Form 8-K Brookdale Senior Living For: May 06

Exhibit 99.1

Brookdale Announces First Quarter 2021 Results

Nashville, Tenn., May 6, 2021 - Brookdale Senior Living Inc. (NYSE: BKD) ("Brookdale" or the "Company") announced results for the quarter ended March 31, 2021.

HIGHLIGHTS

•Net move-ins and move-outs turned positive in March for the first time since the COVID-19 pandemic began and remained positive in April.

•Sequentially, monthly weighted average occupancy grew slightly in March, and increased 50 basis points in April.

•First quarter revenue per occupied unit (RevPOR) increased by 2.9% year-over-year on a same community basis.

•All communities completed at least three vaccine clinics with a 93% resident vaccine acceptance rate. COVID-19 positive resident caseload has decreased by 97% since the peak in mid-December 2020.

“We are pleased that our communities’ occupancy began to grow again by the end of the first quarter and confident in our ability to continue to help our residents, patients and associates put the COVID-19 pandemic behind them", said Lucinda ("Cindy") Baier, Brookdale’s President and CEO. “We recognized early the critically important role vaccines would play in the recovery, and we successfully advocated for priority vaccine access for those in our communities and across our industry. Brookdale’s resident vaccine acceptance rate is 93% and we are pleased to continue helping seniors to live meaningful and joyful lives. We expect to see positive occupancy momentum in the coming months and believe we are making progress on our path to recovery.”

SUMMARY OF FIRST QUARTER RESULTS

Consolidated

The table below presents a summary of consolidated operating results.

| Year-Over-Year Increase / (Decrease) | Sequential Increase / (Decrease) | |||||||||||||||||||||||||

| ($ in millions) | 1Q 2021 | 1Q 2020 | Amount | Percent | 4Q 2020 | Amount | Percent | |||||||||||||||||||

| Resident fee revenue | $ | 664.4 | $ | 782.7 | $ | (118.3) | (15.1)% | $ | 677.5 | $ | (13.1) | (1.9)% | ||||||||||||||

| Management fee revenue | 8.6 | 108.7 | (100.1) | (92.1)% | 10.2 | (1.6) | (15.7)% | |||||||||||||||||||

| Other operating income | 10.7 | — | 10.7 | NM | 78.3 | (67.6) | (86.3)% | |||||||||||||||||||

| Facility operating expense | 556.3 | 588.5 | (32.2) | (5.5)% | 576.8 | (20.5) | (3.6)% | |||||||||||||||||||

| General and administrative expense | 49.9 | 54.6 | (4.7) | (8.6)% | 45.3 | 4.6 | 10.2% | |||||||||||||||||||

| Net income (loss) | (108.3) | 369.5 | 477.8 | NM | (44.1) | (64.2) | (145.6)% | |||||||||||||||||||

Adjusted EBITDA (1) | 35.0 | 185.1 | (150.1) | (81.1)% | 98.6 | (63.6) | (64.5)% | |||||||||||||||||||

| Adjusted EBITDA, excluding $100.0 million management termination fee in 1Q 2020 | 35.0 | 85.1 | (50.1) | (58.9)% | 98.6 | (63.6) | (64.5)% | |||||||||||||||||||

(1) Adjusted EBITDA is a financial measure that is not calculated in accordance with GAAP. See "Reconciliations of Non-GAAP Financial Measures" for the Company's definition of such measure, reconciliations to the most comparable GAAP financial measure, and other important information regarding the use of the Company's non-GAAP financial measures.

•Resident fee revenue.

•1Q 2021 vs 1Q 2020:

◦Consolidated RevPAR decreased $598, or 14.1%, to $3,631 as a result of a decrease in consolidated weighted average occupancy of 1,360 basis points to 69.6%, offset by an increase in consolidated RevPOR of $134, or 2.6%, to $5,219.

◦The disposition of 13 communities through sales and conveyances of owned communities and lease terminations since the beginning of the first quarter of 2020 resulted in $15.3 million less in resident fees during the first quarter of 2021 compared to the first quarter of 2020.

Page 1

•1Q 2021 vs 4Q 2020:

◦Consolidated RevPAR decreased $42, or 1.1%, to $3,631 as a result of a decrease in consolidated weighted average occupancy of 310 basis points to 69.6%, offset by an increase in consolidated RevPOR of $167, or 3.3%, to $5,219.

•Consolidated senior housing occupancy was 70.6% as of March 31, 2021 compared to 71.5% as of December 31, 2020.

•The Company estimates that the COVID-19 pandemic resulted in $117.5 million, $120.1 million, and $5.8 million of lost resident fee revenue for the first quarter of 2021, fourth quarter of 2020, and first quarter of 2020, respectively. The estimated lost resident fee revenue represents the difference between the actual resident fee revenue for the period and the Company's pre-COVID-19 expectations for the 2020 period.

•Management fee revenue.

•1Q 2021 vs 1Q 2020: The decrease was primarily due to $100.0 million of management termination fees recognized for the first quarter of 2020 for the management agreement termination fee payment received from Healthpeak Properties, Inc. ("Healthpeak") in connection with the sale of the Company's ownership interest in the entry fee CCRC venture ("CCRC Venture").

•1Q 2021 vs 4Q 2020: The decrease was primarily due to the transition of management arrangements on 29 net communities since October 1, 2020 for management arrangements on certain former unconsolidated ventures in which the Company sold its interest. The Company received an $8.6 million management agreement termination fee payment during the fourth quarter of 2020, of which $5.0 million of management fee revenue was recognized during the fourth quarter of 2020 and $3.6 million was recognized in the first quarter of 2021. An additional $1.0 million management agreement termination fee was received and recognized in the first quarter of 2021.

•Other operating income.

•The Company recognized $9.0 million of employee retention credits and $1.7 million from government grants as other operating income during the first quarter of 2021, compared to $74.9 million of grants from the Provider Relief Fund and $3.4 million from other government grants as other operating income during the fourth quarter of 2020.

•Facility operating expense.

•1Q 2021 vs 1Q 2020:

◦Facility operating expense decreased $32.2 million, or 5.5%, primarily due to a decrease in labor costs for home health services as a result of the lower census and as the Company adjusted its home health services operational structure to better align its facility operating expenses and business model with the new Patient-Driven Grouping Model ("PDGM").

◦The disposition of communities resulted in $13.6 million less in facility operating expenses during the first quarter of 2021 compared to the first quarter of 2020.

•1Q 2021 vs 4Q 2020: Facility operating expense decreased $20.5 million, or 3.6%, primarily due to a decrease in costs as a result of fewer days of expense during the first quarter of 2021.

•The Company incurred $27.3 million, $30.5 million, and $10.0 million of incremental direct costs during the first quarter of 2021, fourth quarter of 2020, and first quarter of 2020, respectively, to respond to the COVID-19 pandemic, including costs for: acquisition of personal protective equipment ("PPE"), medical equipment, and cleaning and disposable food service supplies; enhanced cleaning and environmental sanitation; increased employee-related costs, including labor, workers compensation, and health plan expense; increased expense for general liability claims; and COVID-19 testing of residents and associates where not otherwise covered by government payor or third-party insurance sources.

•General and administrative expense.

•1Q 2021 vs 1Q 2020: The decrease in general and administrative expense was primarily attributable to a reduction in the Company's corporate headcount, as it scaled its general and administrative costs in connection with community dispositions and a reduction in the Company's travel costs due to the pandemic.

•1Q 2021 vs 4Q 2020: The increase in general and administrative expense was primarily attributable to an increase in incentive compensation costs and non-cash stock-based compensation expense.

•Net income (loss).

•1Q 2021 vs 1Q 2020: The change in net income (loss) was primarily attributable to a $371.7 million decrease in net gain on sale of assets, primarily resulting from the sale of the Company's interest in the entrance fee CCRC venture during the first quarter of 2020, as well as the net impact of the revenue, other operating income, and facility operating expense factors previously discussed, partially offset by a $67.5 million decrease in asset impairment expense.

•1Q 2021 vs 4Q 2020: The decrease in net loss was primarily attributable to the net impact of the revenue, other operating income, and facility operating expense factors previously discussed.

Page 2

•Adjusted EBITDA.

•1Q 2021 vs 1Q 2020: The decrease in Adjusted EBITDA was primarily attributable to the net impact of the revenue (including the $100.0 million management termination fee payment received from Healthpeak), other operating income, and facility operating expense factors previously discussed, partially offset by a $22.1 million decrease in cash facility operating lease payments, primarily reflecting reduced cash lease payments as a result of the lease restructuring transaction with Ventas, Inc. ("Ventas") on July 26, 2020, and the decrease in general and administrative expense.

•1Q 2021 vs 4Q 2020: The decrease in Adjusted EBITDA was primarily attributable to the net impact of the revenue, other operating income, and facility operating expense factors previously discussed.

•COVID-19 Impact.

•Vaccine Clinics Completed. The Company elected to work with CVS Health Corporation ("CVS") to administer vaccinations on site to its residents and associates through the Pharmacy Partnership for Long-Term Care Program offered through the U.S. Centers for Disease Control and Prevention ("CDC"). The Company hosted its first clinics on December 18, 2020 and had completed at least three vaccine clinics at all of its communities by April 9, 2021. Through April 30, 2021, our resident vaccine acceptance rate was 93%, and our COVID-19 positive resident caseload had decreased by 97% since the peak in mid-December 2020.

•Community Restrictions. During the first quarter, the Company continued evaluating restrictions on its communities on a community-by-community basis, including based on regulatory requirements and guidance, completion of baseline testing at the community, and the presence of current confirmed COVID-19 positive cases. The Company may revert to more restrictive measures if the pandemic worsens, as necessary to comply with regulatory requirements, or at the direction of state or local health authorities. As of December 31, 2020, 89% of the Company’s communities were accepting new move-ins. With lower caseloads, restrictions on visits have been relaxed, and as of April 30, 2021, 100% of the Company’s communities have opened for visitors and new prospects.

•Occupancy. In the Company’s consolidated seniors housing portfolio, net move-ins and move-outs turned positive in March 2021 for the first time since the pandemic began. Move-ins increased sequentially each month during the first quarter of 2021 and increased 29% for the first quarter of 2021 compared to the fourth quarter of 2020. The Company’s consolidated senior housing portfolio’s weighted average occupancy decreased 310 basis points for the first quarter of 2021 from the fourth quarter of 2020. Weighted average occupancy for March 2021 increased slightly sequentially and for April 2021 increased 50 basis points sequentially, after having declined sequentially each month from March 2020 through February 2021. The table below sets forth the Company's consolidated occupancy trend during the pandemic.

