Form 8-K FLAGSTAR BANCORP INC For: Oct 22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 22, 2018

(Exact name of registrant as specified in its charter)

Michigan | 1-16577 | 38-3150651 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||

5151 Corporate Drive, Troy, Michigan 48098 | ||||

(Address of principal executive offices) (Zip Code) | ||||

(248) 312-2000

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 | Results of Operations and Financial Condition |

On October 23, 2018, Flagstar Bancorp, Inc. (the "Company") issued a press release regarding its preliminary results of operations and financial condition for the three months ended September 30, 2018. The text of the press release is furnished as Exhibit 99.1 to this report. The Company will include final financial statements and additional analyses for the three and nine months ended September 30, 2018 as part of its Quarterly Report on Form 10-Q.

On October 23, 2018, the Company will hold a conference call to review third quarter 2018 earnings. A copy of the slide presentation to be used by the Company on the conference call is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

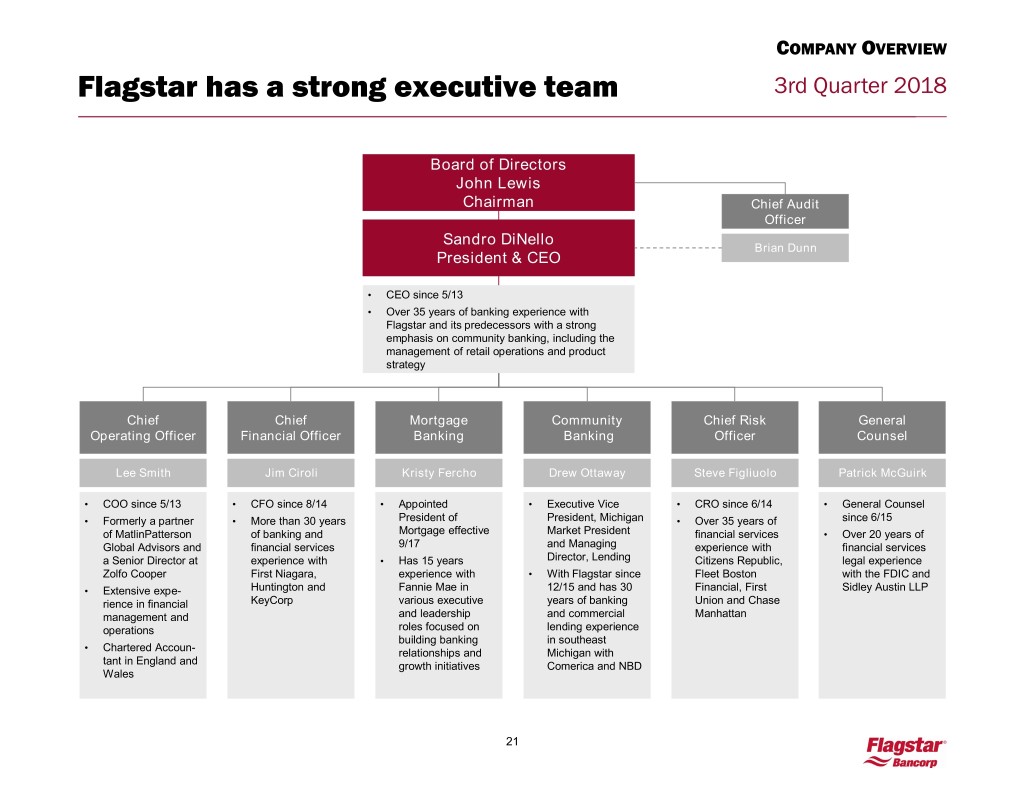

Compensatory Arrangements for Certain Officers

On October 22, 2018, Flagstar Bancorp, Inc. (the "Company") and Flagstar Bank, FSB (the "Bank") entered into separate employment agreements with Alessandro DiNello (the “DiNello Employment Agreement”), to continue serving as President and Chief Executive Officer of the Bank and the Company, and with Lee Smith (the “Smith Employment Agreement”) to continue serving as Executive Vice President and Chief Operating Officer of the Bank and the Company. These employment agreements replace the employment agreements, as amended, that the Company and the Bank had with each of Mr. DiNello and Mr. Smith. Under their respective agreements, Mr. DiNello's annual base salary will be not less than $1,000,000 and Mr. Smith’s annual base salary will be not less than $750,000. The DiNello Employment Agreement and the Smith Employment Agreement continue until December 31, 2021 and December 31, 2020, respectively, and each will automatically renew at the end of their respective terms for successive 12 month periods thereafter unless any party to each such agreement gives notice otherwise at least 180 days in advance. As with their prior employment agreements with the Company and the Bank, these agreements also provide for their participation in the Company’s bonus program, Executive Long Term Incentive Program, and other Company equity programs. In addition, both the DiNello Employment Agreement and the Smith Employment Agreement contain non-compete and non-solicit requirements that apply during the term of employment and for one year thereafter. The agreements also provide that Mr. DiNello will receive three times, and Mr. Smith will receive two times, their respective base salary and targeted bonus if terminated due to a “change in control” as defined therein.

Item 9.01 | Financial Statements and Exhibits |

Exhibits | ||||

99.1 | Press release of Flagstar Bancorp, Inc. dated October 23, 2018 | |||

99.2 | Flagstar Bancorp, Inc. Conference Call Presentation Slides - Earnings Presentation Third Quarter | |||

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

FLAGSTAR BANCORP, INC. | |||||||

Dated: | 10/23/2018 | By: | /s/ James K. Ciroli | ||||

James K. Ciroli | |||||||

Executive Vice President and Chief Financial Officer | |||||||

Exhibit Index

EXHIBIT 99.1

NEWS RELEASE

For more information, contact:

David L. Urban

(248) 312-5970

Flagstar Reports Third Quarter 2018 Net Income of $48 million, or $0.83 per Diluted Share

Strong growth in earning assets and a widening of the net interest margin result in record net interest income levels

Key Highlights - Third Quarter 2018

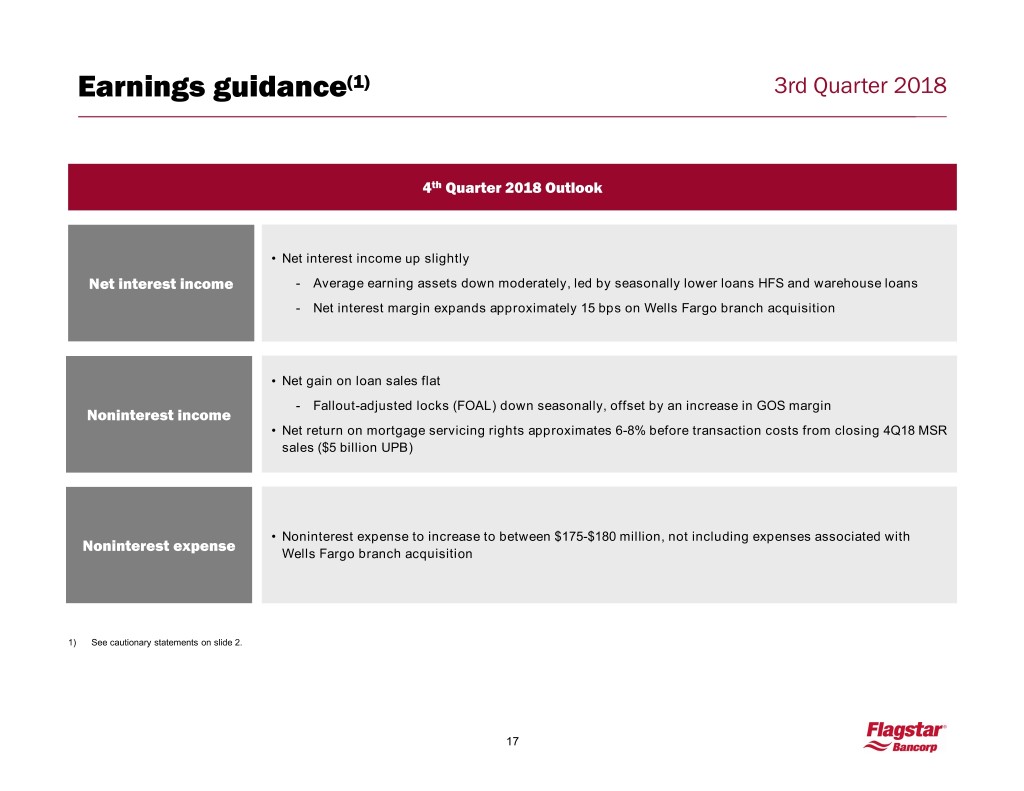

• | Adjusted net income of $49 million, or $0.85 per diluted share, excluding costs for pending Wells Fargo branch acquisition. |

• | Net interest income grew $9 million, or 8 percent from second quarter 2018, led by earning asset growth and net interest margin expansion. |

• | Average loans held-for-investment rose 6 percent while average total deposits increased 9 percent from prior quarter. |

• | Total serviced accounts increased 16 percent from last quarter to nearly 620,000 accounts. |

• | Noninterest expense dropped $4 million, or 2 percent from prior quarter, driven by prudent expense management and lower mortgage expenses. |

• | Pristine asset quality - minimal net charge-offs, very low delinquencies and strong allowance for loan loss coverage. |

TROY, Mich., October 23, 2018 - Flagstar Bancorp, Inc. (NYSE: FBC), the holding company for Flagstar Bank, FSB, today reported third quarter 2018 net income of $48 million, or $0.83 per diluted share, and adjusted net income of $49 million, or $0.85 per diluted share, excluding $1.2 million of pre-tax expenses related to the pending acquisition of Wells Fargo branches. The Company reported net income of $50 million, or $0.85 per diluted share, in the second quarter 2018, and $40 million, or $0.70 per diluted share, in the third quarter 2017.

"Our third quarter results once again demonstrated the strength of our banking business,” said Alessandro DiNello, president and chief executive officer of Flagstar Bancorp, Inc. “Solid growth in banking along with disciplined cost control, helped us deliver an adjusted ROA of 1.1 percent.

"Our banking business provided a stable and growing source of income. Net interest income grew 8 percent from last quarter, as average earning assets increased 5 percent and the net interest margin expanded 7 basis points. Also, we saw total serviced accounts increase 16 percent in the quarter and we now service nearly 620,000 accounts. We expect this total to exceed 800,000 by year-end.

1

"Earnings were also helped by our expense discipline. In the third quarter 2018, total noninterest expense fell 2 percent to $173 million, despite strong growth in the balance sheet and increased mortgage originations, as we continued to scale businesses with a lower level of incremental expense, along with aggressively managing our mortgage expenses.

"Mortgage revenues declined in the quarter as fallout-adjusted locks decreased 8 percent to $8.3 billion and the net gain on loan sale margin fell 20 basis points to 0.51 percent. This decline was partially offset by a stronger MSR return.

"Looking ahead, we believe we are well positioned for continued success. Our pending acquisition of 52 Midwest branches of Wells Fargo, which we expect to close at the beginning of December 2018, will bring us low cost and low beta deposits. Additionally, with the lifting of our Federal Reserve Supervisory Agreement this quarter, we now have more flexibility in managing our capital to maximize risk-adjusted returns for our shareholders.”

