Form 8-K FTI CONSULTING, INC For: Apr 29

First Quarter 2021 Earnings Conference Call FTI Consulting, Inc. April 29, 2021 Exhibit 99.1

Cautionary Note About Forward Looking Statements This presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which involve uncertainties and risks. Forward-looking statements include statements concerning our plans, objectives, goals, strategies, future events, future revenues, future results and performance, expectations, plans or intentions relating to acquisitions, share repurchases and other matters, business trends and other information that is not historical, including statements regarding estimates of our future financial results. When used in this presentation, words such as “estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,” “believes,” “forecasts” and variations of such words or similar expressions are intended to identify forward-looking statements. All forward-looking statements, including, without limitation, estimates of our future financial results, are based upon our expectations at the time we make them and various assumptions. Our expectations, beliefs and projections are expressed in good faith, and we believe there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs and estimates will be achieved, and the Company’s actual results may differ materially from our expectations, beliefs and estimates. Further, unaudited quarterly results are subject to normal year-end adjustments. The Company has experienced fluctuating revenues, operating income and cash flows in prior periods and expects that this will occur from time to time in the future. Other factors that could cause such differences include declines in demand for, or changes in, the mix of services and products that we offer, the mix of the geographic locations where our clients are located or where services are performed, fluctuations in the price per share of our common stock, adverse financial, real estate or other market and general economic conditions, the impact of the COVID-19 pandemic and related events that are beyond our control, which could affect our segments, practices and the geographic regions in which we conduct business, differently and adversely, and other future events, which could impact each of our segments, practices and the geographic regions in which we conduct business differently and could be outside of our control, the pace and timing of the consummation and integration of future acquisitions, the Company’s ability to realize cost savings and efficiencies, competitive and general economic conditions, retention of staff and clients, new laws and regulations, or changes thereto, and other risks described under the heading "Item 1A Risk Factors" in the Company's Annual Report on Form 10-K for the year ended December 31, 2020, filed with the Securities and Exchange Commission (“SEC”) and in the Company's other filings with the SEC. We are under no duty to update any of the forward-looking statements to conform such statements to actual results or events and do not intend to do so.

