Form 8-K Fat Brands, Inc For: Mar 25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 25, 2021

FAT Brands Inc.

(Exact name of Registrant as Specified in Its Charter)

| Delaware | 001-38250 | 82-1302696 | ||

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

9720 Wilshire Blvd., Suite 500 Beverly Hills, CA |

90212 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (310) 319-1850

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| [ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.0001 per share | FAT | The Nasdaq Stock Market LLC | ||

| Series B Cumulative Preferred Stock, par value $0.0001 per share | FATBP | The Nasdaq Stock Market LLC | ||

| Warrants to purchase Common Stock | FATBW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company [X]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [X]

Item 2.02 Results of Operations and Financial Condition.

On March 25, 2021, FAT Brands Inc. (the “Company”) issued a press release announcing its financial results for the thirteen weeks and the fiscal year ending December 27, 2020. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The Company also hosted a conference call on March 25, 2021 in which the financial results were discussed. A replay will be available until Thursday, April 1, 2021, and can be accessed by dialing 1-844-512-2921. The passcode is 13717932.

The webcast will be available at www.fatbrands.com under the “Investors” section and will be archived on the site shortly after the call has concluded.

Item 7.01 Regulation FD Disclosure.

On March 25, 2021, the Company provided supplemental financial information to be used in its earnings presentation for the for the thirteen weeks and the fiscal year ending December 27, 2020 on its website at https://ir.fatbrands.com/events-and-presentations/default.aspx. A copy of the earning supplement is attached hereto as Exhibit 99.2 and incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item 2.02 and 7.01, including Exhibit 99.1 and Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. Such information may be incorporated by reference in another filing under the Securities and Exchange Act of 1934 or the Securities Act of 1933 only if, and to the extent that, such subsequent filing specifically references such information.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit Number |

Description | |

| 99.1 | Press Release Dated March 25, 2021 | |

| 99.2 | Earnings Supplement Q4 - 2020 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| FAT Brands Inc. | |

| Date: March 26, 2021 | /s/ Andrew A. Wiederhorn |

| Andrew A. Wiederhorn | |

| Chief Executive Officer |

Exhibit 99.1

FAT BRANDS INC. REPORTS FOURTH QUARTER AND FULL YEAR 2020 FINANCIAL RESULTS

Conference call and webcast today at 5:00 p.m. ET

LOS ANGELES (March 25, 2021) – FAT (Fresh. Authentic. Tasty.) Brands Inc. (NASDAQ: FAT) (“FAT Brands” or the “Company”) today reported fourth quarter and full year 2020 financial results for the fiscal year ended December 27, 2020.

Andy Wiederhorn, President and CEO of FAT Brands, commented, “We are proud of our franchise partners and employees who have worked incredibly hard and shown impressive versatility throughout this difficult year. We are very hopeful that with the widespread availability of vaccines and accelerated reopening plans in many locations, we will be able to put the COVID-19 pandemic in the rear-view mirror.”

“The fourth quarter proved very productive at FAT Brands and continued our strong rebound during the pandemic. While the initial virus impacts were harsh, this marks another report with improving successive quarterly improvements. Amongst the improving results we have continued to develop our powerful engine for organic growth. We had further new store openings, in addition to more units under construction. We have a solid development pipeline of new franchise locations. And as of today, we have fully integrated Johnny Rockets with plans for the reopening of special venues sometime during the second and third quarters of this year.”

Wiederhorn continued, “We are very excited for the year ahead as we continue our bounce back from the pandemic. In 2021, we will continue to pursue additional accretive acquisition opportunities as well as organic growth of our existing brands.”

“Our existing whole business securitization facility, along with our publicly traded preferred stock and common stock, give us many levers to pull to fund potential acquisitions, reduce our cost of capital further, and drive shareholder value.”

