Form 8-K Forum Merger II Corp For: Jun 12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 12, 2020

FORUM MERGER II CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 001-38615 | 82-5457906 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

1615 South Congress Avenue, Suite 103

Delray Beach, FL 33445

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (212) 739-7860

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Units, each consisting of one share of Class A common stock and one redeemable warrant | FMCIU | The Nasdaq Stock Market LLC | ||

| Class A common stock, par value $0.0001 per share | FMCI | The Nasdaq Stock Market LLC | ||

| Warrants, each exercisable for one share of Class A common stock | FMCIW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure. |

On June 12, 2020, Forum Merger II Corporation (“Forum”) and Myjojo, Inc. (“Ittella Parent”) issued a press release announcing the execution of an agreement and plan of merger (“Merger Agreement”) relating to a proposed business combination (the “Business Combination”) between the Company and Ittella Parent. The press release is furnished hereto as Exhibit 99.1.

In addition, furnished as Exhibit 99.2 hereto is the investor presentation dated June 2020, that will be used by Forum with respect to the Business Combination.

The information in this Item 7.01, including Exhibits 99.1 and 99.2, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of Forum under the Securities Act or the Exchange Act, regardless of any general incorporation language in such filings. This Current Report on Form 8-K will not be deemed an admission as to the materiality of any information of the information in this Item 7.01, including Exhibits 99.1 and 99.2.

Important Information About the Business Combination and Where to Find It

In connection with the Business Combination, Forum intends to file a preliminary proxy statement. Forum will mail a definitive proxy statement and other relevant documents to its stockholders. Forum’s stockholders and other interested persons are advised to read, when available, the preliminary proxy statement and the amendments thereto and the definitive proxy statement and documents incorporated by reference therein filed in connection with the Business Combination, as these materials will contain important information about Forum, Ittella Parent and the Business Combination. When available, the definitive proxy statement and other relevant materials for the Business Combination will be mailed to stockholders of Forum as of a record date to be established for voting on the Business Combination. Stockholders will also be able to obtain copies of the preliminary proxy statement, the definitive proxy statement and other documents filed with the SEC that will be incorporated by reference therein, without charge, once available, at the SEC’s web site at www.sec.gov, or by directing a request to: Forum Merger II Corporation, 1615 South Congress Avenue, Suite 103, Delray Beach, FL 33445, Attention: Secretary, telephone: (212) 739-7860.

Participants in the Solicitation

Forum and its directors and executive officers may be deemed participants in the solicitation of proxies from Forum’s stockholders with respect to the Business Combination. A list of the names of those directors and executive officers and a description of their interests in Forum is contained in Forum’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which was filed with the SEC and is available free of charge at the SEC’s web site at www.sec.gov, or by directing a request to Forum Merger II Corporation, 1615 South Congress Avenue, Suite 103, Delray Beach, FL 33445, Attention: Secretary, telephone: (212) 739-7860. Additional information regarding the interests of such participants will be contained in the proxy statement for the Business Combination when available.

Ittella Parent and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the stockholders of Forum in connection with the Business Combination. A list of the names of such directors and executive officers and information regarding their interests in the Business Combination will be included in the proxy statement for the Business Combination when available.

1

Forward-Looking Statements

This Current Report on Form 8-K includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forum and Ittella Parent’s actual results may differ from their expectations, estimates and projections and consequently, you should not rely on these forward looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, Forum’s and Ittella Parent’s expectations with respect to future performance and anticipated financial impacts of the Business Combination, the satisfaction of the closing conditions to the Business Combination and the timing of the completion of the Business Combination. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside Forum’s and Ittella Parent’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement or could otherwise cause the Business Combination to fail to close; (2) the outcome of any legal proceedings that may be instituted against Forum or Ittella Parent following the announcement of the Merger Agreement and the Business Combination; (3) the inability to complete the Business Combination, including due to failure to obtain approval of the stockholders of Forum or other conditions to closing in the Merger Agreement; (4) the receipt of an unsolicited offer from another party for an alternative business transaction that could interfere with the Business Combination; (5) the inability to obtain the listing of the ordinary shares of the post-acquisition company on the Nasdaq Stock Market or any alternative national securities exchange following the Business Combination; (6) the risk that the announcement and consummation of the Business Combination disrupts current plans and operations; (7) the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably and retain its key employees; (8) costs related to the Business Combination; (9) changes in applicable laws or regulations; (10) the possibility that Ittella Parent may be adversely affected by other economic, business, and/or competitive factors; (11) the impact of COVID-19 on the combined company’s business; and (12) other risks and uncertainties indicated from time to time in the proxy statement to be filed relating to the Business Combination, including those under “Risk Factors” therein, and in Forum’s other filings with the SEC. Some of these risks and uncertainties may in the future be amplified by the COVID-19 outbreak and there may be additional risks that Forum considers immaterial or which are unknown. Forum cautions that the foregoing list of factors is not exclusive. Forum cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Forum does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based.

No Offer or Solicitation

This Current Report on Form 8-K shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination. This Current Report on Form 8-K shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of section 10 of the Securities Act, or an exemption therefrom.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit No. | Description | |

| 99.1 | Press Release, dated June 12, 2020. | |

| 99.2 | Investor Presentation, dated June 12, 2020. |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| FORUM MERGER II CORPORATION | |||

| Dated: June 12, 2020 | By: | /s/ David Boris | |

| Name: | David Boris | ||

| Title: |

Co-Chief Executive Officer and Chief Financial Officer | ||

3

Exhibit 99.1

Ittella International to Combine with Forum Merger II to form Tattooed Chef, Inc.

Transaction Introduces Tattooed Chef as Publicly Listed Company

Conference call to be held today at 8:00 a.m. EDT

Paramount, California and Delray Beach, Florida—June 12, 2020 (GLOBE NEWSWIRE) – Ittella International (the “Company”), a plant-based food company with a broad portfolio of innovative products available both in private label and the Company’s “Tattooed Chef” brand, and Forum Merger II Corporation (Nasdaq: FMCI) (“Forum”), a special purpose acquisition company, today announced a definitive agreement (the “Business Combination Agreement”) to combine the Company and Forum as Tattooed Chef, Inc. (“Tattooed Chef”). This transaction will introduce Tattooed Chef as a Nasdaq-listed public company, with an anticipated initial enterprise value of approximately $482 million, 2.2x Tattooed Chef’s estimated 2021 revenue of $222 million, or 15.6x Tattooed Chef’s estimated 2021 Adjusted EBITDA of $30.8 million.

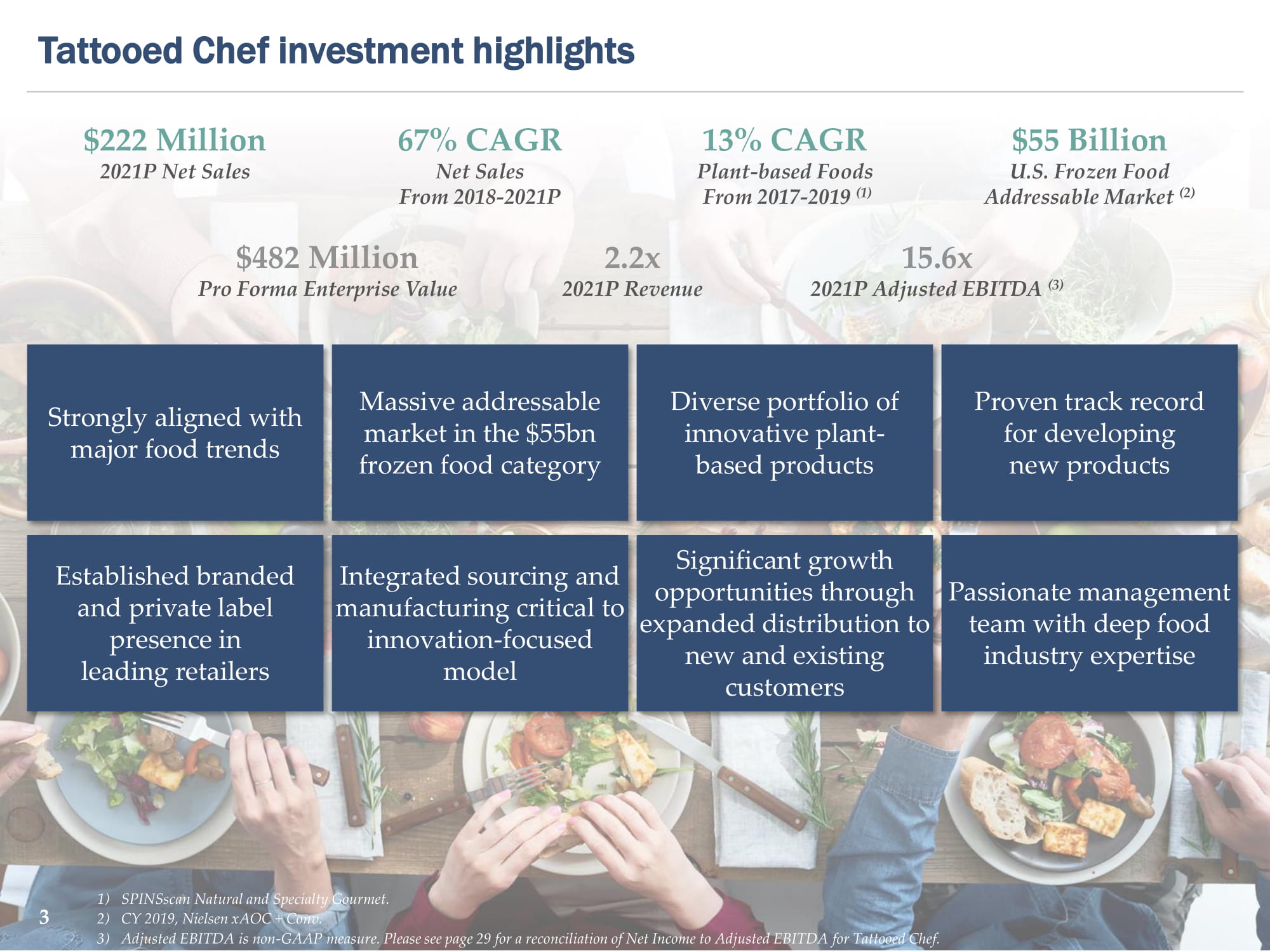

Tattooed Chef Investment Highlights

| ● | High growth and innovative plant-based food company with an established brand as well as a private label presence, serving leading national retailers, with significant growth opportunities through expanded distribution to new and existing customers |

