Form 8-K Forest Road Acquisition For: Feb 09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 9, 2021

Forest Road Acquisition Corp.

(Exact name of registrant as specified in its charter)

| Delaware | 001-39735 | 85-3222090 | ||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

1177 Avenue of the Americas, 5th Floor

New York, New York 10036

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (917) 310-3722

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| þ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Units, each consisting of one share of Class A Common Stock and one-third of one Redeemable Warrant | FRX.U | The New York Stock Exchange | ||

| Class A Common Stock, par value $0.0001 per share | FRX | The New York Stock Exchange | ||

| Warrants, each exercisable for one share of Class A Common Stock for $11.50 per share | FRX WS | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company þ

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 | Entry into a Material Definitive Agreement. |

Merger Agreement

On February 9, 2021, Forest Road Acquisition Corp., a Delaware corporation (“Acquiror” or the “Company”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with BB Merger Sub, LLC, a Delaware limited liability company and direct, wholly-owned subsidiary of Acquiror (“BB Merger Sub”), MFH Merger Sub, LLC, a Delaware limited liability company and direct, wholly-owned subsidiary of Acquiror (“Myx Merger Sub”), The Beachbody Company Group, LLC, a Delaware limited liability company (“Beachbody”), and Myx Fitness Holdings, LLC, a Delaware limited liability company (“Myx”).

Pursuant to the Merger Agreement, and subject to the approval of Acquiror’s shareholders, among other things, at the closing of the transactions contemplated thereby (the “Closing”), upon the terms and subject to the conditions of the Merger Agreement, in accordance with the Delaware General Corporation Law and Delaware Limited Liability Company Act: (1) BB Merger Sub will merge with and into Beachbody, with Beachbody surviving as a wholly-owned subsidiary of Acquiror (the “Surviving Beachbody Entity”); (2) Myx Merger Sub will merge with and into Myx, with Myx surviving as a wholly-owned subsidiary of Acquiror; and (3) the Surviving Beachbody Entity will merge with and into Acquiror, with Acquiror surviving such merger (the “Surviving Company”, and such mergers the “Business Combination”). Upon consummation of the Business Combination all of the outstanding Beachbody and Myx equity interests will be converted into the right to receive equity interests in the Surviving Company, except that certain Myx equity interests will be exchanged for cash consideration and will be cancelled, in each case pursuant to the terms of, and subject to the adjustments set forth in, the Merger Agreement. The Closing is subject to the satisfaction or waiver of certain closing conditions contained in the Merger Agreement.

Other Agreements

The Merger Agreement contemplates the execution of various additional agreements and instruments on or before the Closing including, among others, the following:

Sponsor Agreement

Concurrently with the execution of the Merger Agreement, Acquiror, Forest Road Acquisition Sponsor LLC, a Delaware limited liability company (“Sponsor”), and Beachbody entered into a support agreement (the “Sponsor Agreement”), whereby Sponsor agreed to, among other things, (a) vote in favor of approving the Merger Agreement and the transactions contemplated thereby and (b) waive any adjustment to the conversion ratio with respect to the Acquiror shares of Class B common stock (the “Sponsor Shares”) held by Sponsor as set forth in the Acquiror’s Amended and Restated Certificate of Incorporation, in each case, subject to the terms and conditions set forth in the Sponsor Agreement.

Additionally, pursuant to the terms of the Sponsor Agreement, 50% of the Sponsor Shares will be unvested, and 10% of the unvested Sponsor Shares will vest in upon the occurrence of the Surviving Company’s last sale price on the New York Stock Exchange exceeding each of the following price-per-share thresholds for any 20 trading days within any consecutive 30-day trading period, commencing at least 180 days after the date of the Closing (the “Closing Date”): $12.00, $13.00, $14.00, $15.00 and $16.00 (each, a “Price Threshold”). Subject to the terms and conditions of the Sponsor Agreement, upon the consummation of a transaction involving a change of control at the Surviving Company on or prior to the date that is the tenth anniversary of the Closing Date, if the consideration payable to stockholders of the Surviving Company consists of (x) cash and the price per share payable to holders of Sponsor Shares exceeds any of the Price Thresholds, such Price Threshold will be deemed satisfied and the related portion of unvested Sponsor Shares will be deemed vested, and the holders of such Sponsor Shares will be eligible to participate in such change of control transaction; and (y) equity securities of the surviving company or one of its affiliates that are, or after the closing of such transaction, will be, publicly traded, any unvested Sponsor Shares shall be converted into equity securities in the surviving company with similar rights, including vesting based on applicable Price Thresholds. Any Sponsor Shares that do not vest 10 years after Closing will be forfeited.

1

Support Agreements

Additionally, separate support agreements with terms similar to those of the Sponsor Agreement (excluding the vesting of Sponsor Shares), were entered into by certain of Beachbody’s and Myx’s equity holders (the “Support Agreements”) concurrently with the execution of the Merger Agreement.

PIPE Financing

Concurrently with the execution of the Merger Agreement, on February 9, 2021, the Acquiror entered into subscription agreements (each a “Subscription Agreement” and collectively the “Subscription Agreements”) with certain investors (the “PIPE Investors”). In accordance with these Subscription Agreements, the PIPE Investors have agreed to subscribe for and purchase, and the Acquiror has agreed to issue and sell to the PIPE Investors, an aggregate of 22,500,000 shares of Acquiror Class A Common Stock at a price of $10.00 per share for aggregate gross proceeds of $225,000,000. The shares of Acquiror Class A Common Stock to be issued pursuant to the Subscription Agreements have not been registered under the Securities Act in reliance upon the exemption provided in Section 4(a)(2) of the Securities Act. The Acquiror granted the PIPE Investors certain registration rights in connection with the PIPE financing, which financing is contingent upon, among other things, the Closing.

A copy of the Merger Agreement, the form of the Subscription Agreements, the Sponsor Agreement and the Support Agreements will be filed by amendment on Form 8-K/A to this Current Report within four business days of the date hereof as Exhibit 2.1, Exhibit 10.1, Exhibit 10.2 and Exhibit 10.3, respectively, and the foregoing description of each of the Merger Agreement, Subscription Agreements, Sponsor Agreement and Support Agreements is qualified in its entirety by reference thereto.

| Item 3.02 | Unregistered Sales of Equity Securities. |

The disclosure set forth above in Item 1.01 of this Current Report on Form 8-K with respect to the issuance of the Company’s common stock pursuant to the Subscription Agreements is incorporated by reference herein. The common stock issuable pursuant to the Subscription Agreements will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act and/or Regulation D promulgated thereunder.

| Item 7.01 | Regulation FD Disclosure. |

On February 10, 2021, the Company issued a press release announcing that on February 9, 2021, it executed the Merger Agreement. A copy of the press release is furnished hereto as Exhibit 99.1.

Furnished as Exhibit 99.2 hereto is the investor presentation that will be used by the Company in connection with the Business Combination.

On February 10, 2021, the Company will hold a conference call to discuss the Business Combination at 9:00 am Eastern time on February 10, 2021. A copy of the script is furnished hereto as Exhibit 99.3.

The information in this Item 7.01 and Exhibits 99.1, 99.2 and 99.3 attached hereto will not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor will it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

Important Information About the Business Combination and Where to Find It

In connection with the proposed Business Combination, the Company intends to file a preliminary proxy statement/prospectus and a definitive proxy statement/prospectus with the U.S. Securities and Exchange Commission. The Company’s stockholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus and the amendments thereto and the definitive proxy statement/prospectus and documents incorporated by reference therein filed in connection with the Business Combination, as these materials will contain important information about Acquiror, Beachbody, and Myx and the Business Combination. When available, the definitive proxy statement/prospectus and other relevant materials for the Business Combination will be mailed to stockholders of the Company as of a record date to be established for voting on the Business Combination. Stockholders of the Company will also be able to obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement/prospectus and other documents filed with the SEC that will be incorporated by reference therein, without charge, once available, at the SEC’s web site at www.sec.gov, or by directing a request to: Forest Road Acquisition Corp., 1177 Avenue of the Americas, 5th Floor, New York, New York 10036, Attention: Keith L. Horn.

2

Participants in the Solicitation

The Company and its directors and executive officers may be deemed participants in the solicitation of proxies from the Company’s stockholders with respect to the Business Combination. A list of the names of those directors and executive officers and a description of their interests in the Company is contained in the Registration Statement on Form S-1, which was filed by the Company with the SEC on November 27, 2020 and is available free of charge at the SEC’s web site at www.sec.gov, or by directing a request to Forest Road Acquisition Corp., 1177 Avenue of the Americas, 5th Floor, New York, New York 10036, Attention: Keith L. Horn. Additional information regarding the interests of such participants will be contained in the proxy statement/prospectus for the Business Combination when available.

Beachbody, Myx and their respective directors and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of the Company in connection with the Business Combination. A list of the names of such directors and executive officers and information regarding their interests in the Business Combination will be included in the proxy statement/prospectus for the proposed Business Combination when available.

Forward-Looking Statements

This Current Report on Form 8-K contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed Business Combination between Beachbody and the Company, including statements regarding the anticipated benefits of the Business Combination, the anticipated timing of the Business Combination n, future financial condition and performance of Beachbody and expected financial impacts of the Business Combination (including future revenue, pro forma equity value and cash balance), the satisfaction of closing conditions to the Business Combination, the PIPE transaction, the level of redemptions of the Company’s public stockholders and the products and markets and expected future performance and market opportunities of Beachbody. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this Current Report on Form 8-K, including but not limited to: (i) the risk that the Business Combination may not be completed in a timely manner or at all, which may adversely affect the price of the Company’s securities, (ii) the risk that the Business Combination may not be completed by the Company’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by the Company, (iii) the failure to satisfy the conditions to the consummation of the Business Combination, including the approval of the Merger Agreement by the stockholders of the Company, the satisfaction of the minimum trust account amount following any redemptions by the Company’s public stockholders and the receipt of certain governmental and regulatory approvals, (iv) the lack of a third party valuation in determining whether or not to pursue the proposed Business Combination, (v) the inability to complete the PIPE transaction, (vi) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement, (vii) the effect of the announcement or pendency of the Business Combination on Beachbody’s business relationships, operating results, and business generally, (viii) risks that the proposed Business Combination disrupts current plans and operations of Beachbody, (ix) the outcome of any legal proceedings that may be instituted against Beachbody or against the Company related to the Merger Agreement or the proposed Business Combination, (x) the ability to maintain the listing of the Company’s securities on a national securities exchange, (xi) changes in the competitive and regulated industries in which Beachbody and Myx operate, variations in operating performance across competitors, changes in laws and regulations affecting the business of Beachbody and Myx and changes in the combined capital structure, (xii) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed Business Combination, and identify and realize additional opportunities, (xiii) the risk of downturns and a changing regulatory landscape in the highly competitive residential real estate industry, and (ix) costs related to the Business Combination and the failure to realize anticipated benefits of the Business Combination or to realize estimated pro forma results and underlying assumptions, including with respect to estimated shareholder redemptions. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the "Risk Factors" section of the registration statement on Form S-4 and other documents to be filed by the Company from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Beachbody and the Company assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise. None of Beachbody, Myx or the Company gives any assurance that Beachbody, Myx or the Company, or the combined company, will achieve its expectations.

