Form 8-K CROWN CASTLE INTERNATION For: May 19

Exhibit 3.1

CERTIFICATE OF AMENDMENT

OF THE

RESTATED CERTIFICATE OF INCORPORATION

OF

CROWN CASTLE INTERNATIONAL CORP.

Crown Castle International Corp., a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (“Corporation”),

DOES HEREBY CERTIFY:

FIRST: The Restated Certificate of Incorporation of the Corporation, as amended, is hereby amended by deleting the first paragraph of Article IV thereof and inserting the following:

“The total number of shares of stock which the Corporation shall have authority to issue is one billion one hundred twenty million (1,120,000,000), consisting of twenty million (20,000,000) shares of Preferred Stock, par value $0.01 per share (hereinafter referred to as “Preferred Stock”), and one billion one hundred million (1,100,000,000) shares of Common Stock, par value $0.01 per share (hereinafter referred to as “Common Stock”).”

SECOND: That the aforesaid amendment was duly adopted in accordance with the applicable provisions of Section 242 of the General Corporation Law of the State of Delaware.

IN WITNESS WHEREOF, said Crown Castle International Corp. has caused this certificate to be signed this 20th day of May, 2022.

CROWN CASTLE INTERNATIONAL CORP. | ||||||||||||||

| By: | /s/ Kenneth J. Simon | |||||||||||||

| Name: | Kenneth J. Simon | |||||||||||||

| Title: | Executive Vice President and General Counsel | |||||||||||||

Exhibit 10.2

GRANT DATE: ______________, _____

RESTRICTED STOCK UNIT AGREEMENT

(2022 Long-Term Incentive Plan)

This Restricted Stock Unit Agreement (“Agreement”) is made effective as of ___________, _____ (“Grant Date”), between CROWN CASTLE INTERNATIONAL CORP. (“Company”), a Delaware corporation, and _____________________ (“Holder”).

Holder has been serving as an employee or consultant of the Company or one of its Affiliates. In recognition of service and in order to encourage Holder to remain with the Company or its Affiliates (“Group”) and devote Holder’s best efforts to the Group’s affairs, thereby advancing the interests of the Company and its stockholders, the Company and Holder agree as follows:

1.Issuance of Restricted Stock Units. Upon the execution and return of this Agreement and for consideration from Holder to the Company in the form of services to the Group, the fair market value of which is at least equal to $.01 per each restricted stock unit granted pursuant to the 2022 Plan (defined below) (“Unit”) which may be issued hereunder, the Company shall grant to Holder the number of Units listed on the exhibit(s) (each, an “Exhibit”) attached to this Agreement (“Holder’s Units”), with each such Unit representing the right to potentially receive one share of $.01 par value Common Stock of the Company (“Stock”), subject to all of the terms set forth in this Agreement and in the Crown Castle International Corp. 2022 Long-Term Incentive Plan, as may be amended from time to time (“2022 Plan”), which is incorporated herein by reference as a part of this Agreement. The terms “Affiliate,” “Award”, “Committee”, “Code”, “Dividend Equivalent” and “Performance Award” shall have the meanings assigned to them in the 2022 Plan. If a Performance Measure (as hereinafter defined) is designated on an attached Exhibit, then the Units subject to that Exhibit are hereby designated as Performance Awards for purposes of Article IX of the 2022 Plan.

2.Limitations on Rights Associated with Units and Dividend Equivalents. The Units and Dividend Equivalents granted pursuant to this Agreement are bookkeeping entries only. The Holder as to the Units shall have no rights as a stockholder of the Company, including no dividend rights (other than those described in Section 7 hereof with regard to Dividend Equivalents) and no voting rights.

3.Transfer and Forfeiture Restrictions. The Holder’s Units shall not be sold, assigned, pledged, or otherwise transferred except as provided herein (including the 2022 Plan), and Holder shall be obligated to forfeit and surrender, without further consideration from the Company, such Units (to the extent then subject to the Forfeiture Restrictions) to the Company in accordance with this Agreement. The obligation to forfeit and surrender Units to the Company is referred to herein as the “Forfeiture Restrictions.” The transfer restrictions and Forfeiture Restrictions shall be binding upon and enforceable against any permitted transferee of Units.

