Form 8-K DTE ENERGY CO For: Jul 07

DTE ENERGY BUSINESS UPDATE J U LY 8 , 2 0 2 1 EXHIBIT 99.1

Safe harbor statement 2 The information contained herein is as of the date of this document. DTE Energy expressly disclaims any current intention to update any forward-looking statements contained in this document as a result of new information or future events or developments. Words such as “anticipate,” “believe,” “expect,” “may,” “could,” “would,” “projected,” “aspiration,” “plans” and “goals” signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various assumptions, risks and uncertainties. This document contains forward-looking statements about DTE Energy’s financial results and estimates of future prospects, and actual results may differ materially. Many factors impact forward-looking statements including, but not limited to, the following: risks related to the spin-off of DT Midstream, including that providing DT Midstream with the transition services previously negotiated could disrupt or adversely affect our business, results of operations and financial condition; the duration and impact of the COVID-19 pandemic on DTE Energy and customers, impact of regulation by the EPA, the EGLE, the FERC, the MPSC, the NRC, and for DTE Energy, the CFTC and CARB, as well as other applicable governmental proceedings and regulations, including any associated impact on rate structures; the amount and timing of cost recovery allowed as a result of regulatory proceedings, related appeals, or new legislation, including legislative amendments and retail access programs; economic conditions and population changes in our geographic area resulting in changes in demand, customer conservation, and thefts of electricity and, for DTE Energy, natural gas; the operational failure of electric or gas distribution systems or infrastructure; impact of volatility in prices in the international steel markets on DTE Energy’s power and industrial projects operations; the risk of a major safety incident; environmental issues, laws, regulations, and the increasing costs of remediation and compliance, including actual and potential new federal and state requirements; the cost of protecting assets against, or damage due to, cyber incidents and terrorism; health, safety, financial, environmental, and regulatory risks associated with ownership and operation of nuclear facilities; volatility in commodity markets, deviations in weather, and related risks impacting the results of DTE Energy’s energy trading operations; changes in the cost and availability of coal and other raw materials, purchased power, and natural gas; advances in technology that produce power, store power or reduce power consumption; changes in the financial condition of significant customers and strategic partners; the potential for losses on investments, including nuclear decommissioning and benefit plan assets and the related increases in future expense and contributions; access to capital markets and the results of other financing efforts which can be affected by credit agency ratings; instability in capital markets which could impact availability of short and long-term financing; the timing and extent of changes in interest rates; the level of borrowings; the potential for increased costs or delays in completion of significant capital projects; changes in, and application of, federal, state, and local tax laws and their interpretations, including the Internal Revenue Code, regulations, rulings, court proceedings, and audits; the effects of weather and other natural phenomena on operations and sales to customers, and purchases from suppliers; unplanned outages; employee relations and the impact of collective bargaining agreements; the availability, cost, coverage, and terms of insurance and stability of insurance providers; cost reduction efforts and the maximization of plant and distribution system performance; the effects of competition; changes in and application of accounting standards and financial reporting regulations; changes in federal or state laws and their interpretation with respect to regulation, energy policy, and other business issues; contract disputes, binding arbitration, litigation, and related appeals; and the risks discussed in DTE Energy’s public filings with the Securities and Exchange Commission. New factors emerge from time to time. We cannot predict what factors may arise or how such factors may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. This document should also be read in conjunction with the Forward-Looking Statements section of the joint DTE Energy and DTE Electric 2020 Form 10-K and 2021 Form 10-Q (which sections are incorporated by reference herein), and in conjunction with other SEC reports filed by DTE Energy and DTE Electric.

Focusing on our employees, customers and communities while delivering for investors 3 Employees • Recognized as a Gallup Great Workplace for the ninth consecutive year • Building on our diversity, equity and inclusion focus with acceleration of commitment to build a better workplace Customers • Received MPSC order approving strategy which will further postpone the filing of an electric rate case until October, maintaining steady base rates through 2021 • Ranked in top quartile at both utilities for residential satisfaction by J.D. Power Community • Contributed to Habitat for Humanity effort to weather-proof low-income homes • Supported Detroit small businesses with grant to help navigate beyond the pandemic Investors • Strong start to 2021; on track to deliver 7% operating EPS1 growth from 2020 original guidance midpoint • DTE Energy positioned as a predominantly pure-play, best-in-class utility with 5% - 7% long-term operating EPS growth from 2020 original guidance base 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix

70% 20% 10% 76% 16% 8% Enhanced strategic focus ✓ Premier, predominantly pure-play regulated electric and natural gas utility Investments in growth opportunities ✓ Substantially growing rate base with $17 billion of utility growth capital investment, a 13% increase over prior plan ✓ Aligned with aggressive ESG targets, net zero greenhouse gas emissions by 2050 Distinguished growth profiles ✓ 5% - 7% operating EPS1 growth target from 2020 original guidance midpoint − Targeting average annual operating earnings growth of 7% - 8% at DTE Electric and 9% at DTE Gas from 2020 original guidance midpoint Improved investor alignment ✓ Attracts shareholders desiring predictable, low-risk growth associated with regulated utilities Seasoned management team ✓ Track record of providing clean, safe, reliable and affordable energy to our customers and being a force for growth in the communities where we live and serve Competitive dividends ✓ Targeting dividend growth and payout ratio consistent with pure-play utility peers DTE Energy benefits from being a predominantly pure-play regulated utility 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 4 Operating earnings Predominantly pure-play regulated utility Capital investment 5-year plan 2021 - 2025 Gas utility Non-utilityElectric utility