3

No Offer or Solicitation

This Current Report on Form 8-K will not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination. This Current Report on Form 8-K will also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor will there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities will be made except by means of a prospectus meeting the requirements of section 10 of the Securities Act, or an exemption therefrom.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

The following exhibit is filed herewith:

| Exhibit No. | Description of Exhibits | |

| 99.1 | Press Release, dated February 10, 2021. | |

| 99.2 | Investor Presentation. | |

| 99.3 | Script from Conference Call to be held by the Company on February 10, 2021. |

4

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: February 10, 2021

| FOREST ROAD ACQUISITION CORP. | |||

| By: | /s/ Keith L. Horn | ||

| Name: | Keith L. Horn | ||

| Title: | Chief Executive Officer | ||

5

Exhibit 99.1

The Beachbody Company, A Leader in Digital Fitness Streaming and Nutrition Solutions, to Become Publicly Traded Company

The Beachbody Company, Forest Road Acquisition Corp. and Myx Fitness Enter Three-Way Merger

The Transaction Values the Combined Company at $2.9 Billion and is Expected to Add Over $420 Million of Cash to the Balance Sheet, Including a Committed PIPE of $225 Million, Led by Institutional Investors Including Fidelity Management & Research Company LLC and Fertitta Capital

With This Transaction, Beachbody Will Be Poised to Scale its Growing Platform of Over 2.6 Million Paid Digital Subscribers into the Connected Fitness Space While Also Accelerating International Expansion, Enhanced Innovation and Opportunistic M&A

SANTA MONICA, CA and NEW YORK, NY – February 10, 2021 – The Beachbody Company Group, LLC (“The Beachbody Company,” “Beachbody” or “the Company”) announced today its intention to become a public company by entering into a definitive three-way merger agreement with Forest Road Acquisition Corp. (NYSE: FRX) (“Forest Road”), a publicly traded special purpose acquisition company, and Myx Fitness Holdings, LLC (“Myx Fitness” or “Myx”), an at-home connected fitness platform featuring an industry leading bike and home studio.

Upon closing of the business combination transaction, The Beachbody Company will be the parent company of three premium content and technology-driven businesses: Beachbody On Demand (BOD), Openfit and Myx. The transaction is expected to close in the second quarter of 2021 and the combined company will be listed on the NYSE under a new ticker symbol, “BODY”.

Beachbody will continue to be led by Carl Daikeler, Beachbody’s co-founder, Chairman and Chief Executive Officer and Jon Congdon, co-founder of Beachbody and CEO of Openfit. Forest Road’s strategic advisor Kevin Mayer, former CEO of TikTok and visionary leader behind Disney+, will join the combined company’s Board of Directors. Beachbody management and shareholders are rolling over 100% of their equity stake and will own approximately 84% of the pro forma business at close.

Combined Company Overview

As a leader in digital fitness streaming and nutrition solutions, Beachbody is well-positioned to capitalize on the increased demand for at-home health and wellness offerings and will further invest to drive accelerated customer acquisition, expand internationally and pursue attractive, high-return M&A opportunities.

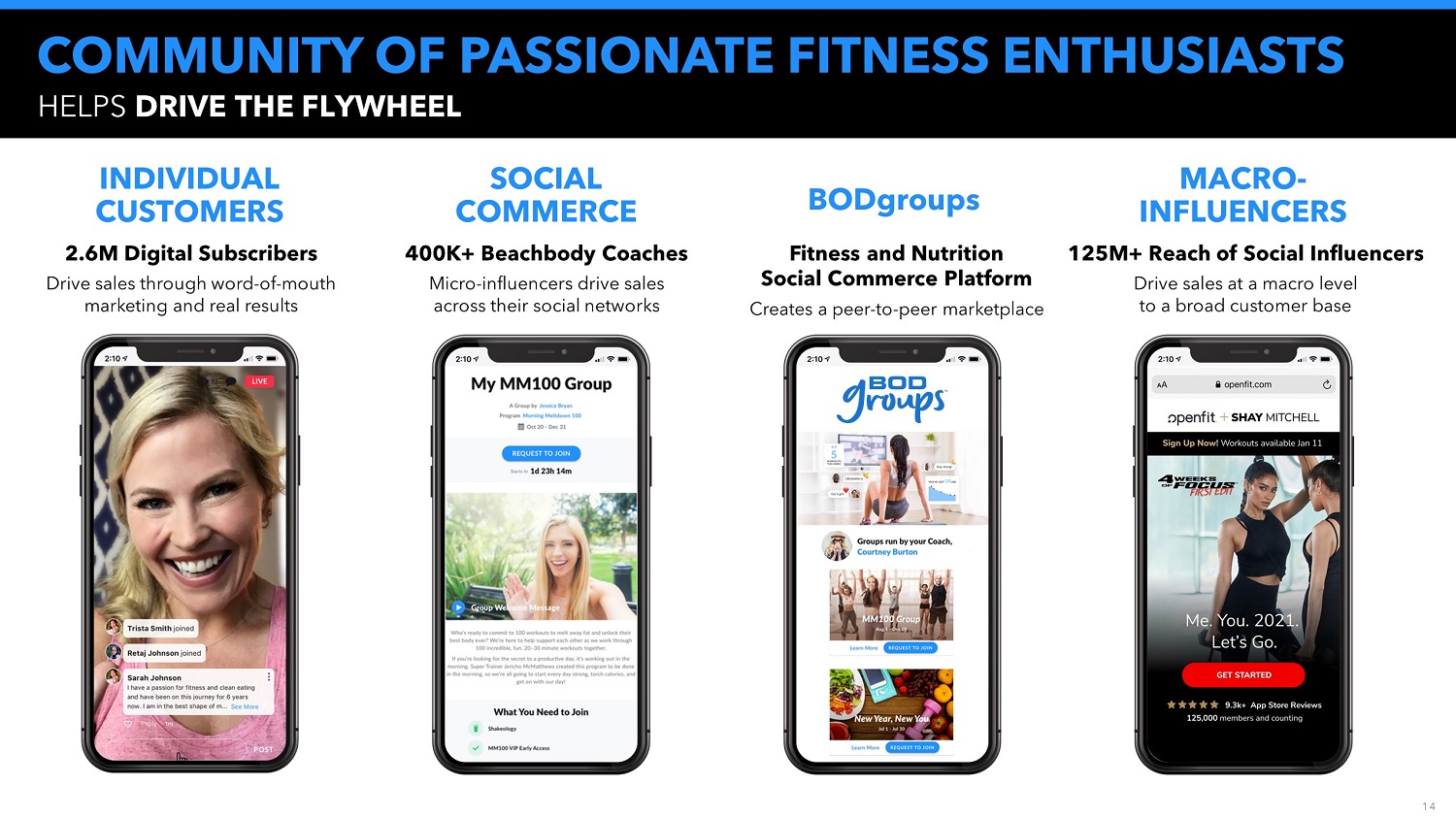

With brands such as P90X®, INSANITY® and 21 Day Fix®, Beachbody has consistently expanded its market share over the past two decades through its proven model of integrating the most comprehensive library of premium fitness content with easy-to-follow nutrition guidance and supplements. Through the BOD and Openfit platforms, the Company has developed a diverse offering of live and on-demand content as well as nutrition solutions that reach a passionate and loyal community, including more than 2.6 million paid digital subscribers.

With the addition of Myx, the Company's portfolio will expand to include a connected fitness offering that provides a holistic and innovative on and off-bike solution with workouts that are personalized based on machine learning and heart rate data. With an attractive price point of $1,299, Myx sold over 27,000 bikes in its first year of operation, and has a highly engaged customer base of users who complete an average of 15 workouts each month. In addition, the merger with Myx will further leverage the scale of The Beachbody Company's platform as it unlocks synergies across distribution, marketing and content creation for all three of its brands.

“We are excited to partner with Forest Road and Myx Fitness, and are humbled by the proven team of executives and industry icons who have stepped forward to support our shared vision,” said Mr. Daikeler. “We have seen incredible digital growth in recent years, which was further fueled in 2020 by a structural and lasting shift in how people embrace health and fitness. With the acquisition of Myx, cutting edge technology meets best-in-class streaming content -- and we will continue to redefine the at-home fitness experience as we pair the integrated hardware, science-based heart rate coaching and personalized smart recommendations behind Myx with Beachbody and Openfit’s best-in-class content libraries, track record of content innovation and vast network.”

Mr. Mayer commented: “Beachbody’s rapid subscriber growth is grounded in the concept of community and accountability with a mission-driven focus that capitalizes on the huge growth in the health and wellness space. The Company's engagement and retention metrics validate the quality and depth of its content library and direct-to-consumer (DTC) technology capabilities. I see many parallels at Beachbody with the work we did at Disney, where we aggressively accelerated our digital transformation and leveraged our content to build Disney+, ESPN+ and Hulu. In addition to its significant organic growth potential, the scale and differentiation of Beachbody’s platform will allow us to pursue attractive M&A opportunities in this highly fragmented ecosystem, which will enable us to increase our market share globally and diversify our product offering. I’m excited to join the board to help further fuel growth and value creation for the company and its shareholders.”

