Form 8-K CARRIAGE SERVICES INC For: Mar 16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 16, 2015

Carriage Services, Inc.

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 1-11961 (Commission File Number) | 76-0423828 (I.R.S. Employer Identification No.) |

3040 Post Oak Boulevard, Suite 300

Houston, Texas 77056

(713) 332-8400

(Address of Principal Executive Offices, Including Zip Code)

Not Applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01 Regulation FD

On March 16, 2015, Mel Payne, our Chief Executive Officer, sent a letter to certain institutional shareholders regarding their investment in Carriage Services, Inc. for communication purposes only. The letter and corresponding enclosures are attached as Exhibit 99.1 to this Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, the information presented herein under Item 7.01 and set forth in the attached Exhibit 99.1 is deemed to be “furnished” solely pursuant to Item 7.01 of this report and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information or the exhibit be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements and information in this Current Report on Form 8-K may constitute “forward-looking statements” intended to qualify for the safe harbors from liability established by the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control. All statements regarding the consummation of the Asset Sale Agreement and all statements other than statements of historical facts included or incorporated herein may constitute forward-looking statements. The words “could,” “believe,” “anticipate,” “intend,” “plan,” “estimate,” “expect,” “may,” “continue,” “predict,” “potential,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Actual results could vary significantly from those expressed or implied in such statements and are subject to a number of risks and uncertainties. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. The forward-looking statements involve risks and uncertainties that affect our operations, financial performance, and other factors as discussed in our filings with the Securities and Exchange Commission. Among the factors that could cause results to differ materially are those risks discussed in the periodic reports we file with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2014. You are urged to carefully review and consider the cautionary statements and other disclosures made in those filings, specifically those under the heading “Risk Factors.” We do not undertake any duty to update any forward-looking statement except as required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit No. | Description of Exhibit | |

99.1 | Shareholder Letter Template and corresponding enclosures dated March 16, 2015. | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

CARRIAGE SERVICES, INC. | ||

Date: | March 16, 2015 | /s/ L. William Heiligbrodt |

L. William Heiligbrodt | ||

Executive Vice President and Secretary | ||

EXHIBIT INDEX

Exhibit No. | Description of Exhibit | |

99.1 | Shareholder Letter Template and corresponding enclosures dated March 16, 2015. | |

MELVIN C. PAYNE

CHAIRMAN AND CEO

(713) 332-8440 (Office)

(713) 332-8444 (Voice Mail)

March 16, 2015

As the Co-founder, Chairman and Chief Executive Officer of Carriage Services, Inc. (Carriage), I am writing you personally to inform you more completely beyond public press releases and filings about your investment in Carriage and to open the line of communication up for any past or future issues or questions you might have of me. The investor relations function has been handled very expertly and professionally since September 2011 by Bill Heiligbrodt and Robert Prescott, so this initial outreach letter by me is in no way a substitute, but rather an addition to their continuing activities to keep our shareholders informed about the progress of our company.

I am enclosing with this letter seven attachments bound in a Carriage Investor Reference Book for your retention and review, on each of which I will offer executive summary editorial comments because I believe each has substantive investment merit you would appreciate learning about. The seven attachments are:

▪ | 2014 Full Year Performance Press Release / 2015 Outlook; |

▪ | Five Year and Five Quarter Trend Reports ending December 31, 2014; |

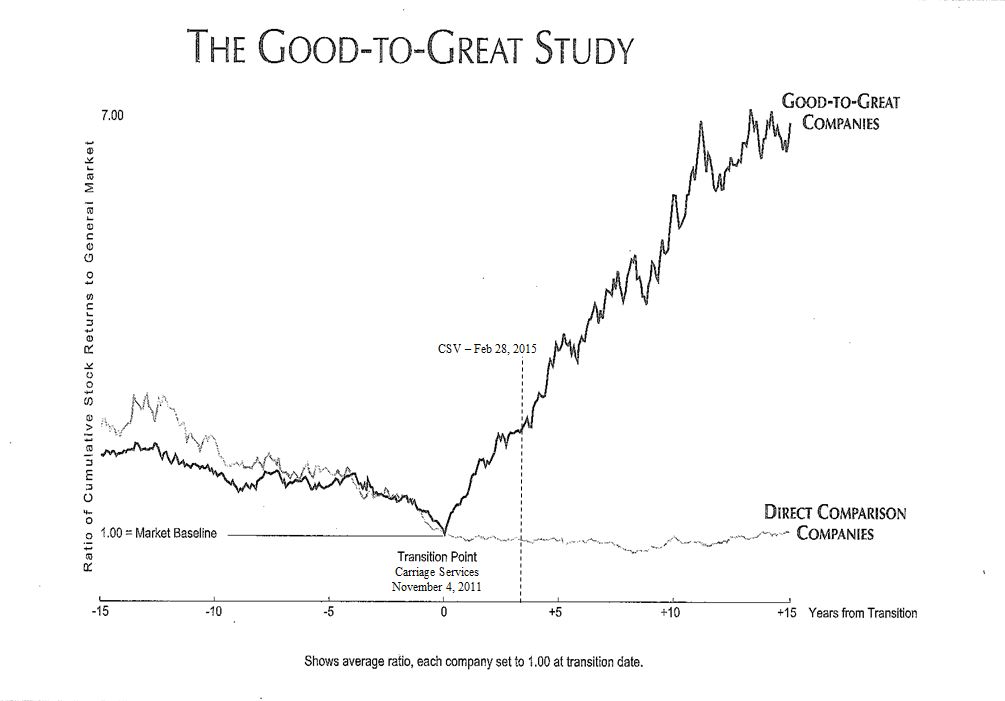

▪ | Carriage Good To Great Journey annual theme letters / Good To Great Study Stock Returns; |

▪ | 2013 Good To Great Annual Report Shareholder Letter Wrap; |

▪ | Company and Investment Profile as of December 31, 2014; |

▪ | Memorandum on High Performance Culture Organizational Structure dated January 22, 2015; |

▪ | Letter on Carriage Executive Compensation Strategy, Policy and Peers from Marsha Cameron, CEO and Founder of Paradox Compensation Advisors. |

First, a little personal history. When I co-founded Carriage on June 1, 1991, it was a dream come true and a conscious choice to embark on a company building journey in the funeral industry that entailed huge risks of failure since I had literally no knowledge of or experience in operating or consolidating funeral home businesses. Yet I personally guaranteed all the debt until it was repaid at our IPO in August 1996. After a career in corporate lending with Prudential and then Texas Commerce Bank, followed by ten years of turnaround and financial restructuring work, I was ready to build something “My Way” from scratch guided only by Five Guiding Principles which I had always relied on to build my career and reputation. Moreover, I wanted to build a company that would “Be The Best,” not the biggest, since that spot had already been claimed and long occupied by Service Corporation International (SCI) going back to the early 1960’s when consolidation of highly fragmented industries began to conceptually get attention from investors (deathcare, waste, food distribution, etc.).

I always thought about the Carriage journey would be more akin to a marathon than a sprint, and was I ever right about this analogy. The highs and lows of the Carriage journey as a public deathcare company have been many, i.e. a brief two to three year early high, followed by almost twelve years of deathcare industry down cycle learning from mistakes followed by innovation, evolution and

3040 Post Oak Boulevard Suite 300 Houston, Texas 77056 (713) 332-8400 Main (713) 332-5444 Fax

and continuous improvement while market expectations were low. The brutal but wonderful Darwinian “adapt or die” nature of the learning journey was reflected in our stock price, which peaked in the 1990’s consolidation mania up cycle at $29.25 in January 1999 and twice almost hit $1 per share, first in late 2000 when everyone except me thought we would go bankrupt, and again in February/March 2009 in the midst of the financial market crash.

The first time we hit the $1 per share price bottom we were way over leveraged and had negative Free Cash Flow (FCF), but the second time we were ready with no debt maturities for six years and rapidly increasing FCF, so we acquired 3.1 million shares equal to a little over 15% of Carriage shares outstanding out of FCF for only $10 million ($3.19 per share). I was accused on a quarterly conference call of “driving the company off a cliff” for not hoarding cash, but I saw this share repurchase program out of FCF as an incredible opportunity for me and all other remaining shareholders to own 15% more of a company that was getting better fast. Since then we have evolved into what I refer to as a “High Performance Culture Company” that just happens to be in the deathcare business.

When I co-founded Carriage on June 1, 1991 as its visionary and CEO, I received 650,000 unregistered founder’s shares. Over the years I began to acquire more shares at every opportunity I had, including market purchases after our IPO in August 1996 and many other times over the years, plus through equity and option grants, while only selling fully owned shares twice, once in the early 2000s when I sold about 30,000 shares to capture a tax loss to shelter phantom income from a failed real estate tax shelter from the 80s, and again in 2011 when I sold approximately 167,000 shares at prices between $5 to $6 per share (that was painful!) to pay down real estate and margin loans to a local bank in order to release 601,000 CSV shares pledged as collateral.

Contrary to expert advice about diversification from numerous financial and estate advisors, I have long had “all of my eggs in the Carriage basket”, believing that at some point our enterprise valuation would reflect the uniquely wonderful consolidation and operating framework that had been created and evolved through trial and error. I now own almost 1.5 million shares directly, and hold options on 363,000 shares, all of which are currently in the money, meaning that my total direct holdings are 1,863,000 shares equal to almost 10% of fully diluted Carriage shares outstanding. I cannot possibly know how much shareholder value will be created at Carriage over the next ten years, but I believe it will be huge compared to the past twenty-four years, especially if death rates begin to increase because of Baby Boomer demographics.

