Form 8-K FACTSET RESEARCH SYSTEMS For: Jul 18

FactSet Overview July 18, 2022

Forward-Looking Statements and Non-GAAP Measures This presentation, and other statements that FactSet may make in connection with this presentation, contains forward-looking statements based on management's current expectations, assumptions, estimates, forecasts and projections as of the date such statements are made about future events and circumstances. All statements that address expectations, guidance, outlook or projections about the future, including statements about our strategy, future financial results, anticipated growth, expected expenditure, product development, market position and trends, are forward-looking statements. Forward-looking statements may be identified by words like "expects," "believes," "anticipates," "plans," "intends," "estimates," "projects," "should," "indicates," "continues," "may," and similar expressions. These statements are not guarantees of future performance and involve numerous risks, uncertainties, and assumptions. Many factors, including those discussed more fully in FactSet's filings with the Securities and Exchange Commission, particularly our latest annual report on Form 10-K and quarterly reports on Form 10-Q, could cause results to differ materially from those stated. These documents are available on our website at http://investor.factset.com and on the SEC's website at http://www.sec.gov. FactSet believes our expectations and assumptions are reasonable, but there can be no assurance that the expectations reflected herein will be achieved. Unless legally required, we undertake no obligation to update any forward-looking statements made in this presentation whether because of new information, future events or otherwise. In addition, this presentation, and oral statements that may be made in connection with this presentation, references non-GAAP financial measures, such as ASV, adjusted operating metrics, adjusted diluted EPS, EBITDA, and free cash flow. Forward-looking non-GAAP financial measures reflect management’s current expectations and beliefs, and we are not able to reconcile such non-GAAP measures to reported measures without unreasonable efforts because it is not possible to predict with a reasonable degree of certainty the actual impact or exact timing of items that may impact comparability. Non-GAAP measures should be considered in addition to, not as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP, as more fully discussed in FactSet's financial statements and filings with the SEC. The use of these non-GAAP measures are limited as they include and/or do not include certain items not included and/or included in the most directly comparable GAAP measure. A reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures is provided in the appendix to this presentation. 2Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only

Our purpose is to drive the investment community to see more, think bigger, and do its best work We are transforming the way our users discover, decide, and act on opportunities 3 We are a growth company We drive sustainable growth through continued investment and executional excellence. Our subscription business provides stability Our subscription-based model provides stable revenues and strong client retention. Our large addressable market provides opportunity We are a market leader with unique content that provides a deep competitive moat. Innovation drives us We relentlessly focus on products and solutions to meet the evolving needs of the market. Talent and culture are our foundation We focus on recruiting, retaining, and rewarding a diverse and empowered workforce. 01 02 03 04 05 Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only

FactSet at a glance1 20G L O B A L F O O T P R I N T ( C O U N T R I E S ) 39O F F I C E S 10K+E M P L O Y E E S 173K+U S E R S 4 C L I E N T S 7K+ 1 Figures as of FactSet fiscal Q3 quarter end, May 31, 2022 2 LTM Organic ASV + Professional Services based on last twelve months as of May 31, 2022 3 FY2022 outlook as of June 21, 2022 4 Includes CUSIP Global Services (CGS) $1.77B 2 A S V 33%-34% 3,4 42 $12.75-$13.153,4 8%-9% 3 F Y 2 2 A S V O R G A N I C G R O W T H R A T E F Y 2 2 A D J U S T E D O P E R A T I N G M A R G I N C O N S E C U T I V E Y E A R S O F R E V E N U E G R O W T H D I L U T E D A D J U S T E D E P S Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only

The market continues to respond favorably to our performance and digital strategy 5 Notes: Market prices as of June 27, 2022 FactSet began trading on the New York Stock Exchange on June 28, 1996 FDS (+136%) S&P 500 (+61%) Apr 20222017 2018 2019 2020 2021 Market Cap: $15B$6B $8B $11B $12B $13B Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only

Efficiency of Operations Technology Disruption, Generational Shift Alpha Driven by Depth of Data Value Investing and Regulation Multi-Asset Class Content and Analytics Five key trends inform our strategic investments to drive growth 6Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only

Client Obsession: Deliver open, flexible, adaptive, solutions as part of our open ecosystem with hyper-personalized digital products to provide the “next best action” across the investment lifecycle Content Refinery: Provide the most comprehensive and connected inventory of client, proprietary, and third-party content in our industry Next-Generation Workflows: Build differentiated next-generation solutions to streamline our clients’ workflows and deliver tangible efficiencies for the front, middle, and back office Our strategy: Build the leading open content and analytics platform to deliver a differentiated advantage for our clients Scale Up Our Content Refinery Drive Next-Generation Workflow Solutions Client Obsession 7 7Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only

8 Centralize Content Expanded content access | Data decision support | Enabling data science Our digital platform is critical to the success of the investment community Digital Platform Operational Efficiencies Cohesive investment process | Frictionless user experience Cost Rationalization Simplification of platforms | Optimize vendor usage Outperformance Best of breed multi-asset capabilities | Differentiated data for investment decisions Competitive Differentiation Access to robust analytics | Enhanced digital engagement Outcomes for the Investment Community Open, cloud-based platform Superior client service Integrated digital products Broad and connected content suite Extensive data hierarchy and taxonomy Deep investment process analytics Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only

