Form 8-K CHEMUNG FINANCIAL CORP For: May 09

UNITED STATES OF AMERICA

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 10, 2019 (May 9, 2019)

CHEMUNG FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

| New York | 0-13888 | 16-1237038 | ||

| (State or other jurisdiction | (Commission File Number) | (IRS Employer | ||

| of incorporation) | Identification No.) |

One Chemung Canal Plaza, Elmira, NY 14901

(Address of principal executive offices) (Zip Code)

(607) 737-3711

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.16e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Common stock, par value $0.01 per share | CHMG | Nasdaq Global Select Market | ||

| (Title of each class) | (Trading symbol) | (Name of exchange on which registered |

| Item 5.07 | Submission of Matters to a Vote of Security Holders |

At the Annual Meeting of Shareholders of Chemung Financial Corporation (“the Corporation”), held on May 9, 2019, shareholders voted on three proposals. The Corporation’s definitive proxy statement on Schedule 14A filed with the Securities and Exchange Commission on March 29, 2019 describes each proposal in detail. Each of the three proposals and vote counts are included below.

Proposal 1: Election of Directors.

| a. | The election of five directors for a term of three years expiring in 2022. |

|

Nominees |

Votes For |

Votes Withheld |

Broker Non-Votes |

| Ronald M. Bentley | 3,234,930 | 178,309 | 818,384 |

| David M. Buicko | 3,327,201 | 86,037 | 818,384 |

| Robert H. Dalrymple | 3,274,938 | 138,300 | 818,384 |

| Jeffrey B. Streeter | 3,329,489 | 83,749 | 818,384 |

| Richard W. Swan | 3,272,834 | 140,404 | 818,384 |

Nominees Bentley, Buicko, Dalrymple, Streeter and Swan were elected.

| b. | The election of one director for a term of one year expiring in 2020. |

|

Nominees |

Votes For |

Votes Withheld |

Broker Non-Votes |

| Larry H. Becker | 3,310,995 | 102,244 | 818,384 |

Nominee Becker was elected.

Proposal 2: To approve, on a non-binding, advisory basis, the compensation of the Named Executive Officers of the Corporation and the Bank (“Say-On-Pay”).

| Say-on-Pay | |||

| Votes For | Votes Against | Votes Abstained | Broker Non-Votes |

| 3,219,280 | 151,145 | 42,814 | 818,384 |

The Corporation’s and Bank’s Named Executive Officers’ compensation was approved.

Proposal 3: Ratification of the appointment of Crowe LLP as the Corporation’s independent registered public accounting firm for the fiscal year ending December 31, 2019.

| Votes For | Votes Against | Votes Abstained | |

| 4,196,668 | 20,281 | 14,673 |

The appointment of Crowe LLP was ratified.

| Item 7.01 | Regulation FD Disclosure |

On May 9, 2019, Chemung Financial Corporation held its Annual Meeting of shareholders. Anders M. Tomson, President and Chief Executive Officer, made a presentation at the Annual Meeting, which included slides containing financial and other information. A copy of the presentation is attached hereto as Exhibit 99.1.

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

Exhibit No.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| CHEMUNG FINANCIAL CORPORATION | ||

| May 10, 2019 | By: | /s/ Karl F. Krebs |

| Karl F. Krebs | ||

| Chief Financial Officer and Treasurer | ||

Exhibit 99.1

Annual Shareholders Meeting Thursday, May 9, 2019

Forward - looking Statements This discussion contains forward - looking statements within the meaning of Section 27 A of the Securities Act, Section 21 E of the Exchange Act, and the Private Securities Litigation Reform Act of 1995 . The Corporation intends its forward - looking statements to be covered by the safe harbor provisions for forward - looking statements in these sections . All statements regarding the Corporation’s expected financial position and operating results, the Corporation’s business strategy, the Corporation’s financial plans, forecasted demographic and economic trends relating to the Corporation’s industry and similar matters are forward - looking statements . These statements can sometimes be identified by the Corporation’s use of forward - looking words such as “may,” “will,” “anticipate,” “estimate,” “expect,” or “intend . ” The Corporation cannot promise that its expectations in such forward - looking statements will turn out to be correct . The Corporation’s actual results could be materially different from expectations because of various factors, including changes in economic conditions or interest rates, credit risk, difficulties in managing the Corporation’s growth, competition, changes in law or the regulatory environment, including the Dodd - Frank Act, and changes in general business and economic trends . Information concerning these and other factors can be found in the Corporation’s periodic filings with the Securities Exchange Commission (“SEC”), including 2018 Annual Report on Form 10 - K . These filings are available publicly on the SEC’s website at www . sec . gov, on the Corporation’s website at www . chemungcanal . com, or upon request from the Corporate Secretary at ( 607 ) 737 - 3746 . Except as otherwise required by law, the Corporation undertakes no obligation to publicly update or revise its forward - looking statements, whether as a result of new information, future events, or otherwise .