Third Quarter 2018 Highlights:

Income Statement Highlights | |||||||||||||||

Three Months Ended | |||||||||||||||

September 30, 2018 | June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | |||||||||||

(Dollars in millions) | |||||||||||||||

Net interest income | $ | 124 | $ | 115 | $ | 106 | $ | 107 | $ | 103 | |||||

Provision (benefit) for loan losses | (2 | ) | (1 | ) | — | 2 | 2 | ||||||||

Noninterest income | 107 | 123 | 111 | 124 | 130 | ||||||||||

Noninterest expense | 173 | 177 | 173 | 178 | 171 | ||||||||||

Income before income taxes | 60 | 62 | 44 | 51 | 60 | ||||||||||

Provision for income taxes (1) | 12 | 12 | 9 | 96 | 20 | ||||||||||

Net income (loss) | $ | 48 | $ | 50 | $ | 35 | $ | (45 | ) | $ | 40 | ||||

Income (loss) per share: | |||||||||||||||

Basic | $ | 0.84 | $ | 0.86 | $ | 0.61 | $ | (0.79 | ) | $ | 0.71 | ||||

Diluted | $ | 0.83 | $ | 0.85 | $ | 0.60 | $ | (0.79 | ) | $ | 0.70 | ||||

(1) | The three months ended December 31, 2017 included an $80 million, or $1.37 per diluted share, non-cash charge to the provision for income taxes, resulting from the revaluation of the Company's net deferred tax asset at a lower statutory rate as a result of the Tax Cuts and Jobs Act. |

Key Ratios | |||||||||||||

Three Months Ended | Change (bps) | ||||||||||||

September 30, 2018 | June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | Seq | Yr/Yr | |||||||

Net interest margin | 2.93 | % | 2.86 | % | 2.76 | % | 2.76 | % | 2.78 | % | 7 | 15 | |

Return on average assets | 1.0 | % | 1.1 | % | 0.8 | % | (1.1 | )% | 1.0 | % | (10) | — | |

Return on average equity | 12.8 | % | 13.5 | % | 9.9 | % | (12.1 | )% | 11.1 | % | (70) | 170 | |

Efficiency ratio | 74.6 | % | 74.4 | % | 79.7 | % | 77.1 | % | 73.5 | % | 20 | 110 | |

2

Balance Sheet Highlights | |||||||||||||||||||

Three Months Ended | % Change | ||||||||||||||||||

September 30, 2018 | June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | Seq | Yr/Yr | |||||||||||||

(Dollars in millions) | |||||||||||||||||||

Average Balance Sheet Data | |||||||||||||||||||

Average interest-earning assets | $ | 16,786 | $ | 15,993 | $ | 15,354 | $ | 15,379 | $ | 14,737 | 5 | % | 14 | % | |||||

Average loans held-for-sale (LHFS) | 4,393 | 4,170 | 4,231 | 4,537 | 4,476 | 5 | % | (2 | )% | ||||||||||

Average loans held-for-investment (LHFI) | 8,872 | 8,380 | 7,487 | 7,295 | 6,803 | 6 | % | 30 | % | ||||||||||

Average total deposits | 11,336 | 10,414 | 9,371 | 9,084 | 9,005 | 9 | % | 26 | % | ||||||||||

Net Interest Income

Net interest income rose $9 million to $124 million for the third quarter 2018, as compared to the second quarter 2018. The results reflected a 5 percent increase in average earning assets, led by balanced growth in loans held-for-sale, commercial and consumer loans. The net interest margin expanded 7 basis points to 2.93 percent for the third quarter 2018 as higher yields on interest-earning assets more than offset higher deposit costs.

Loans held-for-investment averaged $8.9 billion for the third quarter 2018, increasing $492 million, or 6 percent, from the prior quarter. During the third quarter 2018, average commercial loans rose $253 million, or 5 percent, with average warehouse loans increasing $91 million, average commercial real estate loans rising $89 million and average commercial and industrial loans increasing $73 million. Average consumer loans rose $239 million, or 7 percent, driven by an increase in mortgage loans (primarily jumbo).

Average total deposits were $11.3 billion in the third quarter 2018, increasing $922 million, or 9 percent from the second quarter 2018, led primarily by higher custodial and retail deposits. Average custodial deposits rose $366 million, or 23 percent, led by a 16 percent increase in serviced accounts. Average retail deposits increased $211 million, or 3 percent, as higher demand deposits and certificates of deposit were partially offset by a drop in savings deposits.

Provision for Loan Losses

The Company experienced a provision benefit in the third quarter 2018, resulting primarily from a continued decline in loss rates in the held-for-investment portfolio. The provision benefit totaled $2 million for the third quarter 2018, as compared to $1 million for the second quarter 2018.

3

Noninterest Income

Noninterest income fell $16 million, or 13 percent, to $107 million in the third quarter of 2018, as compared to $123 million for the second quarter 2018. The decrease was primarily due to lower net gain on loan sales, partially offset by an increase in the net return on mortgage servicing rights.

Third quarter 2018 net gain on loan sales fell $20 million, or 32 percent, to $43 million, versus $63 million in the second quarter 2018. Fallout-adjusted locks decreased 8 percent to $8.3 billion, due to softer mortgage volume. The net gain on loan sale margin fell 20 basis points to 0.51 percent for the third quarter 2018, as compared to 0.71 percent for the second quarter 2018. The lower margin was primarily due to secondary margin compression and a mix shift toward lower margin, but lower cost delegated correspondent business. Excluding the secondary performance, the net gain on loan sale margin was 66 basis points.

Mortgage Metrics | |||||||||||||||||||

Change (% / bps) | |||||||||||||||||||

September 30, 2018 | June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | Seq | Yr/Yr | |||||||||||||

(Dollars in millions) | |||||||||||||||||||

For the three months ended: | |||||||||||||||||||

Mortgage rate lock commitments (fallout-adjusted) (1) | $ | 8,290 | $ | 9,011 | $ | 7,722 | $ | 8,631 | $ | 8,898 | (8 | )% | (7 | )% | |||||

Net margin on mortgage rate lock commitments (fallout-adjusted) (1) (2) | 0.51 | % | 0.71 | % | 0.77 | % | 0.91 | % | 0.84 | % | (20) | (33) | |||||||

Net gain on loan sales | $ | 43 | $ | 63 | $ | 60 | $ | 79 | $ | 75 | (32 | )% | (43 | )% | |||||

Net (loss) return on the mortgage servicing rights (MSR) | $ | 13 | $ | 9 | $ | 4 | $ | (4 | ) | $ | 6 | 44 | % | 117 | % | ||||

Gain on loan sales + net (loss) return on the MSR | $ | 56 | $ | 72 | $ | 64 | $ | 75 | $ | 81 | (22 | )% | (31 | )% | |||||

At the end of the period: | |||||||||||||||||||

Residential loans serviced (number of accounts - 000's) (3) | 619 | 535 | 470 | 442 | 415 | 16 | % | 49 | % | ||||||||||

Capitalized value of MSRs | 1.43 | % | 1.34 | % | 1.27 | % | 1.16 | % | 1.15 | % | 9 | 28 | |||||||

N/M - Not meaningful | |||||||||||||||||||

(1) Fallout-adjusted mortgage rate lock commitments are adjusted by a percentage of mortgage loans in the pipeline that are not expected to close based on previous historical experience and the level of interest rates. | |||||||||||||||||||

(2) Gain on sale margin is based on net gain on loan sales (excludes net gain on loan sales of $1 million from loans transferred from HFI in the three months ended December 31, 2017) to fallout-adjusted mortgage rate lock commitments. | |||||||||||||||||||

(3) Includes loans serviced for own loan portfolio, serviced for others, and subserviced for others. | |||||||||||||||||||

Net return on mortgage servicing rights (including the impact of hedges) increased $4 million, resulting in a net gain of $13 million for the third quarter 2018, as compared to a net gain of $9 million for the second quarter 2018. The increase from the prior quarter largely reflected higher service fee income due to a larger MSR portfolio and a $1.9 million fair value gain associated with a pending MSR sale of $4.7 billion UPB expected to close in the fourth quarter 2018.

Noninterest Expense

Noninterest expense fell to $173 million for the third quarter 2018, as compared to $177 million for the second quarter 2018, primarily due to lower compensation and benefits and commissions, partially offset by acquisition costs related to the Company's pending acquisition of Wells Fargo branches. Excluding $1.2 million of transaction costs from pending acquisitions, the Company's adjusted noninterest expense was $172 million.

During the third quarter 2018, compensation and benefits declined $4 million, primarily due to cost reduction initiatives and lower incentive compensation, while commissions decreased $4 million, reflecting lower mortgage expenses.

4

The Company's total efficiency ratio rose slightly to 75 percent for the third quarter 2018, as compared to 74 percent for the second quarter 2018, resulting from the decline in mortgage revenue. Revenue decreased 3 percent while expenses fell 2 percent in the third quarter 2018.

Income Taxes

The third quarter 2018 provision for income taxes totaled $12 million, unchanged from the second quarter 2018. The Company's effective tax rate was 20 percent for the third quarter 2018, unchanged from the prior quarter.

Asset Quality

Credit Quality Ratios | |||||||||||||||||||

Three Months Ended | Change (% / bps) | ||||||||||||||||||

September 30, 2018 | June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | Seq | Yr/Yr | |||||||||||||

(Dollars in millions) | |||||||||||||||||||

Allowance for loan loss to LHFI | 1.5 | % | 1.5 | % | 1.7 | % | 1.8 | % | 2.0 | % | 0 | (50) | |||||||

Charge-offs, net of recoveries | $ | 1 | $ | 1 | $ | 1 | $ | 2 | $ | 2 | — | % | (50 | )% | |||||

Total nonperforming loans held-for-investment | $ | 25 | $ | 27 | $ | 29 | $ | 29 | $ | 31 | (7 | )% | (19 | )% | |||||

Net charge-offs to LHFI ratio (annualized) | 0.05 | % | 0.02 | % | 0.06 | % | 0.12 | % | 0.08 | % | 3 | (3) | |||||||

Ratio of nonperforming LHFI and TDRs to LHFI | 0.28 | % | 0.30 | % | 0.35 | % | 0.38 | % | 0.44 | % | (2) | (16) | |||||||

N/M - Not meaningful

The allowance for loan losses was $134 million at September 30, 2018, compared to $137 million at June 30, 2018. The allowance for loan losses covered 1.5 percent of loans held-for-investment at September 30, 2018, unchanged from June 30, 2018.

Net charge-offs in the third quarter 2018 were $1 million, or 5 basis points of HFI loans, compared to $1 million, or 2 basis points in the prior quarter.

Nonperforming loans held-for-investment were $25 million at September 30, 2018, compared to $27 million at June 30, 2018. The ratio of nonperforming loans to loans held-for-investment was 0.28 percent at September 30, 2018, compared to 0.30 percent at June 30, 2018. At September 30, 2018, early stage consumer loan delinquencies totaled $3 million, or 0.08 percent of consumer loans, unchanged from June 30, 2018.

Capital

Capital Ratios (Bancorp) | Three Months Ended | Change (% / bps) | |||||||||||||||||

September 30, 2018 | June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | Seq | Yr/Yr | |||||||||||||

Tangible common equity to assets ratio (1) | 7.74 | % | 7.74 | % | 7.65 | % | 8.15 | % | 8.47 | % | — | (73 | ) | ||||||

Tier 1 leverage (to adj. avg. total assets) | 8.36 | % | 8.65 | % | 8.72 | % | 8.51 | % | 8.80 | % | (29) | (44) | |||||||

Tier 1 common equity (to RWA) | 11.01 | % | 10.84 | % | 10.80 | % | 11.50 | % | 11.65 | % | 17 | (64) | |||||||

Tier 1 capital (to RWA) | 13.04 | % | 12.86 | % | 12.90 | % | 13.63 | % | 13.72 | % | 18 | (68) | |||||||

Total capital (to RWA) | 14.20 | % | 14.04 | % | 14.14 | % | 14.90 | % | 14.99 | % | 16 | (79) | |||||||

MSRs to Tier 1 capital | 20.3 | % | 16.9 | % | 16.2 | % | 20.1 | % | 17.3 | % | 340 | 300 | |||||||

Tangible book value per share (1) | $ | 25.13 | $ | 24.37 | $ | 23.62 | $ | 24.04 | $ | 25.01 | 3 | % | — | % | |||||

(1) | See Non-GAAP Reconciliation for further information. |

N/M - Not meaningful

The Company maintained a robust capital position with regulatory ratios well above current regulatory quantitative guidelines for "well capitalized" institutions. At September 30, 2018, the Company had a Tier 1 leverage ratio of

5

8.36 percent, as compared to 8.65 percent at June 30, 2018. The decrease in the ratio resulted primarily from balance sheet growth and higher MSRs, partially offset by earnings retention.

