Form 8-K HOPE BANCORP INC For: Jul 20

News Release

HOPE BANCORP REPORTS 2021 SECOND QUARTER FINANCIAL RESULTS

LOS ANGELES - July 20, 2021 - Hope Bancorp, Inc. (the “Company”) (NASDAQ: HOPE), the holding company of Bank of Hope (the “Bank”), today reported unaudited financial results for its second quarter and six months ended June 30, 2021.

For the three months ended June 30, 2021, net income increased 23% to $53.8 million, or $0.43 per diluted common share, from $43.7 million, or $0.35 per diluted common share, in the preceding first quarter and increased 101% from $26.8 million, or $0.22 per diluted common share, in the year-ago second quarter.

“Second quarter results underscore the sound management of our operations as the economy gradually recovers from the impact of the COVID-19 pandemic,” said Kevin S. Kim, Chairman, President and Chief Executive Officer of Hope Bancorp, Inc. “The composition of our deposits continued to improve with meaningful increases in our lower-cost deposit categories, and our cost of interest bearing deposits declined another 8 basis points quarter-over-quarter. Together with higher average yield on loans, this supported another quarter of net interest margin expansion. After five quarters of significant reserve build under the CECL methodology, we recorded a negative provision for credit losses of $7.0 million driven largely by the improved macroeconomic factors. We also sold $30 million of SBA 7(a) loans given the near record-high premiums available in the secondary markets, and recorded a gain on sale of $2.4 million. All of these factors contributed to a 23% quarter-over-quarter increase in net income of $53.8 million for the 2021 second quarter.

“Loan originations for the quarter were also strong at a record high $894 million and reflected a 61% increase from the preceding first quarter when excluding the second round of PPP originations. However, a considerable decrease in warehouse line utilizations reflecting industry trends, a strategic sale of $119 million of higher-risk hotel/motel loans, PPP loan forgiveness of $164 million, and residential mortgage and SBA 7(a) loan sales contributed to a 2% quarter-over-quarter decrease in loans receivable. While some of these headwinds to net loan growth are expected to persist near-term, we have a robust loan pipeline supported by strong macroeconomic forecasts, and we believe we are well positioned to deliver enhanced profitability for 2021,” said Kim.

Q2 2021 Highlights

•Net interest income before provision for credit losses increased 3% quarter-over-quarter to $126.6 million.

•Net interest margin expanded 5 basis points quarter-over-quarter, largely reflecting an increase in the average yield on loans and lower cost of deposits.

•Noninterest bearing demand deposits increased 4% quarter-over-quarter and accounted for 38% of total deposits.

•Cost of interest bearing deposits decreased 8 basis points and total cost of deposits decreased 6 basis points quarter-over-quarter marking the seventh consecutive quarter of declining deposit costs.

•Company recorded a negative provision for credit losses of $7.0 million.

•Net income increased 23% quarter-over-quarter and totaled $53.8 million, or $0.43 per diluted common share.

•Pre-tax pre-provision income increased 6% quarter-over-quarter to $64.5 million.

•Return on average assets increased to 1.25% from 1.02% in Q1 2021, and return on average equity increased to 10.41% from 8.53%.

•Loan originations increased to a record high $894.1 million from $847.1 million in the first quarter of 2021.

(more)

2-2-2 NASDAQ: HOPE

•Loans receivable decreased 2% to $13.42 billion, reflecting decreases in warehouse line utilizations, the sales of $30.0 million of SBA loans, $42.6 million of residential mortgage loans and an aggregate $119.3 million of hotel/motel loans, along with payoffs and pay downs.

Financial Highlights

| (dollars in thousands, except per share data) (unaudited) | At or for the Three Months Ended | |||||||||||||||||||||||||

| 6/30/2021 | 3/31/2021 | 6/30/2020 | ||||||||||||||||||||||||

| Net income | $ | 53,763 | $ | 43,687 | $ | 26,753 | ||||||||||||||||||||

| Diluted earnings per share | $ | 0.43 | $ | 0.35 | $ | 0.22 | ||||||||||||||||||||

| Net interest income before provision (credit) for credit losses | $ | 126,577 | $ | 122,579 | $ | 109,814 | ||||||||||||||||||||

| Net interest margin | 3.11 | % | 3.06 | % | 2.79 | % | ||||||||||||||||||||

| Noninterest income | $ | 11,076 | $ | 8,804 | $ | 11,240 | ||||||||||||||||||||

| Noninterest expense | $ | 73,123 | $ | 70,431 | $ | 67,030 | ||||||||||||||||||||

| Net loans receivable | $ | 13,234,849 | $ | 13,494,686 | $ | 12,710,063 | ||||||||||||||||||||

| Deposits | $ | 14,726,230 | $ | 14,301,269 | $ | 14,123,532 | ||||||||||||||||||||

| Total cost of deposits | 0.30 | % | 0.36 | % | 0.87 | % | ||||||||||||||||||||

Nonaccrual loans(1) | $ | 111,008 | $ | 109,858 | $ | 82,137 | ||||||||||||||||||||

Nonperforming loans to loans receivable(1) | 1.24 | % | 1.11 | % | 0.98 | % | ||||||||||||||||||||

ACL to loans receivable | 1.41 | % | 1.52 | % | 1.26 | % | ||||||||||||||||||||

ACL to nonaccrual loans(1) | 170.67 | % | 189.28 | % | 196.95 | % | ||||||||||||||||||||

ACL to nonperforming assets(1) | 103.11 | % | 121.94 | % | 109.62 | % | ||||||||||||||||||||

| Provision (credit) for credit losses | $ | (7,000) | $ | 3,300 | $ | 17,500 | ||||||||||||||||||||

| Net charge offs | $ | 11,491 | $ | 2,098 | $ | 652 | ||||||||||||||||||||

| Return on average assets (“ROA”) | 1.25 | % | 1.02 | % | 0.64 | % | ||||||||||||||||||||

| Return on average equity (“ROE”) | 10.41 | % | 8.53 | % | 5.31 | % | ||||||||||||||||||||

Return on average tangible common equity (“ROTCE”)(2) | 13.50 | % | 11.11 | % | 6.94 | % | ||||||||||||||||||||

| Noninterest expense / average assets | 1.70 | % | 1.65 | % | 1.60 | % | ||||||||||||||||||||

| Efficiency ratio | 53.12 | % | 53.61 | % | 55.37 | % | ||||||||||||||||||||

(1) Excludes delinquent SBA loans that are guaranteed and currently in liquidation.

(2) Return on average tangible common equity is a non-GAAP financial measure. A reconciliation of the Company’s return on average tangible common equity is provided in the accompanying financial information on Table Page 10.

Operating Results for the 2021 Second Quarter

Net interest income before the negative provision for credit losses for the 2021 second quarter increased 3% to $126.6 million from $122.6 million in the 2021 first quarter and increased 15% from $109.8 million in the 2020 second quarter. The Company attributed the increase in net interest income primarily to meaningful reductions in interest expense due to lower trending cost of deposits and higher interest income on average loans.

The net interest margin for the 2021 second quarter increased 5 basis points to 3.11% from 3.06% in the preceding 2021 first quarter, reflecting the benefits of lower deposit costs and higher average yield on loans. The net interest margin in the prior-year second quarter was 2.79%.

The weighted average yield on loans for the 2021 second quarter increased 4 basis points to 3.98% from 3.94% in the 2021 first quarter, reflecting the accelerated recognition of net fees due to PPP loan forgiveness. For the 2020 second quarter, the weighted average yield on loans was 4.23%.

(more)

3-3-3 NASDAQ: HOPE

The weighted average cost of deposits for the 2021 second quarter decreased for the seventh consecutive quarter to 0.30%, representing a 6 basis point decrease from 0.36% for the 2021 first quarter and a 57 basis point decrease from 0.87% for the 2020 second quarter. The Company attributed the significant improvements in the weighted average cost of deposits to a continuing shift in its deposit mix to lower-cost core deposits and the ongoing downward repricing of interest bearing deposits. The cost of interest bearing deposits was 0.48%, 0.56% and 1.17% for the quarters ended June 30, 2021, March 31, 2021 and June 30, 2020, respectively.

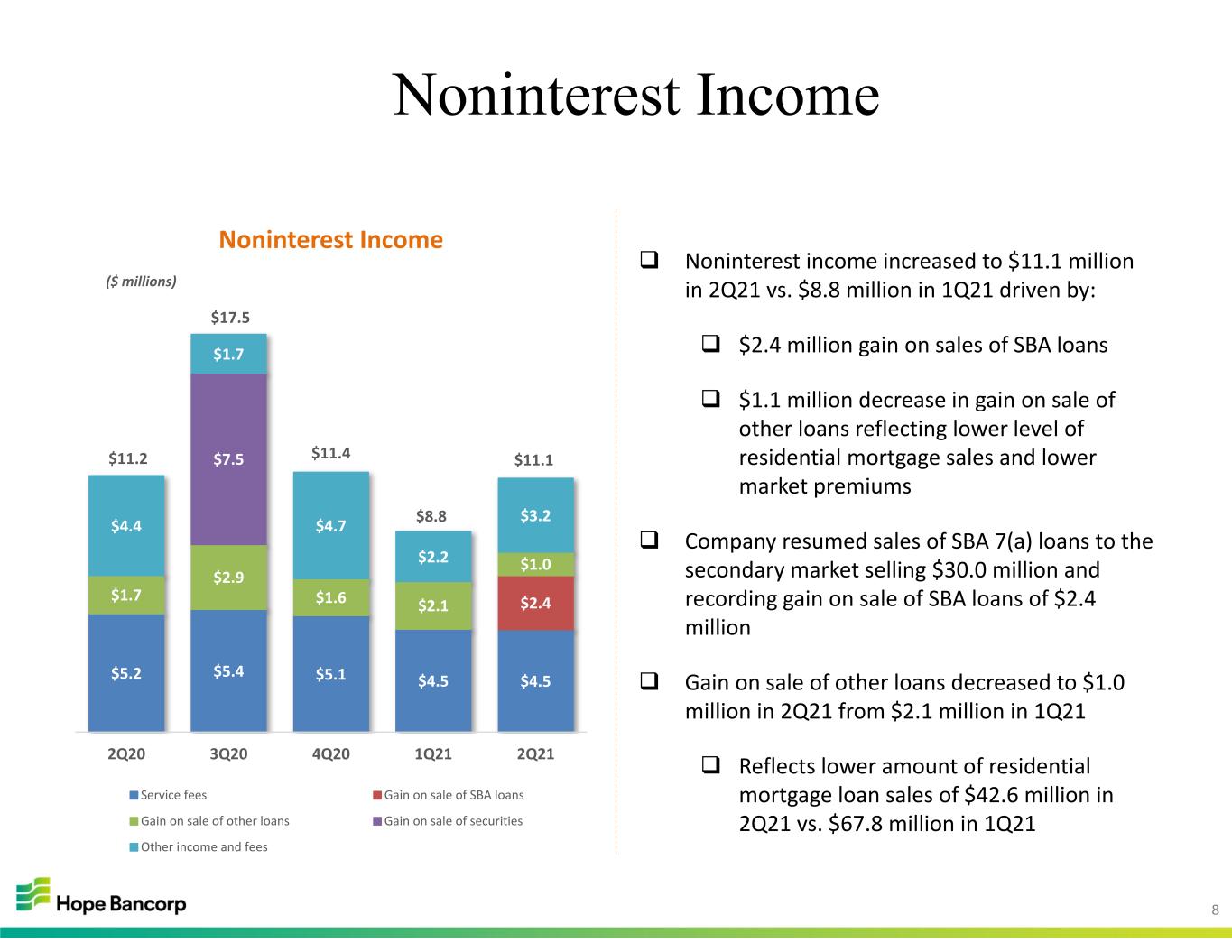

Noninterest income for the 2021 second quarter increased to $11.1 million from $8.8 million for the 2021 first quarter. In response to the significantly increased premiums available in the secondary market for SBA 7(a) loans, the Company sold $30.0 million of the guaranteed portfolio of its SBA 7(a) loans during the 2021 second quarter and recorded $2.4 million in net gains on sales of SBA loans, versus none in the preceding first quarter. This was partially offset by a reduction in net gains on sales of other loans, representing residential mortgage loans of $1.0 million for the 2021 second quarter, compared with $2.1 million in the preceding first quarter. Noninterest income in the year-ago second quarter totaled $11.2 million.

