this presentation have not been approved or licensed by the U.S. Food and Drug Administration or by any other regulatory authority, and they are not commercially available in any market. This presentation also contains estimates and other statistical data made by independent parties and by the Company relating to market size and growth and other data about its industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions, and estimates of the Company’s future performance and the future performance of the markets in which it operates are necessarily subject to a high degree of uncertainty and risk. This presentation shall not constitute an offer to sell or the solicitation of an offer to buy securities. Presentation disclaimer

3 Four differentiated clinical programs INBRX-109 Tetravalent DR5 agonist + Single agent activity in chondrosarcoma + Potential rapid path to approval in chondrosarcoma, registration study initiated + Initial combination cohorts with data in 2H 2022: mesothelioma, pancreatic adenocarcinoma, colorectal cancer and Ewing sarcoma INBRX-106 Hexavalent OX40 agonist + Durable partial responses in combination dose escalation with anti-PD-1 in CPI naïve patients + Durable single agent activity in patients with prior CPI exposure + Potential to combine INBRX-106 with fast-growing IO market + Next data readouts in anti-PD-1 combination expansion cohorts in late 2022 INBRX-105 PD-L1 x 4-1BB tetravalent conditional agonist + Potential across PD-L1 expressing tumors + 4-1BB agonism is clinically validated + Strong mechanistic rational for anti-PD-1 combination + Dose escalation data in combination with anti-PD-1 in Q2 2022 INBRX-101 AAT-Fc fusion protein + Potential for first meaningful advancement for patients in 35 years + Current market size ~$1B in an underserved population + Initial results show favorable safety and tolerability profile and potential to achieve normal AAT levels with monthly dosing + Registration study could start in late 2022 Oncology Cell death pathway Immuno-oncology Rare diseases

4 Why invest in Inhibrx? Backed by solid institutional investor base with substantial internal ownership Four differentiated clinical programs with potentially value- creating readouts in 2022/2023 KEY FINANCIAL HIGHLIGHTS* 39.0M $143.5M 44.7MRobust emerging pre-clinical pipeline Potential to reach financial sustainability with minimal dilution $30M per Qtr Cash Average burn rate Common stock outstanding Fully diluted outstanding *As of 3/31/2022

5 Inhibrx at a glance + Experienced leadership team + Proven innovation and execution PARTNERSHIPS WITH INDUSTRY LEADERS All platforms and programs developed in-house with strong patent protection Inhibrx’s modular sdAb platform + Ability to precision engineer to specific target biology + Smaller than conventional antibodies + Antibody-like PK profile + Readily manufactured at high yields using standard processes

INBRX-101 Recombinant Alpha-1 Antitrypsin Fc-fusion Protein

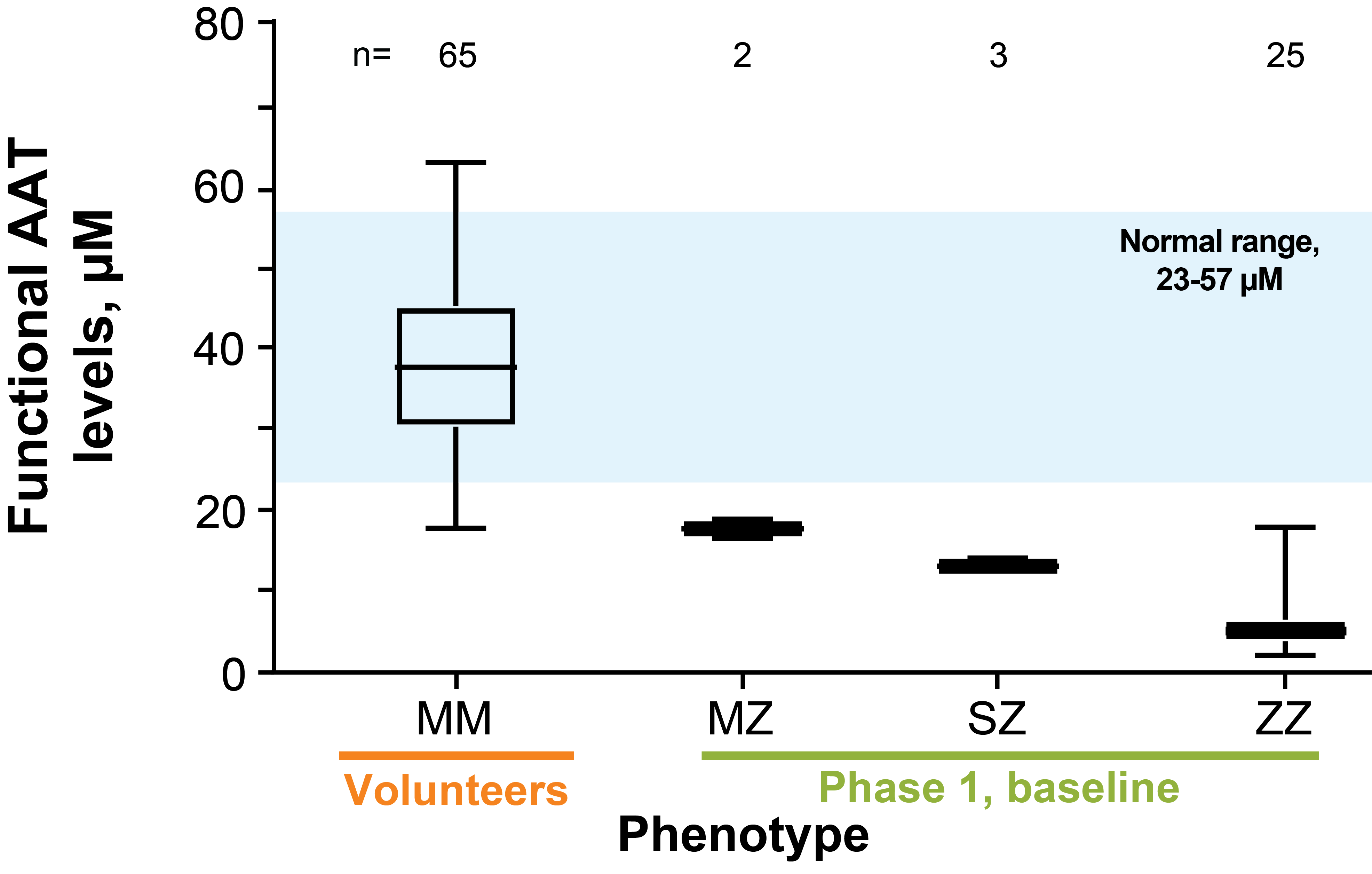

7 Functional AAT levels in healthy individuals vs. AATD patients Disease history + Alpha-1 antitrypsin deficiency (AATD) is an inherited orphan respiratory disease characterized by deficient levels of alpha-1 antitrypsin (AAT) + This causes loss of lung function and decreased life expectancy + A small percentage of patients also develop liver disease MZ SZ ZZ SERPINA1 Phenotype MM N=65 N=2 N=3 N=25 Volunteers Ph 1 Baseline Fu nc tio na l A AT le ve ls (μ M ) 80 60 0 40 20 - Box plots show the minimum, lower quartile, median, upper quartile and maximum - The shaded region represents the 5th-95th percentiles of the normal range of functional AAT in healthy MM genotype adults - AAT variant determination was conducted by the Mayo Clinic Laboratories using an LC-MS/MS method (A1ALC) - The Ph 1 baseline data represents the functional AAT levels measured in patients at the beginning of the study prior to dosing INBRX-101 Study results + Functional AAT levels from 65 MM genotype healthy volunteers ranged from 23 to 57 micromolar (µM), with a median of 38 µM. + Baseline levels of functional AAT for 30 Phase 1 patients prior to dosing of INBRX-101 ranged from 2 to 19 µM, with a median of 6 for ZZ genotype patients.