| ● | Large addressable market in the $55 billion U.S. frozen food category where plant-based products are rapidly expanding share |

| ● | Strong product positioning aligned with major consumer trends |

| ● | Diverse portfolio of plant-based products with a proven innovation track record of creating great tasting, unique flavor profiles that allow consumers to connect with a plant-based lifestyle |

| ● | Passionate management team with deep food industry expertise |

| ● | Compelling financial profile |

| o | Projected $148 million and $222 million in revenue and $17 million and $31 million in Adjusted EBITDA in 2020 and 2021, respectively |

| o | Projected 2018-2021 revenue compounded annual growth rate of 67% |

| o | Anticipated initial enterprise value of approximately $482 million implying a 2.2x and 15.6x multiple of projected 2021 revenue and Adjusted EBITDA, respectively |

“After a thorough search, we are pleased to have signed a definitive agreement to bring Tattooed Chef public,” said David Boris, Co-CEO and CFO of Forum. “The company has an exciting plant-based product portfolio, a compelling financial profile, and a long runway for growth. We look forward to working with the team at Tattooed Chef to further capitalize on these attractive growth prospects.”

“I am incredibly proud of what my team and I have accomplished to date. Today marks the next exciting chapter in our Company history as we become a public company,” said Sam Galletti, President and CEO of the Company. “Looking ahead, we believe we are in the early stages of Tattooed Chef’s growth, and will continue to build brand awareness, expand distribution with new and existing customers, launch innovative products, and invest in our infrastructure in order to capitalize on the global plant-powered food market.”

Tattooed Chef will be led by Sam Galletti, President and CEO, Stephanie Dieckmann, COO and CFO, and Sarah Galletti, the creator of Tattooed Chef and Creative Director. The Company intends to split the roles of CFO and COO and has initiated a search for a new CFO. Stephanie Dieckmann will continue to serve both roles until a new CFO has been appointed.

Key Transaction Terms and Conditions

In connection with the transaction, the Company’s current shareholders are retaining 80% of their equity, which will convert into 60% of the outstanding shares of the combined company at closing, assuming no redemptions by Forum’s public stockholders. After giving effect to any redemptions by the public stockholders of Forum, the balance of the approximately $200 million in cash held in Forum's trust account will be used to pay cash consideration to the Company’s shareholders and transaction expenses, with the remainder staying on the balance sheet to fund the combined company’s growth and for general corporate purposes. The Company’s current shareholders will have the potential to receive an earnout, payable in the form of Tattooed Chef common stock, if certain Tattooed Chef stock price targets are met, as set forth in the definitive agreement.

The transaction has been unanimously approved by the boards of directors of both the Company’s parent and Forum. Completion of the transaction is subject to approval by Forum’s stockholders and certain other closing conditions specified in the Business Combination Agreement. The transaction is expected to close in the third quarter of 2020.

Additional information about the business combination is provided in an investor presentation that will be filed with the Securities and Exchange Commission as an exhibit to a Current Report on Form 8-K and available at the website of the Securities and Exchange Commission (“SEC”) at www.sec.gov.

Harrison Co. acted as financial advisor to Ittella International. Rutan & Tucker, LLP served as legal counsel to Ittella International.

Jefferies LLC served as lead financial advisor and capital markets advisor to Forum. EarlyBirdCapital, Inc. served as financial advisor to Forum. Winston & Strawn LLP served as legal counsel to Forum.

Conference Call Information

Forum and Tattooed Chef management will host a conference call to discuss the transaction today at 8:00 a.m. EDT. Investors interested in participating in the live call can dial 877-407-3982 from the U.S. and 201-493-6780 internationally with conference code 13705349. A telephone replay will be available approximately two hours after the call concludes through Friday, June 26, 2020, by dialing 844-512-2921 from the U.S., or 412-317-6671 from international locations, and entering confirmation code 13705349.

About Tattooed Chef

Tattooed Chef is a leading plant-based food company offering a broad portfolio of innovative plant-based food products that taste great and are sustainably sourced. Tattooed Chef’s signature products include ready-to-cook bowls, zucchini spirals, riced cauliflower, acai and smoothie bowls, and cauliflower pizza crusts, which are available in the frozen food sections of leading national retail food stores across the United States. Understanding consumer lifestyle and food trends, and a commitment to innovation allows Tattooed Chef to continuously introduce highly successful new products. Tattooed Chef provides great-tasting, approachable and innovative products not only to the growing group of consumers who seek to adopt a plant-based lifestyle, but to any of the “People Who Give a Crop”. For more information, please visit www.tattooedchef.com

2

About Ittella International

Ittella International is a plant-based food company with operations in the United States and Italy with a broad portfolio of innovative products available both in private label and under the Company’s “Tattooed Chef” brand. Following completion of the transaction, Ittella International will be renamed Tattooed Chef, Inc.

About Forum Merger II Corporation

Forum Merger II Corporation is a blank check company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. For more information, please visit www.forummerger.com.

Additional Information and Where to Find It

Forum intends to file with the SEC preliminary and definitive proxy statements in connection with the proposed business combination and other matters and will mail a definitive proxy statement to its stockholders as of the record date established for voting on the proposed business combination. Forum’s stockholders and other interested persons are advised to read, once available, the preliminary proxy statement and any amendments thereto and, once available, the definitive proxy statement, in connection with Forum’s solicitation of proxies for its special meeting of stockholders to be held to approve, among other things, the proposed business combination, because these documents will contain important information about Forum, the Company and the proposed business combination. Forum’s stockholders may also obtain a copy of the preliminary or definitive proxy statement, once available, as well as other documents filed with the SEC by Forum, without charge, at the SEC’s website located at www.sec.gov or by directing a request to: Forum Merger II Corporation, 1615 South Congress Avenue, Suite 103, Delray Beach, FL 33445. The information contained on, or that may be accessed through, the websites referenced in this press release is not incorporated by reference into, and is not a part of, this press release.

Forward-Looking Statements

Certain statements made in this release are “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. When used in this release, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside Forum’s or the Company's control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors, among others, that may affect actual results or outcomes include: the inability to complete the transactions contemplated by the Business Combination Agreement due to the failure to obtain approval of the stockholders of Forum or satisfy other conditions to the closing of the proposed business combination; the occurrence of any event, change or other circumstances that could give rise to the termination of the Business Combination Agreement; the outcome of any legal proceedings that may be instituted against the Company or Forum following announcement of the proposed business combination and related transactions; the inability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things, the amount of funds available in Forum’s trust account following any redemptions by Forum’s public stockholders, competition and the ability of the combined business to grow and manage growth profitably; the ability to meet Nasdaq’s listing requirements following the consummation of the transactions contemplated by the proposed business combination; costs related to the proposed business combination; and other risks and uncertainties indicated from time to time in the proxy statement to be filed by Forum with the SEC in connection with the proposed business combination, including those under “Risk Factors” therein, and other factors identified in Forum’s prior and future filings with the SEC, available at www.sec.gov. Some of these risks and uncertainties may be amplified by the COVID-19 outbreak. None of Forum or the Company undertakes any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

3

Participants in the Solicitation

Forum and its directors and executive officers may be considered participants in the solicitation of proxies with respect to the business combination. Information about the directors and executive officers of Forum and a description of their interests in Forum are set forth in its definitive proxy statement in connection with its special meeting of stockholders to approve an extension of time in which Forum must complete an initial business combination or liquidate its trust account, which was filed with the SEC on May 26, 2020, and will also be contained in the preliminary proxy statement and definitive proxy statement, when they are filed with the SEC, in connection with the proposed business combination. These documents can be obtained free of charge from the sources indicated above.