Mar 2020 | Apr 2020 | May 2020 | Jun 2020 | Jul 2020 | Aug 2020 | Sep 2020 | Oct 2020 | Nov 2020 | Dec 2020 | Jan 2021 | Feb 2021 | Mar 2021 | Apr 2021 | |||||||||||||||||||||||||||||||

| Weighted average occupancy | 82.7 | % | 80.4 | % | 78.4 | % | 77.4 | % | 76.4 | % | 75.2 | % | 74.3 | % | 73.8 | % | 72.8 | % | 71.5 | % | 70.0 | % | 69.4 | % | 69.4 | % | 69.9 | % | ||||||||||||||||

| Month-end occupancy | 82.2 | % | 80.0 | % | 78.5 | % | 77.8 | % | 76.6 | % | 75.5 | % | 75.0 | % | 74.1 | % | 73.1 | % | 71.5 | % | 70.4 | % | 70.1 | % | 70.6 | % | 71.1 | % | ||||||||||||||||

Same Community Senior Housing (Independent Living (IL), Assisted Living and Memory Care (AL/MC), and CCRCs)

The table below presents a summary of same community operating results and metrics of the Company's consolidated senior housing portfolio.(2)

| Year-Over-Year Increase / (Decrease) | Sequential Increase / (Decrease) | ||||||||||||||||||||||

| ($ in millions, except RevPAR and RevPOR) | 1Q 2021 | 1Q 2020 | Amount | Percent | 4Q 2020 | Amount | Percent | ||||||||||||||||

| RevPAR | $ | 3,643 | $ | 4,249 | $ | (606) | (14.3)% | $ | 3,693 | $ | (50) | (1.4)% | |||||||||||

| Weighted average occupancy | 69.5 | % | 83.4 | % | (1,390) bps | n/a | 72.7 | % | (320) bps | n/a | |||||||||||||

| RevPOR | $ | 5,244 | $ | 5,097 | $ | 147 | 2.9% | $ | 5,076 | $ | 168 | 3.3% | |||||||||||

| Facility operating expense | $ | 446.3 | $ | 450.7 | $ | (4.4) | (1.0)% | $ | 458.8 | $ | (12.5) | (2.7)% | |||||||||||

(2) The same community portfolio includes operating results and data for 637 communities consolidated and operational for the full period in both comparison years. Consolidated communities excluded from the same community portfolio include communities acquired or disposed of since the beginning of the prior year, communities classified as assets held for sale, certain communities planned for disposition, certain communities that have undergone or are undergoing expansion, redevelopment, and repositioning projects, and certain communities that have experienced a casualty event that significantly impacts their operations. To aid in comparability, same community operating results exclude (i) natural disaster expense of $1.1 million, natural disaster-related insurance recoveries of $1.4 million, and natural disaster expense of $1.6 million for the first quarter of 2021, the first quarter of 2020, and the fourth quarter of 2020, respectively. As presented herein, same community facility operating expense includes the direct costs incurred to respond to the COVID-19 pandemic.

Page 3

•Resident fees.

•1Q 2021 vs 1Q 2020: Same community resident fees decreased $91.8 million to $551.5 million attributable to the decrease in occupancy, partially offset by the increase in RevPOR.

•1Q 2021 vs 4Q 2020: Same community resident fees decreased $7.4 million to $551.5 million attributable to the decrease in occupancy, partially offset by the increase in RevPOR.

•The Company estimates that the COVID-19 pandemic resulted in $91.2 million, $99.2 million, and $1.4 million of lost resident fee revenue for the Company's consolidated same community senior housing portfolio for the first quarter of 2021, fourth quarter of 2020, and first quarter of 2020, respectively.

•Facility operating expense.

•1Q 2021 vs 1Q 2020: The year-over-year decrease was primarily due to decreases in food and supplies costs due to reduced occupancy during the period, partially offset by an increase in labor costs.

•1Q 2021 vs 4Q 2020: The decrease was primarily due to a decrease in costs as a result of fewer days of expense during the first quarter of 2021.

•The Company's consolidated same community senior housing portfolio incurred $25.2 million, $26.5 million, and $9.1 million of incremental direct costs during the first quarter of 2021, fourth quarter of 2020, and first quarter of 2020, respectively, to respond to the COVID-19 pandemic.

Health Care Services

Year-Over-Year Increase / (Decrease) | Sequential Increase / (Decrease) | ||||||||||||||||||||||

| ($ in millions) | 1Q 2021 | 1Q 2020 | Amount | Percent | 4Q 2020 | Amount | Percent | ||||||||||||||||

| Resident fee revenue | $ | 86.9 | $ | 94.8 | $ | (7.9) | (8.3) | % | $ | 91.9 | $ | (5.0) | (5.4) | % | |||||||||

| Facility operating expense | 87.0 | 103.9 | (16.9) | (16.3) | % | 92.1 | (5.1) | (5.5) | % | ||||||||||||||

•Resident fee revenue.

•1Q 2021 vs 1Q 2020: Health Care Services revenue decreased primarily due to a decline of 16.9% in home health average daily census primarily as a result of the pandemic and lower occupancy in the Company's communities.

•1Q 2021 vs 4Q 2020: Health Care Services revenue decreased primarily due to a decline of 7.9% in home health average daily census primarily as a result of the pandemic and lower occupancy in the Company's communities and the severe winter storm in Texas.

•The Company estimates that the COVID-19 pandemic resulted in $23.3 million, $19.6 million, and $3.1 million of lost resident fee revenue for its Health Care Services segment for the first quarter of 2021, fourth quarter of 2020, and first quarter of 2020, respectively.

•Facility operating expense.

•1Q 2021 vs 1Q 2020: The decrease in facility operating expense was primarily attributable to a decrease in labor costs for home health services as a result of the lower census and as the Company adjusted its home health services operational structure, to better align its facility operating expenses and business model in connection with PDGM.

•1Q 2021 vs 4Q 2020: The decrease in facility operating expense was primarily attributable to a decrease in labor costs for home health services as a result of the lower census and due to a decrease in costs as a result of fewer days of expense during the first quarter of 2021.

•The Health Care Services segment incurred $1.4 million, $2.3 million, and $0.4 million of incremental direct costs during the first quarter of 2021, fourth quarter of 2020, and first quarter of 2020, respectively, to respond to the COVID-19 pandemic.

LIQUIDITY

The table below presents a summary of the Company’s net cash provided by (used in) operating activities and Adjusted Free Cash Flow.

| ($ in millions) | 1Q 2021 | 1Q 2020 | Year-Over-Year Increase / (Decrease) | 4Q 2020 | Sequential Increase / (Decrease) | ||||||||||||

| Net cash provided by (used in) operating activities | $ | (23.9) | $ | 57.5 | $ | (81.4) | $ | 73.5 | $ | (97.4) | |||||||

Adjusted Free Cash Flow (3) | (50.7) | 5.2 | (55.9) | 19.9 | (70.6) | ||||||||||||

(3) Adjusted Free Cash Flow is a financial measure that is not calculated in accordance with GAAP. See "Reconciliations of Non-GAAP Financial Measures" for the Company's definition of such measure, reconciliations to the most comparable GAAP financial measure and other important information regarding the use of the Company's non-GAAP financial measures.

Page 4

•Net cash provided by (used in) operating activities.

•1Q 2021 vs 1Q 2020: The change in net cash provided by (used in) operating activities was attributable primarily to the $100.0 million management agreement termination fee payment received from Healthpeak in connection with the sale of the Company's ownership interest in the CCRC Venture in the prior year period and a decrease in same community revenue compared to the prior year period. These changes were partially offset by a decrease in cash payments for accounts payable and accrued expenses compared to the prior year period.

•1Q 2021 vs 4Q 2020: The change in net cash provided by (used in) operating activities was primarily attributable to a decrease in government grants accepted compared to the prior year period.

•Adjusted Free Cash Flow.

•1Q 2021 vs 1Q 2020: The $55.9 million decrease in Adjusted Free Cash Flow was attributable to the change in net cash provided by operating activities, partially offset by a $33.1 million decrease in non-development capital expenditures, net.

•1Q 2021 vs 4Q 2020: The $70.6 million decrease in Adjusted Free Cash Flow was attributable to the change in net cash provided by operating activities, excluding $18.8 million of changes in prepaid insurance premiums financed with notes payable, partially offset by a $7.2 million decrease in non-development capital expenditures, net.

•Total Liquidity. Total liquidity of $438.9 million as of March 31, 2021 included $304.0 million of unrestricted cash and cash equivalents and $134.9 million of marketable securities. Total liquidity as of March 31, 2021 decreased $136.6 million from December 31, 2020, primarily attributable to the negative $50.7 million of Adjusted Free Cash Flow and $38.3 million of payments of mortgage debt during the first quarter of 2021. The current portion of long-term debt as of March 31, 2021 was $224.9 million, which primarily includes $172.6 million of non-recourse mortgage debt maturing in the first quarter of 2022. The Company has no remaining non-recourse mortgage debt maturities in 2021.

TRANSACTION UPDATE

•Health Care Services segment: On February 24, 2021, the Company entered into a Securities Purchase Agreement (the "Purchase Agreement") with affiliates of HCA Healthcare, Inc., providing for the sale of 80% of the Company’s equity in its Health Care Services segment for a purchase price of $400 million in cash, subject to certain adjustments set forth in the Purchase Agreement, including a reduction for the remaining outstanding balance as of the closing of Medicare advanced payments and deferred payroll tax payments related to the Health Care Services segment, which were $75.2 million and $8.9 million, respectively, as of March 31, 2021. The closing of the sale transaction is anticipated to occur in the early second half of 2021, subject to receipt of applicable regulatory approvals and satisfaction of other customary closing conditions set forth in the Purchase Agreement. Pursuant to the Purchase Agreement, at closing of the transaction, the Company will retain a 20% equity interest in the business. There can be no assurance that the transaction will close or, if it does, when the actual closing will occur.

OUTLOOK

Key factors that may impact the Company's financial performance and liquidity for 2021 include:

•Senior Housing Occupancy: With sequential occupancy growth in March, the Company expects, on a sequential basis, growth in the second quarter and stronger growth in the third quarter of 2021. The Company also expects to continue to publish monthly occupancy until it returns to providing financial guidance, at which point it would expect to return to its historical reporting practices.