4.Measures. [Note: The vesting terms set forth in this Section 4 and in the Exhibits hereto or other relevant vesting terms shall be included as applicable in the specific award.]

(a)Except as otherwise provided in Section 5 hereof, the lapsing of the Forfeiture Restrictions shall be contingent on the Holder and the Group, as applicable, meeting

the service and, if applicable, performance conditions described on the applicable Exhibit attached to this Agreement. The Holder shall be required to complete a designated period of service (“Time Measure”) which shall begin on the Grant Date and end on the date specified in the applicable Exhibit attached (“Time Vesting Date”). In addition, to the extent provided in an attached Exhibit, the Holder or the Group may be required to attain one or more performance goals (each, if applicable, a “Performance Measure”, and together with a Time Measure, the “Measures”), which shall be measured over the designated period of time (“Performance Period”), as described on such Exhibit. The date on which the Time Measure and, if applicable, the Performance Measure, are both satisfied shall be the “Measurement Date” for Holder’s Units, subject to such measurement. The Time Measure, Time Vesting Date, Measurement Date and, if applicable, the Performance Period and Performance Measures for this grant of Units are described on the applicable Exhibit attached to this Agreement.

(b)In addition to the conditions set forth in Section 4(a), the lapsing of any Forfeiture Restrictions shall be contingent upon the Holder having complied (as determined by the Company) with all agreements (including any confidentiality, non-competition, non-solicitation and non-disparagement agreements) entered into by and between the Holder and any member of the Group on and prior to the date such Forfeiture Restrictions would otherwise be expected to lapse hereunder.

(c)As soon as administratively feasible after the designated Measurement Date for a Unit, (1) if that Unit is subject to a Performance Measure, the Committee shall certify in writing the extent to which such Performance Measure has been satisfied, (2) the Company shall calculate the number of Units with respect to which the Forfeiture Restrictions shall lapse pursuant to the terms of the applicable Exhibit attached (“Vested Units”), and (3) the Company shall distribute to the Holder one share of Stock (“Distributed Stock”) in exchange for each Vested Unit in accordance with the timing restrictions of Section 9 hereof, and upon such exchange the Vested Units shall be automatically cancelled.

(d)Any Holder’s Units with respect to which Forfeiture Restrictions cannot lapse pursuant to this Section 4 (including any exceptions pursuant to Section 5 hereof) shall be forfeited and surrendered to the Company by Holder.

5.Termination of Employment or Service. If Holder’s employment with the Group terminates or is terminated prior to the applicable Measurement Date, then the remaining Holder’s Units shall be forfeited and surrendered to the Company; provided, however, that, in such event, the Committee may (subject to the terms of the 2022 Plan), in its sole discretion, cause the Forfeiture Restrictions to lapse as to all or a part of the Holder’s Units and, subject to the timing restrictions of Section 9 hereof, cause Distributed Stock to be issued and distributed with respect to such Units as if they were Vested Units subject to such terms set by the Committee, which may include satisfaction of the Measures that would otherwise be applicable to such Units if Holder’s employment with the Group had continued. For purposes of this Section 5, Holder’s services as a consultant or member of the board of directors (or a similar position) of the Group shall be considered employment with the Group (notwithstanding the foregoing, a Holder who is a consultant of the Group shall be and remain an independent contractor of the Group for all purposes, and this Agreement shall not be construed to create an employment relationship). In the event Holder’s employment with the Group terminates or is terminated under circumstances constituting retirement under any then-existing Board-approved retirement policy or program, including the Company’s Extended Service Separation Program (if then in effect), the lapse of the Forfeiture Restrictions with respect to or the forfeiture of Holder’s Units, as applicable, shall be determined in accordance with such retirement policy or program.