Noninterest expense for the 2021 second quarter increased to $73.1 million from $70.4 million in the preceding first quarter and $67.0 million in the year-ago second quarter.

Salaries and employee benefits expense for the 2021 second quarter increased to $42.3 million from $41.2 million in the preceding first quarter, largely reflecting annual merit increases effective at the beginning of the second quarter.

Professional fees for the three months ended June 30, 2021 increased $1.5 million quarter-over-quarter reflecting higher litigation expenses related to existing cases. The Company recorded a one-time $2.1 million impairment during the 2021 second quarter related to the disposition of a licensed software platform. These factors which contributed to higher noninterest expense for the 2021 second quarter were partially offset by a $2.2 million reduction in credit related expenses quarter-over-quarter.

The Company’s efficiency ratio for the 2021 second quarter improved to 53.12% from 53.61% for the preceding first quarter and from 55.37% for the year-ago second quarter. Noninterest expense as a percentage of average assets increased to 1.70% for the 2021 second quarter from 1.65% for the 2021 first quarter and from 1.60% for the 2020 second quarter.

The effective tax rate for the 2021 second quarter increased to 24.8% from 24.2% in the preceding quarter, reflecting the Company’s updated projection for increased annual pretax income than previously budgeted. In the year-ago quarter, the effective tax rate was 26.8%.

Balance Sheet Summary

New loan originations funded during the 2021 second quarter increased to $894.1 million from $847.1 million in the preceding first quarter and $832.0 million in the 2020 second quarter. Following are the components of new loan production for the quarters ended June 30, 2021, March 31, 2021 and June 30, 2020:

| (dollars in thousands) (unaudited) | For the Three Months Ended | |||||||||||||||||||||||||

| 6/30/2021 | 3/31/2021 | 6/30/2020 | ||||||||||||||||||||||||

| Commercial real estate | $ | 454,857 | $ | 277,704 | $ | 213,246 | ||||||||||||||||||||

| Commercial | 288,726 | 156,622 | 58,458 | |||||||||||||||||||||||

| SBA | 77,652 | 36,802 | 5,901 | |||||||||||||||||||||||

| SBA PPP | 19,816 | 304,727 | 480,141 | |||||||||||||||||||||||

| Consumer | 275 | 1,473 | 1,920 | |||||||||||||||||||||||

| Residential mortgage | 52,766 | 69,784 | 72,343 | |||||||||||||||||||||||

| Total new loan originations | $ | 894,092 | $ | 847,112 | $ | 832,009 | ||||||||||||||||||||

(more)

4-4-4 NASDAQ: HOPE

During the 2021 second quarter, the Company acquired $95.6 million of 30-year fixed rate residential mortgage loans. In addition to the sale of $42.6 million in residential mortgage loans and $30.0 million of SBA 7(a) loans during the 2021 second quarter, the Company completed an aggregate $119.3 million in sales of loans from its hotel/motel portfolio that were viewed to be higher risk requiring a longer recovery period from the impact of the COVID-19 pandemic.

Altogether with aggregate payoffs and pay downs, first round PPP loan forgiveness of $164.5 million and a $231.0 million quarter-over-quarter decrease in warehouse line utilizations, loans receivable at June 30, 2021 decreased 2% to $13.42 billion from $13.70 billion at March 31, 2021. Loans receivable at June 30, 2020 amounted to $12.87 billion.

Total deposits at June 30, 2021 increased 3% to $14.73 billion from $14.30 billion at March 31, 2021 and increased 4% from $14.12 billion at June 30, 2020. Quarter-over-quarter, noninterest bearing demand deposits as of June 30, 2021 increased 4% and money market and other interest bearing demand deposit balances increased 16%, while time deposits decreased 16%. On a year-over-year basis, noninterest bearing demand deposits as of June 30, 2021 increased 40% and money market and NOW account balances increased 20%, while time deposits decreased 40%.

Following is the deposit composition as of June 30, 2021, March 31, 2021 and June 30, 2020:

| (dollars in thousands) (unaudited) | 6/30/2021 | 3/31/2021 | % change | 6/30/2020 | % change | ||||||||||||||||||||||||

| Noninterest bearing demand deposits | $ | 5,638,115 | $ | 5,427,174 | 4 | % | $ | 4,036,383 | 40 | % | |||||||||||||||||||

| Money market and other | 5,786,697 | 5,009,419 | 16 | % | 4,831,679 | 20 | % | ||||||||||||||||||||||

| Saving deposits | 308,651 | 305,326 | 1 | % | 296,614 | 4 | % | ||||||||||||||||||||||

| Time deposits | 2,992,767 | 3,559,350 | (16) | % | 4,958,856 | (40) | % | ||||||||||||||||||||||

| Total deposit balances | $ | 14,726,230 | $ | 14,301,269 | 3 | % | $ | 14,123,532 | 4 | % | |||||||||||||||||||

Following is the deposit composition as a percentage of total deposits and a breakdown of cost of deposits as of and for the quarters ended June 30, 2021, March 31, 2021 and June 30, 2020:

| Deposit Breakdown | Cost of Deposits | ||||||||||||||||||||||||||||||||||

| (unaudited) | 6/30/2021 | 3/31/2021 | 6/30/2020 | Q2 2021 | Q1 2021 | Q2 2020 | |||||||||||||||||||||||||||||

| Noninterest bearing demand deposits | 38.3 | % | 38.0 | % | 28.6 | % | — | % | — | % | — | % | |||||||||||||||||||||||

| Money market and other | 39.2 | % | 35.0 | % | 34.2 | % | 0.43 | % | 0.42 | % | 0.62 | % | |||||||||||||||||||||||

| Saving deposits | 2.1 | % | 2.1 | % | 2.1 | % | 1.15 | % | 1.17 | % | 1.22 | % | |||||||||||||||||||||||

| Time deposits | 20.4 | % | 24.9 | % | 35.1 | % | 0.49 | % | 0.69 | % | 1.71 | % | |||||||||||||||||||||||

| Total deposit balances | 100.0 | % | 100.0 | % | 100.0 | % | 0.30 | % | 0.36 | % | 0.87 | % | |||||||||||||||||||||||

Allowance for Credit Losses

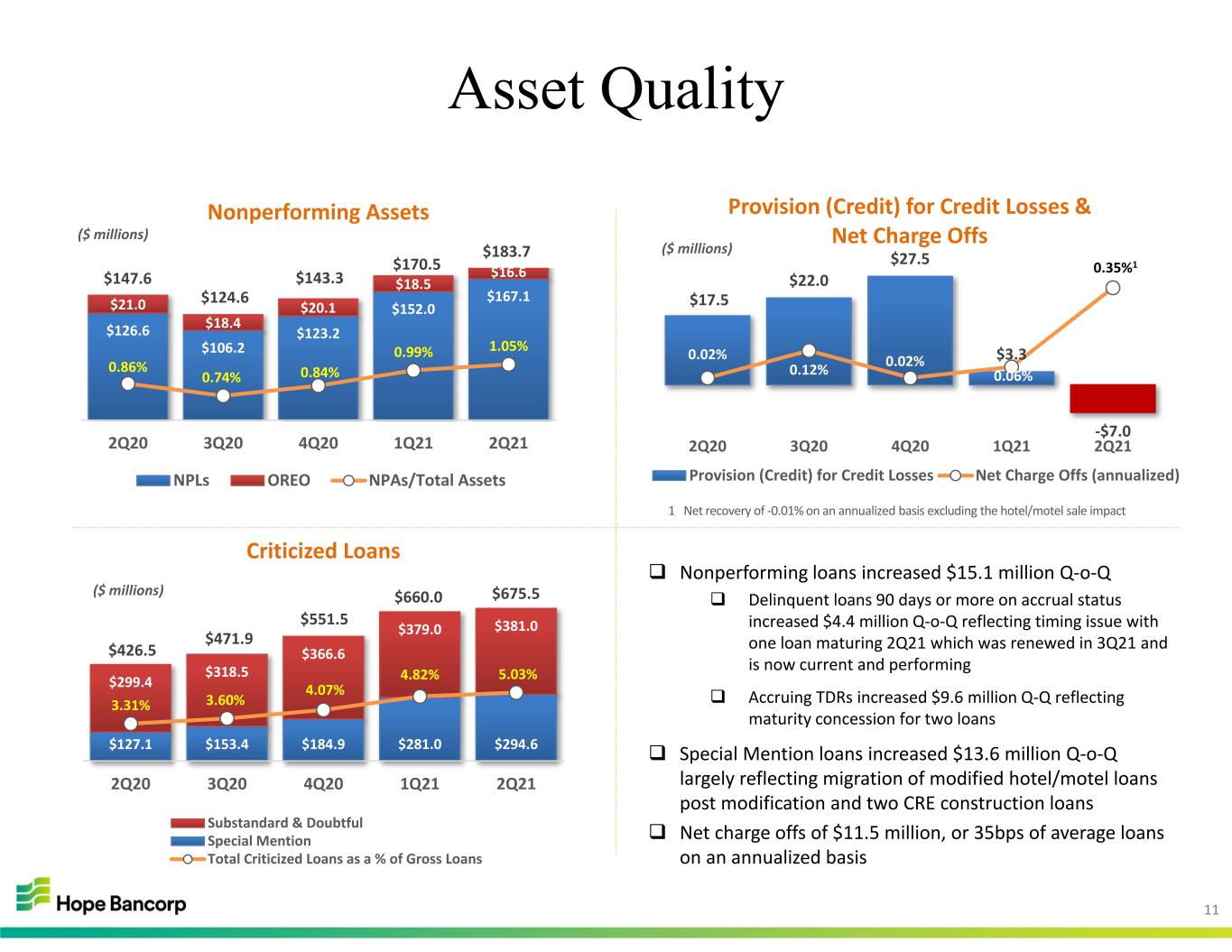

For the 2021 second quarter, the Company recorded a negative provision for credit losses of $7.0 million compared with provision for credit losses of $3.3 million in the preceding first quarter and $17.5 million for the 2020 second quarter. The allowance release in the 2021 second quarter largely reflects improved macroeconomic forecasts, together with the reduction in its loan portfolio and the $119.3 million in sales from the hotel/motel portfolio.

Following is the allowance for credit losses and allowance coverage ratios as of June 30, 2021, March 31, 2021 and June 30, 2020:

| (dollars in thousands) (unaudited) | 6/30/2021 | 3/31/2021 | 6/30/2020 | |||||||||||||||||||||||

| Allowance for credit losses | $ | 189,452 | $ | 207,943 | $ | 161,771 | ||||||||||||||||||||

| Allowance for credit loss/loans receivable | 1.41 | % | 1.52 | % | 1.26 | % | ||||||||||||||||||||

| Allowance for credit losses/nonperforming loans | 113.36 | % | 136.79 | % | 127.79 | % | ||||||||||||||||||||

(more)

5-5-5 NASDAQ: HOPE

Credit Quality

Following are the components of nonperforming assets as of June 30, 2021, March 31, 2021 and June 30, 2020:

| (dollars in thousands) (unaudited) | 6/30/2021 | 3/31/2021 | 6/30/2020 | |||||||||||||||||||||||

Loans on nonaccrual status (1) | $ | 111,008 | $ | 109,858 | $ | 82,137 | ||||||||||||||||||||

Delinquent loans 90 days or more on accrual status | 4,759 | 384 | 430 | |||||||||||||||||||||||

| Accruing troubled debt restructured loans | 51,360 | 41,773 | 44,026 | |||||||||||||||||||||||

| Total nonperforming loans | 167,127 | 152,015 | 126,593 | |||||||||||||||||||||||

| Other real estate owned | 16,619 | 18,515 | 20,983 | |||||||||||||||||||||||

| Total nonperforming assets | $ | 183,746 | $ | 170,530 | $ | 147,576 | ||||||||||||||||||||

(1) Excludes delinquent SBA loans that are guaranteed and currently in liquidation totaling $23.6 million, $25.0 million and $30.3 million, at June 30, 2021, March 31, 2021 and June 30, 2020, respectively.

