Form 8-K Customers Bancorp, Inc. For: Jan 24

Exhibit 99.1

Customers Bancorp, Inc.

701 Reading Avenue

West Reading, PA 19611

Contacts:

Jay Sidhu, Chairman & CEO 610-935-8693

Sam Sidhu, President 484-744-8985

Carla Leibold, CFO 484-923-8802

Jay Sidhu, Chairman & CEO 610-935-8693

Sam Sidhu, President 484-744-8985

Carla Leibold, CFO 484-923-8802

Customers Bancorp Reports Record Results for Full Year 2021

Record Full Year 2021 Net Income of $300.1 million, or $8.91 Per Diluted Share, Up 153% Over Full Year 2020

Record Deposit Growth of $5.5 billion, Up 48% Year-Over-Year

Q4 2021 Net Income of $98.6 million, or $2.87 Per Diluted Share, Up 87% Over Q4 2020

Q4 2021 ROAA of 2.08% and ROCE of 33.2%

Q4 2021 Loan Growth of $1.0 billion (Excluding PPP Loans and Loans to Mortgage Companies), Up 13% Over Q3 2021

Q4 2021 Tangible Book Value Increased 33% Over Q4 2020

•Full year 2021 net income available to common shareholders was $300.1 million, or $8.91 per diluted share, up 153% over full year 2020.

•Full year 2021 core earnings (a non-GAAP measure) were $343.6 million, or $10.20 per diluted share, up 187% over full year 2020.

•Full year 2021 core earnings (excluding Paycheck Protection Program ("PPP") loans) (a non-GAAP measure) were $148.5 million, or $4.41 per diluted share, up 90% over full year 2020.

•Q4 2021 net income available to common shareholders was $98.6 million, or $2.87 per diluted share, up 87% over Q4 2020.

•Q4 2021 core earnings (a non-GAAP measure) were $100.1 million, or $2.92 per diluted share, up 83% over Q4 2020.

•Q4 2021 ROAA was 2.08% and Core ROAA (a non-GAAP measure) was 2.11%. Q4 2020 ROAA was 1.23% and Core ROAA (a non-GAAP measure) was 1.26%.

•Q4 2021 ROCE was 33.2% and Core ROCE (a non-GAAP measure) was 33.7%. Q4 2020 ROCE was 24.3% and Core ROCE (a non-GAAP measure) was 25.1%.

•Adjusted pre-tax pre-provision net income (a non-GAAP measure) for Q4 2021 was $129.3 million, an increase of 66% over Q4 2020. Q4 2021 adjusted pre-tax

1

pre-provision ROAA (a non-GAAP measure) was 2.67% compared to 1.70% for Q4 2020.

•Q4 2021 commercial and industrial (C&I) loan growth of $742.3 million (up 29%), multifamily loan growth of $99.1 million (up 7%), and consumer loan growth of $207.5 million (up 11%) over Q3 2021.

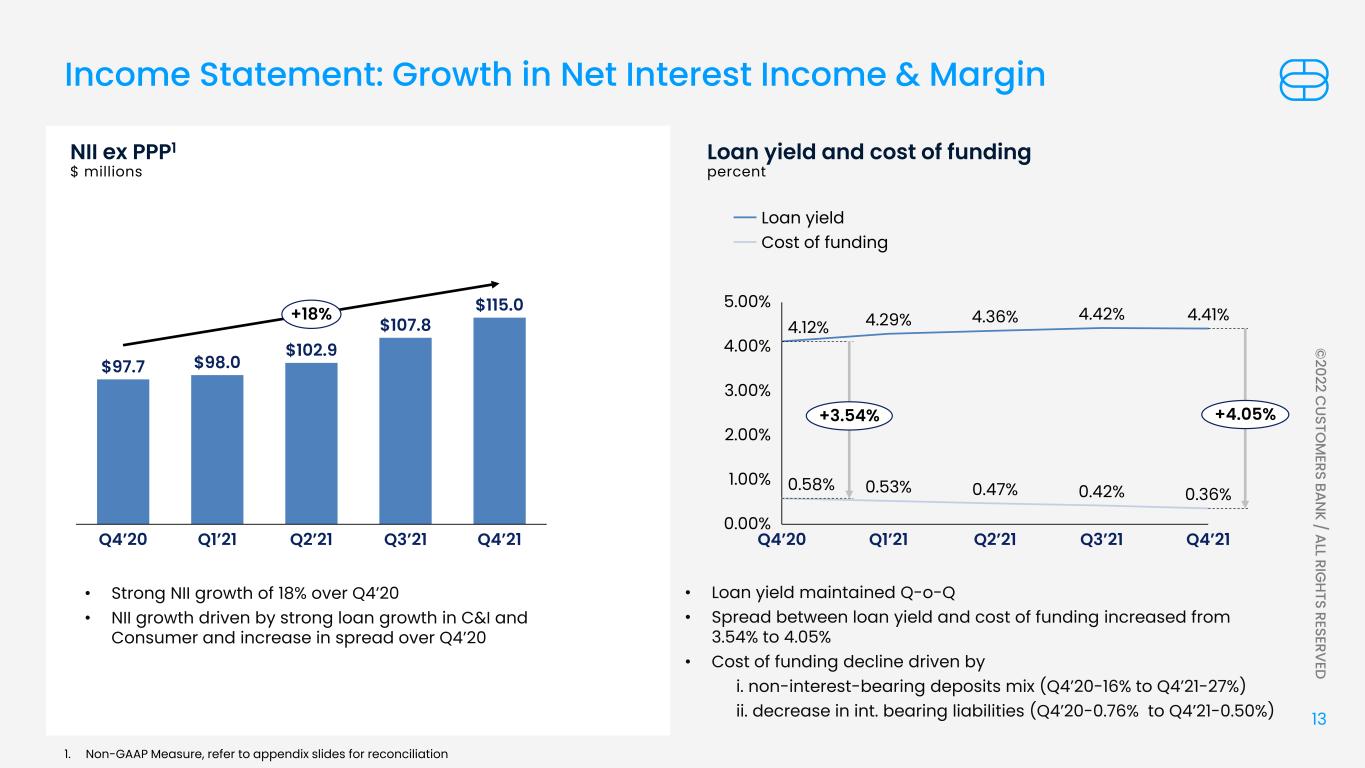

•Net interest margin (a non-GAAP measure) was 4.14% for Q4 2021 and 3.70% for full year 2021. Net interest margin, excluding the impact of PPP loans (a non-GAAP measure) was 3.12% for Q4 2021 and 3.16% for full year 2021. Significant excess cash balances further negatively impacted net interest margin in Q4 2021 by approximately 6 basis points.

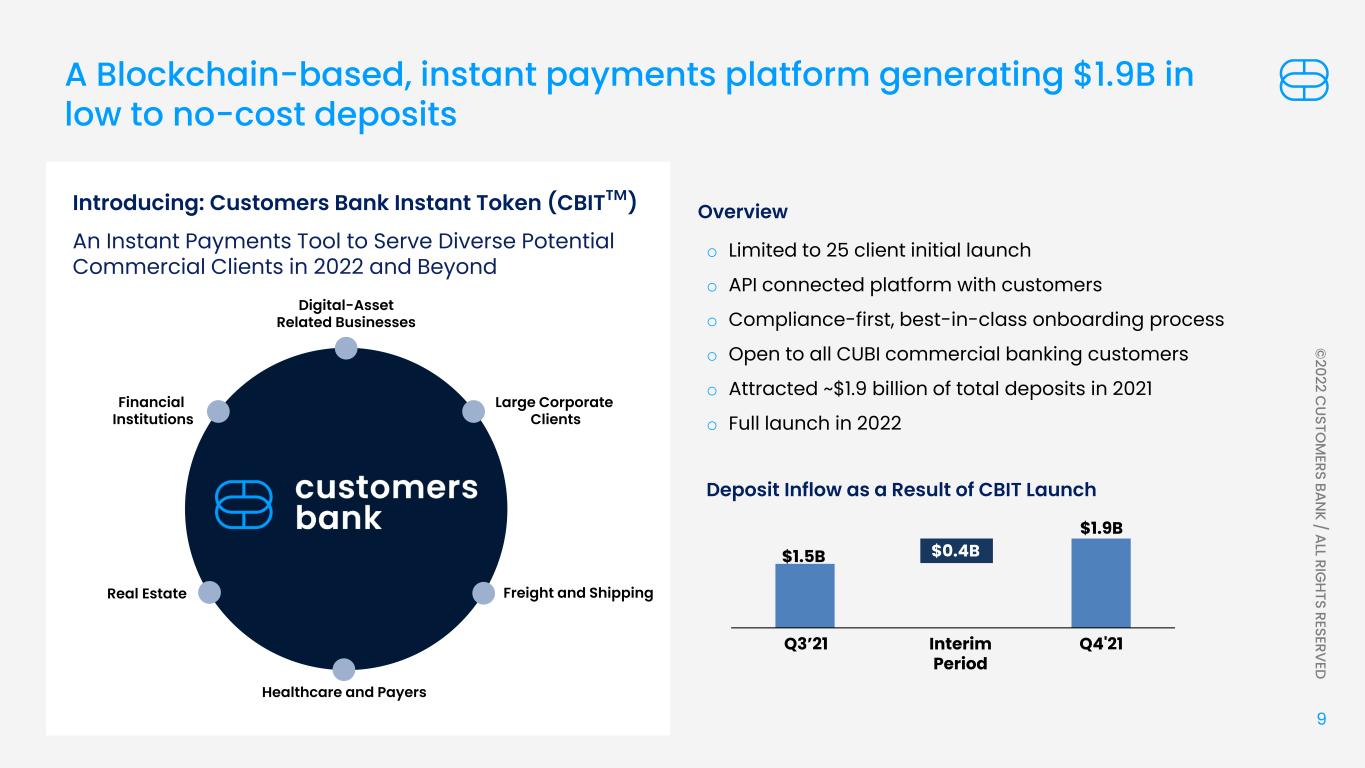

•Digital asset-related deposits increased by $400 million, or 27%, in Q4 2021, bringing total CBIT-related deposits to $1.9 billion by December 31, 2021.

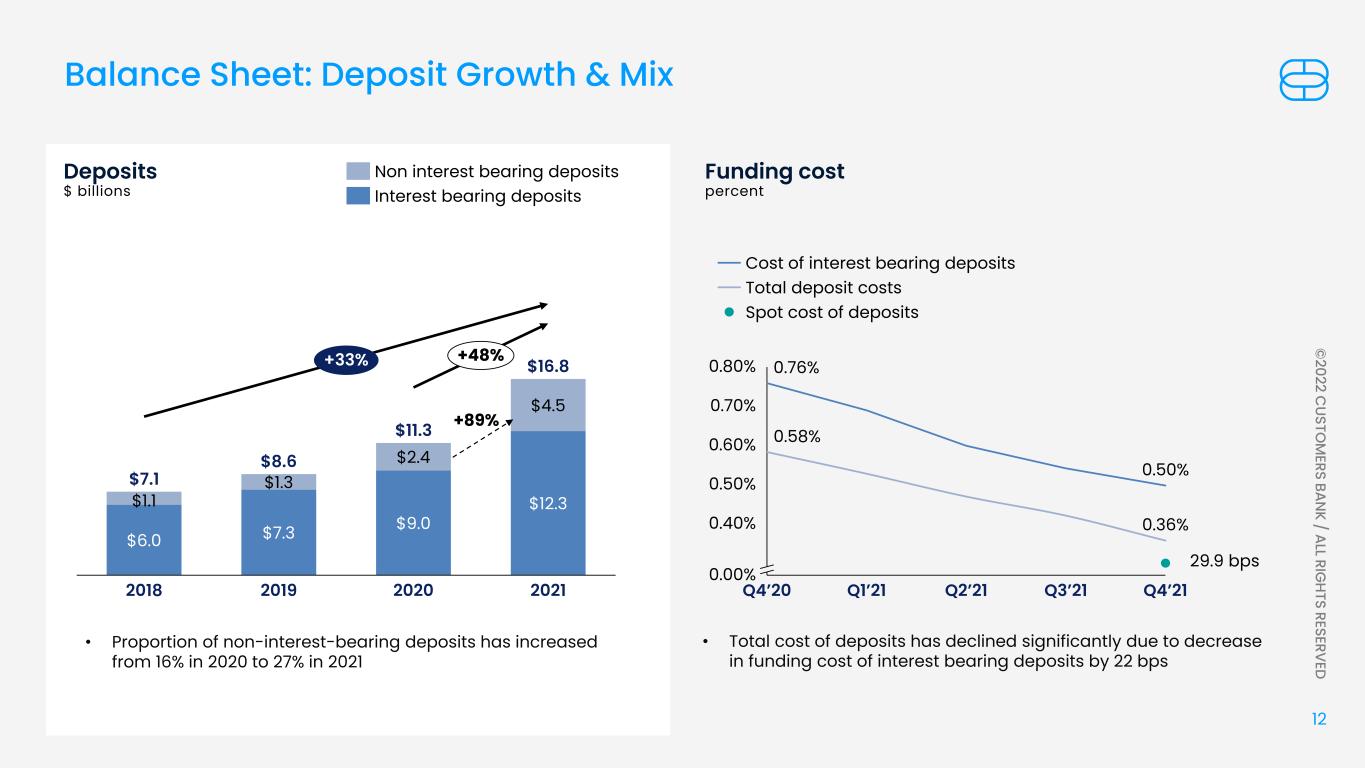

•Total deposits increased $5.5 billion, or 48.3% year-over-year, which included a $6.2 billion, or 130.9%, increase in demand deposits. The total cost of deposits dropped 22 basis points from the year-ago quarter.

