Form 8-K BROADRIDGE FINANCIAL For: Feb 07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 7, 2019

------------

BROADRIDGE FINANCIAL SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

DELAWARE

(State or other jurisdiction of incorporation)

------------

001-33220 | 33-1151291 |

(Commission file number) | (I.R.S. Employer Identification No.) |

5 Dakota Drive

Lake Success, New York 11042

(Address of principal executive offices)

Registrant’s telephone number, including area code: (516) 472-5400

N/A

(Former name or former address, if changed since last report)

------------

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

1

Item 2.02. Results of Operations and Financial Condition.

On February 7, 2019, Broadridge Financial Solutions, Inc. ("Broadridge" or the “Company”) issued a press release announcing its financial results for the second quarter of fiscal year 2019 ended December 31, 2018. On February 7, 2019, the Company also posted an Earnings Webcast & Conference Call Presentation dated February 7, 2019 on the Company’s Investor Relations website at www.broadridge-ir.com.

Copies of the press release and earnings presentation are being furnished as Exhibits 99.1 and 99.2, attached hereto, respectively, and are incorporated herein by reference. The information furnished pursuant to Items 2.02 and 9.01, including Exhibits 99.1 and 99.2, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section, and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act.

Forward-Looking Statements

This current report on Form 8-K may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, and which may be identified by the use of words such as “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be” and other words of similar meaning, are forward-looking statements. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended June 30, 2018 (the “2018 Annual Report”), as they may be updated in any future reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of this 8-K and are expressly qualified in their entirety by reference to the factors discussed in the 2018 Annual Report. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. Factors that could cause actual results to differ materially from those contemplated by the forward-looking statements include: the success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms; a material security breach or cybersecurity attack affecting the information of Broadridge’s clients; changes in laws and regulations affecting Broadridge’s clients or the services provided by Broadridge; declines in participation and activity in the securities markets; the failure of our key service providers to provide the anticipated levels of service; a disaster or other significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; overall market and economic conditions and their impact on the securities markets; Broadridge’s failure to keep pace with changes in technology and the demands of its clients; the ability to attract and retain key personnel; the impact of new acquisitions and divestitures; and competitive conditions.

Broadridge disclaims any obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law.

2

Item 9.01 Financial Statements and Exhibits.

Exhibits. The following exhibits are furnished herewith:

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: February 7, 2019

BROADRIDGE FINANCIAL SOLUTIONS, INC. By: /s/ James M. Young Name: James M. Young Title: Vice President, Chief Financial Officer | |

4

EXHIBIT 99.1

BROADRIDGE REPORTS SECOND QUARTER AND SIX MONTHS FISCAL YEAR 2019 RESULTS

Second Quarter Recurring Fee Revenues Increase 7%, to $604 million

Record Second Quarter Closed Sales of $106 million, up 174%

Broadridge Reaffirms Fiscal Year 2019 Guidance

NEW YORK, N.Y., February 7, 2019 - Broadridge Financial Solutions, Inc. (NYSE: BR) today reported financial results for the second quarter and six months ended December 31, 2018 of its fiscal year 2019. Results for the three and six months ended December 31, 2018 compared with the same period last year were as follows:

Summary Financial Results | Second Quarter | Six Months | |||||||||||

Dollars in millions, except per share data | 2019 | 2018 | Change | 2019 | 2018 | Change | |||||||

Total revenues | $953 | $1,013 | (6 | )% | $1,926 | $1,938 | (1)% | ||||||

Recurring fee revenues | 604 | 562 | 7 | % | 1,179 | 1,110 | 6% | ||||||

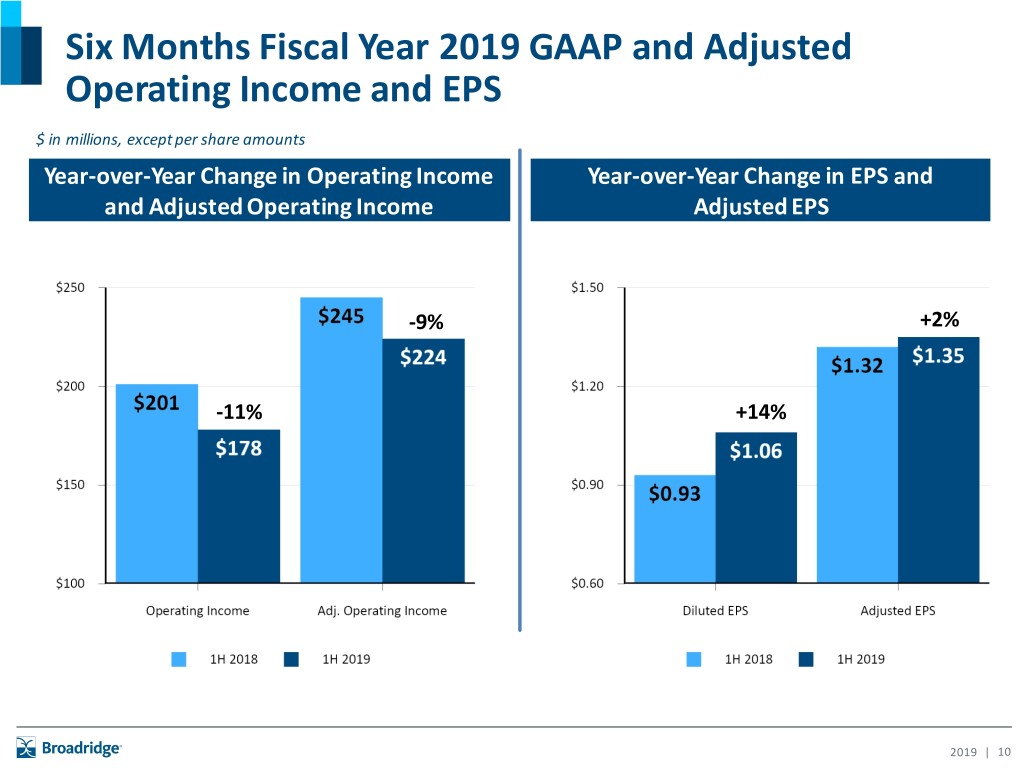

Operating income | 78 | 116 | (33 | )% | 178 | 201 | (11)% | ||||||

Operating income margin | 8.2 | % | 11.4 | % | 9.3 | % | 10.4 | % | |||||

Adjusted Operating income - Non-GAAP | 101 | 138 | (27 | )% | 224 | 245 | (9)% | ||||||

Adjusted Operating income margin - Non-GAAP | 10.6 | % | 13.7 | % | 11.6 | % | 12.6 | % | |||||

Diluted EPS | $0.42 | $0.52 | (19 | )% | $1.06 | $0.93 | 14% | ||||||

Adjusted EPS - Non-GAAP | $0.56 | $0.79 | (29 | )% | $1.35 | $1.32 | 2% | ||||||

Closed sales | $106 | $39 | 174 | % | $124 | $62 | 102% | ||||||

“Broadridge had a strong second quarter and is well positioned for the full year 2019 and beyond,” said Tim Gokey, Broadridge’s President and CEO. “We generated strong increases in recurring revenue, record closed sales, and earnings in-line with our expectations, all of which further strengthen our ability to deliver future growth. As anticipated, event-driven revenues declined significantly, returning to more normalized levels from a near-record quarter a year ago.