20% • Listings • Securities • Entities • People • Transactions • Relationships – Associations (e.g., Revenue, Frequency, History) Data Connectivity Expansive coverage, depth, and speed of FactSet’s core proprietary content portfolio • Core Content: Speed • Core Content: Depth • Unique Data: Broad coverage FactSet Proprietary Content Utilizes FactSet’s powerful data connectivity model to ease the onboarding process of third-party data • Concordance to FactSet permanent entity identifiers • Consolidated contractual process • Sandbox for testing Open: FactSet Marketplace 25 Core Proprietary Content Sets 800+ Third Party Data Vendors 4M+ Client Portfolios DIVERSE DATA MARKET LEADING SYMBOLOGY SCREENED & CONNECTED BY FACTSET INSIGHTS & IDEA GENERATION 9 Comprehensive and connected inventory of client, proprietary and third-party content that drives broader discoverability Our content refinery expands our clients’ knowledge and trust Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only

10 S Y M B O L O G Y C O N C O R D A N C E B E S T I N C L A S S T E C H N O L O G Y B E S T I N B R E E D D A T A R E S E A R C H P O R T F O L I O C O N S T R U C T I O N T R A D I N G P E R F O R M A N C E + A T T R I B U T I O N R E P O R T I N G • Generate ideas and discover opportunities with unique data. • Monitor the global markets, research public and private companies, and gain industry and market insights. • Monitor real-time portfolio performance, risk, characteristics, and composition. • Perform exploratory data and portfolio construction analysis to optimize expected returns. • Ensure pre- and post- trade compliance with active and passive breach management. • Oversee order and execution management and allocations. • Automate trade execution and optimize algorithm selection. • Understand and analyze sources of performance, risk, and exposure historically and over time. • Calculate and manage workflows to lock down official performance or any other analytics. • Combine key analytics and results with proprietary content in client- ready customizable and automated reports. • Distribute results and commentary via reports, web, API or feeds. F R O N T O F F I C E M I D D L E O F F I C E R I S K M A N A G E M E N T • Measure performance, risk, style, and characteristics for multiple portfolios and asset classes. • Choose the risk methodologies that match investment processes. B A C K O F F I C E D A T A M A N A G E M E N T S O L U T I O N S • Optimized integration of internal and third-party content sets • Exploitation of data structure and connectivity to uncover actionable insights • Leverage data connections to create summary views to manage security-level and counter-party risk more effectively • Significantly reduce the costs associated with regulatory reporting requirements Next-generation workflow solutions built on our content refinery Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only

11 Transforming the way our users discover, decide, and act on opportunities using our digital platform Hyper-Personalized Products Open Ecosystem & Self-ServiceTrusted Partner ❖ Remove friction from the client experience with solutions that are open, flexible, and easy to use ❖ Advance the Digital Transformation of our clients through our API program ❖ Offer a modern data layer with database capabilities in the cloud, including cloud marketplace integrations ❖ Partner with our clients to provide the best services in the industry ❖ Provide an elevated level of technology and content expertise ❖ Expand our capabilities in professional services ❖ Push ideas and actions across the portfolio lifecycle ❖ Support anytime, anywhere decision- making via responsive, adaptable and accessible platforms Our clients are at the center of what we do Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only

We see significant opportunity to capture more of the addressable market Total Addressable Market Opportunity A S V CAGR Buy Side Banking Wealth PE/VC Corporates FactSet ASV and Opportunity Size (ASV vs. CAGR) Total Addressable Market (TAM) Serviceable Addressable Market (SAM) $32B Total Addressable Market1 $10B Serviceable Addressable Market1 $1.7B FactSet (FY21)2 1 TAM and SAM are 2020 figures. Source: FactSet internal data, BCG analysis 2 Organic ASV + Professional Services Note: Total addressable market (TAM) is the total market demand for a product or service. Serviceable addressable market (SAM) is the segment of the TAM targeted by FactSet’s products and services within our geographic segments. 12Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only

173K+ $66 $79 $72 $78 $112 FY17 FY18 FY19 FY20 FY21 FY22* G L O B A L U S E R S 12% change since Q3/2021 7.3K+ G L O B A L C L I E N T S 19% change since Q3/2021 1 LTM Organic ASV + Professional Services Growth Rate is based on last twelve months as of May 31, 2022 * FY22 Outlook as of June 21, 2022 $M 98.3% 98.5% 98.1% 98.7% 98.5% 98.7% FY17 FY18 FY19 FY20 FY21 FY22 YTD 13 $1.77B O r g a n i c A S V + P r o f e s s i o n a l S e r v i c e s 1 Incremental ASV1 growth FY22 outlook* $130-$150 million ASV retention remains strong We have accelerated top-line growth while maintaining high retention 8-9% $130-$150* Subscription based-business model 98.6% 98.5% 98.5% 98.4% 98.6% 98.6% FY17 FY18 FY19 FY20 FY21 FY22 YTD Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only