Fiscal Fourth Quarter 2020 Highlights

| ● | Total revenues improved 24% to $6.5 million compared to the fourth quarter of 2019 |

| ● | Excluding revenues attributable to Johnny Rockets which was acquired on September 21, 2020, revenues declined 19% compared to the fourth quarter of 2019, showing sequential improvement compared to a decline in the prior quarter of 39% |

| ○ | System-wide sales growth of 46.0% q/q |

| ■ | United States sales growth of 25.0% q/q |

| ■ | Rest of world sales growth of 119.7% q/q |

| ○ | System-wide same-store sales decline of 7.6% q/q |

| ■ | United States same-store sales decline of 8.4% q/q |

| ■ | Rest of world sales decline of 3.8% q/q |

| ○ | 29 new franchised store openings during the fourth quarter 2020 |

| ■ | Store count as of December 27, 2020: 679 stores system-wide |

| ● | Net Loss of $7.7 million or $0.64 per share on a basic and fully diluted basis, as compared to net loss of $1.0 million or $0.08 per share on a basic and fully diluted basis in the fourth quarter of 2019 |

| ● | EBITDA(1) loss of $7.9 million as compared to EBITDA of $726,000 in the fourth quarter of 2019 |

| ● | Adjusted EBITDA(1) of $1.7 million as compared to $1.8 million in the fourth quarter of 2019. Adjusted EBITDA excludes expenses related to acquisitions, refranchising gain or losses, impairment charges, and certain non-recurring or non-cash items that the Company does not believe directly reflect its core operations and may not be indicative of the Company’s recurring business operations. The reconciliation of EBITDA to Adjusted EBITDA can be found in the accompanying financial tables. |

| (1) | EBITDA and Adjusted EBITDA are non-GAAP measures defined below, under “Non-GAAP Measures”. A reconciliation of GAAP net income to EBITDA and adjusted EBITDA is included in the accompanying financial tables. |

