Form 8-K Entegra Financial Corp. For: Jan 15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of earliest event reported: January 15, 2019

ENTEGRA FINANCIAL CORP.

(Exact Name of Registrant as Specified in its Charter)

| North Carolina | 001-35302 | 45-2460660 | ||

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| 14 One Center Court Franklin, North Carolina |

28734 | |

| (Address of Principal Executive Offices) | (Zip Code) |

| (828) 524-7000 |

|

(Registrant’s telephone number, including area code)

N/A |

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

x Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company þ

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement |

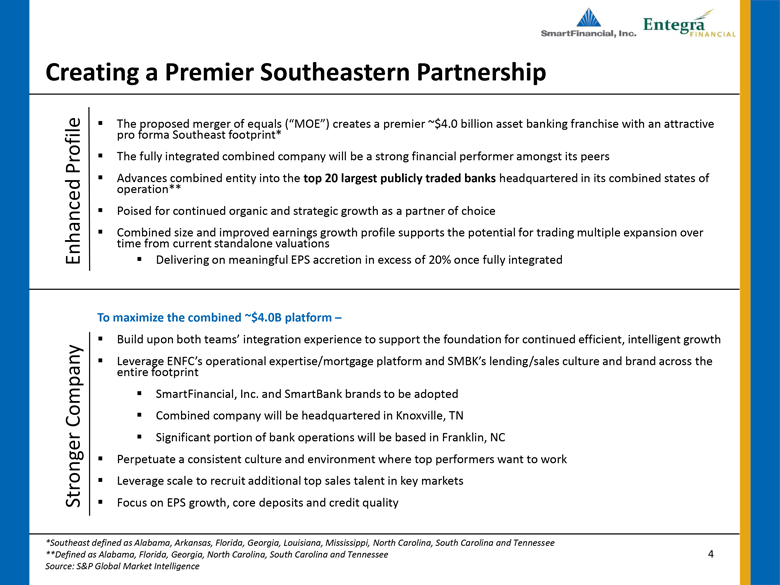

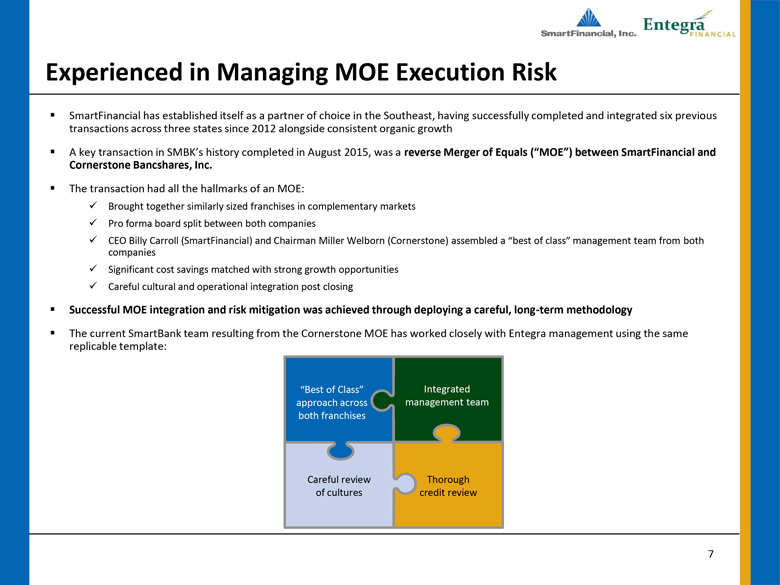

On January 15, 2019, Entegra Financial Corp. (“Entegra”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) with SmartFinancial, Inc., a Tennessee corporation (“SmartFinancial”), and CT Merger Sub, Inc., a North Carolina corporation and a direct, wholly-owned subsidiary of SmartFinancial (“Merger Sub”), pursuant to which, on the terms and subject to the conditions set forth therein, Merger Sub will merge with and into Entegra (the “Merger”), with Entegra surviving the Merger (Entegra as the surviving entity of the Merger, the “Surviving Company”). As soon as reasonably practicable following the Merger and as part of a single integrated transaction, SmartFinancial will cause the Surviving Company to be merged with and into SmartFinancial (the “Second Step Merger”), with SmartFinancial as the surviving entity, on the terms and subject to the conditions set forth in the Merger Agreement. Immediately following the Second Step Merger, Entegra Bank, a North Carolina state bank and a wholly-owned subsidiary of Entegra, will merge with and into SmartBank, a Tennessee state bank and a wholly-owned subsidiary of SmartFinancial (the “Bank Merger” and, together with the Merger and the Second Step Merger, the “Mergers”), pursuant to and in accordance with the terms of a separate agreement and plan of merger entered into by Entegra Bank and SmartBank. The Merger Agreement was approved and adopted by the board of directors of Entegra and the board of directors of SmartFinancial.

Under the terms and subject to the conditions of the Merger Agreement, at the effective time of the Merger (the “Effective Time”), each outstanding share of Entegra common stock (other than certain excluded and dissenting shares) will be converted into the right to receive 1.215 (the “Exchange Ratio”) shares of SmartFinancial common stock (the “Stock Consideration”). As of January 15, 2019, Entegra had 6,917,703 shares of common stock outstanding.

Additionally, in the event that Entegra resolves a certain dispute between Entegra and unrelated third-parties with respect to certain tax matters (the “Entegra Dispute”) and receives all proceeds from the resolution of the Entegra Dispute prior to 5:00 p.m. Eastern Time on the fifteenth business day prior to the closing of the Merger, Entegra will use commercially reasonable efforts to declare and pay a special cash dividend to its shareholders in an amount up to the after-tax net proceeds from the resolution of the Entegra Dispute (the “Special Dividend”). If paid, the Special Dividend must be paid by Entegra prior to 5:00 p.m. Eastern Time on the fifth Business Day prior to the closing of the Merger (such date the “Settlement Date”). If Entegra does not resolve the Entegra Dispute, receive all proceeds from the resolution of the Entegra Dispute, and pay the Special Dividend prior to 5:00 p.m. Eastern Time on the Settlement Date, Entegra shareholders will receive as additional consideration for the Merger one non-transferrable contingent value right (each a “CVR” and, collectively, the “CVRs”) for each share of Entegra common stock held immediately prior to the Effective Time and, prior to or at the closing of the Merger, Entegra and SmartFinancial will execute a Contingent Value Rights Agreement, substantially in the form attached to the Merger Agreement (the “CVR Agreement”), to which the CVRs will be subject, and will use commercially reasonable efforts to cause the initial committee members and a mutually agreed upon paying agent provided for in the CVR Agreement to execute the CVR Agreement. The CVRs will entitle the holders thereof to receive, for a period of up to 24 months following the Merger, a pro rata share of the after-tax net proceeds from the resolution of the Entegra Dispute received by SmartFinancial as successor to Entegra. There is no assurance that Entegra will be able to pay the Special Dividend. Further, if Entegra shareholders receive CVRs as additional consideration for the Merger, there is no assurance that the CVRs will not expire without CVR holders receiving any payment in respect of the CVRs as a result of the resolution of the Entegra Dispute.

The Merger Agreement also includes provisions that address the treatment of outstanding equity awards of Entegra. At the Effective Time, each outstanding Entegra restricted stock unit will fully vest and will be canceled and converted automatically into the right to receive the Stock Consideration and, in the event CVRs are issued in connection with the Merger, a CVR. At the Effective Time, each outstanding option to purchase Entegra common stock will be assumed by SmartFinancial. Each assumed stock option shall represent an option to purchase that number of shares of SmartFinancial common stock equal to the number of shares of Entegra common stock issuable upon the exercise of such stock option immediately prior to the Effective Time multiplied by the Exchange Ratio, and the per share exercise price of the resulting option will be equal to the per share exercise price of such option immediately prior to the Effective Time divided by the Exchange Ratio.

The Merger Agreement contains customary representations and warranties from both Entegra and SmartFinancial, including representations and warranties with respect to its and its subsidiaries’ businesses, and each party has agreed to customary covenants, including, among others, covenants relating to the conduct of its business during the interim period between the execution of the Merger Agreement and the Effective Time. Each party has also agreed to call a meeting of its shareholders to approve, in the case of Entegra, the Merger Agreement and the transactions contemplated thereby, including the Merger (the “Entegra Shareholder Approval”), and, in the case of SmartFinancial, the issuance of the shares of SmartFinancial common stock constituting the Stock Consideration (the “SmartFinancial Shareholder Approval”). Entegra and SmartFinancial have each agreed to customary non-solicitation covenants relating to alternative acquisition proposals that prohibit either party from, subject to certain customary exceptions, soliciting proposals relating to certain alternative acquisition proposals or entering into discussions or negotiations or providing confidential information in connection with certain proposals for an alternative acquisition. Notwithstanding any alternative acquisition proposals, the Merger Agreement requires each of Entegra and SmartFinancial to convene a meeting of its shareholders and submit the required proposals described above to its respective shareholders for approval, unless the Merger Agreement has been terminated.

| 2 |

The completion of the Mergers is subject to customary conditions, including (1) receipt of the Entegra Shareholder Approval and the SmartFinancial Shareholder Approval, (2) authorization for listing on the Nasdaq Capital Market of the shares of SmartFinancial common stock to be issued in the Merger, (3) receipt of required regulatory approvals, including the approval of the Board of Governors of the Federal Reserve System, the North Carolina Office of the Commissioner of Banks, and the Tennessee Department of Financial Institutions, (4) effectiveness of the registration statement on Form S-4 for the SmartFinancial common stock to be issued in connection with the Merger, and (5) the absence of any order, decree, or injunction preventing the completion of the Mergers or making the Mergers illegal.

