Form 8-K Canopy Growth Corp For: Apr 07

Exhibit 99.1

|

|

Canopy Growth to Acquire The Supreme Cannabis Company

TORONTO, and SMITH FALLS, ON April 8, 2021 – Canopy Growth Corporation (“Canopy”) (TSX: WEED, NASDAQ: CGC) and The Supreme Cannabis Company, Inc. (“Supreme Cannabis” or “Supreme”) (TSX: FIRE) (OTCQX: SPRWF) (FRA: 53S1) are pleased to announce that they have entered into a definitive arrangement agreement (the “Arrangement Agreement”) under which Canopy will acquire all of Supreme Cannabis’ issued and outstanding common shares (the “Supreme Cannabis Shares”) in a transaction valued at approximately $435 million on a fully-diluted basis (the “Transaction”).

Under the terms of the Arrangement Agreement, Supreme Cannabis shareholders will receive 0.01165872 of a Canopy common share (the “Exchange Ratio”) and $0.0001 in cash in exchange for each Supreme Cannabis Share held. The Transaction provides Supreme Cannabis shareholders with a premium per Supreme Cannabis Share of approximately 66% based on the closing prices of the Supreme Cannabis Shares and Canopy common shares on the Toronto Stock Exchange (the “TSX”) as of April 7, 2021.

The Transaction is expected to provide several benefits to both Canopy and Supreme Cannabis shareholders. Notably, following completion of the acquisition, Canopy will possess a strengthened brand portfolio including one of Canada’s leading premium brands, 7ACRES. Brand growth is anticipated with distribution supported by Canopy’s robust sales and distribution network as well as superior consumer insights and R&D capabilities. In addition to receiving a market premium, Supreme Cannabis shareholders will also benefit from Canopy’s US CBD business and conditional positioning for continued exposure to the US market expansion. Further value will be derived through the scalable Kincardine, Ontario production facility, which has a demonstrated record of producing premium flower at low cost.

Key Transaction Highlights

| • | Solidifies Canopy’s leadership position in the Canadian recreational market, well-positioned for growth: The Transaction combines Canopy’s preeminent position with Supreme Cannabis’ Top-10 position in Canada to create a pro forma Canadian recreational market share of 13.6%(1), including 7ACRES holding Canada’s number one premium flower brand position, number one in PAX vapes, and Top-5 in pre-rolled joints(2). |

| • | Combined pro forma market share estimated to be 23.3% of the premium flower segment in Ontario and 21.4% in British Columbia(3). |

| • | Adds premium brands to Canopy’s portfolio: The addition of Supreme Cannabis’ premium brands, 7ACRES and 7ACRES Craft Collective, complement Canopy’s current consumer offering and will strengthen Canopy’s brand portfolio, with both brands expected to continue to grow with further investment and expansion. Supreme Cannabis’ Blissco and Truverra brands also add breadth to Canopy’s market presence in both the recreational and medical markets. |

| • | Brings a premium, low-cost and scalable cultivation facility to Canopy’s production capabilities: Supreme Cannabis’ hybrid-greenhouse cultivation facility at Kincardine, Ontario has a demonstrated capability of consistently producing premium flower from sought-after strains at low cost with significant potential for scaling. |

| • | Secures an immediate attractive premium for Supreme Cannabis shareholders: The Transaction provides Supreme Cannabis shareholders with a premium per Supreme Cannabis Share of approximately 66% based on the closing prices of the Supreme Cannabis Shares and Canopy common shares on the TSX as of April 7, 2021. |

| • | Participation by Supreme Cannabis shareholders in the future of Canopy: The Supreme Cannabis shareholders will receive Canopy common shares pursuant to the Transaction and will have access to Canopy’s consumer insights, advanced R&D and innovation capabilities as well as the opportunity to participate in the future growth of the US market based on the Company’s conditional positioning for rapid market entry. Post-Transaction, Canopy’s industry-leading balance sheet and cash position of approximately $2.5 billion positions the company for further expansion and product development. |

| • | Opportunity to achieve potential cost synergies estimated at approximately $30mm within two-years: Canopy anticipates post-Transaction cost synergy opportunities across both cost of goods sold and sales, general and administrative expenses, as it optimizes and integrates Supreme’s operations and shared services. |

“As we continue to expand our leading brand portfolio, we’re excited to reach more consumers

through Supreme’s premium brands and high-quality products, further solidifying Canopy’s market leadership,” said David Klein, Chief Executive Officer of Canopy. “Supreme’s deep commitment to superior genetics, top-tier cultivation and strict quality control, paired with Canopy’s leading consumer insights, advanced R&D and innovation capabilities, is expected to create a powerful combination that

aligns with our strategic focus to generate growth with premium quality products across key categories.”

“This transaction is a testament to the value created by all the teams at Supreme and will be beneficial to all of our stakeholders,” added Beena Goldenberg, President and CEO of Supreme Cannabis. “We have been successful at delivering great products that achieved strong customer loyalty, and operating at levels of efficiency that are industry-leading. We have also built a highly sought-after premium brand in 7ACRES. Combining Supreme Cannabis with Canopy – a Canadian market leader with exposure to the United States – presents a significant value creation opportunity for both companies. We look forward to working with Canopy to complete this transaction.”

