Form 8-K Citizens Community Banco For: Jun 20

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

__________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 20, 2018

CITIZENS COMMUNITY BANCORP, INC.

(Exact name of registrant as specified in its charter)

Maryland

(State or other jurisdiction of incorporation)

001-33003 | 20-5120010 | |

(Commission File Number) | (I.R.S. Employer I.D. Number) | |

2174 EastRidge Center, Eau Claire, Wisconsin | 54701 | |

(Address of Principal Executive Offices) | (Zip Code) | |

715-836-9994

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter.)

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material Definitive Agreement

Stock Purchase Agreement

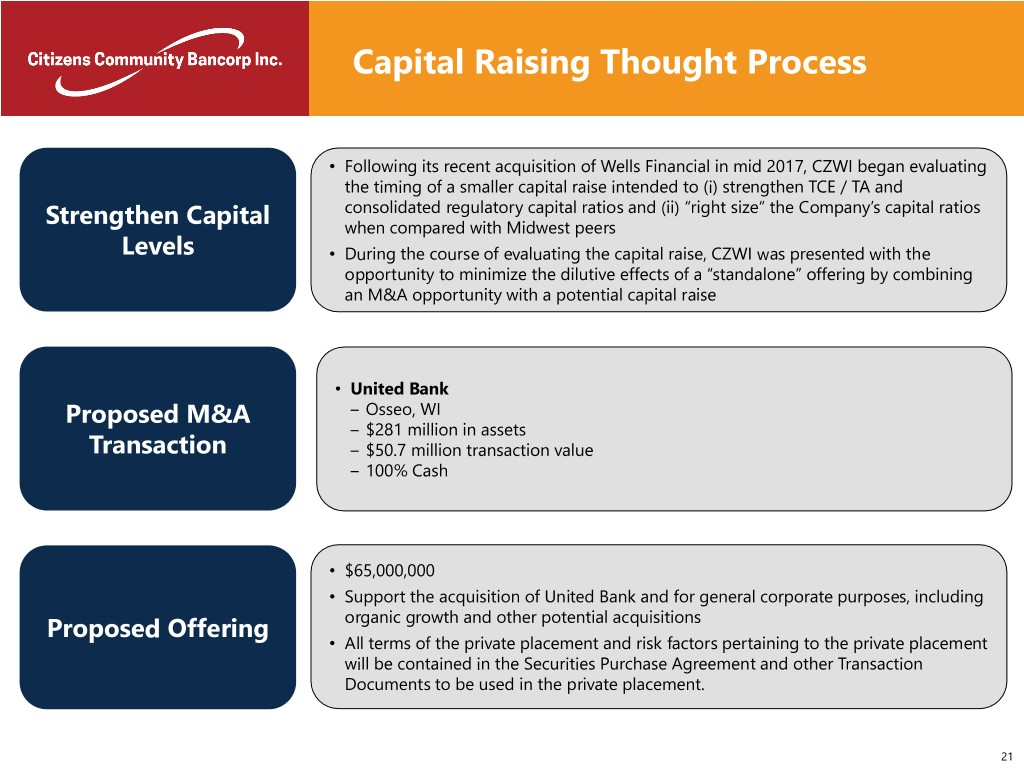

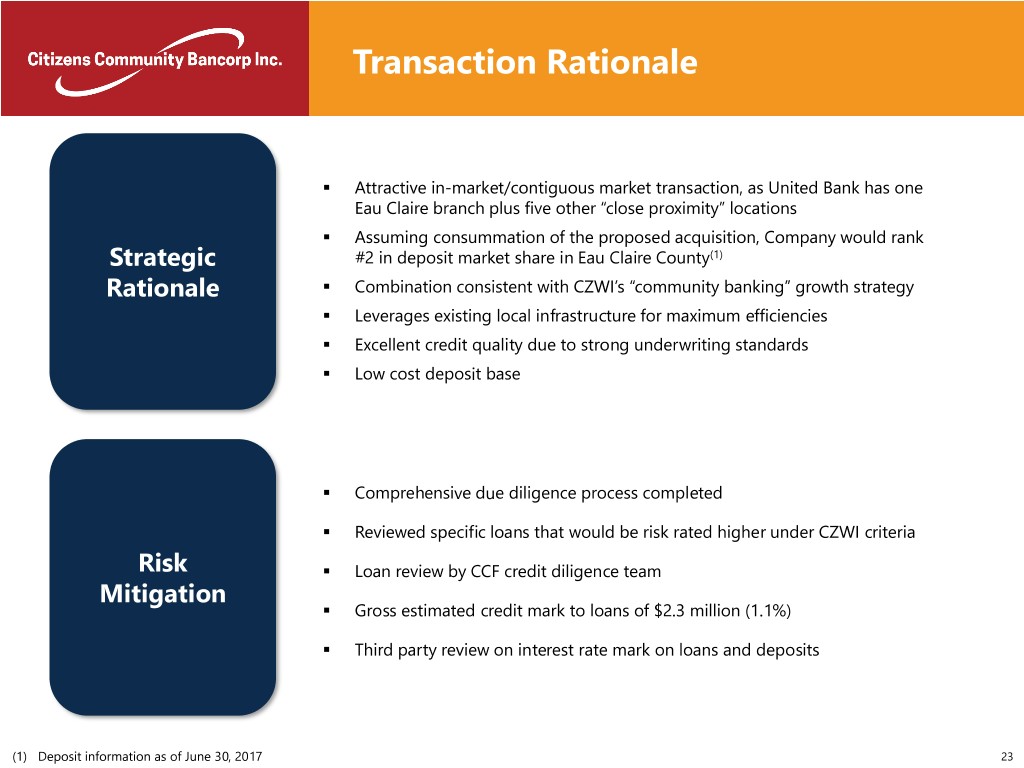

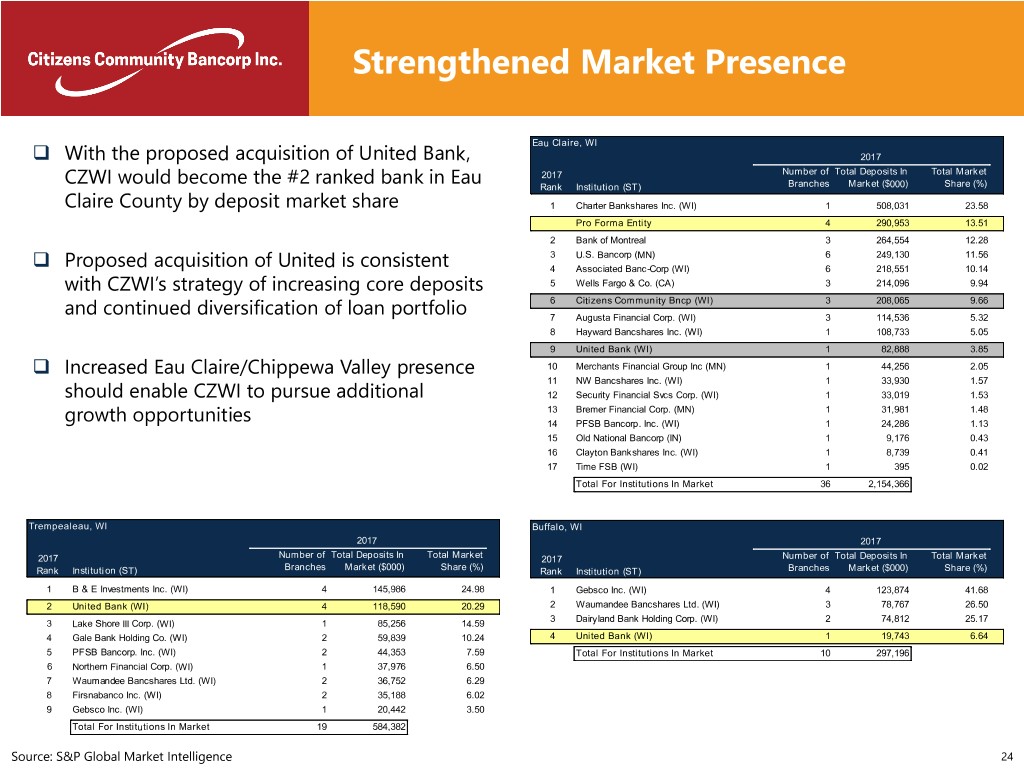

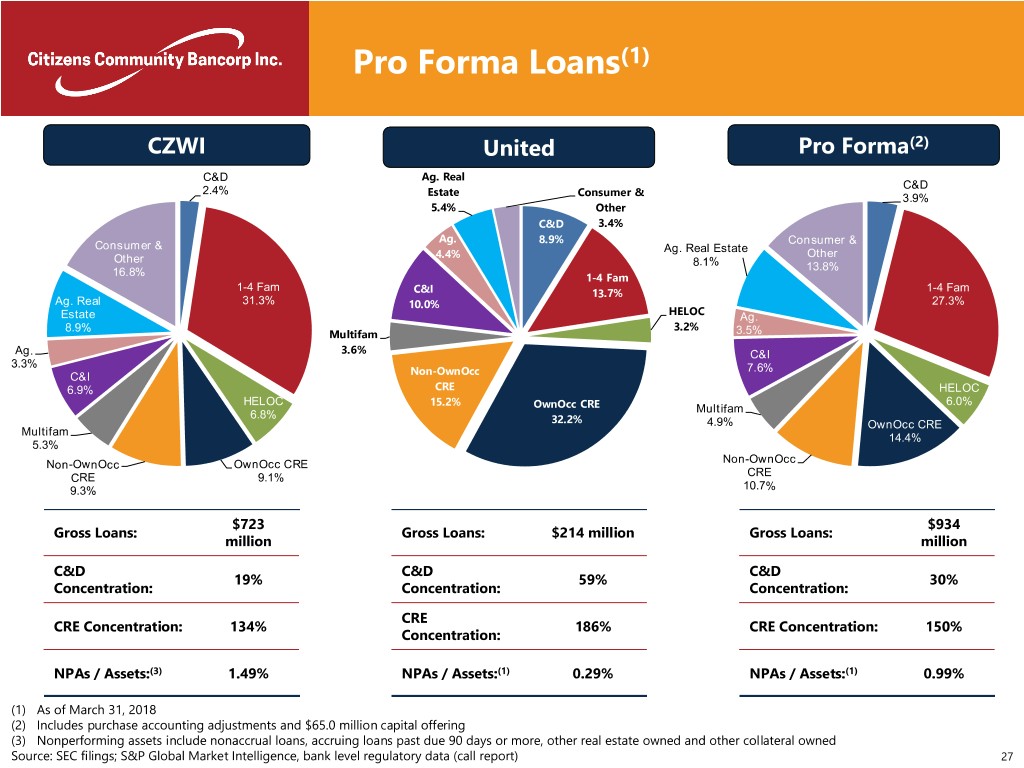

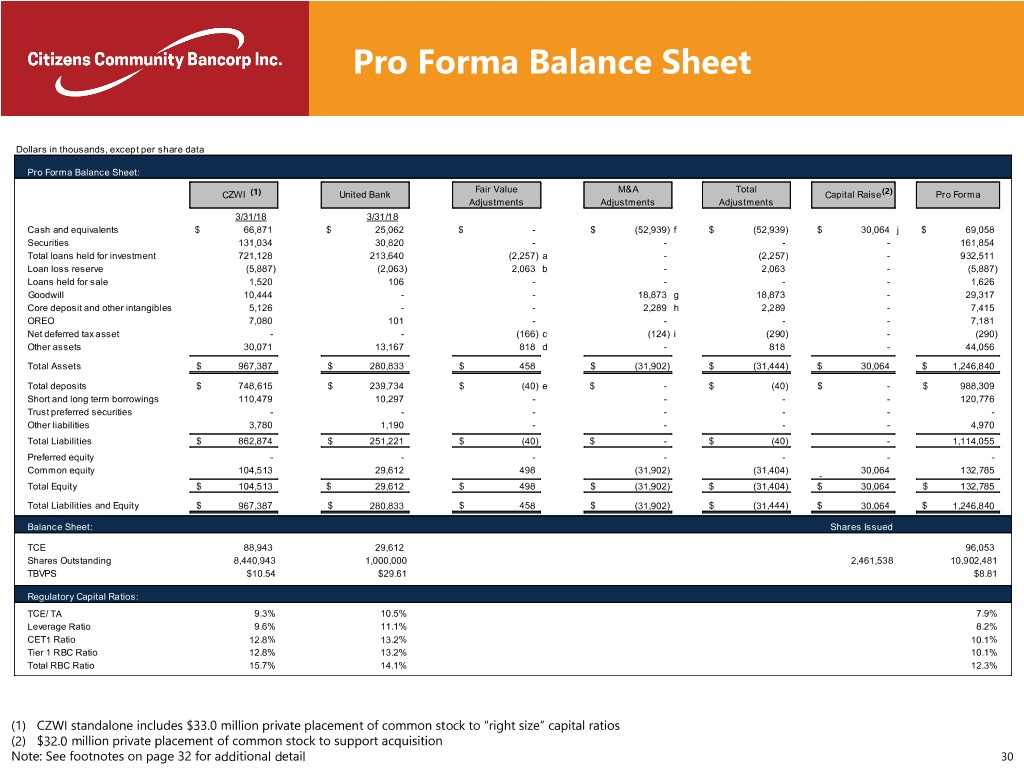

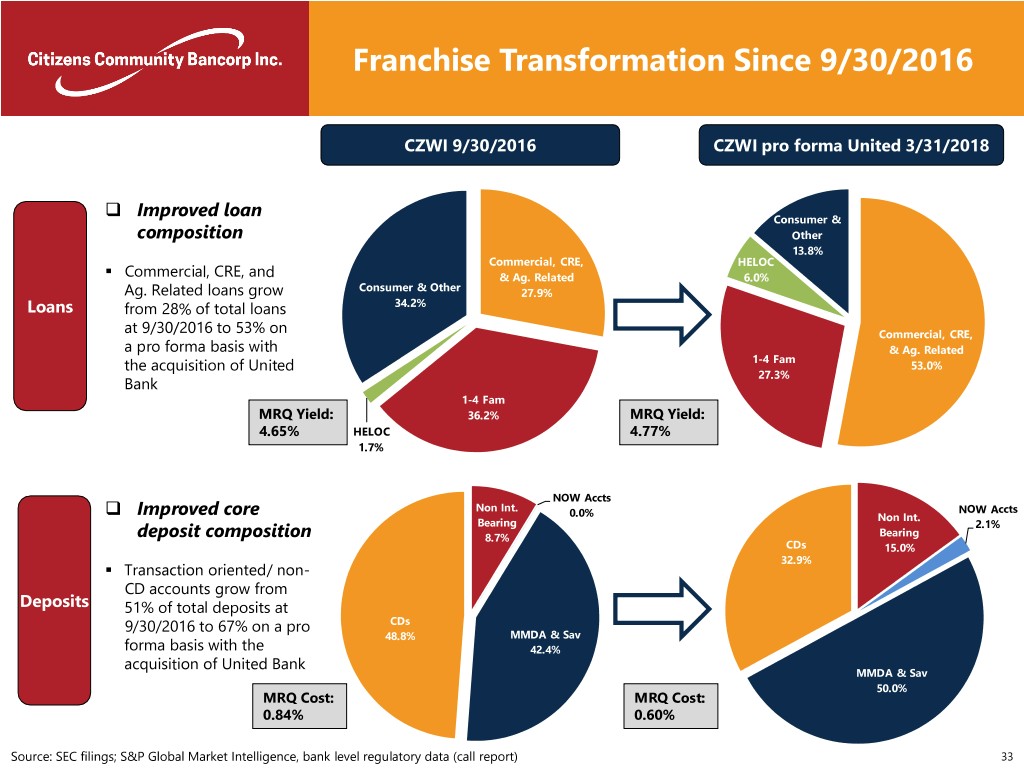

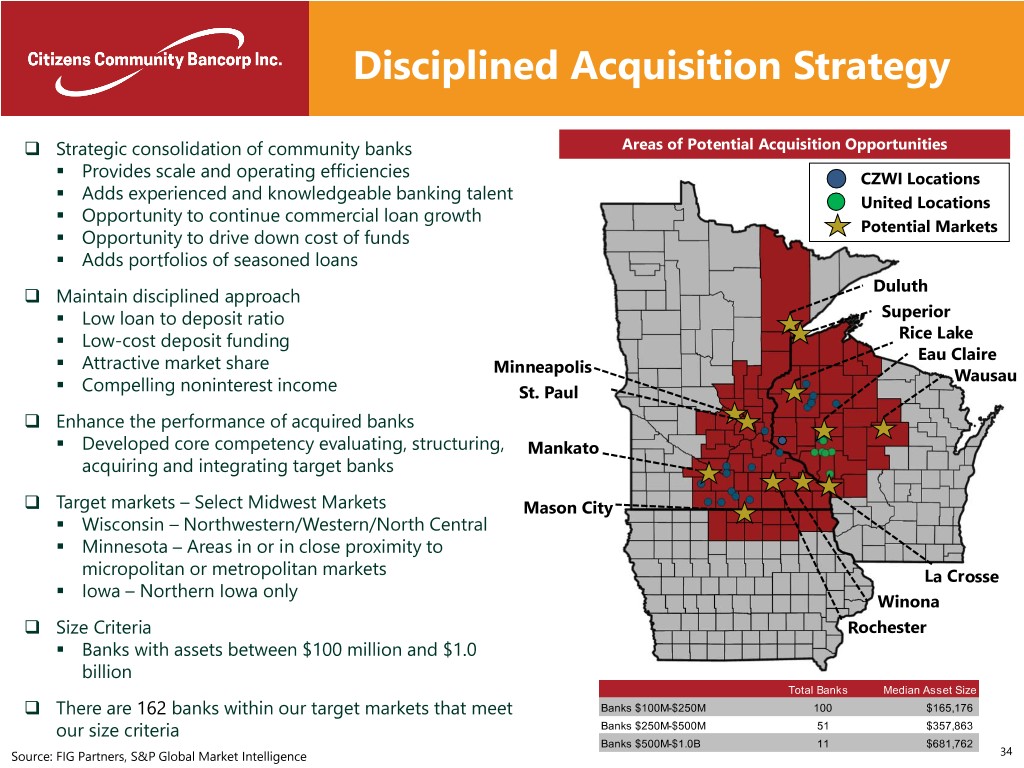

On June 20, 2018, Citizens Community Bancorp, Inc. (the “Company”) entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with United Bancorporation (“Parent”) and its wholly-owned subsidiary, United Bank, a Wisconsin chartered bank (“United Bank”), pursuant to which the Company will, subject to the terms and conditions set forth therein, acquire 100% of the common stock of United Bank (the “Acquisition”) for approximately $50.7 million in cash, subject to adjustment as provided in the Stock Purchase Agreement. At the closing of the Acquisition, United Bank will become a wholly-owned subsidiary of the Company. Immediately following the closing of the Acquisition, the Company intends to merge United Bank with and into Citizens Community Federal, N.A. (“CCF Bank”), a federally-chartered national bank and a wholly-owned subsidiary of the Company, with CCF Bank surviving the Acquisition.

Completion of the Acquisition is subject to certain customary mutual conditions, including: (i) receipt of all required regulatory approvals and expiration of all related statutory waiting periods (and the absence of a burdensome condition (as defined in the Stock Purchase Agreement) in connection with obtaining any such approvals); and (ii) the absence of any law or order prohibiting the consummation of the Acquisition. Each party’s obligation to complete the Acquisition is also conditioned upon certain additional customary conditions, including (i) the accuracy of the representations and warranties of the other party (subject to certain exceptions and qualifications); and (ii) material compliance by the other party with its obligations under the Stock Purchase Agreement. The Company’s obligation to complete the Acquisition is further conditioned upon the absence of a material adverse effect (as defined in the Stock Purchase Agreement) with respect to United Bank or Parent.

