Form 8-K DOVER Corp For: Sep 14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________

FORM 8-K

________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 14, 2017

________________________________

DOVER CORPORATION

(Exact name of registrant as specified in its charter)

________________________________

State of Delaware | 1-4018 | 53-0257888 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

3005 Highland Parkway | ||

Downers Grove, Illinois 60515 | ||

(Address of Principal Executive Offices) | ||

(630) 541-1540

(Registrant’s telephone number, including area code)

______________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure.

Dover Corporation (the “Company” or “Dover”) will present at the Morgan Stanley Laguna Conference in Dana Point, California on Thursday, September 14, 2017 at 10:30 a.m. Pacific time. A copy of the slide presentation to be used by the Company is attached as Exhibit 99.1 to this Current Report on Form 8-K. A link to the live audio webcast of the presentation and related materials will be available on the Company’s website (www.dovercorporation.com) and a replay of the webcast will be available on the website for 90 days.

The information in this report (including Exhibit 99.1) shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that Section, and shall not be incorporated by reference into any registration statement or other document filed by Dover under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

99.1 Dover Corporation Presentation dated September 14, 2017.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

Date: | September 14, 2017 | DOVER CORPORATION | ||

(Registrant) | ||||

By: | /s/ Ivonne M. Cabrera | |||

Ivonne M. Cabrera | ||||

Senior Vice President, General Counsel & Secretary | ||||

EXHIBIT INDEX

Number | Exhibit | |

Morgan Stanley 5th Annual Laguna Conference

September 14, 2017

Bob Livingston

President & Chief Executive Officer

Exhibit 99.1

2

Forward Looking Statements

This presentation may contain "forward-looking" statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements include, but are not limited to, statements related to the potential separation of

our upstream energy businesses (collectively, the Wellsite business), including any potential spin-off, sale or other

strategic transaction. All statements other than statements of historical fact are statements that are, or could be

deemed, “forward-looking” statements. Words such as “may,” “will,” "anticipates," "expects," "believes," "suggests,"

"plans," "should," "would," "could," and "forecast," or others of similar meaning generally identify forward-looking

statements. Forward-looking statements are subject to numerous important risks, uncertainties, assumptions and

other factors, some of which are beyond the company’s control. These factors include, but are not limited to,

uncertainties as to the structure and timing of any separation transaction and whether it will be completed, the

possibility that closing conditions for a separation transaction may not be satisfied or waived, the impact of the

strategic review and any separation transaction on Dover and the Wellsite business on a standalone basis if the

separation is completed, and whether the strategic benefits of separation can be achieved. Other factors include

those discussed in the documents Dover files from time to time with the Securities and Exchange Commission, such

as its reports on Form 10-K, Form 10-Q and Form 8-K. Dover refers you to those documents for a discussion of the

risks and uncertainties that could cause its actual results to differ materially from its current expectations and from the

forward-looking statements made during this presentation. Any forward-looking statements made during this

presentation are made only as of the date they are made and we undertake no obligation to update such statements

to reflect events or circumstances occurring after the date of this presentation except as required by law.

This presentation includes certain non-GAAP financial measures about Dover’s Energy segment, including Adjusted

Earnings and Adjusted EBITDA. These non-GAAP financial measures should be considered only as supplemental

to, and not as superior to, financial measures prepared in accordance with U.S. GAAP. Please refer to the Appendix

of this presentation for definitions of non-GAAP financial measures included in this presentation and a reconciliation

to the most directly comparable financial measures prepared in accordance with U.S. GAAP.

We would also direct your attention to our website, dovercorporation.com, where considerably more information can

be found.

3

Our Evolution Over Past 10 Years

Executed value-creating portfolio strategy, including strategic M&A as well

as non-core divestitures

Made organic investments to improve value-proposition for our customers

through new product innovations

Implemented significant operational improvements and enhanced

margins

Established shared services and Dover business systems across the

enterprise

Continued track record of balanced capital allocation including a strong

and growing dividend

Focused portfolio on key platforms with sustainable growth

runway and margin improvement potential

4

Wellsite Announcement

Completed a strategic review of our portfolio

Evaluating strategic alternatives for the separation of Dover’s upstream

energy businesses (together referred to as “Wellsite”)

- Wellsite includes Dover Artificial Lift, Dover Energy Automation and US

Synthetic

Range of strategic alternatives being evaluated, including a tax-free spin-

off, sale, or other strategic combination

Focused on pursuing a separation of Wellsite that creates the best long-

term results for the businesses and the greatest value for shareholders

Expect to have assessment of separation alternatives completed by the

end of the year

Dover core platform businesses are well-positioned for long-term

sustainable growth and returns

5

Wellsite: Artificial Lift, Automation and Drill Bit Inserts

Overview and Key Brands Financial Highlights

Dover Artificial Lift

(62% of 2017E

Wellsite Revenue)

