Form 8-K DD3 Acquisition Corp. For: Jun 21

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): June 21, 2021

DD3

Acquisition Corp. II

(Exact name of registrant as specified in its charter)

| Delaware | 001-39767 | 85-3244031 | ||

(State

or other jurisdiction |

(Commission File Number) | (I.R.S.

Employer Identification No.) |

Pedregal 24, 3rd Floor, Interior 300 Colonia Molino del Rey, Del. Miguel Hidalgo Mexico City, Mexico |

11040 | |

| (Address of principal executive offices) | (Zip Code) |

+52 (55) 4340-1269

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Units, each consisting of one share of Class A Common Stock and one-half of one Warrant | DDMXU | The Nasdaq Stock Market LLC | ||

| Class A Common Stock, par value $0.0001 per share | DDMX | The Nasdaq Stock Market LLC | ||

| Warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 | DDMXW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

General

On June 21, 2021, DD3 Acquisition Corp. II, a Delaware corporation (“DD3”), Codere Newco, S.A.U., a corporation (sociedad anónima unipersonal) registered and incorporated under the laws of Spain (“Parent”), Servicios de Juego Online S.A.U., a corporation (sociedad anónima unipersonal) registered and incorporated under the laws of Spain (the “Company”) whose sole shareholder is Parent, Codere Online Luxembourg, S.A., a public limited liability company (société anonyme) governed by the laws of the Grand Duchy of Luxembourg (“Holdco”, and collectively with the Company and their consolidated subsidiaries “Codere Online”) whose sole shareholder is Parent, and Codere Online U.S. Corp., a Delaware corporation (“Merger Sub”) whose sole stockholder is Holdco, entered into a business combination agreement (the “Business Combination Agreement”) that provides for DD3 and the Company to become wholly-owned subsidiaries of Holdco through a series of related transactions (collectively, the “Proposed Business Combination”), as described in more detail below. Capitalized terms used in this Current Report on Form 8-K but not otherwise defined herein have the meanings given to them in the Business Combination Agreement.

Business Combination Agreement

Structure of the Proposed Business Combination

| (a) | The Business Combination Agreement provides for, among other things, the following transactions: |

| i. | Pursuant to that certain Contribution and Exchange Agreement, dated as of June 21, 2021, by and among Holdco, the Company and Parent (the “Exchange Agreement”), as further described below, Parent, effective on the Exchange Effective Time, will contribute its ordinary shares of the Company constituting all the issued and outstanding share capital of the Company (“Company Ordinary Shares”) to Holdco in exchange for additional ordinary shares of Holdco (“Holdco Ordinary Shares”), to be subscribed for by Parent (such contribution and exchange of Company Ordinary Shares for Holdco Ordinary Shares, collectively, the “Exchange”); |

| ii. | As a result of the Exchange, the Company will become a wholly-owned subsidiary of Holdco and Holdco will continue to be a wholly-owned subsidiary of Parent at the Exchange Effective Time; |

| iii. | After the Exchange and immediately prior to the Merger Effective Time, each share of DD3’s Class B common stock, par value $0.0001 per share, issued and outstanding immediately prior to the Merger Effective Time will automatically be converted into and exchanged for one share of DD3’s Class A common stock, par value $0.0001 per share (“DD3 Common Stock”, and such conversion, the “Class B Conversion”); |

| iv. | Not earlier than one Business Day following the consummation of the Exchange, Merger Sub will merge with and into DD3, with DD3 surviving such merger and becoming a direct wholly-owned subsidiary of Holdco (the “Merger”); |

| v. | In connection with the Merger, all shares of DD3 Common Stock issued and outstanding immediately prior to the Merger Effective Time, but after the Class B Conversion, will be exchanged with Holdco for the right to receive the Merger Consideration in the form of one Holdco Ordinary Share for each share of DD3 Common Stock pursuant to a share capital increase of Holdco, as set forth in the Business Combination Agreement; and |

| vi. | As of the Merger Effective Time, each DD3 warrant that is outstanding immediately prior to the Merger Effective Time will no longer represent a right to acquire one (1) share of DD3 Common Stock and will instead represent the right to acquire one (1) Holdco Ordinary Share under the same terms. |

| (b) | Certain funds affiliated with Baron Capital Group, Inc. (collectively, “Baron”) have elected to purchase an aggregate of 2,500,000 shares of DD3 Common Stock for an aggregate purchase price of $25,000,000, at a price of $10.00 per each share of DD3 Common Stock, immediately prior to the Closing Date, pursuant to the terms of that certain Forward Purchase Agreement (the “Original Baron FPA”) entered into by DD3 and Baron on November 17, 2020, as amended by Amendment No. 1 to the Original Baron FPA (the “Baron FPA Amendment”) entered into by DD3 and Baron on June 21, 2021 (as amended, the “Baron Forward Purchase Agreement”). |

| 1 |

| (c) | MG Partners Multi-Strategy Fund LP (“MG Partners”) has elected to purchase an aggregate of 2,500,000 shares of DD3 Common Stock for an aggregate purchase price of $25,000,000, at a price of $10.00 per each share of DD3 Common Stock, immediately prior to the Closing Date, pursuant to the terms of that certain Forward Purchase Agreement (the “Original MG Partners FPA”) entered into by DD3 and MG Partners on November 19, 2020, as amended by Amendment No. 1 to the Original MG Partners FPA (the “MG Partners FPA Amendment”) entered into by DD3 and MG Partners on June 21, 2021 (as amended, the “MG Partners Forward Purchase Agreement”, and together with the Baron Forward Purchase Agreement, the “Forward Purchase Agreements”). |

| (d) | Contemporaneously with the execution and delivery of the Business Combination Agreement, DD3 entered into an investor support agreement with Baron, pursuant to which Baron committed to not exercise any of its Redemption Rights with respect to 996,069 shares of DD3 Common Stock (“Baron IPO Shares”) acquired by Baron in DD3’s initial public offering (the “Baron Support Agreement”), as further described below. |

| (e) | Contemporaneously with the execution and delivery of the Business Combination Agreement, DD3 entered into separate subscription agreements (collectively, the “Subscription Agreements”) with DD3 Capital Partners S.A. de C.V. (“DD3 Capital”) and Larrain Investment Inc. (“Larrain”, and collectively with DD3 Capital and other investors who may enter into subscription agreements after the date hereof, “Subscribers”), and in each case to which Holdco is also a party, for the purchase of 1,724,000 shares of DD3 Common Stock at a price of $10.00 per share, immediately prior to the closing of the Proposed Business Combination, as further described below. |

| (f) | Parent, Holdco and the Company have agreed to cause a corporate restructuring to be consummated prior to the Closing of the Proposed Business Combination pursuant to which all of Codere, S.A.’s and Parent’s online gaming, gambling, casino, slots, poker, bingo, sports betting, betting exchanges, lottery operations, racing and pari-mutuel activities will be operated or owned, as applicable, by the Company and the Company Subsidiaries by holding or receiving assets, rights and/or entities from Codere, S.A., Parent and/or their respective subsidiaries in accordance with the Transaction Documents, the Related-Party Agreements and Section 8.18 of the Company Disclosure Schedule of the Business Combination Agreement (the “Restructuring”). |

| (g) | Parent, the Company and/or their respective subsidiaries has entered, or will enter into prior to Closing, the Related-Party Agreements, which, among other matters, provide for licensing arrangements and govern their ability to conduct future online business activities in various markets. |

| (h) | Prior to the Merger Effective Time, Parent and the Company will take or cause to be taken all actions necessary to capitalize or cancel all indebtedness of the Company and Company Subsidiaries by Parent or any of its subsidiaries (other than Holdco) so that at the Exchange Effective Time neither the Company nor any Company Subsidiary has any indebtedness outstanding. |

| (i) | In connection with the Closing of the Proposed Business Combination, the parties thereto will also enter into the Registration Rights and Lock-Up Agreement, Nomination Agreement, Indemnification Letter, Warrant Amendment and Expenses Reimbursement Letter, each as defined and further described below, and the execution and delivery of which are closing conditions of the parties to consummate the Proposed Business Combination. |

| (j) | If the sum of the cash held by DD3 outside of the Trust Account, including the aggregate amount of proceeds from the Investment pursuant to the Forward Purchase Agreements and Subscription Agreements consummated prior to, or as of, the Closing, and the cash held in the Trust Account after deducting all payments made or required to be made pursuant to exercises of Redemption Rights (“Gross Proceeds”) is higher than $125,000,000, Parent shall have the right to cause Holdco to enter into the Redemption Agreement with Parent and redeem from Parent, after the consummation of the Proposed Business Combination and at a redemption price of $10.00 per Holdco Ordinary Share, the number of Holdco Ordinary Shares (“Redeemable Shares”) equal to (rounded down to the nearest whole number of Holdco Ordinary Shares) the quotient of (i) the amount by which the Gross Proceeds exceed $125,000,000, divided by (ii) $10.00. The Redeemable Shares shall not exceed 3,000,000 Holdco Ordinary Shares and the total purchase price under the redemption shall not exceed $30,000,000. |

| 2 |

Consideration

The consideration for the Proposed Business Combination consists of:

Exchange Consideration

At the Exchange Effective Time, Parent will contribute all its Company Ordinary Shares to Holdco in exchange for Holdco Ordinary Shares valued at $10.00 per Holdco Ordinary Share. The Holdco Ordinary Shares to be issued to Parent under the Exchange shall be reduced by the Holdco Ordinary Shares held by Parent immediately prior to the Exchange. The valuation of the Company Ordinary Shares contributed to Holdco by Parent against newly issued Holdco Ordinary Shares pursuant to the Exchange shall be deemed to be, as of the Exchange Effective Time, $300,000,000, on a cash-free and debt-free basis, and subject to a normalized level of working capital, of Holdco, the Company and the Company Subsidiaries. Upon the closing of the Transactions, Parent is expected to maintain between 54% to 73% ownership of Holdco and the total proceeds to Codere Online are expected to range between $77 million and $192 million (prior to any expenses), in each case, depending on redemptions.

Merger Consideration

At the Merger Effective Time, immediately following the Class B Conversion, each share of DD3 Common Stock issued and outstanding immediately prior to the Merger Effective Time shall be exchanged with Holdco against the issue by Holdco, following a share capital increase realized by Holdco, and subscribed by the contributing holders of DD3 Common Stock, acting through the Exchange Agent, of one validly issued and fully paid Holdco Ordinary Share.

Proxy Statement/Prospectus and Stockholder Meeting

As promptly as practicable after the execution of the Business Combination Agreement, (i) Holdco, the Company and DD3 will prepare and Holdco will file with the U.S. Securities and Exchange Commission (“SEC”) the proxy statement/prospectus (as amended or supplemented from time to time, the “Proxy Statement/Prospectus”) to be sent to DD3’s stockholders for the purpose of soliciting proxies for the matters to be acted upon at the special meeting of DD3’s stockholders and providing DD3’s public stockholders an opportunity, in accordance with DD3’s amended and restated certificate of incorporation, to have their shares of DD3 Common Stock redeemed (“Redemption Rights”), in conjunction with the stockholder vote on the proposals set forth in the Proxy Statement/Prospectus and (ii) Holdco, the Company and DD3 will prepare and Holdco will file with the SEC a registration statement on Form F-4 or such other applicable form as the Company and DD3 may agree (as amended or supplemented from time to time, the “Form F-4”), in which the Proxy Statement/Prospectus will be included, in connection with the registration under the Securities Act of 1933, as amended (the “Securities Act”), of the Holdco Ordinary Shares and Holdco Warrants to be issued in the Merger.

Closing

Immediately following the consummation of the Exchange, and in accordance with the terms and conditions of the Business Combination Agreement, the parties shall file a certificate of merger (the “Certificate of Merger”) with the Secretary of State of the State of Delaware, in such form as is required by, and executed in accordance with, the relevant provisions of the General Corporation Law of the State of Delaware and mutually agreed by the parties. The Certificate of Merger shall specify that the Merger shall become effective at 12:01 a.m. New York time on the Business Day immediately following the day of the filing of the Certificate of Merger (the “Merger Effective Time”). On the date of the Merger Effective Time, a closing of the Transactions shall be effected remotely by the exchange of documents and signatures in PDF format by electronic mail. The Business Day on which the Merger Effective Time occurs shall be the “Closing Date” and the closing of the Transactions that occur following the Merger Effective Time on the Closing Date shall be referred to as the “Closing.”

Representations, Warranties and Covenants

The Business Combination Agreement contains customary representations and warranties of (a) Parent and the Company, (b) DD3 and (c) Holdco and Merger Sub relating to, among other things, their ability to enter into the Business Combination Agreement and their outstanding capitalization.

The representations, warranties, agreements and covenants in the Business Combination Agreement or in any certificate, statement or instrument delivered pursuant to the Business Combination Agreement will terminate at the Closing, except that (a) Article XI of the Business Combination Agreement (General Provisions) will survive the Closing and (b) Section 11.02 of the Business Combination Agreement will not limit any covenant, obligation or agreement of the parties that by its terms requires performance after the Closing. Effective as of the Closing, there are no remedies available to the parties to the Business Combination Agreement with respect to any breach of the representations, warranties, obligations, covenants or agreements of the parties to the Business Combination Agreement, except, with respect to those obligations, covenants and agreements contained in the Business Combination Agreement that by their terms apply or are to be performed in whole or in part after the Closing and the remedies that may be available under Section 11.11 of the Business Combination Agreement.

| 3 |

Conditions to Closing

General Conditions

The obligations of Parent, the Company, DD3, Holdco and Merger Sub to consummate the Proposed Business Combination, including the Merger and Exchange, are subject to the satisfaction or waiver (where permissible) of customary closing conditions at or prior to the Closing, including (i) DD3 stockholders’ approvals; (ii) issuance of statutory independent auditor reports regarding the contributions relating to the issuance of Holdco Ordinary Shares under the Merger and the Exchange; (iii) absence of any law, rule, regulation, judgment, decree, executive order or award which is then in effect and has the effect of making the Transactions illegal or otherwise prohibiting consummation of the Transactions, including the Merger or the Exchange; (iv) effectiveness of the registration statement on Form F-4 relating to Holdco Ordinary Shares and Holdco Warrants to be issued in the Merger and absence of any order or proceeding initiated by the SEC (and not withdrawn) that suspends the effectiveness of such registration statement; (v) Nasdaq listing approval of the Holdco Ordinary Shares and Holdco Warrants; (vi) upon consummation of the Proposed Business Combination, Holdco, the Company and the Company Subsidiaries shall not be treated as a domestic corporation pursuant to Code Section 7874 and Treasury Regulations thereunder, (vii) Parent shall have obtained the written consent of not less than a majority in aggregate principal amount of the then-outstanding Codere Super Senior Secured Notes and Codere Senior Secured Notes, respectively, waiving and amending certain matters thereunder in connection with the Transactions, and (viii) DD3 shall have provided all supporting documents from DD3, its stockholders and the Exchange Agent, as may be required by the Luxembourg notary to proceed with the issuance of Holdco Ordinary Shares upon contribution of the DD3 Common Stock to Holdco at the Merger Effective Time.

DD3 Conditions to Closing

The obligations of DD3 to consummate the Proposed Business Combination, including the Merger, are subject to the satisfaction or waiver (where permissible) at or prior to the Exchange Effective Time and at or prior to the Closing of the following additional conditions:

(i) (A) The representations and warranties of each of Parent and the Company contained in Section 4.01 (Organization and Qualification; Subsidiaries), Section 4.03 (Capitalization), Section 4.04 (Authority Relative to this Agreement), and Section 4.21 (Brokers) of the Business Combination Agreement shall each be true and correct in all respects as of the Exchange Effective Time and the Closing Date as though made on the Exchange Effective Time and the Closing Date (as applicable), except to the extent that any such representation and warranty expressly speaks as of an earlier date, in which case such representation and warranty shall be true and correct as of such earlier date, and (B) the rest of the representations and warranties of Parent and the Company contained in Article IV of the Business Combination Agreement shall be true and correct (without giving any effect to any limitation as to “materiality” or “Company Material Adverse Effect” or any similar limitation set forth therein) in all respects as of the Exchange Effective Time and the Closing Date, as though made on and as of the Exchange Effective Time and the Closing Date (as applicable), except (1) to the extent that any such representation and warranty expressly speaks as of an earlier date, in which case such representation and warranty shall be true and correct as of such earlier date, and (2) where the failure of such representations and warranties to be true and correct (whether as of the Exchange Effective Time and the Closing Date (as applicable) or such earlier date), taken as a whole, does not result in a Company Material Adverse Effect.