•Pandemic-related Expenses: With significantly lower COVID-19 cases, the Company expects to reduce pandemic-related expenses more than 50% in the second quarter, compared to the $27.3 million reported in the first quarter of 2021.

•Non-development Capital Expenditures: The Company expects non-development capital expenditures, net of lessor reimbursements, to be approximately $140 million for the full year 2021.

•Working Capital impacts related to Government Temporary Liquidity Relief, excluding Health Care Services segment repayments impacted by the transaction described above:

◦Payroll Tax Deferral Program - The Company expects to pay approximately $32 million of deferred payments in both December 2021 and 2022.

◦Medicare Advanced Payments - The Company expects recoupment of approximately $6 million of advanced payments related to the CCRCs segment during 2021, beginning in the second quarter.

SUPPLEMENTAL INFORMATION

The Company will post on its website at www.brookdale.com/investor supplemental information relating to the Company's first quarter 2021 results, an updated investor presentation, and a copy of this earnings release. The supplemental information and a copy of this earnings release will also be furnished in a Form 8-K to be filed with the SEC.

Page 5

EARNINGS CONFERENCE CALL

Brookdale's management will conduct a conference call to review the financial results for the first quarter 2021 on May 7, 2021 at 9:00 AM ET. The conference call can be accessed by dialing (833) 366-1368 (from within the U.S.) or (639) 380-0044 (from outside of the U.S.) ten minutes prior to the scheduled start and referencing "Brookdale".

A webcast of the conference call will be available to the public on a listen-only basis at www.brookdale.com/investor. Please allow extra time prior to the call to visit the site and download the necessary software required to listen to the internet broadcast. A replay of the webcast will be available through the website following the call.

For those who cannot listen to the live call, a replay will be available until 11:59 PM ET on May 14, 2021 by dialing (800) 585-8367 (from within the U.S.) or (416) 621-4642 (from outside of the U.S.) and referencing access code "7695118".

ABOUT BROOKDALE SENIOR LIVING

Brookdale Senior Living Inc., the nation’s premier operator of senior living communities, is committed to its mission of enriching the lives of the people it serves with compassion, respect, excellence and integrity. The Company operates independent living, assisted living, Alzheimer’s and dementia care communities, and through its comprehensive network of services, Brookdale helps to provide seniors with care and services to support their lifestyle in an environment that feels like home. The Company’s expertise in healthcare, hospitality and real estate provides our residents with opportunities to improve wellness, pursue passions and stay connected with friends and loved ones. The Company operates and manages 695 communities in 42 states as of March 31, 2021, with the ability to serve approximately 60,000 residents and 16,000 patients. Brookdale's stock trades on the New York Stock Exchange under the ticker symbol BKD. For more information, visit brookdale.com or connect with Brookdale on Facebook or Twitter.

DEFINITIONS OF RevPAR AND RevPOR

RevPAR, or average monthly senior housing resident fee revenue per available unit, is defined by the Company as resident fee revenue for the corresponding portfolio for the period (excluding Health Care Services segment revenue, revenue for private duty services provided to seniors living outside of the Company's communities, and entrance fee amortization), divided by the weighted average number of available units in the corresponding portfolio for the period, divided by the number of months in the period.

RevPOR, or average monthly senior housing resident fee revenue per occupied unit, is defined by the Company as resident fee revenue for the corresponding portfolio for the period (excluding Health Care Services segment revenue, revenue for private duty services provided to seniors living outside of the Company's communities, and entrance fee amortization), divided by the weighted average number of occupied units in the corresponding portfolio for the period, divided by the number of months in the period.

SAFE HARBOR

Certain statements in this press release and the associated earnings call may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to various risks and uncertainties and include all statements that are not historical statements of fact and those regarding the Company's intent, belief or expectations. Forward-looking statements are generally identifiable by use of forward-looking terminology such as "may," "will," "should," "could," "would," "potential," "intend," "expect," "endeavor," "seek," "anticipate," "estimate," "believe," "project," "predict," "continue," "plan," "target," or other similar words or expressions. These forward-looking statements are based on certain assumptions and expectations, and the Company's ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Although the Company believes that expectations reflected in any forward-looking statements are based on reasonable assumptions, it can give no assurance that its assumptions or expectations will be attained and actual results and performance could differ materially from those projected. Factors which could have a material adverse effect on the Company's operations and future prospects or which could cause events or circumstances to differ from the forward-looking statements include, but are not limited to, the impacts of the COVID-19 pandemic, including the response efforts of federal, state, and local government authorities, businesses, individuals, and the Company on the Company's business, results of operations, cash flow, liquidity, and strategic initiatives, including plans for future growth, which will depend on many factors, some of which cannot be foreseen, including the duration, severity, and breadth of the pandemic and any resurgence of the disease, the impact of COVID-19 on the nation’s economy and debt and equity markets and the local economies in the Company's markets, the development, availability, utilization, and efficacy of COVID-19 testing, therapeutic agents, and vaccines and the prioritization of such resources among businesses and demographic groups, government financial and regulatory relief efforts that may become available to business and individuals, including the Company's ability to qualify for and satisfy the terms and conditions of financial relief, perceptions regarding the safety of senior living communities during and after the pandemic, changes in demand for senior living communities and the Company's ability to adapt its sales and marketing efforts to meet that demand, the impact of COVID-19 on the Company's residents’ and their families’ ability to afford resident fees, including due to changes in unemployment rates, consumer confidence, housing markets, and equity markets caused by COVID-19, changes in the acuity levels of the Company's new residents, the disproportionate impact of COVID-19 on seniors generally and those residing in the

Page 6

Company's communities, the duration and costs of the Company's response efforts, including increased equipment, supplies, labor, litigation, testing, vaccination clinic, and other expenses, the impact of COVID-19 on the Company's ability to complete financings, refinancings, or other transactions (including dispositions and the Company's pending Health Care Services transaction) or to generate sufficient cash flow to cover required interest and lease payments and to satisfy financial and other covenants in its debt and lease documents, increased regulatory requirements, including unfunded, mandatory testing, increased enforcement actions resulting from COVID-19, government action that may limit the Company's collection or discharge efforts for delinquent accounts, and the frequency and magnitude of legal actions and liability claims that may arise due to COVID-19 or the Company's response efforts; events which adversely affect the ability of seniors to afford resident fees, including downturns in the economy, housing market, consumer confidence, or the equity markets and unemployment among resident family members; changes in reimbursement rates, methods, or timing under governmental reimbursement programs including the Medicare and Medicaid programs; the impact of ongoing healthcare reform efforts; the effects of senior housing construction and development, lower industry occupancy (including due to the pandemic), and increased competition; conditions of housing markets, regulatory changes, acts of nature, and the effects of climate change in geographic areas where the Company is concentrated; terminations of the Company's resident agreements and vacancies in the living spaces it leases, including due to the pandemic; limits on the Company's ability to use net operating loss carryovers to reduce future tax payments; failure to maintain the security and functionality of the Company's information systems, to prevent a cybersecurity attack or breach, or to comply with applicable privacy and consumer protection laws, including HIPAA; the Company's ability to complete its capital expenditures in accordance with its plans; the Company's ability to identify and pursue development, investment and acquisition opportunities and its ability to successfully integrate acquisitions; competition for the acquisition of assets; the Company's ability to complete pending or expected disposition, acquisition, or other transactions (including the Company's pending Health Care Services transaction) on agreed upon terms or at all, including in respect of the satisfaction of closing conditions, the risk that regulatory approvals are not obtained or are subject to unanticipated conditions, and uncertainties as to the timing of closing, and the Company's ability to identify and pursue any such opportunities in the future; risks related to the implementation of the Company's strategy, including initiatives undertaken to execute on the Company's strategic priorities and their effect on its results; delays in obtaining regulatory approvals; disruptions in the financial markets or decreases in the appraised values or performance of the Company's communities that affect the Company's ability to obtain financing or extend or refinance debt as it matures and the Company's financing costs; the Company's ability to generate sufficient cash flow to cover required interest and long-term lease payments and to fund its planned capital projects; the effect of the Company's non-compliance with any of its debt or lease agreements (including the financial covenants contained therein), including the risk of lenders or lessors declaring a cross default in the event of the Company's non-compliance with any such agreements and the risk of loss of the Company's property securing leases and indebtedness due to any resulting lease terminations and foreclosure actions; the effect of the Company's indebtedness and long-term leases on the Company's liquidity; the potential phasing out of LIBOR which may increase the costs of the Company's debt obligations; the Company's ability to obtain additional capital on terms acceptable to it; departures of key officers and potential disruption caused by changes in management; increased competition for or a shortage of personnel (including due to the pandemic), wage pressures resulting from increased competition, low unemployment levels, minimum wage increases and changes in overtime laws, and union activity; environmental contamination at any of the Company's communities; failure to comply with existing environmental laws; an adverse determination or resolution of complaints filed against the Company, including class action and stockholder derivative complaints; the cost and difficulty of complying with increasing and evolving regulation; costs to respond to, and adverse determinations resulting from, government reviews, audits and investigations; unanticipated costs to comply with legislative or regulatory developments; the risks associated with current global economic conditions and general economic factors such as inflation, the consumer price index, commodity costs, fuel and other energy costs, costs of salaries, wages, benefits, and insurance, interest rates, and tax rates; the impact of seasonal contagious illness or an outbreak of COVID-19 or other contagious disease in the markets in which the Company operates; actions of activist stockholders, including a proxy contest; as well as other risks detailed from time to time in the Company's filings with the Securities and Exchange Commission, including those set forth in the Company's Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements in such SEC filings. Readers are cautioned not to place undue reliance on any of these forward-looking statements, which reflect management's views as of the date of this press release and/or associated earnings call. The Company cannot guarantee future results, levels of activity, performance or achievements, and, except as required by law, it expressly disclaims any obligation to release publicly any updates or revisions to any forward-looking statements contained in this press release and/or associated earnings call to reflect any change in the Company's expectations with regard thereto or change in events, conditions, or circumstances on which any statement is based.