“When we raised our SPAC, we were determined to find a company with a strong, proven business model and significant growth potential where we could add value from our experience in the creation and monetization of premium content. Beachbody is a perfect fit with those objectives,” said Tom Staggs, former COO & CFO of Disney and Forest Road board member and strategic advisory committee chair. “We are fortunate to have identified a business poised to benefit from three powerful market trends: digital subscriptions, connected fitness and growing consumer demand for health and wellness. These trends give us even more confidence that we have found an extremely attractive investment for our shareholders. Beachbody has always leveraged its fitness content to acquire customers profitably and with the proceeds of this transaction, Carl and his team at Beachbody can invest to significantly accelerate customer acquisition and financial growth for years to come.”

Combined Company Highlights

| ● | A diverse portfolio that appeals to a broad consumer base through a holistic approach that brings together at-home, digitally enabled fitness, nutrition and community |

| ● | Generated 2020 pro forma revenue of $880 million across BOD, Openfit and Myx, which achieved $30 million of revenue in its first year of operations |

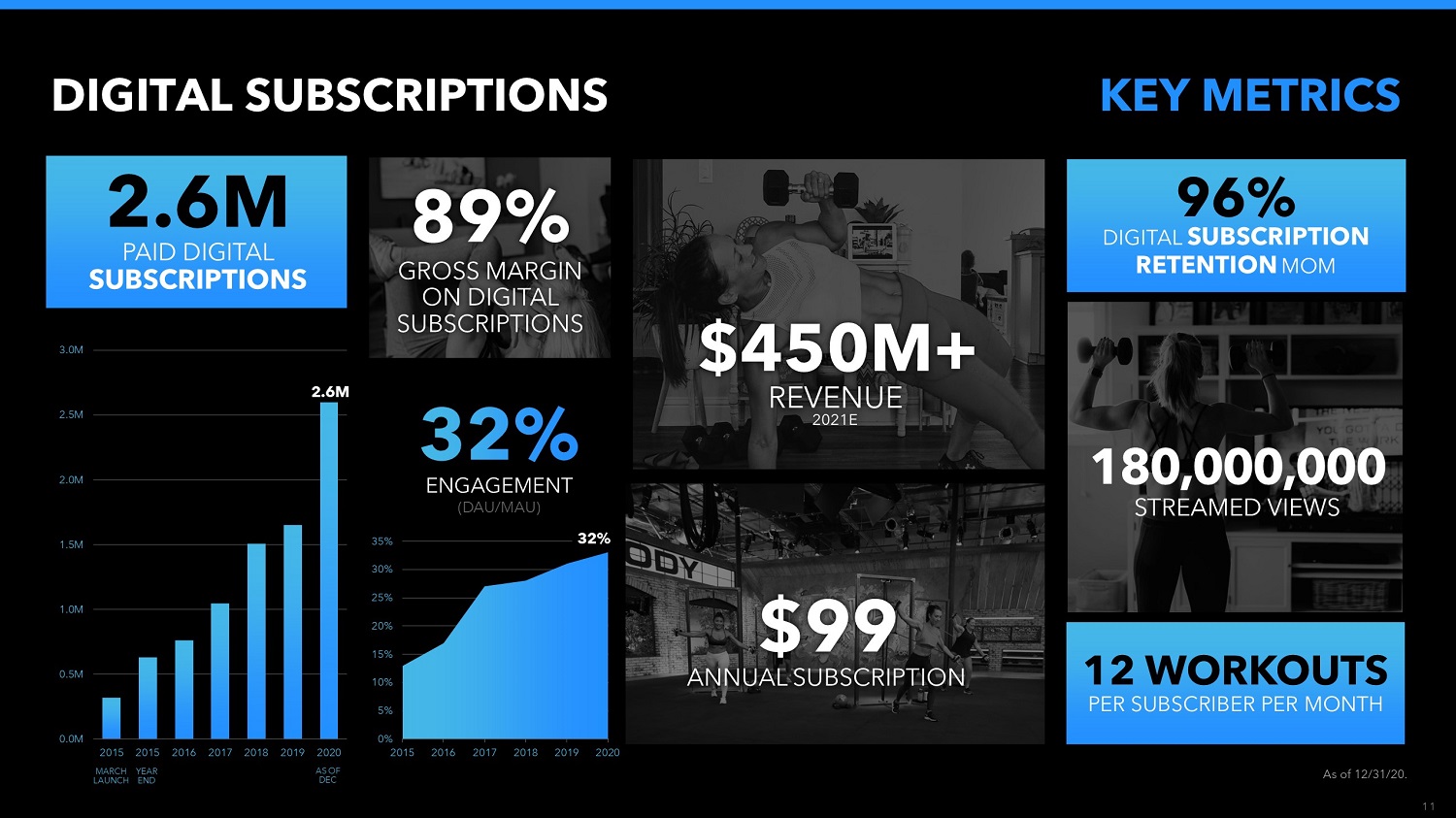

| ● | 2.6 million paid digital fitness subscribers with 96% month over month retention |

| ● | Industry-leading 89% gross margins on digital subscription revenue across all three brands |

| ● | The deepest library of premium fitness content in the industry that generates more than 180 million views annually |

| ● | A premium portfolio of branded nutrition products that are scientifically developed, clinically tested and strategically paired with fitness content for a holistic health and wellness experience |

| ● | Scalable platform that enables synergies across distribution, marketing and content creation |

2

| ● | Management team with over 22 years of experience creating content, acquiring customers and delivering substantial revenue and EBITDA |

| ● | Well-positioned to unlock accelerated growth and expects to achieve compound annual revenue growth of 30% over the next 5 years |

Transaction Overview

In addition to the approximately $300 million held in Forest Road’s trust account (assuming no redemptions), institutional investors, including Fidelity Management & Research Company LLC and Fertitta Capital, have committed to a private placement (“PIPE”) of $225 million to purchase shares of Class A common stock of the combined company that will close concurrently with the business combination.

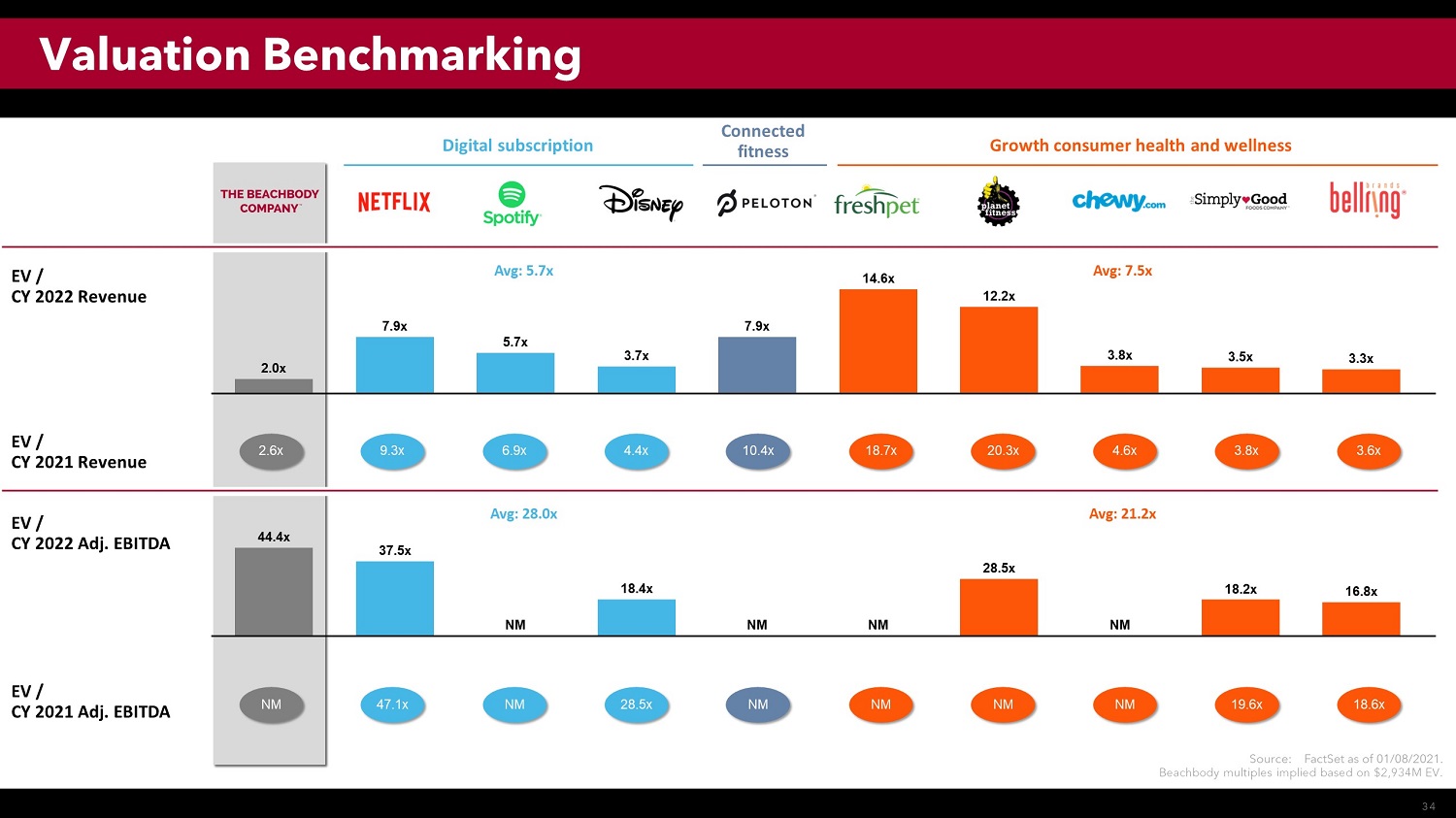

The transaction implies a pro forma enterprise value for Beachbody of approximately $2.9 billion, or 2.0x 2022 estimated revenue. It is anticipated that the combined company will have over $420 million of unrestricted cash on the balance sheet, assuming no redemptions from the trust account, to fund its future growth plans.

The Board of Directors of Forest Road, and the Board of Managers of each of Beachbody and Myx have unanimously approved the transaction, and holders representing a majority of Beachbody equity interests and a majority of Myx equity interests have signed voting and support agreements agreeing to vote for the transaction. In addition to Beachbody and Myx equity holder approvals, the transaction will require the approval of the stockholders of Forest Road, and is subject to other customary closing conditions, including the receipt of certain regulatory approvals.