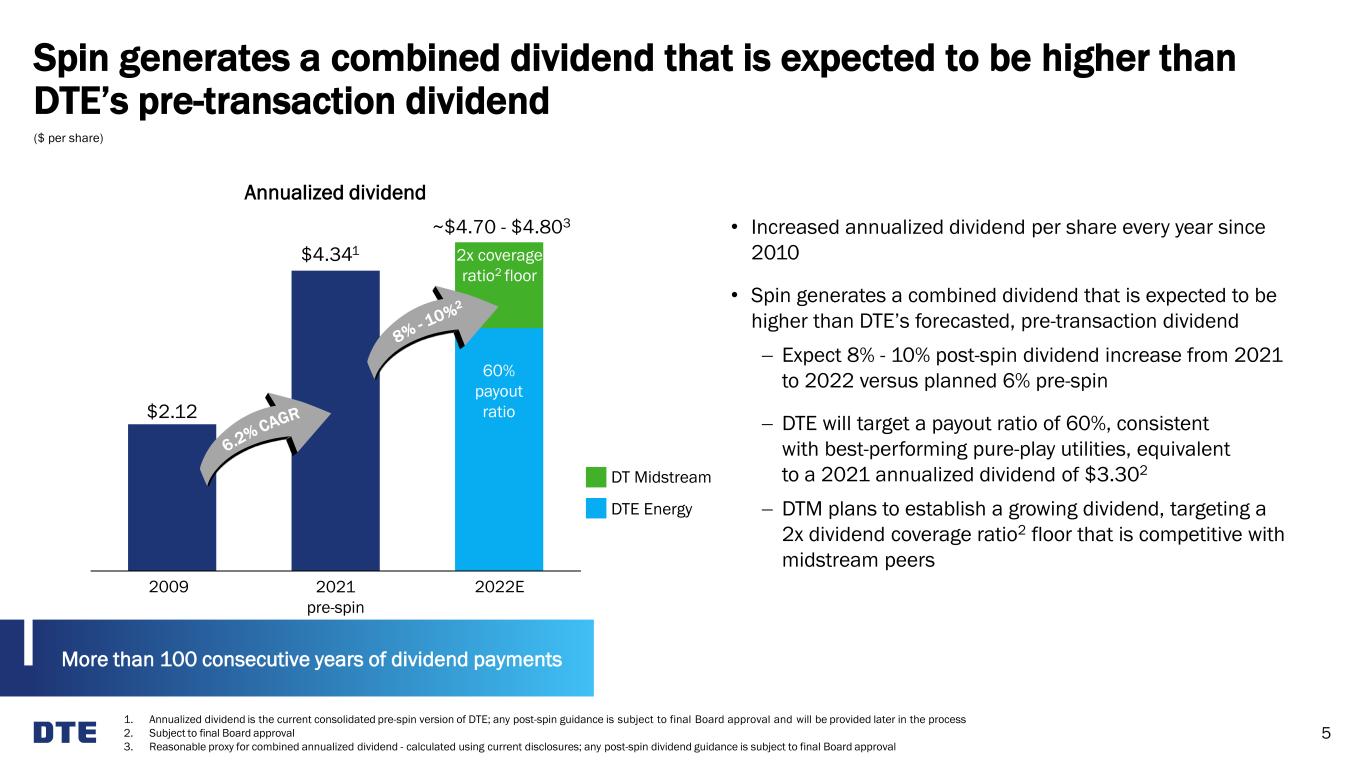

1. Annualized dividend is the current consolidated pre-spin version of DTE; any post-spin guidance is subject to final Board approval and will be provided later in the process 2. Subject to final Board approval 3. Reasonable proxy for combined annualized dividend - calculated using current disclosures; any post-spin dividend guidance is subject to final Board approval 5 Spin generates a combined dividend that is expected to be higher than DTE’s pre-transaction dividend Annualized dividend $2.12 • Increased annualized dividend per share every year since 2010 • Spin generates a combined dividend that is expected to be higher than DTE’s forecasted, pre-transaction dividend − Expect 8% - 10% post-spin dividend increase from 2021 to 2022 versus planned 6% pre-spin − DTE will target a payout ratio of 60%, consistent with best-performing pure-play utilities, equivalent to a 2021 annualized dividend of $3.302 − DTM plans to establish a growing dividend, targeting a 2x dividend coverage ratio2 floor that is competitive with midstream peers More than 100 consecutive years of dividend payments 2009 2021 pre-spin 2022E ($ per share) ~$4.70 - $4.803 DT Midstream DTE Energy 2x coverage ratio2 floor $4.341 60% payout ratio