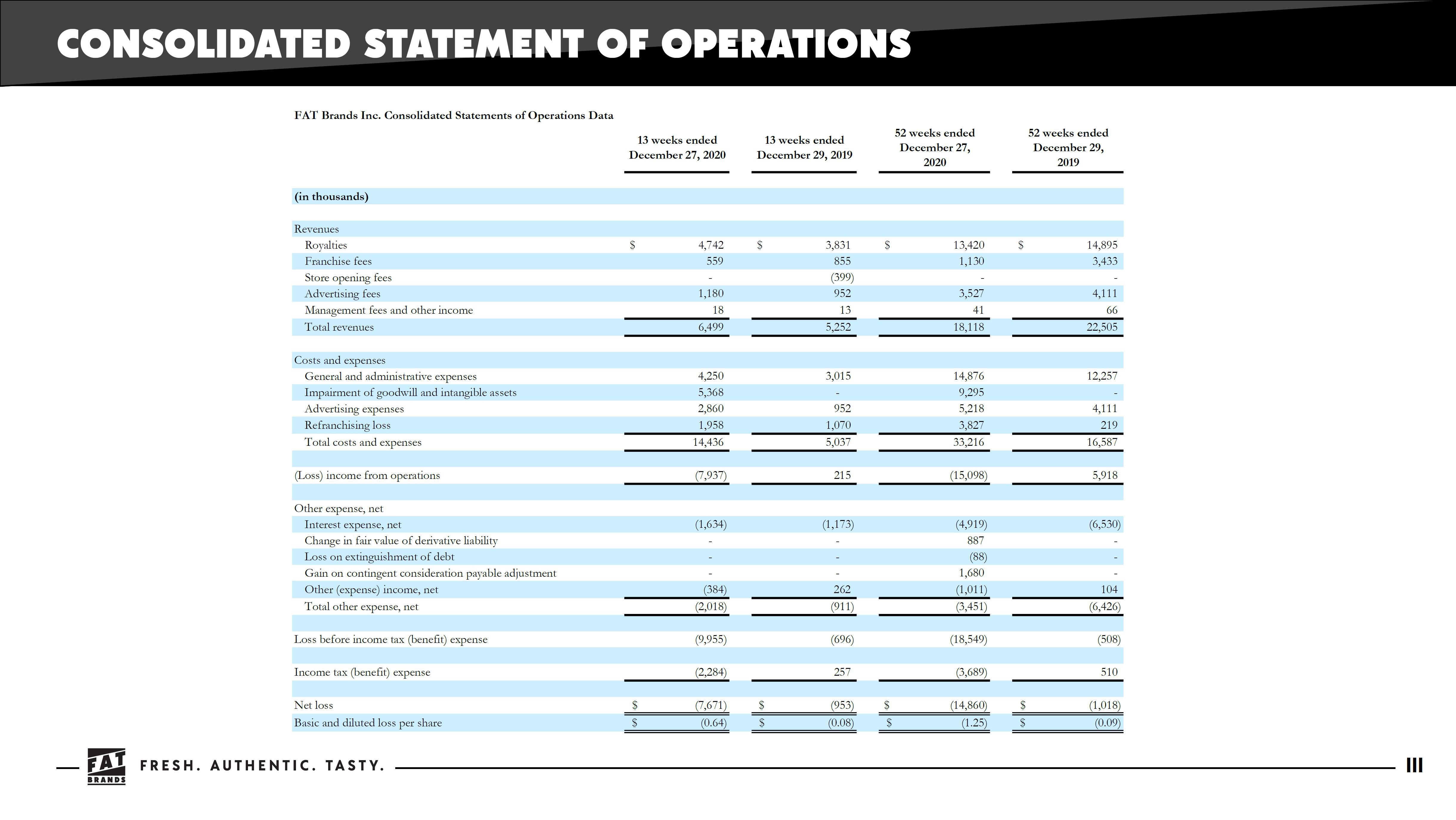

Summary of Fourth Quarter 2020 Financial Results

Total revenues were $6.5 million in the fourth quarter of 2020 and as compared to $5.2 million in the fourth quarter of 2019. Excluding Johnny Rockets which was acquired on September 21, 2020 as well as advertising revenues, revenues were $3.4 million, down from $4.3 million in the fourth quarter of 2019. The revenue performance overwhelmingly reflects a decline in royalty revenue related to the impact of COVID-19.

Costs and expenses increased to $14.4 million in the fourth quarter of 2020 compared to $5.0 million in the fourth quarter of 2019. These costs and expenses included an impairment charge in 2020 of $5.4 million without comparable activity in the prior year, advertising expenses of $2.9 million in 2020 compared to $1.0 million in 2019 reflecting expenditures in excess of collections recognized in the fourth quarter of 2020, and refranchising losses of $2.0 million in 2020 and $1.1 million in 2019. Total general and administrative expenses were $4.3 million in the fourth quarter of 2020 compared to $3.0 million in the prior period. This increase of $1.3 million was attributed to increases in occupancy costs and legal expenses, additional amortization expense related to the intangible assets of Johnny Rockets, and bad debt expenses related to the COVID-19 global pandemic marginally offset by decreases in travel and entertainment expenses.

Other expense was $2.0 million in the fourth quarter of 2020, compared to other expense of $900,000 in the fourth quarter of 2019, and consisted primarily of net interest expense of $1.6 million in 2020 compared to $1.2 million in the prior period as well as $535,000 of expenses related to the acquisition of Fog Cutter Capital Group Inc in the fourth quarter of 2020 without comparable activity in 2019. The $400,000 increase in net interest expense related primarily to the additional interest expense associated with the $40 million of Series 2020-2 Fixed Rate Asset-Backed Notes sold in September 2020, the proceeds of which were used to fund our acquisition of Johnny Rockets as well as for general corporate purposes.

The combination of the aforementioned revenue and expenses resulted in a net loss of $7.7 million in the fourth quarter of 2020, compared to a net loss of $1.0 million in the fourth quarter of 2019.