“We enter our seasonally strong second half with positive momentum and on track to achieve our full-year guidance, including 5-7% recurring fee growth and 9-13% Adjusted EPS growth. Broadridge also remains well positioned to deliver on our three-year growth objectives,” Mr. Gokey added.

1

Fiscal Year 2019 Financial Guidance

Broadridge’s fiscal year 2019 financial guidance is unchanged.

Recurring fee revenue growth | 5-7% | |

Total revenue growth | 3-5% | |

Operating income margin - GAAP | ~14.5% | |

Adjusted Operating income margin - Non-GAAP | ~16.5% | |

Diluted earnings per share growth | 12-16% | |

Adjusted Earnings per share growth - Non-GAAP | 9-13% | |

Free cash flow - Non-GAAP | $565-615M | |

Closed sales | $185-225M | |

Note: Fiscal year 2019 guidance includes $25 million of excess tax benefits related to stock-based compensation, down from $41 million in fiscal year 2018. | ||

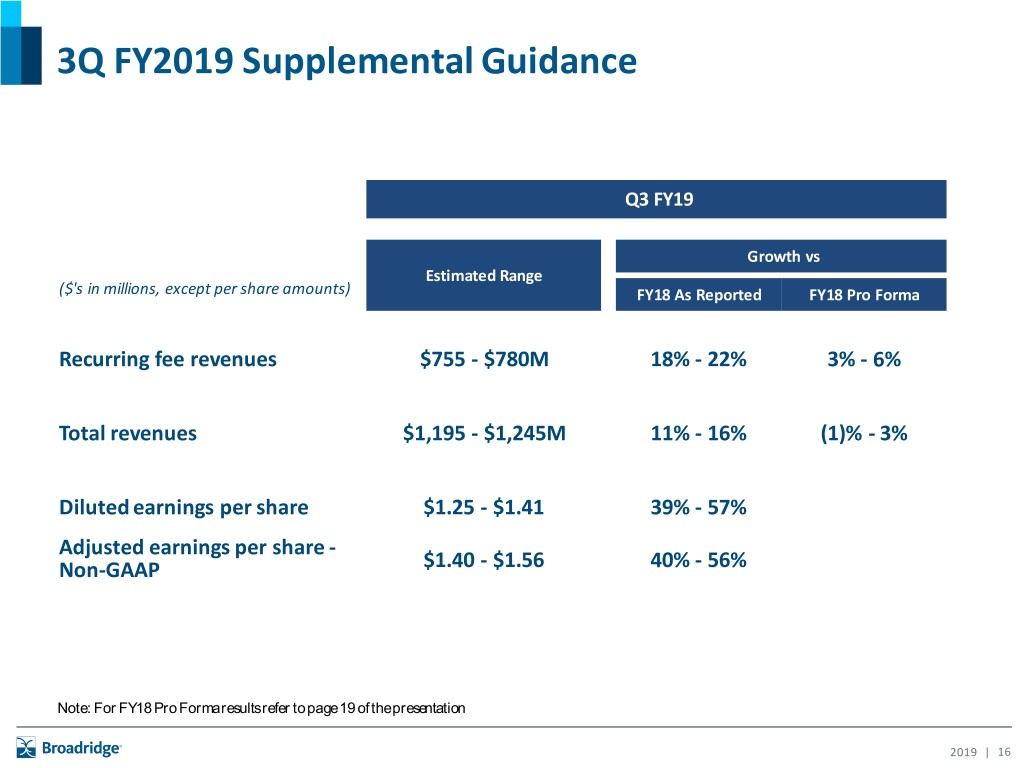

Third Quarter Fiscal Year 2019 Supplemental Financial Guidance

Broadridge also provided supplemental guidance for the third quarter of Fiscal Year 2019

Recurring fee revenue | $755 million - $780 million | |

Total revenue | $1,195 million - $1,245 million | |

Diluted earnings per share | $1.25 - $1.41 | |

Adjusted Earnings per share - Non-GAAP | $1.40 - $1.56 | |

Financial Results for the Second Quarter of Fiscal Year 2019

Revenues

Revenues for the three months ended December 31, 2018 (“second quarter of fiscal year 2019”) decreased 6% to $953 million from $1,013 million in the prior year period.

Recurring fee revenues rose 7% to $604 million from $562 million. The increase in recurring fee revenues reflected organic growth of 6% (including 3pts from Net New Business and 3pts from internal growth), 1pt from our recent acquisitions and 1pt from the impact of the revenue accounting change. Event-driven fee revenues decreased $49 million, or 51%, to $48 million, primarily from decreased mutual fund proxy revenues and equity proxy contests, after previously increasing 227% in the fiscal second quarter of 2018 from increased mutual fund proxy activity and equity proxy contests. Distribution revenues decreased $48 million, or 13%, to $323 million. Changes in foreign currency rates negatively impacted revenues by $4 million as compared to the prior year period.

Operating Income

For the second quarter of fiscal year 2019:

• | Operating income was $78 million, a decrease of $38 million, or 33%, compared to $116 million for the prior year period. Operating income margin decreased to 8.2%, compared to 11.4% for the prior year period. |

• | Adjusted Operating income was $101 million, a decrease of $37 million, or 27%, compared to $138 million for the prior year period. Adjusted Operating income margin decreased to 10.6%, compared to 13.7% for the prior year period. |

• | The decreases in Operating income margin and Adjusted Operating income margin are primarily due to (i) the decrease in higher-margin event-driven fee revenues and (ii) higher selling, general and administrative |

2

expenses, primarily due to higher selling expenses and increased spending on technology initiatives, which more than offset (iii) the decrease in cost of revenues primarily from the decrease in distribution revenues and (iv) the increase in recurring fee revenues.

Interest Expense and Other Non-Operating Expenses

Interest expense, net for the second quarter of fiscal year 2019 was $11 million, an increase of less than $1 million, or 5%, compared to $10 million for the prior year period. Other non-operating expense, net was $3 million, an increase of less than $1 million, compared to $2 million for the prior year period.

Effective Tax Rate

The effective tax rate for the second quarter of fiscal year 2019 was 22.4% compared to 40.0% for the prior year period. The decrease in the effective tax rate is primarily due to the U.S. federal corporate income tax rate change under the Tax Cuts and Jobs Act (the “Tax Act”). Included in the provision for taxes is $0.8 million of excess tax benefits attributable to stock-based compensation, a decline from the $1.5 million benefit recognized in the second quarter of fiscal 2018.

Net Earnings and Earnings per Share

For the second quarter of fiscal year 2019:

• | Net earnings decreased 20% to $50 million, compared to $62 million for the prior year period. |

• | Adjusted Net earnings decreased 29% to $67 million, compared to $95 million for the prior year period. |

• | Diluted earnings per share decreased 19% to $0.42, compared to $0.52 for the prior year period. |

• | Adjusted earnings per share decreased 29% to $0.56, compared to $0.79 for the prior year period. |

Segment and Other Results for the Second Quarter of Fiscal Year 2019

Investor Communication Solutions (“ICS”)

ICS revenues for the second quarter of fiscal year 2019 were $738 million, a decrease of $64 million, or 8%, compared to $802 million for the prior year period.

