Form 8-K Bunker Hill Mining Corp. For: May 04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) May 4, 2021

BUNKER HILL MINING CORP.

(Exact name of registrant as specified in its charter)

| Nevada | 333-249682 | 32-0196442 | ||

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 82 Richmond Street East, Toronto, Ontario, Canada | M5C 1P1 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code 416-477-7771

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.below):

| [ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of each Exchange on which Registered | ||

| None |

Item 8.01 Other Events.

On May 3, 2021, Bunker Hill Mining Corp. filed a technical report entitled “Technical Report for the Bunker Hill Mine, Coeur d’Alene Mining District, Shoshone County, Idaho, USA” with an effective date of March 22, 2021.

ITEM 9.01(b) Exhibits

| Exhibit | Description | |

| 99 | Technical Report for the Bunker Hill Mine, Coeur d’Alene Mining District, Shoshone County, Idaho, USA |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| BUNKER HILL MINING CORP. | ||

| Date: May 4, 2021 | By: | /s/ Sam Ash |

| Sam Ash | ||

| CEO | ||

Exhibit 99

Technical Report

for the

Bunker Hill Mine

Coeur d’Alene Mining District

Shoshone County, Idaho, USA

Effective Date: March 22, 2021

PREPARED FOR:

Bunker Hill Mining Corp.

by

Resource Development Associates Inc.

Qualified Person

Scott E. Wilson, C.P.G., SME

Highlands Ranch, CO 80126

303-717-3672

Date and Signature Page

Bunker Hill Mining Corp.: Technical Report for the Bunker Hill Mine, Coeur d’Alene Mining District, Shoshone County, Idaho, USA.

Technical Report Effective Date: March 22, 2021

Dated this 3rd day of May, 2021

| (signed/sealed) Scott E. Wilson | |

| Scott E. Wilson, SME-RM, CPG | |

| Geologist |

Author Certificate

Scott E. Wilson

I, Scott E. Wilson, CPG, SME-RM, of Highlands Ranch, Colorado, as the author of the technical report entitled “Technical Report for the Bunker Hill Mine, Coeur d’Alene Mining District, Shoshone County, Idaho, USA” (the “Technical Report”) with an effective date of March 22, 2020 prepared for Bunker Hill Mining Corp. (the “Issuer”), do hereby certify:

| 1. | I am currently employed as President by Resource Development Associates, Inc., 10262 Willowbridge Way, Highlands Ranch, Colorado USA 80126. | |

| 2. | I graduated with a Bachelor of Arts degree in Geology from the California State University, Sacramento in 1989. | |

| 3. | I am a Certified Professional Geologist and member of the American Institute of Professional Geologists (CPG #10965) and a Registered Member (#4025107) of the Society for Mining, Metallurgy and Exploration, Inc. | |

| 4. | I have been employed as both a geologist and a mining engineer continuously for a total of 31 years. My experience included resource estimation, mine planning, geological modeling, geostatistical evaluations, project development, and authorship of numerous technical reports and preliminary economic assessments of various projects throughout North America, South America and Europe. I have employed and mentored mining engineers and geologists continuously since 2003. | |

| 5. | I have read the definition of “Qualified Person” set out in National Instrument 43-101 (“NI 43-101) and certify that by reason of my education, affiliation with a professional association (as defined in NI 43-101) and past relevant work experience, I fulfill the requirements to be a “Qualified Person” for the purposes of NI 43-101. | |

| 6. | I have made several personal inspections of the Bunker Hill Project with the most recent visit January 11-13, 2021. | |

| 7. | I am responsible for Sections 1 through 26 of the Technical Report. | |

| 8. | I am independent of the Issuer as independence is described in Section 1.5 of NI 43-101. | |

| 9. | Prior to being retained by the Issuer, I have not had prior involvement with the property that is the subject of the Technical Report. | |

| 10. | I have read NI 43-101 and Form 43-101F1, and this Technical Report was prepared in compliance with NI 43-101. | |

| 11. | As of the effective date of this Technical Report, to the best of my knowledge, information and belief, the portions of the Technical Report for which I am responsible contain all scientific and technical information that is required to be disclosed to make the portions of the Technical Report for which I am responsible not misleading. |

| Dated: May 3, 2021 | |

| (signed/sealed) Scott Wilson | |

| Scott E. Wilson, CPG, SME-RM |

Table of Contents

| 1 | Summary | 7 |

| 2 | Introduction | 10 |

| 3 | Reliance on Other Experts | 11 |

| 4 | Property Description and Location | 12 |

| 5 | Accessibility, Climate, Local Resources, Infrastructure and Physiography | 62 |

| 6 | History | 63 |

| 7 | Geological Setting and Mineralization | 68 |

| 8 | Deposit Types | 85 |

| 9 | Exploration | 86 |

| 10 | Drilling | 89 |

| 11 | Sample Preparation, Analysis and Security | 98 |

| 12 | Data Verification | 106 |

| 13 | Mineral Processing and Metallurgical Testing | 112 |

| 14 | Mineral Resource Estimates | 113 |

| 15 | Mineral Reserves | 126 |

| 16 | Mining Methods | 127 |

| 17 | Recovery Methods | 128 |

| 18 | Project Infrastructure | 129 |

| 19 | MArket Studies and COntracts | 130 |

| 20 | EnvirOnmental Studies, PErmitting and Social or Community IMpact | 131 |

| 21 | Capital and Operating COsts | 132 |

| 22 | Economic Anlysis | 133 |

| 23 | Adjacent Properties | 134 |

| 24 | Other Relevant Data and Information | 135 |

| 25 | Interpretations and Conclusions | 136 |

| 26 | Recommendations | 137 |

| 27 | References | 138 |

Tables

| Table 1-1 | Bunker Hill Indicated Mineral Resource Estimate– Mineralization Underground Accessible – Economic at Metal Selling Prices of $23 Per Ounce Ag, $1.00 Per Pound Zinc and $0.80 Per Pound Lead. Resources Estimated at a 3.30% Zinc Cutoff Grade. (Qualified Person: RDA, Scott Wilson, CPG; Effective March 22, 2021) | 7 | |

| Table 1-2 | Proposed Budget for Project Advancement | 9 | |

| Table 4-1 | Tax Parcels and Mineral Interests Included in the Lease | 14 | |

| Table 4-2 | Patented Mining Claims Included Under Mineral Guarantee | 15 | |

| Table 6-1 | Mine Production by Zone | 65 | |

| Table 12-1 | Chanel Sample Breakdown | 111 | |

| Table 14-1 | Bunker Hill Mine Indicated Mineral Resources at Zinc Selling Price of USD $1.00 per Pound, Pb Selling Price of $0.80 Per Pound and Silver Selling Price of $23 Per Ounce (Effective date March 22, 2021) | 113 | |

| Table 14-2 | Bunker Hill Mine Inferred Mineral Resources at Zinc Selling Price of USD $1.00 per Pound, Pb Selling Price of $0.80 Per Pound and Silver Selling Price of $23 Per Ounce (Effective date March 22, 2021) | 114 | |

| Table 14-3 | Bunker Hill Mine Inferred PbAg Mineral Resource (Effective Date March 22, 2021) | 124 | |

| Table 14-4 | Bunker Hill Mine Inferred ZnAg Mineral Resource (Effective Date March22, 2021) | 125 | |

| Table 14-5 | Bunker Hill Mine Indicated ZnAg Mineral Resource (Effective Date March22, 2021) | 125 | |

| Table 23-1 | Crescent Silver Project Mineral Resource | 135 | |

| Table 23-2 | Sunshine Mine Mineral Resource Estimate | 135 | |

| Table 26-1 | Proposed Phase 1 Work Program to Advance Bunker Hill | 137 |

Figures

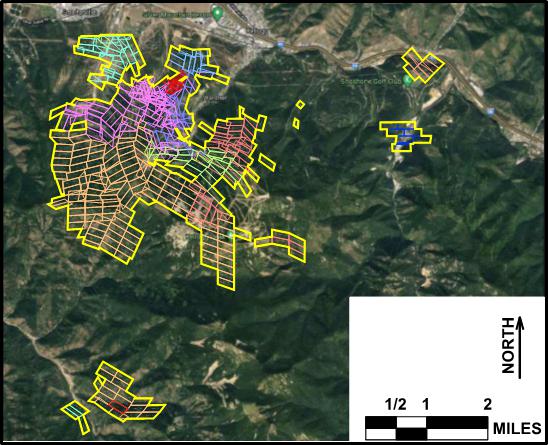

| Figure 4-1 | Property Map of Bunker Hill Mine Patented Mining Claims | 12 | |

| Figure 7-1 | Stratigraphic section of Belt-Purcell Supergroup across northern Idaho and western Montana. Mineral deposits noted in red at stratigraphic position of host rocks (from Lyndon, 2007). | 68 | |

| Figure 7-2 | Geologic map of Shoshone County, clipped and centered on Coeur d’Alene Mining District, Bunker Hill Mine highlighted in red (IGS 2002). | 69 | |

| Figure 7-3- (1 of 2) | Diagrammatic sequence of large-scale events in the structural history of CDA District rocks | 71 | |

| Figure 7-4 (2 of 2) | Diagrammatic sequence of large-scale events in the structural history of CDA District rocks | 72 | |

| Figure 7-5 | Surface geology over Bunker Hill Mine. Cross-Section A-A’ shown below in Fig. X10. (White and Juras 1976) | 73 | |

| Figure 7-6 | Stratigraphic section of Revett formation in Bunker Hill area (White, 1976) | 75 | |

| Figure 7-7 | Geologic Map of Bunker Hill Mine 17 Level showing quartzite units and exploration drill holes | 76 | |

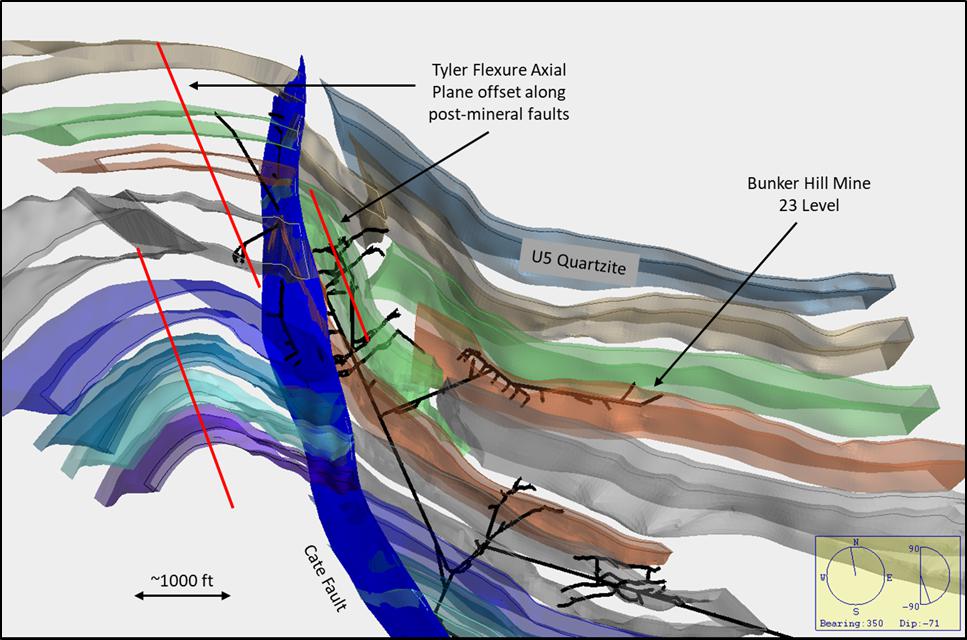

| Figure 7-8 | Isometric view of Vulcan 3D model of L-0 through U-5 Quartzite units, looking nearly down-plunge on the Tyler Ridge Flexure axial plane, shown as red lines offset by faults. Note post-fold offsets of stratigraphy along numerous faults, only Cate Fault i | 77 | |