Board of Directors David J. Dalrymple Anders M. Tomson Larry H. Becker

Board of Directors Bruce W. Boyea Ronald M. Bentley David M. Buicko

Board of Directors Stephen M. Lounsberry III Robert H. Dalrymple Denise V. Gonick

Board of Directors Richard W. Swan G. Thomas Tranter Jr. Jeffrey B. Streeter

Board of Directors Kevin B. Tully Thomas R. Tyrrell

Thank you, Clover! Clover M. Drinkwater

Executive Management Anders Tomson , President & CEO

Executive Management Pam Burns Senior Vice President Human Resources Dale Cole Executive Vice President Chief Information Officer Lou DiFabio Executive Vice President Business Client Services

Executive Management Karl Krebs Executive Vice President Chief Financial Officer Kim Hazelton Executive Vice President Retail Client Services Dan Fariello President Capital Bank

Executive Management Duane Mittan Vice President Chief Auditor Kathy McKillip Assistant Vice President Corporate Secretary Karen Makowski Executive Vice President Chief Risk Officer

Executive Management Tom Wirth Executive Vice President Wealth Management Group Mike Wayne Senior Vice President Director of Marketing

Annual Shareholders Meeting Thursday, May 9, 2019

Anders Tomson , President & CEO

2018 Key Metric Results • Record Earnings • Asset Quality • Growth of Capital • Increased Liquidity

Year Ending: 12/31/2018 Total Assets $1.8 billion Total Loans $1.3 billion Total Deposits $1.6 billion Total Shareholders ’ Equity $165 million

2018 Financial Results RECORD EARNINGS NET INCOME: $19.6 million EPS: $4.06 Year Ending: 12/31/2018

1.14% 12.76% Year Ending: 12/31/2018 Return on Average Assets Return on Average Equity

Tangible Book Value 11.8% Year Ending: 12/31/2018 $29.22

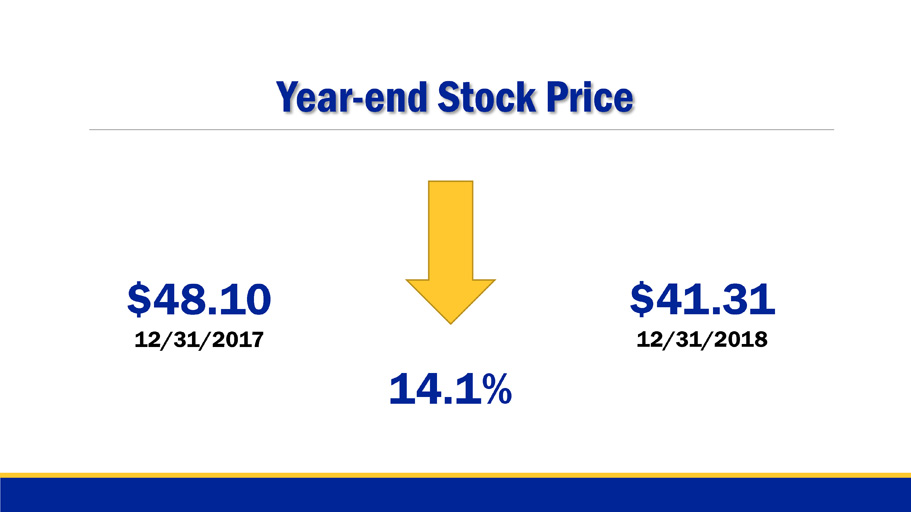

Year - end Stock Price 14.1% $41.31 12/31/2018 $48.10 12/31/2017

Dividends Declared $5.0 million $1.04 per share Year Ending: 12/31/2018

Balance Sheet Growth

Consumer & Residential Mortgage $7,000 $460,000 12/31/2017 $467,000 12/31/2018 In Thousands Average Balances 1.5%