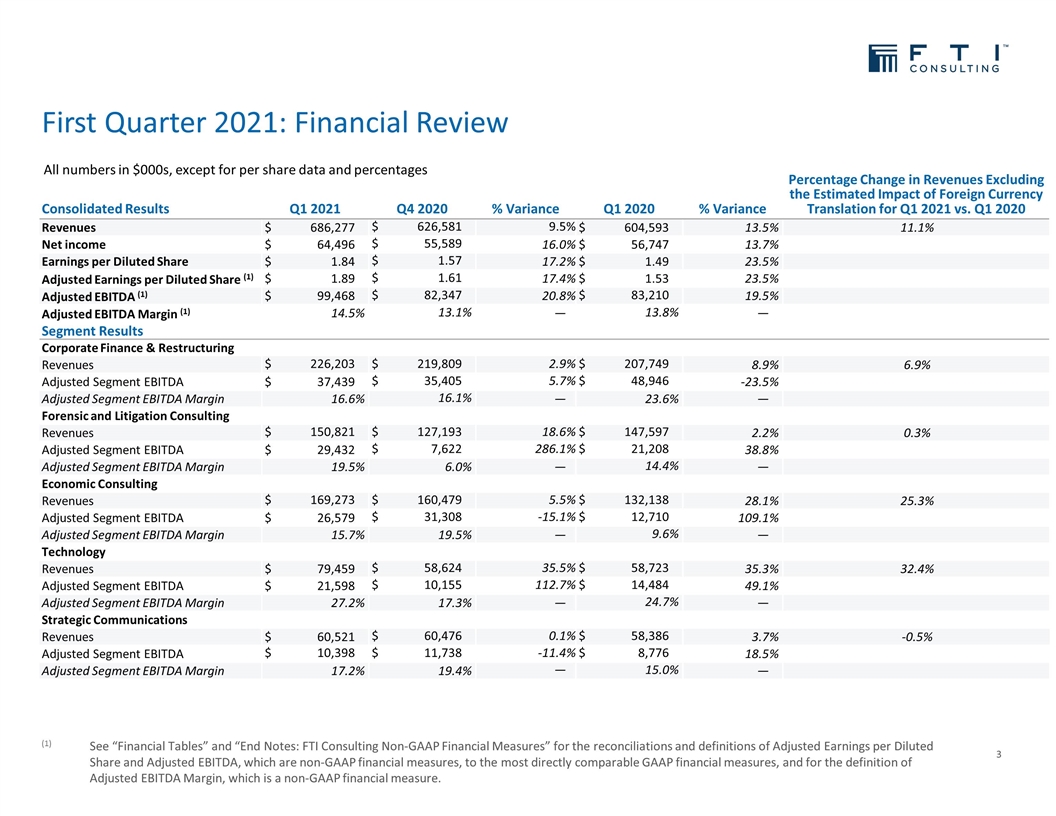

First Quarter 2021: Financial Review (1) See “Financial Tables” and “End Notes: FTI Consulting Non-GAAP Financial Measures” for the reconciliations and definitions of Adjusted Earnings per Diluted Share and Adjusted EBITDA, which are non-GAAP financial measures, to the most directly comparable GAAP financial measures, and for the definition of Adjusted EBITDA Margin, which is a non-GAAP financial measure. All numbers in $000s, except for per share data and percentages Consolidated Results Q1 2021 Q4 2020 % Variance Q1 2020 % Variance Percentage Change in Revenues Excluding the Estimated Impact of Foreign Currency Translation for Q1 2021 vs. Q1 2020 Revenues $ 686,277 $ 626,581 9.5 % $ 604,593 13.5 % 11.1% Net income $ 64,496 $ 55,589 16.0 % $ 56,747 13.7 % Earnings per Diluted Share $ 1.84 $ 1.57 17.2 % $ 1.49 23.5 % Adjusted Earnings per Diluted Share (1) $ 1.89 $ 1.61 17.4 % $ 1.53 23.5 % Adjusted EBITDA (1) $ 99,468 $ 82,347 20.8 % $ 83,210 19.5 % Adjusted EBITDA Margin (1) 14.5 % 13.1 % — 13.8 % — Segment Results Corporate Finance & Restructuring Revenues $ 226,203 $ 219,809 2.9 % $ 207,749 8.9 % 6.9% Adjusted Segment EBITDA $ 37,439 $ 35,405 5.7 % $ 48,946 -23.5 % Adjusted Segment EBITDA Margin 16.6 % 16.1 % — 23.6 % — Forensic and Litigation Consulting Revenues $ 150,821 $ 127,193 18.6 % $ 147,597 2.2 % 0.3% Adjusted Segment EBITDA $ 29,432 $ 7,622 286.1 % $ 21,208 38.8 % Adjusted Segment EBITDA Margin 19.5 % 6.0 % — 14.4 % — Economic Consulting Revenues $ 169,273 $ 160,479 5.5 % $ 132,138 28.1 % 25.3% Adjusted Segment EBITDA $ 26,579 $ 31,308 -15.1 % $ 12,710 109.1 % Adjusted Segment EBITDA Margin 15.7 % 19.5 % — 9.6 % — Technology Revenues $ 79,459 $ 58,624 35.5 % $ 58,723 35.3 % 32.4% Adjusted Segment EBITDA $ 21,598 $ 10,155 112.7 % $ 14,484 49.1 % Adjusted Segment EBITDA Margin 27.2 % 17.3 % — 24.7 % — Strategic Communications Revenues $ 60,521 $ 60,476 0.1 % $ 58,386 3.7 % -0.5% Adjusted Segment EBITDA $ 10,398 $ 11,738 -11.4 % $ 8,776 18.5 % Adjusted Segment EBITDA Margin 17.2 % 19.4 % — 15.0 % —