• | Recurring fee revenues rose $33 million, or 10%, to $367 million. The increase was attributable to: (i) higher internal growth (4pts), (ii) Net New Business from increases in revenue from Closed sales (4pts), (iii) revenues from acquisitions (1pt) and (iv) the impact of the revenue accounting change (1pt). |

• | Event-driven fee revenues decreased $49 million, or 51%, to $48 million, the result of decreased mutual fund proxy revenues and equity proxy contests. |

• | Distribution revenues decreased $48 million, or 13%, to $323 million. |

During the second quarter of fiscal year 2019, Broadridge was able to separate certain annually recurring mutual fund related communications that were previously included in event-driven fee revenues. These activities are presented within recurring fee revenues commencing in the second quarter of fiscal 2019 and resulted in an increase of $4 million in ICS recurring fee revenues and the impact of this reclassification will add approximately $15 million to recurring fee revenues for the year.

ICS earnings before income taxes for the second quarter of fiscal year 2019 were $37 million, a decrease of $35 million, or 49%, compared to $72 million for the prior year period, primarily due to lower event-driven fee revenues offsetting higher recurring fee revenues. Pre-tax margins decreased by 4.0 percentage points to 5.0% from 9.0%.

Global Technology and Operations (“GTO”)

GTO revenues for the second quarter of fiscal year 2019 were $237 million, an increase of $9 million, or 4%, compared to $228 million in the prior year period. The increase was attributable to: (i) higher Net New Business from Closed sales (3pts) and (ii) internal growth driven by higher trade levels (1pt). The impact of the revenue accounting change was negligible.

3

GTO earnings before income taxes for the second quarter of fiscal year 2019 were $47 million, a decrease of $3 million, or 7%, compared to $51 million in the prior year period, due in part to the impact of ongoing new product development expenses and increased conversion costs related to client go-lives. Pre-tax margins decreased by 2.2 percentage points to 20.0% from 22.2%.

Other

Other Pre-tax loss increased 5% in the second quarter of fiscal year 2019 to $28 million from $26 million in the prior year period. The increased loss was primarily due to higher corporate expenses and unrealized losses on marketable securities pursuant to an accounting change that was not in the comparable prior year period.

Financial Results for the Six Months Ended December 31, 2018

Revenues

Revenues for the six months ended December 31, 2018 decreased 1% to $1,926 million from $1,938 million in the prior year period.

Recurring fee revenues rose 6% to $1,179 million from $1,110 million. The increase in recurring fee revenues reflected organic growth of 5% (including 4pts from Net New Business and 2pts from internal growth) and 1pt from our recent acquisitions. The impact of the revenue accounting change was negligible. Event-driven fee revenues decreased $32 million, or 20%, to $125 million, primarily from decreased equity proxy contests and mutual fund proxy activity. Distribution revenues decreased $40 million, or 6%, to $664 million. Changes in foreign currency rates negatively impacted revenues by $8 million as compared to the prior year period.

Operating Income

For the six months ended December 31, 2018:

• | Operating income was $178 million, a decrease of $23 million, or 11%, compared to $201 million for the prior year period. Operating income margin decreased to 9.3%, compared to 10.4% for the prior year period. |

• | Adjusted Operating income was $224 million, a decrease of $21 million, or 9%, compared to $245 million for the prior year period. Adjusted Operating income margin decreased to 11.6%, compared to 12.6% for the prior year period. |

• | The decreases in Operating income margin and Adjusted Operating income margin are primarily due to (i) the decrease in higher-margin event-driven fee revenues and (ii) higher selling, general and administrative expenses, primarily due to higher selling expenses and increased spending on technology initiatives, which more than offset (iii) the decrease in cost of revenues primarily from the decrease in distribution revenues and (iv) the increase in recurring fee revenues. |

Interest Expense and Other Non-Operating Expenses

Interest expense, net for the six months ended December 31, 2018 was $20 million, an increase of less than $1 million, or 4%, compared to $20 million for the prior year period. Other non-operating expense, net was $4 million, an increase of less than $1 million, compared to $4 million for the prior year period.

Effective Tax Rate

The effective tax rate for the six months ended December 31, 2018 was 17.6% compared to 37.0% for the prior year period. The decrease in the effective tax rate is primarily due to the U.S. federal corporate income tax rate change under the Tax Act as well as the recognition of $8 million in excess tax benefits attributable to stock-based compensation as compared to $3 million for the prior year period.

Net Earnings and Earnings per Share

For the six months ended December 31, 2018:

• | Net earnings increased 13% to $127 million, compared to $112 million for the prior year period. |

• | Adjusted Net earnings increased 2% to $162 million, compared to $159 million for the prior year period. |

4

• | Diluted earnings per share increased 14% to $1.06, compared to $0.93 for the prior year period. |

• | Adjusted earnings per share increased 2% to $1.35, compared to $1.32 for the prior year period. |

Segment and Other Results for the Six Months Ended December 31, 2018

Investor Communication Solutions

ICS revenues for the six months ended December 31, 2018 were $1,504 million, a decrease of $25 million, or 2%, compared to $1,529 million for the prior year period.

• | Recurring fee revenues rose $47 million, or 7%, to $715 million. The increase was attributable to: (i) Net New Business from increases in revenue from Closed sales (4pts), (ii) revenues from acquisitions (2pt) and (iii) higher internal growth (1pt). The impact of the revenue accounting change on recurring fee revenue was negligible. |

• | Event-driven fee revenues decreased $32 million, or 20%, to $125 million, the result of decreased equity proxy contests and mutual fund proxy activity. |

• | Distribution revenues decreased $40 million, or 6%, to $664 million. |

ICS earnings before income taxes for the six months ended December 31, 2018 were $96 million, a decrease of $22 million, or 19%, compared to $118 million for the prior year period, primarily due to lower event-driven fee revenues. Pre-tax margins decreased by 1.3 percentage points to 6.4% from 7.7%.

Global Technology and Operations

GTO revenues for the six months ended December 31, 2018 were $464 million, an increase of $21 million, or 5%, compared to $443 million in the prior year period. The increase was attributable to: (i) higher Net New Business from Closed sales (3pts) and (ii) internal growth driven by higher trade levels (2pts). The impact of the revenue accounting change was negligible.

GTO earnings before income taxes for the six months ended December 31, 2018 were $94 million, a decrease of $2 million, or 2%, compared to $96 million in the prior year period, primarily due to the impact of incremental expenditures to drive new business and increased conversion costs related to client go-lives. Pre-tax margins decreased by 1.4 percentage points to 20.2% from 21.6%.

Other

Other Pre-tax loss increased 6% in the six months ended December 31, 2018 to $51 million from $48 million in the prior year period. The increased loss was primarily due to higher corporate expenses.

Adoption of New Accounting Standards

Effective July 1, 2018, Broadridge adopted Accounting Standards Update No. 2014-09 “Revenue from Contracts with Customers” and its related amendments (the “revenue accounting change”). Results for reporting periods beginning after July 1, 2018 reflect the revenue accounting change while prior period amounts have not been adjusted and continue to be reported in accordance with historical accounting guidelines. Please refer to Broadridge’s Quarterly Report on Form 10-Q for the period ended December 31, 2018 for additional information related to this change.

