Form 8-K II-VI INC For: Nov 03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported) November 3, 2017

II-VI Incorporated

(Exact Name of Registrant as Specified in Its Charter)

Pennsylvania

(State or Other Jurisdiction of Incorporation)

| 0-16195 | 25-1214948 | |

| (Commission File Number) | (IRS Employer Identification No.) |

| 375 Saxonburg Boulevard, Saxonburg, Pennsylvania | 16056 | |

| (Address of Principal Executive Offices) | (Zip Code) |

(724) 352-4455

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.07 | Submission of Matters to a Vote of Security Holders. |

(a) II-VI Incorporated (the “Company”) held its Annual Meeting of Shareholders on November 3, 2017 (the “Annual Meeting”). As of the record date of September 1, 2017, there were 62,864,134 shares of common stock outstanding and entitled to vote at the meeting. A total of 59,116,553 shares were present in person or by proxy at the Annual Meeting, or 94.04% of the total shares outstanding.

(b) At the Annual Meeting, the shareholders elected Joseph J. Corasanti and William A. Schromm as Class Three Directors to serve until the Company’s 2020 annual meeting of shareholders or until their respective successors are duly elected and qualified (“Proposal 1”). Proposal 1 received the following votes:

Joseph J. Corasanti

| For |

Against |

Abstain |

Broker Non-Votes | |||

| 49,641,978 |

1,920,484 | 33,335 | 7,520,756 |

William A. Schromm

| For |

Against |

Abstain |

Broker Non-Votes | |||

| 51,141,915 |

433,685 | 20,197 | 7,520,756 |

At the Annual Meeting, the shareholders approved (on a non-binding advisory basis) the Company’s executive compensation (“Proposal 2”). Proposal 2 received the following votes:

| For |

Against |

Abstain |

Broker Non-Votes | |||

| 50,242,119 |

1,293,795 | 59,883 | 7,520,756 |

At the Annual Meeting, the shareholders approved (on a non-binding advisory basis) the frequency of future non-binding advisory votes on the Company’s executive compensation. Proposal 3 received the following votes:

| 1 Year |

2 Year |

3 Year |

Abstain |

Broker Non-Votes | ||||

| 41,614,377 |

60,540 | 9,864,789 | 56,091 | 7,520,756 |

In light of the voting results on this matter, the Company has determined that it intends to hold an advisory vote to approve the compensation of the Company’s named officers annually until the next shareholder vote on the frequency of such advisory votes. A shareholder vote (on a non-binding advisory basis) on the frequency of future non-binding advisory votes on the Company’s executive compensation is required to be held at least once every six years.

At the Annual Meeting, the shareholders ratified the Audit Committee’s selection of Ernst & Young LLP, as the independent registered public accounting firm of the Company for the fiscal year ended June 30, 2018 (“Proposal 4”). Proposal 4 received the following votes:

| For |

Against |

Abstain |

Broker Non-Votes | |||

| 58,697,199 |

387,319 | 32,035 | — |

A copy of the related press release is attached hereto as Exhibit 99.1 and is incorporated by reference.

| Item 7.01. | Regulation FD Disclosures. |

The management of the Company will be presenting at investor conferences in the near future. The presentation materials are attached hereto as Exhibits 99.2 and 99-3and incorporated herein by reference. The materials may also be used at one or more subsequent conferences. The information contained in the attached presentation materials are summary information that are intended to be considered in the context of the Company’s SEC filings and other public announcements. The Company undertakes no duty or obligation to publicly update or revise this information, although it may do so from time to time.

The information in Item 7.01 of this Current Report on Form 8-K, including the exhibits furnished as Exhibits 99.2 and 99.3 herewith, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities under that Section. Furthermore, the information in Item 7.01 of this Current Report on Form 8-K, including the exhibits furnished as Exhibits 99.2 and 99.3 herewith, shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933.

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits.

The following exhibits are filed or furnished, as the case may be, herewith:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| II-VI INCORPORATED | ||||||

| (Registrant) | ||||||

| Date: November 8, 2017 | By: | /s/ Mary Jane Raymond | ||||

| Mary Jane Raymond | ||||||

| Chief Financial Officer | ||||||

Exhibit 99.1

|

375 Saxonburg Boulevard, Saxonburg, PA 16056

Tel. 724.352.4455 ● www.ii-vi.com

Press Release |

II-VI Incorporated Announces Results of Shareholders’ Meeting

Board of Director and Officer Appointments

PITTSBURGH, PA – November 3, 2017 (GLOBE NEWSWIRE) — II-VI Incorporated (Nasdaq: IIVI) announced the results of its Annual Meeting of Shareholders held on Friday, November 3, 2017.

The following proposals submitted to the shareholders were approved:

| • | Election of Joseph J. Corasanti and William A. Schromm to the Company’s Board of Directors for a three-year term; |

| • | The non-binding advisory proposal regarding the Company’s executive compensation; |

| • | Annual frequency of future non-binding advisory votes on the Company’s executive compensation; and |

| • | Ratification of the Audit Committee’s selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2018. |

The Company’s Board of Directors reappointed Francis J. Kramer to serve as the Board’s Chairman and Marc Y.E. Pelaez to serve as the Board’s Lead Independent Director.

The Company’s Board of Directors appointed the following directors to serve as members of the various committees of the Board of Directors:

| • | Audit Committee |

Joseph J. Corasanti, Chair

Shaker Sadasivam

William A. Schromm

Howard H. Xia

| • | Compensation Committee |

Shaker Sadasivam, Chair

Joseph J. Corasanti

Marc Y.E. Pelaez

| • | Corporate Governance and Nominating Committee |

Marc Y.E. Pelaez, Chair

William A. Schromm

Howard H. Xia

| • | Subsidiary Committee |

Howard H. Xia, Chair

Joseph J. Corasanti

Marc Y.E. Pelaez

Shaker Sadasivam

II-VI Incorporated

November 3, 2017

Page 2

The Company’s Board of Directors also elected the following individuals as executive officers of the Company:

| Vincent D. Mattera, Jr. | President and Chief Executive Officer | |

| Giovanni Barbarossa | Chief Technology Officer and President, Laser Solutions Segment | |

| Gary A. Kapusta | Chief Operating Officer | |

| Mary Jane Raymond | Chief Financial Officer, Treasurer and Assistant Secretary | |

| Jo Anne Schwendinger | Chief Legal and Compliance Officer and Secretary | |

| David G. Wagner | Vice President, Human Resources |

About II-VI Incorporated

II-VI Incorporated, a global leader in engineered materials and optoelectronic components, is a vertically integrated manufacturing company that develops innovative products for diversified applications in the industrial, optical communications, military, life sciences, semiconductor equipment, and consumer markets. Headquartered in Saxonburg, Pennsylvania, the Company has research and development, manufacturing, sales, service, and distribution facilities worldwide. The Company produces a wide variety of application-specific photonic and electronic materials and components, and deploys them in various forms, including integrated with advanced software to enable our customers. For more information, please visit us at www.ii-vi.com.

| CONTACT: | II-VI Incorporated | |

| Mark Lourie, Director Corporate Communications | ||

| [email protected] |

November 2017

Exhibit 99.2 |

Company: II-VI Incorporated Presenting:Dr. Vincent D. (Chuck) Mattera, Jr President and CEO Mary Jane Raymond Chief Financial Officer INTRODUCTIONS

Matters discussed in this presentation may contain forward-looking statements that are subject to risks and uncertainties. These risks and uncertainties could cause the forward-looking statements and II-VI Incorporated’s (the “Company’s”) actual results to differ materially. In evaluating these forward-looking statements, you should specifically consider the “Risk Factors” in the Company’s most recent Form 10-K and Form 10-Q. Forward-looking statements are only estimates and actual events or results may differ materially. II-VI Incorporated disclaims any obligation to update information contained in any forward-looking statement. This presentation contains certain non-GAAP financial measures. Reconciliations of non-GAAP financial measures to their most comparable GAAP financial measures are presented at the end of this presentation. Safe Harbor Statement

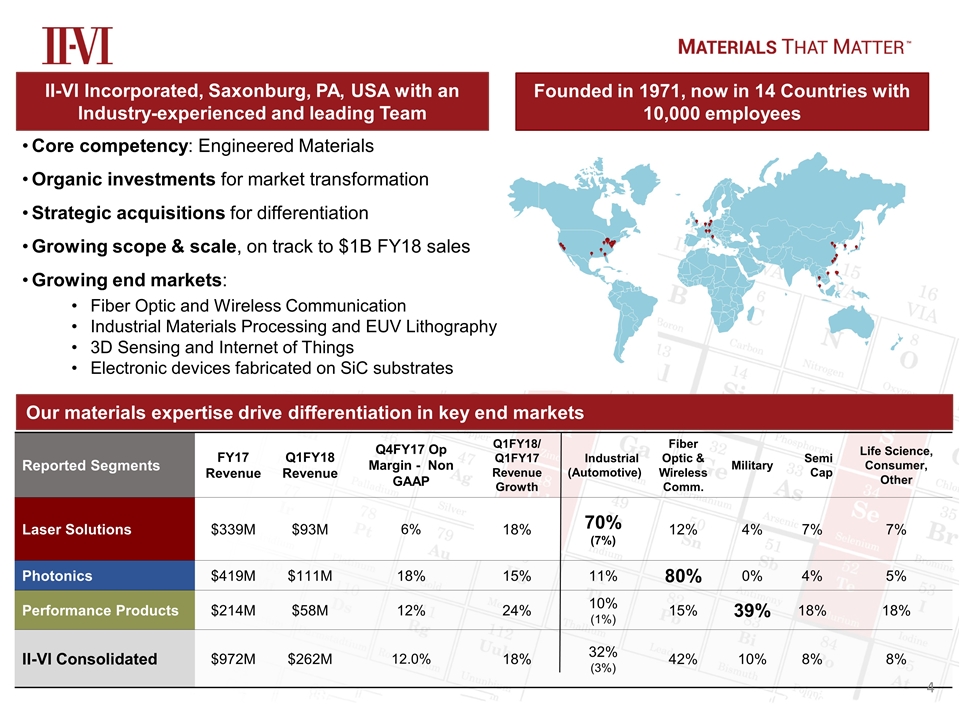

Reported Segments FY17 Revenue Q1FY18 Revenue Q4FY17 Op Margin - Non GAAP Q1FY18/ Q1FY17 Revenue Growth Industrial (Automotive) Fiber Optic & Wireless Comm. Military Semi Cap Life Science, Consumer, Other Laser Solutions $339M $93M 6% 18% 70% (7%) 12% 4% 7% 7% Photonics $419M $111M 18% 15% 11% 80% 0% 4% 5% Performance Products $214M $58M 12% 24% 10% (1%) 15% 39% 18% 18% II-VI Consolidated $972M $262M 12.0% 18% 32% (3%) 42% 10% 8% 8% Core competency: Engineered Materials Organic investments for market transformation Strategic acquisitions for differentiation Growing scope & scale, on track to $1B FY18 sales Growing end markets: Fiber Optic and Wireless Communication Industrial Materials Processing and EUV Lithography 3D Sensing and Internet of Things Electronic devices fabricated on SiC substrates Founded in 1971, now in 14 Countries with 10,000 employees II-VI Incorporated, Saxonburg, PA, USA with an Industry-experienced and leading Team Our materials expertise drive differentiation in key end markets

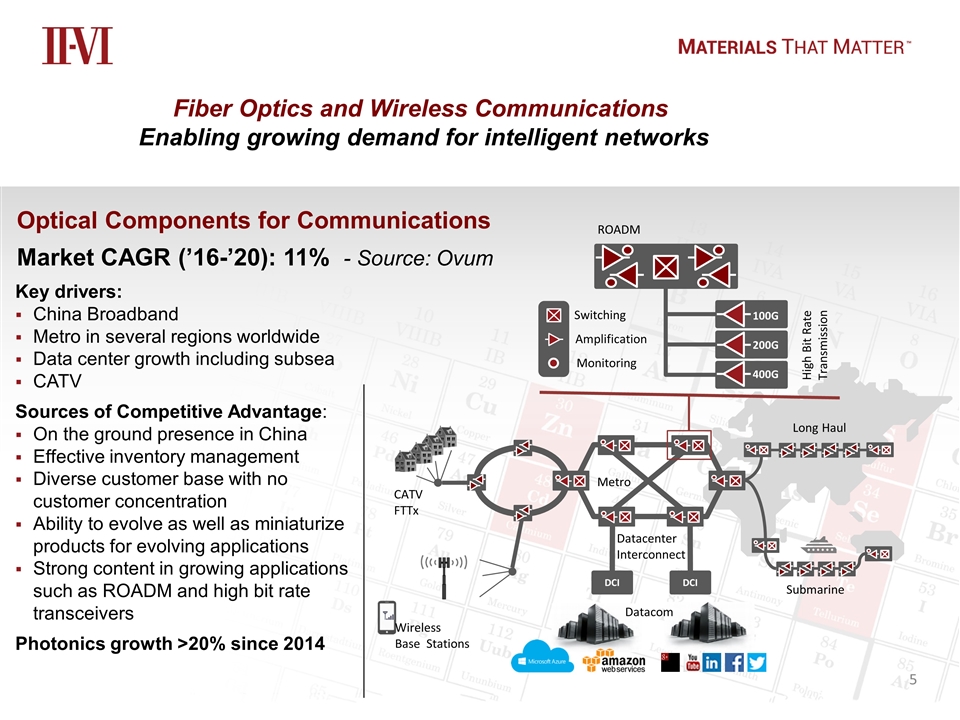

Fiber Optics and Wireless Communications Enabling growing demand for intelligent networks Optical Components for Communications Market CAGR (’16-’20): 11% - Source: Ovum Key drivers: China Broadband Metro in several regions worldwide Data center growth including subsea CATV Sources of Competitive Advantage: On the ground presence in China Effective inventory management Diverse customer base with no customer concentration Ability to evolve as well as miniaturize products for evolving applications Strong content in growing applications such as ROADM and high bit rate transceivers Photonics growth >20% since 2014 Long Haul Submarine DCI DCI Metro Datacenter Interconnect CATV FTTx Wireless Base Stations 400G 200G 100G High Bit Rate Transmission ROADM Switching Amplification Monitoring Datacom

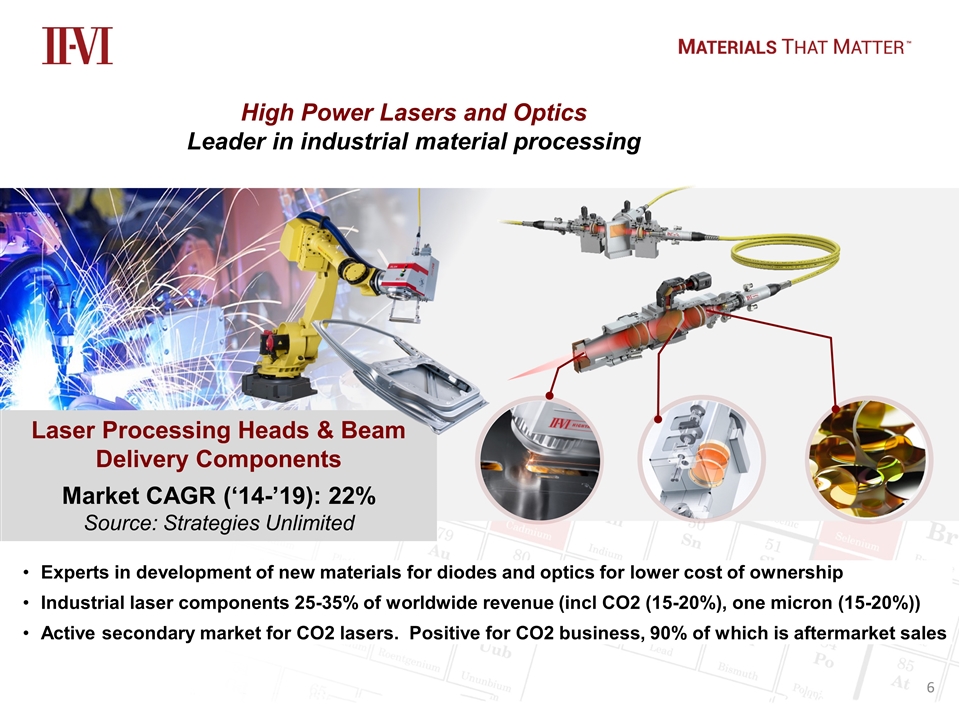

High Power Lasers and Optics Leader in industrial material processing Laser Processing Heads & Beam Delivery Components Market CAGR (‘14-’19): 22% Source: Strategies Unlimited Experts in development of new materials for diodes and optics for lower cost of ownership Industrial laser components 25-35% of worldwide revenue (incl CO2 (15-20%), one micron (15-20%)) Active secondary market for CO2 lasers. Positive for CO2 business, 90% of which is aftermarket sales