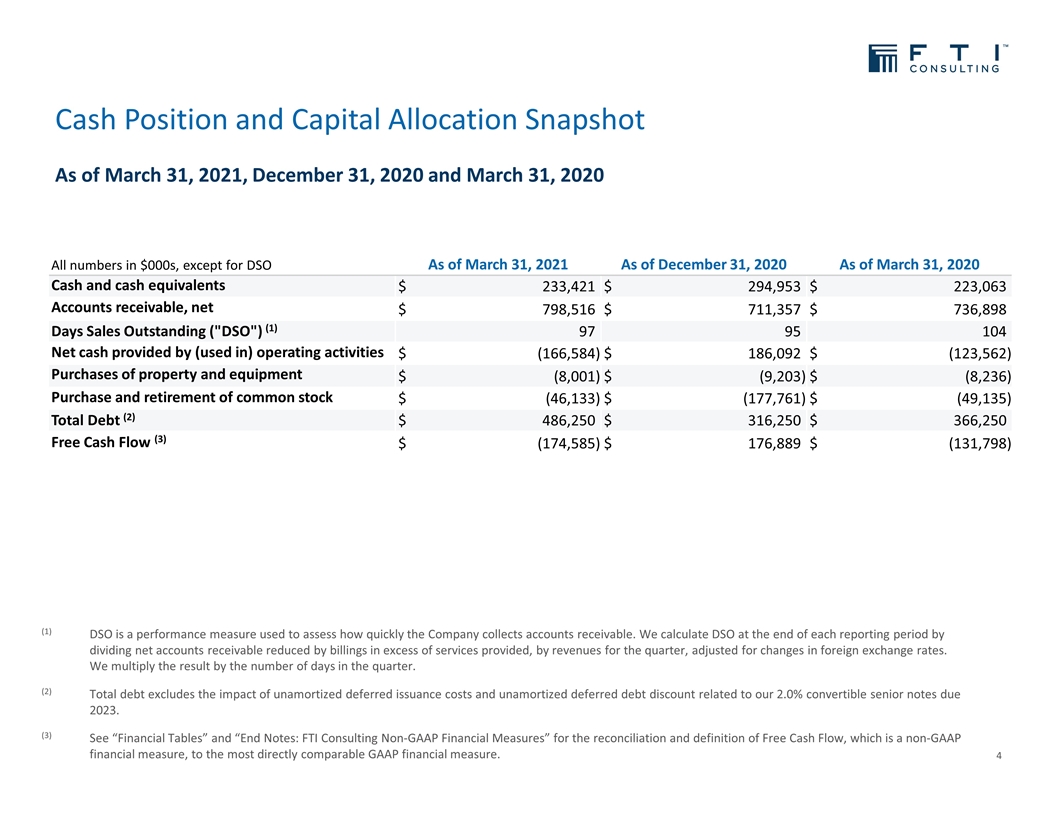

Cash Position and Capital Allocation Snapshot As of March 31, 2021, December 31, 2020 and March 31, 2020 (1)DSO is a performance measure used to assess how quickly the Company collects accounts receivable. We calculate DSO at the end of each reporting period by dividing net accounts receivable reduced by billings in excess of services provided, by revenues for the quarter, adjusted for changes in foreign exchange rates. We multiply the result by the number of days in the quarter. (2)Total debt excludes the impact of unamortized deferred issuance costs and unamortized deferred debt discount related to our 2.0% convertible senior notes due 2023. (3)See “Financial Tables” and “End Notes: FTI Consulting Non-GAAP Financial Measures” for the reconciliation and definition of Free Cash Flow, which is a non-GAAP financial measure, to the most directly comparable GAAP financial measure. All numbers in $000s, except for DSO As of March 31, 2021 As of December 31, 2020 As of March 31, 2020 Cash and cash equivalents $ 233,421 $ 294,953 $ 223,063 Accounts receivable, net $ 798,516 $ 711,357 $ 736,898 Days Sales Outstanding ("DSO") (1) 97 95 104 Net cash provided by (used in) operating activities $ (166,584 ) $ 186,092 $ (123,562 ) Purchases of property and equipment $ (8,001 ) $ (9,203 ) $ (8,236 ) Purchase and retirement of common stock $ (46,133 ) $ (177,761 ) $ (49,135 ) Total Debt (2) $ 486,250 $ 316,250 $ 366,250 Free Cash Flow (3) $ (174,585 ) $ 176,889 $ (131,798 )