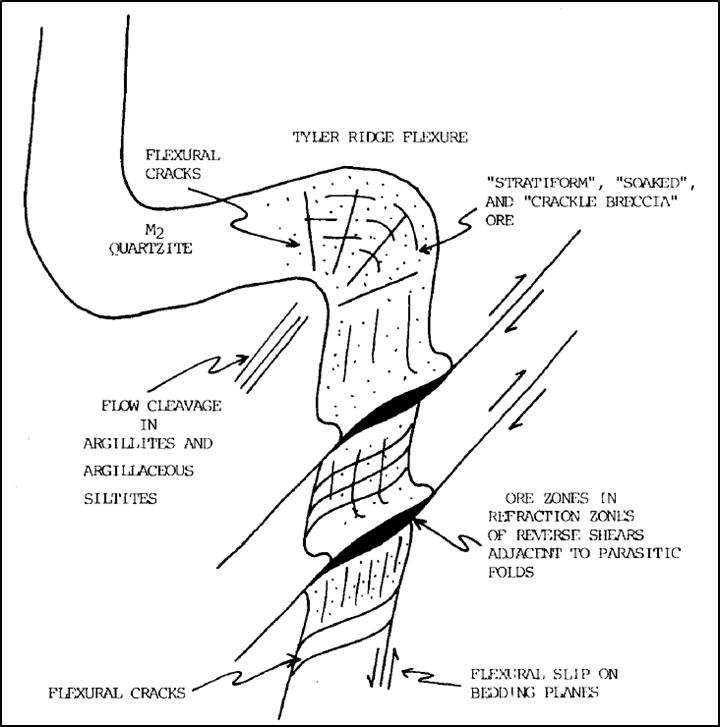

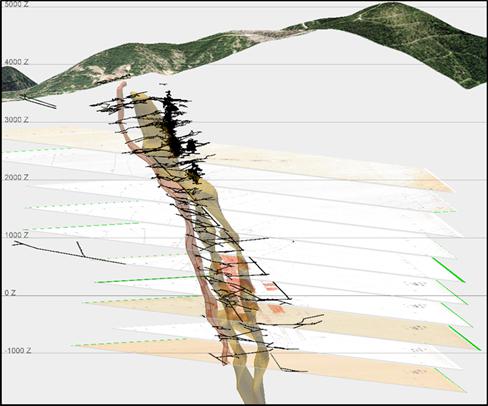

| Figure 7-9 | Diagram of structural preparation of a quartzite bed from folding stresses (Juras and Duff, 2020) | 78 | |

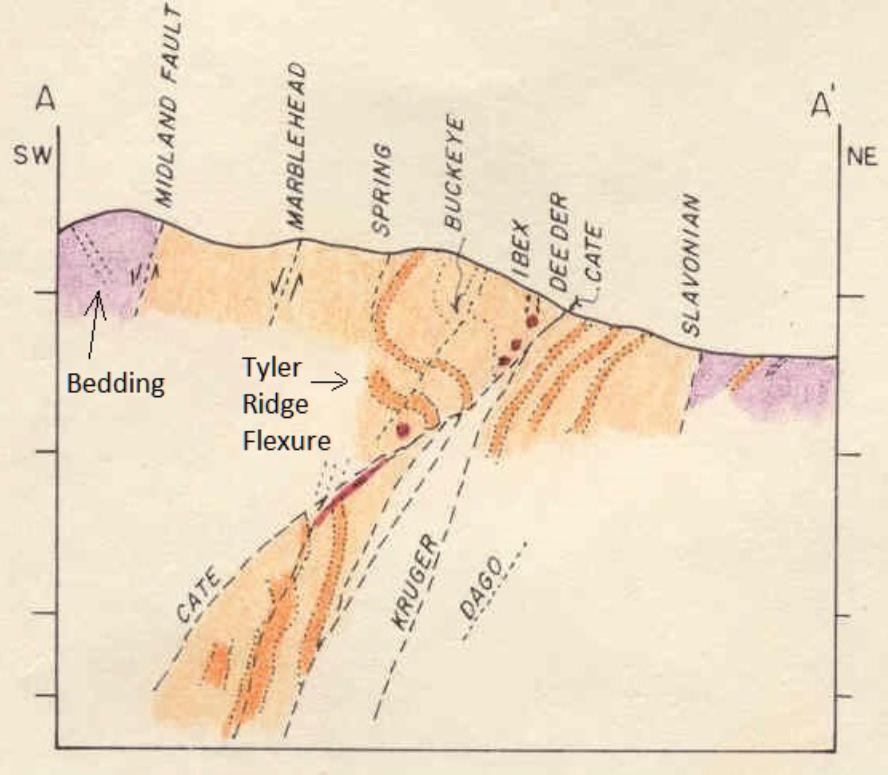

| Figure 7-10 | Cross-section A-A’ looking W-NW, not to scale, from surface geology map Fig. X5 (White and Juras 1976). Darker orange is quartzite bed in Upper Revett Formation, legend on Fig. X5 | 79 | |

| Figure 7-11 | Bunker Hill Mine workings with 3D vein models showing difference between Bluebird and Galena-Quartz Vein systems and location of hybrid mineralized zones. | 81 | |

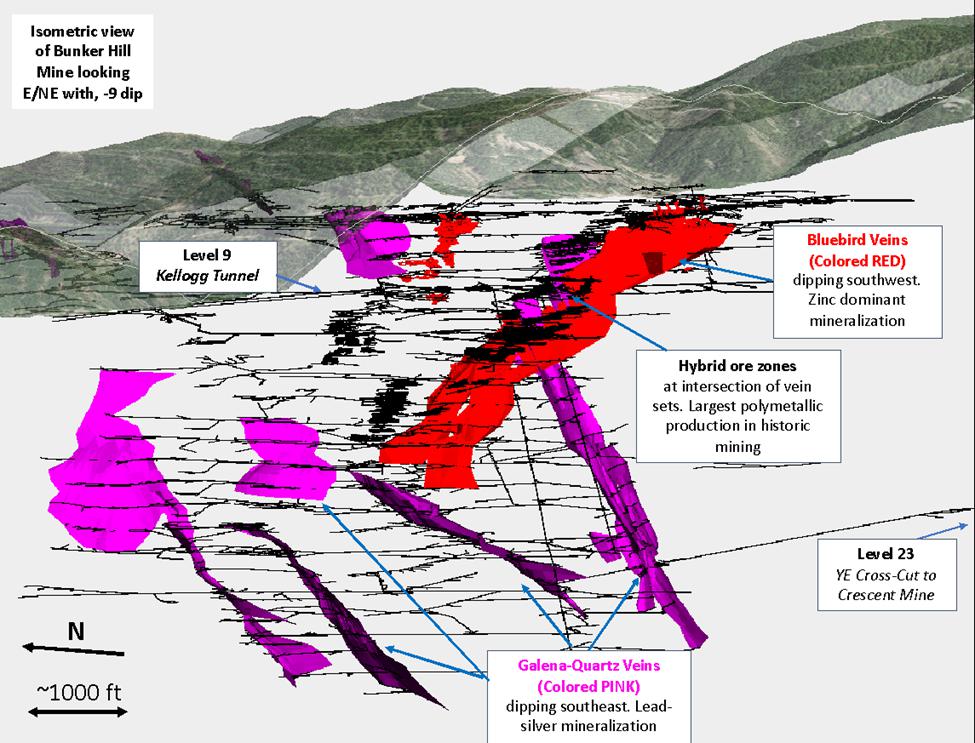

| Figure 7-12 | Plan view and cross-sectional diagram of formation of mineralized shoot along vein in quartzite unit where rheologic contrast between argillite and quartzite causes refraction of vein surface (Juras, 1977) | 83 | |

| Figure 9-1 | 1500 ft thick cross-section along BH #2 Shaft, looking at 106 azm, -12 degrees. Mine levels and shafts are black lines, thin dark orange shape between levels on left is 3D model of U-1 quartzite unit of Revett formation, thick orange shape is M-3 siltite-argillite unit. Shapes built directly from original field mapping. | 86 | |

| Figure 9-2 | Isometric view of plan section through 3D lithology and Fault Models at BH 9 Level. View is looking 311 azm, -21 dip, with 100’ window on either side of stratigraphy map at 2405’ elevation. | 87 | |

| Figure 9-3 | Cross-section through Vulcan 3D models along planned drill hole trace showing expected downhole depths of projected geologic features. Historic Sierra Nevada Mine levels in black center right. | 88 | |

| Figure 12-1 | Rib sample collected from the 082-25-80 sublevel | 108 | |

| Figure 12-2 | Back Sample collected from the 082-25-80 sublevel | 108 | |

| Figure 12-3 | Sample locations on the 070-25-07 sublevel using geo-referenced AutoCAD files | 108 | |

| Figure 12-4 | Sample locations on the 082-25-80 sublevel using geo-referenced AutoCAD files | 109 | |

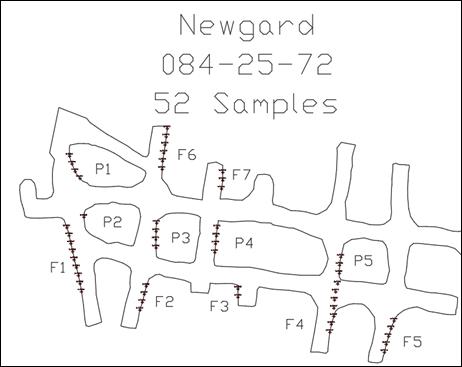

| Figure 12-5 | Sample locations on the 084-25-72 sublevel using geo-referenced AutoCAD files | 110 | |

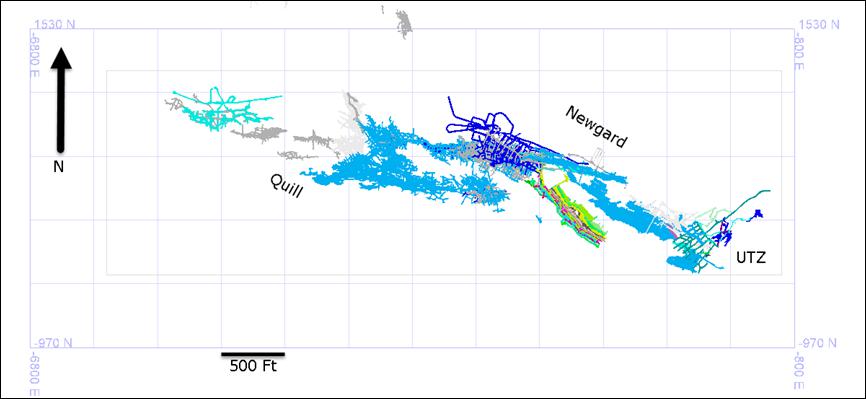

| Figure 14-1 | Quill, Newgard and UTZ deposits of the Bunker Hill Mine. Mineral resources between levels and within pillars have been updated for this report. | 115 | |

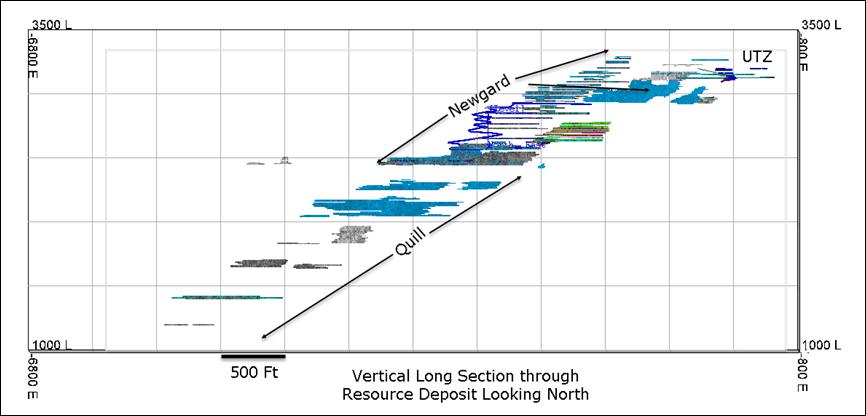

| Figure 14-2 | Vertical long section through the deposit showing currently mined out stopes down-dip and mineralized pillars between stopes. | 116 | |

| Figure 14-3. | Interpretation of mineral envelope based on drilling, mining, and sampling of the deposit. | 117 | |

| Figure 14-4. | Long Section through Drilling used to Support the Mineral Estimate. | 118 | |

