Form 8-K BankUnited, Inc. For: Apr 22

Exhibit 99.1

BANKUNITED, INC. REPORTS FIRST QUARTER 2021 RESULTS

Miami Lakes, Fla. — April 22, 2021 — BankUnited, Inc. (the “Company”) (NYSE: BKU) today announced financial results for the quarter ended March 31, 2021.

“This quarter, non-interest DDA grew by almost $1 billion, our net interest margin expanded, and we released some of the reserves we put up last year. This quarter also marks the culmination of our 2 year cloud journey, and the release of our new mobile banking platform." said Rajinder Singh, Chairman, President and Chief Executive Officer.

For the quarter ended March 31, 2021, the Company reported net income of $98.8 million, or $1.06 per diluted share, compared to a net loss of $(31.0) million, or $(0.33) per diluted share, for the quarter ended March 31, 2020. On an annualized basis, earnings for the quarter ended March 31, 2021 generated a return on average stockholders' equity of 13.2% and a return on average assets of 1.14%.

Financial Highlights

•Net interest income increased by $2.9 million compared to the immediately preceding quarter ended December 31, 2020 and by $15.7 million compared to the quarter ended March 31, 2020. The net interest margin, calculated on a tax-equivalent basis, improved to 2.39% for the quarter ended March 31, 2021 from 2.33% for the immediately preceding quarter and 2.35% for the quarter ended March 31, 2020.

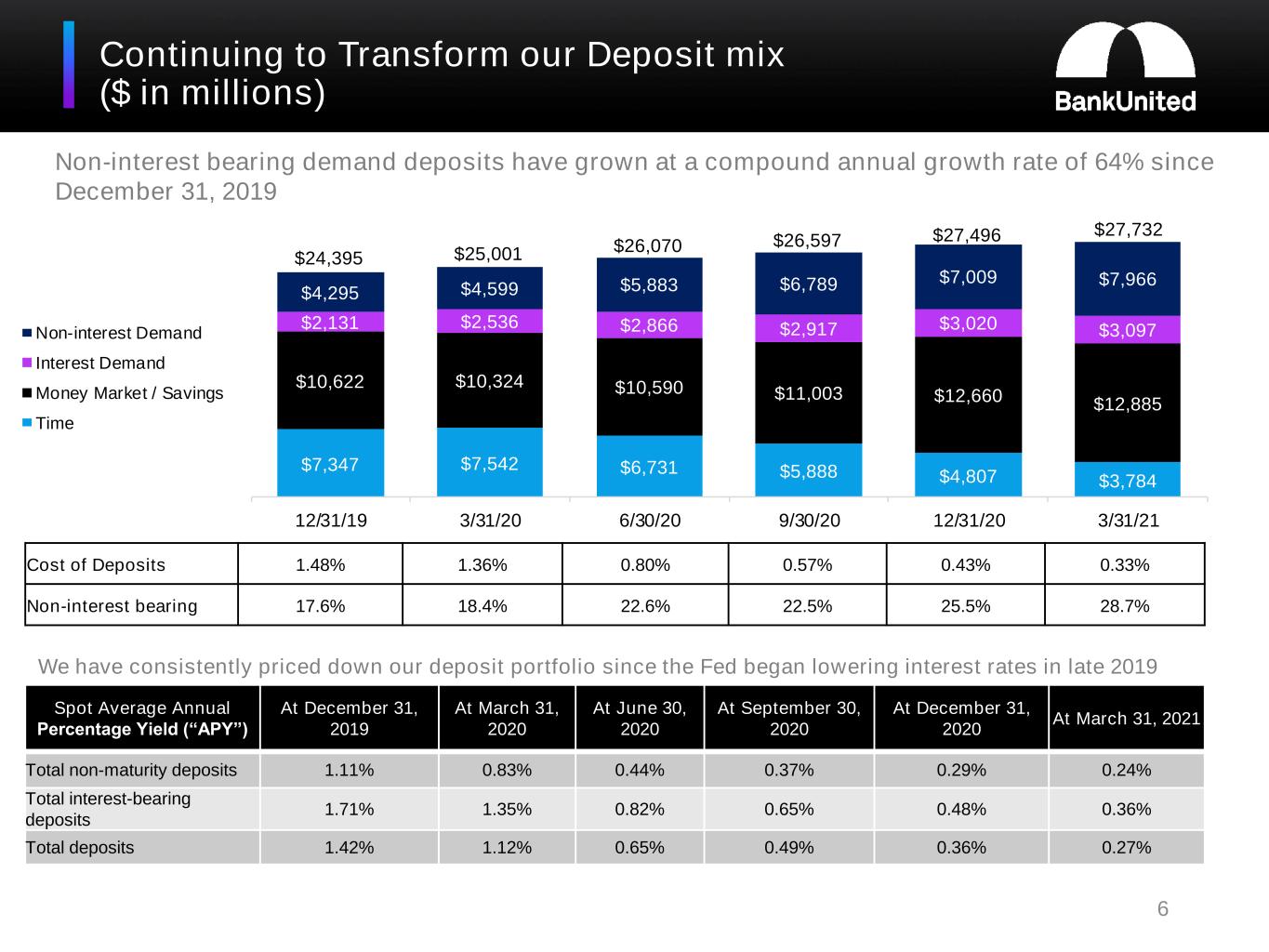

•The average cost of total deposits continued to decline, dropping by 0.10% to 0.33% for the quarter ended March 31, 2021 from 0.43% for the immediately preceding quarter ended December 31, 2020, and 1.36% for the quarter ended March 31, 2020. On a spot basis, the average annual percentage yield ("APY") on total deposits declined to 0.27% at March 31, 2021 from 0.36% at December 31, 2020 and 1.35% at March 31, 2020.

•For the quarter ended March 31, 2021, the Company recorded a recovery of the provision for credit losses of $(28.0) million compared to a recovery of $(1.6) million for the immediately preceding quarter ended December 31, 2020 and a provision for credit losses of $125.4 million for the quarter ended March 31, 2020. The most significant factor leading to the recovery of credit losses for the quarter ended March 31, 2021 was an improving economic forecast. In contrast, the provision for credit losses for the quarter ended March 31, 2020 was driven primarily by a deteriorating economic forecast resulting from the onset of the COVID-19 pandemic.

•Pre-tax, pre-provision net revenue ("PPNR") was $103.3 million for the quarter ended March 31, 2021 compared to $105.3 million for the immediately preceding quarter ended December 31, 2020 and $85.0 million for the quarter ended March 31, 2020.

•Non-interest bearing demand deposits grew by $957 million during the quarter ended March 31, 2021. Total deposits grew by $236 million as higher cost time deposits continued to runoff, declining by $1.0 billion for the quarter ended March 31, 2021. Average non-interest bearing demand deposits grew by $338 million for the quarter ended March 31, 2021 compared to the immediately preceding quarter ended December 31, 2020 and by $3.1 billion compared to the quarter ended March 31, 2020. At March 31, 2021, non-interest bearing demand deposits represented 29% of total deposits, compared to 25% of total deposits at December 31, 2020.

•Total loans and operating lease equipment declined by $487 million for the quarter ended March 31, 2020.

•Loans on deferral totaled $126 million or less than 1% of total loans at March 31, 2021. Loans modified under the CARES Act totaled $636 million at March 31, 2021. In the aggregate, this represents $762 million or 3% of the total loan portfolio at March 31, 2021.

•Non-performing assets totaled $236 million or 0.67% of total assets at March 31, 2020, a decline from $248 million or 0.71% of total assets at December 31, 2020.

1

•Book value per common share and tangible book value per common share at March 31, 2021 increased to $32.83 and $32.00, respectively, from $32.05 and $31.22, respectively at December 31, 2020 and pre-pandemic levels of $31.33 and $30.52, respectively at December 31, 2019.

•As previously reported, on January 20, 2021, the Company's Board of Directors reinstated the share repurchase program that the Company suspended in March 2020. During the quarter ended March 31, 2021, the Company repurchased approximately 0.2 million shares of its common stock for an aggregate purchase price of $7.3 million, at a weighted average price of $35.42 per share.

Loans and Leases

A comparison of loan and lease portfolio composition at the dates indicated follows (dollars in thousands):

| March 31, 2021 | December 31, 2020 | ||||||||||||||||||||||

| Residential and other consumer loans | $ | 6,582,447 | 28.1 | % | $ | 6,348,222 | 26.6 | % | |||||||||||||||

| Multi-family | 1,507,462 | 6.5 | % | 1,639,201 | 6.9 | % | |||||||||||||||||

| Non-owner occupied commercial real estate | 4,871,110 | 20.9 | % | 4,963,273 | 20.8 | % | |||||||||||||||||

| Construction and land | 287,821 | 1.2 | % | 293,307 | 1.2 | % | |||||||||||||||||

| Owner occupied commercial real estate | 1,932,153 | 8.3 | % | 2,000,770 | 8.4 | % | |||||||||||||||||

| Commercial and industrial | 4,048,473 | 17.3 | % | 4,447,383 | 18.6 | % | |||||||||||||||||

| PPP | 911,951 | 3.9 | % | 781,811 | 3.3 | % | |||||||||||||||||

| Pinnacle | 1,088,685 | 4.7 | % | 1,107,386 | 4.6 | % | |||||||||||||||||

| Bridge - franchise finance | 524,617 | 2.2 | % | 549,733 | 2.3 | % | |||||||||||||||||

| Bridge - equipment finance | 460,391 | 2.0 | % | 475,548 | 2.0 | % | |||||||||||||||||

| Mortgage warehouse lending ("MWL") | 1,145,957 | 4.9 | % | 1,259,408 | 5.3 | % | |||||||||||||||||

| $ | 23,361,067 | 100.0 | % | $ | 23,866,042 | 100.0 | % | ||||||||||||||||

| Operating lease equipment, net | $ | 681,003 | $ | 663,517 | |||||||||||||||||||

Growth in residential and other consumer loans for the quarter was attributable to GNMA early buyout loans. At March 31, 2021 and December 31, 2020, the residential portfolio included $1.7 billion and $1.4 billion, respectively, of GNMA early buyout loans. Residential activity for the quarter included purchases of approximately $578 million in GNMA early buyout loans, offset by approximately $237 million in re-poolings and paydowns. Residential and other consumer loans, excluding GNMA early buyout loans, declined by approximately $107 million.

In the aggregate, commercial loans declined by $739 million for the quarter ended March 31, 2021 as the environment remained challenging for new production, line utilization was below historical levels and accelerated prepayment activity continued. MWL line utilization declined seasonally to 55% at March 31, 2021 compared to 62% at December 31, 2020.

We originated $265 million of PPP loans under the Second Draw Program during the quarter ended March 31, 2021. Loans originated under the First Draw Program totaling $138 million were fully or partially forgiven during the quarter.

2

Asset Quality and the Allowance for Credit Losses

The following table presents information about non-performing loans, loans on deferral and CARES Act modifications at March 31, 2021 (dollars in thousands):

| Non-Performing Loans | Currently Under Short-Term Deferral | CARES Act Modification | |||||||||||||||

Residential and other consumer (1) | $ | 26,140 | $ | 90,811 | $ | 15,432 | |||||||||||

| Commercial: | |||||||||||||||||

| CRE by Property Type: | |||||||||||||||||

| Retail | 21,932 | 18,108 | 18,507 | ||||||||||||||

| Hotel | 34,003 | — | 343,354 | ||||||||||||||

| Office | 5,263 | 13,163 | 43,379 | ||||||||||||||

| Multi-family | 15,288 | — | 24,014 | ||||||||||||||

| Other | 4,788 | — | — | ||||||||||||||

| Owner occupied commercial real estate | 23,451 | 3,667 | 11,532 | ||||||||||||||

| Commercial and industrial | 66,491 | — | 141,741 | ||||||||||||||

| Bridge - franchise finance | 36,276 | — | 38,182 | ||||||||||||||

| Total commercial | 207,492 | 34,938 | 620,709 | ||||||||||||||

| Total | $ | 233,632 | $ | 125,749 | $ | 636,141 | |||||||||||

(1) Excludes government insured residential loans.