Transaction Details

The Transaction will be effected by way of a court-approved plan of arrangement under the Canada Business Corporations Act, requiring the approval of at least two-thirds of the votes cast by the shareholders of Supreme Cannabis voting at a special meeting of shareholders to consider the Transaction expected to be held in June 2021. Canopy has entered into voting support agreements with certain of Supreme Cannabis’ directors and officers pursuant to which they have agreed, among other things, to vote their Supreme Cannabis Shares in favour of the Transaction.

In addition to shareholder and court approvals, the Transaction is subject to applicable regulatory approvals including, but not limited to, TSX approval and approval under the Competition Act (Canada) and the satisfaction of certain other closing conditions customary in transactions of this nature. The Arrangement Agreement includes customary provisions, including non-solicitation, “fiduciary out” and “right to match” provisions as well as a termination fee of $12.5 million payable by Supreme Cannabis to Canopy in certain specified circumstances.

Assuming timely receipt of all necessary court, shareholder, regulatory and other third-party approvals and the satisfaction of all other conditions, closing of the Transaction is expected to occur by end of June 2021.

A full description of the Transaction will be set forth in the management information circular of Supreme Cannabis (the “Circular”), which will be mailed to Supreme Cannabis shareholders and filed with the Canadian securities regulators on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com.

Approvals and Recommendation

The Transaction was approved by the board of directors of each of Canopy and Supreme Cannabis, and Supreme Cannabis’ board of directors recommends that Supreme Cannabis shareholders vote in favour of the Transaction.

Each of BMO Capital Markets and Hyperion Capital provided the Supreme Cannabis Board of Directors with an opinion, dated April 7, 2021, to the effect that, as of the date of such opinion, the consideration payable pursuant to the Transaction is fair, from a financial point of view, to the Supreme Cannabis shareholders, in each case, based upon and subject to the respective assumptions, limitations, qualifications and other matters set forth in such opinions.

None of the securities to be issued pursuant to the Transaction have been or will be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws, and any securities issuable in the Transaction are anticipated to be issued in reliance upon available exemptions from such registration requirements pursuant to Section 3(a)(10) of the U.S. Securities Act and applicable exemptions under state securities laws. This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities.

Advisors and Counsel

Cassels Brock & Blackwell LLP is acting as strategic and legal advisor to Canopy.

BMO Capital Markets is acting as exclusive financial advisor to Supreme Cannabis and provided a fairness opinion to the Supreme Cannabis board of directors. Hyperion Capital Inc. provided an independent fairness opinion to the board of directors of Supreme Cannabis. Borden Ladner Gervais LLP is acting as legal counsel to Supreme Cannabis.

| (1) | Source: Provincial Boards; Headset Note: This market share data differs from Canopy’s internal market share data provided during Canopy’s previous earnings calls due to different methodologies and time periods. Market share data represents 01-Oct-20 through latest available data: Provincial Board data for ON online, PEI, NS (27/28-Mar-21) and NB (17-Mar-21); and Headset data for ON retail (28-Feb-21) and AB, BC and SK (31-Mar-21). |

| (2) | Market share data represents 01-Oct-20 through latest available data: Provincial Board data for ON online, PEI, NS (27/28-Mar-21) and NB (17-Mar-21); and Headset data for ON retail (28-Feb-21) and AB, BC and SK (31-Mar-21). |

| (3) | Internal Canopy Growth management estimate. |

About Canopy Growth

Canopy Growth (TSX:WEED, NASDAQ: CGC) is a world-leading diversified cannabis and cannabinoid-based consumer product company, driven by a passion to improve lives, end prohibition, and strengthen communities by unleashing the full potential of cannabis. Leveraging consumer insights and innovation, we offer product varieties in high-quality dried flower, oil, softgel capsule, infused beverage, edible, and topical formats, as well as vaporizer devices by Canopy Growth and industry-leader Storz & Bickel. Our global medical brand, Spectrum Therapeutics, sells a range of full-spectrum products using its colour-coded classification system and is a market leader in both Canada and Germany. Through our award-winning Tweed and Tokyo Smoke banners, we reach our adult-use consumers and have built a loyal following by focusing on top quality products and meaningful customer relationships. Canopy Growth has entered into the health and wellness consumer space in key markets including Canada, the United States, and Europe through BioSteel sports nutrition, and This Works skin and sleep solutions; and has introduced additional federally-permissible CBD products to the United States through our First & Free and Martha Stewart CBD brands. Canopy Growth has an established partnership with Fortune 500 alcohol leader Constellation Brands. For more information visit www.canopygrowth.com.

About Supreme Cannabis

The Supreme Cannabis Company, Inc., (TSX: FIRE) (OTCQX: SPRWF) (FRA: 53S1), is a global diversified portfolio of distinct cannabis companies, products and brands. Since 2014, the Company has emerged as one of the world’s most premium producers of recreational, wholesale and medical cannabis products.

Supreme Cannabis’ portfolio of brands caters to diverse consumer and patient experiences, with brands and products that address recreational, wellness, medical and new consumer preferences. The Company’s recreational brand portfolio includes, 7ACRES, 7ACRES Craft Collective, Blissco, sugarleaf, and Hiway. Supreme Cannabis addresses national and international medical cannabis opportunities through its premium Truverra brand.

Supreme Cannabis’ brands are backed by a focused suite of world-class operating assets that serve key functions in the value chain, including, scaled cultivation, value-add processing, automated packaging and product testing and R&D. Follow the Company on Instagram, Twitter, Facebook, LinkedIn and YouTube.

We simply grow better.

