Form 8-K Independent Bank Group, For: Jul 22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

________________________

FORM 8-K

________________________

CURRENT REPORT

PURSUANT TO SECTION 13 or 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

________________________

Date of Report (Date of earliest event reported):

(Exact Name of Registrant as Specified in Charter)

________________________

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||||||

(Address of principal executive offices) (Zip code)

Registrant’s telephone number, including area code:

(972 ) 562-9004

Not Applicable

(Former name or former address, if changed since last report)

________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Exchange on Which Registered | ||||||

Indicate by checkmark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2):

Emerging growth company ☐

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

In accordance with Item 2.02 of Form 8-K of the Securities and Exchange Commission (the “SEC”), Independent Bank Group, Inc., a Texas corporation (the “Company”), is furnishing to the SEC a press release that the Company issued on July 25, 2022 (the “Press Release”). The Press Release disclosed certain information regarding the Company’s results of operations for the three and six months ended June 30, 2022, and the Company’s financial condition as of June 30, 2022. A copy of the text of the Press Release is attached hereto as Exhibit 99.1.

Item 7.01. Regulation FD Disclosure.

On July 25, 2022, the Company made available earnings release presentation materials regarding its operating and financial results for the quarter ended June 30, 2022. A copy of the earnings release presentation materials is attached hereto as Exhibit 99.2.

In accordance with the General Instruction B.2 of Form 8-K, the information in Item 2.02 and Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2 hereto, which are furnished herewith pursuant to and relate to Item 2.02 and Item 7.01, respectively, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of Section 18 of the Exchange Act. The information in Item 2.02 and Item 7.01 of this Current Report on Form 8-K and Exhibit 99.1 and Exhibit 99.2 hereto shall not be incorporated by reference into any filing or other document filed by the Company with the SEC pursuant to the Securities Act of 1933, as amended, the rules and regulations of the SEC thereunder, the Exchange Act, or the rules and regulations of the SEC thereunder, except as shall be expressly set forth by specific reference in such filing or document.

Item 8.01. Other Events.

On July 25, 2022, the Company also announced in the Press Release that its Board of Directors declared a quarterly dividend on its common stock in the amount of $0.38 per share. The dividend will be payable on August 18, 2022, to shareholders of record as of the close of business on August 4, 2022.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. | Description of Exhibit | |||||||

| Exhibit 99.1 | ||||||||

| Exhibit 99.2 | ||||||||

| Exhibit 104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document) | |||||||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated July 26, 2022

INDEPENDENT BANK GROUP, INC.

| By: | /s/ David R. Brooks | ||||

| Name: | David R. Brooks | ||||

| Title: | Chairman of the Board and Chief Executive Officer | ||||

| Exhibit 99.1 Press Release For Immediate Release | ||||

INDEPENDENT BANK GROUP, INC. REPORTS SECOND QUARTER FINANCIAL RESULTS AND DECLARES QUARTERLY DIVIDEND

July 25, 2022

McKINNEY, Texas, July 25, 2022 -- Independent Bank Group, Inc. (NASDAQ: IBTX) today announced net income of $52.4 million, or $1.25 per diluted share, for the quarter ended June 30, 2022, compared to $58.2 million, or $1.35 per diluted share, for the quarter ended June 30, 2021 and $50.7 million, or $1.18 per diluted share, for the quarter ended March 31, 2022.

The Company also announced that its Board of Directors declared a quarterly cash dividend of $0.38 per share of common stock. The dividend will be payable on August 18, 2022 to stockholders of record as of the close of business on August 4, 2022.

Highlights

•Net income of $52.4 million, or $1.25 per diluted share and adjusted (non-GAAP) net income of $53.3 million, or $1.27 per diluted share

•Robust organic loan growth of 36.0% annualized for the quarter (excluding warehouse and PPP)

•Net interest income grew 5.2% over the linked quarter

•Increase in the net interest margin to 3.51%, up from 3.22% in linked quarter

•Repurchased over 1.6 million shares of common stock for $115.2 million aggregate during the quarter

“These second quarter results reflect the disciplined execution of our teams in generating strong loan growth across all our markets,” said Independent Bank Group Chairman & CEO David R. Brooks. “This growth is broad-based not only geographically, but across product types, and is reflective of the underlying strength and sustained growth of the Texas and Colorado economies we serve as well as significant investments we have made in our production teams. In addition to this growth, we reported healthy profitability metrics for the second quarter, and credit quality metrics remained strong across our loan book. We were also pleased to execute on our buyback and enhance value for our shareholders through the repurchase of over 1.6 million shares of our common stock during the quarter.”

1

Second Quarter 2022 Operating Results

Net Interest Income

•Net interest income was $138.0 million for second quarter 2022 compared to $129.3 million for second quarter 2021 and $131.1 million for first quarter 2022. The increase in net interest income from the prior year was driven by a shift in the mix of interest earning assets from lower yielding interest-bearing deposits to loans and securities, as well as decreased funding costs on deposits for the year over year period offset by lower acquired loan accretion and PPP income. The increase from the linked quarter was due primarily to increased earnings on loans due to robust organic growth during the quarter offset by lower acquired loan accretion and higher funding costs on deposit accounts due to Fed rate increases during the second quarter. The second quarter 2022 includes $2.3 million in acquired loan accretion compared to $3.6 million in first quarter 2022 and $5.2 million in second quarter 2021. In addition, net PPP fees of $837 thousand were recognized in second quarter 2022 compared to $5.1 million in second quarter 2021 and $1.2 million in first quarter 2022, with total fees left to be recognized of $502 thousand as of June 30, 2022.

•The average balance of total interest-earning assets decreased $713.6 million and totaled $15.8 billion for the quarter ended June 30, 2022 compared to $16.5 billion for the quarter ended June 30, 2021 and decreased $746.9 million from $16.5 billion for the quarter ended March 31, 2022. The decrease from the linked quarter and prior year is primarily due to lower average interest bearing cash balances, which decreased approximately $1.5 billion and $2.0 billion for the respective periods, offset by increases in average balances of loans and securities.

•The yield on interest-earning assets was 3.83% for second quarter 2022 compared to 3.54% for second quarter 2021 and 3.46% for first quarter 2022. The increase in asset yield compared to the linked quarter and prior year is a result of the shift in earning assets discussed above, specifically the reduction of lower yielding interest-bearing deposit balances to higher yielding loans due to the strong loan growth during the period. The average loan yield, net of acquired loan accretion and PPP income was 4.18% for the current quarter, compared to 4.09% for the linked and prior year quarter.

•The cost of interest-bearing liabilities, including borrowings, was 0.50% for second quarter 2022 compared to 0.60% for second quarter 2021 and 0.36% for first quarter 2022. The increase from the linked quarter is reflective of higher rates on deposit products tied to Fed funds rates while the decrease from the prior year reflects overall lower funding costs on deposit products for the year over year period.

•The net interest margin was 3.51% for second quarter 2022 compared to 3.14% for second quarter 2021 and 3.22% for first quarter 2022. The net interest margin excluding acquired loan accretion was 3.45% for second quarter 2022 compared to 3.02% second quarter 2021 and 3.13% for first quarter 2022. The increase in net interest margin from the prior year was primarily due to the shift in asset mix to higher yielding assets due to loan and securities growth as well as the lower cost of funds on interest bearing liabilities, offset by a decrease of $2.9 million in acquired loan accretion income. The linked quarter increase primarily resulted from the change in the asset mix due to loan growth during the period offset by the increase in cost of funds on deposits.

Noninterest Income

•Total noninterest income decreased $2.0 million compared to second quarter 2021 and increased $1.0 million compared to first quarter 2022.

•The changes from the prior year and linked quarter primarily reflect decreases of $2.7 million and $536 thousand, respectively, in mortgage banking revenue and $1.0 million and $227 thousand, respectively in mortgage warehouse purchase fees offset by increases of $800 thousand and $298 thousand, respectively in service charges on deposit accounts. The year over year change includes a $628 thousand increase in various types of other noninterest income, while the linked quarter change reflects a $1.5 million loss on loan sale that occurred in the first quarter 2022.

•Both mortgage banking revenue and mortgage warehouse purchase fees were lower in second quarter 2022 compared to prior year and linked quarter due to decreased volumes and margins resulting from rate increases over the year. Offsetting the decrease in mortgage banking revenue was a fair value gain on derivative hedging instruments of $1.2 million in second quarter 2022 compared to losses of $700 thousand in second quarter 2021 and gains of $320 thousand in first quarter 2022.

•The increase in service charges on deposits accounts for both periods is due to higher account analysis charges due to growth in our commercial treasury products while the year over year period also reflects higher overdraft charges that have normalized subsequent to the pandemic.

2

Noninterest Expense

•Total noninterest expense increased $7.9 million compared to second quarter 2021 and increased $3.5 million compared to first quarter 2022.

•The increase in noninterest expense in second quarter 2022 compared to the prior year is due primarily to an increase of $7.3 million in salaries and benefits expenses.

•The increase in noninterest expense in second quarter 2022 compared to the linked quarter is due primarily to increases of $1.6 million in salaries and benefits expenses, $655 thousand in professional fees and $894 thousand in other noninterest expense.

•The increase in salaries and benefits from the prior year is due primarily to $6.7 million in higher salaries, bonus, payroll taxes, insurance expense and 401(k) match related to additional headcount, including executive and senior positions added during the year over year period in addition to annual merit increases in first quarter 2022. The current quarter also reflects $1.1 million in severance and stock amortization expense relating to the separation of an executive officer. Offsetting these increases was $1.2 million in lower mortgage commissions and incentives due to lower volumes for the year over year period.

•The increase from the linked quarter relates to approximately $2.8 million in higher salaries, bonus and insurance expense due to the higher headcount and a full quarter of merit increases. Also contributing to the increase is the executive officer separation expense as discussed above. Offsetting these increases were lower payroll taxes and 401(k) expenses totaling $1.3 million due to elevated first quarter expenses resulting from seasonal payroll taxes, taxes recognized on the vesting of annual stock awards and the Company's 401(k) match on annual bonuses. In addition, deferred salaries expense, which reduces overall salaries, was $1.2 million higher compared to the linked quarter due to higher loan origination activity in the current quarter.

•The increase in professional fees from the linked quarter was primarily due to higher consulting expenses related to ongoing infrastructure projects, while the increase in other noninterest expense compared to the linked quarter is due to increases in employee recruitment fees, loan-related expenses, and charitable contributions.