Earnings Conference Call

An analyst conference call will be held today, Thursday, February 7, 2019 at 8:30 a.m. ET. A live webcast of the call will be available to the public on a listen-only basis. To listen to the live event and access the slide presentation, visit Broadridge’s Investor Relations website at www.broadridge-ir.com prior to the start of the webcast. To listen to the call, investors may also dial 1-844-348-2805 within the United States and international callers may dial 1-213-785-7185.

A replay of the webcast will be available and can be accessed in the same manner as the live webcast at the Broadridge Investor Relations site. Through February 21, 2019, the recording will also be available by dialing

5

1-855-859-2056 passcode: 3145519 within the United States or 1-404-537-3406 passcode: 3145519 for international callers.

Explanation and Reconciliation of the Company’s Use of Non-GAAP Financial Measures

The Company’s results in this press release are presented in accordance with U.S. generally accepted accounting principles (“GAAP”) except where otherwise noted. In certain circumstances, results have been presented that are not generally accepted accounting principles measures (“Non-GAAP”). These Non-GAAP measures are Adjusted Operating income, Adjusted Operating income margin, Adjusted Net earnings, Adjusted earnings per share, and Free cash flow. These Non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Company’s reported results.

The Company believes our Non-GAAP financial measures help investors understand how management plans, measures and evaluates the Company’s business performance. Management believes that Non-GAAP measures provide consistency in its financial reporting and facilitates investors’ understanding of the Company’s operating results and trends by providing an additional basis for comparison. Management uses these Non-GAAP financial measures to, among other things, evaluate our ongoing operations, for internal planning and forecasting purposes and in the calculation of performance-based compensation. In addition, and as a consequence of the importance of these Non-GAAP financial measures in managing our business, the Company’s Compensation Committee of the Board of Directors incorporates Non-GAAP financial measures in the evaluation process for determining management compensation.

Adjusted Operating Income, Adjusted Operating Income Margin, Adjusted Net Earnings and Adjusted Earnings per Share

These Non-GAAP measures reflect Operating income, Operating income margin, Net earnings, and Diluted earnings per share, as adjusted to exclude the impact of certain costs, expenses, gains and losses and other specified items that management believes are not indicative of our ongoing operating performance. These adjusted measures exclude the impact of: (i) Amortization of Acquired Intangibles and Purchased Intellectual Property, (ii) Acquisition and Integration Costs and (iii) Tax Act items. Amortization of Acquired Intangibles and Purchased Intellectual Property represents non-cash amortization expenses associated with the Company’s acquisition activities. Acquisition and Integration Costs represent certain transaction and integration costs associated with the Company’s acquisition activities. Tax Act items represent the net impact of a U.S. federal transition tax on earnings of certain foreign subsidiaries, foreign jurisdiction withholding taxes and certain benefits related to the remeasurement of the Company’s net U.S. federal and state deferred tax liabilities attributable to the Tax Act.

We exclude Amortization of Acquired Intangibles and Purchased Intellectual Property as well as Acquisition and Integration Costs and Tax Act items from our earnings measures because excluding such information provides us with an understanding of the results from the primary operations of our business and these items do not reflect ordinary operations or earnings. Management believes these adjusted measures may be useful to an investor in evaluating the underlying operating performance of our business.

Free Cash Flow

In addition to the Non-GAAP financial measures discussed above, we provide Free cash flow information because we consider Free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated that could be used for dividends, share repurchases, strategic acquisitions, other investments, as well as debt servicing. Free cash flow is a Non-GAAP financial measure and is defined by the Company as Net cash flows provided by operating activities less Capital expenditures as well as Software purchases and capitalized internal use software.

Reconciliations of such Non-GAAP measures to the most directly comparable financial measures presented in accordance with GAAP can be found in the tables that are part of this press release.

Forward-Looking Statements

This press release and other written or oral statements made from time to time by representatives of Broadridge may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

6

1995. Statements that are not historical in nature, and which may be identified by the use of words such as “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be” and other words of similar meaning, are forward-looking statements. In particular, information appearing in the “Fiscal Year 2019 Financial Guidance” section are forward-looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended June 30, 2018 (the “2018 Annual Report”), as they may be updated in any future reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of this press release and are expressly qualified in their entirety by reference to the factors discussed in the 2018 Annual Report.

These risks include: the success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms; a material security breach or cybersecurity attack affecting the information of Broadridge’s clients; changes in laws and regulations affecting Broadridge’s clients or the services provided by Broadridge; declines in participation and activity in the securities markets; the failure of Broadridge’s key service providers to provide the anticipated levels of service; a disaster or other significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; overall market and economic conditions and their impact on the securities markets; Broadridge’s failure to keep pace with changes in technology and demands of its clients; Broadridge’s ability to attract and retain key personnel; the impact of new acquisitions and divestitures; and competitive conditions. Broadridge disclaims any obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law.

About Broadridge

Broadridge Financial Solutions, Inc. (NYSE: BR), a $4 billion global Fintech leader and a part of the S&P 500® Index, is a leading provider of investor communications and technology-driven solutions to banks, broker-dealers, asset managers and corporate issuers globally. Broadridge's investor communications, securities processing and managed services solutions help clients reduce their capital investments in operations infrastructure, allowing them to increase their focus on core business activities. With over 50 years of experience, Broadridge's infrastructure underpins proxy voting services for over 50 percent of public companies and mutual funds globally, and processes on average more than US $5 trillion in fixed income and equity trades per day. Broadridge employs over 10,000 full-time associates in 18 countries. For more information about Broadridge, please visit www.broadridge.com.

Contact Information

Investors:

W. Edings Thibault

Investor Relations

(516) 472-5129

Media:

Gregg Rosenberg

Corporate Communications

(212) 918-6966

7

Condensed Consolidated Statements of Earnings

(Unaudited)

In millions, except per share amounts | Three Months Ended December 31, | Six Months Ended December 31, | |||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||||

Revenues | $ | 953.4 | $ | 1,012.8 | $ | 1,926.2 | $ | 1,937.6 | |||||||||

Operating expenses: | |||||||||||||||||

Cost of revenues | 734.0 | 769.3 | 1,473.0 | 1,495.3 | |||||||||||||

Selling, general and administrative expenses | 141.2 | 127.7 | 274.9 | 241.2 | |||||||||||||

Total operating expenses | 875.2 | 896.9 | 1,747.9 | 1,736.5 | |||||||||||||

Operating income | 78.2 | 115.9 | 178.3 | 201.1 | |||||||||||||

Interest expense, net | 10.7 | 10.2 | 20.4 | 19.6 | |||||||||||||

Other non-operating expenses, net | 3.2 | 2.2 | 4.4 | 3.7 | |||||||||||||

Earnings before income taxes | 64.3 | 103.5 | 153.6 | 177.8 | |||||||||||||

Provision for income taxes | 14.4 | 41.4 | 27.0 | 65.8 | |||||||||||||

Net earnings | $ | 49.9 | $ | 62.1 | $ | 126.6 | $ | 112.0 | |||||||||

Basic earnings per share | $ | 0.43 | $ | 0.53 | $ | 1.09 | $ | 0.96 | |||||||||

Diluted earnings per share | $ | 0.42 | $ | 0.52 | $ | 1.06 | $ | 0.93 | |||||||||

Weighted-average shares outstanding: | |||||||||||||||||

Basic | 116.3 | 116.6 | 116.3 | 116.5 | |||||||||||||

Diluted | 119.1 | 120.3 | 119.4 | 120.1 | |||||||||||||

Dividends declared per common share | $ | 0.485 | $ | 0.365 | $ | 0.97 | $ | 0.73 | |||||||||

Amounts may not sum due to rounding.