Non-Solicitation

This press release does not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed transaction. This press release also does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor will there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities will be made except by means of a prospectus meeting the requirements of section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

Non-GAAP Financial Measure and Related Information

This press release includes references to projected adjusted EBITDA, a financial measure that is not prepared in accordance with U.S. generally accepted accounting principles ("GAAP"). Adjusted EBITDA is defined as net income (loss), before interest expense, income tax benefit (expense), depreciation and amortization expense, and adjusted to reflect certain non-recurring expenses or those expenses not expected to survive the closing, as further described in the investor presentation filed as an exhibit to the Current Report on Form 8-K filed by Forum with the SEC today. The Company’s management believes that this non-GAAP, unaudited measure of financial results provides useful information to management and investors regarding certain financial and business trends relating to the Company’s financial condition and results of operations and you should not rely on any single financial measure to evaluate the Company’s business.

Contact

Investor Relations

(212) 739-7860

4

Exhibit 99.2

Investor Presentation June 2020

Disclaimer This investor presentation (this “presentation”) is for informational purposes only and has been prepared to assist parties i n m aking their own evaluation with respect to the proposed transaction (the “Business Combination”) between Ittella International (“ Ittella ” or “Tattooed Chef”) and Forum Merger II Corporation (“Forum”) contemplated by that certain agreement and plan of merger (th e “ Merger Agreement”), by and among Forum, MYJOJO, INC. and the other parties thereto and for no other purpose. It is not intended to form the basis of any investment decision or any other decisions with respect to the Business Co mbination. No Representation or Warranty. No representation or warranty, express or implied, is or will be given by Forum or Ittella or any of their respective affiliates, directors, officers, employees, advisers or any other person as to the accuracy or completene ss of the information in this presentation or any other written, oral or other communications transmitted or otherwise made availab le to any party in the course of its evaluation of the Business Combination, and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements, negligent or otherwise, relat ing thereto. This presentation does not purport to contain all of the information that may be required to evaluate a possible investment decision with respect to Forum, and does not constitute investment, tax or legal advice. The recipient also acknow led ges and agrees that the information contained in this presentation is preliminary in nature and is subject to change, and any such changes may be material. Forum and Ittella disclaim any duty to update the information contained in this presentation. An y and all trademarks and trade names referred to in this presentation are the property of their respective owners. Forward - Looking Statements. This presentation contains “forward looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward - looking statements include, without limitation, statements regarding the estimated future financial performance, financial position and financial impacts of the Business Combination, satisfaction of cl osing conditions to the Business Combination, the level of redemption by Forum’s public stockholders and purchase price adjustments in connection with the Business Combination, the timing of the completion of the Business Combination, the antici pat ed Adjusted EBITDA of the combined company following the Business Combination, anticipated ownership percentages of the combined company’s stockholders following the Business Combination, and the business strategy, plans and objectives of ma nag ement for future operations, including as they relate to the potential Business Combination. Such statements may be identified by the use of words such as “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and ot her similar expressions that predict or indicate future events or trends or that are not statements of historical matters, but th e absence of these words does not mean that a statement is not forward - looking. When Forum discusses its strategies or plans, incl uding as they relate to the Business Combination, it is making projections, forecasts and forward looking statements. Such statements are based on the beliefs of, as well as assumptions made by and information currently available to, Forum’s manage men t. These forward - looking statements involve significant risk and uncertainties that could cause actual results to differ materially from the expected result. Most of these factors are outside Forum’s and Ittella’s control and are difficult to predict. Fact or s that may cause such differences include, but are not limited to: (1) the occurrence of any event, change or other circumstances th at could give rise to the termination of the Merger Agreement; (2) the outcome of any legal proceedings that may be instituted against the parties or the combined company following announcement of the proposed Business Combination; (3) the inability to co mplete the transactions contemplated by the Merger Agreement due to the failure to obtain approval of the stockholders of Forum or other conditions to closing in the Merger Agreement; (4) the risk that the announcement of the proposed Business Com bin ation disrupts current plans and operations; (5) the ability of the combined company to meet its financial and strategic goals, due to, among other things, competition, the ability of the combined company to grow and manage growth profitability a nd maintain relationships with suppliers and customers; (6) costs related to the Business Combination; (7) changes in applicable laws or regulations; (8) the possibility that the combined company may be adversely affected by other economic, bu sin ess, competitive factors, weather and/or commodity prices; and (9) other risks and uncertainties described in the documents filed with the U.S. Securities and Exchange Commission (the “SEC”) by Forum. You are cautioned not to place undue reliance u pon any forward - looking statements, which speak only as of the date made, and Forum and Ittella undertake no obligation to update or review the forward - looking statements whether as a result of new information, future events or otherwise. No Offer or Solicitation. This presentation shall not constitute a solicitation of a proxy, consent or authorization with res pec t to any securities or in respect of the Business Combination. This presentation shall also not constitute an offer to sell o r t he solicitation of an offer to buy any securities of Forum, Ittella or their affiliates. Use of Projections. This presentation contains financial forecasts. Neither Forum’s nor Ittella’s auditors have audited, revi ewe d, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this presentati on, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the pu rpo se of this presentation. These projections are for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. In this presentation, certain of the above - mentioned projected information has been p rovided for purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and compet iti ve risks and uncertainties that could cause actual results to differ materially from those contained in the prospective finan cia l information. Projections are inherently uncertain due to a number of factors outside of Forum’s or Ittella’s control. Accordi ngl y, there can be no assurance that the prospective results are indicative of future performance of Forum, Ittella or the combi ned company after the Business Combination or that actual results will not differ materially from those presented in the prospect ive financial information. Inclusion of the prospective financial information in this presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. Industry and Market Data. In this presentation, we rely on and refer to information and statistics regarding market participa nts in the sectors in which Ittella competes and other industry data. We obtained this information and statistics from third - party sources, including reports by market research firms and company filings. Being in receipt of this presentation you agree you may be restricted from dealing in (or encouraging others to deal in) price sensitive securities. Non - GAAP Measures. This presentation includes certain non - GAAP financial measures, including EBITDA, Adjusted EBITDA and Adjuste d EBITDA Margin. Adjusted EBITDA is defined as net income (loss), before interest expense, income tax benefit (expense), depreciation and amortization expense, and adjusted to reflect certain non - recurring expenses or those expenses not e xpected to survive the closing. The Company's management believes that this non - GAAP, unaudited measure of financial results provides useful information to management and investors regarding certain financial and business trends relating to t he Company's financial condition and results of operations and you should not rely on any single financial measure to evaluate the Company's business. These non - GAAP financial measures are not calculated in accordance with generally accepted accounting pr inciples in the United States (“GAAP”) and should not be considered as alternatives to GAAP. These non - GAAP financial measures are included herein because Forum and Ittella believe that the use of these non - GAAP financial measures provi des an additional tool for investors to use in evaluating ongoing operating results and trends. Other companies may calculate their non - GAAP financial measures differently, and therefore Ittella’s non - GAAP financial measures may not be directly comparable to similarly titled measures of other companies. For additional information and a reconciliation of these non - GAAP financial measures to the nearest comparable GAAP financial measures, see the section titled “Non - GAAP Reconciliation” in t he Appendix at the end of this presentation. Additionally, to the extent that forward - looking non - GAAP financial measures are provided, they are presented on a non - GAAP basis without reconciliations of such forward - looking non - GAAP financial measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation. Additional Information Forum intends to file a preliminary proxy statement with the SEC in connection with the Business Combination and will mail a def initive proxy statement and other relevant documentation to its stockholders. This presentation does not contain all of the information that should be considered concerning the Business Combination. Forum’s stockholders and other interested parties ar e advised to read, when available, the preliminary proxy statement and any additional information filed by Forum with the SEC concerning the Business Combination, as these materials will contain important information about Ittella , Forum and the Business Combination. A definitive proxy statement will be mailed to stockholders of Forum as of a record da te to be established for voting on the Business Combination. Stockholders will also be able to obtain copies of the proxy statement a nd other documents filed with the SEC that will be incorporated by reference in the proxy statement, without charge, once available at the SEC’s website at www.sec.gov, or by directing a request to Forum Merger II Corporation, 1615 South Congress Ave nue, Suite 103, Delray Beach, FL 33445. Participants in the Solicitation Forum and its directors and executive officers may be deemed participants in the solicitation of proxies from Forum’s stockho lde rs with respect to the Business Combination. A list of names of such directors and executive officers and a description of t hei r interests in Forum is contained in Forum annual report on Form 10 - K for the fiscal year ended December 31, 2019, which was filed with the SEC and is available free of charge at the SEC’s website at www.sec.gov or by directing a request to Forum Merger II Corporation, 1615 South Congress Avenue, Suite 103, Delray Beach, FL 33445. Additional information regarding the interest s o f such directors and executive officers will be contained in the proxy statement for the Business Combination when available. Ittella and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from stockholde rs of Forum in connection with the Business Combination. A list of the names of such directors and executive officers and a description of their interests in the Business Combination will be included in the proxy statement for the Business Combinati on when available. 1