I turned 72 years of age recently and am in excellent health. My personal and professional plan is always developed and then updated annually around a ten year timeframe horizon predicated on the blessing of continued good health, which I work hard at maintaining. I plan to remain as Chairman and CEO of Carriage for another five years and then remain as Executive Chairman for another five years to age 82, assuming of course that our Board, shareholders and other Carriage 4E Leaders and employees continue to see high performance inspiration and “trend is our friend” value creation from my 4E Leadership.

My role models for investment philosophy and corporate leadership characteristics are Warren Buffett and Jack Welch, respectively. Warren Buffet at 84 years of age recently wrote in his shareholder letter that he and Charlie Munger believe there are two capable CEO successor candidates within Berkshire Hathaway, either of which would offer a smooth transition to CEO when Warren is no longer available. When the day comes for me to step down as CEO, I hope to have two worthy candidates to pick from as well. But that time is not now, as the most invigorating and healthy thing for me these days is coming to work each morning with a passion to be with our team of high performance leaders and employees on the Carriage Good To Great Journey.

The two words used most often to describe my leadership by other leaders and employees throughout Carriage are “integrity and passion”, which ironically are the two 4E bookend words used by Jack Welch when he created the 4E Leadership Model at GE while CEO in the 1990’s. To be sure, no one who really knows me doubts my 4E Leadership E’s of personal Energy, ability to Energize others toward a common goal or vision, the Edge to make lonely, difficult decisions (especially about people), and the ability to Execute the production of high and sustainable performance results.

Hopefully, the above personal history will offer a better perspective and framework for your understanding of the seven attachments enclosed and bound as an Investor Reference Book with this letter, starting with our full year 2014 results released on Wednesday, February 25, 2015. My comments in the press release speak to Carriage having reached an “earning power sweet spot”, as we grew full year 2014 Adjusted Diluted EPS by 36.7% to $1.34 per share on a relatively modest increase in revenues of 6.1%, and raised our Rolling Four Quarter Outlook for Adjusted Diluted EPS to a “roughly right range” of $1.55 - $1.59.

Also attached is one of our favorite innovations in transparent Non-GAAP and Non-SEC sector reporting, which are our Five Year and Five Quarter Trend Reports. Since 2010 we have grown revenue by only $50 million or 28% to $226.1 million in 2014 from $176.1 million in 2010 (6.5% CAGR), but have grown Adjusted Diluted EPS by 168% from $0.50 per share in 2010 to $1.34 per share in 2014 (28% CAGR). Our stock price has responded accordingly by increasing 433% over the last five years from $3.93 on December 31, 2009 to $20.95 on December 31, 2014 (40% CAGR). Moreover, our stock price has increased by another 14.4% during the first two plus months of 2015 to $23.97 as of Tuesday, March 3, 2015, and has been one of the top Total Shareholder Return (TSR) small capitalization performances in the Russell 2000/3000 indexes over the last three years.

Throughout this letter I reference the bestselling business book Good To Great by Jim Collins, published in 2001, from which we have taken a few Good To Great High Performance Concepts and customized and integrated them into the Carriage High Performance Culture Framework and language. When we finalized a major Board and Executive / Senior Management Reorganization on November 4, 2011, we then launched a Five Year Carriage Good To Great Journey starting with the first annual theme of Carriage Services 2012 - A NEW BEGINNING! I have enclosed for your review four annual theme letters including the new one for 2015. These are published at the beginning of each year and sent to our field and home office leaders and employees along with other materials that we use internally to educate and inspire for high and sustainable performance and the linked higher enterprise valuation over time. Also attached is last year’s Good To Great Annual Report Shareholder Letter Wrap in which I explain in detail all elements of our extraordinarily innovative High Performance Culture Framework for operating and consolidating the deathcare industry.

Attached is an updated Company and Investment Profile which we began to publish years ago because the ideas and concepts in our High Performance Culture Framework were not easy for investors to understand with only quarterly releases, filings and roadshow investor presentations. The Company and Investment Profile will be updated quarterly on our company investor website and will contain a more comprehensive Five Year Scenario of “roughly right range” results as we execute our three models over five year timeframes.

You may be surprised to learn that there has been no pure common equity (common shares only - not paired with a yield security) raised publicly by a consolidation company in the deathcare industry since a Stewart Enterprises offering in August 1999, so Carriage has had to learn how to create internal financing for new growth the old fashioned way, i.e. from retained earnings and Free Cash Flow. I

believe we have learned to do so exceedingly well to the huge benefit over time to our shareholders, as we can mostly self-finance a modest 8% revenue growth strategy by acquisition that produces 10% - 15% compound Adjusted Diluted EPS returns over time, which in turn drives shareholder value creation. For example, our normalized cash earning power reached an all-time record in 2014 as defined by Adjusted Consolidated EBITDA Margin of 27.3%, and over the next five years, outlined more completely in our Company and Investment Profile, we have a goal of growing revenues at least 8% annually while achieving Adjusted Consolidated EBITDA Margins of 30%, which has never been done in the deathcare industry.

Which brings me to the subject of Carriage’s Executive and Director Compensation, and Comparison To Peers and Benchmarking. You may be aware that in early August 2012, when our stock price was $7.99 per share, we issued 1.6 million conditional option performance shares (right to purchase each share at $9.00 capturing the $12.50 per share spread to Target Price) to senior leaders and Directors and announced a Good To Great Target Price vesting goal for the option performance shares of $21.50 within five years, equal to a 22% compound annual rate of share price appreciation over the full five years. If we did not achieve the Target Price during the five year timeframe, the conditional option shares would have been cancelled. As stated in the press release dated August 6, 2012:

“This new stock award program links all of our field leadership above the business unit level as well as our Houston support leaders and key employees into the five year Good To Great Vision and recognizes and rewards them for their important contribution to the value creation process. It also links each outside member of our Board of Directors into a greater engagement and understanding of Carriage as an investment platform.”

Since co-founding Carriage, I have tried many compensation strategies including equity grants and stock options on leaders and Board members with the intent of creating an ownership mindset that fosters high financial performance and shareholder value creation. I even split half my founders’ shares with two Management Co-Founders (each received 325,000 shares) who never developed an “owner mindset” that produced high and sustainable “ownership value”. Gifting people stock to create an ownership mindset followed by high performance simply doesn’t work, so we now focus relentlessly on getting the Right Who leadership aligned with our Guiding Principles and producing collaborative team high performance BEFORE sharing the precious ownership of our company with them. We call this idea First Who, Then What which is a Good To Great High Performance Culture Concept central to everything we do.

The new young Carriage leaders from a major management reorganization on November 4, 2011 and our relatively new Directors (all since February 2009) included in the Good To Great Program suddenly were more engaged both as individuals and as teams like never before in our history because they had already committed to and were executing on our Carriage Being The Best Vision and Good To Great Journey with high and sustainable operating and financial performance that realized the stated goal of making Carriage a superior value creation investment platform. In other words, we got the “First Who Right”, Then the “Right Who” produced the “What” High and Sustainable Operating and Financial Performance. The Good To Great Program therefore accomplished its intended purpose of unifying our Executive and Senior Leadership Team along with our Board around the idea of High Performance through One Team, One Vision. Therefore, this program “Will Not Be Repeated in the Future”.

The attached Memorandum dated January 22, 2015 with a new “No TITLES for Nobody” organizational structure describes perfectly the highly effective leadership team dynamic in place today for which the Good To Great Program served as the major catalyst. The Operations and Strategic Growth Leadership

Team (OSGLT) in this new structure meets each Friday at 10:00 AM in our Houston office and you would be welcome to join us as a special guest on any Friday.

After launching the Good To Great Program, our operating and financial performance took off and so did our stock price, rising 171% in only eight months from $7.99 per share on August 3, 2012 to $21.63 on April 10, 2013, after which our stock price began a necessary consolidation over the balance of 2013, then rose again briefly in early 2014 to $21.92, followed by another range bound consolidation between $16 - $20 per share. As we entered 2014, our Executive Team recommended and our Board agreed that the Good To Great Program should be settled early in cash at a 20% discount of $10 per option share, saving the company over $4 million cash and “dilution confusion” amongst our shareholders, as the Good To Great Program had succeeded in creating shareholder value beyond what any of us could have expected and had become an obstacle with regard to refinancing our Tides $90 million 7% coupon convertible security (conversion price of $20.44 per share).

We were subsequently successful with refinancing the highly dilutive Tides security (convertible into 4.4 million shares equal to 24% dilution above conversion price of $20.44) with a new $143.75 million, 2.75% coupon subordinated convertible security which is convertible at $22.56 per share but with highly favorable net cash settlement features and options that limit future dilution to only 20% and then only at very high share prices (see dilution / price chart and explanation in full year 2014 earnings release).

Since the 1.6 million option shares in the Good To Great Program were cancelled after the early cash settlement and added back to our key employee Equity Incentive Plan, we had plenty of key employee equity plan capacity for at least two more years, but we mistakenly and unnecessarily asked for a new plan in our 2013 proxy (voted on in May 2014), supported by our compensation consultant at the time. Reflecting back on the decision to ask for a new key employee equity plan, I for the life of me cannot recall anything said by anyone or any reasons that make any sense in hindsight. It was a “really stupid” thing to do, but in no way reflected the far worse human characteristic of “greed”. It was the kind of decision that causes me to call myself internally the Chief Mistake Maker (CMM) of Carriage, a title I have repeatedly earned over many years and that others should not want to take away from me!

We were highly criticized by Institutional Shareholder Services (ISS) for the Good To Great Program in general as well as our “Say on Pay” Proposals, and specifically in the ISS “Pay for Performance Evaluation”, although no one from ISS to my knowledge ever reached out to anyone at Carriage including me about their critical and factually incorrect view of our actions, especially on Pay for Performance. ISS wrongly concluded that Carriage management and Directors took the “unearned” Good To Great cash, implying that shareholders then suffered a loss in the value of their holdings when the stock price subsequently declined below $20 per share into the $16-$20 consolidation range mentioned above.