Provision for Credit Losses

•The Company recorded no provision for credit losses for second quarter 2022, compared to a $6.5 million credit provision expense for second quarter 2021 and a $1.4 million credit provision for the linked quarter. Provision expense during a given period is generally dependent on changes in various factors, including economic conditions, credit quality and past due trends, as well as loan growth and charge-offs or specific credit loss allocations taken during the respective period. The net zero or credit provision taken each quarter over the last year is primarily reflective of changes in the economic forecast related to the COVID pandemic, offset during the linked quarter by the impact for loan growth and a declining macroeconomic outlook from recession concerns in our third party economic forecast.

•The allowance for credit losses on loans was $144.2 million, or 1.11% of total loans held for investment, net of mortgage warehouse purchase loans, at June 30, 2022, compared to $154.8 million, or 1.34% at June 30, 2021 and compared to $146.3 million, or 1.22% at March 31, 2022. The dollar and percentage decrease from the prior year and linked quarter is primarily due to changes in the economic outlook as noted above in addition to changes in specific credit loss allocations and net charge-offs taken during the respective periods, including a $2.4 million charge-off on a commercial real estate loan in second quarter 2022.

•The allowance for credit losses on off-balance sheet exposures was $4.7 million at June 30, 2022 compared to $1.7 million at June 30, 2021 compared to $5.5 million at March 31, 2022. Changes in the allowance for unfunded commitments are generally driven by the remaining unfunded amount and the expected utilization rate of a given loan segment.

Income Taxes

•Federal income tax expense of $13.6 million was recorded for the second quarter 2022, an effective rate of 20.6% compared to tax expense of $15.5 million and an effective rate of 21.0% for the prior year quarter and tax expense of $12.3 million and an effective rate of 19.5% for the linked quarter. The lower effective tax rate in the linked quarter was a result of a favorable permanent tax item related to a donation of real property during first quarter 2022.

3

Second Quarter 2022 Balance Sheet Highlights

Loans

•Total loans held for investment, net of mortgage warehouse purchase loans, were $13.0 billion at June 30, 2022 compared to $12.0 billion at March 31, 2022 and $11.6 billion at June 30, 2021. PPP loans totaled $26.7 million, $67.0 million and $490.5 million as of June 30, 2022, March 31, 2022 and June 30, 2021, respectively. Loans excluding PPP loans and net of loan sales increased $1.1 billion, or 36.0% on an annualized basis, during second quarter 2022 with the growth being geographically distributed across our market footprint.

•Average mortgage warehouse purchase loans decreased to $467.8 million for the quarter ended June 30, 2022 from $549.6 million at March 31, 2022, and $850.5 million for the quarter ended June 30, 2021, a decrease of $81.8 million, or 14.9% from the linked quarter and $382.7 million, or 45.0% decrease year over year. The changes from the linked quarter and prior year are reflective of decreased demand and lower volumes related to mortgage rate increases and shorter hold times for the year over year period.

Asset Quality

•Total nonperforming assets increased to $82.9 million, or 0.46% of total assets at June 30, 2022, compared to $71.1 million or 0.40% of total assets at March 31, 2022, and increased from $53.1 million, or 0.29% of total assets at June 30, 2021.

•Total nonperforming loans decreased to $69.9 million, or 0.54% of total loans held for investment at June 30, 2022, compared to $71.0 million, or 0.59% at March 31, 2022 and increased from $52.5 million, or 0.45% at June 30, 2021.

•The increase in nonperforming assets from the linked quarter is primarily due to a nonaccrual addition of one commercial real estate relationship totaling $12.5 million during second quarter 2022 offset by a $2.4 million charge-off on a nonaccrual commercial real estate loan recorded at foreclosure. The increase for the year over year period reflects the $12.5 million nonaccrual discussed above, a $12.9 million commercial real estate foreclosure and other net nonperforming asset additions of $4.4 million for the year over year period.

•The decrease in nonperforming loans from the linked quarter is primarily due to the foreclosure of a $15.3 million commercial real estate nonaccrual loan, net of the charge-off discussed above, offset by a $12.5 million commercial real estate relationship added to nonaccrual during second quarter 2022. The increase for the year over year period reflects the addition mentioned above as well as $4.9 million net additions to nonperforming loans for the year over year period.

•Charge-offs were 0.09% annualized in the second quarter 2022 compared to 0.01% annualized in the linked quarter and 0.13% annualized in the prior year quarter. As discussed above, the second quarter 2022 ratio reflects the $2.4 million charge-off which was fully reserved in the linked quarter. Charge-offs in second quarter 2021 was primarily due to two charge-offs totaling $2.5 million.

Deposits, Borrowings and Liquidity

•Total deposits were $15.1 billion at June 30, 2022 compared to $14.9 billion at March 31, 2022 and compared to $15.1 billion at June 30, 2021.

•Total borrowings (other than junior subordinated debentures) were $509.7 million at June 30, 2022, an increase of $90.2 million from March 31, 2022 and a decrease of $171.3 million from June 30, 2021. The year over year change reflects the reduction of FHLB advances of $200 million and a $40.0 million redemption of subordinated debentures that occurred in third quarter 2021 offset by a $68 million increase in borrowings on the Company's unsecured line of credit. The linked quarter change reflects a $25.0 million increase in FHLB advances and a $65.0 million increase in borrowings on the Company's unsecured line of credit. The increase in line of credit borrowings for both periods reflects the short-term needs at the holding company for Company stock repurchases.

Capital

•The Company continues to be well capitalized under regulatory guidelines. At June 30, 2022, the estimated common equity Tier 1 to risk-weighted assets, Tier 1 capital to average assets, Tier 1 capital to risk-weighted assets and total capital to risk-weighted asset ratios were 9.81%, 9.28%, 10.17% and 12.24%, respectively, compared to 11.09%, 9.38%, 11.48%, and 13.72%, respectively, at March 31, 2022 and 11.14%, 9.03%, 11.55%, and 14.23%, respectively at June 30, 2021. The decline in the June 30, 2022 ratios are reflective of Company stock repurchases under the 2022 Stock Repurchase Plan.

4

Subsequent Events

The Company is required, under generally accepted accounting principles, to evaluate subsequent events through the filing of its consolidated financial statements for the quarter ended June 30, 2022 on Form 10-Q. As a result, the Company will continue to evaluate the impact of any subsequent events on critical accounting assumptions and estimates made as of June 30, 2022 and will adjust amounts preliminarily reported, if necessary.

About Independent Bank Group, Inc.

Independent Bank Group, Inc. is a bank holding company headquartered in McKinney, Texas. Through its wholly owned subsidiary, Independent Bank, doing business as Independent Financial, Independent Bank Group serves customers across Texas and Colorado with a wide range of relationship-driven banking services tailored to meet the needs of businesses, professionals and individuals. Independent Bank Group, Inc. operates in four market regions located in the Dallas/Fort Worth, Austin and Houston areas in Texas and the Colorado Front Range area, including Denver, Colorado Springs and Fort Collins.

Conference Call

A conference call covering Independent Bank Group’s second quarter earnings announcement will be held on Tuesday, July 26, 2022 at 8:30 am (ET) and can be accessed by the webcast link, https://webcast-eqs.com/register/independentbankgroup07262022_en/en or by calling 1-877-407-0989 and by identifying the meeting number 13731449 or by identifying "Independent Bank Group Second Quarter 2022 Earnings Conference Call." The conference materials will also be available by accessing the Investor Relations page of our website, www.ifinancial.com. If you are unable to participate in the live event, a recording of the conference call will be accessible via the Investor Relations page of our website.

Forward-Looking Statements

From time to time the Company’s comments and releases may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties and are made pursuant to the safe harbor provisions of Section 27A of the Securities Act, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and other related federal security laws. Forward-looking statements include information about the Company’s possible or assumed future results of operations, including its future revenues, income, expenses, provision for taxes, effective tax rate, earnings per share and cash flows, its future capital expenditures and dividends, its future financial condition and changes therein, including changes in the Company’s loan portfolio and allowance for credit losses, the Company’s future capital structure or changes therein, the plan and objectives of management for future operations, the Company’s future or proposed acquisitions, the future or expected effect of acquisitions on the Company’s operations, results of operations and financial condition, the Company’s future economic performance and the statements of the assumptions underlying any such statement. Such statements are typically, but not exclusively, identified by the use in the statements of words or phrases such as “aim,” “anticipate,” “estimate,” “expect,” “goal,” “guidance,” “intend,” “is anticipated,” “is estimated,” “is expected,” “is intended,” “objective,” “plan,” “projected,” “projection,” “will affect,” “will be,” “will continue,” “will decrease,” “will grow,” “will impact,” “will increase,” “will incur,” “will reduce,” “will remain,” “will result,” “would be,” variations of such words or phrases (including where the word “could,” “may” or “would” is used rather than the word “will” in a phrase) and similar words and phrases indicating that the statement addresses some future result, occurrence, plan or objective. The forward-looking statements that the Company makes are based on its current expectations and assumptions regarding its business, the economy, and other future conditions. Because forward-looking statements relate to future results and occurrences, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. The Company’s actual results may differ materially from those contemplated by the forward looking statements, which are neither statements of historical fact nor guarantees or assurances of future performance. Many possible events or factors could affect the Company’s future financial results and performance and could cause those results or performance to differ materially from those expressed in the forward-looking statements. These possible events or factors include, but are not limited to: 1) the effects of infectious disease outbreaks, including the ongoing COVID-19 pandemic and the significant impact that the COVID-19 pandemic and associated efforts to limit its spread have had and may continue to have on economic conditions and the Company's business, employees, customers, asset quality and financial performance; 2) the Company’s ability to sustain its current internal growth rate and total growth rate; 3) changes in geopolitical, business and economic events, occurrences and conditions, including changes in rates of inflation or deflation, nationally, regionally and in the Company’s target markets, particularly in Texas and Colorado; 4) worsening business and economic conditions nationally, regionally and in the Company’s target markets, particularly in Texas and Colorado, and the geographic areas in those states in which the Company operates; 5) the Company’s dependence on its management team and its ability to attract, motivate and retain qualified personnel; 6) the concentration of the Company’s