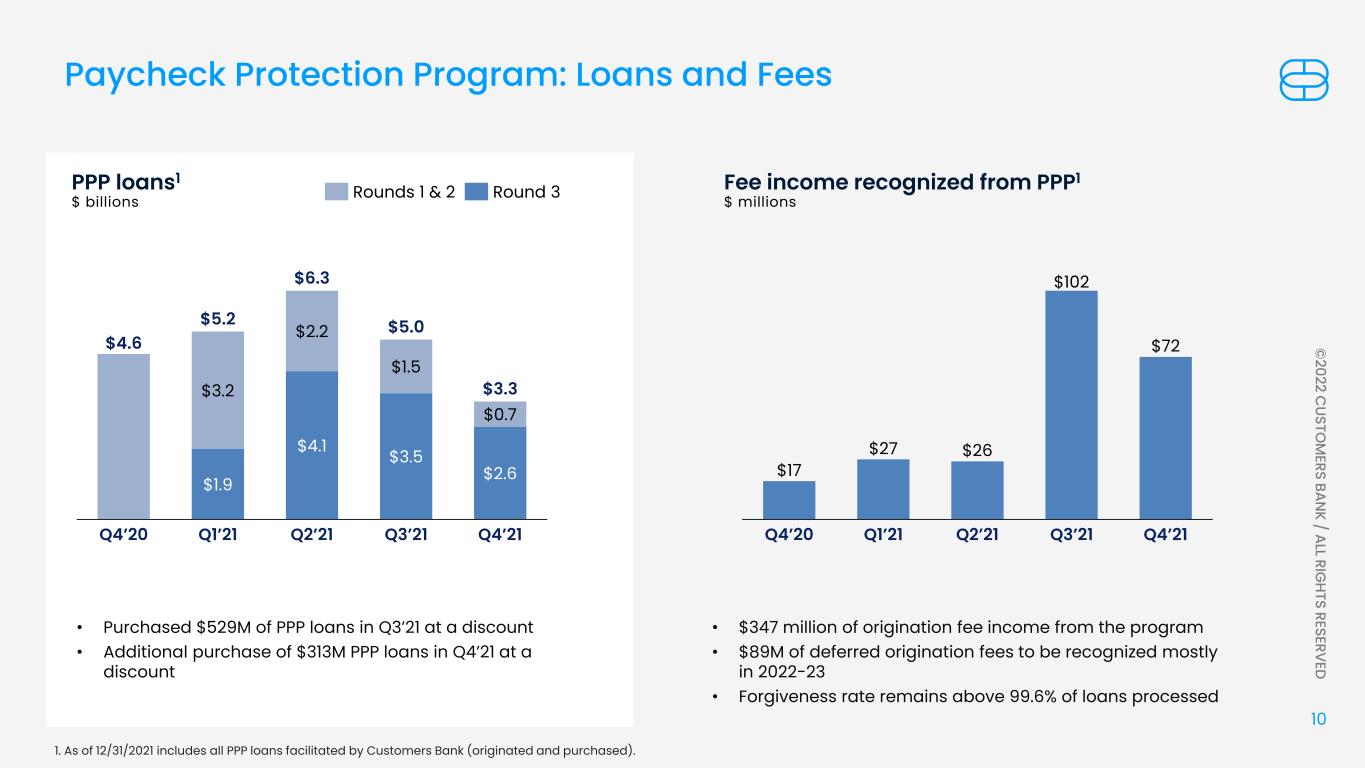

•Funded, directly or indirectly, about 358,000 PPP loans for $10.3 billion in total.

•Purchased $313 million PPP loan portfolio in December 2021 at a discount further increasing deferred revenue recognition in future quarters.

•Technology-led loans sales in Consumer and SBA Groups resulted in gains realized from the sales of consumer and SBA loans of $0.7 million and $1.8 million, respectively, in Q4 2021, bringing full year 2021 gains realized from the sales of consumer and SBA loans to $5.2 million and $6.2 million, respectively, approximately 14% higher than targeted total gains of $10 million for full year 2021.

•Repurchased 527,789 common shares in Q4 2021 at an average price of $52.41 pursuant to a one-year common stock repurchase program to repurchase up to 3.2 million shares of common stock that was adopted in Q3 2021.

•Q4 2021 efficiency ratio was 38.70% compared to 43.56% for Q4 2020. Q4 2021 core efficiency ratio was 38.73% compared to 42.89% in Q4 2020 (non-GAAP measures).

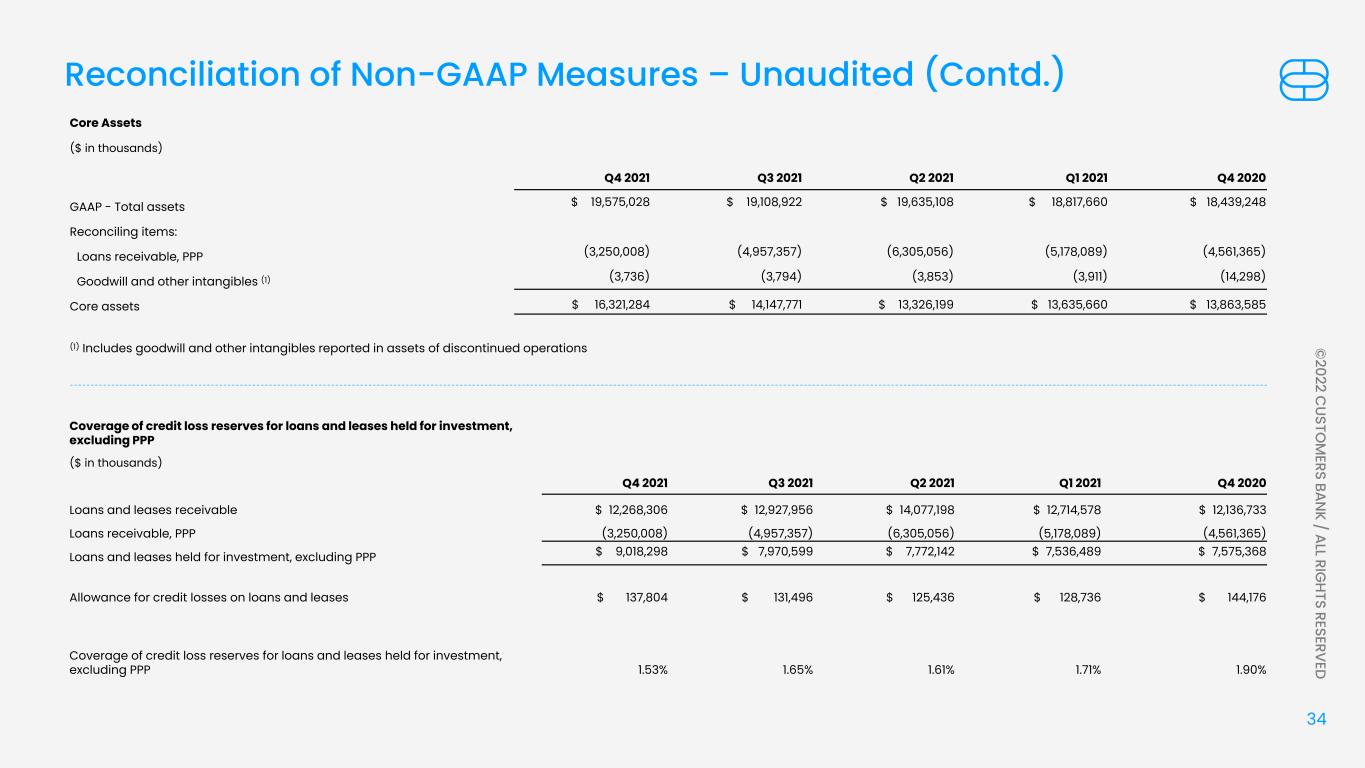

•Q4 2021 provision for credit losses on loans and leases was $13.9 million compared to $13.2 million in Q3 2021. At December 31, 2021, the coverage of credit loss reserves for loans and leases held for investment, excluding PPP loans (a non-GAAP measure), was 1.53% compared to 1.65% at September 30, 2021.

•Non-performing assets were 0.25% of total assets at December 31, 2021 compared to 0.39% at December 31, 2020. Allowance for credit losses equaled 278% of non-performing loans at December 31, 2021, compared to 204% at December 31, 2020.

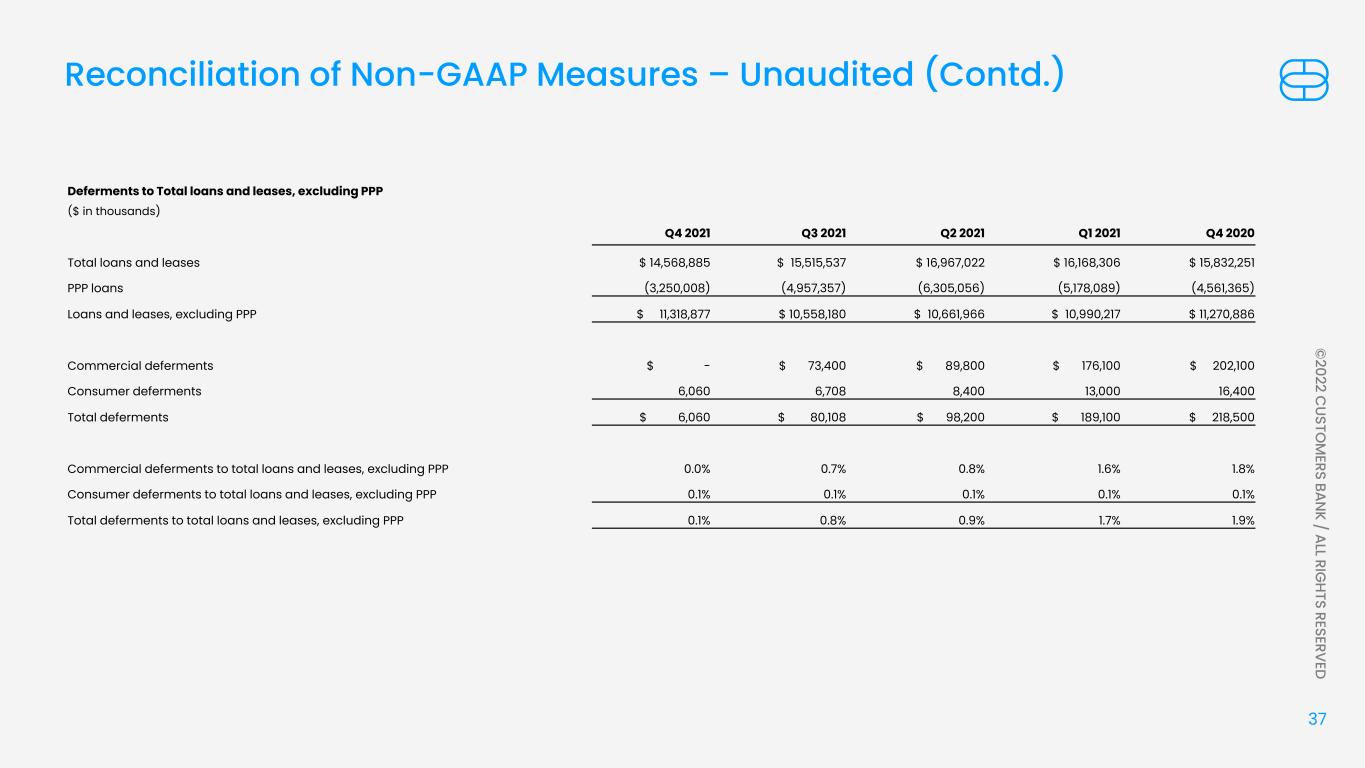

•All commercial loan deferments became current by December 31, 2021, down from a peak of $1.2 billion in July 2020.

2

•Well positioned for strong core sustainable growth in 2022 and 2023 and project core earnings (excluding PPP) between $4.75 - $5.00 in 2022 and well over $6.00 in 2023.

West Reading, PA, January 24, 2022 - Customers Bancorp, Inc. (NYSE: CUBI), the parent company of Customers Bank (collectively "Customers" or "CUBI"), today reported fourth quarter 2021 ("Q4 2021") net income to common shareholders of $98.6 million, or $2.87 per diluted share, resulting in record full year 2021 ("FY 2021") net income to common shareholders of $300.1 million, or $8.91 per diluted share. Q4 2021 core earnings (a non-GAAP measure) was $100.1 million, or $2.92 per diluted share, resulting in record FY 2021 core earnings (a non-GAAP measure) of $343.6 million, or $10.20 per diluted share. Adjusted pre-tax pre-provision net income was $129.3 million for Q4 2021 and $469.8 million for FY 2021 (non-GAAP measures). Net interest margin, tax equivalent ("NIM") was 4.14% for Q4 2021 and 3.70% for FY 2021 (non-GAAP measures). Excluding PPP, NIM was 3.12% for Q4 2021 and 3.16% for FY 2021 (non-GAAP measures).

“2021 was a remarkable year for our company and we could not be prouder of our team members who executed superbly to achieve all of our exceptional accomplishments,” remarked Customers Bancorp Chairman and CEO, Jay Sidhu. “We made over $300 million in net income after taxes, provided our shareholders with approximately $73 million in BMTX stock upon divestiture of BankMobile, helped save over an estimated 1 million American jobs by supporting about 350,000 small businesses across the country through PPP program funding of over $10 billion. In October 2021, we launched a blockchain-based instant payments token that will serve a growing array of B2B clients who want the benefit of instant payments, and generated close to $2 billion of low-to-no cost core deposits in only 90 days. Following a successful soft launch in Q4 2021, we went into full launch in January 2022. Our organic growth rates remain remarkable, with our C&I loans growing 45% year-over-year and non-interest bearing deposits growing 89%. This combined with our market expansion plans, new teams and new lending verticals, and strong pipeline leave us very well positioned to support future growth. We are very excited and optimistic about our future,” Mr. Sidhu continued.

3

Paycheck Protection Program (PPP)

We funded, either directly or indirectly, about 256,000 PPP loans totaling $5.2 billion in 2021, bringing total PPP loans funded to approximately 358,000 and $10.3 billion. We also earned close to $350 million of deferred origination fees from the SBA through the PPP loans, which is significantly accretive to our earnings and capital levels as these loans are forgiven by the government. Through year-end 2021, we recognized about $260 million of these fees in earnings and expect most of the remaining $90 million to be recognized over the next two to three quarters.

Launch of Customers Bank Instant Token (CBITTM)

“We were thrilled to announce that CBIT on the TassatPayTM payments platform went live in October 2021. We received $1.5 billion in new non-interest bearing demand deposits at September 30, 2021 in anticipation of the soft launch, and added $400 million of demand deposits in Q4 2021. We not only developed and implemented this new technology partnership in record time, but did so following a very thorough strategic initiative process," commented Mr. Sidhu. "Following a successful soft launch in Q4 2021, we are pleased to report a full launch of CBIT in January 2022. We believe our technology, compliance and customer service and support systems are among the best in the country," concluded Mr. Sidhu.

As of December 31, 2021, $1.9 billion in core low-to-no cost demand deposits have been attracted to the Bank through this system. We expect these deposits to grow significantly in 2022, giving us an opportunity to transform our deposits into high quality, low-to-no cost, stable and growing deposit franchise.