Additional information about the proposed transaction, including a copy of the merger agreement and investor presentation, will be provided in a Current Report on Form 8-K to be filed with the Securities and Exchange Commission and will be available at www.sec.gov.

Advisors

The Raine Group LLC (“Raine”) acted as exclusive financial advisor to Beachbody. Credit Suisse (USA) LLC (“Credit Suisse”) is acting as lead capital markets advisor to Beachbody. BofA Securities, Inc. is acting as an additional capital markets advisor to Beachbody. Latham & Watkins LLP and Cozen O’Connor C.P. are acting as legal advisors to Beachbody.

Credit Suisse is acting as lead placement agent and Raine and Cantor Fitzgerald & Co are acting as placement agents on the private placement. Paul, Weiss, Rifkind, Wharton & Garrison LLP is acting as legal advisor to Credit Suisse on the private placement.

Guggenheim Securities, LLC is acting as lead financial and capital markets advisor to Forest Road. Greenhill & Co, LLC is also acting as financial advisor to Forest Road. Robert W. Baird & Co. Incorporated is acting as an additional capital markets advisor to Forest Road. Kirkland & Ellis LLP and Ellenoff Grossman & Schole LLP are acting as legal advisors to Forest Road.

Greenberg Traurig, LLP is acting as legal advisor to Myx Fitness.

3

Investor Conference Call Information

Forest Road and Beachbody will host an investor conference call to discuss the proposed transaction on February 10, 2021 at 9:00 am Eastern time.

Interested parties may listen to the prepared remarks call via telephone by dialing 1-877-407-3982 or, for international callers, 1-201-493-6780. For those who are unable to listen to the live call, a replay will be available until 11:59 pm ET on February 24, 2021 and can be accessed by dialing 1-844-512-2921, or for international callers, 1-412-317-6671 and entering replay Pin number: 13716416. A webcast of the call will also be available on the Forest Road website at https://www.spacroadone.com.

The pre-recorded conference call webcast, a related investor presentation with more detailed information regarding the proposed transaction and a transcript of the investor call will also be available at https://www.spacroadone.com/. The investor presentation which will be furnished today to the SEC, can be viewed at the SEC’s website at www.sec.gov.

About The Beachbody Company

Headquartered in Santa Monica, The Beachbody Company is a worldwide leader in health and fitness, with a 22-year track record of creating innovative content and powerful brands. With 2.6 million paid digital fitness subscribers across two platforms, a nationwide peer-support system of over 400,000 influencers and coaches, and a premium portfolio of branded nutrition products, Beachbody is a leading holistic health and wellness company with over $1 billion in revenue projected in 2021. The Beachbody Company is the parent company to the Beachbody On Demand platform, the fast-growing DTC platform Openfit, which launched in 2019 and features 400+ live trainer-led group fitness classes per week with real-time feedback, and following the merger, Myx Fitness, a connected fitness company which offers science-driven, highly personalized heart rate-based training. For more information, please visit TheBeachbodyCompany.com.

With the highest-rated premium content, and a rating of 4.9 out of 5 stars in the App Store, the Beachbody digital model integrates programs such as P90X®, INSANITY®, 21 Day Fix®, Body Beast®, PiYo®, 80 Day Obsession®, Transform:20® and LIIFT4® on the Beachbody On Demand streaming service with proprietary meal planning strategies and clinically-proven nutrition supplements that are developed by top scientists and fitness and nutrition experts – including the Shakeology line of premium, superfood supplements— and a network of social influencer coaches that delivers motivation and accountability to help customers achieve and maintain healthy results. Featuring a broad range of the nation's most popular fitness and weight-loss solutions, the Company offers more than 2,300 titles of streamed fitness content (in English and Spanish) with 84 programs for beginners, extreme, dance, yoga, pre/postnatal, kids, etc.

Openfit is a digital streaming platform that integrates fitness, nutrition and wellness together in one place. Openfit provides world-class fitness programs with live trainer-led and on-demand workouts such as Xtend Barre and 4 Weeks of Focus with Shay Mitchell, designed to help subscribers reach any goal with personalized nutrition plans and tracking. Openfit acquired Ladder in 2020, the sports nutrition company founded by LeBron James and Arnold Schwarzenegger. Ladder product is NSF Certified for Sport®, a third-party certification trusted by all major sports governing bodies and verifies that products do not contain any of approximately 270+ substances banned by major athletic organizations and that the contents of the product match what is printed on the label.

4

About Myx Fitness

Myx Fitness delivers a revolutionary and personalized solution for its members to make connected fitness part of their daily lives. The brand's cornerstone products, The MYX and The MYX Plus, offer professional-quality equipment at an affordable price, hundreds of on-demand classes, combined with expert coaching on a digital platform, designed to improve endurance, strength, mobility and flexibility. Using science-backed methods, Myx Fitness utilizes proprietary heart rate technology and cross-training, brought to life through positive coaching, to deliver lasting results. Myx Fitness was founded in 2016 by Brad Palmer and the team at Palm Ventures, his private investment firm focused on incubating market disrupting businesses.

The MYX and The MYX Plus include a professional-grade Star Trac Stationary Bike, a 21.5" interactive tablet and a Polar OH1 Heart Rate Monitor. The Plus package also includes three sets of SPRI dumbbells, a kettlebell, a resistance band, a 24" foam roller and two mats. Myx Fitness uses science-backed, heart rate-based 1:1 training technology to customize every workout to maximize results, ensure lasting results and avoid wasted time and energy. Myx Fitness is available starting at $1,299 with delivery nationwide in approximately three to five weeks depending on location and scheduling availability.

About Forest Road Acquisition Corp.

Forest Road Acquisition Corp., a blank check company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses, raised $300 million in November 2020 and its securities are listed on the NYSE under the tickers “FRX,” “FRX.U” and “FRX WS.” The Forest Road team includes three former Disney senior executives — Tom Staggs, director and Chairperson of the Strategic Advisory Committee, Kevin Mayer, strategic advisor and Salil Mehta, Chief Financial Officer — and is strengthened by the strategic connectivity and deal-making expertise of directors, officers and strategic advisors like Shaquille O'Neal, Peter Schlessel, Keith Horn, Sheila Stamps, Teresa Miles Walsh and Martin Luther King III. For more information, please visit https://www.spacroadone.com/.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Beachbody and Forest Road, including statements regarding the anticipated benefits of the transaction, the anticipated timing of the transaction, future financial condition and performance of Beachbody and expected financial impacts of the transaction (including future revenue, pro forma equity value and cash balance), the satisfaction of closing conditions to the transaction, the PIPE transaction, the level of redemptions of FRX’s public stockholders and the products and markets and expected future performance and market opportunities of Beachbody. These forward-looking statements generally are identified by the words "believe," "project," "expect," "anticipate," "estimate," "intend," "strategy," "future," "opportunity," "plan," "may," "should," "will," "would," "will be," "will continue," "will likely result" and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect the price of FRX’s securities, (ii) the risk that the transaction may not be completed by FRX’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by FRX, (iii) the failure to satisfy the conditions to the consummation of the transaction, including the approval of the merger agreement by the stockholders of FRX, the satisfaction of the minimum trust account amount following any redemptions by FRX’s public stockholders and the receipt of certain governmental and regulatory approvals, (iv) the lack of a third party valuation in determining whether or not to pursue the proposed transaction, (v) the inability to complete the PIPE transaction, (vi) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement, (vii) the effect of the announcement or pendency of the transaction on Beachbody’s business relationships, operating results, and business generally, (viii) risks that the proposed transaction disrupts current plans and operations of Beachbody, (ix) the outcome of any legal proceedings that may be instituted against Beachbody or against FRX related to the merger agreement or the proposed transaction, (x) the ability to maintain the listing of FRX’s securities on a national securities exchange, (xi) changes in the competitive and regulated industries in which Beachbody and Myx operate, variations in operating performance across competitors, changes in laws and regulations affecting the business of Beachbody and Myx and changes in the combined capital structure, (xii) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities, (xiii) the risk of downturns and a changing regulatory landscape in the highly competitive residential real estate industry, and (ix) costs related to the transaction and the failure to realize anticipated benefits of the transaction or to realize estimated pro forma results and underlying assumptions, including with respect to estimated shareholder redemptions. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the "Risk Factors" section of the registration statement on Form S-4 discussed below and other documents filed by FRX from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Beachbody and FRX assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise. None of Beachbody, Myx or FRX gives any assurance that Beachbody, Myx or FRX, or the combined company, will achieve its expectations.

5

Important Information and Where to Find It

This press release relates to a proposed transaction among The Beachbody Company, Forest Road Acquisition Corp., and Myx Fitness. This press release does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. FRX intends to file a registration statement on Form S-4 with the SEC, which will include a document that serves as a prospectus and proxy statement of FRX, referred to as a proxy statement/prospectus. A proxy statement/prospectus will be sent to all FRX shareholders. FRX also will file other documents regarding the proposed transaction with the SEC. Before making any voting decision, investors and security holders of FRX are urged to read the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transaction.

Investors and security holders will be able to obtain free copies of the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by FRX through the website maintained by the SEC at www.sec.gov.

Participants in the Solicitation

FRX and its directors and executive officers may be deemed to be participants in the solicitation of proxies from FRX’s shareholders in connection with the proposed transaction. A list of the names of such directors and executive officers and information regarding their interests in the business combination will be contained in the proxy statement/prospectus when available. You may obtain free copies of these documents as described in the preceding paragraph.