Each party’s obligation to complete the Mergers is also subject to certain additional customary conditions, including (1) subject to certain exceptions, the accuracy of the representations and warranties of Entegra, in the case of SmartFinancial, and SmartFinancial and Merger Sub, in the case of Entegra, (2) performance in all material respects by Entegra, in the case of SmartFinancial, and SmartFinancial and Merger Sub, in the case of Entegra, of its obligations under the Merger Agreement, and (3) receipt by such party of an opinion from its counsel to the effect that the Merger will qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended. The obligations of SmartFinancial and Merger Sub to complete the Mergers are also subject to Entegra having taken all action necessary to terminate the Tax Benefits Preservation Plan between Entegra and Computershare Trust Company, N.A. effective immediately prior to the Effective Time or otherwise amending the Tax Benefits Preservation Plan so that no rights provided for in the plan are exercisable in connection with or following the transactions contemplated by the Merger Agreement.

The Merger Agreement provides certain termination rights for both Entegra and SmartFinancial and further provides that a termination fee of $6.4 million will be payable by either Entegra or SmartFinancial, upon termination of the Merger Agreement under certain circumstances, including if the other party’s board of directors withdraws or modifies or qualifies in a manner adverse to the other party its recommendation that its shareholders vote in favor of the Merger Agreement and the transactions contemplated thereby (including the Merger), in the case of Entegra shareholders, and in favor of the issuance of SmartFinancial common stock issuable in the Merger, in the case of SmartFinancial shareholders.

The Merger Agreement provides that prior to or at the Effective Time, the SmartFinancial board of directors will take all requisite action to increase the total number of members of the board of directors by five members and to elect five members of the board of directors of Entegra to the board of directors of SmartFinancial effective as of or immediately following the Effective Time. In connection with the execution of the Merger Agreement, SmartFinancial and/or SmartBank have also entered into employment agreements with David A. Bright, the Chief Financial Officer of Entegra, Ryan M. Scaggs, the Chief Operating Officer of Entegra, and Roger D. Plemens, the President and Chief Executive Officer of Entegra, that will become effective upon the consummation of the Mergers. Prior to or at the Effective Time, David A. Bright and Ryan M. Scaggs will each receive a one-time bonus in the amount of $200,000.

In connection with the Merger, SmartFinancial will assume $14.4 million in aggregate principal amount of subordinated debentures issued by Entegra to trust affiliates in connection with the issuance of trust preferred securities. Further, at the Effective Time, SmartFinancial will contribute $1.0 million to the SmartBank Foundation to be allocated to charitable organizations in the banking markets served by Entegra Bank. In connection with the announcement of the Merger, the Company may be required to take an impairment charge to goodwill, which (if taken) would reduce shareholder equity and increase charges against income for 2018; the Company is working to determine if such an impairment charge is required and, if so, the amount.

The foregoing description of the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement, which is attached hereto as Exhibit 2.1 and incorporated herein by reference. The representations, warranties, and covenants of each party set forth in the Merger Agreement have been made only for purposes of, and were and are solely for the benefit of, the parties to the Merger Agreement, may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Merger Agreement instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Accordingly, the representations and warranties may not describe the actual state of affairs at the date they were made or at any other time, and investors should not rely on them as statements of fact. In addition, such representations and warranties (1) will not survive consummation of the Merger and (2) were made only as of the date of the Merger Agreement or such other date specified in the Merger Agreement. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in the parties’ public disclosures. Accordingly, the Merger Agreement is included with this filing only to provide investors with information regarding the terms of the Merger Agreement, and not to provide investors with any other factual information regarding the parties, their respective affiliates, or their respective businesses. The Merger Agreement should not be read alone, but should instead be read in conjunction with the other information regarding Entegra or SmartFinancial, their respective affiliates, their respective businesses, the Merger Agreement and the Merger that will be contained in, or incorporated by reference into, the registration statement on Form S-4 that will include the joint proxy statement of Entegra and SmartFinancial and a prospectus of SmartFinancial, as well as in the Forms 10-K, Forms 10-Q, and other filings that Entegra makes with the Securities and Exchange Commission (“SEC”).

| 3 |

| Item 7.01 | Regulation FD |

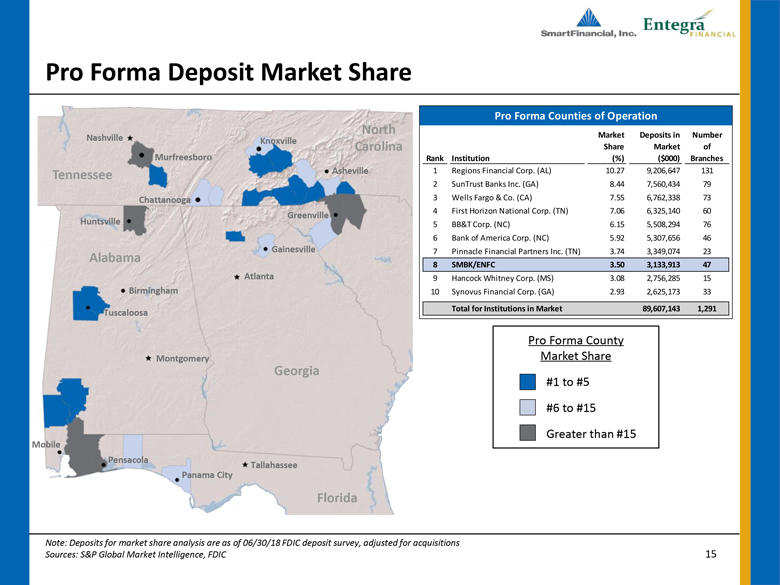

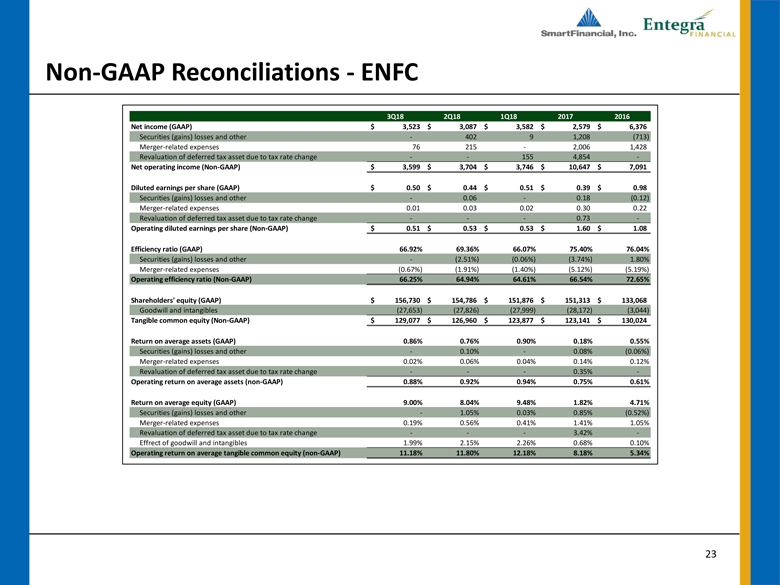

On January 15, 2019, Entegra and SmartFinancial issued a joint press release announcing their entry into the Merger Agreement. A copy of that joint press release attached hereto as Exhibit 99.1 to this current report on Form 8-K and is incorporated by reference. In addition, Entegra and SmartFinancial may provide supplemental information regarding the proposed transaction in connection with presentations to analysts and investors. A copy of the slides that may be made available in connection with the presentations is attached hereto as Exhibit 99.2 and incorporated by reference herein.

The information set forth in this Item 7.01 (including the information in Exhibits 99.1 and 99.2 attached hereto) is being furnished to the SEC and is not deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liability under the Exchange Act. Such information shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 8.01 | Other Events |

Simultaneous with the execution of the Merger Agreement, Entegra entered into Voting Agreements with certain of the directors and officers of SmartFinancial (collectively, the “Entegra Voting Agreements”), and SmartFinancial entered into substantially similar Voting Agreements with certain of the directors and officers of Entegra (the “SmartFinancial Voting Agreements” and, collectively with the Entegra Voting Agreements, the “Voting Agreements”).