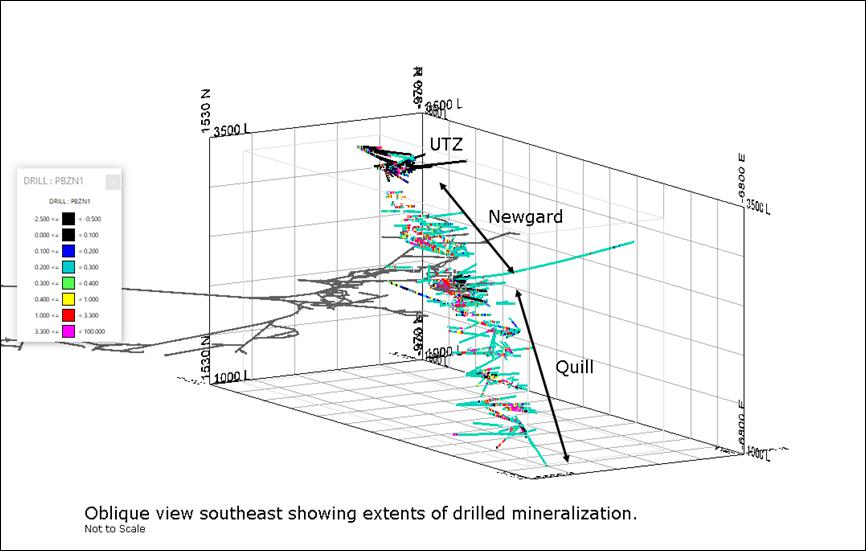

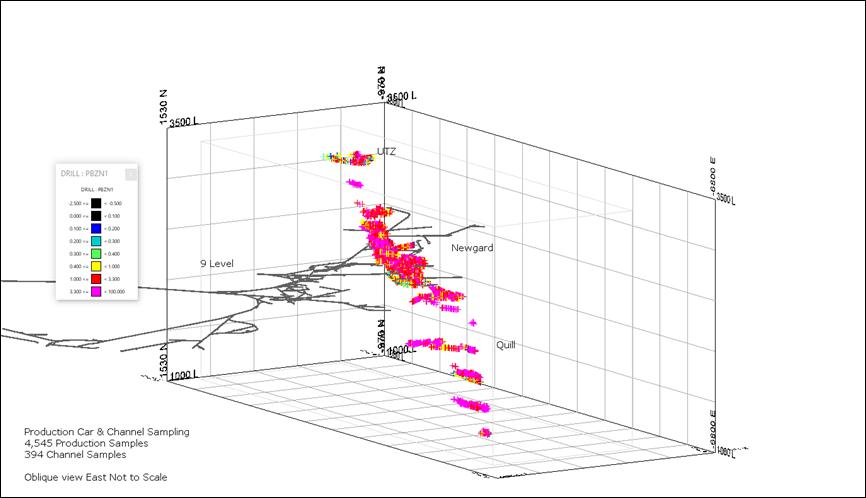

| Figure 14-5. | Oblique view through Drilled Mineralization for the Updated Estimate. | 119 | |

| Figure 14-6 | Channel Sampling and Production Car Sampling use to Support the Mineral Estimate. | 120 | |

| Figure 14-7. | Channel Samples, Production Car Samples and Drilling Composites used for the Mineral Resource Estimate | 121 | |

| Figure 14-8 | Estimated Mineralization at the Zn Cutoff grade of 3.3% | 122 | |

| Figure 14-9 | Classified Mineralization for UTZ, Quill and Newgard Deposits | 123 | |

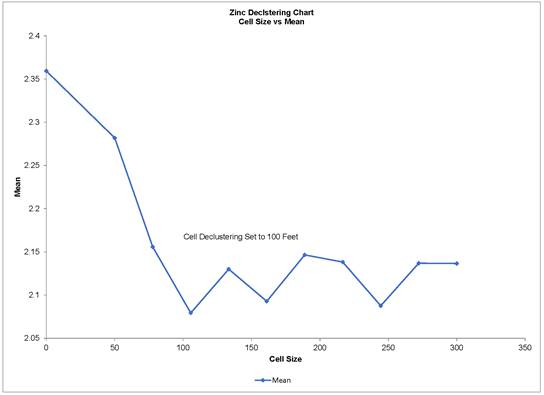

| Figure 14-10 | Cell Declustering used for Zinc and Lead Estimates | 124 |

| Bunker Hill Mining Corp. | |

| Technical Report March 22, 2021 | Page 7 |

1 Summary

This technical report entitled “Technical Report for the Bunker Hill Mine, Coeur d’Alene Mining District, Shoshone County, Idaho, USA” written by Scott E. Wilson, CPG, SME-RM (the “Author”) with an effective date of March 22, 2021 and dated May 3, 2021 (the “Technical Report”) summarizes technical information gathered on the Bunker Hill property (“Bunker” or “Bunker Hill” or “Project” or “Property” or “Bunker Hill Property”) for Bunker Hill Mining Corp. (“BNKR” or the “Company”).

BNKR retained the services of Scott Wilson of Resource Development Associates Inc. (“RDA”) to recommend work programs that would allow the Company to publicly disclose Mineral Resource Estimates for the Bunker Hill mine (the “Bunker Hill Mine” or “Mine”). BNKR first reported Inferred Mineral Resource estimates for the Project on September 29, 2020. These estimates were based on historic reserve estimates which were done historically with a high degree of professionalism and with methodologies that were considered accurate and acceptable within proper engineering principles of the time. RDA concluded that some portion of the mineral resource estimate may be converted to Indicated Mineralization by employing modern resource estimation practices and three-dimensional modelling techniques. RDA completed a grade estimation program for the Newgard and Quill mineral deposits. Additionally, a new inferred and indicated mineral resource has been estimated for the UTZ mineral body which is located near the town of Wardner Idaho.

1.1 Resource Estimates

Table 1-1 Bunker Hill Indicated Mineral Resource Estimate– Mineralization Underground Accessible – Economic at Metal Selling Prices of $23 Per Ounce Ag, $1.00 Per Pound Zinc and $0.80 Per Pound Lead. Resources Estimated at a 3.30% Zinc Cutoff Grade. (Qualified Person: RDA, Scott Wilson, CPG; Effective March 22, 2021)

| Indicated Mineral Resources | Tonnes (x1,000) | Pb % | Pb Lbs. (x1,000) | Ag Oz/Ton | Ag Ounces (x1,000) | Zn % | Zn Lbs. (x1,000) | |||||||||||||||||||||

| ZnAg Indicated Mineral Resources | 4,410 | 2.00 | 176,771 | 0.69 | 3,033 | 5.52 | 487,185 | |||||||||||||||||||||

| Inferred Mineral Resources | Tonnes (x1,000) | Pb % | Pb Lbs. (x1,000) | Ag Oz/Ton | Ag Ounces (x1,000) | Zn % | Zn Lbs. (x1,000) | |||||||||||||||||||||

| PbAg Inferred Mineral Resources | 1,050 | 7.56 | 158,815 | 4.28 | 4,497 | 1.50 | 31,419 | |||||||||||||||||||||

| ZnAg Inferred Mineral Resources | 4,569 | 1.67 | 152,878 | 0.83 | 3,796 | 5.66 | 517,403 | |||||||||||||||||||||

| Bunker Hill Total Inferred Mineral Resources | 5,618 | 2.77 | 311,693 | 1.48 | 8,294 | 4.88 | 548,821 | |||||||||||||||||||||

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources will be converted into Mineral Reserves. Numbers may not add up due to rounding.

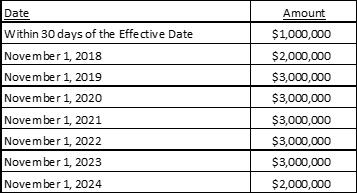

1.2 Property Descriptions and Ownership

Bunker Hill Mine is located in the cities of Kellogg and Wardner of Shoshone County, Idaho. The mine is currently owned by Placer Mining Corporation (“PMC”). On August 17, 2017, BNKR and PMC, entered into a two-year Mining Lease with Option to Purchase (together, the “Lease”). The Lease became effective on November 1, 2017. The lease provides that BNKR will operate the Bunker Hill Mine and make certain improvements on the Mine along with making monthly $60,000 payments to PMC over the term of the lease.

On November 1, 2019, BNKR and the current owner signed an amendment to its Lease for the Bunker Hill Mine. Under the new amended agreement, the lease period has been extended for an additional period of nine months through August 1, 2020.

On July 27, 2020, this Lease was further extended until August 1, 2022.

On November 20, 2020, the parties amended the Lease. Under the amended terms, the purchase price was decreased to $7,700,000, with $5,700,000 payable in cash (with an aggregate of $300,000 to be credited toward the purchase price of the Mine as having been previously paid by BNKR and an aggregate of $5,400,000 payable in cash outstanding) and $2,000,000 in common shares of BNKR. Further, under the amendment to the Lease, BNKR was to make an advance payment of $2,000,000 to PMC, which shall be credited toward the purchase price of the Mine when BNKR elects to exercise its purchase right. BNKR made this advance payment, which had the effect of decreasing the remaining amount payable to purchase the Mine to an aggregate of $3,400,000 payable in cash and $2,000,000 in common shares of BNKR.

Pursuant to the Lease, BNKR has the exclusive right to purchase the Bunker Hill Mine during the lease term upon notice to PMC and the United States (“U.S.”).

| Bunker Hill Mining Corp. | |

| Technical Report March 22, 2021 | Page 8 |

1.3 Geology and Mineralization

The Northern Idaho Panhandle Region in which the Bunker Hill Property is located is underlain by the Middle Proterozoic-aged Belt-Purcell Supergroup of fine-grained, dominantly siliciclastic sedimentary rocks which extends from western Montana (locally named the Belt Supergroup) to southern British Columbia (Locally named the Purcell Supergroup) and is collectively over 23,000 feet in total stratigraphic thickness.

Mineralization at the Bunker Hill Mine is hosted almost exclusively in the Upper Revett formation of the Ravalli Group, a part of the Belt Supergroup of Middle Proterozoic-aged, fine grained sediments. Geologic mapping and interpretation progressed by leaps and bounds following the recognition of a predictable stratigraphic section at the Bunker Hill Mine, and enabled the measurement of specific offsets across major faults, discussed in the following section. From an exploration and mining perspective, there were two critical conclusions from this research: all significant mineralized shoots are hosted in quartzite units where they are cut by vein structures, and the location of the quartzite units can be projected up and down section, and across fault offsets, to targets extensions and offsets of known mineralized shoots and veins.

Mineralization at Bunker Hill falls in four categories, described below from oldest to youngest events:

Bluebird Veins (BB): W—NW striking, SW-dipping (Fig. 7-11), variable ratio of sphalerite-pyrite-siderite mineralization. Thick, tabular cores with gradational margins bleeding out along bedding and fractures. Detailed description in Section 7.2.2.

Stringer/Disseminated Zones: Disseminated, fracture controlled and bedding controlled blebs and stringer mineralization associated with Bluebird Structures, commonly as halos to vein-like bodies or as isolated areas where brecciated quartzite beds are intersected by the W-NW structure and fold fabrics.

Galena-Quartz Veins (GQ): E to NE striking, S to SE dipping (Fig. 7-11), quartz-argentiferous galena +/- siderite-sphalerite-chalcopyrite-tertahedrite veins, sinuous-planar with sharp margins, cross-cut Bluebird Veins. Detailed description in Section 7.2.2.

Hybrid Zones: Formed at intersections where GQ veins cut BB veins (Fig. 7-11), with open space deposition of sulfides and quartz in the vein refraction in quartzite beds, and replacement of siderite in the BB vein structure by argentiferous galena from the GQ Vein.

1.4 Current Exploration and Development

BNKR has a rare exploration opportunity available at the Mine and has embarked on a new path to fully maximize the potential. A treasure trove of geologic and production data has been organized and preserved in good condition in the mine office since the shutdown of major mine operations in the early 1980s. This data represents 70+ years of proper scientific data and sample collection, with high standards of accuracy and precision that were generally at or above industry standards at the time.

The Company saw the wealth of information that was available, but not readily usable, and embarked on a scanning and digitizing program. From this they were able to build a 3D digital model of the mine workings and 3D surfaces and solids of important geologic features. To add to this, all of the historic drill core lithology logs and assay data (>2900 holes) was entered into a database and imported with the other data into Maptek Vulcan 3D software.

Exploration drilling at the Property is focused on the confirmation of silver rich mineralization and wide intercepts of bluebird veins near the Homestake tunnel.

| Bunker Hill Mining Corp. | |

| Technical Report March 22, 2021 | Page 9 |

1.5 Conclusions

BNKR continues investment in the advancement of the Project through drilling, tunnel refurbishment, technical evaluations, internally and with the assistance of reputable consulting firms. RDA is of the opinion that the current Mineral Resources at Bunker Hill are sufficient to warrant continued planning and effort to explore, permit and develop the Project, and that it supports the conclusions herein.

RDA is of the opinion that with a historic silver production of over 160 million ounces, silver mineralization should be investigated with vigorous exploration programs. While base metals are a very important component of the Project and drilling resources are recommended to be allocated to the further delineation and addition of base metal dominant resource, the recent selling price of silver demands attention. The confirmation drilling program identified intercepts of 10 to 20 ounces per ton of sliver. The J vein and Francis stopes hosted high grade silver mineralization and the near-surface historic Caledonia and Sierra Nevada Mines were bonanza grade silver producers in the past. These and other known occurrences of silver must be followed up upon to determine that economic silver occurrences exist on the Bunker Hill Property land package.