Page 7

Condensed Consolidated Statements of Operations

| Three Months Ended March 31, | |||||||||||

| (in thousands, except per share data) | 2021 | 2020 | |||||||||

| Revenue | |||||||||||

| Resident fees | $ | 664,350 | $ | 782,707 | |||||||

| Management fees | 8,566 | 108,715 | |||||||||

| Reimbursed costs incurred on behalf of managed communities | 65,794 | 122,717 | |||||||||

| Other operating income | 10,735 | — | |||||||||

| Total revenue and other operating income | 749,445 | 1,014,139 | |||||||||

| Expense | |||||||||||

Facility operating expense (excluding facility depreciation and amortization of $77,274 and $84,301, respectively) | 556,312 | 588,482 | |||||||||

General and administrative expense (including non-cash stock-based compensation expense of $4,783 and $5,957, respectively) | 49,943 | 54,595 | |||||||||

| Facility operating lease expense | 44,418 | 64,481 | |||||||||

| Depreciation and amortization | 83,891 | 90,738 | |||||||||

| Asset impairment | 10,677 | 78,226 | |||||||||

| Costs incurred on behalf of managed communities | 65,794 | 122,717 | |||||||||

| Total operating expense | 811,035 | 999,239 | |||||||||

| Income (loss) from operations | (61,590) | 14,900 | |||||||||

| Interest income | 421 | 1,455 | |||||||||

| Interest expense: | |||||||||||

| Debt | (35,351) | (41,763) | |||||||||

| Financing lease obligations | (11,383) | (13,282) | |||||||||

| Amortization of deferred financing costs and debt discount | (1,873) | (1,315) | |||||||||

| Gain (loss) on debt modification and extinguishment, net | — | 19,181 | |||||||||

| Equity in earnings (loss) of unconsolidated ventures | (531) | (1,008) | |||||||||

| Gain (loss) on sale of assets, net | 1,112 | 372,839 | |||||||||

| Other non-operating income (loss) | 1,644 | 2,662 | |||||||||

| Income (loss) before income taxes | (107,551) | 353,669 | |||||||||

| Benefit (provision) for income taxes | (752) | 15,828 | |||||||||

| Net income (loss) | (108,303) | 369,497 | |||||||||

| Net (income) loss attributable to noncontrolling interest | 18 | 18 | |||||||||

| Net income (loss) attributable to Brookdale Senior Living Inc. common stockholders | $ | (108,285) | $ | 369,515 | |||||||

| Net income (loss) per share attributable to Brookdale Senior Living Inc. common stockholders: | |||||||||||

| Basic | $ | (0.59) | $ | 2.01 | |||||||

| Diluted | $ | (0.59) | $ | 2.00 | |||||||

| Weighted average common shares outstanding: | |||||||||||

| Basic | 184,011 | 184,186 | |||||||||

| Diluted | 184,011 | 184,522 | |||||||||

Page 8

Condensed Consolidated Balance Sheets

| (in thousands) | March 31, 2021 | December 31, 2020 | |||||||||

| Cash and cash equivalents | $ | 303,952 | $ | 380,420 | |||||||

| Marketable securities | 134,933 | 172,905 | |||||||||

| Restricted cash | 26,503 | 28,059 | |||||||||

| Accounts receivable, net | 52,588 | 109,221 | |||||||||

| Assets held for sale | 247,627 | 16,061 | |||||||||

| Prepaid expenses and other current assets, net | 90,949 | 66,937 | |||||||||

| Total current assets | 856,552 | 773,603 | |||||||||

| Property, plant and equipment and leasehold intangibles, net | 5,018,409 | 5,068,060 | |||||||||

| Operating lease right-of-use assets | 743,346 | 788,138 | |||||||||

| Other assets, net | 127,846 | 271,957 | |||||||||

| Total assets | $ | 6,746,153 | $ | 6,901,758 | |||||||

| Current portion of long-term debt | $ | 224,890 | $ | 68,885 | |||||||

| Current portion of financing lease obligations | 20,083 | 19,543 | |||||||||

| Current portion of operating lease obligations | 140,339 | 146,226 | |||||||||

| Liabilities held for sale | 116,142 | — | |||||||||

| Other current liabilities | 397,508 | 456,079 | |||||||||

| Total current liabilities | 898,962 | 690,733 | |||||||||

| Long-term debt, less current portion | 3,664,901 | 3,847,103 | |||||||||

| Financing lease obligations, less current portion | 539,071 | 543,764 | |||||||||

| Operating lease obligations, less current portion | 797,311 | 819,429 | |||||||||

| Other liabilities | 150,801 | 198,000 | |||||||||

| Total liabilities | 6,051,046 | 6,099,029 | |||||||||

| Total Brookdale Senior Living Inc. stockholders' equity | 692,830 | 800,434 | |||||||||

| Noncontrolling interest | 2,277 | 2,295 | |||||||||

| Total equity | 695,107 | 802,729 | |||||||||

| Total liabilities and equity | $ | 6,746,153 | $ | 6,901,758 | |||||||

Page 9

Condensed Consolidated Statements of Cash Flows

| Three Months Ended March 31, | |||||||||||

| (in thousands) | 2021 | 2020 | |||||||||

| Cash Flows from Operating Activities | |||||||||||

| Net income (loss) | $ | (108,303) | $ | 369,497 | |||||||

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | |||||||||||

| Loss (gain) on debt modification and extinguishment, net | — | (19,181) | |||||||||

| Depreciation and amortization, net | 85,764 | 92,053 | |||||||||

| Asset impairment | 10,677 | 78,226 | |||||||||

| Equity in (earnings) loss of unconsolidated ventures | 531 | 1,008 | |||||||||

| Amortization of entrance fees | (364) | (377) | |||||||||

| Proceeds from deferred entrance fee revenue | 670 | 343 | |||||||||

| Deferred income tax (benefit) provision | 319 | (21,767) | |||||||||

| Operating lease expense adjustment | (4,664) | (6,733) | |||||||||

| Loss (gain) on sale of assets, net | (1,112) | (372,839) | |||||||||

| Non-cash stock-based compensation expense | 4,783 | 5,957 | |||||||||

| Other | (1,416) | (1,460) | |||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Accounts receivable, net | (5,768) | (2,033) | |||||||||

| Prepaid expenses and other assets, net | (6,769) | (1,696) | |||||||||

| Prepaid insurance premiums financed with notes payable | (12,985) | (17,434) | |||||||||

| Trade accounts payable and accrued expenses | (500) | (47,919) | |||||||||

| Refundable fees and deferred revenue | 7,717 | (2,254) | |||||||||

| Operating lease assets and liabilities for lessor capital expenditure reimbursements | 7,563 | 4,088 | |||||||||

| Net cash provided by (used in) operating activities | (23,857) | 57,479 | |||||||||

| Cash Flows from Investing Activities | |||||||||||

| Change in lease security deposits and lease acquisition deposits, net | (62) | 3,211 | |||||||||

| Purchase of marketable securities | (79,932) | (89,414) | |||||||||

| Sale and maturities of marketable securities | 117,995 | 50,000 | |||||||||

| Capital expenditures, net of related payables | (40,361) | (69,385) | |||||||||

| Acquisition of assets, net of related payables and cash received | — | (446,688) | |||||||||

| Investment in unconsolidated ventures | (5,206) | (268) | |||||||||

| Proceeds from sale of assets, net | 3,760 | 304,617 | |||||||||

| Net cash provided by (used in) investing activities | (3,806) | (247,927) | |||||||||

| Cash Flows from Financing Activities | |||||||||||

| Proceeds from debt | 18,575 | 471,785 | |||||||||

| Repayment of debt and financing lease obligations | (49,924) | (263,226) | |||||||||

| Proceeds from line of credit | — | 166,381 | |||||||||

| Purchase of treasury stock, net of related payables | — | (18,123) | |||||||||

| Payment of financing costs, net of related payables | (87) | (5,815) | |||||||||

| Payments of employee taxes for withheld shares | (4,329) | (3,898) | |||||||||

| Other | 203 | 146 | |||||||||

| Net cash provided by (used in) financing activities | (35,562) | 347,250 | |||||||||

| Net increase (decrease) in cash, cash equivalents, and restricted cash | (63,225) | 156,802 | |||||||||

| Cash, cash equivalents, and restricted cash at beginning of period | 465,148 | 301,697 | |||||||||

| Cash, cash equivalents, and restricted cash at end of period | $ | 401,923 | $ | 458,499 | |||||||

Page 10

Reconciliations of Non-GAAP Financial Measures

This earnings release contains the financial measures Adjusted EBITDA and Adjusted Free Cash Flow, which are not calculated in accordance with U.S. generally accepted accounting principles ("GAAP"). Presentations of these non-GAAP financial measures are intended to aid investors in better understanding the factors and trends affecting the Company’s performance and liquidity. However, investors should not consider these non-GAAP financial measures as a substitute for financial measures determined in accordance with GAAP, including net income (loss), income (loss) from operations, or net cash provided by (used in) operating activities. Investors are cautioned that amounts presented in accordance with the Company’s definitions of these non-GAAP financial measures may not be comparable to similar measures disclosed by other companies because not all companies calculate non-GAAP measures in the same manner. Investors are urged to review the following reconciliations of these non-GAAP financial measures from the most comparable financial measures determined in accordance with GAAP.

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP performance measure that the Company defines as net income (loss) excluding: benefit/provision for income taxes, non-operating income/expense items, and depreciation and amortization; and further adjusted to exclude income/expense associated with non-cash, non-operational, transactional, cost reduction, or organizational restructuring items that management does not consider as part of the Company’s underlying core operating performance and that management believes impact the comparability of performance between periods. For the periods presented herein, such other items include non-cash impairment charges, gain/loss on facility lease termination and modification, operating lease expense adjustment, amortization of deferred gain, change in future service obligation, non-cash stock-based compensation expense, and transaction and organizational restructuring costs. Transaction costs include those directly related to acquisition, disposition, financing, and leasing activity, and stockholder relations advisory matters, and are primarily comprised of legal, finance, consulting, professional fees, and other third party costs. Organizational restructuring costs include those related to the Company’s efforts to reduce general and administrative expense and its senior leadership changes, including severance.

The Company believes that presentation of Adjusted EBITDA as a performance measure is useful to investors because (i) it is one of the metrics used by the Company’s management for budgeting and other planning purposes, to review the Company’s historic and prospective core operating performance, and to make day-to-day operating decisions; (ii) it provides an assessment of operational factors that management can impact in the short-term, namely revenues and the controllable cost structure of the organization, by eliminating items related to the Company’s financing and capital structure and other items that management does not consider as part of the Company’s underlying core operating performance and that management believes impact the comparability of performance between periods; and (iii) the Company believes that this measure is used by research analysts and investors to evaluate the Company’s operating results and to value companies in its industry.