8

Condensed Consolidated Balance Sheets

(Unaudited)

In millions, except per share amounts | December 31, 2018 | June 30, 2018 | |||||||

Assets | |||||||||

Current assets: | |||||||||

Cash and cash equivalents | $ | 249.8 | $ | 263.9 | |||||

Accounts receivable, net of allowance for doubtful accounts of $2.2 and $2.7, respectively | 607.4 | 615.0 | |||||||

Other current assets | 109.3 | 112.2 | |||||||

Total current assets | 966.4 | 991.1 | |||||||

Property, plant and equipment, net | 187.9 | 204.1 | |||||||

Goodwill | 1,254.3 | 1,254.9 | |||||||

Intangible assets, net | 445.4 | 494.1 | |||||||

Other non-current assets | 503.6 | 360.5 | |||||||

Total assets | $ | 3,357.6 | $ | 3,304.7 | |||||

Liabilities and Stockholders’ Equity | |||||||||

Current liabilities: | |||||||||

Payables and accrued expenses | $ | 509.1 | $ | 671.0 | |||||

Contract liabilities | 88.8 | 106.3 | |||||||

Total current liabilities | 597.9 | 777.3 | |||||||

Long-term debt | 1,194.1 | 1,053.4 | |||||||

Deferred taxes | 74.0 | 57.9 | |||||||

Contract liabilities | 169.2 | 75.2 | |||||||

Other non-current liabilities | 199.7 | 246.5 | |||||||

Total liabilities | 2,234.9 | 2,210.4 | |||||||

Commitments and contingencies | |||||||||

Stockholders’ equity: | |||||||||

Preferred stock: Authorized, 25.0 shares; issued and outstanding, none | — | — | |||||||

Common stock, $0.01 par value: 650.0 shares authorized; 154.5 and 154.5 shares issued, respectively; and 115.7 and 116.3 shares outstanding, respectively | 1.6 | 1.6 | |||||||

Additional paid-in capital | 1,087.8 | 1,048.5 | |||||||

Retained earnings | 1,843.8 | 1,727.0 | |||||||

Treasury stock, at cost: 38.8 and 38.1 shares, respectively | (1,741.4 | ) | (1,630.8 | ) | |||||

Accumulated other comprehensive loss | (69.2 | ) | (51.9 | ) | |||||

Total stockholders’ equity | 1,122.6 | 1,094.3 | |||||||

Total liabilities and stockholders’ equity | $ | 3,357.6 | $ | 3,304.7 | |||||

Amounts may not sum due to rounding.

9

Condensed Consolidated Statements of Cash Flows

(Unaudited)

Dollars in millions | Six Months Ended December 31, | ||||||

2018 | 2017 | ||||||

Cash Flows From Operating Activities | |||||||

Net earnings | $ | 126.6 | $ | 112.0 | |||

Adjustments to reconcile net earnings to net cash flows provided by operating activities: | |||||||

Depreciation and amortization | 42.5 | 40.0 | |||||

Amortization of acquired intangibles and purchased intellectual property | 43.2 | 39.2 | |||||

Amortization of other assets | 44.6 | 22.9 | |||||

Stock-based compensation expense | 29.4 | 24.7 | |||||

Deferred income taxes | (10.0 | ) | (11.2 | ) | |||

Other | (13.4 | ) | (1.7 | ) | |||

Changes in operating assets and liabilities, net of assets and liabilities acquired: | |||||||

Current assets and liabilities: | |||||||

Decrease in Accounts receivable, net | 11.0 | 18.0 | |||||

Increase in Other current assets | (12.1 | ) | (6.2 | ) | |||

Decrease in Payables and accrued expenses | (158.4 | ) | (147.5 | ) | |||

Increase (decrease) in Contract liabilities | 13.3 | (5.5 | ) | ||||

Non-current assets and liabilities: | |||||||

Increase in Other non-current assets | (87.3 | ) | (37.9 | ) | |||

Increase in Other non-current liabilities | 52.8 | 95.1 | |||||

Net cash flows provided by operating activities | 82.1 | 141.8 | |||||

Cash Flows From Investing Activities | |||||||

Capital expenditures | (21.0 | ) | (42.1 | ) | |||

Software purchases and capitalized internal use software | (9.3 | ) | (10.4 | ) | |||

Acquisitions, net of cash acquired | — | (30.2 | ) | ||||

Other investing activities | (1.8 | ) | (2.8 | ) | |||

Net cash flows used in investing activities | (32.0 | ) | (85.4 | ) | |||

Cash Flows From Financing Activities | |||||||

Debt proceeds | 210.0 | 190.0 | |||||

Debt repayments | (70.0 | ) | (70.0 | ) | |||

Dividends paid | (99.0 | ) | (80.4 | ) | |||

Purchases of Treasury stock | (120.3 | ) | (3.0 | ) | |||

Proceeds from exercise of stock options | 19.1 | 4.4 | |||||

Other financing activities | (1.8 | ) | (5.5 | ) | |||

Net cash flows (used in) provided by financing activities | (61.9 | ) | 35.4 | ||||

Effect of exchange rate changes on Cash and cash equivalents | (2.3 | ) | 3.6 | ||||

Net change in Cash and cash equivalents | (14.1 | ) | 95.4 | ||||

Cash and cash equivalents, beginning of period | 263.9 | 271.1 | |||||

Cash and cash equivalents, end of period | $ | 249.8 | $ | 366.5 | |||

Amounts may not sum due to rounding.

10

Segment Results

(Unaudited)

Dollars in millions | Revenues | ||||||||||||||

Three Months Ended December 31, | Six Months Ended December 31, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

(in millions) | (in millions) | ||||||||||||||

Investor Communication Solutions | $ | 738.1 | $ | 802.2 | $ | 1,503.9 | $ | 1,528.6 | |||||||

Global Technology and Operations | 236.6 | 228.0 | 464.3 | 442.9 | |||||||||||

Foreign currency exchange | (21.4 | ) | (17.4 | ) | (42.0 | ) | (33.9 | ) | |||||||

Total | $ | 953.4 | $ | 1,012.8 | $ | 1,926.2 | $ | 1,937.6 | |||||||

Earnings (Loss) before Income Taxes | |||||||||||||||

Three Months Ended December 31, | Six Months Ended December 31, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

(in millions) | (in millions) | ||||||||||||||

Investor Communication Solutions | $ | 37.0 | $ | 72.4 | $ | 96.0 | $ | 118.0 | |||||||

Global Technology and Operations | 47.3 | 50.6 | 93.7 | 95.7 | |||||||||||

Other | (27.9 | ) | (26.5 | ) | (51.0 | ) | (48.0 | ) | |||||||

Foreign currency exchange | 7.9 | 7.0 | 15.0 | 12.1 | |||||||||||

Total | $ | 64.3 | $ | 103.5 | $ | 153.6 | $ | 177.8 | |||||||

Pre-tax margins: | |||||||||||||||

Investor Communication Solutions | 5.0 | % | 9.0 | % | 6.4 | % | 7.7 | % | |||||||

Global Technology and Operations | 20.0 | % | 22.2 | % | 20.2 | % | 21.6 | % | |||||||

Amounts may not sum due to rounding.