1.6 Recommendations

Exploration resources should be aimed at both continued addition and development of base metal resource material as well as silver-dominant resource expansion. Silver resources that have the reasonable prospects of eventual economic extraction have been identified within the current mineral resource estimate. Significant silver mineralization encountered through exploration and past production suggests that these zones should be given as much weight as past Pb and Zn exploration and resource definition programs.

There is sparse information available on the metallurgical characteristic of mineralization at the project. Obviously, historic production from two smelters suggests that metallurgy was understood or even assumed. Modern projects must understand metallurgy in order to begin the process of economic evaluations for the project. Metallurgical samples need to be collected for bluebird mineralization and quartz-galena mineralization as a starting point.

Digitization of nearly 100 years of paper maps is in progress and should be completed. In addition to unlocking the understanding of the geometry of the mineral deposit much of the information describes the mined-out portion of the Project. This will be critical for future mineral resource estimates as mined out voids need to be accounted for.

The projected costs for the continuing phase of this program are outlined in Table 1-2 and remain the focus as recommended in September 2020.

Table 1-2 Proposed Budget for Project Advancement

| Activity | Amount | |||

| Drilling Program focusing on Silver (includes labor and assaying) | $ | 2.10M | ||

| Metallurgical definition characteristics of Bluebird and Quartz-Galena Mineralization | $ | 0.20M | ||

| Digital compilation of historical information | $ | 0.75M | ||

| Environmental Studies as part of care and maintenance | $ | 0.80M | ||

| Rehabilitation and Infrastructure Improvements in Support of Drilling | $ | 1.30M | ||

| Total | $ | 5.15M | ||

| Bunker Hill Mining Corp. | |

| Technical Report March 22, 2021 | Page 10 |

2 Introduction

2.1 Terms of Reference

BNKR retained RDA to complete an independent NI 43-101 Technical Report for Bunker Hill Property located in the Coeur D’Alene Mining District, Shoshone County, Idaho. BNKR has acquired rights to title and to purchase the Property from its current owners, PMC.

The Bunker Hill Mine is a well-developed underground mining operation that ceased production in 1991. At cessation of mining, the Project contained mineralization that had been developed but not exploited. BNKR is implementing a plan to bring the brownfields Project back into production as a competitive mining operation in the Coeur d’Alene Mining District. No modern exploration has taken place on the Property since 1991.

The Project is located adjacent and directly south of the town of Kellogg Idaho. Mineralization at the Project is related to a large deposit of anomalous Lead, Zinc and Silver mineralization. Silver, lead and zinc were discovered at the Project in 1885. Production records kept annually from 1887 through 1991 show that the mine produced 35.78 million tons of mineralized material with head grades averaging grades of 4.52 opt Ag, 8.76% Pb and 3.67% Zn, containing 161.72 million ounces of Ag, 3.13 million tons of Pb and 1.31 million tons of Zn.

The Author has worked closely with the Company to follow the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines, November 29, 2019 and the CIM Mineral Exploration Best Practice Guidelines, November 23, 2018 with respect to the implementation and execution of the collection of scientific data for the Property.

This Technical Report was prepared by RDA, at the request of Mr. Sam Ash, President and CEO of BNKR, a public company trading on the Canadian Securities Exchange (CSE: BNKR) with its corporate office at 82 Richmond Street East, Toronto, Ontario M5C 1P1.

Mr. Scott E. Wilson, (CPG #10965, SME 4025107RM), an independent qualified person under the terms of NI 43-101, has conducted several site visits of the Property with the most recent visit January 11-13, 2021. The most recent site visit was to review the progress on the RDA recommended drilling and channel sampling program. These drilling and sampling campaigns were required by RDA in order to estimate Mineral Resources for the Project.

All dollar amounts in this document are United States dollars unless otherwise noted.

2.2 Sources of Information

This Technical Report is based, in part, on internal company technical reports, and maps, published government reports, company letters, memoranda, public disclosure and public information as listed in the References at the conclusion of this Technical Report. This Technical Report is supplemented by published and available reports provided by the United States Geological Survey (“USGS”), the Idaho Geological Survey, United States Bureau of Land Management and the United States Public Land Survey.

| Bunker Hill Mining Corp. | |

| Technical Report March 22, 2021 | Page 11 |

3 Reliance on Other Experts

With respect to land issues leases and information, the Author of this Technical Report has relied upon the Title Opinion of Lyons O’Dowd Law Firm dated August 12, 2020 as well as written and verbal communication with BNKR in the preparation of Section 4.

No other experts were relied upon in the preparation of this Technical Report.

| Bunker Hill Mining Corp. | |

| Technical Report March 22, 2021 | Page 12 |

4 Property Description and Location

Bunker Hill Mine is located in the cities of Kellogg and Wardner of Shoshone County, Idaho. The Kellogg Tunnel which is the main access to the mine is located at 47.53611°N latitude, 116.1381W longitude. The Mine is currently owned by PMC. On August 17, 2017, BNKR and PMC, entered into a two-year Lease. The Lease became effective on November 1, 2017. The lease provides that BNKR will operate the Bunker Hill Mine and make certain improvements on the Mine along with making monthly $60,000 payments to PMC over the term of the lease.

On November 1, 2019, BNKR and the current owner signed an amendment to its Lease for the Bunker Hill Mine. Under the new amended agreement, the lease period has been extended for an additional period of nine months through August 1, 2020.

On July 27, 2020, this Lease was further extended until August 1, 2022.

On November 20, 2020, the parties amended the Lease. Under the amended terms, the purchase price was decreased to $7,700,000, with $5,700,000 payable in cash (with an aggregate of $300,000 to be credited toward the purchase price of the Mine as having been previously paid by BNKR and an aggregate of $5,400,000 payable in cash outstanding) and $2,000,000 in common shares of BNKR. The reference price for the payment in common shares will be based on the share price of the last equity raise before the option is exercised. Further, under the amendment to the Lease, BNKR was to make an advance payment of $2,000,000 to PMC, which shall be credited toward the purchase price of the Mine when BNKR elects to exercise its purchase right. BNKR made this advance payment, which had the effect of decreasing the remaining amount payable to purchase the Mine to an aggregate of $3,400,000 payable in cash and $2,000,000 in common shares of BNKR.

In August 2020, this Lease was extended until August 1, 2022. Pursuant to the Lease, BNKR has the exclusive right to purchase the Bunker Hill Mine during the lease term upon notice to PMC and the United States. On October 14, 2020 PMC confirmed in writing that BNKR has made all monthly $60,000 payments due under this lease to date.

Figure 4-1 Property Map of Bunker Hill Mine Patented Mining Claims

| Bunker Hill Mining Corp. | |

| Technical Report March 22, 2021 | Page 13 |

4.1 Bunker Hill History

From its early days in the 1890s and through two World Wars, the Bunker Hill Company (“BMC”) operated as an independent and well-known mining and smelting company. BMC was listed on the New York Stock Exchange. On June 1, 1968, Bunker Hill became a wholly owned subsidiary of Gulf Resources & Chemical Corp.

Growing public concern with the environment in the 1970s compelled Bunker Hill to spend large sums on plant improvements in order to comply with newly enacted federal air and water pollution laws. The Company also made major efforts to reclaim surrounding hillsides which had been impacted by the effects of decades of airborne smelter effluents and timbering for mining purposes.

Ultimately the combination of high costs of environmental compliance and declines in metal prices in the early 1980s led to the decision by Gulf Resources in August 1981 to cease operations at Bunker Hill and to sell the mine. In 1982, the company was sold to the Bunker Limited Partnership (“BLP”). The principal owners of BLP were Harry Magnuson, Duane Hagadone, Jack Kendrick and Simplot Development Corporation. Simplot Development Corporation sold its share of the partnership in 1987.

The mine was reopened from 1988 to 1990 by BLP during which time exploration, resource definition, mine development and small-scale production occurred. A decline in metals prices in the early 1990s led BLP to close the mine in January of 1991. Shortly thereafter BLP filed for bankruptcy.

On May 1, 1992, the Bunker Hill Mine was sold to PMC. The sale related to Bunker Hill Mine only. Pintlar, Inc., a subsidiary of Gulf Resources & Chemical Corporation, remained responsible for the environmental cleanup of the portion of the Bunker Hill Superfund Site related to the smelter site. Title to all patented mining claims included in the transaction was transferred from Bunker Hill Mining Corp. (U.S.) Inc. by Warranty Deed in 1992. The sale of the property was properly approved of by the U.S. Trustee and U.S. Bankruptcy Court.

BNKR’s Lease with PMC includes a mix of patented mining claims and ownership of surface parcels. The transaction also includes certain parcels of fee property which includes mineral and surface rights but are not patented mining claims. Mining claims and fee properties are located in Townships 47, 48 North, Range 2 East, Townships 47, 48 North, Range 3 East, Boise Meridian, Shoshone County, Idaho. The patented mining claims described by Figure 4-1, above, cover an area of 5,802.132 acres. The Lease covers all claims that lie within the tax parcels and fee parcels listed in Table 4-1.

| Bunker Hill Mining Corp. | |

| Technical Report March 22, 2021 | Page 14 |

Table 4-1 Tax Parcels and Mineral Interests Included in the Lease

Patented mining claims are listed in Table 4-2, below. There are 406 patented mineral claims included in BNKR’s Mineral Guarantee (see section 4.1.1). Several additional patented mineral claims are included in the Lease. BNKR has engaged the process with PMC to ensure that the title company includes these claims in the mineral guarantee in the near future.