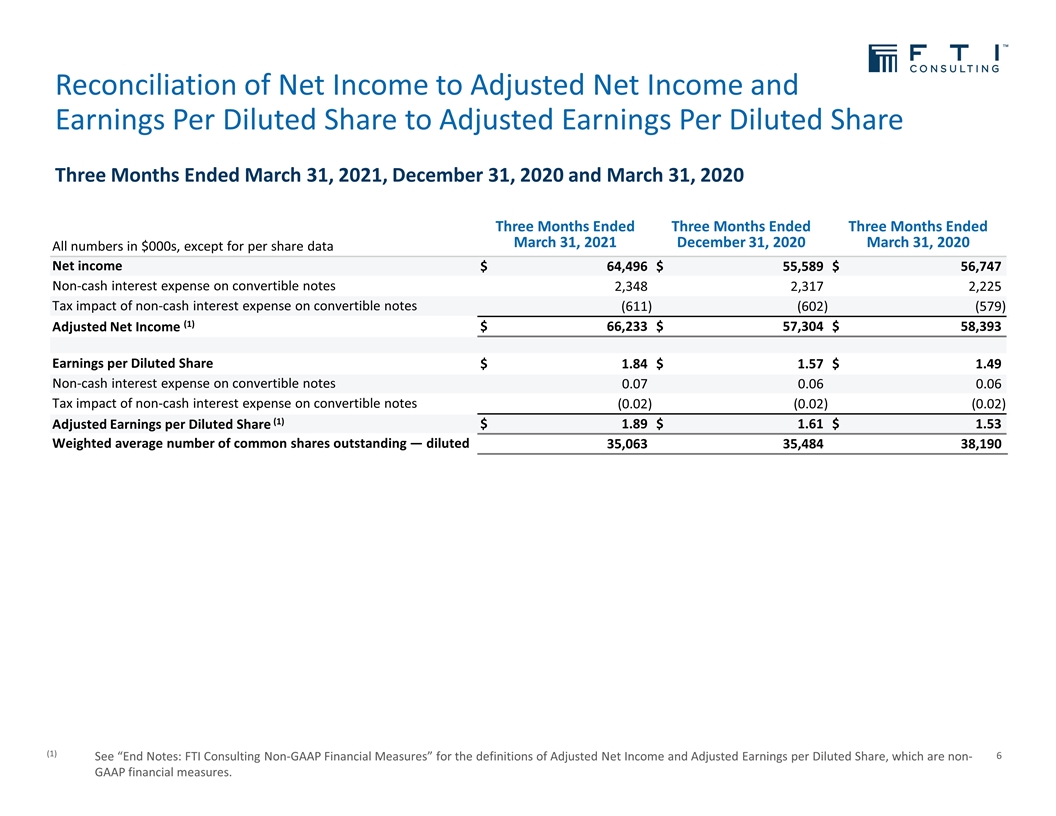

Reconciliation of Net Income to Adjusted Net Income and Earnings Per Diluted Share to Adjusted Earnings Per Diluted Share Three Months Ended March 31, 2021, December 31, 2020 and March 31, 2020 (1)See “End Notes: FTI Consulting Non-GAAP Financial Measures” for the definitions of Adjusted Net Income and Adjusted Earnings per Diluted Share, which are non-GAAP financial measures. All numbers in $000s, except for per share data Three Months Ended March 31, 2021 Three Months Ended December 31, 2020 Three Months Ended March 31, 2020 Net income $ 64,496 $ 55,589 $ 56,747 Non-cash interest expense on convertible notes 2,348 2,317 2,225 Tax impact of non-cash interest expense on convertible notes (611 ) (602 ) (579 ) Adjusted Net Income (1) $ 66,233 $ 57,304 $ 58,393 Earnings per Diluted Share $ 1.84 $ 1.57 $ 1.49 Non-cash interest expense on convertible notes 0.07 0.06 0.06 Tax impact of non-cash interest expense on convertible notes (0.02 ) (0.02 ) (0.02 ) Adjusted Earnings per Diluted Share (1) $ 1.89 $ 1.61 $ 1.53 Weighted average number of common shares outstanding — diluted 35,063 35,484 38,190