11

Supplemental Reporting Detail - Additional Product Line Reporting

(Unaudited)

Dollars in millions | Three Months Ended December 31, | Six Months Ended December 31, | |||||||||||||||||||

Investor Communication Solutions | 2018 | 2017 | Change | 2018 | 2017 | Change | |||||||||||||||

Equity Proxy | $ | 41.7 | $ | 33.6 | 24 | % | $ | 72.7 | $ | 63.6 | 14 | % | |||||||||

Mutual fund and exchange-traded funds (“ETF”) interims | 60.7 | 46.9 | 29 | % | 118.5 | 96.2 | 23 | % | |||||||||||||

Customer communications and fulfillment | 182.6 | 187.3 | (3 | )% | 357.5 | 368.9 | (3 | )% | |||||||||||||

Other ICS | 82.1 | 66.5 | 23 | % | 165.9 | 138.7 | 20 | % | |||||||||||||

Total ICS Recurring fee revenues | 367.2 | 334.4 | 10 | % | 714.6 | 667.4 | 7 | % | |||||||||||||

Equity and other | 19.5 | 28.8 | (32 | )% | 43.6 | 59.5 | (27 | )% | |||||||||||||

Mutual funds | 28.6 | 68.6 | (58 | )% | 81.4 | 97.1 | (16 | )% | |||||||||||||

Total ICS Event-driven fee revenues | 48.1 | 97.3 | (51 | )% | 125.1 | 156.6 | (20 | )% | |||||||||||||

Distribution revenues | 322.9 | 370.4 | (13 | )% | 664.2 | 704.7 | (6 | )% | |||||||||||||

Total ICS Revenues | $ | 738.1 | $ | 802.2 | (8 | )% | $ | 1,503.9 | $ | 1,528.6 | (2 | )% | |||||||||

Global Technology and Operations | |||||||||||||||||||||

Equities and Other | $ | 196.5 | $ | 189.4 | 4 | % | $ | 384.2 | $ | 368.4 | 4 | % | |||||||||

Fixed income | 40.1 | 38.5 | 4 | % | 80.1 | 74.5 | 8 | % | |||||||||||||

Total GTO Recurring fee revenues | 236.6 | 228.0 | 4 | % | 464.3 | 442.9 | 5 | % | |||||||||||||

Foreign currency exchange | (21.4 | ) | (17.4 | ) | 23 | % | (42.0 | ) | (33.9 | ) | 24 | % | |||||||||

Total Revenues | $ | 953.4 | $ | 1,012.8 | (6 | )% | $ | 1,926.2 | $ | 1,937.6 | (1 | )% | |||||||||

Revenues by Type | |||||||||||||||||||||

Recurring fee revenues | $ | 603.8 | $ | 562.4 | 7 | % | $ | 1,179.0 | $ | 1,110.2 | 6 | % | |||||||||

Event-driven fee revenues | 48.1 | 97.3 | (51 | )% | 125.1 | 156.6 | (20 | )% | |||||||||||||

Distribution revenues | 322.9 | 370.4 | (13 | )% | 664.2 | 704.7 | (6 | )% | |||||||||||||

Foreign currency exchange | (21.4 | ) | (17.4 | ) | 23 | % | (42.0 | ) | (33.9 | ) | 24 | % | |||||||||

Total Revenues | $ | 953.4 | $ | 1,012.8 | (6 | )% | $ | 1,926.2 | $ | 1,937.6 | (1 | )% | |||||||||

Amounts may not sum due to rounding.

12

Recurring Fee Revenue Growth Drivers

(Unaudited)

Three Months Ended, December 31, 2018 | Six Months Ended, December 31, 2018 | ||||||||||

ICS | GTO | Total | ICS | GTO | Total | ||||||

Internal growth | 4% | 1% | 3% | 1% | 2% | 2% | |||||

Net new business | 4% | 3% | 3% | 4% | 3% | 4% | |||||

Organic Recurring fee revenue growth | 8% | 4% | 6% | 5% | 5% | 5% | |||||

Acquisitions | 1% | —% | 1% | 2% | —% | 1% | |||||

Revenue accounting change impact | 1% | —% | 1% | —% | —% | —% | |||||

Total Recurring fee revenue growth | 10% | 4% | 7% | 7% | 5% | 6% | |||||

Amounts may not sum due to rounding. | |||||||||||

Select Operating Metrics

(Unaudited)

Three Months Ended December 31, | Six Months Ended December 31, | |||||||||||

Dollars in millions | 2018 | 2017 | % Change | 2018 | 2017 | % Change | ||||||

Closed Sales | $105.9 | $38.7 | 174% | $124.3 | $61.6 | 102% | ||||||

Record Growth1 | ||||||||||||

Equity proxy | 15% | 12% | 15% | 8% | ||||||||

Mutual fund interims | 20% | 10% | 14% | 10% | ||||||||

Internal Trade Growth2 | ||||||||||||

Equity | 16% | 9% | 18% | 8% | ||||||||

Fixed Income | 6% | 2% | 5% | 1% | ||||||||

Amounts may not sum due to rounding. | ||||||||||||

1 Stock record growth and interim record growth measure the annual change in total positions eligible for equity proxies and mutual fund & ETF interims, respectively, for equities and mutual funds position data reported to Broadridge in both the current and prior year periods. | ||||||||||||

2 Internal trade growth represents the growth in trade volumes for clients whose contracts are linked to trade volumes and who were on Broadridge’s trading platforms in both the current and prior year period. | ||||||||||||

13

Reconciliation of Non-GAAP to GAAP Measures

(Unaudited)

Dollars in millions, except per share amounts | Three Months Ended December 31, | Six Months Ended December 31, | |||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

(in millions) | |||||||||||||||

Operating income (GAAP) | $ | 78.2 | $ | 115.9 | $ | 178.3 | $ | 201.1 | |||||||

Adjustments: | |||||||||||||||

Amortization of Acquired Intangibles and Purchased Intellectual Property | 21.3 | 19.7 | 43.2 | 39.2 | |||||||||||

Acquisition and Integration Costs | 1.3 | 2.6 | 2.2 | 4.7 | |||||||||||

Adjusted Operating income (Non-GAAP) | $ | 100.8 | $ | 138.3 | $ | 223.7 | $ | 244.9 | |||||||

Operating income margin (GAAP) | 8.2 | % | 11.4 | % | 9.3 | % | 10.4 | % | |||||||

Adjusted Operating income margin (Non-GAAP) | 10.6 | % | 13.7 | % | 11.6 | % | 12.6 | % | |||||||