The Stock Purchase Agreement contains customary representations and warranties by each of the parties, and each party has agreed to customary covenants. United Bank and Parent have also agreed to customary covenants relating to the conduct of United Bank’s business during the interim period between the execution of the Stock Purchase Agreement and the completion of the Acquisition, and customary non-solicitation covenants relating to alternative acquisition proposals.

The Stock Purchase Agreement contains indemnification obligations of the Company and Parent with respect to breaches of certain of such party’s representations, warranties and covenants and certain other specified matters, which party’s indemnification obligations are also subject to various specified limitations.

The Stock Purchase Agreement provides certain customary termination rights for the Company and Bank Parent, including, among others, (i) a breach of the Stock Purchase Agreement by the other party that is not cured within 30 days’ notice of such breach and which cause the non-breaching party’s closing conditions to not be satisfied; (ii) a final, non-appealable denial of required regulatory approvals or an injunction prohibiting the transactions contemplated by the Stock Purchase Agreement; and (iii) if the Acquisition has not closed on or prior to the twelfth month anniversary of the date of signing, as may be extended by six months, if necessary, to obtain regulatory approvals.

The foregoing summary of the Stock Purchase Agreement and the transactions contemplated thereby does not purport to be complete and is subject to and qualified in its entirety by the full text of the Stock Purchase Agreement, which is filed as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Cautionary Statements Regarding Stock Purchase Agreement Representations and Warranties

The Stock Purchase Agreement has been filed as an exhibit to this Form 8-K to provide information regarding its terms. It is not intended to modify or supplement any factual disclosures about the Company, CCF Bank or United Bank in any public reports filed or to be filed with the U.S. Securities and Exchange Commission (the “SEC”) by the Company. In particular, the assertions embodied in the representations, warranties, and covenants contained in the Stock Purchase Agreement were made only for purposes of the Stock Purchase Agreement and as of specified dates, were solely for the benefit of the parties to the Stock Purchase Agreement, and are subject to limitations, modifications and qualifications agreed upon by the parties to the Stock Purchase Agreement. Moreover, certain representations and warranties in the Stock Purchase Agreement have been made for the purposes of allocating risk between the parties to the Stock Purchase Agreement instead of establishing matters of fact. Accordingly, the representations and warranties in the Stock Purchase Agreement may not constitute the actual state of facts about the Company, CCF Bank or United Bank. The representations and warranties set forth in the Stock Purchase Agreement may also be subject to a contractual standard of materiality different from that generally applicable under federal securities laws. Investors should not rely on the representations, warranties, or covenants or any descriptions thereof as characterizations of the actual state of facts or the actual condition of the Company, CCF Bank or United Bank or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations and warranties may

change after the date of the Stock Purchase Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures.

PIPE Transaction

On June 20, 2018, the Company entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with each of a limited number of institutional and other accredited investors, including certain officers and directors of the Company (collectively the “Purchasers”), pursuant to which the Company expects to sell an aggregate of 500,000 shares of the Company’s 8.00% Series A Mandatorily Convertible Non-Cumulative Non-Voting Perpetual Preferred Stock, par value $0.01 per share, (the “Series A Preferred Stock”), in a private placement (the “Private Placement”) at $130 per share, for aggregate gross proceeds of $65 million. The Securities Purchase Agreement contains customary representations, warranties, and covenants of the Company and the Purchasers.

The Series A Preferred Stock ranks senior to the Company’s common stock, $0.01 par value, of the Company (“Common Stock”) with respect to payment of dividends and distribution of amounts upon liquidation, dissolution or winding up. Each share of Series A Preferred Stock has a “Liquidation Preference” of $130. Holders of the Series A Preferred Stock generally will have limited voting rights as provided below. The Series A Preferred Stock will not be redeemable by either the Company or by a holder.

Each share of Series A Preferred Stock is mandatorily convertible into ten shares of common stock, $0.01 par value, of the Company (“Common Stock”) following the Company’s receipt of stockholder approval of the issuance of the shares of Common Stock into which the Series A Preferred Stock is expected to be converted. The Securities Purchase Agreement requires that the Company hold a special meeting of stockholders for purposes of a stockholder vote regarding approval of issuance of the shares of Common Stock into which the Series A Preferred Stock is expected to be converted.

Each share of the Series A Preferred Stock will bear a cash dividend, when and as authorized by the Board of Directors of the Company, equal to 8% per annum. Such dividends are non-cumulative and shall be payable semiannually in arrears commencing on December 31, 2018 if the Series A Preferred Stock is not converted to Common Stock on or before that date. If the Series A Preferred Stock is converted to Common Stock on or before December 31, 2018, then no dividends will be payable on the Series A Preferred Stock.

The affirmative vote or consent of the holders of at least a majority of the outstanding shares of Series A Preferred Stock, voting together with any class or series of parity securities, shall be required to (i) authorize or issue, or increase the authorized, issued or outstanding amount of, any shares of any class or series of stock ranking senior to the Series A Preferred Stock with respect to the payment of dividends or distribution of assets on the Company’s liquidation, dissolution or winding up or (ii) adversely affect the preferences, conversion or other rights, voting powers, restrictions, limitations as to dividends or other distributions, qualifications or terms or conditions of redemption of the Series A Preferred Stock.

In connection with the Private Placement, the Company entered into a Registration Rights Agreement on June 20, 2018 (the “Registration Rights Agreement”), with each of the Purchasers. Pursuant to the terms of the Registration Rights Agreement, the Company has agreed to file a resale registration statement by no later than the 30th day following the closing of the Private Placement for the purpose of registering the underlying shares of Common Stock into which the shares of Series A Preferred Stock are convertible (following stockholder approval of the conversion of the Series A Preferred Stock into shares of Common Stock). Pursuant to the Registration Rights Agreement, the Company has agreed to use its commercially reasonable efforts to have such registration statement declared effective with the SEC as soon as practical, but not later than the 120th day following the closing of the Private Placement (or, in the event the SEC reviews and has written comments to the registration statement, the 150th day following the closing of the Private Placement) or the 5th trading day after the date the Company is notified by the SEC that the SEC is prepared to declare such registration statement effective.

The foregoing descriptions of the Securities Purchase Agreement, Registrations Rights Agreement and the transactions contemplated thereby do not purport to be complete and are subject to and qualified in their entirety by the full text of the Securities Purchase Agreement and Registrations Rights Agreement, which are filed as Exhibits 1.1 and 1.2, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

Item 3.02. Unregistered Sales of Equity Securities.

The information contained under Item 1.01 under the section “PIPE Transaction” is hereby incorporated by reference into this Item 3.02.

The issuance and sale of the securities pursuant to the Securities Purchase Agreement was a private placement exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), in reliance on Section 4(a)(2) thereof and Rule 506(b) safe harbor of Regulation D promulgated thereunder, as a transaction by an issuer not involving a public offering, involving only a limited number of institutional and other accredited investors.

Item 3.03. Material Modification to Rights of Security Holders

The information contained under Item 1.01 under the section “PIPE Transaction” is hereby incorporated by reference into this Item 3.03.

On June 20, 2018, the Company filed, with the State Department of Assessments and Taxation of the State of Maryland (the “SDAT”), Articles Supplementary (the “Articles Supplementary”), which classified and designated 500,000 authorized but unissued shares of the Company’s preferred stock as shares of Series A Preferred Stock. The preferences, conversion and other rights, voting powers, restrictions, limitations as to dividends and other distributions, qualifications and terms and conditions of redemption of the Series A Preferred Stock are set forth in the Articles Supplementary and are described under Item 1.01 under the section “PIPE Transaction”. The Articles Supplementary became effective on June 20, 2018 upon the acceptance for record by SDAT.

The foregoing description of the Articles Supplementary does not purport to be complete and is qualified in its entirety by the full text of the Articles Supplementary as filed with SDAT, which is attached as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The information contained above in Item 1.01 under the section “PIPE Transaction” and in Item 3.03 is hereby incorporated by reference into this Item 5.03.

Item 7.01. Regulation FD Disclosure.

On June 21, 2018, the Company issued a press release announcing the Acquisition and the Private Placement. A copy of this press release is attached hereto as Exhibit 99.1.

The Company provided certain information to investors in the Private Placement as part of the private placement process. A copy of this information is attached hereto as Exhibits 99.2.

The information in this Item 7.01 and Exhibits 99.1, 99.2 and 99.3 attached hereto shall not be deemed “to be filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liability of such section, nor shall it be deemed incorporated by reference in any filing of the Company under the Securities Act or the Exchange Act, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Cautionary Notice About Forward-looking Statements and Other Statements

This Current Report on Form 8-K and the attached exhibits may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements may be identified by the use of forward-looking words or phrases such as “anticipate,” “believe,” “could,” “expect,” “intend,” “may,” “planned,” “potential,” “should,” “will,” “would” or the negative of those terms or other words of similar meaning. Such forward-looking statements in this release are inherently subject to many uncertainties arising in the operations and business environment of the Company and CCF Bank. These uncertainties include conditions in the financial markets and economic conditions generally; the possibility of a deterioration in the residential real estate markets; interest rate risk; lending risk; the sufficiency of loan allowances; changes in the fair value or ratings downgrades of our securities; competitive pressures among depository and other financial institutions; our ability to realize the benefits of net deferred tax assets; our ability to maintain or increase our market share; the risk that the proposed transaction may be more difficult, costly or time consuming or that the expected benefits are not realized; failure to obtain applicable regulatory approvals and meet other closing conditions to the proposed transaction on the expected terms and schedule; the risk that if the proposed transaction were not completed it could negatively impact the stock price and the future business and financial results of the Company; difficulties and delays in integrating the acquired business operations or fully realizing cost savings and other benefits; acts of

terrorism and political or military actions by the United States or other governments; legislative or regulatory changes or actions, or significant litigation, adversely affecting the Company or CCF Bank; increases in FDIC insurance premiums or special assessments by the FDIC; disintermediation risk; our inability to obtain needed liquidity; our ability to raise capital needed to fund growth or meet regulatory requirements; the possibility that our internal controls and procedures could fail or be circumvented; our ability to attract and retain key personnel; our ability to keep pace with technological change; cybersecurity risks; risks posed by acquisitions and other expansion opportunities; changes in federal or state tax laws; litigation risk; changes in accounting principles, policies or guidelines and their impact on financial performance; restrictions on our ability to pay dividends; and the potential volatility of our stock price. Shareholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. Such uncertainties and other risks that may affect the Company’s performance are discussed further in Part I, Item 1A, “Risk Factors,” in the Company’s Form 10-K, for the year ended September 30, 2017 filed with the Securities and Exchange Commission (“SEC”) on December 13, 2017 and the Company’s subsequent filings with the SEC. The Company undertakes no obligation to update any forward-looking statement to reflect the impact of events, circumstances, or results that arise after the date that the statement was made.