Under the terms of recently proposed changes to regulatory capital requirements, the Company's Tier 1 leverage ratio would have increased approximately 67 basis points and risk-based capital ratios by approximately 30-50 basis points at September 30, 2018 (pro forma basis).

Earnings Conference Call

As previously announced, the Company's third quarter 2018 earnings call will be held Tuesday, October 23, 2018 at 11 a.m. (ET).

To join the call, please dial (877) 260-1479 toll free or (334) 323-0522 and use passcode 9173210. Please call at least 10 minutes before the conference is scheduled to begin. A replay will be available for five business days by calling (888) 203-1112 toll free or (719) 457-0820 and using passcode 9173210.

The conference call will also be available as a live audiocast on the Investor Relations section of flagstar.com, where it will be archived and available for replay and download. The slide presentation accompanying the conference call will be posted on the site.

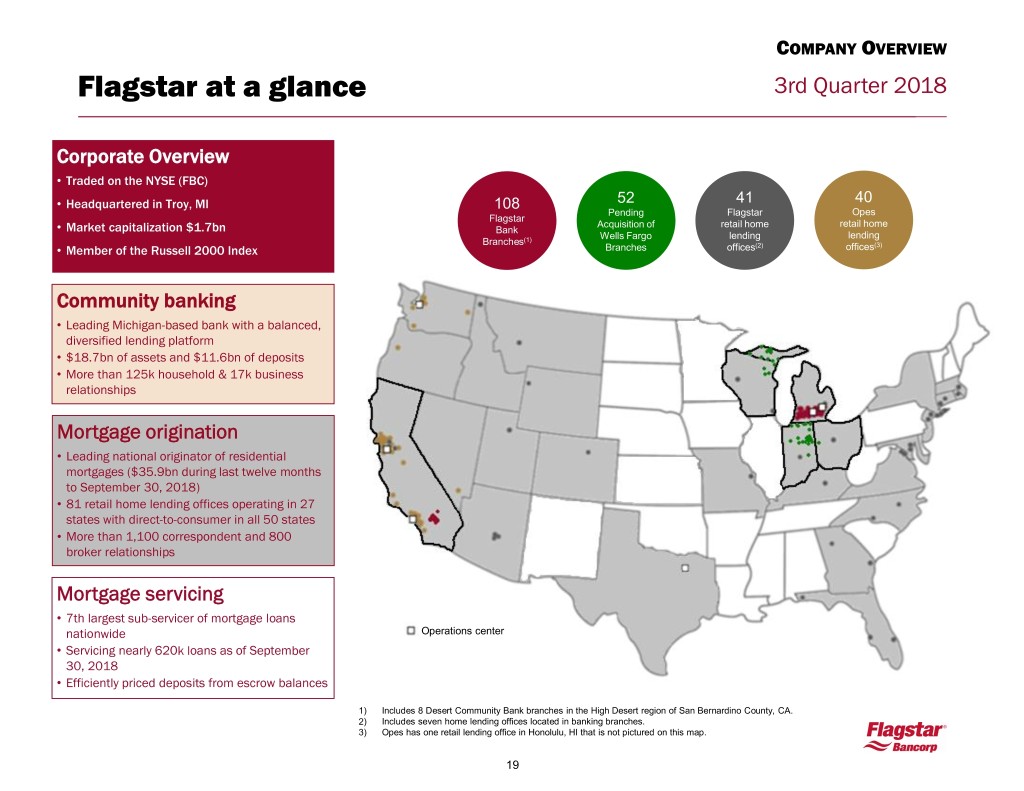

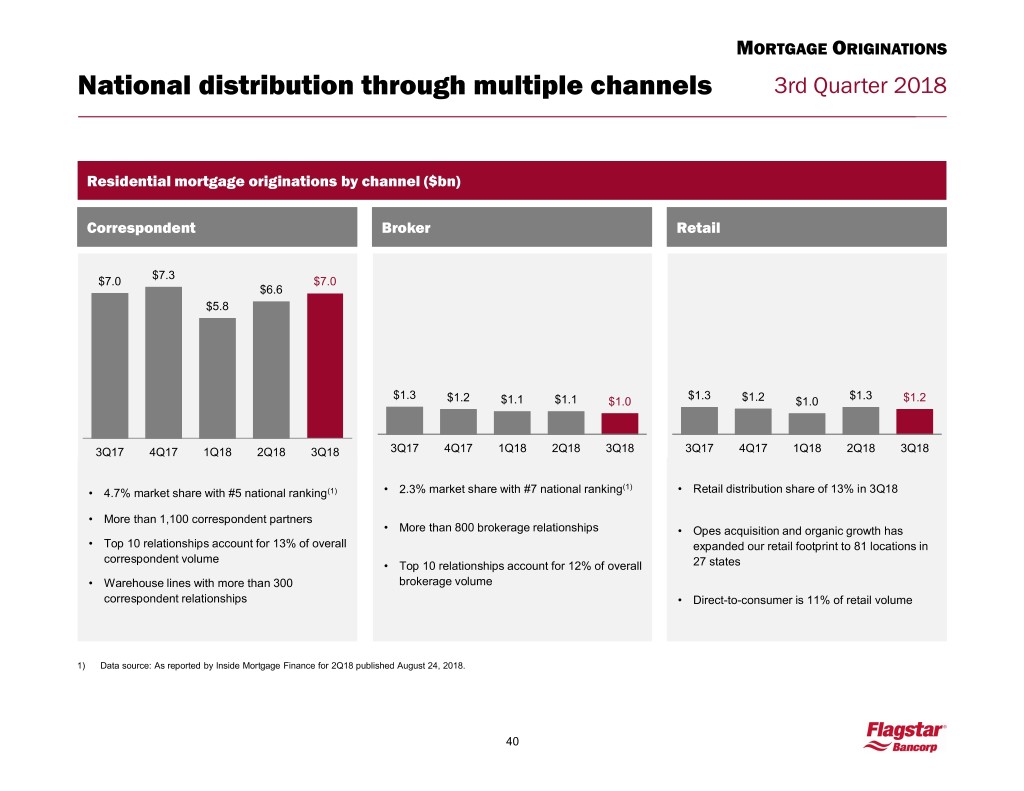

About Flagstar

Flagstar Bancorp, Inc. (NYSE: FBC) is an $18.7 billion savings and loan holding company headquartered in Troy, Mich. Flagstar Bank, FSB, provides commercial, small business, and consumer banking services through 108 branches in Michigan and California. It also provides home loans through a wholesale network of brokers and correspondents in all 50 states, as well as 81 retail locations in 27 states, representing the combined retail branches of Flagstar and its Opes Advisors mortgage division. Flagstar is a leading national originator and servicer of mortgage loans, handling payments and record keeping for $136 billion of home loans representing nearly 620,000 borrowers. For more information, please visit flagstar.com.

Use of Non-GAAP Financial Measures

In addition to results presented in accordance with GAAP, this news release includes non-GAAP financial measures, such as tangible book value per share, tangible common equity to assets ratio, adjusted net income, adjusted diluted earnings per share, adjusted noninterest expense and adjusted return on average assets. The Company believes these non-GAAP financial measures provide additional information that is useful to investors in helping to understand the capital requirements Flagstar will face in the future and underlying performance and trends of Flagstar.

Non-GAAP financial measures have inherent limitations. Readers should be aware of these limitations and should be cautious with respect to the use of such measures. To compensate for these limitations, we use non-GAAP measures as comparative tools, together with GAAP measures, to assist in the evaluation of our operating performance or financial condition. Also, we ensure that these measures are calculated using the appropriate GAAP or regulatory components in their entirety and that they are computed in a manner intended to facilitate consistent period-to-period comparisons. Flagstar’s method of calculating these non-GAAP measures may differ from methods used by other companies. These non-GAAP measures should not be considered in isolation or as a substitute for those financial measures prepared in accordance with GAAP or in-effect regulatory requirements.

Where non-GAAP financial measures are used, the most directly comparable GAAP or regulatory financial measure, as well as the reconciliation to the most directly comparable GAAP or regulatory financial measure, can be found in this news release. Additional discussion of the use of non-GAAP measures can also be found in conference call slides, the Form 8-K Current Report related to this news release and in periodic Flagstar reports

6

filed with the U.S. Securities and Exchange Commission. These documents can all be found on the Company’s website at flagstar.com.

Forward-Looking Statements

This earnings release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of Flagstar Bancorp, Inc.’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. The Company's actual results could differ materially from those described in the forward-looking statements depending upon various factors as described in periodic Flagstar reports filed with the U.S. Securities and Exchange Commission, which are available on the Company’s website (flagstar.com) and on the Securities and Exchange Commission's website (sec.gov). Other than as required under United States securities laws, Flagstar Bancorp does not undertake to update the forward-looking statements to reflect the impact of circumstances or events that may arise after the date of the forward-looking statements.

7

Flagstar Bancorp, Inc.

Consolidated Statements of Financial Condition

(Dollars in millions)

(Unaudited)

September 30, 2018 | June 30, 2018 | December 31, 2017 | September 30, 2017 | ||||||||||||

Assets | |||||||||||||||

Cash | $ | 150 | $ | 139 | $ | 122 | $ | 88 | |||||||

Interest-earning deposits | 114 | 220 | 82 | 145 | |||||||||||

Total cash and cash equivalents | 264 | 359 | 204 | 233 | |||||||||||

Investment securities available-for-sale | 1,857 | 1,871 | 1,853 | 1,637 | |||||||||||

Investment securities held-to-maturity | 724 | 748 | 939 | 977 | |||||||||||

Loans held-for-sale | 4,835 | 4,291 | 4,321 | 4,939 | |||||||||||

Loans held-for-investment | 8,966 | 8,904 | 7,713 | 7,203 | |||||||||||

Loans with government guarantees | 305 | 278 | 271 | 253 | |||||||||||

Less: allowance for loan losses | (134 | ) | (137 | ) | (140 | ) | (140 | ) | |||||||

Total loans held-for-investment and loans with government guarantees, net | 9,137 | 9,045 | 7,844 | 7,316 | |||||||||||

Mortgage servicing rights | 313 | 257 | 291 | 246 | |||||||||||

Federal Home Loan Bank stock | 303 | 303 | 303 | 264 | |||||||||||

Premises and equipment, net | 360 | 355 | 330 | 314 | |||||||||||

Net deferred tax asset | 111 | 119 | 136 | 248 | |||||||||||

Goodwill and intangible assets | 70 | 71 | 21 | 21 | |||||||||||

Other assets | 723 | 711 | 670 | 685 | |||||||||||

Total assets | $ | 18,697 | $ | 18,130 | $ | 16,912 | $ | 16,880 | |||||||

Liabilities and Stockholders' Equity | |||||||||||||||

Noninterest-bearing | $ | 3,096 | $ | 2,781 | $ | 2,049 | $ | 2,272 | |||||||

Interest-bearing | 8,493 | 7,807 | 6,885 | 6,889 | |||||||||||

Total deposits | 11,589 | 10,588 | 8,934 | 9,161 | |||||||||||

Short-term Federal Home Loan Bank advances | 3,199 | 3,840 | 4,260 | 4,065 | |||||||||||

Long-term Federal Home Loan Bank advances | 1,280 | 1,280 | 1,405 | 1,300 | |||||||||||

Other long-term debt | 495 | 494 | 494 | 493 | |||||||||||

Other liabilities | 616 | 453 | 420 | 410 | |||||||||||

Total liabilities | 17,179 | 16,655 | 15,513 | 15,429 | |||||||||||

Stockholders' Equity | |||||||||||||||

Common stock | 1 | 1 | 1 | 1 | |||||||||||

Additional paid in capital | 1,519 | 1,514 | 1,512 | 1,511 | |||||||||||

Accumulated other comprehensive loss | (42 | ) | (32 | ) | (16 | ) | (8 | ) | |||||||