| Bunker Hill Mining Corp. | |

| Technical Report March 22, 2021 | Page 15 |

Table 4-2 Patented Mining Claims Included Under Mineral Guarantee

| Claim Name | M.S. # | Section | Township | Range | ||||||||||||||

| 1 | Tyler | 546 | 12 | 48 North | 2 East | |||||||||||||

| 2 | Emma | 550 | 12 | 48 North | 2 East | |||||||||||||

| 3 | Last Chance | 551 | 12 | 48 North | 2 East | |||||||||||||

| 4 | Sierra Nevada | 554 | 12 | 48 North | 2 East | |||||||||||||

| 5 | Viola | 562 | 12 | 48 North | 2 East | |||||||||||||

| 6 | Oakland | 569 | 11 | 48 North | 2 East | |||||||||||||

| 7 | Jackass | 586 | 13 | 48 North | 2 East | |||||||||||||

| 8 | Lackawana | 614 | 13 | 48 North | 2 East | |||||||||||||

| 9 | Skookum | 615 | 12 | 48 North | 2 East | |||||||||||||

| 10 | Rolling Stone | 619 | 18 | 48 North | 3 East | |||||||||||||

| 11 | Fairview | 621 | 18 | 48 North | 3 East | |||||||||||||

| 12 | San Carlos | 750 | 12 | 48 North | 2 East | |||||||||||||

| 13 | Ontario Fraction | 755 | 11 | 48 North | 2 East | |||||||||||||

| 14 | Sold Again Fraction | 933 | 12 | 48 North | 2 East | |||||||||||||

| 15 | Republican Fraction | 959 | 12 | 48 North | 2 East | |||||||||||||

| 16 | Apex | 1041 | 11 | 48 North | 2 East | |||||||||||||

| 17 | Rambler | 1041 | 11 | 48 North | 2 East | |||||||||||||

| 18 | Tip Top | 1041 | 11 | 48 North | 2 East | |||||||||||||

| 19 | Butte | 1220 | 11 | 48 North | 2 East | |||||||||||||

| 20 | Cariboo | 1220 | 11 | 48 North | 2 East | |||||||||||||

| 21 | Good Luck | 1220 | 11 | 48 North | 2 East | |||||||||||||

| 22 | Jersey Fraction | 1220 | 12 | 48 North | 2 East | |||||||||||||

| 23 | Lilly May | 1220 | 12 | 48 North | 2 East | |||||||||||||

| 24 | Mabundaland | 1227 | 13 | 48 North | 2 East | |||||||||||||

| 25 | Mashonaland | 1227 | 13 | 48 North | 2 East | |||||||||||||

| 26 | Mattabelaland | 1227 | 13 | 48 North | 2 East | |||||||||||||

| 27 | Stopping | 1227 | 13 | 48 North | 2 East | |||||||||||||

| 28 | Zululand | 1227 | 13 | 48 North | 2 East | |||||||||||||

| 29 | Alla | 1228 | 13 | 48 North | 2 East | |||||||||||||

| 30 | Bonanza Fraction | 1228 | 13 | 48 North | 2 East | |||||||||||||

| 31 | East | 1228 | 13 | 48 North | 2 East | |||||||||||||

| 32 | Ironhill | 1228 | 13 | 48 North | 2 East | |||||||||||||

| 33 | Lacrosse | 1228 | 13 | 48 North | 2 East | |||||||||||||

| 34 | Miners Delight | 1228 | 13 | 48 North | 2 East | |||||||||||||

| 35 | No Name | 1228 | 13 | 48 North | 2 East | |||||||||||||

| 36 | Ollie McMillin | 1228 | 13 | 48 North | 2 East | |||||||||||||

| 37 | Schofield | 1228 | 13 | 48 North | 2 East | |||||||||||||

| 38 | Sullivan Extension | 1228 | 13 | 48 North | 2 East | |||||||||||||

| 39 | Summit | 1228 | 13 | 48 North | 2 East | |||||||||||||

| 40 | Allie | 1229 | 13 | 48 North | 2 East | |||||||||||||

| Bunker Hill Mining Corp. | |

| Technical Report March 22, 2021 | Page 16 |

| Claim Name | M.S. # | Section | Township | Range | ||||||||||||||

| 41 | Blue Bird | 1229 | 13 | 48 North | 2 East | |||||||||||||

| 42 | Bought Again | 1229 | 13 | 48 North | 2 East | |||||||||||||

| 43 | Josie | 1229 | 13 | 48 North | 2 East | |||||||||||||

| 44 | Maple | 1229 | 13 | 48 North | 2 East | |||||||||||||

| 45 | Offset | 1229 | 13 | 48 North | 2 East | |||||||||||||

| 46 | Rookery | 1229 | 13 | 48 North | 2 East | |||||||||||||

| 47 | Susie | 1229 | 13 | 48 North | 2 East | |||||||||||||

| 48 | Likely | 1298 | 12 | 48 North | 2 East | |||||||||||||

| 49 | Hornet | 1325 | 12 | 48 North | 2 East | |||||||||||||

| 50 | King | 1325 | 12 | 48 North | 2 East | |||||||||||||

| 51 | Sampson | 1328 | 12 | 48 North | 2 East | |||||||||||||

| 52 | Comstock | 1345 | 18 | 48 North | 3 East | |||||||||||||

| 53 | Daisy | 1345 | 18 | 48 North | 3 East | |||||||||||||

| 54 | Dandy | 1345 | 18 | 48 North | 3 East | |||||||||||||

| 55 | Jessie | 1345 | 18 | 48 North | 3 East | |||||||||||||

| 56 | Julia | 1345 | 18 | 48 North | 3 East | |||||||||||||

| 57 | Justice | 1345 | 18 | 48 North | 3 East | |||||||||||||

| 58 | Ophir | 1345 | 18 | 48 North | 3 East | |||||||||||||

| 59 | Walla Walla | 1345 | 18 | 48 North | 3 East | |||||||||||||

| 60 | Lucky Chance | 1349 | 18 | 48 North | 3 East | |||||||||||||

| 61 | Excelsior | 1356 | 11 | 48 North | 2 East | |||||||||||||

| 62 | No. 1 | 1357 | 11 | 48 North | 2 East | |||||||||||||

| 63 | No. 2 | 1357 | 11 | 48 North | 2 East | |||||||||||||

| 64 | No. 3 | 1357 | 11 | 48 North | 2 East | |||||||||||||

| 65 | No. 4 | 1357 | 11 | 48 North | 2 East | |||||||||||||

| 66 | Reeves | 1412 | 2 | 48 North | 2 East | |||||||||||||

| 67 | Packard | 1413 | 2 | 48 North | 2 East | |||||||||||||

| 68 | Quaker | 1414 | 2 | 48 North | 2 East | |||||||||||||

| 69 | Carter | 1466 | 14 | 48 North | 2 East | |||||||||||||

| 70 | Coxey | 1466 | 14 | 48 North | 2 East | |||||||||||||

| 71 | Deadwood | 1466 | 11 | 48 North | 2 East | |||||||||||||

| 72 | Debs | 1466 | 11 | 48 North | 2 East | |||||||||||||

| 73 | Hamilton | 1466 | 14 | 48 North | 2 East | |||||||||||||

| 74 | Hard Cash | 1466 | 11 | 48 North | 2 East | |||||||||||||

| 75 | Nevada | 1466 | 14 | 48 North | 2 East | |||||||||||||

| 76 | Arizona | 1488 | 12 | 48 North | 2 East | |||||||||||||

| 77 | Danish | 1503 | 2 | 48 North | 2 East | |||||||||||||

| 78 | Wheelbarrow | 1526 | 12 | 48 North | 2 East | |||||||||||||

| 79 | New Era | 1527 | 12 | 48 North | 2 East | |||||||||||||

| 80 | Hamilton Fraction | 1619 | 11 | 48 North | 2 East | |||||||||||||

| 81 | Berniece | 1620 | 14 | 48 North | 2 East | |||||||||||||

| 82 | Mountain King | 1620 | 14 | 48 North | 2 East | |||||||||||||

| 83 | Mountain Queen | 1620 | 14 | 48 North | 2 East | |||||||||||||

| Bunker Hill Mining Corp. | |

| Technical Report March 22, 2021 | Page 17 |

| Claim Name | M.S. # | Section | Township | Range | ||||||||||||||

| 84 | Southern Beauty | 1620 | 14 | 48 North | 2 East | |||||||||||||

| 85 | Waverly | 1620 | 14 | 48 North | 2 East | |||||||||||||

| 86 | Alfred | 1628 | 2 | 48 North | 2 East | |||||||||||||

| 87 | Maggie | 1628 | 2 | 48 North | 2 East | |||||||||||||

| 88 | Good Enough | 1628 | 2 | 48 North | 2 East | |||||||||||||

| 89 | Princess | 1633 | 11 | 48 North | 2 East | |||||||||||||

| 90 | Royal Knight | 1639 | 11 | 48 North | 2 East | |||||||||||||

| 91 | Silver King | 1639 | 11 | 48 North | 2 East | |||||||||||||

| 92 | Phillippine | 1663 | 2 | 48 North | 2 East | |||||||||||||

| 93 | Harrison | 1664 | 11 | 48 North | 2 East | |||||||||||||

| 94 | McClelland | 1681 | 11 | 48 North | 2 East | |||||||||||||

| 95 | 96 | 1715 | 11 | 48 North | 2 East | |||||||||||||

| 96 | Lydia Fraction | 1723 | 2 | 48 North | 2 East | |||||||||||||

| 97 | Mabel | 1723 | 2 | 48 North | 2 East | |||||||||||||

| 98 | Manila | 1723 | 2 | 48 North | 2 East | |||||||||||||

| 99 | O.K. | 1723 | 2 | 48 North | 2 East | |||||||||||||

| 100 | O.K. Western | 1723 | 2 | 48 North | 2 East | |||||||||||||

| 101 | Sunny | 1723 | 2 | 48 North | 2 East | |||||||||||||

| 102 | Whipoorwill | 1723 | 2 | 48 North | 2 East | |||||||||||||

| 103 | Stemwinder | 1830 | 12 | 48 North | 2 East | |||||||||||||

| 104 | Utah | 1882 | 12 | 48 North | 2 East | |||||||||||||

| 105 | Butternut | 1916 | 13 | 48 North | 2 East | |||||||||||||

| 106 | Homestake | 1916 | 13 | 48 North | 2 East | |||||||||||||

| 107 | William Lambert Fraction | 1945 | 2 | 48 North | 2 East | |||||||||||||

| 108 | Overlap | 2052 | 12 | 48 North | 2 East | |||||||||||||

| 109 | Bee | 2072 | 12 | 48 North | 2 East | |||||||||||||

| 110 | Combination | 2072 | 12 | 48 North | 2 East | |||||||||||||

| 111 | Hawk | 2072 | 12 | 48 North | 2 East | |||||||||||||

| 112 | Idaho | 2072 | 12 | 48 North | 2 East | |||||||||||||

| 113 | Iowa | 2072 | 12 | 48 North | 2 East | |||||||||||||

| 114 | Oregon | 2072 | 12 | 48 North | 2 East | |||||||||||||

| 115 | Scorpion Fraction | 2072 | 12 | 48 North | 2 East | |||||||||||||

| 116 | Washington | 2072 | 12 | 48 North | 2 East | |||||||||||||

| 117 | 85 | 2077 | 15 | 48 North | 2 East | |||||||||||||

| 118 | Iowa No. 2 | 2077 | 15 | 48 North | 2 East | |||||||||||||

| 119 | K-10 | 2077 | 15 | 48 North | 2 East | |||||||||||||

| 120 | K-11 | 2077 | 15 | 48 North | 2 East | |||||||||||||

| 121 | K-12 | 2077 | 15 | 48 North | 2 East | |||||||||||||

| 122 | K-13 | 2077 | 15 | 48 North | 2 East | |||||||||||||

| 123 | K-16 | 2077 | 14 | 48 North | 2 East | |||||||||||||

| 124 | K-17 | 2077 | 15 | 48 North | 2 East | |||||||||||||

| 125 | K-18 | 2077 | 15 | 48 North | 2 East | |||||||||||||

| 126 | K-19 | 2077 | 15 | 48 North | 2 East | |||||||||||||

| Bunker Hill Mining Corp. | |

| Technical Report March 22, 2021 | Page 18 |

| Claim Name | M.S. # | Section | Township | Range | ||||||||||||||

| 127 | K-20 | 2077 | 15 | 48 North | 2 East | |||||||||||||

| 128 | K-21 | 2077 | 14 | 48 North | 2 East | |||||||||||||

| 129 | K-22 | 2077 | 14 | 48 North | 2 East | |||||||||||||

| 130 | K-23 | 2077 | 15 | 48 North | 2 East | |||||||||||||

| 131 | K-28 | 2077 | 15 | 48 North | 2 East | |||||||||||||

| 132 | K-29 | 2077 | 15 | 48 North | 2 East | |||||||||||||

| 133 | K-30 | 2077 | 14 | 48 North | 2 East | |||||||||||||

| 134 | K-31 | 2077 | 14 | 48 North | 2 East | |||||||||||||

| 135 | K-32 | 2077 | 22 | 48 North | 2 East | |||||||||||||

| 136 | K-39 | 2077 | 15 | 48 North | 2 East | |||||||||||||

| 137 | Minnesota | 2077 | 15 | 48 North | 2 East | |||||||||||||

| 138 | Missouri No. 2 | 2077 | 15 | 48 North | 2 East | |||||||||||||

| 139 | 91 | 2077 | 15 | 48 North | 2 East | |||||||||||||

| 140 | 92 | 2077 | 15 | 48 North | 2 East | |||||||||||||

| 141 | Chain | 2078 | 12 | 48 North | 2 East | |||||||||||||

| 142 | K-1 | 2080 | 14 | 48 North | 2 East | |||||||||||||

| 143 | K-2 | 2080 | 14 | 48 North | 2 East | |||||||||||||

| 144 | K-3 | 2080 | 14 | 48 North | 2 East | |||||||||||||