(ii) (A) The representations and warranties of each of Holdco and Merger Sub in Section 6.01 (Organization), Section 6.03 (Capitalization), Section 6.04 (Authority Relative to this Agreement), Section 6.07(b) (Vote Required) and Section 6.09 (Brokers) of the Business Combination Agreement shall each be true and correct in all respects as of the Exchange Effective Time and the Closing Date as though made on the Exchange Effective Time and the Closing Date (as applicable), except to the extent that any such representation and warranty expressly speaks as of an earlier date, in which case such representation and warranty shall be true and correct as of such earlier date; and (B) the rest of the representations and warranties of Holdco and Merger Sub contained in the Business Combination Agreement shall be true and correct (without giving any effect to any limitation as to “materiality” or any similar limitation set forth therein) in all respects as of the Exchange Effective Time and the Closing Date, as though made on and as of the Exchange Effective Time and the Closing Date (as applicable), except (1) to the extent that any such representation and warranty expressly speaks as of an earlier date, in which case such representation and warranty shall be true and correct as of such earlier date, and (2) where the failure of such representations and warranties to be true and correct (whether as of the Exchange Effective Time or the Closing Date (as applicable) or such earlier date), taken as a whole, would be materially adverse to Holdco or Merger Sub.

(iii) Parent, the Company, Holdco and Merger Sub shall have performed or complied in all material respects with all agreements and covenants required by the Business Combination Agreement to be performed or complied with by it on or prior to the Exchange Effective Time (except, for the avoidance of doubt, for those required to be performed after the Exchange Effective Time and relating to the Merger) and the Merger Effective Time; provided, that Holdco shall have performed or complied in all respects with the agreements and covenants set forth in Section 7.01(c).

| 4 |

(iv) Parent, the Company, Holdco and Merger Sub shall have delivered to DD3 certificates dated as of the date of the Exchange Effective Time and the Closing Date and signed by an officer of the Company, certifying in each certificate as to the satisfaction of the conditions specified in Section 9.02(a), Section 9.02(b) and Section 9.02(d).

(v) No Company Material Adverse Effect shall have occurred between the date of this Agreement and the Exchange Effective Time and no Company Material Adverse Effect shall have occurred between the Exchange Effective Time and the Closing Date.

(vi) The shareholder approvals of Holdco required under Luxembourg law to consummate the Transactions shall have been obtained and delivered to DD3 in form and substance reasonably acceptable to DD3.

(vii) The Company, Parent and Holdco shall have consummated the Exchange.

(viii) Holdco and Parent shall have duly executed and delivered to DD3 the Registration Rights and Lock-Up Agreement and Nomination Agreement, each in the form attached to the Business Combination Agreement.

(ix) Holdco shall have duly executed and delivered to DD3 the Warrant Amendment in the form attached to the Business Combination Agreement.

(x) The Restructuring shall have been consummated substantially in accordance with the draft step plan set forth in Section 8.18 of the Company Disclosure Schedule except with respect to certain steps related to approvals from Governmental Authorities or third parties (which such third party shall not be an affiliate of Parent, the Company, or such Company Subsidiary) or changes in Laws in any of Colombia, Panama or the City of Buenos Aires (Argentina), as applicable, as long as a Restructuring Agreement is entered into between Parent, the Company and the applicable Company Subsidiary which provides substantially the same economic effect and benefits to the Company and its Company Subsidiaries.

(xi) None of Holdco, Merger Sub, the Company or any of the Company Subsidiaries shall have any indebtedness outstanding.

(xii) Parent, Holdco and the Company shall have duly executed and delivered to DD3 the Indemnification Letter in the form attached to the Business Combination Agreement.

(xiii) Parent and Holdco shall have duly executed and delivered to DD3 and Sponsor the Expenses Reimbursement Letter in the form attached to the Business Combination Agreement.

Company Conditions to Closing

The obligations of the Company to consummate the Proposed Business Combination, including the Merger, are subject to the satisfaction or waiver (where permissible) at or prior to the Closing of the following additional conditions:

(i) (A) The representations and warranties of DD3 contained in Section 5.01 (Company Organization), Section 5.03 (Capitalization), Section 5.04 (Authority Relative to this Agreement), and Section 5.11 (Brokers) of the Business Combination Agreement shall each be true and correct in all respects as of the Exchange Effective Time and the Closing Date as though made on the Exchange Effective Time and the Closing Date (as applicable), except to the extent that any such representation and warranty expressly speaks as of an earlier date, in which case such representation and warranty shall be true and correct as of such earlier date, and (B) the rest of the representations and warranties of DD3 contained in the Business Combination Agreement shall be true and correct (without giving any effect to any limitation as to “materiality” or “SPAC Material Adverse Effect” or any similar limitation set forth therein) in all respects as of the Exchange Effective Time and the Closing Date, as though made on and as of the Exchange Effective Time and the Closing Date (as applicable), except (1) to the extent that any such representation and warranty expressly speaks as of an earlier date, in which case such representation and warranty shall be true and correct as of such earlier date, and (2) where the failure of such representations and warranties to be true and correct (whether as of the Exchange Effective Time and the Closing Date (as applicable) or such earlier date), taken as a whole, does not result in a SPAC Material Adverse Effect.

| 5 |

(ii) DD3 shall have performed or complied in all material respects with all agreements and covenants required by the Business Combination Agreement to be performed or complied with by it on or prior to the Exchange Effective Time and the Closing Date.

(iii) DD3 shall have delivered to the Company certificates dated as of the date of the Exchange Effective Time and the Closing Date and signed by the Chief Executive Officer of DD3, certifying in each certificate as to the satisfaction of the conditions specified in Section 9.03(a), Section 9.03(b) and Section 9.03(d) and the number of shares of DD3 Common Stock in respect of which Redemption Rights have been validly exercised.

(iv) No SPAC Material Adverse Effect shall have occurred between the date of this Agreement and the Exchange Effective Time and no SPAC Material Adverse Effect shall have occurred between the Exchange Effective Time and the Closing Date.

(v) DD3 shall deliver to Holdco a duly executed certificate and notice certifying that DD3 is not, and has not been at any time during the five year period ending on the Closing Date, a U.S. real property holding corporation within the meaning of Section 897(c)(2) of the Code and the Treasury Regulations thereunder.

(vi) DD3 and DD3 Sponsor Group, LLC (“Sponsor”) shall have duly executed and delivered to the Company the Registration Rights and Lock-Up Agreement in the form attached to the Business Combination Agreement.

(vii) Sponsor shall have duly executed and delivered to the Company the Nomination Agreement in the form attached to the Business Combination Agreement.

(viii) DD3 shall have duly executed and delivered to the Company the Warrant Amendment in the form attached to the Business Combination Agreement.

(ix) All officers and directors of DD3 shall have executed written resignations as officers and directors of DD3 effective as of the Merger Effective Time.

(x) The Gross Proceeds shall be at least $77,000,000.

(xi) DD3 shall, and shall have caused Sponsor to, have duly executed and delivered to Parent and Holdco the Expenses Reimbursement Letter in the form attached to the Business Combination Agreement.

Termination

The Business Combination Agreement may be terminated, and the Proposed Business Combination, including the Merger, may be abandoned at any time prior to the Merger Effective Time, notwithstanding any requisite approval and adoption of the Business Combination Agreement and the Proposed Business Combination by the stockholders of the Company or DD3, as follows:

(i) by mutual written consent of DD3 and the Company;

(ii) by either DD3 or the Company if the Merger Effective Time shall not have occurred prior to 5:00 p.m. (New York time) on December 31, 2021 (the “Outside Date”); provided, however, that the Business Combination Agreement may not be terminated under Section 10.01(b) thereof by or on behalf of any party that either directly or indirectly through its affiliates materially breaches or violates any representation, warranty, covenant, agreement or obligation contained therein and such material breach or violation is the principal cause of the failure to satisfy a condition set forth in Article IX of the Business Combination Agreement on or prior to the Outside Date;

(iii) by either DD3 or the Company if any Governmental Authority shall have enacted, issued, promulgated, enforced or entered any injunction, order, decree or ruling (whether temporary, preliminary or permanent) which has become final and non-appealable and has the effect of making consummation of the Transactions, including the Merger, illegal or otherwise preventing or prohibiting consummation of the Transactions or the Merger;

(iv) by either DD3 or the Company if any of the SPAC Proposals shall fail to receive the requisite vote for approval at the SPAC Stockholders’ Meeting;

| 6 |

(v) by DD3 upon a breach of any representation, warranty, covenant or agreement on the part of Parent, the Company, Holdco or Merger Sub set forth in the Business Combination Agreement, or if any representation or warranty of Parent, the Company, Holdco or Merger Sub shall have become untrue, in either case only if the conditions set forth in Section 9.02(a) and Section 9.02(b) of the Business Combination Agreement would not be satisfied (“Terminating Company Breach”); provided that DD3 has not waived such Terminating Company Breach and DD3 is not then in material breach of any of its representations, warranties, covenants or agreements in the Business Combination Agreement; provided further that, if such Terminating Company Breach is curable by Parent, the Company, Holdco or Merger Sub, DD3 may not terminate the Business Combination Agreement under Section 10.01(e) thereof for so long as Parent, the Company, Holdco or Merger Sub continues to exercise its reasonable best efforts to cure such breach, unless such breach is not cured within thirty (30) days after written notice of such breach is provided by DD3 to the Company;