Three Months Ended December 31, | Six Months Ended December 31, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

(in millions) | |||||||||||||||

Net earnings (GAAP) | $ | 49.9 | $ | 62.1 | $ | 126.6 | $ | 112.0 | |||||||

Adjustments: | |||||||||||||||

Amortization of Acquired Intangibles and Purchased Intellectual Property | 21.3 | 19.7 | 43.2 | 39.2 | |||||||||||

Acquisition and Integration Costs | 1.3 | 2.6 | 2.2 | 4.7 | |||||||||||

Taxable adjustments | 22.6 | 22.4 | 45.4 | 43.8 | |||||||||||

Tax Act items | — | 16.1 | — | 16.1 | |||||||||||

Tax impact of adjustments (a) | (5.3 | ) | (5.9 | ) | (10.3 | ) | (13.0 | ) | |||||||

Adjusted Net earnings (Non-GAAP) | $ | 67.2 | $ | 94.7 | $ | 161.8 | $ | 158.9 | |||||||

Three Months Ended December 31, | Six Months Ended December 31, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

Diluted earnings per share (GAAP) | $ | 0.42 | $ | 0.52 | $ | 1.06 | $ | 0.93 | |||||||

Adjustments: | |||||||||||||||

Amortization of Acquired Intangibles and Purchased Intellectual Property | 0.18 | 0.16 | 0.36 | 0.33 | |||||||||||

Acquisition and Integration Costs | 0.01 | 0.02 | 0.02 | 0.04 | |||||||||||

Taxable adjustments | 0.19 | 0.19 | 0.38 | 0.37 | |||||||||||

Tax Act items | — | 0.13 | — | 0.13 | |||||||||||

Tax impact of adjustments (a) | (0.04 | ) | (0.05 | ) | (0.09 | ) | (0.11 | ) | |||||||

Adjusted earnings per share (Non-GAAP) | $ | 0.56 | $ | 0.79 | $ | 1.35 | $ | 1.32 | |||||||

(a) Calculated using the GAAP effective tax rate, adjusted to exclude $0.8 million and $7.9 million of excess tax benefits associated with stock-based compensation for the three and six months ended December 31, 2018, as well as the net $16.1 million charges associated with the Tax Act and $1.5 million and $3.0 million of excess tax benefits associated with stock-based compensation, for the three and six months ended December 31, 2017. For purposes of calculating the Adjusted earnings per share, the same adjustments were made on a per share basis.

14

Six Months Ended December 31, | |||||||

2018 | 2017 | ||||||

(in millions) | |||||||

Net cash flows provided by operating activities (GAAP) | $ | 82.1 | $ | 141.8 | |||

Capital expenditures and Software purchases and capitalized internal use software | (30.3 | ) | (52.5 | ) | |||

Free cash flow (Non-GAAP) | $ | 51.8 | $ | 89.3 | |||

Amounts may not sum due to rounding.

Guidance for Third Quarter and Fiscal Year 2019 Guidance

Reconciliation of Non-GAAP to GAAP Measures

Adjusted Earnings Per Share Growth, Adjusted Operating Income Margin and Free Cash Flow

(Unaudited)

Dollars in millions, except per share amounts | ||

Third Quarter FY19 Adjusted Earnings Per Share (1) | ||

Diluted earnings per share (GAAP) | $1.25 - $1.41 | |

Adjusted earnings per share (Non-GAAP) | $1.40 - $1.56 | |

FY19 Adjusted Earnings Per Share Growth Rate (1) | ||

Diluted earnings per share (GAAP) | 12% - 16% growth | |

Adjusted earnings per share (Non-GAAP) | 9% - 13% growth | |

FY19 Adjusted Operating Income Margin (2) | ||

Operating income margin % (GAAP) | ~14.5% | |

Adjusted Operating income margin % (Non-GAAP) | ~16.5% | |

FY19 Free Cash Flow | ||

Net cash flows provided by operating activities (GAAP) | $660 - $730 | |

Capital expenditures and Software purchases and capitalized internal use software | (95) - (115) | |

Free cash flow (Non-GAAP) | $565 - $615 | |

(1) Adjusted earnings per share growth (Non-GAAP) is adjusted to exclude the projected impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, and Acquisition and Integration Costs, and is calculated using diluted shares outstanding. Fiscal year 2019 Non-GAAP Adjusted earnings per share guidance estimates exclude Amortization of Acquired Intangibles and Purchased Intellectual Property, and Acquisition and Integration Costs, net of taxes, of approximately $0.60 per share. For the third quarter of Fiscal Year 2019, the guidance excludes Amortization of Acquired Intangibles and Purchased Intellectual Property, and Acquisition and Integration Costs, net of taxes, of approximately $0.15 per share

(2) Adjusted Operating income margin (Non-GAAP) is adjusted to exclude the projected impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, and Acquisition and Integration Costs. Fiscal year 2019 Non-GAAP Adjusted Operating income margin guidance estimates exclude Amortization of Acquired Intangibles and Purchased Intellectual Property, and Acquisition and Integration Costs of approximately $94 million.

15

16

EXHIBIT 99.2 Earnings Webcast & Conference Call Second Quarter and First Six Months of Fiscal Year 2019 © 2018 | ‹#›

Forward-Looking Statements This presentation and other written or oral statements made from time to time by representatives of BroadridgeFinancial Solutions, Inc. ("Broadridge" or the "Company") may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, and which may be identified by the use of words such as “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be” and other words of similar meaning, are forward-looking statements. In particular, information appearing in the “Fiscal Year 2019 Guidance” section are forward-looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended June 30, 2018 (the “2018 Annual Report”), as they may be updated in any future reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of this presentation and are expressly qualified in their entirety by reference to the factors discussed in the 2018 Annual Report. These risks include: the success of Broadridgein retaining and selling additional services to its existing clients and in obtaining new clients; Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms; a material security breach or cybersecurity attack affecting the information of Broadridge's clients; changes in laws and regulations affecting Broadridge’s clients or the services provided by Broadridge; declines in participation and activity in the securities markets; the failure of Broadridge's key service providers to provide the anticipated levels of service; a disaster or other significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; overall market and economic conditions and their impact on the securities markets; Broadridge’s failure to keep pace with changes in technology and demands of its clients; Broadridge’s ability to attract and retain key personnel; the impact of new acquisitions and divestitures; and competitive conditions. Broadridgedisclaims any obligation to update or revise forward- looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law. Use of Material Contained Herein The information contained in this presentation is being provided for your convenience and information only. This information is accurate as of the date of its initial presentation. If you plan to use this information for any purpose, verification of its continued accuracy is your responsibility. Broadridge assumes no duty to update or revise the information contained in this presentation. Revenue Accounting Change Effective July 1, 2018, Broadridgeadopted Accounting Standards Update No. 2014-09 “Revenue from Contracts with Customers” and its related amendments (the “revenue accounting change”). Results for reporting periods beginning July 1, 2018 reflect the revenue accounting change while prior period amounts have not been adjusted and continue to be reported in accordance with historical accounting guidelines. For additional information related to this change please refer to the appendix of this presentation and information expected to be filed in Broadridge’s Quarterly Report on Form 10-Q for the second quarter of fiscal year 2019. 2019 | 2