Adjusted EBITDA has material limitations as a performance measure, including: (i) excluded interest and income tax are necessary to operate the Company’s business under its current financing and capital structure; (ii) excluded depreciation, amortization and impairment charges may represent the wear and tear and/or reduction in value of the Company’s communities, goodwill, and other assets and may be indicative of future needs for capital expenditures; and (iii) the Company may incur income/expense similar to those for which adjustments are made, such as gain/loss on sale of assets, facility lease termination and modification, or debt modification and extinguishment, non-cash stock-based compensation expense, and transaction and other costs, and such income/expense may significantly affect the Company’s operating results.

Page 11

The table below reconciles the Company's Adjusted EBITDA from its net income (loss).

| Three Months Ended | |||||||||||||||||

| (in thousands) | March 31, 2021 | December 31, 2020 | March 31, 2020 | ||||||||||||||

| Net income (loss) | $ | (108,303) | $ | (44,139) | $ | 369,497 | |||||||||||

| Provision (benefit) for income taxes | 752 | (2,208) | (15,828) | ||||||||||||||

| Equity in (earnings) loss of unconsolidated ventures | 531 | 1,244 | 1,008 | ||||||||||||||

| Loss (gain) on debt modification and extinguishment, net | — | 211 | (19,181) | ||||||||||||||

| Loss (gain) on sale of assets, net | (1,112) | (513) | (372,839) | ||||||||||||||

| Other non-operating (income) loss | (1,644) | (1,050) | (2,662) | ||||||||||||||

| Interest expense | 48,607 | 49,451 | 56,360 | ||||||||||||||

| Interest income | (421) | (494) | (1,455) | ||||||||||||||

| Income (loss) from operations | (61,590) | 2,502 | 14,900 | ||||||||||||||

| Depreciation and amortization | 83,891 | 87,513 | 90,738 | ||||||||||||||

| Asset impairment | 10,677 | 10,579 | 78,226 | ||||||||||||||

| Loss (gain) on facility lease termination and modification, net | — | (2,303) | — | ||||||||||||||

| Operating lease expense adjustment | (4,664) | (4,000) | (6,733) | ||||||||||||||

| Non-cash stock-based compensation expense | 4,783 | 2,535 | 5,957 | ||||||||||||||

| Transaction and organizational restructuring costs | 1,884 | 1,778 | 1,981 | ||||||||||||||

Adjusted EBITDA(1) | $ | 34,981 | $ | 98,604 | $ | 185,069 | |||||||||||

| $100.0 million management termination fee | — | — | (100,000) | ||||||||||||||

| Adjusted EBITDA, excluding $100.0 million management termination fee | $ | 34,981 | $ | 98,604 | $ | 85,069 | |||||||||||

(1) Adjusted EBITDA includes:

•$10.7 million and $78.3 million benefit for the three months ended March 31, 2021 and December 31, 2020, respectively, of Provider Relief Funds and other government grants and credits recognized in other operating income

•$100.0 million benefit for the three months ended March 31, 2020 for the management agreement termination fee payment received from Healthpeak in connection with the sale of the Company's ownership interest in the CCRC Venture

Adjusted Free Cash Flow

Adjusted Free Cash Flow is a non-GAAP liquidity measure that the Company defines as net cash provided by (used in) operating activities before: distributions from unconsolidated ventures from cumulative share of net earnings, changes in prepaid insurance premiums financed with notes payable, changes in operating lease liability for lease termination, cash paid/received for gain/loss on facility lease termination and modification, and lessor capital expenditure reimbursements under operating leases; plus: property insurance proceeds and proceeds from refundable entrance fees, net of refunds; less: non-development capital expenditures and payment of financing lease obligations. Non-development capital expenditures are comprised of corporate and community-level capital expenditures, including those related to maintenance, renovations, upgrades, and other major building infrastructure projects for the Company’s communities and is presented net of lessor reimbursements. Non-development capital expenditures do not include capital expenditures for: community expansions, major community redevelopment and repositioning projects, and the development of new communities.

The Company believes that presentation of Adjusted Free Cash Flow as a liquidity measure is useful to investors because (i) it is one of the metrics used by the Company’s management for budgeting and other planning purposes, to review the Company’s historic and prospective sources of operating liquidity, and to review the Company’s ability to service its outstanding indebtedness, pay dividends to stockholders, engage in share repurchases, and make capital expenditures, including development capital expenditures; and (ii) it provides an indicator to management to determine if adjustments to current spending decisions are needed.

Adjusted Free Cash Flow has material limitations as a liquidity measure, including: (i) it does not represent cash available for dividends, share repurchases, or discretionary expenditures since certain non-discretionary expenditures, including mandatory debt principal payments, are not reflected in this measure; (ii) the cash portion of non-recurring charges related to gain/loss on facility lease termination generally represent charges/gains that may significantly affect the Company’s liquidity; and (iii) the impact of timing of cash expenditures, including the timing of non-development capital expenditures, limits the usefulness of the measure for short-term comparisons.

Page 12

The table below reconciles the Company's Adjusted Free Cash Flow from its net cash provided by (used in) operating activities.

| Three Months Ended | |||||||||||||||||

| (in thousands) | March 31, 2021 | December 31, 2020 | March 31, 2020 | ||||||||||||||

| Net cash provided by (used in) operating activities | $ | (23,857) | $ | 73,499 | $ | 57,479 | |||||||||||

| Net cash provided by (used in) investing activities | (3,806) | (81,147) | (247,927) | ||||||||||||||

| Net cash provided by (used in) financing activities | (35,562) | (20,279) | 347,250 | ||||||||||||||

| Net increase (decrease) in cash, cash equivalents, and restricted cash | $ | (63,225) | $ | (27,927) | $ | 156,802 | |||||||||||

| Net cash provided by (used in) operating activities | $ | (23,857) | $ | 73,499 | $ | 57,479 | |||||||||||

| Changes in prepaid insurance premiums financed with notes payable | 12,985 | (5,823) | 17,434 | ||||||||||||||

| Changes in assets and liabilities for lessor capital expenditure reimbursements under operating leases | (7,563) | (8,602) | (4,088) | ||||||||||||||

| Non-development capital expenditures, net | (27,450) | (34,643) | (60,556) | ||||||||||||||

| Payment of financing lease obligations | (4,789) | (4,556) | (5,087) | ||||||||||||||

Adjusted Free Cash Flow (1) | $ | (50,674) | $ | 19,875 | $ | 5,182 | |||||||||||

(1) Adjusted Free Cash Flow includes transaction and organizational restructuring costs of $1.9 million, $1.8 million, and $2.0 million for the three months ended March 31, 2021, December 31, 2020, and March 31, 2020, respectively. Additionally, Adjusted Free Cash Flow includes:

•$1.7 million benefit for the three months ended March 31, 2021 from Provider Relief Funds and other government grants accepted

•$77.2 million benefit for the three months ended December 31, 2020 from Provider Relief Funds and other government grants accepted

•$22.6 million benefit for the three months ended December 31, 2020 from payroll taxes deferred

•$100.0 million benefit for the three months ended March 31, 2020 for the management agreement termination fee payment received from Healthpeak in connection with the sale of the Company's ownership interest in the CCRC Venture

Contact:

Kathy MacDonald

SVP Investor Relations

(615) 505-1968

Kathy.MacDonald@brookdale.com

Page 13

Supplemental Information 1st Quarter 2021 Exhibit 99.2

2 COVID-19 Financial Impact 3 Overview 4 Segment Overview 7 Senior Housing 8 Health Care Services 13 G&A Expense 14 Capital Expenditures 15 Cash Facility Lease Payments 16 Capital Structure 17 Definitions 18 Appendices: Summary Financial Impact: COVID-19 21 Non-GAAP Financial Measures 23 Table of Contents

3 COVID-19 Financial Impact 1Q 2021 ($ in 000s) 2020 Consolidated Total Independent Living Assisted Living and Memory Care CCRCs Health Care Services 1Q 2021 Consolidated Total Estimated lost resident fee revenue $ 281,100 $ 16,700 $ 62,900 $ 14,600 $ 23,300 $ 117,500 Other operating income 115,749 1,364 5,104 1,684 2,583 10,735 Facility operating expense 125,534 3,047 18,902 3,985 1,403 27,337 The COVID-19 pandemic adversely impacted the Company's occupancy and resident fee revenue during 2020 and 2021 and resulted in incremental direct costs to respond to the pandemic, including costs for: acquisition of additional personal protective equipment ("PPE"), medical equipment, and cleaning and disposable food service supplies; enhanced cleaning and environmental sanitation; increased employee- related costs, including labor, workers compensation, and health plan expense; increased expense for general liability claims; and COVID-19 testing of residents and associates where not otherwise covered by government payor or third-party insurance sources. On a cumulative basis, the Company has incurred $152.9 million of pandemic-related expenses, of which 38% related to employee-related costs, 37% related to PPE and medical supplies, and 25% related to cleaning and other costs. During the first quarter of 2021 the Company recognized $9.0 million of other operating income for employee retention credits available under the Coronavirus Aid, Relief, and Economic Security Act of 2020 (“CARES Act”) for wages paid from March 12, 2020 through September 30, 2020. Additionally, the Company recognized $1.7 million of government grants in other operating income. The following tables present the known or estimated impacts related to the COVID-19 pandemic to the Company's consolidated and Senior Housing Same Community 2020 and first quarter 2021 results. The estimated lost revenue represents the difference between the actual resident fee revenue for the period and the Company's pre-COVID-19 expectations for the 2020 period. Presentations of these impacts are intended to aid investors in better understanding the factors and trends affecting the Company’s performance and liquidity. See pages 21 and 22 for the known or estimated impacts related to the COVID-19 pandemic to the Company's consolidated and Senior Housing Same Community quarterly and full year 2020 results. 1Q 2021 ($ in 000s) 2020 Same Community Independent Living Assisted Living and Memory Care CCRCs 1Q 2021 Same Community Estimated lost resident fee revenue $ 216,600 $ 16,500 $ 62,600 $ 12,100 $ 91,200 Other operating income 85,859 1,327 4,967 1,260 7,554 Facility operating expense 109,750 2,928 18,789 3,440 25,157 Estimated Impact on Consolidated Portfolio Estimated Impact on Senior Housing: Same Community March 2020 April 2020 May 2020 June 2020 July 2020 August 2020 September 2020 October 2020 November 2020 December 2020 January 2021 February 2021 March 2021 April 2021 Weighted average occupancy 82.7 % 80.4 % 78.4 % 77.4 % 76.4 % 75.2 % 74.3 % 73.8 % 72.8 % 71.5 % 70.0 % 69.4 % 69.4 % 69.9 % Month-end occupancy 82.2 % 80.0 % 78.5 % 77.8 % 76.6 % 75.5 % 75.0 % 74.1 % 73.1 % 71.5 % 70.4 % 70.1 % 70.6 % 71.1 % Consolidated Monthly Occupancy Trend