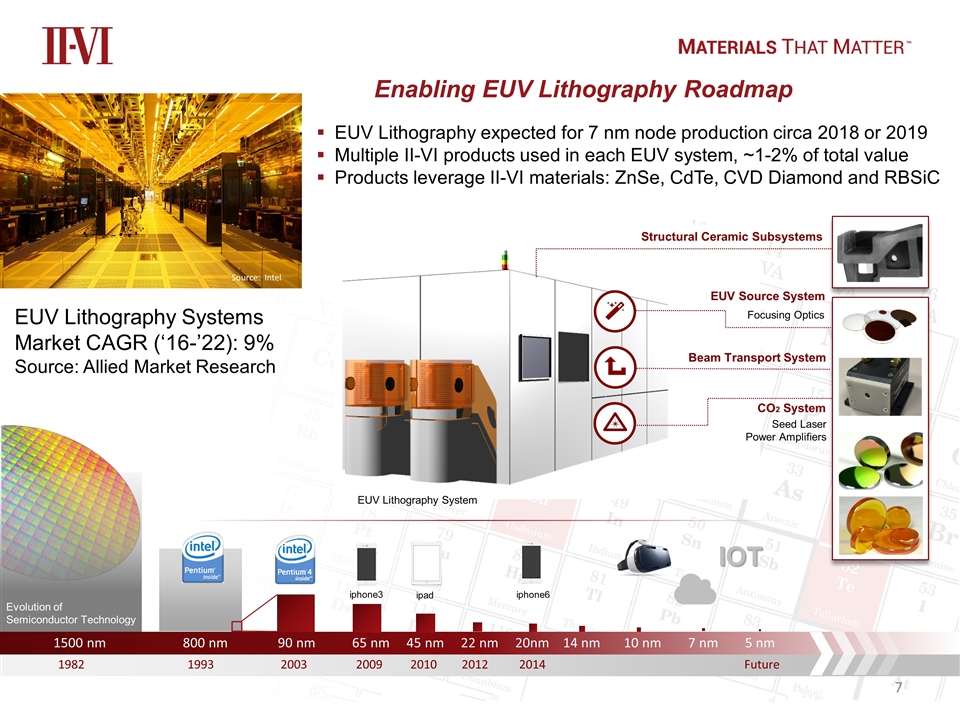

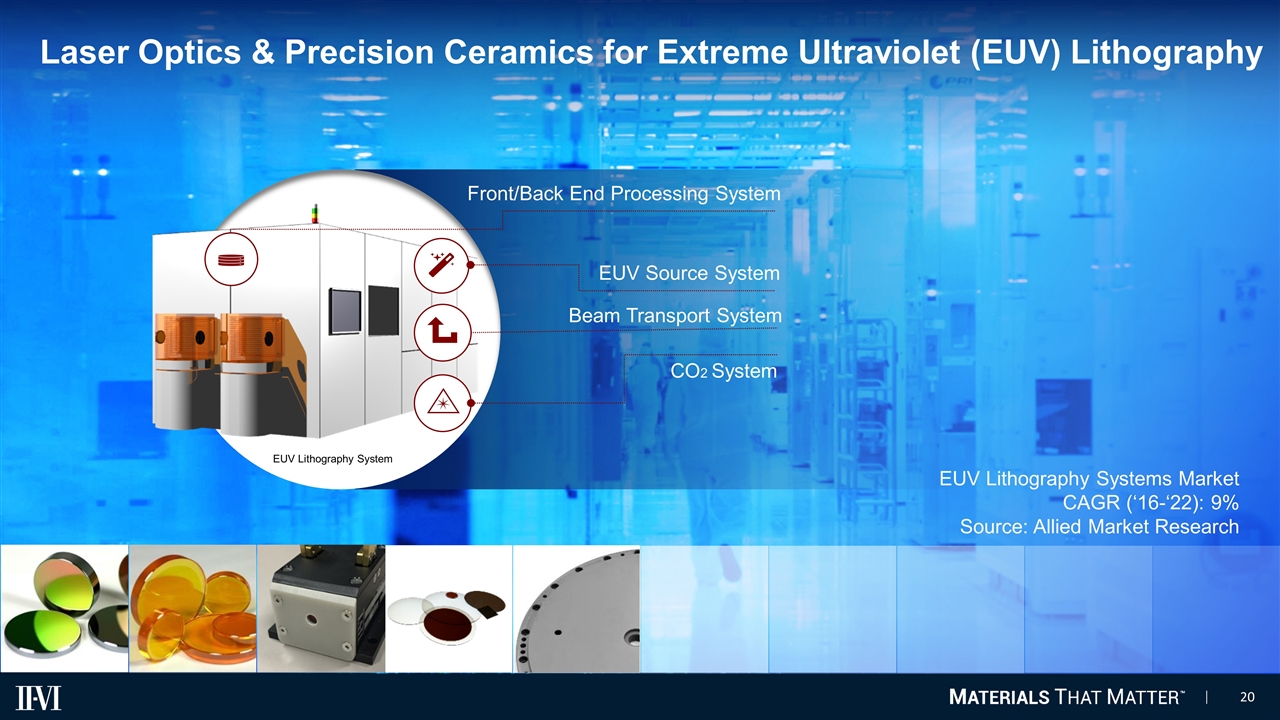

EUV Source System Beam Transport System CO2 System Structural Ceramic Subsystems Seed Laser Power Amplifiers Focusing Optics EUV Lithography System 1500 nm 800 nm 90 nm 65 nm 45 nm 22 nm 20nm 14 nm 10 nm 7 nm 5 nm Evolution of Semiconductor Technology 1982 1993 2003 2009 2010 2012 2014 Future Source: Intel IOT iphone3 iphone6 ipad EUV Lithography Systems Market CAGR (‘16-’22): 9% Source: Allied Market Research Enabling EUV Lithography Roadmap EUV Lithography expected for 7 nm node production circa 2018 or 2019 Multiple II-VI products used in each EUV system, ~1-2% of total value Products leverage II-VI materials: ZnSe, CdTe, CVD Diamond and RBSiC

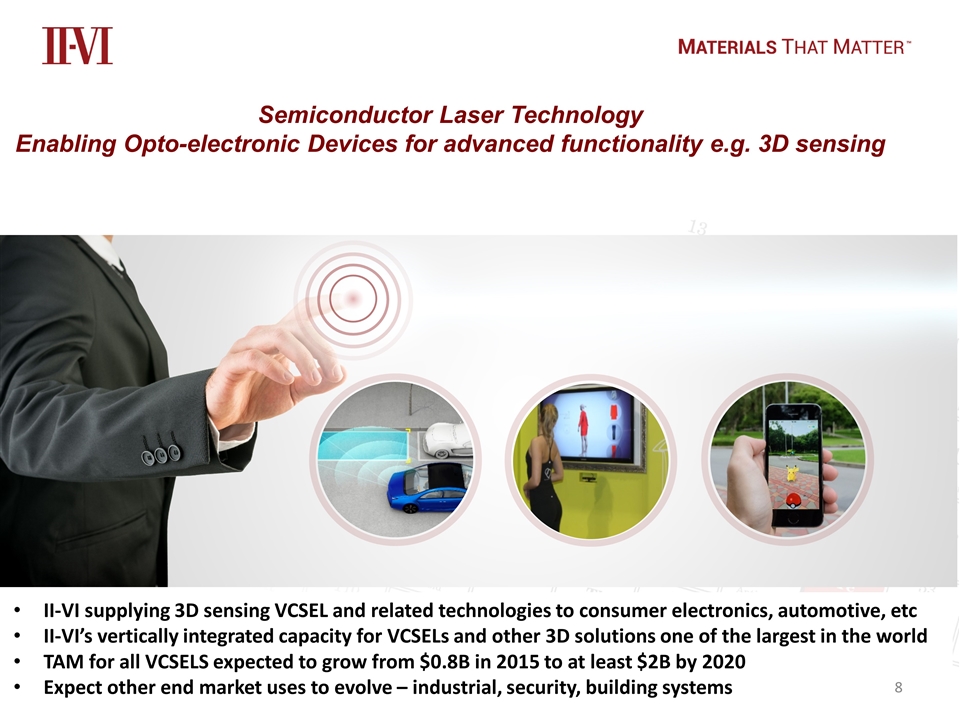

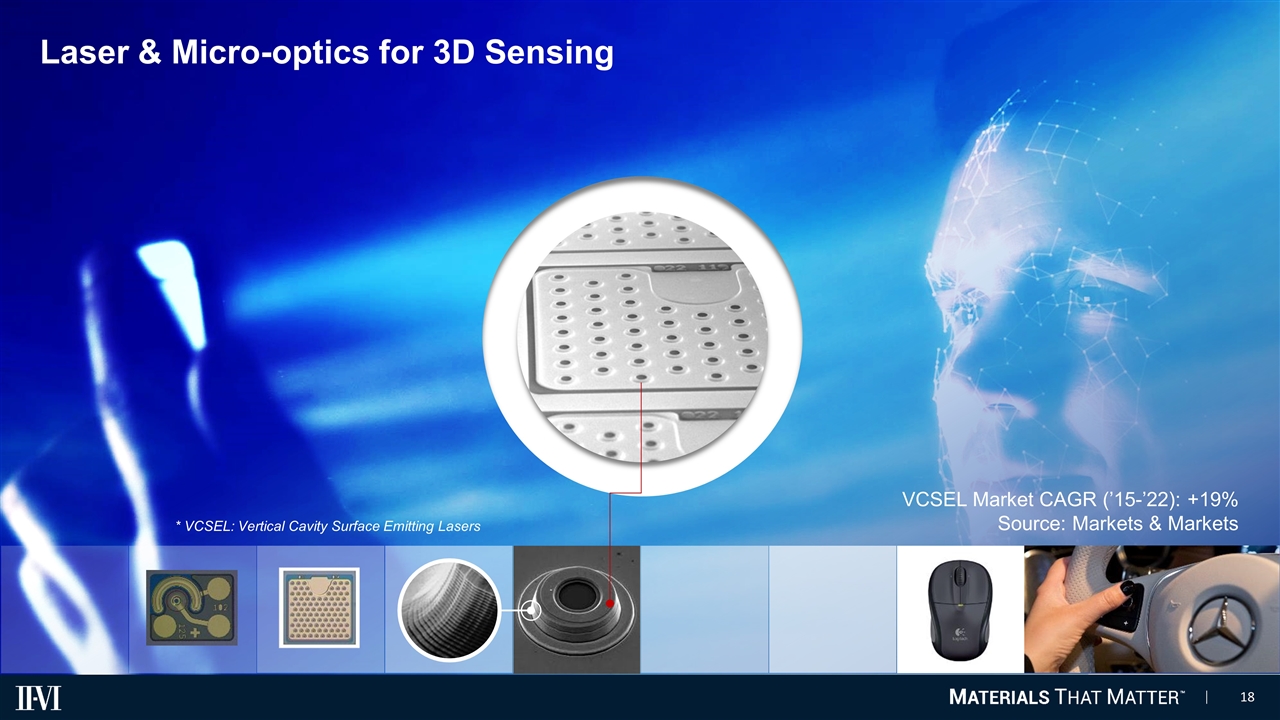

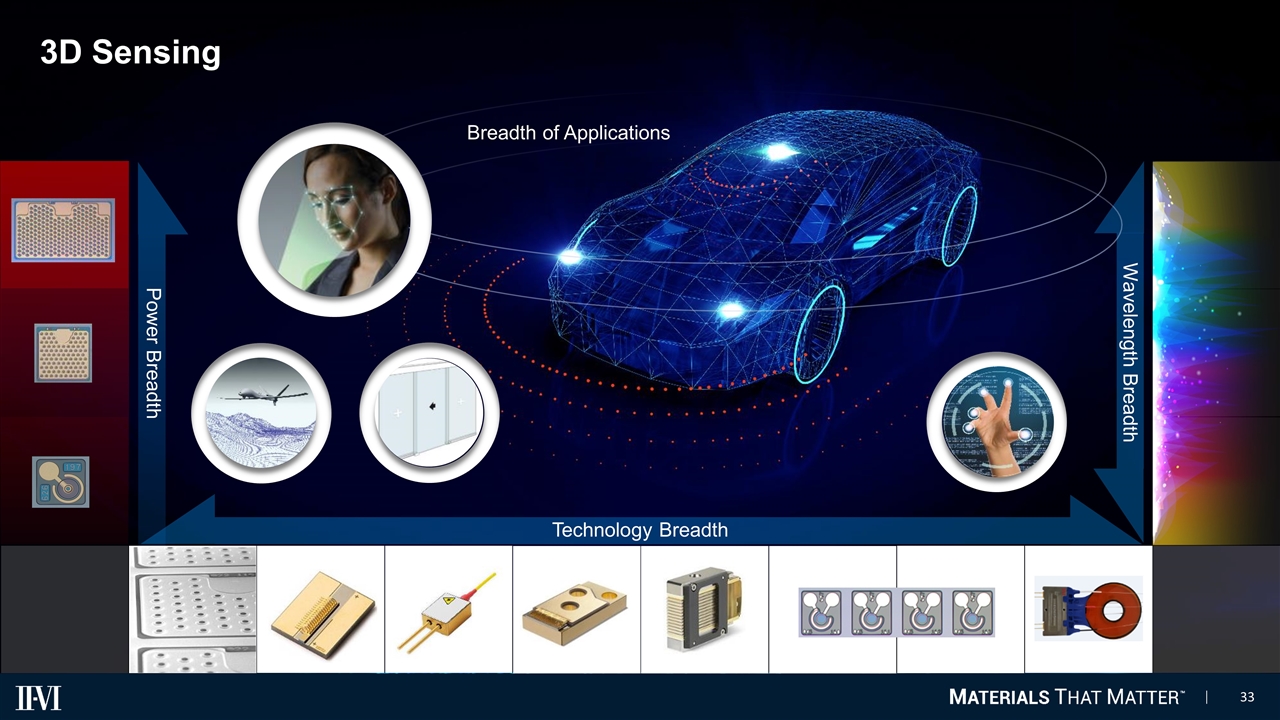

Optical Communications Internet of Things Semiconductor Laser Technology Enabling Opto-electronic Devices for advanced functionality e.g. 3D sensing II-VI supplying 3D sensing VCSEL and related technologies to consumer electronics, automotive, etc II-VI’s vertically integrated capacity for VCSELs and other 3D solutions one of the largest in the world TAM for all VCSELS expected to grow from $0.8B in 2015 to at least $2B by 2020 Expect other end market uses to evolve – industrial, security, building systems

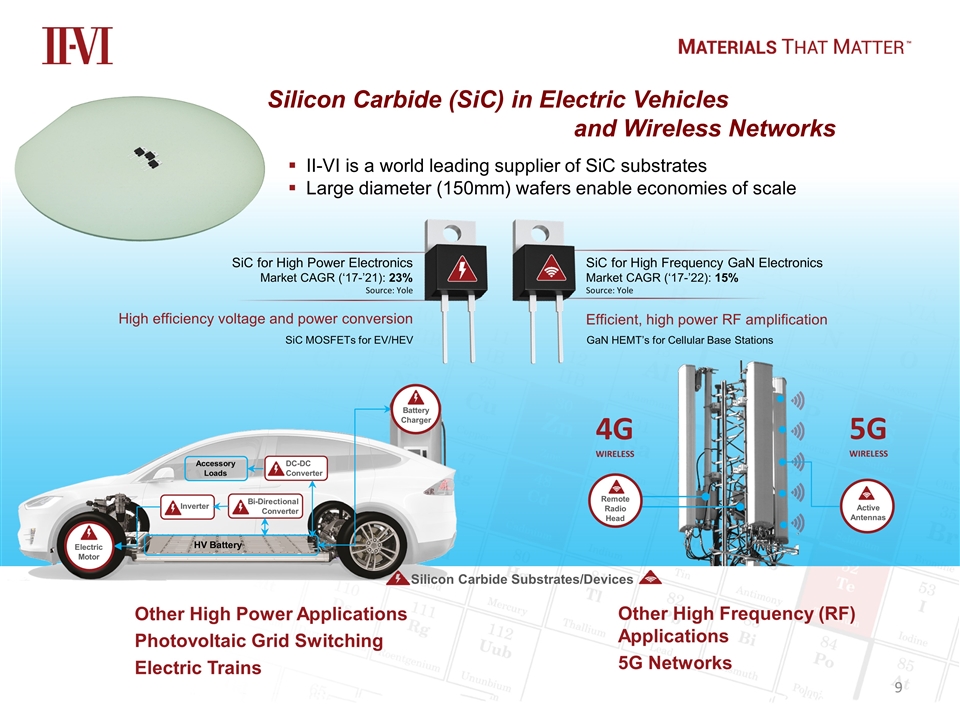

II-VI is a world leading supplier of SiC substrates Large diameter (150mm) wafers enable economies of scale SiC for High Power Electronics Market CAGR (‘17-’21): 23% Source: Yole Other High Power Applications Photovoltaic Grid Switching Electric Trains SiC for High Frequency GaN Electronics Market CAGR (‘17-’22): 15% Source: Yole Other High Frequency (RF) Applications 5G Networks Silicon Carbide (SiC) in Electric Vehicles and Wireless Networks 5G WIRELESS HV Battery Bi-Directional Converter DC-DC Converter Accessory Loads Inverter Battery Charger Electric Motor 4G WIRELESS Remote Radio Head Active Antennas High efficiency voltage and power conversion Efficient, high power RF amplification SiC MOSFETs for EV/HEV GaN HEMT’s for Cellular Base Stations Silicon Carbide Substrates/Devices