Key Balance Sheet Trends

Commercial and industrial loans and leases increased $1.0 billion, or 45% year-over-year, to $3.3 billion, consumer installment loans increased $509.1 million, or 41% year-over-year, to $1.7 billion, commercial real estate owner occupied loans increased $82.6 million, or 14% year-over-year, to $654.9 million and construction loans increased $58.1 million, or 41% year-over-year, to $199.0 million. These increases in loans and leases were partially offset by decreases in multi-family loans of $275.0 million to $1.5 billion and commercial real estate non-owner occupied loans of $92.6 million to $1.1 billion. “Looking ahead, we see continued growth in core C&I, multi-family and consumer loans offsetting the continued expected seasonal and yield curve related decreases in loans to mortgage companies," stated Mr. Sidhu.

Total loans and leases, including PPP loans, decreased $1.3 billion, or 8.0%, to $14.6 billion at December 31, 2021 compared to the year-ago period. As expected, commercial loans to mortgage companies declined $1.3 billion to $2.4 billion compared to the year-ago period. PPP loans declined $1.3 billion to $3.3 billion at December 31, 2021 compared to the year-ago period, primarily driven by $6.5 billion in forgiveness, repayments and associated net deferred fees from the new round and earlier rounds of PPP loans, offset by current year originations and purchases.

4

Excluding PPP loans and commercial loans to mortgage companies, total loans and leases increased $1.3 billion, or 17.6%, as the loan mix continued to improve year-over-year.

Total deposits increased $5.5 billion, or 48.3%, to $16.8 billion at December 31, 2021 compared to the year-ago period. Total demand deposits increased $6.2 billion, or 130.9%, to $10.9 billion. These increases were offset, in part, by decreases in savings deposits of $341.5 million, or 26.0%, to $1.0 billion, money market deposits of $252.4 million, or 5.5%, to $4.3 billion, and time deposits of $144.6 million, or 22.2%, to $507.3 million. The total cost of deposits declined by 22 basis points to 0.36% in Q4 2021 from 0.58% in the year-ago quarter. "Our current spot cost of deposits was approximately 30 basis points at December 31, 2021, a dramatic improvement over the prior year. Given the transformational improvements in the quality of our deposit franchise over the past year, we feel very well positioned against future interest rate hikes from a deposit repricing standpoint," stated Mr. Sidhu.

Other borrowings increased $99.0 million to $223.1 million at December 31, 2021 compared to the year-ago period from the issuance of our 2.875% fixed-to-floating rate senior notes, the proceeds of which were used to redeem all outstanding shares of our Series C and Series D Preferred Stock in Q3 2021.

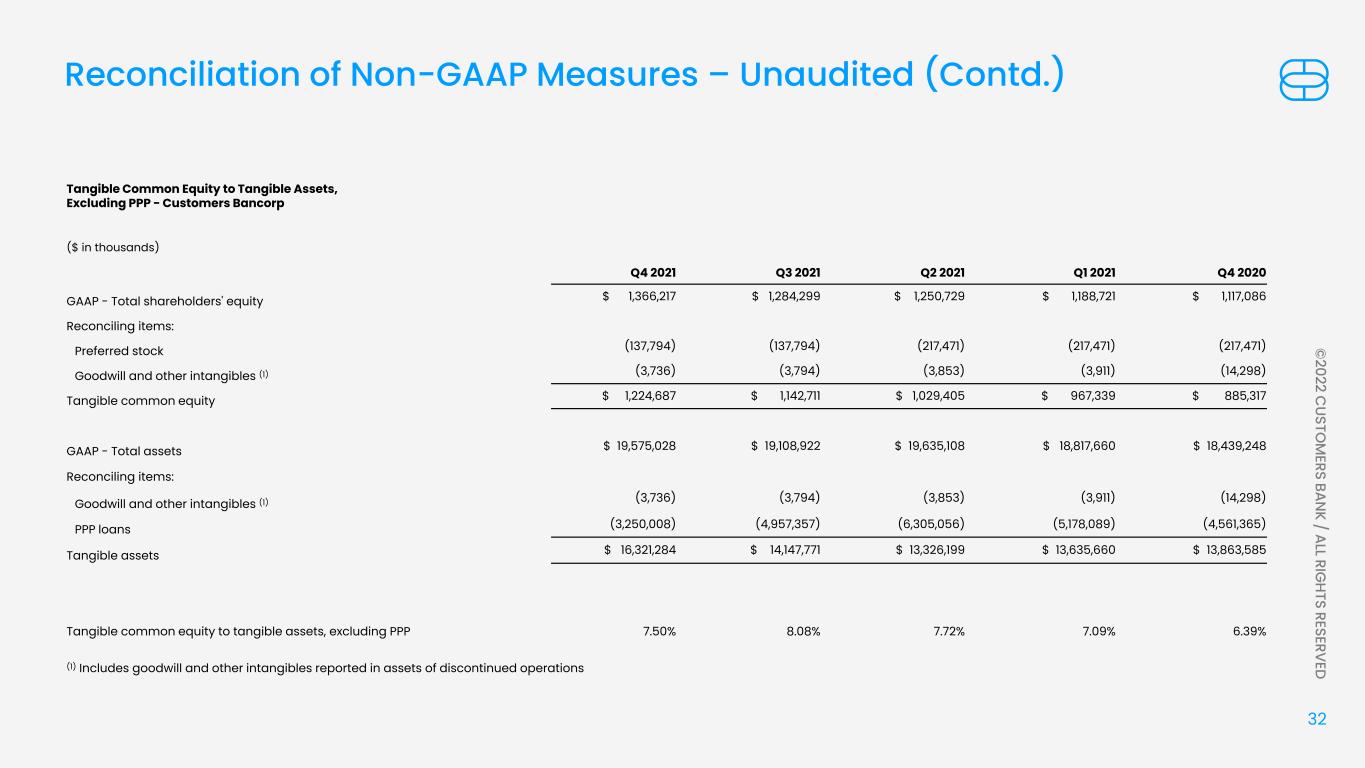

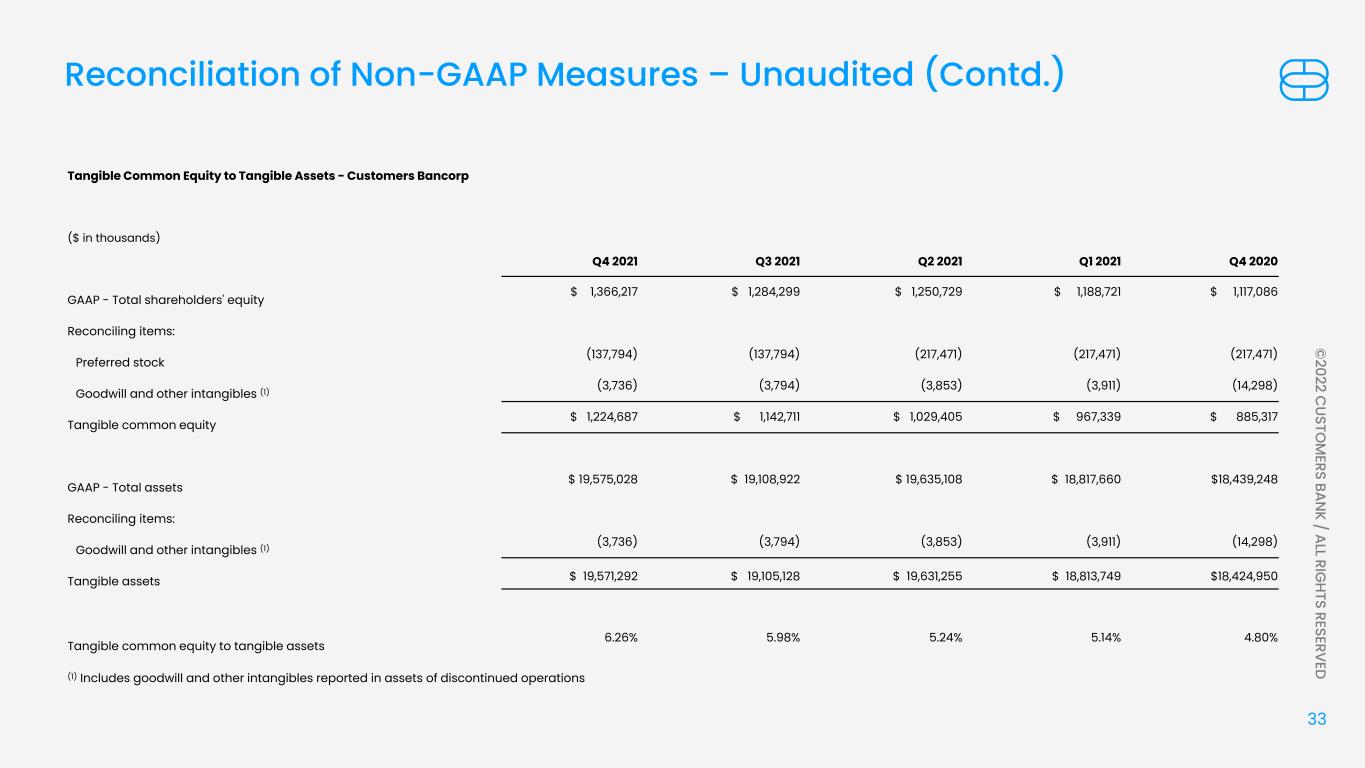

Very Strong Growth in Tangible Common Equity and Tangible Book Value Per Share

Customers experienced significant improvements in regulatory capital ratios in Q4 2021 as compared to a year ago. Customers Bancorp's tangible common equity (a non-GAAP measure) increased by $339.4 million to $1.2 billion at December 31, 2021 from $885.3 million at December 31, 2020, and the tangible book value per common share (a non-GAAP measure) increased to $37.21 at December 31, 2021 from $27.92 at December 31, 2020, an increase of 33.3%. Customers remains well capitalized by all regulatory measures.

At the Customers Bancorp level, the total risk based capital ratio (estimate) and tangible common equity to tangible assets ratio ("TCE ratio"), excluding PPP loans (a non-GAAP measure), were 13.2% and 7.5%, respectively, at December 31, 2021.

Loan Portfolio Management During the COVID-19 Crisis

Over the last decade, Customers has developed a suite of commercial and retail loan products with one particularly important common denominator: relatively low credit risk assumption. The Bank’s C&I, mortgage warehouse, specialty finance lines of business, and multi-family loans for example, are characterized by conservative underwriting standards and low loss rates. Because of this emphasis, the Bank’s credit quality to date has been healthy despite a highly adverse economic environment. Maintaining strong asset quality also requires a highly active portfolio monitoring process. In addition to frequent client outreach and monitoring at the individual loan level, Customers employs a bottom-up data driven approach to analyze its commercial portfolio.

5

Strong commercial loan portfolio with very low concentration in COVID-19 impacted industries and CRE

•All commercial loans previously on deferments became current by December 31, 2021, down from $73.4 million, or 0.7% of total loans and leases, excluding PPP loans (a non-GAAP measure), at September 30, 2021. Customers' commercial deferments peaked at about $1.2 billion in July 2020.

•Exposure to industry segments and CRE significantly impacted by COVID-19 initially is not substantial.

Consumer installment, mortgage and home equity loan portfolios continue to perform well

•Total consumer-related deferments declined to $6.1 million, or 0.1% of total loans and leases, excluding PPP loans (a non-GAAP measure), at December 31, 2021, down from $6.7 million at September 30, 2021.

Key Profitability Trends

Net Interest Income

Net interest income totaled $193.7 million in Q4 2021, a decrease of $26.2 million from Q3 2021, primarily due to lower PPP loan forgiveness from the first two rounds and the latest round, which resulted in lower net deferred loan origination fees recognized in Q4 2021. Excluding PPP loans, average interest-earning assets increased $1.4 billion. Interest-earning asset growth was driven by increases in commercial and industrial loans, consumer installment loans and investment securities, offset in part by decreases in commercial loans to mortgage companies and multi-family loans. Compared to Q3 2021, total loan yields decreased 23 basis points to 5.48% primarily resulting from a lower average balance of PPP loans in Q4 2021 driven by PPP loan forgiveness. Excluding PPP loans, the Q4 2021 total loan yield was relatively unchanged from Q3 2021. Total deposits and borrowing costs decreased by 4 basis points to 0.46% primarily due to growth in non-interest-bearing deposits and 4 basis points decrease in the cost of interest-bearing deposits to 0.50%. "As we've stated previously, it is difficult to predict net interest income in future periods because the timing of PPP forgiveness results in the accelerated recognition of net deferred fees and also affects the amount of net interest income expected to be earned while the PPP loans are held on our balance sheet," commented Mr. Sidhu.

Provision for Credit Losses

The provision for credit losses on loans and leases in Q4 2021 was $13.9 million, compared to a $13.2 million provision in Q3 2021. The provision in Q4 2021 was primarily to support the continued growth in CB Direct consumer installment loan originations. The allowance for credit losses on loans and leases represented 1.53% of total loans and leases receivable, excluding PPP loans (a non-GAAP measure) at December 31, 2021, compared to 1.65% at September 30, 2021 and 1.90% at December 31, 2020. Customers' non-performing loans at December 31, 2021 were only 0.34% of total loans and leases, an improvement from 0.45% at December 31, 2020.

6

Non-Interest Income

Non-interest income totaled $17.0 million for Q4 2021, a decrease of $8.6 million compared to Q3 2021. The decrease was primarily due to lower gains from the sale of investment securities and consumer installment loans of $6.1 million and $3.4 million, respectively, offset in part by an increase in gains realized from the sale of SBA loans of $0.5 million. A technology-led new initiative for selling excess consumer installment loans into securitizations was launched earlier this year. This resulted in a $0.7 million gain on sale in Q4 2021, bringing YTD December 2021 consumer loan gains to $5.2 million. The SBA gains were $1.8 million in Q4 2021, bringing the YTD December 2021 SBA gains to $6.2 million. "We were pleased with the success of this initiative in 2021, exceeding our initial target by 14%," commented Mr. Sidhu.

Non-Interest Expense

The management of non-interest expenses remains a priority at Customers. However, this will not be at the expense of not making adequate investments with new technologies to support efficient growth. Our Q4 2021 total non-interest expenses increased by $1.5 million compared to Q3 2021. The increase was primarily due to higher salaries and employee benefits of $3.7 million mostly due to increased incentives resulting from record 2021 financial performance, $1.6 million increase in occupancy expense primarily associated with the relocation of the Bank headquarters, technology and deposit servicing-related expenses of $1.8 million, and $1.2 million in charitable contributions and corporate sponsorships. These increases were offset in part by certain one-time or other transitory items in Q3 2021 including a $6.2 million make-whole fee paid to a single high-cost deposit customer and a litigation settlement amount of $1.2 million.