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful under the securities laws of any such jurisdiction.

Item 8.01. | Other Events. |

The following “Description of Capital Stock” is being filed to update the description of the Company’s Common Stock, which description is incorporated by reference in certain of the Company’s registration statements filed with the Securities and Exchange Commission.

DESCRIPTION OF CAPITAL STOCK

The following description of the Company’s capital stock is a summary of the material terms of the Company’s charter and bylaws, as amended, and the applicable provisions of Maryland law, including the Maryland General Corporation Law (the “MGCL”). Reference is made to the more detailed provisions of, and the descriptions are qualified in their entirety by reference to, (i) the Articles of Incorporation of the Company filed as Exhibit 3.1 to the Company’s Registration Statement on Form SB-2 filed on June 30, 2006, (ii) the Articles of Amendment to the Articles of Incorporation of the Company filed as Exhibit 3.1 to the Company’s Form 10-Q filed on May 15, 2012, (iii) the Articles Supplementary of the Company filed as Exhibit 3.1 to this Form 8-K, (iv) the Bylaws of the Company filed as Exhibit 3.2 to the Company’s Registration Statement on Form SB-2 filed on June 30, 2006, (v) the Amendment to the Bylaws of the Company filed as Exhibit 99.1 to the Company's Form 8-K filed on December 26, 2013, and (vi) the applicable provisions of the MGCL.

General

The Company’s authorized capital stock consists of 30,000,000 shares of common stock, par value $0.01 per share, and 1,000,000 shares of preferred stock, par value $0.01 per share. 500,000 shares of preferred stock are classified and designated as shares of 8.00% Series A Mandatorily Convertible Non-Cumulative Non-Voting Perpetual Preferred Stock, par value $0.01 per share (the “Series A Preferred Stock”). Shares of outstanding Series A Preferred Stock that are purchased or otherwise acquired by the Company (including shares of Series A Preferred Stock that are converted into shares of common stock) will automatically be reclassified as and revert to authorized but unissued shares of preferred stock without further classification as to class or series. Subject to the rights and preferences granted to holders of the Company’s preferred stock, if any, the authorized but unissued shares of the Company’s capital stock are available for future issuance without stockholder approval, unless otherwise required by applicable law or the rules of any applicable securities exchange. All of the Company’s issued and outstanding shares of capital stock are validly issued, fully paid and non-assessable.

Common Stock

Subject to the rights and preferences granted to holders of the Company’s preferred stock then outstanding, if any, and except with respect to voting rights, conversion rights and certain distributions of the Company’s capital stock, holders of the Company common stock rank equally with respect to distributions and have identical rights, preferences, privileges and restrictions, including the right to attend meetings and receive any information distributed by the Company with respect to such meetings.

Dividends

Holders of the Company common stock are entitled to receive ratably such dividends as may be declared from time to time by the Company board out of legally available funds. In no event will any stock dividends or stock splits or combinations of stock be declared or made on common stock unless the shares of common stock are treated equally and identically. The ability of the Company board to declare and pay dividends on the Company common stock is subject to the laws of the state of Maryland, applicable federal and state banking laws and regulations, and the terms of any senior securities (including preferred stock) the Company may then have outstanding. The Company’s principal source of income is dividends that are declared and paid by its wholly owned banking subsidiary, CCF Bank, on its capital stock. Therefore, the Company’s ability to pay dividends is dependent upon the receipt of dividends from CCF Bank.

Voting Rights

Each holder of common stock is entitled to one vote for each share of record held on all matters submitted to a vote of stockholders, except as otherwise required by law and subject to the rights and preferences of the holders of any outstanding shares of the Company preferred stock. Holders of the Company common stock are not entitled to cumulative voting in the election of directors. Directors are elected by a plurality of the votes cast. In addition to any other vote required by law, the affirmative vote of 80% of the voting power of all of the then-outstanding shares of capital stock of the Company entitled to vote generally in the election of directors is required to amend or repeal the provisions of the Company charter covering the capital stock, directors, bylaws, approval of certain business combinations, acquisitions of equity securities from interested persons, indemnification of directors and officers, limitations of liability or amendment of the charter or to amend or repeal any provision of the Company bylaws.

Liquidation Rights

In the event of the Company’s liquidation, dissolution or winding up, holders of the Company common stock are entitled to share ratably in all of the Company’s assets remaining after payment of liabilities, including but not limited to the liquidation preference of any then outstanding the Company preferred stock. Because the Company is a bank holding company, the Company’s rights and the rights of the Company’s creditors and stockholders to receive the assets of any subsidiary upon liquidation or recapitalization may be subject to prior claims of the Company’s subsidiary’s creditors, except to the extent that the Company may be a creditor with recognized claims against its subsidiary.

Preemptive and Other Rights

Holders of the Company common stock are not entitled to any preemptive, subscription or redemption rights except as may be established by the Company board of directors.

Preferred Stock

The Company’s charter authorizes the Company board to establish one or more series of preferred stock. Unless required by law or any stock exchange and subject to the rights and preferences of the holders of any outstanding shares of the Company preferred stock, the authorized shares of the Company preferred stock are available for issuance without further action by the stockholders. The Company board is authorized to divide the preferred stock into series and, with respect to each series, to fix and determine the designation, powers, preferences and rights of the shares of each series and any qualifications, limitations or restrictions. The number of authorized shares of preferred stock may be increased or decreased (but not below the number of shares then outstanding) by the affirmative vote of the holders of a majority of the Company common stock, without a vote of the holders of the preferred stock, unless a vote of the holders of the preferred stock is required by law or pursuant to the terms of such preferred stock. Without stockholder approval, the Company could issue preferred stock that could impede or discourage an acquisition attempt or other transaction that some, or a majority, of the Company’s stockholders may believe is in their best interests or in which they may receive a premium for their common stock over the market price of the common stock.

Series A Preferred Stock

Authorized Shares, Par Value and Liquidation Preference. The Company has designated 500,000 shares as “8.00% Series A Mandatorily Convertible Non-Cumulative Non-Voting Perpetual Preferred Stock,” each of which has a $0.01 par value and a liquidation preference of $130 per share.

Ranking. The Series A Preferred Stock ranks senior to all of the Company’s common stock and will rank pari passu or senior to all future issuances of the Company’s preferred stock.

Dividends. If stockholder approval of the conversion of the Series A Preferred Stock is not obtained, the shares of Series A Preferred Stock will remain outstanding and, beginning December 31, 2018, and for so long as such shares remain outstanding, the Company will be required to pay dividends on the Series A Preferred Stock, on a non-cumulative basis, at an annual rate of 8% of the liquidation value of the Series A Preferred Stock, which is $130. Dividends after December 31, 2018 will be payable semi-annually in arrears on June 30 and December 31, beginning on December 31, 2018. If all dividends payable on the Series A Preferred Stock have not been declared and paid for an applicable dividend period, the Company shall not declare or pay any dividends on any stock which ranks junior to the Series A Preferred Stock, or redeem, purchase or acquire any stock which ranks pari passu or junior to the Series A Preferred Stock, subject to customary exceptions. If all dividends payable on the Series A Preferred Stock have not been paid in full, any dividend declared on stock which ranks pari passu to the Series A Preferred Stock shall be declared and paid pro rata with respect to the Series A Preferred Stock and such pari passu stock.

Participation in Dividends on Common Stock. So long as any shares of Series A Preferred Stock are outstanding, if the Company declares any dividends on common stock or make any other distribution to the holders of the common stock, the holders of the Series A Preferred Stock will be entitled to participate in such distribution on an as-converted basis.

Mandatory Conversion. The Series A Preferred Stock of each holder will convert into shares of common stock on the third business day following the approval by the holders of the common stock of the conversion of the Series A Preferred Stock into common stock as required by the applicable NASDAQ rules. Upon stockholder approval of the conversion of the Series A Preferred Stock, each share of Series A Preferred Stock will convert into ten shares of common stock.

Voting Rights. The holders of the Series A Preferred Stock will not have any voting rights other than as required by law, except that the approval of the holders of a majority of the Series A Preferred Stock, voting together with any class or series of parity securities, shall be required for certain matters, including to (i) authorize or issue, or increase the authorized, issued or outstanding amount of, any shares of any class or series of stock ranking senior to the Series A Preferred Stock with respect to the payment of dividends or distribution of assets on the Company’s liquidation, dissolution or winding up or (ii) significantly and adversely affect the preferences, conversion or other rights, voting powers, restrictions, limitations as to dividends or other distributions, qualifications or terms or conditions of redemption of the Series A Preferred Stock.

Liquidation. In the event the Company voluntarily or involuntarily liquidates, dissolves or winds up, the holders of the Series A Preferred Stock shall be entitled to liquidating distributions equal to $130 per share plus any declared and unpaid dividends.

Redemption. The Series A Preferred Stock shall be perpetual unless converted in accordance with the Articles Supplementary. The Series A Preferred Stock will not be redeemable at the option of the Company or any holder of Series A Preferred Stock at any time.

Preemptive Rights. Holders of the Series A Preferred Stock have no preemptive rights.

Declassification. Shares of outstanding Series A Preferred Stock that are purchased or otherwise acquired by the Company (including shares of Series A Preferred Stock that are converted into shares of common stock) will automatically be reclassified as and revert to authorized but unissued shares of preferred stock without further classification as to class or series.