(vi) by the Company upon a breach of any representation, warranty, covenant or agreement on the part of DD3 set forth in the Business Combination Agreement, or if any representation or warranty of DD3 shall have become untrue, in either case only if the conditions set forth in Section 9.03(a) and Section 9.03(b) of the Business Combination Agreement would not be satisfied (“Terminating SPAC Breach”); provided that the Company has not waived such Terminating SPAC Breach and Parent, the Company, Holdco or Merger Sub is not then in material breach of their representations, warranties, covenants or agreements in the Business Combination Agreement; provided, further, that, if such Terminating SPAC Breach is curable by DD3, the Company may not terminate the Business Combination Agreement under Section 10.01(f) thereof for so long as DD3 continues to exercise its reasonable best efforts to cure such breach, unless such breach is not cured within thirty (30) days after written notice of such breach is provided by the Company to DD3;

(vii) by DD3 if the PCAOB Financials shall not have been delivered by August 21, 2021;

(viii) by DD3 if the Restructuring shall have not been consummated substantially in accordance with the step plan set forth in Section 8.18 of the Company Disclosure Schedule by September 30, 2021 with respect to Italy, Mexico and Spain;

(ix) by DD3 if the Restructuring shall have not been consummated substantially in accordance with the step plan set forth in Section 8.18 of the Company Disclosure Schedule or a Restructuring Agreement shall not have been entered into by November 15, 2021 with respect to Colombia, Panama and the City of Buenos Aires (Argentina); or

(x) by DD3 if Parent shall not have obtained the Codere Bondholders Consent by August 15, 2021.

In the event that the Business Combination Agreement is terminated in accordance with its Section 10.01, all Transaction Expenses incurred in connection with the Business Combination Agreement, the Ancillary Agreements and the Transactions shall be paid by the party of the Business Combination Agreement incurring such Transaction Expenses. If the Transactions are consummated, subject to the obligations set forth in Section 3.01(b), the Surviving Corporation shall pay or cause to be paid the Company Transaction Expenses and the SPAC Transaction Expenses (either directly or, to the extent paid by Parent or the Company, on a reimbursed basis) to the extent set forth in Section 11.03. All Transaction Expenses incurred in connection with the Business Combination Agreement, the Ancillary Agreements and the Transactions by a party and not expressly payable, in whole or in part, by the Surviving Corporation under the Business Combination Agreement shall be paid by the party incurring such Transaction Expenses.

A copy of the Business Combination Agreement is filed with this Current Report on Form 8-K as Exhibit 2.1 and is incorporated herein by reference. The foregoing description of the Business Combination Agreement is qualified in its entirety by reference to the full text of the Business Combination Agreement filed with this Current Report on Form 8-K. The Business Combination Agreement is included to provide investors and security holders with information regarding its terms. It is not intended to provide any other factual information about DD3, the Company or the other parties thereto. In particular, the assertions embodied in representations and warranties by Parent, the Company, DD3, Holdco and Merger Sub contained in the Business Combination Agreement are qualified by information in the disclosure schedules provided by the parties in connection with the signing of the Business Combination Agreement. These disclosure schedules contain information that modifies, qualifies and creates exceptions to the representations and warranties set forth in the Business Combination Agreement. Moreover, certain representations and warranties in the Business Combination Agreement were used for the purpose of allocating risk between the parties, rather than establishing matters as facts. Accordingly, investors and security holders should not rely on the representations and warranties in the Business Combination Agreement as characterizations of the actual state of facts about Parent, the Company, DD3, Holdco and Merger Sub.

| 7 |

Registration Rights and Lock-Up Agreement

In connection with the Closing of the Proposed Business Combination, DD3, Holdco, Parent, MG Partners, Baron and Sponsor will enter into a Registration Rights and Lock-Up Agreement (the “Registration Rights and Lock-Up Agreement”), which provides customary demand and piggyback registration rights, and pursuant to which each of Parent and Sponsor will agree to not transfer any Lock-Up Securities (as defined in the Registration Rights and Lock-Up Agreement) until the earliest of: (i) the date that is one year from the Closing, (ii) the date on which the closing price of the Holdco Ordinary Shares on the Nasdaq Stock Market (“Nasdaq”) equals or exceeds $12.50 per Holdco Ordinary Share (as adjusted for share splits, share dividends, reorganizations and recapitalizations) for any 20 trading days within any 30-trading day period commencing 150 days after the Closing or (iii) such date on which Holdco completes a liquidation, merger, share exchange or other similar transaction that results in all of Holdco’s stockholders having the right to exchange their Holdco Ordinary Shares for cash, securities or other property, subject to certain exceptions.

The foregoing description of the Registration Rights and Lock-Up Agreement is qualified in its entirety by reference to the full text of the form of Registration Rights and Lock-Up Agreement, a copy of which is included as Exhibit A to the Business Combination Agreement, filed as Exhibit 2.1 to this Current Report on Form 8-K and incorporated herein by reference.

Nomination Agreement

In connection with the Closing of the Proposed Business Combination, Sponsor, Parent and Holdco will enter into a Nomination Agreement (the “Nomination Agreement”), pursuant to which Parent and Sponsor will have the following director nomination rights with respect to Holdco:

From the date of the Closing until the date on which Holdco holds its second general meeting of shareholders after the Closing Date (“Annual Meeting”) at which directors are to be elected, including any adjournment or postponement thereof (the “Sponsor Proposal Period”), the board of directors of Holdco shall consist of seven members and (i) Parent will have the right to propose for appointment four directors, with at least one of them having to qualify as an independent director and one or more of them who may be required by Parent to qualify as a Luxembourg tax resident (the “Parent Directors”); (ii) Sponsor will have the right to propose for appointment two directors (“Sponsor Directors”); and (iii) Parent and Sponsor will have the right to jointly propose for appointment one director who shall qualify as an industry expert and not be an affiliate of either Parent or Sponsor (“Industry Expert Independent Director”). After the Sponsor Proposal Period, Parent will have the right to propose for appointment five directors, with at least two of them having to qualify as independent directors (subject to independence requirements under applicable securities exchange rules that would require a greater number of independent directors) and one or more of them who may be required by Parent to qualify as a Luxembourg tax resident. Parent will have the right to propose for reappointment the Parent Directors and Sponsor will have the right to propose for reappointment the Sponsor Directors appointed within the Sponsor Proposal Period; provided that one Sponsor Director shall not have the right to serve as director past the second Annual Meeting after the Closing Date and the second Sponsor Director shall not have the right to serve as director past the third Annual Meeting after the Closing Date. Parent and Sponsor agreed to cooperate in facilitating any action or right described in or required by the Nomination Agreement, including by voting their respective Holdco Ordinary Shares. Other than reimbursement for reasonable and documented out-of-pocket expenses, only the Industry Expert Independent Director and one independent director who is a Parent Director shall be entitled to compensation as consideration for serving on the board of directors of Holdco and/or any committees. The Nomination Agreement will terminate, with respect to Parent, on the date on which it and/or its affiliates ceases to beneficially own, in the aggregate, at least 30% of the issued and outstanding Holdco Ordinary Shares, and with respect to Sponsor, after the Sponsor Proposal Period.

The foregoing description of the Nomination Agreement is qualified in its entirety by reference to the full text of the form of Nomination Agreement, a copy of which is included as Exhibit B to the Business Combination Agreement, filed as Exhibit 2.1 to this Current Report on Form 8-K and incorporated herein by reference.