5

business within its geographic areas of operation in Texas and Colorado; 7) changes in asset quality, including increases in default rates on loans and higher levels of nonperforming loans and loan charge-offs generally; 8) concentration of the loan portfolio of Independent Financial, before and after the completion of acquisitions of financial institutions, in commercial and residential real estate loans and changes in the prices, values and sales volumes of commercial and residential real estate; 9) the ability of Independent Financial to make loans with acceptable net interest margins and levels of risk of repayment and to otherwise invest in assets at acceptable yields and that present acceptable investment risks; 10) inaccuracy of the assumptions and estimates that the managements of the Company and the financial institutions that the Company acquires make in establishing reserves for credit losses and other estimates generally; 11) lack of liquidity, including as a result of a reduction in the amount of sources of liquidity the Company currently has; 12) material increases or decreases in the amount of deposits held by Independent Financial or other financial institutions that the Company acquires and the cost of those deposits; 13) the Company’s access to the debt and equity markets and the overall cost of funding its operations; 14) regulatory requirements to maintain minimum capital levels or maintenance of capital at levels sufficient to support the Company’s anticipated growth; 15) changes in market interest rates that affect the pricing of the loans and deposits of each of Independent Financial and the financial institutions that the Company acquires and that affect the net interest income, other future cash flows, or the market value of the assets of each of Independent Financial and the financial institutions that the Company acquires, including investment securities; 16) fluctuations in the market value and liquidity of the securities the Company holds for sale, including as a result of changes in market interest rates; 17) effects of competition from a wide variety of local, regional, national and other providers of financial, investment and insurance services; 18) changes in economic and market conditions, that affect the amount and value of the assets of Independent Financial and of financial institutions that the Company acquires; 19) the institution and outcome of, and costs associated with, litigation and other legal proceedings against one or more of the Company, Independent Financial and financial institutions that the Company acquires or to which any of such entities is subject; 20) the occurrence of market conditions adversely affecting the financial industry generally; 21) the impact of recent and future legislative regulatory changes, including changes in banking, securities, and tax laws and regulations and their application by the Company’s regulators, and changes in federal government policies, as well as regulatory requirements applicable to, and resulting from regulatory supervision of, the Company and Independent Financial as a financial institution with total assets greater than $10 billion; 22) changes in accounting policies, practices, principles and guidelines, as may be adopted by the bank regulatory agencies, the Financial Accounting Standards Board, the SEC and the Public Company Accounting Oversight Board, as the case may be, including changes resulting from the implementation of the Current Expected Credit Loss accounting standard; 23) governmental monetary and fiscal policies; 24) changes in the scope and cost of FDIC insurance and other coverage; 25) the effects of war or other conflicts, including, but not limited to, the conflict between Russia and the Ukraine, acts of terrorism (including cyberattacks) or other catastrophic events, including natural disasters such as storms, droughts, tornadoes, hurricanes and flooding, that may affect general economic conditions; 26) the Company’s actual cost savings resulting from previous or future acquisitions are less than expected, the Company is unable to realize those cost savings as soon as expected, or the Company incurs additional or unexpected costs; 27) the Company’s revenues after previous or future acquisitions are less than expected; 28) the liquidity of, and changes in the amounts and sources of liquidity available to the Company, before and after the acquisition of any financial institutions that the Company acquires; 29) deposit attrition, operating costs, customer loss and business disruption before and after the Company completed acquisitions, including, without limitation, difficulties in maintaining relationships with employees, may be greater than the Company expected; 30) the effects of the combination of the operations of financial institutions that the Company has acquired in the recent past or may acquire in the future with the Company’s operations and the operations of Independent Financial, the effects of the integration of such operations being unsuccessful, and the effects of such integration being more difficult, time consuming, or costly than expected or not yielding the cost savings the Company expects; 31) the impact of investments that the Company or Independent Financial may have made or may make and the changes in the value of those investments; 32) the quality of the assets of financial institutions and companies that the Company has acquired in the recent past or may acquire in the future being different than it determined or determine in its due diligence investigation in connection with the acquisition of such financial institutions and any inadequacy of credit loss reserves relating to, and exposure to unrecoverable losses on, loans acquired; 33) the Company’s ability to continue to identify acquisition targets and successfully acquire desirable financial institutions to sustain its growth, to expand its presence in the Company’s markets and to enter new markets; 34) changes in general business and economic conditions in the markets in which the Company currently operates and may operate in the future; 35) changes occur in business conditions and inflation generally; 36) an increase in the rate of personal or commercial customers’ bankruptcies generally; 37) technology-related changes are harder to make or are more expensive than expected; 38) attacks on the security of, and breaches of, the Company's and Independent Financial's digital information systems, the costs the Company or Independent Financial incur to provide security against such attacks and any costs and liability the Company or Independent Financial incurs in connection with any breach of those systems; 38) the potential impact of climate change and related government regulation on the Company and its customers; 39) the potential impact of technology and “FinTech” entities on the banking industry generally; 40) other economic, competitive, governmental, regulatory, technological and geopolitical factors affecting the Company's operations, pricing and services; and 41) the other factors that are described or referenced in Part I, Item 1A, of the Company’s Annual Report on Form 10-K filed with the SEC on February 25, 2022, the Company’s Quarterly Reports on Form 10-Q, in each case under the caption “Risk Factors”; and The Company urges you to consider all of these

6

risks, uncertainties and other factors carefully in evaluating all such forward-looking statements made by the Company. As a result of these and other matters, including changes in facts, assumptions not being realized or other factors, the actual results relating to the subject matter of any forward-looking statement may differ materially from the anticipated results expressed or implied in that forward-looking statement. Any forward-looking statement made in this filing or made by the Company in any report, filing, document or information incorporated by reference in this filing, speaks only as of the date on which it is made. The Company undertakes no obligation to update any such forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. A forward-looking statement may include a statement of the assumptions or bases underlying the forward-looking statement. The Company believes that these assumptions or bases have been chosen in good faith and that they are reasonable. However, the Company cautions you that assumptions as to future occurrences or results almost always vary from actual future occurrences or results, and the differences between assumptions and actual occurrences and results can be material. Therefore, the Company cautions you not to place undue reliance on the forward-looking statements contained in this filing or incorporated by reference herein.

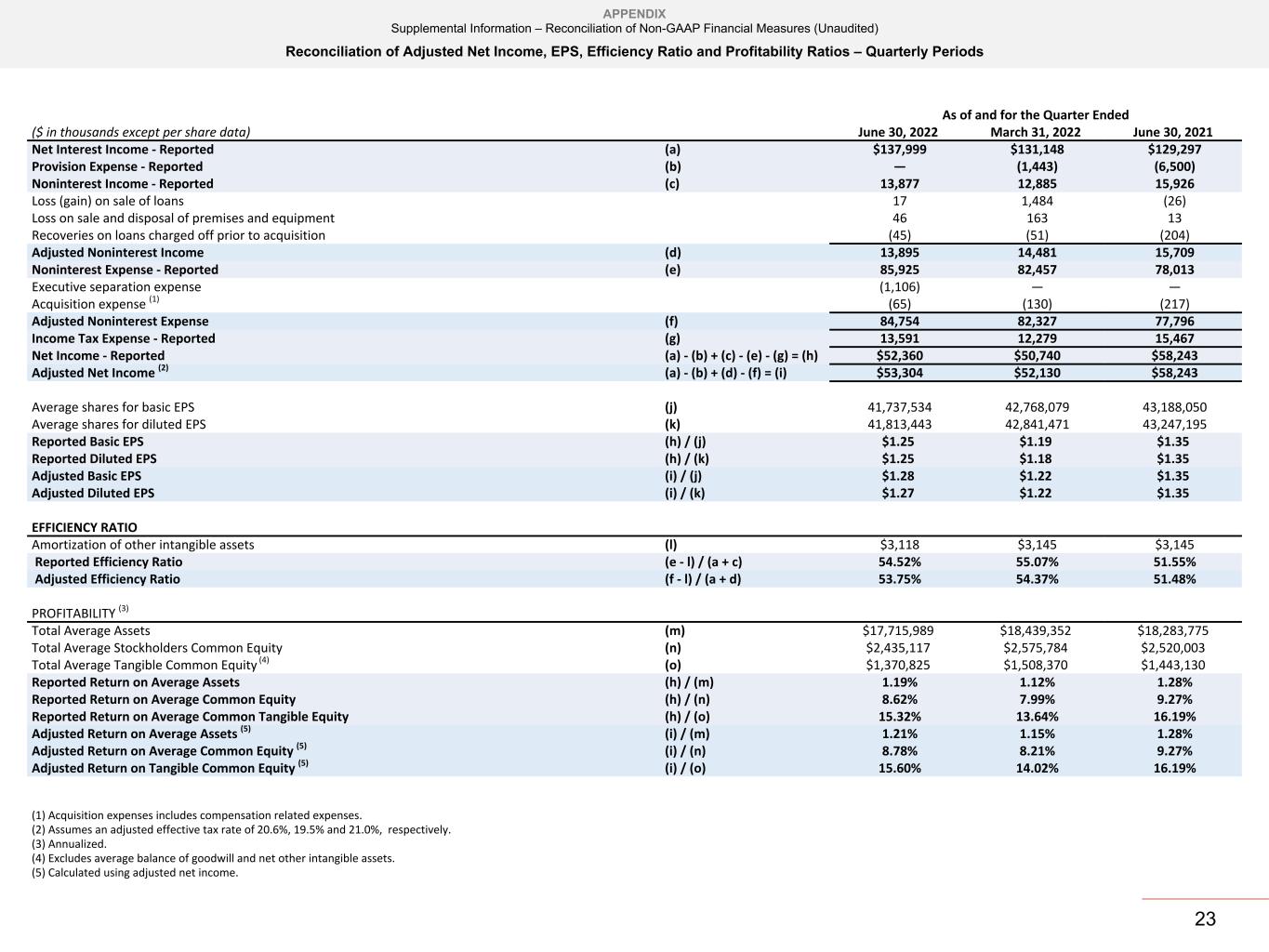

Non-GAAP Financial Measures

In addition to results presented in accordance with GAAP, this press release contains certain non-GAAP financial measures. These measures and ratios include “adjusted net income,” “adjusted earnings,” “tangible book value,” “tangible book value per common share,” “adjusted efficiency ratio,” “tangible common equity to tangible assets,” “adjusted net interest margin,” “return on tangible equity,” “adjusted return on average assets” and “adjusted return on average equity” and are supplemental measures that are not required by, or are not presented in accordance with, accounting principles generally accepted in the United States. We consider the use of select non-GAAP financial measures and ratios to be useful for financial operational decision making and useful in evaluating period-to-period comparisons. We believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance by excluding certain expenditures or assets that we believe are not indicative of our primary business operating results. We believe that management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when planning, forecasting, analyzing and comparing past, present and future periods.