Contacts:

Investors

For the Beachbody Company: ICR - [email protected]

For Forest Road: [email protected]

Media

For The Beachbody Company: ICR - [email protected]

For Forest Road: [email protected]

6

Exhibit 99.2

THE LEADING HOLISTIC HEALTH AND WELLNESS PLATFORM THAT DELIVERS RESULTS 1

This presentation (the “Presentation”) contemplates a business combination (the “Transaction”) involving Forest Road Acquisit ion Corp. (“FRX”), Beachbody, LLC (“Beachbody”) and MYX Fitness LLC. (“MYX,” and, together with Beachbody, the “Target Companies” a nd, together FRX and Beachbody following the Transaction, “The Beachbody Company”). No Offer or Solicitation This Presentation is for informational purposes only and is neither an offer to sell or purchase, nor a solicitation of an of fer to sell, buy or subscribe for any securities, nor is it a solicitation of any vote in any jurisdiction pursuant to the propos ed Transaction or otherwise, nor shall there be any sale, issuance or transfer or securities in any jurisdiction in contravention of applicable law. Forward Looking Statements Certain statements made in this Presentation are “forward looking statements” within the meaning of the “safe harbor” provisi ons of the United States Private Securities Litigation Reform Act of 1995. When used in this Presentation, the words “estimates,” “ projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose” and variati ons of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forwar d - looking statements. These forward - looking statements and factors that may cause such differences include, without limitation, [FRX’s and the Target Companies’ ina bility to enter into a definitive agreement with respect to the Transaction or to complete the transactions contemplated ther eby ; matters discovered by the parties as they complete their respective due diligence investigation of the other; the inability to recognize the antici pat ed benefits of the proposed business combination, which may be affected by, among other things, the amount of cash available fol lowing any redemptions by FRX shareholders; the ability to meet the listing standards of The New York Stock Exchange following the consummation of the tra nsactions contemplated by the proposed business combination; costs related to the proposed business combination; expectations wi th respect to future operating and financial performance and growth, including the timing of the completion of the proposed business combin ati on; The Beachbody Company’s ability to execute its business plans and strategy; and other risks and uncertainties described f rom time to time in filings with the U.S. Securities and Exchange Commission. Readers are cautioned not to place undue reliance upon any forward - loo king statements, which speak only as of the date made. FRX, Beachbody and MYX expressly disclaims any obligations or undertak ing to release publicly any updates or revisions to any forward - looking statements contained herein to reflect any change in the expectations o f FRX, Beachbody or MYX with respect thereto or any change in events, conditions or circumstances on which any statement is b ase d. Actual results, performance or achievements may differ materially, and potentially adversely, from any projections and forwar d - l ooking statements and the assumptions on which those forward - looking statements are based. There can be no assurance that the d ata contained herein is reflective of future performance to any degree. You are cautioned not to place undue reliance on forward - looking statements as a predictor of future performance as projected financial information and other information are based on estimates and assu mpt ions that are inherently subject to various significant risks, uncertainties and other factors, many of which are beyond our control. All information se t forth herein speaks only as of the date hereof in the case of information about FRX, Beachbody and MYX or the date of such inf ormation in the case of information from persons other than FRX, Beachbody or MYX, and we disclaim any intention or obligation to update any forward - loo king statements as a result of developments occurring after the date of this Presentation. Projected and estimated numbers a re used for illustrative purpose only, are not forecasts and may not reflect actual results. Use of Projections This Presentation contains financial forecasts. These unaudited financial projections have been provided by the Target Compan ies ’ management, and the Target Companies’ respective independent auditors have not audited, reviewed, compiled, or performed an y p rocedures with respect to the unaudited financial projections for the purpose of their inclusion in this Presentation and, accordingly, do n ot express an opinion or provide any other form of assurance with respect thereto for the purpose of this Presentation. These un aud ited financial projections should not be relied upon as being necessarily indicative of future results. The inclusion of the unaudited financial project ion s in this Presentation is not an admission or representation by FRX, Beachbody or MYX that such information is material. The ass umptions and estimates underlying the unaudited financial projections are inherently uncertain and are subject to a wide variety of significant busi nes s, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the unaudited financial projections. There can be no assurance that the prospective results are indicative of the future performance of The Beachbody Co mpanies or that actual results will not differ materially from those presented in the unaudited financial projections. Inclus ion of the unaudited financial projections in this Presentation should not be regarded as a representation by any person that the results contained in the u nau dited financial projections will be achieved. Industry and Market Data The information contained herein also includes information provided by third parties, such as market research firms. None of FRX , Beachbody, MYX or their respective affiliates and any third parties that provide information to FRX, Beachbody or MYX, such as market research firms, guarantee the accuracy, completeness, timeliness or availability of any information. None of FRX, Beachbody, MYX or their res pec tive affiliates and any third parties that provide information to FRX, Beachbody or MYX, such as market research firms, are r esp onsible for any errors or omissions (negligent or otherwise), regardless of the cause, or the results obtained from the use of such content. None of FR X, Beachbody, MYX or their respective affiliates give any express or implied warranties, including, but not limited to, any warr ant ies of merchantability or fitness for a particular purpose or use, and they expressly disclaim any responsibility or liability for direct, indirect, in cid ental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees or losses (including los t income or profits and opportunity costs) in connection with the use of the information herein. Additional Information and Where to Find It A full description of the terms of the Transaction will be provided in a proxy statement/prospectus for FRX’s shareholders to be filed with the U.S. Securities and Exchange Commission (the “SEC”). FRX urges investors, shareholders and other interested pe rs ons to read, when available, the preliminary proxy statement/prospectus, as well as other documents filed with the SEC, because these documents wi ll contain important information about FRX, Beachbody, MYX and the proposed Transaction. The definitive proxy statement/pros pec tus will be mailed to shareholders of FRX as of a record date to be established for voting on the proposed Transaction. Shareholders may obtain cop ies of the proxy statement/prospectus, when available, without charge, at the SEC’s website at www.sec.gov or by directing a req uest to: Forest Road Acquisition Corp. 1177 Avenue of the Americas, 5th Floor, New York, New York 10036. Participants in Solicitation FRX, Beachbody, MYX and their respective directors, executive officers and other members of their management and employees ma y b e deemed to be participants in the solicitation of proxies of FRX shareholders in connection with the prospective Transaction de scribed herein under the rules of the SEC. Investors and security holders may obtain more detailed information regarding the names, affiliat ion s and interests of the directors and officers of FRX, Beachbody and MYX in the proxy statement/prospectus relating to the pro pos ed Transaction when it is filed with the SEC. These documents may be obtained free of charge from the sources indicated above. This Investor Presentation shall neither constitute an offer to sell or the solicitation of an offer to buy any securities, n or shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to th e registration or qualification under the securities laws of any such jurisdiction. 2 DISCLAIMER

PRESENTATION SPEAKERS Sue Collyns President and CFO 3 THE BEACHBODY COMPANY Carl Daikeler Co - founder, Chairman and CEO Jon Congdon Co - founder, CEO, Openfit Kevin Mayer Strategic Advisor, FRX Tom Staggs Director, FRX

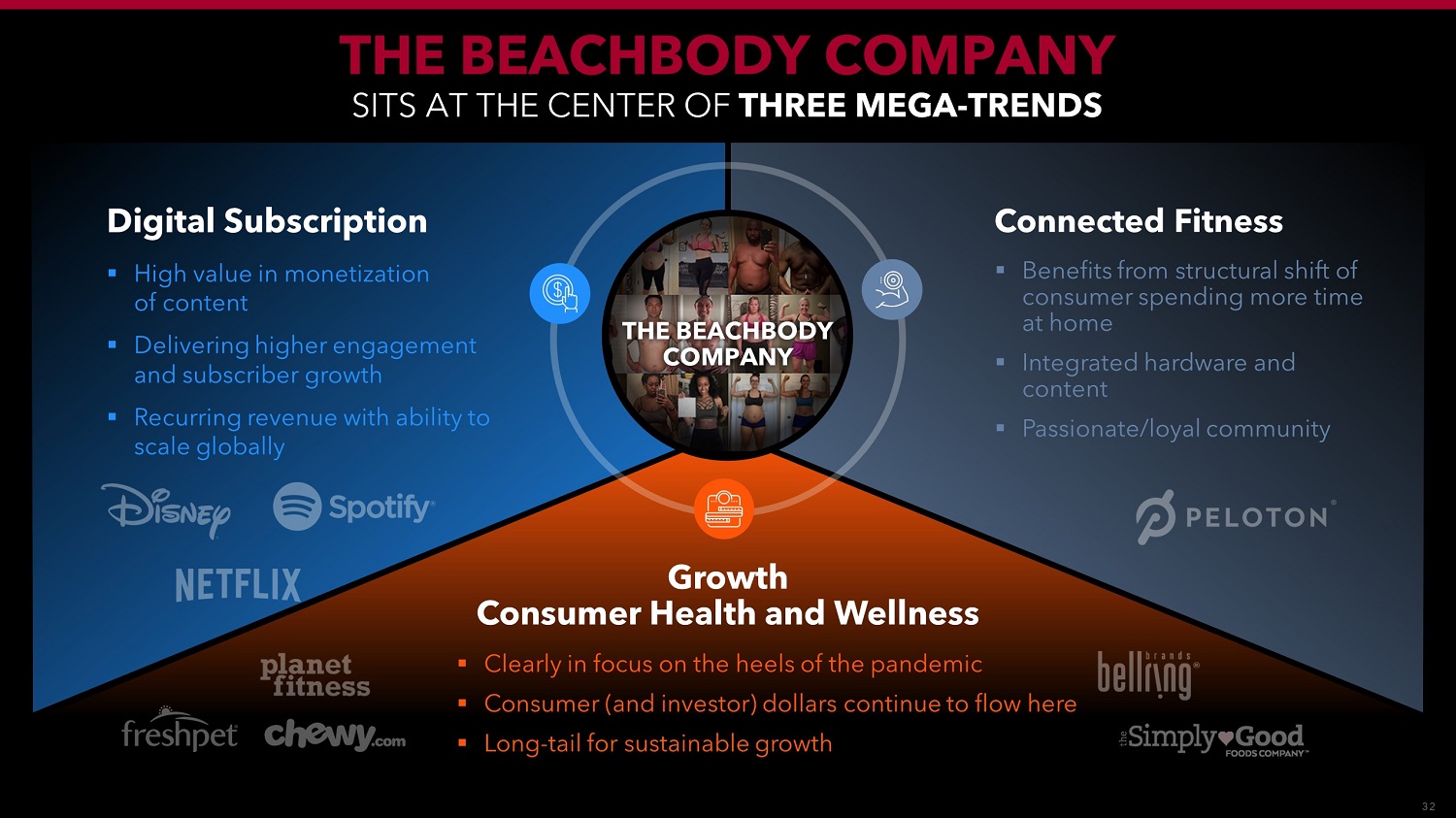

4 ▪ Clearly in focus on the heels of the pandemic ▪ Consumer (and investor) dollars continue to flow here ▪ Long - tail for sustainable growth THE BEACHBODY COMPANY SITS AT THE CENTER OF THREE MEGA - TRENDS Digital Subscription ▪ High value in monetization of content ▪ Delivering higher engagement and subscriber growth ▪ Recurring revenue with ability to scale globally Connected Fitness ▪ Benefits from structural shift of consumer spending more time at home ▪ Integrated hardware and content ▪ Passionate/loyal community THE BEACHBODY COMPANY Growth Consumer Health and Wellness