| 145 | K-4 | 2080 | 14 | 48 North | 2 East | |||||||||||||

| 146 | K-5 | 2080 | 14 | 48 North | 2 East | |||||||||||||

| 147 | K-6 | 2080 | 14 | 48 North | 2 East | |||||||||||||

| 148 | K-7 | 2080 | 14 | 48 North | 2 East | |||||||||||||

| 149 | K-8 | 2080 | 14 | 48 North | 2 East | |||||||||||||

| 150 | K-9 | 2080 | 14 | 48 North | 2 East | |||||||||||||

| 151 | K-14 | 2080 | 14 | 48 North | 2 East | |||||||||||||

| 152 | K-15 | 2080 | 14 | 48 North | 2 East | |||||||||||||

| 153 | K-24 | 2080 | 14 | 48 North | 2 East | |||||||||||||

| 154 | K-25 | 2080 | 14 | 48 North | 2 East | |||||||||||||

| 155 | K-26 | 2080 | 14 | 48 North | 2 East | |||||||||||||

| 156 | K-27 | 2080 | 14 | 48 North | 2 East | |||||||||||||

| 157 | K-33 | 2080 | 23 | 48 North | 2 East | |||||||||||||

| 158 | K-34 | 2080 | 23 | 48 North | 2 East | |||||||||||||

| 159 | K-35 | 2080 | 23 | 48 North | 2 East | |||||||||||||

| 160 | K-36 | 2080 | 23 | 48 North | 2 East | |||||||||||||

| 161 | K-37 | 2080 | 23 | 48 North | 2 East | |||||||||||||

| 162 | K-38 | 2080 | 23 | 48 North | 2 East | |||||||||||||

| 163 | Kansas | 2080 | 14 | 48 North | 2 East | |||||||||||||

| 164 | Missouri | 2080 | 14 | 48 North | 2 East | |||||||||||||

| 165 | Texas | 2080 | 14 | 48 North | 2 East | |||||||||||||

| 166 | Bear | 2081 | 13 | 48 North | 2 East | |||||||||||||

| 167 | Black | 2081 | 13 | 48 North | 2 East | |||||||||||||

| 168 | Brown | 2081 | 13 | 48 North | 2 East | |||||||||||||

| Bunker Hill Mining Corp. | |

| Technical Report March 22, 2021 | Page 19 |

| Claim Name | M.S. # | Section | Township | Range | ||||||||||||||

| 169 | Dewey | 2081 | 13 | 48 North | 2 East | |||||||||||||

| 170 | Ito | 2081 | 13 | 48 North | 2 East | |||||||||||||

| 171 | Oyama | 2081 | 13 | 48 North | 2 East | |||||||||||||

| 172 | S-9 | 2081 | 13 | 48 North | 2 East | |||||||||||||

| 173 | S-10 | 2081 | 13 | 48 North | 2 East | |||||||||||||

| 174 | Sampson | 2081 | 13 | 48 North | 2 East | |||||||||||||

| 175 | Sarnia | 2081 | 13 | 48 North | 2 East | |||||||||||||

| 176 | Star | 2081 | 13 | 48 North | 2 East | |||||||||||||

| 177 | Sims | 2186 | 12 | 48 North | 2 East | |||||||||||||

| 178 | Lincoln | 2187 | 12 | 48 North | 2 East | |||||||||||||

| 179 | Brooklyn | 2201 | 10 | 48 North | 2 East | |||||||||||||

| 180 | New Jersey | 2201 | 10 | 48 North | 2 East | |||||||||||||

| 181 | Schute Fraction | 2201 | 10 | 48 North | 2 East | |||||||||||||

| 182 | Cheyenne | 2249 | 12 | 48 North | 2 East | |||||||||||||

| 183 | Buckeye | 2250 | 13 | 48 North | 2 East | |||||||||||||

| 184 | Timothy Fraction | 2274 | 18 | 48 North | 3 East | |||||||||||||

| 185 | Evening Star | 2274 | 15 | 48 North | 3 East | |||||||||||||

| 186 | Evening Star Fraction | 2274 | 15 | 48 North | 3 East | |||||||||||||

| 187 | Maryland | 2274 | 15 | 48 North | 3 East | |||||||||||||

| 188 | Monmouth | 2274 | 15 | 48 North | 3 East | |||||||||||||

| 189 | Oregon | 2274 | 15 | 48 North | 3 East | |||||||||||||

| 190 | Oregon No. 2 | 2274 | 15 | 48 North | 3 East | |||||||||||||

| 191 | Silver Chord | 2274 | 15 | 48 North | 3 East | |||||||||||||

| 192 | Confidence | 2328 | 12 | 48 North | 2 East | |||||||||||||

| 193 | Flagstaff | 2328 | 12 | 48 North | 2 East | |||||||||||||

| 194 | Norman | 2368 | 11 | 48 North | 2 East | |||||||||||||

| 195 | Grant | 2369 | 11 | 48 North | 2 East | |||||||||||||

| 196 | Cypress | 2429 | 12 | 48 North | 2 East | |||||||||||||

| 197 | Hickory | 2432 | 13 | 48 North | 2 East | |||||||||||||

| 198 | Spruce Fraction | 2432 | 13 | 48 North | 2 East | |||||||||||||

| 199 | Helen Marr | 2452 | 12 | 48 North | 2 East | |||||||||||||

| 200 | Hemlock | 2452 | 13 | 48 North | 2 East | |||||||||||||

| 201 | Band | 2507 | 2 | 48 North | 2 East | |||||||||||||

| 202 | Spokane | 2509 | 12 | 48 North | 2 East | |||||||||||||

| 203 | Heart | 2511 | 12 | 48 North | 2 East | |||||||||||||

| 204 | Jack | 2511 | 12 | 48 North | 2 East | |||||||||||||

| 205 | Key | 2511 | 12 | 48 North | 2 East | |||||||||||||

| 206 | Queen | 2511 | 12 | 48 North | 2 East | |||||||||||||

| 207 | Teddy | 2511 | 12 | 48 North | 2 East | |||||||||||||

| 208 | Ace | 2583 | 12 | 48 North | 2 East | |||||||||||||

| 209 | Club | 2583 | 12 | 48 North | 2 East | |||||||||||||

| 210 | Diamond | 2583 | 12 | 48 North | 2 East | |||||||||||||

| 211 | Nellie | 2583 | 11 | 48 North | 2 East | |||||||||||||

| 212 | Roman | 2583 | 11 | 48 North | 2 East | |||||||||||||

| Bunker Hill Mining Corp. | |

| Technical Report March 22, 2021 | Page 20 |

| Claim Name | M.S. # | Section | Township | Range | ||||||||||||||

| 213 | Spade | 2583 | 12 | 48 North | 2 East | |||||||||||||

| 214 | Brady | 2584 | 12 | 48 North | 2 East | |||||||||||||

| 215 | A | 2587 | 24 | 48 North | 2 East | |||||||||||||

| 216 | B | 2587 | 24 | 48 North | 2 East | |||||||||||||

| 217 | C | 2587 | 24 | 48 North | 2 East | |||||||||||||

| 218 | D | 2587 | 24 | 48 North | 2 East | |||||||||||||

| 219 | E | 2587 | 24 | 48 North | 2 East | |||||||||||||

| 220 | F | 2587 | 24 | 48 North | 2 East | |||||||||||||

| 221 | Drew | 2587 | 13 | 48 North | 2 East | |||||||||||||

| 222 | Edna | 2587 | 13 | 48 North | 2 East | |||||||||||||

| 223 | Emily Grace | 2587 | 13 | 48 North | 2 East | |||||||||||||

| 224 | Foster | 2587 | 13 | 48 North | 2 East | |||||||||||||

| 225 | K-40 | 2587 | 24 | 48 North | 2 East | |||||||||||||

| 226 | Lilly May | 2587 | 12 | 48 North | 2 East | |||||||||||||

| 227 | Medium | 2587 | 13 | 48 North | 2 East | |||||||||||||

| 228 | Missing Link | 2587 | 24 | 48 North | 2 East | |||||||||||||

| 229 | No. 1 | 2587 | 24 | 48 North | 2 East | |||||||||||||

| 230 | No. 2 | 2587 | 24 | 48 North | 2 East | |||||||||||||

| 231 | Peak | 2587 | 24 | 48 North | 2 East | |||||||||||||

| 232 | Penfiled | 2587 | 13 | 48 North | 2 East | |||||||||||||

| 233 | Silver | 2587 | 13 | 48 North | 2 East | |||||||||||||

| 234 | Snowline | 2587 | 25 | 48 North | 2 East | |||||||||||||

| 235 | Yreka No. 10 | 2587 | 19 | 48 North | 3 East | |||||||||||||

| 236 | Yreka No. 11 | 2587 | 19 | 48 North | 3 East | |||||||||||||

| 237 | Yreka No. 12 | 2587 | 30 | 48 North | 3 East | |||||||||||||

| 238 | Yreka No. 13 | 2587 | 30 | 48 North | 3 East | |||||||||||||

| 239 | Yreka No. 14 | 2587 | 30 | 48 North | 3 East | |||||||||||||

| 240 | Yreka No. 15 | 2587 | 30 | 48 North | 3 East | |||||||||||||

| 241 | Yreka No. 16 | 2587 | 30 | 48 North | 3 East | |||||||||||||

| 242 | Yreka No. 17 | 2587 | 30 | 48 North | 3 East | |||||||||||||

| 243 | Yreka No. 18 | 2587 | 30 | 48 North | 3 East | |||||||||||||

| 244 | Yreka No. 19 | 2587 | 30 | 48 North | 3 East | |||||||||||||

| 245 | Yreka No. 20 | 2587 | 30 | 48 North | 3 East | |||||||||||||

| 246 | Yreka No. 21 | 2587 | 30 | 48 North | 3 East | |||||||||||||

| 247 | Yreka No. 22 | 2587 | 24 | 48 North | 2 East | |||||||||||||

| 248 | Yreka No. 23 | 2587 | 19 | 48 North | 3 East | |||||||||||||

| 249 | Yreka No. 24 | 2587 | 19 | 48 North | 3 East | |||||||||||||

| 250 | Yreka No. 25 | 2587 | 24 | 48 North | 2 East | |||||||||||||

| 251 | Yreka No. 26 | 2587 | 19 | 48 North | 3 East | |||||||||||||

| 252 | Boer | 2599 | 12 | 48 North | 2 East | |||||||||||||

| 253 | Grant | 2599 | 12 | 48 North | 2 East | |||||||||||||

| 254 | Asset | 2611 | 12 | 48 North | 2 East | |||||||||||||

| 255 | Childs | 2611 | 12 | 48 North | 2 East | |||||||||||||

| Bunker Hill Mining Corp. | |

| Technical Report March 22, 2021 | Page 21 |

| Claim Name | M.S. # | Section | Township | Range | ||||||||||||||

| 256 | Eli | 2611 | 18 | 48 North | 3 East | |||||||||||||

| 257 | Evans | 2611 | 12 | 48 North | 2 East | |||||||||||||

| 258 | Gun | 2611 | 18 | 48 North | 3 East | |||||||||||||

| 259 | Nick | 2611 | 18 | 48 North | 3 East | |||||||||||||

| 260 | Ox | 2611 | 18 | 48 North | 3 East | |||||||||||||

| 261 | Ruth | 2611 | 18 | 48 North | 3 East | |||||||||||||

| 262 | Sherman | 2611 | 12 | 48 North | 2 East | |||||||||||||

| 263 | Simmons | 2611 | 12 | 48 North | 2 East | |||||||||||||

| 264 | Taft | 2611 | 18 | 48 North | 3 East | |||||||||||||

| 265 | Yale | 2611 | 13 | 48 North | 2 East | |||||||||||||

| 266 | African | 2624 | 13 | 48 North | 2 East | |||||||||||||

| 267 | Gus | 2624 | 13 | 48 North | 2 East | |||||||||||||

| 268 | Roy | 2624 | 13 | 48 North | 2 East | |||||||||||||

| 269 | Trump | 2624 | 13 | 48 North | 2 East | |||||||||||||

| 270 | Maine | 2626 | 11 | 48 North | 2 East | |||||||||||||

| 271 | Kirby Fraction | 2654 | 12 | 48 North | 2 East | |||||||||||||

| 272 | McClellan | 2654 | 12 | 48 North | 2 East | |||||||||||||

| 273 | Miles | 2654 | 12 | 48 North | 2 East | |||||||||||||

| 274 | Pitt | 2654 | 12 | 48 North | 2 East | |||||||||||||

| 275 | Baby (1/6th interest) | 2856 | 3 | 47 North | 2 East | |||||||||||||

| 276 | Keystone (1/6th interest) | 2856 | 3 | 47 North | 2 East | |||||||||||||

| 277 | Van (1/6th interest) | 2856 | 3 | 47 North | 2 East | |||||||||||||

| 278 | Woodrat (1/6th interest) | 2856 | 3 | 47 North | 2 East | |||||||||||||

| 279 | Chief No. 2 | 2862 | 11 | 48 North | 2 East | |||||||||||||

| 280 | Sugar | 2862 | 11 | 48 North | 2 East | |||||||||||||

| 281 | Bonanza King Millsite | 2868 | 8 | 48 North | 3 East | |||||||||||||

| 282 | Milo Millsite | 2869 | 8/17 | 48 North | 3 East | |||||||||||||

| 283 | Flagstaff No. 2 | 2921 | 12 | 48 North | 2 East | |||||||||||||

| 284 | Flagstaff No. 3 | 2921 | 12 | 48 North | 2 East | |||||||||||||

| 285 | Flagstaff No. 4 | 2921 | 12 | 48 North | 2 East | |||||||||||||

| 286 | Scelinda No. 1 | 2921 | 1 | 48 North | 2 East | |||||||||||||

| 287 | Scelinda No. 2 | 2921 | 1 | 48 North | 2 East | |||||||||||||

| 288 | Scelinda No. 3 | 2921 | 1 | 48 North | 2 East | |||||||||||||

| 289 | Scelinda No. 4 | 2921 | 1 | 48 North | 2 East | |||||||||||||