6.Disclosure of Units. If Holder discloses or discusses in any manner this Agreement prior to the applicable Measurement Date to or with any other person (including any

-2-

other employee or consultant of the Group), then the Holder’s Units may be forfeited and the Holder’s Units may be surrendered to the Company; provided, the above restriction is not applicable to the extent of reasonable disclosure (a) to an advisor to the Holder (e.g., accountant, financial planner) that has a legitimate reason to have such information and that is subject to an obligation to maintain the confidentiality of such information, (b) required by applicable law including any applicable securities law, (c) to an employee of the Group specifically involved with the administration of this Agreement, or (d) to Holder’s spouse. Holder acknowledges and agrees that nothing in this Agreement is intended to, nor does it, interfere with or restrain Holder’s right to share or discuss information regarding his/her wages, hours, or other terms and conditions of employment in the exercise of any rights provided by either (x) the National Labor Relations Act, or (y) any applicable state statute or regulation.

7.Dividend Equivalents. While the Holder’s Units are outstanding and still subject to a Forfeiture Restriction, the Company will accrue Dividend Equivalents on behalf of the Holder. The Dividend Equivalents paid with respect to each Holder’s Unit will be equal to the sum of the cash dividends declared and paid by the Company with respect to each share of Distributed Stock while the Holder’s Units are outstanding. No interest will accrue on the Dividend Equivalents. The Dividend Equivalents with respect to a Holder’s Unit shall be earned and distributed in cash generally at or shortly after the time such Holder’s Unit converts to a share of Distributed Stock and in accordance with Section 9 hereof. Any and all Dividend Equivalents with respect to the Holder’s Units that are forfeited shall also be forfeited and not deemed earned by nor distributed to Holder. Following lapsing of the Forfeiture Restrictions with respect to Holder’s Units and pending distribution of Distributed Stock in respect thereto, Holder shall be entitled to receive Dividend Equivalents relating to such Holder’s Units to the extent, if any, that the Holder is not entitled to receive with respect to the Distributed Stock dividends which would otherwise be paid to Holder during such interim period if the Distributed Stock had been so distributed, but in no event shall Holder be entitled to receive both a Dividend Equivalent and a dividend for such interim period.

8.Community Interest of Spouse. The community interest, if any, of any spouse of Holder in any of the Holder’s Units, Dividend Equivalents, and Distributed Stock shall be subject to all of the terms of this Agreement, and shall be forfeited and surrendered to the Company upon the occurrence of any of the events requiring Holder’s interest in such Holder’s Units or Dividend Equivalents to be so forfeited and surrendered pursuant to this Agreement.

9.Internal Revenue Code §409A Compliance. This Agreement is intended to satisfy the requirements of Section 409A of the Internal Revenue Code of 1986, as amended, and the rules and regulations thereunder, and shall be interpreted consistent with such intent. Any Distributed Stock or Dividend Equivalents that become deliverable or payable to the Holder hereunder shall be delivered to the Holder no later than the end of the calendar year in which the designated Measurement Date occurs. Notwithstanding the foregoing, in the event of a deemed lapse of any Forfeiture Restriction under the provisions of Section 5, delivery of Distributed Stock and Dividend Equivalents shall be made no earlier than the designated Measurement Date otherwise applicable hereunder, and not later than the last day of the calendar year containing the designated Measurement Date. In the event that all or part of the Units granted pursuant to this Agreement provide for a deferral of compensation within the meaning of Section 409A, then notwithstanding anything to the contrary contained herein, in the event that Holder is a “specified employee” (as defined under Section 409A) when Holder becomes entitled to a payment or settlement under this Award which is subject to Section 409A on account of a “separation from service” (as defined under Section 409A), to the extent required by the Code, such payment shall not occur until the date that is six months plus one day from the date of such separation from service. Any amount that is otherwise payable within the six-month period described herein will be aggregated and paid in a lump sum without interest. Further, for purposes of Section 409A,

-3-

each payment or settlement of any portion of the Units under this Agreement shall be treated as a separate payment of compensation.

10.Withholding of Tax.

(a)To the extent that any event pursuant to this Agreement, other than any event contemplated in Section 10(b) below, relating to the Holder’s Units or Distributed Stock results in the incurrence of compensation or other taxable income by the Holder (including the Holder’s Spouse) that is subject to tax withholding by the Company, the Holder must satisfy such tax withholding obligation by electing, prior to the delivery of Distributed Stock, to either (1) deliver to the Company an amount of cash equal to the tax withholding amount required under applicable tax laws or regulations, or (2) allow the Company to deduct from the number of shares of Distributed Stock that would have otherwise been delivered to the Holder a number of such shares having a fair market value equal to such tax withholding amount required under applicable tax laws or regulations.