Notice Regarding Forward-Looking Information

This news release contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation. Often, but not always, forward-looking statements and information can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “estimates”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements or information involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Canopy, Supreme Cannabis or their respective subsidiaries to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements or information contained in this news release. Examples of such statements include statements with respect to the timing and outcome of the Arrangement, the anticipated benefits of the Transaction, the estimated potential synergies as a result of the Transaction, the anticipated timing of the Supreme Cannabis special meeting of shareholders and the closing of the Transaction, the satisfaction or waiver of the closing conditions set out in the Arrangement Agreement, including receipt of all regulatory approvals. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information, including assumptions as to the time required to prepare and mail meeting materials to Supreme Cannabis shareholders; the ability of the parties to receive, in a timely manner and on satisfactory terms, the necessary regulatory, court and shareholder approvals; the ability of the parties to satisfy, in a timely manner, the other conditions to the completion of the Transaction; the prompt and effective integration of Canopy’s and Supreme’s businesses and the ability to achieve the anticipated synergies contemplated by the Transaction; inherent uncertainty associated with financial or other projections; risks related to the value of the Canopy common shares to be issued pursuant to the Transaction; the diversion of management time on Transaction-related issues; expectations regarding future investment, growth and expansion of Canopy’s and Supreme’s operations; regulatory and licensing risks; changes in general economic, business and political conditions, including changes in the financial and stock markets; risks related to infectious diseases, including the impacts of the Covid-19 pandemic; legal and regulatory risks inherent in the cannabis industry, including the global regulatory landscape and enforcement related to cannabis, political risks and risks relating to regulatory change; risks relating to anti-money laundering laws; compliance with extensive government regulation and the interpretation of various laws regulations and policies; public opinion and perception of the cannabis industry; and such other risks contained in the public filings of Canopy filed with Canadian securities regulators and available under Canopy’s profile on SEDAR at www.sedar.com and with the United States Securities and Exchange Commission through EDGAR at www.sec.gov/edgar, including Canopy’s annual report on Form 10-K for the year ended March 31, 2020, as amended, and in the public filings of Supreme Cannabis filed with Canadian securities regulators and available under Supreme Cannabis’ profile on SEDAR at www.sedar.com, including Supreme Cannabis’ annual information form for the year ended June 30, 2020.

In respect of the forward-looking statements and information concerning the anticipated benefits and completion of the Transaction and the anticipated timing for completion of the Transaction, Canopy and Supreme Cannabis have provided such statements and information in reliance on certain assumptions that they believe are reasonable at this time. Although Canopy and Supreme Cannabis believe that the assumptions and factors used in preparing the forward-looking information or forward-looking statements in this news release are reasonable, undue reliance should not be placed on such information and no assurance can be given that such events will occur in the disclosed time frames or at all. Should one or more of the foregoing risks or uncertainties materialize, or should assumptions underlying the forward-looking information prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although Canopy and Supreme Cannabis have attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The forward-looking information and forward-looking statements included in this news release are made as of the date of this news release and Canopy and Supreme Cannabis do not undertake any obligation to publicly update such forward-looking information or forward-looking information to reflect new information, subsequent events or otherwise unless required by applicable securities laws.

More Information

| Canopy Growth Corporation | ||||||

| Media Contact: Niklaus Schwenker Director, Communications |

Investor Contacts: Judy Hong Vice President, Investor Relations |

Tyler Burns Director, Investor Relations | ||||

| The Supreme Cannabis Company, Inc. | ||||||

| Craig MacPhail Investor Relations Phone: 416-466-6265 |

Kingsdale Advisors Toll-free: 1-877-659-1819 Collect (Outside North America): 1-416-867-2272 |

|||||

Exhibit 99.2 CANOPY GROWTH CORPORATION + SUPREME CANNABIS Canopy Growth’s Acquisition of Supreme Cannabis (TSX: FIRE) April 2021