The increase in delinquent loans 90 days or more on accrual status as of June 30, 2021 largely reflects one loan which matured during the 2021 second quarter. This loan was renewed early in the third quarter of 2021 and is currently performing. The increase in accruing troubled debt restructured loans largely reflects maturity concessions for two credit relationships.

Following are the components of criticized loan balances as of June 30, 2021, March 31, 2021 and June 30, 2020:

| (dollars in thousands) (unaudited) | 6/30/2021 | 3/31/2021 | 6/30/2020 | |||||||||||||||||||||||

| Special mention | $ | 294,559 | $ | 280,974 | $ | 127,149 | ||||||||||||||||||||

| Substandard | 380,955 | 379,048 | 299,357 | |||||||||||||||||||||||

| Doubtful/loss | — | — | 11 | |||||||||||||||||||||||

| Total criticized loans | $ | 675,514 | $ | 660,022 | $ | 426,517 | ||||||||||||||||||||

The modest increase in special mention loans quarter-over-quarter primarily reflects the addition of two large credit relationships. The first is a hotel/motel relationship that was downgraded from the COVID-watch grade to Special Mention following the expiration of the modification. The second is a construction loan that is taking longer to stabilize following the completion of the project due to the pandemic-related environment.

Following are net charge offs and net charge offs to average loans receivable on an annualized basis for the three months ended June 30, 2021, March 31, 2021 and June 30, 2020:

| (dollars in thousands) (unaudited) | For the Three Months Ended | |||||||||||||||||||||||||

| 6/30/2021 | 3/31/2021 | 6/30/2020 | ||||||||||||||||||||||||

| Net charge offs | $ | 11,491 | $ | 2,098 | $ | 652 | ||||||||||||||||||||

| Net charge offs/average loans receivable (annualized) | 0.35 | % | 0.06 | % | 0.02 | % | ||||||||||||||||||||

Net charge offs for the 2021 second quarter includes charge offs of $11.8 million, all of which was previously reserved, from the sale of $119.3 million in hotel/motel loans during the 2021 second quarter.

(more)

6-6-6 NASDAQ: HOPE

Capital

At June 30, 2021, the Company and the Bank continued to exceed all regulatory capital requirements to be classified as a “well-capitalized” financial institution. Following are capital ratios for the Company as of June 30, 2021, March 31, 2021 and June 30, 2020:

Hope Bancorp, Inc. (unaudited) | 6/30/2021 | 3/31/2021 | 6/30/2020 | Minimum Guideline for “Well-Capitalized” Bank | |||||||||||||||||||

| Common Equity Tier 1 Capital | 11.32% | 11.08% | 11.50% | 6.50% | |||||||||||||||||||

| Tier 1 Leverage Ratio | 10.34% | 10.15% | 10.08% | 5.00% | |||||||||||||||||||

| Tier 1 Risk-Based Ratio | 12.02% | 11.78% | 12.24% | 8.00% | |||||||||||||||||||

| Total Risk-Based Ratio | 13.16% | 13.03% | 13.23% | 10.00% | |||||||||||||||||||

Following are tangible common equity (“TCE”) per share and TCE as a percentage of tangible assets as of June 30, 2021, March 31, 2021 and June 30, 2020:

| (unaudited) | 6/30/2021 | 3/31/2021 | 6/30/2020 | ||||||||||||||

Tangible common equity per share (1) | $13.10 | $12.73 | $12.62 | ||||||||||||||

Tangible common equity to tangible assets (2) | 9.53% | 9.40% | 9.32% | ||||||||||||||

(1) Tangible common equity represents common equity less goodwill and net other intangible assets. Tangible common equity per share represents tangible common equity divided by the number of shares issued and outstanding. Both tangible common equity and tangible common equity per share are non-GAAP financial measures. A reconciliation of the Company’s total stockholders’ equity to tangible common equity is provided in the accompanying financial information on Table Page 10.

(2) Tangible assets represent total assets less goodwill and net other intangible assets. Tangible common equity to tangible assets is the ratio of tangible common equity over tangible assets. Tangible common equity to tangible assets is a non-GAAP financial measure. A reconciliation of the Company’s total assets to tangible assets is provided in the accompanying financial information on Table Page 10.

Investor Conference Call

The Company previously announced that it will host an investor conference call on Wednesday, July 21, 2021 at 9:30 a.m. Pacific Time / 12:30 p.m. Eastern Time to review financial results for its second quarter ended June 30, 2021. Investors and analysts are invited to access the conference call by dialing 866-235-9917 (domestic) or 412-902-4103 (international) and asking for the “Hope Bancorp Call.” A presentation to accompany the earnings call will be available at the Investor Relations section of Hope Bancorp’s website at www.ir-hopebancorp.com. Other interested parties are invited to listen to a live webcast of the call available at the Investor Relations section of Hope Bancorp’s website. After the live webcast, a replay will remain available at the Investor Relations section of Hope Bancorp’s website for one year. A telephonic replay of the call will be available at 877-344-7529 (domestic) or 412-317-0088 (international) for one week through July 28, 2021, replay access code 10158798.

(more)

7-7-7 NASDAQ: HOPE

About Hope Bancorp, Inc.

Hope Bancorp, Inc. is the holding company of Bank of Hope, the first and only super regional Korean-American bank in the United States with $17.47 billion in total assets as of June 30, 2021. Headquartered in Los Angeles and serving a multi-ethnic population of customers across the nation, Bank of Hope operates 53 full-service branches in California, Washington, Texas, Illinois, New York, New Jersey, Virginia and Alabama. The Bank also operates SBA loan production offices in Seattle, Denver, Dallas, Atlanta, Portland, Oregon, New York City, Northern California and Houston; commercial loan production offices in Northern California and Seattle; residential mortgage loan production offices in Southern California; and a representative office in Seoul, Korea. Bank of Hope specializes in core business banking products for small and medium-sized businesses, with an emphasis in commercial real estate and commercial lending, SBA lending and international trade financing. Bank of Hope is a California-chartered bank, and its deposits are insured by the FDIC to the extent provided by law. Bank of Hope is an Equal Opportunity Lender. For additional information, please go to bankofhope.com. By including the foregoing website address link, the Company does not intend to and shall not be deemed to incorporate by reference any material contained or accessible therein.

Forward-Looking Statements

Some statements in this press release may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements relate to, among other things, expectations regarding the business environment in which we operate, projections of future performance, perceived opportunities in the market and statements regarding our business strategies, objectives and vision. Forward-looking statements include, but are not limited to, statements preceded by, followed by or that include the words “will,” “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates” or similar expressions. With respect to any such forward-looking statements, the Company claims the protection provided for in the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties. The Company’s actual results, performance or achievements may differ significantly from the results, performance or achievements expressed or implied in any forward-looking statements. The risks and uncertainties include, but are not limited to: possible deterioration in economic conditions in our areas of operation; interest rate risk associated with volatile interest rates and related asset-liability matching risk; liquidity risks; risk of significant non-earning assets, and net credit losses that could occur, particularly in times of weak economic conditions or times of rising interest rates; the failure of or changes to assumptions and estimates underlying the Company’s allowances for credit losses, regulatory risks associated with current and future regulations; and the COVID-19 pandemic and its impact on our financial position, results of operations, liquidity, and capitalization. For additional information concerning these and other risk factors, see the Company’s most recent Annual Report on Form 10-K. The Company does not undertake, and specifically disclaims any obligation, to update any forward-looking statements to reflect the occurrence of events or circumstances after the date of such statements except as required by law.

Contacts:

Alex Ko Senior EVP & Chief Financial Officer 213-427-6560 alex.ko@bankofhope.com | Angie Yang SVP, Director of Investor Relations & Corporate Communications 213-251-2219 angie.yang@bankofhope.com | ||||

# # #

(tables follow)

Hope Bancorp, Inc.

Selected Financial Data

Unaudited (dollars in thousands, except share data)

| Assets: | 6/30/2021 | 3/31/2021 | % change | 6/30/2020 | % change | ||||||||||||||||||||||||

| Cash and due from banks | $ | 836,957 | $ | 376,666 | 122 | % | $ | 1,468,949 | (43) | % | |||||||||||||||||||

| Securities available for sale, at fair value | 2,274,170 | 2,233,744 | 2 | % | 1,887,604 | 20 | % | ||||||||||||||||||||||

| Federal Home Loan Bank (“FHLB”) stock and other investments | 94,550 | 102,242 | (8) | % | 98,357 | (4) | % | ||||||||||||||||||||||

| Loans held for sale, at the lower of cost or fair value | 54,245 | 19,672 | 176 | % | 11,350 | 378 | % | ||||||||||||||||||||||

| Loans receivable | 13,424,301 | 13,702,629 | (2) | % | 12,871,834 | 4 | % | ||||||||||||||||||||||

| Allowance for credit losses | (189,452) | (207,943) | (9) | % | (161,771) | 17 | % | ||||||||||||||||||||||

| Net loans receivable | 13,234,849 | 13,494,686 | (2) | % | 12,710,063 | 4 | % | ||||||||||||||||||||||

| Accrued interest receivable | 51,886 | 60,498 | (14) | % | 52,859 | (2) | % | ||||||||||||||||||||||

| Premises and equipment, net | 45,302 | 47,918 | (5) | % | 51,029 | (11) | % | ||||||||||||||||||||||

| Bank owned life insurance | 76,428 | 77,089 | (1) | % | 77,050 | (1) | % | ||||||||||||||||||||||

| Goodwill | 464,450 | 464,450 | — | % | 464,450 | — | % | ||||||||||||||||||||||

| Servicing assets | 11,566 | 12,084 | (4) | % | 14,164 | (18) | % | ||||||||||||||||||||||

| Other intangible assets, net | 8,689 | 9,198 | (6) | % | 10,770 | (19) | % | ||||||||||||||||||||||

| Other assets | 316,535 | 300,613 | 5 | % | 322,417 | (2) | % | ||||||||||||||||||||||

| Total assets | $ | 17,469,627 | $ | 17,198,860 | 2 | % | $ | 17,169,062 | 2 | % | |||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||||||||

| Deposits | $ | 14,726,230 | $ | 14,301,269 | 3 | % | $ | 14,123,532 | 4 | % | |||||||||||||||||||

| FHLB advances | 200,000 | 400,000 | (50) | % | 500,000 | (60) | % | ||||||||||||||||||||||

| Convertible notes, net | 215,739 | 215,504 | — | % | 201,987 | 7 | % | ||||||||||||||||||||||

| Subordinated debentures | 104,762 | 104,469 | — | % | 103,602 | 1 | % | ||||||||||||||||||||||

| Accrued interest payable | 4,946 | 8,611 | (43) | % | 26,093 | (81) | % | ||||||||||||||||||||||

| Other liabilities | 125,080 | 123,426 | 1 | % | 183,072 | (32) | % | ||||||||||||||||||||||

| Total liabilities | $ | 15,376,757 | $ | 15,153,279 | 1 | % | $ | 15,138,286 | 2 | % | |||||||||||||||||||

| Stockholders’ Equity: | |||||||||||||||||||||||||||||

| Common stock, $0.001 par value | $ | 136 | $ | 136 | — | % | $ | 136 | — | % | |||||||||||||||||||

| Capital surplus | 1,418,135 | 1,417,137 | — | % | 1,430,757 | (1) | % | ||||||||||||||||||||||

| Retained earnings | 859,548 | 823,085 | 4 | % | 761,734 | 13 | % | ||||||||||||||||||||||

| Treasury stock, at cost | (200,000) | (200,000) | — | % | (200,000) | — | % | ||||||||||||||||||||||

| Accumulated other comprehensive gain, net | 15,051 | 5,223 | 188 | % | 38,149 | (61) | % | ||||||||||||||||||||||

| Total stockholders’ equity | 2,092,870 | 2,045,581 | 2 | % | 2,030,776 | 3 | % | ||||||||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 17,469,627 | $ | 17,198,860 | 2 | % | $ | 17,169,062 | 2 | % | |||||||||||||||||||

| Common stock shares - authorized | 150,000,000 | 150,000,000 | 150,000,000 | ||||||||||||||||||||||||||

| Common stock shares - outstanding | 123,673,832 | 123,480,494 | 123,239,276 | ||||||||||||||||||||||||||

| Treasury stock shares | 12,661,581 | 12,661,581 | 12,661,581 | ||||||||||||||||||||||||||

Table Page 1

Hope Bancorp, Inc.