Indemnification Letter

In connection with the Closing of the Proposed Business Combination, Parent, Holdco and the Company have agreed to cause the Restructuring further described on Section 8.18 of the Company Disclosure Schedule of the Business Combination Agreement and will enter into an agreement (the “Indemnification Letter”), pursuant to which Parent will indemnify Holdco, the Company and their respective subsidiaries (“Indemnitees”), including under the principles of transferee or successor liability but excluding any debts, losses, damages, fines, penalties, expenses and liabilities (“Liabilities”) reflected or reserved against in the Year-End Financial Statements or the Interim Financial Statement, for (i) Liabilities incurred by any Indemnitee and arising under or in connection with the ownership of the assets (other than entities, assets or rights to be transferred to the Company or a Company subsidiary pursuant to the Restructuring) of, or the operation of the business (other than the online business) by, Parent or any affiliate of Parent (excluding Holdco, Merger Sub, the Company and the Company subsidiaries) (“Non-Online Losses”); (ii) Liabilities incurred by any Indemnitee as a result of the consummation of the Restructuring, but only to the extent that such Liabilities would not have been incurred but for the Restructuring (“Restructuring Losses”); and (iii) Taxes of any Indemnitee, including Transfer Taxes, incurred by any Indemnitee as a result of the consummation of the Restructuring, but only to the extent that such Taxes would not have been incurred but for the Restructuring (such Taxes in (iii), together with Non-Online Losses and Restructuring Losses, “Losses”). The obligations of Parent to indemnify and hold harmless the Indemnitees against, or to contribute to, Losses pursuant to the Indemnification Letter shall remain in full force and effect until the date that is 24 months after the Closing Date. The aggregate amount of all Losses for which Parent shall be liable pursuant to the Indemnification Letter, including, for the avoidance of doubt, any legal or other expenses incurred by the Indemnitees and required to be paid by Parent in connection with investigating and defending any related action or claim, shall not exceed $10,000,000 in the aggregate.

| 8 |

The foregoing description of the Indemnification Letter is qualified in its entirety by reference to the full text of the form of Indemnification Letter, a copy of which is included as Exhibit C to the Business Combination Agreement, filed as Exhibit 2.1 to this Current Report on Form 8-K and incorporated herein by reference.

Warrant Amendment

In connection with the Closing of the Proposed Business Combination, DD3, Holdco and Continental Stock Transfer & Trust Company, as warrant agent, will enter into an Assignment, Assumption and Amendment Agreement (the “Warrant Amendment”), pursuant to which, as of the Merger Effective Time, (a) each DD3 warrant that is outstanding immediately prior to the Merger Effective Time will no longer represent a right to acquire one share of DD3 Common Stock and will instead represent the right to acquire one Holdco Ordinary Share under the same terms as set forth in the Existing Warrant Agreement (as defined in the Warrant Amendment) and (b) DD3 will assign to Holdco all of DD3’s right, title and interest in and to the Existing Warrant Agreement and Holdco will assume, and agree to pay, perform, satisfy and discharge in full, all of DD3’s liabilities and obligations under the Existing Warrant Agreement arising from and after the Merger Effective Time.

The foregoing description of the Warrant Amendment is qualified in its entirety by reference to the full text of the form of Warrant Amendment, a copy of which is included as Exhibit F to the Business Combination Agreement, filed as Exhibit 2.1 to this Current Report on Form 8-K and incorporated herein by reference.

Expenses Reimbursement Letter

In connection with the Closing of the Proposed Business Combination, DD3, Holdco, Parent and Sponsor will enter into that certain letter agreement (the “Expenses Reimbursement Letter”), pursuant to which (i) Sponsor will agree to reimburse Holdco, as future sole shareholder of the Surviving Corporation, for any SPAC Transaction Expenses payable by the Surviving Corporation in excess of the maximum SPAC Transaction Expenses required to be paid by the Surviving Corporation pursuant to Section 11.03 of the Business Combination Agreement; and (ii) Parent shall agree to reimburse Holdco, as shareholder of the Company and future sole shareholder of the Surviving Corporation, for any Company Transaction Expenses payable by the Surviving Corporation, Holdco, the Company or any Company Subsidiaries in excess of the maximum Company Transaction Expenses required to be paid by the Surviving Corporation pursuant to Section 11.03 of the Business Combination Agreement.

The foregoing description of the Expenses Reimbursement Letter is qualified in its entirety by reference to the full text of the form of Expenses Reimbursement Letter, a copy of which is included as Exhibit H to the Business Combination Agreement, filed as Exhibit 2.1 to this Current Report on Form 8-K and incorporated herein by reference.

Baron Support Agreement

Contemporaneously with the execution of the Business Combination Agreement, DD3 and Baron entered into the Baron Support Agreement, pursuant to which Baron committed to not exercise any of its Redemption Rights with respect to the Baron IPO Shares and agreed to certain transfer restrictions with respect to the Baron IPO Shares. The Baron Support Agreement and the obligations of Baron under the Baron Support Agreement will automatically terminate upon the earliest of the Closing of the Proposed Business Combination and the termination of the Business Combination Agreement in accordance with its terms.

The foregoing description of the Baron Support Agreement is qualified in its entirety by reference to the full text of the Baron Support Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

| 9 |

Exchange Agreement

Contemporaneously with the execution of the Business Combination Agreement, Holdco, the Company and Parent entered into the Exchange Agreement, pursuant to which Parent has agreed to implement the Exchange by contributing all of the issued and outstanding Company Ordinary Shares in exchange for a maximum amount, pursuant to the terms of the Business Combination Agreement (and reduced by the Holdco Ordinary Shares held by Parent immediately prior to the Exchange), of 30,000,000 Holdco Ordinary Shares valued at $300,000,000, on a cash-free and debt-free basis, and subject to a normalized level of working capital, of Holdco, the Company and the Company Subsidiaries, which valuation shall be confirmed in a valuation report to be prepared and issued at the Exchange Effective Time by a Luxembourg auditor (réviseur d'entreprises). Upon the closing of the Transactions, Parent is expected to maintain between 54% to 73% ownership of Holdco and the total proceeds to Codere Online are expected to range between $77 million and $192 million (prior to any expenses), in each case, depending on redemptions.

The foregoing description of the Exchange Agreement is qualified in its entirety by reference to the full text of the Exchange Agreement, a copy of which is filed as Exhibit 10.2 to this Current Report on Form 8-K and incorporated herein by reference.

Item 3.02. Unregistered Sales of Equity Securities.

Subscription Agreements

Contemporaneously with the execution of the Business Combination Agreement, DD3 entered into separate Subscription Agreements with certain Subscribers, in each case to which Holdco is also a party, pursuant to which DD3 has agreed to issue and sell, in private placements to close immediately prior to the Closing, (i) an aggregate of 500,000 shares of DD3 Common Stock, for an aggregate purchase price of $5,000,000, at a price of $10.00 per each share of DD3 Common Stock, to DD3 Capital, and (ii) an aggregate of 1,224,000 shares of DD3 Common Stock, for an aggregate purchase price of $12,240,000, at a price of $10.00 per each share of DD3 Common Stock, to Larrain (collectively, the “PIPE”), in each case which shares of DD3 Common Stock will become Holdco Ordinary Shares as a result of the Merger (the “PIPE Shares”). The purpose of the PIPE is to raise additional capital for use in connection with the Proposed Business Combination and to assist in meeting the minimum cash requirements provided in the Business Combination Agreement.

The closing of the PIPE (the “PIPE Closing”) is contingent upon the substantially concurrent consummation of the Proposed Business Combination. The PIPE Closing will occur on the date of, and immediately prior to, the consummation of the Proposed Business Combination. The PIPE Closing will be subject to customary conditions, including:

| ● | all representations and warranties of DD3 and the Subscriber contained in the relevant Subscription Agreement will be true and correct in all material respects (other than representations and warranties that are qualified as to materiality or Material Adverse Effect (as defined in the Subscription Agreements), which representations and warranties will be true in all respects) at and as of the PIPE Closing; and |

| ● | all conditions precedent to the Closing of the Proposed Business Combination, including the approval of DD3’s stockholders, will have been satisfied or waived. |

Pursuant to the Subscription Agreements, Holdco agreed that, within 30 calendar days after the Closing, Holdco will file with the SEC a registration statement registering the PIPE Shares received by the Subscribers in connection with the Proposed Business Combination (the “PIPE Registration Statement”), and Holdco shall use its commercially reasonable efforts to have the PIPE Registration Statement declared effective as soon as practicable after the filing thereof; provided, however, that Holdco’s obligations to include the PIPE Shares held by a Subscriber in the PIPE Registration Statement will be contingent upon the respective Subscriber furnishing in writing to Holdco such information regarding the Subscriber, PIPE Shares held by such Subscriber and the intended method of disposition of such shares as shall be reasonably requested by Holdco to effect the registration, and will execute such documents in connection with such registration as Holdco may reasonably request that are customary of a selling stockholder in similar situations.