DISCLAIMERS AND CAUTIONARY STATEMENTS This presentation contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation. Often, but not always, forward-looking statements and information can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “estimates”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements or information involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Canopy Growth Corporation (“Canopy” or “Canopy Growth”), The Supreme Cannabis Company, Inc. (“Supreme” or “Supreme Cannabis”) or their respective subsidiaries to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements or information contained in this presentation. Examples of such statements include statements with respect to the timing and outcome of the Arrangement (as defined below), the anticipated benefits of the Transaction, the estimated potential synergies as a result of the Transaction, the anticipated timing of the Supreme Cannabis special meeting of shareholders and the closing of the Transaction (as defined below), the satisfaction or waiver of the closing conditions set out in the arrangement agreement between Canopy and Supreme announced on April 8, 2021, including receipt of all regulatory approvals. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information, including assumptions as to the time required to prepare and mail meeting materials to Supreme Cannabis shareholders; the ability of the parties to receive, in a timely manner and on satisfactory terms, the necessary regulatory, court and shareholder approvals; the ability of the parties to satisfy, in a timely manner, the other conditions to the completion of the Transaction; the prompt and effective integration of Canopy’s and Supreme’s businesses and the ability to achieve the anticipated synergies contemplated by the Transaction; inherent uncertainty associated with financial or other projections; risks related to the value of the Canopy common shares to be issued pursuant to the Transaction; the diversion of management time on Transaction-related issues; expectations regarding future investment, growth and expansion of Canopy’s and Supreme’s operations; regulatory and licensing risks; changes in general economic, business and political conditions, including changes in the financial and stock markets; risks related to infectious diseases, including the impacts of the Covid-19 pandemic; legal and regulatory risks inherent in the cannabis industry, including the global regulatory landscape and enforcement related to cannabis, political risks and risks relating to regulatory change; risks relating to anti-money laundering laws; compliance with extensive government regulation and the interpretation of various laws regulations and policies; public opinion and perception of the cannabis industry; and such other risks contained in the public filings of Canopy filed with Canadian securities regulators and available under Canopy’s profile on SEDAR at www.sedar.com and with the United States Securities and Exchange Commission through EDGAR at www.sec.gov/edgar, including Canopy’s annual report on Form 10-K for the year ended March 31, 2020, as amended, and in the public filings of Supreme Cannabis filed with Canadian securities regulators and available under Supreme Cannabis’ profile on SEDAR at www.sedar.com, including Supreme Cannabis’ annual information form for the year ended June 30, 2020. In respect of the forward-looking statements and information concerning the anticipated benefits and completion of the Transaction and the anticipated timing for completion of the Transaction, Canopy and Supreme Cannabis have provided such statements and information in reliance on certain assumptions that they believe are reasonable at this time. Although Canopy and Supreme Cannabis believe that the assumptions and factors used in preparing the forward-looking information or forward-looking statements in this presentation are reasonable, undue reliance should not be placed on such information and no assurance can be given that such events will occur in the disclosed time frames or at all. Should one or more of the foregoing risks or uncertainties materialize, or should assumptions underlying the forward-looking information prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although Canopy and Supreme Cannabis have attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The forward-looking information and forward-looking statements included in this presentation are made as of the date of this presentation and Canopy and Supreme Cannabis do not undertake any obligation to publicly update such forward-looking information or forward-looking information to reflect new information, subsequent events or otherwise unless required by applicable securities laws. 2

TRANSACTION RATIONALE Benefits for Supreme Shareholders: Attractive Premium, Enhanced Liquidity and Continued Participation Benefits for Canopy Shareholders: Strengthened Brand Portfolio and Production Capabilities; Attractive Financial Synergies Cost Synergies and Potential to Accelerate Revenue Growth Solidifies Canopy’s Leadership Position in the Canadian Recreational Market Top-tier, Branded Consumer-Focused Platform Well-Capitalized for Continued Global Growth 3

TRANSACTION SUMMARY ❖ Canopy Growth to acquire all of the issued and outstanding shares of Supreme Cannabis (the “Transaction”) by way of a court approved Plan of Arrangement (the “Arrangement”) ❖ Supreme Cannabis shareholders will receive 0.01165872x of a Canopy common share and $0.0001 in cash in exchange for each Proposed Supreme cannabis share held Transaction ❖ Based on Canopy’s closing share price on the TSX of $37.74 on April 7, 2021, the transaction implies a value of $0.44 per Supreme share ❖ Implied premium of ~66% to Supreme’s closing price on April 7, 2021 ❖ Already obtained approval of both Board of Directors Key ❖ Supreme shareholder approval required Approvals & ❖ Two fairness opinions provided Conditions ❖ Regulatory and court approvals required, as well as other customary closing conditions Deal ❖ Termination fee payable to Canopy in the amount of $12.5 mm if the transaction is terminated under certain circumstances Protection ❖ Supreme is subject to customary non-solicitation provisions with fiduciary out and right to match ❖ Special meeting of Supreme shareholders is expected to occur in June 2021 Timing ❖ Expected closing by the end of June 2021 4

COMBINED TRANSACTION HIGHLIGHTS ✓ Solidifies Canopy’s Leadership Position in the Canadian Recreational Market • The transaction combines Canopy’s preeminent position with Supreme Cannabis’ Top-10 position in Canada to create a pro forma Canadian recreational market share of (1) (1) 13.6% , including 7ACRES holding Canada’s number one premium flower brand position, number one in PAX vapes, and Top-5 in pre-rolled joints (2) • Combined pro-forma market share estimated to be 23.3% and 21.4% in the premium segment in Ontario and British Columbia, respectively ✓ Adds Premium Brands to Canopy’s Portfolio • The addition of Supreme Cannabis’ premium brands, 7ACRES and 7ACRES Craft Collective, complement Canopy’s current consumer offering and will strengthen Canopy’s brand assortment, with both brands expected to continue to grow with further investment and expansion (3) • Possess four of the top ten Canadian cannabis brands based on brand awareness • Supreme Cannabis’ Blissco and Truverra brands also add breadth to Canopy’s market presence in both the recreational and medical markets • Potential to further leverage Canopy’s consumer insights, R&D and innovation capabilities to accelerate new product launches ✓ Brings a Premium, Low-Cost and Scalable Cultivation Facility to Canopy’s Production Capabilities • Indoor/greenhouse cultivation platform with demonstrated capability of consistently producing premium flower from sought-after strains at low-cost with significant potential for scaling • Strengthens genetic library and adds expertise in cultivation, strain development and extraction ✓ Opportunity to Achieve Cost Synergies Estimated at Approximately $30 mm Within Two Years • Anticipated post-transaction cost synergy opportunities across both cost of goods sold and sales, general and administrative expenses, as Canopy optimizes and integrates Supreme’s operations and shared services ✓ Well-Capitalized for Continued Global Growth (4) • Post-acquisition, Canopy’s industry-leading balance sheet and cash position of ~$2.5 bn positions the company for further expansion and product development 1. Market share data represents 01-Oct-20 through latest available data: Provincial Board data for ON online, PEI, NS (27/28-Mar-21) and NB (17-Mar-21); and Headset data for ON retail (28-Feb-21) and AB, BC and SK (31-Mar-21). 2. Source: Canopy internal proprietary market share tool that utilizes point of sales data supplied by third-party data providers, government agencies and Canopy’s own retail 5 store operations across the country. Tool captures point of sale data from an average of 39% of stores in AB, BC, SK, MB and NFLD & Labrador, point of sale data from 100% of stores in NB, NS and PEI, as well as depletions and ecommerce sales data from the OCS for Q3 FY21. 3. Source: Brightfield Group Canada Brand Health Survey, W4 2020; aided brand awareness. 4. Pro-forma for debt financing announced on 18-Mar-21.

