Form 8-K DULUTH HOLDINGS INC. For: Jun 04

Investor Presentation First Quarter 2021 June 4, 2021 Exhibit 99.1

Forward-Looking Statements This presentation dated June 4, 2021 includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts included in this presentation, including statements concerning Duluth Holdings Inc.'s (dba Duluth Trading Company) (“Duluth Trading” or the “Company”) plans, objectives, goals, beliefs, business strategies, future events, business conditions, its results of operations, financial position and its business outlook, business trends and certain other information herein are forward-looking statements, including its ability to execute on its growth strategies. You can identify forward-looking statements by the use of words such as “may,” ”might,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “believe,” “estimate,” “project,” “target,” “predict,” “intend,” “future,” “budget,” “goals,” “potential,” “continue,” “design,” “objective,” “would” and other similar expressions. The forward-looking statements are not historical facts, and are based upon Duluth Trading's current expectations, beliefs, estimates, and projections, and various assumptions, many of which, by their nature, are inherently uncertain and beyond Duluth Trading's control. Duluth Trading's expectations, beliefs and projections are expressed in good faith, and Duluth Trading believes there is a reasonable basis for them. However, there can be no assurance that management's expectations, beliefs, estimates, and projections will be achieved and actual results may vary materially from what is expressed in or indicated by the forward-looking statements. Forward-looking statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the forward-looking statements, including, among others, the risks, uncertainties, and factors set forth under Part 1, Item 1A “Risk Factors” in Duluth Trading’s Annual Report on Form 10-K filed with the SEC on March 26, 2021, and other factors as may be periodically described in Duluth Trading’s subsequent filings with the SEC. Forward-looking statements speak only as of the date the statements are made. Duluth Trading assumes no obligation to update forward-looking statements to reflect actual results, subsequent events or circumstances or other changes affecting forward-looking information except to the extent required by applicable securities laws. Non-GAAP Measurements Management believes that non-GAAP financial measures may be useful in certain instances to provide additional meaningful comparisons between current results and results in prior operating periods. Within this presentation, reference is made to adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) and Free Cash Flow. See Appendix Table “Adjusted EBITDA,” for a reconciliation of net income to EBITDA and EBITDA to Adjusted EBITDA and “Free Cash Flow” for a reconciliation of Net cash provided by operating activities to Free Cash Flow. Adjusted EBITDA is a metric used by management and frequently used by the financial community, which provides insight into an organization’s operating trends and facilitates comparisons between peer companies, since interest, taxes, depreciation and amortization can differ greatly between organizations as a result of differing capital structures and tax strategies. Adjusted EBITDA excludes certain items, such as stock-based compensation. Management believes Free Cash Flow is a useful measure of performance as an indication of an organization’s financial strength and provides additional perspective on the ability to efficiently use capital in executing growth strategies. Free Cash Flow is used to facilitate a comparison of operating performance on a consistent basis from period-to-period and the ability to generate cash. Free Cash Flow is defined as net cash provided by operating activities less purchase of property and equipment and capital contributions towards build-to-suit stores. The Company provides this information to investors to assist in comparisons of past, present and future operating results and to assist in highlighting the results of on-going operations. While the Company’s management believes that non-GAAP measurements are useful supplemental information, such adjusted results are not intended to replace the Company’s GAAP financial results and should be read in conjunction with those GAAP results. Disclaimer

Introduction to Duluth Trading Co.