| 290 | Scelinda No. 5 | 2921 | 1 | 48 North | 2 East | |||||||||||||

| 291 | Scelinda No. 7 | 2921 | 1 | 48 North | 2 East | |||||||||||||

| 292 | Scelinda No. 8 | 2921 | 1 | 48 North | 2 East | |||||||||||||

| 293 | Ethel | 2966 | 11 | 48 North | 2 East | |||||||||||||

| 294 | Katherine | 2966 | 11 | 48 North | 2 East | |||||||||||||

| 295 | Manchester | 2966 | 11 | 48 North | 2 East | |||||||||||||

| 296 | McRooney | 2966 | 11 | 48 North | 2 East | |||||||||||||

| 297 | Stuart No. 2 | 2966 | 11 | 48 North | 2 East | |||||||||||||

| 298 | Stuart No. 3 | 2966 | 11 | 48 North | 2 East | |||||||||||||

| Bunker Hill Mining Corp. | |

| Technical Report March 22, 2021 | Page 22 |

| Claim Name | M.S. # | Section | Township | Range | ||||||||||||||

| 299 | Sullivan | 2966 | 11 | 48 North | 2 East | |||||||||||||

| 300 | Switzerland | 2966 | 11 | 48 North | 2 East | |||||||||||||

| 301 | Hoover No. 1 | 2975 | 13 | 48 North | 2 East | |||||||||||||

| 302 | Hoover No. 2 | 2975 | 13 | 48 North | 2 East | |||||||||||||

| 303 | Hoover No. 3 | 2975 | 13 | 48 North | 2 East | |||||||||||||

| 304 | Hoover No. 4 | 2975 | 13 | 48 North | 2 East | |||||||||||||

| 305 | Hoover No. 5 | 2975 | 13 | 48 North | 2 East | |||||||||||||

| 306 | Adath | 2976 | 22 | 48 North | 2 East | |||||||||||||

| 307 | Alykris | 2976 | 22 | 48 North | 2 East | |||||||||||||

| 308 | Anna Laura | 2976 | 22 | 48 North | 2 East | |||||||||||||

| 309 | Atlas | 2976 | 22 | 48 North | 2 East | |||||||||||||

| 310 | Atlas No. 1 | 2976 | 22 | 48 North | 2 East | |||||||||||||

| 311 | Fraction | 2976 | 22 | 48 North | 2 East | |||||||||||||

| 312 | Gay | 2976 | 22 | 48 North | 2 East | |||||||||||||

| 313 | Panorama | 2976 | 23 | 48 North | 2 East | |||||||||||||

| 314 | Red Deer | 2976 | 22 | 48 North | 2 East | |||||||||||||

| 315 | Setzer | 2976 | 22 | 48 North | 2 East | |||||||||||||

| 316 | Lesley | 2977 | 23 | 48 North | 2 East | |||||||||||||

| 317 | Lesley No. 2 | 2977 | 23 | 48 North | 2 East | |||||||||||||

| 318 | Lesley No. 3 | 2977 | 23 | 48 North | 2 East | |||||||||||||

| 319 | Little Ore Grande | 2977 | 23 | 48 North | 2 East | |||||||||||||

| 320 | North Wellington | 2977 | 23 | 48 North | 2 East | |||||||||||||

| 321 | Ore Grande No. 1 | 2977 | 23 | 48 North | 2 East | |||||||||||||

| 322 | Ore Grande No. 2 | 2977 | 23 | 48 North | 2 East | |||||||||||||

| 323 | Ore Grande No. 3 | 2977 | 23 | 48 North | 2 East | |||||||||||||

| 324 | Ore Grande No. 4 | 2977 | 23 | 48 North | 2 East | |||||||||||||

| 325 | Ore Grande No. 5 | 2977 | 23 | 48 North | 2 East | |||||||||||||

| 326 | Wellington | 2977 | 23 | 48 North | 2 East | |||||||||||||

| 327 | Marko | 3051 | 7 | 48 North | 3 East | |||||||||||||

| 328 | V.M. No. 1 | 3051 | 7 | 48 North | 3 East | |||||||||||||

| 329 | V.M. No. 2 | 3051 | 7 | 48 North | 3 East | |||||||||||||

| 330 | Army | 3096 | 22 | 48 North | 2 East | |||||||||||||

| 331 | Navy | 3096 | 22 | 48 North | 2 East | |||||||||||||

| 332 | Oracle | 3097 | 23 | 48 North | 2 East | |||||||||||||

| 333 | Orbit | 3097 | 23 | 48 North | 2 East | |||||||||||||

| 334 | Oreano | 3097 | 23 | 48 North | 2 East | |||||||||||||

| 335 | Ore Shoot | 3097 | 23 | 48 North | 2 East | |||||||||||||

| 336 | Orient | 3097 | 23 | 48 North | 2 East | |||||||||||||

| 337 | Oriental Orphan | 3097 | 23 | 48 North | 2 East | |||||||||||||

| 338 | Orpheum | 3097 | 23 | 48 North | 2 East | |||||||||||||

| 339 | East Midland | 3108 | 19 | 48 North | 3 East | |||||||||||||

| 340 | Midland | 3108 | 19 | 48 North | 3 East | |||||||||||||

| 341 | Midland No. 1 | 3108 | 24 | 48 North | 2 East | |||||||||||||

| Bunker Hill Mining Corp. | |

| Technical Report March 22, 2021 | Page 23 |

| Claim Name | M.S. # | Section | Township | Range | ||||||||||||||

| 342 | Midland No. 3 | 3108 | 24 | 48 North | 2 East | |||||||||||||

| 343 | Midland No. 4 | 3108 | 24 | 48 North | 2 East | |||||||||||||

| 344 | Midland No. 5 | 3108 | 24 | 48 North | 2 East | |||||||||||||

| 345 | Midland No. 6 | 3108 | 24 | 48 North | 2 East | |||||||||||||

| 346 | Midland No. 7 | 3108 | 24 | 48 North | 2 East | |||||||||||||

| 347 | Midland No. 8 | 3108 | 24 | 48 North | 2 East | |||||||||||||

| 348 | North Midland | 3108 | 24 | 48 North | 2 East | |||||||||||||

| 349 | Venture | 3164 | 2 | 48 North | 2 East | |||||||||||||

| 350 | Monte Carlo No. 1 | 3177 | 18 | 48 North | 3 East | |||||||||||||

| 351 | Monte Carlo No. 2 | 3177 | 18 | 48 North | 3 East | |||||||||||||

| 352 | Monte Carlo No. 3 | 3177 | 7/18 | 48 North | 3 East | |||||||||||||

| 353 | Monte Carlo No. 4 | 3177 | 7/18 | 48 North | 3 East | |||||||||||||

| 354 | Monte Carlo No. 5 | 3177 | 18 | 48 North | 3 East | |||||||||||||

| 355 | L-2 | 3214 | 9 | 48 North | 2 East | |||||||||||||

| 356 | L-3 | 3214 | 9 | 48 North | 2 East | |||||||||||||

| 357 | Goth | 3214 | 2 | 48 North | 2 East | |||||||||||||

| 358 | Long John | 3214 | 7 | 48 North | 3 East | |||||||||||||

| 359 | L-1 | 3214 | 2 | 48 North | 2 East | |||||||||||||

| 360 | Spring | 3298 | 15 | 48 North | 3 East | |||||||||||||

| 361 | Anaconda | 3361 | 2 | 47 North | 2 East | |||||||||||||

| 362 | Apex | 3361 | 2 | 47 North | 2 East | |||||||||||||

| 363 | Apex No. 2 | 3361 | 1 | 47 North | 2 East | |||||||||||||

| 364 | Apex No. 3 | 3361 | 1 | 47 North | 2 East | |||||||||||||

| 365 | Blue Bird | 3361 | 2 | 47 North | 2 East | |||||||||||||

| 366 | Blue Grouse | 3361 | 2 | 47 North | 2 East | |||||||||||||

| 367 | Bob White | 3361 | 2 | 47 North | 2 East | |||||||||||||

| 368 | Butte | 3361 | 2 | 47 North | 2 East | |||||||||||||

| 369 | Butte Fraction | 3361 | 2 | 47 North | 2 East | |||||||||||||

| 370 | Cougar | 3361 | 2 | 47 North | 2 East | |||||||||||||

| 371 | Galena | 3361 | 1 | 47 North | 2 East | |||||||||||||

| 372 | Huckleberry No. 2 | 3361 | 2 | 47 North | 2 East | |||||||||||||

| 373 | Leopard | 3361 | 2 | 47 North | 2 East | |||||||||||||

| 374 | Lynx | 3361 | 35 | 47 North | 2 East | |||||||||||||

| 375 | MacBenn | 3361 | 2 | 47 North | 2 East | |||||||||||||

| 376 | Marin | 3361 | 2 | 47 North | 2 East | |||||||||||||

| 377 | Pheasant | 3361 | 2 | 47 North | 2 East | |||||||||||||

| 378 | Robbin | 3361 | 2 | 47 North | 2 East | |||||||||||||

| 379 | Sonora | 3361 | 2 | 47 North | 2 East | |||||||||||||

| 380 | Pete | 3389 | 10 | 48 North | 2 East | |||||||||||||

| 381 | Prominade | 3389 | 10 | 48 North | 2 East | |||||||||||||

| 382 | Sam | 3389 | 10 | 48 North | 2 East | |||||||||||||

| 383 | Zeke | 3389 | 10 | 48 North | 2 East | |||||||||||||

| 384 | Battleship Oregon | 3390 | 14 | 48 North | 2 East | |||||||||||||

| Bunker Hill Mining Corp. | |

| Technical Report March 22, 2021 | Page 24 |

| Claim Name | M.S. # | Section | Township | Range | |||||||||||||

| 385 | Charly T. | 3390 | 14 | 48 North | 2 East | |||||||||||||

| 386 | Lucia | 3390 | 14 | 48 North | 2 East | |||||||||||||

| 387 | Marblehead | 3390 | 10 | 48 North | 2 East | |||||||||||||

| 388 | Margaret | 3390 | 14 | 48 North | 2 East | |||||||||||||

| 389 | Nancy B. | 3390 | 11 | 48 North | 2 East | |||||||||||||

| 390 | Olympia | 3390 | 10 | 48 North | 2 East | |||||||||||||

| 391 | Phil | 3390 | 14 | 48 North | 2 East | |||||||||||||

| 392 | Black Diamond | 3423 | 10 | 48 North | 3 East | |||||||||||||

| 393 | Carbonate | 3423 | 3 | 48 North | 3 East | |||||||||||||

| 394 | Enterprise | 3423 | 3 | 48 North | 3 East | |||||||||||||

| 395 | Enterprise Extension | 3423 | 10 | 48 North | 3 East | |||||||||||||

| 396 | Gelatin | 3423 | 10 | 48 North | 3 East | |||||||||||||

| 397 | Giant | 3423 | 3 | 48 North | 3 East | |||||||||||||

| 398 | Rolling Stone | 3423 | 10 | 48 North | 3 East | |||||||||||||

| 399 | Beta | 3471 | 13 | 48 North | 2 East | |||||||||||||

| 400 | Spokane Central No. 1 | 3472 | 19 | 48 North | 3 East | |||||||||||||

| 401 | Spokane Central No. 2 | 3472 | 20 | 48 North | 3 East | |||||||||||||

| 402 | Spokane Central No. 3 | 3472 | 20 | 48 North | 3 East | |||||||||||||

| 403 | Spokane Central No. 4 | 3472 | 20 | 48 North | 3 East | |||||||||||||

| 404 | Spokane Central No. 5 | 3472 | 20 | 48 North | 3 East | |||||||||||||

| 405 | Castle | 3503 | 17 | 48 North | 2 East | |||||||||||||

| 406 | Silver King Millsite | 3563 | 2 | 48 North | 2 East | |||||||||||||

| Bunker Hill Mining Corp. | |

| Technical Report March 22, 2021 | Page 25 |

4.1.1 Mineral Guarantee

On August 12, 2020, law firm Lyons O’Dowd issued a Title Opinion on both the surface parcels without mineral rights and different mineral claims included in the Lease. The Title Opinion reads as follows:

“Dear Sirs and Madams:

This Firm has been requested by Bunker Hill Mining Corp., a Nevada corporation (“BHMC”) to provide an updated title opinion with respect to the certain real property situated in Shoshone County, Idaho. BHMC has requested that we provide an update to our title opinion expressed in a letter dated July 6, 2018 (“July 2018 Opinion”). The property consists of a combination of patented mining claims with surface rights, patented mining claims without any surface rights, and patented mining claims with surface rights are referred to herein as the “Surface Parcels” and are more particularly described in in that certain Commitment for Title Insurance, dated July 24, 2020 (First American Title File No. 630751-WA, “Title Company”) attached here to as Exhibit 1 (“Commitment”) and incorporated herein by reference. The patented mining claims without any associated surface rights are referred to herein as “Mineral Parcels” and are more particularly described in that certain Guarantee, dated July 24, 2020 (First American Title File No. 5010500-630751B attached hereto as Exhibit 2 (“Guarantee”) and incorporated herein by reference. The Surface Parcels and the Mineral Parcels are collectively referred to herein as the “Property.”