Two high-quality utilities operating in a constructive regulatory environment 1. UBS, December 2020 (50 states and Washington, D.C.) 6 Ranking of U.S. regulatory jurisdictions1 (Michigan in tier 1) 10-month rate cases supported by legislation; recovery mechanisms for renewables and gas infrastructure; 5-year distribution planning Dan Scripps Chair Katherine Peretick Commissioner Tremaine Phillips Commissioner Michigan Public Service Commission 2021 - 2025 MPSC key objectives ✓ Empower customers to make informed utility choices ✓ Assure safe, secure and reliable utility services and infrastructure ✓ Assure accessible and affordable utility services through regulatory oversight ✓ Cultivate open and diverse communication and education 7 9 18 9 8 Tier 1 Tier 2 Tier 3 Tier 4 Tier 5

Peer average Distinctive continuous improvement culture drives strong track record of cost management vs. peer average 1. Source: SNL Financial, FERC Form 1 and FERC Form 2; excluding electric fuel and purchase power and gas production expense 7 • Controlling costs while improving the customer experience and targeting rate increases below 3% − Productivity enhancements − Technology innovations − Automation − Infrastructure replacements − Transition to cleaner energy • Lowered average electric industrial customer rate 11% since 2012 All 10,000+ employees engaged in CI to surface and solve problems Average annual percentage change in O&M costs 2008 - 2019 Electric utility1 Gas utility1 3% 2% 1% 1% DTE Electric Peer average DTE Gas

DTE Electric progressing on key initiatives; accelerating distribution and generation investments 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix Advancing our clean energy investments and plan to accelerate the modernization of our electric grid • Progressing toward net zero carbon emissions target by 2050 • Accelerating voluntary renewables program, one of the largest in the industry • Announced commitment to build extensive electric vehicle charging network Created regulatory certainty • Delayed rate case filing with innovative plan to keep customer base rates unchanged through 2021 • Received approval to provide a one-time voluntary refund to further delay customer rate increases Targeting 7% - 8% long-term operating earnings1 growth from 2020 original guidance midpoint • Investing in generation and distribution for clean and reliable energy • Upgrading substations for load growth and to address aging infrastructure $5 $7 $4 $5 $2 $2 ~$1 Electric investment 2020 - 2024 previous plan $12 $14 Distribution infrastructure Renewables Base infrastructure Natural gas plant 2021 - 2025 current plan 8 (billions)

32% 50% 80% 100% MIGreenPower offers DTE Electric customers simple and affordable renewable energy solutions supporting wind and solar projects 9 • Program initiation: February 2017 • 33,000 customers • Over 900 MW subscribed • Average net cost to residential customer − Wind & solar program: 3.1 cents/kWh − Wind program: 2.2 cents/kWh • An average business customer using 1,000 kWh/month can attribute 100% of their energy use to renewable wind resources for ~$19/month DTE Electric carbon emissions reductionsDTE Electric - MIGreenPower 20502040203020232005