Recent Events and Liquidity

On December 24, 2020, the Company completed the acquisition of Fog Cutter Capital Group Inc., a Delaware corporation (“FCCG”), through the merger of FCCG with and into Fog Cutter Acquisition, LLC, a Delaware limited liability company and wholly-owned subsidiary of the Company. The acquisition of FCCG by the Company (the “Merger”) was consummated pursuant to an Agreement and Plan of Merger (the “Merger Agreement”), dated December 10, 2020, by and among the Company, FCCG, Merger Sub and Fog Cutter Holdings, LLC, a Delaware limited liability company. The Company undertook the Merger primarily to simplify its corporate structure and eliminate limitations that restrict the Company’s ability to issue additional Common Stock for acquisitions and capital raising. FCCG holds a substantial amount of net operating loss carryforwards (“NOLs”), which could only be made available to the Company as long as FCCG owned at least 80% of FAT Brands. With the Merger, the NOLs will be held directly by the Company, which will then have greater flexibility in managing its capital structure. In addition, after the Merger, the Company will no longer be required to compensate FCCG for utilizing its NOLs under the Tax Sharing Agreement between the Company and FCCG.

During the fourth quarter of 2020, the Company repurchased 232,663 warrants to purchase shares of the Company’s common stock with an exercise price of $5.00 per share for $420,000.

Key Financial Definitions

New store openings - The number of new store openings reflects the number of stores opened during a particular reporting period. The total number of new stores per reporting period and the timing of stores openings has, and will continue to have, an impact on our results.

Same-store sales growth - Same-store sales growth reflects the change in year-over-year sales for the comparable store base, which we define as the number of stores open and in the FAT Brands system for at least one full fiscal year. For stores that were temporarily closed, sales in the current and prior period are adjusted accordingly. Given our focused marketing efforts and public excitement surrounding each opening, new stores often experience an initial start-up period with considerably higher than average sales volumes, which subsequently decrease to stabilized levels after three to six months. Additionally, when we acquire a brand, it may take several months to integrate fully each location of said brand into the FAT Brands platform. Thus, we do not include stores in the comparable base until they have been open and in the FAT Brands system for at least one full fiscal year. For 2020, the comparable store base does not include Elevation Burger and Johnny Rockets stores as we did not own the brands for the full year of 2019.

System-wide sales growth - System wide sales growth reflects the percentage change in sales in any given fiscal period compared to the prior fiscal period for all stores in that brand only when the brand is owned by FAT Brands. Because of acquisitions, new store openings and store closures, the stores open throughout both fiscal periods being compared may be different from period to period.

Conference Call and Webcast

FAT Brands will host a conference call and webcast to discuss its fiscal fourth quarter and full year 2020 financial results today at 5:00 PM ET. Hosting the conference call and webcast will be Andy Wiederhorn, President and Chief Executive Officer, and Rebecca Hershinger, Chief Financial Officer.

The conference call can be accessed live over the phone by dialing 1-877-705-6003. A replay will be available after the call until Thursday, April 1, 2021, and can be accessed by dialing 1-844-512-2921. The passcode is 13717932. The webcast will be available at www.fatbrands.com under the “Investors” section and will be archived on the site shortly after the call has concluded.