Each shareholder party to a Voting Agreement agreed, among other things, to vote the shares of SmartFinancial Common Stock or Entegra Common Stock, as applicable, owned beneficially by such shareholder in favor of the Merger Agreement (in the case of the SmartFinancial Voting Agreements) or the stock issuance proposal (in the case of the Entegra Voting Agreements), and against any alternative acquisition proposal, and any action, proposal, transaction or agreement which could reasonably be expected to result in a breach of any covenant, representation or warranty or any other obligation or agreement of SmartFinancial or Entegra, as applicable, under the Merger Agreement, as well as certain other restrictions with respect to the voting and transfer of such shareholder’s shares of SmartFinancial Common Stock or Entegra Common Stock, as applicable.

The Voting Agreements will terminate in certain circumstances, including upon approval of the Merger Agreement by Entegra’s shareholders in accordance with Entegra’s articles of incorporation and bylaws and applicable law or upon the termination of the Merger Agreement in accordance with its terms. The foregoing description of the Voting Agreements does not purport to be complete and is qualified in its entirety by reference to the full text of the Voting Agreements, forms of which are attached to Exhibit 2.1 and are incorporated by reference herein.

| 4 |

| Item 9.01 | Financial Statements & Exhibits |

(d) Exhibits

| Exhibit | |

| Number | Description of Exhibit |

| 2.1 | Agreement and Plan of Merger, dated as of January 15, 2019, by and among Entegra Financial Corp., SmartFinancial, Inc., and CT Merger Sub, Inc. * |

| 99.1 | Press Release, issued by Entegra Financial Corp. and SmartFinancial, Inc., dated January 15, 2019 |

| 99.2 | Investor Presentation Materials |

| * The registrant has omitted schedules and similar attachments to the subject agreement pursuant to Item 601(b)(2) of Regulation S-K. The registrant will furnish a copy of any omitted schedule or similar attachment to the SEC upon request. |

Forward-Looking Statements

Certain of the statements made in this investor presentation may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The words “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” and “estimate,” and similar expressions, are intended to identify such forward-looking statements, but other statements not based on historical information may also be considered forward-looking, including statements about the benefits to Entegra Financial Corp. (“Entegra”) and SmartFinancial, Inc. (“SmartFinancial”) of the proposed merger, Entegra’s and SmartFinancial’s future financial and operating results and their respective plans, objectives, and intentions. All forward-looking statements are subject to risks, uncertainties, and other factors that may cause the actual results, performance, or achievements of Entegra and SmartFinancial to differ materially from any results, performance, or achievements expressed or implied by such forward-looking statements. Such risks, uncertainties, and other factors include, among others, (1) the risk that the cost savings and any revenue synergies from the proposed merger may not be realized or take longer than anticipated to be realized, (2) the risk that the cost savings and any revenue synergies from recently completed mergers may not be realized or may take longer than anticipated to realize, (3) disruption from the proposed merger, or recently completed mergers, with customer, supplier, or employee relationships, (4) the occurrence of any event, change, or other circumstances that could give rise to the termination of the merger agreement, (5) the failure to obtain necessary shareholder or regulatory approvals for the merger, (6) the possibility that the amount of the costs, fees, expenses, and charges related to the merger may be greater than anticipated, including as a result of unexpected or unknown factors, events, or liabilities, (7) the failure of the conditions to the merger to be satisfied, (8) the risk of successful integration of the two companies’ businesses, including the risk that the integration of Entegra’s operations with those of SmartFinancial will be materially delayed or will be more costly or difficult than expected, (9) the risk of expansion into new geographic or product markets, (10) reputational risk and the reaction of the parties’ customers to the merger, (11) the risk of potential litigation or regulatory action related to the merger, (12) the dilution caused by SmartFinancial’s issuance of additional shares of its common stock in the merger, and (13) general competitive, economic, political, and market conditions. Additional factors which could affect the forward-looking statements can be found in Entegra’s annual report on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, or SmartFinancial’s annual report on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, in each case filed with the SEC and available on the SEC’s website at http://www.sec.gov. Entegra and SmartFinancial disclaim any obligation to update or revise any forward-looking statements contained in this communication, which speak only as of the date hereof, whether as a result of new information, future events, or otherwise.

| 5 |

Additional Information About the Proposed Transaction and Where to Find It

Investors and security holders are urged to carefully review and consider each of Entegra’s and SmartFinancial’s public filings with the SEC, including but not limited to their Annual Reports on Form 10-K, their proxy statements, their Current Reports on Form 8-K, and their Quarterly Reports on Form 10-Q.

The documents filed by Entegra with the SEC may be obtained free of charge at Entegra’s Investor Relations website at www.snl.com/IRW/CorporateProfile/4290505 under the heading “SEC Filings. The documents filed by SmartFinancial with the SEC may be obtained free of charge at SmartFinancial’s website at www.SmartFinancialinc.com, under the heading “Investors,” the subheading “Documents,” and the subheading “Regulatory Filings.” The documents filed by each of Entegra and SmartFinancial can also be found at the SEC’s website at www.sec.gov. The Entegra documents may be obtained free of charge from Entegra by requesting them in writing to Entegra Financial Corp., 14 One Center Court, Franklin, North Carolina 28734, or by telephone at (828) 524-7000. The SmartFinancial documents may be similarly obtained free of charge from SmartFinancial by requesting them in writing to SmartFinancial, Inc., 5401 Kingston Pike, Suite 600, Knoxville, Tennessee 37919, or by telephone at (865) 453-2650.

Participants in the Solicitation

Entegra, SmartFinancial and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Entegra and SmartFinancial shareholders in connection with the proposed transaction under the rules of the SEC. Information about the directors and executive officers of Entegra may be found in the definitive proxy statement for Entegra’s 2018 annual meeting of shareholders, filed by Entegra with the SEC on April 2, 2018. Information about the directors and executive officers of SmartFinancial may be found in the definitive proxy statement for SmartFinancial’s 2018 annual meeting of shareholders, filed with the SEC by SmartFinancial on April 2, 2018, and other documents subsequently filed by SmartFinancial with the SEC. Additional information regarding the interests of these participants will also be included in the joint proxy statement/prospectus regarding the proposed transaction when it becomes available. Free copies of these documents maybe obtained as described in the paragraph above.

| 6 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ENTEGRA FINANCIAL CORP. | ||

| Date: January 15, 2019 | ||

| /s/ David A. Bright | ||

| David A. Bright | ||

| Chief Financial Officer |

| 7 |

EXHIBIT INDEX

| 2.1 | Agreement and Plan of Merger, dated as of January 15, 2019 by and among, Entegra Financial Corp., SmartFinancial, Inc., and CT Merger Sub, Inc. * |

| 99.1 | Press Release, issued by SmartFinancial, Inc. and Entegra Financial Corp, dated January 15, 2019 |

| 99.2 | Investor Presentation Materials |

| * The registrant has omitted scheduled and similar attachments to the subject agreement pursuant to Item 601(b)(2) of Regulation S-K. The registrant will furnish a copy of any omitted schedule or similar attachment to the SEC upon request. |

| 8 |

Exhibit 2.1

AGREEMENT AND PLAN

OF

MERGER

SMARTFINANCIAL, INC.

CT MERGER SUB, INC.

and

ENTEGRA FINANCIAL CORP.