Authorized but Unissued Capital Stock

The MGCL does not generally require stockholder approval for the issuance of authorized shares. These additional shares may be used for a variety of corporate purposes, including future public offerings, to raise additional capital or to facilitate acquisitions. However, the listing requirements of the NASDAQ, which would apply so long as the Company common stock remains listed on the NASDAQ, require stockholder approval of certain issuances equal to or exceeding 20% of the then outstanding voting power or then outstanding number of shares of common stock.

One of the effects of the existence of unissued and unreserved shares of common stock or preferred stock may be to enable the Company's board to issue shares to persons friendly to current management, which issuance could render more difficult or discourage an attempt to obtain control of the Company by means of a merger, tender offer, proxy contest or otherwise, and thereby protect the continuity of the Company’s management and possibly deprive the Company’s stockholders of opportunities they may believe are in their best interests or in which they may receive a premium for their the Company common stock over the market price of the common stock.

Anti-Takeover Effects of Provisions of Applicable Law and the Company Charter and the Company Bylaws

The business combination provisions of the MGCL, the control share acquisition provisions of the MGCL, the Subtitle 8 provisions of the MGCL and the supermajority vote requirements, voting rights of the holders of preferred stock, if any, and advance notice requirements for director nominations and stockholder proposals may have the effect of delaying, deterring or preventing a transaction or a change in the control that might involve a premium price for shares of the Company common stock or otherwise be in the best interests of the Company stockholders.

Federal Banking Law

The ability of a third party to acquire the Company’s stock is also limited under applicable U.S. banking laws, including regulatory approval requirements including any applicable approval requirements of the OCC under the National Bank Consolidation and Merger Act, as amended and any applicable approval requirements of the Federal Reserve Board under the BHCA.

Classified Board; Director Removal

The Company charter provides that the Company board of directors shall be divided into three classes of directors, with the classes as nearly equal in number as possible. As a result, approximately one-third of the Company board will be elected each year. The classification of directors has the effect of making it more difficult for stockholders to change the composition of the Company board. Further, the Company directors may only be removed for cause and with an affirmative vote of 80% of the voting power of the then outstanding shares of stock the Company entitled to vote in the election of directors, voting together as a single class.

Limits on Written Consents

The Company charter provides that any action to be taken by the stockholders that the stockholders are required or permitted to take must be effected at a duly called annual or special meeting of stockholders or by unanimous written consent of the stockholders.

Annual Meetings; Limits on Special Meetings

The Company’s 2018 annual meeting of stockholders was held on March 27, 2018. Subject to the rights of the holders of any series of preferred stock, special meetings of the stockholders may be called only by (i) the Company’s president, (ii) the Company board of directors, and (iii) the Company’s secretary upon the written request of the holders of a majority of all shares outstanding and entitled to vote on the business to be transacted at the meeting.

Listing

The Company common stock is listed on the NASDAQ Global Market under the symbol “CZWI.”

Transfer Agent and Registrar

The transfer agent and registrar for the Company common stock is Continental Stock Transfer & Trust.

Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

CITIZENS COMMUNITY BANCORP, INC. | ||||

Date: June 21, 2018 | By: | /s/ James S. Broucek | ||

James S. Broucek | ||||

Chief Financial Officer | ||||

EXECUTION COPY

EXHIBIT 2.1

STOCK PURCHASE AGREEMENT

dated June 20, 2018

UNITED BANK,

UNITED BANCORPORATION,

and

CITIZENS COMMUNITY BANCORP, INC.

dated June 20, 2018

UNITED BANK,

UNITED BANCORPORATION,

and

CITIZENS COMMUNITY BANCORP, INC.

TABLE OF CONTENTS

PAGE

Article I | DEFINITIONS; INTERPRETATION | 1 | ||

1.01 | Definitions | 1 | ||

1.02 | Interpretation | 11 | ||

Article II | PURCHASE AND SALE AND PURCHASE PRICE | 13 | ||

2.01 | Purchase and Sale | 13 | ||

2.02 | Purchase Price | 13 | ||

2.03 | Payment of Terms | 13 | ||

2.04 | Equity Adjustment Amount | 13 | ||

Article III | CLOSING | 14 | ||

Article IV | CONDUCT OF BUSINESS PENDING THE CLOSING | 14 | ||

4.01 | Forbearance of the Sellers | 14 | ||

Article V | REPRESENTATIONS AND WARRANTIES | 18 | ||

5.01 | Disclosure Letters | 18 | ||

5.02 | Representations and Warranties of the Sellers | 18 | ||

5.03 | Representations and Warranties of the Purchaser | 35 | ||

Article VI | OTHER COVENANTS | 35 | ||

6.01 | Commercially Reasonable Efforts | 37 | ||

6.02 | Cooperation | 37 | ||

6.03 | Shareholder Covenants | 37 | ||

6.04 | Regulatory Applications; Third-Party Consents | 37 | ||

6.05 | Press Releases | 38 | ||

6.06 | Acquisition Proposals | 39 | ||

6.07 | Takeover Laws and Provisions | 39 | ||

6.08 | Access; Information | 39 | ||

6.09 | Designated Securities | 40 | ||

6.10 | Employee Benefits Matters | 41 | ||

6.11 | Title Surveys, Environmental Assessments, and Appraisals | 42 | ||

6.12 | Tax Matters | 43 | ||

6.13 | Further Assurances | 47 | ||

6.14 | Non-Competition and Non-Solicitation | 47 | ||

6.15 | Representatives’ Fees | 48 | ||

6.16 | Retention and Stay Bonuses; Employment Agreement | 49 | ||

6.17 | Voting and Support Agreement | 49 | ||

6.18 | MasterCard Covenant | 49 | ||

Article VII | Indemnification | 49 | ||

7.01 | Survival | 50 | ||

7.02 | Indemnification of Shareholder and Bank Directors and Officers by Purchaser | 50 | ||

7.03 | Indemnification of Purchaser by Shareholder | 51 | ||

7.04 | Procedures Relating to Indemnification | 53 | ||

i | ||

TABLE OF CONTENTS

(continued)

PAGE

7.05 | Limitations on Indemnification | 55 | ||

7.06 | Indemnity Payments | 55 | ||

7.07 | Insurance; Recoveries | 55 | ||

7.08 | Waiver | 56 | ||

Article VIII | CONDITIONS PRECEDENT TO THE CLOSING | 56 | ||

8.01 | Conditions to Each Party’s Obligation to Effect the Closing | 56 | ||

8.02 | Conditions to the Obligation of the Sellers | 57 | ||

8.03 | Conditions to the Obligation of Purchaser | 57 | ||

Article IX | TERMINATION | 57 | ||

9.01 | Termination | 58 | ||

9.02 | Effect of Termination and Abandonment | 60 | ||

Article X | MISCELLANEOUS | 60 | ||

10.01 | Expenses | 60 | ||

10.02 | Notices | 60 | ||

10.03 | Amendment | 61 | ||

10.04 | Governing Law | 61 | ||

10.05 | Waiver of Jury Trial | 61 | ||

10.06 | Entire Agreement | 61 | ||

10.07 | Binding Effect; Assignment; No Third-Party Beneficiaries | 62 | ||

10.08 | Counterparts | 62 | ||

10.09 | Specific Performance | 62 | ||

10.10 | Severability | 62 | ||

10.11 | Subsidiary and Affiliate Action | 62 | ||

10.12 | Deadlines | 63 | ||

10.13 | Scope of Agreements | 63 | ||

10.14 | Waivers and Consents | 63 | ||

10.15 | Remedies | 63 | ||

Schedule A | Designated Securities | Sch.A-1 | ||

EXHIBIT A | FORM OF ESCROW AGREEMENT | Exh. A-1 | ||

EXHIBIT B | TRI-PARTY AGREEMENT | Exh. B-1 | ||

EXHIBIT C | NON-COMPETITION AGREEMENT | Exh. C-1 | ||

EXHIBIT D | FORM OF NON-SOLICITATION AGREEMENT | Exh. D-1 | ||

EXHIBIT E | AMENDED AND RESTATED TSA | Exh. E-1 | ||

STOCK PURCHASE AGREEMENT

This STOCK PURCHASE AGREEMENT, dated June 20, 2018 (this “Agreement”), is among United Bank, a Wisconsin chartered bank (the “Bank”), United Bancorporation, a South

ii | ||

Dakota corporation, (“Shareholder,” and together with the Bank, “Sellers”), and Citizens Community Bancorp, Inc., a Maryland corporation (“Purchaser”).

RECITALS

A. The Bank is a state bank organized and existing under the laws of the state of Wisconsin, with authorized capital consisting of 51,025 shares of common stock, $10 par value per share, of which there are currently outstanding 69 shares (hereinafter referred to as the “Bank Common Stock”), all of which are owned by Shareholder; and

B. Shareholder desires to sell, assign and transfer to Purchaser and Purchaser desires to purchase, accept and receive from Shareholder, the Bank Common Stock on the terms and subject to the conditions hereinafter set forth.

C. Purchaser intends to merge the Bank with and into Purchaser’s wholly-owned subsidiary, Citizens Community Federal, National Association, a national bank (“CCF Bank”), with CCF Bank as the surviving entity, immediately following the closing of the transactions contemplated by this Agreement.

D. The respective boards of directors of Purchaser, the Bank, and Shareholder have each determined that the transactions contemplated hereby are consistent with, and will further, their respective business strategies and goals, and are in the best interests of their respective shareholders, and, therefore, have approved this Agreement and the transactions contemplated hereby.

NOW, THEREFORE, in consideration of the premises, and of the mutual representations, warranties, covenants and agreements contained in this Agreement, the parties agree as follows:

Article I

DEFINITIONS; INTERPRETATION

DEFINITIONS; INTERPRETATION

1.01 Definitions. This Agreement uses the following definitions:

“Accounting Referee” has the meaning set forth in Section 2.04(b).