84% 62% 48% 16% 27% 17% 10% 35% APAC EMEA Americas Content Technology Solutions Analytics & Trading Research & Advisory Sell-Side Buy-Side 14 ASV Split by Client, Geography and Business 1 Percentage of Organic ASV + Professional Services as of May 31, 2022 2 Professional Services of $24M not allocated by client type and geography Solutions for investment portfolio lifecycle connecting all essential front and middle office functions CTS A&T R&A Optimized workflows delivering integrated content for vital aspects of the research and advisory process Off-platform products delivering data directly and leveraging FactSet’s core content and technology By Client Type2 By Geography1,2 By Business1 Executing our strategy through three workflow solutions that leverage our content refinery Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only

ASV growth rates1 by geography have largely doubled since 2019 15 Americas $1,093M 2 EMEA $471M 2 AsiaPac $186M 2 • Deep sector and private market investments drive banking growth • Large wealth deals contributing • Significantly higher retention due to product investments • Higher demand for feeds and APIs • Buy side and analytics growth accelerating • Buy side and banking driving growth • Balanced demand across both global and regional clients • Growth increasing in new business 4.7% 3.9% 4.6% 5.6% 8.3% FY18 FY19 FY20 FY21 FY22 Q3 11.2% 10.7% 7.5% 12.3% 14.3% FY18 FY19 FY20 FY21 FY22 Q3 5.3% 4.7% 5.2% 7.4% 10.1% FY18 FY19 FY20 FY21 FY22 Q3 1 FY18 to FY22 Q3 Organic ASV LTM Growth Rates by Region 2 FY22 Q3 Ending ASV; excludes $24M Professional Services ASV Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only

We deliver value to clients that is tailored by market and firm type 16 Research + Advisory Solutions Content + Technology Solutions Analytics + Trading Solutions S A L E S C L I E N T S FY21 ASV APAC EMEA Americas by Market by Firm Type Buy Side Sell Side Wealth Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only

17 E s ta b lis h e d G ro w th Our client-centric solutions drive value in established and growing markets % ASV by Solution Client Need FactSet Value Insights, ESG, Consolidation Performance, Risk, Truvalue Alternative Investments, ESG Cabot, Signals, Private Market Banker Efficiency, Deal Velocity Productivity Tools, Signals/APIs Connectivity, Speed, Flexibility Alt Content, Quant tools Connectivity of Content Data Management Solutions, APIs Sourcing, Portfolio Monitoring Private Company, Cobalt Market Research, Idea Generation Screening, Deep Sector Analytics + Trading Content + Technology Research + Advisory Asset Managers Asset Owners Hedge Funds Banking PE/VC Wealth Corporate Partners Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only Client Engagement Advisor Dashboard, Portfolio Guide

Headquarters San Francisco, CA Boston, MA Lakewood, CO Boston, MA New York, NY Founded 2013 2004 2014 2011 1968 Sponsoring SBU CTS Analytics & Trading Research & Advisory Research & Advisory CTS Strategic Alignment ESG Portfolio Lifecycle Deep Sector Private Markets Data Management Solutions Deal Rationale Expand ESG footprint and enhance technology- enabled content collection capabilities Address product gap in behavioral analytics to differentiate our PLC offering Accelerate the Power/Energy sub- strategy of our Deep Sector roadmap Building block to accelerate entry into private market workflows and path to differentiated data Enhances symbology, concordance, and reference data management Transaction Timing Closed in Q1 FY21 (November 2, 2020) Closed in Q4 FY21 (June 1, 2021) Closed in Q4 FY21 (July 1, 2021) Closed in Q1 FY22 (October 12, 2021) Closed in Q3 FY22 (March 1, 2022) 18 Recent deals complement our product offerings Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only

CUSIP Global Services acquisition is margin accretive and provides product diversity CY 2021 FY 2022 FY 2025 Pre-Acquisition Annual Subscription Value ~ $157M As of Dec 31, 2021 ~ $165M As of Aug 31, 2022 Mid-to-High Single Digit Growth Annual Revenues ~ $180M Calendar Year 2021 ~ $185M Pro Forma Full Year Mid-to-High Single Digit Growth % Non-Subscription ~ 15% < 15% Constant% Subscription ~ 85% > 85% 19 Varies with Market Conditions Post-Acquisition Closed on March 1, 2022 Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only

Our people and culture power our growth agenda • Our client focus drives the creation of industry-leading products and services • Our culture of innovation and collaboration makes FactSet an attractive firm for top talent, including technologists • Our focused investment in learning and development allows us to “upskill” the workforce of the future • The evolution of “the way we work” offers flexibility to support work/life balance and to increase productivity We empower our diverse and engaged team to meet our business needs and the needs of our clients 20Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only

21Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only Committed to Sustainable Growth in the Communities in Which We Live and Work Board consists of ten directors: 9/10 independent, 4/10 women, 5/10 less than 5 years on Board, 7/10 less than 10 years on Board Comprehensive cybersecurity program designed to protect our enterprise environment, manage cyber risk, and maintain compliance Established Supplier Code of Conduct in FY21 Signed the UN PRI and the UN Global Compact in FY21 Created FactSet Global DE&I Council consisting of over 20 senior leaders Hired Chief DE&I Officer and additional employees to support an expanded DEI strategy Published our workplace demographics for the first time, including our EEO-1 Federal data Incorporated the FactSet Charitable Foundation to facilitate our corporate social responsibility goals – during FY21, our CSR program delivered 263 volunteer events globally, with FactSet volunteers contributing over 14,000 hours of service Environmental Social Governance Published our validated Scope 1 and Scope 2 GHG Emissions from FY19 to FY21, with a 44% decrease in Total Scope 1 and Scope 2 Emissions between FY20 and FY21 Reported to CDP and EcoVadis in 2021 Efforts underway for Scope 3 GHG Emissions inventory, supplier assessment and sustainable procurement program, a climate-risk analysis, and monitoring consumption metrics Of FactSet’s global locations, 12 buildings have received LEED or LEED-equivalent certifications FactSet is committed to sustainable growth for our clients, employees, partners, investors, and our communities. We are continually monitoring and improving our social practices, our environmental and climate actions, and our governance initiatives while maintaining and strengthening our relationship with stakeholders. To learn more about our sustainability efforts, please see our 2021 Sustainability Report

Our Awards B E S T D A T A A N A L Y T I C S P R O V I D E R Inside Market Data & Inside Reference Data Award Buy-Side Technology Award Fund Technology & WSL Awards B E S T R E P O R T I N G S Y S T E M P R O V I D E R Waters Ranking Awards Wealth Briefing European Award B E S T O V E R A L L T E C H N O L O G Y P R O V I D E R Buy-Side Technology Award Inside Market Data and Inside Reference Data Awards Financial Technologies Forum Awards B E S T B U Y - S I D E P E R F O R M A N C E M E A S U R E M E N T A N D A T T R I B U T I O N Buy-Side Technology Awards | Waters Ranking Awards Wealth & Finance International Alternative Investment Awards B E S T R I S K M A N A G E M E N T T E C H N O L O G Y P R O V I D E R MENA Fund Services Award Ranked 19 in Chartis RiskTech100 Private Equity Wire 22Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only M A R K E T P L A C E P A R T N E R O F T H E Y E A R Snowflake

Financial Review | Fiscal 2022 Guidance 23

Key Highlights 24Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only Robust financial model with 95% subscription-based revenues supported by pricing discipline, demonstrated EBITDA flow-through and strong free cash flow conversion Strategic investments drive best-in-class solutions and scale up the content refinery, accelerating top-line growth Disciplined capital allocation drives value creation while investment grade balance sheet ensures flexibility Sustainable earnings growth driven by ASV growth, strategic investments and enterprise- wide productivity initiatives *FY22 Q3 Ending ASV and ASV LTM Growth 36.6% Q3 ASV* $1,775M Q3 Adjusted Operating Margin 10.1% Q3 LTM Growth* 01 02 03 04

Attractive financial model with demonstrated strong free cash flow conversion Revenues Adjusted EBITDA and EBITDA Margin1 Capital Expenditures as % of Revenues Free Cash Flow2 Note: Figures as of FactSet fiscal year end August 31; YTD 9-month figure as of May 31 1 See appendix for a reconciliation of EBITDA to GAAP net income. EBITDA margin is defined as EBITDA as a percentage of Revenues. 2 See appendix for a reconciliation of Free Cash Flow to Cash Flows from Operations. FCF conversion is defined as Free Cash Flow as a percentage of EBITDA. 284 352 368 428 494 351 71.1% 83.1% 73.7% 83.8% 91.7% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% 100.0% 110.0% - 100 200 300 400 500 600 FY17 FY18 FY19 FY20 FY21 FY22 YTD Free Cash Flow % FCF Conversion 1,221 1,350 1,435 1,494 1,591 1,345 FY17 FY18 FY19 FY20 FY21 FY22 YTD $M $M $M 3.0% 2.5% 4.1% 5.2% 3.9% 2.7% FY17 FY18 FY19 FY20 FY21 FY22 YTD 399 424 499 511 539 465 32.7% 31.4% 34.8% 34.2% 33.8% 28.0% 30.0% 32.0% 34.0% 36.0% 38.0% 40.0% FY17 FY18 FY19 FY20 FY21 FY22 YTD - 100 200 300 400 500 600 EBITDA % Margin +6.8% +7.8% +14.9% Copyright © 2022 FactSet Research Systems Inc. All rights reserved. FactSet Business Use Only +14.0% +15.4% +8.7% 75.5% 34.6% 25 YoY % YoY % YoY %

31% 34% 28% 30% 30% FY17 FY18 FY19 FY20 FY21 81 89 100 110 118 FY17 FY18 FY19 FY20 FY21 $261 $304 $220 $200 $265 FY17 FY18 FY19 FY20 FY21 Returning capital to shareholders $0.5B over the last five years $1.25B over the last five years $M $M 284 352 368 428 494 FY17 FY18 FY19 FY20 FY21 Avg 30.6% $M +14.9% 29% 25% 27% 26% 24% FY17 FY18 FY19 FY20 FY21 Avg 26.2% Net Income Payout Ratio 2 Free Cash Flow 1 Cash Flow Payout Ratio 3 +9.7% 1 Please see Appendix for free cash flow details. 2 Net income payout ratio reflects dividends as a percentage of net income. 3 Cash flow payout ratio reflects dividends as a percentage of free cash flow. 26Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only Dividends Share Repurchases