Selected Financial Data

Unaudited (dollars in thousands, except share and per share data)

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||

| 6/30/2021 | 3/31/2021 | % change | 6/30/2020 | % change | 6/30/2021 | 6/30/2020 | % change | ||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 131,823 | $ | 129,736 | 2 | % | $ | 134,190 | (2) | % | $ | 261,559 | $ | 288,420 | (9) | % | |||||||||||||||||||||||||||||||

| Interest on securities | 7,713 | 7,915 | (3) | % | 9,891 | (22) | % | 15,628 | 20,500 | (24) | % | ||||||||||||||||||||||||||||||||||||

| Interest on federal funds sold and other investments | 668 | 642 | 4 | % | 980 | (32) | % | 1,310 | 3,009 | (56) | % | ||||||||||||||||||||||||||||||||||||

| Total interest income | 140,204 | 138,293 | 1 | % | 145,061 | (3) | % | 278,497 | 311,929 | (11) | % | ||||||||||||||||||||||||||||||||||||

| Interest on deposits | 10,696 | 12,770 | (16) | % | 29,451 | (64) | % | 23,466 | 70,564 | (67) | % | ||||||||||||||||||||||||||||||||||||

| Interest on other borrowings and convertible notes | 2,931 | 2,944 | — | % | 5,796 | (49) | % | 5,875 | 12,260 | (52) | % | ||||||||||||||||||||||||||||||||||||

| Total interest expense | 13,627 | 15,714 | (13) | % | 35,247 | (61) | % | 29,341 | 82,824 | (65) | % | ||||||||||||||||||||||||||||||||||||

| Net interest income before provision (credit) for credit losses | 126,577 | 122,579 | 3 | % | 109,814 | 15 | % | 249,156 | 229,105 | 9 | % | ||||||||||||||||||||||||||||||||||||

| Provision (credit) for credit losses | (7,000) | 3,300 | N/A | 17,500 | N/A | (3,700) | 45,500 | N/A | |||||||||||||||||||||||||||||||||||||||

| Net interest income after provision (credit) for credit losses | 133,577 | 119,279 | 12 | % | 92,314 | 45 | % | 252,856 | 183,605 | 38 | % | ||||||||||||||||||||||||||||||||||||

| Service fees on deposit accounts | 1,777 | 1,790 | (1) | % | 2,583 | (31) | % | 3,567 | 6,716 | (47) | % | ||||||||||||||||||||||||||||||||||||

| International service fees | 795 | 841 | (5) | % | 667 | 19 | % | 1,636 | 1,456 | 12 | % | ||||||||||||||||||||||||||||||||||||

| Loan servicing fees, net | 934 | 1,044 | (11) | % | 1,106 | (16) | % | 1,978 | 1,471 | 34 | % | ||||||||||||||||||||||||||||||||||||

| Wire transfer fees | 923 | 844 | 9 | % | 820 | 13 | % | 1,767 | 1,818 | (3) | % | ||||||||||||||||||||||||||||||||||||

| Net gains on sales of SBA loans | 2,375 | — | 100 | % | — | 100 | % | 2,375 | — | 100 | % | ||||||||||||||||||||||||||||||||||||

| Net gains on sales of other loans | 1,028 | 2,096 | (51) | % | 1,678 | (39) | % | 3,124 | 3,533 | (12) | % | ||||||||||||||||||||||||||||||||||||

| Other income and fees | 3,244 | 2,189 | 48 | % | 4,386 | (26) | % | 5,433 | 9,510 | (43) | % | ||||||||||||||||||||||||||||||||||||

| Total noninterest income | 11,076 | 8,804 | 26 | % | 11,240 | (1) | % | 19,880 | 24,504 | (19) | % | ||||||||||||||||||||||||||||||||||||

| Salaries and employee benefits | 42,309 | 41,216 | 3 | % | 38,850 | 9 | % | 83,525 | 81,352 | 3 | % | ||||||||||||||||||||||||||||||||||||

| Occupancy | 7,067 | 6,967 | 1 | % | 7,043 | — | % | 14,034 | 14,453 | (3) | % | ||||||||||||||||||||||||||||||||||||

| Furniture and equipment | 4,822 | 4,186 | 15 | % | 4,654 | 4 | % | 9,008 | 8,913 | 1 | % | ||||||||||||||||||||||||||||||||||||

| Advertising and marketing | 2,097 | 1,625 | 29 | % | 1,315 | 59 | % | 3,722 | 2,988 | 25 | % | ||||||||||||||||||||||||||||||||||||

| Data processing and communications | 2,411 | 2,737 | (12) | % | 2,274 | 6 | % | 5,148 | 4,905 | 5 | % | ||||||||||||||||||||||||||||||||||||

| Professional fees | 4,395 | 2,903 | 51 | % | 1,510 | 191 | % | 7,298 | 4,810 | 52 | % | ||||||||||||||||||||||||||||||||||||

| FDIC assessment | 1,284 | 1,255 | 2 | % | 1,652 | (22) | % | 2,539 | 3,211 | (21) | % | ||||||||||||||||||||||||||||||||||||

| Credit related expenses | 43 | 2,218 | (98) | % | 1,361 | (97) | % | 2,261 | 3,023 | (25) | % | ||||||||||||||||||||||||||||||||||||

| OREO expense, net | 298 | 281 | 6 | % | 1,338 | (78) | % | 579 | 2,181 | (73) | % | ||||||||||||||||||||||||||||||||||||

| Software impairment | 2,146 | — | 100 | % | — | 100 | % | 2,146 | — | 100 | % | ||||||||||||||||||||||||||||||||||||

| Other | 6,251 | 7,043 | (11) | % | 7,033 | (11) | % | 13,294 | 13,334 | — | % | ||||||||||||||||||||||||||||||||||||

| Total noninterest expense | 73,123 | 70,431 | 4 | % | 67,030 | 9 | % | 143,554 | 139,170 | 3 | % | ||||||||||||||||||||||||||||||||||||

| Income before income taxes | 71,530 | 57,652 | 24 | % | 36,524 | 96 | % | 129,182 | 68,939 | 87 | % | ||||||||||||||||||||||||||||||||||||

| Income tax provision | 17,767 | 13,965 | 27 | % | 9,771 | 82 | % | 31,732 | 16,233 | 95 | % | ||||||||||||||||||||||||||||||||||||

| Net income | $ | 53,763 | $ | 43,687 | 23 | % | $ | 26,753 | 101 | % | $ | 97,450 | $ | 52,706 | 85 | % | |||||||||||||||||||||||||||||||

| Earnings Per Common Share: | |||||||||||||||||||||||||||||||||||||||||||||||

| Basic | $ | 0.44 | $ | 0.35 | $ | 0.22 | $ | 0.79 | $ | 0.43 | |||||||||||||||||||||||||||||||||||||

| Diluted | $ | 0.43 | $ | 0.35 | $ | 0.22 | $ | 0.78 | $ | 0.42 | |||||||||||||||||||||||||||||||||||||

| Weighted Average Shares Outstanding: | |||||||||||||||||||||||||||||||||||||||||||||||

| Basic | 123,592,695 | 123,324,745 | 123,200,127 | 123,459,461 | 123,747,727 | ||||||||||||||||||||||||||||||||||||||||||

| Diluted | 124,323,888 | 124,336,130 | 123,430,891 | 124,334,227 | 124,054,291 | ||||||||||||||||||||||||||||||||||||||||||

Table Page 2

Hope Bancorp, Inc.

Selected Financial Data

Unaudited (dollars in thousands, except share and per share data)

| For the Three Months Ended (Annualized) | For the Six Months Ended (Annualized) | ||||||||||||||||||||||||||||

| Profitability measures: | 6/30/2021 | 3/31/2021 | 6/30/2020 | 6/30/2021 | 6/30/2020 | ||||||||||||||||||||||||

| ROA | 1.25 | % | 1.02 | % | 0.64 | % | 1.14 | % | 0.65 | % | |||||||||||||||||||

| ROE | 10.41 | % | 8.53 | % | 5.31 | % | 9.48 | % | 5.21 | % | |||||||||||||||||||

ROTCE (1) | 13.50 | % | 11.11 | % | 6.94 | % | 12.31 | % | 6.82 | % | |||||||||||||||||||

| Net interest margin | 3.11 | % | 3.06 | % | 2.79 | % | 3.09 | % | 3.04 | % | |||||||||||||||||||

| Efficiency ratio | 53.12 | % | 53.61 | % | 55.37 | % | 53.36 | % | 54.88 | % | |||||||||||||||||||

| Noninterest expense / average assets | 1.70 | % | 1.65 | % | 1.60 | % | 1.68 | % | 1.73 | % | |||||||||||||||||||

(1) Average tangible equity is calculated by subtracting average goodwill and average core deposit intangible assets from average stockholders’ equity. This is a non-GAAP measure that we believe provides investors with information that is useful in understanding our financial performance and position. | |||||||||||||||||||||||||||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||

| Pre-tax acquisition accounting adjustments: | 6/30/2021 | 3/31/2021 | 6/30/2020 | 6/30/2021 | 6/30/2020 | ||||||||||||||||||||||||

| Accretion on purchased non-impaired loans | $ | 366 | $ | 705 | $ | 658 | $ | 1,071 | $ | 1,717 | |||||||||||||||||||

| Accretion on purchased credit deteriorated/purchased credit impaired loans | 2,188 | 2,255 | 3,046 | 4,443 | 12,495 | ||||||||||||||||||||||||

| Amortization of premium on low income housing tax credits | (74) | (73) | (70) | (147) | (141) | ||||||||||||||||||||||||

| Accretion of discount on acquired subordinated debt | (293) | (291) | (284) | (584) | (567) | ||||||||||||||||||||||||

| Amortization of core deposit intangibles | (509) | (509) | (532) | (1,018) | (1,063) | ||||||||||||||||||||||||

| Total acquisition accounting adjustments | $ | 1,678 | $ | 2,087 | $ | 2,818 | $ | 3,765 | $ | 12,441 | |||||||||||||||||||

Table Page 3

Hope Bancorp, Inc.