Duluth Trading Co. at a Glance Workwear Heritage is the Foundation of our Authentic, Everyday Lifestyle Brand Long History of Product Innovation and Solution-Based Design Humorous and Distinctive Marketing Outstanding and Engaging Customer Experience Nationwide Omnichannel Presence with Controlled Distribution

Investment Highlights Growing lifestyle brand with well-established digitally-driven Omnichannel business Multiple revenue growth opportunities Evolving into a Portfolio of Distinct Brands within the Duluth Trading Co. Ecosystem Growing Sales in Existing Store and Non-Store Markets Strengthening the Core Men’s Duluth Brand Growing our Women’s Duluth Brand Strategic investments support long-term EBITDA margin expansion Generating positive cash flow with a strong balance sheet Seasoned and passionate management team with meaningful equity stake

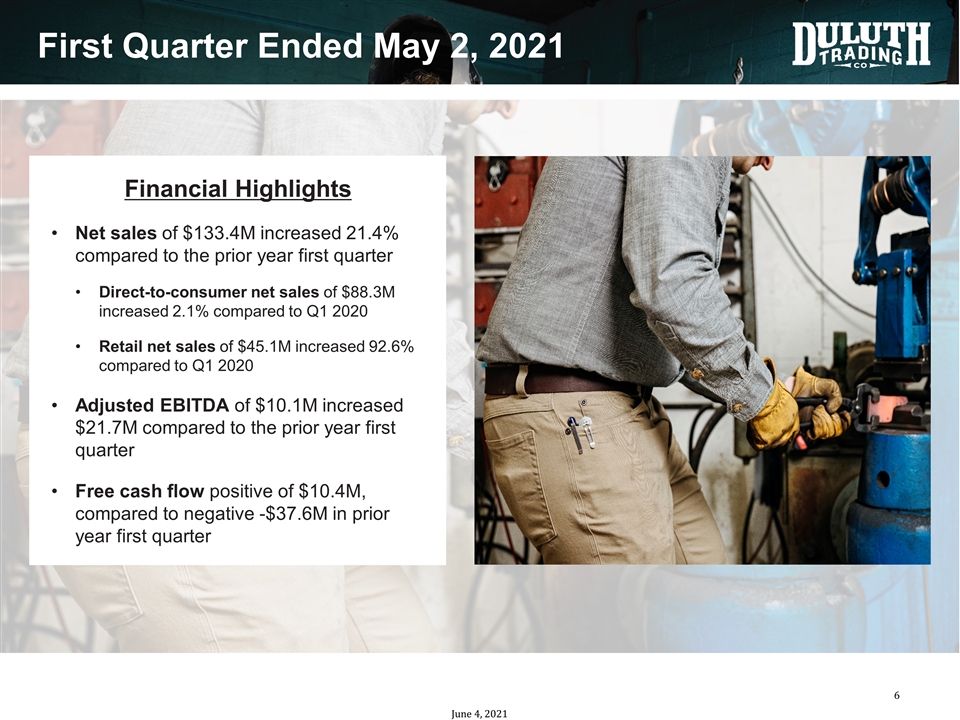

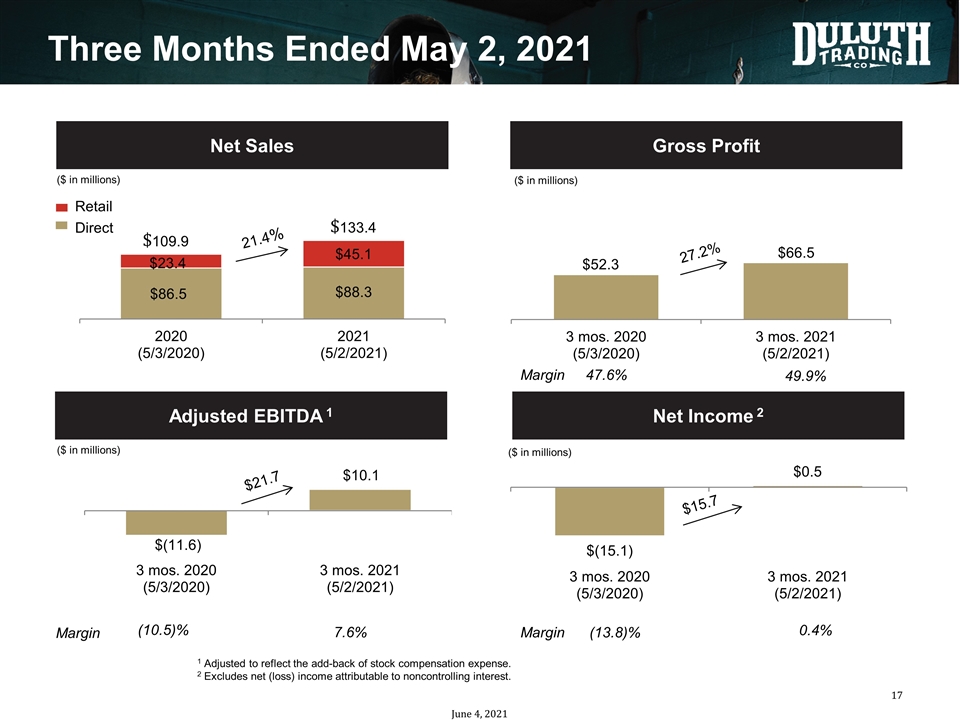

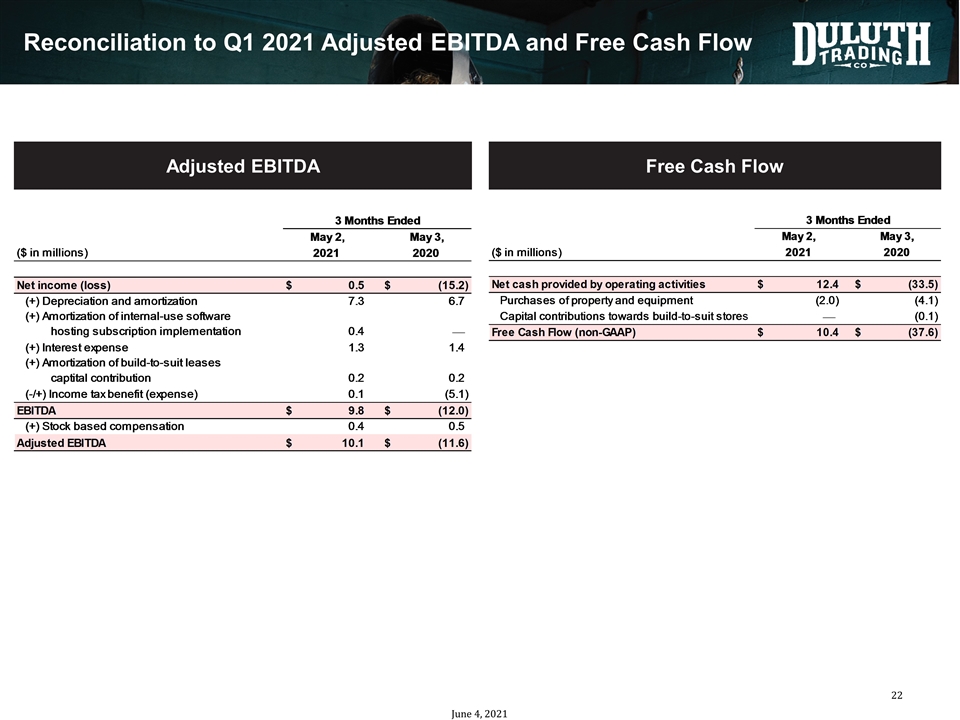

First Quarter Ended May 2, 2021 Financial Highlights Net sales of $133.4M increased 21.4% compared to the prior year first quarter Direct-to-consumer net sales of $88.3M increased 2.1% compared to Q1 2020 Retail net sales of $45.1M increased 92.6% compared to Q1 2020 Adjusted EBITDA of $10.1M increased $21.7M compared to the prior year first quarter Free cash flow positive of $10.4M, compared to negative -$37.6M in prior year first quarter