SCALED, PROFITABLE AT - HOME FITNESS AND NUTRITION MARKET LEADER WITH HOLISTIC SOLUTION COMPELLING MACRO TAILWINDS FOR AT - HOME FITNESS INDUSTRY, PARTICULARLY POST - COVID SUBSTANTIAL REVENUE AND EBITDA GENERATION SEASONED MANAGEMENT TEAM WITH OVER 22 YEARS OF EXPERIENCE TOGETHER SIGNIFICANT NEAR - TERM GROWTH OPPORTUNITIES FROM CUSTOMER ACQUISITION, INTERNATIONAL EXPANSION, AND OPPORTUNISTIC M&A 5 THE BEACHBODY COMPANY COMPETITIVE ADVANTAGE

6 Help people achieve their goals and enjoy a healthy fulfilling life. THE BEACHBODY COMPANY MISSION

Beachbody has been consistently expanding its market share in the $1.5 trillion health and wellness industry 1 72% of Americans are overweight or obese 2 $10 billion of annual consumer spending is expected to leave the gym sector as customers shift to at - home options 3 Digital at - home fitness spend has surged 30 - 40% post - COVID 4 87% of people who feel comfortable returning to the gym will keep at - home workouts as a part of their fitness routine 5 The online fitness market is expected to grow from $6B in 2019 to $59B by 2027, representing a 33% CAGR 6 7 THE HEALTH, WELLNESS, AND FITNESS INDUSTRY IS UNDERGOING A FUNDAMENTAL TRANSITION 1. Global Wellness Institute. Includes Physical Activity and Healthy Eating/Weight Loss. 2. CDC: Center for Disease Control and Prevention. 3. Harrison Co. Proprietary Research. 4. LEK Consulting Study. 5. Wakefield Research. 6. Allied Market Research: Online/Virtual Fitness Market. BEACHBODY WILL CONTINUE TO CAPTURE BILLIONS OF DOLLARS IN VALUE

THE HOLISTIC BEACHBODY APPROACH DRIVES CUSTOMER RESULTS, WHICH DRIVES OVER $1BILLION IN REVENUE 1 Community Digital Subscriptions Connected Fitness Nutrition Products 1. 2021E Forecast. 8

THE TOTAL HEALTH & WELLNESS SOLUTION DIGITAL SUBSCRIPTION, NUTRITION, AND CONNECTED FITNESS PLATFORMS APPEAL TO BROAD MARKET SEGMENTS AND ALL MODALITIES 9

10 DIGITAL SUBSCRIPTIONS

KEY METRICS As of 12/31/20. 89% GROSS MARGIN ON DIGITAL SUBSCRIPTIONS 0% 5% 10% 15% 20% 25% 30% 35% 2015 2016 2017 2018 2019 2020 32% 0.0M 0.5M 1.0M 1.5M 2.0M 2.5M 3.0M 2015 2015 2016 2017 2018 2019 2020 2.6M 2.6M PAID DIGITAL SUBSCRIPTIONS MARCH LAUNCH AS OF DEC YEAR END $450M+ REVENUE 2021E 180,000,000 STREAMED VIEWS 96% DIGITAL SUBSCRIPTION RETENTION MOM 11 ENGAGEMENT (DAU/MAU) 12 WORKOUTS PER SUBSCRIBER PER MONTH DIGITAL SUBSCRIPTIONS $99 ANNUAL SUBSCRIPTION

12 OUR CATALOG OF PREMIUM ON - DEMAND CONTENT IS UNMATCHED IN THE INDUSTRY Ideation Development Marketing Merchandising Data & Analytics

31.5 21.9 15.6 13.5 11.9 10.8 9.1 7.8 7.8 5.7 5.6 5.0 3.0 2.4 2.2 13 ¹ Workout Views as of December 31, 2020 * Includes all views per franchise LEADER IN FITNESS CONTENT PAST, PRESENT, AND FUTURE TREMENDOUS ASSET VALUE IN BEACHBODY LIBRARY DUE TO EVERGREEN NATURE OF PROGRAMS 2016 - 2018 2011 - 2015 Before 2010 Year of Release: 2019 2020 2020 Workout Views by Program (in millions) ¹ * * * * * *

14 SOCIAL COMMERCE MACRO - INFLUENCERS 400K+ Beachbody Coaches Micro - influencers drive sales across their social networks 125M+ Reach of Social Influencers Drive sales at a macro level to a broad customer base BODgroups Fitness and Nutrition Social Commerce Platform Creates a peer - to - peer marketplace INDIVIDUAL CUSTOMERS 2.6M Digital Subscribers Drive sales through word - of - mouth marketing and real results COMMUNITY OF PASSIONATE FITNESS ENTHUSIASTS HELPS DRIVE THE FLYWHEEL

Celebrity and fitness influencer model to drive higher volume of new subscriptions Live and on - demand content starring fitness celebrities and influencers to drive engagement OPENFIT IS BUILT ON BEACHBODY’S CORE COMPETENCIES Obi Vincent 930K Followers Andrea Rogers 103K Followers Shay Mitchell 32M Followers Sophia Rose 515K Followers Arnold Schwarzenegger 21M Followers LeBron James 73M Followers Valeriu Gutu 856K Followers Lita Lewis 534K Followers TO ATTRACT NEW MASS - MARKET AUDIENCES 15 15

16 LIVE CLASSES OVERSEEN BY CERTIFIED TRAINERS Users can turn their camera on, allowing trainers to give feedback on form and encouragement, just like an in - person studio fitness class 400+ LIVE classes per week in Xtend Barre, strength training, Pilates, weights, kickboxing, yoga, stretching, and walking/running Highest - rated classes saved for on - demand accessibility LIVE Running and Walking LIVE chat & photos LIVE classes FOR EVERYONE IN ALL TYPES OF WORKOUTS ON OPENFIT Trainer Trainer

17 CONNECTED FITNESS

18 Holistic on/off - bike fitness solution Lower cost than competitors ($1,299) $29 / month subscription 360 - degree swivel - screen tablet Heart - rate - based training approach Commercial - grade equipment Leverages Beachbody’s distribution, marketing experience, and content creation capabilities AN EXCITING CONNECTED FITNESS EXPERIENCE FOR A WIDER AUDIENCE

MYX FITNESS AT A GLANCE 19 27,000+ BIKES SOLD 15 WORKOUTS PER ACTIVE SUBSCRIBER PER MONTH SUBSCRIPTION MARGINS 2021E $100M REVENUE 2021E $29 PER MONTH SUBSCRIPTION COST 89 % RETENTION MOM 98% Rounded numbers as of 12/31/20. “Must - have fitness gear for 2020.” “If you’re an elite spin class assassin looking to climb to the top of your competitive pool, Peloton is still king and they’re going to make you pay for it. For the 80% or more out there that just want a good workout, some extra guidance, and the convenience of occasional spin classes from the comfort of your own home, the MYX Fitness Bike is half the price of the Peloton for way more than half the bike and experience quality. Save some bucks, and ride with MYX." “Best Peloton alternative, period.” “Best exercise bike.” “The Myx Plus feels like the next level of home gym setups. Instead of banging out five sets of 10 reps with some rusty weights on a cracked leather bench in your garage, you can get the feel of one - on - one personal training with top - tier equipment in your spare bedroom,.”

20 HOLISTIC AT - HOME FITNESS EXPERIENCE POINTS OF DIFFERENTIATION MYX subscribers get access to a wide array of workouts that are personalized based on a subscriber’s heart rate data and preferences SCIENCE - BASED HEART RATE COACHING MYX personalizes each subscriber’s training program and trainer journey using a proprietary recommendation engine PROPRIETARY RECOMMENDATION ENGINE On - and off - bike workouts coupled with MYX Plus accessories and swivel tablet provide a holistic 1:1 training programs for MYX subscribers HOLISTIC 1:1 TRAINING APPROACH Added leverage from Beachbody’s three production studios and 22 - year track record of creating fitness content BEST - IN - CLASS CONTENT CREATION CAPABILITIES

21 MYX WILL BE THE GROWTH ENGINE Connected Fitness Device Sales – 300K+ Digital Subscribers – 600K Revenue - $700M FULLY INTEGRATED PLATFORM LEVERAGING THE POWER OF OPENFIT AND BEACHBODY FORECASTED STEADY - STATE PROJECTIONS (2024) MYX POWERED BY OPENFIT MYX POWERED BY BEACHBODY BEHIND OUR CONNECTED FITNESS OFFERING