January 15, 2019

TABLE OF CONTENTS

| ARTICLE I DEFINITIONS | 1 |

| SECTION 1.1 CERTAIN DEFINITIONS | 1 |

| SECTION 1.2 OTHER DEFINITIONS | 9 |

| ARTICLE II THE MERGERS | 9 |

| SECTION 2.1 THE MERGER | 9 |

| SECTION 2.2 THE SECOND STEP MERGER | 9 |

| SECTION 2.3 MERGER SUB SHAREHOLDER APPROVAL | 10 |

| SECTION 2.4 CLOSING | 11 |

| SECTION 2.5 THE BANK MERGER | 11 |

| ARTICLE III MERGER CONSIDERATION | 11 |

| SECTION 3.1 CONVERSION OF COMPANY COMMON STOCK | 11 |

| SECTION 3.2 EXCHANGE PROCEDURES | 11 |

| SECTION 3.3 RIGHTS AS COMPANY SHAREHOLDERS | 13 |

| SECTION 3.4 NO FRACTIONAL SHARES | 13 |

| SECTION 3.5 EXCLUDED SHARES | 13 |

| SECTION 3.6 MERGER SUB COMMON STOCK | 13 |

| SECTION 3.7 SMARTFINANCIAL STOCK | 14 |

| SECTION 3.8 ADJUSTMENTS UPON CHANGE IN CAPITALIZATION | 14 |

| SECTION 3.9 COMPANY EQUITY AWARDS | 14 |

| SECTION 3.10 WITHHOLDING RIGHTS | 14 |

| ARTICLE IV REPRESENTATIONS AND WARRANTIES OF COMPANY | 15 |

| SECTION 4.1 ENTEGRA DISCLOSURE MEMORANDUM | 15 |

| SECTION 4.2 REPRESENTATIONS AND WARRANTIES | 15 |

| ARTICLE V REPRESENTATIONS AND WARRANTIES OF SMARTFINANCIAL PARTIES | 34 |

| SECTION 5.1 SMARTFINANCIAL DISCLOSURE MEMORANDUM | 34 |

| SECTION 5.2 REPRESENTATIONS AND WARRANTIES | 34 |

| ARTICLE VI CONDUCT PENDING THE MERGER | 53 |

| SECTION 6.1 COMPANY FORBEARANCES | 53 |

| SECTION 6.2 SMARTFINANCIAL FORBEARANCES | 56 |

| SECTION 6.3 ABSENCE OF CONTROL | 59 |

| ARTICLE VII COVENANTS | 59 |

| SECTION 7.1 ACQUISITION PROPOSALS | 59 |

| SECTION 7.2 NOTICE OF CERTAIN MATTERS | 60 |

| SECTION 7.3 ACCESS AND INFORMATION | 61 |

| SECTION 7.4 REGULATORY FILINGS; CONSENTS AND APPROVALS | 62 |

| SECTION 7.5 FURTHER ASSURANCES | 62 |

| SECTION 7.6 PUBLICITY | 62 |

| SECTION 7.7 COMPANY SHAREHOLDERS MEETING | 63 |

| SECTION 7.8 SMARTFINANCIAL SHAREHOLDERS MEETING | 64 |

| SECTION 7.9 TIMING OF SHAREHOLDERS’ MEETINGS | 65 |

| SECTION 7.10 EMPLOYEE AND BENEFIT MATTERS | 65 |

| SECTION 7.11 INDEMNIFICATION | 67 |

| SECTION 7.12 ESTOPPEL LETTERS | 68 |

| SECTION 7.13 REGISTRATION STATEMENT | 68 |

| SECTION 7.14 NASDAQ LISTING | 69 |

| SECTION 7.15 APPOINTMENT OF DIRECTORS | 69 |

i

| SECTION 7.16 EXEMPTION FROM SECTION 16(b) LIABILITY | 69 |

| SECTION 7.17 TAKEOVER LAWS | 69 |

| SECTION 7.18 LITIGATION AND CLAIMS | 70 |

| SECTION 7.19 OPERATING FUNCTIONS | 70 |

| SECTION 7.20 ENTEGRA SPECIAL DIVIDEND; CVR AGREEMENT | 70 |

| SECTION 7.21 TRUST PREFERRED SECURITIES | 71 |

| SECTION 7.22 SMARTBANK FOUNDATION CONTRIBUTION | 71 |

| ARTICLE VIII CONDITIONS TO CONSUMMATION OF MERGER | 71 |

| SECTION 8.1 CONDITIONS TO EACH PARTY’S OBLIGATION | 71 |

| SECTION 8.2 CONDITIONS TO OBLIGATION OF THE COMPANY | 72 |

| SECTION 8.3 CONDITIONS TO OBLIGATIONS OF THE SMARTFINANCIAL PARTIES | 73 |

| ARTICLE IX TERMINATION | 74 |

| SECTION 9.1 TERMINATION | 74 |

| SECTION 9.2 EFFECT OF TERMINATION | 75 |

| SECTION 9.3 TERMINATION FEE | 75 |

| ARTICLE X MISCELLANEOUS | 76 |

| SECTION 10.1 SURVIVAL | 76 |

| SECTION 10.2 INTERPRETATION | 77 |

| SECTION 10.3 AMENDMENT; WAIVER | 77 |

| SECTION 10.4 COUNTERPARTS | 77 |

| SECTION 10.5 GOVERNING LAW | 77 |

| SECTION 10.6 EXPENSES | 77 |

| SECTION 10.7 NOTICES | 78 |

| SECTION 10.8 ENTIRE AGREEMENT; THIRD PARTY BENEFICIARIES | 78 |

| SECTION 10.9 SEVERABILITY | 78 |

| SECTION 10.10 ASSIGNMENT | 78 |

| SECTION 10.11 SPECIFIC PERFORMANCE | 78 |

| SECTION 10.12 SUBMISSION TO JURISDICTION | 79 |

| SECTION 10.13 JURY TRIAL WAIVER | 79 |

EXHIBIT A – FORM OF ENTEGRA VOTING AGREEMENT

EXHIBIT B – FORM OF SMARTFINANCIAL VOTING AGREEMENT

EXHIBIT C – FORM OF CVR AGREEMENT

ii

AGREEMENT AND PLAN OF MERGER

THIS AGREEMENT AND PLAN OF MERGER (this “Agreement”), dated as of the 15th day of January, 2019, is made and entered into by and among SmartFinancial, Inc., a Tennessee corporation (“SmartFinancial”); CT Merger Sub, Inc., a North Carolina corporation and direct, wholly owned subsidiary of SmartFinancial (“Merger Sub”); and Entegra Financial Corp., a North Carolina corporation (the “Company”), under authority of resolutions of their respective boards of directors duly adopted.

R E C I T A L S

A. The board of directors of each of SmartFinancial, Merger Sub, and the Company has determined that this Agreement and the transactions contemplated hereby are advisable and in the best interests of SmartFinancial, Merger Sub, and the Company, respectively, and their respective shareholders.

B. As a material inducement for SmartFinancial and Merger Sub to enter into this Agreement, certain holders of Company Common Stock (as defined below), in their capacity as shareholders of the Company, have entered into Voting Agreements dated as of the date hereof and substantially in the form attached hereto as Exhibit A pursuant to which such Persons have agreed, among other things and subject to the terms and conditions set forth therein, to vote their shares of Company Common Stock in favor of approval of this Agreement and the transactions contemplated hereby.

C. As a material inducement for the Company to enter into this Agreement, certain holders of SmartFinancial Common Stock (as defined below), in their capacity as shareholders of SmartFinancial, have entered into Voting Agreements dated as of the date hereof and substantially in the form attached hereto as Exhibit B pursuant to which such Persons have agreed, among other things and subject to the terms and conditions set forth therein, to vote their shares of SmartFinancial Common Stock in favor of approval of this Agreement and the transactions contemplated hereby.

D. For United States federal income tax purposes, the Parties (as defined below) intend for the Merger (as defined below) and the Second Step Merger (as defined below) provided for herein to, taken together as part of a single integrated transaction for purposes of the Internal Revenue Code of 1986, as amended, and the regulations and formal guidance issued thereunder (the “Code”), qualify as a “reorganization” under the provisions of Section 368(a) of the Code, and this Agreement is intended to be and is adopted as a “plan of reorganization” for purposes of Sections 354 and 361 of the Code.

NOW, THEREFORE, for and in consideration of the foregoing, the mutual covenants, representations, warranties, and agreements set forth herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties, intending to be legally bound, agree as follows:

ARTICLE I

DEFINITIONS

Section 1.1 Certain Definitions. For purposes of and as used in this Agreement, the terms defined below shall, when capitalized, have the indicated meanings.

“Acquisition Proposal” means, with respect to either SmartFinancial or the Company, as applicable, any inquiry, indication, proposal, solicitation, or offer, or the filing of any regulatory application, notice, waiver, or request (whether in draft or final form), from or by any Person relating to (i) any direct or indirect sale, acquisition, purchase, lease, exchange, mortgage, pledge, transfer, or other disposition of 20% or more of the consolidated assets of such Party and its Subsidiaries, in a single transaction or series of related transactions; (ii) any tender offer (including a self-tender) or exchange offer with respect to, or direct or indirect purchase or acquisition of, 20% or more of any class of equity or voting securities of such Party or any of its Subsidiaries; or (iii) any merger, share exchange, consolidation, business combination, reorganization, recapitalization, or similar transaction involving such Party or any of its Subsidiaries, in each case other than the transactions contemplated by this Agreement.

“Affiliate” means, with respect to any Person, any other Person that directly or indirectly through one or more intermediaries controls, is controlled by, or is under common control with such Person. For this purpose, the terms “controls,” “controlled by,” and “under common control with” shall mean the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract, or otherwise.

“Bank” means Entegra Bank, a North Carolina-chartered bank and direct, wholly owned subsidiary of the Company.

“Bank Stock” means the common stock, no par value, of Bank.

“Banking Act” means the Tennessee Banking Act, Tenn. Code Ann. § 45-1--101 et seq.