“Acquisition Proposal” means any expression of interest, proposal or offer by any person to acquire in any manner, directly or indirectly, (i) any voting power in the Bank, or (ii) any of the respective businesses, assets or deposits of the Bank, in each case, other than the transactions contemplated hereby and immaterial asset sales occurring in the ordinary course.

“Adverse Right” means, save as has been waived pursuant to this Agreement, (i) any option, warrant, right (including a conversion or preemptive right of first refusal), agreement or commitment that provides for the issue, subscription or purchase, or which is otherwise convertible or exchangeable into, or exercisable for, any share, debenture or other security interest of any kind of any of the equity or capital of the Bank, (ii) any other security, arrangement or agreement which may require the allotment, issue or transfer of any such share,

1

debenture or other security interest in the Bank and (iii) any right under any shareholders agreement, voting agreement, joint venture, voting trust, proxy or other agreement or arrangement relating to the holding, voting, purchase, redemption, issue or acquisition of, or payment of dividends or distributions in respect of, any such share, debenture or other security interest in the Bank, in each case, including any such rights that are contingent, unvested or otherwise come into effect at a later date.

“Affiliate” means, with respect to a person, those other persons that, directly or indirectly, control, are controlled by or are under common control with such person. For purposes of the definition of “Affiliate” and “Subsidiary”, “control” (including, with correlative meanings, the terms “controlled by” or “under common control with”), as applied to any person, means the possession, directly or indirectly, of (i) ownership, control or power to vote twenty-five percent (25%) or more of the outstanding shares of any class of voting securities of such person; (ii) control, in any manner, over the election of a majority of the directors, trustees, general partners or managing members (or individuals exercising similar functions) of such person; or (iii) the ability to exercise a controlling influence, directly or indirectly, over the management or policies of such person, in each case of clauses (i)–(iii) as calculated or interpreted by the Board of Governors of the Federal Reserve System under 12 C.F.R. § 225.2(e).

“Agreement” has the meaning set forth in the Preamble.

“Applicable Law” means, to the extent applicable, (i) any local, state, national or foreign law, including common law, statute, directive, ordinance, rule, regulation, code, judgment, order, injunction, treaty, decree, declaration, arbitration award, agency requirement, license or permit of any Governmental Entity and (ii) any order, writ, judgment, injunction, decree, declaration, stipulation, determination, formal interpretive letter or award entered by or with, or issued by, any Governmental Entity.

“Audited Financial Statements” has the meaning set forth in Section 5.02(m)(1).

“Bank” has the meaning set forth in the Preamble.

“Bank Board” means the board of directors of the Bank.

“Bank Common Stock” means the common stock, par value ten dollars ($10) per share, of the Bank, of which 100% is owned by Shareholder.

“Bank Financial Statements” has the meaning set forth in Section 5.02(m)(1).

“Bank Insurance Policies” has the meaning set forth in Section 5.02(bb).

“Bank Intellectual Property” has the meaning set forth in Section 5.02(t)(1).

“Bank Marks” has the meaning set forth in Section 6.14(d).

“Bank Merger Act” means the Bank Merger Act, 12 U.S.C. 1828(c).

2

“Bank Plan” means any benefit or compensation plan, program, policy, practice, agreement, Contract, arrangement or other obligation, whether or not in writing and whether or not funded, in each case, which is sponsored or maintained by, or required to be contributed to, or with respect to which any potential Liability is borne by either Seller, which is an “employee benefit plan” within the meaning of Section 3(3) of ERISA or provides retirement, severance, termination or change in control agreements, deferred compensation, equity-based, incentive, bonus, supplemental retirement, profit sharing, medical, welfare, fringe or other employee benefits or remuneration of any kind.

“Bank Real Property” has the meaning set forth in Section 5.02(y)(1).

“Base Equity Amount” means twenty-nine million two hundred forty-six thousand dollars ($29,246,000).

“Burdensome Condition” means any restraint or condition that would reasonably be expected to (i) impair in any material respect the economic or other benefits to Purchaser of the transactions contemplated hereby or the transactions contemplated by this Agreement, (ii) have a materially negative effect on the operation of the business currently conducted by the Bank or on any other business of Purchaser or its Affiliates or (iii) require the sale, transfer, license or other disposition of any assets or categories of assets that, individually or in the aggregate, would be material to any of Purchaser, its existing Affiliates or the Bank.

“Business Day” means any day excluding Saturday, Sunday and any day on which the Federal Reserve Bank of Minneapolis is closed.

“Cash Incentive Plan” has the meaning set forth in Section 6.10(g).

“Closing” has the meaning set forth in Article III.

“Closing Date” has the meaning set forth in Article III.

“COBRA” means the requirements of Part 6 of Subtitle B of Title I of ERISA, Section 4980B of the Code and the rules and regulations issued thereunder and any similar state law.

“Code” means the Internal Revenue Code of 1986, as amended, and the rules and regulations thereunder.

“Competing Business” has the meaning set forth in Section 6.14(a).

“Confidential Information” has the meaning set forth in Section 6.08(c).

“Confidentiality Agreement” means the confidentiality agreement, dated October 27, 2017, between Purchaser and Hovde Group, LLC.

“Constituent Documents” means the charter or articles or certificate of incorporation and by-laws of a corporation or banking organization, the certificate of partnership and partnership agreement of a general or limited partnership, the certificate of formation and limited liability

3

company agreement of a limited liability company, the trust agreement of a trust and the comparable documents of other entities.

“Continuing Employee” has the meaning set forth in Section 6.10(d).

“Contract” means, with respect to any person, any agreement, contract, indenture, undertaking, debt instrument, lease, understanding, arrangement or commitment, whether a single document or multiple documents that collectively form a contractual relationship, to which such person or any of its Subsidiaries is a party or by which any of them is bound or to which any of their assets or properties is subject, whether or not in writing.

“CRA” means the Community Reinvestment Act of 1977.

“De Minimis Claim” has the meaning specified in Section 7.05(a).

“Designated Markets” means (i) with respect to a branch-based banking Competing Business, within a sixty (60)-mile radius of any of the Bank’s bank branches; and (ii) with respect to any other Competing Business, the markets in which the Bank conducts such activities as of the Closing Date.

“Designated Securities” means (i) the securities listed on Schedule A and (ii) any of the following types of securities acquired after the date hereof:

(1) Callable bonds issued by a GSE;

(2) Structured notes that include step up bonds issued by a GSE;

(3) Mutual funds;

(4) Common stock;

(5) Trust-preferred securities;

(6) Asset-backed securities;

(7) Private label collateralized mortgage obligations (also described as non GSE issued collateralized mortgage operations);

(8) Corporate bonds; and

(9) Municipal revenue bonds.

“Determination Date” has the meaning set forth in Section 2.03.

“Determination Date Balance Sheet” has the meaning set forth in Section 2.04.

“Disclosure Letter” has the meaning set forth in Section 5.01.

4

“Environmental Laws” means any Applicable Law: (i) relating to the manufacture, handling, transport, use, treatment, storage, presence or disposal of Hazardous Materials or materials containing Hazardous Materials or (ii) otherwise relating to pollution or to the protection of health, safety or the environment including exposure to any Hazardous Materials.

“Equity Adjustment Amount” means the difference between the Equity Amount and the Base Equity Amount.

“Equity Amount” means the Stockholders Equity as of the Determination Date.

“ERISA” means the Employee Retirement Income Security Act of 1974.

“ERISA Affiliate” means all employers (whether or not incorporated) that would be treated together with the Bank as a “single employer” within the meaning of Section 414(b), (c), (m) or (o) of the Code.

“Escrow Agent” has the meaning set forth in Section 2.02(a).

“Escrow Agreement” has the meaning set forth in Section 2.02(a).

“Exchange Act” means the Securities Exchange Act of 1934.

“Extensions of Credit” has the meaning set forth in Section 5.02(cc)(1).

“FDI Act” means the Federal Deposit Insurance Act of 1950.

“Final Determination” has the meaning set forth in Section 6.12(h).

“GAAP” means United States generally accepted accounting principles, consistently applied.

“Governmental Entity” means any nation, state or political subdivision of any of the foregoing, or any national, state, local or foreign governmental or regulatory authority, court, commission, arbitration panel, department, division, committee, administration, board, bureau, agency, tribunal, instrumentality or other body or entity, or any supranational or quasi-governmental or similar body or entity, or any securities exchange, futures exchange, contract market other exchange or market body or entity, or any self-regulatory body or organization, in each case, whether temporary, preliminary or permanent.

“GSE” means government-sponsored enterprise.

“Hazardous Materials” means any hazardous or toxic substances, materials, wastes, pollutants, contaminants or harmful substances, including petroleum compounds, asbestos, mold and lead-containing and any other substance regulated under or which may give rise to Liability under any Environmental Law.

5

“Indebtedness” means, with respect to any person, (i) all indebtedness and other obligations of such person, whether or not contingent, for borrowed money, whether or not evidenced by notes, debentures, bonds or other similar instruments and any obligations issued in substitute for or exchange of obligations for borrowed money, (ii) all obligations of such person for cash overdrafts, (iii) all obligations of such person for the deferred purchase price of property or services, (iv) all indebtedness and other obligations of such person created or arising under any conditional sale or other title retention agreement, (v) all obligations, contingent or otherwise, of such person under acceptance, letter of credit or similar facilities, (vi) all obligations of such person to purchase, redeem, retire, defease or otherwise acquire for value any share capital of such person or any warrants, rights or options to acquire such share capital, valued, in the case of redeemable preferred stock, at the greater of its voluntary or involuntary liquidation preference plus accrued and unpaid dividends, (vii) all of such person’s obligations in respect of swap or hedge agreements, derivatives, or similar agreements, (viii) all of such person’s obligations under finance leases, (ix) all indebtedness and other obligations of others to the extent directly or indirectly guaranteed or assumed by or otherwise made with recourse to such person, (x) all indebtedness and other obligations of others to the extent secured by any asset of such person, whether or not the indebtedness or other obligation is guaranteed or assumed by that person and (xi) accrued and unpaid interest, penalties, fines and fees with respect to any of the foregoing.