As the overall third largest but largest individual shareholder of Carriage, I never suffered any realized loss because of the temporary share price decline in our stock because the company continued to get better throughout 2014, and rather than sell any shares (only way to realize a loss is to sell shares below the acquired purchase price), I bought another 30,000 shares in the $16 - $17 per share range when Carriage was “on sale by Mr. Market!” Nonetheless, we had our “Say on Pay” Proposal and new Equity Incentive Plan rejected by a vote of shareholders, which was the first time in my career I’ve received a vote of no confidence from someone I didn’t know for reasons I didn’t understand at the time.

A copy of this letter and the Carriage Investor Reference Book will also be sent to ISS to inform them before our 2014 Proxy is published about our outreach to you and all other shareholders about matters that impact future shareholder value creation. If ISS is offering to evaluate whether Carriage, its Board Members and its Executive Team Leadership including me, believe in the concept of “Performance Before Pay”, ISS representatives should at least prepare themselves by reading this letter and all the enclosures. Then someone from ISS should give me a call and schedule a visit to discuss any matter related to Carriage on which they intend to offer our shareholders an opinion. I am always open to constructive input that has the potential to make our company better.

If there is a group devoted solely to proxy voting matters that is separate from security selection and portfolio management decisions, I would greatly appreciate you conveying this letter and enclosed materials to them with any collaborative and helpful input from you about the matters covered in my letter. If separate outreach to them by me would also be helpful, please let me know their name and contact information and it will be done.

As CEO of a public company, I learned a valuable “know thy shareholders” leadership lesson from the self-inflicted mistake with last year’s proxy proposals, which is the reason for my personal outreach to you and other fellow shareholders. Accordingly, we retained a new compensation consultant, Marsha Cameron with Paradox Compensation Advisors, whose recommendations in the attached letter to our Compensation Committee are already being implemented. I would welcome any input or questions from you about anything at any time, including our Governance and Compensation policies. I will never be too busy or inaccessible to take a call or visit with fellow shareholders who have entrusted their precious capital with our company and its leaders as fiduciaries. I commit to always live up to our First Guiding Principle, which is by far the most important:

Honesty, Integrity and Quality in All that We Do.

Best personal regards,

Melvin C. Payne

| |

CARRIAGE SERVICES ANNOUNCES RECORD 2014 ANNUAL RESULTS

RAISES ROLLING FOUR QUARTER OUTLOOK

HOUSTON – February 25, 2015 – Carriage Services, Inc. (NYSE: CSV) today announced record results for the year ending December 31, 2014.

Mel Payne, Chief Executive Officer, stated, “Our 2014 full year performance was an earning power milestone record with Adjusted Net Income of $24.8 million equal to Adjusted Diluted EPS of $1.34 and Adjusted Net Income Margin of 11.0% on record revenues of $226.1 million, made possible by an extraordinarily strong fourth quarter finish of Adjusted Diluted EPS of $0.38 on record revenues of $59.4 million. Carriage as a consolidation and operating platform for funeral homes and cemeteries has reached an “earning power sweet spot” in maturity and size, as reflected by the leveraging of a 12.9% total revenue increase in the fourth quarter into much larger increases of 25.6% in Total Field EBITDA, 27.8% in Adjusted Consolidated EBITDA, and 52.0% in Adjusted Diluted EPS.

We fully expect this sustainable earning power trend from existing operations and the value creation leveraging dynamics to continue into 2015 and thereafter and to be supplemented by new, high quality acquisitions from our growing pipeline of top quality acquisition candidates in strategic markets. We are therefore raising our Rolling Four Quarter Outlook range on revenue to $244 - $248 million and Adjusted Diluted EPS to $1.55 - $1.59.

The 2014 year was the third year in our defined Five Year Carriage Good To Great Journey with an annual theme of Carriage Services 2014: Being the Best - One Team, One Vision! Highlights of the year were as follows:

1. | Dave DeCarlo joined Bill Heiligbrodt and me in March as a member of the Executive Team with the primary responsibility of growing the Company by selective, strategic acquisitions; |

2. | Entered two large, new strategic markets, New Orleans and Washington, D.C., with the acquisition from SCI in May of five funeral homes and one combination business; |

3. | Completed the refinancing in May of all the old high rate components of our balance sheet with low rate $325 million syndicated five year bank credit facilities and $143.75 million seven year convertible subordinated notes; |

4. | Established a highly collaborative Operations and Strategic Growth Leadership Team (OSGLT) comprised of the Executive Team and twelve senior leaders representing field operations and Houston Support teams. This group operates informally as owner leaders without titles, direct reports, etc., and addresses all important Carriage value creation matters consistent with One Team, One Vision; |

5. | Updated and revised Strategic Acquisition Model criteria and methodologies to directly align with Standards Operating and 4E Leadership Models, and began building a new Strategic Development Team under Dave's leadership focused on building relationships with top quality acquisition candidates in large and medium strategic markets and areas. |

Year Ended December 31, 2014

• | Total Revenue of $226.1 million, an increase of 6.1%; |

• | Adjusted Consolidated EBITDA of $61.7 million, an increase of 10.1%; |

• | Adjusted Consolidated EBITDA Margin up 100 basis points to 27.3%; |

• | Adjusted Diluted Earnings Per Share of $1.34, an increase of 36.7%; and |

• | Adjusted Free Cash Flow of $34.2 million, an increase of 2.8%. |

Three Months Ended December 31, 2014

• | Total Revenue of $59.4 million, an increase of 12.9%; |

• | Adjusted Consolidated EBITDA of $17.1 million, an increase of 27.8%; |

• | Adjusted Consolidated EBITDA Margin up 330 basis points to 28.7%; |

• | Adjusted Diluted Earnings Per Share of $0.38, an increase of 52.0%; and |

• | Adjusted Free Cash Flow of $7.0 million, an increase of 4.0% |

We begin the fourth year of our defined Five Year Carriage Good To Great Journey with a company that is materially better in all areas than one year ago. While we understand that public investors must rely on our reported quantitative financial results covering a recent short period of time to judge our progress, the internal qualitative drivers of our increasing quantitative success are our Five Guiding Principles, three innovative operating, leadership and growth models, High Performance Standards, relentless focus on 4E Leadership and Right Quality of Staff and the collaboration dynamic across all field operations and Houston Support teams. Linked together, these ideas and concepts form our High Performance Culture Framework of value creation, which we believe will produce superior quantitative results over the next several years that will attract the best acquisition candidates and talent in our industry to join and contribute to the Carriage Good To Great Journey.

As we successfully execute our three models (Standards Operating, Strategic Acquisition and 4E Leadership) over this year and next to complete our Five Year Good to Great Journey, we fully expect to accelerate the earning power of our Carriage Consolidation and Operating Platform. However, by the end of 2016 we will also have redefined our Carriage Good to Great Journey over a new five year timeframe with new goals, always keeping our Mission of Being The Best and Five Guiding Principles together with shareholder value creation uppermost in mind. Lastly and importantly for our company leadership and employees, I am extremely proud to publicly announce our Good To Great annual theme for this year,” concluded Mr. Payne.

“Carriage Services 2015: High Performance through Passion and Partnership!”

TOTAL FIELD OPERATIONS

For the Year Ended December 31, 2014 compared to Year Ended December 31, 2013

• | Total Field Revenue increased 6.1% to $226.1 million; |

• | Total Field EBITDA increased 7.0% to $90.4 million; |

• | Total Field EBITDA Margin increased 40 basis points to 40.0%; |

• | Total Funeral Operating Revenue increased 6.8% to $164.3 million; |

• | Same Store Funeral Revenue decreased 0.7% with same store volume decreasing 1.2%; |

• | Acquisition Funeral Revenue increased 33.5% with acquisition volume increasing 26.9%; |

• | Total Funeral Field EBITDA increased 9.0% to $60.5 million; |

• | Total Funeral Field EBITDA Margin increased 80 basis points to 36.8%; |

• | Total Cemetery Operating Revenue increased 5.9% to $42.9 million; |

• | Cemetery preneed property sale contracts increased 5.5% to 7,408; |

• | Preneed property revenue recognized increased 5.4% and At-need revenue increased 10.8%; |

• | Total Cemetery Field EBITDA increased 4.1% to $12.2 million; |

• | Total Cemetery Field EBITDA Margin decreased 40 basis points to 28.5%; |

• | Total Financial Revenue increased 1.5% to $19.0 million; |

• | Funeral Financial Revenue increased 2.7% to $9.5 million; |

• | Cemetery Financial Revenue remained flat at $9.5 million; |

• | Total Financial EBITDA increased 2.2% to $17.7 million; |

• | Total Financial EBITDA Margin increased 70 basis points to 93.0%. |

ADJUSTED FREE CASH FLOW

Carriage produced Adjusted Free Cash Flow from operations for the year ended December 31, 2014 of $34.2 million compared to $33.2 million for the corresponding period in 2013. The sources and uses of cash for the year ended December 31, 2013 and 2014 consisted of the following (in millions):

Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||

2013 | 2014 | 2013 | 2014 | ||||||||||||

Cash flow provided by operations | $ | 8.6 | $ | 8.9 | $ | 39.8 | $ | 36.6 | |||||||

Adjustment for tax benefit from Good to Great stock awards | — | — | — | 4.8 | |||||||||||

Cash used for maintenance capital expenditures | (1.9 | ) | (1.9 | ) | (6.6 | ) | (7.2 | ) | |||||||