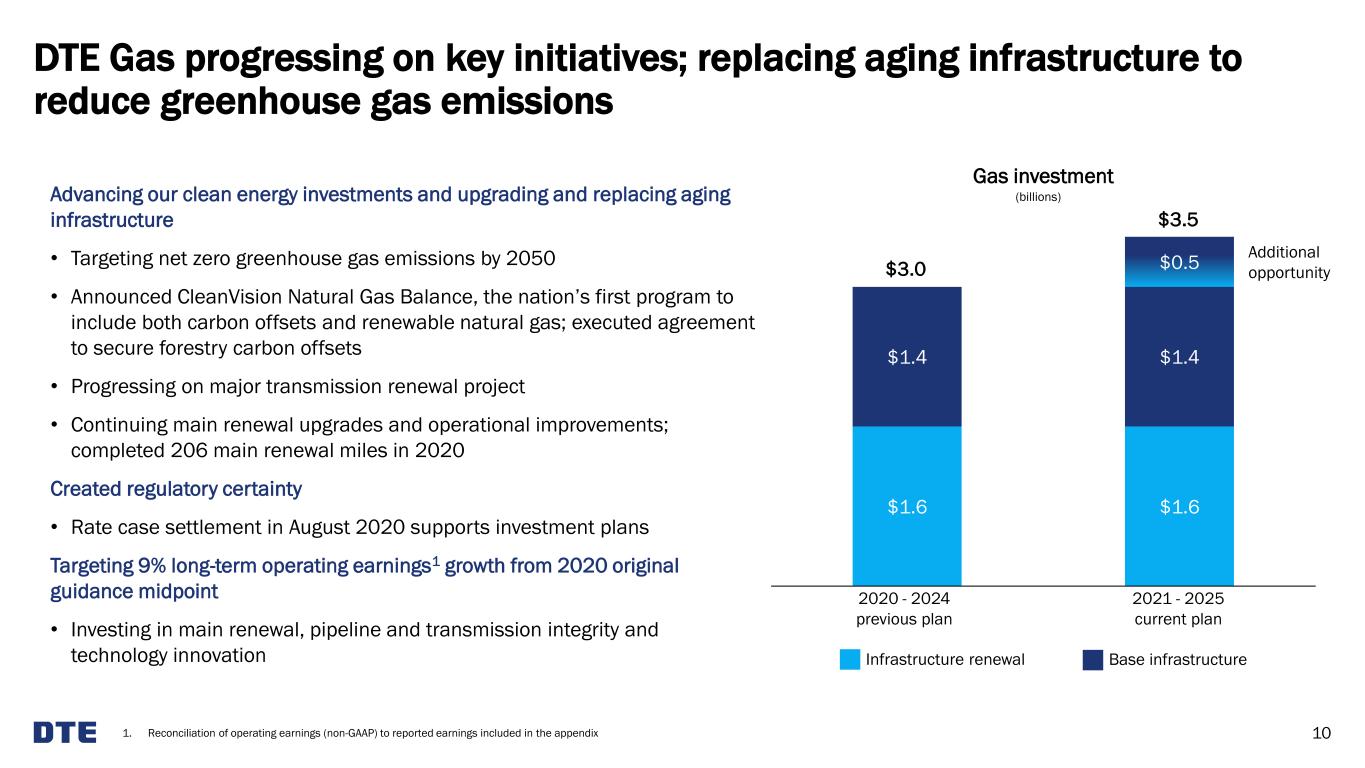

DTE Gas progressing on key initiatives; replacing aging infrastructure to reduce greenhouse gas emissions 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix Advancing our clean energy investments and upgrading and replacing aging infrastructure • Targeting net zero greenhouse gas emissions by 2050 • Announced CleanVision Natural Gas Balance, the nation’s first program to include both carbon offsets and renewable natural gas; executed agreement to secure forestry carbon offsets • Progressing on major transmission renewal project • Continuing main renewal upgrades and operational improvements; completed 206 main renewal miles in 2020 Created regulatory certainty • Rate case settlement in August 2020 supports investment plans Targeting 9% long-term operating earnings1 growth from 2020 original guidance midpoint • Investing in main renewal, pipeline and transmission integrity and technology innovation 10 Gas investment $3.0 Additional opportunity $3.5 Infrastructure renewal Base infrastructure $1.6 $1.6 $1.4 $1.4 $0.5 2020 - 2024 previous plan 2021 - 2025 current plan (billions)

45% 65% 80% 100% CleanVision Natural Gas Balance helps reduce the carbon emissions footprint of DTE Gas customers through carbon offsets and RNG 11 DTE Gas – Natural Gas Balance • Program initiation: January 2021 • Customers: 2,800+ • RNG will be sourced by transforming landfill emissions and wastewater treatment plant by-products into usable gas • Carbon offset program is focused on protecting Michigan forests that naturally absorb greenhouse gases • Offers customers a way to affordably offset 25% to 100% of greenhouse gas emissions from an average home’s natural gas use • Partnered with Bluesource, the nation’s largest carbon offset developer, on the Greenleaf Improved Forest Management project in Michigan’s Upper Peninsula to protect and preserve forests DTE Gas greenhouse gas emissions reductions 20502040203020202005

Delivering premium results through disciplined planning and management 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 2. Bloomberg as of 6/30/2021 12 2010 - 2020 operating EPS1 CAGR highest among Midwest pure-play utility peers Total shareholder return2 well above industry average 25% 54% 270% 1-year 5-year 10-year S&P 500 Utilities DTEMidwest pure-play peers DTE 7.2% 7.0% 7.0% 5.9% 5.6% 2.4%

Maintaining long-term operating EPS1 growth of 5% - 7% 13 2020 original guidance midpoint 2021 guidance midpoint 2022E 2023E 2024E 2025E DTE annualized operating EPS3 excluding Midstream • 7.4% operating EPS growth from 2020 original guidance midpoint to 2021 guidance midpoint • Continuing 5% - 7% long-term operating EPS growth through significant milestones − Generating 90% of future operating earnings from regulated utilities − Delivering higher than targeted 5-year average utility operating earnings growth in early years of plan − Converting $1.3 billion of mandatory equity in 2022 − Sunsetting REF business after 2021 $5.13 $5.51 1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 2. January – June results for Midstream will be moved to discontinued operations beginning in 3Q 3. Reasonable proxy for DTE operating EPS excluding Midstream 2021 DTE guidance DTE Electric $826 - $840 DTE Gas 202 - 212 Power & Industrial Projects 147 - 163 Energy Trading 15 - 25 Corporate & Other (148) - (138) DTE Energy $1,042 - $1,102 Operating EPS $5.36 - $5.66 2021 DTE guidance – continuing operations2 (millions, except EPS)

V I S I T U S : D T E I N V E S T O R R E L AT I O N S 2 0 2 0 E S G R E P O R T 2 01 9 - 2 0 2 0 C O R P O R AT E C I T I Z E N S H I P H I G H L I G H T S