Selected Financial Data

Unaudited (dollars in thousands)

| Three Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6/30/2021 | 3/31/2021 | 6/30/2020 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest | Annualized | Interest | Annualized | Interest | Annualized | ||||||||||||||||||||||||||||||||||||||||||||||||

| Average | Income/ | Average | Average | Income/ | Average | Average | Income/ | Average | |||||||||||||||||||||||||||||||||||||||||||||

| Balance | Expense | Yield/Cost | Balance | Expense | Yield/Cost | Balance | Expense | Yield/Cost | |||||||||||||||||||||||||||||||||||||||||||||

| INTEREST EARNING ASSETS: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans, including loans held for sale | $ | 13,293,591 | $ | 131,823 | 3.98 | % | $ | 13,346,264 | $ | 129,736 | 3.94 | % | $ | 12,755,088 | $ | 134,190 | 4.23 | % | |||||||||||||||||||||||||||||||||||

| Securities available for sale | 2,253,135 | 7,713 | 1.37 | % | 2,267,409 | 7,915 | 1.42 | % | 1,750,156 | 9,891 | 2.27 | % | |||||||||||||||||||||||||||||||||||||||||

| FHLB stock and other investments | 759,182 | 668 | 0.35 | % | 640,392 | 642 | 0.41 | % | 1,317,049 | 980 | 0.30 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest earning assets | $ | 16,305,908 | $ | 140,204 | 3.45 | % | $ | 16,254,065 | $ | 138,293 | 3.45 | % | $ | 15,822,293 | $ | 145,061 | 3.69 | % | |||||||||||||||||||||||||||||||||||

| INTEREST BEARING LIABILITIES: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposits: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Demand, interest bearing | $ | 5,484,047 | $ | 5,909 | 0.43 | % | $ | 5,256,579 | $ | 5,490 | 0.42 | % | $ | 4,903,786 | $ | 7,563 | 0.62 | % | |||||||||||||||||||||||||||||||||||

| Savings | 308,530 | 887 | 1.15 | % | 301,184 | 870 | 1.17 | % | 284,050 | 862 | 1.22 | % | |||||||||||||||||||||||||||||||||||||||||

| Time deposits | 3,222,457 | 3,900 | 0.49 | % | 3,767,109 | 6,410 | 0.69 | % | 4,954,446 | 21,026 | 1.71 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest bearing deposits | 9,015,034 | 10,696 | 0.48 | % | 9,324,872 | 12,770 | 0.56 | % | 10,142,282 | 29,451 | 1.17 | % | |||||||||||||||||||||||||||||||||||||||||

| FHLB advances | 202,198 | 631 | 1.25 | % | 215,889 | 642 | 1.21 | % | 593,407 | 2,238 | 1.52 | % | |||||||||||||||||||||||||||||||||||||||||

| Convertible notes, net | 215,599 | 1,323 | 2.43 | % | 215,002 | 1,322 | 2.46 | % | 201,169 | 2,358 | 4.64 | % | |||||||||||||||||||||||||||||||||||||||||

| Subordinated debentures | 100,701 | 977 | 3.84 | % | 100,392 | 980 | 3.90 | % | 99,534 | 1,200 | 4.77 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest bearing liabilities | $ | 9,533,532 | $ | 13,627 | 0.57 | % | $ | 9,856,155 | $ | 15,714 | 0.65 | % | $ | 11,036,392 | $ | 35,247 | 1.28 | % | |||||||||||||||||||||||||||||||||||

| Noninterest bearing demand deposits | 5,445,457 | 5,052,532 | 3,510,783 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total funding liabilities/cost of funds | $ | 14,978,989 | 0.36 | % | $ | 14,908,687 | 0.43 | % | $ | 14,547,175 | 0.97 | % | |||||||||||||||||||||||||||||||||||||||||

| Net interest income/net interest spread | $ | 126,577 | 2.88 | % | $ | 122,579 | 2.80 | % | $ | 109,814 | 2.41 | % | |||||||||||||||||||||||||||||||||||||||||

| Net interest margin | 3.11 | % | 3.06 | % | 2.79 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Cost of deposits: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest bearing demand deposits | $ | 5,445,457 | $ | — | — | % | $ | 5,052,532 | $ | — | — | % | $ | 3,510,783 | $ | — | — | % | |||||||||||||||||||||||||||||||||||

| Interest bearing deposits | 9,015,034 | 10,696 | 0.48 | % | 9,324,872 | 12,770 | 0.56 | % | 10,142,282 | 29,451 | 1.17 | % | |||||||||||||||||||||||||||||||||||||||||

| Total deposits | $ | 14,460,491 | $ | 10,696 | 0.30 | % | $ | 14,377,404 | $ | 12,770 | 0.36 | % | $ | 13,653,065 | $ | 29,451 | 0.87 | % | |||||||||||||||||||||||||||||||||||

Table Page 4

Hope Bancorp, Inc.

Selected Financial Data

Unaudited (dollars in thousands)

| Six Months Ended | |||||||||||||||||||||||||||||||||||

| 6/30/2021 | 6/30/2020 | ||||||||||||||||||||||||||||||||||

| Interest | Annualized | Interest | Annualized | ||||||||||||||||||||||||||||||||

| Average | Income/ | Average | Average | Income/ | Average | ||||||||||||||||||||||||||||||

| Balance | Expense | Yield/Cost | Balance | Expense | Yield/Cost | ||||||||||||||||||||||||||||||

| INTEREST EARNING ASSETS: | |||||||||||||||||||||||||||||||||||

| Loans, including loans held for sale | $ | 13,319,782 | $ | 261,559 | 3.96 | % | $ | 12,507,468 | $ | 288,420 | 4.64 | % | |||||||||||||||||||||||

| Securities available for sale | 2,260,233 | 15,628 | 1.39 | % | 1,731,094 | 20,500 | 2.38 | % | |||||||||||||||||||||||||||

| FHLB stock and other investments | 700,115 | 1,310 | 0.38 | % | 918,179 | 3,009 | 0.66 | % | |||||||||||||||||||||||||||

| Total interest earning assets | $ | 16,280,130 | $ | 278,497 | 3.45 | % | $ | 15,156,741 | $ | 311,929 | 4.14 | % | |||||||||||||||||||||||

| INTEREST BEARING LIABILITIES: | |||||||||||||||||||||||||||||||||||

| Deposits: | |||||||||||||||||||||||||||||||||||

| Demand, interest bearing | $ | 5,370,941 | $ | 11,399 | 0.43 | % | $ | 4,554,096 | $ | 22,443 | 0.99 | % | |||||||||||||||||||||||

| Savings | 304,877 | 1,757 | 1.16 | % | 279,063 | 1,670 | 1.20 | % | |||||||||||||||||||||||||||

| Time deposits | 3,493,278 | 10,310 | 0.60 | % | 4,927,425 | 46,451 | 1.90 | % | |||||||||||||||||||||||||||

| Total interest bearing deposits | 9,169,096 | 23,466 | 0.52 | % | 9,760,584 | 70,564 | 1.45 | % | |||||||||||||||||||||||||||

| FHLB advances | 209,006 | $ | 1,273 | 1.23 | % | 594,148 | 4,885 | 1.65 | % | ||||||||||||||||||||||||||

| Convertible notes, net | 215,302 | 2,645 | 2.44 | % | 200,565 | 4,704 | 4.64 | % | |||||||||||||||||||||||||||

| Subordinated debentures | 100,547 | 1,957 | 3.87 | % | 99,393 | 2,671 | 5.32 | % | |||||||||||||||||||||||||||

| Total interest bearing liabilities | $ | 9,693,951 | $ | 29,341 | 0.61 | % | $ | 10,654,690 | $ | 82,824 | 1.56 | % | |||||||||||||||||||||||

| Noninterest bearing demand deposits | 5,250,080 | 3,236,960 | |||||||||||||||||||||||||||||||||

| Total funding liabilities/cost of funds | $ | 14,944,031 | 0.40 | % | $ | 13,891,650 | 1.20 | % | |||||||||||||||||||||||||||

| Net interest income/net interest spread | $ | 249,156 | 2.84 | % | $ | 229,105 | 2.58 | % | |||||||||||||||||||||||||||

| Net interest margin | 3.09 | % | 3.04 | % | |||||||||||||||||||||||||||||||

| Cost of deposits: | |||||||||||||||||||||||||||||||||||

| Noninterest bearing demand deposits | $ | 5,250,080 | $ | — | — | % | $ | 3,236,960 | $ | — | — | % | |||||||||||||||||||||||

| Interest bearing deposits | 9,169,096 | 23,466 | 0.52 | % | 9,760,584 | 70,564 | 1.45 | % | |||||||||||||||||||||||||||

| Total deposits | $ | 14,419,176 | $ | 23,466 | 0.33 | % | $ | 12,997,544 | $ | 70,564 | 1.09 | % | |||||||||||||||||||||||

Table Page 5

Hope Bancorp, Inc.

Selected Financial Data

Unaudited (dollars in thousands)

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||

| AVERAGE BALANCES: | 6/30/2021 | 3/31/2021 | % change | 6/30/2020 | % change | 6/30/2021 | 6/30/2020 | % change | |||||||||||||||||||||||||||||||||||||||

| Loans receivable, including loans held for sale | $ | 13,293,591 | $ | 13,346,264 | — | % | $ | 12,755,088 | 4 | % | $ | 13,319,782 | $ | 12,507,468 | 6 | % | |||||||||||||||||||||||||||||||

| Investments | 3,012,317 | 2,907,801 | 4 | % | 3,067,205 | (2) | % | 2,960,348 | 2,649,273 | 12 | % | ||||||||||||||||||||||||||||||||||||

| Interest earning assets | 16,305,908 | 16,254,065 | — | % | 15,822,293 | 3 | % | 16,280,130 | 15,156,741 | 7 | % | ||||||||||||||||||||||||||||||||||||

| Total assets | 17,164,893 | 17,115,407 | — | % | 16,759,147 | 2 | % | 17,140,286 | 16,102,977 | 6 | % | ||||||||||||||||||||||||||||||||||||

| Interest bearing deposits | 9,015,034 | 9,324,872 | (3) | % | 10,142,282 | (11) | % | 9,169,096 | 9,760,584 | (6) | % | ||||||||||||||||||||||||||||||||||||

| Interest bearing liabilities | 9,533,532 | 9,856,155 | (3) | % | 11,036,392 | (14) | % | 9,693,951 | 10,654,690 | (9) | % | ||||||||||||||||||||||||||||||||||||

| Noninterest bearing demand deposits | 5,445,457 | 5,052,532 | 8 | % | 3,510,783 | 55 | % | 5,250,080 | 3,236,960 | 62 | % | ||||||||||||||||||||||||||||||||||||

| Stockholders’ equity | 2,066,016 | 2,047,506 | 1 | % | 2,016,947 | 2 | % | 2,056,812 | 2,022,271 | 2 | % | ||||||||||||||||||||||||||||||||||||

| Net interest earning assets | 6,772,376 | 6,397,910 | 6 | % | 4,785,901 | 42 | % | 6,586,179 | 4,502,051 | 46 | % | ||||||||||||||||||||||||||||||||||||

| LOAN PORTFOLIO COMPOSITION: | 6/30/2021 | 3/31/2021 | % change | 12/31/2020 | % change | 6/30/2020 | % change | ||||||||||||||||||||||||||||||||||||||||

| Commercial loans | $ | 4,001,423 | $ | 4,346,244 | (8) | % | $ | 4,157,787 | (4) | % | $ | 3,415,111 | 17 | % | |||||||||||||||||||||||||||||||||

| Real estate loans | 8,832,276 | 8,811,423 | — | % | 8,772,134 | 1 | % | 8,686,939 | 2 | % | |||||||||||||||||||||||||||||||||||||

| Consumer and other loans | 590,602 | 544,962 | 8 | % | 633,292 | (7) | % | 769,784 | (23) | % | |||||||||||||||||||||||||||||||||||||

| Loans, net of deferred loan fees and costs | 13,424,301 | 13,702,629 | (2) | % | 13,563,213 | (1) | % | 12,871,834 | 4 | % | |||||||||||||||||||||||||||||||||||||