Taxes

Income tax expense from continuing operations decreased by $23.3 million to $13.0 million in Q4 2021 from $36.3 million in Q3 2021 primarily due to lower pre-tax income from continuing operations during Q4 2021 compared to Q3 2021 pre-tax income from continuing operations, an increase in excess tax benefits from stock option exercises, additional investments in tax credit vehicles and a reduction in the overall state tax effective rate. The effective tax rate from continuing operations for FY 2021 was 20%. Customers expects the full-year 2022 effective tax rate from continuing operations to be approximately 21% to 23%.

Net Loss From Discontinued Operations

The divestiture of BankMobile Technologies, Inc. was completed on January 4, 2021, and its historical financial results are presented as discontinued operations. An income tax expense of $1.6 million was recorded in net loss from discontinued operations in Q4 2021 resulting from the refinement of state income tax expense on the gain from the divestiture treated as a taxable asset sale for tax purposes.

7

BM Technologies, Inc. (BMTX)

We previously entered into a Deposit Servicing Agreement with BMTX, which was profitable at the time as we were in the early stage of building out our commercial and digital deposit franchise. However, with the advent of CBIT, which went into full launch in January 2022, we now have a low-to-no cost core deposit aggregation strategy that is expected to be far more profitable. We are preparing for the expiration of the Deposit Servicing Agreement scheduled to expire on December 31, 2022, which cost us approximately $60 million ($48 million after taxes) in 2021 and will not be renewed. The expiration of the Deposit Servicing Agreement is expected to be accretive to our 2023 earnings by $60 million (pre-tax). At December 31, 2021, $1.8 billion of deposits were serviced by BMTX, which we expect to leave the Bank by December 31, 2022.

Outlook

“Looking ahead, we have sustainable core growth and are very optimistic about the prospects of our company. We expect strong core above average low-double-digit growth in loans and deposits, improving profitability, and an efficiency ratio in the low 40s through a combination of revenue growth and prudent expense management over the next two to three years. The best-in-class tech agility of Customers Bancorp allowed us to be a major participant in the PPP program, significantly improving our capital ratios. We also incubated new lines of businesses that leverage our fintech relationships. In 2021 we launched a private instant, blockchain-based B2B payments platform with integration of digital and legacy payment rails. The platform will deliver enhanced payments functionality for our business clients and is expected to generate additional deposit growth in targeted niches, such as real estate, monetary and currency exchanges and institutional investments. We've achieved significant accretion in our capital levels over the past 12 months and our credit quality is expected to remain in line with or better than peers. We project our core earnings (excluding PPP) to be between $4.75 - $5.00 in 2022 and well over $6.00 in 2023, two to three years ahead of our previous guidance of $6.00 by 2025/2026,” concluded Mr. Sidhu.

8

Webcast

Date: Tuesday, January 25, 2022

Time: 9:00 AM EST

The live audio webcast, presentation slides, and earnings press release will be made available at https://www.customersbank.com/investor-relations/ and at the Customers Bancorp 4th Quarter Earnings Webcast.

You may submit questions in advance of the live webcast by emailing Customers' Communications & Marketing Director, David Patti at dpatti@customersbank.com; questions may also be asked during the webcast through the webcast application.

The webcast will be archived for viewing on the Customers Bank Investor Relations page and available beginning approximately two hours after the conclusion of the live event.

Institutional Background

Customers Bancorp, Inc. (NYSE:CUBI) is a bank holding company located in West Reading, Pennsylvania engaged in banking and related businesses through its bank subsidiary, Customers Bank, a full-service bank with $19.6 billion in assets at December 31, 2021. A member of the Federal Reserve System with deposits insured by the Federal Deposit Insurance Corporation, Customers Bank is an equal opportunity lender that provides a range of banking and lending services to small and medium-sized businesses, professionals, individuals and families. Services and products are available wherever permitted by law through mobile-first apps, online portals, and a network of offices and branches. Customers Bank provides blockchain-based digital payments via the Customers Bank Instant Token (CBITTM) which allows clients to make instant payments in U.S. dollars, 24 hours a day, 7 days a week, 365 days a year.

“Safe Harbor” Statement

In addition to historical information, this press release may contain “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements with respect to Customers Bancorp, Inc.’s strategies, goals, beliefs, expectations, estimates, intentions, capital raising efforts, financial condition and results of operations, future performance and business. Statements preceded by, followed by, or that include the words “may,” “could,” “should,” “pro forma,” “looking forward,” “would,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “project,” or similar expressions generally indicate a forward-looking statement. These forward-looking statements involve risks and uncertainties that are subject to change based on various important factors (some of which, in whole or in part, are beyond Customers Bancorp, Inc.’s control). Numerous competitive, economic, regulatory, legal and technological events and factors, among others, could cause Customers Bancorp, Inc.’s financial performance to differ materially from the goals, plans, objectives, intentions and expectations expressed in such forward-looking statements, including: the impact of the ongoing pandemic on the U.S. economy and customer behavior, the

9

impact that changes in the economy have on the performance of our loan and lease portfolio, the market value of our investment securities, the continued success and acceptance of our blockchain payments system, the demand for our products and services and the availability of sources of funding; the effects of actions by the federal government, including the Board of Governors of the Federal Reserve System and other government agencies, that affect market interest rates and the money supply; actions that we and our customers take in response to these developments and the effects such actions have on our operations, products, services and customer relationships; and the effects of any changes in accounting standards or policies. Customers Bancorp, Inc. cautions that the foregoing factors are not exclusive, and neither such factors nor any such forward-looking statement takes into account the impact of any future events. All forward-looking statements and information set forth herein are based on management’s current beliefs and assumptions as of the date hereof and speak only as of the date they are made. For a more complete discussion of the assumptions, risks and uncertainties related to our business, you are encouraged to review Customers Bancorp, Inc.’s filings with the Securities and Exchange Commission, including its most recent annual report on Form 10-K for the year ended December 31, 2020, subsequently filed quarterly reports on Form 10-Q and current reports on Form 8-K, including any amendments thereto, that update or provide information in addition to the information included in the Form 10-K and Form 10-Q filings, if any. Customers Bancorp, Inc. does not undertake to update any forward-looking statement whether written or oral, that may be made from time to time by Customers Bancorp, Inc. or by or on behalf of Customers Bank, except as may be required under applicable law.

10

Q4 2021 Overview

The following table presents a summary of key earnings and performance metrics for the quarter ended December 31, 2021, the preceding four quarters, and full year 2021 and 2020:

| CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||

| EARNINGS SUMMARY - UNAUDITED | |||||||||||||||||||||||||||||

(Dollars in thousands, except per share data and stock price data) | Q4 | Q3 | Q2 | Q1 | Q4 | Twelve Months Ended December 31, | |||||||||||||||||||||||

| 2021 | 2021 | 2021 | 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||||||

| GAAP Profitability Metrics: | |||||||||||||||||||||||||||||

Net income available to common shareholders (from continuing and discontinued operations) | $ | 98,647 | $ | 110,241 | $ | 58,042 | $ | 33,204 | $ | 52,831 | $ | 300,134 | $ | 118,537 | |||||||||||||||

Per share amounts: | |||||||||||||||||||||||||||||

Earnings per share - basic | $ | 3.02 | $ | 3.40 | $ | 1.80 | $ | 1.04 | $ | 1.67 | $ | 9.29 | $ | 3.76 | |||||||||||||||

| Earnings per share - diluted | $ | 2.87 | $ | 3.25 | $ | 1.72 | $ | 1.01 | $ | 1.65 | $ | 8.91 | $ | 3.74 | |||||||||||||||

Book value per common share (1) | $ | 37.32 | $ | 35.24 | $ | 31.94 | $ | 30.13 | $ | 28.37 | $ | 37.32 | $ | 28.37 | |||||||||||||||

CUBI stock price (1) | $ | 65.37 | $ | 43.02 | $ | 38.99 | $ | 31.82 | $ | 18.18 | $ | 65.37 | $ | 18.18 | |||||||||||||||

CUBI stock price as % of book value (1) | 175 | % | 122 | % | 122 | % | 106 | % | 64 | % | 175 | % | 64 | % | |||||||||||||||

| Average shares outstanding - basic | 32,625,960 | 32,449,853 | 32,279,625 | 31,883,946 | 31,638,447 | 32,312,262 | 31,506,699 | ||||||||||||||||||||||

| Average shares outstanding - diluted | 34,320,327 | 33,868,553 | 33,741,468 | 32,841,711 | 31,959,100 | 33,697,547 | 31,727,784 | ||||||||||||||||||||||

Shares outstanding (1) | 32,913,267 | 32,537,976 | 32,353,256 | 32,238,762 | 31,705,088 | 32,913,267 | 31,705,088 | ||||||||||||||||||||||

| Return on average assets ("ROAA") | 2.08 | % | 2.33 | % | 1.27 | % | 0.80 | % | 1.23 | % | 1.64 | % | 0.85 | % | |||||||||||||||

| Return on average common equity ("ROCE") | 33.18 | % | 40.82 | % | 23.22 | % | 14.66 | % | 24.26 | % | 28.75 | % | 14.55 | % | |||||||||||||||

| Efficiency ratio | 38.70 | % | 33.42 | % | 46.59 | % | 48.89 | % | 43.56 | % | 40.38 | % | 48.20 | % | |||||||||||||||

Non-GAAP Profitability Metrics (2): | |||||||||||||||||||||||||||||

| Core earnings | $ | 100,095 | $ | 113,876 | $ | 59,303 | $ | 70,308 | $ | 54,588 | $ | 343,582 | $ | 119,526 | |||||||||||||||

| Adjusted pre-tax pre-provision net income | $ | 129,335 | $ | 167,215 | $ | 86,467 | $ | 86,769 | $ | 77,896 | $ | 469,786 | $ | 240,198 | |||||||||||||||

| Per share amounts: | |||||||||||||||||||||||||||||

| Core earnings per share - diluted | $ | 2.92 | $ | 3.36 | $ | 1.76 | $ | 2.14 | $ | 1.71 | $ | 10.20 | $ | 3.77 | |||||||||||||||

Tangible book value per common share (1) | $ | 37.21 | $ | 35.12 | $ | 31.82 | $ | 30.01 | $ | 27.92 | $ | 37.21 | $ | 27.92 | |||||||||||||||

CUBI stock price as % of tangible book value (1) | 176 | % | 122 | % | 123 | % | 106 | % | 65 | % | 176 | % | 65 | % | |||||||||||||||

| Core ROAA | 2.11 | % | 2.35 | % | 1.30 | % | 1.61 | % | 1.26 | % | 1.85 | % | 0.86 | % | |||||||||||||||

| Core ROCE | 33.67 | % | 42.16 | % | 23.72 | % | 31.03 | % | 25.06 | % | 32.91 | % | 14.67 | % | |||||||||||||||

| Adjusted ROAA - pre-tax and pre-provision | 2.67 | % | 3.36 | % | 1.80 | % | 1.90 | % | 1.70 | % | 2.45 | % | 1.54 | % | |||||||||||||||

| Adjusted ROCE - pre-tax and pre-provision | 42.82 | % | 60.81 | % | 33.27 | % | 36.80 | % | 34.20 | % | 43.88 | % | 27.76 | % | |||||||||||||||

| Net interest margin, tax equivalent | 4.14 | % | 4.59 | % | 2.98 | % | 3.00 | % | 2.78 | % | 3.70 | % | 2.71 | % | |||||||||||||||

| Net interest margin, tax equivalent, excluding PPP loans | 3.12 | % | 3.24 | % | 3.30 | % | 2.99 | % | 3.04 | % | 3.16 | % | 2.96 | % | |||||||||||||||

| Core efficiency ratio | 38.73 | % | 30.36 | % | 44.33 | % | 41.13 | % | 42.89 | % | 37.71 | % | 46.92 | % | |||||||||||||||

| Asset Quality: | |||||||||||||||||||||||||||||

| Net charge-offs | $ | 7,582 | $ | 7,104 | $ | 6,591 | $ | 12,521 | $ | 8,472 | $ | 33,798 | $ | 54,807 | |||||||||||||||

| Annualized net charge-offs to average total loans and leases | 0.21 | % | 0.17 | % | 0.16 | % | 0.33 | % | 0.21 | % | 0.22 | % | 0.41 | % | |||||||||||||||

Non-performing loans ("NPLs") to total loans and leases (1) | 0.34 | % | 0.34 | % | 0.27 | % | 0.30 | % | 0.45 | % | 0.34 | % | 0.45 | % | |||||||||||||||

Reserves to NPLs (1) | 277.72 | % | 252.68 | % | 269.96 | % | 264.21 | % | 204.48 | % | 277.72 | % | 204.48 | % | |||||||||||||||

| Non-performing assets ("NPAs") to total assets | 0.25 | % | 0.27 | % | 0.24 | % | 0.26 | % | 0.39 | % | 0.25 | % | 0.39 | % | |||||||||||||||

Customers Bank Capital Ratios (3): | |||||||||||||||||||||||||||||

| Common equity Tier 1 capital to risk-weighted assets | 12.13 | % | 12.77 | % | 12.40 | % | 11.75 | % | 10.62 | % | 12.13 | % | 10.62 | % | |||||||||||||||

| Tier 1 capital to risk-weighted assets | 12.13 | % | 12.77 | % | 12.40 | % | 11.75 | % | 10.62 | % | 12.13 | % | 10.62 | % | |||||||||||||||

| Total capital to risk-weighted assets | 13.46 | % | 14.16 | % | 13.77 | % | 13.11 | % | 12.06 | % | 13.46 | % | 12.06 | % | |||||||||||||||

| Tier 1 capital to average assets (leverage ratio) | 7.92 | % | 8.66 | % | 9.07 | % | 9.35 | % | 9.21 | % | 7.92 | % | 9.21 | % | |||||||||||||||