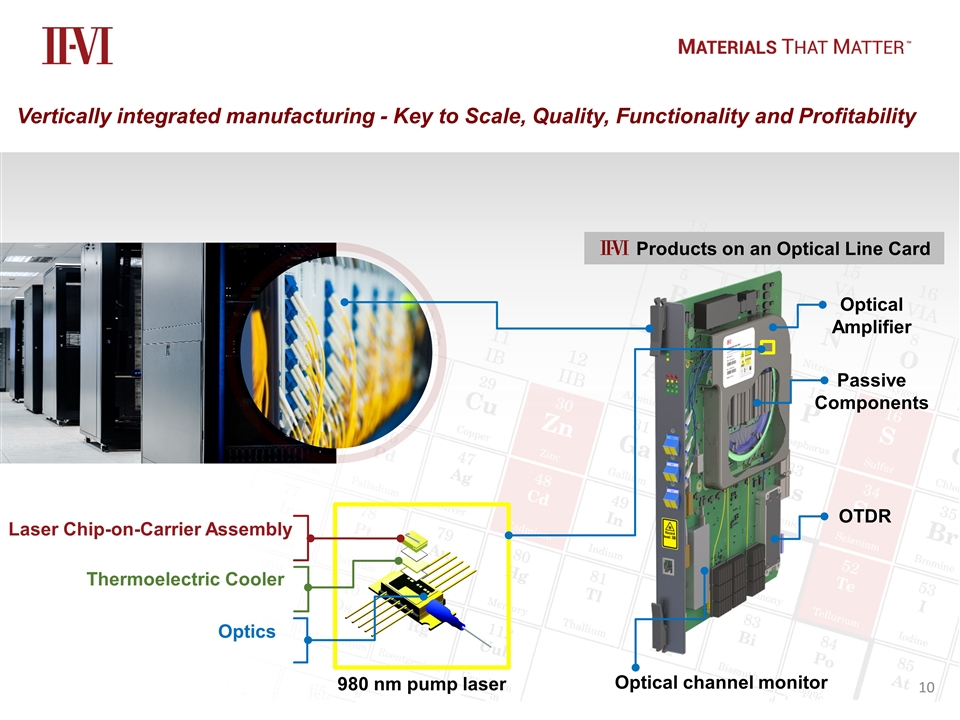

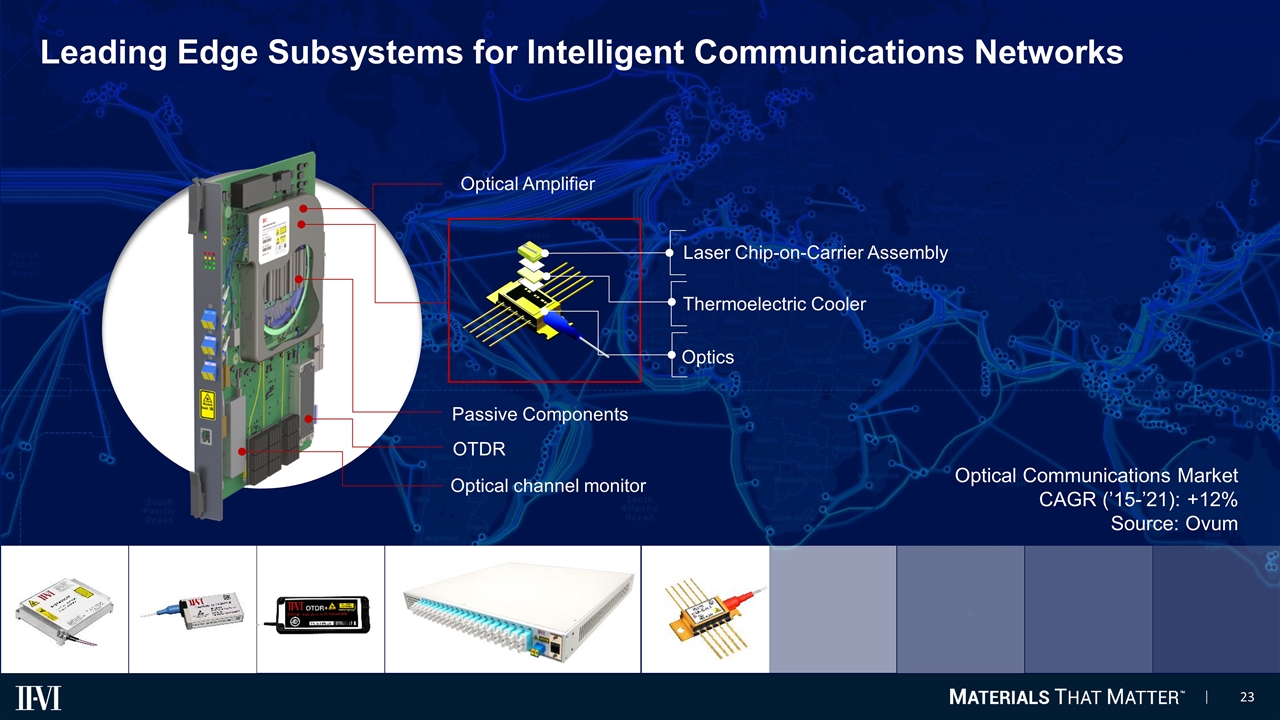

Products on an Optical Line Card Laser Chip-on-Carrier Assembly Thermoelectric Cooler Optics Vertically integrated manufacturing - Key to Scale, Quality, Functionality and Profitability 980 nm pump laser Optical channel monitor OTDR Passive Components Optical Amplifier

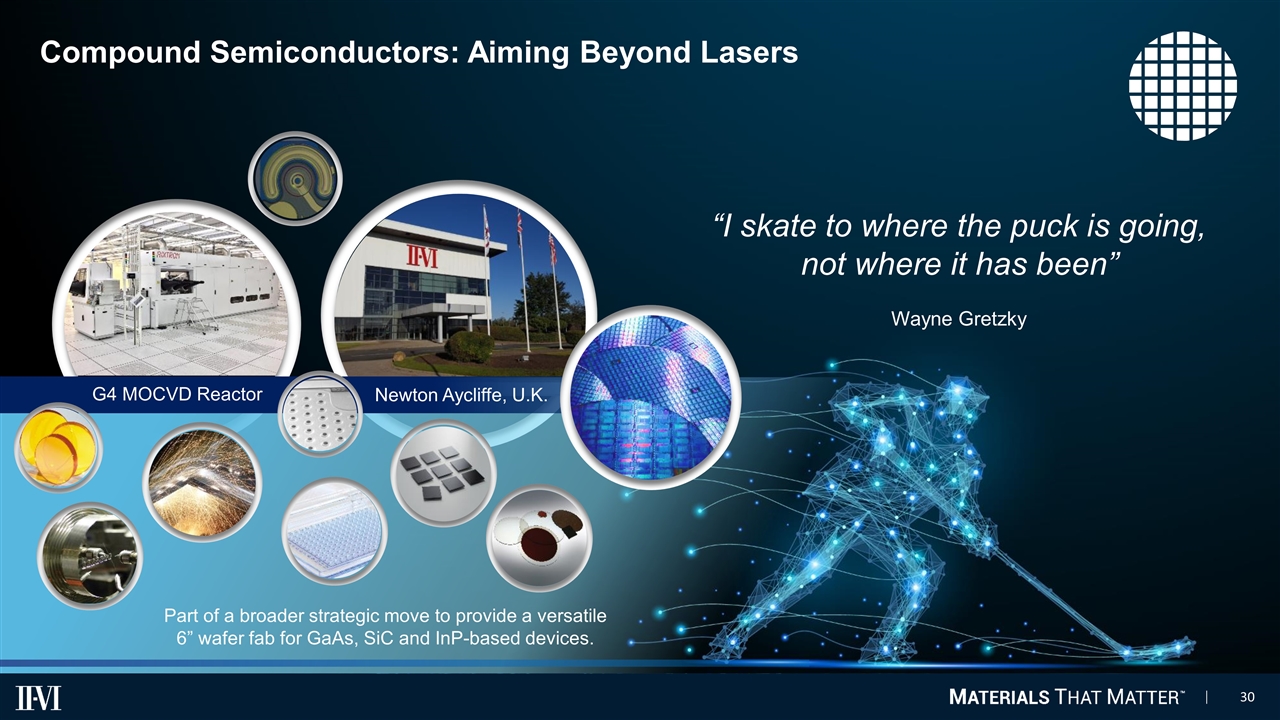

World leader in Faraday rotator crystals Spun from AT&T Bell Labs Murray Hill in 2000 Size: ~100 people located in Hillsborough, NJ Applications: Tunable & DFB lasers, amplifiers, fiber lasers Pro Forma Expectations: Revenue: < 5% incremental annually with GM higher than Corporate average and CAGR expected > 20% Expected to be accretive in its first full quarter 11 2017 Acquisitions Garnet Magnet Magnet P/B Input Output Reflection Garnet (IPI) + magnet = Faraday rotator P/B: Polarizer or Birefringent material Optical Isolator P/B Acquisition of Kaiam Laser Limited 300,000 sq.ft facility with a 100,000 sq.ft clean room Located in near Newcastle U.K. 6” wafer fab for GaAs, SiC and InP devices capabilities Multi-purpose fab to further penetrate of markets driven by: 3D sensing, 5G wireless, electric cars, daata center communications Pro Forma Expectations: Purchase price $80 million in cash $0.03 to 0.05 dilutive to EPS quarterly

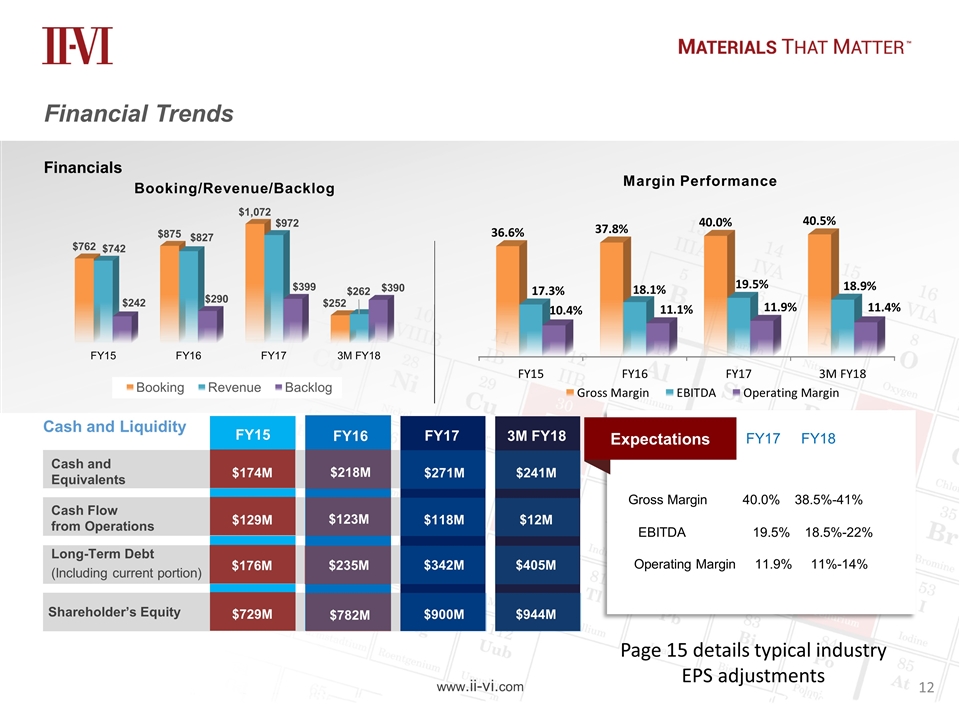

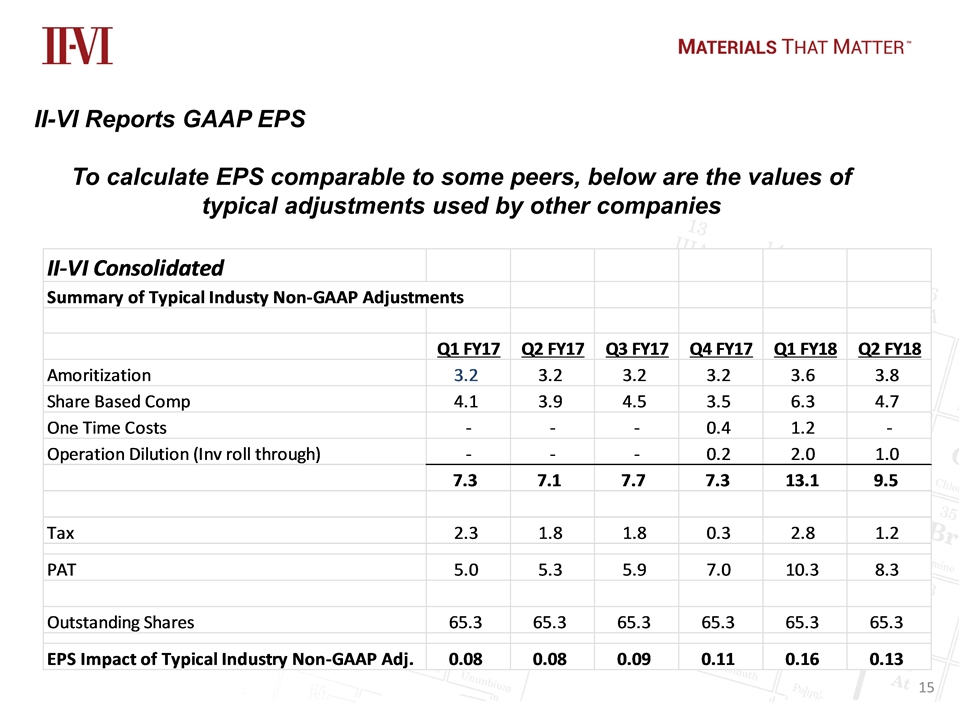

www.ii-vi.com Financial Trends Financials Expectations Gross Margin 40.0% 38.5%-41% EBITDA 19.5% 18.5%-22% Operating Margin 11.9% 11%-14% FY17 FY18 Cash and Equivalents Cash Flow from Operations Long-Term Debt (Including current portion) FY17 FY15 FY16 Shareholder’s Equity $271M $174M $218M $118M $129M $123M $342M $176M $235M $900M $729M $782M Cash and Liquidity 3M FY18 $241M $12M $405M $944M Page 15 details typical industry EPS adjustments

Industry-Experienced Team with Deep Innovation Skills Leading Market Positions in Diverse End Markets 1 Vertically-Integrated and Scalable Manufacturing Successful Return on Investment Within 12-24 months 3 4 Significant Competitive Strengths and Differentiation for Emerging Markets 5 2 www.ii-vi.com Key Investment Considerations