Today’s presenters 1) Note that as a public company, the CFO role will be separated. The Company has initiated a search for a new CFO. Stephanie wi ll remain as COO once the CFO role has been filled. Sam Galletti CEO / President o Sam has 35 years of experience in the food industry having served in both operational and investor roles within seafood, breaded vegetables, salsas and dips, grilled chicken, and organic foods companies Stephanie Dieckmann CFO / COO (1) o Stephanie joined Tattooed Chef in 2017 as COO and currently oversees the organization’s ongoing operations and procedures o Prior to Tattooed Chef, Stephanie spent 12 years in the food industry, including seven years as the CFO of APPA Fine Foods David Boris Co - CEO / CFO o David has over 30 years of Wall Street experience in mergers and corporate finance and has been involved in more than 15 SPAC transactions as a board member, underwriter and M&A advisor, including seven business combinations totaling over $3.4 billion o David is a former Director of ConvergeOne o Active member of the Young Presidents’ Organization Tattooed Chef Forum Merger II Sarah Galletti The “Tattooed Chef” and Creative Director o Creator of The Tattooed Chef o Sarah joined the Company in 2014 and began spearheading the shift to being a plant - based food company, which included the creation and development of Tattooed Chef’s products o Prior to Tattooed Chef, Sarah worked as a chef in Italy at a variety of places 2

Tattooed Chef investment highlights 3 13% CAGR Plant - based Foods From 2017 - 2019 (1) Proven track record for developing new products Passionate management team with deep food industry expertise $55 Billion U.S. Frozen Food Addressable Market (2) Strongly aligned with major food trends Established branded and private label presence in leading retailers $222 Million 2021P Net Sales Integrated sourcing and manufacturing critical to innovation - focused model Massive addressable market in the $55bn frozen food category 67% CAGR Net Sales From 2018 - 2021P 1) SPINSscan Natural and Specialty Gourmet. 2) CY 2019, Nielsen xAOC + Conv. 3) Adjusted EBITDA is non - GAAP measure. Please see page 29 for a reconciliation of Net Income to Adjusted EBITDA for Tattooed Chef. Diverse portfolio of innovative plant - based products Significant growth opportunities through expanded distribution to new and existing customers $482 Million Pro Forma Enterprise Value 2.2x 2021P Revenue 15.6x 2021P Adjusted EBITDA (3)

Introduction o Introduction 4 I. Business Overview II. Financial Overview & Projections III. Transaction Details IV. Appendix A GENDA

SECTION I BUSINESS OVERVIEW

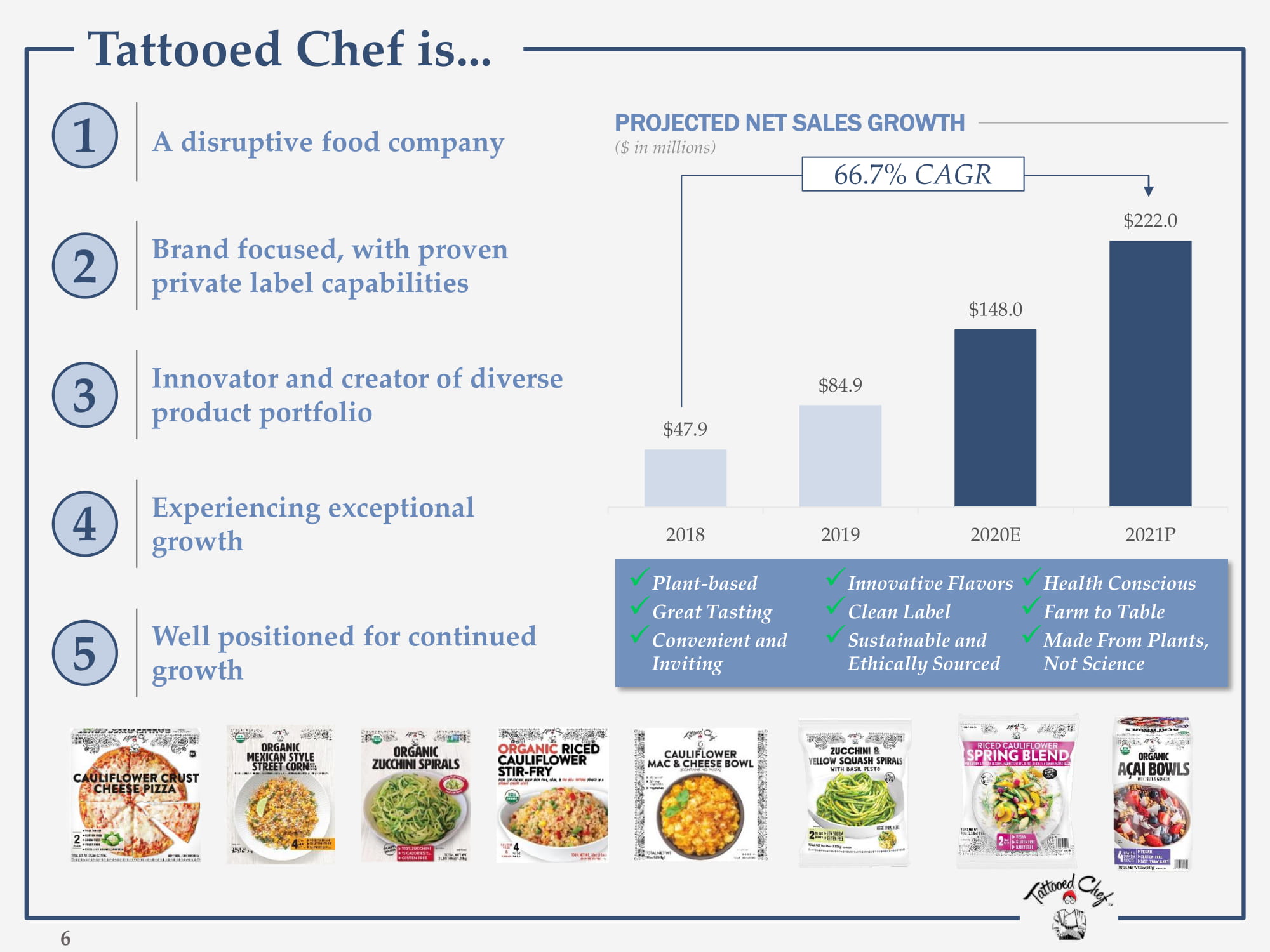

x 6 Tattooed Chef is... A disruptive food company Brand focused, with proven private label capabilities Innovator and creator of diverse product portfolio Experiencing exceptional growth Well positioned for continued growth $47.9 $84.9 $148.0 $222.0 2018 2019 2020E 2021P PROJECTED NET SALES GROWTH ($ in millions) 66.7% CAGR x Plant - based x Great Tasting x Convenient and Inviting x Innovative Flavors x Clean Label x Sustainable and Ethically Sourced x Health Conscious x Farm to Table x Made From Plants, Not Science 6 1 2 3 4 5

$2.1 $4.4 $10.9 $12.9 $32.5 $84.9 $148.0 The history of Tattooed Chef 7 Tattooed Chef has evolved from an importer of Italian vegetables and products to a highly disruptive, modern brand that is capturing significant market share in the fast - growing plant - based food market 2009 CEO Sam Galletti opens Stonegate Foods and begins importing vegetables and other Italian products to be sold to national natural channel retailer 2010 Stonegate begins selling private label products to leading natural channel retailer and national discount supermarket Stonegate becomes Ittella Int. and begins manufacturing in own facility 2015 2014 Sarah Galletti, current Creative Director, joins firm 2019 Releases 12 new SKUs under the Tattooed Chef brand in the club channels (Net sales $ in millions) Stonegate Foods / Ittella Tattooed Chef The Tattooed Chef brand is launched and begins focusing on plant - based food products 2017 Current Italy plant is opened Giuseppe Bardari, current President of Italian operations, joins the Company 2020E Changes name to Tattooed Chef (1) Doubled production capacity 20+ SKUs available to conventional retail 1) Ittella International to formally change name to Tattooed Chef upon completion of merger.

Tattooed Chef: plant - powered food for everyone o The Tattooed Chef brand was created in 2017 by Sam’s daughter, Sarah Galletti, after she experienced different food scenes and cultures while abroad, and began noticing a lack of high - quality, plant - based ready - to - cook products that were available to consumers o Tattooed Chef’s innovative plant - based products, eye - catching packaging and edgy branding has had significant success appealing to not just the younger, eco - and health - conscious consumers, but also to the greater population of people seeking more wholesome foods o Strong consumer demand has helped expand Tattooed Chef products into stores across the country, including the predominant club stores o The brand and Sarah have also been recognized for their success: – 2 nd Place for Best New Product of the Year at Sam’s Club (Tattooed Chef’s Cauliflower Mac & Cheese) – 2019 Progressive Grocer’s GenNext Award (Sarah Galletti) (1) 1) 2019 GenNext Award Winners: The Disruption Generation, 2019. 8 Tattooed Chef’s foundation is based on providing great - tasting, plant - based products to the growing group of consumers who seek to adopt a more eco - friendly and health - conscious lifestyle Serving Up Plant - Powered Foods To People Who Give A Crop The Tattooed Chef The Tattooed Chef