(b)To the extent that any event pursuant to this Agreement relating to the Dividend Equivalents deemed to be earned results in the incurrence of compensation or other taxable income by the Holder (including the Holder’s Spouse) that is subject to withholding by the Company, the Holder must satisfy such tax withholding obligation with such amount of cash as the Company may require to meet its obligation under applicable tax laws or regulations.

(c)Regardless of any action of the Company, the Holder acknowledges that the Holder is ultimately liable for such tax withholding obligation. The Company shall not be required to deliver Distributed Stock or cash in respect of Dividend Equivalents under this Agreement until such liability is satisfied.

(d)To the extent that Holder is treated by Company as a consultant for tax purposes, Holder shall (1) pay all taxes arising from any event relating to the Holder’s Units or Distributed Stock that results in the incurrence of compensation or other taxable income by the Holder and (2) indemnify the Group and hold the Group harmless from any liability resulting from or relating to any and all taxes, liens, duties, assessments, deductions and expenses (including any penalty, interest or other charge that may be levied with respect thereto) as a result of Holder’s late payment, insufficient payment or failure to pay any taxes.

11.Binding Effect. This Agreement shall be binding upon and inure to the benefit of any successors to the Company and all persons lawfully claiming under Holder.

12.Contract Terms. Notwithstanding the terms of this Agreement, if the Holder has entered into a separate written agreement with the Company which specifically affects the Units issued hereunder, the terms of such separate agreement shall control over any inconsistent terms of this Agreement.

13.Modification. Any modification of this Agreement will be effective only if it is in writing and signed by each party whose rights hereunder are affected thereby, except to the extent that such modification occurs pursuant to Section XIII of the 2022 Plan or as a result of an amendment of the 2022 Plan made in accordance with Section XIV of the 2022 Plan.

14.Governing Law. This Agreement shall be governed by, and construed in accordance with, the laws of the State of Texas, without regard to conflicts of laws principles thereof.

15.Interpretation. Unless otherwise specified or the context otherwise requires, as used herein, (a) the term “including”, and any variation thereof, means “including, without

-4-

limitation,” (b) the word “or” shall not be exclusive, and (c) a reference to the “terms” of an agreement, instrument or document or “terms” established by the Committee shall be a reference to “terms, provisions, conditions and restrictions.”

IN WITNESS WHEREOF, the Company has executed this Agreement by its duly authorized officer and Holder has executed this Agreement, effective as of the Grant Date.

| CROWN CASTLE INTERNATIONAL CORP. | |||||||||||

| By: | |||||||||||

| Name: | |||||||||||

| Title: | |||||||||||

| Date: | |||||||||||

-5-

Exhibit A

GRANT ID: ___________________

GRANT DATE: ____________, ______

Measures Applicable To

Restricted Stock Unit Agreement

(2022 Long-Term Incentive Plan)

Time Vesting Award

Name: ____________________

Number of Units: ____________________

The terms of this Exhibit A shall apply to the number of Units listed above. The terms of any other Exhibit to Holder’s Restricted Stock Unit Agreement shall only apply to the Units listed on such Exhibit.

1. General. The Holder’s Units subject to this Exhibit A shall become vested based on the completion of the Time Measure as outlined below.

2. Time Measure. The Time Measure shall be satisfied with respect to a Unit if the Holder is an employee, consultant or a member of the board of directors (or a similar position) of the Group for the period beginning on the Grant Date and ending on the applicable Time Vesting Date listed below.

Time Vesting Date Incremental Percentage Aggregate Percentage

____________, ____ __.__% __.__%

____________, ____ __.__% __.__%

____________, ____ __.__% 100.00%

If the Time Measure is satisfied, the designated percentage of the Holder’s Units listed above shall no longer be subject to the Forfeiture Restrictions on the designated Time Vesting Date.