8 Current standard of care + The current standard of care, plasma-derived AAT (pdAAT)**, dosed once weekly at 60 mg/kg, achieves an average level (Cavg) of functional AAT of 17.8 µM over the weekly dosing interval as calculated from steady-state area under the curve (AUC) values***. + Due to its short half-life (5-6 days), patients require weekly infusions to achieve target levels, but levels typically fall below the normal range within 1-2 days of infusion. **Current pdAAT therapies include: Aralast, Glassia, Prolastin-C & Zemaira ***Source~ reported in Stocks et al. BMC Clinical Pharmacology 2010, 10:13 Mean functional AAT serum levels at steady-state in patients receiving weekly pdAAT 60 M ea n fu nc tio na l s er um A AT le ve l ( μM ) 40 20 0 0 7 Days Normal functional AAT serum range* (23 - 57 μM) Below normal functional AAT serum range (<23 μM) Dose *Source~ Normal range calculated based on Inhibrx ANEC assay results from 65 healthy MM genotype adults

9 Potential advantages of recombinant AAT Fc-fusion protein INBRX-101 AAT Fc Potential to extend the dosing interval from weekly to monthly Has demonstrated potential to maintain patients in normal functional AAT range Recombinant manufacturing provides abundant supply with no pathogen risk

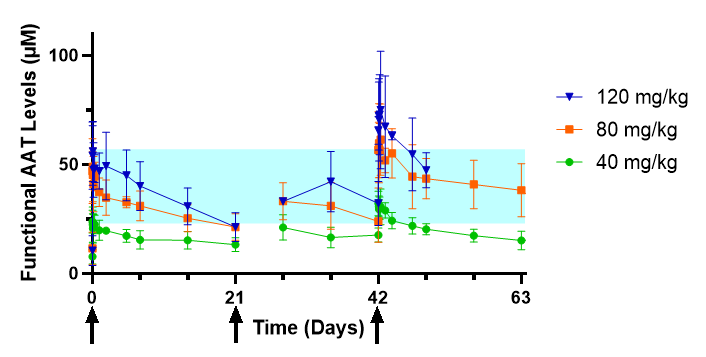

10 Complete Ongoing INBRX-101 - Topline results from Phase 1, Part 2 N=18 * bronchoalveolar lavage N=6 40 mg/kg N=6 80 mg/kg* N=6 120 mg/kg* INBRX-101 Topline Results - 40, 80 or 120 mg/kg(Q3W) + MAD cohorts demonstrate Cavg of functional AAT of 40.4 µM over the 21-day dosing interval following the third 80 mg/kg dose PART 2 Time (days) Fu nc tio na l A AT le ve ls (μ M ) 0 21 42 63 0 50 100Multiple ascending dose escalation (MAD) *Indicates timing of each dose 120 mg/kg 80 mg/kg 40 mg/kg 25 75 + Favorable safety and tolerability profile with only mild and a few moderate AEs that were transient and fully reversible with minimal or no symptomatic care + Dose related increases in maximal and total exposure occurred across entirety of SAD and MAD ranges of 10-120 mg/kg + Revealed potential to achieve normal AAT levels with monthly dosing

11 INBRX-101 - Results from Phase 1, Part 1 N=24 Complete N=6 10 mg/kg N=6 40 mg/kg N=6 120 mg/kg N=6 80 mg/kg Single ascending dose escalation (SAD) PART 1 + Favorable safety and tolerability profile with no drug-related SAEs at doses up to and including 120 mg/kg SAD + Dose related increases in maximal and total exposure were observed across entirety of SAD range of 10-120 mg/kg + Revealed potential to achieve normal AAT levels with monthly dosing Key functional AAT levels by dose Fu nc tio na l A AT le ve ls (μ M ) 10 40 80 120 20 0 40 60 Baseline AAT Max AAT Day 21 AAT 80 INBRX-101 single ascending dose (mg/kg)

12 INBRX-101 has the potential to achieve ~$3B in annual U.S. revenue with expected rapid uptake in patients with severe AATD Notes: *Pricing assumption is for modelling purposes only Source: KOL Qualitative Interviews (n=~25); EvaluatePharma, Datamonitor, IQVIA, Fortune Business Insights, Analog analysis of other recombinant products $0B $3B $0.3B 1721 3 $0.7B $1.3B $3.0B U. S. p ro je ct ed s al es (U SD ) Years post launch + “Severe (ZZ/SZ)” AATD patients (same as pdAATs today) + 7% CAGR throughout forecast period (conservative estimate given CAGR of ~17% from 2016 to 2020) + ~75% peak market share + 3-year time to peak share + Price parity with current pdAATs* & 2% annual price growth KEY ASSUMPTIONS 3 years to peak market share UPSIDE POTENTIAL + Potential for higher pricing if “double dose” (120 mg/kg) pdAAT targeting normal trough levels is positive (SPARTA trial) INBRX-101 top line projected U.S. sales & key assumptions

13 INBRX-101 has the potential to shift the treatment paradigm, expanding augmentation therapy to a broad group of AATD patients in the U.S. Notes: *Market Revenue for the “Less Severe” dependent on multitude of factors including pricing based on optimal dose in this population Sources: KOL Interviews, 1. Sandhaus Chronic Obstr Pulm Dis 2016; 2. Barjaktarevic and Miravitlles BMC Pulm Med 2021 TODAY FUTURE PI*ZZ or PI*SZ PI*ZZ or PI*SZ PI*MZ* U.S. prevalence ~100K ~100K (same as today) ~5-12M Treatment rate ~8-10% ~40% (driven by increased diagnosis rates) ~1-3% (driven by new clinical studies) Total treated U.S. patients ~8K ~40K ~50-360K Market revenue potential ~$1 Billion ~$4 Billion * + pdAATs only utilized for severe AATD patients today + Despite 8-10% treatment rate, the market is still worth ~$1B today and growing at ~17% annually KEY TAKEAWAYS FOR AATD MARKET TODAY + PI*ZZ & PI*SZ AATD market projected to grow to $4B due to increased diagnosis + PI*MZ patients may also benefit from treatment in the future + Commercial viability and exploration of augmentation therapy in PI*MZ patients requires abundant supply only available via INBRX-101 KEY TAKEAWAYS FOR FUTURE AATD MARKET “The results of the RAPID trial stress the importance of early intervention. Patients who started augmentation late were unable to regain lung tissue lost during placebo treatment and did not ‘catch up’ to patients who started augmentation early.” – U.S. KOL

INBRX-109 Tetravalent DR5 Agonist

15 Tetravalent DR5 agonist + Death receptor 5 (DR5) is a receptor for the tumor necrosis factor-related apoptosis-inducing ligand (TRAIL) + DR5 activation naturally eliminates damaged and neoplastic cells DR5: sdAb DR5: sdAbDR5: sdAb DR5: sdAb 105 kDa Fc: effector function disabled