BENEFITS FOR SUPREME SHAREHOLDERS ✓ Secures an Immediate Attractive Premium for Supreme Cannabis Shareholders • The transaction provides Supreme Cannabis shareholders with a premium per Supreme Cannabis share of approximately 66% based on the closing prices of the Supreme and Canopy common shares on the TSX on April 7, 2021 ✓ Enhanced Trading Liquidity and Capital Markets Profile • Canopy common shares are highly liquid with an average daily trading volume of ~9.7 mm shares, representing ~C$375 mm on a daily basis over the last 6 months through trading via both Nasdaq and TSX listings ✓ Participation by Supreme Cannabis Shareholders in the Future of Canopy • Brand growth is anticipated with distribution supported by Canopy’s robust sales and distribution network as well as superior consumer insights and R&D capabilities • Supreme Cannabis shareholders will also benefit from Canopy’s US CBD business and conditional positioning for continued exposure to the US market expansion • Benefit from being a part of diversified cannabis company with established medical and international presence and key strategic partnership with Constellation Brands • Transaction provides substantial financial scale and industry leading operational know-how to accelerate Supreme’s growth strategy, future product development and innovation 6

BENEFITS TO BOTH CANOPY AND SUPREME SHAREHOLDERS ➢ Leading premium brands in ➢ Leading brands across both 1.0 and 2.0 ➢ R&D focused on Plant Sciences, Human Canada product formats in Canada Effects and User Technology and Design ➢ Consumer-driven new product innovation➢ Advanced manufacturing operations in ➢ A premium, low-cost and Smith Falls, ON scalable cultivation facility in Kincardine, ON 7

TRANSACTION DELIVERS SUBSTANTIAL FINANCIAL BENEFITS ✓ Opportunity to Achieve Potential Cost Synergies Estimated at Approximately $30 mm Within Two-Years • Increase scale to drive improved utilization and fixed cost absorption • Production and supply chain optimization • SG&A savings from corporate overhead reduction and elimination of other duplicative expenses • These cost synergies are incremental to Canopy’s announced $150-$200 mm cost savings program already underway ✓ Potential Revenue Upside • Combined capabilities and infrastructure expected to drive faster product commercialization and speed to market • Leverage Canopy’s retail store network to increase penetration of Supreme products ✓ Ample Capital to Support Continued Growth (1) • ~$2.5 bn in cash on balance sheet of pro-forma entity 1. Pro-forma for debt financing announced on 18-Mar-21. 8

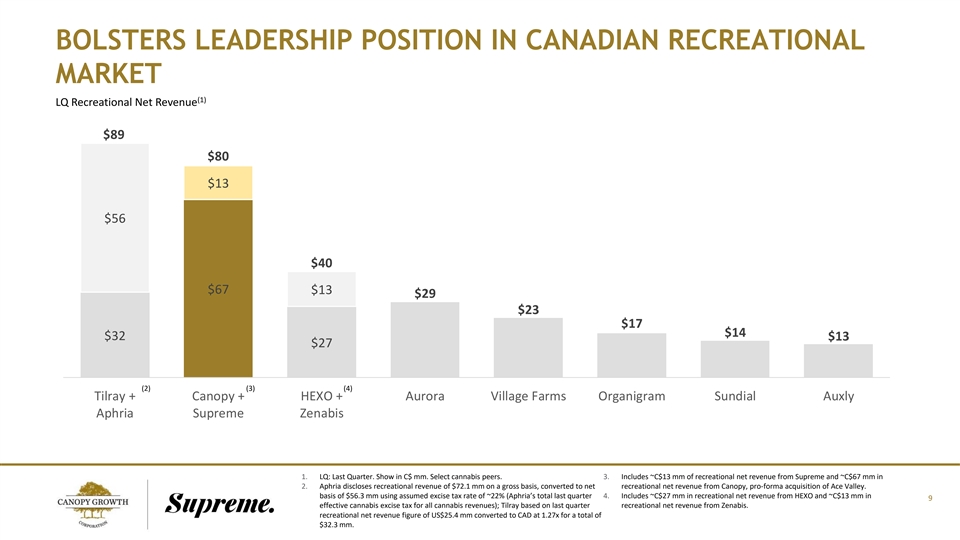

BOLSTERS LEADERSHIP POSITION IN CANADIAN RECREATIONAL MARKET (1) LQ Recreational Net Revenue $89 $80 $13 $56 $40 $67 $13 $29 $23 $17 $14 $32 $13 $27 (2) (3) (4) Tilray + Canopy + HEXO + Aurora Village Farms Organigram Sundial Auxly Aphria Supreme Zenabis 1. LQ: Last Quarter. Show in C$ mm. Select cannabis peers. 3. Includes ~C$13 mm of recreational net revenue from Supreme and ~C$67 mm in 2. Aphria discloses recreational revenue of $72.1 mm on a gross basis, converted to net recreational net revenue from Canopy, pro-forma acquisition of Ace Valley. basis of $56.3 mm using assumed excise tax rate of ~22% (Aphria’s total last quarter 4. Includes ~C$27 mm in recreational net revenue from HEXO and ~C$13 mm in 9 effective cannabis excise tax for all cannabis revenues); Tilray based on last quarter recreational net revenue from Zenabis. recreational net revenue figure of US$25.4 mm converted to CAD at 1.27x for a total of $32.3 mm.