15 Appendix

Maintaining strong cash flow, balance sheet and credit profile 1. Funds from Operations (FFO) is calculated using operating earnings 2. Debt excludes a portion of DTE Gas’ short-term debt and considers 50% of the junior subordinated notes and 100% of the convertible equity units as equity 16 • Issued $1 billion in green bonds in 2021; $2 billion issued in total in the past four years • Strong investment-grade credit rating − Spin transaction is credit enhancing allowing FFO1 / Debt2 target to be lowered from 18% to ~16% • Significant debt paydown with proceeds from DTM debt raise − Retiring ~$2.6 billion of long-term parent debt $0.0 - $0.2 $0.0 - $0.2 $1.3 Convertible equity units Planned equity issuances 2021 - 2023 Credit ratings S&P Moody’s Fitch DTE Energy (unsecured) BBB Baa2 BBB DTE Electric (secured) A Aa3 A+ DTE Gas (secured) A A1 A (billions) 2021 2022 2023 $1.3 - $1.7 Strong cash flows have reduced equity needs in plan; targeting low end of planned equity issuances in 2021

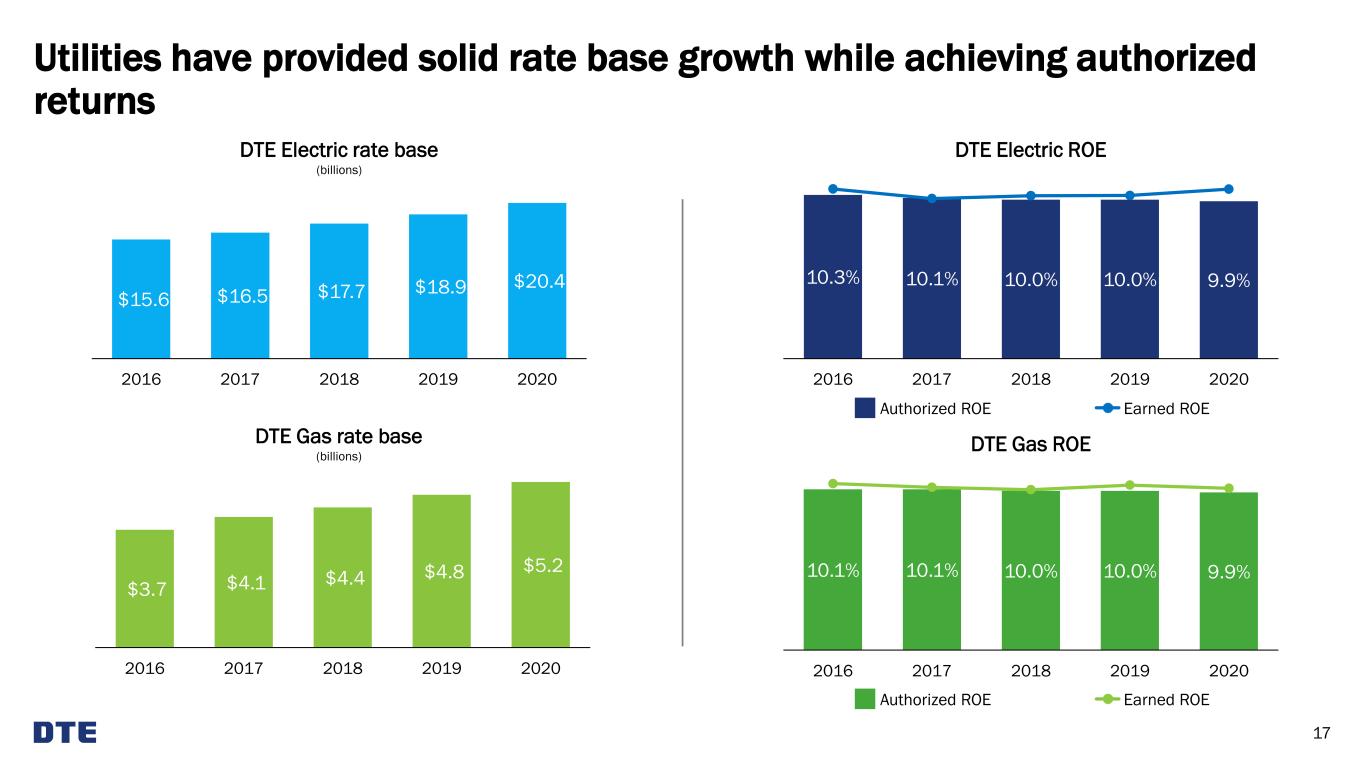

Utilities have provided solid rate base growth while achieving authorized returns 17 DTE Electric ROE 10.1% 10.1% 10.0% 10.0% 9.9% 2016 2017 2018 2019 2020 10.3% 10.1% 10.0% 10.0% 9.9% 2016 2017 2018 2019 2020 DTE Gas ROE Authorized ROE Earned ROE Authorized ROE Earned ROE $15.6 $16.5 $17.7 $18.9 $20.4 2016 2017 2018 2019 2020 DTE Electric rate base (billions) $3.7 $4.1 $4.4 $4.8 $5.2 2016 2017 2018 2019 2020 DTE Gas rate base (billions)