In the table above, "currently under short-term deferral" refers to loans subject to either a first or second 90-day payment deferral at March 31, 2021 and "CARES Act modification" refers to loans subject to longer-term modifications that, were it not for the provisions of the CARES Act, would likely have been reported as TDRs. Non-performing loans may include some loans that have been modified under the CARES Act.

Non-performing loans declined to $233.6 million or 1.00% of total loans at March 31, 2021, from $244.5 million or 1.02% of total loans at December 31, 2020. Non-performing loans included $48.2 million and $51.3 million of the guaranteed portion of SBA loans on non-accrual status, representing 0.21% and 0.22% of total loans at March 31, 2021 and December 31, 2020, respectively.

The following table presents criticized and classified commercial loans at the dates indicated (in thousands):

| March 31, 2021 | December 31, 2020 | ||||||||||

| Special mention | $ | 420,331 | $ | 711,516 | |||||||

| Substandard - accruing | 1,983,191 | 1,758,654 | |||||||||

| Substandard - non-accruing | 189,589 | 203,758 | |||||||||

| Doubtful | 17,903 | 11,867 | |||||||||

| Total | $ | 2,611,014 | $ | 2,685,795 | |||||||

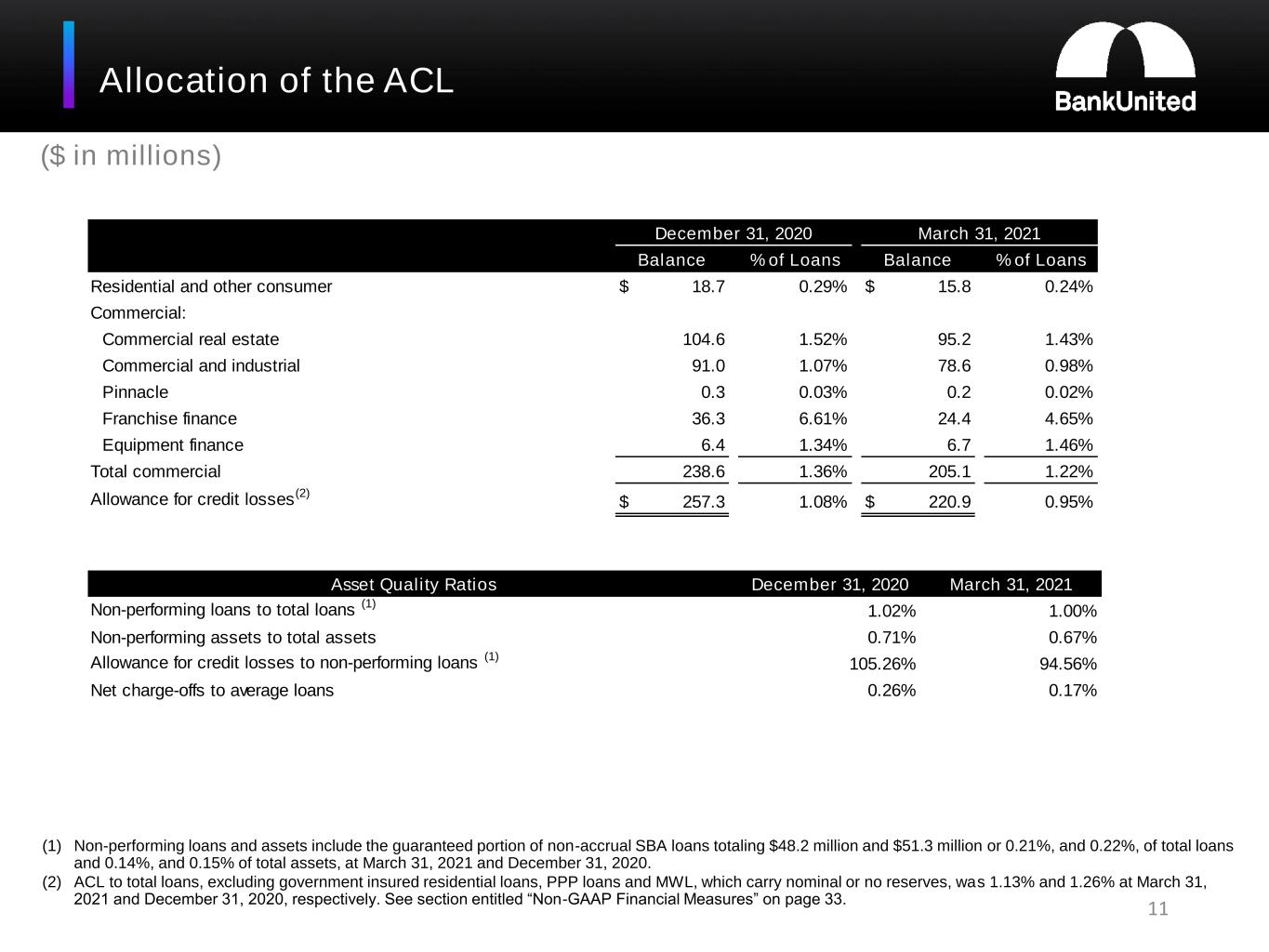

The following table presents the ACL at the dates indicated, related ACL coverage ratios and net charge-off rates for the quarter and year ended March 31, 2021 and December 31, 2020, respectively (dollars in thousands):

| ACL | ACL to Total Loans (1) | ACL to Non-Performing Loans | Net Charge-offs to Average Loans (2) | ||||||||||||||||||||

| December 31, 2020 | $ | 257,323 | 1.08 | % | 105.26 | % | 0.26 | % | |||||||||||||||

| March 31, 2021 | $ | 220,934 | 0.95 | % | 94.56 | % | 0.17 | % | |||||||||||||||

(1) ACL to total loans, excluding government insured residential loans, PPP loans and MWL, which carry nominal or no reserves, was 1.13% and 1.26% at March 31, 2021 and December 31, 2020, respectively.

(2) Annualized for the three months ended March 31, 2021.

The ACL at March 31, 2021 represents management's estimate of lifetime expected credit losses from the loan portfolio given our assessment of historical data, current conditions and a reasonable and supportable economic forecast as of the balance sheet date. The estimate was informed by Moody's economic scenarios published in March 2021, economic information provided by additional sources, data reflecting the impact of recent events on individual borrowers and other relevant information. The

3

decline in the ACL and in ACL coverage ratios from December 31, 2020 to March 31, 2021 related primarily to to the recovery of credit losses recorded during the quarter. The decline in the ACL was primarily related to the pass rated portion of the portfolio.

For the quarter ended March 31, 2021, the Company recorded a recovery of credit losses of $(28.0) million, which included a recovery of $(26.3) million related to funded loans as well as immaterial amounts related to unfunded loan commitments, accrued interest receivable and an AFS debt security. The recovery of provision for credit losses was largely driven by improvements in forecasted economic conditions.

The following table summarizes the activity in the ACL for the periods indicated (in thousands):

| Three Months Ended March 31, | |||||||||||

| 2021 | 2020 | ||||||||||

| Beginning balance | $ | 257,323 | $ | 108,671 | |||||||

| Cumulative effect of adoption of CECL | — | 27,305 | |||||||||

| Balance after adoption of CECL | 257,323 | 135,976 | |||||||||

| Provision (recovery) | (26,306) | 121,865 | |||||||||

| Net charge-offs | (10,083) | (7,262) | |||||||||

| Ending balance | $ | 220,934 | $ | 250,579 | |||||||

Net interest income

Net interest income for the quarter ended March 31, 2021 was $196.2 million compared to $193.4 million for the immediately preceding quarter ended December 31, 2020 and $180.6 million for the quarter ended March 31, 2020.

Interest income decreased by $5.7 million for the quarter ended March 31, 2021 compared to the immediately preceding quarter, and by $48.7 million compared to the quarter ended March 31, 2020. Interest expense decreased by $8.6 million compared to the immediately preceding quarter and by $64.4 million compared to the quarter ended March 31, 2020. Decreases in interest income resulted from declines in market interest rates including the impact of repayment of assets originated in a higher rate environment and, with respect to comparison to the immediately preceding quarter, declines in average loans and investment securities. Declines in interest expense reflected decreases in market interest rates, the impact of our strategy focused on lowering the cost of deposits and improving the deposit mix and declines in average interest bearing liabilities.

The Company’s net interest margin, calculated on a tax-equivalent basis, increased by 0.06% to 2.39% for the quarter ended March 31, 2021, from 2.33% for the immediately preceding quarter ended December 31, 2020. The decline in the average rate paid on interest bearing liabilities, particularly deposits, exceeded the decline in the average yield on interest earning assets. Offsetting factors contributing to the increase in the net interest margin for the quarter ended March 31, 2021 compared to the immediately preceding quarter ended December 31, 2020 included:

•The average rate paid on interest bearing deposits decreased to 0.45% for the quarter ended March 31, 2021, from 0.58% for the quarter ended December 31, 2020. This decline reflected continued initiatives taken to lower rates paid on deposits,including the re-pricing of term deposits.

•The tax-equivalent yield on investment securities decreased to 1.73% for the quarter ended March 31, 2021 from 1.82% for the quarter ended December 31, 2020. This decrease resulted from the impact of purchases of lower-yielding securities, prepayments of higher yielding mortgage-backed securities and decreases in coupon interest rates on existing floating rate assets.

•The tax-equivalent yield on loans increased to 3.58% for the quarter ended March 31, 2021, from 3.55% for the quarter ended December 31, 2020. Accelerated amortization of origination fees on PPP loans that were partially or fully forgiven during the quarter impacted the yield on loans by approximately 0.06%.

•The average rate paid on FHLB and PPPLF borrowings increased to 2.32% for the quarter ended March 31, 2021, from 2.07% for the quarter ended December 31, 2020, reflecting the maturity of short-term, lower rate FHLB advances and the payoff of all PPPLF borrowings during the fourth quarter of 2020.

•The increase in average non-interest bearing demand deposits as a percentage of average total deposits also positively impacted the cost of total deposits and the net interest margin.

4

Non-interest income

Non-interest income totaled $30.3 million for the quarter ended March 31, 2021 compared to $35.3 million for the immediately preceding quarter ended December 31, 2020 and $23.3 million for the quarter ended March 31, 2020. These fluctuations in non-interest income were primarily attributable to gain (loss) on investment securities, net which totaled $2.4 million, $7.2 million and $(3.5) million for the quarters ended March 31, 2021, December 31, 2020 and March 31, 2020, respectively. Increases in "other non-interest income" related primarily to increased revenue from our customer derivative program.

Non-interest expense

Non-interest expense totaled $123.2 million for the quarter ended March 31, 2021 compared to $123.3 million for the immediately preceding quarter ended December 31, 2020 and $118.9 million for the quarter ended March 31, 2020. Significant factors contributing to the increase in non-interest expense for the quarter ended March 31, 2021 compared to the quarter ended March 31, 2020 included:

•Technology and telecommunications expense increased by $3.1 million reflecting investments in digital and data analytics capabilities and in the infrastructure to support cloud migration.