(continued) | |||||||||||||||||||||||||||||

11

| (1) Metric is a spot balance for the last day of each quarter presented. | |||||||||||||||||||||||||||||

| (2) Non-GAAP measures exclude net loss from discontinued operations, loss on sale of foreign subsidiaries, unrealized gains (losses) on loans held for sale, investment securities gains and losses, loss on cash flow hedge derivative terminations, severance expense, merger and acquisition-related expenses, losses realized from the sale of non-QM residential mortgage loans, loss upon acquisition of interest-only GNMA securities, legal reserves, credit valuation adjustments on derivatives, risk participation agreement mark-to-market adjustments, deposit relationship adjustment fees, loss on redemption of preferred stock, goodwill and intangible assets, and PPP loans. These notable items are not included in Customers' disclosures of core earnings and other core profitability metrics. Please note that not each of the aforementioned adjustments affected the reported amount in each of the periods presented. Customers' reasons for the use of these non-GAAP measures and a detailed reconciliation between the non-GAAP measures and the comparable GAAP amounts are included at the end of this document. | |||||||||||||||||||||||||||||

| (3) Regulatory capital ratios are estimated for Q4 2021 and actual for the remaining periods. In accordance with regulatory capital rules, Customers elected an option to delay the estimated impact of CECL on its regulatory capital over a five-year transition period ending January 1, 2025. As a result, capital ratios and amounts as of Q4 2021 exclude the impact of the increased allowance for credit losses on loans and leases and unfunded loan commitments attributed to the adoption of CECL and 25% of the quarterly provision for credit losses for subsequent quarters through Q4 2021. | |||||||||||||||||||||||||||||

12

| CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||||||||||||||

CONSOLIDATED STATEMENTS OF OPERATIONS - UNAUDITED | |||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | Twelve Months Ended | ||||||||||||||||||||||||||||||||||||||||

| Q4 | Q3 | Q2 | Q1 | Q4 | December 31, | ||||||||||||||||||||||||||||||||||||

| 2021 | 2021 | 2021 | 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||||||||||||||||||

| Interest income: | |||||||||||||||||||||||||||||||||||||||||

| Loans and leases | $ | 198,000 | $ | 233,097 | $ | 153,608 | $ | 152,117 | $ | 145,414 | $ | 736,822 | $ | 512,048 | |||||||||||||||||||||||||||

| Investment securities | 15,202 | 8,905 | 8,327 | 7,979 | 6,777 | 40,413 | 24,206 | ||||||||||||||||||||||||||||||||||

| Other | 835 | 849 | 946 | 1,019 | 902 | 3,649 | 7,050 | ||||||||||||||||||||||||||||||||||

| Total interest income | 214,037 | 242,851 | 162,881 | 161,115 | 153,093 | 780,884 | 543,304 | ||||||||||||||||||||||||||||||||||

| Interest expense: | |||||||||||||||||||||||||||||||||||||||||

| Deposits | 15,415 | 15,915 | 15,653 | 15,658 | 16,107 | 62,641 | 92,045 | ||||||||||||||||||||||||||||||||||

| FHLB advances | 51 | 5 | 963 | 5,192 | 5,749 | 6,211 | 21,637 | ||||||||||||||||||||||||||||||||||

| Subordinated debt | 2,688 | 2,689 | 2,689 | 2,689 | 2,688 | 10,755 | 10,755 | ||||||||||||||||||||||||||||||||||

| FRB PPP liquidity facility, federal funds purchased and other borrowings | 2,189 | 4,350 | 4,819 | 4,845 | 5,603 | 16,203 | 15,179 | ||||||||||||||||||||||||||||||||||

| Total interest expense | 20,343 | 22,959 | 24,124 | 28,384 | 30,147 | 95,810 | 139,616 | ||||||||||||||||||||||||||||||||||

| Net interest income | 193,694 | 219,892 | 138,757 | 132,731 | 122,946 | 685,074 | 403,688 | ||||||||||||||||||||||||||||||||||

| Provision (benefit) for credit losses on loans and leases | 13,890 | 13,164 | 3,291 | (2,919) | (2,913) | 27,426 | 62,774 | ||||||||||||||||||||||||||||||||||

| Net interest income after provision (benefit) for credit losses on loans and leases | 179,804 | 206,728 | 135,466 | 135,650 | 125,859 | 657,648 | 340,914 | ||||||||||||||||||||||||||||||||||

| Non-interest income: | |||||||||||||||||||||||||||||||||||||||||

| Interchange and card revenue | 84 | 83 | 84 | 85 | 91 | 336 | 646 | ||||||||||||||||||||||||||||||||||

| Deposit fees | 1,026 | 994 | 891 | 863 | 823 | 3,774 | 2,526 | ||||||||||||||||||||||||||||||||||

| Commercial lease income | 5,378 | 5,213 | 5,311 | 5,205 | 4,853 | 21,107 | 18,139 | ||||||||||||||||||||||||||||||||||

| Bank-owned life insurance | 1,984 | 1,988 | 2,765 | 1,679 | 1,744 | 8,416 | 7,009 | ||||||||||||||||||||||||||||||||||

| Mortgage warehouse transactional fees | 2,262 | 3,100 | 3,265 | 4,247 | 3,681 | 12,874 | 11,535 | ||||||||||||||||||||||||||||||||||

| Gain (loss) on sale of SBA and other loans | 2,493 | 5,359 | 1,900 | 1,575 | 1,689 | 11,327 | 2,009 | ||||||||||||||||||||||||||||||||||

| Loan fees | 2,513 | 1,909 | 1,670 | 1,436 | 1,746 | 7,527 | 5,652 | ||||||||||||||||||||||||||||||||||

| Mortgage banking income (loss) | 262 | 425 | 386 | 463 | 346 | 1,536 | 1,693 | ||||||||||||||||||||||||||||||||||

| Gain (loss) on sale of investment securities | (49) | 6,063 | 1,812 | 23,566 | 44 | 31,392 | 20,078 | ||||||||||||||||||||||||||||||||||

| Unrealized gain (loss) on investment securities | — | — | 1,746 | 974 | 1,387 | 2,720 | 1,447 | ||||||||||||||||||||||||||||||||||

| Loss on sale of foreign subsidiaries | — | — | (2,840) | — | — | (2,840) | — | ||||||||||||||||||||||||||||||||||

| Unrealized gain (loss) on derivatives | 586 | 524 | (439) | 2,537 | 804 | 3,208 | (3,951) | ||||||||||||||||||||||||||||||||||

| Loss on cash flow hedge derivative terminations | — | — | — | (24,467) | — | (24,467) | — | ||||||||||||||||||||||||||||||||||

| Other | 452 | (72) | 271 | 305 | (1,125) | 957 | (2,965) | ||||||||||||||||||||||||||||||||||

| Total non-interest income | 16,991 | 25,586 | 16,822 | 18,468 | 16,083 | 77,867 | 63,818 | ||||||||||||||||||||||||||||||||||

| Non-interest expense: | |||||||||||||||||||||||||||||||||||||||||

| Salaries and employee benefits | 29,940 | 26,268 | 28,023 | 23,971 | 25,600 | 108,202 | 94,067 | ||||||||||||||||||||||||||||||||||

| Technology, communication and bank operations | 22,657 | 21,281 | 19,618 | 19,988 | 16,021 | 83,544 | 50,668 | ||||||||||||||||||||||||||||||||||

| Professional services | 7,058 | 6,871 | 6,882 | 5,877 | 4,732 | 26,688 | 13,557 | ||||||||||||||||||||||||||||||||||

| Occupancy | 4,336 | 2,704 | 2,482 | 2,621 | 2,742 | 12,143 | 11,362 | ||||||||||||||||||||||||||||||||||

| Commercial lease depreciation | 4,625 | 4,493 | 4,415 | 4,291 | 3,982 | 17,824 | 14,715 | ||||||||||||||||||||||||||||||||||

| FDIC assessments, non-income taxes and regulatory fees | 2,427 | 2,313 | 2,602 | 2,719 | 2,642 | 10,061 | 11,661 | ||||||||||||||||||||||||||||||||||

| Loan servicing | 4,361 | 4,265 | 1,700 | 437 | 879 | 10,763 | 3,431 | ||||||||||||||||||||||||||||||||||

| Merger and acquisition related expenses | — | — | — | 418 | 709 | 418 | 1,367 | ||||||||||||||||||||||||||||||||||

| Loan workout | 226 | 198 | 102 | (261) | 123 | 265 | 3,143 | ||||||||||||||||||||||||||||||||||

| Advertising and promotion | 344 | 302 | 313 | 561 | — | 1,520 | 1,796 | ||||||||||||||||||||||||||||||||||

| Deposit relationship adjustment fees | — | 6,216 | — | — | — | 6,216 | — | ||||||||||||||||||||||||||||||||||

| Other | 5,574 | 5,098 | 4,686 | 1,305 | 2,503 | 16,663 | 9,209 | ||||||||||||||||||||||||||||||||||

| Total non-interest expense | 81,548 | 80,009 | 70,823 | 61,927 | 59,933 | 294,307 | 214,976 | ||||||||||||||||||||||||||||||||||

| Income before income tax expense | 115,247 | 152,305 | 81,465 | 92,191 | 82,009 | 441,208 | 189,756 | ||||||||||||||||||||||||||||||||||

| Income tax expense | 12,993 | 36,263 | 20,124 | 17,560 | 23,447 | 86,940 | 46,717 | ||||||||||||||||||||||||||||||||||

| Net income from continuing operations | $ | 102,254 | $ | 116,042 | $ | 61,341 | $ | 74,631 | $ | 58,562 | $ | 354,268 | $ | 143,039 | |||||||||||||||||||||||||||

(continued) | |||||||||||||||||||||||||||||||||||||||||

13

| CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||||||||||||||

CONSOLIDATED STATEMENTS OF OPERATIONS - UNAUDITED (CONTINUED) | |||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | Twelve Months Ended | ||||||||||||||||||||||||||||||||||||||||

| Q4 | Q3 | Q2 | Q1 | Q4 | December 31, | ||||||||||||||||||||||||||||||||||||

| 2021 | 2021 | 2021 | 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||||||||||||||||||

| Loss from discontinued operations before income taxes | $ | — | $ | — | $ | — | $ | (20,354) | $ | (3,539) | $ | (20,354) | $ | (13,798) | |||||||||||||||||||||||||||

| Income tax expense (benefit) from discontinued operations | 1,585 | — | — | 17,682 | (1,222) | 19,267 | (3,337) | ||||||||||||||||||||||||||||||||||

| Net loss from discontinued operations | (1,585) | — | — | (38,036) | (2,317) | (39,621) | (10,461) | ||||||||||||||||||||||||||||||||||

| Net income | 100,669 | 116,042 | 61,341 | 36,595 | 56,245 | 314,647 | 132,578 | ||||||||||||||||||||||||||||||||||

| Preferred stock dividends | 2,022 | 2,981 | 3,299 | 3,391 | 3,414 | 11,693 | 14,041 | ||||||||||||||||||||||||||||||||||

| Loss on redemption of preferred stock | — | 2,820 | — | — | — | 2,820 | — | ||||||||||||||||||||||||||||||||||

| Net income available to common shareholders | $ | 98,647 | $ | 110,241 | $ | 58,042 | $ | 33,204 | $ | 52,831 | $ | 300,134 | $ | 118,537 | |||||||||||||||||||||||||||

| Basic earnings per common share from continuing operations | $ | 3.07 | $ | 3.40 | $ | 1.80 | $ | 2.23 | $ | 1.74 | $ | 10.51 | $ | 4.09 | |||||||||||||||||||||||||||

| Basic earnings per common share | 3.02 | 3.40 | 1.80 | 1.04 | 1.67 | 9.29 | 3.76 | ||||||||||||||||||||||||||||||||||

| Diluted earnings per common share from continuing operations | 2.92 | 3.25 | 1.72 | 2.17 | 1.73 | 10.08 | 4.07 | ||||||||||||||||||||||||||||||||||

| Diluted earnings per common share | 2.87 | 3.25 | 1.72 | 1.01 | 1.65 | 8.91 | 3.74 | ||||||||||||||||||||||||||||||||||

14

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||

CONSOLIDATED BALANCE SHEET - UNAUDITED | |||||||||||||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||||||||||||

| December 31, | September 30, | June 30, | March 31, | December 31, | |||||||||||||||||||||||||

| 2021 | 2021 | 2021 | 2021 | 2020 | |||||||||||||||||||||||||

ASSETS | |||||||||||||||||||||||||||||

| Cash and due from banks | $ | 35,238 | $ | 51,169 | $ | 36,837 | $ | 3,123 | $ | 78,090 | |||||||||||||||||||

| Interest earning deposits | 482,794 | 1,000,885 | 393,663 | 512,241 | 615,264 | ||||||||||||||||||||||||

| Cash and cash equivalents | 518,032 | 1,052,054 | 430,500 | 515,364 | 693,354 | ||||||||||||||||||||||||

| Investment securities, at fair value | 3,817,150 | 1,866,697 | 1,526,792 | 1,441,904 | 1,210,285 | ||||||||||||||||||||||||

| Loans held for sale | 16,254 | 29,957 | 34,540 | 46,106 | 79,086 | ||||||||||||||||||||||||

| Loans receivable, mortgage warehouse, at fair value | 2,284,325 | 2,557,624 | 2,855,284 | 3,407,622 | 3,616,432 | ||||||||||||||||||||||||

| Loans receivable, PPP | 3,250,008 | 4,957,357 | 6,305,056 | 5,178,089 | 4,561,365 | ||||||||||||||||||||||||

| Loans and leases receivable | 9,018,298 | 7,970,599 | 7,772,142 | 7,536,489 | 7,575,368 | ||||||||||||||||||||||||

| Allowance for credit losses on loans and leases | (137,804) | (131,496) | (125,436) | (128,736) | (144,176) | ||||||||||||||||||||||||

| Total loans and leases receivable, net of allowance for credit losses on loans and leases | 14,414,827 | 15,354,084 | 16,807,046 | 15,993,464 | 15,608,989 | ||||||||||||||||||||||||

| FHLB, Federal Reserve Bank, and other restricted stock | 64,584 | 57,184 | 39,895 | 69,420 | 71,368 | ||||||||||||||||||||||||

| Accrued interest receivable | 92,239 | 93,514 | 90,009 | 83,186 | 80,412 | ||||||||||||||||||||||||

| Bank premises and equipment, net | 8,890 | 9,944 | 10,391 | 10,943 | 11,225 | ||||||||||||||||||||||||

| Bank-owned life insurance | 333,705 | 331,423 | 329,421 | 281,923 | 280,067 | ||||||||||||||||||||||||

| Goodwill and other intangibles | 3,736 | 3,794 | 3,853 | 3,911 | 3,969 | ||||||||||||||||||||||||

| Other assets | 305,611 | 310,271 | 362,661 | 371,439 | 338,438 | ||||||||||||||||||||||||

| Assets of discontinued operations | — | — | — | — | 62,055 | ||||||||||||||||||||||||