4 695 communities 59,598 units (1) Adjusted EBITDA for the first quarter and full year of 2020 includes the $100.0 million management agreement termination fee payment received from Healthpeak Properties Inc. ("Healthpeak" or "PEAK") related to the sale of Brookdale’s interest in the entry fee CCRC venture ("CCRC Venture"), which closed on January 31, 2020. Adjusted EBITDA includes government grants and credits recognized during the respective periods as presented in other operating income. Adjusted EBITDA for the third quarter and full year of 2020 includes the $119.2 million one-time cash lease payment made to Ventas, Inc. ("Ventas" or "VTR") in connection with the Company's lease restructuring transaction effective July 26, 2020 ("one-time cash lease payment"). Important Note Regarding Non-GAAP Financial Measures • Adjusted EBITDA and Adjusted Free Cash Flow are financial measures that are not calculated in accordance with GAAP. See “Definitions” and “Non-GAAP Financial Measures” for the definitions of such measures and other important information regarding such measures, including reconciliations to the most comparable GAAP measures. 2020 2021 1Q21 vs. 1Q20 ($ in 000s) 1Q 2Q 3Q 4Q Full Year 1Q Better (B)/ (Worse) (W) Resident fee revenue $ 782,707 $ 731,629 $ 700,771 $ 677,460 $ 2,892,567 $ 664,350 (15.1) % Management fee revenue $ 108,715 $ 6,076 $ 5,669 $ 10,230 $ 130,690 $ 8,566 (92.1) % Other operating income $ — $ 26,693 $ 10,765 $ 78,291 $ 115,749 $ 10,735 NM Net income (loss) $ 369,497 $ (118,420) $ (124,993) $ (44,139) $ 81,945 $ (108,303) NM Net cash provided by (used in) operating activities $ 57,479 $ 151,840 $ (77,169) $ 73,499 $ 205,649 $ (23,857) NM Adjusted EBITDA(1) $ 185,069 $ 44,733 $ (64,019) $ 98,604 $ 264,387 $ 34,981 (81.1) % PEAK management termination fee $ 100,000 $ — $ — $ — $ 100,000 $ — NM VTR one-time cash lease payment $ — $ — $ (119,180) $ — $ (119,180) $ — NM Adjusted EBITDA, excluding PEAK management termination fee and VTR one-time cash lease payment $ 85,069 $ 44,733 $ 55,161 $ 98,604 $ 283,567 $ 34,981 (58.9) % Adjusted Free Cash Flow $ 5,182 $ 113,451 $ (114,327) $ 19,875 $ 24,181 $ (50,674) NM Period end consolidated number of units 54,037 54,019 53,110 52,982 52,982 52,946 (2.0) % 1Q 2021 weighted average occupancy (consolidated communities) Occupancy Band Community Count % of Period End Communities Greater than 95% 18 3% 90% > 95% 32 5% 85% > 90% 47 7% 80% > 85% 55 8% 75% > 80% 68 10% 70% > 75% 94 15% Less than 70% 336 52% Total 650 100% Consolidated Portfolio Average Asset Age ~ 24 years Overview As of March 31, 2021 Consolidated: 52,946 Consolidated: 650 Leased 301 Managed 45 Owned 349 Leased 21,127 Managed 6,652 Owned 31,819

5 2020 2021 1Q21 vs. 1Q20 ($ in 000s) 1Q 2Q 3Q 4Q Full Year 1Q B(W) Resident fee revenue $ 782,707 $ 731,629 $ 700,771 $ 677,460 $ 2,892,567 $ 664,350 (15.1) % Management fee revenue 108,715 6,076 5,669 10,230 130,690 8,566 (92.1) % Other operating income — 26,693 10,765 78,291 115,749 10,735 NM Facility operating expense (588,482) (606,034) (570,530) (576,813) (2,341,859) (556,312) 5.5 % Combined Segment Operating Income 302,940 158,364 146,675 189,168 797,147 127,339 (58.0) % General and administrative expense (1) (46,657) (43,031) (41,752) (41,011) (172,451) (43,276) 7.2 % Cash facility operating lease payments (see page 16) (71,214) (70,600) (168,942) (49,553) (360,309) (49,082) 31.1 % Adjusted EBITDA (2) 185,069 44,733 (64,019) 98,604 264,387 34,981 (81.1) % PEAK management termination fee (100,000) — — — (100,000) — NM VTR one-time cash lease payment — — 119,180 — 119,180 — NM Adjusted EBITDA, excluding PEAK management termination fee and VTR one-time cash lease payment 85,069 44,733 55,161 98,604 283,567 34,981 (58.9) % PEAK management termination fee 100,000 — — — 100,000 — NM VTR one-time cash lease payment — — (119,180) — (119,180) — NM Transaction and Organizational Restructuring Costs (1,981) (3,368) (6,250) (1,778) (13,377) (1,884) 4.9 % Interest expense, net (see page 16) (53,590) (48,623) (48,209) (47,130) (197,552) (46,313) - 1 13.6 % Payment of financing lease obligations (5,087) (4,677) (4,548) (4,556) (18,868) (4,789) 5.9 % Changes in working capital (3) (53,902) 149,055 33,794 9,945 138,892 (5,320) 90.1 % Other (4) (4,771) (2,148) (2,223) (567) (9,709) 101 NM Non-Development Capital Expenditures, net (see page 15) (60,556) (21,521) (22,872) (34,643) (139,592) (27,450) 54.7 % Adjusted Free Cash Flow $ 5,182 $ 113,451 $ (114,327) $ 19,875 $ 24,181 $ (50,674) NM Adjusted EBITDA and Adjusted Free Cash Flow (1) Excluding non-cash stock-based compensation expense and Transaction and Organizational Restructuring Costs, see page 14. (2) Adjusted EBITDA for the first quarter and full year 2020 includes the $100.0 million benefit for the management agreement termination fee payment received from Healthpeak in connection with the sale of Brookdale’s interest in the CCRC Venture. Adjusted EBITDA includes government grants and credits recognized during the respective periods as presented in other operating income. Adjusted EBITDA for the third quarter and full year of 2020 includes the $119.2 million one-time cash lease payment. (3) Excludes changes in prepaid insurance premiums financed with notes payable and lessor capital expenditure reimbursements under operating leases and includes the working capital impacts related to CARES Act programs. (4) Primarily consists of proceeds from property insurance and cash paid for state income taxes.