“BHCA” means the Bank Holding Company Act of 1956, as amended (12 U.S.C. § 1841 et seq.).

“Book-Entry Shares” means shares of Company Common Stock which immediately prior to the Effective Time are non-certificated.

“Business Day” means Monday through Friday of each week, excluding legal holidays recognized as such by the United States government and any day on which banking institutions in Knoxville, Tennessee or Franklin, North Carolina are authorized or obligated to close.

“Certificate” means a certificate which immediately prior to the Effective Time represents shares of Company Common Stock.

“Company Common Stock” means the common stock, no par value, of the Company.

“Company Equity Award” means a Company Option or Company RSU Award.

“Company Option” means an option to purchase or acquire shares of Company Common Stock granted under the Entegra Financial Corp. 2015 Long-Term Stock Incentive Plan, as amended.

“Company Preferred Stock” means the preferred stock, no par value, of the Company, including without limitation the Company Series A Preferred Stock.

“Company RSU Award” means a restricted stock unit award in respect of shares of Company Common Stock granted under the Entegra Financial Corp. 2015 Long-Term Stock Incentive Plan, as amended.

“Company Series A Preferred Stock” means the Junior Participating Preferred Stock, Series A, no par value, of the Company.

“Company Stock” means, collectively, the Company Common Stock and the Company Preferred Stock.

“Confidentiality Agreement” means that certain Confidentiality Agreement dated August 29, 2018, between SmartFinancial and the Company.

“Contract” means any contract, lease, deed, deed of trust, mortgage, license, instrument, note, commitment, undertaking, indenture, or other agreement or legally binding understanding or arrangement, whether written or oral.

2

“CVR Agreement” means the Contingent Value Rights Agreement to be entered into prior to or at the Closing by SmartFinancial, the Company, the initial committee members identified therein, and a paying agent mutually agreed upon by SmartFinancial and the Company in accordance with Section 7.20(b), the same to be in substantially the form attached hereto as Exhibit C (subject to any reasonable revisions thereto that are required by such paying agent and approved by SmartFinancial (which approval will not be unreasonably withheld, conditioned, or delayed) or that are contemplated by Section 7.20(b)).

“Disclosure Memoranda” means, collectively, the SmartFinancial Disclosure Memorandum and the Entegra Disclosure Memorandum.

“Entegra Data” means all information, data, and records owned, licensed, maintained, or possessed by, or in the custody or under the control of, the Company or the Bank or any of their Subsidiaries. Entegra Data includes, without limitation, “nonpublic personal information” (as defined in 15 U.S.C. § 6809(4)) of customers of the Bank, financial information, payment cardholder data, and any information, data, or records stored, communicated, transmitted, or otherwise processed on the Entegra IT Systems.

“Entegra Information Security Incident” means any actual or reasonably suspected (i) unauthorized or accidental access to or loss, use, disclosure, modification, destruction, or acquisition of any Entegra Data or (ii) compromise to the security, integrity, or availability of the Entegra IT Systems that has resulted in or would reasonably be expected to result in (A) a material and adverse impact on the business operations of the Company or the Bank or any of their Subsidiaries or (B) unauthorized access to or acquisition of or misuse of data maintained, processed, or communicated on the Entegra IT Systems.

“Entegra IT Systems” means all information technology and computer systems, components, equipment, and facilities (including without limitation any software, information technology or telecommunications hardware or equipment, network, or website) owned, operated, licensed, or controlled by or on behalf of the Company or the Bank or any of their Subsidiaries, or otherwise necessary for or material to the conduct of the business of the Company or the Bank or any of their Subsidiaries.

“Entegra Loan Property” means any property in which the Company or a Subsidiary of the Company holds a security interest, and, where required by the context, includes the owner or operator of such property, but only with respect to such property.

“Entegra Participation Facility” means any facility in which the Company or a Subsidiary of the Company participates in the management thereof (including all property held as trustee or in any other fiduciary capacity), and, where required by the context, includes the owner or operator of such property, but only with respect to such property.

“Entegra Parties” means, collectively, the Company and the Bank.

“Environmental Law” means any Law relating to (i) pollution, the protection, preservation, remediation, or restoration of the indoor or outdoor environment, human health and safety, or natural resources, (ii) the handling, use, storage, recycling, treatment, generation, transportation, processing, production, presence, disposal, release, or threatened release of or exposure to any Hazardous Substance or (iii) any injury or threat of injury to persons or property in connection with any Hazardous Substance. The term Environmental Law includes, without limitation, (i) the following statutes, as amended, any successors thereto, and any regulations promulgated pursuant thereto, and any state or local statutes, ordinances, rules, regulations, and the like addressing similar matters: the Comprehensive Environmental Response, Compensation and Liability Act, as amended by the Superfund Amendments and Reauthorization Act of 1986, as amended, 42 U.S.C. § 9601 et seq.; the Resource Conservation and Recovery Act, as amended, 42 U.S.C. § 6901 et seq.; the Clean Air Act, as amended, 42 U.S.C. § 7401 et seq.; the Federal Water Pollution Control Act, as amended, 33 U.S.C. § 1251 et seq.; the Toxic Substances Control Act, as amended, 15 U.S.C. § 2601 et seq.; the Emergency Planning and Community Right to Know Act, 42 U.S.C. § 1101 et seq.; the Safe Drinking Water Act, 42 U.S.C. § 300f et seq.; and the Occupational Safety and Health Act, 29 U.S.C. § 651 et seq., and (ii) any common Law that may impose liability (including without limitation strict liability) or obligations for injuries or damages due to the presence of or exposure to any Hazardous Substance.

3

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended.

“ERISA Affiliate” means any Person that is considered one employer with a Party or any of such Party’s Subsidiaries under Section 4001(b)(1) of ERISA or Section 414 of the Code.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Excluded Shares” means shares of Company Common Stock that, immediately prior to the Effective Time, are owned or held, other than in a bona fide fiduciary or agency capacity, by SmartFinancial, Merger Sub, or the Company, or any Subsidiary of SmartFinancial, Merger Sub, or the Company, including shares of Company Common Stock held by the Company as treasury stock.

“FDIC” means the Federal Deposit Insurance Corporation.

“Federal Reserve” means the Board of Governors of the Federal Reserve System.

“GAAP” means accounting principles generally accepted in the United States.

“Governmental Entity” means any federal, state, provincial, local, or foreign court, agency, arbitrator, mediator, tribunal, commission, governmental or regulatory authority, or other governmental or administrative body, instrumentality, or authority, including without limitation the SEC, the Federal Trade Commission, the United States Department of Justice, the United States Department of Labor, the IRS, the Federal Reserve, the FDIC, and the TDFI.

“Hazardous Substance” means any and all substances (whether solid, liquid, or gas) that (i) are defined, listed, designated, classified, or otherwise regulated as pollutants, hazardous or toxic wastes, hazardous or toxic substances, hazardous or toxic materials, extremely hazardous or toxic wastes, flammable or explosive materials, radioactive materials, or words of similar meaning or regulatory effect under any present or future Environmental Law or (ii) may have a negative impact on human health or the environment. The term Hazardous Substance includes, without limitation, oil, petroleum and petroleum products, asbestos and asbestos-containing materials, urea formaldehyde foam insulation, polychlorinated biphenyls, lead, radon, radioactive materials, flammables and explosives, mold, mycotoxins, microbial matter, and airborne pathogens (naturally occurring or otherwise).

“Intellectual Property” means (i) all inventions, whether or not patentable and whether or not reduced to practice, and all improvements thereon, and all patents, patent applications, and patent disclosures, together with all re-issues, continuations, continuations-in-part, divisions, extensions, and re-examinations thereof; (ii) all trademarks, whether registered or unregistered, service marks, logos, domain names, rights in or to Internet web sites, and corporate, fictitious, assumed, and trade names; (iii) all copyrights, whether registered or unregistered, and all applications, registrations, and renewals relative thereto; (iv) all datasets, databases, and related information and documentation; (v) all trade secrets and proprietary know-how; and (vi) any and all other intellectual property and proprietary rights.

“IRS” means the United States Internal Revenue Service.

“Joint Proxy Statement/Prospectus” means the joint proxy statement prepared by SmartFinancial and the Company to solicit the approval of this Agreement and the transactions contemplated hereby by the shareholders of SmartFinancial and the Company, which will include the prospectus of SmartFinancial relating to the issuance by SmartFinancial of SmartFinancial Common Stock to holders of Company Common Stock pursuant to and in accordance with Article III of this Agreement.

“Knowledge” means (i) with respect to SmartFinancial, the actual knowledge after reasonable inquiry of those individuals set forth on Schedule 1.1 of the SmartFinancial Disclosure Memorandum and (ii) with respect to the Company, the actual knowledge after reasonable inquiry of those individuals set forth on Schedule 1.1 of the Entegra Disclosure Memorandum.