Retained earnings/(accumulated deficit) | 40 | (8 | ) | (98 | ) | (53 | ) | ||||||||

Total stockholders' equity | 1,518 | 1,475 | 1,399 | 1,451 | |||||||||||

Total liabilities and stockholders' equity | $ | 18,697 | $ | 18,130 | $ | 16,912 | $ | 16,880 | |||||||

8

Flagstar Bancorp, Inc. Condensed Consolidated Statements of Operations (Dollars in millions, except per share data) (Unaudited) | |||||||||||||||||||||||||||

Third Quarter 2018 Compared to: | |||||||||||||||||||||||||||

Three Months Ended | Second Quarter 2018 | Third Quarter 2017 | |||||||||||||||||||||||||

September 30, 2018 | June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | Amount | Percent | Amount | Percent | |||||||||||||||||||

Interest Income | |||||||||||||||||||||||||||

Total interest income | $ | 183 | $ | 167 | $ | 152 | $ | 148 | $ | 140 | $ | 16 | 10 | % | $ | 43 | 31 | % | |||||||||

Total interest expense | 59 | 52 | 46 | 41 | 37 | 7 | 13 | % | 22 | 59 | % | ||||||||||||||||

Net interest income | 124 | 115 | 106 | 107 | 103 | 9 | 8 | % | 21 | 20 | % | ||||||||||||||||

Provision (benefit) for loan losses | (2 | ) | (1 | ) | — | 2 | 2 | (1 | ) | 100 | % | (4 | ) | N/M | |||||||||||||

Net interest income after provision (benefit) for loan losses | 126 | 116 | 106 | 105 | 101 | 10 | 9 | % | 25 | 25 | % | ||||||||||||||||

Noninterest Income | |||||||||||||||||||||||||||

Net gain on loan sales | 43 | 63 | 60 | 79 | 75 | (20 | ) | (32 | )% | (32 | ) | (43 | )% | ||||||||||||||

Loan fees and charges | 23 | 24 | 20 | 24 | 23 | (1 | ) | (4 | )% | — | — | % | |||||||||||||||

Deposit fees and charges | 5 | 5 | 5 | 4 | 5 | — | — | % | — | — | % | ||||||||||||||||

Loan administration income | 5 | 5 | 5 | 5 | 5 | — | — | % | — | — | % | ||||||||||||||||

Net return (loss) on the mortgage servicing rights | 13 | 9 | 4 | (4 | ) | 6 | 4 | 44 | % | 7 | 117 | % | |||||||||||||||

Other noninterest income | 18 | 17 | 17 | 16 | 16 | 1 | 6 | % | 2 | 13 | % | ||||||||||||||||

Total noninterest income | 107 | 123 | 111 | 124 | 130 | (16 | ) | (13 | )% | (23 | ) | (18 | )% | ||||||||||||||

Noninterest Expense | |||||||||||||||||||||||||||

Compensation and benefits | 76 | 80 | 80 | 80 | 76 | (4 | ) | (5 | )% | — | — | % | |||||||||||||||

Commissions | 21 | 25 | 18 | 23 | 23 | (4 | ) | (16 | )% | (2 | ) | (9 | )% | ||||||||||||||

Occupancy and equipment | 31 | 30 | 30 | 28 | 28 | 1 | 3 | % | 3 | 11 | % | ||||||||||||||||

Federal insurance premiums | 6 | 6 | 6 | 5 | 5 | — | — | % | 1 | 20 | % | ||||||||||||||||

Loan processing expense | 14 | 15 | 14 | 16 | 15 | (1 | ) | (7 | )% | (1 | ) | (7 | )% | ||||||||||||||

Legal and professional expense | 7 | 6 | 6 | 8 | 7 | 1 | 17 | % | — | — | % | ||||||||||||||||

Other noninterest expense | 18 | 15 | 19 | 18 | 17 | 3 | 20 | % | 1 | 6 | % | ||||||||||||||||

Total noninterest expense | 173 | 177 | 173 | 178 | 171 | (4 | ) | (2 | )% | 2 | 1 | % | |||||||||||||||

Income before income taxes | 60 | 62 | 44 | 51 | 60 | (2 | ) | (3 | )% | — | — | % | |||||||||||||||

Provision for income taxes | 12 | 12 | 9 | 96 | 20 | — | — | % | (8 | ) | (40 | )% | |||||||||||||||

Net income (loss) | $ | 48 | $ | 50 | $ | 35 | $ | (45 | ) | $ | 40 | $ | (2 | ) | (4 | )% | $ | 8 | 20 | % | |||||||

Income (loss) per share | |||||||||||||||||||||||||||

Basic | $ | 0.84 | $ | 0.86 | $ | 0.61 | $ | (0.79 | ) | $ | 0.71 | $ | (0.02 | ) | (2 | )% | $ | 0.13 | 18 | % | |||||||

Diluted | $ | 0.83 | $ | 0.85 | $ | 0.60 | $ | (0.79 | ) | $ | 0.70 | $ | (0.02 | ) | (2 | )% | $ | 0.13 | 19 | % | |||||||

N/M - Not meaningful

9

Flagstar Bancorp, Inc. Consolidated Statements of Operations (Dollars in millions, except per data share) (Unaudited) | ||||||||||||

Nine Months Ended September 30, 2018 | ||||||||||||

Nine Months Ended | Compared to: Nine Months Ended September 30, 2017 | |||||||||||

September 30, 2018 | September 30, 2017 | Amount | Percent | |||||||||

Total interest income | $ | 502 | $ | 379 | $ | 123 | 32 | % | ||||

Total interest expense | 157 | 96 | 61 | 64 | % | |||||||

Net interest income | 345 | 283 | 62 | 22 | % | |||||||

Provision (benefit) for loan losses | (3 | ) | 4 | (7 | ) | N/M | ||||||

Net interest income after provision (benefit) for loan losses | 348 | 279 | 69 | 25 | % | |||||||

Noninterest Income | ||||||||||||

Net gain on loan sales | 166 | 189 | (23 | ) | (12 | )% | ||||||

Loan fees and charges | 67 | 58 | 9 | 16 | % | |||||||

Deposit fees and charges | 15 | 14 | 1 | 7 | % | |||||||

Loan administration income | 15 | 16 | (1 | ) | (6 | )% | ||||||

Net return on the mortgage servicing rights | 26 | 26 | — | — | % | |||||||

Other noninterest income | 52 | 43 | 9 | 21 | % | |||||||

Total noninterest income | 341 | 346 | (5 | ) | (1 | )% | ||||||

Noninterest Expense | ||||||||||||

Compensation and benefits | 236 | 219 | 17 | 8 | % | |||||||

Commissions | 64 | 49 | 15 | 31 | % | |||||||

Occupancy and equipment | 91 | 75 | 16 | 21 | % | |||||||

Federal insurance premiums | 18 | 12 | 6 | 50 | % | |||||||

Loan processing expense | 43 | 41 | 2 | 5 | % | |||||||

Legal and professional expense | 19 | 22 | (3 | ) | (14 | )% | ||||||

Other noninterest expense | 52 | 47 | 5 | 11 | % | |||||||

Total noninterest expense | 523 | 465 | 58 | 12 | % | |||||||

Income before income taxes | 166 | 160 | 6 | 4 | % | |||||||

Provision for income taxes | 33 | 52 | (19 | ) | (37 | )% | ||||||

Net income | $ | 133 | $ | 108 | $ | 25 | 23 | % | ||||

Income per share | ||||||||||||

Basic | $ | 2.32 | $ | 1.90 | $ | 0.42 | 22 | % | ||||

Diluted | $ | 2.28 | $ | 1.86 | $ | 0.42 | 23 | % | ||||

N/M - Not meaningful

10

Flagstar Bancorp, Inc.

Summary of Selected Consolidated Financial and Statistical Data

(Dollars in millions, except share data)

(Unaudited)

Three Months Ended | Nine Months Ended | ||||||||||||||||||

September 30, 2018 | June 30, 2018 | September 30, 2017 | September 30, 2018 | September 30, 2017 | |||||||||||||||

Selected Mortgage Statistics: | |||||||||||||||||||

Mortgage rate lock commitments (fallout-adjusted) (1) | $ | 8,290 | $ | 9,011 | $ | 8,898 | $ | 25,024 | $ | 23,896 | |||||||||

Mortgage loans originated (2) | $ | 9,199 | $ | 9,040 | $ | 9,572 | $ | 26,125 | $ | 24,659 | |||||||||

Mortgage loans sold and securitized | $ | 8,423 | $ | 9,260 | $ | 8,924 | $ | 24,930 | $ | 22,397 | |||||||||

Selected Ratios: | |||||||||||||||||||

Interest rate spread (3) | 2.57 | % | 2.58 | % | 2.58 | % | 2.57 | % | 2.56 | % | |||||||||

Net interest margin | 2.93 | % | 2.86 | % | 2.78 | % | 2.85 | % | 2.74 | % | |||||||||

Net margin on loans sold and securitized | 0.51 | % | 0.69 | % | 0.84 | % | 0.66 | % | 0.84 | % | |||||||||

Return on average assets | 1.04 | % | 1.12 | % | 0.99 | % | 1.00 | % | 0.94 | % | |||||||||

Return on average equity | 12.80 | % | 13.45 | % | 11.10 | % | 12.10 | % | 10.23 | % | |||||||||

Efficiency ratio | 74.6 | % | 74.4 | % | 73.5 | % | 76.2 | % | 73.9 | % | |||||||||

Equity-to-assets ratio (average for the period) | 8.13 | % | 8.29 | % | 8.95 | % | 8.23 | % | 9.16 | % | |||||||||

Average Balances: | |||||||||||||||||||

Average common shares outstanding | 57,600,360 | 57,491,714 | 57,162,025 | 57,483,802 | 57,062,696 | ||||||||||||||

Average fully diluted shares outstanding | 58,332,598 | 58,258,577 | 58,186,593 | 58,301,920 | 58,133,296 | ||||||||||||||

Average interest-earning assets | $ | 16,786 | $ | 15,993 | $ | 14,737 | $ | 16,050 | $ | 13,709 | |||||||||

Average interest-paying liabilities | $ | 13,308 | $ | 13,164 | $ | 12,297 | $ | 13,150 | $ | 11,481 | |||||||||

Average stockholders' equity | $ | 1,514 | $ | 1,475 | $ | 1,471 | $ | 1,468 | $ | 1,412 | |||||||||

(1) | Fallout-adjusted mortgage rate lock commitments are adjusted by a percentage of mortgage loans in the pipeline that are not expected to close based on previous historical experience and the level of interest rates. |

(2) | Includes residential first mortgage. |

(3) | Interest rate spread is the difference between the annualized yield earned on average interest-earning assets for the period and the annualized rate of interest paid on average interest-bearing liabilities for the period. |

September 30, 2018 | June 30, 2018 | December 31, 2017 | September 30, 2017 | ||||||||||||

Selected Statistics: | |||||||||||||||

Book value per common share | $ | 26.34 | $ | 25.61 | $ | 24.40 | $ | 25.38 | |||||||

Tangible book value per share (1) | 25.13 | 24.37 | 24.04 | 25.01 | |||||||||||

Number of common shares outstanding | 57,625,439 | 57,598,406 | 57,321,228 | 57,181,536 | |||||||||||

Number of FTE employees | 3,496 | 3,682 | 3,525 | 3,495 | |||||||||||

Number of bank branches | 108 | 107 | 99 | 99 | |||||||||||

Ratio of nonperforming assets to total assets (2) | 0.17 | % | 0.19 | % | 0.22 | % | 0.24 | % | |||||||

Common equity-to-assets ratio | 8.12 | % | 8.14 | % | 8.27 | % | 8.60 | % | |||||||