| Total assets | $ | 19,575,028 | $ | 19,108,922 | $ | 19,635,108 | $ | 18,817,660 | $ | 18,439,248 | |||||||||||||||||||

| LIABILITIES AND SHAREHOLDERS' EQUITY | |||||||||||||||||||||||||||||

| Demand, non-interest bearing deposits | $ | 4,459,790 | $ | 4,954,331 | $ | 2,699,869 | $ | 2,687,628 | $ | 2,356,998 | |||||||||||||||||||

| Interest bearing deposits | 12,318,134 | 12,016,694 | 11,174,070 | 9,784,812 | 8,952,931 | ||||||||||||||||||||||||

| Total deposits | 16,777,924 | 16,971,025 | 13,873,939 | 12,472,440 | 11,309,929 | ||||||||||||||||||||||||

| Federal funds purchased | 75,000 | — | — | 365,000 | 250,000 | ||||||||||||||||||||||||

| FHLB advances | 700,000 | — | — | 850,000 | 850,000 | ||||||||||||||||||||||||

| Other borrowings | 223,086 | 223,151 | 124,240 | 124,138 | 124,037 | ||||||||||||||||||||||||

| Subordinated debt | 181,673 | 181,603 | 181,534 | 181,464 | 181,394 | ||||||||||||||||||||||||

| FRB PPP liquidity facility | — | — | 3,865,865 | 3,284,156 | 4,415,016 | ||||||||||||||||||||||||

| Accrued interest payable and other liabilities | 251,128 | 448,844 | 338,801 | 351,741 | 152,082 | ||||||||||||||||||||||||

| Liabilities of discontinued operations | — | — | — | — | 39,704 | ||||||||||||||||||||||||

| Total liabilities | 18,208,811 | 17,824,623 | 18,384,379 | 17,628,939 | 17,322,162 | ||||||||||||||||||||||||

| Preferred stock | 137,794 | 137,794 | 217,471 | 217,471 | 217,471 | ||||||||||||||||||||||||

| Common stock | 34,722 | 33,818 | 33,634 | 33,519 | 32,986 | ||||||||||||||||||||||||

| Additional paid in capital | 542,391 | 525,894 | 519,294 | 515,318 | 455,592 | ||||||||||||||||||||||||

| Retained earnings | 705,732 | 607,085 | 496,844 | 438,802 | 438,581 | ||||||||||||||||||||||||

| Accumulated other comprehensive income (loss), net | (4,980) | 1,488 | 5,266 | 5,391 | (5,764) | ||||||||||||||||||||||||

| Treasury stock, at cost | (49,442) | (21,780) | (21,780) | (21,780) | (21,780) | ||||||||||||||||||||||||

| Total shareholders' equity | 1,366,217 | 1,284,299 | 1,250,729 | 1,188,721 | 1,117,086 | ||||||||||||||||||||||||

| Total liabilities & shareholders' equity | $ | 19,575,028 | $ | 19,108,922 | $ | 19,635,108 | $ | 18,817,660 | $ | 18,439,248 | |||||||||||||||||||

15

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | ||||||||||||||||||||||||||

| AVERAGE BALANCE SHEET / NET INTEREST MARGIN - UNAUDITED | ||||||||||||||||||||||||||

(Dollars in thousands) | ||||||||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||

| December 31, 2021 | September 30, 2021 | December 31, 2020 | ||||||||||||||||||||||||

| Average Balance | Average Yield or Cost (%) | Average Balance | Average Yield or Cost (%) | Average Balance | Average Yield or Cost (%) | |||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||

| Interest earning deposits | $ | 1,568,510 | 0.15% | $ | 1,279,983 | 0.15% | $ | 413,381 | 0.12% | |||||||||||||||||

Investment securities (1) | 2,621,844 | 2.32% | 1,511,319 | 2.36% | 1,120,491 | 2.42% | ||||||||||||||||||||

| Loans and leases: | ||||||||||||||||||||||||||

| Commercial loans to mortgage companies | 2,289,061 | 3.02% | 2,658,020 | 3.14% | 3,518,371 | 3.06% | ||||||||||||||||||||

| Multi-family loans | 1,327,732 | 3.72% | 1,443,846 | 3.64% | 1,871,956 | 3.70% | ||||||||||||||||||||

Commercial & industrial loans and leases (2) | 3,514,186 | 3.71% | 3,024,620 | 3.76% | 2,801,172 | 3.96% | ||||||||||||||||||||

| Loans receivable, PPP | 3,898,607 | 8.35% | 5,778,367 | 8.04% | 4,782,606 | 2.45% | ||||||||||||||||||||

| Non-owner occupied commercial real estate loans | 1,334,184 | 3.80% | 1,346,629 | 3.73% | 1,358,541 | 3.80% | ||||||||||||||||||||

| Residential mortgages | 314,551 | 3.68% | 325,851 | 3.50% | 400,771 | 3.80% | ||||||||||||||||||||

| Installment loans | 1,657,049 | 8.96% | 1,615,411 | 9.21% | 1,253,679 | 8.50% | ||||||||||||||||||||

Total loans and leases (3) | 14,335,370 | 5.48% | 16,192,744 | 5.71% | 15,987,096 | 3.62% | ||||||||||||||||||||

| Other interest-earning assets | 50,709 | 1.81% | 49,780 | 2.86% | 81,031 | 3.80% | ||||||||||||||||||||

| Total interest-earning assets | 18,576,433 | 4.57% | 19,033,826 | 5.06% | 17,601,999 | 3.46% | ||||||||||||||||||||

| Non-interest-earning assets | 637,808 | 705,514 | 573,400 | |||||||||||||||||||||||

| Assets of discontinued operations | — | — | 75,320 | |||||||||||||||||||||||

| Total assets | $ | 19,214,241 | $ | 19,739,340 | $ | 18,250,719 | ||||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||

| Interest checking accounts | 5,258,982 | 0.58% | 4,537,421 | 0.67% | 2,240,959 | 0.86% | ||||||||||||||||||||

| Money market deposit accounts | 5,293,529 | 0.43% | 5,131,433 | 0.43% | 4,166,635 | 0.60% | ||||||||||||||||||||

| Other savings accounts | 1,189,899 | 0.45% | 1,376,077 | 0.50% | 1,205,592 | 0.74% | ||||||||||||||||||||

| Certificates of deposit | 541,528 | 0.51% | 614,404 | 0.59% | 833,689 | 1.30% | ||||||||||||||||||||

Total interest-bearing deposits (4) | 12,283,938 | 0.50% | 11,659,335 | 0.54% | 8,446,875 | 0.76% | ||||||||||||||||||||

| Federal funds purchased | 815 | 0.15% | — | —% | 120,891 | 0.10% | ||||||||||||||||||||

| FRB PPP liquidity facility | — | —% | 2,788,897 | 0.35% | 4,684,756 | 0.35% | ||||||||||||||||||||

| Borrowings | 465,600 | 4.20% | 371,077 | 4.90% | 1,155,321 | 3.40% | ||||||||||||||||||||

| Total interest-bearing liabilities | 12,750,353 | 0.63% | 14,819,309 | 0.62% | 14,407,843 | 0.83% | ||||||||||||||||||||

Non-interest-bearing deposits (4) | 4,817,835 | 3,335,198 | 2,543,529 | |||||||||||||||||||||||

| Total deposits and borrowings | 17,568,188 | 0.46% | 18,154,507 | 0.50% | 16,951,372 | 0.71% | ||||||||||||||||||||

| Other non-interest-bearing liabilities | 328,782 | 310,519 | 162,723 | |||||||||||||||||||||||

| Liabilities of discontinued operations | — | — | 52,742 | |||||||||||||||||||||||

| Total liabilities | 17,896,970 | 18,465,026 | 17,166,837 | |||||||||||||||||||||||

| Shareholders' equity | 1,317,271 | 1,274,314 | 1,083,882 | |||||||||||||||||||||||

| Total liabilities and shareholders' equity | $ | 19,214,241 | $ | 19,739,340 | $ | 18,250,719 | ||||||||||||||||||||

| Interest spread | 4.11% | 4.56% | 2.75% | |||||||||||||||||||||||

| Net interest margin | 4.14% | 4.58% | 2.78% | |||||||||||||||||||||||

Net interest margin tax equivalent (5) | 4.14% | 4.59% | 2.78% | |||||||||||||||||||||||

Net interest margin tax equivalent excl. PPP (6) | 3.12% | 3.24% | 3.04% | |||||||||||||||||||||||

(1) For presentation in this table, average balances and the corresponding average yields for investment securities are based upon historical cost, adjusted for amortization of premiums and accretion of discounts. | ||||||||||||||||||||||||||

| (2) Includes owner occupied commercial real estate loans. | ||||||||||||||||||||||||||

| (3) Includes non-accrual loans, the effect of which is to reduce the yield earned on loans and leases, and deferred loan fees. | ||||||||||||||||||||||||||

(4) Total costs of deposits (including interest bearing and non-interest bearing) were 0.36%, 0.42% and 0.58% for the three months ended December 31, 2021, September 30, 2021 and December 31, 2020, respectively. | ||||||||||||||||||||||||||

(5) Non-GAAP tax-equivalent basis, using an estimated marginal tax rate of 26% for the three months ended December 31, 2021, September 30, 2021 and December 31, 2020, presented to approximate interest income as a taxable asset. Management uses non-GAAP measures to present historical periods comparable to the current period presentation. In addition, management believes the use of these non-GAAP measures provides additional clarity when assessing Customers’ financial results. These disclosures should not be viewed as substitutes for results determined to be in accordance with U.S. GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other entities. | ||||||||||||||||||||||||||

(6) Non-GAAP tax-equivalent basis, as described in note (5) for the three months ended December 31, 2021, September 30, 2021 and December 31, 2020, excluding net interest income from PPP loans and related borrowings, along with the related PPP loan balances and PPP fees receivable from interest-earning assets. Management uses non-GAAP measures to present historical periods comparable to the current period presentation. In addition, management believes the use of these non-GAAP measures provides additional clarity when assessing Customers’ financial results. These disclosures should not be viewed as substitutes for results determined to be in accordance with U.S. GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other entities. | ||||||||||||||||||||||||||

16

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||

| AVERAGE BALANCE SHEET / NET INTEREST MARGIN - UNAUDITED | |||||||||||||||||

(Dollars in thousands) | |||||||||||||||||

Twelve Months Ended | |||||||||||||||||

| December 31, 2021 | December 31, 2020 | ||||||||||||||||

Average Balance | Average Yield or Cost (%) | Average Balance | Average Yield or Cost (%) | ||||||||||||||

| Assets | |||||||||||||||||

| Interest earning deposits | $ | 1,169,416 | 0.14% | $ | 564,218 | 0.59% | |||||||||||

Investment securities (1) | 1,753,649 | 2.30% | 836,815 | 2.89% | |||||||||||||

| Loans and leases: | |||||||||||||||||

| Commercial loans to mortgage companies | 2,699,300 | 3.09% | 2,668,642 | 3.11% | |||||||||||||

| Multi-family loans | 1,501,878 | 3.77% | 2,020,640 | 3.85% | |||||||||||||

Commercial & industrial loans and leases (2) | 3,068,005 | 3.75% | 2,581,119 | 4.12% | |||||||||||||

| Loans receivable, PPP | 5,108,192 | 5.46% | 3,121,157 | 2.10% | |||||||||||||

| Non-owner occupied commercial real estate loans | 1,349,563 | 3.81% | 1,368,684 | 3.91% | |||||||||||||

| Residential mortgages | 339,845 | 3.65% | 422,696 | 3.82% | |||||||||||||

| Installment loans | 1,517,165 | 9.14% | 1,264,255 | 8.68% | |||||||||||||

Total loans and leases (3) | 15,583,948 | 4.73% | 13,447,193 | 3.81% | |||||||||||||

| Other interest-earning assets | 59,308 | 3.48% | 85,091 | 4.41% | |||||||||||||

| Total interest-earning assets | 18,566,321 | 4.21% | 14,933,317 | 3.64% | |||||||||||||

| Non-interest-earning assets | 633,615 | 592,770 | |||||||||||||||

| Assets of discontinued operations | — | 78,714 | |||||||||||||||

| Total assets | $ | 19,199,936 | $ | 15,604,801 | |||||||||||||

| Liabilities | |||||||||||||||||

| Interest checking accounts | $ | 4,006,354 | 0.69% | $ | 2,098,138 | 0.89% | |||||||||||

| Money market deposit accounts | 4,933,027 | 0.47% | 3,657,422 | 0.96% | |||||||||||||

| Other savings accounts | 1,358,708 | 0.56% | 1,162,472 | 1.44% | |||||||||||||

| Certificates of deposit | 619,859 | 0.72% | 1,357,688 | 1.58% | |||||||||||||

Total interest-bearing deposits (4) | 10,917,948 | 0.57% | 8,275,720 | 1.11% | |||||||||||||

| Federal funds purchased | 22,110 | 0.07% | 239,481 | 0.19% | |||||||||||||

| FRB PPP liquidity facility | 2,636,925 | 0.35% | 2,537,744 | 0.35% | |||||||||||||

| Borrowings | 610,503 | 3.92% | 1,265,279 | 3.02% | |||||||||||||

| Total interest-bearing liabilities | 14,187,486 | 0.68% | 12,318,224 | 1.13% | |||||||||||||

Non-interest-bearing deposits (4) | 3,470,788 | 2,052,376 | |||||||||||||||

| Total deposits and borrowings | 17,658,274 | 0.54% | 14,370,600 | 0.97% | |||||||||||||

| Other non-interest-bearing liabilities | 304,078 | 148,045 | |||||||||||||||

| Liabilities of discontinued operations | — | 53,916 | |||||||||||||||

| Total liabilities | 17,962,352 | 14,572,561 | |||||||||||||||

| Shareholders' equity | 1,237,584 | 1,032,240 | |||||||||||||||

| Total liabilities and shareholders' equity | $ | 19,199,936 | $ | 15,604,801 | |||||||||||||

| Interest spread | 3.66% | 2.67% | |||||||||||||||

| Net interest margin | 3.69% | 2.70% | |||||||||||||||

Net interest margin tax equivalent (5) | 3.70% | 2.71% | |||||||||||||||

Net interest margin tax equivalent excl. PPP (6) | 3.16% | 2.96% | |||||||||||||||