| Allowance for credit losses | (189,452) | (207,943) | (9) | % | (206,741) | (8) | % | (161,771) | 17 | % | |||||||||||||||||||||||||||||||||||||

| Loan receivable, net | $ | 13,234,849 | $ | 13,494,686 | (2) | % | $ | 13,356,472 | (1) | % | $ | 12,710,063 | 4 | % | |||||||||||||||||||||||||||||||||

| REAL ESTATE LOANS BY PROPERTY TYPE: | 6/30/2021 | 3/31/2021 | % change | 12/31/2020 | % change | 6/30/2020 | % change | ||||||||||||||||||||||||||||||||||||||||

| Retail buildings | $ | 2,361,891 | $ | 2,317,017 | 2 | % | $ | 2,293,396 | 3 | % | $ | 2,278,448 | 4 | % | |||||||||||||||||||||||||||||||||

| Hotels/motels | 1,439,770 | 1,619,661 | (11) | % | 1,634,287 | (12) | % | 1,701,909 | (15) | % | |||||||||||||||||||||||||||||||||||||

| Gas stations/car washes | 954,394 | 913,176 | 5 | % | 892,110 | 7 | % | 836,314 | 14 | % | |||||||||||||||||||||||||||||||||||||

| Mixed-use facilities | 798,373 | 752,729 | 6 | % | 750,867 | 6 | % | 706,827 | 13 | % | |||||||||||||||||||||||||||||||||||||

| Warehouses | 1,149,393 | 1,092,549 | 5 | % | 1,091,389 | 5 | % | 1,040,303 | 10 | % | |||||||||||||||||||||||||||||||||||||

| Multifamily | 575,943 | 531,306 | 8 | % | 518,498 | 11 | % | 497,948 | 16 | % | |||||||||||||||||||||||||||||||||||||

| Other | 1,552,512 | 1,584,985 | (2) | % | 1,591,587 | (2) | % | 1,625,190 | (4) | % | |||||||||||||||||||||||||||||||||||||

| Total | $ | 8,832,276 | $ | 8,811,423 | — | % | $ | 8,772,134 | 1 | % | $ | 8,686,939 | 2 | % | |||||||||||||||||||||||||||||||||

| DEPOSIT COMPOSITION | 6/30/2021 | 3/31/2021 | % change | 12/31/2020 | % change | 6/30/2020 | % change | ||||||||||||||||||||||||||||||||||||||||

| Noninterest bearing demand deposits | $ | 5,638,115 | $ | 5,427,174 | 4 | % | $ | 4,814,254 | 17 | % | $ | 4,036,383 | 40 | % | |||||||||||||||||||||||||||||||||

| Money market and other | 5,786,697 | 5,009,419 | 16 | % | 5,232,413 | 11 | % | 4,831,679 | 20 | % | |||||||||||||||||||||||||||||||||||||

| Saving deposits | 308,651 | 305,326 | 1 | % | 300,770 | 3 | % | 296,614 | 4 | % | |||||||||||||||||||||||||||||||||||||

| Time deposits | 2,992,767 | 3,559,350 | (16) | % | 3,986,475 | (25) | % | 4,958,856 | (40) | % | |||||||||||||||||||||||||||||||||||||

| Total deposit balances | $ | 14,726,230 | $ | 14,301,269 | 3 | % | $ | 14,333,912 | 3 | % | $ | 14,123,532 | 4 | % | |||||||||||||||||||||||||||||||||

| DEPOSIT COMPOSITION (%) | 6/30/2021 | 3/31/2021 | 12/31/2020 | 6/30/2020 | |||||||||||||||||||||||||||||||||||||||||||

| Noninterest bearing demand deposits | 38.3 | % | 38.0 | % | 33.6 | % | 28.6 | % | |||||||||||||||||||||||||||||||||||||||

| Money market and other | 39.2 | % | 35.0 | % | 36.5 | % | 34.2 | % | |||||||||||||||||||||||||||||||||||||||

| Saving deposits | 2.1 | % | 2.1 | % | 2.1 | % | 2.1 | % | |||||||||||||||||||||||||||||||||||||||

| Time deposits | 20.4 | % | 24.9 | % | 27.8 | % | 35.1 | % | |||||||||||||||||||||||||||||||||||||||

| Total deposit balances | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | |||||||||||||||||||||||||||||||||||||||

Table Page 6

Hope Bancorp, Inc.

Selected Financial Data

Unaudited (dollars in thousands, except share and per share data)

| CAPITAL RATIOS: | 6/30/2021 | 3/31/2021 | 6/30/2020 | ||||||||||||||||||||||||||||||||||||||

| Total stockholders’ equity | $ | 2,092,870 | $ | 2,045,581 | $ | 2,030,776 | |||||||||||||||||||||||||||||||||||

| Common equity tier 1 ratio | 11.32 | % | 11.08 | % | 11.50 | % | |||||||||||||||||||||||||||||||||||

| Tier 1 risk-based capital ratio | 12.02 | % | 11.78 | % | 12.24 | % | |||||||||||||||||||||||||||||||||||

| Total risk-based capital ratio | 13.16 | % | 13.03 | % | 13.23 | % | |||||||||||||||||||||||||||||||||||

| Tier 1 leverage ratio | 10.34 | % | 10.15 | % | 10.08 | % | |||||||||||||||||||||||||||||||||||

| Total risk weighted assets | $ | 14,354,682 | $ | 14,338,828 | $ | 13,388,522 | |||||||||||||||||||||||||||||||||||

| Book value per common share | $ | 16.92 | $ | 16.57 | $ | 16.48 | |||||||||||||||||||||||||||||||||||

Tangible common equity to tangible assets 1 | 9.53 | % | 9.40 | % | 9.32 | % | |||||||||||||||||||||||||||||||||||

Tangible common equity per share 1 | $ | 13.10 | $ | 12.73 | $ | 12.62 | |||||||||||||||||||||||||||||||||||

1 Tangible common equity to tangible assets is a non-GAAP financial measure that represents common equity less goodwill and core deposit intangible assets, net divided by total assets less goodwill and core deposit intangible assets, net. Management reviews tangible common equity to tangible assets in evaluating the Company’s capital levels and has included this ratio in response to market participant interest in tangible common equity as a measure of capital. | |||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||

| ALLOWANCE FOR CREDIT LOSSES CHANGES: | 6/30/2021 | 3/31/2021 | 12/31/2020 | 9/30/2020 | 6/30/2020 | 6/30/2021 | 6/30/2020 | ||||||||||||||||||||||||||||||||||

| Balance at beginning of period | $ | 207,943 | $ | 206,741 | $ | 179,849 | $ | 161,771 | $ | 144,923 | $ | 206,741 | $ | 94,144 | |||||||||||||||||||||||||||

| CECL day 1 adoption impact | — | — | — | — | — | — | 26,200 | ||||||||||||||||||||||||||||||||||

| Provision (credit) for credit losses | (7,000) | 3,300 | 27,500 | 22,000 | 17,500 | (3,700) | 45,500 | ||||||||||||||||||||||||||||||||||

| Recoveries | 1,301 | 1,423 | 2,207 | 2,428 | 252 | 2,724 | 2,788 | ||||||||||||||||||||||||||||||||||

| Charge offs | (12,792) | (3,521) | (2,815) | (6,350) | (904) | (16,313) | (6,861) | ||||||||||||||||||||||||||||||||||

| Balance at end of period | $ | 189,452 | $ | 207,943 | $ | 206,741 | $ | 179,849 | $ | 161,771 | $ | 189,452 | $ | 161,771 | |||||||||||||||||||||||||||

| Net charge offs/average loans receivable (annualized) | 0.35 | % | 0.06 | % | 0.02 | % | 0.12 | % | 0.02 | % | 0.20 | % | 0.07 | % | |||||||||||||||||||||||||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||

| NET LOAN CHARGE OFFS (RECOVERIES): | 6/30/2021 | 3/31/2021 | 12/31/2020 | 9/30/2020 | 6/30/2020 | 6/30/2021 | 6/30/2020 | ||||||||||||||||||||||||||||||||||

| Real estate loans | $ | 11,281 | $ | 2,234 | $ | (726) | $ | 5,154 | $ | 148 | $ | 13,515 | $ | 2,378 | |||||||||||||||||||||||||||

| Commercial loans | 181 | (80) | 1,167 | (1,451) | 240 | 101 | 916 | ||||||||||||||||||||||||||||||||||

| Consumer loans | 29 | (56) | 167 | 219 | 264 | (27) | 779 | ||||||||||||||||||||||||||||||||||

| Total net charge offs | $ | 11,491 | $ | 2,098 | $ | 608 | $ | 3,922 | $ | 652 | $ | 13,589 | $ | 4,073 | |||||||||||||||||||||||||||

Table Page 7

Hope Bancorp, Inc.

Selected Financial Data

Unaudited (dollars in thousands)

| NONPERFORMING ASSETS: | 6/30/2021 | 3/31/2021 | 12/31/2020 | 9/30/2020 | 6/30/2020 | ||||||||||||||||||||||||

Loans on nonaccrual status 3 | $ | 111,008 | $ | 109,858 | $ | 85,238 | $ | 69,205 | $ | 82,137 | |||||||||||||||||||

| Delinquent loans 90 days or more on accrual status | 4,759 | 384 | 614 | 1,537 | 430 | ||||||||||||||||||||||||

| Accruing troubled debt restructured loans | 51,360 | 41,773 | 37,354 | 35,429 | 44,026 | ||||||||||||||||||||||||

| Total nonperforming loans | 167,127 | 152,015 | 123,206 | 106,171 | 126,593 | ||||||||||||||||||||||||

| Other real estate owned | 16,619 | 18,515 | 20,121 | 18,410 | 20,983 | ||||||||||||||||||||||||

| Total nonperforming assets | $ | 183,746 | $ | 170,530 | $ | 143,327 | $ | 124,581 | $ | 147,576 | |||||||||||||||||||

| Nonperforming assets/total assets | 1.05 | % | 0.99 | % | 0.84 | % | 0.74 | % | 0.86 | % | |||||||||||||||||||

| Nonperforming assets/loans receivable & OREO | 1.37 | % | 1.24 | % | 1.06 | % | 0.95 | % | 1.14 | % | |||||||||||||||||||

| Nonperforming assets/total capital | 8.78 | % | 8.34 | % | 6.98 | % | 6.11 | % | 7.27 | % | |||||||||||||||||||

| Nonperforming loans/loans receivable | 1.24 | % | 1.11 | % | 0.91 | % | 0.81 | % | 0.98 | % | |||||||||||||||||||

| Nonaccrual loans/loans receivable | 0.83 | % | 0.80 | % | 0.63 | % | 0.53 | % | 0.64 | % | |||||||||||||||||||

| Allowance for credit losses/loans receivable | 1.41 | % | 1.52 | % | 1.52 | % | 1.37 | % | 1.26 | % | |||||||||||||||||||

| Allowance for credit losses/nonaccrual loans | 170.67 | % | 189.28 | % | 242.55 | % | 259.88 | % | 196.95 | % | |||||||||||||||||||

| Allowance for credit losses/nonperforming loans | 113.36 | % | 136.79 | % | 167.80 | % | 169.40 | % | 127.79 | % | |||||||||||||||||||

| Allowance for credit losses/nonperforming assets | 103.11 | % | 121.94 | % | 144.24 | % | 144.36 | % | 109.62 | % | |||||||||||||||||||