MSR Key Statistics and Ratios: | |||||||||||||||

Weighted average service fee (basis points) | 34.3 | 32.4 | 28.9 | 28.2 | |||||||||||

Capitalized value of mortgage servicing rights | 1.43 | % | 1.34 | % | 1.16 | % | 1.15 | % | |||||||

Mortgage servicing rights to Tier 1 capital | 20.3 | % | 16.9 | % | 20.1 | % | 17.3 | % | |||||||

(1) | Excludes goodwill and intangibles of $70 million, $71 million, $21 million, and $21 million at September 30, 2018, June 30, 2018, December 31, 2017, and September 30, 2017, respectively. See Non-GAAP Reconciliation for further information. |

(2) | Ratio excludes LHFS. |

11

Average Balances, Yields and Rates

(Dollars in millions)

(Unaudited)

Three Months Ended | ||||||||||||||||||||||||||

September 30, 2018 | June 30, 2018 | September 30, 2017 | ||||||||||||||||||||||||

Average Balance | Interest | Annualized Yield/Rate | Average Balance | Interest | Annualized Yield/Rate | Average Balance | Interest | Annualized Yield/Rate | ||||||||||||||||||

Interest-Earning Assets | ||||||||||||||||||||||||||

Loans held-for-sale | $ | 4,393 | $ | 52 | 4.69 | % | $ | 4,170 | $ | 47 | 4.50 | % | $ | 4,476 | $ | 45 | 3.99 | % | ||||||||

Loans held-for-investment | ||||||||||||||||||||||||||

Residential first mortgage | 3,027 | 27 | 3.63 | % | 2,875 | 25 | 3.53 | % | 2,594 | 22 | 3.32 | % | ||||||||||||||

Home equity | 695 | 9 | 5.12 | % | 679 | 8 | 5.05 | % | 486 | 6 | 5.11 | % | ||||||||||||||

Other | 128 | 2 | 5.54 | % | 57 | 1 | 5.39 | % | 26 | — | 4.52 | % | ||||||||||||||

Total Consumer loans | 3,850 | 38 | 3.96 | % | 3,611 | 34 | 3.85 | % | 3,106 | 28 | 3.61 | % | ||||||||||||||

Commercial Real Estate | 2,106 | 29 | 5.37 | % | 2,017 | 26 | 5.09 | % | 1,646 | 19 | 4.43 | % | ||||||||||||||

Commercial and Industrial | 1,330 | 18 | 5.28 | % | 1,257 | 17 | 5.30 | % | 1,073 | 13 | 4.77 | % | ||||||||||||||

Warehouse Lending | 1,586 | 21 | 5.10 | % | 1,495 | 19 | 5.03 | % | 978 | 12 | 4.82 | % | ||||||||||||||

Total Commercial loans | 5,022 | 68 | 5.26 | % | 4,769 | 62 | 5.13 | % | 3,697 | 44 | 4.63 | % | ||||||||||||||

Total loans held-for-investment | 8,872 | 106 | 4.70 | % | 8,380 | 96 | 4.58 | % | 6,803 | 72 | 4.16 | % | ||||||||||||||

Loans with government guarantees | 292 | 3 | 4.20 | % | 280 | 2 | 3.66 | % | 264 | 3 | 4.58 | % | ||||||||||||||

Investment securities | 3,100 | 21 | 2.81 | % | 3,049 | 21 | 2.72 | % | 3,101 | 20 | 2.58 | % | ||||||||||||||

Interest-earning deposits | 129 | 1 | 2.38 | % | 114 | 1 | 1.72 | % | 93 | — | 1.23 | % | ||||||||||||||

Total interest-earning assets | 16,786 | $ | 183 | 4.32 | % | 15,993 | $ | 167 | 4.17 | % | 14,737 | $ | 140 | 3.77 | % | |||||||||||

Other assets | 1,825 | 1,791 | 1,702 | |||||||||||||||||||||||

Total assets | $ | 18,611 | $ | 17,784 | $ | 16,439 | ||||||||||||||||||||

Interest-Bearing Liabilities | ||||||||||||||||||||||||||

Retail deposits | ||||||||||||||||||||||||||

Demand deposits | $ | 727 | $ | 3 | 1.62 | % | $ | 704 | $ | 1 | 0.60 | % | $ | 489 | $ | — | 0.14 | % | ||||||||

Savings deposits | 3,229 | 7 | 0.90 | % | 3,412 | 8 | 0.86 | % | 3,838 | 7 | 0.76 | % | ||||||||||||||

Money market deposits | 252 | — | 0.62 | % | 247 | — | 0.54 | % | 276 | — | 0.57 | % | ||||||||||||||

Certificates of deposit | 2,150 | 10 | 1.78 | % | 2,006 | 8 | 1.63 | % | 1,182 | 4 | 1.19 | % | ||||||||||||||

Total retail deposits | 6,358 | 20 | 1.27 | % | 6,369 | 17 | 1.06 | % | 5,785 | 11 | 0.78 | % | ||||||||||||||

Government deposits | ||||||||||||||||||||||||||

Demand deposits | 283 | 1 | 0.59 | % | 243 | — | 0.47 | % | 250 | — | 0.43 | % | ||||||||||||||

Savings deposits | 564 | 2 | 1.48 | % | 488 | 2 | 1.26 | % | 362 | 1 | 0.71 | % | ||||||||||||||

Certificates of deposit | 327 | 1 | 1.52 | % | 380 | 1 | 1.35 | % | 329 | 1 | 0.89 | % | ||||||||||||||

Total government deposits | 1,174 | 4 | 1.28 | % | 1,111 | 3 | 1.12 | % | 941 | 2 | 0.70 | % | ||||||||||||||

Wholesale deposits and other | 537 | 3 | 2.03 | % | 264 | 1 | 1.96 | % | 35 | — | 1.49 | % | ||||||||||||||

Total interest-bearing deposits | 8,069 | 27 | 1.32 | % | 7,744 | 21 | 1.10 | % | 6,761 | 13 | 0.78 | % | ||||||||||||||

Short-term Federal Home Loan Bank advances and other | 3,465 | 18 | 2.10 | % | 3,646 | 17 | 1.85 | % | 3,809 | 11 | 1.17 | % | ||||||||||||||

Long-term Federal Home Loan Bank advances | 1,280 | 7 | 2.11 | % | 1,280 | 7 | 2.25 | % | 1,234 | 6 | 1.99 | % | ||||||||||||||

Other long-term debt | 494 | 7 | 5.62 | % | 494 | 7 | 5.60 | % | 493 | 7 | 5.09 | % | ||||||||||||||

Total interest-bearing liabilities | 13,308 | 59 | 1.75 | % | 13,164 | 52 | 1.58 | % | 12,297 | 37 | 1.19 | % | ||||||||||||||

Noninterest-bearing deposits (1) | 3,267 | 2,670 | 2,244 | |||||||||||||||||||||||

Other liabilities | 522 | 475 | 427 | |||||||||||||||||||||||

Stockholders' equity | 1,514 | 1,475 | 1,471 | |||||||||||||||||||||||

Total liabilities and stockholders' equity | $ | 18,611 | $ | 17,784 | $ | 16,439 | ||||||||||||||||||||

Net interest-earning assets | $ | 3,478 | $ | 2,829 | $ | 2,440 | ||||||||||||||||||||

Net interest income | $ | 124 | $ | 115 | $ | 103 | ||||||||||||||||||||

Interest rate spread (2) | 2.57 | % | 2.58 | % | 2.58 | % | ||||||||||||||||||||

Net interest margin (3) | 2.93 | % | 2.86 | % | 2.78 | % | ||||||||||||||||||||

Ratio of average interest-earning assets to interest-bearing liabilities | 126.1 | % | 121.5 | % | 119.9 | % | ||||||||||||||||||||

Total average deposits | $ | 11,336 | $ | 10,414 | $ | 9,005 | ||||||||||||||||||||

(1) | Includes noninterest-bearing custodial deposits that arise due to the servicing of loans for others. |

(2) | Interest rate spread is the difference between rate of interest earned on interest-earning assets and rate of interest paid on interest-bearing liabilities. |

(3) | Net interest margin is net interest income divided by average interest-earning assets. |

12

Average Balances, Yields and Rates

(Dollars in millions)

(Unaudited)

Nine Months Ended | |||||||||||||||||

September 30, 2018 | September 30, 2017 | ||||||||||||||||

Average Balance | Interest | Annualized Yield/Rate | Average Balance | Interest | Annualized Yield/Rate | ||||||||||||

Interest-Earning Assets | |||||||||||||||||

Loans held-for-sale | $ | 4,265 | $ | 142 | 4.44 | % | $ | 4,014 | $ | 119 | 3.96 | % | |||||

Loans held-for-investment | |||||||||||||||||

Residential first mortgage | 2,893 | 76 | 3.52 | % | 2,497 | 62 | 3.34 | % | |||||||||

Home equity | 681 | 26 | 5.13 | % | 453 | 17 | 5.04 | % | |||||||||

Other | 71 | 3 | 5.37 | % | 26 | 1 | 4.52 | % | |||||||||

Total Consumer loans | 3,645 | 105 | 3.86 | % | 2,976 | 80 | 3.61 | % | |||||||||

Commercial Real Estate | 2,026 | 79 | 5.12 | % | 1,482 | 47 | 4.15 | % | |||||||||

Commercial and Industrial | 1,269 | 51 | 5.26 | % | 929 | 33 | 4.71 | % | |||||||||

Warehouse Lending | 1,312 | 51 | 5.08 | % | 840 | 30 | 4.70 | % | |||||||||

Total Commercial loans | 4,607 | 181 | 5.15 | % | 3,251 | 110 | 4.45 | % | |||||||||

Total loans held-for-investment | 8,252 | 286 | 4.58 | % | 6,227 | 190 | 4.05 | % | |||||||||

Loans with government guarantees | 288 | 8 | 3.86 | % | 300 | 10 | 4.41 | % | |||||||||

Investment securities | 3,127 | 64 | 2.74 | % | 3,093 | 59 | 2.55 | % | |||||||||

Interest-earning deposits | 118 | 2 | 1.95 | % | 75 | 1 | 1.08 | % | |||||||||

Total interest-earning assets | 16,050 | $ | 502 | 4.15 | % | 13,709 | $ | 379 | 3.68 | % | |||||||

Other assets | 1,784 | 1,697 | |||||||||||||||

Total assets | $ | 17,834 | $ | 15,406 | |||||||||||||

Interest-Bearing Liabilities | |||||||||||||||||

Retail deposits | |||||||||||||||||

Demand deposits | $ | 660 | $ | 4 | 0.89 | % | $ | 502 | $ | 1 | 0.16 | % | |||||

Savings deposits | 3,376 | 21 | 0.85 | % | 3,899 | 22 | 0.76 | % | |||||||||

Money market deposits | 235 | 1 | 0.54 | % | 264 | 1 | 0.49 | % | |||||||||

Certificates of deposit | 1,927 | 24 | 1.64 | % | 1,116 | 9 | 1.12 | % | |||||||||

Total retail deposits | 6,198 | 50 | 1.09 | % | 5,781 | 33 | 0.76 | % | |||||||||

Government deposits | |||||||||||||||||

Demand deposits | 256 | 1 | 0.54 | % | 228 | 1 | 0.41 | % | |||||||||

Savings deposits | 512 | 5 | 1.29 | % | 410 | 2 | 0.59 | % | |||||||||

Certificates of deposit | 369 | 4 | 1.34 | % | 314 | 1 | 0.73 | % | |||||||||

Total government deposits | 1,137 | 10 | 1.14 | % | 952 | 4 | 0.59 | % | |||||||||

Wholesale deposits and other | 325 | 5 | 1.99 | % | 16 | — | 1.21 | % | |||||||||

Total interest-bearing deposits | 7,660 | 65 | 1.13 | % | 6,749 | 37 | 0.74 | % | |||||||||

Short-term Federal Home Loan Bank advances and other | 3,713 | 50 | 1.81 | % | 3,028 | 23 | 1.01 | % | |||||||||

Long-term Federal Home Loan Bank advances | 1,283 | 21 | 2.15 | % | 1,211 | 17 | 1.92 | % | |||||||||

Other long-term debt | 494 | 21 | 5.53 | % | 493 | 19 | 5.06 | % | |||||||||

Total interest-bearing liabilities | 13,150 | 157 | 1.58 | % | 11,481 | 96 | 1.12 | % | |||||||||

Noninterest-bearing deposits (1) | 2,721 | 2,098 | |||||||||||||||

Other liabilities | 495 | 415 | |||||||||||||||

Stockholders' equity | 1,468 | 1,412 | |||||||||||||||

Total liabilities and stockholders' equity | $ | 17,834 | $ | 15,406 | |||||||||||||

Net interest-earning assets | $ | 2,900 | $ | 2,228 | |||||||||||||

Net interest income | $ | 345 | $ | 283 | |||||||||||||

Interest rate spread (2) | 2.57 | % | 2.56 | % | |||||||||||||

Net interest margin (3) | 2.85 | % | 2.74 | % | |||||||||||||

Ratio of average interest-earning assets to interest-bearing liabilities | 122.1 | % | 119.4 | % | |||||||||||||

Total average deposits | $ | 10,381 | $ | 8,847 | |||||||||||||

(1) | Includes noninterest-bearing custodial deposits that arise due to the servicing of loans for others. |

(2) | Interest rate spread is the difference between rate of interest earned on interest-earning assets and rate of interest paid on interest-bearing liabilities. |

(3) | Net interest margin is net interest income divided by average interest-earning assets. |

13

Flagstar Bancorp, Inc.