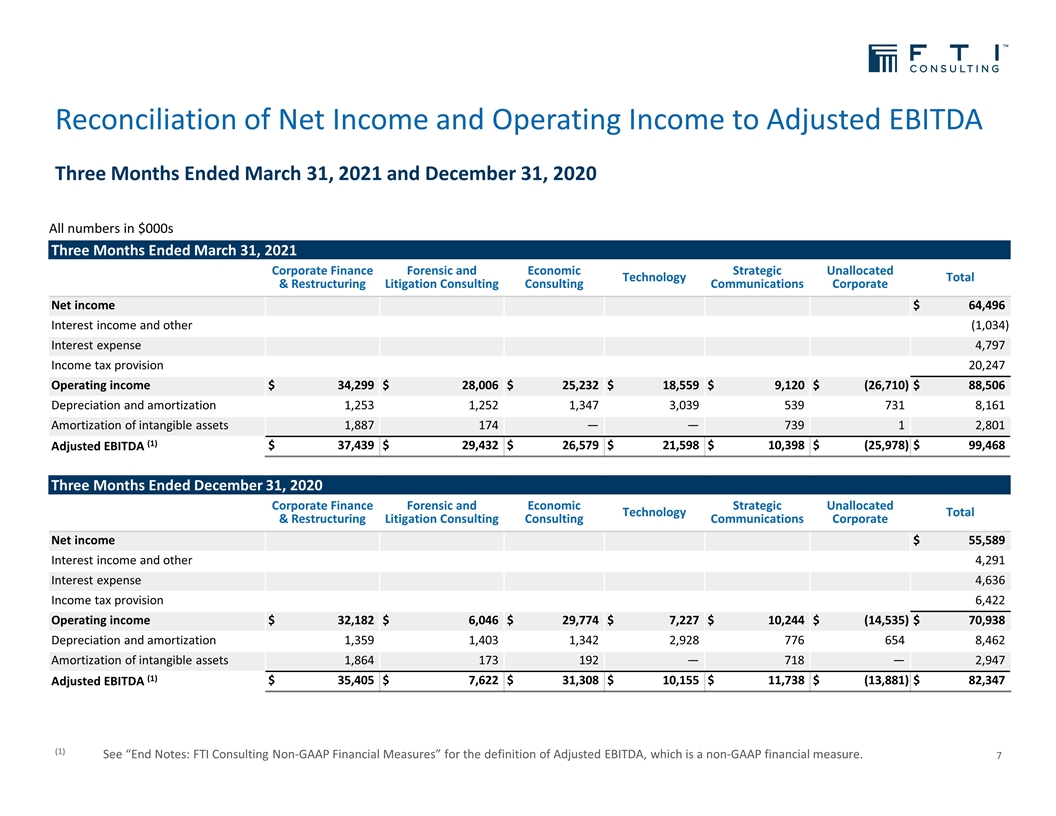

Reconciliation of Net Income and Operating Income to Adjusted EBITDA Three Months Ended March 31, 2021 and December 31, 2020 All numbers in $000s (1)See “End Notes: FTI Consulting Non-GAAP Financial Measures” for the definition of Adjusted EBITDA, which is a non-GAAP financial measure. Three Months Ended March 31, 2021 Corporate Finance & Restructuring Forensic and Litigation Consulting Economic Consulting Technology Strategic Communications Unallocated Corporate Total Net income $ 64,496 Interest income and other (1,034 ) Interest expense 4,797 Income tax provision 20,247 Operating income $ 34,299 $ 28,006 $ 25,232 $ 18,559 $ 9,120 $ (26,710 ) $ 88,506 Depreciation and amortization 1,253 1,252 1,347 3,039 539 731 8,161 Amortization of intangible assets 1,887 174 — — 739 1 2,801 Adjusted EBITDA (1) $ 37,439 $ 29,432 $ 26,579 $ 21,598 $ 10,398 $ (25,978 ) $ 99,468 Three Months Ended December 31, 2020 Corporate Finance & Restructuring Forensic and Litigation Consulting Economic Consulting Technology Strategic Communications Unallocated Corporate Total Net income $ 55,589 Interest income and other 4,291 Interest expense 4,636 Income tax provision 6,422 Operating income $ 32,182 $ 6,046 $ 29,774 $ 7,227 $ 10,244 $ (14,535 ) $ 70,938 Depreciation and amortization 1,359 1,403 1,342 2,928 776 654 8,462 Amortization of intangible assets 1,864 173 192 — 718 — 2,947 Adjusted EBITDA (1) $ 35,405 $ 7,622 $ 31,308 $ 10,155 $ 11,738 $ (13,881 ) $ 82,347