22 NUTRITION PRODUCTS

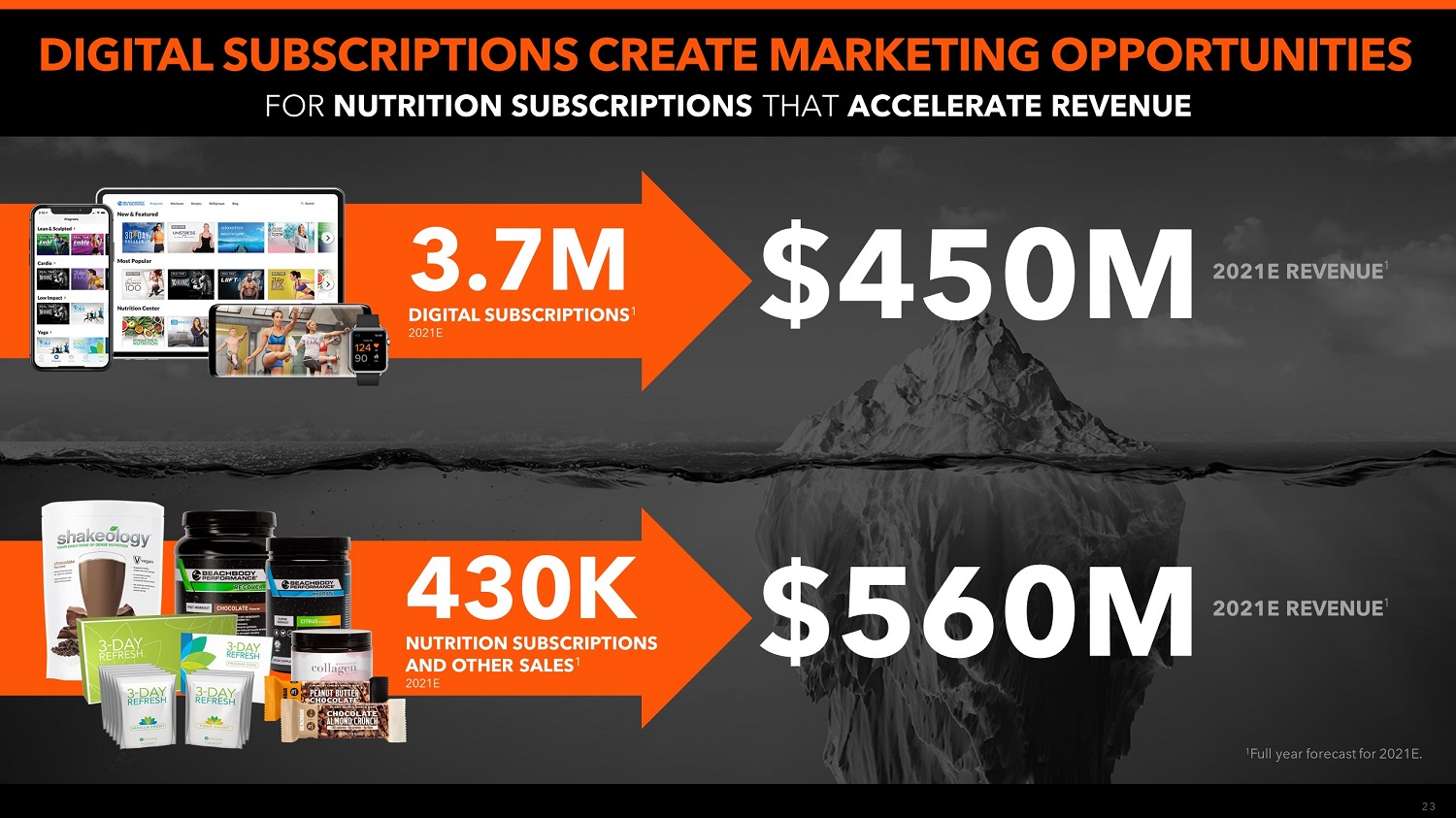

DIGITAL SUBSCRIPTIONS CREATE MARKETING OPPORTUNITIES FOR NUTRITION SUBSCRIPTIONS THAT ACCELERATE REVENUE $450M $560M 1 Full year forecast for 2021E. 2021E REVENUE 1 2021E REVENUE 1 3.7M DIGITAL SUBSCRIPTIONS 1 2021E 430K NUTRITION SUBSCRIPTIONS AND OTHER SALES 1 2021E 23

DIVERSE PORTFOLIO OF BRANDED NUTRITION PRODUCTS FITNESS CONTENT IS THE LEVERAGE TO CROSS - SELL NUTRITION PRODUCTS 24 OTHER NUTRITIONAL AND ACCESSORIES PRE - AND POST - WORKOUT SNACK BARS WHEY AND PLANT PROTEIN PLANT PROTEIN SUPERFOOD GREENS PRE - WORKOUT HYDRATION WHEY PROTEIN

GROWTH AND INVESTMENT OPPORTUNITIES 25

THE LEADERSHIP TEAM Sue Collyns President and CFO Michael Neimand President, Beachbody Robert Gifford President and COO Sunil Kaki EVP, Growth and Acquisition Marketing, Beachbody and Openfit Selina Tobaccowala Chief Digital Officer, Openfit 26 THE BEACHBODY COMPANY Irfan Ranmal EVP, Data, Analytics, and Consumer Insights Carl Daikeler Co - founder, Chairman and CEO Jon Congdon Co - founder, CEO, Openfit Herbie Calves President, MYX Fitness Bryan Muehlberger Chief Information Officer

SIGNIFICANT OPPORTUNITIES TO ACCELERATE GROWTH 27 Increased investment in customer acquisition while maintaining historical return profile Accelerating international expansion Tech and supply chain improvements, enabling more rapid development of nutrition products Market and product expansion through opportunistic M&A Founder - led business focused on cohort level profitability Dominating U.S. market with a holistic health and fitness solution Premium nutrition products using the highest quality ingredients with proven efficacy Proven experience executing and integrating bolt - on acquisitions (Gixo, Ladder, and MYX) WHERE WE ARE GOING WHERE WE ARE

FINANCIAL OVERVIEW 28

THE BEACHBODY COMPANY GROUP. CONFIDENTIAL AND PROPRIETARY. THIS INFORMATION MAY NOT BE DISCLOSED OR REPRODUCED. REVENUE (2018A – 2025E) COMMENTARY THE BEACHBODY COMPANY HISTORICAL AND PROJECTED FINANCIALS ($ in millions) 29 $581 $503 $526 $560 $634 $783 $992 $1,261 $209 $253 $326 $456 $649 $879 $1,144 $1,452 $28 $97 $195 $296 $494 $581 $790 $756 $880 $1,112 $1,479 $1,958 $2,631 $3,294 2018A 2019A 2020E 2021E 2022E 2023E 2024E 2025E REVENUE GROWTH % (4.4%) 16.4% 26.4% 33.0% 32.4% 34.4% 25.2% DIGITAL SUBSCRIBERS 1 1.5M 1.7M 2.6M 3.7M 5.2M 6.8M 8.8M 10.9M CONNECTED DEVICES SOLD - - 27K 73K 136K 203K 338K 398K Connected Fitness Digital Subscriptions Nutritional Products ¹Includes subscribers for Beachbody, Openfit, and MYX. Numbers are presented on a pro forma basis. | Increased investment in customer acquisition, both domestically and internationally, forecasted to help accelerate digital subscriber growth over the projection period | Bundling of nutritional products, integration of Ladder, and faster ability to develop new products forecasted to increase customer lifetime revenue and drive incremental nutrition subscriptions | International expansion of Openfit and MYX not included in forecast ‘20E – ‘25E CAGR: 83.7% 34.8% 19.1%

THE BEACHBODY COMPANY GROUP. CONFIDENTIAL AND PROPRIETARY. THIS INFORMATION MAY NOT BE DISCLOSED OR REPRODUCED. ADJUSTED EBITDA (2018A – 2025E) COMMENTARY ($ in millions) 30 $68 $78 $32 ($30) $66 $181 $348 $532 2018A 2019A 2020E 2021E 2022E 2023E 2024E 2025E Adj. EBITDA % of Revenue 8.6% 10.3% 3.6% NM 4.5% 9.2% 13.2% 16.2% TOTAL MARKETING SPEND $69 $54 $97 $156 $186 $248 $305 $365 | Beachbody core business generates significant cash flow with highly profitable unit economics | Media investment is variable and will be used to drive incremental subscriber growth and increase ROI on marketing dollars | Capital raised from SPAC transaction will allow the Company to flex overall marketing spending based on market conditions | Initial investment in customer acquisition expected to generate significant returns across all three platforms by 2022 once MYX is fully integrated ¹Adjusted EBITDA calculated by adding back amortization of content assets, stock - based compensation, D&A, non - recurring/transaction fees, income taxes/benefit and net interest expense to Net Income. THE BEACHBODY COMPANY HISTORICAL AND PROJECTED FINANCIALS

THE BEACHBODY COMPANY GROUP. CONFIDENTIAL AND PROPRIETARY. THIS INFORMATION MAY NOT BE DISCLOSED OR REPRODUCED. TRANSACTION SUMMARY PRO FORMA CAPITALIZATION AND OWNERSHIP FRX TRANSACTION DETAILS 31 1 Shares and ownership based on fully diluted shares outstanding using the treasury stock method. 2 Dual class common share structure to be implemented at closing, with certain persons receiving high vote common shares with 10:1 voting power. Excludes impact of 15.3 million public and private placement warrants struck at $11.50. Also excludes impact of 3.8 million unvested founder shares; which vest ratably at $12.00, $13.00, $14.00, $15.00 and $16.00 per share. ($ in millions) ($ and shares in millions; other than per share value) SOURCES FRX cash in trust $300 PIPE investment $225 Total $525 USES Cash to balance sheet $424 Secondary proceeds $38 Estimated fees and expenses $63 Total $525 ▪ Beachbody to merge with Forest Road (“FRX”) at a pro forma enterprise value of $2.9 billion (2.0x ’22E revenue) ▪ Founders and selling shareholders to maintain over 80% pro forma ownership ▪ 50% of FRX Founder Shares (3.8 million) to vest ratably at $12.00, $13.00, $14.00, $15.00 and $16.00 per share PRO FORMA VALUATION Pro forma shares outstanding 1 342.5 Illustrative share price $10.00 Pro forma equity value $3,425 Pro forma cash on balance sheet ($491) Pro forma enterprise value $2,934 Pro forma EV / ’22E revenue ($1.5 billion) 2.0x PRO FORMA OWNERSHIP 2 Carl Daikeler 41.1% Jonathan Congdon 6.6% Other owners 35.8% FRX Public Shares 8.8% PIPE Shares 6.6% FRX Founder Shares 1.1% Existing shareholders to hold ~84% of the pro forma business – led by founders with ~48% ownership

32 ▪ Clearly in focus on the heels of the pandemic ▪ Consumer (and investor) dollars continue to flow here ▪ Long - tail for sustainable growth THE BEACHBODY COMPANY SITS AT THE CENTER OF THREE MEGA - TRENDS Digital Subscription ▪ High value in monetization of content ▪ Delivering higher engagement and subscriber growth ▪ Recurring revenue with ability to scale globally Connected Fitness ▪ Benefits from structural shift of consumer spending more time at home ▪ Integrated hardware and content ▪ Passionate/loyal community THE BEACHBODY COMPANY Growth Consumer Health and Wellness