Dover Energy

Automation

(16% of 2017E

Wellsite Revenue)

US Synthetic

(22% of 2017E

Wellsite Revenue)

$753 $876

$1,016

2016A LTM 2017E

$140

$195

$250

2016A LTM 2017E

% Adjusted EBITDA Margin

19% 22%

% YoY Growth

(30%)

Note: See appendix for definitions and reconciliations of non-GAAP financial measures

R

e

v

e

n

u

e

A

dj

.

E

B

IT

D

A

Leading provider of artificial

lift and production

optimization solutions

The most trusted partner in

the industry for artificial lift

Leading provider of

productivity tools and

performance management

software

Industry leader in the

development and

production of polycrystalline

diamond for oil & gas and

mining applications

35%

25%

Expect mid-

to-high

teens year-

over-year

organic

growth in

2018

~75% of revenues from U.S.

Expect 2018

incremental

margin to

remain

strong

2%

Wellsite is a great set of businesses that are leaders in their markets,

differentiated by their technology, customer service and trusted brands

6

Marking & Coding

Digital Printing

Vehicle Services

Solid Waste Processing

Dover Core Businesses - Positioned for Growth & Margin Expansion

(1) Represents three-year projections from year-end 2016, as previously stated by the Company in the June Investor Day.

(2) For presentation purposes only, includes Bearings and Compression and TWG businesses currently reported within the Energy segment.

Fluids

Engineered

Systems(2)

Refrigeration & Food

Equipment

2017E Revenue

Mid-

Term

Outlook

Growth Drivers

Focus Areas for

Inorganic Investment

3% - 5%

~$2.3B ~$2.9B ~$1.6B

Organic Rev.

Growth(1)

3-year Margin

Improvement(1)