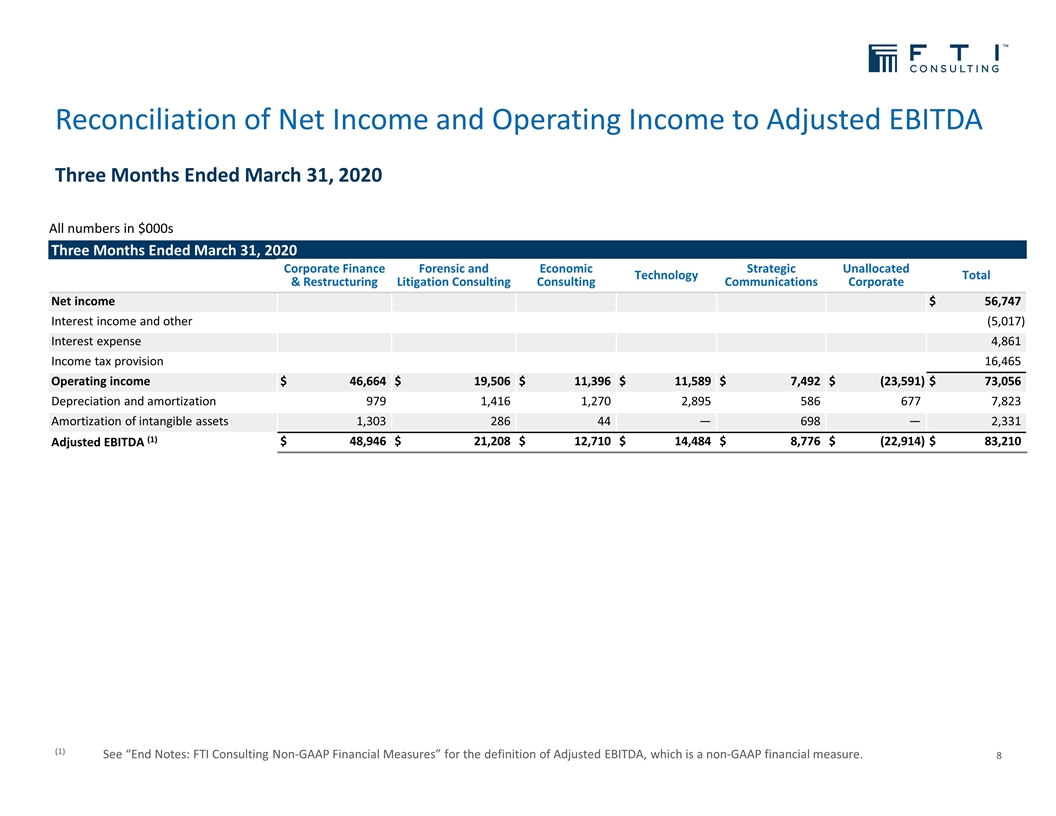

Reconciliation of Net Income and Operating Income to Adjusted EBITDA Three Months Ended March 31, 2020 (1)See “End Notes: FTI Consulting Non-GAAP Financial Measures” for the definition of Adjusted EBITDA, which is a non-GAAP financial measure. Three Months Ended March 31, 2020 Corporate Finance & Restructuring Forensic and Litigation Consulting Economic Consulting Technology Strategic Communications Unallocated Corporate Total Net income $ 56,747 Interest income and other (5,017 ) Interest expense 4,861 Income tax provision 16,465 Operating income $ 46,664 $ 19,506 $ 11,396 $ 11,589 $ 7,492 $ (23,591 ) $ 73,056 Depreciation and amortization 979 1,416 1,270 2,895 586 677 7,823 Amortization of intangible assets 1,303 286 44 — 698 — 2,331 Adjusted EBITDA (1) $ 48,946 $ 21,208 $ 12,710 $ 14,484 $ 8,776 $ (22,914 ) $ 83,210 All numbers in $000s