DTE Electric • General rate case final order (U-20561) − Effective: May 15, 2020 − Rate recovery: $188 million − ROE: 9.9% − Capital structure: 50% equity, 50% debt − Rate base: $17.9 billion • Renewable energy plan (U-18232) − Received order: July 2020 − 350 MW of additional renewable energy by 2022 (225 MW of wind and 125 MW of solar) • Alternative rate case strategy (U-20835) − Received order: April 2021 − Delays rate case filing to October 2021 or later DTE Gas • General rate case filed February 2021 (U-20940) − Effective: January 1, 2022 − Rate recovery: $195 million − ROE: 10.25% − Capital structure: 52% equity, 48% debt − Rate base: $5.6 billion • Voluntary emissions offset plan (U-20839) − Received order: October 2020 − Comprised of a combination of both carbon offsets and Renewable Natural Gas (RNG) − 95% of planned emissions reduction is carbon emissions − 5% of planned emissions reduction is RNG DTE Electric and DTE Gas regulatory update 18 • Voluntary renewable plan (U-20713) − Received order: June 2021 − Additional 420 MW in 2022; additional 380 MW from 2023 – 2025 − Program offerings to provide low- income customers greater access to renewable energy • Innovative, one-time customer refund regulatory liability (U-20921) − Received order: December 2020 − $30 million voluntary refund • Securitization filing (U-21015) − Received order: June 2021 − $73.2 million for River Rouge retirement and $156.9 million for vegetation management program

Environmental, social and governance efforts are key priorities; aspiring to be the best in the industry 19 Environmental Transitioning towards net zero greenhouse gas emissions Delivering clean and reliable energy to customers Protecting our natural resources Social Focusing on the diversity, safety, well-being and success of our employees Committing to a strong culture provides a solid framework for success Revitalizing neighborhoods and investing in communities World-class volunteerism Governance Focusing on the oversight of environmental sustainability, social and governance Ensuring board diversity Providing incentive plans tied to safety and customer satisfaction targets

Award-winning commitment to being a top ESG employer in the country 20 Gallup Great Workplace Award 9 consecutive years Inclusion of women-owned businesses in their supply chains Overall excellence in diversity Superior corporate citizenship and community involvement Ambassadors Championing Excellence Award for commitment to supporting minority businesses America’s Most Responsible Companies 2021 Veteran friendly employer

Environmental sustainability is critical to the creation of long-term shareholder value 21 Driving collaboration in the fight against climate change • Leading by example with aggressive goal to achieve net zero carbon emissions by 2050 • Active participant in coalitions that advocate for strong environmental public policies • Key participant in Governor Whitmer’s initiative to develop and implement pathways to meet the state of Michigan’s economy-wide climate goals • Leading EEI’s strategic plan for effective federal climate policy Protecting our natural resources and promoting environmental sustainability through stewardship and conservation • Targeting a 25% reduction of energy, water and waste at our facilities by 2022 compared to 2016 levels • Providing habitats for hundreds of species of birds, mammals, fish and insects in our service territory • Over 35 sites certified under the Wildlife Habitat Council • Received Corporate Conservation Leadership award from the Wildlife Habitat Council for leadership in wildlife management • Corporate-wide certification to the ISO14001 Standard for Environmental Management Systems

Continuing the journey to provide clean and reliable energy to customers 1. Timing and mix subject to change 2. Majority retired in 2020 with remaining capacity retired in 2021 22 Planned capacity additions 2020 – 20251 • Wind: 850 MW • Solar: 935 MW • Blue Water Energy Center: 1,100 MW Planned coal capacity retirements 2020 – 2025 • 2021 River Rouge: 272 MW2 • 2022 St. Clair: 1,065 MW • 2022 Trenton Channel: 495 MW Current renewable energy portfolio 1,800 MW capacity

77% 45% 30% 20% 20% 20% 2% 18% 20 - 25% 1% 17% 25 – 30% 2005 2023E 2030E More than doubling renewable energy by 2024 23 Cleaner generation mix River Rouge Trenton Channel Belle River Monroe 2022 2030 2040 St. Clair Renewables Natural gas Nuclear & other Coal 2021

A force for growth and prosperity in the Michigan communities we serve 2424 World class volunteerism improves our communities and contributes to employee engagement Consistently recognized as a top employer Our efforts include education and mentoring programs Partnering with a correctional facility to train inmates to become tree trimmers upon their release 1,700 high school and college students hired or sponsored in 2019, providing experience in different office or skilled trade careers 1,000 individuals with multiple barriers to employment committed to be hired over the next five years $11 billion purchased from Michigan businesses since 2010 34,000 local jobs have been created as a result of our investments into our communities 50 companies nationwide received this honor from Points of Light Only company in Michigan to be recognized Revitalizing neighborhoods and investing in communities DTE’s commitment to community involvement has led to increasing customer satisfaction ratings and DTE being named #1 utility in the “Civic 50” by Points of Light

Health and safety of our people is a priority 25 • Multiple safety committees spanning all levels of the company providing input into seasonal safety plans, addressing unique challenges of each business unit • Regular employee safety training with culture that everyone at DTE is 100% accountable for their own safety and 100% accountable for the safety of everyone around them • Received American Gas Association Safety Achievement Award for excellence in employee safety • Recognized in the top 2% of companies surveyed in company safety culture by the National Safety Council • Led the development of statewide COVID-19 prevention campaign aimed at young adults