Adjusted Free Cash Flow | $ | 6.7 | $ | 7.0 | $ | 33.2 | $ | 34.2 | |||||||

Cash at beginning of period | 0.9 | 3.0 | 1.7 | 1.4 | |||||||||||

Acquisitions and land for new construction | (13.7 | ) | (1.0 | ) | (19.7 | ) | (57.9 | ) | |||||||

Net proceeds from sale of businesses and other assets | 1.9 | 0.3 | 10.2 | 2.2 | |||||||||||

Net (payments) borrowings on our revolving credit facility, term loan and long-term debt obligations | 7.6 | (4.3 | ) | (19.0 | ) | 6.1 | |||||||||

Proceeds from issuance of convertible subordinated notes | — | — | — | 143.7 | |||||||||||

Payment of debt issuance costs related to the convertible subordinated notes | — | — | — | (4.7 | ) | ||||||||||

Payment of loan origination costs related to the credit facility | — | — | (0.6 | ) | (0.8 | ) | |||||||||

Redemption of convertible junior subordinated debentures | — | — | — | (89.7 | ) | ||||||||||

Payments for performance-based stock awards | — | — | — | (16.2 | ) | ||||||||||

Cash used for growth capital expenditures | (1.3 | ) | (3.6 | ) | (4.1 | ) | (16.5 | ) | |||||||

Dividends on common stock | (0.5 | ) | (0.5 | ) | (1.8 | ) | (1.8 | ) | |||||||

Excess tax benefit of equity compensation, net of benefit from Good to Great stock awards | (0.4 | ) | (0.6 | ) | 0.6 | (0.8 | ) | ||||||||

Other investing and financing activities | 0.2 | 0.1 | 0.9 | 1.2 | |||||||||||

Cash at end of period | $ | 1.4 | $ | 0.4 | $ | 1.4 | $ | 0.4 | |||||||

ROLLING FOUR QUARTER OUTLOOK RAISED

The Rolling Four Quarter Outlook (“Outlook”) reflects management’s opinion on the performance of our existing portfolio of businesses for the rolling four quarter period ending December 31, 2015, the performance of the trusts, and our view of the activity within the industry acquisition landscape. This Outlook is not intended to be management estimates or forecasts of our future performance, as we believe such precise rolling estimates will be precisely wrong all the time. Rather our intent and goal is to reflect a “roughly right range” most of the time of future Rolling Four Quarter Outlook performance as we execute our Standards Operating, Strategic Acquisition and 4E Leadership Models over time.

ROLLING FOUR QUARTER OUTLOOK – Period Ending December 31, 2015

Range (in millions, except per share amounts) | |

Revenues | $244 - $248 |

Adjusted Consolidated EBITDA | $70 - $72 |

Adjusted Net Income | $28 - $30 |

Adjusted Diluted Earnings Per Share(1) | $1.55 - $1.59 |

Factors affecting our analysis include, among others, number, size and timing of closing of acquisitions, funeral contract volumes, average revenue per funeral service, cemetery interment volumes, preneed cemetery sales, capital expenditures, execution of our funeral and cemetery Standards Operating Model, Strategic Acquisition Model, Withdrawable Trust Income and changes in Federal Reserve monetary policy. Revenues, Adjusted Consolidated EBITDA, Adjusted Net Income and Adjusted Diluted Earnings Per Share for the four quarter period ending December 31, 2015 are expected to improve relative to the same period in the previous period for the following reasons:

• | Increases in Acquired Funeral Revenue and Acquired Funeral Field EBITDA; |

• | Increases in Acquired Cemetery Revenue and Acquired Cemetery Field EBITDA; |

• | Modest increases in Same Store Funeral Revenue and Same Store Funeral Field EBITDA; |

• | Increases in Same Store Cemetery Revenue and Same Store Cemetery Field EBITDA; |

• | Increases in Financial Revenue and Financial EBITDA from trust funds; and |

• | Reduced interest expense in conjunction with the fourth and fifth amendments to our bank credit facilities and the $143.75 2.75% Convertible Notes, including the add-back to Adjusted Diluted EPS of non-tax deductible accretion on the Convertible Notes to reflect the Non-GAAP normalized earning power of the Company. |

(1) | The Rolling Four Quarter Outlook on Adjusted Diluted Earnings Per Share does not include any changes to our fully diluted share count that could occur related to a share price increase and EPS dilution calculations related to our new convertible notes, as explained more fully on page 6 in this press release. |

CONFERENCE CALL AND INVESTOR RELATIONS CONTACT

Carriage Services has scheduled a conference call for tomorrow, February 26, 2015 at 9:30 a.m. CT. To participate in the call, please dial 866-516-3867 (ID-67804537) and ask for the Carriage Services conference call. A replay of the conference call will be available through March 2, 2015 and may be accessed by dialing 855-859-2056 (ID-67804537). The conference call will also be available at www.carriageservices.com. For any investor relations questions, please contact Bill Heiligbrodt at 713-332-8553.

TRUST FUND PERFORMANCE

For the year ended December 31, 2014, Carriage’s discretionary trust funds gained 8.3% compared to our 70/30 index benchmark of 5.8%. Over the same period in the discretionary portfolio, the fixed income return was 6.9%, beating the High Yield Index of 2.5% while the equity return was 7.6%, underperforming the S&P 500 at 13.7%. The current yield on Carriage's discretionary fixed income portfolio, which comprises 72% of discretionary trust assets, is 8.5% and the estimated annual income for the discretionary portfolio is approximately $10.8 million.

Shown below are consolidated performance metrics for the combined trust fund portfolios (preneed funeral, cemetery merchandise and services and cemetery perpetual care) at key dates.

Investment Performance | ||||||||||||

Investment Performance(1) | Index Performance | |||||||||||

Discretionary | Total Trust | S&P 500 Stock Index | High Yield Index | 70/30 index Benchmark(2) | ||||||||

1 year ended 12/31/14 | 8.3 | % | 7.9 | % | 13.7 | % | 2.5 | % | 5.8 | % | ||

2 years ended 12/31/14 | 23.8 | % | 22.7 | % | 50.4 | % | 10.1 | % | 22.2 | % | ||

3 years ended 12/31/14 | 48.9 | % | 43.7 | % | 74.5 | % | 27.5 | % | 41.6 | % | ||

4 years ended 12/31/14 | 44.6 | % | 41.0 | % | 78.1 | % | 33.8 | % | 47.1 | % | ||

5 years ended 12/31/14 | 74.5 | % | 66.6 | % | 105.0 | % | 54.1 | % | 69.3 | % | ||

(1) | Investment performance includes realized income and unrealized appreciation (depreciation). |

(2) | The 70/30 Benchmark is 70% weighted to the High Yield Index and 30% weighted to the S&P 500 Stock Index. |

Asset Allocation as of December 31, 2014 (in thousands) | ||||||||||||||

Discretionary Trust Funds | Total Trust Funds | |||||||||||||

Asset Class | MV | % | MV | % | ||||||||||

Cash | $ | 13,628 | 7 | % | $ | 29,366 | 12 | % | ||||||

Equities | 36,232 | 19 | % | 54,035 | 23 | % | ||||||||

Fixed Income | 134,107 | 72 | % | 149,622 | 63 | % | ||||||||

Other/Insurance | 3,386 | 2 | % | 3,629 | 2 | % | ||||||||

Total Portfolios | $ | 187,353 | 100 | % | $ | 236,652 | 100 | % | ||||||

CONVERTIBLE NOTES

On March 13, 2014, when our common stock closed at $17.03 per share, we executed a new seven year convertible subordinated debenture (new convertible notes) in the amount of $143.75 million with a coupon of 2.75% and 32.5% conversion premium equal to a conversion price of $22.56 per share. We used a majority of the proceeds to refinance a traditional 7% coupon, $90 million convertible security due in 2029 (Tides convertible) with a conversion price of $20.44, which was adding 4.4 million shares to our reported fully diluted EPS calculation (24% dilution) when our stock price traded “in the money” above $20.44 even though none of these securities were ever converted into common stock.

In most traditional convertible securities issued prior to the last ten years (including in our refinanced Tides security issued in 1999), full dilution kicks in to the calculation of EPS once the stock price rises above the conversion price (in the money). That will not be the case with our new convertible notes because of highly favorable anti-dilution features (net share settlement). The in the money option value can be settled in cash using any form of financing at our discretion, meaning that depending on the amount of net share settlement need at any time and the financing method selected by management, the actual number of new shares outstanding in the future may differ materially from the technical calculation of EPS pursuant to the share count mechanics of the new convertible notes.

While the mechanics of the in the money payment features on our new convertible notes are somewhat complex, the main points are that dilution is restricted to under 20% of outstanding shares as of the March 19, 2014 issue date (about 3.6 million shares). The new convertible notes become eligible for conversion at $29.33 per share and reach the maximum potential 20% dilution at a price of $54 per share, as the New York Stock Exchange rules restrict the maximum dilution of an unregistered convertible to 20% for any listed member such as Carriage.

We had about 18 million fully diluted shares outstanding when the new convertible notes were issued in March 2014, so it is easy using the chart below to determine the EPS share count dilution calculation as our share price increases over time. For example, at a share price of $26, the threshold of 5% dilution is reached, so 5% of 18 million or 900,000 shares are added to the weighted average number of fully diluted shares for the period whose EPS performance is covered. Likewise, a share price of $32 triggers the 10% dilution threshold or 1.8 million added shares, a share price of $40 triggers the 15% dilution threshold or 2.7 million additional shares, and a $54 share price triggers the 20% dilution maximum threshold adding 3.6 million shares to our EPS calculation for the EPS period covered.