Earnings Per Share

(Dollars in millions, except share data)

(Unaudited)

Three Months Ended | Nine Months Ended | ||||||||||||||||||

September 30, 2018 | June 30, 2018 | September 30, 2017 | September 30, 2018 | September 30, 2017 | |||||||||||||||

Net income | 48 | 50 | 40 | 133 | 108 | ||||||||||||||

Weighted average shares | |||||||||||||||||||

Weighted average common shares outstanding | 57,600,360 | 57,491,714 | 57,162,025 | 57,483,802 | 57,062,696 | ||||||||||||||

Effect of dilutive securities | |||||||||||||||||||

May Investor warrants | — | — | — | — | 16,383 | ||||||||||||||

Stock-based awards | 732,238 | 766,863 | 1,024,568 | 818,118 | 1,054,217 | ||||||||||||||

Weighted average diluted common shares | 58,332,598 | 58,258,577 | 58,186,593 | 58,301,920 | 58,133,296 | ||||||||||||||

Earnings per common share | |||||||||||||||||||

Basic earnings per common share | $ | 0.84 | $ | 0.86 | $ | 0.71 | $ | 2.32 | $ | 1.90 | |||||||||

Effect of dilutive securities | |||||||||||||||||||

May Investor warrants | — | — | — | — | — | ||||||||||||||

Stock-based awards | (0.01 | ) | (0.01 | ) | (0.01 | ) | (0.04 | ) | (0.04 | ) | |||||||||

Diluted earnings per common share | $ | 0.83 | $ | 0.85 | $ | 0.70 | $ | 2.28 | $ | 1.86 | |||||||||

Regulatory Capital - Bancorp

(Dollars in millions)

(Unaudited)

September 30, 2018 | June 30, 2018 | December 31, 2017 | September 30, 2017 | ||||||||||||||||||||

Amount | Ratio | Amount | Ratio | Amount | Ratio | Amount | Ratio | ||||||||||||||||

Tier 1 leverage (to adjusted avg. total assets) | $ | 1,540 | 8.36 | % | $ | 1,525 | 8.65 | % | $ | 1,442 | 8.51 | % | $ | 1,423 | 8.80 | % | |||||||

Total adjusted avg. total asset base | $ | 18,426 | $ | 17,630 | $ | 16,951 | $ | 16,165 | |||||||||||||||

Tier 1 common equity (to risk weighted assets) | $ | 1,300 | 11.01 | % | $ | 1,285 | 10.84 | % | $ | 1,216 | 11.50 | % | $ | 1,208 | 11.65 | % | |||||||

Tier 1 capital (to risk weighted assets) | $ | 1,540 | 13.04 | % | $ | 1,525 | 12.86 | % | $ | 1,442 | 13.63 | % | $ | 1,423 | 13.72 | % | |||||||

Total capital (to risk weighted assets) | $ | 1,677 | 14.20 | % | $ | 1,665 | 14.04 | % | $ | 1,576 | 14.90 | % | $ | 1,554 | 14.99 | % | |||||||

Risk-weighted asset base | $ | 11,811 | $ | 11,855 | $ | 10,579 | $ | 10,371 | |||||||||||||||

Regulatory Capital - Bank

(Dollars in millions)

(Unaudited)

September 30, 2018 | June 30, 2018 | December 31, 2017 | September 30, 2017 | ||||||||||||||||||||

Amount | Ratio | Amount | Ratio | Amount | Ratio | Amount | Ratio | ||||||||||||||||

Tier 1 leverage (to adjusted avg. total assets) | $ | 1,617 | 8.77 | % | $ | 1,594 | 9.04 | % | $ | 1,531 | 9.04 | % | $ | 1,519 | 9.38 | % | |||||||

Total adjusted avg. total asset base | $ | 18,433 | $ | 17,637 | $ | 16,934 | $ | 16,191 | |||||||||||||||

Tier 1 common equity (to risk weighted assets) | $ | 1,617 | 13.68 | % | $ | 1,594 | 13.44 | % | $ | 1,531 | 14.46 | % | $ | 1,519 | 14.61 | % | |||||||

Tier 1 capital (to risk weighted assets) | $ | 1,617 | 13.68 | % | $ | 1,594 | 13.44 | % | $ | 1,531 | 14.46 | % | $ | 1,519 | 14.61 | % | |||||||

Total capital (to risk weighted assets) | $ | 1,753 | 14.84 | % | $ | 1,734 | 14.62 | % | $ | 1,664 | 15.72 | % | $ | 1,651 | 15.88 | % | |||||||

Risk-weighted asset base | $ | 11,818 | $ | 11,863 | $ | 10,589 | $ | 10,396 | |||||||||||||||

14

Loan Originations (Dollars in millions) (Unaudited) | |||||||||||||||||

Three Months Ended | |||||||||||||||||

September 30, 2018 | June 30, 2018 | September 30, 2017 | |||||||||||||||

Residential first mortgage | $ | 9,199 | 96.1 | % | $ | 9,040 | 95.2 | % | $ | 9,572 | 96.3 | % | |||||

Home equity (1) | 80 | 0.8 | % | 77 | 0.8 | % | 82 | 0.8 | % | ||||||||

Other | 56 | 0.6 | % | 64 | 0.7 | % | 12 | 0.1 | % | ||||||||

Total consumer loans | 9,335 | 97.5 | % | 9,181 | 96.7 | % | 9,666 | 97.2 | % | ||||||||

Commercial loans (2) | 241 | 2.5 | % | 317 | 3.3 | % | 275 | 2.8 | % | ||||||||

Total loan originations | $ | 9,576 | 100.0 | % | $ | 9,498 | 100.0 | % | $ | 9,941 | 100.0 | % | |||||

(1) | Includes second mortgage loans, HELOC loans. |

(2) | Includes CRE and C&I loans that were net funded within the period. |

Loan Originations (Dollars in millions) (Unaudited) | |||||||||||

Nine Months Ended | |||||||||||

September 30, 2018 | September 30, 2017 | ||||||||||

Residential first mortgage | $ | 26,125 | 96.1 | % | $ | 24,659 | 95.5 | % | |||

Home equity (1) | 220 | 0.8 | % | 209 | 0.8 | % | |||||

Other | 122 | 0.4 | % | 16 | 0.1 | % | |||||

Total consumer loans | 26,467 | 97.3 | % | 24,884 | 96.4 | % | |||||

Commercial loans (2) | 727 | 2.7 | % | 946 | 3.6 | % | |||||

Total loan originations | $ | 27,194 | 100.0 | % | $ | 25,830 | 100.0 | % | |||

(1) | Includes second mortgage loans, HELOC loans. |

(2) | Includes CRE and C&I loans that were net funded within the period. |

Residential Loans Serviced

(Dollars in millions)

(Unaudited)

September 30, 2018 | June 30, 2018 | December 31, 2017 | September 30, 2017 | ||||||||||||||||||||

Unpaid Principal Balance (1) | Number of accounts | Unpaid Principal Balance (1) | Number of accounts | Unpaid Principal Balance (1) | Number of accounts | Unpaid Principal Balance (1) | Number of accounts | ||||||||||||||||

Serviced for own loan portfolio (2) | $ | 8,033 | 35,185 | $ | 7,303 | 32,012 | $ | 7,013 | 29,493 | $ | 7,376 | 31,135 | |||||||||||

Serviced for others | 21,835 | 88,410 | 19,249 | 78,898 | 25,073 | 103,137 | 21,342 | 87,215 | |||||||||||||||

Subserviced for others (3) | 106,297 | 494,950 | 93,761 | 424,331 | 65,864 | 309,814 | 62,351 | 296,913 | |||||||||||||||

Total residential loans serviced | $ | 136,165 | 618,545 | $ | 120,313 | 535,241 | $ | 97,950 | 442,444 | $ | 91,069 | 415,263 | |||||||||||

(1) | UPB, net of write downs, does not include premiums or discounts. |

(2) | Includes loans held-for-investment (residential first mortgage and home equity), loans-held-for-sale (residential first mortgage), loans with government guarantees (residential first mortgage), and repossessed assets. |

(3) | Includes temporary short-term subservicing performed as a result of sales of servicing-released mortgage servicing rights. Includes repossessed assets. |

15

Loans Held-for-Investment

(Dollars in millions)

(Unaudited)

September 30, 2018 | June 30, 2018 | December 31, 2017 | September 30, 2017 | ||||||||||||||||||||

Consumer loans | |||||||||||||||||||||||

Residential first mortgage | $ | 3,085 | 34.4 | % | $ | 2,986 | 33.5 | % | $ | 2,754 | 35.7 | % | $ | 2,665 | 37.0 | % | |||||||

Home equity | 704 | 7.9 | % | 685 | 7.7 | % | 664 | 8.6 | % | 496 | 6.9 | % | |||||||||||

Other | 150 | 1.7 | % | 88 | 1.0 | % | 25 | 0.3 | % | 26 | 0.4 | % | |||||||||||

Total consumer loans | 3,939 | 43.9 | % | 3,759 | 42.2 | % | 3,443 | 44.6 | % | 3,187 | 44.3 | % | |||||||||||

Commercial loans | |||||||||||||||||||||||

Commercial real estate | 2,160 | 24.1 | % | 2,020 | 22.7 | % | 1,932 | 25.1 | % | 1,760 | 24.4 | % | |||||||||||

Commercial and industrial | 1,317 | 14.7 | % | 1,324 | 14.9 | % | 1,196 | 15.5 | % | 1,097 | 15.2 | % | |||||||||||

Warehouse lending | 1,550 | 17.3 | % | 1,801 | 20.2 | % | 1,142 | 14.8 | % | 1,159 | 16.1 | % | |||||||||||

Total commercial loans | 5,027 | 56.1 | % | 5,145 | 57.8 | % | 4,270 | 55.4 | % | 4,016 | 55.7 | % | |||||||||||

Total loans held-for-investment | $ | 8,966 | 100.0 | % | $ | 8,904 | 100.0 | % | $ | 7,713 | 100.0 | % | $ | 7,203 | 100.0 | % | |||||||

Allowance for Loan Losses

(Dollars in millions)

(Unaudited)