$263.8 $106.4 $80.1 $62.4 Vegeterian Diet (+1.0%) Pescaterian Diet (+0.5%) Plant Based Diet (+1.6%) Vegan Diet (+1.7%) Strongly aligned with major food trends 1) Total Consumer Report 2019. Nielsen. 2019. 2) Consumer Health Claims 3.0: The Next Generation of Mindful Food Consumption. L.E.K. Consulting. 2018. 9 Tattooed Chef’s products are plant - based, organic, non - GMO and protein - rich, making it well aligned with multiple leading consumer lifestyles and positioning it for long - term growth SALES (AND % YOY GROWTH) BY LIFESTYLE CLAIM (1) ($ in billions) Tattooed Chef is aligned with three of the four most popular lifestyle claims o Consumers’ increased focus on clean label eating continues to drive the growing popularity of a plant - based lifestyle o These secular food consumption trends position Tattooed Chef for growth given its focus on providing great - tasting, plant - based food, such as cauliflower stir fry, organic acai bowls and value - added zucchini spirals 69% 66% 55% 54% 35% 60% 55% 47% 42% 35% 31% 23% 18% No artificial ingredients All-natural Organic Non-GMO Clean label Protein-rich Healthy fats Antioxidant- rich Plant-based Gluten-free Vegeterian Vegan Paleo Natural Enhanced Alternative dietary lifestyle MOST POPULAR FOOD CLAIMS AMONG CONSUMERS (2) (% of U.S. consumers who “always”, “frequently” or “occasionally” purchases foods with these food claims)

17% 31% 45% 1% 1% 5% Much more often Somewhat more often About the same Somewhat less often Much less often Do not eat plant- based foods Growth in plant - based consumption is expected to continue 1) SPINSscan Natural and Specialty Gourmet. 2) Homescan Panel Protein Survey. Nielsen. 2018. 3) Beyond Meat Initiating Coverage Report. Jefferies. 2019. 4) Nielsen xAOC + Conv. Animal - based Meats excludes processed meats. 10 Plant - based foods are expected to experience strong long - term growth; consumer surveys indicate an increase in consumption of foods in this category CONSUMERS ARE SHIFTING THEIR DIETS… ( 3 ) (% of respondents) 48% of respondents say they want to eat more plant - based foods 71% 19% 2% 1% 55% 25% 5% 2% Meat Eater Flexitarian Vegetarian Vegan How I eat today How I want to eat tomorrow INCREASED CONSUMPTION OF PLANT - BASED FOODS (2) (% of respondents who responded to how often they want eat plant - based foods) o Plant - based food sales reached approximately $5 billion in 2019, growing 13% annually since 2017 (1) Consumers want to eat less meat… …And shift their diets to include more plant - based options by adopting a flexitarian, vegetarian or vegan diet - 3.9% 2.2% 6.8% 13.1% Milk Meat Animal-based Plant-based …EVIDENCED BY GROWTH IN RETAIL SALES (4) (2016 - 2019 CAGR)

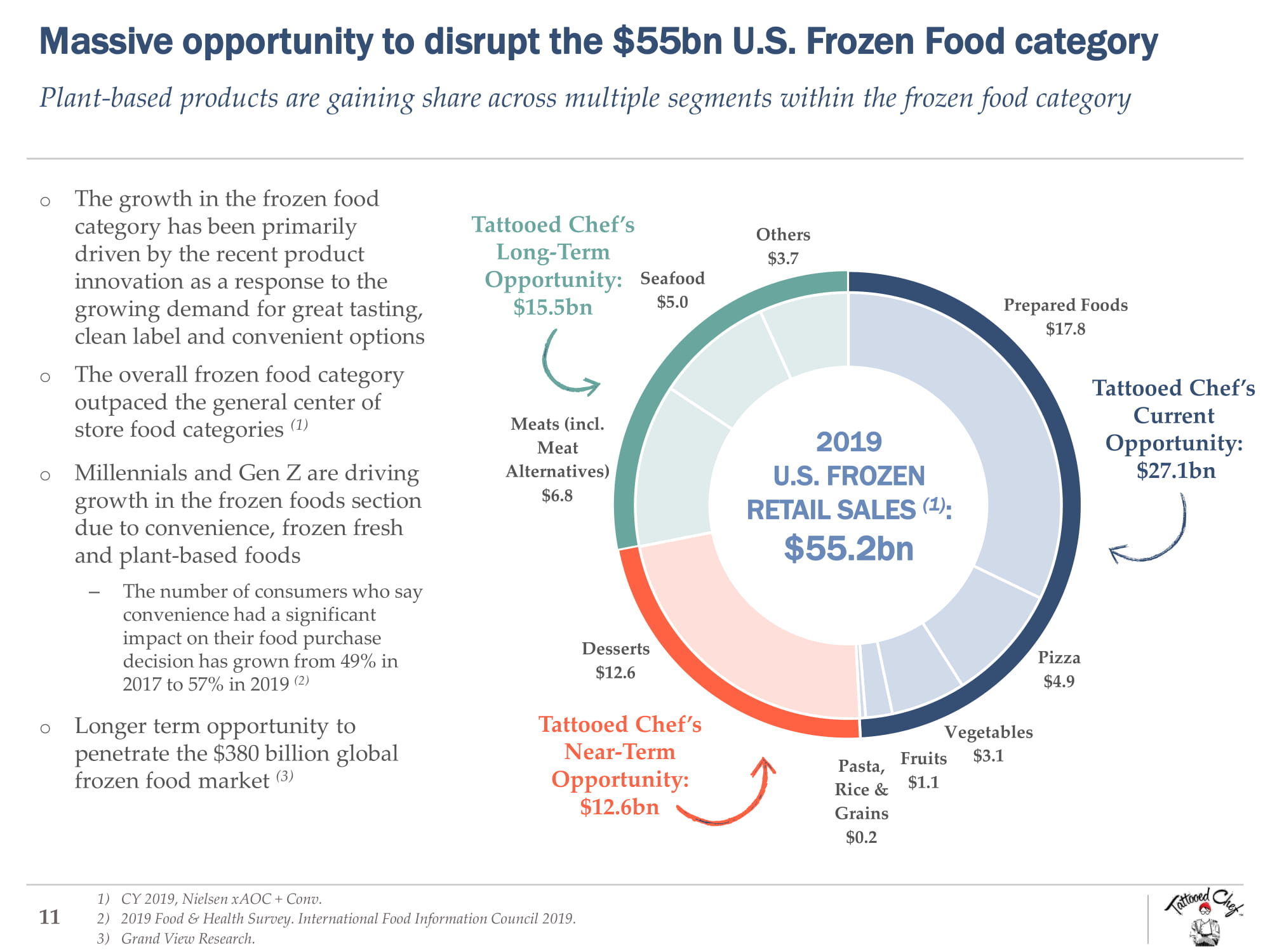

Prepared Foods $17.8 Pizza $4.9 Vegetables $3.1 Fruits $1.1 Pasta, Rice & Grains $0.2 Desserts $12.6 Meats (incl. Meat Alternatives) $6.8 Seafood $5.0 Others $3.7 Massive opportunity to disrupt the $55bn U.S. Frozen Food category 1) CY 2019, Nielsen xAOC + Conv. 2) 2019 Food & Health Survey. International Food Information Council 2019. 3) Grand View Research. 11 Plant - based products are gaining share across multiple segments within the frozen food category 2019 U.S. FROZEN RETAIL SALES (1) : $55.2bn Tattooed Chef’s Current Opportunity: $27.1bn Tattooed Chef’s Long - Term Opportunity: $15.5bn o The growth in the frozen food category has been primarily driven by the recent product innovation as a response to the growing demand for great tasting, clean label and convenient options o The overall frozen food category outpaced the general center of store food categories (1) o Millennials and Gen Z are driving growth in the frozen foods section due to convenience, frozen fresh and plant - based foods – The number of consumers who say convenience had a significant impact on their food purchase decision has grown from 49% in 2017 to 57% in 2019 (2) o Longer term opportunity to penetrate the $380 billion global frozen food market (3) Tattooed Chef’s Near - Term Opportunity: $12.6bn

Diverse offering of value - added plant - based products Tattooed Chef serves consumers’ various demands, from snack to side dish to main course, making them the ideal supplier for retailers seeking to offer a more complete plant - based portfolio COMPANY PRODUCTS (1) NET SALES BREAKDOWN 2020E (2) 1) Products shown are representative and do not include all of Tattooed Chef’s offerings. 2) Does not include miscellaneous sales. 3) Consists of mostly pasta, fish (only through 2019) and other desserts. 12 35% 20% 19% 13% 9% 1% 3% Meals Smoothie Bowls Vegetables Pizza Veg. Spirals Healthy Grains Other 53% 47% Tattooed Chef (Branded) Private Label (3)