Each Subscription Agreement will terminate upon the earlier to occur of (x) such date and time as the Business Combination Agreement is terminated in accordance with its terms without the Proposed Business Combination being consummated, (y) upon the mutual written agreement of each of the parties to the Subscription Agreement or (z) any of the conditions to the PIPE Closing are not satisfied or waived on or prior to the PIPE Closing and, as a result thereof, the transactions contemplated by the Subscription Agreement are not consummated at the PIPE Closing.

The foregoing description of the Subscription Agreements is qualified in its entirety by reference to the full text of the form of Subscription Agreement, a copy of which is included as Exhibit 10.3 to this Current Report on Form 8-K and incorporated herein by reference.

| 10 |

Forward Purchase Agreements

In connection with the Proposed Business Combination, (i) Baron has elected to purchase an aggregate of 2,500,000 shares of DD3 Common Stock for an aggregate purchase price of $25,000,000, at a price of $10.00 per each share of DD3 Common Stock, pursuant to the terms of the Baron Forward Purchase Agreement, and (ii) MG Partners has elected to purchase an aggregate of 2,500,000 shares of DD3 Common Stock for an aggregate purchase price of $25,000,000, at a price of $10.00 per each share of DD3 Common Stock, pursuant to the terms of the MG Partners Forward Purchase Agreement, in each case in a private placement to occur immediately prior to the Closing Date.

Pursuant to the Baron FPA Amendment and the MG Partners FPA Amendment, among other matters, (i) DD3 agreed not to enter into any agreement with any other investor or prospective investor on terms that are more favorable to such other investor or prospective investor than the terms provided to Baron or MG Partners, as applicable, and (ii) certain closing conditions were amended in part to align with the closing conditions in the Business Combination Agreement. For a detailed description of the initial terms and conditions of the Forward Purchase Agreements, see the final prospectus for DD3’s initial public offering filed with the SEC on December 10, 2020.

The foregoing description of the Forward Purchase Agreements is qualified in its entirety by reference to the full text of the Original Baron FPA and the Original MG Partners FPA, copies of which were initially filed as exhibits to DD3’s registration statement on Form S-1 (File No. 333-250212) and are incorporated by reference as Exhibits 10.4 and 10.5, respectively, to this Current Report on Form 8-K, and the Baron FPA Amendment and the MG Partners FPA Amendment, copies of which are included as Exhibits 10.6 and 10.7, respectively, to this Current Report on Form 8-K.

The securities to be issued pursuant to the Subscription Agreements and the Forward Purchase Agreements are not anticipated to be registered under the Securities Act in reliance on the exemption from registration provided in Section 4(a)(2) of the Securities Act and/or Regulation D promulgated thereunder.

Item 7.01. Regulation FD Disclosure.

On June 21, 2021, DD3 and Codere Online issued a joint press release announcing the execution of the Business Combination Agreement and that DD3 and Codere Online will hold a pre-recorded conference call regarding the Proposed Business Combination on June 22, 2021 at 8:30 a.m., Eastern Time. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference. Such exhibit and the information set forth therein is being furnished and shall not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act.

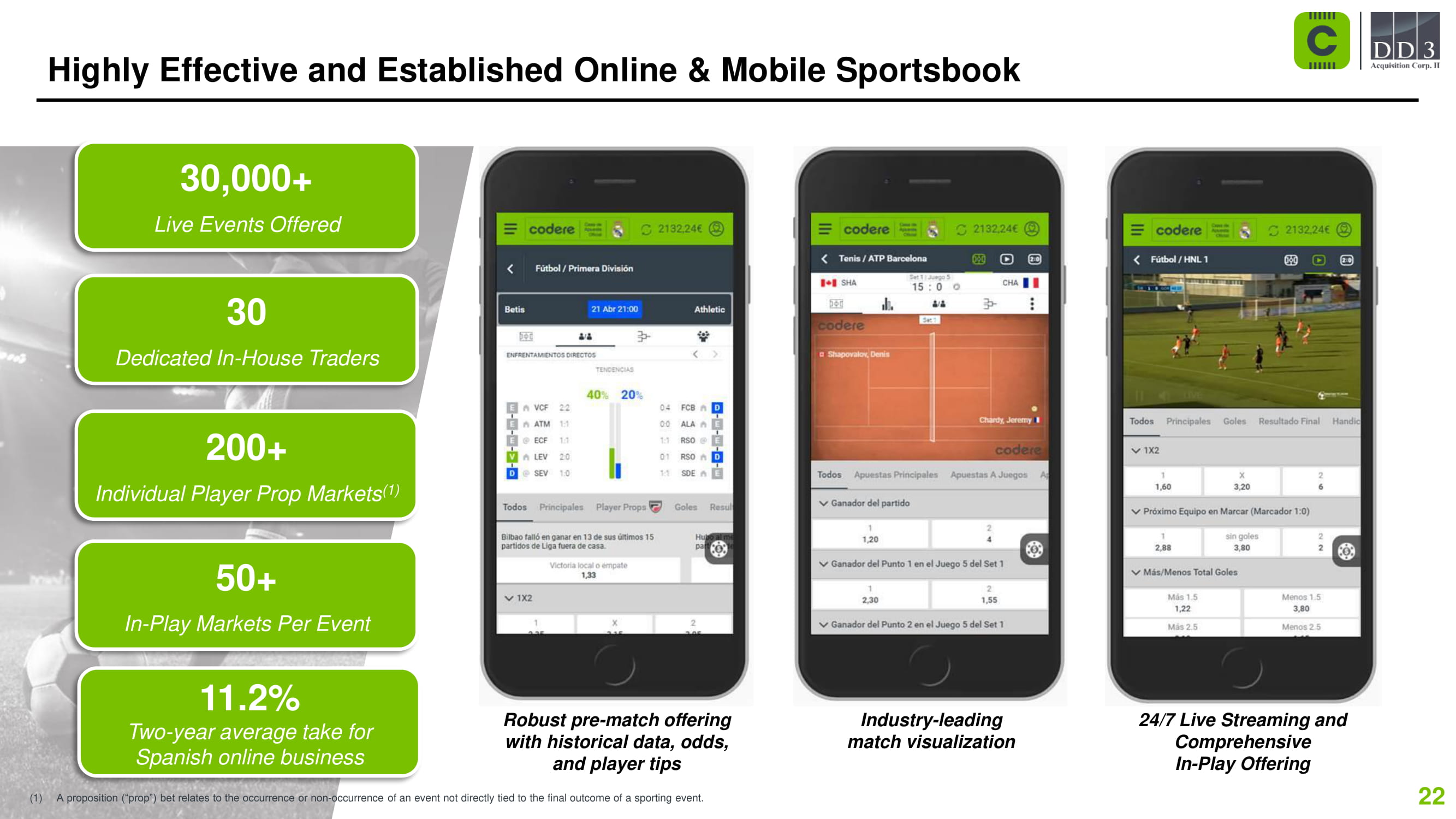

Attached hereto as Exhibit 99.2 and incorporated herein by reference is the form of presentation to be used by DD3 and Codere Online in presentations for certain of DD3’s stockholders and other persons. Such exhibit and the information set forth therein is being furnished and shall not be deemed to be filed for purposes of Section 18 of the Exchange Act, or otherwise be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act.

Additional Information and Where to Find It

In connection with the Proposed Business Combination, the Form F-4 is expected to be filed by Holdco with the SEC that will include a proxy statement to be distributed to stockholders of DD3 in connection with DD3’s solicitation of proxies from DD3’s stockholders in connection with the Proposed Business Combination and other matters to be described in the Form F-4, as well as a prospectus of Holdco relating to the offer of the securities to be issued in connection with the completion of the Proposed Business Combination. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE FORM F-4 AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. After the Form F-4 has been filed and declared effective, the definitive Proxy Statement/Prospectus will be mailed to DD3’s stockholders as of a record date to be established for voting on the Proposed Business Combination. Stockholders will also be able to obtain copies of such documents, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to Codere Online Luxembourg, S.A., 7 rue Robert Stümper, L-2557 Luxembourg, Grand Duchy of Luxembourg.

| 11 |

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Participants in Solicitation

DD3, the Company and Holdco and their respective directors, executive officers and other members of their management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of DD3’s stockholders in connection with the Proposed Business Combination. Information regarding the names, affiliations and interests of DD3’s directors and executive officers is set forth in the final prospectus for DD3’s initial public offering filed with the SEC on December 10, 2020, as well as in other documents DD3 has filed with the SEC. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies of DD3’s stockholders in connection with the Proposed Business Combination will be set forth in the Form F-4 when available. Information concerning the interests of DD3’s, the Company’s and Holdco’s participants in the solicitation, which may, in some cases, be different than those of DD3’s, the Company’s and Holdco’s equity holders generally, will be set forth in the Form F-4 when it becomes available. Shareholders, potential investors and other interested persons should read the Proxy Statement/Prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from the sources indicated above.