4

“Laws” means any and all federal, state, provincial, local, and foreign laws, constitutions, common law principles, ordinances, codes, statutes, judgments, determinations, injunctions, decrees, orders, rules, and regulations.

“Liability” means any debt, liability, commitment, or obligation of any kind, character, or nature whatsoever (whether accrued, contingent, absolute, known, unknown, or otherwise and whether due or to become due).

“Lien” means any lien, claim, attachment, garnishment, imperfection of title, defect, pledge, mortgage, deed of trust, hypothecation, security interest, charge, option, restriction, easement, reversionary interest, right of refusal, voting trust arrangement, buy-sell agreement, preemptive right, or other adverse claim, encumbrance, or right of any nature whatsoever.

“Loan” means a loan, commitment, lease, advance, credit enhancement, guarantee, or other extension of credit or borrowing arrangement.

“Material Adverse Effect” means, with respect to SmartFinancial or the Company, as the case may be, an effect, circumstance, occurrence, event, development, or change that, individually or in the aggregate with one or more other effects, circumstances, occurrences, events, developments, or changes, (i) has had, or would reasonably be expected to have, a material and adverse effect on the business, properties, assets, liabilities, financial condition, operations, or results of operations of such Party and its Subsidiaries taken as a whole or (ii) prevents or materially impedes the consummation by such Party of the transactions contemplated by this Agreement; provided, however, that, with respect to clause (i), the term Material Adverse Effect shall not be deemed to include the impact of any effect, circumstance, occurrence, event, development, or change resulting from (A) changes after the date of this Agreement in Laws of general applicability that apply to insured depository institutions and/or registered bank holding companies generally, or interpretations thereof by Governmental Entities, (B) changes after the date of this Agreement in GAAP or regulatory accounting requirements applicable to insured depository institutions and/or registered bank holding companies generally, (C) changes in economic conditions, or changes in global, national, or regional political or market conditions (including changes in prevailing interest or exchange rates), in either case affecting the banking and financial services industry generally, (D) actions and omissions of SmartFinancial and the Company required under this Agreement or taken or omitted with the prior written consent of the Company (in the case of actions and omissions by SmartFinancial) or SmartFinancial (in the case of actions and omissions by the Company), (E) any failure by SmartFinancial or the Company, in and of itself, to meet any internal or published industry analyst projections, forecasts, or estimates of revenue, earnings, or other financial or operating metrics for any period (it being expressly agreed that any facts or circumstances giving rise to or contributing to any such failure that are not otherwise excluded from the definition of Material Adverse Effect may be taken into account in determining whether there exists or has occurred a Material Adverse Effect), or (F) changes, in and of themselves, in the trading price or trading volume of the SmartFinancial Common Stock or the Company Common Stock (it being expressly agreed that any facts or circumstances giving rise to or contributing to any such changes that are not otherwise excluded from the definition of Material Adverse Effect may be taken into account in determining whether there exists or has occurred a Material Adverse Effect); provided that effects, circumstances, occurrences, events, developments, and changes resulting from the changes or other matters described in clauses (A), (B), and (C) shall not be excluded in determining whether there exists or has occurred a Material Adverse Effect to the extent of any materially disproportionate impact they have on the subject Party and its Subsidiaries taken as a whole as measured relative to similarly situated companies in the banking and financial services industry.

“Merger Sub Common Stock” means the common stock, no par value, of Merger Sub.

“Mergers” means, collectively, the Merger and the Second Step Merger.

“Nasdaq” means The Nasdaq Capital Market.

“NC Banking Laws” means Chapter 53 and Chapter 53C of the North Carolina General Statutes Annotated (N.C. Gen. Stat. Ann. § 53-1.1 et seq. and N.C. Gen. Stat. Ann. § 53C-1-1 et seq.).

5

“NCBCA” means the North Carolina Business Corporation Act, N.C. Gen. Stat. Ann. § 55-1-01 et seq.

“NCCOB” means the North Carolina Office of the Commissioner of Banks.

“Parties” means, collectively, SmartFinancial, Merger Sub, and the Company.

“Person” means an individual, a corporation, a limited liability company, a partnership, an association, a trust, and any other entity or organization, whether or not incorporated, including without limitation any Governmental Entity.

“Permitted Liens” means (i) liens for Taxes not yet delinquent or the amount of which or the liability therefor (or both) is being diligently contested in good faith by appropriate proceedings and with respect to which adequate reserves for the payment of such Taxes have been established in accordance with GAAP and applicable regulatory accounting requirements; (ii) mechanics’, carriers’, workers’, repairers’, and similar inchoate liens arising or incurred in the ordinary course of business for amounts which are not delinquent or are being diligently contested in good faith by appropriate proceedings and with respect to which adequate reserves for the payment thereof have been established in accordance with GAAP and applicable regulatory accounting requirements; (iii) zoning, entitlement, building, and other land use regulations imposed by Governmental Entities having jurisdiction over the subject Person’s owned or leased real property, which are not violated by the current use and operation of such real property; (iv) covenants, conditions, restrictions, easements, and other similar non-monetary matters of record affecting title to the subject Person’s owned or leased real property, which do not materially impair the occupancy or use of such real property for the purpose(s) for which it is currently used in connection with such Person’s business; (v) any right of way or easement related to public roads and highways, which does not materially impair the occupancy or use of such real property for the purpose(s) for which it is currently used in connection with the subject Person’s business; and (vi) inchoate liens arising or incurred in the ordinary course of business under workers’ compensation, unemployment insurance, social security, retirement, and similar legislation for amounts that are not delinquent.

“Personal Information” means any information relating to an identified or identifiable natural person to the extent such information is owned, licensed, maintained, or possessed by, or in the custody or under the control of, a Party or any of its Subsidiaries. The term Personal Information includes, without limitation, any personally identifiable financial information, cardholder data, or other information specifically defined, identified, protected, or regulated by or under any Privacy Law.

“Privacy Laws” means all Laws relating to the privacy, confidentiality, protection, or security of Personal Information or the SmartFinancial IT Systems or the Entegra IT Systems, as applicable. The term Privacy Laws includes, without limitation, (i) Title V (Privacy) of the Gramm-Leach-Bliley Act (“GLBA”) (15 U.S.C. §§ 6801-6827) and all implementing regulations promulgated thereunder; (ii) the Fair Credit Reporting Act, as amended, 15 U.S.C. § 1681 et seq. (the “FCRA”), and all regulations implementing the FCRA; and (iii) all Laws concerning financial privacy, data breach notification, information security safeguards, the secure disposal of records containing Personal Information, and the transmission of marketing or commercial messages through any means (including without limitation via email or text message). The term Privacy Laws shall also include the Payment Card Industry (“PCI”) Data Security Standard and any other applicable security standards, requirements, or assessment procedures published by the PCI Security Standards Council in connection with a PCI Security Standards Council program.

“Registration Statement” means the registration statement on Form S-4, or other appropriate form, including any pre-effective or post-effective amendments or supplements thereto, filed or to be filed by SmartFinancial with the SEC under the Securities Act with respect to the shares of SmartFinancial Common Stock to be issued by SmartFinancial to the holders of Company Common Stock in connection with the transactions contemplated by this Agreement.

“Regulation O” means Regulation O of the Federal Reserve (12 C.F.R. Part 215).

“Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002, as amended.

6

“SEC” means the United States Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended.

“SmartBank” means SmartBank, a Tennessee-chartered commercial bank and direct, wholly owned subsidiary of SmartFinancial.

“SmartBank Common Stock” means the common stock, par value $1.00 per share, of SmartBank.

“SmartBank Preferred Stock” means the preferred stock, par value $1.00 per share, of SmartBank.

“SmartBank Stock” means, collectively, the SmartBank Common Stock and the SmartBank Preferred Stock.

“SmartFinancial Common Stock” means the common stock, par value $1.00 per share, of SmartFinancial.

“SmartFinancial Data” means all information, data, and records owned, licensed, maintained, or possessed by, or in the custody or under the control of, SmartFinancial or SmartBank or any of their Subsidiaries. SmartFinancial Data includes, without limitation, “nonpublic personal information” (as defined in 15 U.S.C. § 6809(4)) of customers of SmartBank, financial information, payment cardholder data, and any information, data, or records stored, communicated, transmitted, or otherwise processed on the SmartFinancial IT Systems.

“SmartFinancial Equity Award” means a SmartFinancial Option, a grant or award of SmartFinancial Common Stock subject to vesting, repurchase, or other lapse restriction granted under the SmartFinancial, Inc. 2015 Stock Incentive Plan, as amended, or a grant of stock appreciation rights with respect to Company Common Stock.