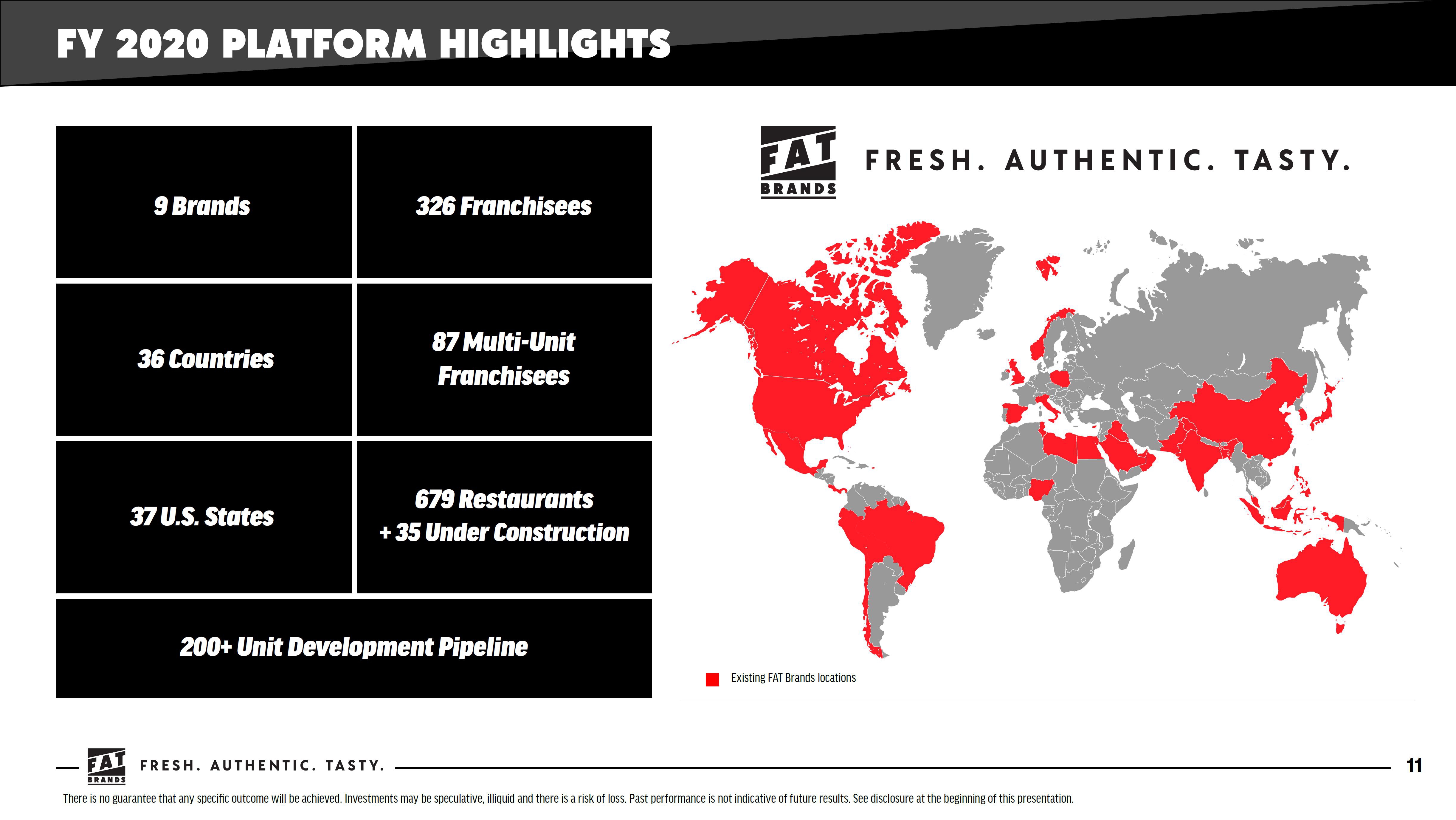

About FAT (Fresh. Authentic. Tasty.) Brands

FAT Brands Inc. (NASDAQ: FAT) is a leading global franchising company that strategically acquires, markets and develops fast casual and casual dining restaurant concepts around the world. The Company currently owns nine restaurant brands: Fatburger, Johnny Rockets, Buffalo’s Cafe, Buffalo’s Express, Hurricane Grill & Wings, Elevation Burger, Yalla Mediterranean and Ponderosa and Bonanza Steakhouses, and franchises over 700 units worldwide. For more information, please visit www.fatbrands.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to the future financial and operating results of the Company, our future acquisitions, and the effects on our business of the current novel coronavirus pandemic (“COVID-19”). Forward-looking statements generally use words such as “expect,” “foresee,” “anticipate,” “believe,” “project,” “should,” “estimate,” “will,” “plans,” “forecast,” and similar expressions, and reflect our expectations concerning the future. It is possible that our future performance may differ materially from current expectations expressed in these forward-looking statements. Forward-looking statements are subject to significant business, economic and competitive risks, uncertainties and contingencies including, but not limited to, uncertainties surrounding the severity, duration and effects of the COVID-19 pandemic, many of which are difficult to predict and beyond our control, which could cause our actual results to differ materially from the results expressed or implied in such forward-looking statements. We refer you to the documents we file from time to time with the Securities and Exchange Commission, such as our reports on Form 10-K, Form 10-Q and Form 8-K, for a discussion of these and other risks and uncertainties that could cause our actual results to differ materially from our current expectations and from the forward-looking statements contained in this press release. We undertake no obligation to update any forward-looking statement to reflect events or circumstances occurring after the date of this press release.

Non-GAAP Measures (Unaudited)

This press release includes the non-GAAP financial measure of EBITDA and Adjusted EBITDA.