Strategic investments have accelerated top-line growth FY19 FY20 FY21 FY22 Guidance Base growth Acceleration from Investments 1 Cumulative three-year investments (FY20 - FY22) based internal attribution estimates 2 Organic LTM growth reported for respective FY quarter ends 3 FactSet’s expectations as of June 21, 2022. Actual results may differ materially from expectations above Digital Platform Private Markets Other Deep Sector Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only 5.1% 5.3% 7.2% 8% - 9% Organic ASV + Professional Services Growth 2~$150M Incremental ASV from ~$100M Investment 1 27 3

28 Disciplined capital allocation framework drives value creation Last 5 Years (FY17 - FY21) 50% Return Reinvest Dividend Share Repurchase M&A CapEx R&D 1 FactSet’s expectations as of April 5, 2022. Actual results may differ materially from expectations above. Investments (R&D / CapEx) Share Repurchase Dividends Acquisitions Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only Capital Deployed Capital Allocation Framework 50% Medium Term Goals 1 Target annual organic investment net ~100 to 150 bps of revenues CapEx goal 2.5% – 3% revenues Target quarterly dividend ~ 25% - 30% of net income Current focus on cash flow neutral tuck-in acquisitions and partnerships Normalized share repurchase (targeting to resume ~ late FY23)

Optimizing capital structure to ensure flexibility 1.0x 3.9x 3.5x 2.0x - 2.5x Feb 28, 2022 March 1, 2022 May 31, 2022 Target Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only • Investment grade ratings from Moody’s (Baa3) and Fitch (BBB) • New credit agreement with $500 million revolver ($250 million drawn) and additional $750 million accordion feature • $1 billion unsecured senior notes issued (5 year $500 million 2.9% coupon; 10 year $500 million 3.45% coupon) • $1 billion pre-payable three-year term loan - $875 million outstanding as of May 31, 2022 • Annual interest expense ~$50 million, ramping down to ~$40 million as term loan is repaid • Floating rate exposure hedged with 24-month fixed rate swap Debt incurred for CGS on March 1, 2022 included $1.0B of new senior notes, $1.0B of new term loan, $250M drawn new revolver, net of repayment of $575M previous revolver 1 Based on $575M of drawn revolver as of February 28, 2022, and $561M of FY22 Q2 LTM Adjusted EBITDA (excludes CGS); see appendix for Adjusted EBITDA reconciliation 2 Based on May 31, 2022, net of repayment of $125m of the term facility includes unamortized discounts and debt issuance fees. Gross Debt of $2,125m /$601m LTM Q3 Adj. EBITDA = 3.5x 3 FactSet’s expectations as of April 5, 2022. Actual results may differ materially from expectations above 21 3 29 Capital Structure OptimizationGross Leverage (Debt / LTM EBITDA) $575Total Debt ($MM) $2,250 Debt incurred for CGS $2,125 Debt incurred for CGS; net of repayment

$1.4 $1.4 $1.5 $1.6 $1.80-$1.83 FY18 FY19 FY20 FY21 FY22* $79 $72 $78 $112 $130-$150 FY18 FY19 FY20 FY21 FY22* $8.53 $10.00 $10.87 $11.20 $12.75- $13.15 FY18 FY19 FY20 FY21 FY22* In fiscal year 2022, we expect to deliver 8% - 9% Higher ASV1 Growth and Expanded Margin …building on momentum of the last several years $1.80-1.83B Revenue2 Adj Operating margin1,2 Adj Diluted EPS1,2 33-34%$130-150M ASV growth3 $12.75-13.15 31.3% 33.2% 33.6% 32.5% 33%-34% FY18 FY19 FY20 FY21 FY22* $B$M $ +8.3%4 +8.2%4,5 +12.1%4 30 YoYYoY YoY YoY 1 Please see Appendix for a reconciliation of these non-GAAP metrics to GAAP metrics. 2 Includes CUSIP Global Services (CGS) 3 Incremental ASV Growth 4 FY17-FY22 Guidance (mid-point March 24) 5 Total Organic ASV Growth *FY22 Outlook as of June 21, 2022 Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only