As of/For the Three Months Ended | |||||||||||

September 30, 2018 | June 30, 2018 | September 30, 2017 | |||||||||

Allowance for loan losses | |||||||||||

Residential first mortgage | $ | 40 | $ | 45 | $ | 52 | |||||

Home equity | 20 | 19 | 20 | ||||||||

Other | 2 | 1 | 1 | ||||||||

Total consumer loans | 62 | 65 | 73 | ||||||||

Commercial real estate | 46 | 45 | 42 | ||||||||

Commercial and industrial | 20 | 21 | 19 | ||||||||

Warehouse lending | 6 | 6 | 6 | ||||||||

Total commercial loans | 72 | 72 | 67 | ||||||||

Total allowance for loan losses | $ | 134 | $ | 137 | $ | 140 | |||||

Charge-offs | |||||||||||

Total consumer loans | (2 | ) | (2 | ) | (3 | ) | |||||

Total commercial loans | — | — | — | ||||||||

Total charge-offs | $ | (2 | ) | $ | (2 | ) | $ | (3 | ) | ||

Recoveries | |||||||||||

Total consumer loans | 1 | 1 | 1 | ||||||||

Total commercial loans | — | — | — | ||||||||

Total recoveries | 1 | 1 | 1 | ||||||||

Charge-offs, net of recoveries | $ | (1 | ) | $ | (1 | ) | $ | (2 | ) | ||

Net charge-offs to LHFI ratio (annualized) (1) | 0.05 | % | 0.02 | % | 0.08 | % | |||||

Net charge-offs/(recoveries) to LHFI ratio (annualized) by loan type (1): | |||||||||||

Residential first mortgage | 0.10 | % | 0.04 | % | 0.12 | % | |||||

Home equity and other consumer | 0.21 | % | 0.10 | % | 0.52 | % | |||||

Commercial and industrial | — | % | (0.01 | )% | (0.01 | )% | |||||

(1) | Excludes loans carried under the fair value option. |

16

Allowance for Loan Losses

(Dollars in millions)

(Unaudited)

As of/For the Nine Months Ended | |||||||

September 30, 2018 | September 30, 2017 | ||||||

Total allowance for loan losses | $ | 134 | $ | 140 | |||

Charge-offs | |||||||

Total consumer loans | (6 | ) | (10 | ) | |||

Total commercial loans | — | — | |||||

Total charge-offs | $ | (6 | ) | $ | (10 | ) | |

Recoveries | |||||||

Total consumer loans | 3 | 4 | |||||

Total commercial loans | — | — | |||||

Total recoveries | 3 | 4 | |||||

Charge-offs, net of recoveries | $ | (3 | ) | $ | (6 | ) | |

Net charge-offs to LHFI ratio (annualized) (1) | 0.05 | % | 0.12 | % | |||

Net charge-offs/(recoveries) to LHFI ratio (annualized) by loan type (1): | |||||||

Residential first mortgage | 0.09 | % | 0.26 | % | |||

Home equity and other consumer | 0.19 | % | 0.28 | % | |||

Commercial real estate | (0.01 | )% | (0.01 | )% | |||

Commercial and industrial | (0.01 | )% | (0.01 | )% | |||

(1) | Excludes loans carried under the fair value option. |

Nonperforming Loans and Assets

(Dollars in millions)

(Unaudited)

September 30, 2018 | June 30, 2018 | December 31, 2017 | September 30, 2017 | ||||||||||||

Nonperforming LHFI | $ | 12 | $ | 13 | $ | 13 | $ | 16 | |||||||

Nonperforming TDRs | 4 | 4 | 5 | 4 | |||||||||||

Nonperforming TDRs at inception but performing for less than six months | 9 | 10 | 11 | 11 | |||||||||||

Total nonperforming LHFI and TDRs (1) | 25 | 27 | 29 | 31 | |||||||||||

Real estate and other nonperforming assets, net | 7 | 7 | 8 | 9 | |||||||||||

LHFS | $ | 10 | $ | 7 | $ | 9 | $ | 8 | |||||||

Total nonperforming assets | $ | 42 | $ | 41 | $ | 46 | $ | 48 | |||||||

Ratio of nonperforming assets to total assets (2) | 0.17 | % | 0.19 | % | 0.22 | % | 0.24 | % | |||||||

Ratio of nonperforming LHFI and TDRs to LHFI | 0.28 | % | 0.30 | % | 0.38 | % | 0.44 | % | |||||||

Ratio of nonperforming assets to LHFI and repossessed assets (2) | 0.35 | % | 0.38 | % | 0.48 | % | 0.58 | % | |||||||

(1) | Includes less than 90 day past due performing loans placed on nonaccrual. Interest is not being accrued on these loans. |

(2) | Ratio excludes LHFS. |

17

Asset Quality - Loans Held-for-Investment

(Dollars in millions)

(Unaudited)

30-59 Days Past Due | 60-89 Days Past Due | Greater than 90 days (1) | Total Past Due | Total Loans Held-for-Investment | |||||||||||||||

September 30, 2018 | |||||||||||||||||||

Consumer loans | $ | 2 | $ | 1 | $ | 25 | $ | 28 | $ | 3,939 | |||||||||

Commercial loans | — | — | — | — | 5,027 | ||||||||||||||

Total loans | $ | 2 | $ | 1 | $ | 25 | $ | 28 | $ | 8,966 | |||||||||

June 30, 2018 | |||||||||||||||||||

Consumer loans | $ | 3 | $ | — | $ | 27 | $ | 30 | $ | 3,759 | |||||||||

Commercial loans | — | — | — | — | 5,145 | ||||||||||||||

Total loans | $ | 3 | $ | — | $ | 27 | $ | 30 | $ | 8,904 | |||||||||

December 31, 2017 | |||||||||||||||||||

Consumer loans | $ | 3 | $ | 2 | $ | 29 | $ | 34 | $ | 3,443 | |||||||||

Commercial loans | — | — | — | — | 4,270 | ||||||||||||||

Total loans | $ | 3 | $ | 2 | $ | 29 | $ | 34 | $ | 7,713 | |||||||||

September 30, 2017 | |||||||||||||||||||

Consumer loans | 4 | 1 | 30 | $ | 35 | $ | 3,187 | ||||||||||||

Commercial loans | — | — | 1 | 1 | 4,016 | ||||||||||||||

Total loans | $ | 4 | $ | 1 | $ | 31 | $ | 36 | $ | 7,203 | |||||||||

(1) | Includes performing nonaccrual loans that are less than 90 days delinquent and for which interest cannot be accrued. |

Troubled Debt Restructurings

(Dollars in millions)

(Unaudited)

TDRs | |||||||||||

Performing | Nonperforming | Total | |||||||||

September 30, 2018 | |||||||||||

Consumer loans | $ | 43 | $ | 13 | $ | 56 | |||||

Total TDR loans | $ | 43 | $ | 13 | $ | 56 | |||||

June 30, 2018 | |||||||||||

Consumer loans | $ | 43 | $ | 14 | $ | 57 | |||||

Total TDR loans | $ | 43 | $ | 14 | $ | 57 | |||||

December 31, 2017 | |||||||||||

Consumer loans | $ | 43 | $ | 16 | $ | 59 | |||||

Total TDR loans | $ | 43 | $ | 16 | $ | 59 | |||||

September 30, 2017 | |||||||||||

Consumer loans | $ | 46 | $ | 15 | $ | 61 | |||||

Total TDR loans | $ | 46 | $ | 15 | $ | 61 | |||||

18

Non-GAAP Reconciliation

(Dollars in millions)

(Unaudited)

Tangible book value per share, tangible common equity to assets ratio, adjusted net income, adjusted diluted earnings per share, adjusted noninterest expense and adjusted return on average assets. In addition to analyzing the Company's results on a reported basis, management reviews the Company's results and the results on an adjusted basis. This non-GAAP measure reflects the adjustments of the reported U.S.GAAP results for significant items that management does not believe are reflective of the Company's current and ongoing operations. The Company believes that tangible book value per share, tangible common equity to assets ratio, adjusted net income, adjusted diluted earnings per share, adjusted noninterest expense and adjusted return on average assets provide a meaningful representation of its operating performance on an ongoing basis. Management uses these measures to assess performance of the Company against its peers and evaluate overall performance. The Company believes these non-GAAP financial measures provide useful information for investors, securities analysts and others because it provides a tool to evaluate the Company’s performance on an ongoing basis and compared to its peers.

The following tables provide a reconciliation of non-GAAP financial measures.

Tangible book value per share and tangible common equity to assets ratio

September 30, 2018 | June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | |||||||||||||||

(Dollars in millions, except share data) | |||||||||||||||||||

Total stockholders' equity | $ | 1,518 | $ | 1,475 | $ | 1,427 | $ | 1,399 | $ | 1,451 | |||||||||

Goodwill and intangibles | 70 | 71 | 72 | 21 | 21 | ||||||||||||||

Tangible book value | $ | 1,448 | $ | 1,404 | $ | 1,355 | $ | 1,378 | $ | 1,430 | |||||||||

Number of common shares outstanding | 57,625,439 | 57,598,406 | 57,399,993 | 57,321,228 | 57,181,536 | ||||||||||||||

Tangible book value per share | $ | 25.13 | $ | 24.37 | $ | 23.62 | $ | 24.04 | $ | 25.01 | |||||||||

Total Assets | $ | 18,697 | $ | 18,130 | $ | 17,736 | $ | 16,912 | $ | 16,880 | |||||||||

Tangible common equity to assets ratio | 7.74 | % | 7.74 | % | 7.65 | % | 8.15 | % | 8.47 | % | |||||||||

Adjusted Net Income, Diluted Earnings per Share, Noninterest Expense and Return on Average Assets

Three Months Ended | |||||||

September 30, 2018 | June 30, 2018 | ||||||

(Dollars in millions) (Unaudited) | |||||||

Net income (loss) | $ | 48 | $ | 50 | |||

Adjustment for acquisition costs (net of tax) | 1 | — | |||||

Adjusted net income | $ | 49 | $ | 50 | |||

Weighted average diluted common shares | 58,332,598 | 58,258,577 | |||||

Adjusted diluted earnings per share | $ | 0.85 | $ | 0.85 | |||

Total noninterest expense | $ | 173 | $ | 177 | |||

Adjustment for acquisition costs (net of tax) | 1 | — | |||||

Adjusted total noninterest expense | $ | 172 | $ | 177 | |||

Average total assets | $ | 18,611 | $ | 17,784 | |||

Return on average assets | 1.04 | % | 1.12 | % | |||

Adjusted return on average assets | 1.05 | % | 1.12 | % | |||

19

3rd Quarter 2018 Flagstar Bancorp, Inc. (NYSE: FBC) Earnings Presentation 3rd Quarter 2018 October 23, 2018