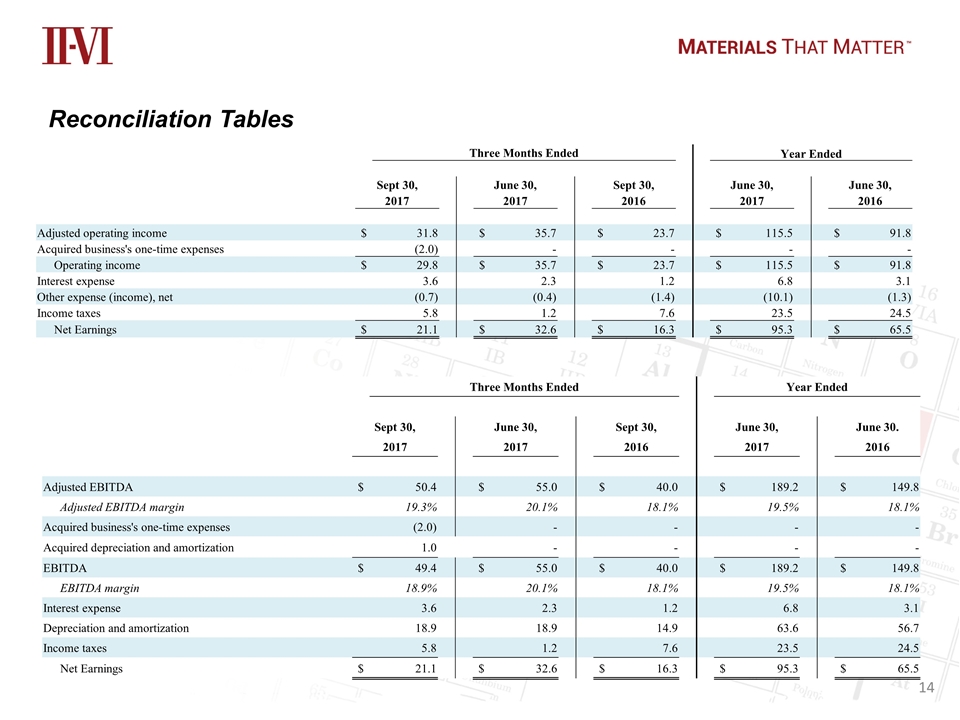

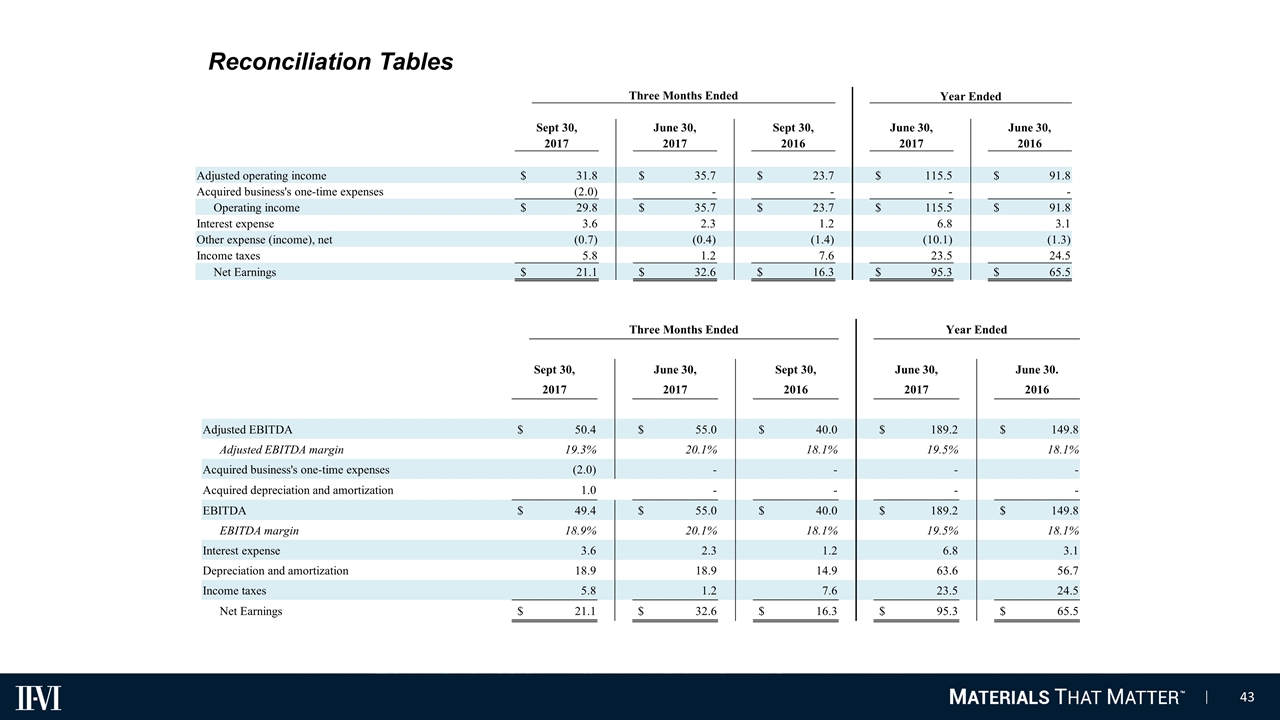

Reconciliation Tables Three Months Ended Year Ended Sept 30, June 30, Sept 30, June 30, June 30, 2017 2017 2016 2017 2016 Adjusted operating income $ 31.8 $ 35.7 $ 23.7 $ 115.5 $ 91.8 Acquired business's one-time expenses (2.0) - - - - Operating income $ 29.8 $ 35.7 $ 23.7 $ 115.5 $ 91.8 Interest expense 3.6 2.3 1.2 6.8 3.1 Other expense (income), net (0.7) (0.4) (1.4) (10.1) (1.3) Income taxes 5.8 1.2 7.6 23.5 24.5 Net Earnings $ 21.1 $ 32.6 $ 16.3 $ 95.3 $ 65.5 Three Months Ended Year Ended Sept 30, June 30, Sept 30, June 30, June 30. 2017 2017 2016 2017 2016 Adjusted EBITDA $ 50.4 $ 55.0 $ 40.0 $ 189.2 $ 149.8 Adjusted EBITDA margin 19.3% 20.1% 18.1% 19.5% 18.1% Acquired business's one-time expenses (2.0) - - - - Acquired depreciation and amortization 1.0 - - - - EBITDA $ 49.4 $ 55.0 $ 40.0 $ 189.2 $ 149.8 EBITDA margin 18.9% 20.1% 18.1% 19.5% 18.1% Interest expense 3.6 2.3 1.2 6.8 3.1 Depreciation and amortization 18.9 18.9 14.9 63.6 56.7 Income taxes 5.8 1.2 7.6 23.5 24.5 Net Earnings $ 21.1 $ 32.6 $ 16.3 $ 95.3 $ 65.5

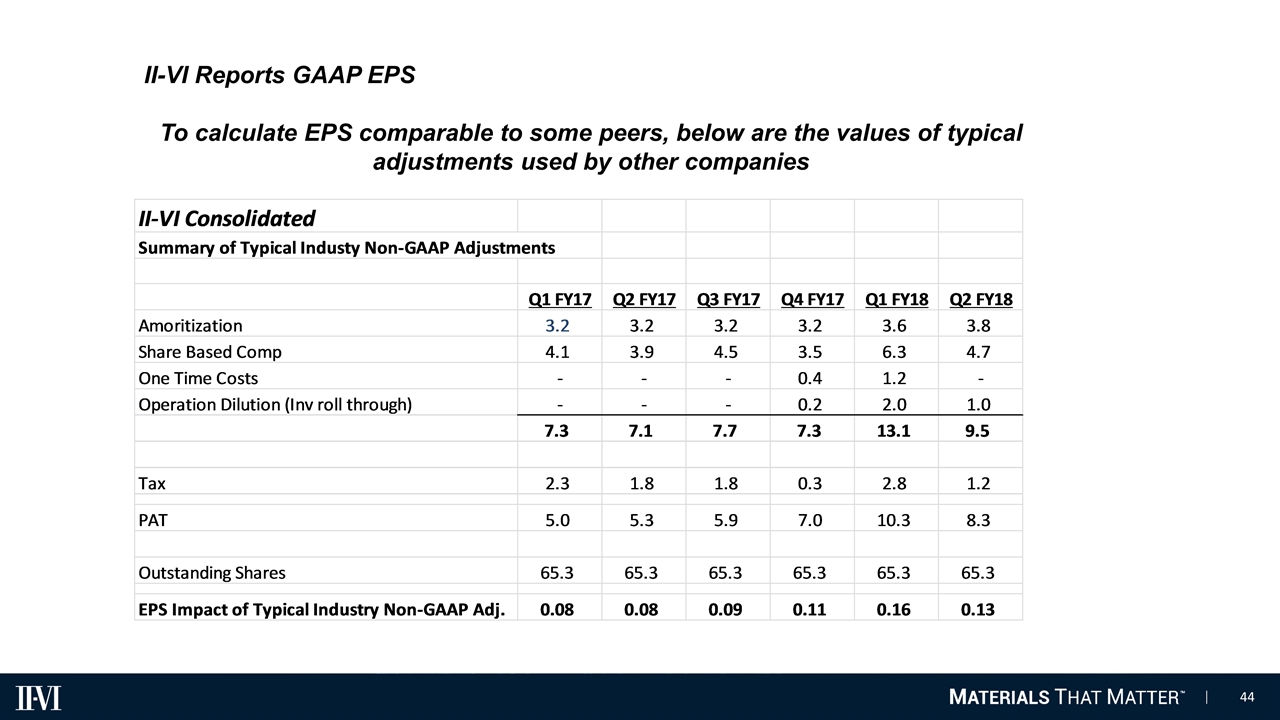

II-VI Reports GAAP EPS To calculate EPS comparable to some peers, below are the values of typical adjustments used by other companies

INVESTOR DAY November 8th, 2017 IIVI Exhibit 99.3

Matters discussed in this presentation may contain forward-looking statements that are subject to risks and uncertainties. These risks and uncertainties could cause the forward-looking statements and II-VI Incorporated’s (the “Company’s”) actual results to differ materially. In evaluating these forward-looking statements, you should specifically consider the “Risk Factors” in the Company’s most recent Form 10-K and Form 10-Q. Forward-looking statements are only estimates and actual events or results may differ materially. II-VI Incorporated disclaims any obligation to update information contained in any forward-looking statement. This presentation contains certain non-GAAP financial measures. Reconciliations of non-GAAP financial measures to their most comparable GAAP financial measures are presented at the end of this presentation. Safe Harbor Statement

Welcome Mark Lourie, Director of Corporate Communications Introduction Fran Kramer, Chairman of the Board Strategic Overview Dr. Chuck Mattera, President & Chief Executive Officer Innovation Dr. Giovanni Barbarossa, Chief Technology Officer and President, Laser Solutions Segment Financial Outlook Mary Jane Raymond, Chief Financial Officer Agenda INVESTOR DAY November 8th, 2017

Introduction Fran Kramer, Chairman of the Board INVESTOR DAY November 8th, 2017

Origins of Our Company Name Refers to groups II and VI of the Periodic Table of Elements. “TWO SIX” S Sulfur Se Selenium Zn Zinc Te Tellurium Cd Cadmium

1971 1987 2017 INVESTOR DAY November 8th, 2017 Since 1971 IPO 30th Anniversary since the IPO We Started In Saxonburg, PA Francis J. Kramer(Left) and Dr. Carl J. Johnson(Right) Saxonburg Campus in 1997 Pittsburg Saxonburg

II-VI Worldwide Values Customers First Honesty and Integrity Open Communications Continuous Improvement and Learning Manage by the Facts Teamwork A Safe, Clean, and Orderly Workplace Worldwide Values

INVESTOR DAY November 8th, 2017 Strategic Overview Dr. Chuck Mattera, President & Chief Executive Officer

Our Company Structure Laser Solutions Photonics Performance Products

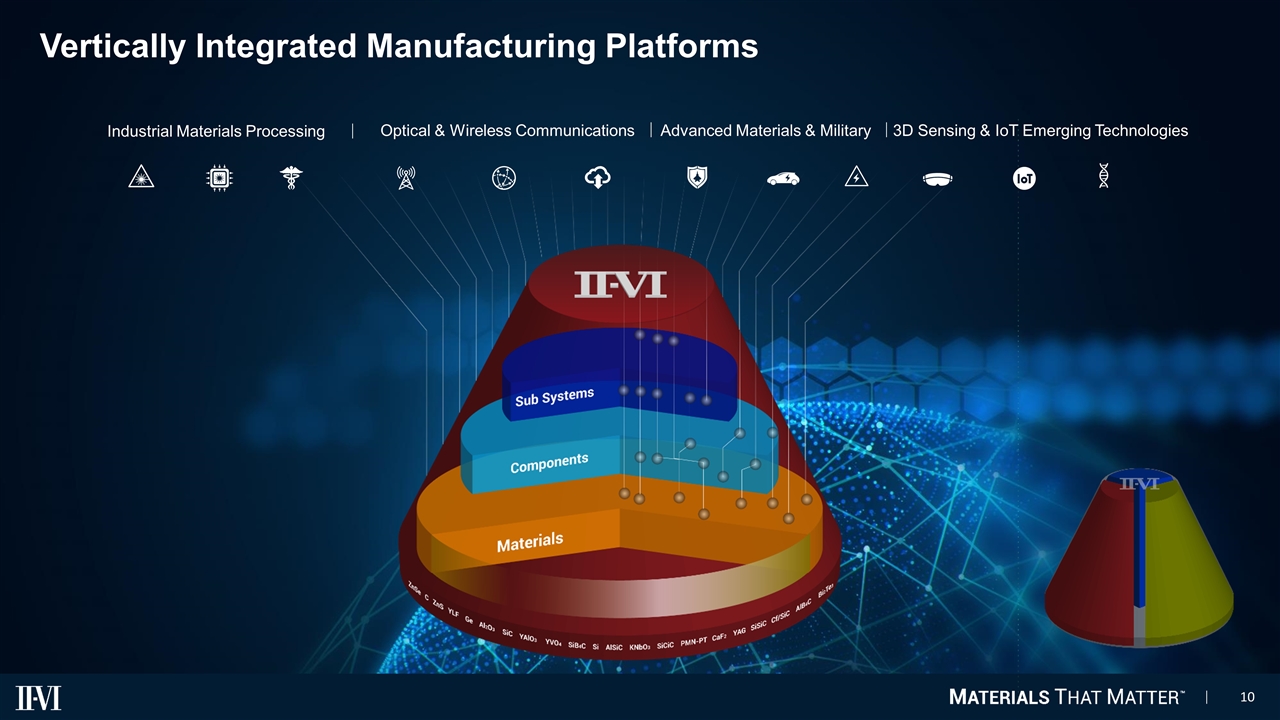

Vertically Integrated Manufacturing Platforms Industrial Materials Processing Optical & Wireless Communications Advanced Materials & Military 3D Sensing & IoT Emerging Technologies

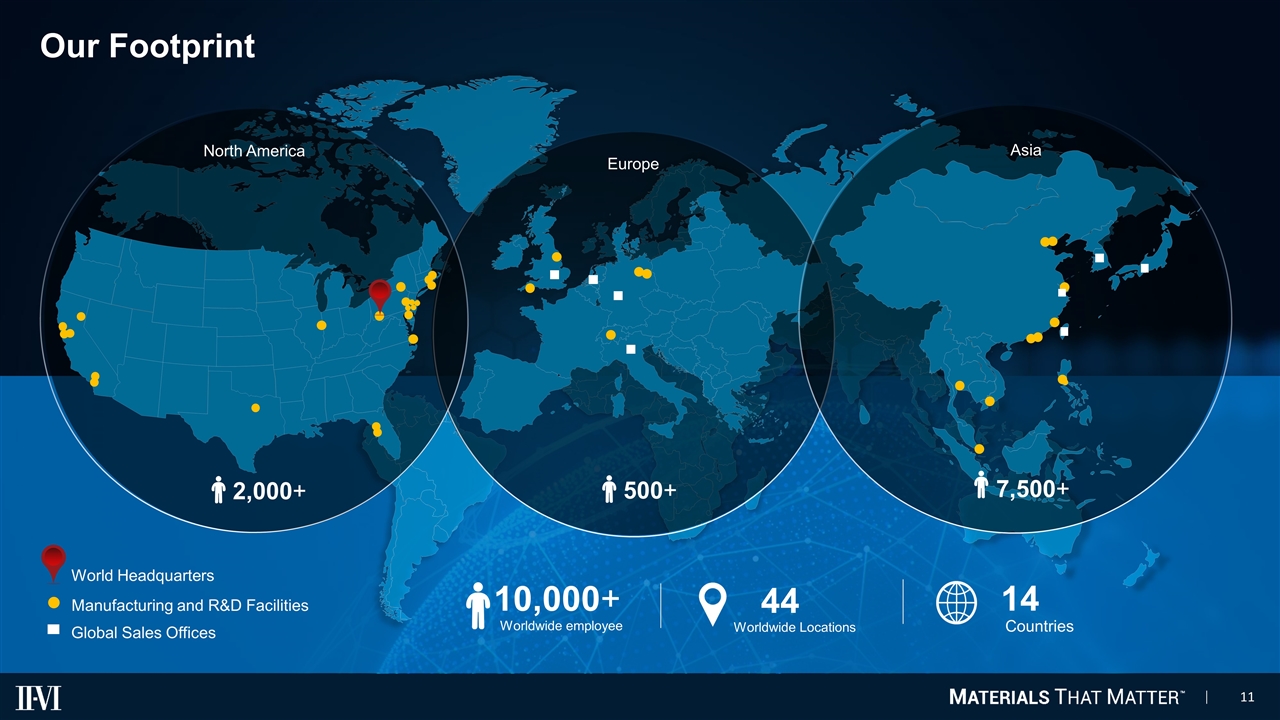

Our Footprint 14 Countries 44 Worldwide Locations 10,000+ Worldwide employee World Headquarters Manufacturing and R&D Facilities Global Sales Offices North America Europe Asia 2,000+ 500+ 7,500+