LEADING MARKET SHARE POSITION IN CANADIAN RECREATIONAL (1) MARKET 15.0% 13.6% 2.9% 10.7% 7.8% 7.3% 6.3% 6.0% 4.5% 3.4% 2.4% 1.9% (2) (3) (4) PF Tilray PF Canopy Redecan PF HEXO Aurora Village Farms Auxly Organigram Cronos Indiva #2 in oral & #1 in dried flower #2 in beverages #3 in pre-roll sublingual market share market share market share market share Source: Provincial Boards; Headset 2. Pro-forma merger with Aphria. Note: This market share data differs from Canopy’s internal market share data provided 3. Pro-forma acquisition of Supreme. during Canopy’s previous earnings calls due to different methodologies and time periods 4. Pro-forma acquisition of Zenabis. 10 1. Market share data represents 01-Oct-20 through latest available data: Provincial Board data for ON online, PEI, NS (27/28-Mar-21) and NB (17-Mar-21); and Headset data for ON retail (28-Feb-21) and AB, BC and SK (31-Mar-21)

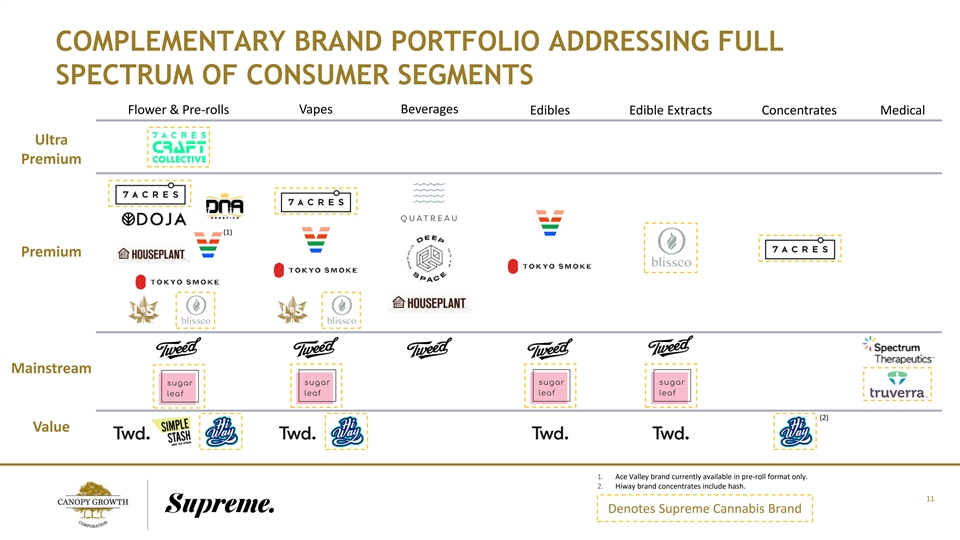

COMPLEMENTARY BRAND PORTFOLIO ADDRESSING FULL SPECTRUM OF CONSUMER SEGMENTS Beverages Flower & Pre-rolls Vapes Edibles Edible Extracts Concentrates Medical Ultra Premium (1) Premium Mainstream (2) Value 1. Ace Valley brand currently available in pre-roll format only. 2. Hiway brand concentrates include hash. 11 Denotes Supreme Cannabis Brand

CANOPY GROWTH OVERVIEW ❖ Financial Highlights (1) o LQA Revenue: ~$610 mm (2) o Expect to achieve positive Adjusted EBITDA during the second half of FY 2022 (3) o Strong Pro-forma balance sheet with cash & short-term investments of ~$2.5 bn ❖ Leading Cannabis Business Focused on Canada, US and Germany o Top-2 market share position in Canadian recreational market o Leading market share in German medical market o Scaling US business via CBD brands and CPG brands ❖ Consumer-driven Approach; Focused on Execution and Increased Agility o Building a differentiated product portfolio driven by consumer insights, R&D and innovation o Entire organization oriented around aligning product innovation, market fit and sales execution ❖ Strategic Relationship with Constellation Brands o C$5.8 bn of investment and a 38% ownership interest o Ability to leverage strategic support through partnership 1. LQA: Last Quarter Annualized. 2. As used by Canopy, Adjusted EBITDA is a non-GAAP measure used by management that is not defined by U.S. GAAP and may not be comparable to similar measures presented by other companies. Adjusted EBITDA is calculated as the reported net loss, adjusted to exclude income tax recovery (expense); other 12 income (expense), net; loss on equity method investments; share-based compensation expense; depreciation and amortization expense; asset impairment and restructuring costs; expected credit losses on financial assets and related charges; restructuring costs recorded in cost of goods sold; and charges related to the flow-through of inventory stepup on business combinations, and further adjusted to remove acquisition-related costs. 3. Pro-forma for debt financing announced on 18-Mar-21.