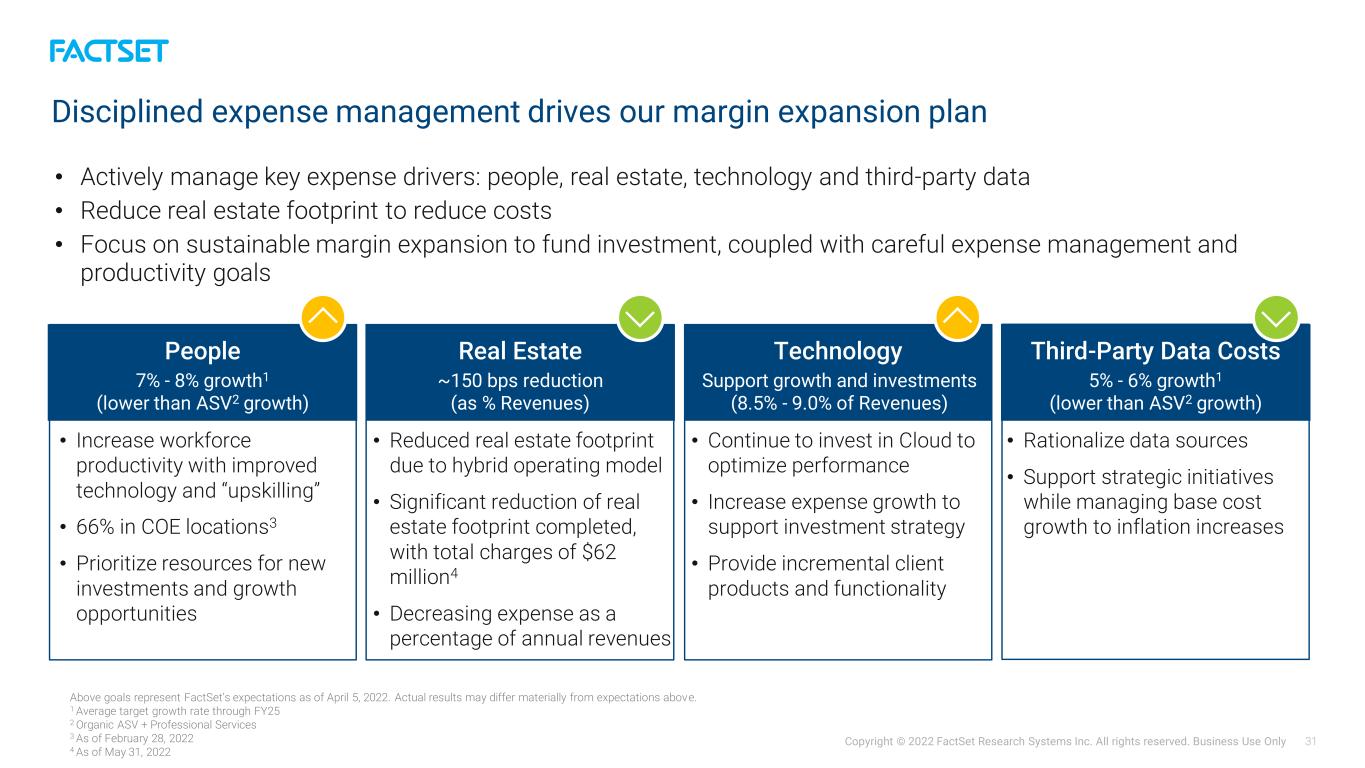

Disciplined expense management drives our margin expansion plan • Actively manage key expense drivers: people, real estate, technology and third-party data • Reduce real estate footprint to reduce costs • Focus on sustainable margin expansion to fund investment, coupled with careful expense management and productivity goals People 7% - 8% growth1 (lower than ASV2 growth) Real Estate ~150 bps reduction (as % Revenues) Technology Support growth and investments (8.5% - 9.0% of Revenues) Third-Party Data Costs 5% - 6% growth1 (lower than ASV2 growth) • Increase workforce productivity with improved technology and “upskilling” • 66% in COE locations3 • Prioritize resources for new investments and growth opportunities • Reduced real estate footprint due to hybrid operating model • Significant reduction of real estate footprint completed, with total charges of $62 million4 • Decreasing expense as a percentage of annual revenues • Continue to invest in Cloud to optimize performance • Increase expense growth to support investment strategy • Provide incremental client products and functionality • Rationalize data sources • Support strategic initiatives while managing base cost growth to inflation increases 31Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only Above goals represent FactSet’s expectations as of April 5, 2022. Actual results may differ materially from expectations above. 1 Average target growth rate through FY25 2 Organic ASV + Professional Services 3 As of February 28, 2022 4 As of May 31, 2022

We expect 8-9% ASV growth and 50-75 basis points of margin expansion per year to deliver 35-36% adjusted operating margin by year-end 2025 Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only 32 FactSet Organic ASV Growth 2, 3 FactSet Adjusted Operating Margin 4, 5 FactSet Adjusted Diluted EPS Growth 3, 5 8 - 9% 35 - 36% 11 - 13% Medium Term Outlook 1 Research + Advisory (high single digit growth) Analytics + Trading (high single digit growth) Content + Technology Solutions (low teens growth) 1 Medium term outlook represents FactSet’s expectations as of April 5, 2022. Actual results may differ materially from expectations above. 2 Organic ASV + Professional Services 3 Average target growth rate through FY25 (per year on average) 4 Target margin by year-end FY25 5 Includes CUSIP Global Services (CGS)

APPENDIX 33

We reaffirm fiscal 2022 guidance of 8% - 9% ASV1 growth and expanded margin FISCAL 2022 OUTLOOK As of June 21, 20222 Organic ASV + Professional Services Growth3 $130 - $150 million Revenues $1,800 - $1,830 million Operating Margin 25.5% - 26.5% Adjusted Operating Margin 33% - 34% Effective Tax Rate 12.5% - 13.5% Diluted EPS $9.75 - $10.15 Adjusted Diluted EPS $12.75 - $13.15 1 Organic ASV + Professional Services 2 FactSet’s expectations as of June 21, 2022. Actual results may differ materially from the expectations above 3 Growth over fiscal 2021. Guiding to the higher end of the ranges, with tax expected to come in at the lower end of the range The Fiscal 2022 Outlook shown here is a forward-looking statement. Given the risks, uncertainties and assumptions related to FactSet's business and operations, FactSet’s actual future results may differ materially from these expectations. Investors should review the Company’s cautionary statements and risk factors referred to in this presentation Copyright © 2022 FactSet Research Systems Inc. All rights reserved. FactSet Business Use Only