16 INBRX-109 is a best-in-class DR5 agonist CANDIDATE VALENCY SIZE (KDA) INBRX-109 Tetravalent 105 TAS-2661 Tetravalent 60 Eftozanermin alpha (TRAIL-Fc fusion) Hexavalent 167 GEN10291,2 Dodecavalent 150 ka (2x mAbs) IGM-8444 Decavalent3 ~950 Dulanermin (recombinant TRAIL) Trivalent 150 Tigatuzumab Bivalent 150 LBY-135 Conatumumab Drozitumab Lexatumumab 1. Discontinued 2. Two hexamerizing non-competing mAbs 3. Size and rigidity of IgM may prevent effective clustering of DR5

17 Best Response 3mo 6mo 9mo 12mo SD (-20%) 77wks SD (-11%) 64wks SD (-7%) 62wks PR (-61%) SD (-13%) SD (+3%) PR (-32%) SD (-4%) ** SD (-1%) ► SD (-3%) SD (-20%) ► SD (+5%) SD (+3%) * SD (-5%) * SD (+5%) SD (+7%) PD (+31%) PD (+16%) Pending ► Pending ► Weeks 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 45 46 47 48 49 50 51 52 53 54 55 Preliminary Phase 1 data in unresectable or metastatic conventional chondrosarcoma + Data cut point 01-Oct-2021 from Nov 2021 CTOS presentation, study ongoing + Response per RECISTv1.1 per Investigator assessment, data subject to change (e.g., some data raw and not verified) + PR=Partial Response, SD=Stable Disease, PD=Progressive Disease + ► Subject ongoing + *Off-study per subject request (e.g., resection) or **Investigator discretion

18 ENDPOINTS Primary: Progression free survival Secondary: Overall survival, quality of life, overall response rate, duration of response, disease control rate, safety, etc. INBRX-109 Phase 2 potentially registration-enabling study design in chondrosarcoma Randomization Conventional chondrosarcoma, Grades 1, 2 and 3, unresectable or metastatic Stratification by line of therapy, Grade and IDH1/2 mutation status INBRX-109 Placebo Until PD or toxicity with cross-over to INBRX-109 *Including interim analysis N=134* N=67 * 3 mg/kg every three weeks 1H 2024 Initiated PFS from other placebo-controlled chondrosarcoma studies Therapeutic IPI-926 (HH) Control arm Placebo Subject number 100 (2:1) Placebo arm Median PFS 2.9 months Source~ European Journal of Cancer 2021 Florence Duffaud et al. Therapeutic Regorafenib Control arm Placebo Subject number 46 (2:1) Placebo arm Median PFS~ 2 months Source~ CTOS 2013 Wagner et al. + No approved systemic therapeutic for the treatment of chondrosarcoma + FDA Fast Track designation and orphan-drug designation in unresectable and metastatic conventional chondrosarcoma

19 Many patients with local disease eventually progress to unresectable or metastatic chondrosarcoma, providing an annual prevalent patient pool of ~2.5K in the U.S. At Diagnosis Recurrence at 10 years Conventional chondorsarcoma Local (~75%) Low grade resectable (~55%) Metastatic (~25%) High grade resectable (~12%) Only local (~14%) Unresectable or metastatic (~2%) Only local (~2%) Unresectable or metastatic (~5%) Cured (~39%) Cured (~5%) Unresectable (~8%) Conventional chondrosarcoma patient flow KEY TAKEAWAYS + Unresectable or metastatic opportunity estimated at ~2.5K patients in the U.S. today vs. reported incidence of ~1.5K given tendency for local disease to progress to unresectable or metastatic + Longer term growth opportunity in the peri- operative setting for high-risk patients with ~1.6K prevalent patients in the U.S. today Legend: Unresectable or metastatic population (opportunity at launch) Peri-operative opportunity in high-risk patients (growth opportunity) Sources: KOL Interviews (n=20); Kythera claims database (~60% of all U.S. insurance claims); Inhibrx secondary research; Hua et al., Treatment Method and Prognostics…, 2020

20 Based on current trends and lack of approved options, INBRX-109 has the potential to achieve ~$1B in annual revenue with rapid uptake post launch Notes: *Pricing assumption is for modelling purposes only based on analogous market research for oncology products in rare indications; Sources: KOL qualitative interviews (n=~20); Inhibrx secondary research; Hua et al., Treatment Method and Prognostics…, 2020 $0B $1B $1.0B $0.3B 3 $0.1B 21 $0.6B 17 U. S. p ro je ct ed s al es (U SD ) Years post launch + ~375K* annual price per patient + ~85% peak share + ~30% 10-year recurrence rate for local, low- grade patients + ~65% 10-year recurrence rates for local, high- grade patients KEY ASSUMPTIONS 3 years to peak market share INCREMENTAL GROWTH OPPORTUNITY + Peri-operative setting provides an incremental ~$500M annual opportunity in the U.S. alone INBRX-109 top line projected U.S. sales in the unresectable/metastatic setting & key assumptions

21 Best response 3mo 6mo 9mo SD (-24%) * SD (-17%) SD (-12%) PR (-100%) SD (-22%) SD (-20%) SD (-12%) SD (-5%) SD (-2%) SD (+9%) SD (+13%) SD (+16%) SD (+1%) * PD PD PD PD (+25%) PD (+33%) PD (+33%) Weeks 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 Combination study Mesothelioma with Cisplatin or Carboplatin N=10 + Time on treatment in weeks + Data cut point 24-N0V-2020, data from Ph1 INBRX-109 study, single agent mesothelioma cohort closed + Response per RECISTv1.1 or modified RECIST, and per Investigator assessment, data subject to change (e.g., some data raw and not verified) Phase 1 single agent data in malignant pleural mesothelioma, epithelioid subtype Late 2022 PART 3 + Efficacy population (subjects who completed 2 cycles and had at least one tumor assessment, or discontinued early due to PD); three subjects not evaluable for efficacy were excluded + PR=Partial Response, SD=Stable Disease, PD=Progressive Disease + * Off-study per subject or Investigator request N=10 Mesothelioma with Cisplatin or Carboplatin with Pemetrexed PARTs 1 & 2