33 Operational Benchmarking Connected fitness Source: FactSet as of 01/08/2021. Revenue CAGR CY 2021 - 2023 Adj. EBITDA margin % CY 2022 Adj. EBITDA margin % CY 2021 33% 21% 18% 14% 29% 43% 27% 21% 8% 6% Gross profit margin % CY 2022 Gross profit margin % CY 2021 Digital subscription Growth consumer health and wellness Avg: 18% Avg: 21% 68% 26% 40% 33% 44% 63% 46% 27% 34% 41% Avg: 33% Avg: 42% 4% NA 21% 20% 11% 43% 16% 3% 20% 20% Avg: 14% Avg: 20% 68 % 25% 39% 30 % 67% 45% 26% 34% 41% NA NA 20 % 15% 30% 15% 2 % 20 % 19% 42% 9%

34 Valuation Benchmarking Connected fitness Source: FactSet as of 01/08/2021. Beachbody multiples implied based on $2,934M EV. EV / CY 2022 Revenue 2.0x 7.9x 5.7x 3.7x 7.9x 14.6x 12.2x 3.8x 3.5x 3.3x Avg: 5.7x Avg: 7.5x 44.4x 37.5x NM 18.4x NM NM 28.5x NM 18.2x 16.8x Avg: 28.0x Avg: 21.2x 2.6 x 9.3 x 6.9x 4.4x 18.7x 20.3x 4.6x 3.8x 3.6x NM 47.1x NM 28.5x NM NM NM 19.6x 18.6x EV / CY 2021 Revenue EV / CY 2022 Adj. EBITDA EV / CY 2021 Adj. EBITDA 10.4x NM Growth consumer health and wellness Digital subscription

THE LEADING HOLISTIC HEALTH AND WELLNESS PLATFORM THAT DELIVERS RESULTS 35

Exhibit 99.3

Project Core Call Script

Operator

Good morning, ladies and gentlemen. Thank you for standing by and welcome to The Beachbody Company (“Beachbody”) and Forest Road Acquisition Corp. call and webcast. We appreciate everyone joining us today. The information discussed today is qualified in its entirety by the Form 8-K that has been filed today by Forest Road Acquisition Corp. and may be accessed on the SEC’s website, including the exhibits thereto. Please note that the press release issued this morning and related SEC documents can also be found on Forest Road Acquisition Corp’s website at https://www.spacroadone.com/ and on Beachbody’s website at https://www.thebeachbodycompany.com/investors.

The investor deck that will be presented as part of today’s discussion has been publicly filed with the SEC and posted on Forest Road Acquisition Corp’s website and Beachbody’s website, where it is available for download. Please review the disclaimers included therein and refer to that as the guide for today’s call. In particular, this call contains forward-looking statements that are subject to risks and uncertainties. Further information about us will be contained in filings with the SEC and we encourage you to read those carefully.

For everyone on the phone, Forest Road Acquisition Corp. and Beachbody will not be fielding any questions on today’s call.

Hosting today’s call are Carl Daikeler, Co-founder, Chairman and CEO of The Beachbody Company and Kevin Mayer, Strategic Advisor of Forest Road Acquisition Corp.

I will now turn the call over to Kevin Mayer. Please go ahead, sir.

Kevin Mayer.

Thank you, and good morning, everyone.

We are very excited to announce that Forest Road Acquisition Corp. has entered into a merger agreement to combine our public company with The Beachbody Company, and execute a concurrent combination with MYXfitness.

Since the announcement of our SPAC, we have been inundated with ideas. We knew we were looking for a company that had a proven and predictable business model and a really strong foundation for growth. At the same time, we wanted to make an investment that fit our expertise in monetizing premium content.

1

At Disney, Tom Staggs and I were at the center of the ideation and execution of a digital revolution driven by premium content. We acquired premium IP, with acquisitions like Pixar, Marvel, and Lucasfilm. We oversaw a massive pipeline of premium content production. And we helped build new Direct-to-Consumer distribution channels like Disney+, ESPN+, and Hulu. I not only see many parallels at Beachbody to the work we did over the last 15 years, but also the opportunity to leverage the Company’s assets and infrastructure to drive growth, which is why I am excited to join the board of the company and partner with their incredible team for many years to come.

The Beachbody Company today consists of two strong brands in the digital fitness content space, Beachbody on Demand, with the fortuitous acronym of BOD, and Openfit. In my humble opinion, BOD is the Disney+ of fitness, while Openfit is like Masterclass, centered around major influencers, offering live instructional workouts and a unique gamified boutique fitness experience. Each of these brands, or doors into the ecosystem as I call them, have associated nutrition products -- Beachbody supplements for BOD and Ladder Supplements for Openfit. Both serve as a powerful flywheel for retention and results. And soon both will have the opportunity to offer customers a connected in-home fitness option with the MYX bike when we close this deal.

The more we investigated this story during our diligence process, the more we fell in love with it. Rarely do you find a business that is well positioned to capitalize on one mega trend. And yet, in the case of The Beachbody Company, we believe it is positioned perfectly at the epicenter of THREE tailwinds; Digital Subscriptions, Connected Fitness, and Consumer Health and Wellness.

Clearly, digital is now the way we live our lives; our days revolve around screens and content, and BOD, along with Openfit, deliver subscription content solutions at the time and place of people’s choosing, on the devices that people love the most -- we have truly democratized the fitness content industry.

With respect to Connected Fitness, now that more consumers are spending more time at home, they want fitness solutions with high quality equipment that are accessible, convenient, and fit into their busy schedules. With the acquisition of MYX, we will add to our digital subscription base substantially.

And finally, Consumer Health & Wellness. Today, more people than ever are focused on their health, and we believe this trend will continue well into the future. With branded lines of premium nutrition products, we believe Beachbody supplements and Ladder, which is the sports nutrition supplement line founded by LeBron James and Arnold Schwarzenegger that Openfit acquired last year, we have an opportunity to accelerate market share gains. By the way, Lebron and Arnold are shareholders in The Beachbody Company as well as a result of that transaction.

We believe The Beachbody Company’s ability to capitalize on each of these three trends presents a unique opportunity that sets it apart from its competitors in the industry, and with the combination of these three great brands, Beachbody, Openfit, and MYX, we are well-positioned to further unlock the scale of the platform across distribution, marketing, and content creation.

2

At its core, The Beachbody Company has a 22-year foundation built on content, subscribers, and marketing expertise. We believe the company has the right skillset to invest across these categories, and we will use the proceeds from this transaction to increase marketing spend in order to grow revenue from $1.1 billion in 2021 to over $3 billion in 2025. This forecast is underpinned by solid subscriber retention metrics, and with approximately 40% of revenue in each year carrying over from the previous year, and a very stable and predictable LTV to CAC of over 4 times.

Our conviction in the tremendous success to come for The Beachbody Company is centered around several operating advantages, including:

| ● | A scaled, branded fitness and nutrition platform generating over $880 million of revenue, 2.6 million paid digital subs in 2020, and a strong track record of profitability |

| ● | A management team that has over 22 years of experience creating high-quality evergreen content with a track record of consistently efficient customer acquisition, and |

| ● | The opportunity to leverage their digital expertise to unlock significant value in connected fitness. |

We are confident that these competitive advantages will lead to strong engagement and industry-leading retention rates; and with the backdrop of the three significant tailwinds I highlighted earlier, the company is positioned for significant growth over the coming years. Importantly, we believe the transaction sets the combined company up for long-term success. Forest Road has $300 million in its trust account and we have also secured $225 million in a PIPE led by blue chip institutional investors such as Fidelity and Fertitta Capital. Upon closing, we expect The Beachbody Company will have over $420 million of unrestricted cash on the balance sheet to fund its growth plans. It is worth noting that Carl and all other Beachbody shareholders are not selling a share in this transaction. Following the deal, the founders of Beachbody will own about 48% of the combined business on a fully diluted basis.

And with that, I will hand it over to my new partner and Beachbody Co-Founder Carl Daikeler to talk more about the incredible business he has built.

Carl Daikeler

Thank you Kevin. Good morning and welcome everyone. I share Kevin’s excitement and enthusiasm for the combination of these companies and the opportunities ahead as we shift into a more aggressive period of growth, reaching more people with our holistic solution that brings together fitness, nutrition, and community.

3

Beachbody is a mission-driven company. While the digital disruption that the fitness industry is currently experiencing is extraordinary, the underlying value of our business comes from our mission to help people achieve their goals and enjoy healthy, fulfilling lives.

This mission puts The Beachbody Company squarely in the center of a $1.5 trillion health and wellness industry, at a time when consumers are increasingly looking for and need effective, affordable, at-home digitally enabled fitness and nutrition solutions. And this evolution in consumer preferences brings with it a massive opportunity - digital fitness spending is projected to reach $59 billion by 2027, up from $6 billion in 2019.

With more than two decades of leadership in at-home wellness, we believe The Beachbody Company is uniquely positioned to capture a meaningful share from this shift to online, and the newly combined company gives us a wide moat and unique competitive advantages to deliver cost-effective results to the mass-market. These include:

| ● | The deepest library of premium digital fitness content in the industry |

| ● | The tools to support customers seeking healthy results by providing effective meal planning and proprietary nutrition products, and |

| ● | A differentiated at-home connected fitness solution through MYX |

| ● | All underpinned by a scalable platform that leverages our expertise in distribution, marketing and content creation. |

As Kevin mentioned, this holistic approach today happens on two customer facing digital platforms, Beachbody on Demand, where our subscribers have access to over 2,000 different on-demand workout videos and an incredible team of coaches helping people stay on track to get results, and Openfit, our newer platform that offers live and on-demand content that incorporates the power of celebrities, brands and influencers. And through the acquisition of MYX Fitness, we are expanding into connected fitness.

Let me walk through each of these platforms in a bit more detail.

Beachbody is the leader in digital fitness content with over 180 million streamed views in 2020. Today, Beachbody has 2.6 million paid digital subscribers that generated $326 million in annual revenue with 89% gross margins. As you can see, it is a profitable model underpinned by impressive KPI’s led by a 96% month over month digital retention rate, world-class engagement of 32% daily average users to monthly average users, and active subscribers averaging 12 workouts a month. Over 70% of our subscribers purchase our annual subscription for access to all our content which is created in-house and is developed as part of a program – a program that is always paired with a nutrition plan and works with a set day-by-day plan and goal in mind. These are network TV quality productions that take our customers on a complete journey to get healthy results, and each program lives in the catalog creating incredible long-term value. A great example is P90X, which is over 15 years old and still generated more than 5 million views last year.

4