CARRIAGE SERVICES, INC. | |||||||||||||||||

OPERATING AND FINANCIAL TREND REPORT | |||||||||||||||||

FROM CONTINUING OPERATIONS (IN THOUSANDS - EXCEPT PER SHARE AMOUNTS) | |||||||||||||||||

Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||||

2013 | 2014 | % Change | 2013 | 2014 | % Change | ||||||||||||

Same Store Contracts | |||||||||||||||||

Atneed Contracts | 4,400 | 4,578 | 4.0 | % | 18,149 | 18,133 | -0.1 | % | |||||||||

Preneed Contracts | 1,188 | 1,193 | 0.4 | % | 4,908 | 4,641 | -5.4 | % | |||||||||

Total Same Store Funeral Contracts | 5,588 | 5,771 | 3.3 | % | 23,057 | 22,774 | -1.2 | % | |||||||||

Acquisition Contracts | |||||||||||||||||

Atneed Contracts | 1,513 | 2,079 | 37.4 | % | 5,689 | 7,260 | 27.6 | % | |||||||||

Preneed Contracts | 280 | 387 | 38.2 | % | 1,108 | 1,368 | 23.5 | % | |||||||||

Total Acquisition Funeral Contracts | 1,793 | 2,466 | 37.5 | % | 6,797 | 8,628 | 26.9 | % | |||||||||

Total Funeral Contracts | 7,381 | 8,237 | 11.6 | % | 29,854 | 31,402 | 5.2 | % | |||||||||

Funeral Operating Revenue | |||||||||||||||||

Same Store Revenue | $ | 29,563 | $ | 30,619 | 3.6 | % | $ | 120,191 | $ | 119,322 | -0.7 | % | |||||

Acquisition Revenue | 8,880 | 12,841 | 44.6 | % | 33,660 | 44,930 | 33.5 | % | |||||||||

Total Funeral Operating Revenue | $ | 38,443 | $ | 43,460 | 13.1 | % | $ | 153,851 | $ | 164,252 | 6.8 | % | |||||

Cemetery Operating Revenue | |||||||||||||||||

Same Store Revenue | $ | 9,695 | $ | 10,624 | 9.6 | % | $ | 40,181 | $ | 41,257 | 2.7 | % | |||||

Acquisition Revenue | 66 | 565 | 756.1 | % | 298 | 1,599 | 436.6 | % | |||||||||

Total Cemetery Operating Revenue | $ | 9,761 | $ | 11,189 | 14.6 | % | $ | 40,479 | $ | 42,856 | 5.9 | % | |||||

Financial Revenue | |||||||||||||||||

Preneed Funeral Commission Income | $ | 418 | $ | 400 | -4.3 | % | $ | 1,853 | $ | 2,036 | 9.9 | % | |||||

Preneed Funeral Trust Earnings | 1,794 | 1,949 | 8.6 | % | 7,378 | 7,447 | 0.9 | % | |||||||||

Cemetery Trust Earnings | 1,875 | 2,051 | 9.4 | % | 8,095 | 8,123 | 0.3 | % | |||||||||

Preneed Cemetery Finance Charges | 348 | 370 | 6.3 | % | 1,418 | 1,410 | -0.6 | % | |||||||||

Total Financial Revenue | $ | 4,435 | $ | 4,770 | 7.6 | % | $ | 18,744 | $ | 19,016 | 1.5 | % | |||||

Total Revenue | $ | 52,639 | $ | 59,419 | 12.9 | % | $ | 213,074 | $ | 226,124 | 6.1 | % | |||||

Field EBITDA | |||||||||||||||||

Same Store Funeral Field EBITDA | $ | 10,004 | $ | 12,050 | 20.5 | % | $ | 44,973 | $ | 44,756 | -0.5 | % | |||||

Same Store Funeral Field EBITDA Margin | 33.8 | % | 39.4 | % | 560 bp | 37.4 | % | 37.5 | % | 10 bp | |||||||

Acquisition Funeral Field EBITDA | 2,743 | 4,711 | 71.7 | % | 10,486 | 15,718 | 49.9 | % | |||||||||

Acquisition Funeral Field EBITDA Margin | 30.9 | % | 36.7 | % | 580 bp | 31.2 | % | 35.0 | % | 380 bp | |||||||

Total Funeral Field EBITDA | $ | 12,747 | $ | 16,761 | 31.5 | % | $ | 55,459 | $ | 60,474 | 9.0 | % | |||||

Total Funeral Field EBITDA Margin | 33.2 | % | 38.6 | % | 540 bp | 36.0 | % | 36.8 | % | 80 bp | |||||||

Same Store Cemetery Field EBITDA | $ | 2,684 | $ | 3,290 | 22.6 | % | $ | 11,757 | $ | 11,845 | 0.7 | % | |||||

Same Store Cemetery Field EBITDA Margin | 27.7 | % | 31.0 | % | 330 bp | 29.3 | % | 28.7 | % | -60 bp | |||||||

Acquisition Cemetery Field EBITDA | (10 | ) | 112 | 1,220.0 | % | (43 | ) | 351 | 916.3 | % | |||||||

Acquisition Cemetery Field EBITDA Margin | -15.2 | % | 19.8 | % | 3,500 bp | -14.4 | % | 22.0 | % | 3,640 bp | |||||||

Total Cemetery Field EBITDA | $ | 2,674 | $ | 3,402 | 27.2 | % | $ | 11,714 | $ | 12,196 | 4.1 | % | |||||

Total Cemetery Field EBITDA Margin | 27.4 | % | 30.4 | % | 300 bp | 28.9 | % | 28.5 | % | -40 bp | |||||||

Funeral Financial EBITDA | $ | 1,958 | $ | 2,041 | 4.2 | % | $ | 7,966 | $ | 8,348 | 4.8 | % | |||||

Cemetery Financial EBITDA | 2,179 | 2,358 | 8.2 | % | 9,338 | 9,341 | — | % | |||||||||

Total Financial EBITDA | $ | 4,137 | $ | 4,399 | 6.3 | % | $ | 17,304 | $ | 17,689 | 2.2 | % | |||||

Total Financial EBITDA Margin | 93.3 | % | 92.2 | % | -110 bp | 92.3 | % | 93.0 | % | 70 bp | |||||||

Total Field EBITDA | $ | 19,558 | $ | 24,562 | 25.6 | % | $ | 84,477 | $ | 90,359 | 7.0 | % | |||||

Total Field EBITDA Margin | 37.2 | % | 41.3 | % | 410 bp | 39.6 | % | 40.0 | % | 40 bp | |||||||

OPERATING AND FINANCIAL TREND REPORT | |||||||||||||||||

FROM CONTINUING OPERATIONS (IN THOUSANDS - EXCEPT PER SHARE AMOUNTS) | |||||||||||||||||

Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||||

2013 | 2014 | % Change | 2013 | 2014 | % Change | ||||||||||||

Overhead | |||||||||||||||||

Total Variable Overhead | $ | 1,944 | $ | 2,425 | 24.7 | % | $ | 8,845 | $ | 10,764 | 21.7 | % | |||||

Total Regional Fixed Overhead | 538 | 758 | 40.9 | % | 3,346 | 3,136 | -6.3 | % | |||||||||

Total Corporate Fixed Overhead | 4,819 | 4,902 | 1.7 | % | 20,829 | 20,227 | -2.9 | % | |||||||||

Total Overhead | $ | 7,301 | $ | 8,085 | 10.7 | % | $ | 33,020 | $ | 34,127 | 3.4 | % | |||||

Overhead as a percent of sales | 13.9 | % | 13.6 | % | -30 bp | 15.5 | % | 15.1 | % | -40 bp | |||||||

Consolidated EBITDA | $ | 12,257 | $ | 16,477 | 34.4 | % | $ | 51,457 | $ | 56,232 | 9.3 | % | |||||

Consolidated EBITDA Margin | 23.3 | % | 27.7 | % | 440 bp | 24.1 | % | 24.9 | % | 80 bp | |||||||

Other Expenses and Interest | |||||||||||||||||

Property Depreciation & Amortization | $ | 2,823 | $ | 3,142 | 11.3 | % | $ | 11,635 | $ | 11,923 | 2.5 | % | |||||

Non Cash Stock Compensation | 617 | 920 | 49.1 | % | 2,916 | 3,832 | 31.4 | % | |||||||||

Interest Expense | 3,066 | 2,593 | -15.4 | % | 13,437 | 10,308 | -23.3 | % | |||||||||

Accretion on Convertible Subordinated Notes | — | 805 | — | 2,452 | |||||||||||||

Loss on Early Extinguishment of Debt | — | — | — | 1,042 | |||||||||||||

Loss on Redemption of Convertible Junior Subordinated Debentures | — | — | — | 3,779 | |||||||||||||

Other, Net | — | 571 | (896 | ) | 195 | -121.8 | % | ||||||||||

Pretax Income | $ | 5,751 | $ | 8,446 | 46.9 | % | $ | 24,365 | $ | 22,701 | -6.8 | % | |||||

Net Tax Provision | 1,519 | 3,079 | 9,245 | 7,255 | |||||||||||||

GAAP Net Income | $ | 4,232 | $ | 5,367 | 26.8 | % | $ | 15,120 | $ | 15,446 | 2.2 | % | |||||

Special Items, Net of tax except for ** | |||||||||||||||||

Withdrawable Trust Income | $ | 281 | $ | 198 | $ | 960 | $ | 1,181 | |||||||||

Acquisition and Divestiture Expenses | 246 | 49 | 496 | 764 | |||||||||||||

Severance Costs | 105 | 101 | 965 | 697 | |||||||||||||

Consulting Fees | 90 | 41 | 368 | 277 | |||||||||||||

Other Incentive Compensation | — | — | — | 660 | |||||||||||||

Accretion on Convertible Subordinated Notes ** | — | 805 | — | 2,452 | |||||||||||||