•Deposit insurance expense increased by $3.0 million reflecting an increase in the assessment rate.

Earnings Conference Call and Presentation

A conference call to discuss quarterly results will be held at 9:00 a.m. ET on Thursday, April 22, 2021 with Chairman, President and Chief Executive Officer, Rajinder P. Singh, Chief Financial Officer, Leslie N. Lunak and Chief Operating Officer, Thomas M. Cornish.

The earnings release and slides with supplemental information relating to the release will be available on the Investor Relations page under About Us on www.bankunited.com prior to the call. Due to recent demand for conference call services, participants are encouraged to listen to the call via a live Internet webcast at http://www.ir.bankunited.com/. The dial in telephone number for the call is (855) 798-3052 (domestic) or (234) 386-2812 (international). The name of the call is BankUnited, Inc. and the conference ID for the call is 7587207. A replay of the call will be available from 12:00 p.m. ET on April 22nd through 11:59 p.m. ET on April 29th by calling (855) 859-2056 (domestic) or (404) 537-3406 (international). The conference ID for the replay is 7587207. An archived webcast will also be available on the Investor Relations page of www.bankunited.com.

About BankUnited, Inc.

BankUnited, Inc., with total assets of $35.2 billion at March 31, 2021, is the bank holding company of BankUnited, N.A., a national bank headquartered in Miami Lakes, Florida with 69 banking centers in 14 Florida counties and 4 banking centers in the New York metropolitan area at March 31, 2021.

5

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect the Company’s current views with respect to, among other things, future events and financial performance.

The Company generally identifies forward-looking statements by terminology such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “could,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” "forecasts" or the negative version of those words or other comparable words. Any forward-looking statements contained in this press release are based on the historical performance of the Company and its subsidiaries or on the Company’s current plans, estimates and expectations. The inclusion of this forward-looking information should not be regarded as a representation by the Company that the future plans, estimates or expectations contemplated by the Company will be achieved. Such forward-looking statements are subject to various risks and uncertainties and assumptions, including (without limitations) those relating to the Company’s operations, financial results, financial condition, business prospects, growth strategy and liquidity, including as impacted by the COVID-19 pandemic. If one or more of these or other risks or uncertainties materialize, or if the Company’s underlying assumptions prove to be incorrect, the Company’s actual results may vary materially from those indicated in these statements. These factors should not be construed as exhaustive. The Company does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. A number of important factors could cause actual results to differ materially from those indicated by the forward-looking statements. Information on these factors can be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 and any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K, which are available at the SEC’s website (www.sec.gov).

Contact

BankUnited, Inc.

Investor Relations:

Leslie N. Lunak, 786-313-1698

llunak@bankunited.com

Source: BankUnited, Inc.

6

BANKUNITED, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS - UNAUDITED

(In thousands, except share and per share data)

| March 31, 2021 | December 31, 2020 | ||||||||||

| ASSETS | |||||||||||

| Cash and due from banks: | |||||||||||

| Non-interest bearing | $ | 20,750 | $ | 20,233 | |||||||

| Interest bearing | 1,029,046 | 377,483 | |||||||||

| Cash and cash equivalents | 1,049,796 | 397,716 | |||||||||

| Investment securities (including securities recorded at fair value of $9,234,784 and $9,166,683) | 9,244,784 | 9,176,683 | |||||||||

| Non-marketable equity securities | 177,709 | 195,865 | |||||||||

| Loans held for sale | 13,770 | 24,676 | |||||||||

| Loans | 23,361,067 | 23,866,042 | |||||||||

| Allowance for credit losses | (220,934) | (257,323) | |||||||||

| Loans, net | 23,140,133 | 23,608,719 | |||||||||

| Bank owned life insurance | 301,881 | 294,629 | |||||||||

| Operating lease equipment, net | 681,003 | 663,517 | |||||||||

| Goodwill | 77,637 | 77,637 | |||||||||

| Other assets | 492,526 | 571,051 | |||||||||

| Total assets | $ | 35,179,239 | $ | 35,010,493 | |||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||||||

| Liabilities: | |||||||||||

| Demand deposits: | |||||||||||

| Non-interest bearing | $ | 7,965,658 | $ | 7,008,838 | |||||||

| Interest bearing | 3,096,668 | 3,020,039 | |||||||||

| Savings and money market | 12,885,645 | 12,659,740 | |||||||||

| Time | 3,784,111 | 4,807,199 | |||||||||

| Total deposits | 27,732,082 | 27,495,816 | |||||||||

| Federal funds purchased | — | 180,000 | |||||||||

| FHLB advances | 3,022,174 | 3,122,999 | |||||||||

| Notes and other borrowings | 721,753 | 722,495 | |||||||||

| Other liabilities | 641,395 | 506,171 | |||||||||

| Total liabilities | 32,117,404 | 32,027,481 | |||||||||

| Commitments and contingencies | |||||||||||

| Stockholders' equity: | |||||||||||

| Common stock, par value $0.01 per share, 400,000,000 shares authorized; 93,263,632 and 93,067,500 shares issued and outstanding | 933 | 931 | |||||||||

| Paid-in capital | 1,008,603 | 1,017,518 | |||||||||

| Retained earnings | 2,091,124 | 2,013,715 | |||||||||

| Accumulated other comprehensive loss | (38,825) | (49,152) | |||||||||

| Total stockholders' equity | 3,061,835 | 2,983,012 | |||||||||

| Total liabilities and stockholders' equity | $ | 35,179,239 | $ | 35,010,493 | |||||||

7

BANKUNITED, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME - UNAUDITED

(In thousands, except per share data)

| Three Months Ended | |||||||||||||||||

| March 31, | December 31, | March 31, | |||||||||||||||

| 2021 | 2020 | 2020 | |||||||||||||||

| Interest income: | |||||||||||||||||

| Loans | $ | 205,335 | $ | 207,232 | $ | 234,359 | |||||||||||

| Investment securities | 38,501 | 42,260 | 56,060 | ||||||||||||||

| Other | 1,593 | 1,628 | 3,720 | ||||||||||||||

| Total interest income | 245,429 | 251,120 | 294,139 | ||||||||||||||

| Interest expense: | |||||||||||||||||

| Deposits | 22,376 | 29,290 | 82,822 | ||||||||||||||

| Borrowings | 26,813 | 28,464 | 30,741 | ||||||||||||||

| Total interest expense | 49,189 | 57,754 | 113,563 | ||||||||||||||

| Net interest income before provision for credit losses | 196,240 | 193,366 | 180,576 | ||||||||||||||

| Provision for (recovery of) credit losses | (27,989) | (1,643) | 125,428 | ||||||||||||||

| Net interest income after provision for credit losses | 224,229 | 195,009 | 55,148 | ||||||||||||||

| Non-interest income: | |||||||||||||||||

| Deposit service charges and fees | 4,900 | 4,569 | 4,186 | ||||||||||||||

Gain on sale of loans, net | 1,754 | 2,425 | 3,466 | ||||||||||||||

| Gain (loss) on investment securities, net | 2,365 | 7,203 | (3,453) | ||||||||||||||

| Lease financing | 12,488 | 13,547 | 15,481 | ||||||||||||||

| Other non-interest income | 8,789 | 7,536 | 3,618 | ||||||||||||||

| Total non-interest income | 30,296 | 35,280 | 23,298 | ||||||||||||||

| Non-interest expense: | |||||||||||||||||

| Employee compensation and benefits | 59,288 | 60,944 | 58,887 | ||||||||||||||

| Occupancy and equipment | 11,875 | 11,797 | 12,369 | ||||||||||||||

| Deposit insurance expense | 7,450 | 6,759 | 4,403 | ||||||||||||||

| Professional fees | 1,912 | 2,937 | 3,204 | ||||||||||||||

| Technology and telecommunications | 15,741 | 16,052 | 12,596 | ||||||||||||||

| Depreciation of operating lease equipment | 12,217 | 12,270 | 12,603 | ||||||||||||||

| Other non-interest expense | 14,738 | 12,565 | 14,806 | ||||||||||||||

| Total non-interest expense | 123,221 | 123,324 | 118,868 | ||||||||||||||

| Income (loss) before income taxes | 131,304 | 106,965 | (40,422) | ||||||||||||||

| Provision (benefit) for income taxes | 32,490 | 21,228 | (9,471) | ||||||||||||||

| Net income (loss) | $ | 98,814 | $ | 85,737 | $ | (30,951) | |||||||||||

| Earnings (loss) per common share, basic | $ | 1.06 | $ | 0.89 | $ | (0.33) | |||||||||||

| Earnings (loss) per common share, diluted | $ | 1.06 | $ | 0.89 | $ | (0.33) | |||||||||||

8

BANKUNITED, INC. AND SUBSIDIARIES

AVERAGE BALANCES AND YIELDS

(Dollars in thousands)

| Three Months Ended March 31, 2021 | Three Months Ended December 31, 2020 | Three Months Ended March 31, 2020 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Balance | Interest (1)(2) | Yield/ Rate (1)(2) | Average Balance | Interest (1)(2) | Yield/ Rate (1)(2) | Average Balance | Interest (1)(2) | Yield/ Rate (1)(2) | |||||||||||||||||||||||||||||||||||||||||||||

| Assets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest earning assets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans | $ | 23,549,309 | $ | 208,821 | 3.58 | % | $ | 23,706,859 | $ | 210,896 | 3.55 | % | $ | 22,850,065 | $ | 238,108 | 4.18 | % | |||||||||||||||||||||||||||||||||||

Investment securities (3) | 9,070,185 | 39,188 | 1.73 | % | 9,446,389 | 42,966 | 1.82 | % | 8,107,649 | 56,951 | 2.81 | % | |||||||||||||||||||||||||||||||||||||||||

| Other interest earning assets | 1,062,840 | 1,593 | 0.61 | % | 726,273 | 1,628 | 0.89 | % | 646,628 | 3,720 | 2.31 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest earning assets | 33,682,334 | 249,602 | 2.98 | % | 33,879,521 | 255,490 | 3.01 | % | 31,604,342 | 298,779 | 3.79 | % | |||||||||||||||||||||||||||||||||||||||||

| Allowance for credit losses | (254,438) | (280,243) | (138,842) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-interest earning assets | 1,724,176 | 1,817,476 | 1,749,752 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 35,152,072 | $ | 35,416,754 | $ | 33,215,252 | |||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities and Stockholders' Equity: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest bearing liabilities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest bearing demand deposits | $ | 2,942,874 | $ | 2,774 | 0.38 | % | $ | 2,903,300 | $ | 3,637 | 0.50 | % | $ | 2,173,628 | $ | 6,959 | 1.29 | % | |||||||||||||||||||||||||||||||||||

| Savings and money market deposits | 12,793,019 | 12,127 | 0.38 | % | 11,839,631 | 14,517 | 0.49 | % | 10,412,202 | 37,756 | 1.46 | % | |||||||||||||||||||||||||||||||||||||||||

| Time deposits | 4,330,781 | 7,475 | 0.70 | % | 5,360,630 | 11,136 | 0.83 | % | 7,510,070 | 38,107 | 2.04 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest bearing deposits | 20,066,674 | 22,376 | 0.45 | % | 20,103,561 | 29,290 | 0.58 | % | 20,095,900 | 82,822 | 1.66 | % | |||||||||||||||||||||||||||||||||||||||||

| Federal funds purchased | 8,000 | 3 | 0.15 | % | 20,707 | 6 | 0.12 | % | 94,066 | 367 | 1.56 | % | |||||||||||||||||||||||||||||||||||||||||

| FHLB and PPPLF borrowings | 3,072,717 | 17,558 | 2.32 | % | 3,698,666 | 19,207 | 2.07 | % | 4,414,830 | 25,084 | 2.29 | % | |||||||||||||||||||||||||||||||||||||||||

| Notes and other borrowings | 722,305 | 9,252 | 5.12 | % | 722,581 | 9,251 | 5.12 | % | 429,098 | 5,290 | 4.93 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest bearing liabilities | 23,869,696 | 49,189 | 0.83 | % | 24,545,515 | 57,754 | 0.94 | % | 25,033,894 | 113,563 | 1.82 | % | |||||||||||||||||||||||||||||||||||||||||

| Non-interest bearing demand deposits | 7,491,249 | 7,152,967 | 4,368,553 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Other non-interest bearing liabilities | 746,973 | 772,277 | 749,101 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 32,107,918 | 32,470,759 | 30,151,548 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Stockholders' equity | 3,044,154 | 2,945,995 | 3,063,704 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and stockholders' equity | $ | 35,152,072 | $ | 35,416,754 | $ | 33,215,252 | |||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 200,413 | $ | 197,736 | $ | 185,216 | |||||||||||||||||||||||||||||||||||||||||||||||

| Interest rate spread | 2.15 | % | 2.07 | % | 1.97 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Net interest margin | 2.39 | % | 2.33 | % | 2.35 | % | |||||||||||||||||||||||||||||||||||||||||||||||

