Form 8-K BSD Medical Corp For: Dec 14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 14, 2016

BSD MEDICAL CORPORATION

(Exact name of registrant as specified in its charter)

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-32526

|

75-1590407

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

1969 Claremont Dr.

Bountiful, Utah 84010

(Address of principal executive offices, including Zip Code)

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including area code: (801) 725-4625

N/A

(Former name or former address, if changed since last report)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.03 Bankruptcy or Receivership.

As reported previously, on May 23, 2016, BSD Medical Corporation f/k/a Perseon Corporation (the “Company”) filed a voluntary petition for relief under Chapter 11 of 11 U.S.C. §§ 101 et seq. of the United States Code (the “Bankruptcy Code”). The matter is styled as In re BSD Medical Corporation, fka Perseon Corporation, Case No. 16-24435 (Bankr. D. Utah) (the “Chapter 11 Case”) in the United States Bankruptcy Court for the District of Utah (the “Bankruptcy Court”). In addition, as disclosed previously, on August 22, 2016, the Company sold substantially all of the assets of the Company to Scion Medical Technologies, LLC.

Confirmation of Plan

On December 28, 2016, the Bankruptcy Court entered findings of fact and conclusions of law (“Findings and Conclusions”), which supported the Bankruptcy Court’s entry of an order (the “Confirmation Order”) confirming the Company’s Plan Pursuant to Chapter 11 of the Bankruptcy Code (the “Plan”). Copies of the Findings and Conclusions, the Confirmation Order, and the Plan are filed as Exhibit 99.1, Exhibit 99.2 and Exhibit 2.1, respectively, to this Current Report on Form 8-K and are incorporated by reference into this Item 1.03.

Summary of Plan

The Plan, as confirmed by the Bankruptcy Court, provides for distributions by the Company to holders of allowed claims on the effective date of the Plan, and the appointment of a disbursing agent (the “Disbursing Agent”). The Disbursing Agent will administer the Plan and will also serve as a representative of the Company’s estate for the purpose of (i) liquidating the Company’s remaining assets, (ii) resolving all disputed claims and interests, (iii) making distributions to holders of allowed claims and allowed interests in accordance with the terms of the Plan, (iv) dissolving the Company, and (v) otherwise implementing the Plan.

The classes and types of claims and interests in the Company are described in detail in the Plan. The Plan generally provides that:

|

·

|

Administrative Claims will receive payment in full in cash for the unpaid portions of such claims.

|

|

·

|

Priority claims identified in the Plan will be paid in full in cash plus interest accrued, if applicable, on the amount allowed under the plan at an interest rate of 5% from May 23, 2016 through the Effective Date.

|

|

·

|

General unsecured claims will receive payment in full in cash plus interest accrued on the amount allowed under the Plan at an interest rate of 5% from May 23, 2016 through the Effective Date.

|

|

·

|

Holders of the Company’s common stock will receive their pro rata share of the Company’s assets being disbursed under the Plan, subject to a de minimis distribution threshold of $25 per holder.

|

|

·

|

Holders of those certain warrants issued by the Company on April 12, 2013, with an exercise price of $16.50, and on July 2, 2014, with an exercise price of $11.00 (together, the “Private Warrants”), will receive their pro rata share of the Company’s assets being disbursed under the Plan, subject to a de minimis distribution threshold of $25 per holder.

|

|

·

|

Holders of those certain warrants issued by the Company on July 29, 2015 and on August 4, 2015, at an exercise price of $0.99 (the “Public Warrants”), will not receive any distribution on account of such warrants.

|

-2-

The effective date of the Plan will be a date specified by the Company in a notice filed with the Bankruptcy Court as the date on which the Plan will take effect (the “Effective Date”), which date will be the first business date after the later of: (i) the Confirmation Order shall have become a final order that has not been stayed or modified or vacated on appeal; and (ii) the Disbursing Agent is appointed pursuant to a Disbursing Agent Agreement. We anticipate that the Effective Date will be no later than January 20, 2017. Except for the purpose of evidencing a right to distribution under the Plan and except as otherwise set forth in the Plan, on the Effective Date, all notes, stock, warrants, agreements, instruments, certificates, and other documents evidencing any claim against or interest in the Company will be cancelled and the obligations of the Company thereunder or in any way related thereto will be fully released. All derivative claims of the Company and most third party claims will also be released on the Effective Date, in accordance with the provisions of the Plan.

The foregoing description is a summary of the material terms of the Plan and does not purport to be complete, and is qualified in its entirety by reference to the full text of the Plan filed as Exhibit 2.1 to this Current Report on Form 8-K.

Common Stock

As of December 28, 2016, the Company had issued and outstanding 9,766,323 shares of common stock, Private Warrants exercisable for 985,736 shares of common stock and Public Warrants exercisable for 11,500,000 shares of common stock. Under the Plan, the holders of the Company’s common stock and Private Warrants will receive pro rata distributions in accordance with the Plan. Holders of the Public Warrants will not receive any distribution on account of such warrants. The Company’s common stock, the Private Warrants and the Public Warrants will be cancelled on the Effective Date.

No shares of the Company’s common stock, Private Warrants or Public Warrants are being reserved for future issuance in respect of claims and interests filed and allowed under the Plan.

Assets and Liabilities

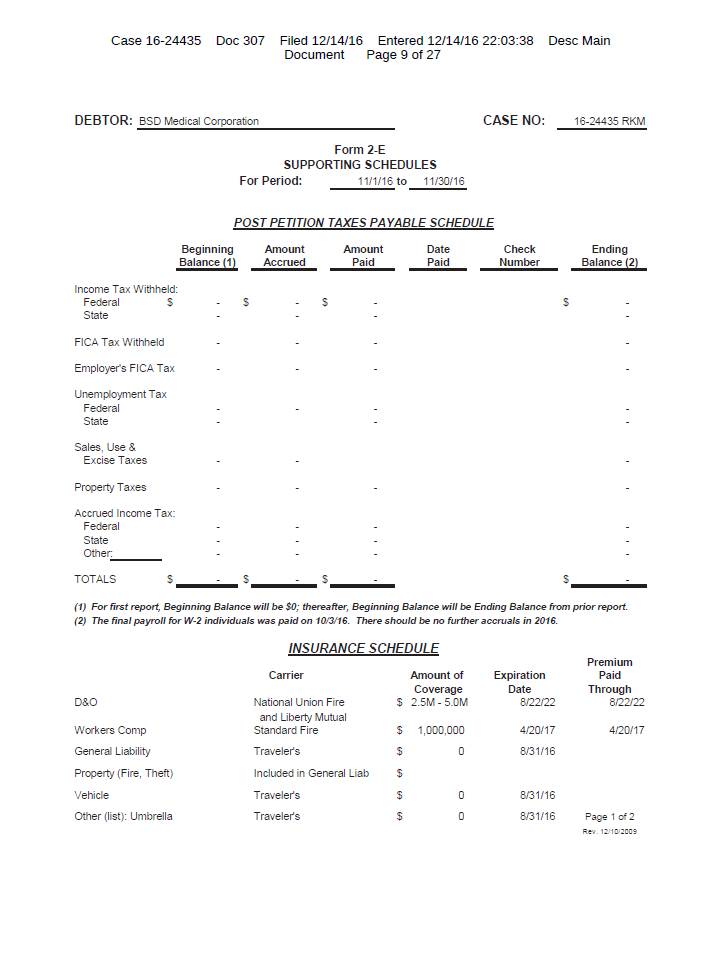

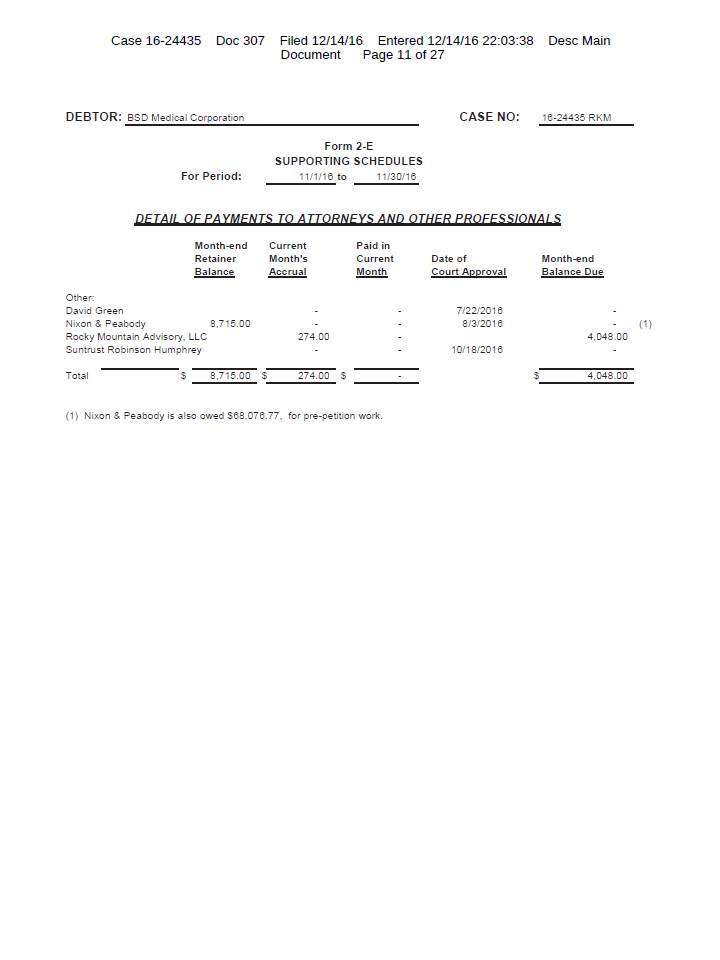

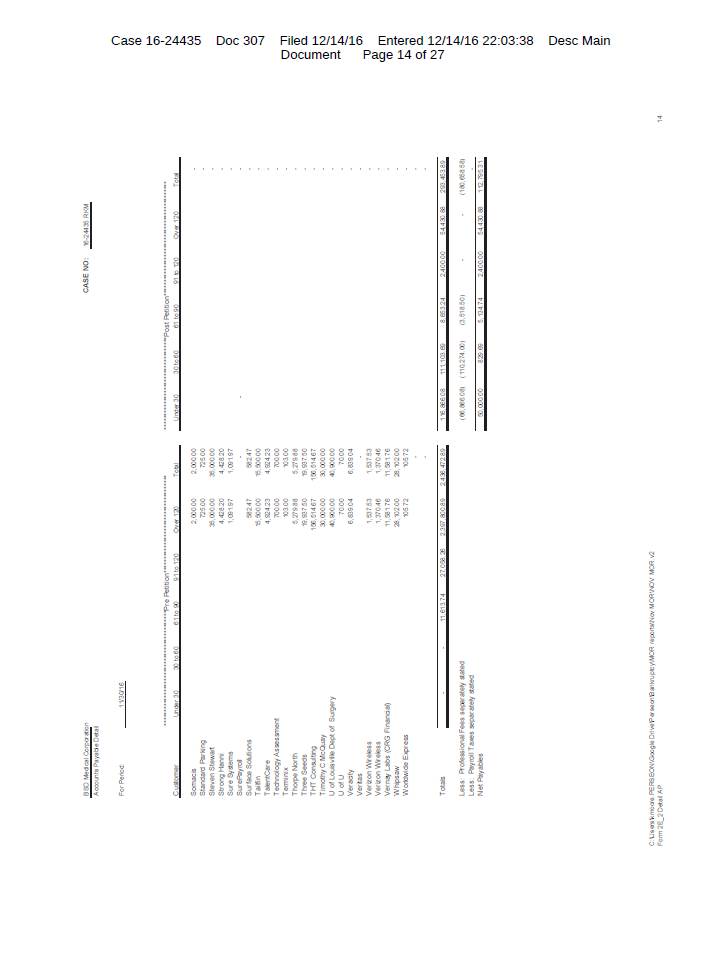

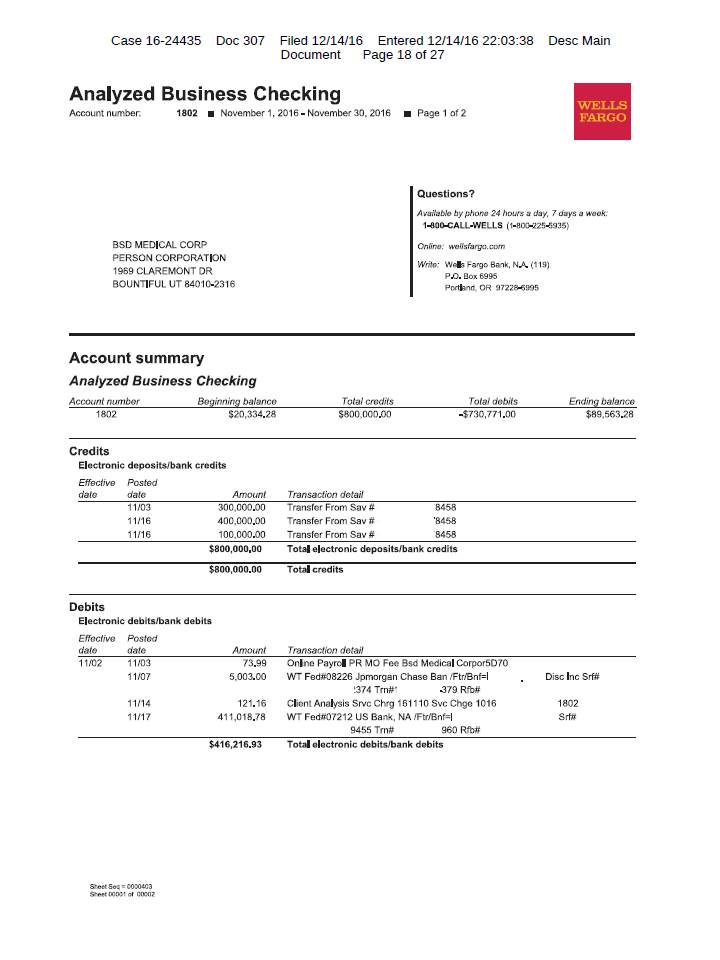

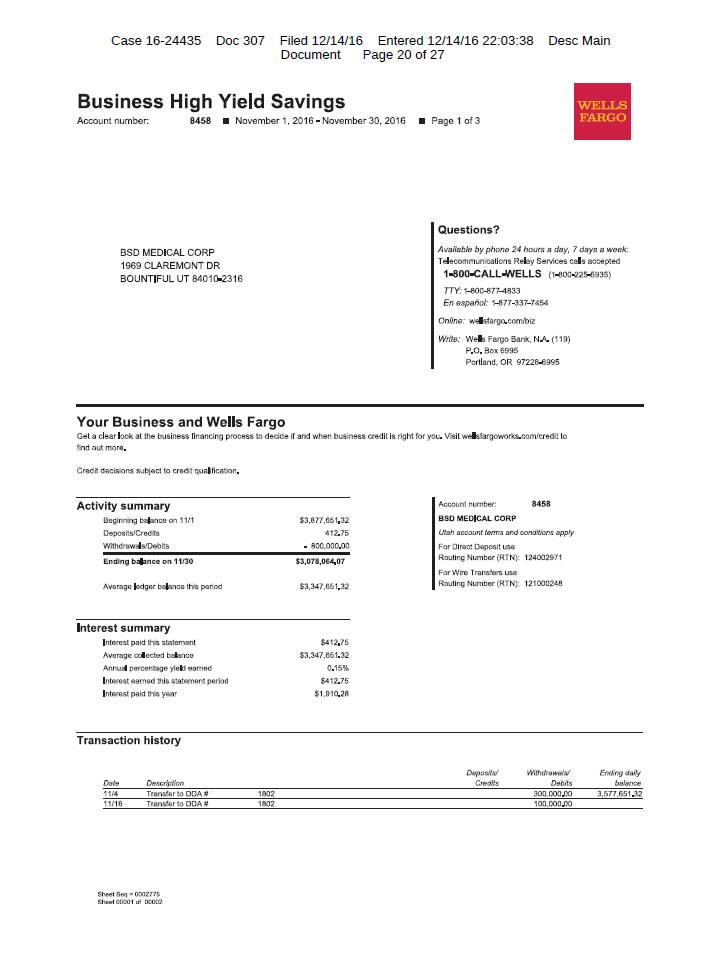

In the Company’s most recent monthly operating report filed with the Bankruptcy Court on December 14, 2016 and furnished as Exhibit 99.3 to this Current Report on Form 8-K, the Company reported total assets of $3,538,295.30 and total liabilities of $2,736,203.75 as of November 30, 2016.

Item 3.03 Material Modification to Rights of Security Holders.

As provided in the Plan, all notes, stock, warrants, agreements, instruments, certificates, and other documents evidencing any claim against or interest in the Company will be cancelled on the Effective Date and the obligations of the Company thereunder or in any way related thereto will be fully released. The registered securities to be cancelled on the Effective Date include all of the Company’s common stock as well as the Private Warrants and Public Warrants.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The Plan provides that the Company’s board of directors will be dissolved and its officers will be discharged on the Effective Date. As provided in the Plan, each of the Company’s directors, Timothy C. McQuay, Harold R. Wolcott, Steven G. Stewart, Damian E. Dupuy and Peter Vitulli, and Mr. McQuay in his role as President of the Company, will cease to be directors and officers of the Company on the Effective Date. Also on the Effective Date, the Disbursing Agent will succeed to

-3-

such powers as would have been applicable to the Company’s officers, directors and shareholders and will become the sole representative of the Company.

Item 7.01 Regulation FD Disclosure.

Modified SEC Reporting

During the pendency of the Chapter 11 Case, the Company has adopted a modified reporting program with respect to its reporting obligations under federal securities laws. In lieu of filing annual reports on Form 10-K and quarterly reports on Form 10-Q, each month the Company will file with the Securities and Exchange Commission (the “SEC”) a current report on Form 8-K that will have attached to it the monthly operating report required by the Bankruptcy Court. The Company does not intend to file periodic reports while the Chapter 11 Case is pending, but will continue to file current reports on Form 8-K as required by federal securities laws. The Company believes that this modified reporting program is consistent with the protection of its investors as set forth in Exchange Act Release No. 9660, dated June 30, 1972.

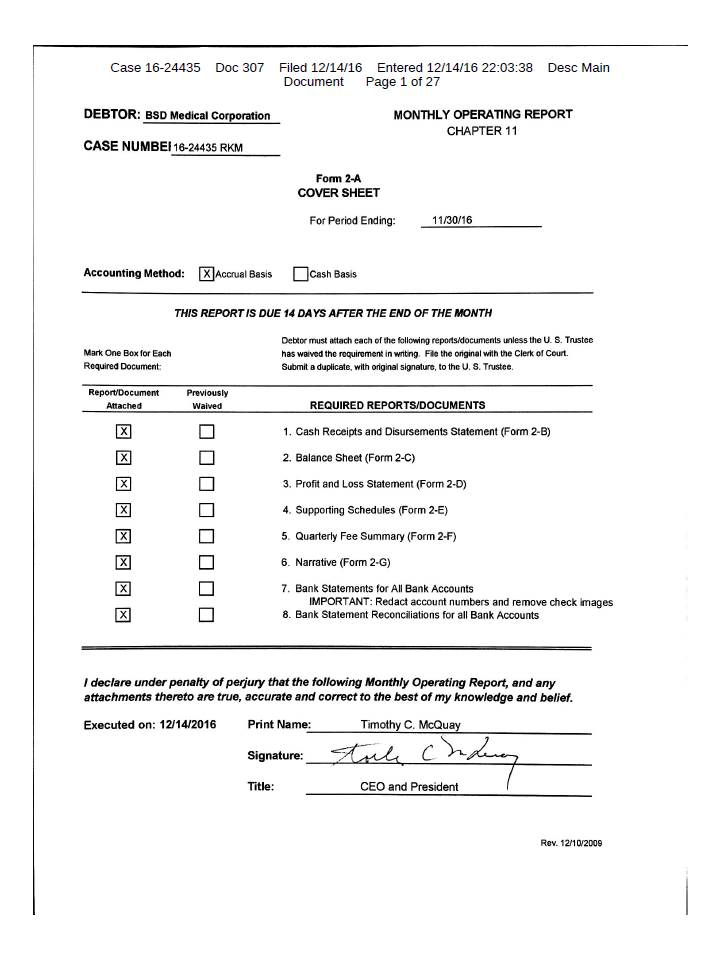

Operating Reports

On December 14, 2016, the Company filed a monthly operating report with the Bankruptcy Court that presides over the Chapter 11 Case for the period that began on November 1, 2016 and ended on November 30, 2016 (the “Operating Report”). The Operating Report is attached hereto as Exhibit 99.3 and is incorporated herein by reference.

The Operating Report is furnished for informational purposes only and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor will such information be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such a filing. This Current Report on Form 8-K (including the exhibits hereto) should not be deemed an admission as to the materiality of any information required to be disclosed solely by Regulation FD.

Cautionary Note Regarding the Operating Reports

The Company cautions investors and potential investors not to place undue reliance upon the information contained in the Operating Report, which report was not prepared for the purpose of providing the basis for an investment decision relating to any of the securities of the Company. The Operating Report is limited in scope, covers a limited time period, has been prepared solely for the purpose of complying with the requirements applicable in the Chapter 11 Case and is in a format acceptable to the U.S. Trustee. The financial information contained in the Operating Report was not audited or reviewed by independent public accountants, does not contain all of the information and footnotes required by generally accepted accounting principles in the United States, is in a format prescribed by applicable bankruptcy laws, and is subject to future adjustment and reconciliation. There can be no assurance that, from the perspective of an investor or potential investor in the Company's securities, the financial information contained in the Operating Report is complete. The Operating Report also contains information for periods which are shorter or otherwise different from those required in the Company's reports pursuant to the Exchange Act, and such information might not be indicative of the Company's financial condition or operating results for the period that would be reflected in the Company's financial statements or in its reports pursuant to the Exchange Act. Results set forth in the Operating Report should not be viewed as indicative of future results.

-4-

Cautionary Note Regarding Forward-Looking Statements

Certain statements and information included herein may constitute “forward-looking” statements that are generally identifiable through the use of words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “project” and similar expressions and include any statements that are made regarding earnings expectations. The forward-looking statements speak only as of the date of this report, and the Company undertakes no obligation to update or revise such statements to reflect new information or events as they occur. These statements are based on a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company. Investors are cautioned that any such statements are not guarantees of future performance and that actual future results may differ materially due to a variety of factors. Factors that could cause the Company's results to differ materially include: (i) the Company's ability to obtain Bankruptcy Court approval with respect to motions in the Chapter 11 Case; (ii) the Company's ability to operate its business during this process, (iii) the effects of the Company's bankruptcy filing on the Company's business and the interests of various creditors, equity holders and other constituents, (iv) the length of time the Company will operate under the Chapter 11 Case, (v) risks associated with third-party motions in the Chapter 11 Case, which may interfere with the Company's ability to develop and consummate a plan of reorganization, (vi) the potential adverse effects of the Chapter 11 Case on the Company's liquidity or results of operations, and (vii) other factors disclosed by the Company from time to time in its filings with the SEC, including those described under the caption “Risk Factors” in the Company's Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. As a result of these factors, the Company's actual results may differ materially from those indicated or implied by such forward-looking statements.

Item 9.01 Financial Statements and Exhibits.

|

Exhibit

Number |

Description

|

|

|

2.1

|

Company’s Plan Pursuant to Chapter 11 of the Bankruptcy Code

|

|

|

99.1

|

Findings and Conclusions of the Bankruptcy Court

|

|

|

99.2

|

Order Confirming Company’s Plan Pursuant to Chapter 11 of the Bankruptcy Code

|

|

|

99.3

|

November 2016 Monthly Operating Report

|

-5-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

BSD MEDICAL CORPORATION

Date: January 3, 2017

By: /s/ Timothy C. McQuay

Name: Timothy C. McQuay

Title: President

-6-

EXHIBIT INDEX

|

Exhibit

Number |

Description

|

|

|

2.1

|

Company’s Plan Pursuant to Chapter 11 of the Bankruptcy Code

|

|

|

99.1

|

Findings and Conclusions of the Bankruptcy Court

|

|

|

99.2

|

Order Confirming Company’s Plan Pursuant to Chapter 11 of the Bankruptcy Code

|

|

|

99.3

|

November 2016 Monthly Operating Report

|

-7-

EXHIBIT 2.1

EXHIBIT 99.1

Prepared and Submitted By: Steven T. Waterman (4164) Michael F. Thomson (9707) Jeffrey M. Armington (14050) DORSEY & WHITNEY LLP136 South Main Street, Suite 1000 Salt Lake City, UT 84101-1685Telephone: (801) 933-7360Facsimile: (801) 933-7373Email: [email protected] thomson.michael @dorsey.com [email protected] for Debtor-in-Possession BSD Medical Corporation fka Perseon Corporation IN THE UNITED STATES BANKRUPTCY COURTFOR THE DISTRICT OF UTAH, CENTRAL DIVISION In re:BSD MEDICAL CORPORATION fka PERSEON CORPORATION,Debtor. Case No. 16-24435Chapter 11Chief Judge R. Kimball Mosier FINDINGS OF FACT AND CONCLUSIONS OF LAW REGARDING CONFIRMATION OF THE DEBTOR’S PLAN PURSUANT TO CHAPTER 11 OF THE BANKRUPTCY CODE Dated: December 28, 2016R. KIMBALL MOSIERU.S. Bankruptcy Judge Case 16-24435 Doc 316This order is SIGNED. Filed 12/28/16 Entered 12/28/16 13:42:50 Desc Main Document Page 1 of 18

BSD Medical Corporation fka Perseon Corporation (the “Debtor”) having:1Commenced, on May 23, 2016, this Chapter 11 Case by filing a voluntary petition in this Bankruptcy Court;continued to operate its business as a debtor in possession pursuant to sections 1107(a) and 1108 of the Bankruptcy Code;obtained, on August 11, 2016, an Order Authorizing Sale of Assets [Docket No. 160] (the “APA Order”);closed, on August 22, 2016, the sale of substantially all of the Debtor’s assets pursuant to the APA Order [See Docket No. 178];filed, on September 16, 2016, the Debtor’s Motion for Entry of Order (I) Approving the Disclosure Statement; (II) Approving Solicitation and Notice Materials; (III) Approving Forms of Ballots; (IV) Establishing Solicitation and Voting Procedures;(V) Scheduling a Confirmation Hearing; and (VI) Establishing Notice of Objection Procedures [Docket No. 211] (the “Disclosure Statement Motion”);obtained, on November 4, 2016, an Order approving the Disclosure Statement Motion [Docket No. 287] (the “Disclosure Statement Order”);caused the mailing of the Solicitation Packages and notices to Holders of Claims and Interests of the date for the Confirmation Hearing as directed in the Disclosure Statement Order as established in the Certificate of Service [Docket No. 308];filed, on December 9, 2016, the Plan Supplement, which contained a proposed Disbursing Agent Agreement;filed, on December 14, 2016, the Armington Declaration regarding the voting on and tabulation of votes on the Plan [Docket No. 306];This Court having: 1 -2- Capitalized terms used herein and not defined shall have the meanings ascribed to them in the Debtor’s PlanPursuant to Chapter 11 of the Bankruptcy Code [Docket No. 305] (the “Plan”), a copy of which is attached to the Confirmation Order as Exhibit A; the memorandum in support of confirmation of the Plan [Docket No. 309] (the “Confirmation Brief”); the Declaration of Timothy C. McQuay in support of confirmation of the Plan [Docket No. 309, Exhibit A] (the “McQuay Declaration”) as applicable. Case 16-24435 Doc 316 Filed 12/28/16 Entered 12/28/16 13:42:50 Desc Main Document Page 2 of 18

-2- set December 20, 2016, as the date of the Confirmation Hearing;reviewed the Plan, the Disclosure Statement, the Confirmation Brief, the McQuay Declaration, the Armington Declaration, the Plan Supplement, and all pleadings, exhibits, statements, responses, objections, and comments regarding confirmation of the Plan;held the Confirmation Hearing;heard the statements and arguments of counsel regarding confirmation of the Plan (“Confirmation”);received into evidence the McQuay Declaration [Docket No. 309, Exhibit A], the Armington Declaration [Docket No. 306, and the “Liquidation Analysis” [Docket No. 211, Exhibit 3];considered all oral representations, documents, filings, and other evidence regarding Confirmation;overruled any and all objections to the Plan and to Confirmation and all statements and reservations of rights not consensually resolved or withdrawn unless otherwise indicated; andtaken judicial notice of all papers and pleadings filed in the Chapter 11 Case.NOW, THEREFORE, the Court having found that notice of the Confirmation Hearing and the opportunity for any party in interest to object to Confirmation of the Plan having been adequate and appropriate as to all parties affected or to be affected by the Plan and the transactions contemplated thereby; and the record of the Chapter 11 Case and the legal and factual bases set forth in the documents filed in support of Confirmation and presented at the Confirmation Hearing establish just cause for the relief sought in the Confirmation Order; and after due deliberation thereon and good cause appearing therefor, the Court hereby adopts the following findings of fact and conclusions of law (these “Findings and Conclusions”) to accompany the Court’s entry of its Order Confirming the Debtor’s Plan Pursuant to Chapter 11 of the Bankruptcy Code (the “Confirmation Order”): Case 16-24435 Doc 316 Filed 12/28/16 Entered 12/28/16 13:42:50 Desc Main Document Page 3 of 18

-2- FINDINGS OF FACT AND CONCLUSIONS OF LAWIT IS HEREBY DETERMINED, FOUND, ADJUDGED, AND DECREED THAT:Jurisdiction and VenueOn the Petition Date, the Debtor commenced the Chapter 11 Case. Venue in this Court was proper as of the Petition Date and remains proper under 28 U.S.C. §§ 1408 and 1409. Confirmation of the Plan is a core proceeding under 28 U.S.C. § 157(b)(2). The Court has subject matter jurisdiction over this matter under 28 U.S.C. § 1334. The Court has exclusive jurisdiction to determine whether the Plan complies with the applicable provisions of the Bankruptcy Code and should be confirmed.Eligibility for ReliefThe Debtor was and continues to be an entity eligible for relief under section 109 of the Bankruptcy Code.Plan SupplementOn December 9, 2016, the Debtor filed the Plan Supplement containing the proposed Disbursing Agent Agreement with the Court [Docket No. 304]. The Plan Supplement complies with the terms of the Plan, and the filing and notice of the Plan Supplement was good and proper and in accordance with the Bankruptcy Code, the Bankruptcy Rules, the Disclosure Statement Order, and the facts and circumstances of the Chapter 11 Case. No other or further notice is or will be required with respect to the Plan Supplement.Modifications to the PlanAny modifications to the Plan described or set forth in these Findings and Conclusions:(a) were appropriate under the facts and circumstances of the Chapter 11 Case, (b) do not Case 16-24435 Doc 316 Filed 12/28/16 Entered 12/28/16 13:42:50 Desc Main Document Page 4 of 18

-2- require, in accordance with Bankruptcy Rule 3019, additional disclosure under section 1125 ofthe Bankruptcy Code or the resolicitation of votes under section 1126 of the Bankruptcy Code, and (c) do not require that Holders of Interests be afforded an opportunity to change previously cast acceptances or rejections of the Plan.Objections OverruledAll unresolved objections, statements and reservations of rights are hereby overruled on the merits, including but not limited to the objection to Confirmation of the Plan filed by Paul M. Schwartz [Docket No. 303] (the “Schwartz Objection”).Disclosure Statement OrderOn November 4, 2016, the Court entered the Disclosure Statement Order, which among other things: (a) fixed November 1, 2016 at 5:00 p.m. (prevailing Mountain Time) as the Voting Record Date; (b) fixed December 7, 2016 at 4:00 p.m. (prevailing Mountain Time) as the deadline for objecting to Confirmation of the Plan; (c) fixed December 9, 2016 at 5:00 p.m. (prevailing Mountain Time) as the Voting Deadline; and (d) set December 20, 2016 at 3:00 p.m. (prevailing Mountain Time) as the date and time of the Confirmation Hearing.Mailing of Materials and NoticeDue, adequate, and sufficient notice of the Plan, the Plan Supplement, the Confirmation Hearing, the Voting Deadline, and all deadlines for voting on the Plan or objecting to Confirmation have been given in substantial compliance with the Disclosure Statement Order, Bankruptcy Rules 2002(b), 3017, 3019, and 3020(b), and the Local Bankruptcy Rules for the District of Utah (the “Local Rules”), and no other or further notice is or shall be required.Solicitation Case 16-24435 Doc 316 Filed 12/28/16 Entered 12/28/16 13:42:50 Desc Main Document Page 5 of 18

-2- The Debtor solicited votes for acceptance and rejection of the Plan in good faith, andsuch solicitation complied with sections 1125 and 1126, and all other applicable sections, of the Bankruptcy Code, Bankruptcy Rules 3017, 3018, and 3019, the Disclosure Statement Order, and all other applicable rules, laws, and regulations.Voting ResultsOn December 14, 2016, the Debtor filed the Armington Declaration [Docket No. 306], which detailed the results of voting on the Plan and the tabulation process used to calculate votes to accept or reject the Plan. The procedures used to tabulate Ballots were fair and conducted in accordance with the Disclosure Statement Order, the Bankruptcy Code, the Bankruptcy Rules, the Local Bankruptcy Rules, and all other applicable rules, laws, and regulations.As set forth in the Plan and the Disclosure Statement, holders of Interests in Classes 3 and 4 (collectively, the “Voting Classes”) were eligible to vote on the Plan in accordance with the Solicitation Procedures. Holders of Claims in Classes 1 and 2 are Unimpaired and conclusively presumed to accept the Plan and, therefore, could not vote on the Plan. Holders of Interests in Class 5 (the “Deemed Rejecting Class”) are Impaired, entitled to no recovery under the Plan, are therefore deemed to have rejected the Plan, and, therefore, could not vote on the Plan.As evidenced by the Armington Declaration, Holders of Class 3 – Common Stock Interests voted to accept the Plan, and no Holder of a Class 4 – Private Warrant Interest cast a vote on the Plan.Burden of Proof Case 16-24435 Doc 316 Filed 12/28/16 Entered 12/28/16 13:42:50 Desc Main Document Page 6 of 18

-2- The Debtor, as proponent of the Plan, has satisfied its burden of proving the elements ofsections 1129(a) and 1129(b) of the Bankruptcy Code by a preponderance of the evidence, the applicable evidentiary standard for Confirmation. Further, the Debtor has proven the elements of sections 1129(a) and 1129(b) by clear and convincing evidence.Compliance with the Requirements of Section 1129 of the Bankruptcy CodeThe Plan complies with all applicable provisions of section 1129 of the Bankruptcy Code as follows:Section 1129(a)(1)—Compliance of the Plan with Applicable Provisions of the Bankruptcy CodeThe Plan complies with all applicable provisions of the Bankruptcy Code, including sections 1122 and 1123, as required by section 1129(a)(1) of the Bankruptcy Code.Sections 1122 and 1123(a)(1)—Proper ClassificationThe Plan’s classification of Claims and Interests satisfies the requirements of sections 1122(a) and 1123(a)(1) of the Bankruptcy Code because the Plan places Claims and Interests into five separate Classes, which are different from the Claims and Interests in every other Class based on their legal or factual nature. Valid business, factual, and legal reasons exist for the separate classification of the various Classes of Claims and Interests created under the Plan, the classifications were not implemented for any improper purpose, and the creation of such Classes does not unfairly discriminate between or among holders of Claims and Interests.In accordance with section 1122(a) of the Bankruptcy Code, each Class of Claims or Interests contains only Claims or Interests substantially similar to the other Claims or Interests within that Class. Accordingly, the Plan satisfies the requirements of sections 1122(a), 1122(b), and 1123(a)(1) of the Bankruptcy Code. Case 16-24435 Doc 316 Filed 12/28/16 Entered 12/28/16 13:42:50 Desc Main Document Page 7 of 18

4843-0939-1631\1 6/11/2012 2:14 PM ii. Section 1123(a)(2)—Specification of Unimpaired ClassesArticle II of the Plan specifies which Classes of Claims and Interests are not impaired under the Plan. Accordingly, the Plan satisfies the requirements of section 1123(a)(2) of the Bankruptcy Code. iii. Section 1123(a)(3)—Specification of Treatment of Impaired Classes Article II of the Plan specifies the treatment of each Impaired Class under the Plan.Accordingly, the Plan satisfies the requirements of section 1123(a)(3) of the Bankruptcy Code.Section 1123(a)(4)—No DiscriminationArticle II of the Plan provides the same treatment for each Claim or Interest within a particular Class (unless the Holder of a particular Claim or Interest agrees to less favorable treatment on account of its Claim or Interest). Accordingly, the Plan satisfies the requirements of section 1123(a)(4) of the Bankruptcy Code.Section 1123(a)(5)—Adequate Means for Plan ImplementationArticle III of the Plan provide adequate means for the Plan’s implementation including:(a) the sources of consideration for Distributions under the Plan; (b) the process for settling Claims and Interests; (c) the preservation of Causes of Action; (d) provisions governing the wind-down and dissolution of the Debtor; and (e) the appointment of the Disbursing Agent. Accordingly, the Plan satisfies the requirements of section 1123(a)(5) of the Bankruptcy Code.vi. Sections 1123(a)(6)-(7)—Applicability to PlanThe Debtor is liquidating, its existing securities are being cancelled pursuant to the Plan, and the Debtor will not issue any new securities. Accordingly, the Plan satisfies the requirements of section 1123(a)(6) of the Bankruptcy Code. The Debtor’s directors and officer-8- Case 16-24435 Doc 316 Filed 12/28/16 Entered 12/28/16 13:42:50 Desc Main Document Page 8 of 18

9 will be discharged as of the Effective Date and the Disbursing Agent will be appointed. Therewill not be a reorganized entity. The appointment of the Disbursing Agent is in the best interests of the Debtor’s Claim and Interest Holders and is consistent with public policy. Accordingly, the Plan satisfies the requirements of section 1123(a)(7) of the Bankruptcy Code.`Section 1123(b)—Discretionary Contents of the PlanThe Plan contains various provisions that may be construed as discretionary but not necessary for Confirmation under the Bankruptcy Code. Any such discretionary provision complies with section 1123(b) of the Bankruptcy Code and is not inconsistent with the applicable provisions of the Bankruptcy Code. Thus, the Plan satisfies section 1123(b).Compromise and SettlementIn accordance with section 1123(b)(3)(A) of the Bankruptcy Code and Bankruptcy Rule 9019 and in consideration for the distributions and other benefits provided under the Plan, the provisions of the Plan generally constitute a good-faith compromise of all Claims, Interests, and controversies relating to the contractual, legal, and subordination rights that a Holder of a Claim or Interest may have with respect to any Allowed Claim or Interest or any distribution to be made on account of such Allowed Claim or Interest.Debtor ReleaseThe releases and discharges of Claims and Causes of Action by the Debtor described in Article VI.B of the Plan in accordance with section 1123(b)(3)(A) of the Bankruptcy Code represent a valid exercise of the Debtor’s business judgment under Bankruptcy Rule 9019. The Debtor’s or the Disbursing Agent’s pursuit of any such claims against the Released Parties is not in the best interest of the Estate’s various constituencies because the costs involved would likely Case 16-24435 Doc 316 Filed 12/28/16 Entered 12/28/16 13:42:50 Desc Main Document Page 9 of 18

10 outweigh any potential benefit from pursuing such Claims. The Debtor Release is furthermore anintegral part of the Plan and is in the best interests of the Debtor’s Estate.The Debtor Release appropriately offers protection to parties that constructively participated in the Chapter 11 Case. Such protections from liability facilitated the participation of many of the Debtor’s stakeholders in the formation of the Plan.The scope of the Debtor Release is appropriately tailored under the facts and circumstances of the Chapter 11 Case. In light of the critical nature of the Debtor Release to the Plan, the Debtor Release is approved.iii. Third Party ReleaseThe Third-Party Release, set forth in Article VI.C of the Plan, is an essential provision of the Plan. The Third-Party Release is: (a) a consensual third-party release; (b) in exchange for the good and valuable consideration provided by the Released Parties; (c) a good-faith settlement and compromise of the Claims and Causes of Action released by the Third-Party Release; (d) in the best interests of the Debtor and its Estate; (e) fair, equitable, and reasonable; (f) given and made after due notice and opportunity for hearing; and (g) a bar to any of the Releasing Parties asserting any Claim or Cause of Action released by the Third-Party Release against any of the Released Parties.The Third-Party Release is an integral part of the Plan. The Released Parties played a critical role in this Chapter 11 Case and were integral to consummating the Debtor’s transactions and formulating the Plan. As such, the Third-Party Release appropriately offers protection to parties that constructively participated in the formation of the Plan and the underlying transactions. Case 16-24435 Doc 316 Filed 12/28/16 Entered 12/28/16 13:42:50 Desc Main Document Page 10 of 18

11 The scope of the Third-Party Release in the Plan is appropriately tailored under the factsand circumstances of the Chapter 11 Case, and parties received due and adequate notice of the Third-Party Release and the opportunity to opt out of the Third-Party Release, as applicable. Such releases by Holders of Interests that voted in favor of the Plan, that abstained from voting and did not timely submit the relevant opt-out form, or that otherwise consented to give such release are consensual. In light of, among other things, the value provided by the Released Parties to the Debtor’s Estate and the critical nature of the Third-Party Release to the Plan, the Third-Party Release is approved.ExculpationThe Exculpation provisions set forth in Article VIII.D of the Plan are essential to the Plan. The record in the Chapter 11 Case fully supports the Exculpation and the Exculpation provisions set forth in Article VIII.D of the Plan, which are appropriately tailored to protect the Exculpated Parties from inappropriate litigation.InjunctionThe injunction provisions set forth in Article VI.E of the Plan are essential to the Plan and are necessary to implement the Plan and to preserve and enforce the Debtor Release, the Third-Party Release, and the Exculpation provisions in Article VI.D of the Plan. Such injunction provisions are appropriately tailored to achieve those purposes. vi. Preservation of Causes of Action and Appointment of Disbursing Agent Article III.D and Article III.F of the Plan appropriately provide for the preservation bythe Debtor of the Causes of Action in accordance with section 1123(b)(3)(B) of the Bankruptcy Code and the transfer of the Debtor’s rights to pursue those Causes of Action to the Disbursing Case 16-24435 Doc 316 Filed 12/28/16 Entered 12/28/16 13:42:50 Desc Main Document Page 11 of 18

12 Agent. Further, the Debtor’s appointment of the Disbursing Agent pursuant to the DisbursingAgent Agreement upon the Effective Date is appropriate and in the best interests of the Debtor, its Estate, and Holders of Claims and Interests.3. Section 1129(a)(2)—Compliance of the Debtor with the Applicable Provisions of the Bankruptcy CodeThe Debtor, as proponent of the Plan, has complied with all applicable provisions of the Bankruptcy Code as required by section 1129(a)(2) of the Bankruptcy Code, including sections 1122, 1123, 1124, 1125, 1126, and 1128, and Bankruptcy Rules 3017, 3018, and 3019.Votes to accept or reject the Plan were solicited by the Debtor pursuant to section 1125(a) of the Bankruptcy Code and the Disclosure Statement Order, and the Debtor’s use of the Disclosure Statement to solicit votes on the Plan was appropriate.The Debtor has solicited and tabulated votes on the Plan and has participated in the activities described in section 1125 of the Bankruptcy Code fairly, in good faith within the meaning of section 1125(e), and in a manner consistent with the applicable provisions of the Disclosure Statement Order, the Bankruptcy Code, the Bankruptcy Rules, and all other applicable rules, laws, and regulations and are entitled to the protections afforded by section 1125(e) of the Bankruptcy Code and the Exculpation provisions set forth in Article VI.D of the Plan.The Debtor has participated in good faith and in compliance with the applicable provisions of the Bankruptcy Code with regard to the distribution of recoveries under the Plan and therefore is not, and on account of such distributions will not be, liable at any time for the violation of any applicable law, rule, or regulation governing the solicitation of acceptances or Case 16-24435 Doc 316 Filed 12/28/16 Entered 12/28/16 13:42:50 Desc Main Document Page 12 of 18

13 rejections of the Plan or distributions made pursuant to the Plan, so long as such distributions aremade consistent with and pursuant to the Plan.Section 1129(a)(3)—Proposal of Plan in Good FaithThe Debtor commenced this Chapter 11 Case to consummate the sale of substantially all of its assets pursuant to the asset purchase agreement that it entered into with MedLink LLC, or to a higher and better offeror. The Debtor did this to maximize value for its stakeholders and it has acted in a manner consistent with its fiduciary duties from the inception of this Chapter 11 Case through the present. The Debtor’s efforts yielded the maximum return possible for its assets and enabled the Debtor to file the Plan, which will pay creditors in full, and yield a return to equity. At this juncture, consummating the Plan is necessary to bring this Chapter 11 Case to its conclusion and it is in the best interests of the Debtor’s constituents to confirm the Plan. Accordingly, the Plan fully complies with and satisfies the requirements of section 1129(a)(3) of the Bankruptcy Code.Section 1129(a)(4)—Court Approval of Certain Payments as ReasonableThe procedures set forth in the Plan for the Court’s review and ultimate determination of the fees and expenses paid by the Debtor’s Estate in connection with the Chapter 11 Case or in connection with the Plan and incident to the Chapter 11 Case satisfies the objectives of, and are in compliance with, section 1129(a)(4) of the Bankruptcy Code, including but not limited to the provision in Article II.B of the Plan which state that all Professional Fee Claims and Administrative Claims will be considered by the Court, after notice and a hearing, and Article IX of the Plan which provides that the Court will retain jurisdiction to decide and resolve all matters relating to applications for the allowance of compensation or reimbursement of expenses to Case 16-24435 Doc 316 Filed 12/28/16 Entered 12/28/16 13:42:50 Desc Main Document Page 13 of 18

14 Professionals authorized pursuant to the Bankruptcy Code or the Plan. Accordingly, the Plansatisfies the requirements of section 1129(a)(4).Sections 1129(a)(5) and (6) do Not ApplyFollowing the Effective Date of the Plan, the Debtor’s directors and officers will be released from their duties, so there is no need to identify the post-confirmation directors and officers pursuant to section 1129(a)(5). The Plan has identified the Disbursing Agent, who will be vested with authority to make Distributions pursuant to the Plan, and to pursue any Causes of Action, or objections to Claims and Interests on behalf of the Debtor. The Disbursing Agent’s hourly rate of compensation was previously disclosed to the Court and approved in connection with the Court’s Order approving the Debtor’s retention of Rocky Mountain Advisory, LLC [Docket No. 205]. Further, the regulatory rate change disclosures required by section 1129(a)(6) are not applicable. Accordingly, to the extent applicable, the Plan satisfies the requirements of sections 1129(a)(5) and (6).Section 1129(a)(7)—Best Interests of Holders of Claims and InterestsThe evidence in support of the Plan that was proffered or adduced at the Confirmation Hearing, including pursuant to the Liquidation Analysis and the facts and circumstances of the Chapter 11 Case, establishes that Holders of Allowed Claims or Interests in every Class will recover as much or more value under the Plan on account of such Claim or Interest, as of the Effective Date, than the amount such Holder would receive if the Debtor was liquidated on the Effective Date under chapter 7 of the Bankruptcy Code. Accordingly, the Plan satisfies all of the requirements of section 1129(a)(7).Section 1129(a)(8)—Conclusive Presumption of Acceptance by Unimpaired Classes; Acceptance of the Plan by Each Impaired Class Case 16-24435 Doc 316 Filed 12/28/16 Entered 12/28/16 13:42:50 Desc Main Document Page 14 of 18

15 The Plan does not meet the requirements of section 1129(a)(8), because no Holder of aClass 4 – Private Warrant Interest voted on the Plan and Deemed Rejecting Class is conclusively presumed to reject the Plan. Nevertheless, the Plan may be confirmed under the “cram down” provisions of section 1129(b) of the Bankruptcy Code.Section 1129(a)(9)—Treatment of Claims Entitled to Priority Pursuant to Section 507(a) of the Bankruptcy CodeThe treatment of Administrative Claims, Professional Fee Claims, and Class 1- Priority Claims under Article II of the Plan satisfies the requirements of, and complies in all respects with, section 1129(a)(9) of the Bankruptcy Code.Section 1129(a)(10)—Acceptance by at Least One Impaired ClassAs set forth in the Armington Declaration, the Holders of Class 3 – Common Stock Interests, voted to accept the Plan. Therefore, the Plan satisfies the requirements of section 1129(a)(10).Section 1129(a)(11)—Feasibility of the PlanThe Plan satisfies section 1129(a)(11) of the Bankruptcy Code. The evidence supporting the Plan proffered or adduced by the Debtor at or before the Confirmation Hearing, including the applicable financial projections as set forth in Liquidation Analysis: (a) is reasonable, persuasive, credible, and accurate as of the dates such evidence was prepared, presented, or proffered; (b) has not been controverted by other credible evidence; (c) establishes that the Plan is feasible; and(d) establishes that the Debtor will have sufficient funds available to meet their obligations under the Plan, including sufficient amounts of Cash to reasonably ensure payment of Allowed Administrative Claims, Allowed Priority Claims, Allowed Professional Fee Claims, and other Case 16-24435 Doc 316 Filed 12/28/16 Entered 12/28/16 13:42:50 Desc Main Document Page 15 of 18

16 expenses in accordance with the terms of the Plan and section 507(a) of the Bankruptcy Code.Accordingly, to the extent this requirement is applicable to the liquidating Debtor, the Plan is feasible and complies with the requirements imposed by section 1129(a)(11).Section 1129(a)(12)—Payment of Statutory FeesArticle X.B of the Plan provides that the Debtor shall pay all fees under section 1930(a) of the Judicial Code. Accordingly, the Plan fully complies with and satisfies the requirements of section 1129(a)(12) of the Bankruptcy Code.Sections 1129(a)(13)-(16) do Not Apply to the PlanThe Debtor does not provide and will not continue to provide retiree benefits pursuant to section 1129(a)(13). Sections 1129(a)(14)-(15) apply to individual debtors, and section 1129(a)(16) applies to nonprofit entities. Accordingly, sections 1129(a)(13)-(16) do not apply to this Chapter 11 Case.Section 1129(b)—Confirmation of Plan over Nonacceptance of Impaired ClassesNotwithstanding that Holders of Class 4 – Private Warrant Interests, and the Deemed Rejecting Class (collectively, the “Rejecting Classes”) have not accepted the Plan, the Plan may be confirmed pursuant to section 1129(b)(1) of the Bankruptcy Code because the Plan does not discriminate unfairly and is fair and equitable with respect to those Classes. Accordingly, the Plan is fair and equitable toward all Holders of Claims and Interests in the Rejecting Classes. As a result, the Plan satisfies the requirements of section 1129(b) of the Bankruptcy Code. Thus, the Plan may be confirmed even though section 1129(a)(8) of the Bankruptcy Code is not satisfied. After entry of the Confirmation Order and upon the occurrence of the Effective Date, the Plan shall be binding upon the members of the Rejecting Classes. Case 16-24435 Doc 316 Filed 12/28/16 Entered 12/28/16 13:42:50 Desc Main Document Page 16 of 18

17 Section 1129(c)—Only One PlanOther than the Plan, no other plan has been filed in the Chapter 11 Case. Accordingly, the requirements of section 1129(c) of the Bankruptcy Code have been satisfied.Section 1129(d)—Principal Purpose of the Plan Is Not Avoidance of Taxes or Section 5 of the Securities ActNo Governmental Unit has requested that the Court refuse to confirm the Plan on the grounds that the principal purpose of the Plan is the avoidance of taxes or the avoidance of the application of section 5 of the Securities Act. As evidenced by its terms, the principal purpose of the Plan is not such avoidance. Accordingly, the requirements of section 1129(d) of the Bankruptcy Code have been satisfied.Satisfaction of Confirmation RequirementsBased upon the foregoing, the Plan satisfies the requirements for plan confirmation set forth in section 1129 of the Bankruptcy Code.Conditions to Effective DateEntry of the Confirmation Order shall satisfy the condition to the Effective Date as set forth in Article VII.A.1 of the Plan, provided that the Confirmation Order shall not have been stayed, modified, or vacated on appeal.ImplementationAll documents and agreements necessary to implement the Plan, including those contained in the Plan Supplement, and all other relevant and necessary documents have been negotiated in good faith and at arm’s length, are in the best interests of the Debtor, and shall, upon completion of documentation and execution, be valid, binding, and enforceable documents and agreements not in conflict with any federal, state, or local law. Case 16-24435 Doc 316 Filed 12/28/16 Entered 12/28/16 13:42:50 Desc Main Document Page 17 of 18

20. Retention of JurisdictionThe Court properly retains jurisdiction over the matters set forth in Article IX and in other applicable provisions of the Plan. (End of Document) 18 Case 16-24435 Doc 316 Filed 12/28/16 Entered 12/28/16 13:42:50 Desc Main Document Page 18 of 18

EXHIBIT 99.2

EXHIBIT 99.3

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Dimensional Fund Advisors Ltd. : Form 8.3 - DS SMITH PLC - Ordinary Shares

- The Baby Gifting Company Achieves B Corp Certification

- Dimensional Fund Advisors Ltd. : Form 8.3 - BARRATT DEVELOPMENTS PLC - Ordinary Shares

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share