Commercial Loan Portfolio 7.7% $853,000 12/31/2018 $792,000 12/31/2017 Average Balances $61,000 In Thousands

810,000,000 820,000,000 830,000,000 840,000,000 850,000,000 860,000,000 870,000,000 880,000,000 890,000,000 900,000,000 Commercial Loan Balances $843,000,000 $864,000,000 12/31/2017 12/31/2018

Non - Performing Assets 33.4% $12,828 12/31/2018 $19,264 12/31/2017 In Thousands

Total Deposits: $ 101.8 million 6.9% Deposit Growth Year Ending: 12/31/2018

Interest Rates

Graphic: FACTSET

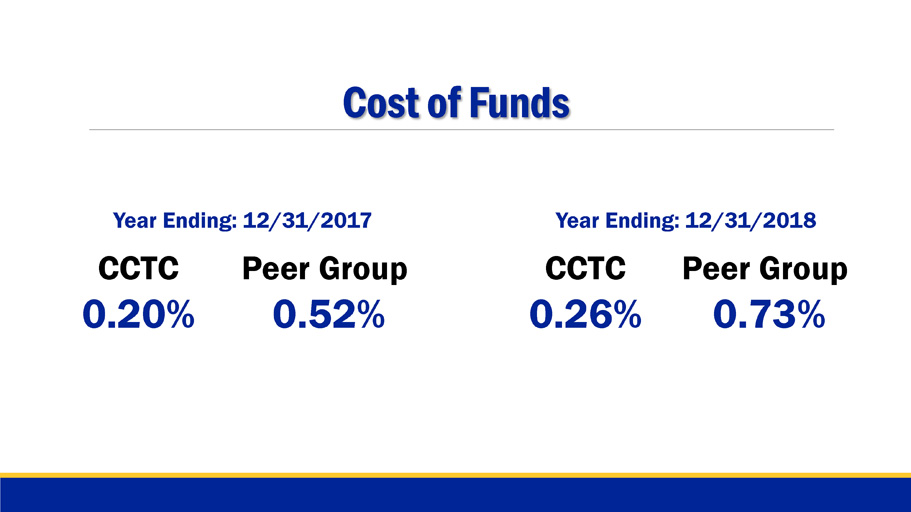

Cost of Funds CCTC 0.26% Peer Group 0.73% CCTC 0.20% Peer Group 0.52% Year Ending: 12/31/2017 Year Ending: 12/31/2018

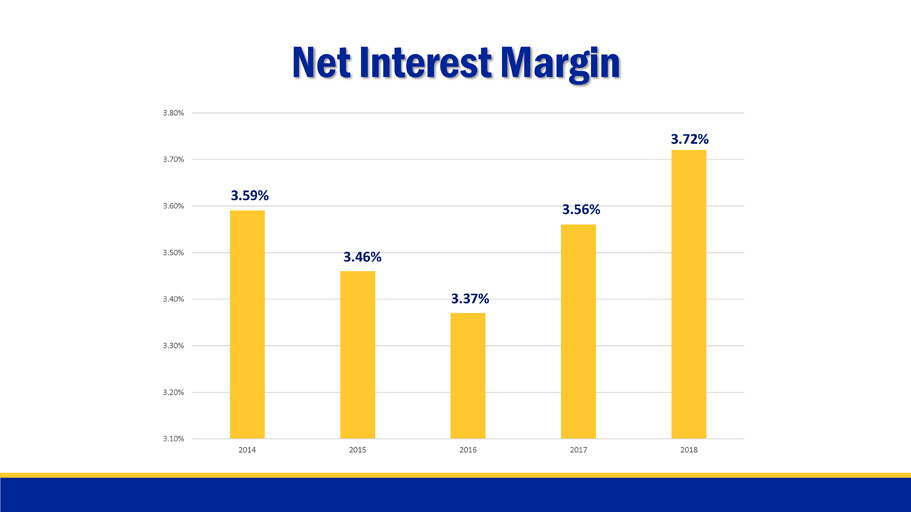

Net Interest Margin 3.10% 3.20% 3.30% 3.40% 3.50% 3.60% 3.70% 3.80% 2014 2015 2016 2017 2018 3.59% 3.46% 3.37% 3.56% 3.72%