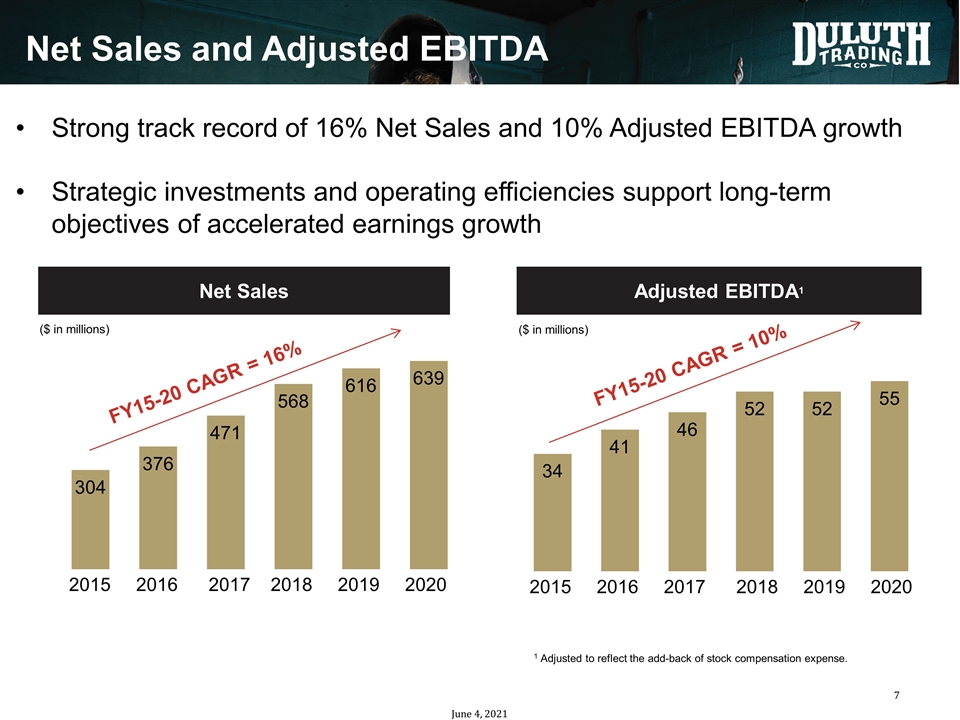

Strong track record of 16% Net Sales and 10% Adjusted EBITDA growth Strategic investments and operating efficiencies support long-term objectives of accelerated earnings growth Net Sales and Adjusted EBITDA Net Sales Adjusted EBITDA1 1 Adjusted to reflect the add-back of stock compensation expense. ($ in millions) ($ in millions) FY15-20 CAGR = 16% 2015 2016 2017 2018 2019 2020 2015 2016 2017 2018 2019 2020 FY15-20 CAGR = 10%

Growth Strategy

Growth Strategies Evolve into a Portfolio of Distinct Brands within the Duluth Ecosystem Growing Sales in Existing Store and Non-Store Markets Growing our Women’s Duluth Brand Strengthening the Core Men’s Duluth Brand 1 2 3 4

Duluth Trading Co. Brand Platform Our “can-do” customers Core line of innovative men’s and women’s workwear apparel Performance outdoor work apparel Tough, no-frills basics workwear line Premium hardgoods and apparel A store like no other enabling brand discovery, service and experience Product development creating exclusive, innovative products Leading digital and data capabilities driving personalized experiences Continued investment in sustainability across all brands Efficient distribution systems to meet shipping expectations Our family of brands: Celebrating the “can-do” spirit by enabling anyone who takes on life with their own two hands: Our direct-to-consumer brand platform: Customer-centric support delivering exceptional service Poke Average in the Eye Unique creative producing memorable storytelling 1