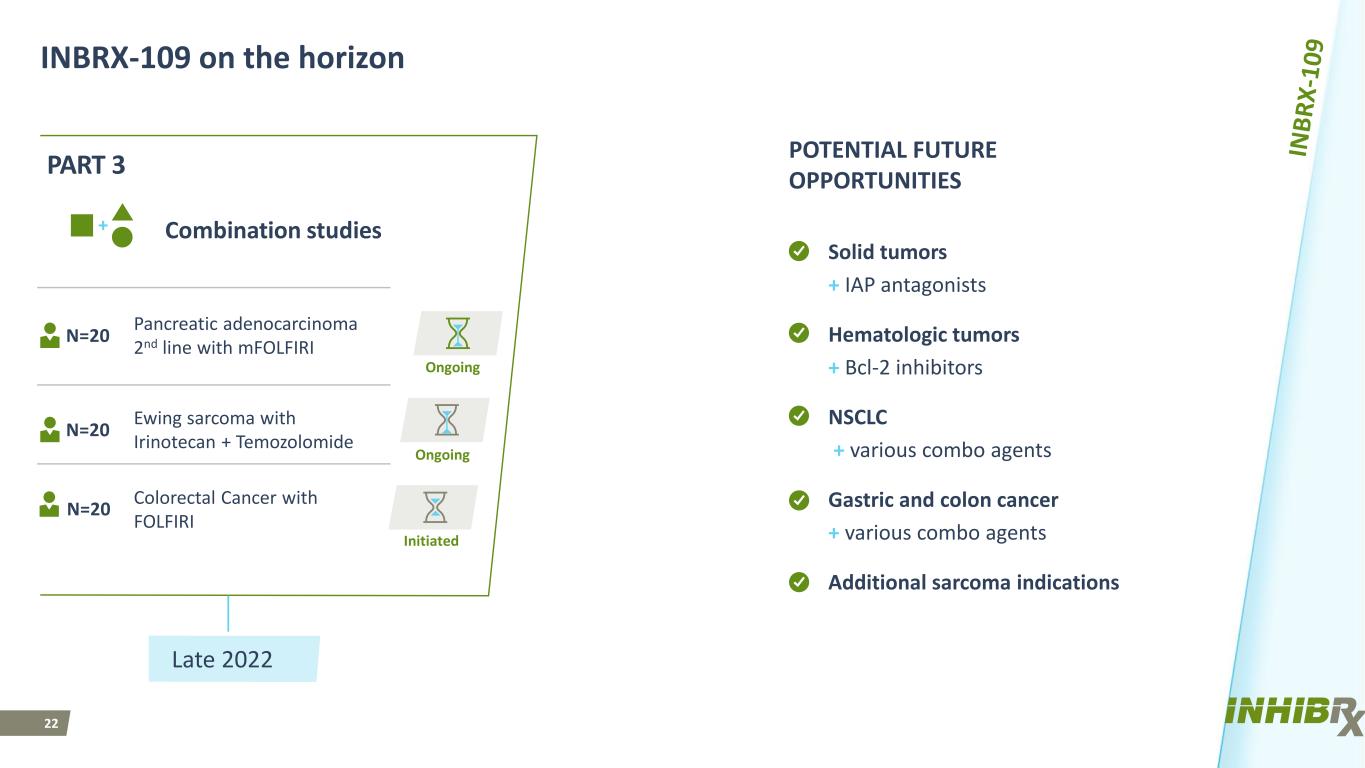

22 Ongoing Ongoing POTENTIAL FUTURE OPPORTUNITIES Solid tumors + IAP antagonists Hematologic tumors + Bcl-2 inhibitors NSCLC + various combo agents Gastric and colon cancer + various combo agents Additional sarcoma indications INBRX-109 on the horizon Combination studies Pancreatic adenocarcinoma 2nd line with mFOLFIRIN=20 Ewing sarcoma with Irinotecan + TemozolomideN=20 PART 3 Colorectal Cancer with FOLFIRI Initiated N=20 Late 2022

INBRX-106 Hexavalent OX40 Agonist

24 Hexavalent OX40 agonist OX40 is a co-stimulatory receptor on activated T-cells designed to: + Provide co-stimulation to activated T-cells + Reverse regulatory T-cell induced immune suppression + Enhance T-cell functionality + Provide additional benefit in combination with PD-1 blockade OX40: sdAb OX40: sdAb OX40: sdAbOX40: sdAb OX40: sdAb OX40: sdAb Fc 129 kDa

25 INBRX-106 is a best-in-class OX40 agonist CANDIDATES VALENCY ISOTYPE LIGAND BLOCKING STATUS INBRX-106 Hexa- IgG1 N Ph 1 (2019) MOXR-0916 Bi- IgG1 Y Discontinued GSK-3174998 Discontinued BMS-986178 Ph 1 (2016) INCAGN-1949 Ph 1 (2016) ABBV-368 Ph 1 (HNSCC, 2020) IBI-101 Ph 1 (2018) MEDI-0562 Discontinued PF-04518600 Bi- IgG2 Y Discontinued BGB-A445 Bi- IgG1 N Ph 1 (2020) BAT6026 Bi- IgG1 afucosylated mAb n/a INBRX-106 Hexavalent Strong OX40 signaling OX40 Bivalent anti- OX40 Weak OX40 signaling OX40

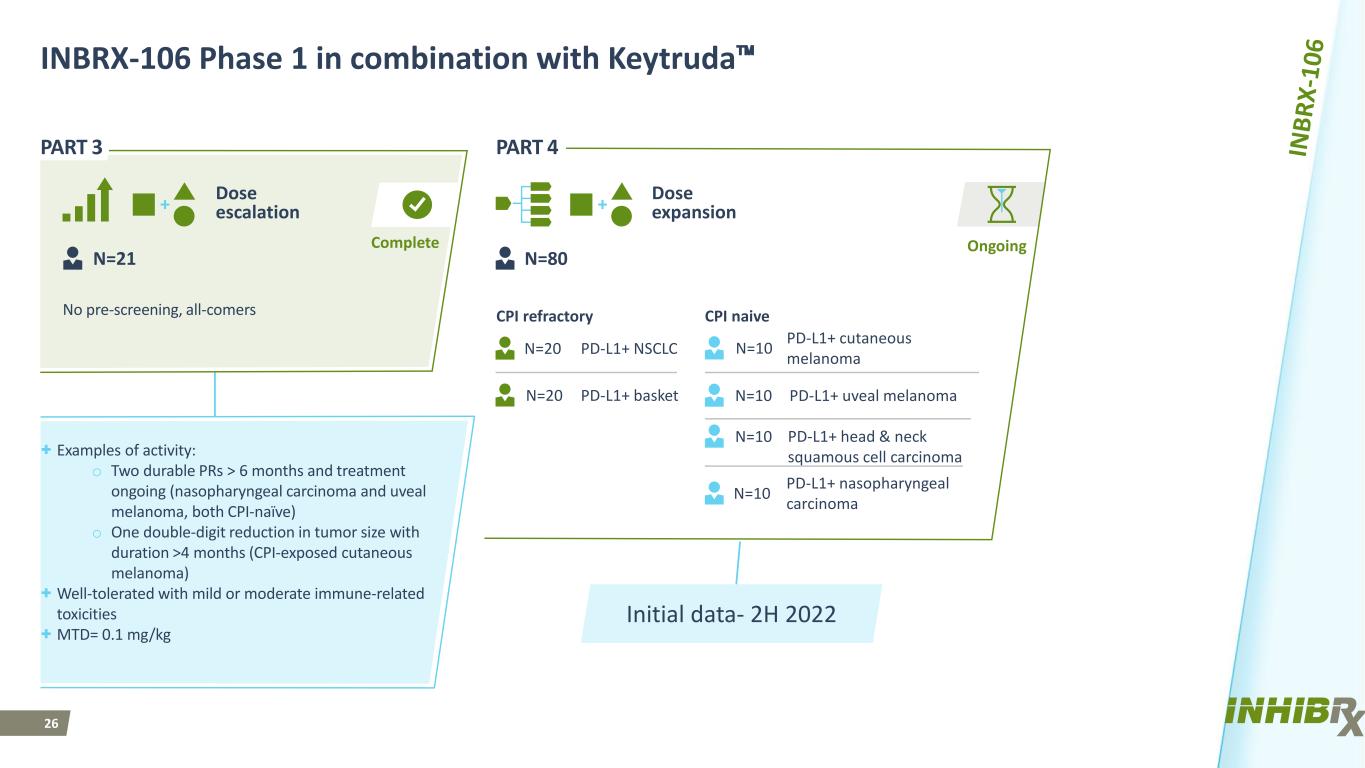

26 Complete PART 3 + Examples of activity: o Two durable PRs > 6 months and treatment ongoing (nasopharyngeal carcinoma and uveal melanoma, both CPI-naïve) o One double-digit reduction in tumor size with duration >4 months (CPI-exposed cutaneous melanoma) + Well-tolerated with mild or moderate immune-related toxicities + MTD= 0.1 mg/kg INBRX-106 Phase 1 in combination with Keytruda™ Ongoing No pre-screening, all-comers N=80N=21 N=20 PD-L1+ NSCLC N=20 PD-L1+ basket Initial data- 2H 2022 PD-L1+ head & neck squamous cell carcinoma N=10 CPI refractory CPI naive N=10 PD-L1+ cutaneous melanoma N=10 PD-L1+ nasopharyngeal carcinoma N=10 PD-L1+ uveal melanoma Dose escalation Dose expansion PART 4