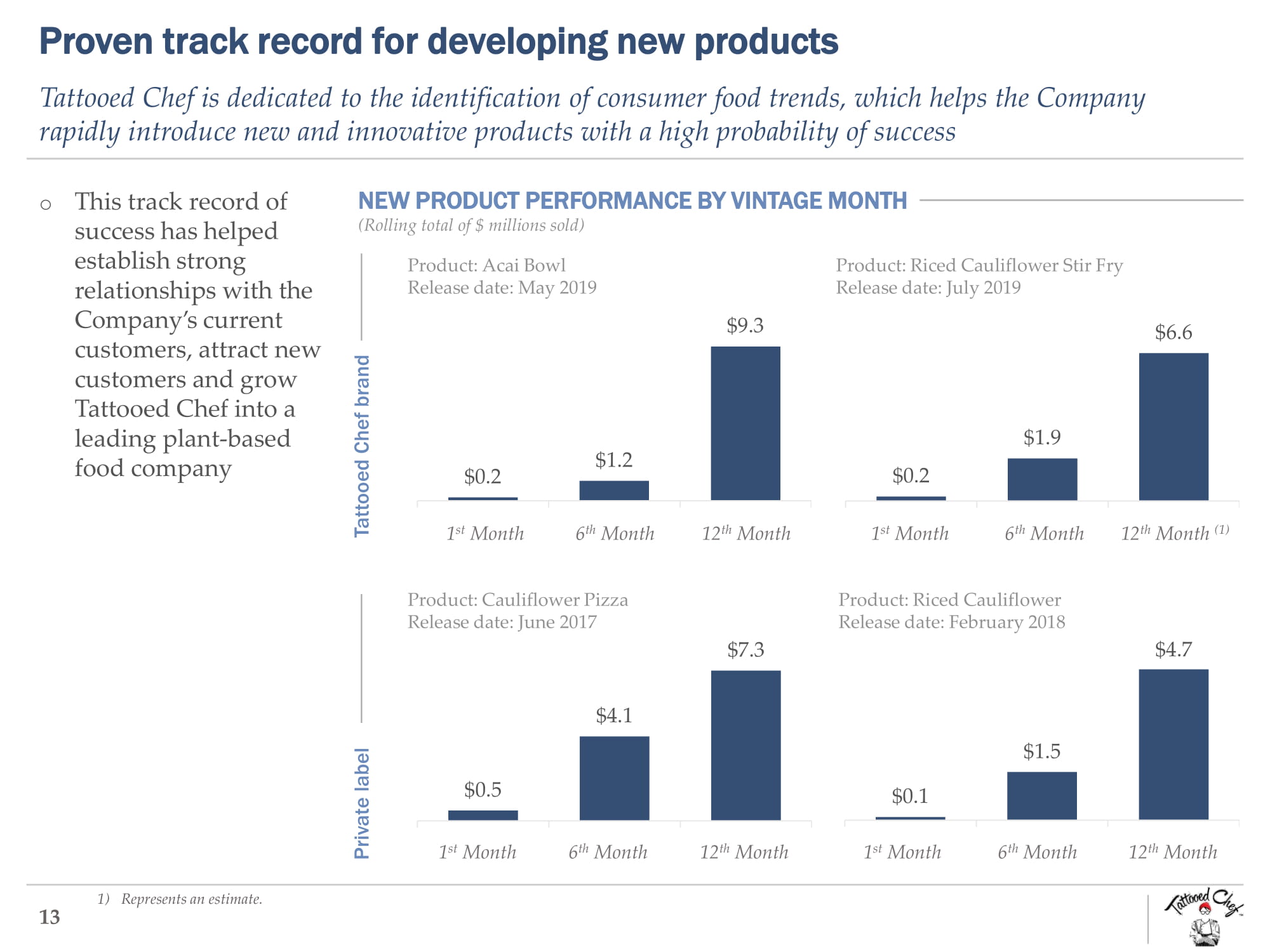

Proven track record for developing new products o This track record of success has helped establish strong relationships with the Company’s current customers, attract new customers and grow Tattooed Chef into a leading plant - based food company 1) Represents an estimate. 13 Tattooed Chef is dedicated to the identification of consumer food trends, which helps the Company rapidly introduce new and innovative products with a high probability of success NEW PRODUCT PERFORMANCE BY VINTAGE MONTH (Rolling total of $ millions sold) Tattooed Chef brand 1 st Month 6 th Month 12 th Month Product: Acai Bowl Release date: May 2019 1 st Month 6 th Month 12 th Month (1) Product: Riced Cauliflower Stir Fry Release date: July 2019 $0.2 $1.2 $9.3 $0.2 $1.9 $6.6 1 st Month 6 th Month 12 th Month Product: Cauliflower Pizza Release date: June 2017 Product: Riced Cauliflower Release date: February 2018 Private label 1 st Month 6 th Month 12 th Month $0.5 $4.1 $7.3 $0.1 $1.5 $4.7

26% 52% 63% 93% 94% 74% 48% 37% 2017 2018 2019 2020E 2021P Branded Private Label BRANDED AND PRIVATE LABEL NET SALES BREAKDOWN ($ in millions, % share of total branded and private net sales) Established branded and private label presence in leading retailers o Since Tattooed Chef began selling plant - based products in 2017, retailers have relied on the Company to provide high - quality, plant - based options in order to meet growing consumer demand for these types of foods o Tattooed Chef’s growing reputation in the food industry has led to it being approached by multiple retailers that request the Company sell both its branded and private label products in their stores 14 Tattooed Chef’s branded sales are expected to outpace growth of private label as the Company continues to launch new products and expand into new retail doors x Largest national retailer x Leading natural channel retailer x National discount supermarket $32.5 $47.9 $84.9 $148.0 $222.0

Increasing demand for the Tattooed Chef brand 1) Select customer reviews sourced from Samsclub.com & Walmart.com. 15 Tattooed Chef’s innovative plant - based products and unique flavor profiles have helped the brand achieve significant growth and a nationwide presence in just three years BRANDED SALES GROWTH AND SKU PROLIFERATION ($ in millions) Great Healthy Treat. These bowls are amazing. A great healthy treat. I have already recommended to so many people! Sam’s Club please keep them on the shelf! “ Yum! Absolutely love this stuff, the only sad thing is knowing it’s a seasonal product and will eventually disappear from the shelves. Enjoy it while it lasts!! “ Amazing! This is amazing! I’m glad I bought multiple bags. I’m a huge fan of Tattooed Chef items. I hope this is available at Sam’s Club FOREVER! “ Please keep this as a regular club item! These frozen noodles are so good! They are convenient and perfect for healthy plant based diets… “ O.M.G!!!!! This pizza is something else! I am a pizza brat and I think I found my go to frozen pizza! …I am definitely buying this again and telling EVERYONE to get it! “ “ SELET CONSUMER REVIEWS (1) I ate all 4 in less than 3 days. These are seriously amazing and I don’t normally like sweet potatoes AT ALL!! Seriously worth a try!! $1.6 $2.3 $19.8 $77.1 $140.0 6 12 26 39 59 0 10 20 30 40 50 60 70 $0.0 $50.0 $100.0 $150.0 $200.0 2017 2018 2019 2020E 2021P Tattooed Chef Revenue SKUs Sold