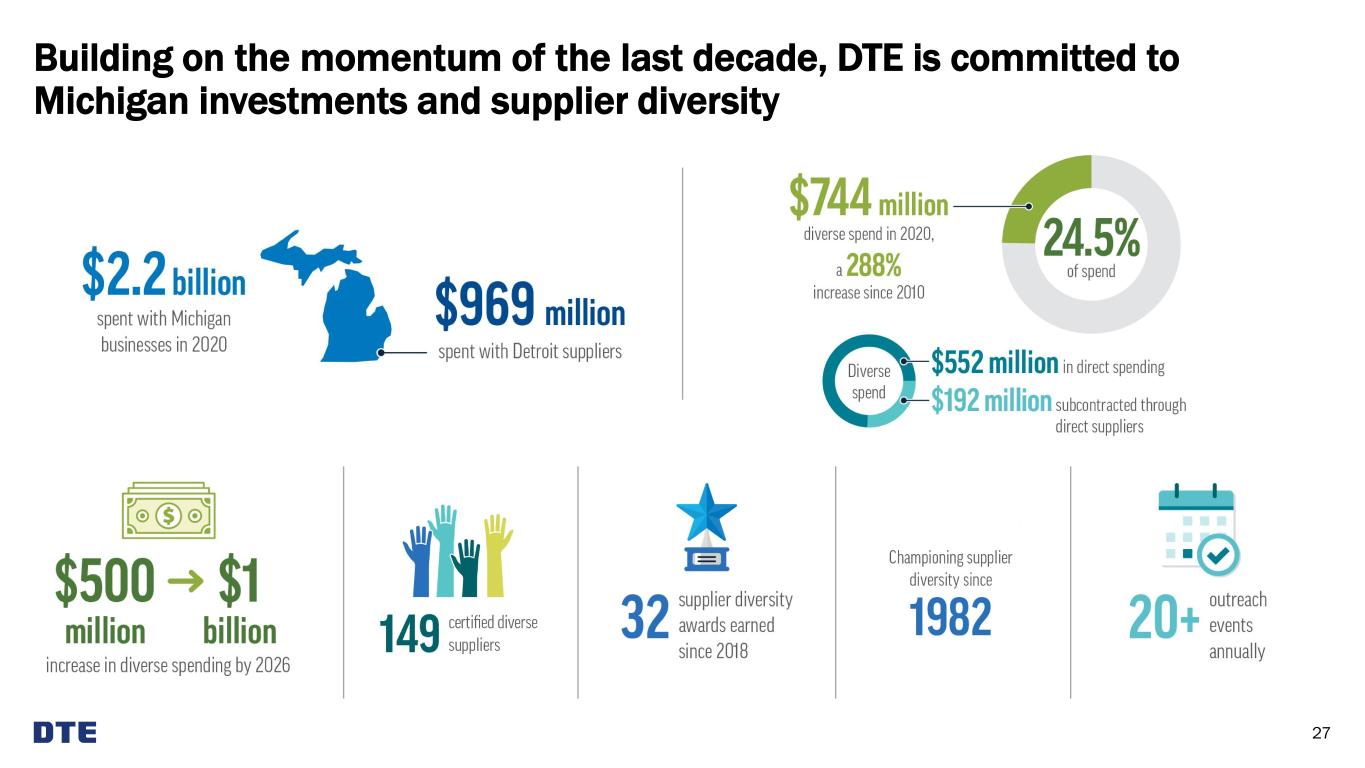

Committed to diversity, equity and inclusion, creating an environment where all are welcome 26 Office of Diversity, Equity and Inclusion • Led by our CEO and key executive leaders, including a Director of Diversity, Equity and Inclusion • Focused on sustaining a diverse workforce which is representative of the communities we serve Commitment to create a diverse, equitable and inclusive workforce and supplier base influences our hiring strategies and business practices • Annual review of compensation practices to ensure equitable pay • Formal training programs including unconscious bias training for employees and leaders • Hiring people with disabilities and returning citizens • Over $700 million invested with diverse suppliers in 2020 as part of our award-winning supplier diversity program • Public advocacy and financial support − Michigan civil rights reform − Removing the digital divide − Equity funding for schools Differently-abled group Latinx professionals group Young professionals group LGBTQ group Black professionals group Family oriented group Asian and Middle Eastern group Veteran empowerment group Women’s group 9 active employee resource groups that promote a safe and welcoming environment, and offer professional development, networking, mentoring and support

Building on the momentum of the last decade, DTE is committed to Michigan investments and supplier diversity 27