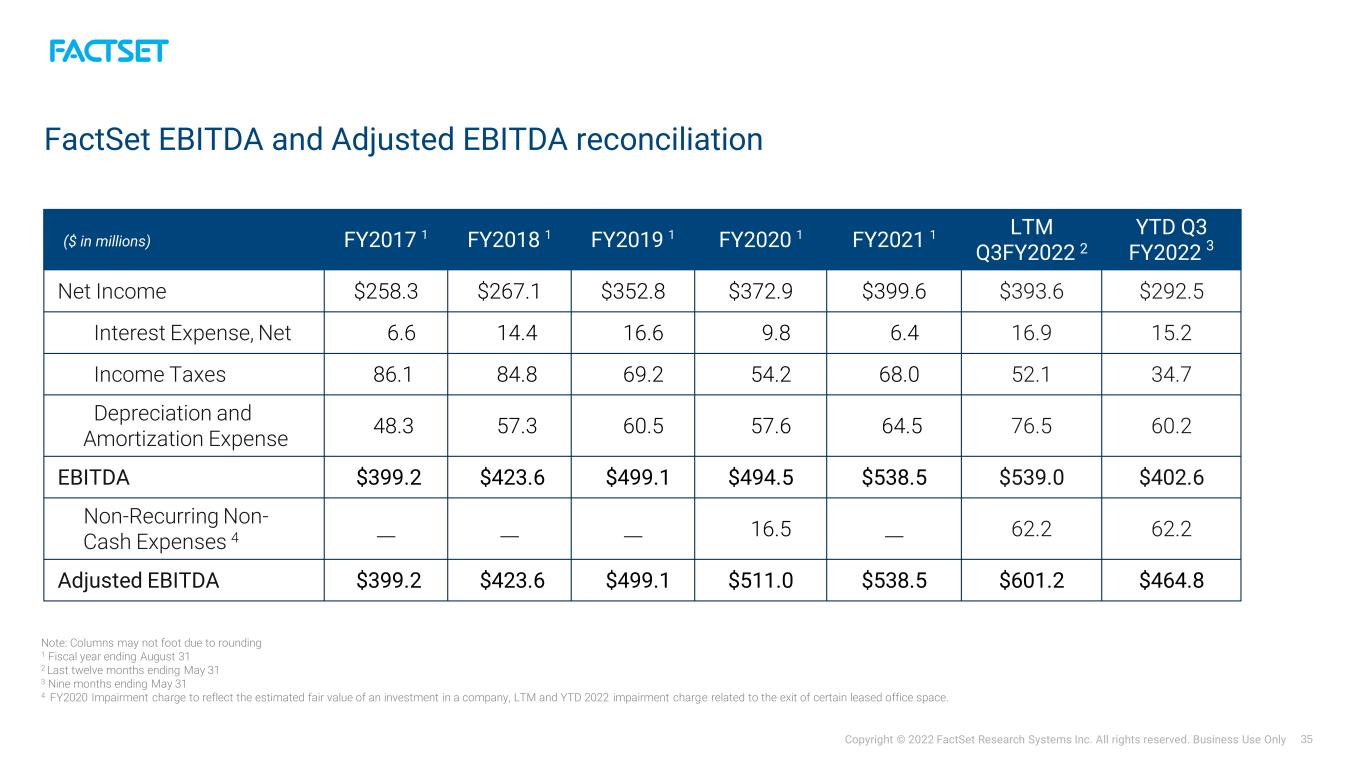

FactSet EBITDA and Adjusted EBITDA reconciliation FY2017 1 FY2018 1 FY2019 1 FY2020 1 FY2021 1 LTM Q3FY2022 2 YTD Q3 FY2022 3 Net Income $258.3 $267.1 $352.8 $372.9 $399.6 $393.6 $292.5 Interest Expense, Net 6.6 14.4 16.6 9.8 6.4 16.9 15.2 Income Taxes 86.1 84.8 69.2 54.2 68.0 52.1 34.7 Depreciation and Amortization Expense 48.3 57.3 60.5 57.6 64.5 76.5 60.2 EBITDA $399.2 $423.6 $499.1 $494.5 $538.5 $539.0 $402.6 Non-Recurring Non- Cash Expenses 4 __ __ __ 16.5 __ 62.2 62.2 Adjusted EBITDA $399.2 $423.6 $499.1 $511.0 $538.5 $601.2 $464.8 ($ in millions) 35 Note: Columns may not foot due to rounding 1 Fiscal year ending August 31 2 Last twelve months ending May 31 3 Nine months ending May 31 4 FY2020 Impairment charge to reflect the estimated fair value of an investment in a company, LTM and YTD 2022 impairment charge related to the exit of certain leased office space. Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only