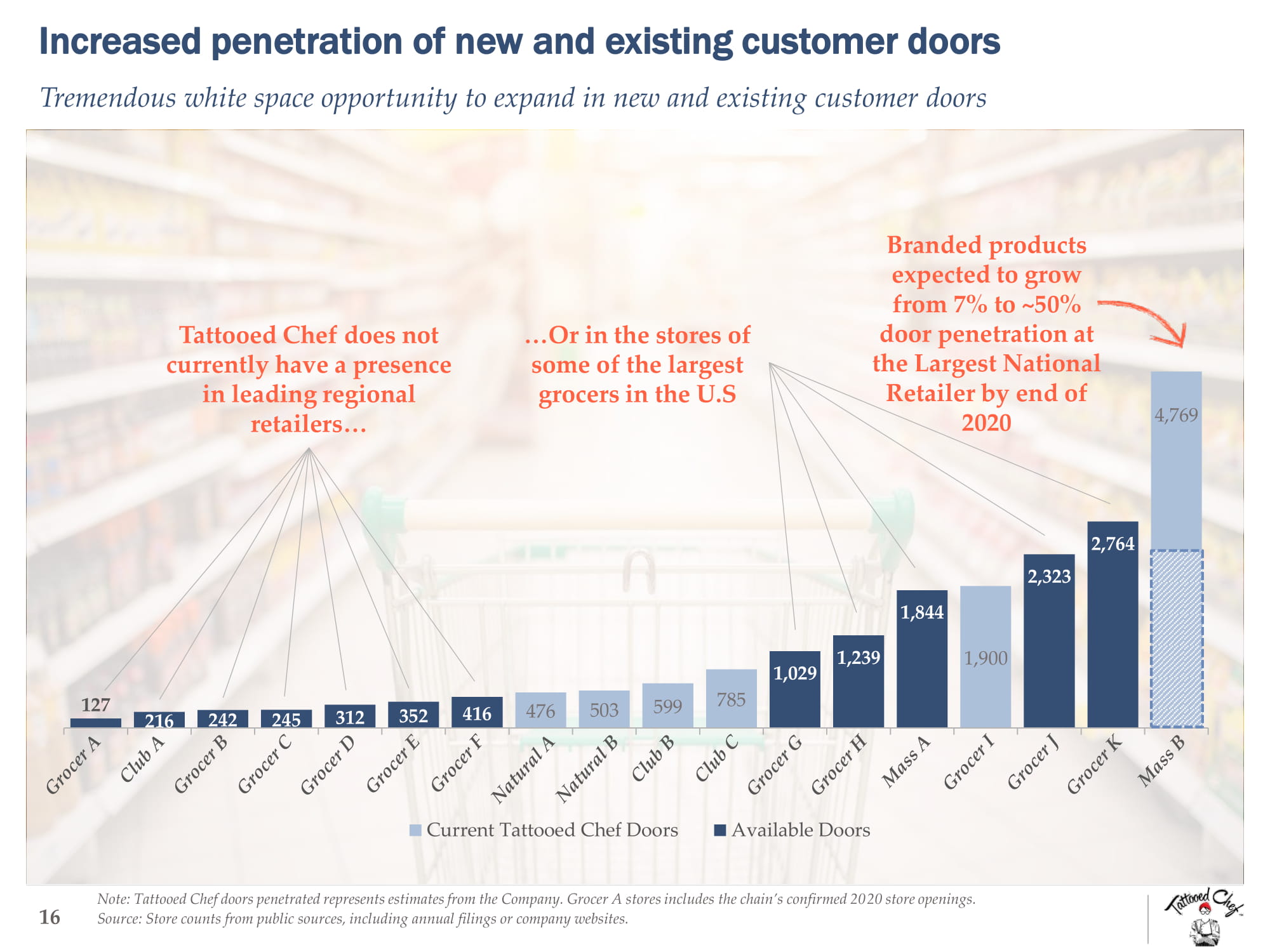

Increased penetration of new and existing customer doors Note: Tattooed Chef doors penetrated represents estimates from the Company. Grocer A stores includes the chain’s confirmed 20 20 store openings. Source: Store counts from public sources, including annual filings or company websites. 16 Tremendous white space opportunity to expand in new and existing customer doors Tattooed Chef does not currently have a presence in leading regional retailers… …Or in the stores of some of the largest grocers in the U.S Branded products expected to grow from 7% to ~50% door penetration at the Largest National Retailer by end of 2020 476 503 599 785 1,900 4,769 127 216 242 245 312 352 416 1,029 1,239 1,844 2,323 2,764 Current Tattooed Chef Doors Available Doors

Certification Italy facility U.S. facility Integrated sourcing and manufacturing critical to innovation - focused model 1) Kosher certification. 17 Tattooed Chef’s U.S. and Italian operations provide the infrastructure to develop its innovative products using sustainable ingredients OPERATIONAL OVERVIEW SIGNIFICANT CERTIFICATIONS ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ -- Prossedi, Italy Paramount, California o Raw material supply – strong relationships with local growers allow Tattooed Chef to have a supply of high - quality, non - GMO and organic produce o Vegetable production – Tattooed Chef’s Italy facility has proprietary manufacturing capabilities, significant capacity and a robust team to help support expected future growth ITALY OPERATIONS o Value - added production – Tattooed Chef’s agile operations are aligned with the Company’s innovation - driven business model as it allows for seamless new product development, production, numerous different packaging types and the ability to meet short timelines o Inventory control – complete control of production allows the Company to efficiently manage its inventory and minimize waste U.S. OPERATIONS (1)

SECTION II FINANCIAL OVERVIEW & PROJECTIONS

Summary financials Consistent, proven growth track record with significant upside potential 1) Adjusted EBITDA is non - GAAP measure. Please see page 29 for a reconciliation of Net Income to Adjusted EBITDA for Tattooed Chef. NET SALES ($ in millions) ADJ. EBITDA AND ADJ.EBITDA MARGIN (1) ($ in millions, % of net sales) 19 $47.9 $84.9 $148.0 $222.0 2018 2019 2020E 2021P ($0.1) $7.0 $17.2 $30.8 8.2% 11.6% 13.9% -5.0% 0.0% 5.0% 10.0% 15.0% ($2.5) $7.5 $17.5 $27.5 $37.5 $47.5 2018 2019 2020E 2021P

Strong momentum continued in Q1 2020 The first quarter of 2020 showed strong continued momentum driven by explosive growth within the Tattooed Chef brand across all customers 1) Adjusted EBITDA is non - GAAP measure. Please see page 29 for a reconciliation of Net Income to Adjusted EBITDA for Tattooed Chef. 20 NET SALES ($ in millions) ADJ. EBITDA AND ADJ.EBITDA MARGIN (1) ($ in millions, % of net sales) $17.0 $34.1 Q1 2019 Q1 2020 $1.6 $5.8 9.4% 17.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 Q1 2019 Q1 2020 YoY Growth 264% YoY Growth 101%

Long term growth targets 21 Net Sales Growth 20%+ Adjusted EBITDA Margin High - Teens Adjusted EBITDA Growth 20%+

SECTION III TRANSACTION DETAILS

Sources of Funds Uses of Funds Cash Held in Trust $207 Stock Consideration $344 Issuance of Shares $344 Cash Consideration $75 Estimated Fees & Expenses $30 Cash to Balance Sheet $102 Total Sources $551 Total Uses $551 Proposed transaction overview 1) Adjusted EBITDA is non - GAAP measure. Please see page 29 for a reconciliation of Net Income to Adjusted EBITDA for Tattooed Chef. 2) Pro Forma share count includes 20.0mm Forum Merger II public shares, 3.1mm Forum Merger II founding shares, and 34.4mm rollov er shares issued to sellers. Excludes shares underlying warrants ($11.50 strike price) and earnout shares (which vest at $12.00 and $14.00). Pro Forma Net Cash include $102mm of cash to bala nce sheet less $8mm of net debt from Company as of 3/31/20. 3) Assumes no redemption of public shares, balance as of 6/8/20. 23 o Pro Forma enterprise value of $482 million (15.6x 2021P Adj. EBITDA) (1) o Existing shareholders of Ittella Intl. to be paid $75 million cash consideration and roll - over shares in Tattooed Chef that are valued at $344 million o Completion of transaction expected in Q3 2020 PRO FORMA VALUATION ($ in millions, except per share values) SOURCES & USES ($ in millions) ILLUSTRATIVE POST - TRANSACTION OWNERSHIP BREAKDOWN Tattooed Chef Shareholders 60% Public Shareholders 35% Forum II Management 5% (3) (2) (2) Pro-Forma for Transaction Close Illustrative Share Price $10.00 Pro Forma Shares Outstanding 57.5 Total Equity Value $575 Pro Forma Net Cash $94 Pro Forma Enterprise Value $482 Pro-Forma Enterprise Value / Adj. EBITDA 2020E Adj. EBITDA 27.9x 2021P Adj. EBITDA 15.6x Pro-Forma Enterprise Value / Revenue 2020E Revenue 3.3x 2021P Revenue 2.2x

Growth and margin benchmarking to comparable companies Source: S&P Capital IQ and company filings as of June 10, 2020. 1) Pro Forma for acquisition of Quest. 2) Pro Forma for acquisition of Voortman. 24 CY 2019 – 2021P NET SALES CAGR CY 2019 – 2021P ADJUSTED EBITDA CAGR Health & Wellness Food Median: 11.9% Mid - Cap Food Median: 1.9% 61.7% 55.4% 25.2% 11.9% 8.4% (4.2%) 3.1% 2.8% 2.1% 2.0% 1.9% 1.6% 0.4% (0.6%) (2.2%) (1) (2) 110.1% 72.2% 45.7% 12.2% 4.6% 3.0% 5.2% 5.0% 4.9% 4.8% 3.0% 2.6% 1.7% 1.3% (9.2%) (1) (2) CY 2021P ADJUSTED EBITDA MARGIN 13.9% 19.6% 18.5% 16.1% 10.4% 10.1% 23.9% 21.4% 21.1% 21.1% 19.2% 18.3% 17.3% 11.8% 10.9% Health & Wellness Food Median: 16.1% Mid - Cap Food Median: 19.2% Health & Wellness Food Median: 12.2% Mid - Cap Food Median: 3.0%

Valuation benchmarking to comparable companies Source: S&P Capital IQ and company filings as of June 10, 2020. 1) Pro Forma for acquisition of Quest. 2) Pro Forma for acquisition of Voortman. 25 CY 2021P ADJUSTED EBITDA MULTIPLE Health & Wellness Food Median: 17.1x Mid - Cap Food Median: 11.0x 15.6x 126.8x 50.3x 17.1x 15.5x 12.8x 18.2x 16.0x 13.0x 11.9x 11.0x 10.6x 10.5x 10.2x 9.6x CY 2021P REVENUE MULTIPLE Health & Wellness Food Median: 3.0x Mid - Cap Food Median: 2.1x 2.2x 13.2x 8.1x 3.0x 2.4x 1.7x 3.4x 3.2x 2.5x 2.5x 2.1x 2.0x 2.0x 1.4x 1.1x 61.7% 55.4% 25.2% 11.9% 8.4% (4.2%) (2.2%) 1.6% (0.6%) 2.0% 2.1% 3.1% 2.8% 1.9% 0.4% 0.04x 0.24x 0.32x 0.25x 0.28x (0.41x) (1.53x) 2.03x (4.44x) 1.28x 1.02x 0.66x 0.71x 0.73x 2.54x 2019 – 2021P Revenue Growth Revenue Multiple / Revenue Growth EBITDA Mult. / EBITDA Growth Median: 1.76x EBITDA Mult. / EBITDA Growth Median: 2.51x Revenue Mult. / Revenue Growth Median: 0.25x Revenue Mult. / Revenue Growth Median: 0.73x 110.1% 72.2% 45.7% 4.6% 3.0% 12.2% 2.6% (9.2%) 5.2% 4.8% 3.0% 4.9% 5.0% 1.7% 1.3% 0.14x 1.76x 1.10x 3.68x 5.13x 1.05x 7.11x (1.74x) 2.51x 2.46x 3.65x 2.17x 2.12x 6.08x 7.26x 2019 – 2021P EBITDA Growth EBITDA Multiple / EBITDA Growth (1) (1) (2) (2)