4% - 5% 3% - 4%

300 – 400 bps 175 – 225 bps 300 – 400 bps

Multi-year EMV

upgrade cycle

Global industrial

production

Consistent growth in

Marking & Coding markets

Global industrial

production

Energy efficiency &

productivity

Changing trends in food

merchandising

Targeted pump

markets

Printing platform

Selected industrial

businesses

Food equipment

Growth Platforms

Retail Fueling

Pumps

Food Service Equipment

Retail Refrigeration

Margin Expansion

Drivers

Synergy benefits in

retail fueling

Consolidate

manufacturing footprint

Multiple productivity

opportunities

Commercial excellence

Multiple productivity

opportunities

Factory automation /

Footprint consolidation

7

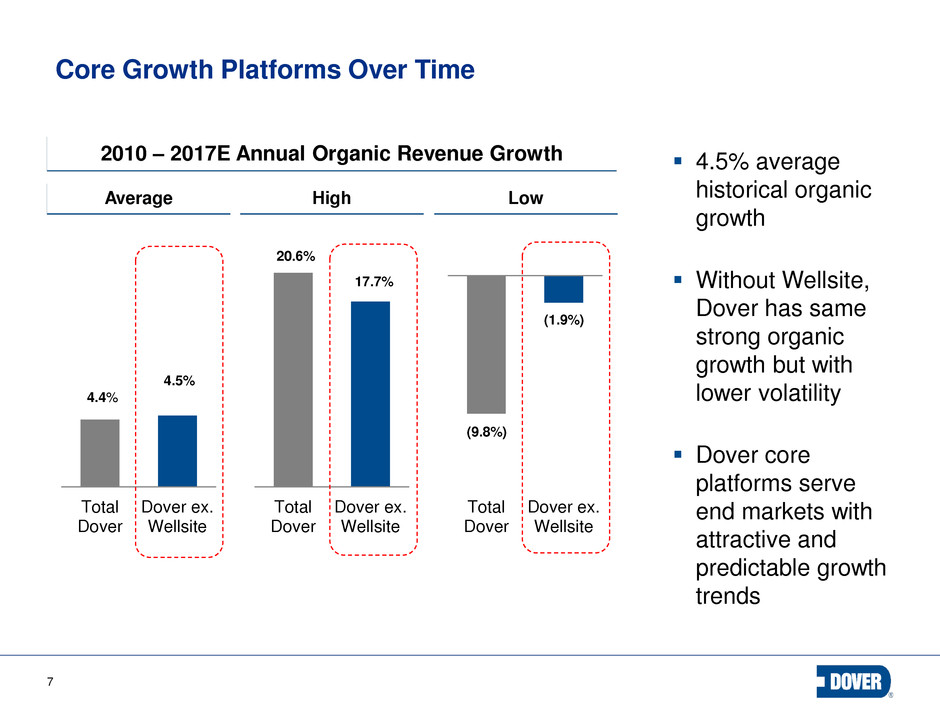

Core Growth Platforms Over Time

7

2010 – 2017E Annual Organic Revenue Growth 4.5% average

historical organic

growth

Without Wellsite,

Dover has same

strong organic

growth but with

lower volatility

Dover core

platforms serve

end markets with

attractive and

predictable growth

trends

Average Low High

Total

Dover

Dover ex.

Wellsite

4.4%

4.5%

Total

Dover

Dover ex.

Wellsite

Total

Dover

Dover ex.

Wellsite

20.6%

17.7%

(9.8%)

(1.9%)

8

Expanding Dover Management Tools and Processes

Driving Business Improvement

8

Enterprise-wide business processes to drive continuous improvement

Global sourcing

Shared services

India Innovation

Center

Lean/Continuous

improvement

M&A and integration

Performance management

Development & training

Mobility & deployment

Leveraging Scale Standardizing Process

Developing Talent

9

Capital Allocation

9

Capital Deployment (2010-17E)

40%

60%

Invest in Growth

• Capex

• Acquisitions

Return capital to

shareholders

• Dividends

• Repurchases

Organic growth and development of core

platforms

Strategic acquisitions in core platforms

Consistent and growing dividend

Return excess capital to shareholders via

repurchase

~

~

10

Our Focus on Long-Term Value Creation

1

0

Build platforms in attractive

markets with consistent

growth

Drive margin and cash flow

utilizing Dover business

system processes

Provide larger set of products

and solutions to customers

on a global basis

Invest to grow through

organic and inorganic actions

Platforms create opportunities

while leveraging channel and

customer synergies

Customer-focused innovation

creates value for our

customers and builds loyalty

Clear margin improvement

runway across businesses

plus strong & stable cash flow

Track record of value-creating

capital allocation through

strategic M&A and organic

investments

Our distinctive culture focuses on our customers thereby driving opportunities

to grow and invest in our businesses, creating shareholder value

11

12

Appendix:

Reconciliation of Wellsite Financials to Dover Energy Segment

(1) Includes Bearings and Compression and TWG businesses currently reported within the Energy segment

(2) Includes segment eliminations, segment overhead expenses and acquisition-related amortization expenses, as applicable

(3) Last twelve months as of June 30, 2017

(4) D&A for Wellsite includes depreciation of $13M, $13M, and an estimate of $15M in 2016, LTM and 2017E, respectively, for assets used in customer leasing programs

(5) Includes amortization of acquisition-related intangibles in Segment Eliminations

Wellsite Non-Wellsite(1) Total Dover Energy

Segment

Eliminations(2)

(3) (3) (3) (3)

2016 LTM 2017E 2016 LTM 2017E 2016 LTM 2017E 2016 LTM 2017E

Revenue $753 $876 $1,016 $357 $376 $393 ($2) ($3) ($4) $1,108 $1,249 $1,406

Earnings $73 $141 $196 $64 $79 $84 ($82) ($80) ($82) $55 $139 $198

Restructuring Expenses 15 5 0 3 1 3 (0) (0) 0 18 7 3

Adj. Earnings $88 $146 $197 $67 $80 $87 ($82) ($80) ($82) $73 $146 $201

% Margin 12% 17% 19% 19% 21% 22% NA NA NA 7% 12% 14%

Dep. & Amort. (4) (5) $52 $49 $53 $12 $12 $12 $67 $66 $65 $131 $127 $131

Adj. EBITDA $140 $195 $250 $79 $93 $99 ($14) ($15) ($17) $205 $273 $332

% Margin 19% 22% 25% 22% 25% 25% NA NA NA 18% 22% 24%

(as reported)

Note: Earnings represents earnings before interest and tax. Adjusted Earnings is calculated by adding back restructuring expenses to earnings. Adjusted EBITDA is calculated by

adding back depreciation and amortization expense and restructuring charges to earnings, which is the most directly comparable GAAP measure. We do not present segment

net income because corporate expenses are not allocated at a segment level. Totals may be impacted due to rounding.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Dover Corp. (DOV) Tops Q1 EPS by 8c, Beats on Revenue; Offers FY24 Guidance

- Dover Reports First Quarter 2024 Results

- Vehicle Service Group Launches Two New Products to Further Expand EMEA Portfolio

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share