27 Complete INBRX-106 Phase 1 preliminary single agent activity Ongoing Dose escalation Dose expansion PART 1 + 4/10 response evaluable NSCLC & melanoma patients with duration of stable disease* greater than 6 months (three CPI-exposed patients and one CPI-naïve uveal melanoma patient) + Longest duration of stable disease to date as of January 10, 2022= 95 weeks and ongoing (NSCLC patient refractory to Keytruda™) + Well-tolerated with mild or moderate immune-related toxicities PART 2 0.03 mg/kg in two different dosing schedules in patients with tumor types responsive to CPIs Patients were all-comers *per investigator assessment N=20 N=24

28 Market opportunity for INBRX-106 and INBRX-105 The figures on this slide represent market research estimates from Evaluate Pharma *Keytruda™ and Opdivo® go off patent in 2028 $14.4 $7.9 $2.9 $2.0 $1.0 $28.2$27.1 $14.2 $7.4 $4.7 $10.1 $63.5 $0 $10 $20 $30 $40 $50 $60 $70 KEYTRUDA* OPDIVO* TECENTRIQ IMFINZI OTHER TOTAL 2020 Projected 2026 0 5 10 15 20 25 30 Total Other indications SCLC Gastrointestinal adenocarcinoma Head & neck cancers Bladder cancer Renal cell carcinoma Melanoma NSCLC 2020 PD-1/PD-L1 WW Revenue (in $ billions) PD-1/PD-L1 WW Revenue by Indication (in $ billions)

INBRX-105 PD-L1 x 4-1BB Multispecific

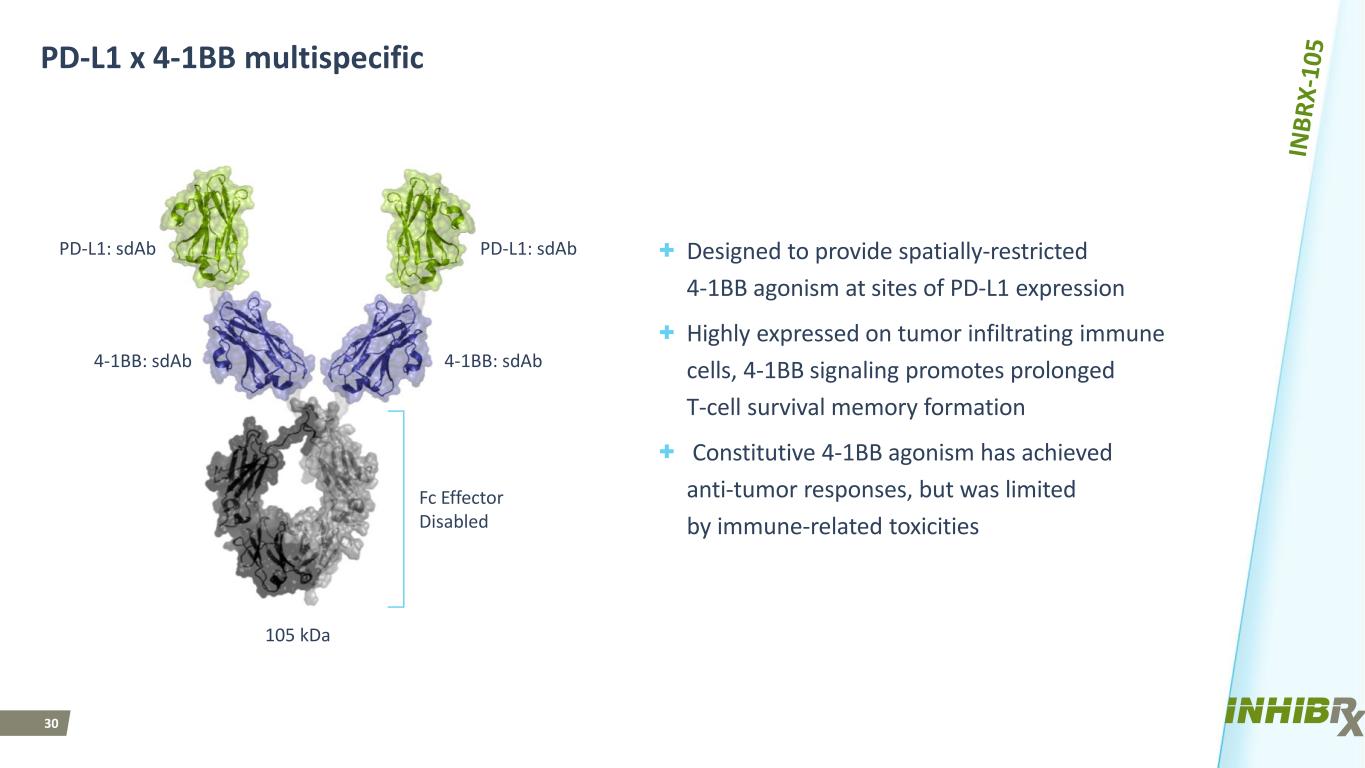

30 PD-L1 x 4-1BB multispecific + Designed to provide spatially-restricted 4-1BB agonism at sites of PD-L1 expression + Highly expressed on tumor infiltrating immune cells, 4-1BB signaling promotes prolonged T-cell survival memory formation + Constitutive 4-1BB agonism has achieved anti-tumor responses, but was limited by immune-related toxicities PD-L1: sdAb 4-1BB: sdAb Fc Effector Disabled PD-L1: sdAb 4-1BB: sdAb 105 kDa

31 INBRX-105 is a potential best-in-class 4-1BB agonist CANDIDATE FORMAT 4-1BBL BLOCKING INBRX-105 Bivalent/Bivalent No Gen-1064 Monovalent/Monovalent n/a MCLA-145 Monovalent/Monovalent Yes FS222 Bivalent/Bivalent n/a PRS-343 Bivalent/Bivalent No ND021 Monovalent/Monovalent n/a CANDIDATE IGG SUBCLASS 4-1BBL BLOCKING STATUS Urelumab IgG4 Yes Discontinued Utomilumab IgG2 No Discontinued CTX-471 IgG4 No Phase I ADG106 IgG4 Yes Phase I ATOR-1017 IgG4 Yes Phase I AGEN2373 IgG1 No Phase I LVGN6051 unknown n/a Phase I PD-L1 x 4-1BB Bispecifics Monoclonal 4-1BB Antibodies