(1) For presentation in this table, average balances and the corresponding average yields for investment securities are based upon historical cost, adjusted for amortization of premiums and accretion of discounts. | |||||||||||||||||

| (2) Includes owner occupied commercial real estate loans. | |||||||||||||||||

| (3) Includes non-accrual loans, the effect of which is to reduce the yield earned on loans and leases, and deferred loan fees. | |||||||||||||||||

(4) Total costs of deposits (including interest bearing and non-interest bearing) were 0.44% and 0.89% for the twelve months ended December 31, 2021 and 2020, respectively. | |||||||||||||||||

(5) Non-GAAP tax-equivalent basis, using an estimated marginal tax rate of 26% for the twelve months ended December 31, 2021 and 2020, presented to approximate interest income as a taxable asset. Management uses non-GAAP measures to present historical periods comparable to the current period presentation. In addition, management believes the use of these non-GAAP measures provides additional clarity when assessing Customers’ financial results. These disclosures should not be viewed as substitutes for results determined to be in accordance with U.S. GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other entities. | |||||||||||||||||

(6) Non-GAAP tax-equivalent basis as described in note (5), for the twelve months ended December 31, 2021 and 2020, excluding net interest income from PPP loans and related borrowings, along with the related PPP loan balances and PPP fees receivable from interest-earning assets. Management uses non-GAAP measures to present historical periods comparable to the current period presentation. In addition, management believes the use of these non-GAAP measures provides additional clarity when assessing Customers’ financial results. These disclosures should not be viewed as substitutes for results determined to be in accordance with U.S. GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other entities. | |||||||||||||||||

17

| CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||

| PERIOD END LOAN AND LEASE COMPOSITION - UNAUDITED | |||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

| December 31, | September 30, | June 30, | March 31, | December 31, | |||||||||||||||||||||||||

| 2021 | 2021 | 2021 | 2021 | 2020 | |||||||||||||||||||||||||

| Commercial: | |||||||||||||||||||||||||||||

| Multi-family | $ | 1,486,308 | $ | 1,387,166 | $ | 1,497,485 | $ | 1,659,529 | $ | 1,761,301 | |||||||||||||||||||

| Loans to mortgage companies | 2,362,438 | 2,626,483 | 2,922,217 | 3,463,490 | 3,657,350 | ||||||||||||||||||||||||

| Commercial & industrial | 3,346,670 | 2,604,367 | 2,293,723 | 2,164,784 | 2,304,206 | ||||||||||||||||||||||||

| Commercial real estate owner occupied | 654,922 | 656,044 | 653,649 | 590,093 | 572,338 | ||||||||||||||||||||||||

| Loans receivable, PPP | 3,250,008 | 4,957,357 | 6,305,056 | 5,178,089 | 4,561,365 | ||||||||||||||||||||||||

| Commercial real estate non-owner occupied | 1,121,238 | 1,144,643 | 1,206,646 | 1,194,832 | 1,213,815 | ||||||||||||||||||||||||

| Construction | 198,981 | 198,607 | 179,198 | 156,837 | 140,905 | ||||||||||||||||||||||||

| Total commercial loans and leases | 12,420,565 | 13,574,667 | 15,057,974 | 14,407,654 | 14,211,280 | ||||||||||||||||||||||||

| Consumer: | |||||||||||||||||||||||||||||

| Residential | 350,984 | 260,820 | 273,493 | 295,654 | 323,322 | ||||||||||||||||||||||||

| Manufactured housing | 52,861 | 55,635 | 57,904 | 59,977 | 62,243 | ||||||||||||||||||||||||

| Installment | 1,744,475 | 1,624,415 | 1,577,651 | 1,405,021 | 1,235,406 | ||||||||||||||||||||||||

| Total consumer loans | 2,148,320 | 1,940,870 | 1,909,048 | 1,760,652 | 1,620,971 | ||||||||||||||||||||||||

| Total loans and leases | $ | 14,568,885 | $ | 15,515,537 | $ | 16,967,022 | $ | 16,168,306 | $ | 15,832,251 | |||||||||||||||||||

| CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||

| PERIOD END DEPOSIT COMPOSITION - UNAUDITED | |||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

| December 31, | September 30, | June 30, | March 31, | December 31, | |||||||||||||||||||||||||

| 2021 | 2021 | 2021 | 2021 | 2020 | |||||||||||||||||||||||||

| Demand, non-interest bearing | $ | 4,459,790 | $ | 4,954,331 | $ | 2,699,869 | $ | 2,687,628 | $ | 2,356,998 | |||||||||||||||||||

| Demand, interest bearing | 6,488,406 | 5,023,081 | 4,206,355 | 3,228,941 | 2,384,691 | ||||||||||||||||||||||||

| Total demand deposits | 10,948,196 | 9,977,412 | 6,906,224 | 5,916,569 | 4,741,689 | ||||||||||||||||||||||||

| Savings | 973,317 | 1,310,343 | 1,431,756 | 1,483,482 | 1,314,817 | ||||||||||||||||||||||||

| Money market | 4,349,073 | 5,090,121 | 4,908,809 | 4,406,508 | 4,601,492 | ||||||||||||||||||||||||

| Time deposits | 507,338 | 593,149 | 627,150 | 665,881 | 651,931 | ||||||||||||||||||||||||

| Total deposits | $ | 16,777,924 | $ | 16,971,025 | $ | 13,873,939 | $ | 12,472,440 | $ | 11,309,929 | |||||||||||||||||||

18

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||||||||||||||||||||

ASSET QUALITY - UNAUDITED | |||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | As of December 31, 2021 | As of September 30, 2021 | As of December 31, 2020 | ||||||||||||||||||||||||||||||||||||||||||||

| Total loans | Non accrual /NPLs | Allowance for credit losses | Total NPLs to total loans | Total reserves to total NPLs | Total loans | Non accrual /NPLs | Allowance for credit losses | Total NPLs to total loans | Total reserves to total NPLs | Total loans | Non accrual /NPLs | Allowance for credit losses | Total NPLs to total loans | Total reserves to total NPLs | |||||||||||||||||||||||||||||||||

| Loan type | |||||||||||||||||||||||||||||||||||||||||||||||

| Multi-family | $ | 1,486,308 | $ | 22,654 | $ | 4,477 | 1.52 | % | 19.76 | % | $ | 1,369,876 | $ | 24,524 | $ | 4,397 | 1.79 | % | 17.93 | % | $ | 1,761,301 | $ | 21,728 | $ | 12,620 | 1.23 | % | 58.08 | % | |||||||||||||||||

Commercial & industrial (1) | 3,424,783 | 6,096 | 12,702 | 0.18 | % | 208.37 | % | 2,673,226 | 6,951 | 10,860 | 0.26 | % | 156.24 | % | 2,289,441 | 8,453 | 12,239 | 0.37 | % | 144.79 | % | ||||||||||||||||||||||||||

| Commercial real estate owner occupied | 654,922 | 2,475 | 3,213 | 0.38 | % | 129.82 | % | 656,044 | 2,412 | 3,617 | 0.37 | % | 149.96 | % | 572,338 | 3,411 | 9,512 | 0.60 | % | 278.86 | % | ||||||||||||||||||||||||||

| Commercial real estate non-owner occupied | 1,121,238 | 2,815 | 6,210 | 0.25 | % | 220.60 | % | 1,144,643 | 2,845 | 7,375 | 0.25 | % | 259.23 | % | 1,196,564 | 2,356 | 19,452 | 0.20 | % | 825.64 | % | ||||||||||||||||||||||||||

| Construction | 198,981 | — | 692 | — | % | — | % | 198,607 | — | 886 | — | % | — | % | 140,905 | — | 5,871 | — | % | — | % | ||||||||||||||||||||||||||

| Total commercial loans and leases receivable | 6,886,232 | 34,040 | 27,294 | 0.49 | % | 80.18 | % | 6,042,396 | 36,732 | 27,135 | 0.61 | % | 73.87 | % | 5,960,549 | 35,948 | 59,694 | 0.60 | % | 166.06 | % | ||||||||||||||||||||||||||

| Residential | 334,730 | 7,727 | 2,383 | 2.31 | % | 30.84 | % | 248,153 | 7,738 | 1,912 | 3.12 | % | 24.71 | % | 317,170 | 9,911 | 3,977 | 3.12 | % | 40.13 | % | ||||||||||||||||||||||||||

| Manufactured housing | 52,861 | 3,563 | 4,278 | 6.74 | % | 120.07 | % | 55,635 | 3,520 | 4,410 | 6.33 | % | 125.28 | % | 62,243 | 2,969 | 5,189 | 4.77 | % | 174.77 | % | ||||||||||||||||||||||||||

| Installment | 1,744,475 | 3,783 | 103,849 | 0.22 | % | 2745.15 | % | 1,624,415 | 3,544 | 98,039 | 0.22 | % | 2766.34 | % | 1,235,406 | 3,211 | 75,316 | 0.26 | % | 2345.56 | % | ||||||||||||||||||||||||||

| Total consumer loans receivable | 2,132,066 | 15,073 | 110,510 | 0.71 | % | 733.17 | % | 1,928,203 | 14,802 | 104,361 | 0.77 | % | 705.05 | % | 1,614,819 | 16,091 | 84,482 | 1.00 | % | 525.03 | % | ||||||||||||||||||||||||||

Loans and leases receivable (1) | 9,018,298 | 49,113 | 137,804 | 0.54 | % | 280.59 | % | 7,970,599 | 51,534 | 131,496 | 0.65 | % | 255.16 | % | 7,575,368 | 52,039 | 144,176 | 0.69 | % | 277.05 | % | ||||||||||||||||||||||||||

| Loans receivable, PPP | 3,250,008 | — | — | — | % | — | % | 4,957,357 | — | — | — | % | — | % | 4,561,365 | — | — | — | % | — | % | ||||||||||||||||||||||||||

| Loans receivable, mortgage warehouse, at fair value | 2,284,325 | — | — | — | % | — | % | 2,557,624 | — | — | — | % | — | % | 3,616,432 | — | — | — | % | — | % | ||||||||||||||||||||||||||

| Total loans held for sale | 16,254 | 507 | — | 3.12 | % | — | % | 29,957 | 507 | — | 1.69 | % | — | % | 79,086 | 18,469 | — | 23.35 | % | — | % | ||||||||||||||||||||||||||

| Total portfolio | $ | 14,568,885 | $ | 49,620 | $ | 137,804 | 0.34 | % | 277.72 | % | $ | 15,515,537 | $ | 52,041 | $ | 131,496 | 0.34 | % | 252.68 | % | $ | 15,832,251 | $ | 70,508 | $ | 144,176 | 0.45 | % | 204.48 | % | |||||||||||||||||

(1) Excluding loans receivable, PPP from total loans and leases receivable is a non-GAAP measure. Management believes the use of these non-GAAP measures provides additional clarity when assessing Customers' financial results. These disclosures should not be viewed as substitutes for results determined to be in accordance with U.S. GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other entities. Please refer to the reconciliation schedules that follow this table.

19

| CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||||||||||||||

| NET CHARGE-OFFS/(RECOVERIES) - UNAUDITED | |||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||

Q4 | Q3 | Q2 | Q1 | Q4 | Twelve Months Ended December 31, | ||||||||||||||||||||||||||||||||||||

| 2021 | 2021 | 2021 | 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||||||||||||||||||

Loan type | |||||||||||||||||||||||||||||||||||||||||

| Multi-family | $ | — | $ | — | $ | — | $ | 1,132 | $ | — | $ | 1,132 | $ | — | |||||||||||||||||||||||||||

| Commercial & industrial | 240 | 116 | (283) | 375 | 155 | 448 | 139 | ||||||||||||||||||||||||||||||||||

| Commercial real estate owner occupied | 66 | 50 | (1) | 134 | 12 | 249 | 51 | ||||||||||||||||||||||||||||||||||

| Commercial real estate non-owner occupied | (14) | 943 | (59) | (10) | (35) | 860 | 24,486 | ||||||||||||||||||||||||||||||||||

| Construction | (3) | (3) | (114) | (5) | (6) | (125) | (128) | ||||||||||||||||||||||||||||||||||

| Residential | (6) | 54 | (12) | 40 | 46 | 76 | (26) | ||||||||||||||||||||||||||||||||||

| Installment | 7,299 | 5,944 | 7,060 | 10,855 | 8,300 | 31,158 | 30,285 | ||||||||||||||||||||||||||||||||||

| Total net charge-offs (recoveries) from loans held for investment | $ | 7,582 | $ | 7,104 | $ | 6,591 | $ | 12,521 | $ | 8,472 | $ | 33,798 | $ | 54,807 | |||||||||||||||||||||||||||