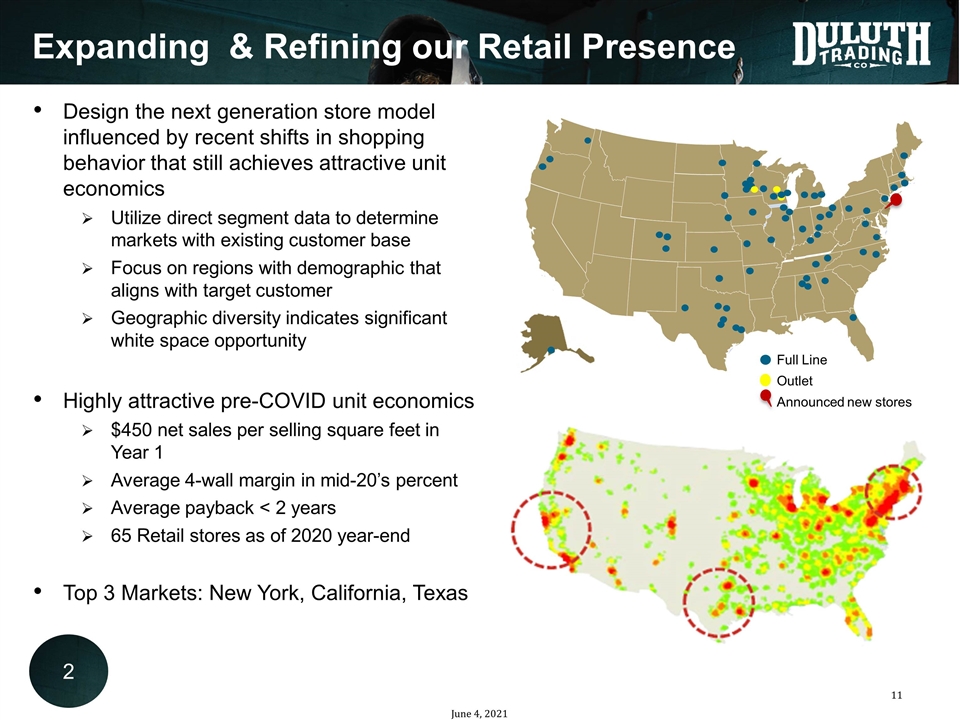

Expanding & Refining our Retail Presence Design the next generation store model influenced by recent shifts in shopping behavior that still achieves attractive unit economics Utilize direct segment data to determine markets with existing customer base Focus on regions with demographic that aligns with target customer Geographic diversity indicates significant white space opportunity Highly attractive pre-COVID unit economics $450 net sales per selling square feet in Year 1 Average 4-wall margin in mid-20’s percent Average payback < 2 years 65 Retail stores as of 2020 year-end Top 3 Markets: New York, California, Texas Outlet Announced new stores Full Line 2