“Indemnification Escrow Account” has the meaning set forth in Section 2.02(a).

“Indemnification Escrow Amount” has the meaning set forth in Section 2.02(a).

“Indemnity Threshold” has the meaning set forth in Section 7.05(a).

“Insolvency Procedure” means any procedure (i) relating to or ensuing from a person being bankrupt or Insolvent or being a debtor under any bankruptcy, insolvency or other Applicable Law respecting debtor relief, (ii) relating to or ensuing from the appointment of a receiver, conservator, administrator, liquidator, trustee or similar officer, (iii) relating to or ensuing from any voluntary or involuntary arrangement with creditors or suspension of any creditor’s rights or (iv) relating to or ensuing from the liquidation or winding-up of a person or all or a substantial part of the assets of a person.

“Insolvent” means a person (i) not being in a position to satisfy all of such person’s Indebtedness or other Liabilities (including reasonably foreseeable prospective Liabilities) as they fall due for payment, or whose Indebtedness or other Liabilities (including reasonably foreseeable prospective Liabilities) are of an amount that is greater than the value of such person’s assets, (ii) admitting to any of the foregoing in writing, (iii) voluntarily suspending payment of such person’s obligations, (iv) making any assignment for the benefit of creditors, or (v) being subject to an Insolvency Procedure or having all or substantially all of such person’s property subject to an Insolvency Procedure.

“Intellectual Property” means all (i) trademarks, service marks, brand names, d/b/a’s, Internet domain names, logos, symbols, trade dress, trade names, and other indicia of origin, all applications and registrations for the foregoing, and all goodwill associated therewith and

6

symbolized thereby, including all renewals of the same; (ii) inventions and discoveries, whether patentable or not, and all patents, registrations, invention disclosures and applications therefor, including divisions, continuations, continuations-in-part and renewal applications, and including renewals, extensions, reexaminations and reissues; (iii) Trade Secrets; (iv) published and unpublished works of authorship, whether copyrightable or not (including databases and other compilations of information), copyrights therein and thereto, and registrations and applications therefor, and all renewals, extensions, restorations and reversions thereof; and (v) all other intellectual property or proprietary rights or protections throughout the world, in each case whether currently existing or hereafter developed or acquired, arising under Applicable Law or by Contract, and whether or not perfected, registered or issued, including all applications, disclosures, registrations, issuances and extensions with respect thereto.

“Interest Rate Instruments” has the meaning set forth in Section 5.02(dd).

“IRS” means the Internal Revenue Service of the United States of America.

“IT Assets” means the information technology and computer systems, including all computers, computer software, firmware, middleware, servers, workstations, routers, hubs, switches, data communications lines, and all other information technology and telecommunication hardware and other equipment, and all associated documentation used in or necessary to the conduct of the Bank’s businesses as conducted as of the date of this Agreement.

“Knowledge” means: (i) when used with respect to the Sellers (collectively, not individually), the actual knowledge, after reasonable inquiry, of any of the following persons: the CEO (or equivalent position), CFO, or Director of HR of the Bank; and the President, CIO, CCO, and CTO of Shareholder, and (iii) when used with respect to Purchaser, the actual knowledge, after reasonable inquiry, of the following persons: the CEO and CFO of Purchaser. For purposes of this definition, any person who is an officer or employee of a company shall be deemed to have actual knowledge of facts that would be reasonably expected to come to the attention of such officer or employee in the course of customary management reporting practices consistent with such officer’s or employee’s position, and the employer of such person shall be deemed to have knowledge of all facts that its officers and employees have knowledge of.

“Liabilities” means all debts, liabilities, commitments and obligations of any kind, whether fixed, contingent or absolute, matured or unmatured, liquidated or unliquidated, accrued or not accrued, asserted or not asserted, known or unknown, determinable or indeterminable, or otherwise, whenever or however arising (including whether arising out of any Contract or tort).

“Licensed Intellectual Property” has the meaning set forth in Section 5.02(t)(1).

“Lien” means any right, interest or equity of any person (including any pre-emption right, right of first refusal, option or right to acquire) or any mortgage, deed of trust, encumbrance, claim, charge, deposit arrangement, pledge, lien, assignment, restriction, hypothecation, security or priority interest, participation interest, title retention, conditional sale, financing lease or other security, preference or priority agreement or arrangement, however arising (including any

7

created by Applicable Law), or an agreement or commitment to create any of the foregoing, other than a Permitted Lien.

“Loss” means any losses, Liabilities, claims, fines, deficiencies, damages, obligations, payments (including those arising out of any settlement, judgment or compromise relating to any Proceeding), costs and expenses (including interest, fines, penalties and fees with respect thereto and attorneys’ and accountants’ fees and any other out-of-pocket expenses incurred in investigating, preparing, defending, avoiding or settling any Proceeding), diminution in value and loss of future revenue, income or profits, including any of the foregoing arising under, out of or in connection with any Proceeding or award of any arbitrator of any kind, or any Applicable Law, or Contract.

“MasterCard” has the meaning set forth in Section 7.03(a)(5).

“MasterCard Agreement” has the meaning set forth in Section 7.03(a)(5).

“Material Adverse Effect” means, as applicable, with respect to any Seller or Purchaser, any effect that:

(a) is material and adverse to the assets, Liabilities, condition (financial or otherwise), results of operations, business, or prospects of the Bank, taken as a whole, or Purchaser and its Subsidiaries, taken as a whole, respectively, excluding (with respect to each of clauses (i), (ii) or (iii), only to the extent that the effect of a change on it is not disproportionate to the effect of such change on comparable banking organizations organized and operated in the United States) the impact of (i) changes in banking and other laws of general applicability or changes in the interpretation thereof by Governmental Entities, (ii) changes in GAAP or regulatory accounting requirements applicable to banking services organizations generally, (iii) changes in prevailing interest rates or market prices or other general economic conditions generally affecting banking organizations operating in the United States or any state therein, and (iv) actions or omissions of a party to this Agreement that are expressly required by this Agreement or taken upon the written request or with the prior written consent of the other party to this Agreement, in contemplation of the transactions contemplated hereby; or

(b) would materially impair the ability of any Seller (or in any representation made by it, Purchaser), to perform its obligations under this Agreement or to consummate the transactions contemplated hereby on a timely basis.

“Material Contracts” has the meaning set forth in Section 5.02(z)(1).

“Non-Competition Period” has the meaning set forth in Section 6.14(a).

“Open Source Software” means all open source software, public source software, “copyleft” software, shareware, freeware and similar software, as such terms are understood in the software industry, in executable code and/or source code form.

“Other Incentive Plans” has the meaning set forth in Section 6.10(g).

8

“Outside Date” has the meaning set forth in Section 9.01(d).

“Owned Intellectual Property” has the meaning set forth in Section 5.02(t)(1).

“PBGC” means the Pension Benefit Guaranty Corporation.

“Permitted Enforceability Exceptions” means those exceptions with respect to receivership, conservatorship and supervisory powers of bank regulatory agencies generally as well as bankruptcy, insolvency, reorganization, moratorium or other Applicable Law of general applicability relating to or affecting creditors’ rights or the limiting effect of rules of law governing specific performance, equitable relief and other equitable remedies or the waiver of rights or remedies.

“Permitted Liens” has the meaning set forth in Section 5.02(y)(1).

“Phase I Assessment” has the meaning set forth in Section 6.11(a).

“Post-Closing Tax Period” has the meaning set forth in Section 6.12(a)(1).

“Preamble” means the paragraph preceding the Recitals.

“Pre-Closing Tax Period” means all Tax periods ending on or before the Closing Date and the portion ending on the Closing Date of any Straddle Period.

“Previously Disclosed” means information fully, clearly and accurately disclosed (with sufficient details to identify the nature and scope of the matter disclosed) by the Sellers or Purchaser in the applicable paragraph of its respective Disclosure Letter and, with respect to Purchaser, information disclosed in Purchaser SEC Filings (disregarding risk factor disclosures contained under the heading “Risk Factors” or disclosure of risks set forth in any “forward-looking statements” disclaimer).

“Proceeding” means any judicial, administrative or arbitration action, suit, or other proceeding (whether governmental, public, private, civil, criminal or any other kind) or any claim, complaint, dispute or investigation of any kind.

“Profit-Sharing Bonus Plan” has the meaning set forth in Section 6.10(g).

“Purchase Price” has the meaning set forth in Section 2.01.

“Purchaser” has the meaning set forth in the Preamble.

“Purchaser Indemnified Party” has the meaning set forth in Section 7.03(a).

“Purchaser SEC Filings” means all reports, registration statements, definitive proxy statements, or other information statements or filings filed by Purchaser with the SEC under the Exchange Act.

9

“Registered” means issued by, registered with, renewed by or the subject of a pending application before any Governmental Entity or Internet domain name registrar.

“Representatives” means, with respect to any person, such person’s directors, managers, officers, employees, agents, advisors and representatives (including attorneys, accountants, consultants and bankers).

“Required Third-Party Consents” has the meaning set forth in Section 5.02(f).

“Requisite Regulatory Approvals” has the meaning set forth in Section 6.04(a).

“Restricted Lending Action” has the meaning set forth in Section 4.01(i).

“Rights” means, with respect to any person, securities or obligations convertible into or exercisable or exchangeable for, or giving any other person any right to subscribe for or acquire, or any options, calls or commitments relating to, or any stock appreciation right or other instrument the value of which is determined in whole or in part by reference to the market price, book or other value of, shares of capital stock, units or other equity or voting interests of, such first person.

“SEC” means the United States Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933.

“Seller Indemnified Parties” has the meaning set forth in Section 7.02(a).

“Sellers” has the meaning set forth in the Preamble.

“Shareholder” has the meaning set forth in the Recitals.

“Stockholders’ Equity” means, as of a given date, the aggregate amount of the common stockholders’ equity of the Bank, determined in accordance with GAAP.

“Straddle Period” means all Tax periods that include (but do not end on) the Closing Date.

“Subsidiary” means, with respect to a person, any other person directly or indirectly controlled by that person.

“Takeover Laws” has the meaning set forth in Section 5.02(i).