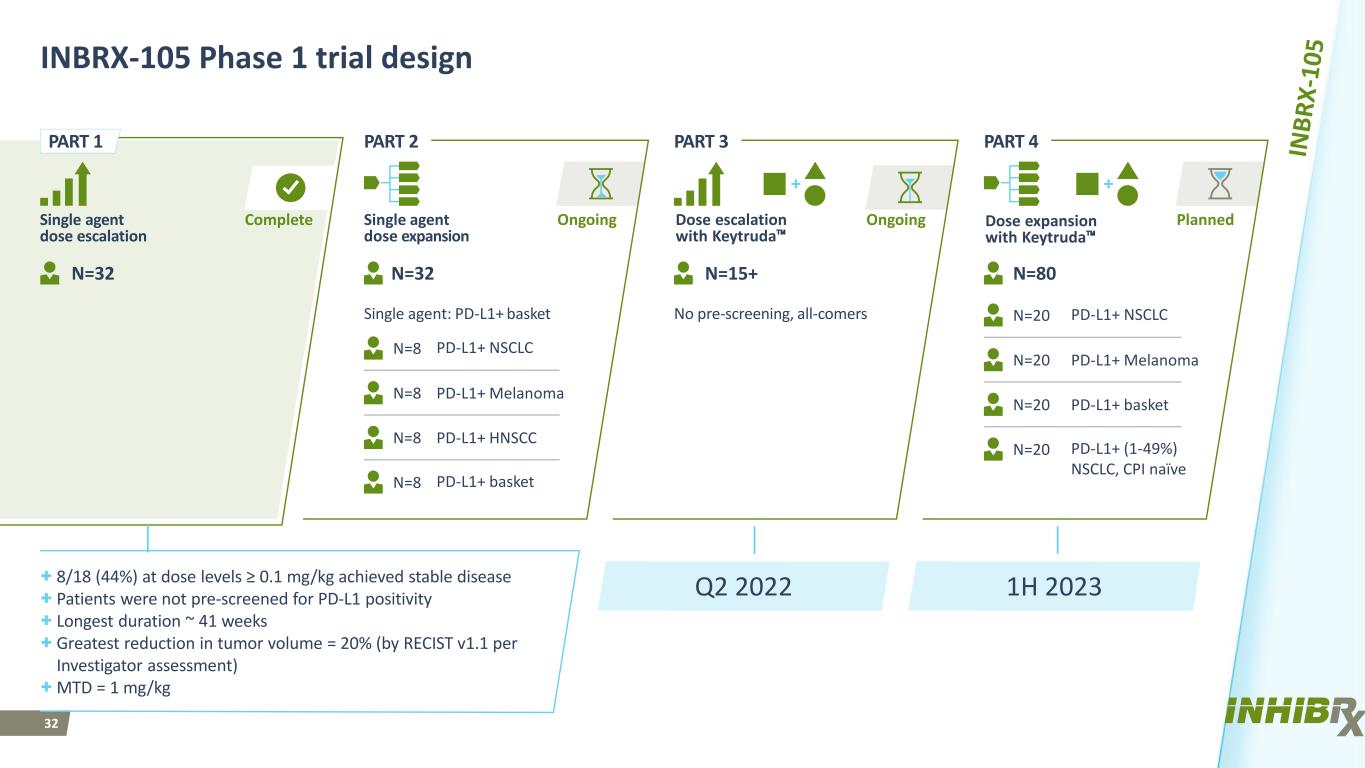

32 PlannedOngoingOngoingComplete INBRX-105 Phase 1 trial design Single agent: PD-L1+ basket Single agent dose escalation Single agent dose expansion N=80N=32 N=15+N=32 No pre-screening, all-comers + 8/18 (44%) at dose levels ≥ 0.1 mg/kg achieved stable disease + Patients were not pre-screened for PD-L1 positivity + Longest duration ~ 41 weeks + Greatest reduction in tumor volume = 20% (by RECIST v1.1 per Investigator assessment) + MTD = 1 mg/kg N=20 PD-L1+ NSCLC N=20 PD-L1+ Melanoma N=20 PD-L1+ basket N=20 PD-L1+ (1-49%) NSCLC, CPI naїve N=8 PD-L1+ NSCLC N=8 PD-L1+ Melanoma N=8 PD-L1+ HNSCC N=8 PD-L1+ basket Q2 2022 1H 2023 PART 1 PART 2 PART 3 PART 4 Dose expansion with Keytruda™ Dose escalation with Keytruda™

Molecular Targeted Cytokine (MTC) Platform A Targeted Detuned IL-2 Platform

34 Affinity differential enables directed IL-2 expansion/enhancement of specific cell types High affinity antibody targeting INHIBRX has developed sdAbs to an extensive number of antigens + T-cell or NK cell subsets + Activating/co-stimulatory receptors + Inhibitory receptors + Exhaustion markers Proprietary IL2-X: affinity detuned cytokine + Eliminates CD25 binding + Attenuates CD122 binding + Targeting allows for potent pinpointed signaling High affinity sdAb sdAb Low affinity Fc – effector function disabled Proprietary IL2-X

INBRX-121 NKp46 Targeted Detuned IL-2

36 INBRX-121 expanded the NK cell population and enhanced cytotoxicity + NKp46 is an NK-specific marker that maintains expression on tumor-infiltrating NK cells + Proprietary IL2-X engineering ensures specific modulation of NK Cells without impacting T-cell subsets (Tcon and Treg) NKp46 sdAb NKp46 sdAb Fc – effector function disabled Proprietary IL2-X

37 INBRX-121 INBRX-121 is poised to bring NK cells to the forefront of immunotherapy NK NK NK NK NK NK NK NK NK NK Improved NK Activity Safety with durability Single agent Activated NK cells exhibit immediate cytotoxicity Multiple potential paths forward Combination therapy Enhances the activity of therapeutic antibodies ⁺ Expands NK cell numbers ⁺ Overcomes suppression ⁺ Enhances cytotoxic capacity ⁺ Cytokine release syndrome not caused by NK cells ⁺ Extended exposure drives durability CYTOKINES INBRX-121

38 Expanded mouse NK cells and enhanced their cytotoxic potential 0 2,000 3,000 4,000 5,000 KL RG 1 le ve ls 5,000 10,000 15,000 20,000 Gr an zy m e B le ve ls M ax . f ol d- ch an ge (r el at iv e to v eh ic le ) 0 5 10 20 25 15 NK cells CD8 T cells Tregs CD4+Tcon B cells NK cell cytolytic activityNK cell activationNK cell expansion Vehicle INBRX-121 1,000 0 Vehicle INBRX-121

39 Synergized with approved therapeutic antibodies INBRX-121 synergized with Rituxan® in a subcutaneous Raji tumor model resulting in complete tumor regression Dosing Days TREATMENT COMPLETE RESPONSES Rituxan® 0/10 INBRX-121 + Rituxan® 9/10 Raji tumor growth 0 42 Time (days) 0 Tu m or Vo lu m e (m m 3 ) 500 1,000 1,500 2,000 7 14 21 28 35 INBRX-121 + Rituxan INBRX-121 Rituxan Vehicle