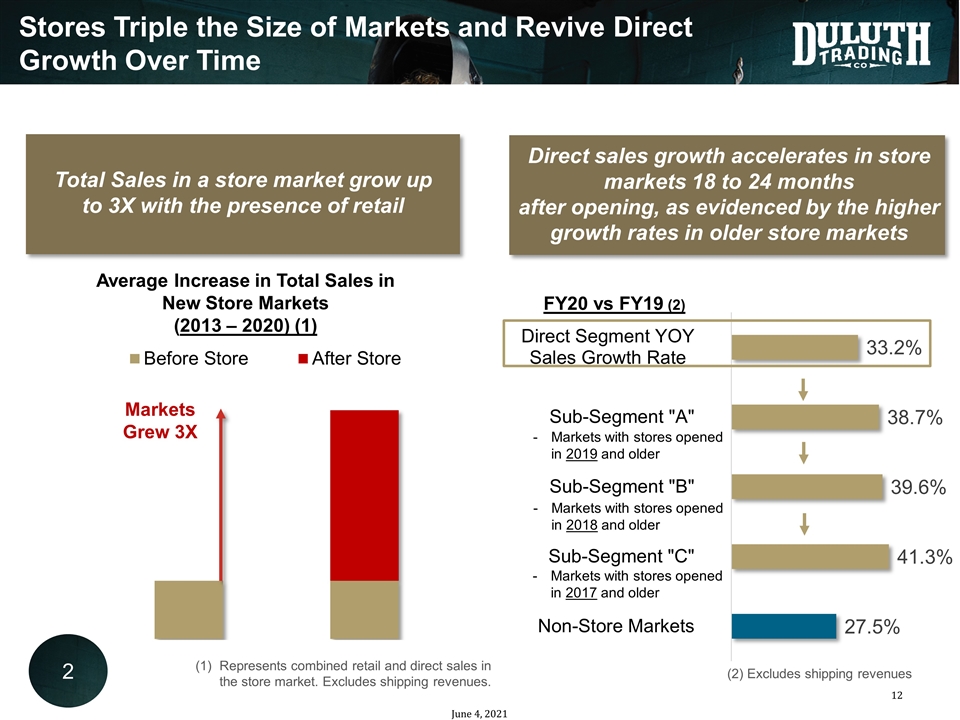

Stores Triple the Size of Markets and Revive Direct Growth Over Time Total Sales in a store market grow up to 3X with the presence of retail Markets Grew 3X Direct sales growth accelerates in store markets 18 to 24 months after opening, as evidenced by the higher growth rates in older store markets FY20 vs FY19 (2) (2) Excludes shipping revenues Represents combined retail and direct sales in the store market. Excludes shipping revenues. Average Increase in Total Sales in New Store Markets (2013 – 2020) (1) 2

Retail Stores Attract New, More Valuable Customers Retail customers more likely to shop across channels, categories, and spend more Note: Data based on 2020 internal 12-month active buyer file. Multi-Channel Buyers Multi-Category Buyers Sales Per Customer 2

Strengthening the Core Men’s Duluth Brand On a trailing twelve-month basis, Duluth brand men’s net sales increased 5% over the prior year period Selectively broaden our assortment in certain product categories Cement Duluth as the most innovative workwear destination. Extend core products through color, fabric and size Increase penetration in spring and transitional product (rain, mid-weight jackets, etc.) Continue to develop innovative products in our Center for Underwear Advancement initiative 3

Growing the Women’s Duluth Brand On a trailing twelve-month basis, Duluth women’s net sales increased 8% over the prior year period Continue customer acquisition through marketing investments and retail presence Expand product offering to address more of her lifestyle and appeal to wider range of female customers Plus sizes grew to 11% of women’s sales in fiscal 2020 FY15 -20 CAGR = 23% ($ in millions) Net Sales 2015 2016 2017 2018 2019 2020 4

Financial Review

Three Months Ended May 2, 2021 Net Sales Gross Profit Net Income 2 Adjusted EBITDA 1 ($ in millions) ($ in millions) ($ in millions) ($ in millions) Margin 47.6% (10.5)% Margin 21.4% 49.9% 7.6% 27.2% 1 Adjusted to reflect the add-back of stock compensation expense. 2 Excludes net (loss) income attributable to noncontrolling interest. Margin (13.8)% 0.4% $133.4 $109.9 $10.1 $(11.6) Retail Direct