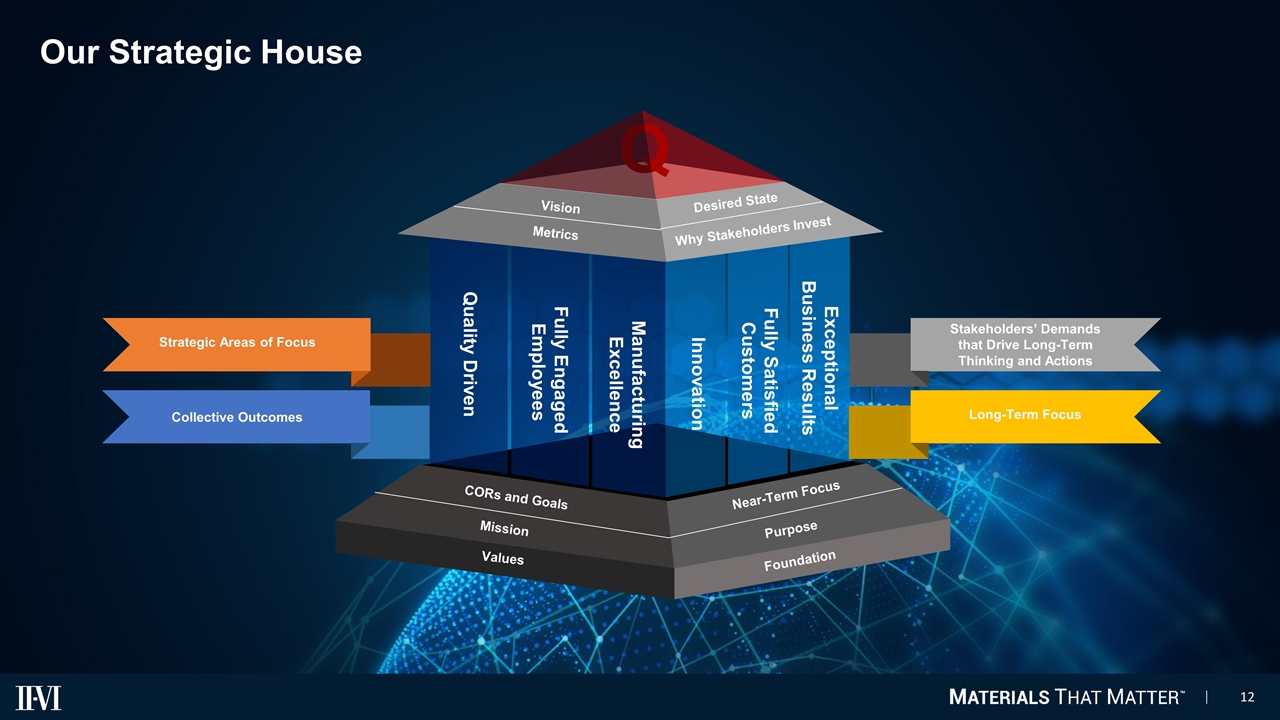

Our Strategic House Values Foundation Mission CORs and Goals Purpose Near-Term Focus Q Vision Metrics Desired State Why Stakeholders Invest Quality Driven Fully Engaged Employees Manufacturing Excellence Innovation Fully Satisfied Customers Exceptional Business Results Strategic Areas of Focus Collective Outcomes Stakeholders’ Demands that Drive Long-Term Thinking and Actions Long-Term Focus

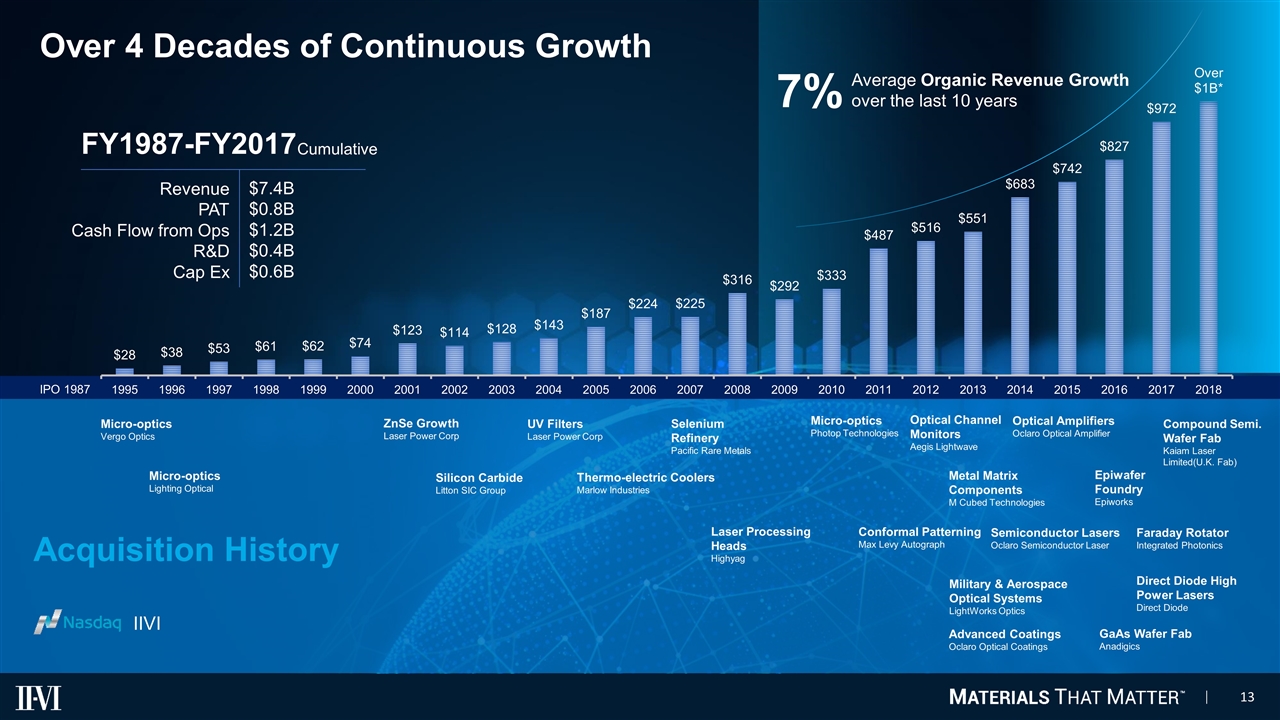

Over 4 Decades of Continuous Growth Micro-optics Vergo Optics Micro-optics Lighting Optical ZnSe Growth Laser Power Corp Silicon Carbide Litton SIC Group UV Filters Laser Power Corp Thermo-electric Coolers Marlow Industries Selenium Refinery Pacific Rare Metals Laser Processing Heads Highyag Micro-optics Photop Technologies Conformal Patterning Max Levy Autograph Optical Channel Monitors Aegis Lightwave Metal Matrix Components M Cubed Technologies Military & Aerospace Optical Systems LightWorks Optics Advanced Coatings Oclaro Optical Coatings Optical Amplifiers Oclaro Optical Amplifier Semiconductor Lasers Oclaro Semiconductor Laser Epiwafer Foundry Epiworks GaAs Wafer Fab Anadigics Compound Semi. Wafer Fab Kaiam Laser Limited(U.K. Fab) Faraday Rotator Integrated Photonics Direct Diode High Power Lasers Direct Diode IIVI IPO 1987 Acquisition History Average Organic Revenue Growth over the last 10 years 7% FY1987-FY2017 Revenue PAT Cash Flow from Ops R&D Cap Ex $7.4B $0.8B $1.2B $0.4B $0.6B Cumulative

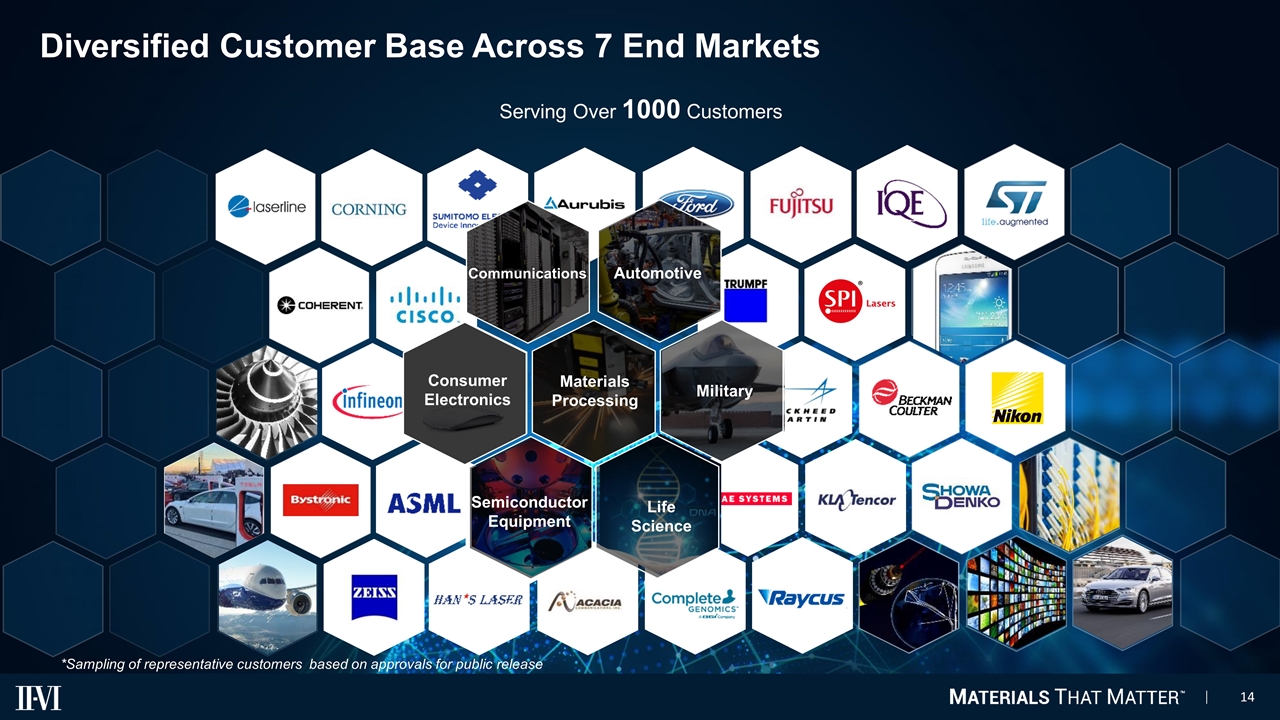

Diversified Customer Base Across 7 End Markets *Sampling of representative customers based on approvals for public release Life Science Military Automotive Communications Materials Processing Semiconductor Equipment Consumer Electronics Serving Over 1000 Customers

Megatrends Ubiquitous Connectivity Big Data Internet of Things Renewable Energy Industry 4.0 Next Generation Defense Systems Low Emission Vehicles Consumer Electronics Robotics

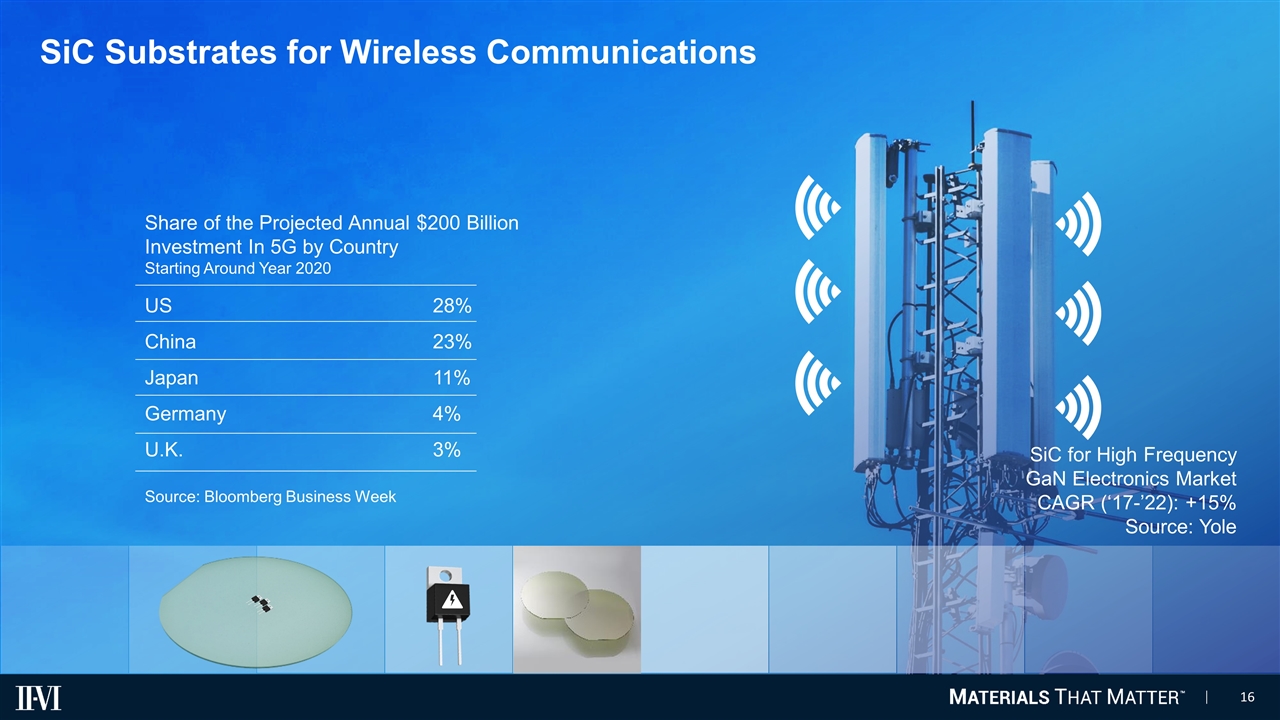

SiC Substrates for Wireless Communications Share of the Projected Annual $200 Billion Investment In 5G by Country Starting Around Year 2020 US28% China23% Japan11% Germany4% U.K.3% Source: Bloomberg Business Week SiC for High Frequency GaN Electronics Market CAGR (‘17-’22): +15% Source: Yole