We believe that these measures provide useful information to management and investors that is supplementary to our financial condition, results of operations and cash flows computed in accordance with GAAP; however we acknowledge that our financial measures have a number of limitations relative to GAAP financial measures. Certain non-GAAP financial measures exclude items of income, expenditures, expenses, assets, or liabilities, including provisions for credit losses and the effect of goodwill, other intangible assets and income from accretion on acquired loans arising from purchase accounting adjustments, that we believe cause certain aspects of our results of operations or financial condition to be not indicative of our primary operating results. All of these items significantly impact our financial statements. Additionally, the items that we exclude in our adjustments are not necessarily consistent with the items that our peers may exclude from their results of operations and key financial measures and therefore may limit the comparability of similarly named financial measures and ratios. We compensate for these limitations by providing the equivalent GAAP measures whenever we present the non-GAAP financial measures and by including a reconciliation of the impact of the components adjusted for in the non-GAAP financial measure so that both measures and the individual components may be considered when analyzing our performance.

A reconciliation of our non-GAAP financial measures to the comparable GAAP financial measures is included at the end of the financial statements tables.

7

CONTACTS:

Analysts/Investors:

| Paul Langdale Executive Vice President Director of Corporate Development & Strategy (972) 562-9004 Paul.Langdale@ifinancial.com | Michelle Hickox Executive Vice President, Chief Financial Officer (972) 562-9004 Michelle.Hickox@ifinancial.com | ||||

Media:

Wendi Costlow Executive Vice President, Chief Marketing Officer (972) 562-9004 Wendi.Costlow@ifinancial.com | ||

Source: Independent Bank Group, Inc.

8

Independent Bank Group, Inc. and Subsidiaries

Consolidated Financial Data

Three Months Ended June 30, 2022, March 31, 2022, December 31, 2021, September 30, 2021 and June 30, 2021

(Dollars in thousands, except for share data)

(Unaudited)

| As of and for the Quarter Ended | |||||||||||||||||||||||||||||

| June 30, 2022 | March 31, 2022 | December 31, 2021 | September 30, 2021 | June 30, 2021 | |||||||||||||||||||||||||

| Selected Income Statement Data | |||||||||||||||||||||||||||||

| Interest income | $ | 150,696 | $ | 140,865 | $ | 145,954 | $ | 144,032 | $ | 145,805 | |||||||||||||||||||

| Interest expense | 12,697 | 9,717 | 13,303 | 15,387 | 16,508 | ||||||||||||||||||||||||

| Net interest income | 137,999 | 131,148 | 132,651 | 128,645 | 129,297 | ||||||||||||||||||||||||

| Provision for credit losses | — | (1,443) | — | — | (6,500) | ||||||||||||||||||||||||

| Net interest income after provision for credit losses | 137,999 | 132,591 | 132,651 | 128,645 | 135,797 | ||||||||||||||||||||||||

| Noninterest income | 13,877 | 12,885 | 15,086 | 16,896 | 15,926 | ||||||||||||||||||||||||

| Noninterest expense | 85,925 | 82,457 | 79,908 | 80,572 | 78,013 | ||||||||||||||||||||||||

| Income tax expense | 13,591 | 12,279 | 13,642 | 12,629 | 15,467 | ||||||||||||||||||||||||

| Net income | 52,360 | 50,740 | 54,187 | 52,340 | 58,243 | ||||||||||||||||||||||||

Adjusted net income (1) | 53,304 | 52,130 | 54,995 | 52,570 | 58,243 | ||||||||||||||||||||||||

| Per Share Data (Common Stock) | |||||||||||||||||||||||||||||

| Earnings: | |||||||||||||||||||||||||||||

| Basic | $ | 1.25 | $ | 1.19 | $ | 1.26 | $ | 1.22 | $ | 1.35 | |||||||||||||||||||

| Diluted | 1.25 | 1.18 | 1.26 | 1.21 | 1.35 | ||||||||||||||||||||||||

| Adjusted earnings: | |||||||||||||||||||||||||||||

Basic (1) | 1.28 | 1.22 | 1.28 | 1.22 | 1.35 | ||||||||||||||||||||||||

Diluted (1) | 1.27 | 1.22 | 1.28 | 1.22 | 1.35 | ||||||||||||||||||||||||

| Dividends | 0.38 | 0.38 | 0.36 | 0.34 | 0.32 | ||||||||||||||||||||||||

| Book value | 57.45 | 58.94 | 60.26 | 59.77 | 58.89 | ||||||||||||||||||||||||

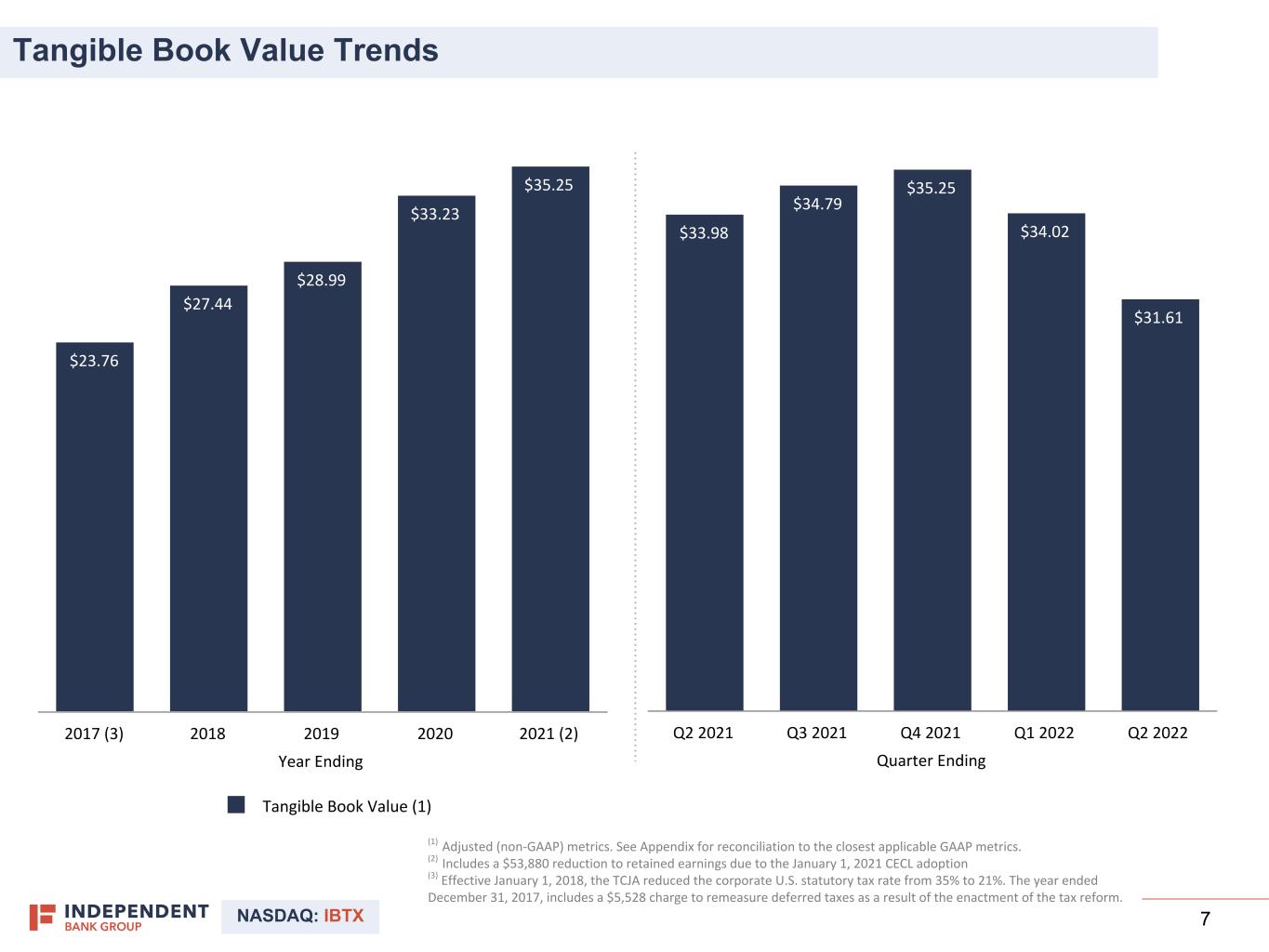

Tangible book value (1) | 31.61 | 34.02 | 35.25 | 34.79 | 33.98 | ||||||||||||||||||||||||

| Common shares outstanding | 41,156,261 | 42,795,228 | 42,756,234 | 42,941,715 | 43,180,607 | ||||||||||||||||||||||||

Weighted average basic shares outstanding (2) | 41,737,534 | 42,768,079 | 42,874,182 | 43,044,683 | 43,188,050 | ||||||||||||||||||||||||

Weighted average diluted shares outstanding (2) | 41,813,443 | 42,841,471 | 42,940,354 | 43,104,075 | 43,247,195 | ||||||||||||||||||||||||

| Selected Period End Balance Sheet Data | |||||||||||||||||||||||||||||

| Total assets | $ | 18,107,093 | $ | 17,963,253 | $ | 18,732,648 | $ | 18,918,225 | $ | 18,447,721 | |||||||||||||||||||

| Cash and cash equivalents | 776,131 | 1,604,256 | 2,608,444 | 3,059,826 | 2,794,700 | ||||||||||||||||||||||||

| Securities available for sale | 1,846,132 | 1,938,726 | 2,006,727 | 1,781,574 | 1,574,435 | ||||||||||||||||||||||||

| Securities held to maturity | 207,972 | 188,047 | — | — | — | ||||||||||||||||||||||||

| Loans, held for sale | 26,519 | 22,743 | 32,124 | 31,471 | 43,684 | ||||||||||||||||||||||||

Loans, held for investment (3) | 12,979,938 | 11,958,759 | 11,650,598 | 11,463,714 | 11,576,332 | ||||||||||||||||||||||||

| Mortgage warehouse purchase loans | 538,190 | 569,554 | 788,848 | 977,800 | 894,324 | ||||||||||||||||||||||||

| Allowance for credit losses on loans | 144,170 | 146,313 | 148,706 | 150,281 | 154,791 | ||||||||||||||||||||||||

| Goodwill and other intangible assets | 1,063,248 | 1,066,366 | 1,069,511 | 1,072,656 | 1,075,801 | ||||||||||||||||||||||||

| Other real estate owned | 12,900 | — | — | — | 475 | ||||||||||||||||||||||||

| Noninterest-bearing deposits | 5,123,321 | 5,003,728 | 5,066,588 | 4,913,580 | 4,634,530 | ||||||||||||||||||||||||

| Interest-bearing deposits | 9,940,627 | 9,846,543 | 10,487,320 | 10,610,602 | 10,429,261 | ||||||||||||||||||||||||

| Borrowings (other than junior subordinated debentures) | 509,718 | 419,545 | 433,371 | 631,697 | 681,023 | ||||||||||||||||||||||||

| Junior subordinated debentures | 54,320 | 54,270 | 54,221 | 54,171 | 54,122 | ||||||||||||||||||||||||

| Total stockholders' equity | 2,364,335 | 2,522,460 | 2,576,650 | 2,566,693 | 2,542,885 | ||||||||||||||||||||||||