3 Excludes delinquent SBA loans that are guaranteed and currently in liquidation totaling $23.6 million, $25.0 million, $26.5 million, $26.2 million and $30.3 million at June 30, 2021, March 31, 2021, December 31, 2020, September 30, 2020, and June 30, 2020, respectively. | |||||||||||||||||||||||||||||

| NONACCRUAL LOANS BY TYPE: | 6/30/2021 | 3/31/2021 | 12/31/2020 | 9/30/2020 | 6/30/2020 | ||||||||||||||||||||||||

| Real estate loans | $ | 95,622 | $ | 91,940 | $ | 67,450 | $ | 51,739 | $ | 64,060 | |||||||||||||||||||

| Commercial loans | 12,217 | 14,080 | 13,911 | 13,022 | 12,079 | ||||||||||||||||||||||||

| Consumer loans | 3,169 | 3,838 | 3,877 | 4,444 | 5,998 | ||||||||||||||||||||||||

| Total nonaccrual loans | $ | 111,008 | $ | 109,858 | $ | 85,238 | $ | 69,205 | $ | 82,137 | |||||||||||||||||||

| BREAKDOWN OF ACCRUING TROUBLED DEBT RESTRUCTURED LOANS: | 6/30/2021 | 3/31/2021 | 12/31/2020 | 9/30/2020 | 6/30/2020 | ||||||||||||||||||||||||

| Retail buildings | $ | 12,110 | $ | 6,319 | $ | 5,408 | $ | 5,451 | $ | 5,526 | |||||||||||||||||||

| Gas stations/car washes | 206 | 210 | 219 | 224 | 1,789 | ||||||||||||||||||||||||

| Mixed-use facilities | 7,967 | 3,377 | 3,521 | 4,323 | 3,583 | ||||||||||||||||||||||||

| Warehouses | 14,099 | 14,124 | 7,296 | 7,320 | 13,433 | ||||||||||||||||||||||||

Other 5 | 16,978 | 17,743 | 20,910 | 18,111 | 19,695 | ||||||||||||||||||||||||

| Total | $ | 51,360 | $ | 41,773 | $ | 37,354 | $ | 35,429 | $ | 44,026 | |||||||||||||||||||

5 Includes commercial business, consumer, and other loans | |||||||||||||||||||||||||||||

Table Page 8

Hope Bancorp, Inc.

Selected Financial Data

Unaudited (dollars in thousands)

| ACCRUING DELINQUENT LOANS 30-89 DAYS PAST DUE: | 6/30/2021 | 3/31/2021 | 12/31/2020 | 9/30/2020 | 6/30/2020 | ||||||||||||||||||||||||

| 30 - 59 days | $ | 22,466 | $ | 18,175 | $ | 11,347 | $ | 5,962 | $ | 18,857 | |||||||||||||||||||

| 60 - 89 days | 6,987 | 8,314 | 16,826 | 58,065 | 29,975 | ||||||||||||||||||||||||

| Total | $ | 29,453 | $ | 26,489 | $ | 28,173 | $ | 64,027 | $ | 48,832 | |||||||||||||||||||

| ACCRUING DELINQUENT LOANS 30-89 DAYS PAST DUE BY TYPE: | 6/30/2021 | 3/31/2021 | 12/31/2020 | 9/30/2020 | 6/30/2020 | ||||||||||||||||||||||||

| Real estate loans | $ | 21,432 | $ | 18,331 | $ | 15,689 | $ | 60,510 | $ | 27,245 | |||||||||||||||||||

| Commercial loans | 560 | 1,002 | 3,393 | 624 | 5,987 | ||||||||||||||||||||||||

| Consumer loans | 7,461 | 7,156 | 9,091 | 2,893 | 15,600 | ||||||||||||||||||||||||

| Total | $ | 29,453 | $ | 26,489 | $ | 28,173 | $ | 64,027 | $ | 48,832 | |||||||||||||||||||

| CRITICIZED LOANS: | 6/30/2021 | 3/31/2021 | 12/31/2020 | 9/30/2020 | 6/30/2020 | ||||||||||||||||||||||||

| Special mention | $ | 294,559 | $ | 280,974 | $ | 184,941 | $ | 153,388 | $ | 127,149 | |||||||||||||||||||

| Substandard | 380,955 | 379,048 | 366,556 | 311,902 | 299,357 | ||||||||||||||||||||||||

| Doubtful/loss | — | — | 1 | 6,640 | 11 | ||||||||||||||||||||||||

| Total criticized loans | $ | 675,514 | $ | 660,022 | $ | 551,498 | $ | 471,930 | $ | 426,517 | |||||||||||||||||||

Table Page 9

Hope Bancorp, Inc.

Selected Financial Data

Unaudited (dollars in thousands, except share and per share data)

| Reconciliation of GAAP financial measures to non-GAAP financial measures | |||||||||||||||||||||||||||||

Management reviews select non-GAAP financial measures in evaluating the Company’s and the Bank’s financial performance and in response to market participant interest. A reconciliation of the GAAP to non-GAAP financial measures utilized by management is provided below. | |||||||||||||||||||||||||||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||

| 6/30/2021 | 3/31/2021 | 6/30/2020 | 6/30/2021 | 6/30/2020 | |||||||||||||||||||||||||

| RETURN ON AVERAGE TANGIBLE COMMON EQUITY | |||||||||||||||||||||||||||||

| Average stockholders’ equity | $ | 2,066,016 | $ | 2,047,506 | $ | 2,016,947 | $ | 2,056,812 | $ | 2,022,271 | |||||||||||||||||||

| Less: Goodwill and core deposit intangible assets, net | (473,445) | (473,961) | (475,534) | (473,702) | (475,793) | ||||||||||||||||||||||||

| Average tangible common equity | $ | 1,592,571 | $ | 1,573,545 | $ | 1,541,413 | $ | 1,583,110 | $ | 1,546,478 | |||||||||||||||||||

| Net income | $ | 53,763 | $ | 43,687 | $ | 26,753 | $ | 97,450 | $ | 52,706 | |||||||||||||||||||

| Return on average tangible common equity (annualized) | 13.50 | % | 11.11 | % | 6.94 | % | 12.31 | % | 6.82 | % | |||||||||||||||||||

| 6/30/2021 | 3/31/2021 | 12/31/2020 | 6/30/2020 | ||||||||||||||||||||||||||

| TANGIBLE COMMON EQUITY | |||||||||||||||||||||||||||||

| Total stockholders’ equity | $ | 2,092,870 | $ | 2,045,581 | $ | 2,053,745 | $ | 2,030,776 | |||||||||||||||||||||

| Less: Goodwill and core deposit intangible assets, net | (473,139) | (473,648) | (474,158) | (475,220) | |||||||||||||||||||||||||

| Tangible common equity | $ | 1,619,731 | $ | 1,571,933 | $ | 1,579,587 | $ | 1,555,556 | |||||||||||||||||||||

| Total assets | $ | 17,469,627 | $ | 17,198,860 | $ | 17,106,664 | $ | 17,169,062 | |||||||||||||||||||||

| Less: Goodwill and core deposit intangible assets, net | (473,139) | (473,648) | (474,158) | (475,220) | |||||||||||||||||||||||||

| Tangible assets | $ | 16,996,488 | $ | 16,725,212 | $ | 16,632,506 | $ | 16,693,842 | |||||||||||||||||||||

| Common shares outstanding | 123,673,832 | 123,480,494 | 123,264,864 | 123,239,276 | |||||||||||||||||||||||||

| Tangible common equity to tangible assets | 9.53 | % | 9.40 | % | 9.50 | % | 9.32 | % | |||||||||||||||||||||

| Tangible common equity per share | $ | 13.10 | $ | 12.73 | $ | 12.81 | $ | 12.62 | |||||||||||||||||||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||

| 6/30/2021 | 3/31/2021 | 6/30/2020 | 6/30/2021 | 6/30/2020 | |||||||||||||||||||||||||

| PRE-TAX PRE-PROVISION INCOME | |||||||||||||||||||||||||||||

| Net income | $ | 53,763 | $ | 43,687 | $ | 26,753 | $ | 97,450 | $ | 52,706 | |||||||||||||||||||

| Add back - tax provision | 17,767 | 13,965 | 9,771 | 31,732 | 16,233 | ||||||||||||||||||||||||

| Add back - provision (credit) for credit losses | (7,000) | 3,300 | 17,500 | (3,700) | 45,500 | ||||||||||||||||||||||||

| Pre-tax pre-provision income | $ | 64,530 | $ | 60,952 | $ | 54,024 | $ | 125,482 | $ | 114,439 | |||||||||||||||||||

Table Page 10

News Release

HOPE BANCORP DECLARES QUARTERLY CASH DIVIDEND OF $0.14 PER SHARE

LOS ANGELES - July 20, 2021 - Hope Bancorp, Inc. (NASDAQ: HOPE) today announced that its Board of Directors declared a quarterly cash dividend of $0.14 per common share. The dividend is payable on or about August 13, 2021 to all stockholders of record as of the close of business on July 30, 2021.

Investor Conference Call

The Company previously announced that it will host an investor conference call on Wednesday, July 21, 2021 at 9:30 a.m. Pacific Time / 12:30 p.m. Eastern Time to review financial results for its second quarter ended June 30, 2021. Investors and analysts are invited to access the conference call by dialing 866-235-9917 (domestic) or 412-902-4103 (international) and asking for the “Hope Bancorp Call.” A presentation to accompany the earnings call will be available at the Investor Relations section of Hope Bancorp’s website at www.ir-hopebancorp.com. Other interested parties are invited to listen to a live webcast of the call available at the Investor Relations section of Hope Bancorp’s website. After the live webcast, a replay will remain available at the Investor Relations section of Hope Bancorp’s website for one year. A telephonic replay of the call will be available at 877-344-7529 (domestic) or 412-317-0088 (international) for one week through July 28, 2021, replay access code 10158798.

About Hope Bancorp, Inc.

Hope Bancorp, Inc. is the holding company of Bank of Hope, the first and only super regional Korean-American bank in the United States with $17.47 billion in total assets as of June 30, 2021. Headquartered in Los Angeles and serving a multi-ethnic population of customers across the nation, Bank of Hope operates 53 full-service branches in California, Washington, Texas, Illinois, New York, New Jersey, Virginia and Alabama. The Bank also operates SBA loan production offices in Seattle, Denver, Dallas, Atlanta, Portland, Oregon, New York City, Northern California and Houston; commercial loan production offices in Northern California and Seattle; residential mortgage loan production offices in Southern California; and a representative office in Seoul, Korea. Bank of Hope specializes in core business banking products for small and medium-sized businesses, with an emphasis in commercial real estate and commercial lending, SBA lending and international trade financing. Bank of Hope is a California-chartered bank, and its deposits are insured by the FDIC to the extent provided by law. Bank of Hope is an Equal Opportunity Lender. For additional information, please go to bankofhope.com. By including the foregoing website address link, the Company does not intend to and shall not be deemed to incorporate by reference any material contained or accessible therein.

Contacts:

Alex Ko Senior EVP & Chief Financial Officer 213-427-6560 alex.ko@bankofhope.com | Angie Yang SVP, Director of Investor Relations & Corporate Communications 213-251-2219 angie.yang@bankofhope.com | ||||

# # #

1 2021 Second Quarter Earnings Conference Call Wednesday, July 21, 2021

2 Forward Looking Statements & Additional Disclosures This presentation may contain statements regarding future events or the future financial performance of the Company that constitute forward‐looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward‐looking statements relate to, among other things, expectations regarding the business environment in which we operate, projections of future performance, perceived opportunities in the market, and statements regarding our business strategies, objectives and vision. Forward‐ looking statements include, but are not limited to, statements preceded by, followed by or that include the words “will,” “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates” or similar expressions. With respect to any such forward‐looking statements, the Company claims the protection provided for in the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties. The Company’s actual results, performance or achievements may differ significantly from the results, performance or achievements expressed or implied in any forward‐looking statements. The risks and uncertainties include, but are not limited to: possible deterioration in economic conditions in our areas of operation; interest rate risk associated with volatile interest rates and related asset‐liability matching risk; liquidity risks; risk of significant non‐earning assets, and net credit losses that could occur, particularly in times of weak economic conditions or times of rising interest rates; the failure of or changes to assumptions and estimates underlying the Company’s allowances for credit losses, including the timing and effects of the implementation of the current expected credit losses model; and regulatory risks associated with current and future regulations, and the COVID‐19 pandemic and its impact on our financial position, results of operations, liquidity, and capitalization. For additional information concerning these and other risk factors, see the Company’s most recent Annual Report on Form 10‐K. The Company does not undertake, and specifically disclaims any obligation, to update any forward‐looking statements to reflect the occurrence of events or circumstances after the date of such statements except as required by law.