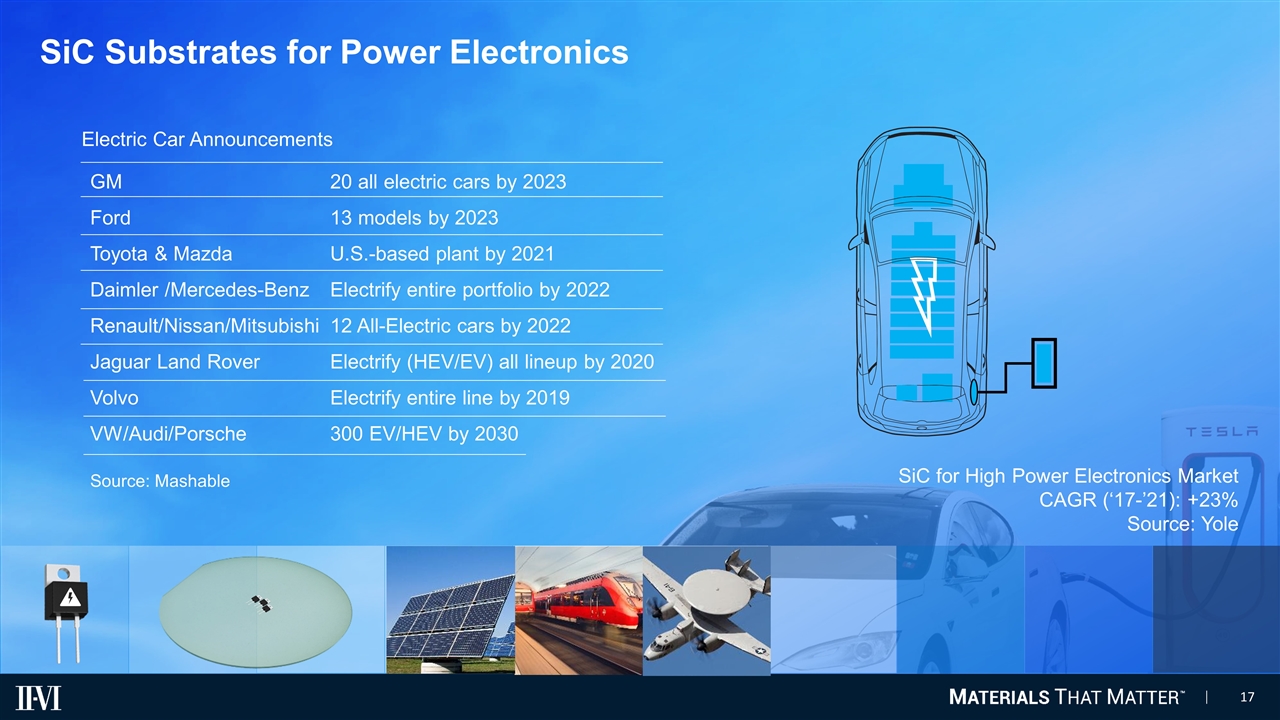

SiC Substrates for Power Electronics Electric Car Announcements GM20 all electric cars by 2023 Ford13 models by 2023 Toyota & MazdaU.S.-based plant by 2021 Daimler /Mercedes-BenzElectrify entire portfolio by 2022 Renault/Nissan/Mitsubishi12 All-Electric cars by 2022 Jaguar Land Rover Electrify (HEV/EV) all lineup by 2020 VolvoElectrify entire line by 2019 VW/Audi/Porsche300 EV/HEV by 2030 SiC for High Power Electronics Market CAGR (‘17-’21): +23% Source: Yole Source: Mashable

Laser & Micro-optics for 3D Sensing * VCSEL: Vertical Cavity Surface Emitting Lasers VCSEL Market CAGR (’15-’22): +19% Source: Markets & Markets

Opto-Electronics for LiDAR Laser Diodes for LiDAR Market (’17-’22): +20% Source: Strategies Unlimited Self-driving car availability by car manufacturer Volvo2020 Daimler2020 BMW2021 Ford2021 Honda2025 Tesla2017 GM2018 Hyundai2020 Renault-Nissan2020 Toyota2020 Source: AXIOS

EUV Lithography System EUV Source System CO2 System Front/Back End Processing System Beam Transport System Laser Optics & Precision Ceramics for Extreme Ultraviolet (EUV) Lithography EUV Lithography Systems Market CAGR (‘16-‘22): 9% Source: Allied Market Research

Differentiated Product Portfolio for Industrial Lasers Fiber Lasers Direct diode Lasers Fiber Lasers Market CAGR (‘17-‘22): +8% Direct Diode Market CAGR (‘17-‘22): +7% Source: Strategies Unlimited Laser Remote Welding Head Direct Diode Laser Engine Broad portfolio of components including: pump lasers, high power combiners, acousto-optic modulators, high power isolators, gratings and micro-optics.

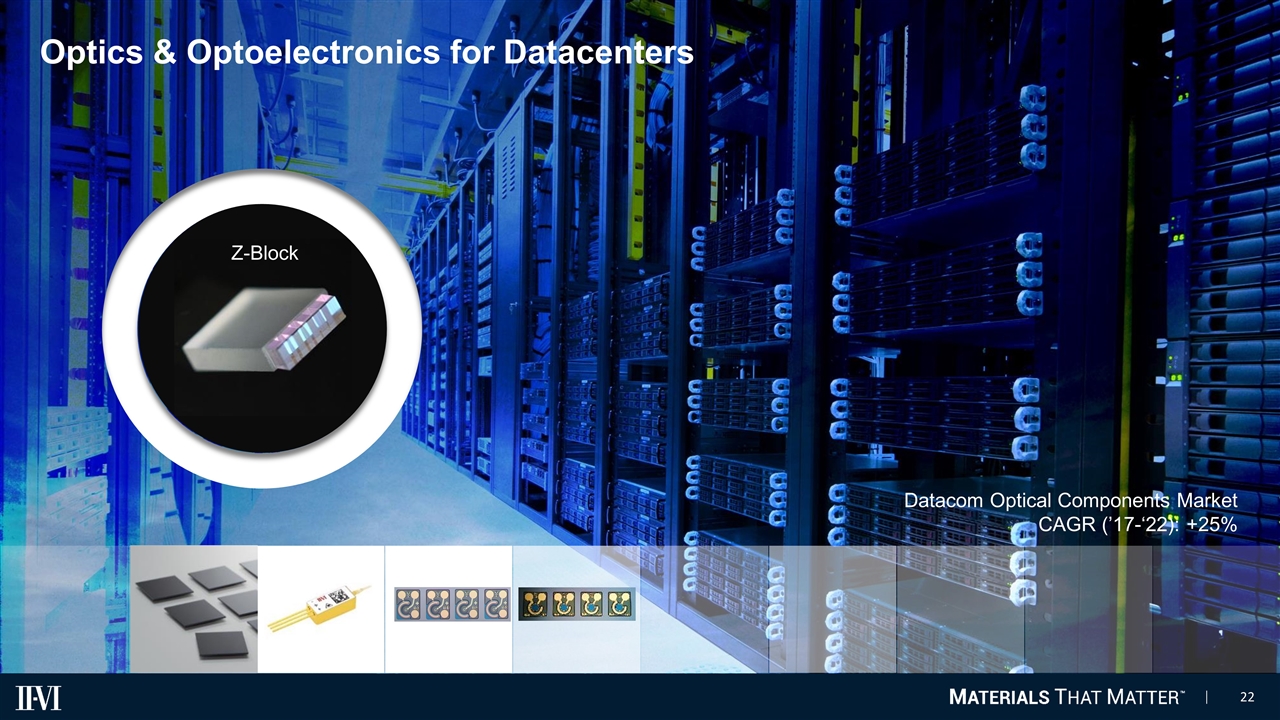

Optics & Optoelectronics for Datacenters Datacom Optical Components Market CAGR (’17-‘22): +25% Z-Block

Leading Edge Subsystems for Intelligent Communications Networks Laser Chip-on-Carrier Assembly Thermoelectric Cooler Optics Optical channel monitor OTDR Passive Components Optical Amplifier Optical Communications Market CAGR (’15-’21): +12% Source: Ovum

Engineered Materials, High Energy Laser and Optics for Military & Aerospace World leader in large sapphire panel output 24,000 sf dedicated facility F-35 Electro-Optical Targeting System (EOTS) Infrared Countermeasure Systems Market CAGR (’17-’22): +8% Source: Strategies Unlimited

INVESTOR DAY November 8th, 2017 Strategy for Growth by Acquisition Dr. Chuck Mattera, President & Chief Executive Officer

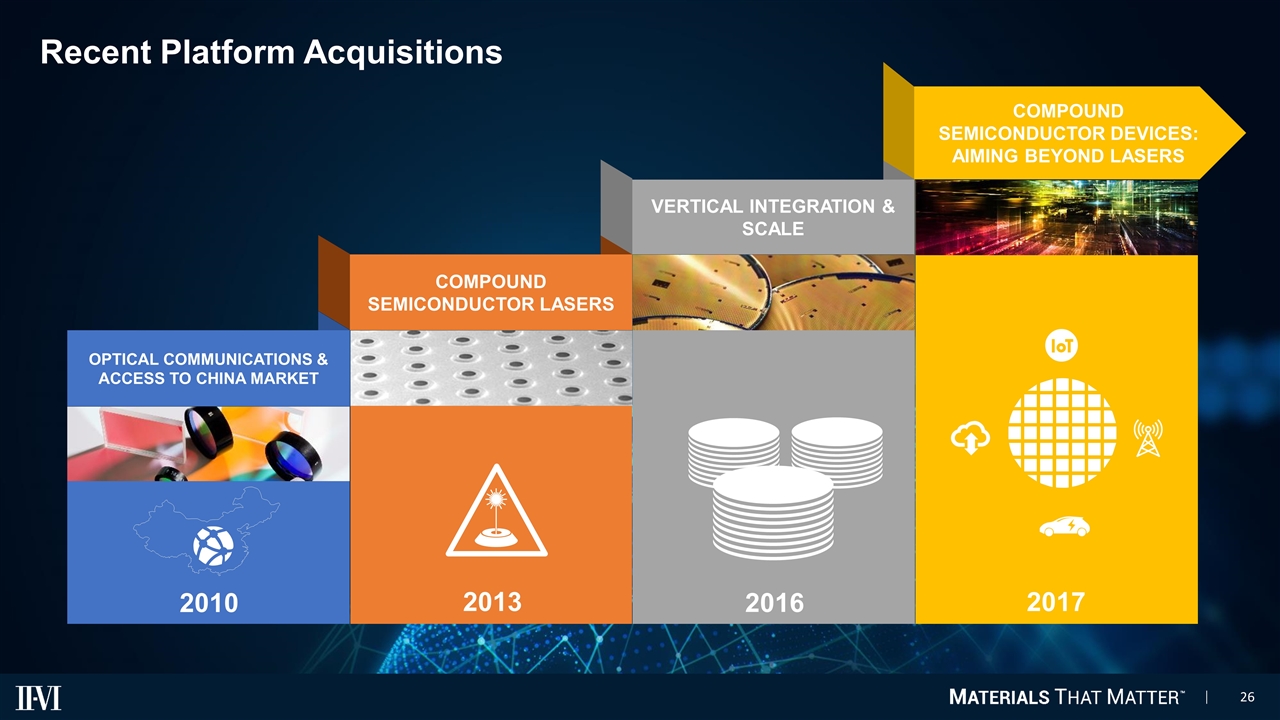

Recent Platform Acquisitions COMPOUND SEMICONDUCTOR LASERS COMPOUND SEMICONDUCTOR DEVICES: AIMING BEYOND LASERS VERTICAL INTEGRATION & SCALE OPTICAL COMMUNICATIONS & ACCESS TO CHINA MARKET 2010 2013 2016 2017

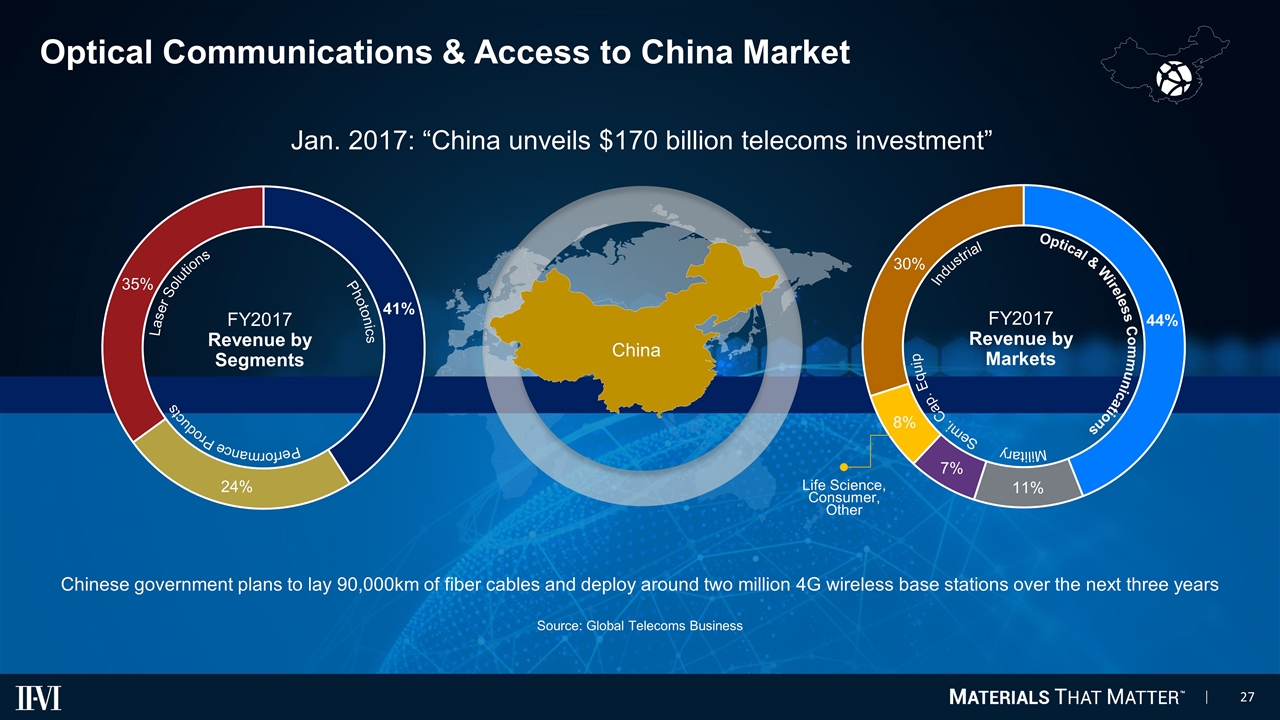

Optical Communications & Access to China Market Life Science, Consumer, Other China FY2017 Revenue by Markets Optical & Wireless Communications Military Semi. Cap. Equip Industrial FY2017 Revenue by Segments Photonics Performance Products Laser Solutions Chinese government plans to lay 90,000km of fiber cables and deploy around two million 4G wireless base stations over the next three years Source: Global Telecoms Business Jan. 2017: “China unveils $170 billion telecoms investment”

Life Sciences Compound Semiconductor Lasers Material Processing Communications Consumer Electronics Automotive Military

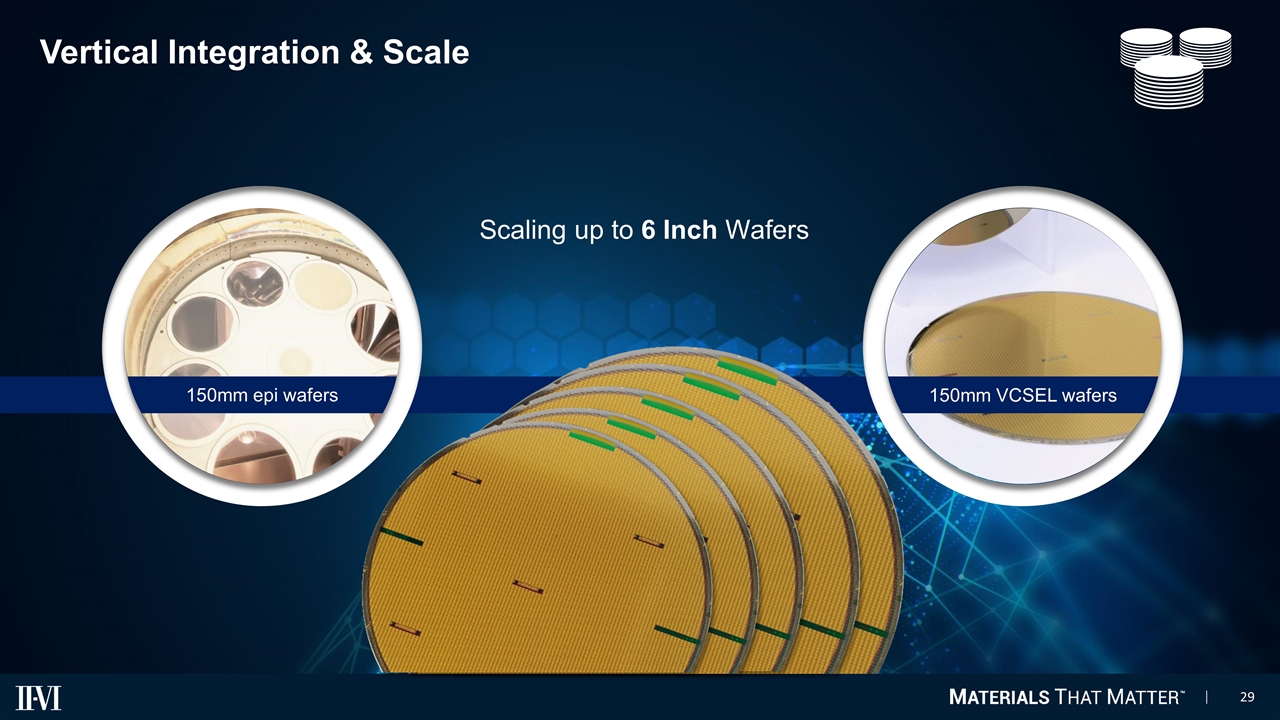

Vertical Integration & Scale 150mm epi wafers 150mm VCSEL wafers Scaling up to 6 Inch Wafers

Compound Semiconductors: Aiming Beyond Lasers “I skate to where the puck is going, not where it has been” Wayne Gretzky Newton Aycliffe, U.K. G4 MOCVD Reactor Part of a broader strategic move to provide a versatile 6” wafer fab for GaAs, SiC and InP-based devices.