-6-

Exhibit B

GRANT ID: ______________

GRANT DATE: _______________

Measures Applicable To

Restricted Stock Unit Agreement

(2022 Long-Term Incentive Plan)

Performance Award - Absolute TSR Award

Name: _____________________

Target Number of Units (“Target Level”): ____________________

The terms of this Exhibit B shall apply to the Units listed above. The terms of any other Exhibit to Holder’s Restricted Stock Unit Agreement shall only apply to the Units listed on such Exhibit.

1. General. The Holder’s Units shall become vested based on the satisfaction of both the Time Measure and the Performance Measure, each as outlined below. The Units subject to this Exhibit are hereby designated as Performance Awards for purposes of Article IX of the 2022 Plan. The initial number of Units specified above in this Exhibit as the “Target Level” is the “target” number of shares of Stock that may be delivered upon settlement of the Units subject to this Exhibit. Such initial number of Units shall be adjusted based on the attainment of the Performance Measure described in Section 3 below.

2. Time Measure. The Time Measure shall be satisfied with respect to a Unit if the Holder is an employee, consultant or a member of the board of directors (or a similar position) of the Group for the period beginning on the Grant Date and ending on __________, _____, which shall be the “Time Vesting Date” for each Unit subject to this Exhibit B.

3. Performance Measure.

(a)The initial number of Units subject to this Exhibit B is listed above, which number of Units assumes the Performance Measure described in this Section 3 is attained at the Target Level. The final number of Units, if any, subject to this Exhibit B at the end of the Performance Period (defined below) shall be calculated as described below based upon the Payout Percentage (see table below in Section 3(c)).

(b)The Performance Measure determines (1) the number of Holder’s Units for which the Forfeiture Restrictions shall lapse on the Measurement Date, and (2) the number of shares of Stock delivered upon settlement of such Units. The number of Holder’s Units which cease to be subject to Forfeiture Restrictions on the Measurement Date, and the number of shares of Stock delivered with respect to Holder’s Units, is based upon the Company’s Annualized Total Stockholder Return (“Annualized TSR”) for the three year period beginning on _________, ____ and ending on and including _____________, ____ (“Performance Period”). As provided in Section 3(c) below, the Performance Measure will be satisfied based on the Company’s Annualized TSR during the Performance Period, as certified in writing by the Committee following the end of the Performance Period.

(c)The Forfeiture Restriction shall lapse if the Company’s Annualized TSR is at least __________ percent (___%); provided that the number of Units as of the Measurement Date shall be determined based on Annualized TSR as described in the table below. If Annualized TSR is between the levels designated in the table below, then the Payout Percentage shall be adjusted based on linear interpolation between applicable percentages. For example, (1)

-7-

if Annualized TSR is ______%, then the payout percentage would be ____% of the Target Level, and (2) if Annualized TSR is ______%, then the payout percentage would be _____% of the Target Level.

| Level | Annualized TSR | Payout Percentage | ||||||

| Maximum | ____% | ____% of Target Level | ||||||

| Target | ____% | ____% of Target Level | ||||||

| Threshold | ____% | ____% of Target Level | ||||||

| Below ____% | 0% | |||||||

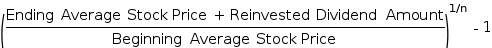

(d)Annualized TSR shall be calculated as:

where n represents the number of years over which Annualized TSR is measured.

The “Ending Average Stock Price” shall be calculated as the average Closing Stock Price for the last ___ trading days of the Performance Period.

The “Beginning Average Stock Price” shall be calculated as the average Closing Stock Price for the last ___ trading days prior to the first day of the Performance Period.

The “Closing Stock Price” of a share of Stock shall be the closing quotation on the New York Stock Exchange (“NYSE”) for the applicable date (or an applicable substitute exchange or quotation system if the NYSE is no longer applicable).

“Reinvested Dividend Amount” shall be calculated as the sum of the total dividends paid1 on one share of Stock during the Performance Period, assuming reinvestment of such dividends in such Stock (based on the Closing Stock Price of such Stock on the ex-dividend date). For the avoidance of doubt, it is intended that the foregoing calculation of Reinvested Dividend Amount shall take into account not only the reinvestment of dividends in a share of Stock but also capital appreciation or depreciation in the shares of Stock deemed acquired by such reinvestment.