Size benchmarking to previous high growth food company IPOs Source: S&P Capital IQ and Equity research reports . 1) LTM as of 3/31/20. Adjusted EBITDA is non - GAAP measure. Please see page 29 for a reconciliation of Net Income to Adjusted EBITDA for Tattooed Chef. 26 LTM NET SALES $102.1 $162.8 $117.6 $87.9 $74.2 Median LTM Net Sales: $102.8 LTM ADJUSTED EBITDA Median LTM Adj. EBITDA: $6.5 $11.2 $67.8 $16.0 ($3.0) ($19.3) ($ in millions, at IPO) ($ in millions, at IPO) (1) (1)

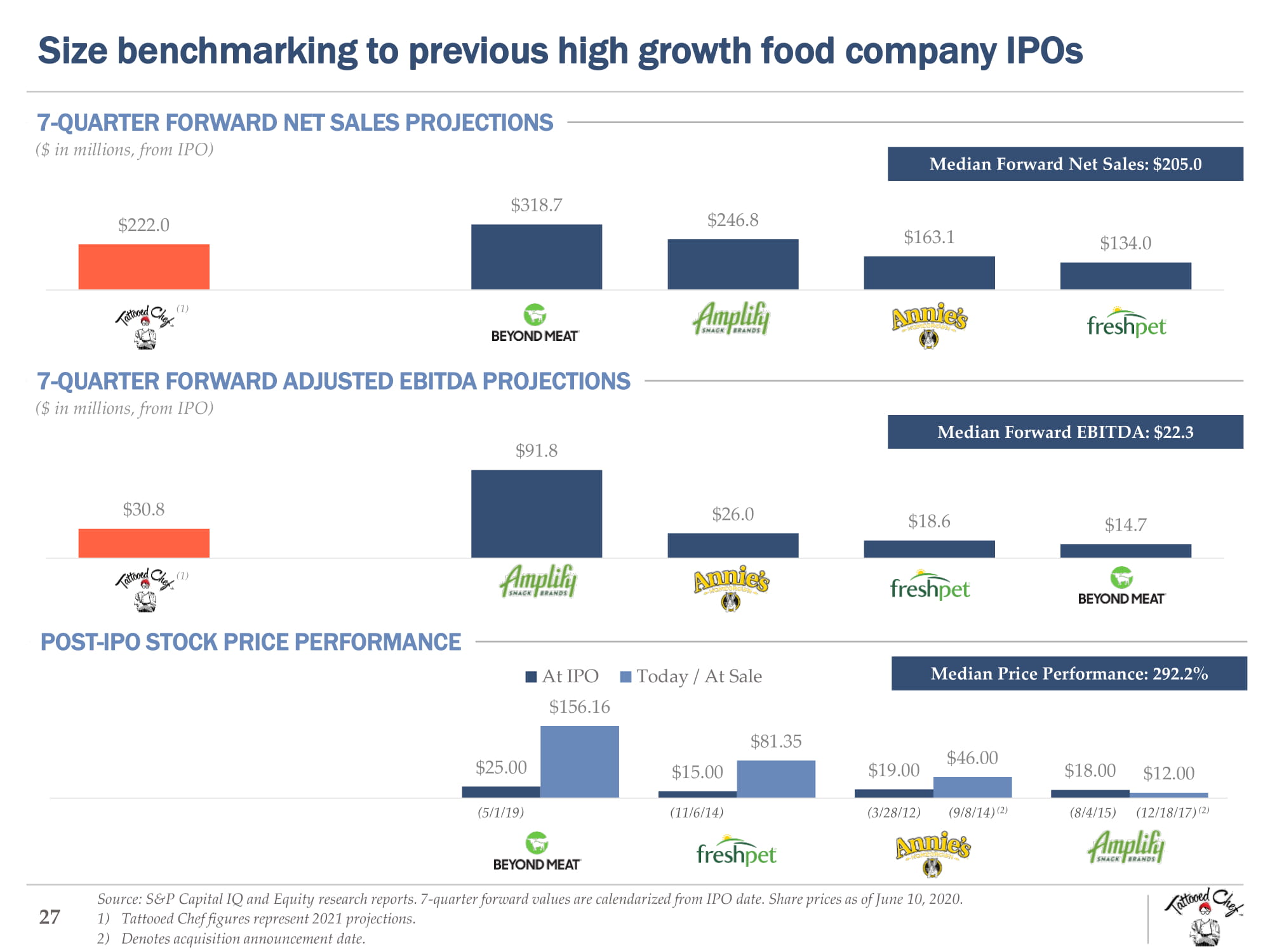

Size benchmarking to previous high growth food company IPOs Source: S&P Capital IQ and Equity research reports . 7 - quarter forward values are calendarized from IPO date. Share prices as of June 10, 2020. 1) Tattooed Chef figures represent 2021 projections. 2) Denotes acquisition announcement date. 27 7 - QUARTER FORWARD NET SALES PROJECTIONS $222.0 $318.7 $246.8 $163.1 $134.0 Median Forward Net Sales: $205.0 7 - QUARTER FORWARD ADJUSTED EBITDA PROJECTIONS Median Forward EBITDA: $22.3 $30.8 $91.8 $26.0 $18.6 $14.7 ($ in millions, from IPO) ($ in millions, from IPO) (1) (1) POST - IPO STOCK PRICE PERFORMANCE Median Price Performance: 292.2% $25.00 $15.00 $19.00 $18.00 $156.16 $81.35 $46.00 $12.00 At IPO Today / At Sale (5/1/19) (11/6/14) (3/28/12) (8/4/15) (9/8/14) (2) (12/18/17) (2)

SECTION IV APPENDIX

29 Non – GAAP reconciliation (unaudited) 1) In FY 2019, the Company was made aware that their third - party cold storage facility failed to ship all goods held at its facilit y to a customer, which resulted in the Company writing off receivables from the customer associated with these unshipped products. This adjustment removes bad debt expense from earning s a s this loss was one - time in nature and related to the actions of a third party. 2) Related Party Expenses consist of expenses primarily associated with activities outside of normal course operations and allow anc es to management that will likely be reduced or eliminated following the proposed transaction. (1) (2) Historical FY Ended 12/31, Historical Q1 Ended 3/31, ($ in thousands) 2018 2019 2019 2020 Net Income (loss) ($8) $5,221 $1,132 $3,959 Tax Expense ($742) ($402) $201 $1,438 Interest Expense $162 $944 $110 $202 Depreciation $310 $565 $57 $102 EBITDA ($278) $6,328 $1,500 $5,701 Inventory Lost by Third Party $0 $373 $0 $0 Related Party Expenses $214 $297 $90 $87 Adjusted EBITDA ($64) $6,998 $1,590 $5,788

30 Case study: Forum Merger I / ConvergeOne 1) Source: ConvergeOne website (https://investor.convergeone.com/home/default.aspx) and Forum Merger/ConvergeOne SEC filings. 20 18E Revenue and EBITDA represents midpoint of ConvergeOne’s 2018 financial expectations ( https://www.sec.gov/Archives/edgar/data/1697152/000119312518158306/d583890dex991.htm ). 2) Based on share purchased for $12.50, right for 1/10th share worth $1.25 and ½ warrant tendered for $0.60 in Forum I’s warrant te nder. ConvergeOne is a leading IT services provider of collaboration and technology solutions for large and medium enterprises Approximately 90%+ services renewal rate for Managed, Cloud and Maintenance (MC&M) 9,000+ customers and 2,700+ employees Experienced management team with 25+ of industry experience including public company experience ($ in millions) Industry with a large and growing total addressable market Company with history of growth and recurring revenue model Company with large cap and deeply entrenched clients Able to utilize company as a platform for future mergers and acquisitions Significant retained ownership by seller $1.3 billion enterprise value representing ~8.3x 2018E adj. EBITDA vs. median comparable valuations >10.0x Transaction funded through combination of newly issued Forum shares and cash including $144 million raised from common stock private placement (“PIPE”) from institutional investors Pre - existing ConvergeOne stockholders led by PE Sponsor Clearlake Capital (“Sellers”) retained approximately 55% at closing Sellers and Forum Management had the potential to receive earnouts if certain criteria were met PF adj. EBITDA targets were $144 million, $155 million and $165 million in 2018, 2019 and 2020 respectively ‒ Earnout consisted of 9.9 million shares and $99 million in cash, of which 100% had been earned by 9/30/18 ‒ Earnout included catch up payments for prior earnouts if the later earnouts were achieved ‒ ConvergeOne was acquired for $1.8 billion by CVC Capital nine months after the merger, or $12.50 per share, netting a return of 43.5% to investors who purchased units in Forum I’s IPO (2) Investment Thesis Transaction Overview Company Overview Financial Overview (1) $492 $601 $816 $919 $1,500 $59 $70 $88 $139 $160 $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 2014 2015 2016 2017 2018E Revenue Adj. EBITDA

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Hempacco Co (HPCO) Receives Nasdaq Non-compliance Notice

- Fed to extend through May 31, 2024, the public comment period for the application by Capital One Financial (COF) to acquire Discover Financial Services (DFS)

- InVitae (NVTA) Enters into Agreement with Labcorp (LH) for Sale of Business

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Definitive AgreementSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share