EBITDA is defined as earnings before interest, taxes, depreciation and amortization. We use the term EBITDA, as opposed to income from operations, as it is widely used by analysts, investors and other interested parties to evaluate companies in our industry. We believe that EBITDA is an appropriate measure of operating performance because it eliminates the impact of expenses that do not relate to business performance. EBITDA is not a measure of our financial performance or liquidity that is determined in accordance with generally accepted accounting principles (“GAAP”), and should not be considered as an alternative to net income (loss) as a measure of financial performance or cash flows from operations as measures of liquidity, or any other performance measure derived in accordance with GAAP.

Adjusted EBITDA is defined as EBITDA (as defined above), excluding expenses related to acquisitions, refranchising gain or losses, impairment charges, and certain non-recurring or non-cash items that the Company does not believe directly reflect its core operations and may not be indicative of the Company’s recurring business operations.

A reconciliation of net income presented in accordance with GAAP to EBITDA and adjusted EBITDA is set forth in the tables below.

Investor Relations:

ICR

Ashley DeSimone

646-677-1827

Media Relations:

JConnelly

Erin Mandzik

862-246-9911

###

FAT Brands Inc. Consolidated Statements of Operations Data

| 13 weeks ended December 27, 2020 | 13 weeks ended December 29, 2019 | 52 weeks ended December 27, 2020 | 52 weeks ended December 29, 2019 | |||||||||||||

| (in thousands) | ||||||||||||||||

| Revenues | ||||||||||||||||

| Royalties | $ | 4,742 | $ | 3,831 | $ | 13,420 | $ | 14,895 | ||||||||

| Franchise fees | 559 | 855 | 1,130 | 3,433 | ||||||||||||

| Store opening fees | - | (399 | ) | - | - | |||||||||||

| Advertising fees | 1,180 | 952 | 3,527 | 4,111 | ||||||||||||

| Management fees and other income | 18 | 13 | 41 | 66 | ||||||||||||

| Total revenues | 6,499 | 5,252 | 18,118 | 22,505 | ||||||||||||

| Costs and expenses | ||||||||||||||||

| General and administrative expenses | 4,250 | 3,015 | 14,876 | 12,257 | ||||||||||||

| Impairment of goodwill and intangible assets | 5,368 | - | 9,295 | - | ||||||||||||

| Advertising expenses | 2,860 | 952 | 5,218 | 4,111 | ||||||||||||

| Refranchising loss | 1,958 | 1,070 | 3,827 | 219 | ||||||||||||

| Total costs and expenses | 14,436 | 5,037 | 33,216 | 16,587 | ||||||||||||

| (Loss) income from operations | (7,937 | ) | 215 | (15,098 | ) | 5,918 | ||||||||||