(1) On a tax-equivalent basis where applicable

(2) Annualized

(3) At fair value except for securities held to maturity

9

BANKUNITED, INC. AND SUBSIDIARIES

EARNINGS PER COMMON SHARE

(In thousands except share and per share amounts)

| Three Months Ended March 31, | |||||||||||

| c | 2021 | 2020 | |||||||||

| Basic earnings per common share: | |||||||||||

| Numerator: | |||||||||||

| Net income (loss) | $ | 98,814 | $ | (30,951) | |||||||

Distributed and undistributed earnings allocated to participating securities | (1,252) | — | |||||||||

| Income (loss) allocated to common stockholders for basic earnings per common share | $ | 97,562 | $ | (30,951) | |||||||

| Denominator: | |||||||||||

| Weighted average common shares outstanding | 93,075,702 | 93,944,529 | |||||||||

| Less average unvested stock awards | (1,205,529) | (1,101,370) | |||||||||

| Weighted average shares for basic earnings (loss) per common share | 91,870,173 | 92,843,159 | |||||||||

| Basic earnings (loss) per common share | $ | 1.06 | $ | (0.33) | |||||||

| Diluted earnings (loss) per common share: | |||||||||||

| Numerator: | |||||||||||

| Income (loss) allocated to common stockholders for basic earnings per common share | $ | 97,562 | $ | (30,951) | |||||||

Adjustment for earnings reallocated from participating securities | 1 | — | |||||||||

| Income (loss) used in calculating diluted earnings per common share | $ | 97,563 | $ | (30,951) | |||||||

| Denominator: | |||||||||||

| Weighted average shares for basic earnings (loss) per common share | 91,870,173 | 92,843,159 | |||||||||

| Dilutive effect of stock options and certain shared-based awards | 93,540 | — | |||||||||

Weighted average shares for diluted earnings per common share | 91,963,713 | 92,843,159 | |||||||||

| Diluted earnings (loss) per common share | $ | 1.06 | $ | (0.33) | |||||||

10

BANKUNITED, INC. AND SUBSIDIARIES

SELECTED RATIOS

| Three Months Ended March 31, | |||||||||||

| 2021 | 2020 | ||||||||||

Financial ratios (4) | |||||||||||

| Return on average assets | 1.14 | % | (0.37) | % | |||||||

| Return on average stockholders’ equity | 13.2 | % | (4.1) | % | |||||||

Net interest margin (3) | 2.39 | % | 2.35 | % | |||||||

| March 31, 2021 | December 31, 2020 | ||||||||||

| Asset quality ratios | |||||||||||

Non-performing loans to total loans (1)(5) | 1.00 | % | 1.02 | % | |||||||

Non-performing assets to total assets (2)(5) | 0.67 | % | 0.71 | % | |||||||

| Allowance for credit losses to total loans | 0.95 | % | 1.08 | % | |||||||

Allowance for credit losses to non-performing loans (1)(5) | 94.56 | % | 105.26 | % | |||||||

Net charge-offs to average loans (4) | 0.17 | % | 0.26 | % | |||||||

(1) We define non-performing loans to include non-accrual loans and loans other than purchased credit deteriorated and government insured residential loans that are past due 90 days or more and still accruing. Contractually delinquent purchased credit deteriorated and government insured residential loans on which interest continues to be accrued are excluded from non-performing loans.

(2) Non-performing assets include non-performing loans, OREO and other repossessed assets.

(3) On a tax-equivalent basis.

(4) Annualized for the three month periods.

(5) Non-performing loans and assets include the guaranteed portion of non-accrual SBA loans totaling $48.2 million or 0.21% of total loans and 0.14% of total assets, at March 31, 2021; and $51.3 million or 0.22% of total loans and 0.15% of total assets, at December 31, 2020.

| March 31, 2021 | December 31, 2020 | Required to be Considered Well Capitalized | |||||||||||||||||||||||||||

| BankUnited, Inc. | BankUnited, N.A. | BankUnited, Inc. | BankUnited, N.A. | ||||||||||||||||||||||||||

| Capital ratios | |||||||||||||||||||||||||||||

| Tier 1 leverage | 8.7 | % | 9.8 | % | 8.6 | % | 9.5 | % | 5.0 | % | |||||||||||||||||||

| Common Equity Tier 1 ("CET1") risk-based capital | 13.2 | % | 14.8 | % | 12.6 | % | 13.9 | % | 6.5 | % | |||||||||||||||||||

| Total risk-based capital | 15.2 | % | 15.5 | % | 14.7 | % | 14.8 | % | 10.0 | % | |||||||||||||||||||

On a fully-phased in basis with respect to the adoption of CECL, the Company's and the Bank's CET1 risk-based capital ratios would have been 13.0% and 14.6%, respectively, at March 31, 2021.

11

Non-GAAP Financial Measures

PPNR is a non-GAAP financial measure. Management believes this measure is relevant to understanding the performance of the Company attributable to elements other than the provision for credit losses and the ability of the Company to generate earnings sufficient to cover estimated credit losses, particularly in view of the volatility of the provision for credit losses resulting from the COVID-19 pandemic. This measure also provides a meaningful basis for comparison to other financial institutions since it is commonly employed and is a measure frequently cited by investors and analysts. The following table reconciles the non-GAAP financial measurement of PPNR to the comparable GAAP financial measurement of income (loss) before income taxes for the three months ended March 31, 2021 and 2020 and the three months ended December 31, 2020 (in thousands):

| Three Months Ended | |||||||||||||||||

| March 31, 2021 | December 31, 2020 | March 31, 2020 | |||||||||||||||

| Income (loss) before income taxes (GAAP) | $ | 131,304 | $ | 106,965 | $ | (40,422) | |||||||||||

| Plus: Provision for (recovery of) credit losses | (27,989) | (1,643) | 125,428 | ||||||||||||||

PPNR (non-GAAP) | $ | 103,315 | $ | 105,322 | $ | 85,006 | |||||||||||

ACL to total loans, excluding government insured residential loans, PPP loans and MWL is a non-GAAP financial measure. Management believes this measure is relevant to understanding the adequacy of the ACL coverage, excluding the impact of loans which carry nominal or no reserves. Disclosure of this non-GAAP financial measure also provides a meaningful basis for comparison to other financial institutions. The following table reconciles the non-GAAP financial measurement of ACL to total loans, excluding government insured residential loans, PPP loans and MWL to the comparable GAAP financial measurement of ACL to total loans at March 31, 2021 and December 31, 2020 (dollars in thousands):

| March 31, 2021 | December 31, 2020 | ||||||||||

| Total loans (GAAP) | $ | 23,361,067 | $ | 23,866,042 | |||||||

| Less: Government insured residential loans | 1,759,289 | 1,419,074 | |||||||||

| Less: PPP loans | 911,951 | 781,811 | |||||||||

| Less: MWL | 1,145,957 | 1,259,408 | |||||||||

| Total loans, excluding government insured residential loans, PPP loans and MWL (non-GAAP) | $ | 19,543,870 | $ | 20,405,749 | |||||||

| ACL | $ | 220,934 | $ | 257,323 | |||||||

| ACL to total loans (GAAP) | 0.95 | % | 1.08 | % | |||||||

| ACL to total loans, excluding government insured residential loans, PPP loans and MWL (non-GAAP) | 1.13 | % | 1.26 | % | |||||||

12

Tangible book value per common share is a non-GAAP financial measure. Management believes this measure is relevant to understanding the capital position and performance of the Company. Disclosure of this non-GAAP financial measure also provides a meaningful basis for comparison to other financial institutions as it is a metric commonly used in the banking industry. The following table reconciles the non-GAAP financial measurement of tangible book value per common share to the comparable GAAP financial measurement of book value per common share at the dates indicated (in thousands except share and per share data):

| March 31, 2021 | December 31, 2020 | December 31, 2019 | |||||||||||||||

| Total stockholders’ equity (GAAP) | $ | 3,061,835 | $ | 2,983,012 | $ | 2,980,779 | |||||||||||

| Less: goodwill and other intangible assets | 77,637 | 77,637 | 77,674 | ||||||||||||||

| Tangible stockholders’ equity (non-GAAP) | $ | 2,984,198 | $ | 2,905,375 | $ | 2,903,105 | |||||||||||

| Common shares issued and outstanding | 93,263,632 | 93,067,500 | 95,128,231 | ||||||||||||||

| Book value per common share (GAAP) | $ | 32.83 | $ | 32.05 | $ | 31.33 | |||||||||||

| Tangible book value per common share (non-GAAP) | $ | 32.00 | $ | 31.22 | $ | 30.52 | |||||||||||

13

April 22, 2021 Q1 2021 – Supplemental Information Exhibit 99.2

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect the current views of BankUnited, Inc. (“BankUnited,” “BKU” or the “Company”) with respect to, among other things, future events and financial performance. The Company generally identifies forward-looking statements by terminology such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “could,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” "forecasts" or the negative version of those words or other comparable words. Any forward-looking statements contained in this presentation are based on the historical performance of the Company and its subsidiaries or on the Company’s current plans, estimates and expectations. The inclusion of this forward-looking information should not be regarded as a representation by the Company that the future plans, estimates or expectations contemplated by the Company will be achieved. Such forward-looking statements are subject to various risks and uncertainties and assumptions, including (without limitations) those relating to the Company’s operations, financial results, financial condition, business prospects, growth strategy and liquidity, including as impacted by the COVID-19 pandemic. If one or more of these or other risks or uncertainties materialize, or if the Company’s underlying assumptions prove to be incorrect, the Company’s actual results may vary materially from those indicated in these statements. These factors should not be construed as exhaustive. The Company does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. A number of important factors could cause actual results to differ materially from those indicated by the forward-looking statements. Information on these factors can be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 and any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K, which are available at the SEC’s website (www.sec.gov). 2

Financial Highlights

Strong Quarterly Results in a Challenging Environment 4 Operating results Continued improvement in deposit mix Asset Quality Robust capital levels • EPS for the quarter of $1.06 • Annualized ROE for the quarter of 13.2% and ROA of 1.14% • Net interest income grew by $3 million linked quarter and $16 million compared to Q1 2020 • NIM of 2.39% compared to 2.33% linked quarter • Recovery of credit losses of $(28) million reflecting an improving economic forecast • Non-interest DDA grew by $957 million for the quarter to 29% of total deposits • Non-interest DDA now 29% of total deposits compared to 25% at 12/31/20 and 18% at 12/31/19 • Average non-interest DDA up $3.1 billion compared to Q1 2020 • Average total cost of deposits continued to decline, to 0.33% for the quarter • “Spot” APY on total deposits was 0.27% at March 31, 2021 • Loans on deferral totaled $126 million or less than 1% of total loans at March 31, 2021 • Commercial: $35 million or less than 1% of commercial loans • Residential: $91 million or 2% of residential loans • CARES Act modifications totaled $636 million at March 31, 2021 • Commercial: $621 million or 4% of commercial loans • Residential: $15 million or less than 1% of residential loans • NPA ratio declined to 0.67% of total assets from 0.71% at December 31, 2020 • CET1 ratios of 13.2% at the holding company and 14.8% at the bank at March 31, 2021 • Book value per share grew to $32.83 and tangible book value grew to $32.00 at March 31, 2021, up from pre-pandemic levels of $31.33 and $30.52, respectively, at December 31, 2019. • Reinstated the share repurchase program that the Company suspended in March 2020.