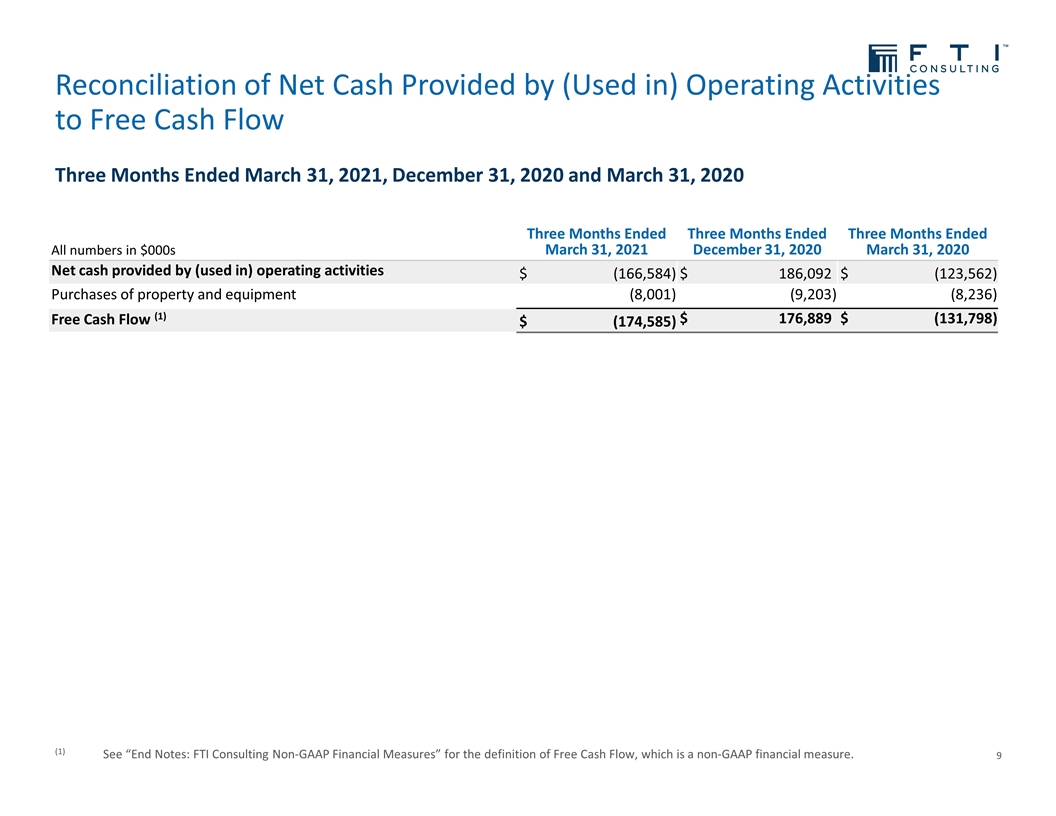

Reconciliation of Net Cash Provided by (Used in) Operating Activities to Free Cash Flow Three Months Ended March 31, 2021, December 31, 2020 and March 31, 2020 (1)See “End Notes: FTI Consulting Non-GAAP Financial Measures” for the definition of Free Cash Flow, which is a non-GAAP financial measure. All numbers in $000s Three Months Ended March 31, 2021 Three Months Ended December 31, 2020 Three Months Ended March 31, 2020 Net cash provided by (used in) operating activities $ (166,584 ) $ 186,092 $ (123,562 ) Purchases of property and equipment (8,001 ) (9,203 ) (8,236 ) Free Cash Flow (1) $ (174,585 ) $ 176,889 $ (131,798 )

End Notes: FTI Consulting Non-GAAP Financial Measures In this presentation, we sometimes use information derived from consolidated and segment financial information that may not be presented in our financial statements or prepared in accordance with generally accepted accounting principles in the United States ("GAAP"). Certain of these measures are considered “non-GAAP financial measures” under the Securities and Exchange Commission ("SEC") rules. Specifically, we have referred to the following non-GAAP financial measures in this presentation: Adjusted EBITDA Adjusted EBITDA Margin Adjusted Net Income Adjusted Earnings per Diluted Share Free Cash Flow We have included the definitions of Segment Operating Income and Adjusted Segment EBITDA, which are GAAP financial measures, below in order to more fully define the components of certain non-GAAP financial measures in this presentation. We define Segment Operating Income as a segment’s share of consolidated operating income. We use Segment Operating Income for the purpose of calculating Adjusted Segment EBITDA. We define Adjusted Segment EBITDA as a segment’s share of consolidated operating income before depreciation, amortization of intangible assets, remeasurement of acquisition-related contingent consideration, special charges and goodwill impairment charges. We use Adjusted Segment EBITDA as a basis to internally evaluate the financial performance of our segments because we believe it reflects current core operating performance and provides an indicator of the segment’s ability to generate cash. We define Adjusted EBITDA, which is a non-GAAP financial measure, as consolidated net income before income tax provision, other non-operating income (expense), depreciation, amortization of intangible assets, remeasurement of acquisition-related contingent consideration, special charges, goodwill impairment charges, gain or loss on sale of a business and losses on early extinguishment of debt. We believe that this non-GAAP financial measure, when considered together with our GAAP financial results and GAAP financial measures, provide management and investors with a more complete understanding of our operating results, including underlying trends. In addition, EBITDA is a common alternative measure of operating performance used by many of our competitors. It is used by investors, financial analysts, rating agencies and others to value and compare the financial performance of companies in our industry. Therefore, we also believe that this non-GAAP financial measure, considered along with corresponding GAAP financial measures, provide management and investors with additional information for comparison of our operating results with the operating results of other companies. We define Adjusted EBITDA Margin, which is a non-GAAP financial measure, as Adjusted EBITDA as a percentage of total revenues. We define Adjusted Net Income and Adjusted Earnings per Diluted Share (“Adjusted EPS”), which are non-GAAP financial measures, as net income and earnings per diluted share ("EPS"), respectively, excluding the impact of remeasurement of acquisition-related contingent consideration, special charges, goodwill impairment charges, losses on early extinguishment of debt, non-cash interest expense on convertible notes and the gain or loss on sale of a business. We use Adjusted Net Income for the purpose of calculating Adjusted EPS. Management uses Adjusted EPS to assess total Company operating performance on a consistent basis. We believe that these non-GAAP financial measures, when considered together with our GAAP financial results and GAAP financial measures, provide management and investors with an additional understanding of our business operating results, including underlying trends. We define Free Cash Flow, which is a non-GAAP financial measure, as net cash provided by (used in) operating activities less cash payments for purchases of property and equipment. We believe this non-GAAP financial measure, when considered together with our GAAP financial results, provides management and investors with an additional understanding of the Company’s ability to generate cash for ongoing business operations and other capital deployment. Non-GAAP financial measures are not defined in the same manner by all companies and may not be comparable with other similarly titled measures of other companies. Non-GAAP financial measures should be considered in addition to, but not as a substitute for or superior to, the information contained in our Condensed Consolidated Statements of Comprehensive Income and Condensed Consolidated Statements of Cash Flows.