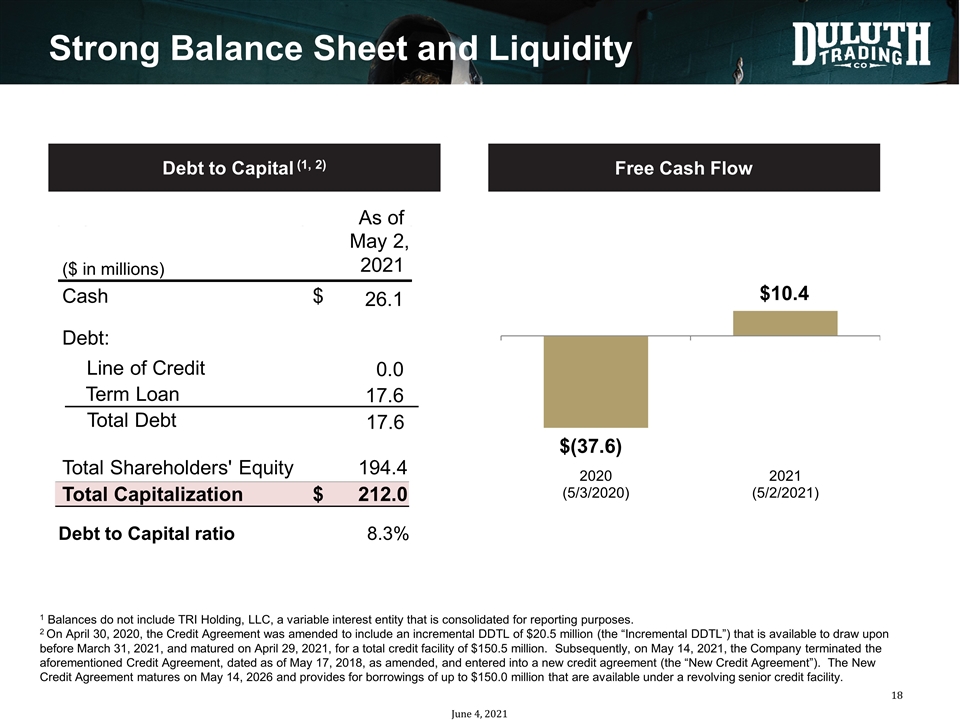

Strong Balance Sheet and Liquidity As of ($ in millions) May 2, 2021 Cash 26.1 $ Debt: Line of Credit 0.0 Total Debt 17.6 Total Shareholders' Equity 194.4 Total Capitalization 212.0 $ Debt to Capital ratio 8.3% 1 Balances do not include TRI Holding, LLC, a variable interest entity that is consolidated for reporting purposes. 2 On April 30, 2020, the Credit Agreement was amended to include an incremental DDTL of $20.5 million (the “Incremental DDTL”) that is available to draw upon before March 31, 2021, and matured on April 29, 2021, for a total credit facility of $150.5 million. Subsequently, on May 14, 2021, the Company terminated the aforementioned Credit Agreement, dated as of May 17, 2018, as amended, and entered into a new credit agreement (the “New Credit Agreement”). The New Credit Agreement matures on May 14, 2026 and provides for borrowings of up to $150.0 million that are available under a revolving senior credit facility. 17.6 Term Loan Debt to Capital (1, 2) Free Cash Flow