“Tax” and “Taxes” means all federal, state, local or foreign taxes, duties, charges, fees, levies or other assessments, however denominated, including all net income, gross income, gains, gross receipts, sales, use, ad valorem, goods and services, capital, capital stock, value added, production, transfer, franchise, registration, windfall profits, license, withholding, payroll, employment, disability, employer health, excise, estimated, severance, stamp, premium, occupation, property, environmental, unemployment, social security (or similar), net worth,

10

escheat, alternative or add-on minimum, estimated or other taxes, custom duties, charges, fees, assessments or charges of any kind whatsoever, together with any interest and any penalties, fines, fees, additions to tax or additional amounts imposed by any Governmental Entity whether arising before, on or after the Closing Date and whether disputed or not and any obligation to indemnify or otherwise assume or succeed to the tax Liability of any other person.

“Tax Claim” has the meaning set forth in Section 6.12(e)(1).

“Tax Returns” means any return, amended return or other report (including elections, declarations, disclosures, schedules, statements, estimates, information returns and claims for refund) required to be filed with respect to any Tax and any amendments or attachments thereto.

“Third-Party Claim” has the meaning set forth in Section 7.04(a).

“Trade Secrets” means confidential information, trade secrets and know-how, including processes, schematics, business methods, formulae, drawings, prototypes, models, designs, customer lists and supplier lists.

“Unaudited Financial Statements” has the meaning set forth in Section 5.02(m)(1).

“Visa Agreement” has the meaning set forth in Section 6.18.

“WARN Act” has the meaning set forth in Section 5.02(w)(2).

“WBL” means the Wisconsin banking law.

1.02 Interpretation.

(a) In this Agreement, except as context may otherwise require, references:

(1) to the Preamble, Recitals, Articles, Sections, Schedules, or Exhibits refer, respectively, to the Preamble to, a Recital, Article or Section of, Schedule, or Exhibit to, this Agreement;

(2) to this Agreement are to this Agreement and the Schedules and Exhibits to it, taken as a whole;

(3) to the “transactions contemplated hereby” include the transactions provided for in this Agreement;

(4) to any agreement (including this Agreement) or Contract are to the agreement or Contract as amended, modified, supplemented, restated or replaced from time to time, to the extent permitted by the terms thereof;

(5) to any Applicable Law or other law refer to such Applicable Law or other law as amended, modified, supplemented or replaced from time to time (and, in the case

11

of statutes, include any rules and regulations promulgated under the statute) and references to any section of any Applicable Law or other law include any successor to such section;

(6) to any Governmental Entity include any successor to that Governmental Entity;

(7) to the terms defined in the singular have a comparable meaning when used in the plural, and vice versa;

(8) to the terms “dollars”, “cents” and “$” mean U.S. Dollars and Cents;

(9) to any gender include the other gender;

(10) to the phrase “date hereof” or “date of this Agreement” shall be deemed to refer to the date set forth in the Preamble; and

(11) to “foreign” or “federal” shall be by reference to the United States.

(b) The words “hereby”, “herein”, “hereof”, “hereunder” and similar terms, when used in this Agreement, refer to this Agreement as a whole and not to any particular provision of this Agreement.

(c) The words “include”, “includes” or “including” are to be deemed followed, in each case, by the words “without limitation”.

(d) The word “party” is to be deemed to refer to any of the Bank, Shareholder or Purchaser.

(e) The word “person” is to be interpreted broadly to include any individual, savings association, bank, trust company, corporation, limited liability company, partnership, association, joint-stock company, business trust or unincorporated organization.

(f) The phrase “in the ordinary course” as used in this Agreement, shall be deemed to mean, in each case, “in the usual and ordinary course of business consistent with past practice”.

(g) The table of contents and article and section headings in this Agreement are for reference purposes only and do not limit or otherwise affect any of the provisions of this Agreement or the meaning thereof.

(h) This Agreement is the product of negotiation by the parties, each having the assistance of counsel and other advisers. The parties intend that this Agreement not be construed more strictly with regard to one party than with regard to any other.

12

(i) No provision of this Agreement is to be construed to require, directly or indirectly, any person to take any action, or omit to take any action, to the extent such action or omission would violate Applicable Law.

ARTICLE II

PURCHASE AND SALE AND PURCHASE PRICE

PURCHASE AND SALE AND PURCHASE PRICE

2.01 Purchase and Sale. At the Closing, Purchaser shall purchaser from Shareholder, and Shareholder shall sell, convey, assign, transfer and deliver to Purchaser, all of Shareholder’s right, title and interest in and to the Bank Common Stock, free and clear of all Liens.

2.02 Purchase Price. The purchase price to be paid by Purchaser to Shareholder for the Bank Common Stock (the “Purchase Price”) shall be equal to the sum of:

(a) fifty million seven hundred thousand dollars ($50,700,000), PLUS OR MINUS

(b) the Equity Adjustment Amount, PLUS

(c) interest on the Base Equity Amount at a rate of four and one half percent (4.5%) per annum from the period from the Determination Date through the Closing Date.

2.03 Payment of Terms. The Purchase Price shall be paid by Purchaser to Shareholder on the Closing Date in immediately available funds as follows:

(a) Purchaser shall deposit, or shall cause to be deposited, six million dollars ($6,000,000) (the “Indemnification Escrow Amount”) into an escrow account (the “Indemnification Escrow Account”) established pursuant to the terms of an Escrow Agreement to be entered into at Closing among Purchaser, Shareholder, and Bankers’ Bank, a Wisconsin state bank, as escrow agent (the “Escrow Agent”), substantially in the form attached hereto as Exhibit A (the “Escrow Agreement”), in order to support Shareholder’s indemnification obligations under Article VII hereof.

(b) The balance of the Purchase Price shall be paid by Purchaser to Shareholder.

2.04 Equity Adjustment Amount.

(a) At least ten (10) Business Days prior to the Closing Date, Sellers shall deliver to Purchaser an unaudited consolidated balance sheet of the Bank as of the close of business on the Business Day that is the last Business Day of the calendar month immediately preceding the calendar month in which the Closing is scheduled to occur (such date, the “Determination Date”, and the balance sheet, the “Determination Date Balance Sheet”), prepared on a basis consistent with the accounting practices and policies used in the preparation of the Bank Financial Statements, as well as Sellers’ calculation of the Equity Amount. Sellers shall afford Purchaser and its Representatives the opportunity to review all work papers and

13

documentation used by Sellers in preparing the Determination Date Balance Sheet and Sellers’ calculation of the Equity Amount. For clarity, the Determination Date Balance Sheet shall reflect the Bank’s payment or accrual of (i) all fees and expenses incurred (or estimated to be incurred) in connection with the consummation of the transactions contemplated by this Agreement, (including all fees payable to the Bank’s financial advisor, legal counsel, and accountants), and (ii) all vendor or funding termination or breakage penalties, management change-in-control or retention payments, employee severance costs, and any payments or distributions under any Bank Plan due as a result of this Agreement or the transactions contemplated by this Agreement.

(b) Sellers’ calculation of the Equity Adjustment Amount shall be final and binding on the parties hereto, unless, no later than five (5) Business Days following Purchaser’s receipt of the Determination Date Balance Sheet and Sellers’ calculation of the Equity Amount, Purchaser shall notify Sellers’ in writing of its disagreement with any amount included therein or omitted therefrom (each dispute, an “Objection”), in which case, the Closing shall be delayed and, if the parties are unable to resolve the Objections within three (3) Business Days of the receipt by the Sellers of the Objection(s), such unresolved Objections shall be determined by a regionally recognized independent accounting firm selected by mutual agreement between Purchaser and Sellers (the “Accounting Referee”). The Accounting Referee shall be instructed to resolve the Objections within five (5) Business Days of engagement, to the extent reasonably practicable. The determination of the Accounting Referee shall be final and binding on the parties hereto. The fees and costs of the Accounting Referee, if one is required, shall be payable (i) fifty percent (50%) by Shareholder, on the one hand, and (ii) fifty percent (50%) by Purchaser, on the other hand.

ARTICLE III

CLOSING

CLOSING

The closing of the purchase and sale of the Bank Common Stock contemplated hereunder (the “Closing”) shall take place electronically on a date mutually agreed upon by Purchaser and Shareholder, provided: (1) such date shall not occur before September 30, 2018; (2) such date shall be no later than thirty (30) days following the date Purchaser is in receipt of all regulatory approvals required for consummation of the transactions hereunder, to the extent such date is after September 30, 2018; and (3) if such date is after the dates set forth in (1) and (2) because of a dispute regarding the Equity Amount pursuant to Section 2.03(b), then such date shall be no later than five (5) days after the Accounting Referee has made its determination regarding the Objection(s) (said day of Closing hereinbefore and hereinafter called the “Closing Date”).

ARTICLE IV

CONDUCT OF BUSINESS PENDING THE CLOSING

CONDUCT OF BUSINESS PENDING THE CLOSING

4.01 Forbearances of the Sellers. Shareholder agrees that from the date hereof until the Closing, except as expressly contemplated by this Agreement or as Previously Disclosed, without the prior written consent of Purchaser (which consent will not be unreasonably withheld or delayed), Shareholder shall cause the Bank not to:

14

(a) Ordinary Course. Conduct its business other than in the ordinary course or fail to use reasonable efforts to preserve intact its business organizations and assets and maintain its rights, franchises and authorizations and its existing relations with customers, suppliers, vendors, employees and business associates.

(b) Operations. Enter into any new line of business or change its lending, investment, underwriting, risk and asset liability management or other banking and operating policies or practices, except (i) as required by Applicable Law or policies imposed by any Governmental Entity or (ii) for immaterial adjustments to such policies or practices made in the ordinary course.

(c) Products. Materially alter any of its policies or practices with respect to the rates, fees, charges, credit or underwriting policies, levels of services or products available to customers of the Bank or, other than in response to market developments and with notice to Purchaser, offer any promotional pricing with respect to any product or service available to customers of the Bank; provided that the Bank’s response to market developments is comparable with its past practices in responding to similar market developments.