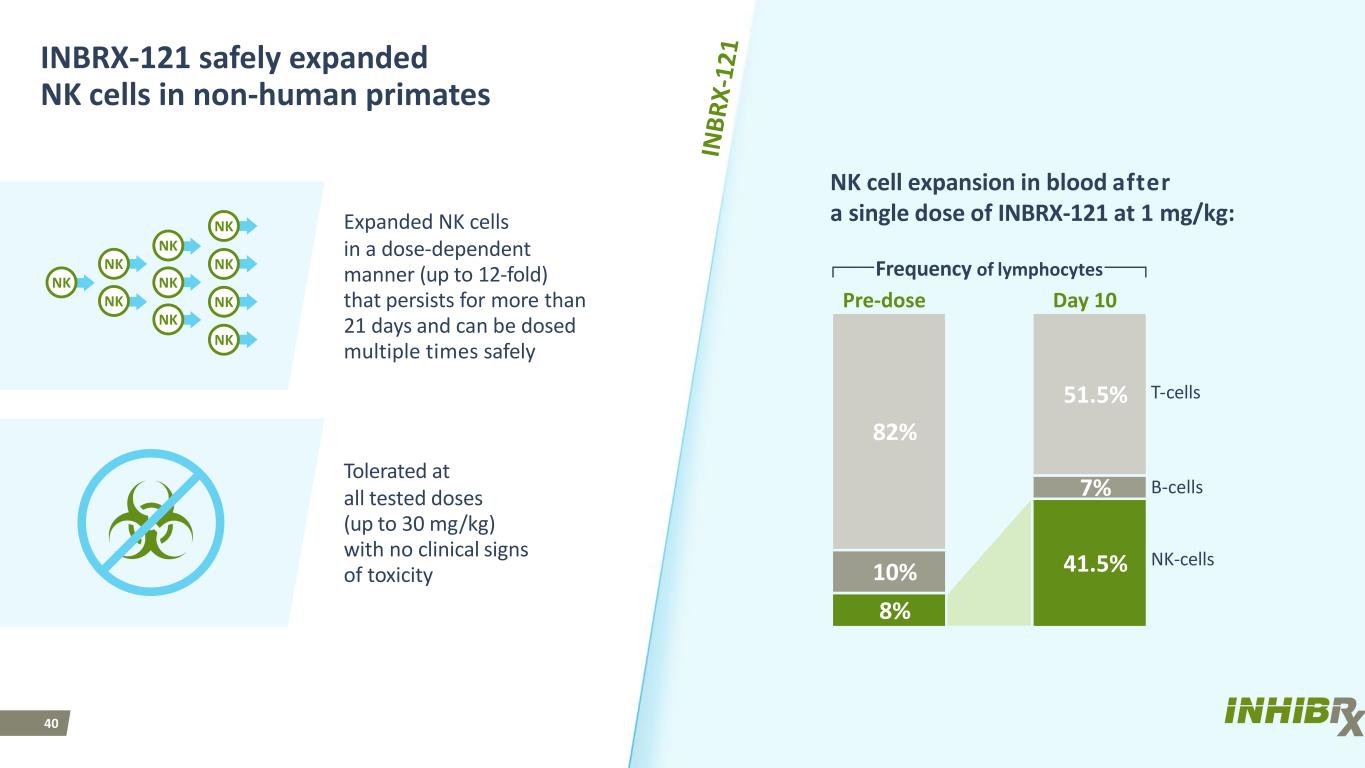

40 INBRX-121 safely expanded NK cells in non-human primates 8% 82% 10% 41.5% 51.5% 7% Expanded NK cells in a dose-dependent manner (up to 12-fold) that persists for more than 21 days and can be dosed multiple times safely Tolerated at all tested doses (up to 30 mg/kg) with no clinical signs of toxicity NK cell expansion in blood after a single dose of INBRX-121 at 1 mg/kg: T-cells B-cells NK-cells Frequency of lymphocytes Pre-dose Day 10 NK NK NK NK NK NK NK NK NK NK

41 Expanded NK cells from Lymphoma patients NK cells from Lymphoma patients expressed NKp46 at levels similar or above that of healthy donors Patient NK cells responded to stimulation with INBRX-121 by upregulating pSTAT5 and showed an increased proliferative potential - + Healthy Donor 0 20 40 % p ST AT 5 po sit iv e - + FL - + MCL % K i6 7 po sit iv e 60 IL-2 signaling in patient NK cells Patient NK cell proliferation - + DLBCL 0 20 40 60 - + Healthy Donor - + FL - + MCL - + DLBCL - +: 1 nM INBRX-121 DLBCL: Diffuse large B-cell Lymphoma MCL: Mantle cell Lymphoma FL: Follicular Lymphoma INBRX-121 INBRX-121

42 Expanded the number of NK cells while enhancing their individual cytotoxic capacities INBRX-121 increased NK cell-mediated killing of Raji cells in the presence of a Rituximab sequence analog (Anti-hCD20- hIgG1). Raji cell killing after INBRX-121 pre-incubation Effector: target ratio 0 % Ta rge t c ell de ath 40 80 100 120 2.5:1 5:1 10:1 20:1 40:1 Anti-hCD20-hlgG1 + INBRX-121 Anti-hCD20-hlgG1 only 60 20

43 Near term expected clinical milestones 1H 2022 2H 2022 (OX40) / Keytruda initial dose expansion cohort data (AAT) Additional Phase 1 data (PD-L1 x 41BB) Keytruda dose escalation data (PD-L1 x 41BB) Keytruda dose expansion cohort data (DR5) Initial mesothelioma, Ewing sarcoma, pancreatic cancer, and colorectal cancer combination study data INBRX-105 INBRX-109 INBRX-105 INBRX-101 INBRX-106 INBRX-101 (AAT) Potential start to registration study 1H 2023 INBRX-121 (IL-2) IND filing

11025 N. Torrey Pines Rd Ste 200 La Jolla, CA 92037 www.inhibrx.com

Exhibit 99.2

INBRX-101 Shows Favorable Safety Profile in Patients with Alpha-1 Antitrypsin Deficiency and Demonstrates Potential to Achieve Normal Functional Alpha-1 Antitrypsin Levels with Monthly Dosing

•Topline results from the Phase 1 study showed a favorable safety and tolerability profile with no drug-related severe or serious adverse events.

•Topline data from the multiple ascending dose cohorts of 40, 80 and 120 mg/kg demonstrated the average level (“Cavg”) of functional alpha-1 antitrypsin (“AAT”) achieved by INBRX-101 was 40.4 micromolar (“µM”) over the 21-day dosing interval following the third 80 mg/kg dose.

•Functional AAT levels collected from 65 healthy individuals with the MM genotype revealed a 5th/95th percentile range of 23 to 57 µM and a median of 38 µM.

SAN DIEGO, May 16, 2022 /PRNewswire/ -- Inhibrx Inc. (Nasdaq: INBX), a biotechnology company with four clinical programs in development and an emerging pre-clinical pipeline, today announced topline results from a Phase 1 clinical trial evaluating the safety, pharmacokinetics (“PK”) and pharmacodynamics (“PD”) of INBRX-101, an optimized recombinant human AAT-Fc fusion protein, in patients with alpha-1 antitrypsin deficiency (“AATD”).

Data from this multi-country Phase 1 study are from 31 patients with AATD: 26 with the ZZ genotype, 3 with the SZ genotype and 2 with the MZ genotype of the SERPINA1 gene, the underlying cause of AATD. Treatment was well tolerated with no severe or serious adverse events related to the study drug. Drug-related adverse events were predominantly mild and those few that were moderate in severity were all transient and reversible, with minimal or no symptomatic care. No safety-related or PK/PD-related signs of neutralizing anti-drug antibodies were observed.