Costs Related to Credit Facility | — | — | 248 | 688 | |||||||||||||

Loss on Redemption of Convertible Junior Subordinated Debentures | — | — | — | 2,493 | |||||||||||||

Loss (Gain) on Asset Purchase | — | 379 | — | (367 | ) | ||||||||||||

Securities Transaction Expenses | — | — | 160 | — | |||||||||||||

Other Special Items | — | — | (484 | ) | 503 | ||||||||||||

Tax Adjustment from Prior Period ** | (338 | ) | — | 260 | — | ||||||||||||

Sum of Special Items, Net of tax | $ | 384 | $ | 1,573 | 309.6 | % | $ | 2,973 | $ | 9,348 | 214.4 | % | |||||

Adjusted Net Income | $ | 4,616 | $ | 6,940 | 50.3 | % | $ | 18,093 | $ | 24,794 | 37.0 | % | |||||

Adjusted Net Profit Margin | 8.8 | % | 11.7 | % | 290 bp | 8.5 | % | 11.0 | % | 250 bp | |||||||

Adjusted Basic Earnings Per Share | $ | 0.25 | $ | 0.38 | 52.0 | % | $ | 1.00 | $ | 1.35 | 35.0 | % | |||||

Adjusted Diluted Earnings Per Share | $ | 0.25 | $ | 0.38 | 52.0 | % | $ | 0.98 | $ | 1.34 | 36.7 | % | |||||

GAAP Basic Earnings Per Share | $ | 0.23 | $ | 0.29 | 26.1 | % | $ | 0.83 | $ | 0.84 | 1.2 | % | |||||

GAAP Diluted Earnings Per Share | $ | 0.23 | $ | 0.29 | 26.1 | % | $ | 0.82 | $ | 0.83 | 1.2 | % | |||||

Effective Tax Rate | 26.4 | % | 36.5 | % | 37.9 | % | 32.0 | % | |||||||||

Reconciliation to Adjusted Consolidated EBITDA | |||||||||||||||||

Consolidated EBITDA | $ | 12,257 | $ | 16,477 | 34.4 | % | $ | 51,457 | $ | 56,232 | 9.3 | % | |||||

Withdrawable Trust Income | 426 | 300 | 1,454 | 1,788 | |||||||||||||

Acquisition and Divestiture Expenses | 372 | 74 | 752 | 1,158 | |||||||||||||

Severance Costs | 158 | 153 | 1,462 | 1,056 | |||||||||||||

Consulting Fees | 136 | 62 | 557 | 419 | |||||||||||||

Securities Transaction Expenses | — | — | 242 | — | |||||||||||||

Other Incentive Compensation | — | — | — | 1,000 | |||||||||||||

Other Special Items | — | — | 83 | — | |||||||||||||

Adjusted Consolidated EBITDA | $ | 13,349 | $ | 17,066 | 27.8 | % | $ | 56,007 | $ | 61,653 | 10.1 | % | |||||

Adjusted Consolidated EBITDA Margin | 25.4 | % | 28.7 | % | 330 bp | 26.3 | % | 27.3 | % | 100 bp | |||||||

CARRIAGE SERVICES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

December 31, | |||||||

2013 | 2014 | ||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 1,377 | $ | 413 | |||

Accounts receivable, net | 17,950 | 19,264 | |||||

Assets held for sale | 3,544 | — | |||||

Inventories | 5,300 | 5,294 | |||||

Prepaid expenses | 4,421 | 4,590 | |||||

Other current assets | 3,525 | 7,144 | |||||

Total current assets | 36,117 | 36,705 | |||||

Preneed cemetery trust investments | 68,341 | 71,972 | |||||

Preneed funeral trust investments | 97,144 | 97,607 | |||||

Preneed receivables, net | 24,521 | 26,284 | |||||

Receivables from preneed trusts | 11,166 | 12,809 | |||||

Property, plant and equipment, net | 160,690 | 186,211 | |||||

Cemetery property | 72,911 | 75,564 | |||||

Goodwill | 221,087 | 257,442 | |||||

Deferred charges and other non-current assets | 12,280 | 14,264 | |||||

Cemetery perpetual care trust investments | 42,342 | 48,670 | |||||

Total assets | $ | 746,599 | $ | 827,528 | |||

LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

Current liabilities: | |||||||

Current portion of long-term debt and capital lease obligations | $ | 13,424 | $ | 9,838 | |||

Accounts payable | 7,046 | 6,472 | |||||

Other liabilities | 9,939 | 1,437 | |||||

Accrued liabilities | 12,854 | 15,203 | |||||

Liabilities associated with assets held for sale | 4,357 | — | |||||

Total current liabilities | 47,620 | 32,950 | |||||

Long-term debt, net of current portion | 105,642 | 111,887 | |||||

Revolving credit facility | 36,900 | 40,500 | |||||

Convertible junior subordinated debentures due in 2029 to an affiliate | 89,770 | — | |||||

Convertible subordinated notes due 2021 | — | 114,542 | |||||

Obligations under capital leases, net of current portion | 3,786 | 3,098 | |||||

Deferred preneed cemetery revenue | 55,479 | 56,875 | |||||

Deferred preneed funeral revenue | 30,588 | 31,265 | |||||

Deferred tax liability | 11,915 | 36,414 | |||||

Other long-term liabilities | 1,548 | 2,401 | |||||

Deferred preneed cemetery receipts held in trust | 68,341 | 71,972 | |||||

Deferred preneed funeral receipts held in trust | 97,144 | 97,607 | |||||

Care trusts’ corpus | 41,893 | 48,142 | |||||

Total liabilities | 590,626 | 647,653 | |||||

Commitments and contingencies: | |||||||

Stockholders’ equity: | |||||||

Common stock, $.01 par value; 80,000,000 shares authorized; 22,183,000 and 22,434,000 issued as of December 31, 2013 and 2014, respectively | 222 | 224 | |||||

Additional paid-in capital | 204,324 | 212,386 | |||||

Accumulated deficit | (33,306 | ) | (17,468 | ) | |||

Treasury stock, at cost; 3,922,000 shares at December 31, 2013 and 2014 | (15,267 | ) | (15,267 | ) | |||

Total stockholders’ equity | 155,973 | 179,875 | |||||

Total liabilities and stockholders’ equity | $ | 746,599 | $ | 827,528 | |||

CARRIAGE SERVICES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data)

(unaudited) | |||||||||||||||

For the Three Months Ended December 31, | For the Twelve Months Ended December 31, | ||||||||||||||

2013 | 2014 | 2013 | 2014 | ||||||||||||

Revenues | $ | 52,639 | $ | 59,419 | $ | 213,074 | $ | 226,124 | |||||||

Field costs and expenses | 38,239 | 40,492 | 148,789 | 156,116 | |||||||||||

Gross profit | $ | 14,400 | $ | 18,927 | $ | 64,285 | $ | 70,008 | |||||||

General and administrative expenses | 5,583 | 6,512 | 27,379 | 30,293 | |||||||||||

Operating income | $ | 8,817 | $ | 12,415 | $ | 36,906 | $ | 39,715 | |||||||

Interest expense, net | (3,066 | ) | (2,593 | ) | (12,622 | ) | (10,308 | ) | |||||||

Accretion of discount on convertible subordinated notes | — | (805 | ) | — | (2,452 | ) | |||||||||

Loss on early extinguishment of debt and other costs | — | — | — | (1,042 | ) | ||||||||||

Loss on redemption of convertible junior subordinated debentures | — | — | — | (3,779 | ) | ||||||||||

Other, net | — | (571 | ) | 81 | 567 | ||||||||||

Income from continuing operations before income taxes | $ | 5,751 | $ | 8,446 | $ | 24,365 | $ | 22,701 | |||||||

Net provision for income taxes | (1,519 | ) | (3,079 | ) | (9,245 | ) | (7,255 | ) | |||||||

Net income from continuing operations | $ | 4,232 | $ | 5,367 | $ | 15,120 | $ | 15,446 | |||||||

Net income (loss) from discontinued operations, net of tax | (233 | ) | 11 | 4,176 | 392 | ||||||||||

Net income | $ | 3,999 | $ | 5,378 | $ | 19,296 | $ | 15,838 | |||||||

Preferred stock dividend | — | — | (4 | ) | — | ||||||||||

Net income available to common stockholders | $ | 3,999 | $ | 5,378 | $ | 19,292 | $ | 15,838 | |||||||

Basic earnings per common share: | |||||||||||||||

Continuing operations | $ | 0.23 | $ | 0.29 | $ | 0.83 | $ | 0.84 | |||||||

Discontinued operations | (0.01 | ) | — | 0.23 | 0.02 | ||||||||||

Basic earnings per common share | $ | 0.22 | $ | 0.29 | $ | 1.06 | $ | 0.86 | |||||||

Diluted earnings per common share: | |||||||||||||||

Continuing operations | $ | 0.23 | $ | 0.29 | $ | 0.82 | $ | 0.83 | |||||||

Discontinued operations | (0.01 | ) | — | 0.18 | 0.02 | ||||||||||

Diluted earnings per common share | $ | 0.22 | $ | 0.29 | $ | 1.00 | $ | 0.85 | |||||||

Dividends declared per common share | $ | 0.025 | $ | 0.025 | $ | 0.100 | $ | 0.100 | |||||||

Weighted average number of common and common equivalent shares outstanding: | |||||||||||||||

Basic | 17,920 | 18,170 | 17,826 | 18,108 | |||||||||||

Diluted | 22,488 | 18,358 | 22,393 | 18,257 | |||||||||||

The GAAP Diluted EPS and Adjusted Diluted EPS for the three and twelve months ended December 31, 2013 includes 4.4 million shares that would be issued upon conversion of our convertible subordinated debentures (TIDES) as a result of the if-converted method prescribed by accounting standards.