“SmartFinancial Information Security Incident” means any actual or reasonably suspected (i) unauthorized or accidental access to or loss, use, disclosure, modification, destruction, or acquisition of any SmartFinancial Data or (ii) compromise to the security, integrity, or availability of the SmartFinancial IT Systems that has resulted in or would reasonably be expected to result in (A) a material and adverse impact on the business operations of SmartFinancial or SmartBank or any of their Subsidiaries or (B) unauthorized access to or acquisition of or misuse of data maintained, processed, or communicated on the SmartFinancial IT Systems.

“SmartFinancial IT Systems” means all information technology and computer systems, components, equipment, and facilities (including without limitation any software, information technology or telecommunications hardware or equipment, network, or website) owned, operated, licensed, or controlled by or on behalf of SmartFinancial or SmartBank or any of their Subsidiaries, or otherwise necessary for or material to the conduct of the business of SmartFinancial or SmartBank or any of their Subsidiaries.

“SmartFinancial Loan Property” means any property in which SmartFinancial or a Subsidiary of SmartFinancial holds a security interest, and, where required by the context, includes the owner or operator of such property, but only with respect to such property.

“SmartFinancial Option” means an option to purchase or acquire shares of SmartFinancial Common Stock under the Cornerstone Bancshares, Inc. Statutory-NonStatutory Stock Option Plan, as amended; the Cornerstone Bancshares, Inc. 2002 Long Term Incentive Plan, as amended; the SmartBank Stock Option Plan, as amended; the SmartFinancial, Inc. 2010 Incentive Plan, as amended; the SmartFinancial, Inc. 2015 Stock Incentive Plan, as amended; or the Capstone Bancshares, Inc. 2008 Long-Term Equity Incentive Plan, as amended.

“SmartFinancial Parties” means, collectively, SmartFinancial and Merger Sub.

“SmartFinancial Preferred Stock” means the preferred stock, par value $1.00 per share, of SmartFinancial, including the SmartFinancial Series B Stock.

7

“SmartFinancial Series B Stock” means the Non-Cumulative Perpetual Preferred Stock, Series B, par value $1.00 per share, of SmartFinancial.

“SmartFinancial Stock” means, collectively, the SmartFinancial Common Stock and the SmartFinancial Preferred Stock.

“Subsidiary” means any corporation, limited liability company, partnership, joint venture, trust, or other entity in which a Party or any of its Subsidiaries has, directly or indirectly, an equity or ownership interest representing 50% or more of any class of the capital stock thereof or other equity or ownership interests therein.

“Superior Proposal” means any bona fide written Acquisition Proposal which the board of directors of SmartFinancial or the Company, as applicable, determines in good faith, after taking into account all legal, financial, regulatory, and other aspects of the proposal (including without limitation the amount, form, and timing of payment of consideration, the financing thereof, any associated break-up or termination fees, including those provided for in this Agreement, expense reimbursement provisions, and all conditions to consummation) and the Person making the proposal, and after consulting with its financial advisor (which shall be a nationally recognized investment banking firm) and outside legal counsel, is (i) more favorable from a financial point of view to such Party’s shareholders than the transactions contemplated by this Agreement and (ii) reasonably likely to be timely consummated on the terms set forth; provided, however, that for purposes of this definition of Superior Proposal, references to “20% or more” in the definition of Acquisition Proposal shall be deemed to be references to “more than 50%.”

“Tax” or “Taxes” means any and all federal, state, provincial, local, and foreign taxes, including without limitation (i) any income, profits, alternative or add-on minimum, gross receipts, sales, use, value-added, ad valorem, transfer, franchise, license, withholding, payroll, employment, unemployment, excise, severance, stamp, occupation, net worth, premium, real property, personal property, vehicle, airplane, boat, vessel, or other title or registration, environmental, or windfall profit tax, custom, or duty, or any other tax, fee, assessment, levy, tariff, or charge of any kind whatsoever, together with any interest or penalty, addition to tax, or other additional amount imposed by any Governmental Entity or other Person responsible for the imposition or collection of any such tax, and (ii) any Liability for the payment of any amounts of the type described in clause (i) above as a result of any express or implied agreement or obligation to indemnify any other Person or any contractual arrangement or agreement.

“Tax Benefits Plan” means the Tax Benefits Preservation Plan dated November 16, 2015, by and between the Company and Computershare Trust Company, N.A., as amended from time to time.

“Tax Return” means any return (including any amended return), declaration, or other report, including without limitation elections, claims for refunds, schedules, estimates, and information returns and statements, with respect to any Taxes (including estimated Taxes).

“TBCA” means the Tennessee Business Corporation Act, Tenn. Code Ann. § 48-11-101 et seq.

“TDFI” means the Tennessee Department of Financial Institutions.

“TPS Documents” means, collectively, all agreements, documents, and instruments governing or related to the TPS Trust, the Trust Debentures, or the Trust Preferred Securities.

“TPS Trust” means Macon Capital Trust I, a statutory trust created under the laws of the State of Delaware, all of the common securities of which are held by the Company.

“Trust Debentures” means those certain Floating Rate Junior Subordinated Notes due 2034 issued by the Company to the TPS Trust on or about December 30, 2003.

“Trust Indenture” means that certain Junior Subordinated Indenture dated December 30, 2003, between Macon Bancorp, a North Carolina Corporation (as issuer), and Deutsche Bank Trust Company Americas (as trustee), under which the Trust Debentures were issued.

8

“Trust Preferred Securities” means those certain preferred securities issued by the TPS Trust on or about December 30, 2003.

“USA PATRIOT Act” means the USA PATRIOT Act of 2001, as amended.

Section 1.2 Other Definitions. Capitalized terms used in this Agreement and not defined in Section 1.1, but otherwise defined in this Agreement, shall have the meanings otherwise ascribed thereto.

ARTICLE II

THE MERGERS

Section 2.1 The Merger.

(a) General. Subject to and upon the terms and conditions set forth in this Agreement, at the Effective Time (as defined below), Merger Sub shall be merged with and into the Company in accordance with, and with the effects provided in, this Agreement and applicable provisions of the NCBCA (the “Merger”). At the Effective Time, the separate corporate existence of Merger Sub shall cease and the Company shall continue, as the surviving corporation of the Merger, as a corporation incorporated under the laws of the State of North Carolina (the Company in such capacity as the surviving corporation of the Merger is sometimes referred to herein as the “Interim Surviving Company”).

(b) Effective Time. Prior to or at the Closing, and in order to effect the Merger, Merger Sub and the Company shall duly execute and deliver articles of merger for filing with the North Carolina Secretary of State (the “Articles of Merger”), such Articles of Merger to be in such form and of such substance as is consistent with applicable provisions of the NCBCA and otherwise mutually agreed upon by Merger Sub and the Company. The Merger shall become effective on such date and at such time as set forth in the Articles of Merger (the date and time the Merger becomes effective being referred to in this Agreement as the “Effective Time”).

(c) Effects of the Merger. The Merger shall have the effects set forth in this Agreement and applicable provisions of the NCBCA. Without limiting the generality of the foregoing, and subject thereto, at the Effective Time, all property, rights, interests, privileges, powers, and franchises of Merger Sub shall vest in the Interim Surviving Company, and all debts, liabilities, obligations, restrictions, disabilities, and duties of Merger Sub shall become and be debts, liabilities, obligations, restrictions, disabilities, and duties of the Interim Surviving Company.

(d) Articles of Incorporation, Bylaws, and Name of Interim Surviving Company. The articles of incorporation and bylaws of the Company, in each case as amended and/or restated and in effect immediately prior to the Effective Time, shall at and after the Effective Time be the articles of incorporation and bylaws of the Interim Surviving Company until such time as the same shall be amended in accordance with applicable Law. The legal name of the Interim Surviving Company shall be “Entegra Financial Corp.”

(e) Directors and Officers of Interim Surviving Company. The directors and officers of Merger Sub as of immediately prior to the Effective Time shall, at and after the Effective Time, be the directors and officers, respectively, of the Interim Surviving Company, such individuals to serve in such capacities until such time as their successors shall have been duly elected or appointed and qualified or until their earlier death, resignation, or removal from office.

Section 2.2 The Second Step Merger.

(a) General. As soon as reasonably practicable following the Effective Time, SmartFinancial shall cause the Interim Surviving Company to be, and the Interim Surviving Company shall be, merged with and into SmartFinancial in accordance with, and with the effects provided in, this Agreement and applicable provisions of the TBCA and NCBCA (the “Second Step Merger”). At the Second Step Effective Time (as defined below), the separate corporate existence of the Interim Surviving Company shall cease and SmartFinancial shall continue, as the surviving corporation of the Second Step Merger, as a corporation chartered under the laws of the State of Tennessee (SmartFinancial in such capacity as the surviving corporation of the Second Step Merger is sometimes referred to herein as the “Surviving Corporation”).