INVESTOR DAY November 8th, 2017 Innovation Dr. Giovanni Barbarossa, Chief Technology Officer and President, Laser Solutions Segment

Innovation Strategy BEST PRODUCT Process Intensive Vertical Integration Diversified per Platforms Engineered Materials Valued By Customers Capital Intensive Markets Differentiation Performance Products Infrastructure Business Model

Power Breadth 3D Sensing Breadth of Applications Wavelength Breadth Technology Breadth

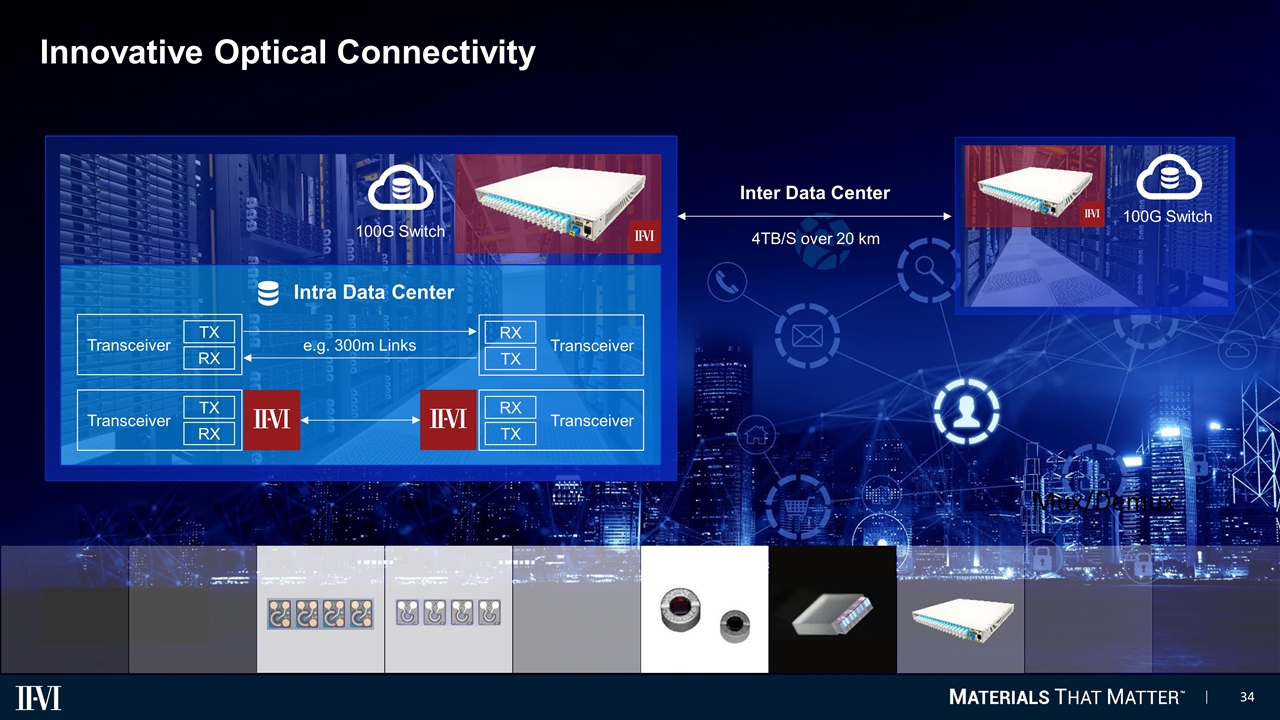

Innovative Optical Connectivity Mux/Demux Transceiver TX RX Transceiver TX RX Transceiver RX TX Transceiver RX TX e.g. 300m Links Intra Data Center Inter Data Center 100G Switch 100G Switch 4TB/S over 20 km

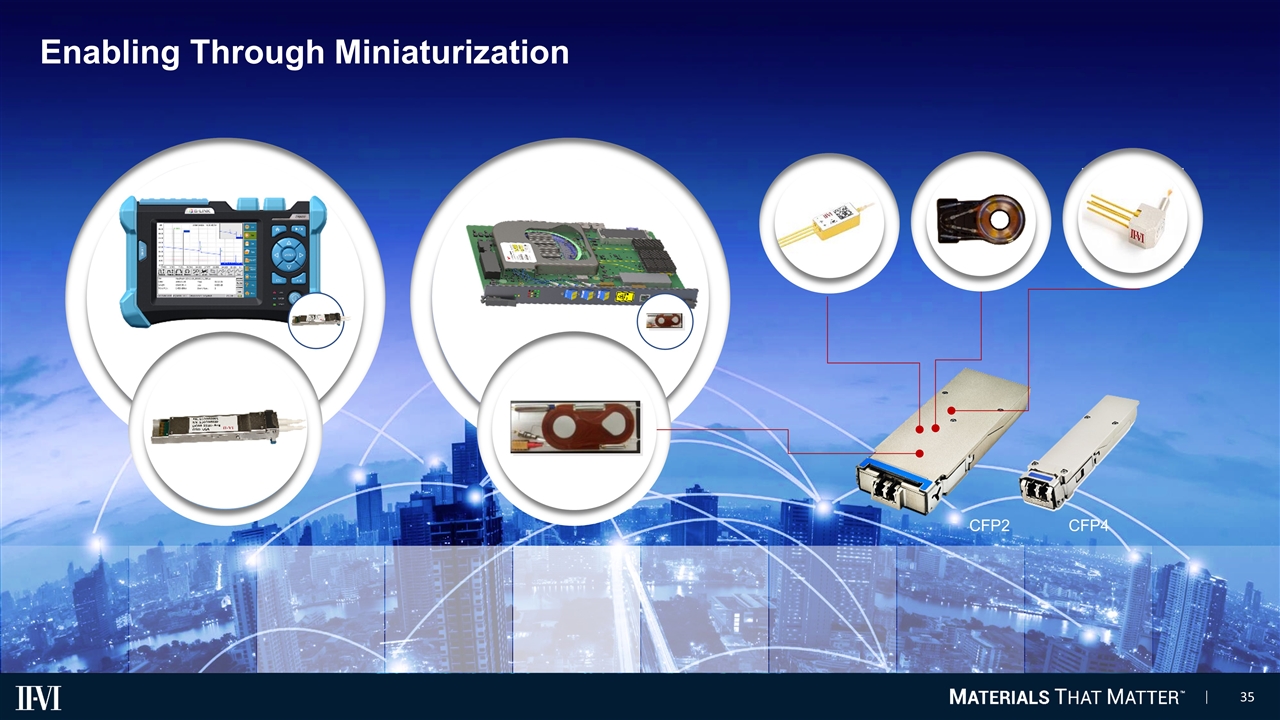

Enabling Through Miniaturization CFP2 CFP4

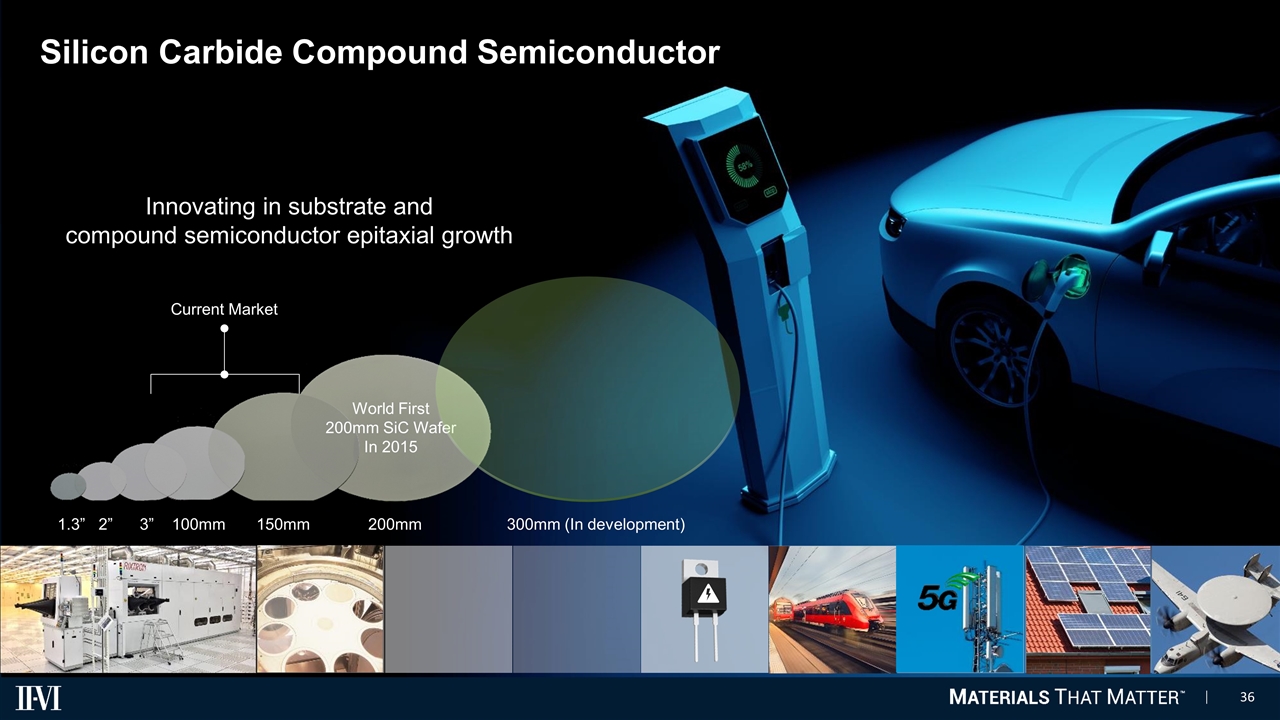

Silicon Carbide Compound Semiconductor Innovating in substrate and compound semiconductor epitaxial growth Innovating in substrate and compound semiconductor epitaxial growth 1.3” 2” 3” 100mm 150mm 200mm 300mm (In development) World First 200mm SiC Wafer In 2015 Current Market

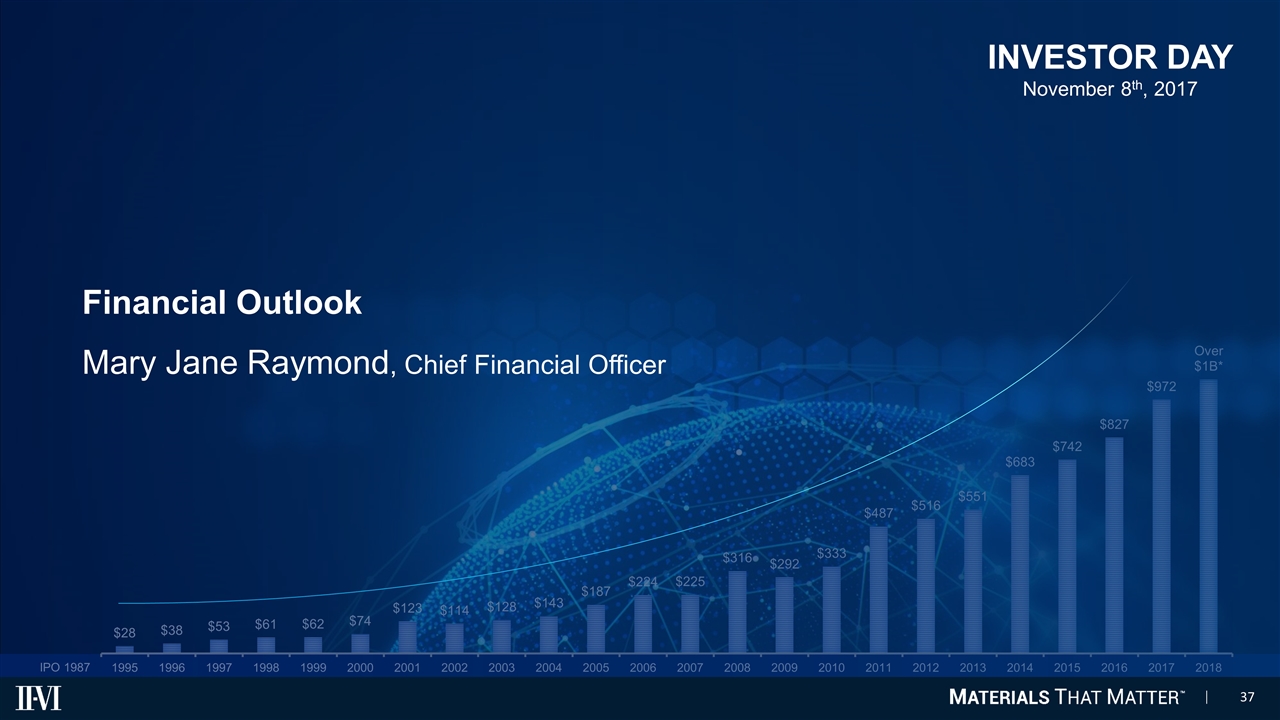

IPO 1987 Financial Outlook Mary Jane Raymond, Chief Financial Officer INVESTOR DAY November 8th, 2017

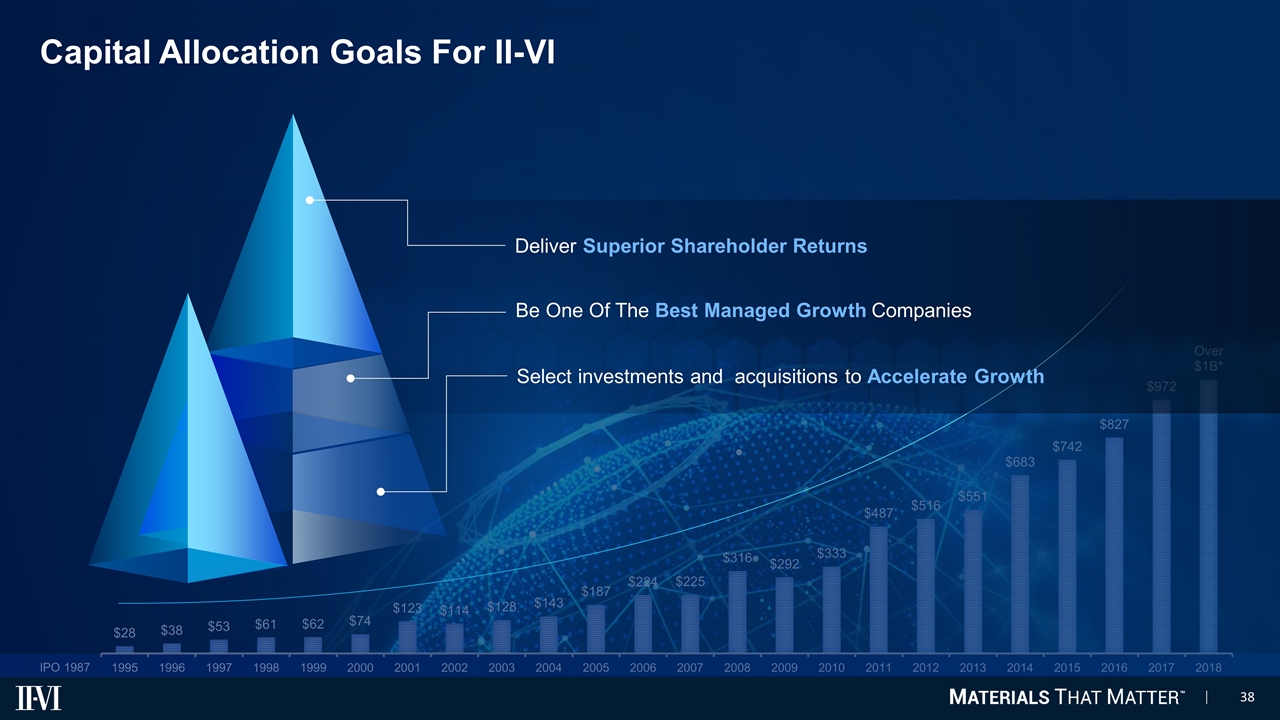

IPO 1987 Capital Allocation Goals For II-VI Deliver Superior Shareholder Returns Be One Of The Best Managed Growth Companies Select investments and acquisitions to Accelerate Growth