Cautionary statements 3rd Quarter 2018 This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements are based on management’s current expectations and assumptions regarding the Company’s business and performance, the economy and other future conditions, and forecasts of future events, circumstances and results. However, they are not guarantees of future performance and are subject to known and unknown risks, uncertainties, contingencies and other factors. Generally, forward-looking statements are not based on historical facts but instead represent our management’s beliefs regarding future events. Such statements may be identified by words such as believe, expect, anticipate, intend, plan, estimate, may increase, may fluctuate, and similar expressions or future or conditional verbs such as will, should, would and could. Such statements are based on management’s current expectations and are subject to risks, uncertainties and changes in circumstances. Actual results and capital and other financial conditions may differ materially from those included in these statements due to a variety of factors, including without limitation those found in periodic Flagstar reports filed with the U.S. Securities and Exchange Commission, which are available on the Company’s website (flagstar.com) and on the Securities and Exchange Commission's website (sec.gov). Any forward-looking statements made by or on behalf of us speak only as to the date they are made, and we do not undertake to update forward-looking statements to reflect the impact of circumstances or events that arise after the date the forward-looking statements were made, except as required under United States securities laws. In addition to results presented in accordance with GAAP, this presentation includes non-GAAP financial measures. The Company believes these non-GAAP financial measures provide additional information that is useful to investors in helping to understand the capital requirements Flagstar will face in the future and underlying performance and trends of Flagstar. Non-GAAP financial measures have inherent limitations, which are not required to be uniformly applied. Readers should be aware of these limitations and should be cautious with respect to the use of such measures. To compensate for these limitations, we use non-GAAP measures as comparative tools, together with GAAP measures, to assist in the evaluation of our operating performance or financial condition. Also, we ensure that these measures are calculated using the appropriate GAAP or regulatory components in their entirety and that they are computed in a manner intended to facilitate consistent period-to-period comparisons. Flagstar’s method of calculating these non-GAAP measures may differ from methods used by other companies. These non-GAAP measures should not be considered in isolation or as a substitute for those financial measures prepared in accordance with GAAP or in-effect regulatory requirements. Where non-GAAP financial measures are used, the most directly comparable GAAP or regulatory financial measure, as well as the reconciliation to the most directly comparable GAAP or regulatory financial measure, can be found in these conference call slides. Additional discussion of the use of non-GAAP measures can also be found in the Form 8-K Current Report related to this presentation and in periodic Flagstar reports filed with the U.S. Securities and Exchange Commission. These documents can all be found on the Company’s website at flagstar.com. 2

Executive Overview 3rd Quarter 2018 Sandro DiNello, CEO

Strategic highlights 3rd Quarter 2018 Unique • Third quarter 2018 results demonstrated strength of banking business relationship-based • Pending acquisition of 52 Midwest branches of Wells Fargo will transform banking franchise business model - Provides low cost, low beta deposits; more than doubles customer base with 200,000 new customer relationships • Solid growth in banking and disciplined cost control delivered solid profitability Grow community - Net interest income of $124 million; up 8% vs. 2Q18 and 20% vs. 3Q17 banking - Adjusted noninterest expense(1) of $172 million; down 3% vs. 2Q18 and up 1% vs. 3Q17 Strengthen • Mortgage business continued to be challenged by industry overcapacity and secondary margin compression mortgage revenues - Mortgage revenue(2) of $56 million; down 22% vs. 2Q18 and down 31% vs. 3Q17 • Adjusted net income(1) of $0.85 per diluted share; unchanged vs. 2Q18 and up 21% vs. 3Q17 Highly profitable • Built scale and profitability in servicing business; nearly 620,000 loans serviced, up 16% vs. 2Q18 operations • Adjusted return on assets(1) 1.1%; adjusted return on average equity(1) 13.0% • Strong credit metrics and low delinquency levels supported by 1.5% allowance coverage ratio Positioned to thrive in any market • Strong total risk based capital ratio of 14.2%; Capital Simplification NPR would improve total risk based capital ratio to 14.5%(1) 1) Non-GAAP number. Please see reconciliation on page 46. 2) Mortgage revenue is defined as net gain on loan sales plus net return on MSRs. 4

Financial Overview 3rd Quarter 2018 Jim Ciroli, CFO

Financial highlights 3rd Quarter 2018 • Adjusted net income(1) of $49 million, or $0.85 per diluted share, in 3Q18 Solid earnings with - Higher net interest income; average earning assets up 5%; net interest margin up 7 bps to 2.93% cost discipline - Net gain on loan sales of $43 million; lowest quarter since 4Q11 - Lower noninterest expense reflecting lower mortgage expenses and cost reduction initiatives • Net interest income rose $9 million, or 8%, led by growth of high quality, relationship-based loans Strong growth in - Average earning assets up $793 million, driven by growth of LHFI of $492 million, or 6% community banking - Net interest margin expanded as increased deposit growth allowed a reduction in FHLB borrowings • Mortgage revenue(2) down $16 million, or 22%, on lower net gain on loan sales, partially offset by improved MSR return Lower mortgage - Net gain on loan sales fell $20 million, or 32%, reflecting lower GOS margin (down 20 bps) revenue - Net return on MSRs $4 million higher reflecting lower prepayments and stronger valuations • Negligible net charge-offs Pristine asset • Nonperforming loan ratio fell to 0.28%; early stage consumer delinquencies low quality • Allowance for loan losses covered 1.5% of loans HFI • Capital remained strong with regulatory capital ratios well above current “well capitalized” guidelines Robust capital - Total risk based capital ratio at 14.2%; up 16 bps vs. 2Q18 position - Company expects total risk based capital ratio to be 13.7% at 12/31/2018, reflecting Wells Fargo branch acquisition, recognition of deferred hedging gains in AOCI, and enactment of Capital Simplification regulations 1) Non-GAAP number. Please see reconciliation on page 46. 2) Mortgage revenue is defined as net gain on loan sales HFS plus the net return on the MSRs. 6

Quarterly income comparison 3rd Quarter 2018 $mm Observations A 3Q18 2Q18 $ Variance % Variance Net interest income A Net interest income $124 $115 $9 8% • Net interest income rose $9mm, or 8% Provision (benefit) for loan losses ("PLL") (2) (1) (1) N/M - Average earning assets increased 5%, led by Net interest income after PLL 126 116 10 9% balanced growth in loans HFS, commercial and Net gain on loan sales 43 63 (20) (32%) consumer loans Loan fees and charges 23 24 (1) (4%) - Average deposits increased 9%, led by higher Loan administration income 5 5 - - custodial, brokered and commercial deposits Net return on mortgage servicing rights 13 9 4 44% Other noninterest income 23 22 1 5% B Noninterest income Total noninterest income B 107 123 (16) (13%) Compensation and benefits 76 80 (4) (5%) • Noninterest income decreased $16mm, or 13% Commissions and loan processing expense 35 40 (5) (13%) - Net gain on loan sales fell $20mm, or 32%, on Other noninterest expenses 61 (1) 57 4 7% lower GOS margin, primarily due to secondary marketing performance and a mix shift toward Total noninterest expense C 172 (1) 177 (5) (3%) delegated correspondent channel Income before income taxes 61 (1) 62 (1) (2%) - Net return on MSRs improved $4mm Provision for income taxes 12 12 - - Net income $49 (1) $50 ($1) (2%) C Noninterest expense Diluted income per share $0.85 (1) $0.85 - - • Noninterest expense fell $4mm, or 2%; down Profitability $5mm, or 3%, excluding Wells Fargo branch Net interest margin 2.93% 2.86% 7 bps acquisition costs Total revenues $233 $239 ($6) (3%) - Commissions and loan processing expense fell Net gain on loan sales / total revenue 18% 26% (800 bps) $5mm, or 13%, reflecting shift in channel mix Mortgage rate lock commitments, fallout adjusted $8,290 $9,011 ($721) (8%) Mortgage closings $9,199 $9,040 $159 2% - Compensation and benefits declined $4mm, or Net gain on loan sale margin, HFS 0.51% 0.71% (20 bps) 5%, led by cost reduction initiatives and lower incentive compensation 1) Non-GAAP number. Number shown excludes $1 million of transaction costs related to pending Wells Fargo branch acquisition. Please see reconciliation on page 46. N/M – not meaningful 7

Average balance sheet highlights 3rd Quarter 2018 3Q18 ($mm) Observations Average Balance Sheet Interest-earning assets Incr (Decr)(1) $ $ % • Solid gains in commercial loan portfolio; warehouse loans increased $91mm, or 6%, CRE loans increased $88mm, Loans held-for-sale $4,393 $223 5% or 4%, and C&I loans increased $74mm, or 6% (2) Consumer loans 3,850 239 7% • Consumer loans up $239mm, or 7%; focus on adding Commercial loans(2) 5,022 253 5% residential mortgage and indirect marine/RV loans with high risk adjusted returns Total loans held-for-investment 8,872 492 6% (3) Other earning assets 3,521 78 2% Interest-bearing liabilities Interest-earning assets $16,786 $793 5% • Custodial deposits increased $366mm, or 23%, on higher Other assets 1,825 34 2% subserviced accounts Total assets $18,611 $827 5% • Brokered deposits increased $273mm Deposits $11,336 $922 9% • Commercial demand deposits increased $259mm, or 25% Short-term FHLB advances & other 3,465 (181) (5%) - Provides additional risk based capital and funding at Long-term FHLB advances 1,280 - 0% cost favorable to marginal alternatives Other long-term debt 494 - - Other liabilities 522 47 10% Equity(4) Total liabilities $17,097 $788 5% Stockholders' equity 1,514 39 3% • Tangible common equity to asset ratio of 7.74% Total liabilities and stockholders' equity $18,611 $827 5% • FBC closing share price of $30.14 on October 22, 2018 is 120% of tangible book value per share Tangible book value per common share(4) $25.13 $0.76 3% 1) Measured vs. the prior quarter. 2) Consumer loans include first and second mortgages, HELOC and other loans; commercial loans include commercial real estate, commercial & industrial and warehouse loans. 3) Other earning assets include interest earning deposits, investment securities and loans with government guarantees. 4) Tangible book value per common share references a non-GAAP number. Please see reconciliation on page 46. 8

Asset quality 3rd Quarter 2018 Delinquencies ($mm) Performing TDRs and NPLs ($mm) Performing TDRs NPLs $36 $34 $34 $30 $28 $77 $78 $72 $70 $68 31 29 29 27 25 46 43 49 43 43 9/30/2017 12/31/2017 3/31/2018 6/30/2018 9/30/2018 9/30/2017 12/31/2017 3/31/2018 6/30/2018 9/30/2018 Allowance coverage(1) (% of loans HFI) Nonperforming loan and asset ratios (2) (2) Total Consumer Commercial NPA/LHFI & Repos NPL & TDRs/LHFI NPA/Total Assets 2.3% 0.58% 0.48% 2.0% 2.0% 2.0% 0.42% 0.38% 1.8% 1.7% 0.35% 1.7% 1.6% 0.44% 0.38% 1.5% 0.35% 1.7% 1.5% 1.6% 0.30% 0.28% 1.5% 0.24% 0.22% 1.4% 1.4% 0.19% 0.19% 0.17% 9/30/2017 12/31/2017 3/31/2018 6/30/2018 9/30/2018 9/30/2017 12/31/2017 3/31/2018 6/30/2018 9/30/2018 1) Excludes loans carried under the fair value option and loans with government guarantees. 2) Excludes loans held-for-sale 9

Robust capital 3rd Quarter 2018 Flagstar Bancorp Capital Ratios Observations 3Q18 Balance sheet impact Net earnings contribution Change in MSR balance Goodwill / intangibles from Wells Fargo acquisition Tier 1 CET-1 Tier 1 Total RBC Proforma ratio under Capital Simplification proposal(1) Recognition of hedging gains currently in AOCI, Leverage to RWA to RWA to RWA net of merger expenses 3Q18 Actual 8.4% 11.0% 13.1% 14.2% 2Q18 Actual 8.7% 10.8% 12.9% 14.0% Total Risk Based Capital 14.52% 14.17% • With pending acquisition of Wells Fargo branches, Company is 13.30% 14.04% +5bps 14.20% now constrained by total risk based capital ratio -34bps +45bps -134bps - Wells Fargo acquisition reduces ratio to 13.3% (pro forma as of -15bps +12bps 12.83% 9/30/2018), led by decrease from acquired goodwill and intangible assets, partially offset by recognition of deferred hedging gains in AOCI and enactment of Capital Simplification regulations Well Well Capitalized Capitalized - Long-term target range of 13-14% 10.0% 10.0% - Given low level of residual risk, Company is comfortable operating in bottom half of targeted range • Lifting of Supervisory Agreement provides increased flexibility in capital management - Investing capital in the business provides highest risk-adjusted returns - If not deployed in business, Company expects to consider other options for excess capital, including share repurchases and dividends 6/30/2018 9/30/2018 9/30/2018 Pro Forma 1) Non-GAAP number. Please see reconciliation on page 46. 10

Business Segment Overview 3rd Quarter 2018 Lee Smith, COO