9

(b) Second Step Effective Time. In order to effect the Second Step Merger, SmartFinancial and the Interim Surviving Company shall duly execute and deliver articles of merger for filing with the Tennessee Secretary of State (the “Second Step Tennessee Articles of Merger”) and articles of merger for filing with the North Carolina Secretary of State (the “Second Step North Carolina Articles of Merger”), such Second Step Tennessee Articles of Merger and Second Step North Carolina Articles of Merger to be in such form and of such substance as is consistent with applicable provisions of the TBCA and NCBCA and otherwise mutually agreed upon by SmartFinancial and the Interim Surviving Company. The Second Step Merger shall become effective on such date and at such time as set forth in the Second Step Tennessee Articles of Merger and Second Step North Carolina Articles of Merger (the date and time the Second Step Merger becomes effective being referred to in this Agreement as the “Second Step Effective Time”).

(c) Effects of the Second Step Merger. The Second Step Merger shall have the effects set forth in this Agreement and applicable provisions of the TBCA and NCBCA. Without limiting the generality of the foregoing, and subject thereto, at the Second Step Effective Time, all property, rights, interests, privileges, powers, and franchises of the Interim Surviving Company shall vest in the Surviving Corporation, and all debts, liabilities, obligations, restrictions, disabilities, and duties of the Interim Surviving Company shall become and be debts, liabilities, obligations, restrictions, disabilities, and duties of the Surviving Corporation.

(d) Cancellation of Interim Surviving Company Stock. Each share of common stock, no par value, of the Interim Surviving Company, as well as each share of any other class or series of capital stock of the Interim Surviving Company, in each case that is issued and outstanding immediately prior to the Second Step Effective Time, shall, at the Second Step Effective Time, solely by virtue and as a result of the Second Step Merger and without any action on the part of any holder thereof, automatically be cancelled and retired for no consideration and shall cease to exist.

(e) SmartFinancial Stock. The shares of SmartFinancial Stock issued and outstanding immediately prior to the Second Step Effective Time shall not be affected by the Second Step Merger, and, accordingly, each share of SmartFinancial Stock issued and outstanding immediately prior to the Second Step Effective Time shall, at and after the Second Step Effective Time, remain issued and outstanding.

(f) Charter, Bylaws, and Name of Surviving Corporation. The charter and bylaws of SmartFinancial, in each as amended and/or restated and in effect immediately prior to the Second Step Effective Time, shall at and after the Second Step Effective Time be the charter and bylaws of the Surviving Corporation until such time as the same shall be amended in accordance with applicable Law. The name of the Surviving Corporation shall be “SmartFinancial, Inc.”

(g) Directors and Officers of Surviving Corporation. The directors and officers of SmartFinancial as of immediately prior to the Second Step Effective Time shall, at and after the Second Step Effective Time, continue as the directors and officers, respectively, of the Surviving Corporation, such individuals to serve in such capacities until such time as their successors shall have been duly elected or appointed and qualified or until their earlier death, resignation, or removal from office, subject, however, to Section 7.15.

Section 2.3 Merger Sub Shareholder Approval. Prior to or as soon as reasonably practicable following the approval of this Agreement and the Merger by the shareholders of the Company in accordance with the articles of incorporation and bylaws of the Company and applicable Law and the approval of the Stock Issuance Proposal by the shareholders of SmartFinancial, SmartFinancial shall approve this Agreement and the transactions contemplated hereby as the sole shareholder of Merger Sub in accordance with the articles of incorporation and bylaws of Merger Sub and applicable Law.

10

Section 2.4 Closing. Subject to the satisfaction or waiver (subject to applicable Law) of the conditions precedent set forth in Article VIII hereof (other than those conditions that by their nature are to be satisfied at the Closing, but subject to the satisfaction or waiver (subject to applicable Law) of such conditions at the Closing), the closing of the transactions contemplated by this Agreement, including the Merger and the Second Step Merger (the “Closing”), shall take place at the offices of Butler Snow LLP, The Pinnacle at Symphony Place, Suite 1600, 150 3rd Avenue South, Nashville, Tennessee 37201, at 10:00 a.m. Central Time on such date as shall be designated by SmartFinancial, provided that such date shall be not more than 30 days after the satisfaction or waiver (subject to applicable Law) of all of the conditions precedent set forth in Article VIII hereof (other than those conditions that by their nature are to be satisfied at the Closing), or at such other place, at such other time, or on such other date as the Parties may otherwise agree. Notwithstanding the foregoing, the Parties expressly agree that the Closing may take place by the electronic, facsimile, and/or overnight courier exchange of executed documents. The actual date on which the Closing shall occur is referred to in this Agreement as the “Closing Date.”

Section 2.5 The Bank Merger. Simultaneously with the Parties’ execution of this Agreement, SmartBank and the Bank have executed and delivered an agreement and plan of merger dated the date hereof (the “Bank Merger Agreement”), which provides for the merger of the Bank with and into SmartBank immediately following the Second Step Merger in accordance with the terms and conditions of, and with the effects provided by, the Bank Merger Agreement and applicable provisions of the Banking Act, the TBCA, the NC Banking Laws, and the NCBCA (the “Bank Merger”). SmartBank will be the banking corporation to survive the Bank Merger (SmartBank in such capacity as the surviving banking corporation of the Bank Merger is sometimes referred to herein as the “Surviving Bank”), and at the effective time of the Bank Merger, the separate corporate existence of the Bank will cease. Prior to or as soon as reasonably practicable following the approval of this Agreement and the Merger by the shareholders of the Company in accordance with the charter and bylaws of the Company and applicable Law and the approval of the Stock Issuance Proposal by the shareholders of SmartFinancial, SmartFinancial shall approve the Bank Merger Agreement as the sole shareholder of SmartBank and the Company shall approve the Bank Merger Agreement as the sole shareholder of the Bank. Prior to or at the Closing, SmartFinancial will cause SmartBank to execute and deliver and the Company will cause the Bank to execute and deliver such articles of merger and other documents and certificates as are necessary or appropriate to effectuate the Bank Merger (the “Bank Merger Certificates”).

ARTICLE III

MERGER CONSIDERATION

Section 3.1 Conversion of Company Common Stock. Subject to the other provisions of this Article III, solely by virtue and as a result of the Merger, each share of Company Common Stock issued and outstanding immediately prior to the Effective Time (other than Excluded Shares) shall at the Effective Time, automatically and without any action on the part of the holder(s) thereof, be converted into and canceled in exchange for the right to receive (a) 1.215 (the “Exchange Ratio”) shares of SmartFinancial Common Stock and (b) if (but only if) the Dispute Resolution Condition has not occurred, one contractual contingent value right (a “CVR”), which shall be subject to the terms of the CVR Agreement (together with any cash payable in lieu of fractional shares of SmartFinancial Common Stock pursuant to Section 3.4, the “Merger Consideration”).

Section 3.2 Exchange Procedures.

(a) Deposit with Exchange Agent. At or prior to the Closing, SmartFinancial shall deliver or cause to be delivered to an exchange agent mutually agreed upon by SmartFinancial and the Company, which the Parties agree in advance may be SmartFinancial’s customary stock transfer agent (the “Exchange Agent”), for the benefit of holders of Company Common Stock (other than holders of Excluded Shares), (i) a certificate or certificates or, at SmartFinancial’s election, evidence of shares in book-entry form representing the number of shares of SmartFinancial Common Stock issuable to holders of Company Common Stock (other than holders of Excluded Shares) in the form of Merger Consideration pursuant to this Article III and (ii) cash in an amount sufficient to make payment in respect of fractional share interests in accordance with Section 3.4. The Exchange Agent shall not be entitled to vote or exercise any other rights of ownership with respect to the shares of SmartFinancial Common Stock held by it from time to time hereunder, provided that the Exchange Agent shall receive and hold all dividends and other distributions payable or distributable with respect to such shares for the account of the Persons entitled thereto.

11

(b) Letter of Transmittal. SmartFinancial shall take all steps reasonably necessary to cause the Exchange Agent to, as soon as reasonably practicable after the Effective Time (but in no event later than five Business Days after the Effective Time), mail or deliver to each holder of record of shares of Company Common Stock immediately prior to the Effective Time (other than holders of Excluded Shares) a letter of transmittal in customary form and containing such provisions as SmartFinancial shall reasonably require (including provisions confirming that delivery of Certificates and Book-Entry Shares shall be effected, and that risk of loss of and title to Certificates and Book-Entry Shares shall pass, only upon proper delivery of the Certificates or Book-Entry Shares to the Exchange Agent) and instructions for use in effecting the surrender of Certificates and Book-Entry Shares in exchange for the Merger Consideration issuable or payable in respect of the shares of Company Common Stock previously represented by such Certificates or in respect of such Book-Entry Shares, as applicable, pursuant to the provisions of this Agreement.