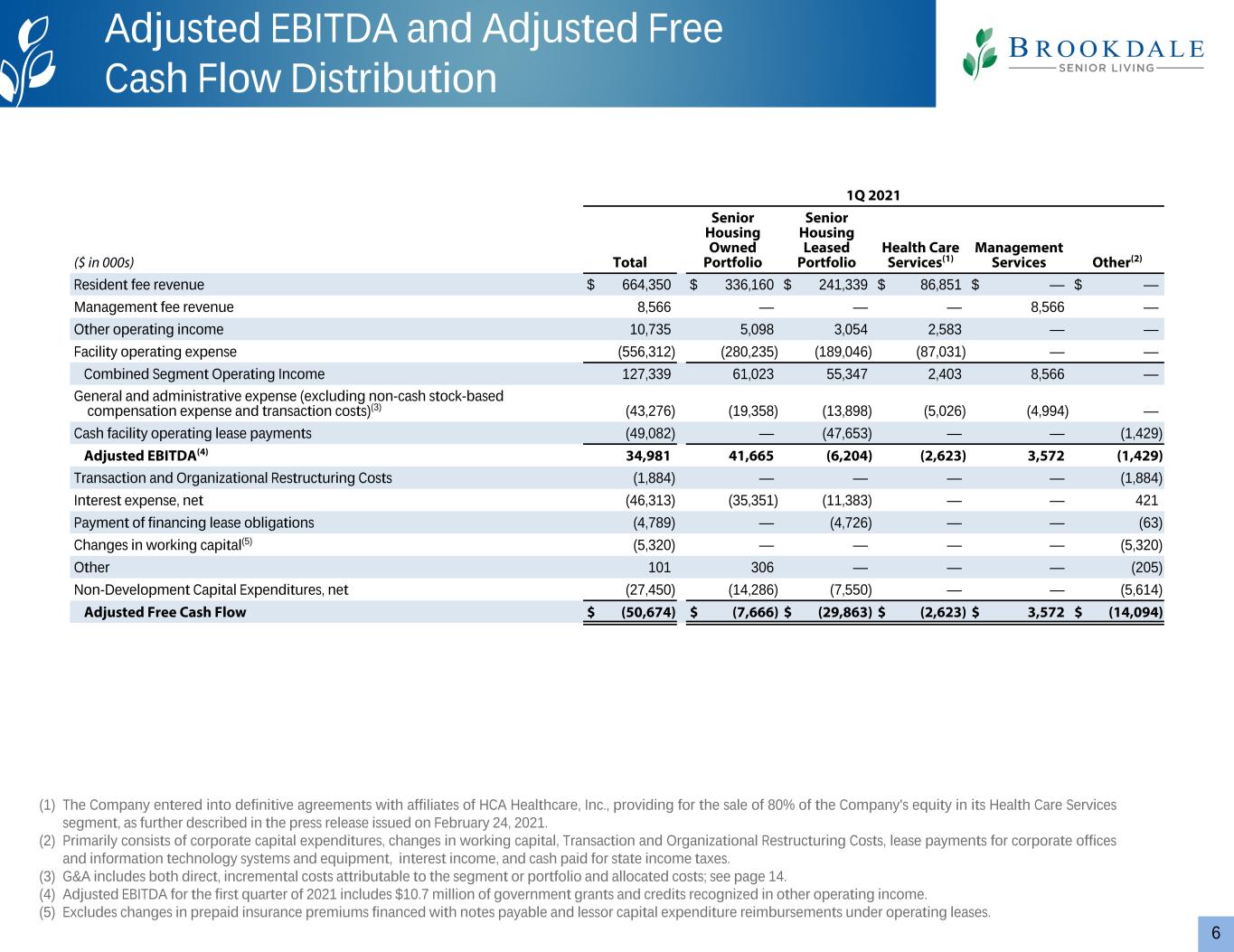

6 (1) The Company entered into definitive agreements with affiliates of HCA Healthcare, Inc., providing for the sale of 80% of the Company's equity in its Health Care Services segment, as further described in the press release issued on February 24, 2021. (2) Primarily consists of corporate capital expenditures, changes in working capital, Transaction and Organizational Restructuring Costs, lease payments for corporate offices and information technology systems and equipment, interest income, and cash paid for state income taxes. (3) G&A includes both direct, incremental costs attributable to the segment or portfolio and allocated costs; see page 14. (4) Adjusted EBITDA for the first quarter of 2021 includes $10.7 million of government grants and credits recognized in other operating income. (5) Excludes changes in prepaid insurance premiums financed with notes payable and lessor capital expenditure reimbursements under operating leases. 1Q 2021 ($ in 000s) Total Senior Housing Owned Portfolio Senior Housing Leased Portfolio Health Care Services(1) Management Services Other(2) Resident fee revenue $ 664,350 $ 336,160 $ 241,339 $ 86,851 $ — $ — Management fee revenue 8,566 — — — 8,566 — Other operating income 10,735 5,098 3,054 2,583 — — Facility operating expense (556,312) (280,235) (189,046) (87,031) — — Combined Segment Operating Income 127,339 61,023 55,347 2,403 8,566 — General and administrative expense (excluding non-cash stock-based compensation expense and transaction costs)(3) (43,276) (19,358) (13,898) (5,026) (4,994) — Cash facility operating lease payments (49,082) — (47,653) — — (1,429) Adjusted EBITDA(4) 34,981 41,665 (6,204) (2,623) 3,572 (1,429) Transaction and Organizational Restructuring Costs (1,884) — — — — (1,884) Interest expense, net (46,313) (35,351) (11,383) — — 421 Payment of financing lease obligations (4,789) — (4,726) — — (63) Changes in working capital(5) (5,320) — — — — (5,320) Other 101 306 — — — (205) Non-Development Capital Expenditures, net (27,450) (14,286) (7,550) — — (5,614) Adjusted Free Cash Flow $ (50,674) $ (7,666) $ (29,863) $ (2,623) $ 3,572 $ (14,094) Adjusted EBITDA and Adjusted Free Cash Flow Distribution

7 2020 2021 1Q21 vs. 1Q20 ($ in 000s, except RevPAR and RevPOR) 1Q 2Q 3Q 4Q Full Year 1Q B(W) Total Senior Housing, Health Care Services, and Management Services Revenue (1) $ 891,422 $ 737,705 $ 706,440 $ 687,690 $ 3,023,257 $ 672,916 (24.5) % Other operating income $ — $ 26,693 $ 10,765 $ 78,291 $ 115,749 $ 10,735 NM Combined Segment Operating Income $ 302,940 $ 158,364 $ 146,675 $ 189,168 $ 797,147 $ 127,339 (58.0) % Combined segment operating margin 34.0 % 20.7 % 20.5 % 24.7 % 25.4 % 18.6 % (1,540) bps Combined segment adjusted operating margin (2) 34.0 % 17.8 % 19.2 % 16.1 % 22.5 % 17.3 % (1,670) bps Senior Housing (see page 8) Revenue $ 687,888 $ 641,459 $ 610,868 $ 585,542 $ 2,525,757 $ 577,499 (16.0) % Other operating income $ — $ 9,698 $ 4,873 $ 78,291 $ 92,862 $ 8,152 NM Senior Housing Operating Income $ 203,346 $ 142,596 $ 139,544 $ 179,108 $ 664,594 $ 116,370 (42.8) % Senior Housing operating margin 29.6 % 21.9 % 22.7 % 27.0 % 25.4 % 19.9 % (970) bps Senior Housing adjusted operating margin(2) 29.6 % 20.7 % 22.0 % 17.2 % 22.6 % 18.7 % (1,090) bps Number of communities (period end) 661 660 652 651 651 650 (1.7) % Period end number of units 54,037 54,019 53,110 52,982 52,982 52,946 (2.0) % Total Average Units 54,184 54,040 53,440 53,086 53,687 52,971 (2.2) % RevPAR $ 4,229 $ 3,954 $ 3,806 $ 3,673 $ 3,917 $ 3,631 (14.1) % Weighted average unit occupancy 83.2 % 78.7 % 75.3 % 72.7 % 77.5 % 69.6 % (1,360) bps RevPOR $ 5,085 $ 5,022 $ 5,056 $ 5,052 $ 5,054 $ 5,219 2.6 % Health Care Services Segment (see page 13) Revenue $ 94,819 $ 90,170 $ 89,903 $ 91,918 $ 366,810 $ 86,851 (8.4) % Other operating income $ — $ 16,995 $ 5,892 $ — $ 22,887 $ 2,583 NM Segment Operating Income $ (9,121) $ 9,692 $ 1,462 $ (170) $ 1,863 $ 2,403 NM Segment operating margin (9.6) % 9.0 % 1.5 % (0.2) % 0.5 % 2.7 % NM Segment adjusted operating margin(2) (9.6) % (8.1) % (4.9) % (0.2) % (5.7) % (0.2) % 940 bps Management Services Segment Segment Operating Income (comprised solely of management fees) $ 108,715 $ 6,076 $ 5,669 $ 10,230 $ 130,690 $ 8,566 (92.1) % Resident fee revenue under management(3) $ 184,145 $ 131,558 $ 116,576 $ 107,817 $ 540,096 $ 82,468 (55.2) % Number of communities (period end)(3) 80 77 74 75 75 45 (43.8) % Period end number of units(3) 11,033 10,694 9,980 10,129 10,129 6,652 (39.7) % Total Average Units(3) 13,325 10,905 10,446 10,062 11,184 8,258 (38.0) % Weighted average unit occupancy(3) 84.0 % 78.0 % 74.6 % 72.1 % 77.6 % 69.4 % (1,460) bps Segment Overview (1) Excludes reimbursed costs on behalf of managed communities. (2) Excludes other operating income (3) Not included in consolidated reported amounts.

8 2020 2021 1Q21 vs. 1Q20 ($ in 000s, except RevPAR and RevPOR) 1Q 2Q 3Q 4Q Full Year 1Q B(W) Independent Living Revenue $ 135,862 $ 130,278 $ 125,762 $ 120,696 $ 512,598 $ 118,782 (12.6) % Other operating income $ — $ — $ 96 $ 11,727 $ 11,823 $ 1,364 NM Segment Operating Income $ 51,414 $ 41,038 $ 42,438 $ 47,923 $ 182,813 $ 37,329 (27.4) % Segment operating margin 37.8 % 31.5 % 33.7 % 36.2 % 34.9 % 31.1 % (670) bps Segment adjusted operating margin (1) 37.8 % 31.5 % 33.7 % 30.0 % 33.4 % 30.3 % (750) bps Number of communities (period end) 68 68 68 68 68 68 — Period end number of units 12,537 12,534 12,534 12,534 12,534 12,542 — Total Average Units 12,529 12,534 12,534 12,534 12,533 12,539 0.1 % RevPAR $ 3,615 $ 3,465 $ 3,345 $ 3,210 $ 3,408 $ 3,158 (12.6) % Weighted average unit occupancy 87.1 % 83.5 % 80.0 % 76.7 % 81.8 % 73.6 % (1,350) bps RevPOR $ 4,151 $ 4,147 $ 4,182 $ 4,183 $ 4,165 $ 4,290 3.3 % Assisted Living and Memory Care Revenue $ 457,479 $ 432,156 $ 408,695 $ 392,946 $ 1,691,276 $ 386,938 (15.4) % Other operating income $ — $ 152 $ 1,936 $ 60,497 $ 62,585 $ 5,104 NM Segment Operating Income $ 132,001 $ 87,708 $ 87,152 $ 121,740 $ 428,601 $ 71,433 (45.9) % Segment operating margin 28.9 % 20.3 % 21.2 % 26.8 % 24.4 % 18.2 % (1,070) bps Segment adjusted operating margin (1) 28.9 % 20.3 % 20.9 % 15.6 % 21.6 % 17.1 % (1,180) bps Number of communities (period end) 571 570 563 563 563 562 (1.6) % Period end number of units 35,789 35,744 35,124 35,126 35,126 35,082 (2.0) % Total Average Units 35,944 35,785 35,268 35,126 35,530 35,110 (2.3) % RevPAR $ 4,242 $ 4,025 $ 3,863 $ 3,729 $ 3,967 $ 3,673 (13.4) % Weighted average unit occupancy 81.9 % 77.8 % 74.4 % 71.8 % 76.5 % 68.3 % (1,360) bps RevPOR $ 5,178 $ 5,172 $ 5,193 $ 5,193 $ 5,184 $ 5,376 3.8 % CCRCs Revenue $ 94,547 $ 79,025 $ 76,411 $ 71,900 $ 321,883 $ 71,779 (24.1) % Other operating income $ — $ 9,546 $ 2,841 $ 6,067 $ 18,454 $ 1,684 NM Segment Operating Income $ 19,931 $ 13,850 $ 9,954 $ 9,445 $ 53,180 $ 7,608 (61.8) % Segment operating margin 21.1 % 15.6 % 12.6 % 12.1 % 15.6 % 10.4 % (1,070) bps Segment adjusted operating margin (1) 21.1 % 5.4 % 9.3 % 4.7 % 10.8 % 8.3 % (1,280) bps Number of communities (period end) 22 22 21 20 20 20 (9.1) % Period end number of units 5,711 5,741 5,452 5,322 5,322 5,322 (6.8) % Total Average Units 5,711 5,721 5,638 5,426 5,624 5,322 (6.8) % RevPAR $ 5,496 $ 4,572 $ 4,477 $ 4,385 $ 4,738 $ 4,473 (18.6) % Weighted average unit occupancy 82.4 % 74.0 % 70.7 % 69.2 % 74.2 % 68.5 % (1,390) bps RevPOR $ 6,669 $ 6,181 $ 6,332 $ 6,334 $ 6,389 $ 6,534 (2.0) % Senior Housing Segments (1) Excludes other operating income