Highlights from First Quarter Earnings 5 Key Highlights Reflective of an improving economic forecast 73% YoY non-interest DDA growth. 11% YoY deposit growth, primarily from non-interest bearing. Spot APY on total deposits declined to 0.27% at March 31, 2021 (1) PPNR is a non-GAAP financial measure. See section entitled “Non-GAAP Financial Measures” on page 32 (2) Includes guaranteed portion of non-accrual SBA loans. (3) YTD net charge-offs, annualized for Q1 21 and Q1 20. ($ in millions, except per share data) Q1 21 Q4 20 Q1 20 4Q 20 1Q 20 Net Interest Income $196 $193 $181 $3 $16 Provision for (Recovery of) Credit Losses ($28) ($2) $125 ($26) ($153) Total Non-interest Income $30 $35 $23 ($5) $7 Total Non-interest Expense $123 $123 $119 $- $4 Net Income $99 $86 ($31) $13 $130 EPS $1.06 $0.89 ($0.33) $0.17 $1.39 Pre-Provision, Net Revenue (PPNR) (1) $103 $105 $85 ($2) $18 Period-end Loans $23,361 $23,866 $23,184 ($505) $177 Period-end Non-interest DDA $7,966 $7,009 $4,599 $957 $3,367 Period-end Deposits $27,732 $27,496 $25,001 $236 $2,731 CET1 13.2% 12.6% 11.8% 0.6% 1.4% Total Capital 15.2% 14.7% 12.6% 0.5% 2.6% Yield on Loans 3.58% 3.55% 4.18% 0.03% (0.60%) Cost of Deposits 0.33% 0.43% 1.36% (0.10%) (1.03%) Net Interest Margin 2.39% 2.33% 2.35% 0.06% 0.04% Non-performing Assets to Total Assets (2) 0.67% 0.71% 0.61% (0.04%) 0.06% Allowance for Credit Losses to Total Loans 0.95% 1.08% 1.08% (0.13%) (0.13%) Net Charge-offs to Average Loans (3) 0.17% 0.26% 0.13% (0.09%) 0.04% Change From

Continuing to Transform our Deposit mix ($ in millions) 6 $7,347 $7,542 $6,731 $5,888 $4,807 $3,784 $10,622 $10,324 $10,590 $11,003 $12,660 $12,885 $2,131 $2,536 $2,866 $2,917 $3,020 $3,097 $4,295 $4,599 $5,883 $6,789 $7,009 $7,966 $24,395 $25,001 $26,070 $26,597 $27,496 $27,732 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 Non-interest Demand Interest Demand Money Market / Savings Time Non-interest bearing demand deposits have grown at a compound annual growth rate of 64% since December 31, 2019 Cost of Deposits 1.48% 1.36% 0.80% 0.57% 0.43% 0.33% Non-interest bearing 17.6% 18.4% 22.6% 22.5% 25.5% 28.7% We have consistently priced down our deposit portfolio since the Fed began lowering interest rates in late 2019 Spot Average Annual Percentage Yield (“APY”) At December 31, 2019 At March 31, 2020 At June 30, 2020 At September 30, 2020 At December 31, 2020 At March 31, 2021 Total non-maturity deposits 1.11% 0.83% 0.44% 0.37% 0.29% 0.24% Total interest-bearing deposits 1.71% 1.35% 0.82% 0.65% 0.48% 0.36% Total deposits 1.42% 1.12% 0.65% 0.49% 0.36% 0.27%

Prudently Underwritten and Well-Diversified Loan Portfolio At March 31, 2021 ($ in millions) 7 Loan Portfolio Over Time CRE C&I Non-owner Occupied 73% Multi- family 23% Construction and Land 4% Commercial and Industrial 59% Owner Occupied 28% SBA PPP 13% Lending Subs Residential Loan Product Type Pinnacle 53% Bridge - Franchise 25% Bridge - Equipment 22% $5,661 $5,635 $5,578 $5,941 $6,348 $6,582 $7,493 $7,178 $7,081 $6,984 $6,896 $6,666 $6,718 $7,035 $7,560 $7,309 $7,230 $6,893 $768 $852 $1,161 $1,251 $1,259 $1,146 $2,515 $2,484 $2,455 $2,294 $2,133 $2,074 $23,155 $23,184 $23,835 $23,779 $23,866 $23,361 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 Residential CRE C&I(1) Mortgage Warehouse Lending Lending Subs 30 Yr Fixed 18% 15 & 20 Year Fixed 9% 10/1 ARM 18% 5/1 & 7/1 ARM 27% Formerly Covered 2% Govt Insured 26% (1) Includes SBA PPP loans

Allowance for Credit Losses

CECL Methodology 9 Underlying Principles Economic Forecast Key Variables • The ACL under CECL represents management’s best estimate at the balance sheet date of expected credit losses over the life of the loan portfolio. • Required to consider historical information, current conditions and a reasonable and supportable economic forecast. • For most portfolio segments, BankUnited uses econometric models to project PD, LGD and expected losses at the loan level and aggregates those expected losses by segment. • Qualitative adjustments may be applied to the quantitative results. • Accounting standard requires an estimate of expected prepayments which may significantly impact the lifetime loss estimate. • Our ACL estimate was informed by Moody’s economic scenarios published in March 2021. • Unemployment at 6.0% for Q2 2021, steadily declining to 5% through end of 2021, and continuing to 4.2% by end of 2022 • Annualized growth in GDP at 6.2% for Q2 2021, increasing to 7.1% by end of 2021 and 2.3% by end of 2022 • VIX trending at stabilized levels through the forecast horizon • S&P 500 averaging near 3700 through the R&S period • 2 year reasonable and supportable forecast period. • The models ingest numerous national, regional and MSA level economic variables and data points. Economic data and variables to which portfolio segments are most sensitive: • Commercial o Market volatility index o S&P 500 index o Unemployment rate o A variety of interest rates and spreads • CRE o Unemployment o CRE property forecast o 10-year treasury o Baa corporate yield o Real GDP growth • Residential o HPI o Unemployment rate o Real GDP growth o Freddie Mac 30-year rate

Drivers of Change in the ACL 10 ACL 12/31/20 ACL 3/31/21 Assumption Changes Net Portfolio Migration Portfolio Changes Economic Forecast Net Charge- Offs Change in Qualitative Overlay ($ in millions) % of Total Loans 1.08% 0.95% • Updated prepayment assumptions • Updates to certain assumptions for criticized and classified loans • Risk rating migration • Changes in specific reserves • New loans • Exits/runoff • Portfolio seasoning • Current market adjustment • Changes to forward path of economic forecast • Additional qualitative overlay for borrowers impacted by COVID- 19

Allocation of the ACL 11 ($ in millions) (1) Non-performing loans and assets include the guaranteed portion of non-accrual SBA loans totaling $48.2 million and $51.3 million or 0.21%, and 0.22%, of total loans and 0.14%, and 0.15% of total assets, at March 31, 2021 and December 31, 2020. (2) ACL to total loans, excluding government insured residential loans, PPP loans and MWL, which carry nominal or no reserves, was 1.13% and 1.26% at March 31, 2021 and December 31, 2020, respectively. See section entitled “Non-GAAP Financial Measures” on page 33. Balance % of Loans Balance % of Loans Residential and other consumer 18.7$ 0.29% 15.8$ 0.24% Commercial: Commercial real estate 104.6 1.52% 95.2 1.43% Commercial and industrial 91.0 1.07% 78.6 0.98% Pinnacle 0.3 0.03% 0.2 0.02% Franchise finance 36.3 6.61% 24.4 4.65% Equipment finance 6.4 1.34% 6.7 1.46% Total commercial 238.6 1.36% 205.1 1.22% Allowance for credit losses (2) 257.3$ 1.08% 220.9$ 0.95% December 31, 2020 March 31, 2021 Asset Quality Ratios December 31, 2020 March 31, 2021 Non-performing loans to total loans (1) 1.02% 1.00% Non-performing assets to total assets 0.71% 0.67% Allowance for credit losses to non-performing loans (1) 105.26% 94.56% Net charge-offs to average loans 0.26% 0.17%