9

Independent Bank Group, Inc. and Subsidiaries

Consolidated Financial Data

Three Months Ended June 30, 2022, March 31, 2022, December 31, 2021, September 30, 2021 and June 30, 2021

(Dollars in thousands, except for share data)

(Unaudited)

| As of and for the Quarter Ended | |||||||||||||||||||||||||||||

| June 30, 2022 | March 31, 2022 | December 31, 2021 | September 30, 2021 | June 30, 2021 | |||||||||||||||||||||||||

| Selected Performance Metrics | |||||||||||||||||||||||||||||

| Return on average assets | 1.19 | % | 1.12 | % | 1.11 | % | 1.11 | % | 1.28 | % | |||||||||||||||||||

| Return on average equity | 8.62 | 7.99 | 8.35 | 8.10 | 9.27 | ||||||||||||||||||||||||

Return on tangible equity (4) | 15.32 | 13.64 | 14.30 | 13.93 | 16.19 | ||||||||||||||||||||||||

Adjusted return on average assets (1) | 1.21 | 1.15 | 1.13 | 1.11 | 1.28 | ||||||||||||||||||||||||

Adjusted return on average equity (1) | 8.78 | 8.21 | 8.48 | 8.13 | 9.27 | ||||||||||||||||||||||||

Adjusted return on tangible equity (1) (4) | 15.60 | 14.02 | 14.51 | 14.00 | 16.19 | ||||||||||||||||||||||||

| Net interest margin | 3.51 | 3.22 | 3.00 | 3.01 | 3.14 | ||||||||||||||||||||||||

Efficiency ratio (5) | 54.52 | 55.07 | 51.96 | 53.20 | 51.55 | ||||||||||||||||||||||||

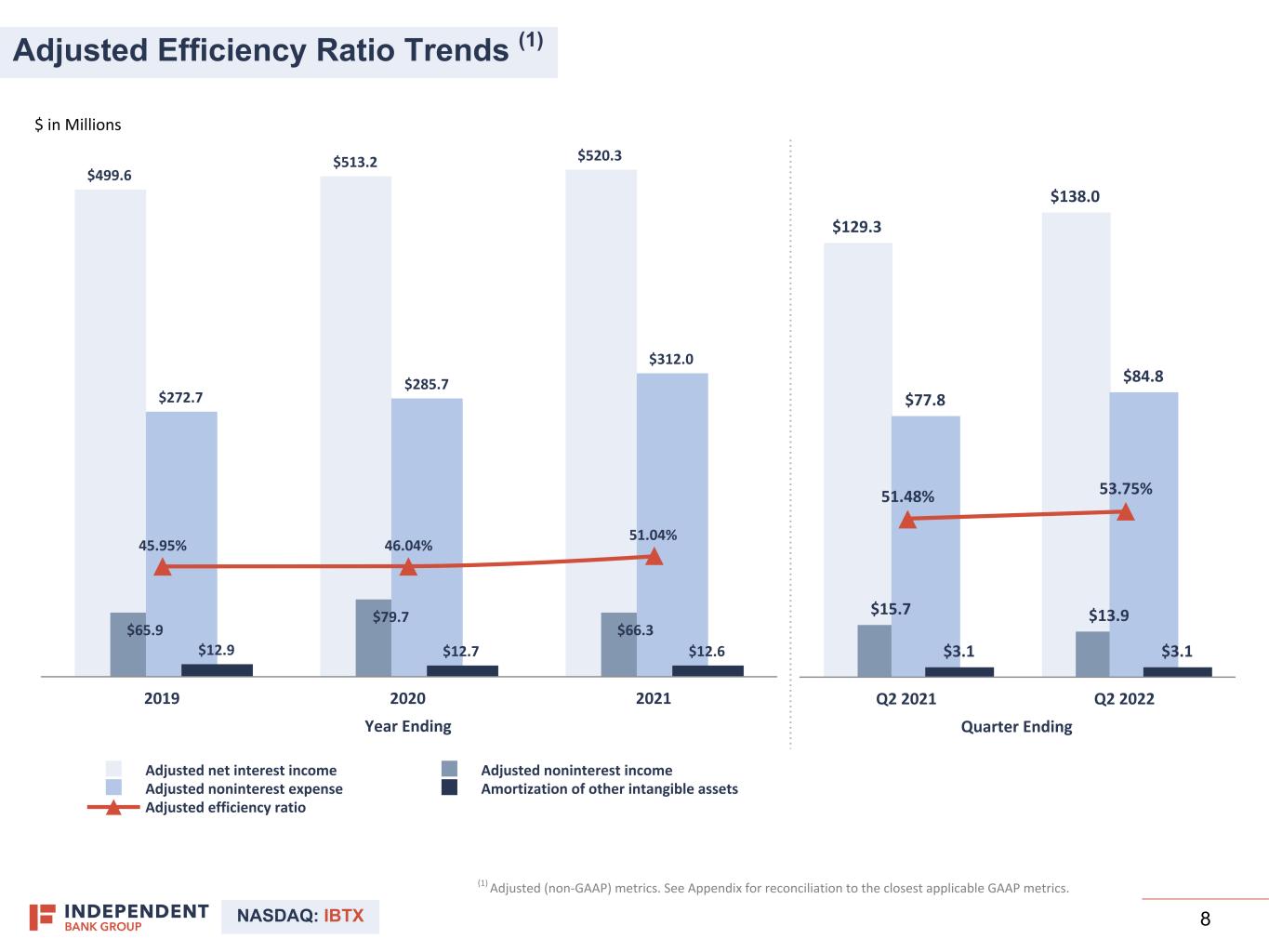

Adjusted efficiency ratio (1)(5) | 53.75 | 54.37 | 51.33 | 52.99 | 51.48 | ||||||||||||||||||||||||

Credit Quality Ratios (3) (6) | |||||||||||||||||||||||||||||

| Nonperforming assets to total assets | 0.46 | % | 0.40 | % | 0.31 | % | 0.44 | % | 0.29 | % | |||||||||||||||||||

| Nonperforming loans to total loans held for investment | 0.54 | 0.59 | 0.49 | 0.72 | 0.45 | ||||||||||||||||||||||||

| Nonperforming assets to total loans held for investment and other real estate | 0.64 | 0.59 | 0.49 | 0.72 | 0.46 | ||||||||||||||||||||||||

| Allowance for credit losses on loans to nonperforming loans | 206.28 | 205.99 | 259.35 | 181.69 | 294.88 | ||||||||||||||||||||||||

| Allowance for credit losses to total loans held for investment | 1.11 | 1.22 | 1.28 | 1.31 | 1.34 | ||||||||||||||||||||||||

| Net charge-offs to average loans outstanding (annualized) | 0.09 | 0.01 | 0.10 | — | 0.13 | ||||||||||||||||||||||||

| Capital Ratios | |||||||||||||||||||||||||||||

| Estimated common equity Tier 1 capital to risk-weighted assets | 9.81 | % | 11.09 | % | 11.12 | % | 11.06 | % | 11.14 | % | |||||||||||||||||||

| Estimated tier 1 capital to average assets | 9.28 | 9.38 | 8.80 | 8.94 | 9.03 | ||||||||||||||||||||||||

| Estimated tier 1 capital to risk-weighted assets | 10.17 | 11.48 | 11.52 | 11.46 | 11.55 | ||||||||||||||||||||||||

| Estimated total capital to risk-weighted assets | 12.24 | 13.72 | 13.67 | 13.64 | 14.23 | ||||||||||||||||||||||||

| Total stockholders' equity to total assets | 13.06 | 14.04 | 13.75 | 13.57 | 13.78 | ||||||||||||||||||||||||

Tangible common equity to tangible assets (1) | 7.63 | 8.62 | 8.53 | 8.37 | 8.45 | ||||||||||||||||||||||||

____________

(1) Non-GAAP financial measure. See reconciliation.

(2) Total number of shares includes participating shares (those with dividend rights).

(3) Loans held for investment excludes mortgage warehouse purchase loans and includes SBA PPP loans of $26,669, $67,011, $112,128, $243,919 and $490,485, respectively.

(4) Non-GAAP financial measure. Excludes average balance of goodwill and net other intangible assets.

(5) Efficiency ratio excludes amortization of other intangible assets. See reconciliation of non-GAAP financial measures.

(6) Credit metrics - Nonperforming assets, which consist of nonperforming loans, OREO and other repossessed assets, totaled $82,905, $71,143, $57,452, $82,829 and $53,081, respectively. Nonperforming loans, which consists of nonaccrual loans, loans delinquent 90 days and still accruing interest, and troubled debt restructurings totaled $69,891, $71,029, $57,338, $82,714 and $52,492, respectively.