9 2020 2021 1Q21 vs. 1Q20 ($ in 000s, except RevPAR and RevPOR) 1Q 2Q 3Q 4Q Full Year 1Q B(W) Revenue $ 643,232 $ 602,682 $ 579,036 $ 558,891 $ 2,383,841 $ 551,467 (14.3) % Other operating income — 7,044 3,856 74,959 85,859 7,554 NM Revenue and other operating income 643,232 609,726 582,892 633,850 2,469,700 559,021 (13.1) % Community Labor Expenses (291,322) (297,071) (291,452) (300,400) (1,180,245) (294,319) (1.0) % Other facility operating expenses (159,358) (175,886) (153,988) (158,380) (647,612) (152,020) 4.6 % Facility operating expenses(2) (450,680) (472,957) (445,440) (458,780) (1,827,857) (446,339) 1.0 % Same Community Operating Income $ 192,552 $ 136,769 $ 137,452 $ 175,070 $ 641,843 $ 112,682 (41.5) % Same Community operating margin 29.9 % 22.4 % 23.6 % 27.6 % 26.0 % 20.2 % (970) bps Same Community adjusted operating margin(3) 29.9 % 21.5 % 23.1 % 17.9 % 23.3 % 19.1 % (1,080) bps Total Average Units 50,458 50,451 50,450 50,452 50,453 50,455 — RevPAR $ 4,249 $ 3,982 $ 3,826 $ 3,693 $ 3,938 $ 3,643 (14.3) % Weighted average unit occupancy 83.4 % 79.0 % 75.4 % 72.7 % 77.6 % 69.5 % (1,390) bps RevPOR $ 5,097 $ 5,040 $ 5,071 $ 5,076 $ 5,071 $ 5,244 2.9 % Same Community Operating Income / Weighted Average Occupancy $192,552 $136,769 $137,452 $175,070 $112,682 83.4% 79.0% 75.4% 72.7% 69.5% 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Same Community RevPAR $4,249 $3,982 $3,826 $3,693 $3,643 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Senior Housing: Same Community(1) (1) Same Community portfolio reflects 637 communities. (2) Excludes natural disaster expense of $2.9 million and $1.1 million for the full year 2020 and the first quarter of 2021, respectively. (3) Excludes other operating income (4) Same Community Operating Income includes government grants and credits recognized in other operating income. (2) (4)(4) (4) (4)

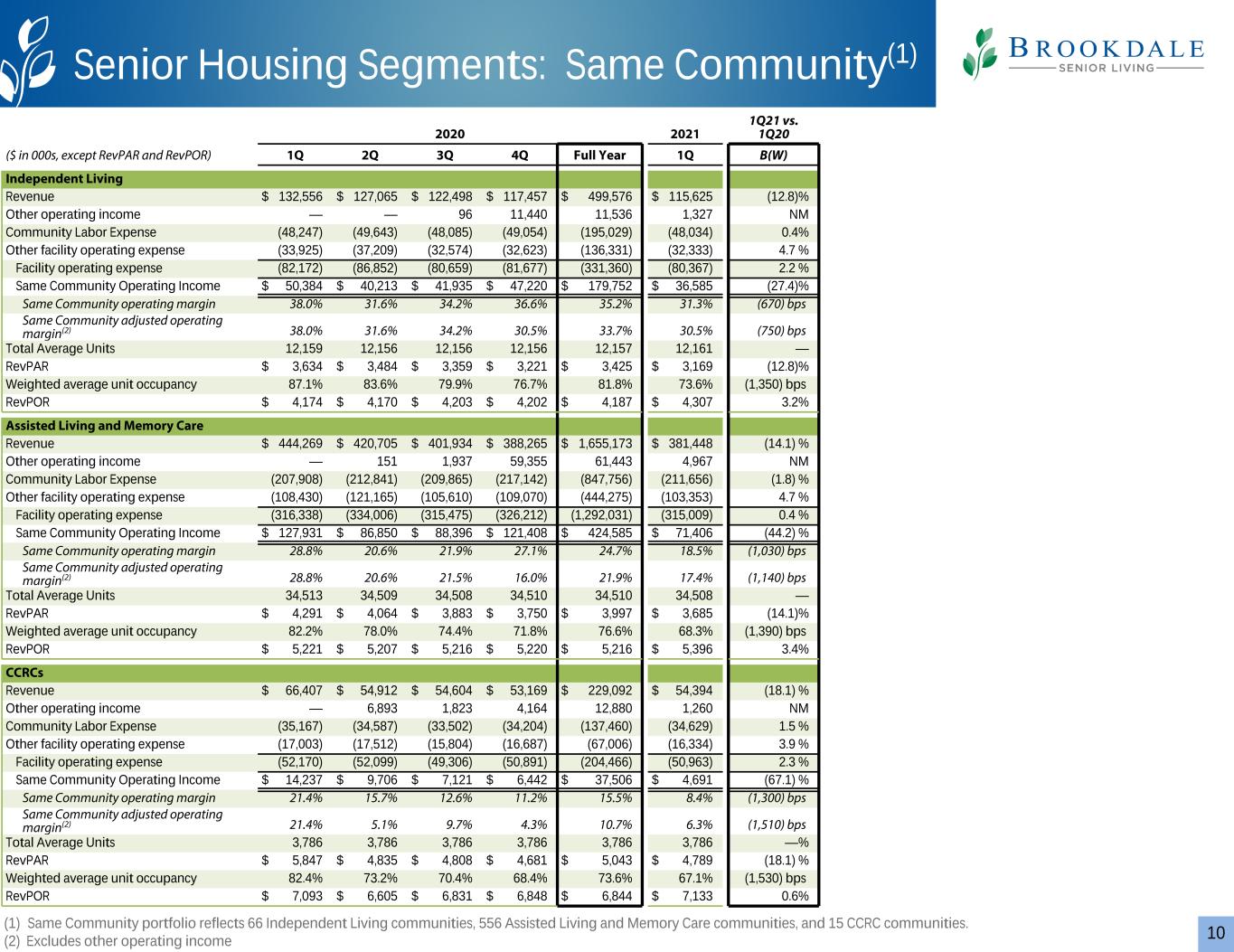

10 2020 2021 1Q21 vs. 1Q20 ($ in 000s, except RevPAR and RevPOR) 1Q 2Q 3Q 4Q Full Year 1Q B(W) Independent Living Revenue $ 132,556 $ 127,065 $ 122,498 $ 117,457 $ 499,576 $ 115,625 (12.8) % Other operating income — — 96 11,440 11,536 1,327 NM Community Labor Expense (48,247) (49,643) (48,085) (49,054) (195,029) (48,034) 0.4 % Other facility operating expense (33,925) (37,209) (32,574) (32,623) (136,331) (32,333) 4.7 % Facility operating expense (82,172) (86,852) (80,659) (81,677) (331,360) (80,367) 2.2 % Same Community Operating Income $ 50,384 $ 40,213 $ 41,935 $ 47,220 $ 179,752 $ 36,585 (27.4) % Same Community operating margin 38.0 % 31.6 % 34.2 % 36.6 % 35.2 % 31.3 % (670) bps Same Community adjusted operating margin(2) 38.0 % 31.6 % 34.2 % 30.5 % 33.7 % 30.5 % (750) bps Total Average Units 12,159 12,156 12,156 12,156 12,157 12,161 — RevPAR $ 3,634 $ 3,484 $ 3,359 $ 3,221 $ 3,425 $ 3,169 (12.8) % Weighted average unit occupancy 87.1 % 83.6 % 79.9 % 76.7 % 81.8 % 73.6 % (1,350) bps RevPOR $ 4,174 $ 4,170 $ 4,203 $ 4,202 $ 4,187 $ 4,307 3.2 % Assisted Living and Memory Care Revenue $ 444,269 $ 420,705 $ 401,934 $ 388,265 $ 1,655,173 $ 381,448 (14.1) % Other operating income — 151 1,937 59,355 61,443 4,967 NM Community Labor Expense (207,908) (212,841) (209,865) (217,142) (847,756) (211,656) (1.8) % Other facility operating expense (108,430) (121,165) (105,610) (109,070) (444,275) (103,353) 4.7 % Facility operating expense (316,338) (334,006) (315,475) (326,212) (1,292,031) (315,009) 0.4 % Same Community Operating Income $ 127,931 $ 86,850 $ 88,396 $ 121,408 $ 424,585 $ 71,406 (44.2) % Same Community operating margin 28.8 % 20.6 % 21.9 % 27.1 % 24.7 % 18.5 % (1,030) bps Same Community adjusted operating margin(2) 28.8 % 20.6 % 21.5 % 16.0 % 21.9 % 17.4 % (1,140) bps Total Average Units 34,513 34,509 34,508 34,510 34,510 34,508 — RevPAR $ 4,291 $ 4,064 $ 3,883 $ 3,750 $ 3,997 $ 3,685 (14.1) % Weighted average unit occupancy 82.2 % 78.0 % 74.4 % 71.8 % 76.6 % 68.3 % (1,390) bps RevPOR $ 5,221 $ 5,207 $ 5,216 $ 5,220 $ 5,216 $ 5,396 3.4 % CCRCs Revenue $ 66,407 $ 54,912 $ 54,604 $ 53,169 $ 229,092 $ 54,394 (18.1) % Other operating income — 6,893 1,823 4,164 12,880 1,260 NM Community Labor Expense (35,167) (34,587) (33,502) (34,204) (137,460) (34,629) 1.5 % Other facility operating expense (17,003) (17,512) (15,804) (16,687) (67,006) (16,334) 3.9 % Facility operating expense (52,170) (52,099) (49,306) (50,891) (204,466) (50,963) 2.3 % Same Community Operating Income $ 14,237 $ 9,706 $ 7,121 $ 6,442 $ 37,506 $ 4,691 (67.1) % Same Community operating margin 21.4 % 15.7 % 12.6 % 11.2 % 15.5 % 8.4 % (1,300) bps Same Community adjusted operating margin(2) 21.4 % 5.1 % 9.7 % 4.3 % 10.7 % 6.3 % (1,510) bps Total Average Units 3,786 3,786 3,786 3,786 3,786 3,786 — % RevPAR $ 5,847 $ 4,835 $ 4,808 $ 4,681 $ 5,043 $ 4,789 (18.1) % Weighted average unit occupancy 82.4 % 73.2 % 70.4 % 68.4 % 73.6 % 67.1 % (1,530) bps RevPOR $ 7,093 $ 6,605 $ 6,831 $ 6,848 $ 6,844 $ 7,133 0.6 % Senior Housing Segments: Same Community(1) (1) Same Community portfolio reflects 66 Independent Living communities, 556 Assisted Living and Memory Care communities, and 15 CCRC communities. (2) Excludes other operating income