Non-Solicitation

This Current Report on Form 8-K is not a proxy statement and does not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Proposed Business Combination. This Current Report on Form 8-K also does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor will there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities will be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act or an exemption therefrom.

Forward-Looking Statements

This Current Report on Form 8-K includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact contained in this Current Report on Form 8-K are forward-looking statements. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. DD3’s and Codere Online’s actual results may differ from their expectations, estimates and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predict,” “likely,” “potential,” “continue,” and similar expressions (or the negative versions of such words or expressions) are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, DD3’s and Codere Online’s expectations with respect to market growth, future revenues, future performance, the anticipated financial impacts of the Proposed Business Combination, the satisfaction or waiver of the closing conditions to the Proposed Business Combination and the timing of the completion of the Proposed Business Combination.

These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially, and potentially adversely, from those expressed or implied in the forward-looking statements. Most of these factors are outside DD3’s and Codere Online’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the occurrence of any event, change, or other circumstances that could give rise to the termination of the Business Combination Agreement; (2) the outcome of any legal proceedings that may be instituted against DD3 and/or Codere Online following the announcement of the Business Combination Agreement and the transactions contemplated therein; (3) the inability to complete the Proposed Business Combination, including due to failure to obtain approval of DD3’s stockholders, certain regulatory approvals, or satisfy other closing conditions in the Business Combination Agreement; (4) the occurrence of any other event, change, or other circumstance that could cause the Proposed Business Combination to fail to close; (5) the impact of COVID-19 on Codere Online’s business and/or the ability of the parties to complete the Proposed Business Combination; (6) the inability to obtain and/or maintain the listing of Holdco’s ordinary shares or warrants on Nasdaq following the Proposed Business Combination; (7) the risk that the Proposed Business Combination disrupts current plans and operations as a result of the announcement and consummation of the Proposed Business Combination; (8) the ability to recognize the anticipated benefits of the Proposed Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, and retain its key employees; (9) costs related to the Proposed Business Combination; (10) changes in applicable laws or regulations; (11) the amount of redemptions by DD3’s stockholders in connection with the Proposed Business Combination; and (12) the possibility that DD3 or Codere Online may be adversely affected by other economic, business and/or competitive factors. The foregoing list of factors is not exclusive. Additional information concerning certain of these and other risk factors is contained in DD3’s most recent filings with the SEC and will be contained in the Form F-4, including the Proxy Statement/Prospectus expected to be filed in connection with the Proposed Business Combination. All subsequent written and oral forward-looking statements concerning DD3, the Company or Holdco, the Proposed Business Combination or other matters and attributable to DD3 or Codere Online or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Each of DD3 and Codere Online expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in their expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based, except as required by law.

| 12 |

Item 9.01. Financial Statements and Exhibits.

| (d) | Exhibits. |

| 13 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| DD3 Acquisition Corp. ii | |||

| By: | /s/ Martin Werner | ||

| Name: | Martin Werner | ||

| Title: | Chief Executive Officer | ||

Date: June 22, 2021

| 14 |

Exhibit 2.1

Execution Version

BUSINESS COMBINATION AGREEMENT

by and among

DD3 ACQUISITION CORP. II,

CODERE NEWCO S.A.U.,

SERVICIOS DE JUEGO ONLINE S.A.U.,

CODERE ONLINE LUXEMBOURG, S.A.

and

CODERE ONLINE U.S. CORP.

Dated as of June 21, 2021

TABLE OF CONTENTS

| Page | ||

| ARTICLE I DEFINITIONS | 4 | |

| Section 1.01 | Certain Definitions | 4 |

| Section 1.02 | Further Definitions | 20 |

| Section 1.03 | Construction | 24 |

| ARTICLE II PRE-MERGER; MERGER | 24 | |

| Section 2.01 | Pre-Merger Actions | 24 |

| Section 2.02 | The Merger | 25 |

| Section 2.03 | Closing; Merger Effective Time | 25 |

| Section 2.04 | Effect of the Merger | 26 |

| Section 2.05 | Certificate of Incorporation; Organizational Documents | 26 |

| Section 2.06 | Directors and Officers | 26 |

| Section 2.07 | Tax Treatment of the Exchange and the Merger | 26 |

| Section 2.08 | Withholding | 27 |

| Section 2.09 | Merger Deliverables | 27 |

| Section 2.10 | Redeemable Shares | 27 |

| ARTICLE III EXCHANGE | 27 | |

| Section 3.01 | Exchange Consideration | 27 |

| Section 3.02 | Conversion of Securities | 28 |

| Section 3.03 | Exchange of Certificates | 29 |

| Section 3.04 | Stock Transfer Books | 31 |

| Section 3.05 | SPAC Warrants | 31 |

| ARTICLE IV REPRESENTATIONS AND WARRANTIES OF PARENT AND THE COMPANY | 31 | |

| Section 4.01 | Organization and Qualification; Subsidiaries; Insolvency and Spanish Equity Ratios | 31 |

| Section 4.02 | Organizational Documents, Books and Records; Directors | 33 |

| Section 4.03 | Capitalization | 33 |

| Section 4.04 | Authority Relative to this Agreement | 34 |

| Section 4.05 | No Conflict; Required Filings and Consents | 35 |

| Section 4.06 | Permits; Compliance | 36 |

| Section 4.07 | Financial Statements | 36 |

| Section 4.08 | Absence of Certain Changes or Events | 38 |

| Section 4.09 | Absence of Litigation | 38 |

| Section 4.10 | Employee Benefit Plans | 39 |

| Section 4.11 | Labor and Employment Matters | 40 |

| Section 4.12 | Real Property; Title to Assets | 43 |

| Section 4.13 | Intellectual Property | 44 |

| Section 4.14 | Taxes | 48 |

| Section 4.15 | Material Contracts | 50 |

| Section 4.16 | Insurance | 53 |

i

| Section 4.17 | Board Approval; Vote Required | 54 |

| Section 4.18 | Certain Business Practices | 54 |

| Section 4.19 | Related Party Transactions Interested Party Transactions | 55 |

| Section 4.20 | Exchange Act | 56 |

| Section 4.21 | Brokers | 56 |

| Section 4.22 | Sanctions, Import Control, and Export Control Laws | 56 |

| Section 4.23 | Exchange Agreement | 56 |

| Section 4.24 | Exclusivity of Representations and Warranties | 57 |

| ARTICLE V REPRESENTATIONS AND WARRANTIES OF SPAC | 57 | |

| Section 5.01 | Corporate Organization | 57 |

| Section 5.02 | SPAC Organizational Documents | 58 |

| Section 5.03 | Capitalization | 58 |

| Section 5.04 | Authority Relative to this Agreement | 59 |

| Section 5.05 | No Conflict; Required Filings and Consents | 59 |

| Section 5.06 | Compliance | 60 |

| Section 5.07 | SEC Filings; Financial Statements; Sarbanes-Oxley | 60 |

| Section 5.08 | Absence of Certain Changes or Events | 62 |

| Section 5.09 | Absence of Litigation | 62 |

| Section 5.10 | Board Approval; Vote Required | 62 |

| Section 5.11 | Brokers | 62 |

| Section 5.12 | SPAC Trust Fund | 63 |

| Section 5.13 | Employees | 63 |

| Section 5.14 | Taxes | 64 |

| Section 5.15 | Listing | 65 |

| Section 5.16 | Prior Business Operation | 66 |

| Section 5.17 | SPAC Material Contracts | 66 |

| Section 5.18 | Investment Company Act; JOBS Act | 66 |

| Section 5.19 | Proxy Statement/Prospectus and Registration Statement | 67 |

| Section 5.20 | SPAC’s Investigation and Reliance | 67 |

| Section 5.21 | Baron Investment | 67 |

| Section 5.22 | MG Investment | 67 |

| Section 5.23 | SPAC’s Related Party Transactions | 67 |

| Section 5.24 | Sanctions, Import Control, and Export Control Laws | 67 |

| ARTICLE VI REPRESENTATIONS AND WARRANTIES OF HOLDCO AND MERGER SUB | 68 | |

| Section 6.01 | Organization | 68 |

| Section 6.02 | Organization Documents | 68 |

| Section 6.03 | Capitalization | 68 |

| Section 6.04 | Authority Relative to this Agreement | 69 |

| Section 6.05 | No Conflict; Required Filings and Consents | 70 |

| Section 6.06 | Compliance | 70 |

| Section 6.07 | Board Approval; Vote Required | 70 |

| Section 6.08 | No Prior Operations of Holdco or Merger Sub; Post-Closing Operations | 71 |