10

Independent Bank Group, Inc. and Subsidiaries

Consolidated Statements of Income

Three and Six Months Ended June 30, 2022 and 2021

(Dollars in thousands)

(Unaudited)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||||||

| Interest income: | ||||||||||||||||||||||||||

| Interest and fees on loans | $ | 138,426 | $ | 137,620 | $ | 267,605 | $ | 277,772 | ||||||||||||||||||

| Interest on taxable securities | 8,243 | 5,252 | 16,602 | 10,009 | ||||||||||||||||||||||

| Interest on nontaxable securities | 2,741 | 2,061 | 5,074 | 4,130 | ||||||||||||||||||||||

| Interest on interest-bearing deposits and other | 1,286 | 872 | 2,280 | 1,665 | ||||||||||||||||||||||

| Total interest income | 150,696 | 145,805 | 291,561 | 293,576 | ||||||||||||||||||||||

| Interest expense: | ||||||||||||||||||||||||||

| Interest on deposits | 8,110 | 11,487 | 13,720 | 24,494 | ||||||||||||||||||||||

| Interest on FHLB advances | 164 | 537 | 343 | 1,070 | ||||||||||||||||||||||

| Interest on other borrowings | 3,869 | 4,043 | 7,351 | 8,103 | ||||||||||||||||||||||

| Interest on junior subordinated debentures | 554 | 441 | 1,000 | 883 | ||||||||||||||||||||||

| Total interest expense | 12,697 | 16,508 | 22,414 | 34,550 | ||||||||||||||||||||||

| Net interest income | 137,999 | 129,297 | 269,147 | 259,026 | ||||||||||||||||||||||

| Provision for credit losses | — | (6,500) | (1,443) | (9,000) | ||||||||||||||||||||||

| Net interest income after provision for credit losses | 137,999 | 135,797 | 270,590 | 268,026 | ||||||||||||||||||||||

| Noninterest income: | ||||||||||||||||||||||||||

| Service charges on deposit accounts | 3,050 | 2,250 | 5,802 | 4,511 | ||||||||||||||||||||||

| Investment management fees | 2,391 | 2,086 | 4,842 | 4,129 | ||||||||||||||||||||||

| Mortgage banking revenue | 2,490 | 5,237 | 5,516 | 12,732 | ||||||||||||||||||||||

| Mortgage warehouse purchase program fees | 731 | 1,730 | 1,689 | 3,699 | ||||||||||||||||||||||

| (Loss) gain on sale of loans | (17) | 26 | (1,501) | 26 | ||||||||||||||||||||||

| Loss on sale and disposal of premises and equipment | (46) | (13) | (209) | (20) | ||||||||||||||||||||||

| Increase in cash surrender value of BOLI | 1,327 | 1,287 | 2,637 | 2,559 | ||||||||||||||||||||||

| Other | 3,951 | 3,323 | 7,986 | 6,899 | ||||||||||||||||||||||

| Total noninterest income | 13,877 | 15,926 | 26,762 | 34,535 | ||||||||||||||||||||||

| Noninterest expense: | ||||||||||||||||||||||||||

| Salaries and employee benefits | 51,130 | 43,837 | 100,685 | 87,496 | ||||||||||||||||||||||

| Occupancy | 10,033 | 10,852 | 20,033 | 20,458 | ||||||||||||||||||||||

| Communications and technology | 5,830 | 5,581 | 11,731 | 11,117 | ||||||||||||||||||||||

| FDIC assessment | 1,589 | 1,467 | 3,082 | 3,172 | ||||||||||||||||||||||

| Advertising and public relations | 703 | 376 | 1,159 | 614 | ||||||||||||||||||||||

| Other real estate owned expenses, net | 66 | 4 | 66 | 12 | ||||||||||||||||||||||

| Amortization of other intangible assets | 3,118 | 3,145 | 6,263 | 6,290 | ||||||||||||||||||||||

| Professional fees | 4,094 | 3,756 | 7,533 | 7,426 | ||||||||||||||||||||||

| Other | 9,362 | 8,995 | 17,830 | 16,541 | ||||||||||||||||||||||

| Total noninterest expense | 85,925 | 78,013 | 168,382 | 153,126 | ||||||||||||||||||||||

| Income before taxes | 65,951 | 73,710 | 128,970 | 149,435 | ||||||||||||||||||||||

| Income tax expense | 13,591 | 15,467 | 25,870 | 31,212 | ||||||||||||||||||||||

| Net income | $ | 52,360 | $ | 58,243 | $ | 103,100 | $ | 118,223 | ||||||||||||||||||

11

Independent Bank Group, Inc. and Subsidiaries

Consolidated Balance Sheets

As of June 30, 2022 and December 31, 2021

(Dollars in thousands)

(Unaudited)

| June 30, | December 31, | ||||||||||

| Assets | 2022 | 2021 | |||||||||

| Cash and due from banks | $ | 179,394 | $ | 243,926 | |||||||

| Interest-bearing deposits in other banks | 596,737 | 2,364,518 | |||||||||

| Cash and cash equivalents | 776,131 | 2,608,444 | |||||||||

| Certificates of deposit held in other banks | 1,265 | 3,245 | |||||||||

| Securities available for sale, at fair value | 1,846,132 | 2,006,727 | |||||||||

| Securities held to maturity, net of allowance for credit losses of $0 and $0, respectively | 207,972 | — | |||||||||

| Loans held for sale (includes $23,885 and $28,249 carried at fair value, respectively) | 26,519 | 32,124 | |||||||||

| Loans, net of allowance for credit losses of $144,170 and $148,706, respectively | 13,373,958 | 12,290,740 | |||||||||

| Premises and equipment, net | 337,679 | 308,023 | |||||||||

| Other real estate owned | 12,900 | — | |||||||||

| Federal Home Loan Bank (FHLB) of Dallas stock and other restricted stock | 18,495 | 21,573 | |||||||||

| Bank-owned life insurance (BOLI) | 237,714 | 235,637 | |||||||||

| Deferred tax asset | 69,467 | 26,178 | |||||||||

| Goodwill | 994,021 | 994,021 | |||||||||

| Other intangible assets, net | 69,227 | 75,490 | |||||||||

| Other assets | 135,613 | 130,446 | |||||||||

| Total assets | $ | 18,107,093 | $ | 18,732,648 | |||||||

| Liabilities and Stockholders’ Equity | |||||||||||

| Deposits: | |||||||||||

| Noninterest-bearing | $ | 5,123,321 | $ | 5,066,588 | |||||||

| Interest-bearing | 9,940,627 | 10,487,320 | |||||||||

| Total deposits | 15,063,948 | 15,553,908 | |||||||||

| FHLB advances | 175,000 | 150,000 | |||||||||

| Other borrowings | 334,718 | 283,371 | |||||||||

| Junior subordinated debentures | 54,320 | 54,221 | |||||||||

| Other liabilities | 114,772 | 114,498 | |||||||||

| Total liabilities | 15,742,758 | 16,155,998 | |||||||||

| Commitments and contingencies | — | — | |||||||||

| Stockholders’ equity: | |||||||||||

| Preferred stock (0 and 0 shares outstanding, respectively) | — | — | |||||||||

| Common stock (41,156,261 and 42,756,234 shares outstanding, respectively) | 412 | 428 | |||||||||

| Additional paid-in capital | 1,951,317 | 1,945,497 | |||||||||

| Retained earnings | 578,201 | 625,484 | |||||||||

| Accumulated other comprehensive (loss) income | (165,595) | 5,241 | |||||||||

| Total stockholders’ equity | 2,364,335 | 2,576,650 | |||||||||

| Total liabilities and stockholders’ equity | $ | 18,107,093 | $ | 18,732,648 | |||||||

12

Independent Bank Group, Inc. and Subsidiaries

Consolidated Average Balance Sheet Amounts, Interest Earned and Yield Analysis

Three Months Ended June 30, 2022 and 2021

(Dollars in thousands)

(Unaudited)

The analysis below shows average interest-earning assets and interest-bearing liabilities together with the average yield on the interest-earning assets and the average cost of the interest-bearing liabilities for the periods presented.

| Three Months Ended June 30, | ||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | |||||||||||||||||||||||||||||||||||||

| Average Outstanding Balance | Interest | Yield/ Rate (4) | Average Outstanding Balance | Interest | Yield/ Rate (4) | |||||||||||||||||||||||||||||||||

| Interest-earning assets: | ||||||||||||||||||||||||||||||||||||||

Loans (1) | $ | 12,993,624 | $ | 138,426 | 4.27 | % | $ | 12,480,653 | $ | 137,620 | 4.42 | % | ||||||||||||||||||||||||||

| Taxable securities | 1,703,850 | 8,243 | 1.94 | 1,068,446 | 5,252 | 1.97 | ||||||||||||||||||||||||||||||||

| Nontaxable securities | 440,972 | 2,741 | 2.49 | 349,347 | 2,061 | 2.37 | ||||||||||||||||||||||||||||||||

| Interest bearing deposits and other | 649,649 | 1,286 | 0.79 | 2,603,276 | 872 | 0.13 | ||||||||||||||||||||||||||||||||

| Total interest-earning assets | 15,788,095 | 150,696 | 3.83 | 16,501,722 | 145,805 | 3.54 | ||||||||||||||||||||||||||||||||

| Noninterest-earning assets | 1,927,894 | 1,782,053 | ||||||||||||||||||||||||||||||||||||

| Total assets | $ | 17,715,989 | $ | 18,283,775 | ||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | ||||||||||||||||||||||||||||||||||||||

| Checking accounts | $ | 5,881,199 | $ | 4,587 | 0.31 | % | $ | 5,811,703 | $ | 5,927 | 0.41 | % | ||||||||||||||||||||||||||

| Savings accounts | 797,211 | 97 | 0.05 | 702,208 | 273 | 0.16 | ||||||||||||||||||||||||||||||||

| Money market accounts | 2,072,654 | 2,709 | 0.52 | 2,511,010 | 3,537 | 0.56 | ||||||||||||||||||||||||||||||||

| Certificates of deposit | 877,237 | 717 | 0.33 | 1,316,277 | 1,750 | 0.53 | ||||||||||||||||||||||||||||||||

| Total deposits | 9,628,301 | 8,110 | 0.34 | 10,341,198 | 11,487 | 0.45 | ||||||||||||||||||||||||||||||||

| FHLB advances | 132,143 | 164 | 0.50 | 375,000 | 537 | 0.57 | ||||||||||||||||||||||||||||||||

| Other borrowings - short-term | 42,402 | 405 | 3.83 | 797 | 4 | 2.01 | ||||||||||||||||||||||||||||||||

| Other borrowings - long-term | 266,658 | 3,464 | 5.21 | 305,962 | 4,039 | 5.29 | ||||||||||||||||||||||||||||||||

| Junior subordinated debentures | 54,303 | 554 | 4.09 | 54,104 | 441 | 3.27 | ||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 10,123,807 | 12,697 | 0.50 | 11,077,061 | 16,508 | 0.60 | ||||||||||||||||||||||||||||||||

| Noninterest-bearing checking accounts | 5,044,507 | 4,587,786 | ||||||||||||||||||||||||||||||||||||

| Noninterest-bearing liabilities | 112,558 | 98,925 | ||||||||||||||||||||||||||||||||||||

| Stockholders’ equity | 2,435,117 | 2,520,003 | ||||||||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 17,715,989 | $ | 18,283,775 | ||||||||||||||||||||||||||||||||||

| Net interest income | $ | 137,999 | $ | 129,297 | ||||||||||||||||||||||||||||||||||

| Interest rate spread | 3.33 | % | 2.94 | % | ||||||||||||||||||||||||||||||||||

Net interest margin (2) | 3.51 | 3.14 | ||||||||||||||||||||||||||||||||||||

Net interest income and margin (tax equivalent basis) (3) | $ | 139,112 | 3.53 | $ | 130,267 | 3.17 | ||||||||||||||||||||||||||||||||

| Average interest-earning assets to interest-bearing liabilities | 155.95 | 148.97 | ||||||||||||||||||||||||||||||||||||

____________

(1) Average loan balances include nonaccrual loans.