(e)In addition to any other authority or powers granted to the Committee herein or in the 2022 Plan, the Committee shall have the authority to interpret and determine the application and calculation of any matter relating to the determination of Annualized TSR, including any terms in the Agreement or this Exhibit B related thereto. The Committee shall also have the power to make any and all adjustments it deems appropriate to reflect any changes in

1 The relevant date for determining whether a dividend is included in the calculation of “Reinvested Dividend Amount” is the ex-dividend date (and not the payment date). In the event that the stock of the measured company goes ex-dividend during the Performance Period (including the ___-day trading period during which the Ending Average Stock Price is to be calculated), such dividend shall be included in the determination of “Reinvested Dividend Amount,” notwithstanding the fact that the payment date of such dividend may actually occur after the conclusion of the Performance Period. In the event that the stock of the measured company goes ex-dividend prior to the commencement of the Performance Period (for example, during the ___-day trading period during which the Beginning Average Stock Price is to be calculated), such dividend shall not be included in the termination of “Reinvested Dividend Amount,” notwithstanding the fact that the payment date of such dividend may actually occur during the Performance Period.

-8-

the Company’s outstanding Stock, including by reason of subdivision or consolidation of Stock or other capital readjustment, the payment of a stock dividend on the Stock, other increase or reduction in the number of shares of Stock outstanding, recapitalizations, reorganizations, mergers, consolidations, combinations, split-ups, split-offs, spin-offs, exchanges or other relevant changes in capitalization or distributions to holders of Stock. The determination of the Committee with respect to any such matter shall be conclusive.

(f)Holder shall receive a Dividend Equivalent payment with respect to each share of Distributed Stock as if Holder had held such share since the Grant Date.

-9-

Exhibit C

GRANT ID: ___________

GRANT DATE: ____________, ______

Measures Applicable To

Restricted Stock Unit Agreement

(2022 Long-Term Incentive Plan)

Performance Award - Relative TSR Award

Name: ______________________

Target Number of Units (“Target Level”): _____________________

The terms of this Exhibit C shall apply to the Units listed above. The terms of any other Exhibit to Holder’s Restricted Stock Unit Agreement shall only apply to the Units listed on such Exhibit.

1. General. The Holder’s Units shall become vested based on the satisfaction of both the Time Measure and the Performance Measure, each as outlined below. The Units subject to this Exhibit are hereby designated as Performance Awards for purposes of Article IX of the 2022 Plan. The initial number of Units specified above in this Exhibit as the “Target Level” is the “target” number of shares of Stock that may be delivered upon settlement of the Units subject to this Exhibit. Such initial number of Units shall be adjusted based on the attainment of the Performance Measure described in Section 3 below.

2. Time Measure. The Time Measure shall be satisfied with respect to a Unit if the Holder is an employee, consultant or a member of the board of directors (or a similar position) of the Group for the period beginning on the Grant Date and ending ___________, _____, which shall be the “Time Vesting Date” for each Unit subject to this Exhibit C.

3. Performance Measure.

(a)The number of Units subject to this Exhibit C is listed above, which number of Units assumes the Performance Measure described in this Section 3 is attained at the Target Level. The final number of Units, if any, subject to this Exhibit C at the end of the Performance Period shall be calculated as described below based upon the Payout Percentage (see table below in Section 3(c)).

(b)The Performance Measure determines (1) the number of Holder’s Units for which the Forfeiture Restrictions shall lapse on the Measurement Date, and (2) the number of shares of Stock delivered upon settlement of such Units. The number of Holder’s Units which cease to be subject to Forfeiture Restrictions on the Measurement Date, and the number of shares of Stock delivered with respect to Holder’s Units, is based upon the Company’s Annualized Total Stockholder Return (“Annualized TSR”) ranking relative to the TSR Peer Group (“Relative TSR Performance Rank”) for the three year period beginning on _______________, _____ and ending on and including ______________, _____ (“Performance Period”). For this purpose, the companies included in the Standard & Poor’s 500 index on ___________, _____ will be the “TSR Peer Group”. As provided in Section 3(c) below, the Performance Measure will be satisfied based on the Company’s Relative TSR during the Performance Period, as certified in writing by the Committee following the end of the Performance Period.

-10-

(c)The Forfeiture Restriction shall lapse if the Company’s Relative TSR Performance Rank is at least the 30th percentile; provided that the final number of Units subject to this Exhibit as of the Measurement Date, and the number of shares of Stock delivered with respect to Holder’s Units, shall be determined based on the Company’s Relative TSR Performance Rank as described in the table below. If the Company’s Relative TSR Performance Rank is between the levels designated in the table below, then the Payout Percentage (shown in the table below) shall be adjusted based on linear interpolation between applicable percentages. For example, (1) if the Company’s Relative TSR is in the ___th percentile, then the payout percentage would be ___% of the Target Level, and (2) if the Company’s Relative TSR is in the ___th percentile, then the payout percentage would be ____% of the Target Level.

| Level | Relative TSR Performance Rank | Payout Percentage | ||||||

| Maximum | ___th Percentile and above | ____% of Target Level | ||||||

| Target | ___th percentile | ____% of Target Level | ||||||

| Threshold | ___th percentile | ____% of Target Level | ||||||

| Below ___th percentile | 0% | |||||||

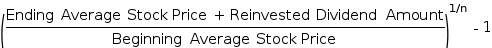

(d)Annualized TSR shall be calculated as follows:

where n represents the number of years over which Annualized TSR is measured.

The “Ending Average Stock Price” shall be calculated as the average Closing Stock Price for the last ___ trading days of the Performance Period.

The “Beginning Average Stock Price” shall be calculated as the average Closing Stock Price for the last ___ trading days prior to the first day of the Performance Period.

The “Closing Stock Price” of a share of Stock shall be the closing quotation on the New York Stock Exchange (“NYSE”) for the applicable date (or an applicable substitute exchange or quotation system if the NYSE is no longer applicable).

“Reinvested Dividend Amount” shall be calculated as the sum of the total dividends paid2 on one share of Stock during the Performance Period, assuming reinvestment of such dividends in such stock (based on the Closing Stock Price of such Stock on the ex-dividend date). For the avoidance of doubt, it is intended that the foregoing calculation of Reinvested Dividend Amount shall take into account not only the reinvestment of

2 The relevant date for determining whether a dividend is included in the calculation of “Reinvested Dividend Amount” is the ex-dividend date (and not the payment date). In the event that the stock of the measured company goes ex-dividend during the Performance Period (including the ___-day trading period during which the Ending Average Stock Price is to be calculated), such dividend shall be included in the determination of “Reinvested Dividend Amount,” notwithstanding the fact that the payment date of such dividend may actually occur after the conclusion of the Performance Period. In the event that the stock of the measured company goes ex-dividend prior to the commencement of the Performance Period (for example, during the ___-day trading period during which the Beginning Average Stock Price is to be calculated), such dividend shall not be included in the termination of “Reinvested Dividend Amount,” notwithstanding the fact that the payment date of such dividend may actually occur during the Performance Period.

-11-

dividends in a share of Stock but also capital appreciation or depreciation in the shares deemed acquired by such reinvestment.

The Annualized TSR for the TSR Peer Group companies will be determined using the calculation method described above based on information specific to the TSR Peer Group companies.

(e)In addition to any other authority or powers granted to the Committee herein or in the 2022 Plan, the Committee shall have the authority to interpret and determine the application and calculation of any matter relating to the determination of Annualized TSR and Relative TSR Performance Rank, including any terms in the Agreement or this Exhibit C related thereto. The Committee shall also have the power to make any and all adjustments it deems appropriate to reflect any changes in the Company’s outstanding Stock, including by reason of subdivision or consolidation of Stock or other capital readjustment, the payment of a stock dividend on the Stock, other increase or reduction in the number of shares of Stock outstanding, recapitalizations, reorganizations, mergers, consolidations, combinations, split-ups, split-offs, spin-offs, exchanges or other relevant changes in capitalization or distributions to holders of Stock. The determination of the Committee with respect to any such matter shall be conclusive.