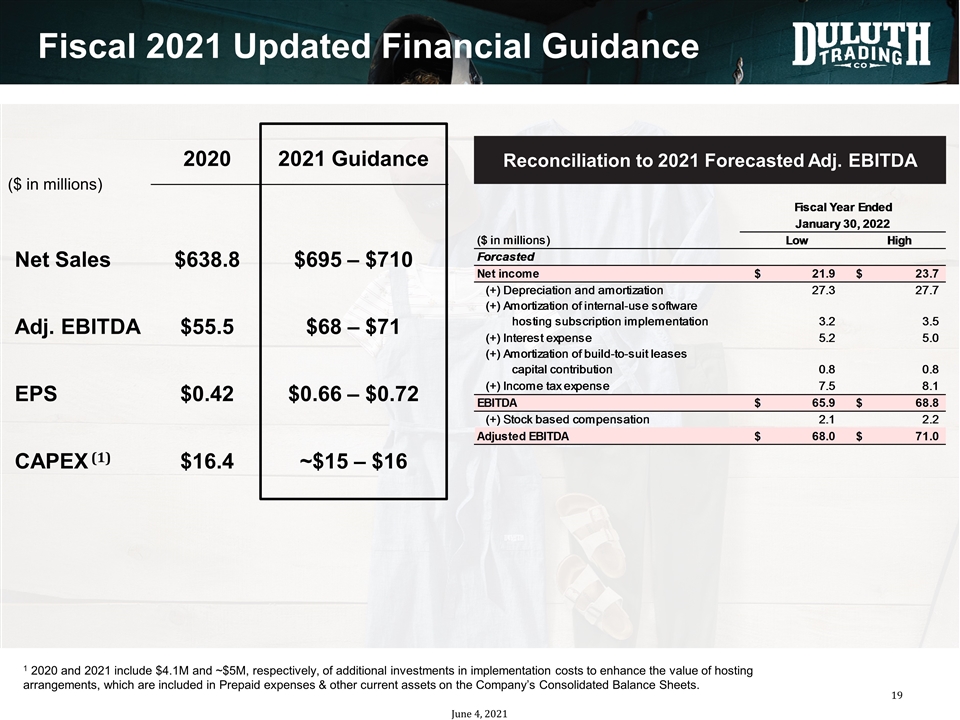

Fiscal 2021 Updated Financial Guidance 2020 $638.8 $55.5 $0.42 $16.4 2021 Guidance $695 – $710 $68 – $71 $0.66 – $0.72 ~$15 – $16 Net Sales Adj. EBITDA EPS CAPEX (1) ($ in millions) Reconciliation to 2021 Forecasted Adj. EBITDA 1 2020 and 2021 include $4.1M and ~$5M, respectively, of additional investments in implementation costs to enhance the value of hosting arrangements, which are included in Prepaid expenses & other current assets on the Company’s Consolidated Balance Sheets.

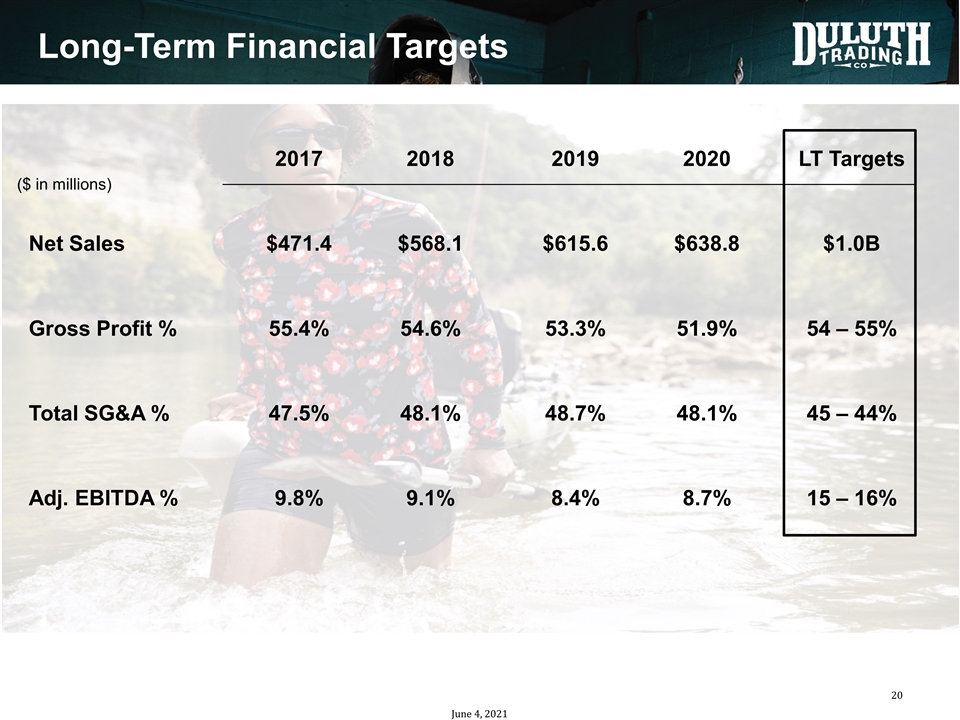

Long-Term Financial Targets 2019 $615.6 53.3% 48.7% 8.4% 2020 $638.8 51.9% 48.1% 8.7% LT Targets $1.0B 54 – 55% 45 – 44% 15 – 16% Net Sales Gross Profit % Total SG&A % Adj. EBITDA % 2018 $568.1 54.6% 48.1% 9.1% 2017 $471.4 55.4% 47.5% 9.8% ($ in millions)

Appendix

Reconciliation to Q1 2021 Adjusted EBITDA and Free Cash Flow Adjusted EBITDA Free Cash Flow

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Phillips Edison & Company Reports First Quarter 2024 Results and Affirms Full Year Earnings Guidance

- Blackwell 3D Acquires Operating Dubai LLC, Inches Closer to Project Readiness

- Boba Mint Holdings Ltd. Approved for CSE Listing on April 26, 2024

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share