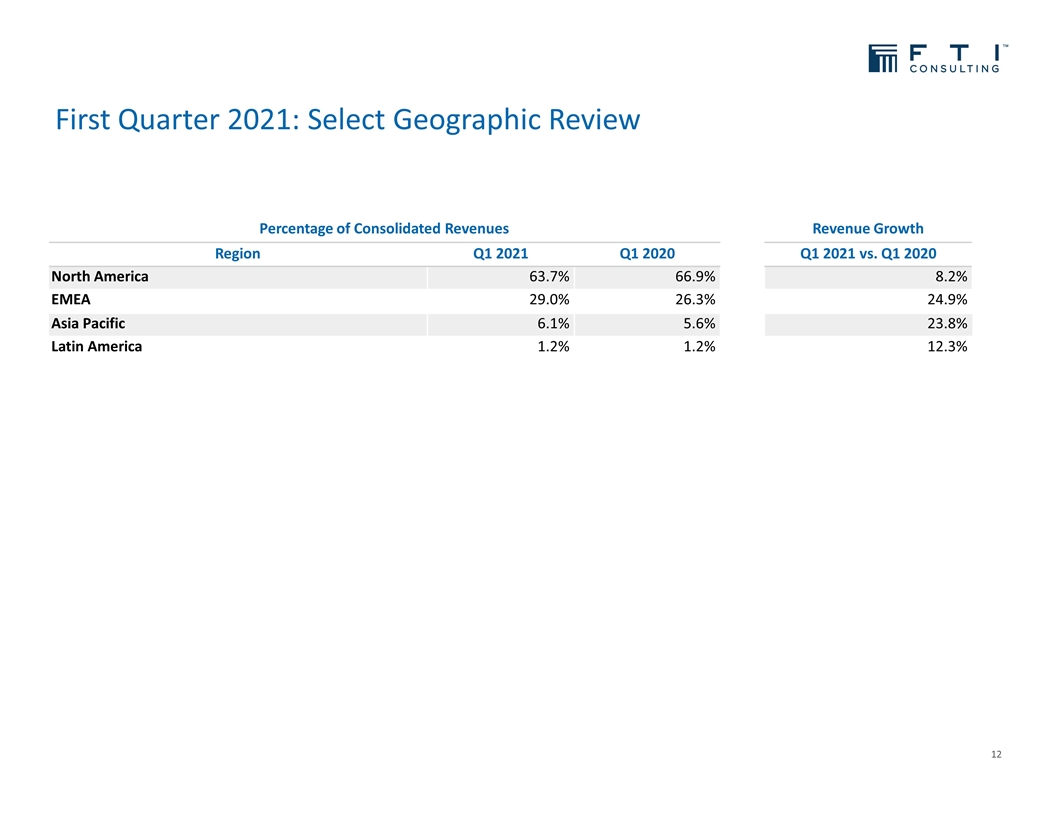

First Quarter 2021: Select Geographic Review Percentage of Consolidated Revenues Revenue Growth Region Q1 2021 Q1 2020 Q1 2021 vs. Q1 2020 North America 63.7 % 66.9 % 8.2 % EMEA 29.0 % 26.3 % 24.9 % Asia Pacific 6.1 % 5.6 % 23.8 % Latin America 1.2 % 1.2 % 12.3 %

First Quarter 2021: Select Awards & Accolades

Experts with Impact TM

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Director Appointment

- Proposed Increase in Size of Offer for Subscription and Re-Opening of Offer for Subscription to Further Applications

- Hofseth Biocare ASA: HBC ANNUAL REPORT 2023

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share