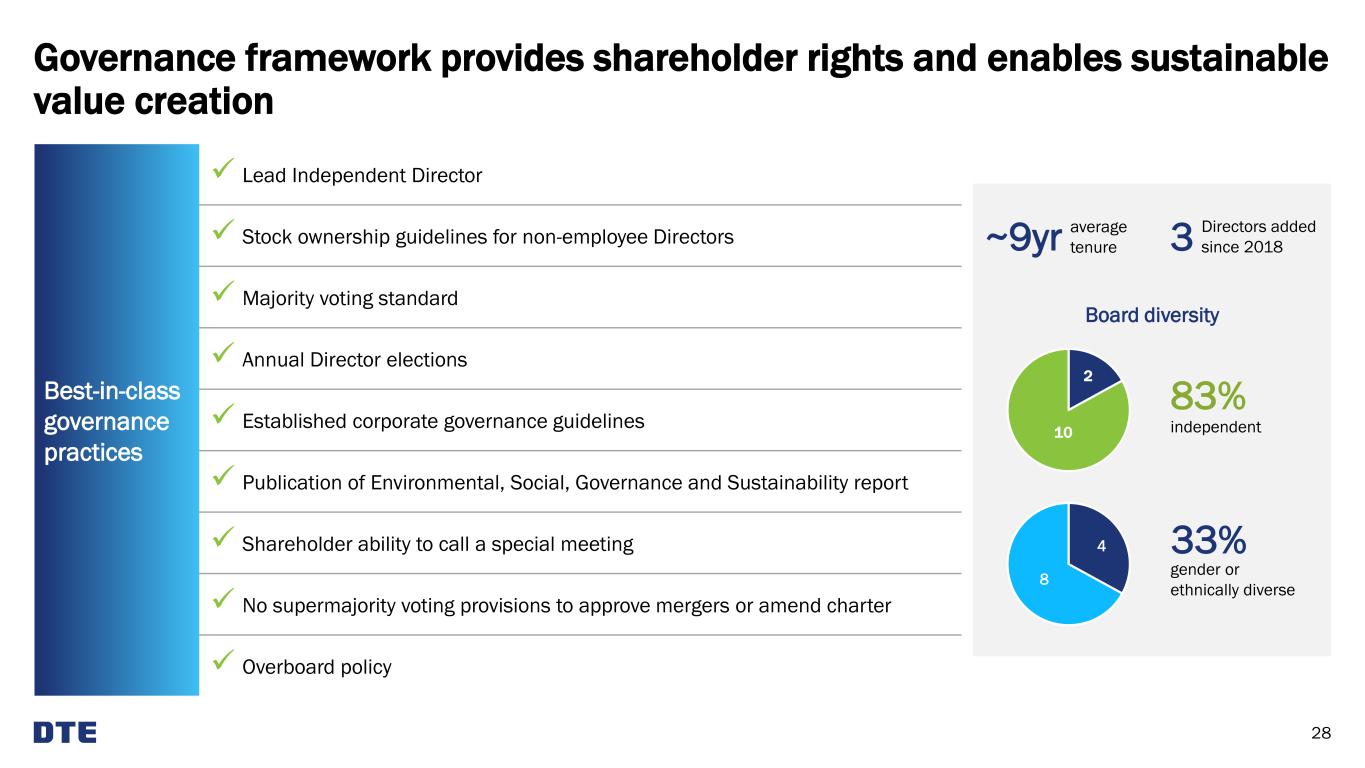

Governance framework provides shareholder rights and enables sustainable value creation 28 average tenure~9yr 3 Directors added since 2018 33% gender or ethnically diverse 83% independent 2 10 4 8 Board diversity Best-in-class governance practices ✓ Lead Independent Director ✓ Stock ownership guidelines for non-employee Directors ✓ Majority voting standard ✓ Annual Director elections ✓ Established corporate governance guidelines ✓ Publication of Environmental, Social, Governance and Sustainability report ✓ Shareholder ability to call a special meeting ✓ No supermajority voting provisions to approve mergers or amend charter ✓ Overboard policy

Priorities Performance-based compensation elements Annual incentive metrics Long-term metrics Highly engaged employees • Employee engagement • Employee safety Top decile customer satisfaction • Customer satisfaction • Customer complaints Distinctive continuous improvement capability • Utility operating excellence • Customer satisfaction improvement Strong political & regulatory context • Customer satisfaction improvement • Utility operating excellence index Clear growth & value creation strategy • Relative TSR Superior & sustainable financial performance • EPS • Cash flow • Balance sheet health Executive management compensation plan is aligned with our core priorities 29

Reconciliation of reported to operating earnings (non-GAAP) 30 Use of Operating Earnings Information – Operating earnings exclude non-recurring items, certain mark-to-market adjustments and discontinued operations. DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. In this presentation, DTE Energy provides guidance for future period operating earnings. It is likely that certain items that impact the company’s future period reported results will be excluded from operating results. A reconciliation to the comparable future period reported earnings is not provided because it is not possible to provide a reliable forecast of specific line items (i.e. future non-recurring items, certain mark-to-market adjustments and discontinued operations). These items may fluctuate significantly from period to period and may have a significant impact on reported earnings.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- DTE Energy (DTE) PT Raised to $113 at BMO Capital

- NovaBay Pharmaceuticals Receives a NYSE American Notice Regarding Stockholder Equity

- Four ONDA Partners Earn Placement on D Magazine’s Best Lawyers List

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share