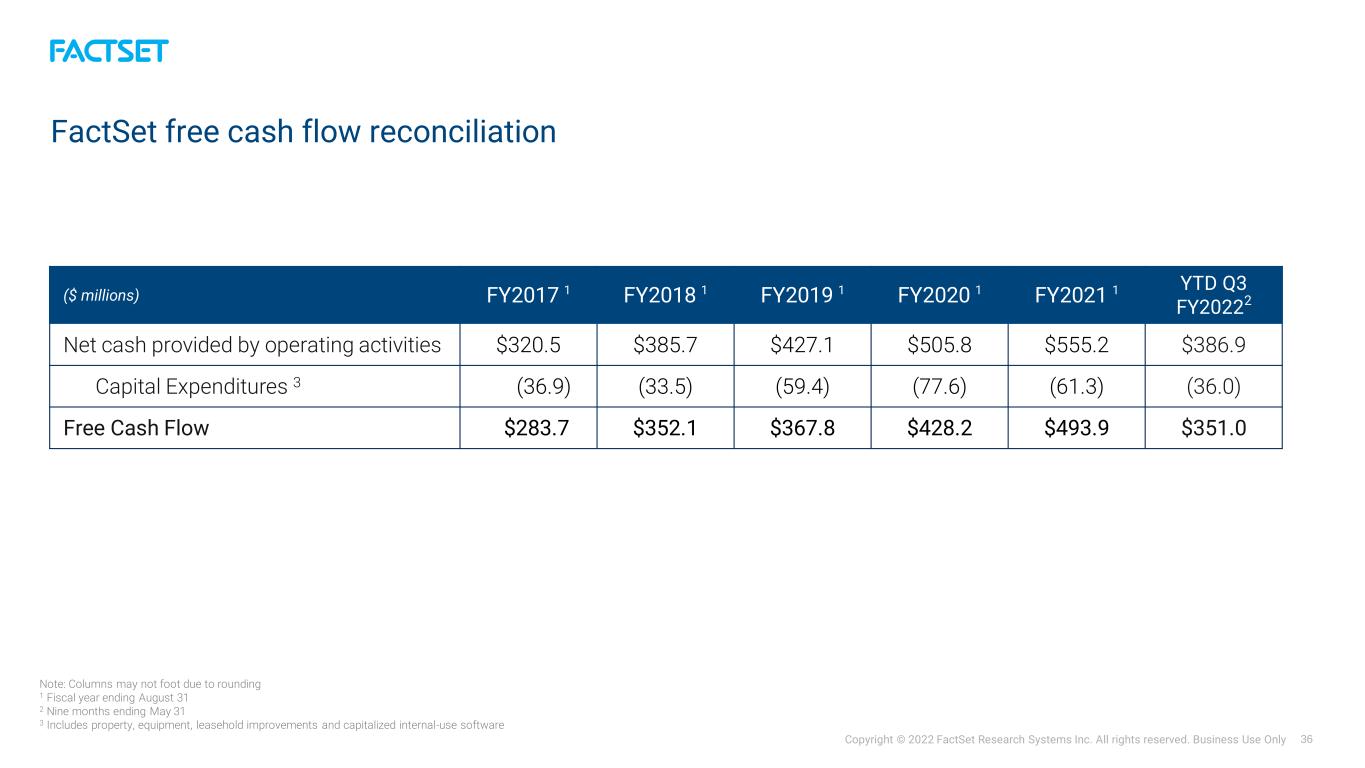

($ in thousands) 36 Note: Columns may not foot due to rounding 1 Fiscal year ending August 31 2 Nine months ending May 31 3 Includes property, equipment, leasehold improvements and capitalized internal-use software ($ millions) FY2017 1 FY2018 1 FY2019 1 FY2020 1 FY2021 1 YTD Q3 FY20222 Net cash provided by operating activities $320.5 $385.7 $427.1 $505.8 $555.2 $386.9 Capital Expenditures 3 (36.9) (33.5) (59.4) (77.6) (61.3) (36.0) Free Cash Flow $283.7 $352.1 $367.8 $428.2 $493.9 $351.0 Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only FactSet free cash flow reconciliation

($ in thousands) 37 1 Costs primarily related to professional fees associated with the ongoing multi-year investment plan. ($ millions) Low end of range High end of range Revenues $1,800 $1,830 Operating income $459 $485 Operating margin 25.5% 26.5% Intangible asset amortization 26 26 Real estate charges 55 55 Business acquisition costs 40 42 Restructuring / severance 9 9 Transformation costs 1 5 5 Adjusted operating income $594 $622 Adjusted operating margin 33.0% 34.0% Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only FactSet adjusted operating margin reconciliation FY2022 Outlook (as of June 21, 2022)

($ in thousands) 38 Note: Columns may not foot due to rounding ($ millions) Low end of range High end of range Diluted earnings per common share $9.75 $10.15 Intangible asset amortization 0.58 0.58 Real estate charges 1.26 1.26 Business acquisition costs 0.91 0.91 Restructuring / severance 0.20 0.20 Transformation costs 0.11 0.11 Discrete tax items (0.06) (0.06) Adjusted diluted earnings per common share $12.75 $13.15 Copyright © 2022 FactSet Research Systems Inc. All rights reserved. Business Use Only FactSet adjusted diluted EPS reconciliation FY2022 Outlook (as of June 21, 2022)

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- GXO Announces Pricing of $1.1 Billion Notes Offering

- ROSEN, A TOP RANKED LAW FIRM, Encourages Plug Power Inc. Investors to Secure Counsel Before Important Deadline in Securities Class Action – PLUG

- The First of Long Island Corporation Reports Earnings for the First Quarter of 2024

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share