| Other expense, net | ||||||||||||||||

| Interest expense, net | (1,634 | ) | (1,173 | ) | (4,919 | ) | (6,530 | ) | ||||||||

| Change in fair value of derivative liability | - | - | 887 | - | ||||||||||||

| Loss on extinguishment of debt | - | - | (88 | ) | - | |||||||||||

| Gain on contingent consideration payable adjustment | - | - | 1,680 | - | ||||||||||||

| Other (expense) income, net | (384 | ) | 262 | (1,011 | ) | 104 | ||||||||||

| Total other expense, net | (2,018 | ) | (911 | ) | (3,451 | ) | (6,426 | ) | ||||||||

| Loss before income tax (benefit) expense | (9,955 | ) | (696 | ) | (18,549 | ) | (508 | ) | ||||||||

| Income tax (benefit) expense | (2,284 | ) | 257 | (3,689 | ) | 510 | ||||||||||

| Net loss | $ | (7,671 | ) | $ | (953 | ) | $ | (14,860 | ) | $ | (1,018 | ) | ||||

| Basic and diluted loss per share | $ | (0.64 | ) | $ | (0.08 | ) | $ | (1.25 | ) | $ | (0.09 | ) |

Consolidated Balance Sheet for FAT Brands Inc. as of December 27, 2020

| As of December 27, 2020 | ||||

| (in thousands) | ||||

| Cash and restricted cash | $ | 7,211 | ||

| Total assets | $ | 121,144 | ||

| Total liabilities | $ | 163,027 | ||

| Total stockholders’ deficit | $ | (41,883 | ) | |

FAT Brands Inc. Consolidated EBITDA and Adjusted EBITDA Reconciliation

| 13 weeks ended December 27, 2020 | 13 weeks ended December 29, 2019 | 52 weeks ended December 27, 2020 | 52 weeks ended December 29, 2019 | |||||||||||||

| (in thousands) | ||||||||||||||||

| Net loss | $ | (7,671 | ) | $ | (953 | ) | $ | (14,860 | ) | $ | (1,018 | ) | ||||

| Interest expense, net | 1,634 | 1,173 | 4,919 | 6,530 | ||||||||||||

| Income tax (benefit) expense | (2,284 | ) | 257 | (3,689 | ) | 510 | ||||||||||

| Depreciation and amortization | 409 | 249 | 1,172 | 785 | ||||||||||||

| EBITDA | $ | (7,912 | ) | $ | 726 | $ | (12,458 | ) | $ | 6,807 | ||||||

| Share-based compensation | 38 | 44 | 99 | 262 | ||||||||||||

| Non-cash lease expenses | 69 | 17 | 243 | 174 | ||||||||||||

| Acquisition costs | 535 | (46 | ) | 1,168 | 201 | |||||||||||

| Refranchising loss | 1,958 | 1,070 | 3,827 | 219 | ||||||||||||

| Impairment of goodwill and intangible assets | 5,368 | - | 9,295 | - | ||||||||||||

| Advertising expenditures exceeding collections | 1,680 | - | 1,680 | - | ||||||||||||

| Change in fair value of derivative liability | - | - | (887 | ) | - | |||||||||||

| Loss on extinguishment of debt | - | - | 88 | - | ||||||||||||

| Gain on contingent consideration payable adjustment | - | - | (1,680 | ) | - | |||||||||||

| Adjusted EBITDA | $ | 1,736 | $ | 1,811 | $ | 1,375 | $ | 7,663 | ||||||||

Exhibit 99.2

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- FAT Brands Inc. Announces Second Quarter Cash Dividend on Class A Common Stock and Class B Common Stock

- Andromeda Partners with Optum to Transform Healthcare User-Insurance Experience

- Golden MagFi (GMFI) Is Now Available for Trading on LBank Exchange

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share