On August 1, 2014, we received notification that the Internal Revenue Service completed its examination of our tax year ended December 31, 2011 citing no change. As a result, we have re-measured our tax liability for unrecognized tax benefits related to personal goodwill which resulted in a tax benefit recognized of $1.7 million and an increase to Deferred tax liability of $5.6 million. The tax benefit reduced the effective tax rate for the year ended December 31, 2014. Additionally, we recognized a credit to interest expense of $0.6 million related to the settled portion of the uncertain tax position.

CARRIAGE SERVICES, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

For the Years Ended December 31, | ||||||||

2013 | 2014 | |||||||

Cash flows from operating activities: | ||||||||

Net income | $ | 19,296 | $ | 15,838 | ||||

Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

Depreciation and amortization | 11,748 | 11,945 | ||||||

Gain on sale of businesses and purchase of assets | (6,091 | ) | (2,150 | ) | ||||

Impairment of goodwill | 100 | 1,180 | ||||||

Loss on early extinguishment of debt and other costs | — | 1,042 | ||||||

Amortization of deferred financing costs | 362 | 908 | ||||||

Accretion of discount on convertible subordinated notes | — | 2,452 | ||||||

Provision for losses on accounts receivable | 2,005 | 2,877 | ||||||

Stock-based compensation expense | 3,583 | 4,622 | ||||||

Deferred income tax expense | 12,572 | 5,295 | ||||||

Loss on redemption of convertible junior subordinated debentures | — | 2,932 | ||||||

Other | 85 | — | ||||||

Changes in operating assets and liabilities that provided (required) cash: | ||||||||

Accounts and preneed receivables | (3,329 | ) | (4,146 | ) | ||||

Inventories and other current assets | (337 | ) | (2,590 | ) | ||||

Deferred charges and other | (35 | ) | (165 | ) | ||||

Preneed funeral and cemetery trust investments | (1,415 | ) | (203 | ) | ||||

Accounts payable | 1,142 | (562 | ) | |||||

Accrued and other liabilities | (3,294 | ) | (1,529 | ) | ||||

Deferred preneed funeral and cemetery revenue | 1,187 | 303 | ||||||

Deferred preneed funeral and cemetery receipts held in trust | 2,266 | (1,484 | ) | |||||

Net cash provided by operating activities | 39,845 | 36,565 | ||||||

Cash flows from investing activities: | ||||||||

Acquisitions and land for new construction | (19,701 | ) | (57,874 | ) | ||||

Net proceeds from sale of businesses and other assets | 10,184 | 2,192 | ||||||

Capital expenditures | (10,695 | ) | (23,675 | ) | ||||

Net cash used in investing activities | (20,212 | ) | (79,357 | ) | ||||

Cash flows from financing activities: | ||||||||

Net borrowings (payments) on the revolving credit facility | (7,800 | ) | 3,600 | |||||

Net borrowings on the term loan | — | 3,313 | ||||||

Proceeds from the issuance of convertible subordinated notes | — | 143,750 | ||||||

Payment of debt issuance costs related to the convertible subordinated notes | — | (4,650 | ) | |||||

Payments on long-term debt and obligations under capital leases | (11,219 | ) | (840 | ) | ||||

Redemption of convertible junior subordinated debentures | — | (89,748 | ) | |||||

Payments for performance-based stock awards | — | (16,150 | ) | |||||

Proceeds from the exercise of stock options and employee stock purchase plan contributions | 894 | 1,228 | ||||||

Dividends on common stock | (1,817 | ) | (1,840 | ) | ||||

Dividends on redeemable preferred stock | (4 | ) | — | |||||

Payment of loan origination costs | (621 | ) | (825 | ) | ||||

Excess tax benefit of equity compensation | 613 | 3,990 | ||||||

Net cash provided by (used in) financing activities | (19,954 | ) | 41,828 | |||||

Net decrease in cash and cash equivalents | (321 | ) | (964 | ) | ||||

Cash and cash equivalents at beginning of year | 1,698 | 1,377 | ||||||

Cash and cash equivalents at end of year | $ | 1,377 | $ | 413 | ||||

CARRIAGE SERVICES, INC.

CALCULATION OF EARNINGS PER SHARE

(in thousands, except share and per share data)

Year Ended December 31, | |||||||

2013 | 2014 | ||||||

Numerator for basic earnings per share: | |||||||

Numerator from continuing operations | |||||||

Income from continuing operations | $ | 15,120 | $ | 15,446 | |||

Less: Earnings allocated to unvested restricted stock | (314 | ) | (295 | ) | |||

Income attributable to continuing operations | $ | 14,806 | $ | 15,151 | |||

Numerator from discontinued operations | |||||||

Income from discontinued operations | $ | 4,176 | $ | 392 | |||

Less: Earnings allocated to unvested restricted stock | (85 | ) | (8 | ) | |||

Income attributable to discontinued operations | $ | 4,091 | $ | 384 | |||

Numerator for diluted earnings per share: | |||||||

Adjustment for diluted earnings per share: | |||||||

Interest on convertible junior subordinated debentures, net of tax | 3,454 | — | |||||

$ | 3,454 | $ | — | ||||

Income attributable to continuing operations | $ | 18,260 | $ | 15,151 | |||

Income attributable to discontinuing operations | $ | 4,091 | $ | 384 | |||

Denominator | |||||||

Denominator for basic earnings per common share - weighted average shares outstanding | 17,826 | 18,108 | |||||

Effect of dilutive securities: | |||||||

Stock options | 175 | 149 | |||||

Convertible junior subordinated debentures | 4,392 | — | |||||

Denominator for diluted earnings per common share - weighted average shares outstanding | 22,393 | 18,257 | |||||

Basic earnings per common share: | |||||||

Continuing operations | $ | 0.83 | $ | 0.84 | |||

Discontinued operations | 0.23 | 0.02 | |||||

Basic earnings per common share | $ | 1.06 | $ | 0.86 | |||

Diluted earnings per common share: | |||||||

Continuing operations | $ | 0.82 | $ | 0.83 | |||

Discontinued operations | 0.18 | 0.02 | |||||

Diluted earnings per common share | $ | 1.00 | $ | 0.85 | |||

NON-GAAP FINANCIAL MEASURES

This press release uses Non-GAAP financial measures to present the financial performance of the Company. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the Company’s reported operating results or cash flow from operations or any other measure of performance as determined in accordance with GAAP. We believe the Non-GAAP results are useful to investors because such results help investors compare our results to previous periods and provide insights into underlying trends in our business. The Company’s GAAP financial statements accompany this release. Reconciliations of the Non-GAAP financial measures to GAAP measures are provided in this press release.

The Non-GAAP financial measures include “Adjusted Net Income”, “Adjusted Basic Earnings Per Share”, “Adjusted Diluted Earnings Per Share”, “Consolidated EBITDA”, “Adjusted Consolidated EBITDA”, “Adjusted Free Cash Flow”, “Funeral, Cemetery and Financial EBITDA”, “Total Field EBITDA” and “Special Items” in this press release. These financial measurements are defined as similar GAAP items adjusted for Special Items and are reconciled to GAAP in this press release. In addition, the Company’s presentation of these measures may not be comparable to similarly titled measures in other companies’ reports. The definitions used by the Company for our internal management purposes and in this press release are as follows:

• | Adjusted Net Income is defined as net income from continuing operations plus adjustments for special items and other non-recurring expenses or credits. |

• | Consolidated EBITDA is defined as net income from continuing operations before income taxes, interest expenses, non-cash stock compensation, depreciation and amortization, and interest income and other, net. |

• | Adjusted Consolidated EBITDA is defined as Consolidated EBITDA plus adjustments for special items and non-recurring expenses or credits. |

• | Adjusted Free Cash Flow is defined as net cash provided by operations, adjusted by special items as deemed necessary, less cash for maintenance capital expenditures. |

• | Funeral Field EBITDA is defined as Funeral Gross Profit less depreciation and amortization, regional and unallocated overhead expenses and net financial income. |

• | Cemetery Field EBITDA is defined as Cemetery Gross Profit less depreciation and amortization, regional and unallocated overhead expenses and net financial income. |

• | Financial EBITDA is defined as Financial Revenue less Financial Expenses. |

• | Total Field EBITDA is defined as Gross Profit less depreciation and amortization, regional and unallocated overhead expenses. |

• | Special Items is defined as charges or credits that are deemed as Non-GAAP items such as withdrawable trust income, acquisition and divestiture expenses, severance costs, loss on early retirement of debt and other costs, discrete tax items and other non-recurring amounts. Special items are taxed at the federal statutory rate of 34 percent for the three and twelve months ended December 31, 2013 and 2014, except for the accretion of the discount on Convertible Notes as this is a non-tax deductible item and the tax adjustment from prior period. |

• | Adjusted Basic Earnings Per Share is defined as GAAP Basic Earnings Per Share, adjusted for special items. |

• | Adjusted Diluted Earnings Per Share is defined as GAAP Diluted Earnings Per Share, adjusted for special items. |

Certain state regulations allow the withdrawal of financial income from preneed cemetery merchandise and services trust funds when realized in the trust. Under current generally accepted accounting principles, trust income is only recognized in the Company’s financial statements at a later time when the related merchandise and services sold on the preneed contract is delivered at the time of death. Carriage has provided financial income from the trusts, termed “Withdrawable Trust Income” and reported on a Non-GAAP proforma basis within Special Items in the accompanying Operating and Financial Trend Report (a Non-GAAP Unaudited Income Statement), to reflect

the current cash results. Management believes that the Withdrawable Trust Income provides useful information to investors because it presents income and cash flow when earned by the trusts.