(2) Net interest margins for the periods presented represent: (i) the difference between interest income on interest-earning assets and the interest expense on interest-bearing liabilities, divided by (ii) average interest-earning assets for the period.

(3) A tax-equivalent adjustment has been computed using a federal income tax rate of 21%.

(4) Yield and rates for the three month periods are annualized.

13

Independent Bank Group, Inc. and Subsidiaries

Consolidated Average Balance Sheet Amounts, Interest Earned and Yield Analysis

Six Months Ended June 30, 2022 and 2021

(Dollars in thousands)

(Unaudited)

The analysis below shows average interest-earning assets and interest-bearing liabilities together with the average yield on the interest-earning assets and the average cost of the interest-bearing liabilities for the periods presented.

| Six Months Ended June 30, | ||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | |||||||||||||||||||||||||||||||||||||

| Average Outstanding Balance | Interest | Yield/Rate (4) | Average Outstanding Balance | Interest | Yield/Rate (4) | |||||||||||||||||||||||||||||||||

| Interest-earning assets: | ||||||||||||||||||||||||||||||||||||||

Loans (1) | $ | 12,658,541 | $ | 267,605 | 4.26 | % | $ | 12,679,592 | $ | 277,772 | 4.42 | % | ||||||||||||||||||||||||||

| Taxable securities | 1,696,572 | 16,602 | 1.97 | 1,007,664 | 10,009 | 2.00 | ||||||||||||||||||||||||||||||||

| Nontaxable securities | 426,447 | 5,074 | 2.40 | 350,887 | 4,130 | 2.37 | ||||||||||||||||||||||||||||||||

| Interest bearing deposits and other | 1,377,902 | 2,280 | 0.33 | 2,214,691 | 1,665 | 0.15 | ||||||||||||||||||||||||||||||||

| Total interest-earning assets | 16,159,462 | 291,561 | 3.64 | 16,252,834 | 293,576 | 3.64 | ||||||||||||||||||||||||||||||||

| Noninterest-earning assets | 1,916,191 | 1,784,355 | ||||||||||||||||||||||||||||||||||||

| Total assets | $ | 18,075,653 | $ | 18,037,189 | ||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | ||||||||||||||||||||||||||||||||||||||

| Checking accounts | $ | 6,058,317 | $ | 7,669 | 0.26 | % | $ | 5,652,511 | $ | 12,001 | 0.43 | % | ||||||||||||||||||||||||||

| Savings accounts | 788,842 | 191 | 0.05 | 686,442 | 533 | 0.16 | ||||||||||||||||||||||||||||||||

| Money market accounts | 2,204,570 | 4,412 | 0.40 | 2,606,418 | 7,563 | 0.59 | ||||||||||||||||||||||||||||||||

| Certificates of deposit | 925,099 | 1,448 | 0.32 | 1,353,451 | 4,397 | 0.66 | ||||||||||||||||||||||||||||||||

| Total deposits | 9,976,828 | 13,720 | 0.28 | 10,298,822 | 24,494 | 0.48 | ||||||||||||||||||||||||||||||||

| FHLB advances | 141,022 | 343 | 0.49 | 375,000 | 1,070 | 0.58 | ||||||||||||||||||||||||||||||||

| Other borrowings - short-term | 23,048 | 423 | 3.70 | 2,511 | 24 | 1.93 | ||||||||||||||||||||||||||||||||

| Other borrowings - long-term | 266,571 | 6,928 | 5.24 | 305,876 | 8,079 | 5.33 | ||||||||||||||||||||||||||||||||

| Junior subordinated debentures | 54,278 | 1,000 | 3.72 | 54,080 | 883 | 3.29 | ||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 10,461,747 | 22,414 | 0.43 | 11,036,289 | 34,550 | 0.63 | ||||||||||||||||||||||||||||||||

| Noninterest-bearing checking accounts | 5,002,121 | 4,407,624 | ||||||||||||||||||||||||||||||||||||

| Noninterest-bearing liabilities | 106,723 | 89,678 | ||||||||||||||||||||||||||||||||||||

| Stockholders’ equity | 2,505,062 | 2,503,598 | ||||||||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 18,075,653 | $ | 18,037,189 | ||||||||||||||||||||||||||||||||||

| Net interest income | $ | 269,147 | $ | 259,026 | ||||||||||||||||||||||||||||||||||

| Interest rate spread | 3.21 | % | 3.01 | % | ||||||||||||||||||||||||||||||||||

Net interest margin (2) | 3.36 | 3.21 | ||||||||||||||||||||||||||||||||||||

Net interest income and margin (tax equivalent basis) (3) | $ | 271,290 | 3.39 | $ | 260,956 | 3.24 | ||||||||||||||||||||||||||||||||

| Average interest-earning assets to interest-bearing liabilities | 154.46 | 147.27 | ||||||||||||||||||||||||||||||||||||

____________

(1) Average loan balances include nonaccrual loans.

(2) Net interest margins for the periods presented represent: (i) the difference between interest income on interest-earning assets and the interest expense on interest-bearing liabilities, divided by (ii) average interest-earning assets for the period.

(3) A tax-equivalent adjustment has been computed using a federal income tax rate of 21%.

(4) Yield and rates for the six month periods are annualized.

14

Independent Bank Group, Inc. and Subsidiaries

Loan Portfolio Composition

As of June 30, 2022 and December 31, 2021

(Dollars in thousands)

(Unaudited)

| Total Loans By Class | ||||||||||||||||||||||||||

| June 30, 2022 | December 31, 2021 | |||||||||||||||||||||||||

| Amount | % of Total | Amount | % of Total | |||||||||||||||||||||||

Commercial (1) | $ | 2,153,514 | 15.9 | % | $ | 1,983,886 | 15.9 | % | ||||||||||||||||||

| Mortgage warehouse purchase loans | 538,190 | 4.0 | 788,848 | 6.3 | ||||||||||||||||||||||

| Real estate: | ||||||||||||||||||||||||||

| Commercial real estate | 7,405,015 | 54.7 | 6,617,455 | 53.1 | ||||||||||||||||||||||

| Commercial construction, land and land development | 1,293,252 | 9.5 | 1,180,181 | 9.5 | ||||||||||||||||||||||

Residential real estate (2) | 1,496,771 | 11.0 | 1,332,246 | 10.7 | ||||||||||||||||||||||

| Single-family interim construction | 457,168 | 3.4 | 380,627 | 3.0 | ||||||||||||||||||||||

| Agricultural | 120,126 | 0.9 | 106,512 | 0.8 | ||||||||||||||||||||||

| Consumer | 80,611 | 0.6 | 81,815 | 0.7 | ||||||||||||||||||||||

| Total loans | 13,544,647 | 100.0 | % | 12,471,570 | 100.0 | % | ||||||||||||||||||||

| Allowance for credit losses | (144,170) | (148,706) | ||||||||||||||||||||||||

| Total loans, net | $ | 13,400,477 | $ | 12,322,864 | ||||||||||||||||||||||

____________

(1) Includes SBA PPP loans of $26,669 with net deferred loan fees of $502 and $112,128 with net deferred fees of $2,552 at June 30, 2022 and December 31, 2021, respectively.

(2) Includes loans held for sale of $26,519 and $32,124 at June 30, 2022 and December 31, 2021, respectively.

15

Independent Bank Group, Inc. and Subsidiaries

Reconciliation of Non-GAAP Financial Measures

Three Months Ended June 30, 2022, March 31, 2022, December 31, 2021, September 30, 2021 and June 30, 2021

(Dollars in thousands, except for share data)

(Unaudited)

| For the Three Months Ended | ||||||||||||||||||||||||||||||||

| June 30, 2022 | March 31, 2022 | December 31, 2021 | September 30, 2021 | June 30, 2021 | ||||||||||||||||||||||||||||

| ADJUSTED NET INCOME | ||||||||||||||||||||||||||||||||

| Net Interest Income - Reported | (a) | $ | 137,999 | $ | 131,148 | $ | 132,651 | $ | 128,645 | $ | 129,297 | |||||||||||||||||||||

| Provision Expense - Reported | (b) | — | (1,443) | — | — | (6,500) | ||||||||||||||||||||||||||

| Noninterest Income - Reported | (c) | 13,877 | 12,885 | 15,086 | 16,896 | 15,926 | ||||||||||||||||||||||||||

| Loss (gain) on sale of loans | 17 | 1,484 | (30) | — | (26) | |||||||||||||||||||||||||||

| Gain on sale of other real estate | — | — | — | (63) | — | |||||||||||||||||||||||||||

| Gain on sale of securities available for sale | — | — | (13) | — | — | |||||||||||||||||||||||||||

| Loss on sale and disposal of premises and equipment | 46 | 163 | 243 | 41 | 13 | |||||||||||||||||||||||||||

| Recoveries on loans charged off prior to acquisition | (45) | (51) | (27) | (21) | (204) | |||||||||||||||||||||||||||

| Adjusted Noninterest Income | (d) | 13,895 | 14,481 | 15,259 | 16,853 | 15,709 | ||||||||||||||||||||||||||

| Noninterest Expense - Reported | (e) | 85,925 | 82,457 | 79,908 | 80,572 | 78,013 | ||||||||||||||||||||||||||

| Executive separation expense | (1,106) | — | — | — | — | |||||||||||||||||||||||||||

| Impairment of assets | — | — | — | (115) | — | |||||||||||||||||||||||||||

COVID-19 expense (1) | — | — | (614) | — | — | |||||||||||||||||||||||||||

Acquisition expense (2) | (65) | (130) | (225) | (214) | (217) | |||||||||||||||||||||||||||

| Adjusted Noninterest Expense | (f) | 84,754 | 82,327 | 79,069 | 80,243 | 77,796 | ||||||||||||||||||||||||||

| Income Tax Expense - Reported | (g) | 13,591 | 12,279 | 13,642 | 12,629 | 15,467 | ||||||||||||||||||||||||||

| Net Income - Reported | (a) - (b) + (c) - (e) - (g) = (h) | 52,360 | 50,740 | 54,187 | 52,340 | 58,243 | ||||||||||||||||||||||||||