20

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||

RECONCILIATION OF GAAP TO NON-GAAP MEASURES - UNAUDITED | |||||||||||||||||||||||||||||

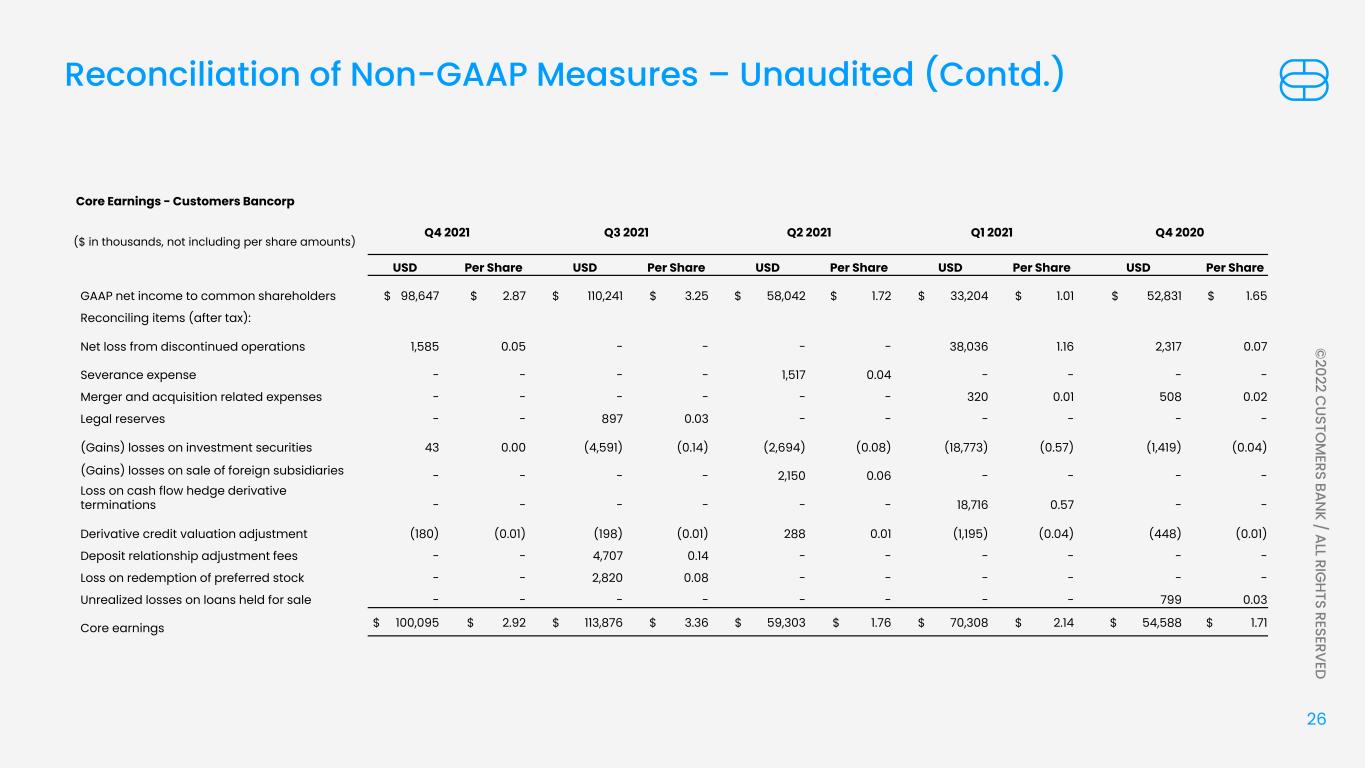

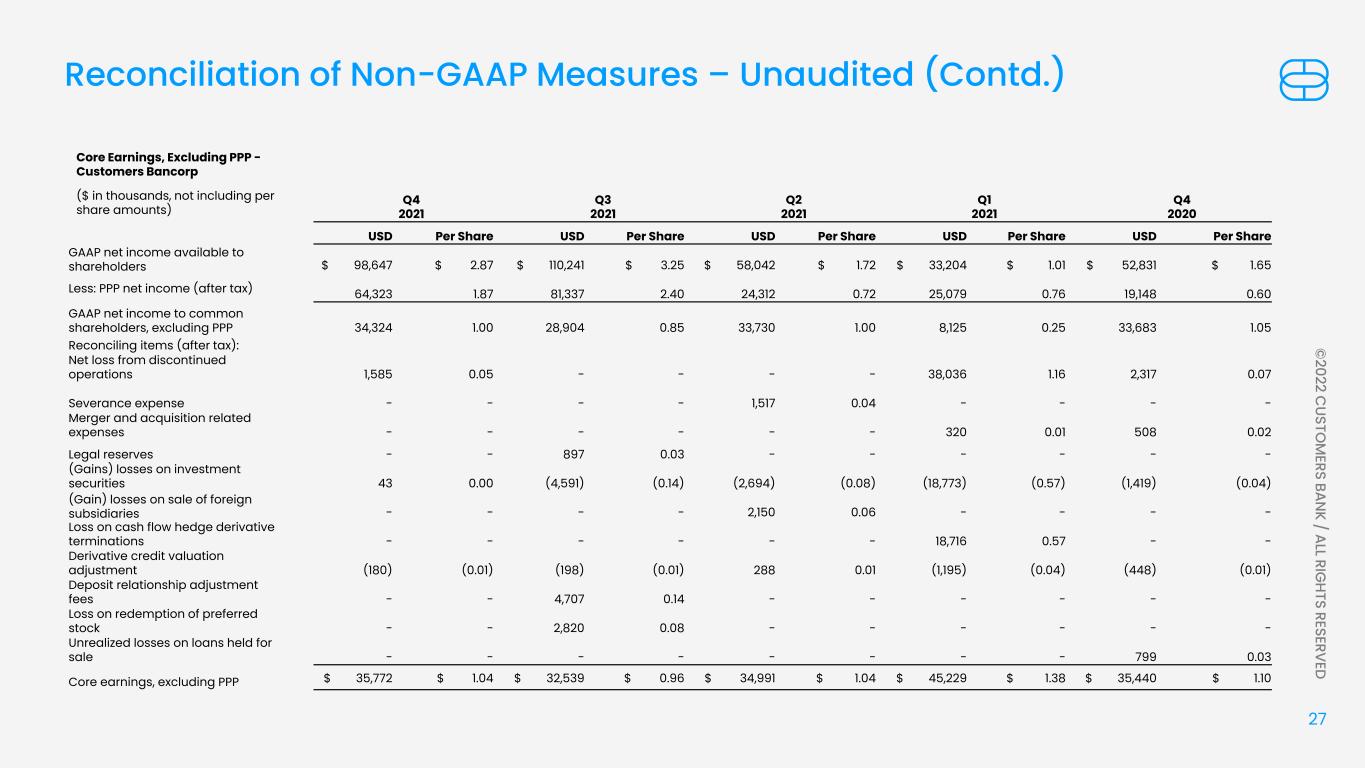

Customers believes that the non-GAAP measurements disclosed within this document are useful for investors, regulators, management and others to evaluate our core results of operations and financial condition relative to other financial institutions. These non-GAAP financial measures are frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in Customers' industry. These non-GAAP financial measures exclude from corresponding GAAP measures the impact of certain elements that we do not believe are representative of our ongoing financial results, which we believe enhance an overall understanding of our performance and increases comparability of our period to period results. Investors should consider our performance and financial condition as reported under GAAP and all other relevant information when assessing our performance or financial condition. The non-GAAP measures presented are not necessarily comparable to non-GAAP measures that may be presented by other financial institutions. Although non-GAAP financial measures are frequently used in the evaluation of a company, they have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our results of operations or financial condition as reported under GAAP.

The following tables present reconciliations of GAAP to non-GAAP measures disclosed within this document.

Core Earnings - Customers Bancorp | Twelve Months Ended December 31, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Q4 2021 | Q3 2021 | Q2 2021 | Q1 2021 | Q4 2020 | 2021 | 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands except per share data) | USD | Per share | USD | Per share | USD | Per share | USD | Per share | USD | Per share | USD | Per share | USD | Per share | ||||||||||||||||||||||||||||||||||||||||||||||||

| GAAP net income to common shareholders | $ | 98,647 | $ | 2.87 | $ | 110,241 | $ | 3.25 | $ | 58,042 | $ | 1.72 | $ | 33,204 | $ | 1.01 | $ | 52,831 | $ | 1.65 | $ | 300,134 | $ | 8.91 | $ | 118,537 | $ | 3.74 | ||||||||||||||||||||||||||||||||||

| Reconciling items (after tax): | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net loss from discontinued operations | 1,585 | 0.05 | — | — | — | — | 38,036 | 1.16 | 2,317 | 0.07 | 39,621 | 1.18 | 10,461 | 0.33 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Severance expense | — | — | — | — | 1,517 | 0.04 | — | — | — | — | 1,517 | 0.05 | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Merger and acquisition related expenses | — | — | — | — | — | — | 320 | 0.01 | 508 | 0.02 | 320 | 0.01 | 1,038 | 0.03 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Legal reserves | — | — | 897 | 0.03 | — | — | — | — | — | — | 897 | 0.03 | 258 | 0.01 | ||||||||||||||||||||||||||||||||||||||||||||||||

| (Gains) losses on investment securities | 43 | 0.00 | (4,591) | (0.14) | (2,694) | (0.08) | (18,773) | (0.57) | (1,419) | (0.04) | (26,015) | (0.77) | (17,412) | (0.55) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Loss on sale of foreign subsidiaries | — | — | — | — | 2,150 | 0.06 | — | — | — | — | 2,150 | 0.06 | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Loss on cash flow hedge derivative terminations | — | — | — | — | — | — | 18,716 | 0.57 | — | — | 18,716 | 0.56 | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Derivative credit valuation adjustment | (180) | (0.01) | (198) | (0.01) | 288 | 0.01 | (1,195) | (0.04) | (448) | (0.01) | (1,285) | (0.04) | 5,811 | 0.18 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Risk participation agreement mark-to-market adjustment | — | — | — | — | — | — | — | — | — | — | — | — | (1,080) | (0.03) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Deposit relationship adjustment fees | — | — | 4,707 | 0.14 | — | — | — | — | — | — | 4,707 | 0.14 | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Loss on redemption of preferred stock | — | — | 2,820 | 0.08 | — | — | — | — | — | — | 2,820 | 0.08 | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Unrealized losses on loans held for sale | — | — | — | — | — | — | — | — | 799 | 0.03 | — | — | 1,913 | 0.06 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Core earnings | $ | 100,095 | $ | 2.92 | $ | 113,876 | $ | 3.36 | $ | 59,303 | $ | 1.76 | $ | 70,308 | $ | 2.14 | $ | 54,588 | $ | 1.71 | $ | 343,582 | $ | 10.20 | $ | 119,526 | $ | 3.77 | ||||||||||||||||||||||||||||||||||

21

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||

RECONCILIATION OF GAAP TO NON-GAAP MEASURES - UNAUDITED (CONTINUED) | |||||||||||||||||||||||||||||

(Dollars in thousands, except per share data) | |||||||||||||||||||||||||||||

Core Earnings, excluding PPP - Customers Bancorp | Twelve Months Ended December 31, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Q4 2021 | Q3 2021 | Q2 2021 | Q1 2021 | Q4 2020 | 2021 | 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands except per share data) | USD | Per share | USD | Per share | USD | Per share | USD | Per share | USD | Per share | USD | Per share | USD | Per share | ||||||||||||||||||||||||||||||||||||||||||||||||

| GAAP net income to common shareholders | $ | 98,647 | $ | 2.87 | $ | 110,241 | $ | 3.25 | $ | 58,042 | $ | 1.72 | $ | 33,204 | $ | 1.01 | $ | 52,831 | $ | 1.65 | $ | 300,134 | $ | 8.91 | $ | 118,537 | $ | 3.74 | ||||||||||||||||||||||||||||||||||

| Less: PPP net income (after tax) | 64,323 | 1.87 | 81,337 | 2.40 | 24,312 | 0.72 | 25,079 | 0.76 | 19,148 | 0.60 | 195,050 | 5.79 | 41,509 | 1.31 | ||||||||||||||||||||||||||||||||||||||||||||||||

| GAAP net income to common shareholders, excluding PPP | 34,324 | 1.00 | 28,904 | 0.85 | 33,730 | 1.00 | 8,125 | 0.25 | 33,683 | 1.05 | 105,084 | 3.12 | 77,028 | 2.43 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Reconciling items (after tax): | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net loss from discontinued operations | 1,585 | 0.05 | — | — | — | — | 38,036 | 1.16 | 2,317 | 0.07 | 39,621 | 1.18 | 10,461 | 0.33 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Severance expense | — | — | — | — | 1,517 | 0.04 | — | — | — | — | 1,517 | 0.05 | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Merger and acquisition related expenses | — | — | — | — | — | — | 320 | 0.01 | 508 | 0.02 | 320 | 0.01 | 1,038 | 0.03 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Legal reserves | — | — | 897 | 0.03 | — | — | — | — | — | — | 897 | 0.03 | 258 | 0.01 | ||||||||||||||||||||||||||||||||||||||||||||||||

| (Gains) losses on investment securities | 43 | 0.00 | (4,591) | (0.14) | (2,694) | (0.08) | (18,773) | (0.57) | (1,419) | (0.04) | (26,015) | (0.77) | (17,412) | (0.55) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Loss on sale of foreign subsidiaries | — | — | — | — | 2,150 | 0.06 | — | — | — | — | 2,150 | 0.06 | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Loss on cash flow hedge derivative terminations | — | — | — | — | — | — | 18,716 | 0.57 | — | — | 18,716 | 0.56 | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Derivative credit valuation adjustment | (180) | (0.01) | (198) | (0.01) | 288 | 0.01 | (1,195) | (0.04) | (448) | (0.01) | (1,285) | (0.04) | 5,811 | 0.18 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Risk participation agreement mark-to-market adjustment | — | — | — | — | — | — | — | — | — | — | — | — | (1,080) | (0.03) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Deposit relationship adjustment fees | — | — | 4,707 | 0.14 | — | — | — | — | — | — | 4,707 | 0.14 | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Loss on redemption of preferred stock | — | — | 2,820 | 0.08 | — | — | — | — | — | — | 2,820 | 0.08 | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Unrealized losses on loans held for sale | — | — | — | — | — | — | — | — | 799 | 0.03 | — | — | 1,913 | 0.06 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Core earnings, excluding PPP | $ | 35,772 | $ | 1.04 | $ | 32,539 | $ | 0.96 | $ | 34,991 | $ | 1.04 | $ | 45,229 | $ | 1.38 | $ | 35,440 | $ | 1.10 | $ | 148,532 | $ | 4.41 | $ | 78,017 | $ | 2.46 | ||||||||||||||||||||||||||||||||||

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||

RECONCILIATION OF GAAP TO NON-GAAP MEASURES - UNAUDITED (CONTINUED) | |||||||||||||||||||||||||||||

(Dollars in thousands, except per share data) | |||||||||||||||||||||||||||||

| Core Return on Average Assets - Customers Bancorp | Twelve Months Ended December 31, | ||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands except per share data) | Q4 2021 | Q3 2021 | Q2 2021 | Q1 2021 | Q4 2020 | 2021 | 2020 | ||||||||||||||||||||||||||||||||||

| GAAP net income | $ | 100,669 | $ | 116,042 | $ | 61,341 | $ | 36,595 | $ | 56,245 | $ | 314,647 | $ | 132,578 | |||||||||||||||||||||||||||

| Reconciling items (after tax): | |||||||||||||||||||||||||||||||||||||||||

| Net loss from discontinued operations | 1,585 | — | — | 38,036 | 2,317 | 39,621 | 10,461 | ||||||||||||||||||||||||||||||||||

| Severance expense | — | — | 1,517 | — | — | 1,517 | — | ||||||||||||||||||||||||||||||||||

Merger and acquisition related expenses | — | — | — | 320 | 508 | 320 | 1,038 | ||||||||||||||||||||||||||||||||||

| Legal reserves | — | 897 | — | — | — | 897 | 258 | ||||||||||||||||||||||||||||||||||

| (Gains) losses on investment securities | 43 | (4,591) | (2,694) | (18,773) | (1,419) | (26,015) | (17,412) | ||||||||||||||||||||||||||||||||||

| Loss on sale of foreign subsidiaries | — | — | 2,150 | — | — | 2,150 | — | ||||||||||||||||||||||||||||||||||