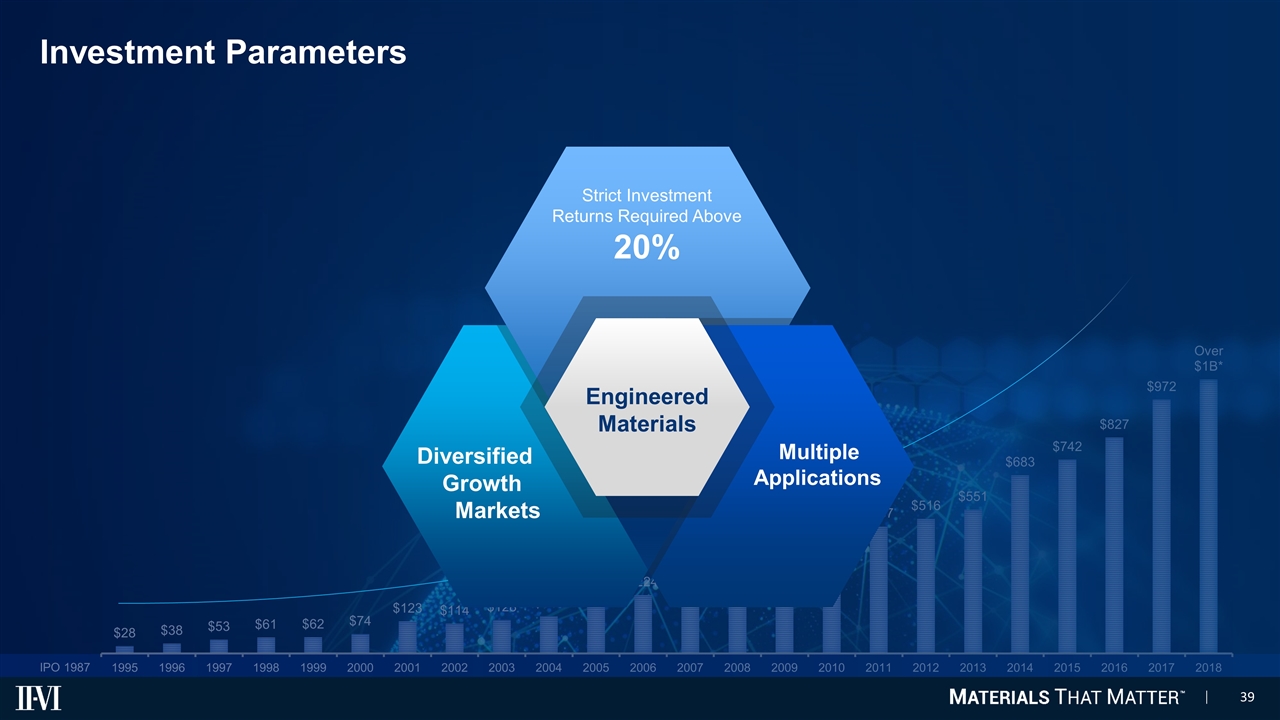

IPO 1987 Investment Parameters Engineered Materials Diversified Growth Markets Strict Investment Returns Required Above 20% Multiple Applications

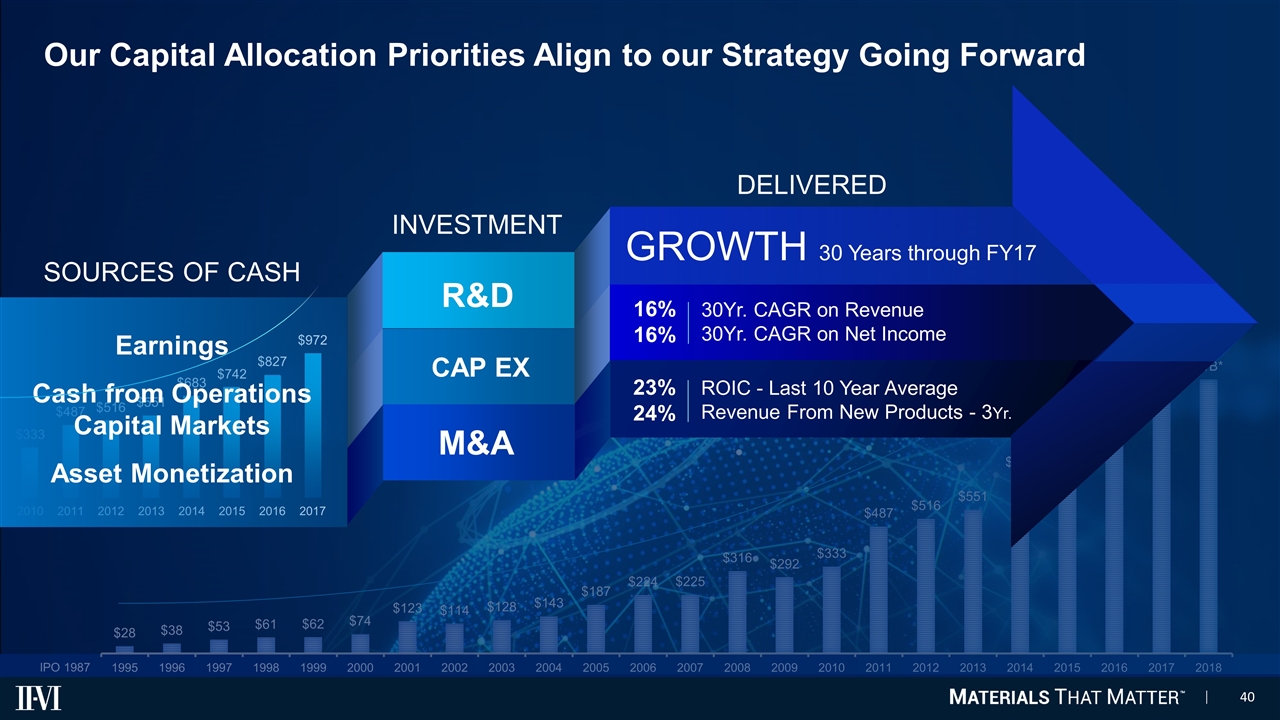

IPO 1987 Our Capital Allocation Priorities Align to our Strategy Going Forward SOURCES OF CASH INVESTMENT 16% 16% 30Yr. CAGR on Revenue 30Yr. CAGR on Net Income R&D CAP EX M&A Earnings Cash from Operations Capital Markets Asset Monetization DELIVERED GROWTH 30 Years through FY17 23% 24% ROIC - Last 10 Year Average Revenue From New Products - 3Yr.

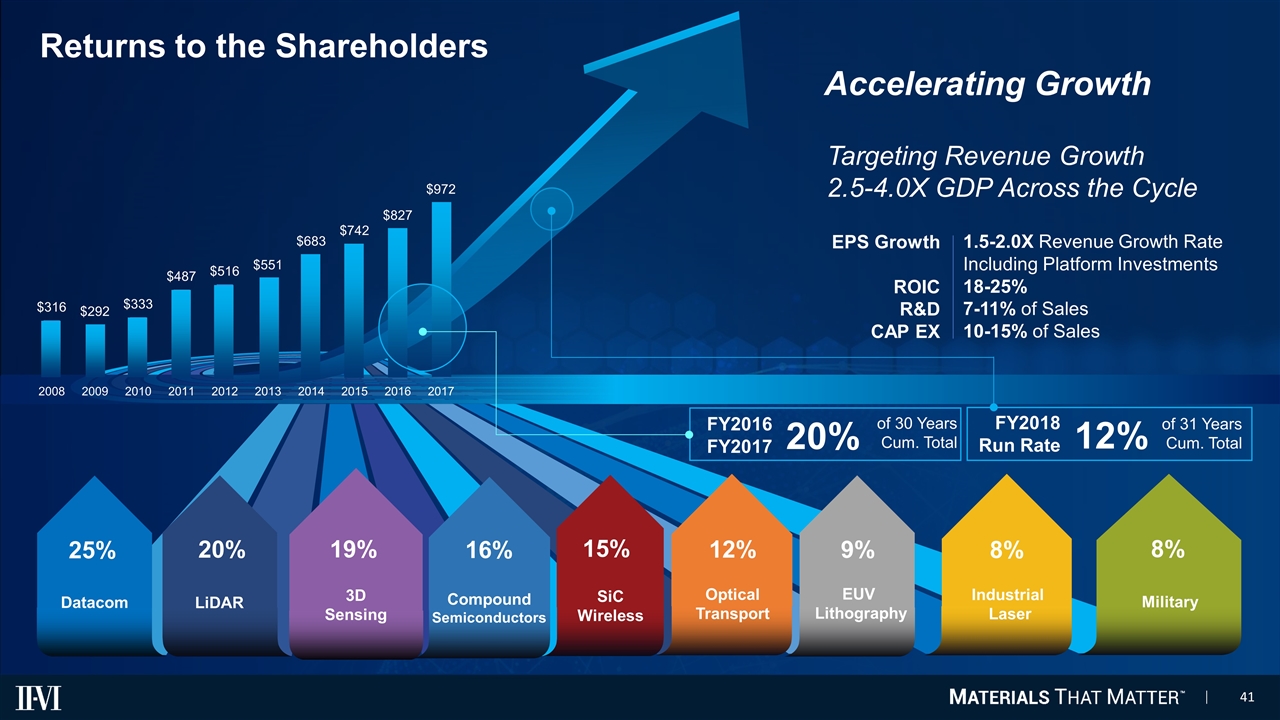

Returns to the Shareholders Accelerating Growth Military Compound Semiconductors 3D Sensing LiDAR EUV Lithography SiC Wireless Industrial Laser Datacom Optical Transport 9% 8% 16% 19% 20% 12% 25% 8% 15% EPS Growth ROIC R&D CAP EX 1.5-2.0X Revenue Growth Rate Including Platform Investments 18-25% 7-11% of Sales 10-15% of Sales of 31 Years Cum. Total FY2018 Run Rate 12% FY2016 FY2017 of 30 Years Cum. Total 20% Targeting Revenue Growth 2.5-4.0X GDP Across the Cycle

www.ii-vi.com IIVI

Reconciliation Tables Three Months Ended Year Ended Sept 30, June 30, Sept 30, June 30, June 30, 2017 2017 2016 2017 2016 Adjusted operating income $ 31.8 $ 35.7 $ 23.7 $ 115.5 $ 91.8 Acquired business's one-time expenses (2.0) - - - - Operating income $ 29.8 $ 35.7 $ 23.7 $ 115.5 $ 91.8 Interest expense 3.6 2.3 1.2 6.8 3.1 Other expense (income), net (0.7) (0.4) (1.4) (10.1) (1.3) Income taxes 5.8 1.2 7.6 23.5 24.5 Net Earnings $ 21.1 $ 32.6 $ 16.3 $ 95.3 $ 65.5 Three Months Ended Year Ended Sept 30, June 30, Sept 30, June 30, June 30. 2017 2017 2016 2017 2016 Adjusted EBITDA $ 50.4 $ 55.0 $ 40.0 $ 189.2 $ 149.8 Adjusted EBITDA margin 19.3% 20.1% 18.1% 19.5% 18.1% Acquired business's one-time expenses (2.0) - - - - Acquired depreciation and amortization 1.0 - - - - EBITDA $ 49.4 $ 55.0 $ 40.0 $ 189.2 $ 149.8 EBITDA margin 18.9% 20.1% 18.1% 19.5% 18.1% Interest expense 3.6 2.3 1.2 6.8 3.1 Depreciation and amortization 18.9 18.9 14.9 63.6 56.7 Income taxes 5.8 1.2 7.6 23.5 24.5 Net Earnings $ 21.1 $ 32.6 $ 16.3 $ 95.3 $ 65.5

II-VI Reports GAAP EPS To calculate EPS comparable to some peers, below are the values of typical adjustments used by other companies

Biographies Francis J. Kramer. Mr. Kramer joined the Company in 1983 and served as its President from 1985 to 2014, its Chief Executive Officer from 2007, and its Chairman and CEO from 2014 to 2016. He now serves as the Company’s Chairman of the Board of Directors. Mr. Kramer holds a B.S. degree in Industrial Engineering from the University of Pittsburgh and an M.S. degree in Industrial Administration from Purdue University. Mr. Kramer had served as director of Barnes Group Inc., a publicly traded aerospace and industrial manufacturing company (NYSE: B), from 2012 to 2016. Mr. Kramer provides our Board and the Company with guidance on our growth strategy, in particular on the profitable execution of the strategy to achieve sustainable competitive advantage. He contributes considerable business development experience. He also has significant operations experience that is relevant to the Company’s strategy. Vincent D. Mattera, Jr. Dr. Mattera initially served as a member of the II-VI Board of Directors from 2000-2002. Dr. Mattera joined the company as Vice President in 2004 and served as Executive Vice President from January of 2010 to November of 2013, when he became the Chief Operating Officer. In November of 2014, Dr. Mattera became the President and Chief Operating Officer, and was reappointed to the Board of Directors. In November of 2015, he became the President of II-VI. In September of 2016, Dr. Mattera became the Company’s third President and Chief Executive Officer in 45 years. During his career at II-VI he has assumed successively broader management roles, including as a lead architect of the company’s diversification strategy. He has provided vision, energy and dispatch to the company’s growth initiatives including overseeing the acquisition-related integration activities in the US, Europe, and Asia-especially in China-thereby establishing additional platforms. These have contributed to a new positioning of the company into large and transformative global growth markets while increasing considerably the global reach of the company, deepening the technology and IP portfolio, broadening the product roadmap and customer base, and increasing the potential of II-VI. Prior to joining II-VI as an executive, Dr. Mattera had a continuous 20 year career in the Optoelectronic Device Division of AT&T Bell Laboratories, Lucent Technologies and Agere Systems during which he led the development and manufacturing of semiconductor laser based materials and devices for optical and data communications networks. Dr. Mattera has 34 years of leadership experience in the compound semiconductor materials and device technology, operations and markets that are core to II-VI’s business and strategy. Dr. Mattera holds a B.S. in chemistry from the University of Rhode Island (1979), and a Ph.D. degree in chemistry from Brown University (1984). He completed the Stanford University Executive Program (1996). His 14 year tenure at II-VI underpins a valuable historical knowledge about the Company’s operational and strategic issues. We believe that Dr. Mattera’s expertise and experience qualifies him to provide the board with continuity and a unique perspective about on the Company.

Biographies Giovanni Barbarossa Giovanni Barbarossa joined II-VI in 2012 and has been the President, Laser Solutions Segment, since 2014, and the Chief Technology Officer since 2012. Dr. Barbarossa was employed at Avanex Corporation from 2000 through 2009, serving in various executive positions in product development and general management, ultimately serving as President and Chief Executive Officer. When Avanex merged with Bookham Technology, forming Oclaro, Dr. Barbarossa became a member of the Board of Directors of Oclaro and served as such from 2009 to 2011. Previously, he had management responsibilities at British Telecom, AT&T Bell Labs, Lucent Technologies, and Hewlett-Packard. Dr. Barbarossa graduated from the University of Bari, Italy, with a B.S. in Electrical Engineering, and a Ph.D. in Photonics from the University of Glasgow, U.K. Mary Jane Raymond Mary Jane Raymond has been Chief Financial Officer and Treasurer of the Company since March 2014. Previously, Ms. Raymond was Executive Vice President and Chief Financial Officer of Hudson Global, Inc. (NASDAQ: HSON) from 2005 to 2013. Ms. Raymond was the Chief Risk Officer and Vice President and Corporate Controller at Dun and Bradstreet, Inc., from 2002 to 2005. Additionally, she was the Vice President, Merger Integration, at Lucent Technologies, Inc., from 1997 to 2002 and held several management positions at Cummins Engine Company from 1988 to 1997. Ms. Raymond holds a B.A. degree in Public Management from St. Joseph’s University, and an MBA from Stanford University.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Correction: DOVRE GROUP TRADING STATEMENT JANUARY 1 – MARCH 31, 2024

- Dimensional Fund Advisors Ltd. : Form 8.3 - DS SMITH PLC - Ordinary Shares

- Check Point Software Reports 2024 First Quarter Financial Results

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share