CANOPY OFFERS ROBUST PRODUCTS ACROSS DISTINCT BRANDS Flower and Pre-Rolls Vapes ▪ Highly curated and broad appeal Tokyo Smoke Luma: ▪ Focused on terpenes and aromas UL 8139 certified vape system with rechargeable ▪ Appeals to enthusiasts batteries ▪ Experience-based products ▪ Exports medically approved vaporizers to 50 510 Rechargeable ▪ Value brand markets globally, with heat-not-burn Battery Vape Pen technology to produce vapors instead of smoke with buttonless ▪ Growing distribution network to expand U.S. activation: UL 8139 consumer reach ▪ High-quality flower grown in the Okanagan certified 510 Valley and produced in small batches cartridges ▪ Expertly cultivated and hand-crafted Beverages Topicals Edibles and Animal Health ▪ Current offering includes 9 ready-to- drink (RTD) beverages, pre-mixed TM with Distilled Cannabis ▪ Cannabis-infused craft chocolate ▪ This Works is a natural wellness skincare line with international ▪ Recently launched Twd. gummies▪ Sport nutrition CBD beverages and presence gum through BioSteel currently sold in ▪ Martha Stewart CBD gummies, softgels and oil drops in the U.S. ▪ This Works has CBD Boosters launched online in the U.S. & the U.K. the U.S. market with additional ▪ Pet CBD product portfolio under Martha Stewart branded Soft products anticipated over time Baked Chews and Oil Drops and SurityPro (science-backed, vet ▪ First & Free offers hemp-derived CBD product line offered in a variety of endorsed) Soft Chews and Oil Drops formats, including softgels, oil drops and creams in the U.S. 13

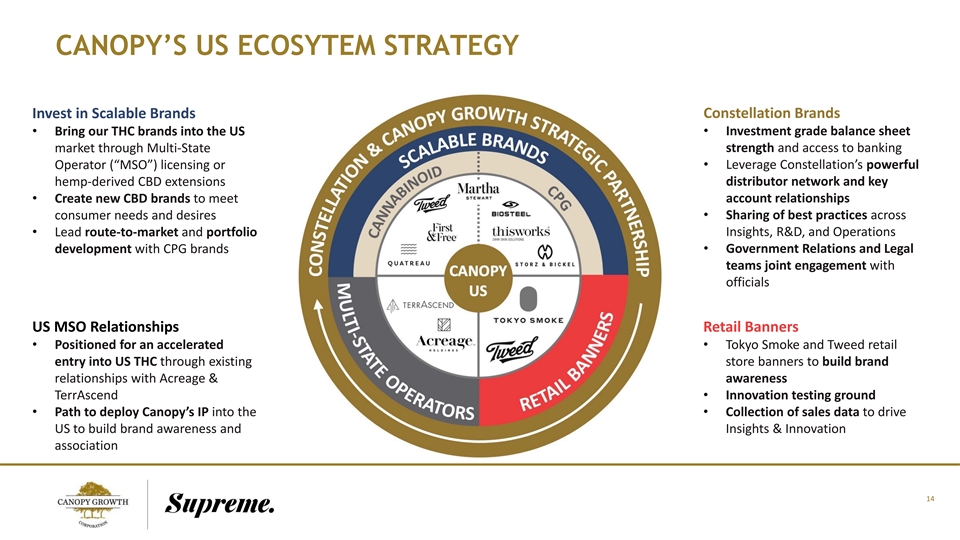

CANOPY’S US ECOSYTEM STRATEGY Invest in Scalable Brands Constellation Brands • Investment grade balance sheet • Bring our THC brands into the US market through Multi-State strength and access to banking Operator (“MSO”) licensing or • Leverage Constellation’s powerful hemp-derived CBD extensions distributor network and key • Create new CBD brands to meet account relationships • Sharing of best practices across consumer needs and desires • Lead route-to-market and portfolio Insights, R&D, and Operations development with CPG brands• Government Relations and Legal teams joint engagement with officials US MSO Relationships Retail Banners • Positioned for an accelerated • Tokyo Smoke and Tweed retail entry into US THC through existing store banners to build brand relationships with Acreage & awareness TerrAscend• Innovation testing ground • Path to deploy Canopy’s IP into the • Collection of sales data to drive US to build brand awareness and Insights & Innovation association 14