Dose-related increases in maximal and total INBRX-101 exposure occurred across the entirety of the single and multiple ascending dose ranges.

Data from the multiple ascending dose cohorts of INBRX-101 at 40, 80 and 120 mg/kg IV every three weeks showed the expected accumulation of functional AAT levels. Based on PK modeling, accumulation is expected to continue following subsequent doses and reach a steady-state after a total of approximately five to six consecutive doses, administered every three weeks.

Exhibit 99.2

Functional AAT levels over time in AATD patients administered

40, 80 or 120 mg/kg INBRX-101 every three weeks

–Arrows indicate INBRX-101 IV dosing.

–The shaded region represents the normal range of functional AAT in healthy adults.

–Functional AAT samples were not collected immediately following the second dose (Day 21).

–Results shown are from preliminary, unaudited data. Data shown from the 120 mg/kg multiple dose cohort are from the first 4 evaluable patients; the full dataset is still being collected and analyzed and will be presented at a later date.

The current standard of care, plasma-derived AAT, dosed once weekly at 60 mg/kg, achieves a Cavg of functional AAT of 17.8 µM over the weekly dosing interval as calculated from steady-state area under the curve (“AUC”) values reported in Stocks et al. BMC Clinical Pharmacology 2010, 10:13. INBRX-101 achieved a mean Cavg of functional AAT of 40.4 µM over the 21-day dosing interval following the third 80 mg/kg dose.

To date, bronchoalveolar lavage fluid samples have been processed from two 80 mg/kg multiple ascending dose cohort individuals and confirm the presence of INBRX-101 in the lung fluid.

Additionally, functional AAT levels were measured in plasma samples from 65 normal MM genotype individuals. This analysis revealed the 5th and 95th percentiles of functional AAT levels in the normal MM genotype individuals were 23 and 57 µM, respectively, with a median of 38 µM.

Exhibit 99.2

Functional AAT levels in 65 healthy volunteers and 30 Phase 1 AAT study participants at baseline prior to dosing of INBRX-101

–Box plots show the minimum, lower quartile, median, upper quartile and maximum.

–The shaded region represents the 5th-95th percentiles of the normal range of functional AAT in healthy MM genotype adults.

–AAT variant determination was conducted by the Mayo Clinic Laboratories using an LC-MS/MS method (A1ALC).

–The Ph 1 baseline data represents the functional AAT levels measured in patients at the beginning of the study prior to dosing of INBRX-101.

“We believe this data demonstrates the potential of INBRX-101 to change the paradigm of treatment of AAT deficiency by maintaining patients in the normal range of functional AAT while reducing infusions from 52 annually to as few as 12 annually. We look forward to working with regulators, clinicians and patients to expedite this therapy to AAT deficient patients as rapidly as possible,” said Mark Lappe, CEO of Inhibrx.

The Company will host a live webcast presentation today, May 16th, at 1:30 p.m. PT to further discuss the results.

About the Conference Call

Investors may join via the web: https://app.webinar.net/60dmpLaBwqx or may listen to the call by dialing (1-888-220-8451). Please refer to Inhibrx, Inc. or confirmation code 2516861 when calling in. Following the webcast, the presentation may be accessed through a link on the investors section of Inhibrx’s website at https://inhibrx.investorroom.com/events-and-presentations. The webcast will be available for 60 days following the event. Following the presentation, Inhibrx will update its corporate presentation within the “Investors” section of its website at www.inhibrx.com.

Exhibit 99.2

About INBRX-101 and AATD

INBRX-101 is a precisely engineered recombinant human AAT-Fc fusion protein designed to safely achieve and maintain levels of AAT found in healthy individuals with the potential for once-monthly dosing.

AATD is an inherited orphan disease affecting an estimated 100,000 patients in the United States. AATD is characterized by deficient levels of the AAT protein, which causes loss of lung tissue and function and decreased life expectancy. Plasma-derived AAT is the current standard of care and does not maintain patients in the normal AAT range, requires frequent and inconvenient once-weekly IV dosing, and relies on plasma collection practices that might not be sustainable.

About Inhibrx, Inc.

Inhibrx is a clinical-stage biotechnology company focused on developing a broad pipeline of novel biologic therapeutic candidates in oncology and orphan diseases. Inhibrx utilizes diverse methods of protein engineering to address the specific requirements of complex target and disease biology, including its proprietary sdAb platform. Inhibrx has collaborations with 2seventy bio (formerly bluebird bio), Bristol-Myers Squibb and Chiesi. For more information, please visit www.inhibrx.com.

Forward-Looking Statements

Inhibrx cautions you that statements contained in this press release regarding matters that are not historical facts are forward-looking statements. These statements are based on Inhibrx's current beliefs and expectations. These forward-looking statements include, but are not limited to, statements regarding: Inhibrx's and its investigators’ judgments and beliefs regarding the observed safety and efficacy to date of its therapeutic candidate, INBRX-101, discussions with and beliefs regarding future action by the U.S. Food and Drug Administration, statements and beliefs regarding the current standard of care for AAT and the sustainability of current plasma collection practices and the potential for INBRX-101 to change the standard of care, future clinical development, application and dosage of INBRX-101 and the presumption that topline data will be representative of final data and that PK modeling is an accurate predictor of PK levels on a broader basis. Actual results may differ from those set forth in this press release due to the risks and uncertainties inherent in Inhibrx's business, including, without limitation, risks and uncertainties regarding: the initiation, timing, progress and results of its preclinical studies and clinical trials, and its research and development programs; its ability to advance therapeutic candidates into, and successfully complete, clinical trials; its interpretation of initial, interim or preliminary data from its clinical trials, including interpretations regarding disease control and disease response; the timing or likelihood of regulatory filings and approvals; the successful commercialization of its therapeutic candidates, if approved; the pricing, coverage and reimbursement of its therapeutic candidates, if approved; its ability to utilize its technology platform to generate and advance additional therapeutic candidates; the implementation of its business model and strategic plans for its business and therapeutic candidates; its ability to successfully manufacture therapeutic candidates for clinical trials and commercial use, if approved; its ability to contract with third-party suppliers and manufacturers and their ability to perform adequately; the scope of protection it is able to establish and maintain for intellectual property rights covering its therapeutic candidates; its ability to enter into strategic partnerships

Exhibit 99.2

and the potential benefits of these partnerships; its estimates regarding expenses, capital requirements and needs for additional financing and financial performance; its expectations regarding the impact of the COVID-19 pandemic on its business; and other risks described in Inhibrx's filings with the U.S. Securities and Exchange Commission (the "SEC"), including under the heading "Risk Factors" in Inhibrx's Annual Report on Form 10-K for the year ended December 31, 2021, as filed with the SEC on February 28, 2022, as well as its Quarterly Reports on Form 10-Q, and supplemented from time to time by its Current Reports on Form 8-K. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and Inhibrx undertakes no obligation to update these statements to reflect events that occur or circumstances that exist after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. This press release contains estimates and other statistical data made by independent parties and by Inhibrx. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates.

Investor and Media Contact:

Kelly Deck, CFO

kelly@inhibrx.com

858-795-4260

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Biodesix to Report First Quarter 2024 Financial Results on May 8, 2024

- Virtu Announces First Quarter 2024 Results

- Hilton Reports First Quarter Results

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share