Loan Portfolio and Credit

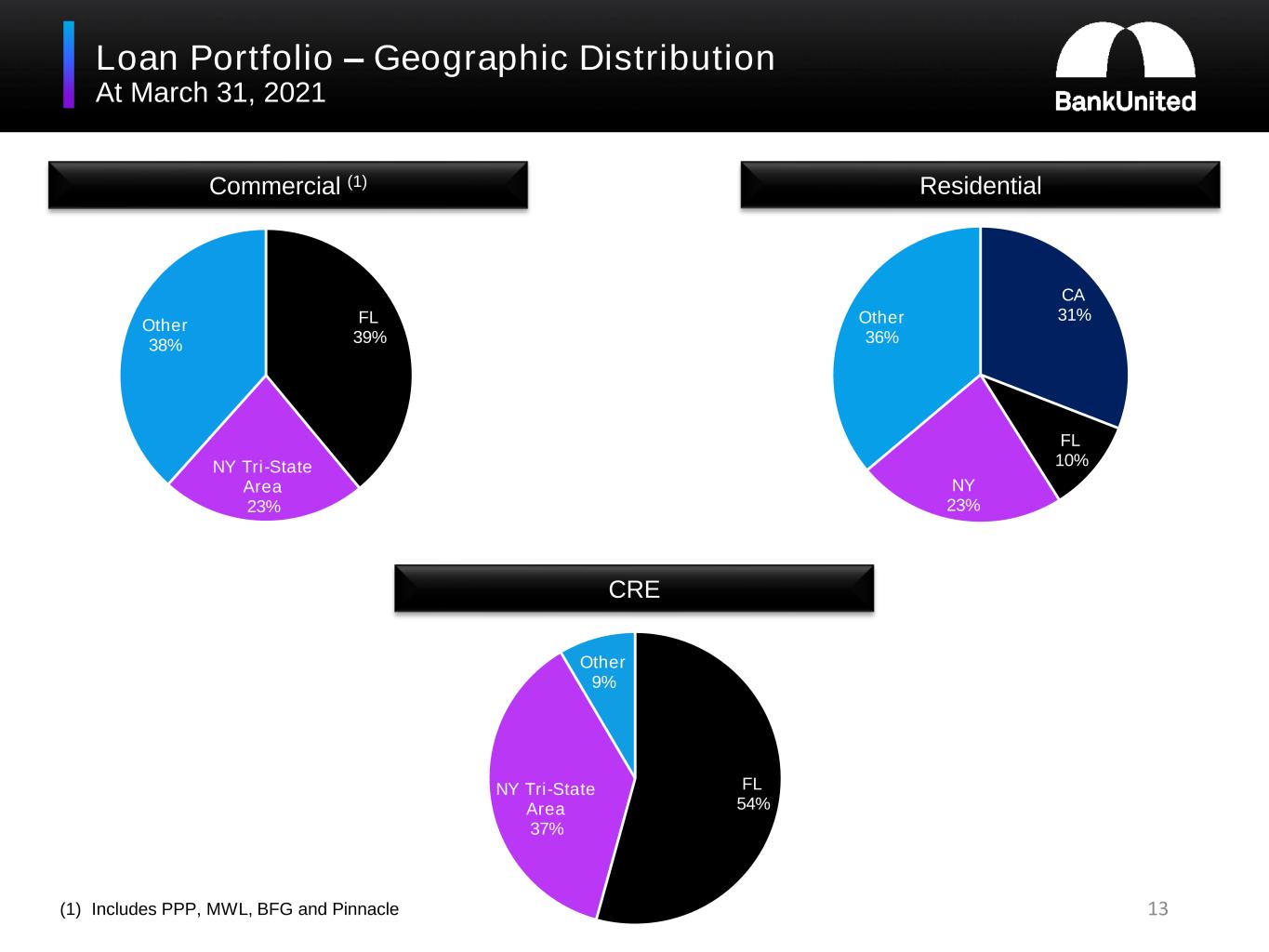

Loan Portfolio – Geographic Distribution At March 31, 2021 Commercial (1) Residential CRE (1) Includes PPP, MWL, BFG and Pinnacle CA 31% FL 10% NY 23% Other 36% FL 54% NY Tri-State Area 37% Other 9% FL 39% NY Tri-State Area 23% Other 38% 13

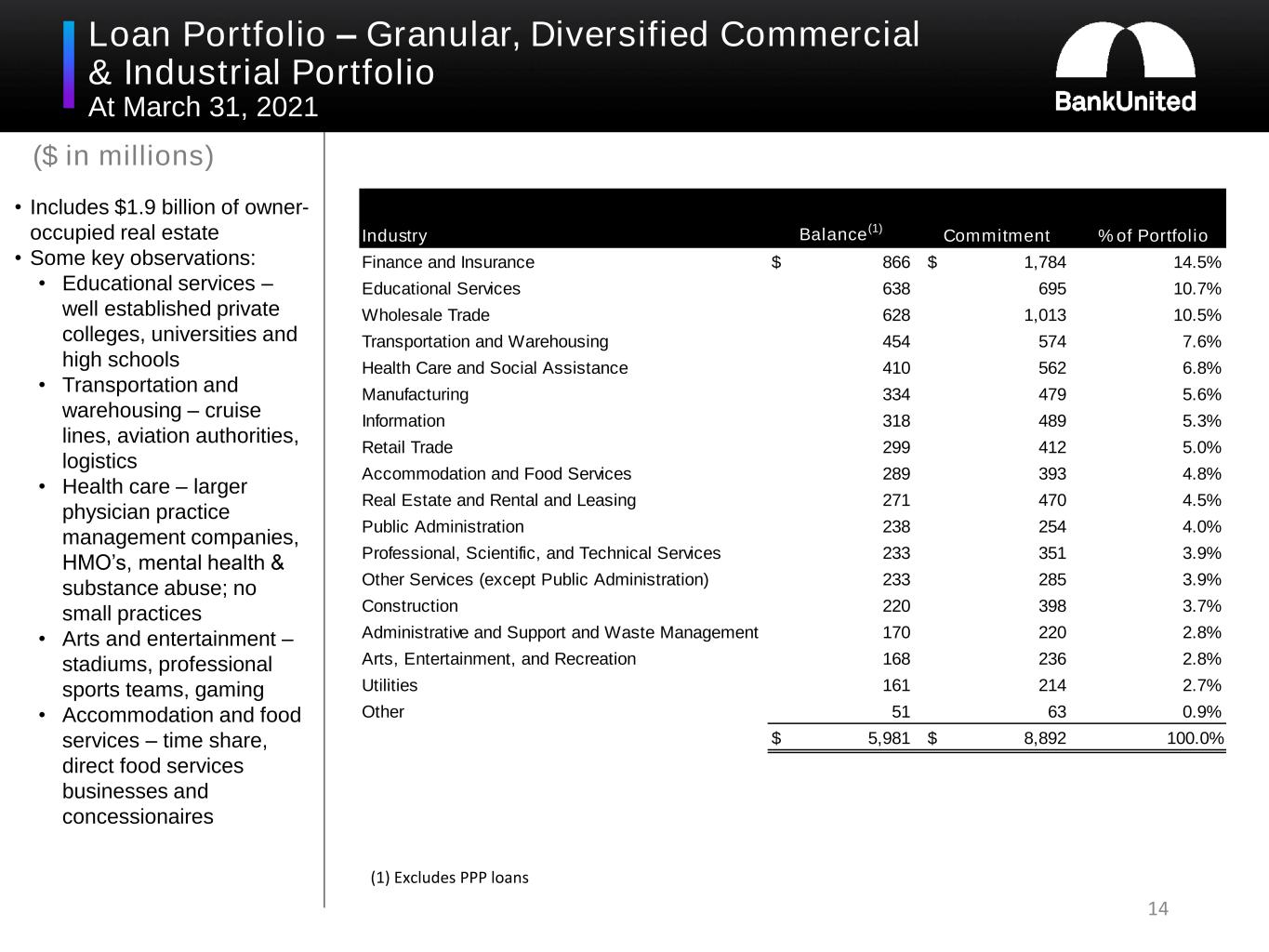

14 Loan Portfolio – Granular, Diversified Commercial & Industrial Portfolio At March 31, 2021 ($ in millions) • Includes $1.9 billion of owner- occupied real estate • Some key observations: • Educational services – well established private colleges, universities and high schools • Transportation and warehousing – cruise lines, aviation authorities, logistics • Health care – larger physician practice management companies, HMO’s, mental health & substance abuse; no small practices • Arts and entertainment – stadiums, professional sports teams, gaming • Accommodation and food services – time share, direct food services businesses and concessionaires (1) Excludes PPP loans Industry Balance (1) Commitment % of Portfolio Finance and Insurance 866$ 1,784$ 14.5% Educational Services 638 695 10.7% Wholesale Trade 628 1,013 10.5% Transportation and Warehousing 454 574 7.6% Health Care and Social Assistance 410 562 6.8% Manufacturing 334 479 5.6% Information 318 489 5.3% Retail Trade 299 412 5.0% Accommodation and Food Services 289 393 4.8% Real Estate and Rental and Leasing 271 470 4.5% Public Administration 238 254 4.0% Professional, Scientific, and Technical Services 233 351 3.9% Other Services (except Public Administration) 233 285 3.9% Construction 220 398 3.7% Administrative and Support and Waste Management 170 220 2.8% Arts, Entertainment, and Recreation 168 236 2.8% Utilities 161 214 2.7% Other 51 63 0.9% 5,981$ 8,892$ 100.0%

Loan Portfolio – Commercial Real Estate by Property Type At March 31, 2021 Property Type Balance FL NY Tri State Other Wtd. Avg. DSCR Wtd. Avg. LTV Non- Performing Office 2,078$ 59% 26% 15% 2.39 57.1% 5$ Multifamily 1,689 34% 65% 1% 1.78 56.8% 15 Retail 1,292 53% 40% 7% 1.47 57.8% 22 Warehouse/Industrial 845 65% 24% 11% 2.29 53.4% 0 Hotel 619 74% 16% 10% 1.22 62.8% 34 Other 143 86% 13% 1% 2.06 36.9% 5 6,666$ 54% 37% 9% 1.93 56.8% 81$ • Commercial real estate loans are secured by income-producing, non-owner occupied properties, typically with well capitalized middle market sponsors • Construction and land loans, included in the table above by property type, represent only 1% of the total loan portfolio. • Average rent collections for the first quarter, based on a sample of borrowers: • Office – 96% NY, 96% FL • Multi-family – 90% NY, 92% FL • Retail – 85% NY, 99% FL • Hotel occupancy – Improved to 80% for the month of March in Florida, compared to 56% for January and 46% for the fourth quarter of 2020. 2 hotels in NY are open, with 80% occupancy for March; the third is expected to re-open in June. • NY commercial Real Estate portfolio contains $254 million of mixed-used properties; $187 million included in the table above in multi-family, $48 million in retail and $19 million in office. ($ in millions) 15

16 Loan Portfolio – Deferrals and Modifications At March 31, 2021 ($ in millions) • Loans subject to COVID related deferral or modification under the CARES Act totaled $762 million or 3% of the total loan portfolio at March 31, 2021. By comparison, at the end of Q2 2020, we reported that we had granted 90-day payment deferrals on $3.6 billion of loans or 15% of the total loan portfolio. • Commercial CARES Act modifications are most often 9 to 12- month interest only periods. • Percentage of the portfolio subject to deferral or CARES Act modification remained consistent with the prior quarter-end Residential – Excluding Government Insured Through March 31, 2021, a total of $525 million of residential loans, excluding government insured loans, had been granted an initial short-term payment deferral. The status of those loans at March 31, 2021 is presented in the table below: Currently Under Short-Term Deferral CARES Act Modification Total % of Portfolio Residential -excluding government insured 91$ 15$ 106$ 2% CRE by Property Type: Retail 18$ 19$ 37$ 3% Hotel - 343 343 55% Office 13 43 56 3% Multifamily - 24 24 1% Other - - - 0% Total CRE 31$ 429$ 460$ 7% C&I - Industry: Accomm. and Food Services -$ 25$ 25$ 9% Retail Trade - 34 34 11% Manufacturing - 13 13 4% Transportation and Warehousing (cruise lines) - 48 48 10% Finance and Insurance - 18 18 2% Other 4 16 20 1% Total C&I 4$ 154$ 158$ 3% BFG - Franchise -$ 38$ 38$ 7% Total Commercial 35$ 621$ 656$ 4% Total 126$ 636$ 762$ 3% % of Total Loans <1% 3% 3% Balance % of Loans Inititally Granted Short-Term Deferral Balance % of Loans Rolled Off Short-Term Deferral Balance % of Loans Rolled Off Short-Term Deferral 91$ 17% 408$ 94% 26$ 6% Loans Still Under Short-Term Deferral Paid Off or Paying as Agreed Not Resumed Regular Payments Loans That Have Rolled Off of Short-Term Deferral

Loan Portfolio – Segments Identified for Heightened Monitoring At March 31, 2021 Moderate exposure to sectors most impacted by the pandemic ($ in millions) • 76% of commercial loans deferred or modified and 52% of criticized and classified assets are in these sub-segments Portfolio Balance % of Total Loans Short-Term Deferral or CARES Modification % of Portfolio Segment Non- Performing Loans Special Mention Classified Retail - CRE 1,292$ 6% 37$ 3% 22$ 52$ 306$ Retail - C&I 299 1% 34 11% 4 4 47 BFG - franchise finance 525 2% 38 7% 36 11 277 Hotel 619 3% 343 55% 34 34 487 Airlines and aviation authoritites 117 1% - - - - 75 Cruise line 82 - 48 59% - - 70 2,934$ 13% 500$ 17% 96$ 101$ 1,262$ 17