Reconciliation of Non-GAAP Financial Measures:

This press release includes the use of certain financial measures that are not GAAP measures. The Non-GAAP financial measures are presented for additional information and are reconciled to their most comparable GAAP measures below.

Reconciliation of Net Income from continuing operations to Adjusted Net Income for the three and twelve months ended December 31, 2013 and 2014 (in thousands):

Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||

2013 | 2014 | 2013 | 2014 | ||||||||||||

Net Income from continuing operations | $ | 4,232 | $ | 5,367 | $ | 15,120 | $ | 15,446 | |||||||

Special items, net of tax except for ** | |||||||||||||||

Withdrawable Trust Income | 281 | 198 | 960 | 1,181 | |||||||||||

Acquisition and Divestiture Expenses | 246 | 49 | 496 | 764 | |||||||||||

Severance Costs | 105 | 101 | 965 | 697 | |||||||||||

Consulting Fees | 90 | 41 | 368 | 277 | |||||||||||

Other Incentive Compensation | — | — | — | 660 | |||||||||||

Securities Transaction Expenses | — | — | 160 | — | |||||||||||

Accretion of Discount on Convertible Subordinated Notes ** | — | 805 | — | 2,452 | |||||||||||

Costs Related to the Credit Facility | — | — | 248 | 688 | |||||||||||

Loss on Redemption of Convertible Junior Subordinated Debentures | — | — | — | 2,493 | |||||||||||

Loss (gain) on Asset Purchase | — | 379 | — | (367 | ) | ||||||||||

Other Special Items | — | — | (484 | ) | 503 | ||||||||||

Tax Adjustment from Prior Period ** | (338 | ) | — | 260 | — | ||||||||||

Total Special items affecting net income | $ | 384 | $ | 1,573 | $ | 2,973 | $ | 9,348 | |||||||

Adjusted Net Income | $ | 4,616 | $ | 6,940 | $ | 18,093 | $ | 24,794 | |||||||

Reconciliation of Net Income from continuing operations to Consolidated EBITDA and Adjusted Consolidated EBITDA for the three and twelve months ended December 31, 2013 and 2014 (in thousands):

Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||

2013 | 2014 | 2013 | 2014 | ||||||||||||

Net income from continuing operations | $ | 4,232 | $ | 5,367 | $ | 15,120 | $ | 15,446 | |||||||

Net provision for income taxes | 1,519 | 3,079 | 9,245 | 7,255 | |||||||||||

Pre-tax earnings from continuing operations | $ | 5,751 | $ | 8,446 | $ | 24,365 | $ | 22,701 | |||||||

Interest expense | 3,066 | 2,593 | 13,437 | 10,308 | |||||||||||

Accretion of discount on convertible subordinated notes | — | 805 | — | 2,452 | |||||||||||

Loss on early extinguishment of debt and other costs | — | — | — | 1,042 | |||||||||||

Loss on redemption of convertible junior subordinated debentures | — | — | — | 3,779 | |||||||||||

Non-cash stock compensation | 617 | 920 | 2,916 | 3,832 | |||||||||||

Depreciation & amortization | 2,823 | 3,142 | 11,635 | 11,923 | |||||||||||

Other, net | — | 571 | (896 | ) | 195 | ||||||||||

Consolidated EBITDA | $ | 12,257 | $ | 16,477 | $ | 51,457 | $ | 56,232 | |||||||

Adjusted For: | |||||||||||||||

Withdrawable Trust Income | $ | 426 | $ | 300 | $ | 1,454 | $ | 1,788 | |||||||

Acquisition and Divestiture Expenses | 372 | 74 | 752 | 1,158 | |||||||||||

Severance Costs | 158 | 153 | 1,462 | 1,056 | |||||||||||

Consulting Fees | 136 | 62 | 557 | 419 | |||||||||||

Other Incentive Compensation | — | — | — | 1,000 | |||||||||||

Securities Transaction Expenses | — | — | 242 | — | |||||||||||

Other Special Items | — | — | 83 | — | |||||||||||

Adjusted Consolidated EBITDA | $ | 13,349 | $ | 17,066 | $ | 56,007 | $ | 61,653 | |||||||

Revenue | $ | 52,639 | $ | 59,419 | $ | 213,074 | $ | 226,124 | |||||||

Adjusted Consolidated EBITDA Margin | 25.4 | % | 28.7 | % | 26.3 | % | 27.3 | % | |||||||

Reconciliation of funeral and cemetery income before income taxes to Field EBITDA for the three and twelve months ended December 31, 2013 and 2014 (in thousands):

Funeral Field EBITDA | Three Months Ended December 31, | Twelve Months Ended December 31, | |||||||||||||

2013 | 2014 | 2013 | 2014 | ||||||||||||

Gross Profit (GAAP) | $ | 11,057 | $ | 14,537 | $ | 48,874 | $ | 54,102 | |||||||

Depreciation & amortization | 1,771 | 1,782 | 6,440 | 6,841 | |||||||||||

Regional & unallocated costs | 1,877 | 2,483 | 8,111 | 7,879 | |||||||||||

Net financial income | (1,958 | ) | (2,041 | ) | (7,966 | ) | (8,348 | ) | |||||||

Funeral Field EBITDA | $ | 12,747 | $ | 16,761 | $ | 55,459 | $ | 60,474 | |||||||

Funeral Field Operating Revenue | $ | 38,443 | $ | 43,460 | $ | 153,851 | $ | 164,252 | |||||||

Funeral Field EBITDA Margin | 33.2 | % | 38.6 | % | 36.0 | % | 36.8 | % | |||||||

Cemetery Field EBITDA | Three Months Ended December 31, | Twelve Months Ended December 31, | |||||||||||||

2013 | 2014 | 2013 | 2014 | ||||||||||||

Gross Profit (GAAP) | $ | 3,343 | $ | 4,390 | $ | 15,411 | $ | 15,906 | |||||||

Depreciation & amortization | 1,166 | 1,019 | 3,739 | 3,704 | |||||||||||

Regional & unallocated costs | 344 | 351 | 1,902 | 1,927 | |||||||||||

Net financial income | (2,179 | ) | (2,358 | ) | (9,338 | ) | (9,341 | ) | |||||||

Cemetery Field EBITDA | $ | 2,674 | $ | 3,402 | $ | 11,714 | $ | 12,196 | |||||||

Cemetery Field Operating Revenue | $ | 9,761 | $ | 11,189 | $ | 40,479 | $ | 42,856 | |||||||

Cemetery Field EBITDA Margin | 27.4 | % | 30.4 | % | 28.9 | % | 28.5 | % | |||||||

Total Field EBITDA | Three Months Ended December 31, | Twelve Months Ended December 31, | |||||||||||||

2013 | 2014 | 2013 | 2014 | ||||||||||||

Funeral Field EBITDA | $ | 12,747 | $ | 16,761 | $ | 55,459 | $ | 60,474 | |||||||

Cemetery Field EBITDA | 2,674 | 3,402 | 11,714 | 12,196 | |||||||||||

Funeral Financial EBITDA | 1,958 | 2,041 | 7,966 | 8,348 | |||||||||||

Cemetery Financial EBITDA | 2,179 | 2,358 | 9,338 | 9,341 | |||||||||||

Total Field EBITDA | $ | 19,558 | $ | 24,562 | $ | 84,477 | $ | 90,359 | |||||||

Reconciliation of cash provided by operating activities to Adjusted Free Cash Flow from operations for the three and twelve months ended December 31, 2013 and 2014 (in thousands):

Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||

2013 | 2014 | 2013 | 2014 | ||||||||||||

Cash flow provided by operations | $ | 8,629 | $ | 8,916 | $ | 39,845 | $ | 36,565 | |||||||

Adjustment for tax benefit from Good to Great stock awards | — | — | — | 4,802 | |||||||||||

Cash used for maintenance capital expenditures | (1,888 | ) | (1,904 | ) | (6,615 | ) | (7,211 | ) | |||||||

Adjusted Free Cash Flow | $ | 6,741 | $ | 7,012 | $ | 33,230 | $ | 34,156 | |||||||

Reconciliation of GAAP basic earnings per share to Adjusted basic earnings per share for the three and twelve months ended December 31, 2013 and 2014:

Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||

2013 | 2014 | 2013 | 2014 | ||||||||||||

GAAP basic earnings per share from continuing operations | $ | 0.23 | $ | 0.29 | $ | 0.83 | $ | 0.84 | |||||||

Special items affecting net income | 0.02 | 0.09 | 0.17 | 0.51 | |||||||||||

Adjusted basic earnings per share | $ | 0.25 | $ | 0.38 | $ | 1.00 | $ | 1.35 | |||||||

Reconciliation of GAAP diluted earnings per share to Adjusted diluted earnings per share for the three and twelve months ended December 31, 2013 and 2014:

Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||

2013 | 2014 | 2013 | 2014 | ||||||||||||

GAAP diluted earnings per share from continuing operations | $ | 0.23 | $ | 0.29 | $ | 0.82 | $ | 0.83 | |||||||

Special items affecting net income | 0.02 | 0.09 | 0.13 | 0.51 | |||||||||||

Dilution effect of convertible junior subordinated debentures | — | — | 0.03 | — | |||||||||||

Adjusted diluted earnings per share | $ | 0.25 | $ | 0.38 | $ | 0.98 | $ | 1.34 | |||||||

CAUTIONARY STATEMENT ON FORWARD-LOOKING STATEMENTS