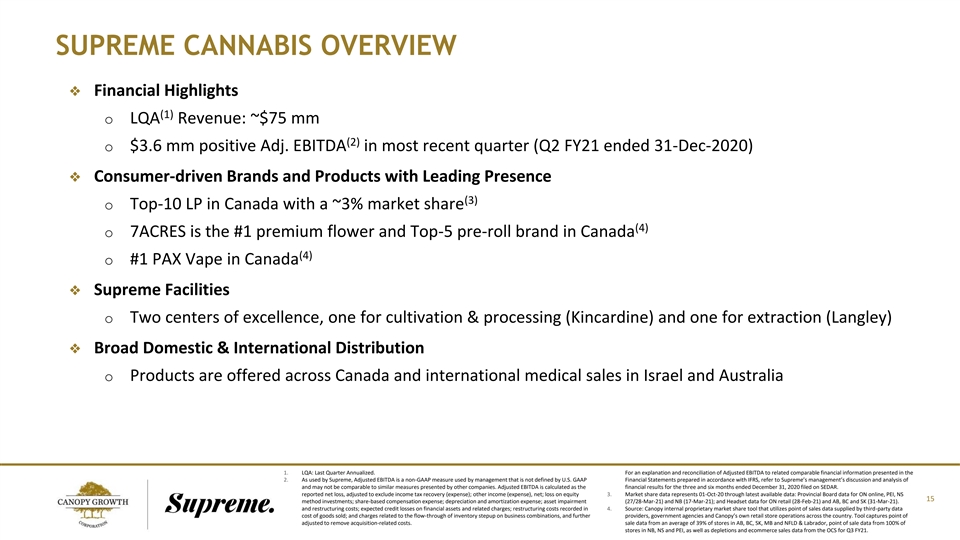

SUPREME CANNABIS OVERVIEW ❖ Financial Highlights (1) o LQA Revenue: ~$75 mm (2) o $3.6 mm positive Adj. EBITDA in most recent quarter (Q2 FY21 ended 31-Dec-2020) ❖ Consumer-driven Brands and Products with Leading Presence (3) o Top-10 LP in Canada with a ~3% market share (4) o 7ACRES is the #1 premium flower and Top-5 pre-roll brand in Canada (4) o #1 PAX Vape in Canada ❖ Supreme Facilities o Two centers of excellence, one for cultivation & processing (Kincardine) and one for extraction (Langley) ❖ Broad Domestic & International Distribution o Products are offered across Canada and international medical sales in Israel and Australia 1. LQA: Last Quarter Annualized. 1. For an explanation and reconciliation of Adjusted EBITDA to related comparable financial information presented in the 2. As used by Supreme, Adjusted EBITDA is a non-GAAP measure used by management that is not defined by U.S. GAAP Financial Statements prepared in accordance with IFRS, refer to Supreme’s management’s discussion and analysis of and may not be comparable to similar measures presented by other companies. Adjusted EBITDA is calculated as the financial results for the three and six months ended December 31, 2020 filed on SEDAR. reported net loss, adjusted to exclude income tax recovery (expense); other income (expense), net; loss on equity 3. Market share data represents 01-Oct-20 through latest available data: Provincial Board data for ON online, PEI, NS 15 method investments; share-based compensation expense; depreciation and amortization expense; asset impairment (27/28-Mar-21) and NB (17-Mar-21); and Headset data for ON retail (28-Feb-21) and AB, BC and SK (31-Mar-21). and restructuring costs; expected credit losses on financial assets and related charges; restructuring costs recorded in 4. Source: Canopy internal proprietary market share tool that utilizes point of sales data supplied by third-party data cost of goods sold; and charges related to the flow-through of inventory stepup on business combinations, and further providers, government agencies and Canopy’s own retail store operations across the country. Tool captures point of adjusted to remove acquisition-related costs. sale data from an average of 39% of stores in AB, BC, SK, MB and NFLD & Labrador, point of sale data from 100% of stores in NB, NS and PEI, as well as depletions and ecommerce sales data from the OCS for Q3 FY21.

DIVERSE CANNABIS BRANDS AND PRODUCTS H i g h - Q u a l i t y P r o d u c t s a t E v e r y K e y P r i c e P o i n t Multi-award-winning cannabis Ultra premium brand extension Affordable cannabis brand Accessible recreational brand Premium wellness brand International medical brand brand regarded for its premium delivering high-potency craft delivering quality products at an focusing on high-quality producing high-quality cannabis delivering CBD and cannabis flower products and inputs. cannabis products. accessible price. convenience products. and CBD offerings. products. For discerning recreational For experienced enthusiast For experienced value-oriented For new cannabis and For wellness-focused For medical cannabis consumers. consumers. consumers. convenience consumers. consumers. consumers. Whole Flower Whole Flower Pre-Rolls Pre-Rolls CBD Oils CBD Medicinal Products Whole Flower Pre-Rolls Pre-Rolls Vaporizer THC and CBD Oils Whole Flower Medical Cannabis Vaporizer (PAX Pods) Hash Gummies Pre-Rolls Concentrates Concentrates Vaporizer (5:10) Vaporizer 16

KINCARDINE: SUPREME’S CULTIVATION CENTER OF EXCELLENCE 7ACRES FACILITY | KINCARDINE, ONTARIO Core Capabilities Hybrid facility | Indoor sealed cultivation with greenhouse roof Product | Produces premium flower with high consistency in small batch grows Advanced processing | Proprietary whole-plant dry and hand-trim finish including small batch processing for craft production Value-add processing | Pre-roll and concentrates production Automated packaging | Packaged to high-quality visual specification Genetics practice | Cambium Plant Sciences R&D lab within 7ACRES Scalability | Premium and scalable cultivation facility with demonstrated record of producing premium flower at a low cost 17

Canopy Growth Corporation The Supreme Cannabis Company NASDAQ: CGC | TSX : WEED TSX : FIRE Canopygrowth.com Supreme.ca THANK YOU Investor Relations: Judy Hong Tyler Burns Craig MacPhail Vice President, Investor Relations Director, Investor Relations Investor Relations [email protected] [email protected] [email protected] 18

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Cannabis Market Flourishes Amid Global Legalization, Driving Concerns About Road Safety

- Canopy Growth Announces CBI Conversion to Exchangeable Shares and Newly Constituted Board of Directors

- American Kidney Fund Recognized as a Top Nonprofit Workplace in the United States

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share