Adjusted Net Income (3) | (a) - (b) + (d) - (f) = (i) | $ | 53,304 | $ | 52,130 | $ | 54,995 | $ | 52,570 | $ | 58,243 | |||||||||||||||||||||

| ADJUSTED PROFITABILITY | ||||||||||||||||||||||||||||||||

| Total Average Assets | (j) | $ | 17,715,989 | $ | 18,439,352 | $ | 19,374,914 | $ | 18,766,344 | $ | 18,283,775 | |||||||||||||||||||||

| Total Average Stockholders' Equity | (k) | $ | 2,435,117 | $ | 2,575,784 | $ | 2,574,374 | $ | 2,563,986 | $ | 2,520,003 | |||||||||||||||||||||

Total Average Tangible Stockholders' Equity (4) | (l) | $ | 1,370,825 | $ | 1,508,370 | $ | 1,503,815 | $ | 1,490,259 | $ | 1,443,130 | |||||||||||||||||||||

| Reported Return on Average Assets | (h) / (j) | 1.19 | % | 1.12 | % | 1.11 | % | 1.11 | % | 1.28 | % | |||||||||||||||||||||

| Reported Return on Average Equity | (h) / (k) | 8.62 | % | 7.99 | % | 8.35 | % | 8.10 | % | 9.27 | % | |||||||||||||||||||||

| Reported Return on Average Tangible Equity | (h) / (l) | 15.32 | % | 13.64 | % | 14.30 | % | 13.93 | % | 16.19 | % | |||||||||||||||||||||

Adjusted Return on Average Assets (5) | (i) / (j) | 1.21 | % | 1.15 | % | 1.13 | % | 1.11 | % | 1.28 | % | |||||||||||||||||||||

Adjusted Return on Average Equity (5) | (i) / (k) | 8.78 | % | 8.21 | % | 8.48 | % | 8.13 | % | 9.27 | % | |||||||||||||||||||||

Adjusted Return on Tangible Equity (5) | (i) / (l) | 15.60 | % | 14.02 | % | 14.51 | % | 14.00 | % | 16.19 | % | |||||||||||||||||||||

| EFFICIENCY RATIO | ||||||||||||||||||||||||||||||||

| Amortization of other intangible assets | (m) | $ | 3,118 | $ | 3,145 | $ | 3,145 | $ | 3,145 | $ | 3,145 | |||||||||||||||||||||

| Reported Efficiency Ratio | (e - m) / (a + c) | 54.52 | % | 55.07 | % | 51.96 | % | 53.20 | % | 51.55 | % | |||||||||||||||||||||

| Adjusted Efficiency Ratio | (f - m) / (a + d) | 53.75 | % | 54.37 | % | 51.33 | % | 52.99 | % | 51.48 | % | |||||||||||||||||||||

____________

(1) COVID-19 expense includes expenses for COVID testing kits, vaccination incentive bonuses, and personal protection and cleaning supplies.

(2) Acquisition expenses includes compensation related expenses.

(3) Assumes an adjusted effective tax rate of 20.6%, 19.5%, 20.1%, 19.4%, and 21.0%, respectively.

(4) Excludes average balance of goodwill and net other intangible assets.

(5) Calculated using adjusted net income.

16

Independent Bank Group, Inc. and Subsidiaries

Reconciliation of Non-GAAP Financial Measures

As of June 30, 2022, March 31, 2022, December 31, 2021, September 30, 2021 and June 30, 2021

(Dollars in thousands, except per share information)

(Unaudited)

| Tangible Book Value & Tangible Common Equity To Tangible Assets Ratio | |||||||||||||||||||||||||||||

| As of the Quarter Ended | |||||||||||||||||||||||||||||

| June 30, 2022 | March 31, 2022 | December 31, 2021 | September 30, 2021 | June 30, 2021 | |||||||||||||||||||||||||

| Tangible Common Equity | |||||||||||||||||||||||||||||

| Total common stockholders' equity | $ | 2,364,335 | $ | 2,522,460 | $ | 2,576,650 | $ | 2,566,693 | $ | 2,542,885 | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||

| Goodwill | (994,021) | (994,021) | (994,021) | (994,021) | (994,021) | ||||||||||||||||||||||||

| Other intangible assets, net | (69,227) | (72,345) | (75,490) | (78,635) | (81,780) | ||||||||||||||||||||||||

| Tangible common equity | $ | 1,301,087 | $ | 1,456,094 | $ | 1,507,139 | $ | 1,494,037 | $ | 1,467,084 | |||||||||||||||||||

| Tangible Assets | |||||||||||||||||||||||||||||

| Total assets | $ | 18,107,093 | $ | 17,963,253 | $ | 18,732,648 | $ | 18,918,225 | $ | 18,447,721 | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||

| Goodwill | (994,021) | (994,021) | (994,021) | (994,021) | (994,021) | ||||||||||||||||||||||||

| Other intangible assets, net | (69,227) | (72,345) | (75,490) | (78,635) | (81,780) | ||||||||||||||||||||||||

| Tangible assets | $ | 17,043,845 | $ | 16,896,887 | $ | 17,663,137 | $ | 17,845,569 | $ | 17,371,920 | |||||||||||||||||||

| Common shares outstanding | 41,156,261 | 42,795,228 | 42,756,234 | 42,941,715 | 43,180,607 | ||||||||||||||||||||||||

| Tangible common equity to tangible assets | 7.63 | % | 8.62 | % | 8.53 | % | 8.37 | % | 8.45 | % | |||||||||||||||||||

| Book value per common share | $ | 57.45 | $ | 58.94 | $ | 60.26 | $ | 59.77 | $ | 58.89 | |||||||||||||||||||

| Tangible book value per common share | 31.61 | 34.02 | 35.25 | 34.79 | 33.98 | ||||||||||||||||||||||||

17

Earnings Presentation July 25, 2022 NASDAQ: IBTX Exhibit 99.2

NASDAQ: IBTX 2 Safe Harbor Statement The numbers as of and for the quarter ended June 30, 2022 are unaudited. This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans and the future performance of Independent Bank Group, Inc. (“IBTX”). Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “could,” “may,” “should,” “will” or other similar words and expressions are intended to identify these forward-looking statements. These forward-looking statements are based on IBTX’s current expectations and assumptions regarding IBTX’s business, the economy, and other future conditions. Because forward-looking statements relate to future results and occurrences, they are subject to inherent uncertainties, assumptions, risks, and changes in circumstances that are difficult to predict. Many possible events or factors could materialize or IBTX’s underlying assumptions could prove incorrect and affect IBTX’s future financial results and performance and could cause actual results or performance to differ materially from anticipated results or performance. Such risks and uncertainties include, among others, risks relating to the conflict between Russia and the Ukraine, risks relating to the coronavirus (COVID-19) pandemic and its effect on U.S. and world financial markets, potential regulatory actions, changes in consumer behaviors and impacts on and modifications to the operations and business of IBTX relating thereto, and the business, economic and political conditions in the markets in which IBTX operates. Except to the extent required by applicable law or regulation, IBTX disclaims any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments. Further information regarding IBTX and factors which could affect the forward-looking statements contained herein can be found in IBTX’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, its Quarterly Report on Form 10-Q for the period ended March 31, 2022 and its other filings with the Securities and Exchange Commission.

NASDAQ: IBTX 3 Safe Harbor Statement (cont.) Non-GAAP Financial Measures In addition to results presented in accordance with GAAP, this presentation contains certain non-GAAP financial measures. These measures and ratios include “adjusted net income,” “tangible book value,” “tangible book value per common share,” “adjusted efficiency ratio,” “tangible common equity to tangible assets,” “return on tangible common equity,” “adjusted return on average assets,” “adjusted return on average common equity,” “adjusted return on tangible common equity,” “adjusted earnings per share,” “adjusted diluted earnings per share,” “adjusted net interest margin,” “adjusted net interest income,” “adjusted noninterest expenses” and “adjusted noninterest income” and are supplemental measures that are not required by, or are not presented in accordance with, accounting principles generally accepted in the United States. We believe that these measures provide useful information to management and investors that is supplementary to our financial condition, results of operations and cash flows computed in accordance with GAAP; however we acknowledge that our financial measures have a number of limitations relative to GAAP financial measures. Certain non-GAAP financial measures exclude items of income, expenditures, expenses, assets, or liabilities, including provisions for credit losses and the effect of goodwill, other intangible assets and income from accretion on acquired loans arising from purchase accounting adjustments, that we believe cause certain aspects of our results of operations or financial condition to be not indicative of our primary operating results. All of these items significantly impact our financial statements. Additionally, the items that we exclude in our adjustments are not necessarily consistent with the items that our peers may exclude from their results of operations and key financial measures and therefore may limit the comparability of similarly named financial measures and ratios. We compensate for these limitations by providing the equivalent GAAP measures whenever we present the non-GAAP financial measures and by including a reconciliation of the impact of the components adjusted for in the non-GAAP financial measure so that both measures and the individual components may be considered when analyzing our performance. A reconciliation of our non-GAAP financial measures to the comparable GAAP financial measures is included at the end of this presentation.

NASDAQ: IBTX 4 David R. Brooks Chairman of the Board and CEO, Director • 42 years in the financial services industry; 34 years at Independent Bank • Active in community banking since the early 1980s - led the investor group that acquired Independent Bank in 1988 Michelle S. Hickox Executive Vice President, Chief Financial Officer • 32 years in the financial services industry; 10 years at Independent Bank • Formerly a Financial Services Audit Partner at RSM US LLP • Certified Public Accountant Daniel W. Brooks Vice Chairman, Director • 39 years in the financial services industry; 33 years at Independent Bank • Active in community banking since the early 1980s Today's Presenters

NASDAQ: IBTX 5 2022 Q2 Results GAAP $1.25 EPS $52.4 Million Net Income 1.19% Return on Average Assets 8.62% Return on Average Equity 12.24% Total Capital Ratio 9.28% Leverage Ratio Non-GAAP1 $1.28 Adj. EPS $53.3 Million Adj. Net Income 1.21% Adj. Return on Average Assets 8.78% Adj. Return on Average Equity 15.32% Return on Tangible Equity 7.63% TCE Highlights • Net income of $52.4 million, or $1.25 per diluted share and adjusted (non-GAAP) net income of $53.3 million, or $1.27 per diluted share • Robust organic loan growth of 36.0% annualized for the quarter (excluding warehouse and PPP) • Net interest income grew 5.2% over the linked quarter • Increase in the net interest margin to 3.51%, up from 3.22% in linked quarter • Repurchased over 1.6 million shares of common stock for $115.2 million aggregate during the quarter 1Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics.