Form 8-K COMMERCIAL METALS Co For: Jun 16

Exhibit No. 99.1

News Release

COMMERCIAL METALS COMPANY REPORTS THIRD QUARTER FISCAL 2022 RESULTS

•Net earnings of $312.4 million, or $2.54 per diluted share, increased by 140% compared with $130.4 million, or $1.07 per diluted share, in the prior year period

•Core EBITDA of $483.9 million increased 110% year-on-year; a total of $1.4 billion of Core EBITDA achieved over the trailing 12 months

•Margins over scrap in North America and Europe reflect strong market conditions and favorable customer sentiment

•Continued strength in North America downstream pipeline, with record bid activity and backlog levels on both a volume and price basis

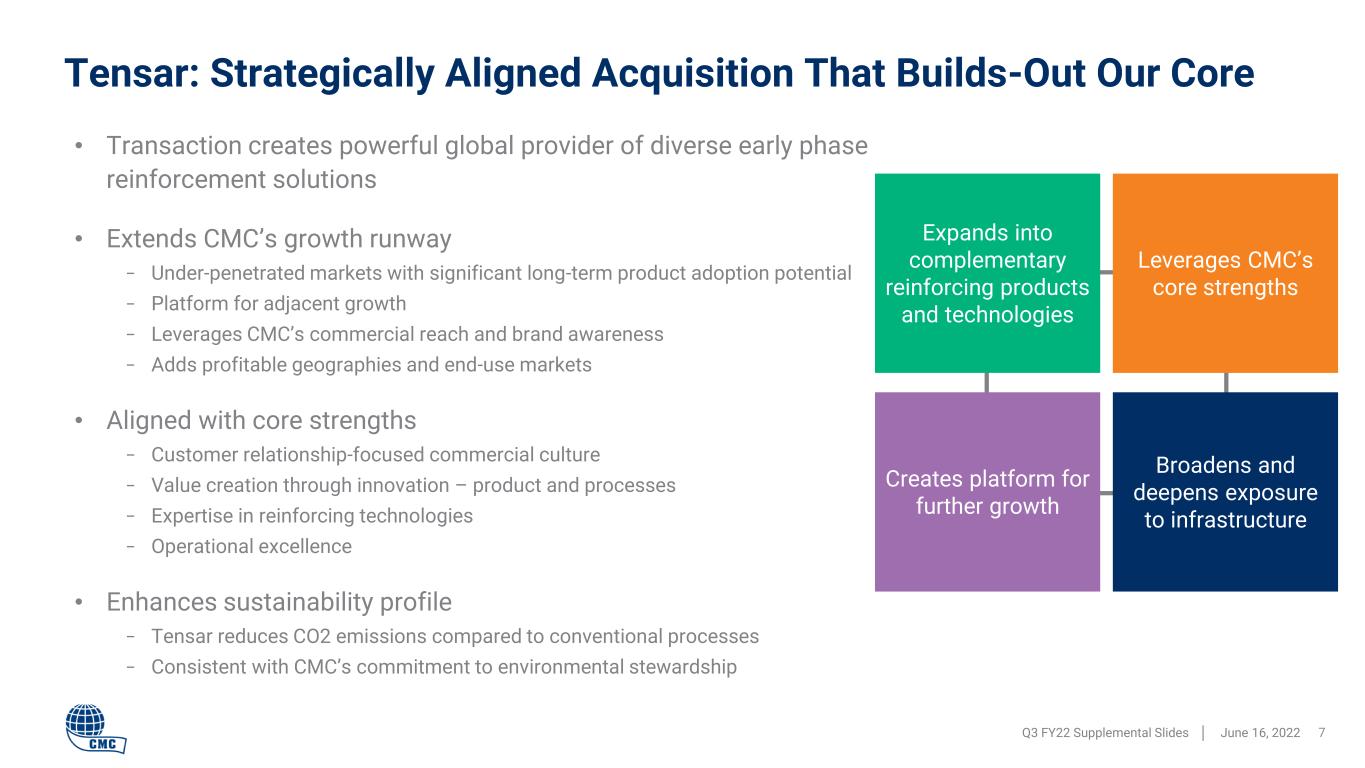

•Completed the acquisition of Tensar Corporation, creating a new, attractive strategic growth platform

Irving, TX - June 16, 2022 - Commercial Metals Company (NYSE: CMC) today announced financial results for its fiscal third quarter ended May 31, 2022. Net earnings were $312.4 million, or $2.54 per diluted share, on net sales of $2.5 billion, compared to prior year period net earnings of $130.4 million, or $1.07 per diluted share, on net sales of $1.8 billion.

During the third quarter of fiscal 2022, the Company recorded net after-tax costs of $7.8 million related to the acquisition of Tensar Corporation and an asset impairment. Excluding this expense, third quarter adjusted earnings were $320.2 million, or $2.61 per diluted share, compared to adjusted earnings of $127.1 million, or $1.04 per diluted share, in the prior year period. "Adjusted EBITDA," "core EBITDA," "adjusted earnings" and "adjusted earnings per diluted share" are non-GAAP financial measures. Details, including a reconciliation of each such non-GAAP financial measure to the most directly comparable measure prepared and presented in accordance with GAAP, can be found in the financial tables that follow.

Barbara R. Smith, Chairman of the Board, President and Chief Executive Officer, said, "The third quarter was another remarkable financial result for our Company, underpinned by strong operational execution and robust market conditions across our key geographies. I am extremely proud of CMC’s financial achievements during the quarter, especially in Europe. CMC employees in Poland have opened their homes and communities in a heartfelt grassroots effort to assist refugees fleeing the war in Ukraine. Amazingly, while responding to dire humanitarian needs, our team produced record quarterly adjusted EBITDA that nearly matched the best annual performance in the history of CMC’s Europe segment.”

(CMC Third Quarter Fiscal 2022 - 2)

Ms. Smith continued, “In late April, we welcomed Tensar to the CMC organization. Seeing the early results of the teams working together has only further reinforced our confidence in the strategic merits of this transaction and the potential for meaningful commercial synergies. With the onboarding of Tensar, CMC has added a highly attractive new growth platform and is creating a valuable and unique portfolio of solutions for existing and new markets.”

The Company's balance sheet and liquidity position remained strong as of May 31, 2022. Cash and cash equivalents ended the quarter with a balance of $410.3 million, following a $550 million payment, net of cash acquired, to complete the purchase of Tensar. In addition, $624.3 million remained available under the Company's credit and accounts receivable facilities. CMC repurchased approximately one million shares of common stock during the quarter, returning $38.6 million of cash to shareholders. As of May 31, 2022, $294.4 million remained under the current share repurchase authorization.

On June 15, 2022, the board of directors declared a quarterly dividend of $0.14 per share of CMC common stock payable to stockholders of record on June 29, 2022. The dividend to be paid on July 13, 2022, marks the 231st consecutive quarterly payment by the Company, and represents a 17% increase from the dividend paid in July 2021.

Business Segments - Fiscal Third Quarter 2022 Review

Demand for CMC's finished steel products in North America was again robust during the quarter, with several key internal and external indicators pointing toward continued strength. Downstream bid volumes, a key indicator of the construction project pipeline, increased meaningfully from a year ago, resulting in the expansion of contract backlog levels. Demand from industrial end markets continued to trend positively, with most end use applications increasing compared to the prior year period.

The North America segment reported adjusted EBITDA of $379.4 million for the third quarter of fiscal 2022, an increase of 83% compared to $207.3 million in the prior year period. This improvement was driven by record margins on sales of both steel products and raw materials. Steel products have experienced five consecutive quarters of year-over-year margin expansion, while margins on raw material sales have grown for nine consecutive quarters. Controllable costs per ton of finished steel shipped were unchanged in comparison to the second fiscal quarter, but were up from the prior year period primarily as a result of higher per unit purchase costs for freight, energy and alloys.

Shipment volumes of finished steel, which include steel products and downstream products, followed typical seasonal patterns, and were essentially unchanged from the prior year period. The average selling price for steel products increased by $316 per ton compared to the third quarter of fiscal 2021, while the cost of scrap utilized rose $103 per ton. The result was a year-over-year increase of $213 per ton in margin over scrap. The average selling price for downstream products increased by $281 per ton from the prior year period and $75 per ton on a sequential

(CMC Third Quarter Fiscal 2022 - 3)

basis. Future pricing indicators on new work entering the backlog remain positive, as average price levels for bids and new awards climbed significantly from the prior year period.

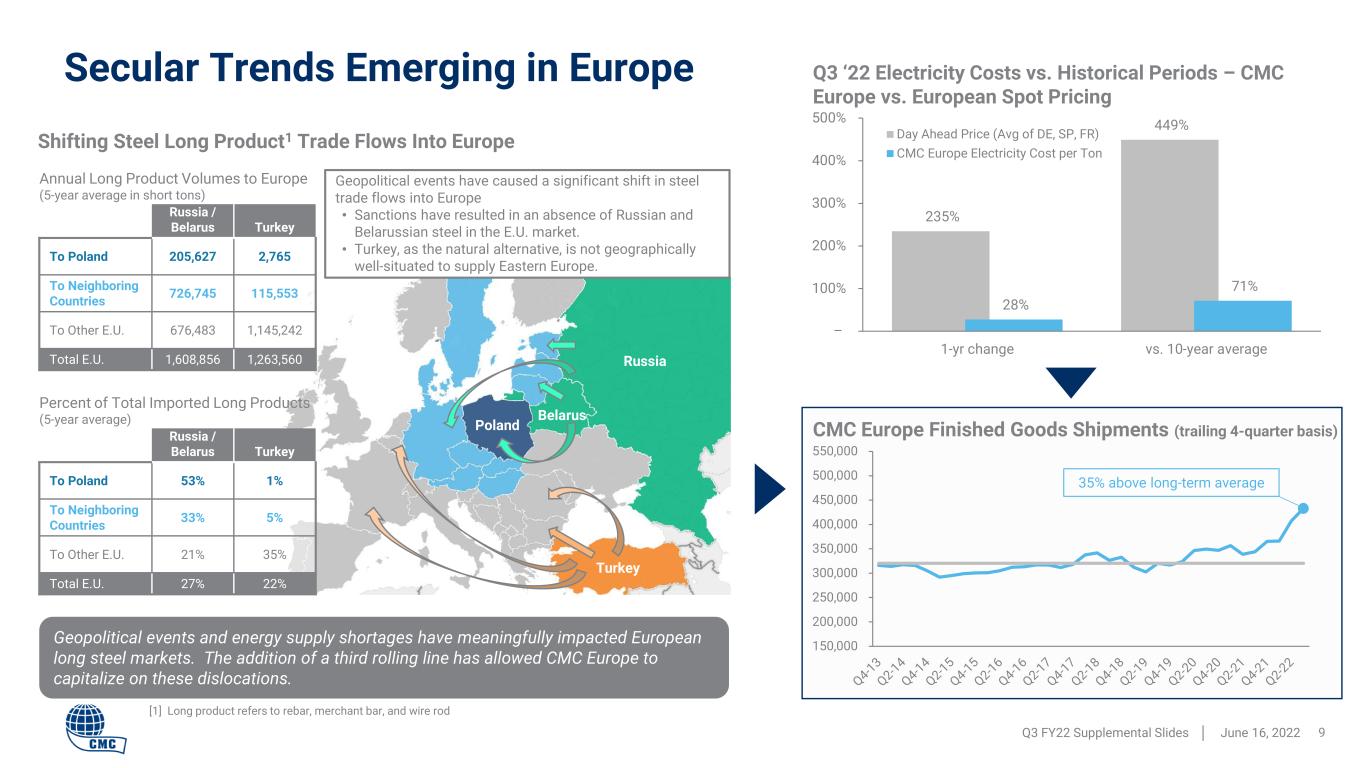

The Europe segment reported record adjusted EBITDA of $121.0 million for the third quarter of fiscal 2022, up 142% compared to adjusted EBITDA of $50.0 million for the prior year quarter. The improvement was driven by a significant expansion in both shipment volume and margin over scrap. Similar to North America, underlying demand for steel products remained robust. Volumes of rebar, merchant bar, and wire rod increased on a year-over-year basis, assisted by the addition of a third rolling line, which improved production flexibility and the mill’s ability to capitalize on favorable market conditions. During the first 12 months of operating the new rolling line, quarterly shipment volumes of finished products have increased 35% compared to the average of the preceding five years.

As a result of continued strong demand and constrained supply in the wake of trade sanctions against Russia and Belarus, average selling price increased by $303 per ton compared to the prior year quarter, while the cost of scrap utilized rose $154 per ton. The result was a year-over-year increase in margin over scrap of $149 per ton.

The Company's new Tensar business generated EBITDA of $4.9 million during its first five weeks as part of CMC. Excluding a $2.2 million charge to reflect purchasing accounting effect on inventory, EBITDA amounted to $7.1 million on net sales of $28.0 million. EBITDA margin of 25.4% was consistent with Tensar's trailing five-year average. Tensar's financial performance is included within CMC's existing operating segments, with North American results incorporated into CMC's North America segment and all other operations included in the Europe segment.

Outlook

Ms. Smith said, "We anticipate strong financial performance to continue in the fourth quarter. Robust demand for each of CMC’s major product lines is expected to persist, augmented by our growing downstream backlog and solid levels of new work entering the project pipeline. Margins over scrap in both North America and Europe should remain at levels near those of the third quarter, driven by favorable market conditions across our geographies."

Ms. Smith added, "Looking into CMC’s fiscal 2023, we see several factors that should support continued strength in construction markets. Firstly, as a result of the continued high levels of new bidding activity, we anticipate entering our new fiscal year with historically high levels of contract backlog. In addition, new project bid levels should remain strong based on the benefits of rising activity related to the recently enacted federal infrastructure bill, non-residential construction activity supported by follow-on investment in the wake of historically high new residential community formation in our home markets, and from the continuation of reshoring trends that have already resulted in significant new projects. The expected early calendar 2023 startup of our Arizona 2 micro mill will provide CMC with a greater flexibility to capitalize on these anticipated favorable demand conditions.”

(CMC Third Quarter Fiscal 2022 - 4)

Conference Call

CMC invites you to listen to a live broadcast of its third quarter fiscal 2022 conference call today, Thursday, June 16, 2022, at 11:00 a.m. ET. Barbara R. Smith, Chairman of the Board, President and Chief Executive Officer, and Paul Lawrence, Senior Vice President and Chief Financial Officer, will host the call. The call is accessible via our website at www.cmc.com. In the event you are unable to listen to the live broadcast, the call will be archived and available for replay on our website on the next business day. Financial and statistical information presented in the broadcast are located on CMC's website under "Investors."

About Commercial Metals Company

Commercial Metals Company and its subsidiaries manufacture, recycle and fabricate steel and metal products and provide related materials and services through a network of facilities that includes seven electric arc furnace ("EAF") mini mills, two EAF micro mills, one rerolling mill, steel fabrication and processing plants, construction-related product warehouses, and metal recycling facilities in the United States and Poland. Through its Tensar division, CMC is a leading global provider of innovative ground and soil stabilization solutions selling into more than 80 national markets through its two major product lines: Tensar® geogrids and Geopier® foundation systems.

Forward-Looking Statements

This news release contains forward-looking statements within the meaning of the federal securities laws with respect to general economic conditions, key macro-economic drivers that impact our business, the impact of the Russian invasion of Ukraine, the effects of ongoing trade actions, the effects of continued pressure on the liquidity of our customers, potential synergies and organic growth provided by acquisitions and strategic investments, demand for our products, metal margins, the effect of COVID-19 and related governmental and economic responses thereto, the ability to operate our steel mills at full capacity, future availability and cost of supplies of raw materials and energy for our operations, share repurchases, legal proceedings, the undistributed earnings of our non-U.S. subsidiaries, U.S. non-residential construction activity, international trade, capital expenditures, our liquidity and our ability to satisfy future liquidity requirements, estimated contractual obligations, the expected capabilities and benefits of new facilities, the timeline for execution of our growth plan, and our expectations or beliefs concerning future events. The statements in this release that are not historical statements, are forward-looking statements. These forward-looking statements can generally be identified by phrases such as we or our management "expects," "anticipates," "believes," "estimates," "future," "intends," "may," "plans to," "ought," "could," "will," "should," "likely," "appears," "projects," "forecasts," "outlook" or other similar words or phrases, as well as by discussions of strategy, plans, or intentions.

Our forward-looking statements are based on management’s expectations and beliefs as of the time this news release was prepared. Although we believe that our expectations are reasonable, we can give no assurance that these

(CMC Third Quarter Fiscal 2022 - 5)

expectations will prove to have been correct, and actual results may vary materially. Except as required by law, we undertake no obligation to update, amend or clarify any forward-looking statements to reflect changed assumptions, the occurrence of anticipated or unanticipated events, new information or circumstances or any other changes. Important factors that could cause actual results to differ materially from our expectations include those described in our filings with the Securities and Exchange Commission, including, but not limited to, in Part I, Item 1A, "Risk Factors" of our annual report on Form 10-K for the fiscal year ended August 31, 2021, and Part II, Item IA, "Risk Factors" of our subsequent quarterly reports on Form 10-Q, as well as the following: changes in economic conditions which affect demand for our products or construction activity generally, and the impact of such changes on the highly cyclical steel industry; rapid and significant changes in the price of metals, potentially impairing our inventory values due to declines in commodity prices or reducing the profitability of our downstream contracts due to rising commodity pricing; impacts from COVID-19 on the economy, demand for our products, global supply chain and on our operations, including the responses of governmental authorities to contain COVID-19 and the impact of various COVID-19 vaccines; excess capacity in our industry, particularly in China, and product availability from competing steel mills and other steel suppliers including import quantities and pricing; the impact of the Russian invasion of Ukraine on the global economy, energy supplies and raw materials, which is uncertain, but may prove to negatively impact our business and operations; compliance with and changes in existing and future laws, regulations and other legal requirements and judicial decisions that govern our business, including increased environmental regulations associated with climate change and greenhouse gas emissions; involvement in various environmental matters that may result in fines, penalties or judgments; evolving remediation technology, changing regulations, possible third-party contributions, the inherent uncertainties of the estimation process and other factors that may impact amounts accrued for environmental liabilities; potential limitations in our or our customers' abilities to access credit and non-compliance of their contractual obligations, including payment obligations; activity in repurchasing shares of our common stock under our repurchase program; financial covenants and restrictions on the operation of our business contained in agreements governing our debt; our ability to successfully identify, consummate and integrate acquisitions, and the effects that acquisitions may have on our financial leverage; risks associated with acquisitions generally, such as the inability to obtain, or delays in obtaining, required approvals under applicable antitrust legislation and other regulatory and third party consents and approvals; operating and startup risks, as well as market risks associated with the commissioning of new projects could prevent us from realizing anticipated benefits and could result in a loss of all or a substantial part of our investments; lower than expected future levels of revenues and higher than expected future costs; failure or inability to implement growth strategies in a timely manner; impact of goodwill impairment charges; impact of long-lived asset impairment charges; currency fluctuations; global factors, such as trade measures, military conflicts and political uncertainties, including changes to current trade regulations, such as Section 232 trade tariffs and quotas, tax legislation and other regulations which might adversely impact our business; availability and pricing of electricity, electrodes and natural gas for mill operations; ability to hire and retain key executives and other employees; competition from other materials or from competitors that have a lower cost structure or access to greater financial resources; information technology interruptions and breaches in security; ability to make necessary capital expenditures; availability and pricing of raw materials and other items over which

(CMC Third Quarter Fiscal 2022 - 6)

we exert little influence, including scrap metal, energy and insurance; unexpected equipment failures; losses or limited potential gains due to hedging transactions; litigation claims and settlements, court decisions, regulatory rulings and legal compliance risks; risk of injury or death to employees, customers or other visitors to our operations; and civil unrest, protests and riots.

(CMC Third Quarter Fiscal 2022 - 7)

| COMMERCIAL METALS COMPANY FINANCIAL & OPERATING STATISTICS (UNAUDITED) | ||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | Nine Months Ended | |||||||||||||||||||||||||||||||||||||||||||

| (in thousands, except per ton amounts) | 5/31/2022 | 2/28/2022 | 11/30/2021 | 8/31/2021 | 5/31/2021 | 5/31/2022 | 5/31/2021 | |||||||||||||||||||||||||||||||||||||

| North America | ||||||||||||||||||||||||||||||||||||||||||||

| Net sales | $ | 2,033,150 | $ | 1,614,224 | $ | 1,653,622 | $ | 1,660,409 | $ | 1,558,068 | $ | 5,300,996 | $ | 4,010,567 | ||||||||||||||||||||||||||||||

| Adjusted EBITDA | 379,355 | 535,463 | 268,524 | 212,018 | 207,330 | 1,183,342 | 534,576 | |||||||||||||||||||||||||||||||||||||

| External tons shipped | ||||||||||||||||||||||||||||||||||||||||||||

| Raw materials | 353 | 329 | 334 | 331 | 368 | 1,016 | 1,000 | |||||||||||||||||||||||||||||||||||||

| Rebar | 505 | 407 | 442 | 469 | 500 | 1,354 | 1,458 | |||||||||||||||||||||||||||||||||||||

| Merchant and other | 274 | 245 | 257 | 302 | 289 | 776 | 821 | |||||||||||||||||||||||||||||||||||||

| Steel products | 779 | 652 | 699 | 771 | 789 | 2,130 | 2,279 | |||||||||||||||||||||||||||||||||||||

| Downstream products | 399 | 327 | 400 | 415 | 408 | 1,126 | 1,122 | |||||||||||||||||||||||||||||||||||||

| Average selling price per ton | ||||||||||||||||||||||||||||||||||||||||||||

| Raw materials | $ | 1,207 | $ | 1,103 | $ | 1,034 | $ | 1,069 | $ | 949 | $ | 1,116 | $ | 813 | ||||||||||||||||||||||||||||||

| Steel products | 1,110 | 1,041 | 976 | 900 | 794 | 1,045 | 702 | |||||||||||||||||||||||||||||||||||||

| Downstream products | 1,244 | 1,169 | 1,092 | 1,014 | 963 | 1,168 | 943 | |||||||||||||||||||||||||||||||||||||

| Cost of raw materials per ton | $ | 908 | $ | 834 | $ | 766 | $ | 805 | $ | 697 | $ | 837 | $ | 597 | ||||||||||||||||||||||||||||||

| Cost of ferrous scrap utilized per ton | $ | 472 | $ | 436 | $ | 428 | $ | 434 | $ | 369 | $ | 446 | $ | 327 | ||||||||||||||||||||||||||||||

| Steel products metal margin per ton | $ | 638 | $ | 605 | $ | 548 | $ | 466 | $ | 425 | $ | 599 | $ | 375 | ||||||||||||||||||||||||||||||

| Europe | ||||||||||||||||||||||||||||||||||||||||||||

| Net sales | $ | 484,564 | $ | 395,758 | $ | 329,056 | $ | 368,290 | $ | 284,107 | $ | 1,209,378 | $ | 680,769 | ||||||||||||||||||||||||||||||

| Adjusted EBITDA | 120,974 | 81,149 | 79,832 | 67,676 | 50,005 | 281,955 | 80,582 | |||||||||||||||||||||||||||||||||||||

| External tons shipped | ||||||||||||||||||||||||||||||||||||||||||||

| Rebar | 170 | 172 | 103 | 174 | 141 | 445 | 347 | |||||||||||||||||||||||||||||||||||||

| Merchant and other | 306 | 278 | 262 | 286 | 263 | 846 | 807 | |||||||||||||||||||||||||||||||||||||

| Steel products | 476 | 450 | 365 | 460 | 404 | 1,291 | 1,154 | |||||||||||||||||||||||||||||||||||||

| Average selling price per ton | ||||||||||||||||||||||||||||||||||||||||||||

| Steel products | $ | 967 | $ | 851 | $ | 869 | $ | 763 | $ | 664 | $ | 898 | $ | 552 | ||||||||||||||||||||||||||||||

| Cost of ferrous scrap utilized per ton | $ | 530 | $ | 444 | $ | 434 | $ | 448 | $ | 376 | $ | 472 | $ | 324 | ||||||||||||||||||||||||||||||

| Steel products metal margin per ton | $ | 437 | $ | 407 | $ | 435 | $ | 315 | $ | 288 | $ | 426 | $ | 228 | ||||||||||||||||||||||||||||||

(CMC Third Quarter Fiscal 2022 - 8)

| COMMERCIAL METALS COMPANY BUSINESS SEGMENTS (UNAUDITED) | ||||||||||||||||||||||||||||||||||||||||||||

| (in thousands) | Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||||

| Net sales | 5/31/2022 | 2/28/2022 | 11/30/2021 | 8/31/2021 | 5/31/2021 | 5/31/2022 | 5/31/2021 | |||||||||||||||||||||||||||||||||||||

| North America | $ | 2,033,150 | $ | 1,614,224 | $ | 1,653,622 | $ | 1,660,409 | $ | 1,558,068 | $ | 5,300,996 | $ | 4,010,567 | ||||||||||||||||||||||||||||||

| Europe | 484,564 | 395,758 | 329,056 | 368,290 | 284,107 | 1,209,378 | 680,769 | |||||||||||||||||||||||||||||||||||||

| Corporate and Other | (1,987) | (1,094) | (877) | 1,947 | 2,866 | (3,958) | 7,778 | |||||||||||||||||||||||||||||||||||||

| Total net sales | $ | 2,515,727 | $ | 2,008,888 | $ | 1,981,801 | $ | 2,030,646 | $ | 1,845,041 | $ | 6,506,416 | $ | 4,699,114 | ||||||||||||||||||||||||||||||

| Adjusted EBITDA | ||||||||||||||||||||||||||||||||||||||||||||

| North America | $ | 379,355 | $ | 535,463 | $ | 268,524 | $ | 212,018 | $ | 207,330 | $ | 1,183,342 | $ | 534,576 | ||||||||||||||||||||||||||||||

| Europe | 120,974 | 81,149 | 79,832 | 67,676 | 50,005 | 281,955 | 80,582 | |||||||||||||||||||||||||||||||||||||

| Corporate and Other | (35,049) | (52,493) | (34,334) | (31,897) | (36,214) | (121,876) | (108,671) | |||||||||||||||||||||||||||||||||||||

(CMC Third Quarter Fiscal 2022 - 9)

| COMMERCIAL METALS COMPANY CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS (UNAUDITED) | |||||||||||||||||||||||

| Three Months Ended May 31, | Nine Months Ended May 31, | ||||||||||||||||||||||

| (in thousands, except share and per share data) | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||

| Net sales | $ | 2,515,727 | $ | 1,845,041 | $ | 6,506,416 | $ | 4,699,114 | |||||||||||||||

| Costs and operating expenses (income): | |||||||||||||||||||||||

| Cost of goods sold | 1,956,459 | 1,533,768 | 5,157,834 | 3,936,930 | |||||||||||||||||||

| Selling, general and administrative expenses | 139,556 | 134,357 | 391,119 | 368,882 | |||||||||||||||||||

| Interest expense | 13,433 | 11,965 | 36,479 | 40,245 | |||||||||||||||||||

| Loss on debt extinguishment | 39 | — | 16,091 | 16,841 | |||||||||||||||||||

| Asset impairments | 3,245 | 277 | 4,473 | 4,345 | |||||||||||||||||||

| Gain on sale of assets | (2,024) | (3,909) | (276,106) | (9,390) | |||||||||||||||||||

| Net costs and operating expenses | 2,110,708 | 1,676,458 | 5,329,890 | 4,357,853 | |||||||||||||||||||

| Earnings before income taxes | 405,019 | 168,583 | 1,176,526 | 341,261 | |||||||||||||||||||

| Income taxes | 92,590 | 38,175 | 247,894 | 80,709 | |||||||||||||||||||

| Net earnings | $ | 312,429 | $ | 130,408 | $ | 928,632 | $ | 260,552 | |||||||||||||||

| Earnings per share: | |||||||||||||||||||||||

| Basic | $ | 2.58 | $ | 1.08 | $ | 7.66 | $ | 2.17 | |||||||||||||||

| Diluted | $ | 2.54 | $ | 1.07 | $ | 7.55 | $ | 2.14 | |||||||||||||||

| Cash dividends per share | $ | 0.14 | $ | 0.12 | $ | 0.42 | $ | 0.36 | |||||||||||||||

| Average basic shares outstanding | 121,247,105 | 120,613,652 | 121,277,553 | 120,241,579 | |||||||||||||||||||

| Average diluted shares outstanding | 122,799,869 | 122,193,655 | 122,927,291 | 121,852,144 | |||||||||||||||||||

(CMC Third Quarter Fiscal 2022 - 10)

COMMERCIAL METALS COMPANY AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) | ||||||||||||||

| (in thousands, except share and per share data) | May 31, 2022 | August 31, 2021 | ||||||||||||

| Assets | ||||||||||||||

| Current assets: | ||||||||||||||

| Cash and cash equivalents | $ | 410,265 | $ | 497,745 | ||||||||||

| Restricted cash | 126,264 | 3,384 | ||||||||||||

Accounts receivable (less allowance for doubtful accounts of $5,070 and $5,553) | 1,330,279 | 1,105,580 | ||||||||||||

| Inventories, net | 1,346,286 | 935,387 | ||||||||||||

| Prepaid and other current assets | 230,414 | 169,649 | ||||||||||||

| Assets held for sale | 60 | 25,083 | ||||||||||||

| Total current assets | 3,443,568 | 2,736,828 | ||||||||||||

| Property, plant and equipment, net | 1,808,392 | 1,566,123 | ||||||||||||

| Intangible assets, net | 266,440 | 10,101 | ||||||||||||

| Goodwill | 253,563 | 66,137 | ||||||||||||

| Other noncurrent assets | 331,739 | 259,482 | ||||||||||||

| Total assets | $ | 6,103,702 | $ | 4,638,671 | ||||||||||

| Liabilities and stockholders' equity | ||||||||||||||

| Current liabilities: | ||||||||||||||

| Accounts payable | $ | 492,947 | $ | 450,723 | ||||||||||

| Accrued expenses and other payables | 474,653 | 475,384 | ||||||||||||

| Current maturities of long-term debt and short-term borrowings | 423,091 | 54,366 | ||||||||||||

| Total current liabilities | 1,390,691 | 980,473 | ||||||||||||

| Deferred income taxes | 223,979 | 112,067 | ||||||||||||

| Other noncurrent liabilities | 231,385 | 235,607 | ||||||||||||

| Long-term debt | 1,115,478 | 1,015,415 | ||||||||||||

| Total liabilities | 2,961,533 | 2,343,562 | ||||||||||||

| Stockholders' equity: | ||||||||||||||

Common stock, par value $0.01 per share; authorized 200,000,000 shares; issued 129,060,664 shares; outstanding 120,490,407 and 120,586,589 shares | 1,290 | 1,290 | ||||||||||||

| Additional paid-in capital | 375,386 | 368,064 | ||||||||||||

| Accumulated other comprehensive loss | (85,730) | (84,820) | ||||||||||||

| Retained earnings | 3,040,554 | 2,162,925 | ||||||||||||

Less treasury stock, 8,570,257 and 8,474,075 shares at cost | (189,563) | (152,582) | ||||||||||||

| Stockholders' equity | 3,141,937 | 2,294,877 | ||||||||||||

| Stockholders' equity attributable to non-controlling interests | 232 | 232 | ||||||||||||

| Total stockholders' equity | 3,142,169 | 2,295,109 | ||||||||||||

| Total liabilities and stockholders' equity | $ | 6,103,702 | $ | 4,638,671 | ||||||||||

(CMC Third Quarter Fiscal 2022 - 11)

| COMMERCIAL METALS COMPANY AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) | ||||||||||||||

| Nine Months Ended May 31, | ||||||||||||||

| (in thousands) | 2022 | 2021 | ||||||||||||

| Cash flows from (used by) operating activities: | ||||||||||||||

| Net earnings | $ | 928,632 | $ | 260,552 | ||||||||||

| Adjustments to reconcile net earnings to cash flows from (used by) operating activities: | ||||||||||||||

| Depreciation and amortization | 125,943 | 125,176 | ||||||||||||

| Deferred income taxes and other long-term taxes | 64,241 | (17,175) | ||||||||||||

| Stock-based compensation | 37,856 | 35,558 | ||||||||||||

| Loss on debt extinguishment | 16,052 | 16,841 | ||||||||||||

| Asset impairments | 4,473 | 4,345 | ||||||||||||

| Other | 1,449 | 243 | ||||||||||||

| Amortization of acquired unfavorable contract backlog | — | (4,540) | ||||||||||||

| Net gain on disposals of assets | (276,106) | (9,390) | ||||||||||||

| Changes in operating assets and liabilities | (660,793) | (317,378) | ||||||||||||

Net cash flows from operating activities | 241,747 | 94,232 | ||||||||||||

| Cash flows from (used by) investing activities: | ||||||||||||||

| Acquisitions, net of cash acquired | (552,449) | — | ||||||||||||

| Proceeds from the sale of property, plant and equipment and other | 314,971 | 25,890 | ||||||||||||

| Capital expenditures | (294,346) | (127,395) | ||||||||||||

| Proceeds from insurance | 3,081 | — | ||||||||||||

| Other | — | (2,500) | ||||||||||||

Net cash flows used by investing activities | (528,743) | (104,005) | ||||||||||||

| Cash flows from (used by) financing activities: | ||||||||||||||

| Proceeds from issuance of long-term debt, net | 740,403 | 309,187 | ||||||||||||

| Repayments of long-term debt | (319,706) | (361,855) | ||||||||||||

| Debt extinguishment costs | (13,642) | (13,128) | ||||||||||||

| Debt issuance costs | (3,064) | (2,830) | ||||||||||||

| Proceeds from accounts receivable facilities | 327,665 | 145,864 | ||||||||||||

| Repayments under accounts receivable facilities | (290,666) | (118,312) | ||||||||||||

| Treasury stock acquired | (55,597) | — | ||||||||||||

| Dividends | (51,003) | (43,295) | ||||||||||||

| Stock issued under incentive and purchase plans, net of forfeitures | (10,132) | (3,807) | ||||||||||||

| Contribution from non-controlling interest | — | 19 | ||||||||||||

Net cash flows from (used by) financing activities | 324,258 | (88,157) | ||||||||||||

| Effect of exchange rate changes on cash | (1,862) | (423) | ||||||||||||

Increase (decrease) in cash, restricted cash, and cash equivalents | 35,400 | (98,353) | ||||||||||||

| Cash, restricted cash and cash equivalents at beginning of period | 501,129 | 544,964 | ||||||||||||

| Cash, restricted cash and cash equivalents at end of period | $ | 536,529 | $ | 446,611 | ||||||||||

| Supplemental information: | ||||||||||||||

| Cash paid for income taxes | $ | 189,491 | $ | 59,041 | ||||||||||

| Cash paid for interest | 34,394 | 43,403 | ||||||||||||

| Noncash activities: | ||||||||||||||

| Liabilities related to additions of property, plant and equipment | $ | 50,948 | $ | 16,601 | ||||||||||

| Cash and cash equivalents | $ | 410,265 | $ | 443,120 | ||||||||||

| Restricted cash | 126,264 | 3,491 | ||||||||||||

| Total cash, restricted cash and cash equivalents | $ | 536,529 | $ | 446,611 | ||||||||||

(CMC Third Quarter Fiscal 2022 - 12)

COMMERCIAL METALS COMPANY

NON-GAAP FINANCIAL MEASURES (UNAUDITED)

This press release contains financial measures not derived in accordance with U.S. generally accepted accounting principles ("GAAP"). Reconciliations to the most comparable GAAP measure are provided below.

Adjusted EBITDA, core EBITDA and adjusted earnings are non-GAAP financial measures. Adjusted earnings per diluted share is defined as adjusted earnings on a diluted per share basis.

Non-GAAP financial measures should be viewed in addition to, and not as alternatives for, the most directly comparable measures derived in accordance with GAAP and may not be comparable to similar measures presented by other companies. However, we believe that the non-GAAP financial measures provide relevant and useful information to management, investors, analysts, creditors and other interested parties in our industry as they allow: (i) comparison of our earnings to those of our competitors; (ii) a supplemental measure of our underlying business operational performance; and (iii) the assessment of period-to-period performance trends. Management uses non-GAAP financial measures to evaluate financial performance and set target benchmarks for annual and long-term cash incentive performance plans.

A reconciliation of net earnings to adjusted EBITDA and core EBITDA is provided below:

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||

| (in thousands) | 5/31/2022 | 2/28/2022 | 11/30/2021 | 8/31/2021 | 5/31/2021 | 5/31/2022 | 5/31/2021 | ||||||||||||||||||||||||||||||||||

| Net earnings | $ | 312,429 | $ | 383,314 | $ | 232,889 | $ | 152,313 | $ | 130,408 | $ | 928,632 | $ | 260,552 | |||||||||||||||||||||||||||

| Interest expense | 13,433 | 12,011 | 11,035 | 11,659 | 11,965 | 36,479 | 40,245 | ||||||||||||||||||||||||||||||||||

| Income taxes | 92,590 | 126,432 | 28,872 | 40,444 | 38,175 | 247,894 | 80,709 | ||||||||||||||||||||||||||||||||||

| Depreciation and amortization | 43,583 | 41,134 | 41,226 | 42,437 | 41,804 | 125,943 | 125,176 | ||||||||||||||||||||||||||||||||||

| Asset impairments | 3,245 | 1,228 | — | 2,439 | 277 | 4,473 | 4,345 | ||||||||||||||||||||||||||||||||||

| Amortization of acquired unfavorable contract backlog | — | — | — | (1,495) | (1,508) | — | (4,540) | ||||||||||||||||||||||||||||||||||

| Adjusted EBITDA | 465,280 | 564,119 | 314,022 | 247,797 | 221,121 | 1,343,421 | 506,487 | ||||||||||||||||||||||||||||||||||

| Non-cash equity compensation | 11,986 | 16,251 | 9,619 | 8,119 | 13,800 | 37,856 | 35,558 | ||||||||||||||||||||||||||||||||||

| Acquisition and integration related costs and other | 4,478 | — | 3,165 | — | — | 7,643 | — | ||||||||||||||||||||||||||||||||||

| Purchase accounting effect on inventory | 2,169 | — | — | — | — | 2,169 | — | ||||||||||||||||||||||||||||||||||

| Gain on sale of assets | — | (273,315) | — | — | (4,457) | (273,315) | (10,334) | ||||||||||||||||||||||||||||||||||

| Loss on debt extinguishment | — | 16,052 | — | — | — | 16,052 | 16,841 | ||||||||||||||||||||||||||||||||||

| Facility closure | — | — | — | — | — | — | 10,908 | ||||||||||||||||||||||||||||||||||

| Labor cost government refund | — | — | — | — | — | — | (1,348) | ||||||||||||||||||||||||||||||||||

| Core EBITDA | $ | 483,913 | $ | 323,107 | $ | 326,806 | $ | 255,916 | $ | 230,464 | $ | 1,133,826 | $ | 558,112 | |||||||||||||||||||||||||||

(CMC Third Quarter Fiscal 2022 - 13)

A reconciliation of net earnings to adjusted earnings is provided below:

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||

| (in thousands) | 5/31/2022 | 2/28/2022 | 11/30/2021 | 8/31/2021 | 5/31/2021 | 5/31/2022 | 5/31/2021 | ||||||||||||||||||||||||||||||||||

| Net earnings | $ | 312,429 | $ | 383,314 | $ | 232,889 | $ | 152,313 | $ | 130,408 | $ | 928,632 | $ | 260,552 | |||||||||||||||||||||||||||

| Asset impairments | 3,245 | 1,228 | — | 2,439 | 277 | 4,473 | 4,345 | ||||||||||||||||||||||||||||||||||

| Acquisition and integration related costs and other | 4,478 | — | 3,165 | — | — | 7,643 | — | ||||||||||||||||||||||||||||||||||

| Purchase accounting effect on inventory | 2,169 | — | — | — | — | 2,169 | — | ||||||||||||||||||||||||||||||||||

| Gain on sale of assets | — | (273,315) | — | — | (4,457) | (273,315) | (10,334) | ||||||||||||||||||||||||||||||||||

| Loss on debt extinguishment | — | 16,052 | — | — | — | 16,052 | 16,841 | ||||||||||||||||||||||||||||||||||

| Facility closure | — | — | — | — | — | — | 10,908 | ||||||||||||||||||||||||||||||||||

| Labor cost government refund | — | — | — | — | — | — | (1,348) | ||||||||||||||||||||||||||||||||||

| Total adjustments (pre-tax) | $ | 9,892 | $ | (256,035) | $ | 3,165 | $ | 2,439 | $ | (4,180) | $ | (242,978) | $ | 20,412 | |||||||||||||||||||||||||||

| Tax items | |||||||||||||||||||||||||||||||||||||||||

| International restructuring | — | — | (36,237) | — | — | (36,237) | — | ||||||||||||||||||||||||||||||||||

| Related tax effects on adjustments | (2,077) | 60,274 | (665) | (512) | 878 | 57,532 | (4,313) | ||||||||||||||||||||||||||||||||||

| Total tax items | (2,077) | 60,274 | (36,902) | (512) | 878 | 21,295 | (4,313) | ||||||||||||||||||||||||||||||||||

| Adjusted earnings | $ | 320,244 | $ | 187,553 | $ | 199,152 | $ | 154,240 | $ | 127,106 | $ | 706,949 | $ | 276,651 | |||||||||||||||||||||||||||

| Net earnings per diluted share | $ | 2.54 | $ | 3.12 | $ | 1.90 | $ | 1.24 | $ | 1.07 | $ | 7.55 | $ | 2.14 | |||||||||||||||||||||||||||

| Adjusted earnings per diluted share | $ | 2.61 | $ | 1.53 | $ | 1.62 | $ | 1.26 | $ | 1.04 | $ | 5.75 | $ | 2.27 | |||||||||||||||||||||||||||

Media Contact:

Susan Gerber

(214) 689-4300

RE COMMERCIAL METALS COMPANY Q 3 F Y ’ 2 2 S u p p l e m e n t a l S l i d e s

Forward-Looking Statements Q3 FY22 Supplemental Slides │ June 16, 2022 2 This presentation contains “forward-looking statements" within the meaning of the federal securities laws with respect to general economic conditions, key macro-economic drivers that impact our business, the effects of ongoing trade actions, the effects of continued pressure on the liquidity of our customers, potential synergies and organic growth provided by acquisitions and strategic investments, demand for our products, metal margins, the effect of COVID-19 and related governmental and economic responses thereto, the ability to operate our steel mills at full capacity, future availability and cost of supplies of raw materials and energy for our operations, share repurchases, legal proceedings, the undistributed earnings of our non-U.S. subsidiaries, U.S. non-residential construction activity, international trade, the impact of Russia’s invasion of Ukraine, capital expenditures, our liquidity and our ability to satisfy future liquidity requirements, estimated contractual obligations, the expected capabilities and benefits of new facilities, the timeline for execution of our growth plan, and our expectations or beliefs concerning future events. The statements in this presentation that are not historical statements, are forward-looking statements. These forward-looking statements can generally be identified by phrases such as we or our management "expects," "anticipates," "believes," "estimates," "future," "intends," "may," "plans to," "ought," "could," "will," "should," "likely," "appears," "projects," "forecasts," "outlook" or other similar words or phrases, as well as by discussions of strategy, plans, or intentions. Our forward-looking statements are based on management’s expectations and beliefs as of the date of this presentation. Although we believe that our expectations are reasonable, we can give no assurance that these expectations will prove to have been correct, and actual results may vary materially. Except as required by law, we undertake no obligation to update, amend or clarify any forward-looking statements to reflect changed assumptions, the occurrence of anticipated or unanticipated events, new information or circumstances or any other changes. Important factors that could cause actual results to differ materially from our expectations include those described in Part I, Item 1A, Risk Factors, of our annual report on Form 10-K for the fiscal year ended August 31, 2021, and Part II, Item A, risk factors of our subsequent quarterly reports on Form 10-Q, as well as the following: changes in economic conditions which affect demand for our products or construction activity generally, and the impact of such changes on the highly cyclical steel industry; rapid and significant changes in the price of metals, potentially impairing our inventory values due to declines in commodity prices or reducing the profitability of our downstream contracts due to rising commodity pricing; impacts from COVID-19 on the economy, demand for our products, global supply chain and on our operations, including the responses of governmental authorities to contain COVID-19 and the impact of various COVID-19 vaccines; excess capacity in our industry, particularly in China, and product availability from competing steel mills and other steel suppliers including import quantities and pricing, the potential impact of the Russian invasion of Ukraine on the global economy, energy supplies and raw materials, which is uncertain but may prove to negatively impact our business and operations; compliance with and changes in existing and future laws, regulations and other legal requirements and judicial decisions that govern our business, including increased environmental regulations associated with climate change and greenhouse gas emissions; involvement in various environmental matters that may result in fines, penalties or judgments; evolving remediation technology, changing regulations, possible third-party contributions, the inherent uncertainties of the estimation process and other factors that may impact amounts accrued for environmental liabilities; potential limitations in our or our customers' abilities to access credit and non- compliance of their contractual obligations, including payment obligations; activity in repurchasing shares of our common stock under our repurchase program; financial covenants and restrictions on the operation of our business contained in agreements governing our debt; our ability to successfully identify, consummate and integrate acquisitions, and the effects that acquisitions may have on our financial leverage; risks associated with acquisitions generally, such as the inability to obtain, or delays in obtaining, required approvals under applicable antitrust legislation and other regulatory and third party consents and approvals; operating and startup risks, as well as market risks associated with the commissioning of new projects could prevent us from realizing anticipated benefits and could result in a loss of all or a substantial part of our investments; lower than expected future levels of revenues and higher than expected future costs; failure or inability to implement growth strategies in a timely manner; impact of goodwill impairment charges; impact of long-lived asset impairment charges; currency fluctuations; global factors, such as trade measures, military conflicts and political uncertainties, including changes to current trade regulations, such as Section 232 trade tariffs and quotas, tax legislation and other regulations which might adversely impact our business; availability and pricing of electricity, electrodes and natural gas for mill operations; ability to hire and retain key executives and other employees; competition from other materials or from competitors that have a lower cost structure or access to greater financial resources; information technology interruptions and breaches in security; ability to make necessary capital expenditures; availability and pricing of raw materials and other items over which we exert little influence, including scrap metal, energy and insurance; unexpected equipment failures; losses or limited potential gains due to hedging transactions; litigation claims and settlements, court decisions, regulatory rulings and legal compliance risks; risk of injury or death to employees, customers or other visitors to our operations; and civil unrest, protests and riots.

3 ✓ Vertical structure optimizes returns through the entire value chain ✓ Disciplined capital allocation focused on maximizing returns for our shareholders Q3 FY22 Supplemental Slides │ June 16, 2022 ✓ Leading positions in core product and geographical markets ✓ Focused strategy that leverages capabilities, competitive strengths, and market knowledge ✓ Strong balance sheet and cash generation provides flexibility to execute on strategy A Clear Path to Value Creation

Continued record-level financial performance • High margins on steel products and raw materials • End market activity remained strong across geographies Positioned for resilience through the economic cycle • Near-term leading indicators point toward market strength • Structural trends expected to bolster U.S. construction activity • CMC positioned to capitalize on upside; backlog and operational flexibility provide protection if markets weaken Tensar acquisition creates an attractive growth platform • Deepens reach into existing markets and expands access to new markets • Meaningful commercial synergy opportunities Secular trends emerging in Europe • CMC Europe generated record earnings during Q3; steel market challenges indicate continued opportunity Strong financial position • Balance sheet strength and cash flow profile provide capital allocation flexibility Key Takeaways From Today’s Call Q3 FY22 Supplemental Slides │ June 16, 2022 4 $484 million Q3 Core EBITDA(1) 1 Core EBITDA, adjusted earnings, adjusted earnings per share, and return on invested capital are non-GAAP financial measures. For definitions and reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document $320 million $2.61 30% Q3 Adjusted Earnings (1) Q3 Adjusted EPS(1) Q3 Annualized ROIC(1) ✔ ✔ ✔ ✔ ✔

7.8% achieved 2.7 % currently C o n te n t 0.82 MT CO2e / MT 1.89 MT CO2e / MT 20.62 GJ / MT 28.60 m3 / MT 69.5% of content 0.197 0.698 3.710 1.241 2.0% Scope 1 Scope 1-3 Energy Intensity Water Intake Virgin Material G H G E m is s io n s E n e rg y U s e W a te r U s e Industry AverageCMC Performance 63% lower than industry average 96% lower than industry average 67.5 percentage points lower than industry average A Clearly Sustainable Future – Proud of Our Progress 5 Reduce our Scope 1 and 2 GHG emissions intensity by 20% 2030 Goals1 Increase our renewable energy usage by 12% points Reduce our energy consumption intensity by 5% [1] Baseline for progress on environmental goals is fiscal year 2019 Sources: CMC 2021 Sustainability Report; scope 1 emissions based on direct emissions reported to the U.S. Environmental Protection Agency; virgin material content for industry based on data from Bureau of International Recycling; all other industry data sourced from the World Steel Association Q3 FY22 Supplemental Slides │ June 16, 2022 With GHG emissions intensity already below the 2040 Paris Climate Agreement industry target, CMC continues to set new lower emissions targets 82% lower than industry average 6.2% currently Progress on 2030 Goals1 Reduce our water withdrawal intensity by 8% 7.8% currently At CMC, good business always aligns with good environmental practices: • Environmental Stewardship • Product Stewardship • Reducing and managing our environmental impactR E S P E C T FOR OUR ENVIRONMENT

Resilient Markets, Resilient Company Key construction indicators continue to point toward strength over the near-term. Looking further ahead, several structural trends are underway that could provide meaningful tailwinds to activity. CMC is positioned well to capitalize on upside or respond to softness. Q3 FY22 Supplemental Slides │ June 16, 2022 6 Architectural Billings Index Federal Infrastructure Package Arizona 2 Startup (early CY 2023) • 65% increase in funding for surface transportation compared to prior federal package • Expected to add 1.5 million tons of incremental annual rebar consumption • Related projects expected to enter pipeline in early CY 2023 Dodge Momentum Index • Reached 14 year high in May • Commercial and institutional non-residential starts showing strength CMC Downstream Bid Activity • Volumes and average pricing reached a new record in Q3 2022 • Good activity across sectors and geographies • Points to expansion in non-residential spending over next 9 to 12 months • Strongest readings in CMC’s key Southern and Western markets Non-res Investment Following Residential • Single family housing construction has been extremely strong since early 2020, particularly in the Southern U.S. • Local infrastructure and non-residential investments to support newly formed residential communities (generally trails residential by 12 to 18 months) Reshoring of Critical Industries • Several massive projects already underway • Continued emergence of new global supply chain rebalancing likely to add more target industries • Expected to add 500,000 tons of low-cost production with ability to flex between rebar and merchant bar Tensar Acquisition • Increases CMC’s exposure to infrastructure • Customer value proposition enhanced by environment of labor and material shortages • Extends CMC’s market reach into new markets such as asphalt and rail Record Downstream Backlog • Currently at all-time high volume and average pricing levels Working Capital Release • CMC has invested roughly $900 million in working capital since mid-FY 2020 Highly Flexible Operations Network • Ability to optimize production across facilities and products in various demand scenarios Construction Leading Indicators Structural Trends Company PositioningConstruction Market Indicators and Trends U p s id e F le xi b ili ty D o w n s id e P ro te c ti o n

Tensar: Strategically Aligned Acquisition That Builds-Out Our Core Q3 FY22 Supplemental Slides │ June 16, 2022 7 • Transaction creates powerful global provider of diverse early phase reinforcement solutions • Extends CMC’s growth runway − Under-penetrated markets with significant long-term product adoption potential − Platform for adjacent growth − Leverages CMC’s commercial reach and brand awareness − Adds profitable geographies and end-use markets • Aligned with core strengths − Customer relationship-focused commercial culture − Value creation through innovation – product and processes − Expertise in reinforcing technologies − Operational excellence • Enhances sustainability profile − Tensar reduces CO2 emissions compared to conventional processes − Consistent with CMC’s commitment to environmental stewardship Expands into complementary reinforcing products and technologies Leverages CMC’s core strengths Creates platform for further growth Broadens and deepens exposure to infrastructure

2.5x 0.9x 0.8x 0.7x NM 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x Q4 2019 Q4 2020 Q4 2021 Q3 2022 Financially Attractive Transaction Q3 FY22 Supplemental Slides │ June 16, 2022 8 0 x 2 x 4 x 6 x 8 x 10 x 12 x 14 x Tensar Building Materials Construction Materials – 5% 10% 15% 20% 25% 30% Tensar Building Materials Construction Materials EV / FY ‘21 EBITDA EBITDA Margins Transaction Valuation and Margin Comparisons Impact on CMC Net Leverage Earnings Profile • Stable EBITDA Margins − 5-year average: 25.3% − 5-year low: 24.3% − 5-year high: 27.5% − GFC level: >20% Earnings Outlook • Meaningful commercial synergy opportunities • Executing on pre-acquisition plan to achieve significant organic growth over next 5 years − Commercialization of existing and new products − Baseline growth of key end markets − Excludes impact of U.S. infrastructure package Free Cash Flow Profile • Far less capital intensive than legacy CMC • Low capital expenditure requirements, even for new product line launches • 75%+ free cash flow conversion of EBITDA 1 EBITDA multiple illustrated for Tensar includes cost synergies of $5 million 2 Net debt to EBITDA is a non-GAAP financial measure. For definitions and reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document Net Debt to Trailing 12-Month Adjusted EBITDA

235% 449% 28% 71% – 100% 200% 300% 400% 500% 1-yr change vs. 10-year average Day Ahead Price (Avg of DE, SP, FR) CMC Europe Electricity Cost per Ton Secular Trends Emerging in Europe Q3 FY22 Supplemental Slides │ June 16, 2022 9 Q3 ‘22 Electricity Costs vs. Historical Periods – CMC Europe vs. European Spot Pricing Shifting Steel Long Product1 Trade Flows Into Europe 150,000 200,000 250,000 300,000 350,000 400,000 450,000 500,000 550,000 CMC Europe Finished Goods Shipments (trailing 4-quarter basis) Geopolitical events and energy supply shortages have meaningfully impacted European long steel markets. The addition of a third rolling line has allowed CMC Europe to capitalize on these dislocations. 35% above long-term average Poland Russia Belarus Turkey Russia / Belarus Turkey To Poland 205,627 2,765 To Neighboring Countries 726,745 115,553 To Other E.U. 676,483 1,145,242 Total E.U. 1,608,856 1,263,560 Annual Long Product Volumes to Europe (5-year average in short tons) Russia / Belarus Turkey To Poland 53% 1% To Neighboring Countries 33% 5% To Other E.U. 21% 35% Total E.U. 27% 22% Percent of Total Imported Long Products (5-year average) Geopolitical events have caused a significant shift in steel trade flows into Europe • Sanctions have resulted in an absence of Russian and Belarussian steel in the E.U. market. • Turkey, as the natural alternative, is not geographically well-situated to supply Eastern Europe. [1] Long product refers to rebar, merchant bar, and wire rod

• Q4 financial results are expected to be strong • Volumes in North America should be supported by a replenished downstream backlog, as well as broad end market strength • Downstream backlog is expected to continue repricing higher • Europe volumes should be supported by a robust construction market • Fourth quarter FY 2022 finished steel shipments should follow a typical seasonal pattern – generally consistent with third quarter levels • Margins in the fourth quarter FY 2022 are expected to be consistent with recent levels • Import sanctions against Russia and Belarus are expected to tighten market supply of long steel products in Central and Eastern Europe • Significant increase in steel product margins over scrap in North America and Europe − Margins up $213 per ton y/y in North America, up $149 per ton y/y in Europe • Margins on sales of raw materials reached $299 per ton compared to a seven-year average of $160 • Downstream average selling price increased $75 per ton from the prior quarter, a reflection of ongoing repricing of CMC’s backlog driven by higher priced new contracts • Downstream backlog volume grew on a year-over-year basis for fourth consecutive quarter • North America controllable costs per ton of finished steel were flat from the prior quarter, but up y/y on increased per unit purchase costs for freight, alloys, and energy • Third rolling line in Poland running at high utilization, allowing CMC Europe to achieve record levels of finished goods shipments • Energy costs in Europe segment increased from the third quarter of 2021, but were more than offset by strong market dynamics − Hedged position provided large cost offset − Electricity rates in the Polish market have experienced less volatility compared to Western European countries • Major end markets in North America and Europe remained strong P e rf o rm a n c e D ri v e rs O u tl o o k Operational Update 10Q3 FY22 Supplemental Slides │ June 16, 2022 FY 2022 Core EBITDA is expected to achieve new record

230 484 172 71 1 9 0 50 100 150 200 250 300 350 400 450 500 Q3 2021 NA Segment EBITDA Europe Segment EBITDA Corp & Eliminations Other Non-Op Items Q3 2022 Consolidated Operating Results 11Q3 FY22 Supplemental Slides │ June 16, 2022 Q3 ‘21 Q4 ‘21 Q1 ‘22 Q2 ‘22 Q3 ‘22 External Finished Steel Tons Shipped1 1,601 1,646 1,464 1,429 1,654 Core EBITDA2 $230,464 $255,916 $326,806 $323,107 $483,913 Core EBITDA per Ton of Finished Steel Shipped2 $144 $155 $223 $226 $293 Adjusted Earnings2 $127,106 $154,240 $199,152 $187,553 $320,244 Performance Summary Units in 000’s except per ton amounts • $4.5 million charge related to Tensar acquisition and integration • $2.2 million charge for purchase accounting effect on inventory valuation Non-Operating Charges (excluded from results above) Figures are pre-tax for Q3 2022 [1] External Finished Steel Tons Shipped equal to shipments of Steel Products plus Downstream Products [2] Core EBITDA, Core EBITDA per ton of finished steel shipped, and adjusted earnings are non-GAAP measures. For a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document. Core EBITDA Bridge – Q3 2021 to Q3 2022 $ Millions

173 179 244 268 322 619 645 658 741 808 425 466 548 605 638 0 50 100 150 200 250 300 350 0 100 200 300 400 500 600 700 800 900 Q3 '21 Q4 '21 Q1 '22 Q2 '22 Q3 '22 Adjusted EBITDA per Ton of Finished Steel Shipped Downstream Products Margin Over Scrap (1 Qtr Lag) Steel Products Margin Over Scrap 100 125 150 175 200 Q3 '21 Q4 '21 Q1 '22 Q2 '22 Q3 '22 Adjusted EBITDA per ton Wgt Avg Finished Steel ASP Wgt Avg Finished Steel Mgn Over Scrap Controllable Costs Key Performance Drivers Q3 2022 vs Q3 2021 North America 12Q3 FY22 Supplemental Slides │ June 16, 2022 Q3 ’21 Q4 ‘21 Q1 ‘22 Q2 ‘22 Q3 ’22 External Finished Steel Tons Shipped1 1,197 1,186 1,099 979 1,178 Adjusted EBITDA $207,330 $212,018 $268,524 $262,148 $379,355 Adjusted EBITDA per Ton of Finished Steel Shipped $173 $179 $244 $268 $322 Adjusted EBITDA Margin 13.3% 12.8% 16.2% 16.2% 18.7% Performance Summary Units in 000’s except per ton amounts (excludes California land sale) • Significant increase in steel product margins over scrap − Up $213 per ton y/y and $33 per ton sequentially • Expanded margins on sales of raw materials − Spread of selling price over purchase cost increased $47 per ton on a y/y basis • Expanded margins on sales of downstream products − Margin over scrap cost increased nearly $180 per ton y/y − Full value chain profitability on sales of downstream products above long-term average • Controllable costs negatively impacted by planned maintenance, freight, energy, and alloys − CMC remains very competitively positioned in comparison to the broader industry Notes: [1] External Finished Steel Tons Shipped equal to shipments of Steel Products plus Downstream Products [2] Steel Products Margin Over Scrap equals Average Selling Price minus Cost of ferrous scrap utilized [3] Downstream Products Margin Over Scrap equals Average Selling Price minus prior quarter cost of ferrous scrap utilized Tensar contributed $4 million, which includes a $1.4 million charge related to purchase accounting effects on inventory North America – Key Margins $ / ton (excludes California land sale) D P a n d S P M a rg in O ve r S c ra p A d ju s te d E B IT D A p e r to n North America Indexed Margins and Controllable Costs $ / ton of external finished steel shipped (excludes California land sale) [2] [3]

80 85 90 95 100 105 110 124 147 219 180 254 288 315 435 407 437 0 50 100 150 200 250 300 100 150 200 250 300 350 400 450 500 Q3 '21 Q4 '21 Q1 '22 Q2 '22 Q3 '22 Adjusted EBITDA per Ton Steel Products Margin Over Scrap Key Performance Drivers Q3 2022 vs Q3 2021 Europe 13Q3 FY22 Supplemental Slides │ June 16, 2022 Q3 ‘21 Q4 ‘21 Q1 ‘22 Q2 ’22 Q3 ’22 External Finished Steel Tons Shipped1 404 460 365 450 476 Adjusted EBITDA $50,005 $67,676 $79,832 $81,149 $120,974 Adjusted EBITDA per Ton of Finished Steel Shipped $124 $147 $219 $180 $254 Adjusted EBITDA Margin 17.6% 18.4% 24.3% 20.5% 25.0% Performance Summary Units in 000’s except per ton amounts • Significant increase in margin over scrap − Up $149 per ton y/y • Strong contribution from third rolling line − Allowed for increased sales of finished steel products into favorable market − Increased shipments y/y of rebar, merchant bar, and wire rod • Strong steel market dynamics more than offset impact of significant increase in electricity costs • Robust volumes and pricing on downstream mesh and wire products Europe – Key Margins $ / ton A d ju s te d E B IT D A p e r to n Polish and E.U. Construction Activity Index Average of trailing three months [2] Notes: [1] External Finished Steel Tons Shipped equal to shipments of Steel Products [2] Steel Products Margin Over Scrap equals Average Selling Price minus Cost of ferrous scrap utilized [3] Data sourced from Eurostat Tensar contributed $1 million, which includes a $0.8 million charge related to purchase accounting effects on inventory S te e l P ro d u c t M a rg in O ve r S c ra p 3 E.U. 27 Poland

2 31 Disciplined Capital Allocation Strategy 14Q3 FY22 Supplemental Slides │ June 16, 2022 CMC Capital Allocation Priorities: $350 million share repurchase program in place Quarterly dividend of $0.14 per share (increased 17% in Q4 2021) Shareholder Cash Distribution Programs in Place • Operating cash flow • Sale of southern California real estate ($313 million of gross proceeds) • $600 million notes issuance • $150 million tax-exempt bond1 • Funding of Tensar acquisition • Growth initiatives, including completion of Arizona 2 micro mill • Share repurchases • Opportunistic redemption of 2027 notes Value-generating Growth Shareholder Distributions Debt Management CMC will prudently allocate capital while maintaining a strong and flexible balance sheet YTD 2022 Sources of Cash Uses and Intended Uses Notes: [1] Use of cash raised from offering of tax-exempt bond is limited to funding of Arizona 2 project

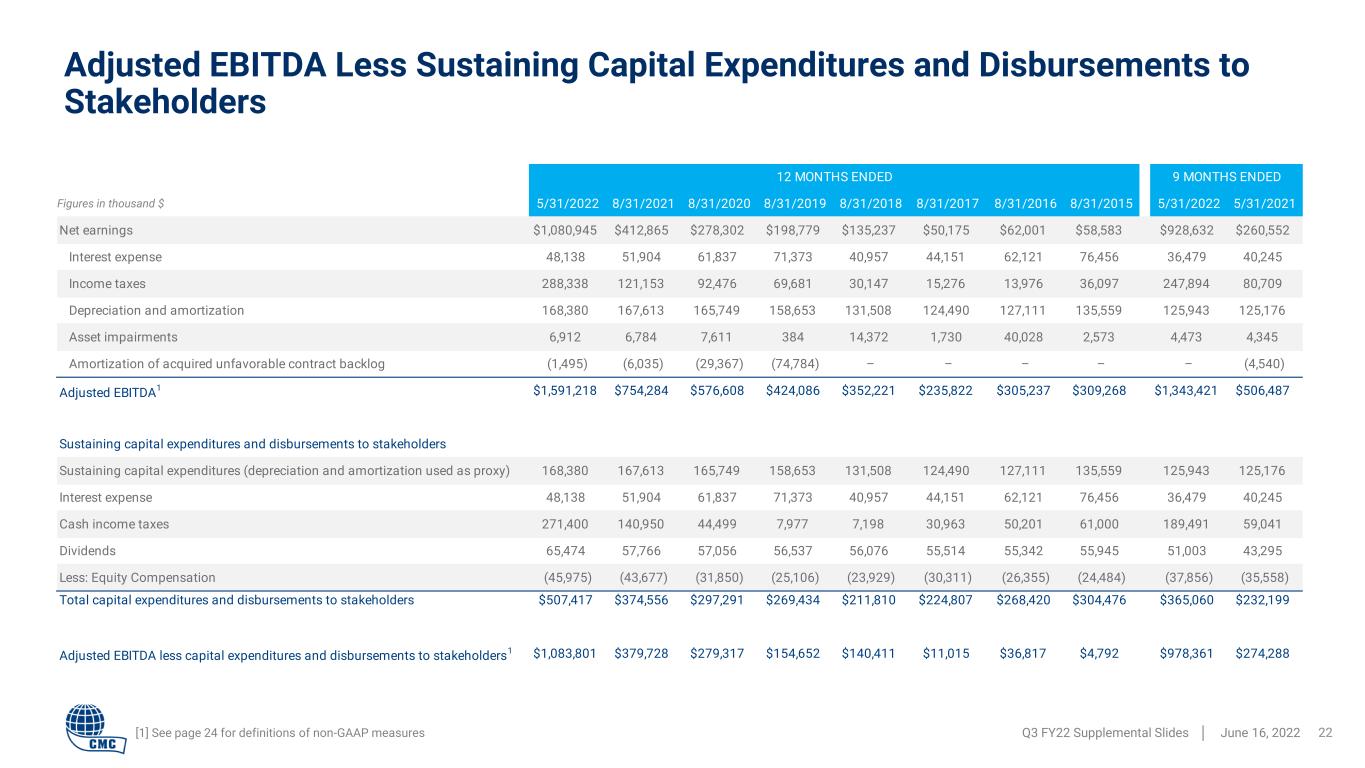

$811 $5 $37 $11 $140 $155 $279 $380 $1,084 $0 $200 $400 $600 $800 $1,000 $1,200 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 L12M (to Q3 '22) Cash Generation Profile 15Q3 FY22 Supplemental Slides │ June 16, 2022 Adjusted EBITDA Less Sustaining Capital Expenditures and Disbursements to Stakeholders 1 (in millions) CMC’s cash flow capabilities have been greatly enhanced through our strategic transformation FY 2022 capital expenditures expected in a range of $475 million to $500 million Source: Public filings, Internal data [1] Adjusted EBITDA less Sustaining Capital Expenditures and Disbursements to Stakeholders is a non-GAAP financial measure. For a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document. Gain on California land sale

69 150 399 410 $330 $300 $300 $300 $145 $400 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2047 Balance Sheet Strength 16Q3 FY22 Supplemental Slides │ June 16, 2022 [1] 2047 tax-exempt bonds were priced to yield 3.5%; coupon rate is 4.0% [2] Availability as of May 31, 2022 excludes proceeds related to 2047 tax-exempt bond as these funds are held as restricted cash Source: Public filings Revolver U.S. Accounts Receivable Facility Poland Credit Facilities (US$ in millions) Revolving Credit Facility 4.125% Notes Cash and Cash Equivalents 4.875% Notes 3.875% Notes Debt maturity profile provides strategic flexibility Debt Maturity Profile Q3 FY’22 Liquidity2 (US$ in millions) 4.375% Notes 4.0% Bond Poland Accounts Receivable Facility

46% 42% 37% 33% 32% 24% 18% 21% 22% 20% 17% 18% 14% 24% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% 3.9x 3.2x 2.5x 1.9x 1.6x 1.2x 0.9x 1.1x 1.2x 1.0x 0.8x 0.7x 0.5x 0.7x NM 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x 3.5x 4.0x 4.5x Leverage Profile 17Q3 FY22 Supplemental Slides │ June 16, 2022 Source: Public filings, Internal data Notes: 1. Total debt is defined as long-term debt plus current maturities of long-term debt and short-term borrowings. 2. Net Debt is defined as total debt less cash & cash equivalents. 3. EBITDA depicted is adjusted EBITDA from continuing operations on a trailing 12-month basis. 4. Net debt-to-capitalization is defined as net debt on CMC’s balance sheet divided by the sum of total debt and stockholders’ equity For a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document. Financial strength gives us the flexibility to fund our announced projects, pursue opportunistic M&A, and distribute cash to shareholders Net Debt1,2 / EBITDA3 Net Debt-to-Capitalization4

Q3 FY22 Supplemental Slides │ June 16, 2022 18 Appendix: Non-GAAP Financial Reconciliations

3 MONTHS ENDED 5/31/2022 2/28/2022 11/30/2021 8/31/2021 5/31/2021 Net earnings $312,429 $383,314 $232,889 $152,313 $130,408 Interest expense 13,433 12,011 11,035 11,659 11,965 Income taxes 92,590 126,432 28,872 40,444 38,175 Depreciation and amortization 43,583 41,134 41,226 42,437 41,804 Amortization of acquired unfavorable contract backlog – – – (1,495) (1,508) Asset impairments 3,245 1,228 – 2,439 277 Adjusted EBITDA1 $465,280 $564,119 $314,022 $247,797 $221,121 Non-cash equity compensation 11,986 16,251 9,619 8,119 13,800 Loss on debt extinguishment – 16,052 – – – Gain on sale of assets – (273,315) – – (4,457) Facility closure – – – – – Acquisition and integration related costs and other 4,478 – 3,165 – – Purchase accounting effect on inventory 2,169 – – – – Core EBITDA1 $483,913 $323,107 $326,806 $255,916 $230,464 North America steel product shipments 779 652 699 771 789 North America downstream shipments 399 327 400 415 408 Europe steel product shipments 476 450 365 460 404 Total finished steel shipments 1,654 1,429 1,464 1,646 1,601 Core EBITDA per ton of finished steel shipped 293 226 223 155 144 Adjusted EBITDA and Core EBITDA Q3 FY22 Supplemental Slides │ June 16, 2022 19[1] See page 24 for definitions of non-GAAP measures Figures in thousand $

Adjusted Earnings Q3 FY22 Supplemental Slides │ June 16, 2022 20[1] See page 24 for definitions of non-GAAP measures Figures in thousand $ 3 MONTHS ENDED 5/31/2022 2/28/2022 11/30/2021 8/31/2021 5/31/2021 Net earnings $312,429 $383,314 $232,889 $152,313 $130,408 Gain on sale of assets – (273,315) – – (4,457) Loss on debt extinguishment – 16,052 – – – Facility closure – – – – – Asset impairments 3,245 1,228 – 2,439 277 Acquisition and integration related costs and other 4,478 – 3,165 – – Purchase accounting effect on inventory 2,169 – – – – Total adjustments (pre-tax) $9,892 ($256,035) $3,165 $2,439 ($4,180) Tax impact International restructuring – – (36,237) – – Related tax effects on adjustments (2,077) 60,274 (665) (512) 878 Total tax impact ($2,077) $60,274 ($36,902) ($512) $878 Adjusted earnings1 $320,244 $187,553 $199,152 $154,240 $127,106 Average diluted shares outstanding (thousands) 122,780 122,852 122,798 122,376 122,194 Adjusted earnings per diluted share $2.61 $1.53 $1.62 $1.26 $1.04 3 MONTHS ENDED 5/31/202 2/28/202 1 /30/2021 8/31/2021 5/31/2021 Net earnings $312,429 $383,314 $232,8 9 $152,313 $130,408 Gain on sale of as ets – (273,315) – – (4, 57) Los on debt extinguishment – 16,052 – – – Facil ty closure – – – – – As et impairments 3,245 1,2 8 – 2,439 27 Acquisition and integration related costs and other 4,478 – 3,165 – – Purchase ac ounting effect on inventory 2,169 – – – – Total adjustments (pre-tax) $9,892 ($256,035) $3,165 $2,439 ($4,180) Tax impact International restructuring – – (36,237) – – Related tax effects on adjustments (2,07 ) 60,274 (6 5) (512) 878 Total tax impact ($2,07 ) $60,274 ($36,902) ($512) $878 Adjusted earnings1 $320,24 $187,5 3 $19 ,152 $154,240 $127,106 Average diluted shares outstanding (thousands) 12 ,780 12 ,852 12 ,798 12 ,376 12 ,194 Adjusted earnings per diluted share $2.61 $1.53 $1.62 $1.26 $1.04

3 MOS ENDED 5/31/2022 Earnings before income taxes $405,019 Plus: interest expense 13,433 Plus: acquisition and integration related costs 4,478 Plus: loss on extinguishment of debt 39 Plus: asset impairments 3,245 Plus: purchase accounting effect on inventory 2,169 Less: gain on sale of assets (2,024) Operating profit - adjusted $426,359 Operating profit - adjusted $426,359 Less: income tax at statutory rate 1 101,473 Net operating profit after tax $324,886 Assets $6,103,702 Less: cash and cash equivalents 410,265 Less: accounts payable 492,947 Less: accrued expenses and other payables 474,653 Invested capital $4,725,837 Annualized net operating profit after tax $1,299,542 Invested capital (average of Q3 2022 and Q2 2022 ending amounts) $4,292,354 Return on Invested Capital2 30.3% Return on Invested Capital Q3 FY22 Supplemental Slides │ June 16, 2022 21 [1] Federal statutory rate of 21% plus approximate impact of state level income tax [2] See page 24 for definitions of non-GAAP measures Figures in thousand $

[1] See page 24 for definitions of non-GAAP measures Adjusted EBITDA Less Sustaining Capital Expenditures and Disbursements to Stakeholders Q3 FY22 Supplemental Slides │ June 16, 2022 22 Figures in thousand $ 12 MONTHS ENDED 9 MONTHS ENDED 5/31/2022 8/31/2021 8/31/2020 8/31/2019 8/31/2018 8/31/2017 8/31/2016 8/31/2015 5/31/2022 5/31/2021 Net earnings $1,080,945 $412,865 $278,302 $198,779 $135,237 $50,175 $62,001 $58,583 $928,632 $260,552 Interest expense 48,138 51,904 61,837 71,373 40,957 44,151 62,121 76,456 36,479 40,245 Income taxes 288,338 121,153 92,476 69,681 30,147 15,276 13,976 36,097 247,894 80,709 Depreciation and amortization 168,380 167,613 165,749 158,653 131,508 124,490 127,111 135,559 125,943 125,176 Asset impairments 6,912 6,784 7,611 384 14,372 1,730 40,028 2,573 4,473 4,345 Amortization of acquired unfavorable contract backlog (1,495) (6,035) (29,367) (74,784) – – – – – (4,540) Adjusted EBITDA1 $1,591,218 $754,284 $576,608 $424,086 $352,221 $235,822 $305,237 $309,268 $1,343,421 $506,487 Sustaining capital expenditures and disbursements to stakeholders Sustaining capital expenditures (depreciation and amortization used as proxy) 168,380 167,613 165,749 158,653 131,508 124,490 127,111 135,559 125,943 125,176 Interest expense 48,138 51,904 61,837 71,373 40,957 44,151 62,121 76,456 36,479 40,245 Cash income taxes 271,400 140,950 44,499 7,977 7,198 30,963 50,201 61,000 189,491 59,041 Dividends 65,474 57,766 57,056 56,537 56,076 55,514 55,342 55,945 51,003 43,295 Less: Equity Compensation (45,975) (43,677) (31,850) (25,106) (23,929) (30,311) (26,355) (24,484) (37,856) (35,558) Total capital expenditures and disbursements to stakeholders $507,417 $374,556 $297,291 $269,434 $211,810 $224,807 $268,420 $304,476 $365,060 $232,199 Adjusted EBITDA less capital expenditures and disbursements to stakeholders 1 $1,083,801 $379,728 $279,317 $154,652 $140,411 $11,015 $36,817 $4,792 $978,361 $274,288

3 MONTHS ENDED 5/31/2022 2/28/2022 11/30/2021 8/31/2021 5/31/2021 2/28/2021 11/30/2020 8/31/2020 5/31/2020 2/29/2020 11/30/2019 8/31/2019 5/31/2019 2/28/2019 11/30/2018 8/31/2018 5/31/2018 Long-term debt $1,115,478 $1,445,755 $1,007,801 $1,015,415 $1,020,129 $1,011,035 $1,064,893 $1,065,536 $1,153,800 $1,144,573 $1,179,443 $1,227,214 $1,306,863 $1,310,150 $1,307,824 $1,138,619 $1,139,103 Current maturities of long-term debt and short-term borrowings 423,091 27,554 56,896 54,366 56,735 22,777 20,701 18,149 17,271 22,715 13,717 17,439 54,895 88,902 29,083 19,746 19,874 Total debt $1,538,569 $1,473,309 $1,064,697 $1,069,781 $1,076,864 $1,033,812 $1,085,594 $1,083,685 $1,171,071 $1,167,288 $1,193,160 $1,244,653 $1,361,758 $1,399,052 $1,336,907 $1,158,365 $1,158,977 Less: Cash and cash equivalents 410,265 846,587 415,055 497,745 443,120 367,347 465,162 542,103 462,110 232,442 224,797 192,461 120,315 66,742 52,352 622,473 600,444 Net debt1 $1,128,304 $626,722 $649,642 $572,036 $633,744 $666,465 $620,432 $541,582 $708,961 $934,846 $968,363 $1,052,192 $1,241,443 $1,332,310 $1,284,555 $535,892 $558,533 Earnings from continuing operations $312,429 $383,314 $232,889 $152,313 $130,408 $66,233 $63,911 $67,782 $64,169 $63,596 $82,755 $85,880 $78,551 $14,928 $19,420 $51,260 $42,325 Interest expense 13,433 12,011 11,035 11,659 11,965 14,021 14,259 13,962 15,409 15,888 16,578 17,702 18,513 18,495 16,663 15,654 11,511 Income taxes 92,590 126,432 28,872 40,444 38,175 20,941 21,593 18,495 23,804 22,845 27,332 16,826 29,105 18,141 5,609 6,682 13,312 Depreciation and amortization 43,583 41,134 41,226 42,437 41,804 41,573 41,799 41,654 41,765 41,389 40,941 41,051 41,181 41,245 35,176 32,610 32,949 Asset impairments 3,245 1,228 – 2,439 277 474 3,594 1,098 5,983 – 530 369 15 – – 840 935 Amortization of acquired unfavorable contract backlog – – – (1,495) (1,508) (1,509) (1,523) (10,691) (4,348) (5,997) (8,331) (16,582) (23,394) (23,476) (11,332) – – Adjusted EBITDA from continuing operations1 $465,280 $564,119 $314,022 $247,797 $221,121 $141,733 $143,633 $132,300 $146,782 $137,721 $159,805 $145,246 $143,971 $69,333 $65,536 $107,046 $101,032 Trailing 12 month adjusted EBITDA from continuing operations $1,591,218 $1,347,059 $924,673 $754,284 $638,787 $564,448 $560,436 $576,608 $589,554 $586,743 $518,355 $424,086 $385,886 $342,947 Total debt $1,538,569 $1,473,309 $1,064,697 $1,069,781 $1,076,864 $1,033,812 $1,085,594 $1,083,685 $1,171,071 $1,167,288 $1,193,160 $1,244,653 $1,361,758 $1,399,052 $1,336,907 $1,158,365 $1,158,977 Total stockholders' equity 3,142,169 2,869,947 2,486,189 2,295,109 2,156,597 2,009,492 1,934,899 1,889,413 1,800,662 1,758,055 1,701,697 1,624,057 1,564,195 1,498,496 1,489,027 1,493,583 1,452,902 Total capitalization $4,680,738 $4,343,256 $3,550,886 $3,364,890 $3,233,461 $3,043,304 $3,020,493 $2,973,098 $2,971,733 $2,925,343 $2,894,857 $2,868,710 $2,925,953 $2,897,548 $2,825,934 $2,651,948 $2,611,879 Net debt to trailing 12 month adjusted EBITDA from continuing operations 0.7x 0.5x 0.7x 0.8x 1.0x 1.2x 1.1x 0.9x 1.2x 1.6x 1.9x 2.5x 3.2x 3.9x Net debt to capitalization 24% 14% 18% 17% 20% 22% 21% 18% 24% 32% 33% 37% 42% 46% Net Debt to Adjusted EBITDA and Net Debt to Capitalization Q3 FY22 Supplemental Slides │ June 16, 2022 23 Figures in thousand $ [1] See page 24 for definitions of non-GAAP measures

Definitions for non-GAAP financial measures Q3 FY22 Supplemental Slides │ June 16, 2022 24 ADJUSTED EARNINGS Adjusted earnings is a non-GAAP financial measure that is equal to earnings before debt extinguishment costs, certain gains on sale of assets, certain facility closure costs, asset impairments, purchase accounting effect on inventory and acquisition settlements, including the estimated income tax effects thereof. Adjusted earnings should not be considered as an alternative to net earnings or any other performance measure derived in accordance with GAAP. However, we believe that adjusted earnings provides relevant and useful information to investors as it allows: (i) a supplemental measure of our ongoing core performance and (ii) the assessment of period-to-period performance trends. Management uses adjusted earnings to evaluate our financial performance. Adjusted earnings may be inconsistent with similar measures presented by other companies. Adjusted earnings per diluted share is defined as adjusted earnings on a diluted per share basis. CORE EBITDA Core EBITDA is the sum of net earnings before interest expense and income taxes. It also excludes recurring non-cash charges for depreciation and amortization and asset impairments. Core EBITDA also excludes debt extinguishment costs, non-cash equity compensation, certain gains on sale of assets, certain facility closure costs, acquisition settlement costs and purchase accounting effect on inventory. Core EBITDA should not be considered an alternative to earnings (loss) from continuing operations or net earnings (loss), or as a better measure of liquidity than net cash flows from operating activities, as determined by GAAP. However, we believe that Core EBITDA provides relevant and useful information, which is often used by analysts, creditors and other interested parties in our industry as it allows: (i) comparison of our earnings to those of our competitors; (ii) a supplemental measure of our ongoing core performance; and (iii) the assessment of period-to-period performance trends. Additionally, Core EBITDA is the target benchmark for our annual and long-term cash incentive performance plans for management. Core EBITDA may be inconsistent with similar measures presented by other companies. ADJUSTED EBITDA Adjusted EBITDA is a non-GAAP financial measure. Adjusted EBITDA is the sum of the Company’s net earnings before interest expense, income taxes, depreciation and amortization expense, impairment expense, and amortization of acquired unfavorable contract backlog. Adjusted EBITDA should not be considered as an alternative to net earnings, or any other performance measure derived in accordance with GAAP. However, we believe that adjusted EBITDA provides relevant and useful information to investors as it allows: (i) a supplemental measure of our ongoing performance and (ii) the assessment of period-to-period performance trends. Management uses adjusted EBITDA to evaluate our financial performance. Adjusted EBITDA may be inconsistent with similar measures presented by other companies. ADJUSTED EBITDA LESS CAPITAL EXPENDITURES AND DISBURSEMENTS TO STAKEHOLDERS Adjusted EBITDA less sustaining capital expenditures and disbursements to shareholders is defined as Adjusted EBITDA less depreciation and amortization (used as a proxy for sustaining capital expenditures) less interest expense, less cash income taxes less dividend payments plus stock-based compensation. NET DEBT Net debt is defined as total debt less cash and cash equivalents. RETURN ON INVESTED CAPITAL Return on Invested Capital is defined as: 1) after-tax operating profit divided by 2) total assets less cash & cash equivalents less non-interest-bearing liabilities

Q3 FY22 Supplemental Slides │ June 16, 2022 25 Thank You

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Cielo Announces Grant of Stock Options

- Bayridge Announces Closing of $6.9 Million Private Placement

- bettermoo(d)'s Moodrink(TM) Secures Product Listing with Banner Store of Canada's Second Largest Grocer

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share