3 Q2 2021 Financial Highlights Net Income $53.8MM EPS (diluted) $0.43 Gross Loans $13.42B Total Deposits $14.73B • Net interest income before provision for credit loss increased 3% to $126.6 million – 4th consecutive Q‐o‐Q increase • Net interest margin expanded 5bps Q‐o‐Q benefiting from lower deposit costs and higher loan yields – 4th consecutive quarter of margin expansion • Net income increased 23% Q‐o‐Q to $53.8 million, or $0.43 per diluted common share • Pre‐tax pre‐provision income increased 6% Q‐o‐Q • ROA increased 23bps Q‐o‐Q to 1.25%, and ROE increased 188bps Q‐o‐Q to 10.41% • Excluding PPP, new loan originations increased significantly to a record $874.3 million vs. $542.4 million in 1Q21 • Origination mix excluding PPP of CRE 59%, C&I 34% and Consumer 6% reflects slower rebound for C&I loans post‐ pandemic • Noninterest bearing deposits increased 4% Q‐o‐Q to a record high and accounted for a record high 38% of total deposits • Cost of interest bearing deposits decreased 8 basis points Q‐o‐Q • Total cost of deposits decreased for the 7th consecutive quarter, down 6bps Q‐o‐Q • Negative provision for credit losses of $7.0 million, reflecting improving macroeconomic forecasts, loan portfolio reduction and $119.3 million sale of higher risk, criticized and classified hotel/motel loans • CARES Act loan modifications declined to 2.4% of total loans at 6/30/21 • Net charge offs of $11.5 million, or 0.35% of average loans receivable annualized, which included $11.8 million in charge offs related to hotel/motel loan sale Loan Production Asset Quality Deposit TrendsEarnings & Profitability

4 $216 $244 $340 $311 $520 $480 $305 $20 $61 $433 $439 $160 $301 $74 $105 $65 $71 $53 3.39%1 2.88% 3.27% 3.44%1 3.38%1 2Q20 3Q20 4Q20 1Q21 2Q21 New Loan Originations Funded CRE PPP C&I Consumer Average Rate Loan Production & Portfolio Trends New loan originations funded increased to record high $894.1 million Excluding PPP loans, new loan production increased 61% to $874.3 million from $542.4 million in 1Q21 Mix of loan originations excluding PPP reflects slower rebounding C&I market post‐pandemic 59% CRE / 34% C&I / 6% Consumer In addition to new loan originations, purchased $95.6 million of 30‐year fixed rate residential mortgage loans in 2Q21 Aggregate payoffs and paydowns totaled $890.8 million vs. $571.8 million in 1Q21 Traditional SBA loan originations of $77.7 million of which $64.3 million was SBA 7(a) loans vs. $36.8 million in 1Q21 all of which was SBA 7(a) Residential mortgage originations of $52.8 million vs. $69.8 million in 1Q21 Record loan production was offset by lower warehouse line balances, higher than usual payoffs which included $164.5 million in PPP forgiveness, hotel/motel loan sale of $119.3 million and other loan sales, resulting in 2% decrease Q‐o‐Q in loans receivable 64%32% 4% 66% 30% 4% 6/30/20213/31/2021 Loan Portfolio Composition ($ millions) $782.4 $844.2 $847.1$832.0 $894.1 67% 27% 6% 6/30/2020 1 Represents average rate on new loans excluding PPP loans. Including PPP loans, the average rate on new loan originations was 3.32% for 2Q21, 2.56% for 1Q21 and 2.01% for 2Q20 (Excluding PPP loans)

5 Active COVID-19 Loan Modifications & Expiration Schedule • Active modifications outstanding as of 6/30/2021 totaled $319 million, or 2.4% of total loan portfolio • Based on modifications expiration schedule, active modifications outstanding expected to decrease substantially to less than 1% of total loans by 9/30/2021 assuming no new modifications • Virtually all expired modifications current and performing as of 6/30/2021 Active COVID‐19 Modifications ($ millions) (As of June 30, 2021) Total Loans Active Mods Outstanding % of Respective Loan Portfolio % of All Mod Loans Real Estate $ 8,832 $ 269 3.0% 84.6% Retail $ 2,362 $ 74 3.1% 23.2% Hotel/Motel $ 1,440 $ 113 7.9% 35.4% Mixed Use $ 798 $ 23 2.9% 7.5% Industrial & Warehouse $ 1,149 $ 4 0.3% 1.3% Other Real Estate $ 3,083 $ 55 1.8% 17.2% C&I $ 4,001 $ 12 0.3% 3.8% Consumer (predominantly residential mortgage) $ 591 $ 37 6.3% 11.6% Total $ 13,424 $ 319 2.4% 100.0% COVID‐19 Modifications Expiration Schedule Date Amount of Active Mods Scheduled to Expire ($ millions) Mods Expiring as % of Active Mods at 6/30/2021 Active Mods Outstanding as % of Total Loans at 6/30/2021* Jul‐21 $73 23.0% 1.8% Aug‐21 $27 8.4% 1.6% Sep‐21 $93 29.2% 0.9% Oct‐21 $26 8.3% 0.7% Nov‐21 $28 8.8% 0.5% Dec‐21 $59 18.4% 0.1% * Percentages in this column depicts the decline in active modifications outstanding at month end as a percentage of total loans at June 30, 2021, assuming no new modifications.

6 • Majority of Hotel/Motel properties are limited service facilities • Less impacted by lockdowns than full‐service hotel properties • 73% of Hotel/Motel portfolio represented by flagged properties • 95%+ of Hotel/Motel exposure located in major MSAs or regions where the Bank has presence and knowledge of the market • Vast majority of the portfolio supported by personal guarantees COVID-19 Impacted Portfolios - Hotel/Motel and Retail CRE - Hotel/Motel Loan Sale • Aggregate $119.3 million hotel/motel loans sold during Q2 2021 • Strategic Goal: – De‐risk portion of portfolio viewed as higher risk with a need for longer recovery period from COVID‐19 impact on the travel industry • Achieved loan pricing within ACL levels: – Aggregate net discount was $11.8 million including fees versus aggregate allowance for credit losses of $13.6 million • Largely represents “strip mall” type of properties (not shopping malls) • Majority of tenants comprised of service oriented businesses – traditionally less impacted by e‐commerce • Local supermarkets are representative anchor tenants of larger strip mall properties • 95%+ of retail CRE exposure located in major MSAs or regions where the Bank has presence and knowledge of the market Hotel/Motel CRE Property Characteristics Retail CRE Property Characteristics Active Modifications 3Q21 Expirations • 8% of hotel/motel portfolio, or $113 million, modified as of 6/30/21, a decrease from approximately 33% as 3/31/21 • 3% of retail CRE portfolio, or $74 million, modified as of 6/30/21, a decrease from approximately 8% as of 3/31/21 • $82 million of hotel/motel COVID‐19 modifications scheduled to expire during 3Q21 • $24 million of retail CRE COVID‐19 modifications scheduled to expire during 3Q21

7 $109.8 $117.6 $120.8 $122.6 $126.6 2.79% 2.91% 3.02% 3.06% 3.11% 2Q20 3Q20 4Q20 1Q21 2Q21 Net Interest Income & NIM Net Interest Income NIM Net Interest Income and Margin 4.23% 4.20% 4.03% 3.94% 3.98% 0.35% 0.16% 0.15% 0.12% 0.10% 2Q20 3Q20 4Q20 1Q21 2Q21 Average Loan Yield & Average 1M LIBOR Rate Avg Loan Yield Avg 1M LIBOR Rate Net interest income increased 3% primarily due to lower deposit costs and higher loan yields Represents 4th consecutive quarter of increasing net interest income Net interest margin excluding purchase accounting adjustments, expanded 7bps Q‐o‐Q from 1Q21 $10.1 $9.9 $9.5 $9.3 $9.0 0.87% 0.64% 0.48% 0.36% 0.30% 1.17% 0.92% 0.71% 0.56% 0.48% 2Q20 3Q20 4Q20 1Q21 2Q21 Average Interest Bearing Deposits & Cost of Deposits Average Interest Bearing Deposits Total Cost of Deposits Cost of Interest Bearing Deposits ($ millions) ($ billions) ‐2 bps Average cash balance increase ‐2 bps Discount accretion decline +4 bps Deposit cost decline +4 bps Loan yield increase +1 bps Interest bearing deposit balance decline

8 $5.2 $5.4 $5.1 $4.5 $4.5 $2.4$1.7 $2.9 $1.6 $2.1 $1.0 $4.4 $1.7 $4.7 $2.2 $3.2 $7.5 2Q20 3Q20 4Q20 1Q21 2Q21 Noninterest Income Service fees Gain on sale of SBA loans Gain on sale of other loans Gain on sale of securities Other income and fees Noninterest Income Noninterest income increased to $11.1 million in 2Q21 vs. $8.8 million in 1Q21 driven by: $2.4 million gain on sales of SBA loans $1.1 million decrease in gain on sale of other loans reflecting lower level of residential mortgage sales and lower market premiums Company resumed sales of SBA 7(a) loans to the secondary market selling $30.0 million and recording gain on sale of SBA loans of $2.4 million Gain on sale of other loans decreased to $1.0 million in 2Q21 from $2.1 million in 1Q21 Reflects lower amount of residential mortgage loan sales of $42.6 million in 2Q21 vs. $67.8 million in 1Q21 $17.5 $11.4 $8.8 $11.1$11.2 ($ millions)

9 Noninterest Expense and Efficiency 55.37% 54.31% 53.77% 53.61% 53.12% 1.60% 1.73% 1.69% 1.65% 1.70% 2Q20 3Q20 4Q20 1Q21 2Q21 Efficiency Ratio & Noninterest Expense to Average Assets Efficiency Ratio Noninterest Expense/Avg Assets Noninterest expense increased to $73.1 million from $70.4 million in 1Q21 – 2Q21 salaries and benefits expense reflects annual merit increases effective Apr 2021 – Professional fees increased $1.5 million Q‐o‐Q reflecting litigation expenses – Company recognized a one‐time $2.1 million charge off expense of licensed software – Increases offset by $2.2 million reduction Q‐o‐Q in credit related expenses Efficiency ratio improved 49bps to 53.12% ($ millions) $38.9 $40.7 $40.9 $41.2 $42.3 $18.4 $18.3 $18.3 $19.7 $22.1 $2.7 $3.6 $1.9 $2.5 $0.3$7.0 $7.3 $7.6 $7.0 $6.3 $3.61 $2.42 $2.13 1,474 1,416 1,408 1,444 1,438 2Q20 3Q20 4Q20 1Q21 2Q21 Breakdown of Noninterest Expense & FTE Compensation Other core operating expenses Credit related & OREO Other Other non‐core Full‐time employee (FTE) $73.4 $71.1 $70.4 $73.1 $67.0 1 3Q20 noninterest expenses included FHLB prepayment fee of $3.6 million 2 4Q20 noninterest expenses included branch restructuring costs of $2.4 million 3 2Q21 noninterest expenses included software charge off expense of $2.1 million 4 Other core operating expenses includes: Occupancy & equipment, Advertising & marketing, Data & communications, Professional fees and FDIC assessment 4