| Section 6.09 | Brokers | 71 |

| Section 6.10 | Proxy Statement/Prospectus and Registration Statement | 71 |

| Section 6.11 | Tax Matters | 71 |

ii

| ARTICLE VII CONDUCT OF BUSINESS PENDING THE MERGER | 72 | |

| Section 7.01 | Conduct of Business by the Company, Holdco and Merger Sub Pending the Merger | 72 |

| Section 7.02 | Conduct of Business by SPAC Pending the Merger | 77 |

| Section 7.03 | Claims Against Trust Account | 79 |

| Section 7.04 | SPAC Public Filings | 79 |

| ARTICLE VIII ADDITIONAL AGREEMENTS | 80 | |

| Section 8.01 | Proxy Statement; Registration Statement | 80 |

| Section 8.02 | SPAC Stockholders’ Meetings | 82 |

| Section 8.03 | Access to Information; Confidentiality | 82 |

| Section 8.04 | Directors’ and Officers’ Indemnification | 83 |

| Section 8.05 | Notification of Certain Matters | 84 |

| Section 8.06 | Further Action; Reasonable Best Efforts | 84 |

| Section 8.07 | Public Announcements | 85 |

| Section 8.08 | Tax Matters | 85 |

| Section 8.09 | Stock Exchange Listing | 87 |

| Section 8.10 | Delisting and Deregistration | 87 |

| Section 8.11 | Antitrust | 87 |

| Section 8.12 | PCAOB Financials | 88 |

| Section 8.13 | Subsequent Unaudited Company Financials | 88 |

| Section 8.14 | Investments; Cooperation | 89 |

| Section 8.15 | Exclusivity | 89 |

| Section 8.16 | Trust Account | 90 |

| Section 8.17 | Holdco Approvals | 90 |

| Section 8.18 | Restructuring | 90 |

| Section 8.19 | Company Debt. | 91 |

| Section 8.20 | Section 16 Matters. | 91 |

| ARTICLE IX CONDITIONS TO THE MERGER | 92 | |

| Section 9.01 | Conditions to the Obligations of Each Party | 92 |

| Section 9.02 | Conditions to the Obligations of SPAC | 93 |

| Section 9.03 | Conditions to the Obligations of the Company | 94 |

| ARTICLE X TERMINATION, AMENDMENT AND WAIVER | 96 | |

| Section 10.01 | Termination | 96 |

| Section 10.02 | Notice of Termination; Effect of Termination | 97 |

| Section 10.03 | Amendment | 97 |

| Section 10.04 | Waiver | 97 |

| ARTICLE XI GENERAL PROVISIONS | 98 | |

| Section 11.01 | Notices | 98 |

| Section 11.02 | Non-Survival of Representations, Warranties and Covenants | 99 |

| Section 11.03 | Expenses | 99 |

| Section 11.04 | Severability | 100 |

| Section 11.05 | Entire Agreement; Assignment | 101 |

| Section 11.06 | Parties in Interest | 101 |

| Section 11.07 | Governing Law | 101 |

| Section 11.08 | Waiver of Jury Trial | 101 |

| Section 11.09 | Headings | 102 |

| Section 11.10 | Counterparts | 102 |

| Section 11.11 | Specific Performance | 102 |

| Section 11.12 | Drafting of the Agreement | 102 |

iii

EXHIBITS

| EXHIBIT A | Registration Rights and Lock-Up Agreement |

| EXHIBIT B | Nomination Agreement |

| EXHIBIT C | Indemnification Letter |

| EXHIBIT D | [Reserved] |

| EXHIBIT E | Directors and Officers of Holdco and the Surviving Corporation |

| EXHIBIT F | SPAC Warrant Amendment |

| EXHIBIT G | Redemption Agreement |

| EXHIBIT H | Expenses Reimbursement Letter |

SCHEDULES

| SCHEDULE A | Company Knowledge Parties |

iv

This BUSINESS COMBINATION AGREEMENT is made and entered into as of June 21, 2021 (this “Agreement”), by and among DD3 Acquisition Corp. II, a Delaware corporation (“SPAC”), Codere Newco, S.A.U., a corporation (sociedad anónima unipersonal) registered and incorporated under the laws of Spain and with its registered office at Avenida de Bruselas 26, 28108, Alcobendas (Madrid, Spain) (“Parent”), Servicios de Juego Online S.A.U., a corporation (sociedad anónima unipersonal) registered and incorporated under the laws of Spain and with its registered office at Avenida de Bruselas 26, 28108, Alcobendas (Madrid, Spain) and whose sole shareholder is Parent (the “Company”), Codere Online Luxembourg, S.A., a public limited liability company (société anonyme) governed by the laws of the Grand Duchy of Luxembourg with its registered office at 7 rue Robert Stümper, L-2557 Luxembourg, Grand Duchy of Luxembourg whose sole shareholder is Parent and is registered with the Luxembourg Trade and Companies Register (Registre de Commerce et des Sociétés, Luxembourg) (“Holdco”), and Codere Online U.S. Corp., a Delaware corporation (“Merger Sub”) whose sole stockholder is Holdco. Each of SPAC, Parent, the Company, Holdco and Merger Sub shall individually be referred to herein as a “Party” and, collectively, the “Parties”.

WHEREAS, SPAC is a special purpose acquisition company incorporated under the laws of Delaware for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, recapitalization, reorganization or other similar business combination with one or more businesses or entities;

WHEREAS, each of the Company and Holdco is a direct wholly owned subsidiary of Parent;

WHEREAS, Merger Sub is a direct wholly owned subsidiary of Holdco;

WHEREAS, each of Holdco and Merger Sub is an entity newly formed for the purposes of the transactions proposed herein;

WHEREAS, upon the terms and subject to the conditions of this Agreement and that certain Contribution and Exchange Agreement dated as of the date hereof (the “Exchange Agreement”), by and among Holdco, the Company and Parent, and in accordance with the Luxembourg Law of 10 August 1915 on commercial companies (as amended from time to time, the “1915 Law”), and the General Corporation Law of the State of Delaware (the “DGCL”), SPAC, Parent, Holdco, Merger Sub and the Company will enter into a business combination transaction pursuant to which, among other things, (a) pursuant to the Exchange Agreement, Parent, effective on the Exchange Effective Time, will contribute its Company Ordinary Shares to Holdco in exchange for additional ordinary shares of Holdco (“Holdco Ordinary Shares”), to be subscribed for by Parent (such contribution and exchange of Company Ordinary Shares for Holdco Ordinary Shares, collectively, the “Exchange”), (b) as a result of the Exchange, the Company will become a wholly-owned subsidiary of Holdco and Parent will continue to hold all the issued and outstanding Holdco Ordinary Shares and (c) not earlier than one Business Day following the consummation of the Exchange, Merger Sub will merge with and into SPAC, with SPAC surviving such merger and becoming a direct wholly-owned subsidiary of Holdco (the “Merger”) and, in connection with the Merger, all shares of SPAC Class A Common Stock issued and outstanding immediately prior to the Merger Effective Time, but after the SPAC Class B Conversion, shall be contributed to Holdco in exchange for the Merger Consideration in the form of Holdco Ordinary Shares pursuant to a share capital increase of Holdco, as set forth in this Agreement;

WHEREAS, in connection with the Exchange and the Merger, the Parties desire for Holdco to register with the SEC to become a publicly traded company;

1

WHEREAS, the board of directors of Parent and its sole shareholder have unanimously (a) determined that the Transactions are in the best interests of Parent and (b) approved this Agreement, the Ancillary Agreements to which Parent is or will be a party, and the Transactions;

WHEREAS, the directors of the Company (the “Company Directors”) have unanimously (a) determined that the Transactions are in the best interests of the Company and (b) approved this Agreement, the Ancillary Agreements to which the Company is or will be a party, and the Transactions;

WHEREAS, the board of directors of SPAC (the “SPAC Board”) has unanimously (a) determined that the Merger and the other Transactions are fair to, and in the best interests of, SPAC and its stockholders (the “SPAC Stockholders”), (b) adopted a resolution approving this Agreement and the Ancillary Agreements to which SPAC is or will be a party and declaring their advisability and approving the Merger and the other Transactions, and (c) recommended the approval and adoption of this Agreement, the Ancillary Agreements to which SPAC is a party, and the Transactions, by the SPAC Stockholders;