Loan Portfolio – Retail At March 31, 2021 ($ in millions) Retail - Commercial Real Estate Property Type Balance Currently Under Short-Term Deferral CARES Act Modification Retail - Anchored 634$ -$ 6$ Retail - Unanchored 603 18 13 Construction to Perm 7 - - Gas Station 24 - - Restaurant 24 - - 1,292$ 18$ 19$ • No significant mall or “big box” exposure • $43 million and $18 million of Retail-Unanchored and Retail- Anchored, respectively, are mixed-used properties Retail – Commercial & Industrial Industry Not Secured by Real Estate Owner Occupied Real Estate Total Balance Currently Under Short- Term Deferral CARES Act Modification Gasoline Stations 1$ 84$ 85$ -$ -$ Health and Personal Care Stores 30 7 37 - 14 Furniture Stores 15 5 20 - - Vending Machine Operators 20 - 20 - 20 Specialty Food Stores 1 12 13 - - Grocery Stores 2 18 20 - - Automobile Dealers 7 6 13 - - Clothing Stores 1 11 12 - - Florists 11 - 11 - - Other 19 49 68 - - 107$ 192$ 299$ -$ 34$ 18

Loan Portfolio – BFG Franchise Finance At March 31, 2021 ($ in millions) Portfolio Breakdown by Concept Restaurant Concepts Balance % of BFG Franchise Currently Under Short- Term Deferral CARES Act Modification Burger King 61$ 12% -$ -$ Popeyes 28 5% - - Dunkin Donuts 27 5% - - Jimmy John's 19 4% - - Domino's 17 3% - - Other 154 29% - 13 306$ 58% -$ 13$ Portfolio Breakdown by Geography Non-Restaurant Concepts Balance % of BFG Franchise Currently Under Short- Term Deferral CARES Act Modifications Planet Fitness 95$ 18% -$ 25$ Orange Theory Fitness 83 16% - - Other 41 8% - - 219$ 42% -$ 25$ CA 20% FL 9% TX 7% UT 6% Other 58% 19

Loan Portfolio – Hotel At March 31, 2021 ($ in millions) • 74% of our exposure is in Florida, followed by 16% in New York • Includes $60.3 million in SBA loans • All hotel properties in Florida and two of three properties in New York are now open Exposure by Flag Marriott $170 27% Independent $162 26% Others $103 17% Hilton $86 14% IHG $59 10% Sheraton $39 6% Total Portfolio: $619 million 20

Credit Quality – Residential At March 31, 2021 High quality residential portfolio consists of primarily prime jumbo mortgages with de-minimis charge- offs since inception as well as fully government insured assets FICO Distribution(1) Breakdown by LTV(1) Breakdown by Vintage(1) (1) Excludes government insured residential loans. FICOs are refreshed routinely. LTVs are typically based on valuation at origination. <720 or NA 12% 720-759 19% >759 69% 60% or less 33% 61% - 70% 25% 71% - 80% 40% More than 80% 2% Prior 40% 2017 11% 2018 7% 2019 12% 2020 26% 2021 4% 21

Asset Quality Metrics Non-performing Loans to Total Loans Non-performing Assets to Total Assets Net Charge-offs to Average Loans(1) (1) YTD net charge-offs, annualized at March 31, 2021. 0.88% 0.85% 0.86% 0.84% 1.02% 1.00% 0.68% 0.64% 0.67% 0.66% 0.80% 0.79% 0.00% 0.25% 0.50% 0.75% 1.00% 1.25% 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 Incl. guaranteed portion of non-accrual SBA loans Excl. guaranteed portion of non-accrual SBA loans 0.63% 0.61% 0.60% 0.58% 0.71% 0.67% 0.49% 0.46% 0.47% 0.46% 0.56% 0.53% 0.00% 0.25% 0.50% 0.75% 1.00% 1.25% 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 Incl. guaranteed portion of non-accrual SBA loans Excl. guaranteed portion of non-accrual SBA loans 22 0.05% 0.26% 0.17% 0.00% 0.20% 0.40% 0.60% 12/31/19 12/31/20 3/31/21

Non-Performing Loans by Portfolio Segment ($ in millions) (1) Includes the guaranteed portion of non-accrual SBA loans totaling $48.2 million, $51.3 million, $43.6 million, $45.7 million, $49.1 million, and $45.7 million at March 31, 2021, December 31, 2020, September 30, 2020, June 30, 2020, March 31, 2020, and December 31, 2019, respectively. $19 $17 $13 $12 $29 $26 $18 $11 $22 $31 $36 $38 $6 $6 $6 $24 $13 $65 $51 $66 $65 $43 $58 $21 $11 $1 $14 $38 $33 $33 $45 $36 $62 $64 $64 $59 $67 $63 $205 $198 $204 $200 $244 $234 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 Residential CRE Multifamily C&I Equipment Franchise SBA(1) 23

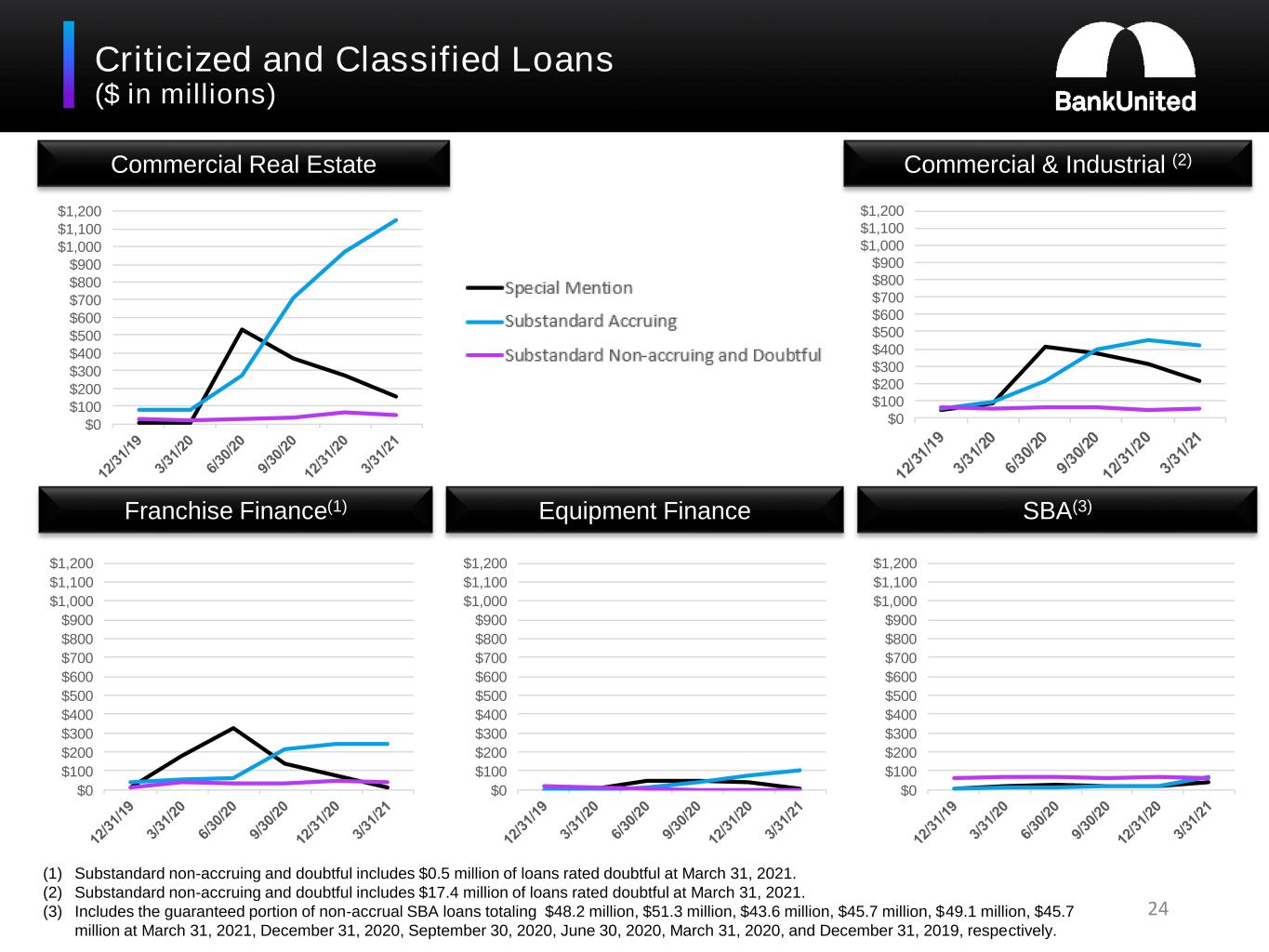

Criticized and Classified Loans ($ in millions) Commercial Real Estate Commercial & Industrial (2) Franchise Finance(1) Equipment Finance SBA(3) (1) Substandard non-accruing and doubtful includes $0.5 million of loans rated doubtful at March 31, 2021. (2) Substandard non-accruing and doubtful includes $17.4 million of loans rated doubtful at March 31, 2021. (3) Includes the guaranteed portion of non-accrual SBA loans totaling $48.2 million, $51.3 million, $43.6 million, $45.7 million, $49.1 million, $45.7 million at March 31, 2021, December 31, 2020, September 30, 2020, June 30, 2020, March 31, 2020, and December 31, 2019, respectively. $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 $1,100 $1,200 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 $1,100 $1,200 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 $1,100 $1,200 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 $1,100 $1,200 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 $1,100 $1,200 24

Criticized and Classified – CRE by Property Type ($ in millions) Office Multifamily Retail Warehouse/Industrial Hotel Other $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 25

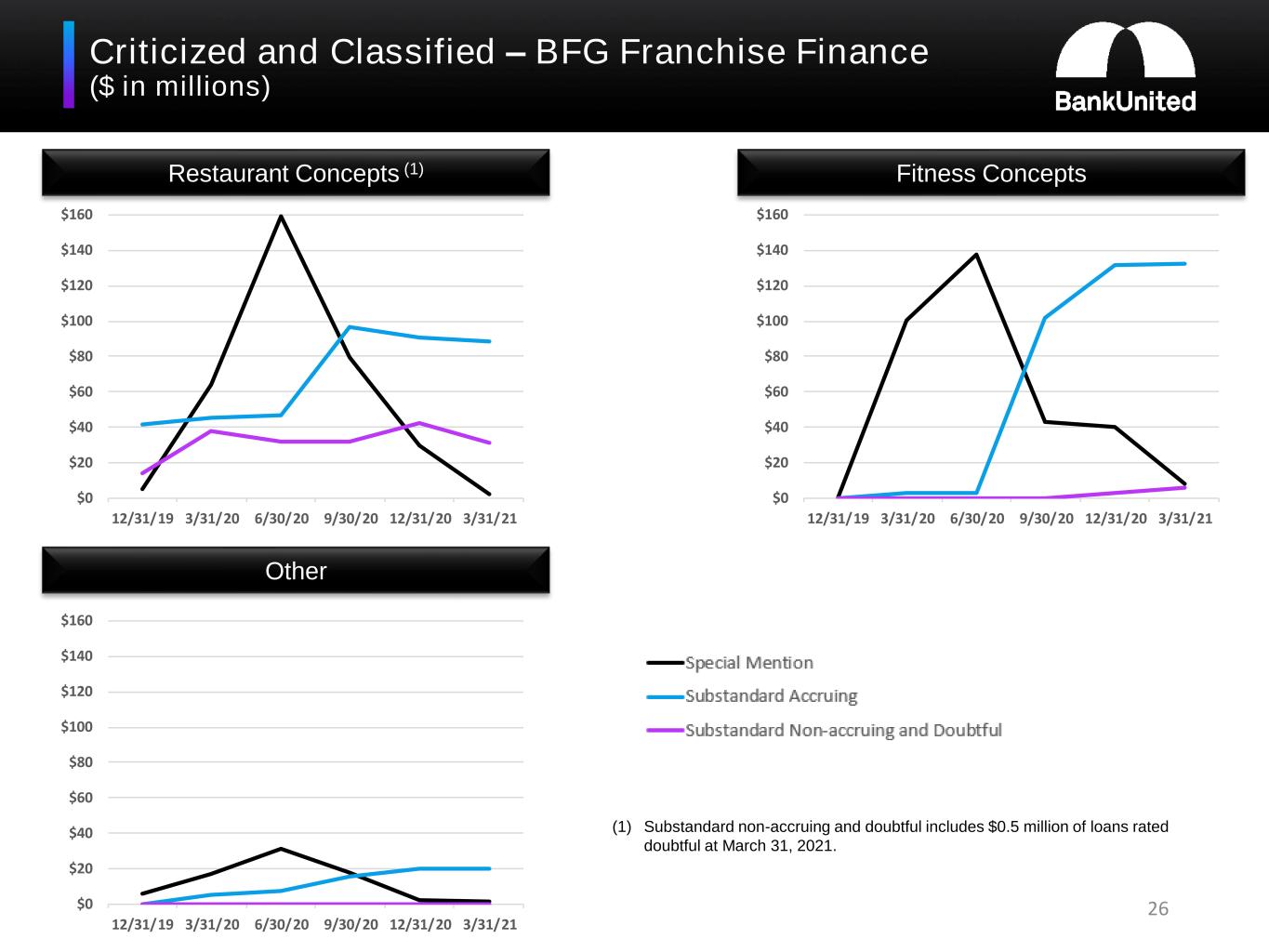

Criticized and Classified – BFG Franchise Finance ($ in millions) Restaurant Concepts (1) Fitness Concepts Other (1) Substandard non-accruing and doubtful includes $0.5 million of loans rated doubtful at March 31, 2021. $0 $20 $40 $60 $80 $100 $120 $140 $160 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 $0 $20 $40 $60 $80 $100 $120 $140 $160 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 $0 $20 $40 $60 $80 $100 $120 $140 $160 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 26

Asset Quality – Delinquencies ($ in millions) Commercial(1) CRE Residential (2) (1) Includes lending subsidiaries (2) Excludes government insured residential loans. $0 $20 $40 $60 $80 $100 $120 $140 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 $0 $20 $40 $60 $80 $100 $120 $140 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 $0 $20 $40 $60 $80 $100 $120 $140 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 27

Investment Portfolio

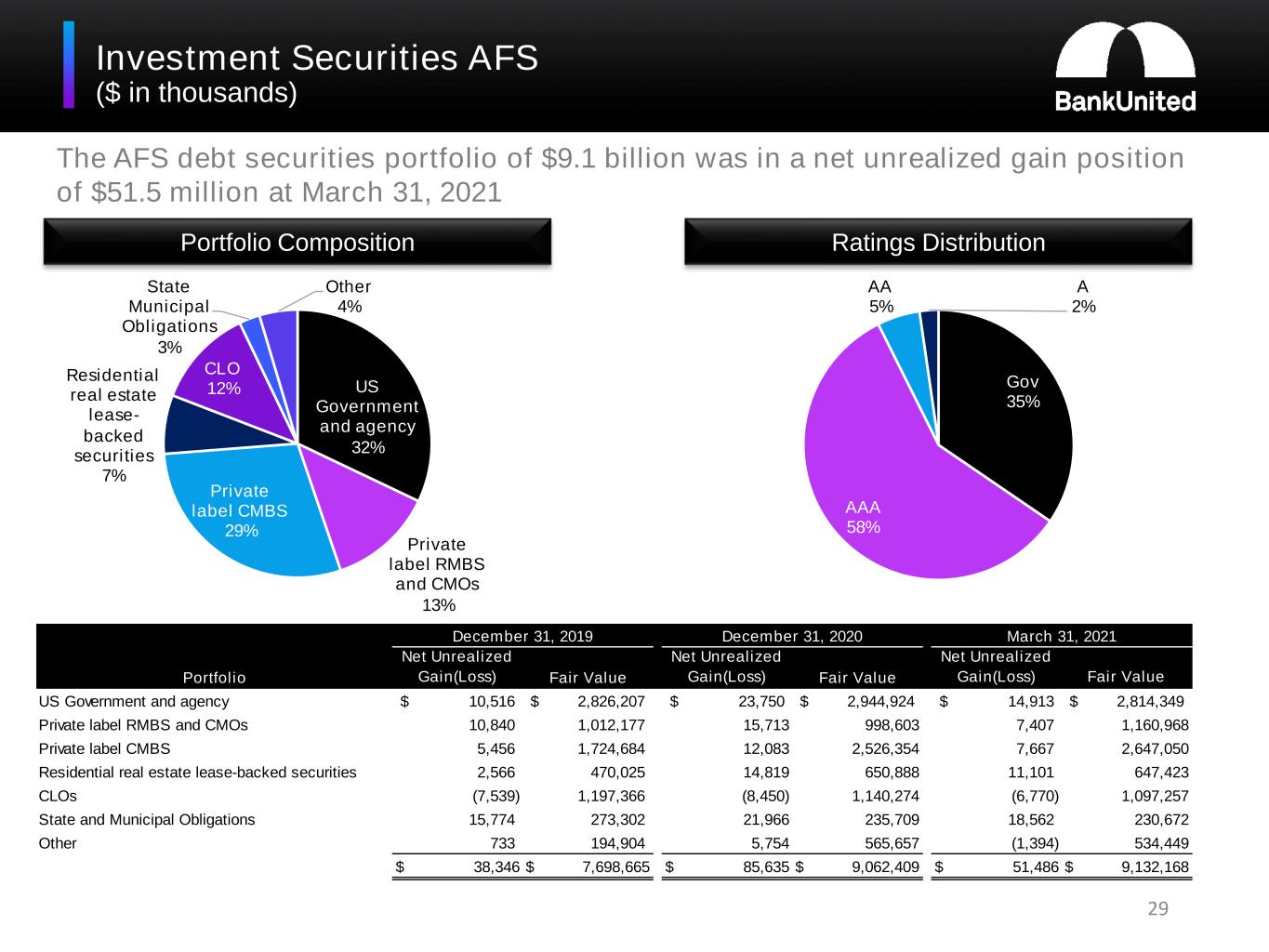

29 Investment Securities AFS ($ in thousands) The AFS debt securities portfolio of $9.1 billion was in a net unrealized gain position of $51.5 million at March 31, 2021 Portfolio Composition Ratings Distribution Gov 35% AAA 58% AA 5% A 2% US Government and agency 32% Private label RMBS and CMOs 13% Private label CMBS 29% Residential real estate lease- backed securities 7% CLO 12% State Municipal Obligations 3% Other 4% Portfolio Net Unrealized Gain(Loss) Fair Value Net Unrealized Gain(Loss) Fair Value Net Unrealized Gain(Loss) Fair Value US Government and agency 10,516$ 2,826,207$ 23,750$ 2,944,924$ 14,913$ 2,814,349$ Private label RMBS and CMOs 10,840 1,012,177 15,713 998,603 7,407 1,160,968 Private label CMBS 5,456 1,724,684 12,083 2,526,354 7,667 2,647,050 Residential real estate lease-backed securities 2,566 470,025 14,819 650,888 11,101 647,423 CLOs (7,539) 1,197,366 (8,450) 1,140,274 (6,770) 1,097,257 State and Municipal Obligations 15,774 273,302 21,966 235,709 18,562 230,672 Other 733 194,904 5,754 565,657 (1,394) 534,449 38,346$ 7,698,665$ 85,635$ 9,062,409$ 51,486$ 9,132,168$ December 31, 2020 March 31, 2021December 31, 2019

30 Investment Securities – Asset Quality of Select Non-Agency Securities At March 31, 2021 Strong credit enhancement levels on CLOs and CMBS AAA 90% AA 7% A 3% Rating Min Max Avg AAA 29.4 99.1 43.0 12.2 AA 31.1 60.4 39.9 11.3 A 24.5 69.8 39.3 10.5 Wtd. Avg. 29.3 95.5 42.6 12.1 Wtd. Avg. Stress Scenario Loss Subordination Rating Min Max Avg AAA 36.1 56.5 44.0 18.9 AA 27.7 40.7 34.2 21.5 A 24.5 29.9 26.6 21.7 Wtd. Avg. 34.6 53.4 42.1 19.4 Subordination Wtd. Avg. Stress Scenario Loss AAA 83% AA 13% A 4% Collateralized Loan Obligations (CLOs) Private Label Commercial Mortgage-Backed Securities (CMBS)

Non-GAAP Financial Measures

32 Non-GAAP Financial Measures PPNR is a non-GAAP financial measure. Management believes this measure is relevant to understanding the performance of the Company attributable to elements other than the provision for credit losses and the ability of the Company to generate earnings sufficient to cover estimated credit losses, particularly in view of the volatility of the provision for credit losses resulting from the COVID-19 pandemic. This measure also provides a meaningful basis for comparison to other financial institutions since it is commonly employed and is a measure frequently cited by investors and analysts. The following table reconciles the non-GAAP financial measure of PPNR to the comparable GAAP financial measurement of income (loss) before income taxes for the three months ended March 31, 2021 and 2020 and the three months ended December 31, 2020 (in thousands): March 31, 2021 December 31, 2020 March 31, 2020 Income (loss) before income taxes (GAAP) 131,304$ 106,965$ (40,422)$ Plus: provision for (recovery of) credit losses (27,989) (1,643) 125,428 PPNR (non-GAAP) 103,315$ 105,322$ 85,006$ Three Months Ended

33 Non-GAAP Financial Measures (continued) ACL to total loans, excluding government insured residential loans, PPP and MWL is a non-GAAP financial measure. Management believes this measure is relevant to understanding the adequacy of the ACL coverage, excluding the impact of loans which carry nominal or no reserves. Disclosure of this non-GAAP financial measure also provides meaningful basis for comparison to other financial institutions. The following table reconciles the non-GAAP financial measurement of ACL to total loans, excluding government insured residential loans, PPP loans and MWL to the comparable GAAP financial measurement of ACL to total loans at March 31, 2021 and December 31, 2020 (dollars in thousands): March 31, 2020 December 31, 2020 Total loans (GAAP) 23,361,067$ 23,866,042$ Less: Government insured residential loans 1,759,289 1,419,074 Less: PPP loans 911,951 781,811 Less: MWL 1,145,957 1,259,408 Total loans, excluding government insured residential loans, PPP loans and MWL (non-GAAP) 19,543,870$ 20,405,749$ ACL 220,934$ 257,323$ ACL to total loans (GAAP) 0.95% 1.08% ACL to total loans, excluding government insured residential loans, PPP loans and MWL (non-GAAP) 1.13% 1.26%

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- BankUnited (BKU) PT Lowered to $28 at Citi

- Alchimie Announces Its 2023 Annual Results

- Adam Peters, CEO for Air Liquide North America, Joins the Group Executive Committee

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share