Non - Interest Income 12.6% $23,074 12/31/2018 $20,491 12/31/2017 In Thousands

Wealth Management Group $1.8 billion Assets Under Management & Administration Year Ending: 12/31/2018

Operating Costs 5.6% $56.8 million 12/31/2018 $53.8 million 12/31/2017

Efficiency Ratio 78.75 76.18 74.43 66.6 0 67.22 60 62 64 66 68 70 72 74 76 78 80 2014 2015 2016 2017 2018 Efficiency Ratio Adjusted

Full - Time Employees 355 360 365 370 375 380 385 390 395 2014 2015 2016 2017 2018 Year Ending 393 377 368 371 374

Income Tax Expense 44.8% $4,009 12/31/2018 $7,262 12/31/2017 In Thousands

Continuing Our 3 - Year Information Technology Strategic Plan ▪ Focus on our Digital Future ▪ Align Technology and the Business Functions ▪ Focus on Risk Management ▪ Drive Reliable Technology Outcomes ▪ Robotic Process Automation

Expanding Our Digital Services

Industry “Banking Channel” Usage 2015 - 2019 Graphic: FIS Global PACE Survey

Contact Center • Manages approximately 95,000 calls per year • Client Assistance: • Balances • Transfers • Card users • Digital support • Creating opportunities for: • Cross selling to clients • Outbound calling to clients or prospects

eBanking Users • Web Banking: 30,216 • Mobile App: 17,900 • Mobile Deposit: 2,749 Year Ending: 12/31/2018

2018 Website Users • Unique Visitors: 556,569 • Sessions: 2,126,870 • Pageviews: 5,503,247 Year Ending: 12/31/2018 Includes both Chemung Canal and Capital Bank Websites.

Distribution Strategy Open in 2018 Consolidated in Q1 2019

Small Business Is Big Business Graphic: US Small Business Administration Office of Advocacy 2018 Small Business Profile

Downtown Revitalization Initiatives Update Parts of our footprint awarded f unding: • Albany • Auburn • Cortland • Elmira • Owego • Watkins Glen Auburn Mayor Michael Quill speaks about $10 million Downtown Revitalization Competition. Auburnpub.com Governor Cuomo awards Watkins Glen $10 million for revitalization projects. Governor.ny.gov

Downtown Revitalization Initiatives Update In Chemung County: • 100 W. Water St. • LECOM • LIBERTAD Project • South Main St. Redevelopment Project • Maple Avenue Apartments 100 West Water Apartments Photo: Park Grove Realty, LLC

Thank you, Tom! G. Thomas Tranter, Jr.

Supporting our Community

Market Challenges & Uncertainties • Flat Yield Curve • Margin Compression • Competition for Liquidity • Unpredictable Economic Growth

Congratulations Retirees! Dave Wakeman Resource Recovery 31 years of service Barb Jenkins Real Estate Lending 28 years of service Joyce Desarno Montour Falls 29 years of service Libby Courtright Regulatory Risk 25 years of service

Congratulations Retirees! Julie Conover Account Services 23 years of service Toni Parker Real Estate Lending 23 years of service Nancy Schierloh Finance Division 23 years of service Patricia Dunn Resource Recovery 22 years of service

Congratulations Retirees! Lewann Neifert Real Estate Lending 18 years of service Michael Crimmins Support Services Group 11 years of service Robert Pichette Commercial Loans 14 years of service

Questions?

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Chemung Financial (CHMG) PT Lowered to $49 at Keefe, Bruyette & Woods

- Amplifire and Kahuna Collaborate to Provide Better Learning Experiences Through Targeted Skills and Competency Training

- Hithium Hosts Roundtable at the BNEF Summit New York, Discussing Next Generation Battery Energy Storage System

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share