In this case, the Surface Parcels described in Exhibit 1 are being recognized for coverage by a title insurance policy to be issued by Old Republic National Title Insurance Company through its local representative First American Title Company.

The Firm’s opinion of title to the Property is based on its review of the documentation, research, title examination and information described herein, and such opinion remains subject to all qualifications, exceptions, reservations, assumptions, disclaimers, and limitations outlined herein.

INTRODUCTION

When evaluating title, it is usual and customary to request a commitment of title insurance from a title company doing business in the geographical area where the land is situated. The title company reviews its records which include the documents on file with the County Recorder, and then issues a preliminary title commitment for title insurance with respect to the property. After the land is purchased, the title company issues a title insurance policy in the amount of the purchase price (or the purchase price amount selected by the purchaser). Title commitments list as “Exceptions” from insurance coverage items of record that may detract from good and merchantable title. Attorneys commonly rely on the exceptions listed in the title commitments as a basis for forming legal opinions concerning title.

Title insurance companies will not provide title insurance (or commitments) for real property interests without associated surface rights (such as the Mineral Parcels). However, some title companies will issue a mineral guarantee to identify the owners of the surface rights and mineral interests, as well as any unsatisfied leases, mortgages, liens and judgments of record. In making these determinations, the title company reviews its records which include the records on file with the County Recorder. Attorneys commonly rely on the information provided in these guarantees when forming an opinion of title with respect to mineral rights.

| Bunker Hill Mining Corp. | |

| Technical Report March 22, 2021 | Page 26 |

The property at issue in this opinion consists of a combination of patented mining claims with surface rights, patented mining claims without any surface rights, and additional land not acquired through the federal land patent process. The additional land and the patented mining claims with surface rights are referred to herein as the “Surface Parcels” and are more particularly described in the Commitment. The patented mining claims without any associated surface rights are referred to herein as “Mineral Parcels” and are more particularly described in the Guarantee. The Property is located in Shoshone County.

In creating this opinion, the Firm has relied on the accuracy and completeness of the Commitment with respect to all of-record interests which may impact title to the Surface Parcels. With respect to the vested ownership interest of the Mineral Parcels, the Firm has relied on the accuracy and completeness of the Guarantee.

The Firm understands from communications with Janell Anthis, the Title Officer at First American Title Company in Kellogg, Idaho, that the description of the Property has not changed since the Firm’s prior Title Opinion in July 2018 (“July 2018 Opinion”) and an updated Commitment and Guarantee were provided to show any changes in title since the July 2018 Opinion. In providing the Commitment, First American also reviewed the courthouse register and confirmed that there are no other items that would affect title to the Surface Parcels as of July 24, 2020. The First American office that prepared the Commitment is located in Kellogg, Idaho. First American is a reputable title company and considered to be thorough with respect to reviewing records and keeping them on file for public inspection.

In reaching the opinions set forth herein, the Firm has also inquired of BHMC management about any occurrence or event that would have caused a change to anything stated in the July 2018 Opinion regarding the Property. Management reports that it is unaware of anything that would alter any of the facts set forth in such opinion.

In addition to these communications, the Firm has reviewed an executed copy of the Bunker Hill Mining Lease with Option to Purchase, effective November 1, 2017 (and amendments thereto) between Placer Mining Corporation, a Nevada corporation (“Placer”) and BHMC. The Lease contemplates a definitive agreement to be reached by the parties in order to transfer the assets of Placer to BHMC.

As a result of the aforementioned discussions, and after reviewing the documents identified in the exceptions and the other documents noted herein, the Firm has a good understanding of the circumstances involved with the Exceptions identified in the Commitment and the Guarantee.

EXECUTIVE SUMMARY - SURFACE PARCELS

Based on the Firm’s review of the Commitment and our communications with the Title Company and BHMC management and subject to the qualifications, exceptions, reservations, assumptions and disclaimers in the Commitment and set forth herein, it is the Firm’s opinion that, with respect to the Surface Parcels, William M. Pangburn and Shirley A. Pangburn have good and merchantable title to the property identified as Parcels #1 and #2 in the Commitment; Placer Mining Corporation, a Nevada corporation, has good and merchantable title to the property identified as Parcels #3-38 in the Commitment. With respect to Parcel #39, title is vested with Tim Hopper, Personal Representative of the Estate of Robert Dwayne Hopper, aka Robert Hopper, deceased, Case No CV-11-12 in the District Court of the First Judicial District of the State of Idaho in and for the County of Shoshone, subject to proceedings pending in the United States Bankruptcy Court District of Idaho; RE: the Estate of Robert Dwayne Hopper, Dec’d Case No: CV-2011-12, wherein a petition for relief was filed on July 29, 2019, Case No. 19-20510-TLM; and also subject to a Notice of Pending Issue of Tax Deed issued by Shoshone County, which may convey Parcel #39 to Shoshone County via tax deed as early as August 10, 2020.

| Bunker Hill Mining Corp. | |

| Technical Report March 22, 2021 | Page 27 |

With respect to this opinion, and only for the purposes of providing a summary thereof, the most prevalent exceptions to title are noted in this Executive Summary. This summary, however, does not limit the opinions expressed in greater detail throughout the remainder of this document.

Exceptions

Issuance of the title policy (through the Commitment) is contingent on removal and satisfaction of all judgments, liens and encumbrances disclosed in the Commitment (See Schedule B-Section I Requirements (e) (requiring release or reconveyance of Exceptions #8, 9, 10, 32, 44-45, 47, 56, 58-64). The Firm recommends that any purchase agreement created for purposes of conveying the Property to BHMC require, as a condition of closing, that Placer remove all exceptions necessary for issuance of a title policy by the Title Company prior to closing. Without limiting the foregoing and with respect to financial liens/obligations, such agreement could also reduce the purchase price in an amount necessary to satisfy such exceptions directly by BHMC. The contemplated purchase price is $5.9 million in cash and $4.8 million in shares of BHMC. This cash payment (with confirmation of lien amounts regarding Exceptions #63 and 64 and without addressing Exception #42, the EPA lien, which is discussed below) is sufficient to pay off the lien amounts noted in Exceptions #8, 9, 10, 44, 45, 59-61 required for issuance of a title policy. It is customary in Idaho to have the Escrow Company obtain lien payoff information, secure payment thereof out of the closing proceeds and ensure satisfaction and removal of the encumbrances prior to closing. Based on the requirements imposed in the Commitment, it is the Firm’s opinion that, except for Exception #42 and with confirmation of the lien amounts in Exceptions #63 and 64, the foregoing financial obligations encumbering the Property will be satisfied and released at the time BHMC completes the purchase of the Property.

To ensure clear title with respect to the property held by William M. Pangburn, identified as Parcels #1 and 2 in the Commitment, a deed by William M. Pangburn and Shirley A. Pangburn will be required. Mr. Pangburn is believed to be a major shareholder of Placer Mining Corporation. The Firm has communicated with Mr. Ash with respect to the interests held by Mr. Pangburn. Mr. Ash reports that William M. Pangburn communicated his intent to convey the parcels prior to the sale to BHMC, as well as any interest held by his spouse. A written consent form documenting this acknowledgement was signed by Mr. and Mrs. Pangburn on December 2, 2017. An updated consent form has been drafted and was reported to be in route to Mr. and Mrs. Pangburn for execution. At the time of drafting this opinion, an executed copy of the updated consent form has not been received. With a conveyance deed executed by both William M. Pangburn and Shirley A. Pangburn, Exception #47 should be satisfied and removed by the Title Company.

To ensure clear title with respect to the property held by the Estate of Robert Hopper, identified as Parcel #39, further analysis of Exceptions #56, 57, 58 and 62 would be required. However, it is the Firm’s understanding that Parcel 39 has yet to be agreed to be transferred at closing. If the Company decides to acquire Parcel 39 from the Hopper Estate, the Title Company will require proof of proper administration thereof including seeking leave of the Bankruptcy court to such a transfer as identified in Exception #62 herein. The Title Company will also require completion of items (n) through (p) of Schedule B-Section I, all of which pertain to Parcel 39.

The Firm has not provided an independent analysis of access rights to and from the Surface Parcels. However, the Firm notes that access to the Kellogg Tunnel, which is critical to the operation of the mine, can be made as follows: first using the public street of McKinley Avenue, then using

| Bunker Hill Mining Corp. | |

| Technical Report March 22, 2021 | Page 28 |

Bunker Mine Road (which is the internal roadway for the Mine Plant Short Plat subdivision and was dedicated to the public at the time of platting) and then over existing roads/mine haulage tracks across the Mill Site Parcel (located immediately north of the Parcel 1 (also sometimes referred to herein as the “Kellogg Tunnel Parcel”) to the tunnel entrance pursuant to an express easement. This access easement is described in greater detail below under Exception #16. In addition, Bunker Mine Road directly abuts the northern tip of the Kellogg Tunnel Parcel; though topographic limitations exist that would make immediate access to the tunnel difficult. Thus, access to the Kellogg Tunnel could be obtained pursuant to an express easement or by extending the existing roads to reach the tunnel entrance (assuming Parcels 1 and 2 held by the Pangburns are included in a sale to BHMC).

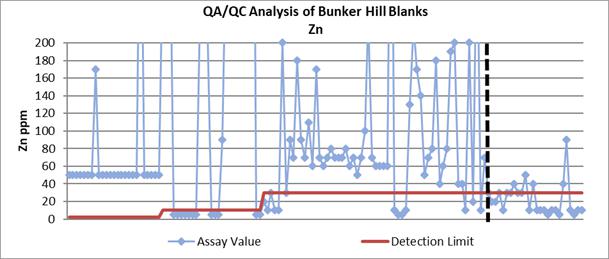

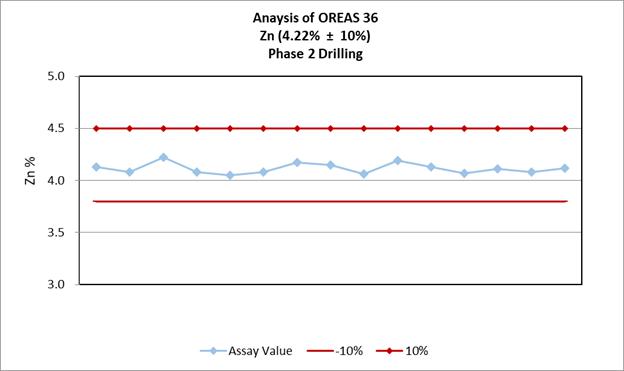

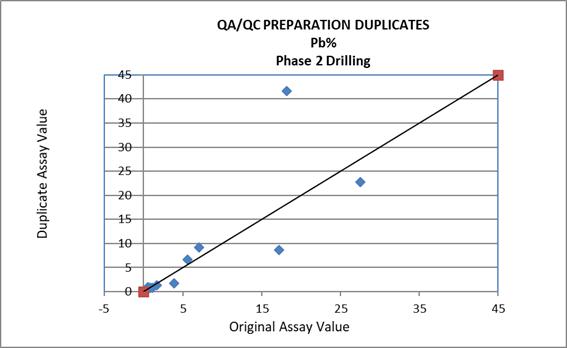

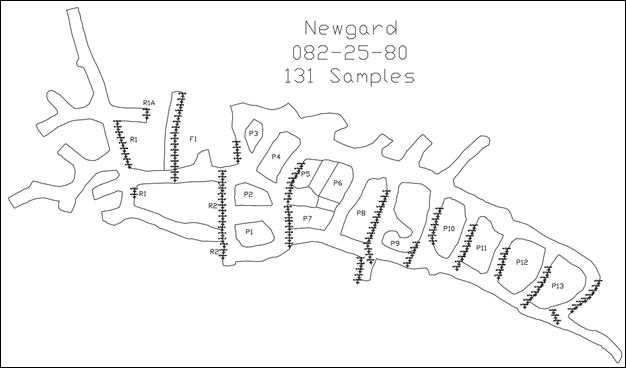

The Firm did not perform an independent analysis of the legal descriptions provided in the Commitment with respect to the Surface Parcels and recommends retaining a surveyor to review and evaluate the same. Without limiting the foregoing, the Firm notes that the Florence claim (M.S. 2862) is limited in various respects as more particularly described in Exceptions #30, 31, 32 and 33. With respect to Exception 32 in particular, there is a cloud on title for the Florence claim held by the Department of Environmental Quality. This issue must be resolved before closing for issuance of a title policy and would likely be satisfied by a quitclaim deed executed by the Department of Environmental Quality as to the Florence Claim.