(f)Adjustments to TSR Peer Group. The TSR Peer Group may be adjusted or changed by the Committee as circumstances warrant, including the following:

(1) If a TSR Peer Group company becomes bankrupt, the bankrupt company will remain in the TSR Peer Group positioned at one level below the lowest performing non-bankrupt TSR Peer Group. In the case of multiple bankruptcies, the bankrupt TSR Peer Group companies will be positioned below the non-bankrupt companies in chronological order by bankruptcy date with the first to go bankrupt at the bottom.

(2) If a TSR Peer Group company is acquired by another company, including through a management buy-out or going-private transaction, the acquired TSR Peer Group company will be removed from the TSR Peer Group for the entire Performance Period; provided that if the acquired TSR Peer Group company became bankrupt prior to its acquisition it shall be treated as provided in paragraph (1), above, or if it shall become delisted according to paragraph (5) below prior to its acquisition it shall be treated as provided in paragraph (5).

(3) If a TSR Peer Group company spins-off a portion a portion of its business in a manner which results in the TSR Peer Group company and the spin-off company both being publicly traded, the TSR Peer Group company will be removed from the TSR Peer Group for the entire Performance Period and the spin-off company will not be added to the TSR Peer Group.

(4) If a TSR Peer Group company acquires another company, the acquiring TSR Peer Group company will remain in the TSR Peer Group for the Performance Period.

(5) If a TSR Peer Group company is delisted from either the New York Stock Exchange (NYSE) or the National Association of Securities Dealers Automated Quotations (NASDAQ) such that it is no longer listed on either exchange, such delisted TSR Peer Group company will remain in the TSR Peer Group positioned at one level below the lowest performing listed company and above the highest ranked bankrupt TSR Peer Group company (see paragraph (1) above). In the case of multiple delistings, the delisted TSR Peer Group companies will be positioned below the listed and above the bankrupt TSR Peer Group companies in chronological order by delisting date with the

-12-

first to be delisted at the bottom of the delisted companies. If a delisted company shall become bankrupt, it shall be treated as provided in paragraph (1) above. If a delisted company shall be later acquired, it shall be treated as a delisted company under this paragraph. If a delisted company shall relist during the Performance Period, it shall remain in its relative delisted position determined under this paragraph.

(6) If the Company’s or any TSR Peer Group company’s stock splits (or if there are other similar subdivisions, consolidations or changes in such company’s stock or capitalization), such company’s Annualized TSR performance will be adjusted for the stock split so as not to give an advantage or disadvantage to such company by comparison to the other TSR Peer Group companies.

(g)Holder shall receive Dividend Equivalent payments with respect to each share of Distributed Stock as if Holder had held such share since the Grant Date.

-13-

Exhibit 10.3

AMENDMENT TO

CROWN CASTLE INTERNATIONAL CORP. 2013 STOCK INCENTIVE PLAN

THIS AMENDMENT by Crown Castle International Corp. ("Company"),

W I T N E S S E T H:

WHEREAS, the Company previously established the Crown Castle International Corp. 2013 Stock Incentive Plan, as amended ("Plan");

WHEREAS, Article XIV of the Plan provides in relevant part that the Board of Directors of Crown Castle International Corp. ("Board") may (i) terminate the Plan at any time with respect to any shares of Common Stock for which any Awards have not theretofore been granted, and (ii) amend the Plan; and

WHEREAS, the Company desires to amend the Plan to cease grants under the Plan, subject to and contingent upon the approval by the stockholders of the Company of the adoption of the Crown Castle International Corp. 2022 Long-Term Incentive Plan;

NOW, THEREFORE, effective as of, and subject to and contingent upon, the approval by the stockholders of the Company of the adoption of the Crown Castle International Corp. 2022 Long-Term Incentive Plan, the Plan is hereby amended to provide that no further Awards shall be made under the Plan.

Adopted by the Board

on February 16, 2022

By: /s/ Donald J. Reid | ||

| Donald J. Reid Corporate Secretary | ||

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Crown Castle (CCI) PT Raised to $112 at Barclays

- Aterian Sets Date for First Quarter 2024 Earnings Announcement & Investor Conference Call

- Crown Castle (CCI) PT Lowered to $109 at Deutsche Bank

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share