Use of Non-GAAP Financial Measures Explanation and Reconciliation of the Company’s Use of Non-GAAP Financial Measures The Company’s results in this presentation are presented in accordance with U.S. generally accepted accounting principles ("GAAP") except where otherwise noted. In certain circumstances, results have been presented that are not generally accepted accounting principles measures (“Non-GAAP”). These Non-GAAP measures are Adjusted Operating income, Adjusted Operating income margin, Adjusted Net earnings, Adjusted earnings per share, and Free cash flow. These Non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Company’s reported results. The Company believes its Non-GAAP financial measures help investors understand how management plans, measures and evaluates the Company’s business performance. Management believes that Non-GAAP measures provide consistency in its financial reporting and facilitates investors’ understanding of the Company’s operating results and trends by providing an additional basis for comparison. Management uses these Non-GAAP financial measures to, among other things, evaluate the Company's ongoing operations, for internal planning and forecasting purposes and in the calculation of performance-based compensation. In addition, and as a consequence of the importance of these Non-GAAP financial measures in managing its business, the Company’s Compensation Committee of the Board of Directors incorporates Non-GAAP financial measures in the evaluation process for determining management compensation. Adjusted Operating Income, Adjusted Operating Income Margin, Adjusted Net Earnings and Adjusted Earnings per Share These Non-GAAP measures reflect Operating income, Operating income margin, Net earnings, and Diluted earnings per share, as adjusted to exclude the impact of certain costs, expenses, gains and losses and other specified items that management believes are not indicative of ourongoing operating performance. These adjusted measures exclude the impact of: (i) Amortization of Acquired Intangibles and Purchased Intellectual Property, (ii) Acquisition and Integration Costs and (iii) Tax Act items. Amortization of Acquired Intangibles and Purchased Intellectual Property represents non-cash amortization expenses associated with the Company's acquisition activities. Acquisition and Integration Costs represent certain transaction and integration costs associated with the Company’s acquisition activities. Tax Act items represent the net impact of a U.S. federal transition tax on earnings of certainforeign subsidiaries, foreign jurisdiction withholding taxes and certain benefits related to the remeasurement of the Company’s net U.S. federal and state deferred tax liabilities attributable to the Tax Act. The Company excludes Amortization of Acquired Intangibles and Purchased Intellectual Property as well as Acquisition and Integration Costs and Tax Act items from our earnings measures because excluding such information provides us with an understanding of the results from the primary operations of our business and these items do not reflect ordinary operations or earnings. Management believes these adjusted measures may be useful to an investor in evaluating the underlying operating performance of our business. Free Cash Flow In addition to the Non-GAAP financial measures discussed above, we provide Free cash flow information because we consider Free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated that could be used for dividends, share repurchases, strategic acquisitions, other investments, as well as debt servicing. Free cash flow is a Non-GAAP financial measure and is defined by the Company as Net cash flows provided by operating activities less Capital expenditures as well as Software purchases and capitalized internal use software. Reconciliations of such Non-GAAP measures to the most directly comparable financial measures presented in accordance with GAAP can be found in the tables that are part of this presentation. 2019 | 3

Highlights . Strong second quarter 2019 financial results • Recurring fee revenues rose 7% • Closed sales of $106 million, a second quarter record o Strong Closed sales growth even excluding landmark sale to UBS • As expected, event-driven revenues of $48 million declined relative to near record $97 million in 2Q18. • Diluted EPS declined 19% to $0.42 and Adjusted EPS fell to $0.56 o Decline of higher-margin event-driven revenues in seasonally small 2Q o SG&A up 11% versus 2Q18 on increased growth investments in technology and sales . Reaffirming fiscal year 2019 financial guidance . On track to achieve FY17-FY20 growth objectives 2019 | 4

Key Stakeholder Messages . Broadridge's role powering the critical infrastructure behind Investing, Governance, and Communications strengthens our clients and enables better financial lives . Broadridge has transformed over the past seven years as demonstrated by recent "Most Admired Company" award . That transformation gives Broadridge tremendous opportunity . Three key areas of focus to capture that opportunity over the near- , medium-, and long-term Deliver on FY2019 guidance and FY2020 objectives Execute against Investor Day growth plans across Governance, Capital Markets and Wealth Management Build on current capabilities like culture, product and technology . Maintain balanced, shareholder friendly capital allocation 2019 | 5

Business Update . 2Q record Closed sales of $106 million in second quarter • Year to date Closed sales of $124 million, up 102% • Strong Closed sales result even excluding UBS sale • Pipeline remains strong . ICS Recurring fee revenues up 10% • 25% Recurring fee revenue growth ex-Customer Communications driven by higher mutual fund interims, data-driven services and stock record growth • Event-driven revenues down 51% as expected from near-record second quarter 2018 . GTO Revenues up 4% • Longer implementation times on recent sales wins creating modest lull in growth • Investments underway to support long-term growth outlook 2019 | 6

Second Quarter 2019 Revenue Growth Drivers ▪ Second Quarter 2019 Total revenues declined 6% to $953 million +4% (5)% (6)% $1,013M (5)% (0)% $953M ▪ Second Quarter 2019 Recurring fee revenues grew 7% to $604 million Organic Growth: 6% +7% +6% +3% +1% +1% (3)% $604M $562M Note: Amounts may not sum due to rounding 2019 | 7

1H 2019 Revenue Growth Drivers ▪ Six Months Fiscal 2019 Total revenues declined 1% to $1.93 billion +4% (2)% (1)% $1.94B (2)% (0)% $1.93B ▪ Six Months Fiscal 2019 Recurring fee revenues grew 6% to $1.18 billion Organic Growth: 5% +6% +1% 0% +6% $1.18B (3)% +2% $1.11B Note: Amounts may not sum due to rounding 2019 | 8

Second Quarter 2019 GAAP and Adjusted Operating Income and EPS $ in millions, except per share amounts Year-over-Year Change in Operating Income Year-over-Year Change in EPS and and Adjusted Operating Income Adjusted EPS -27% -29% -33% -19% 2019 | 9

Six Months Fiscal Year 2019 GAAP and Adjusted Operating Income and EPS $ in millions, except per share amounts Year-over-Year Change in Operating Income Year-over-Year Change in EPS and and Adjusted Operating Income Adjusted EPS -9% +2% -11% +14% 2019 | 10

Second Quarter Cost of Revenues & Selling, General, and Administrative Expenses ($'s in millions) 2Q FY17 2Q FY18 2Q FY19 Cost of Revenues $707.4 $769.3 $734.0 Gross Margin 20.7% 24.0% 23.0% SG&A $125.9 $127.7 $141.2 Growth 21% 1% 11% 2019 | 11

First Half Contribution to Full Year EPS Adjusted EPS - Non-GAAP Diluted EPS 32% 29%1 26% 26% 26%1 23% 1 FY19 first half Diluted and Adjusted (Non-GAAP) EPS % of Full Year EPS based on mid-point of full year FY19 Diluted and Adjusted (Non-GAAP) EPS guidance. 2019 | 12

Segment Results ($ in millions) Investor Communication Solutions ("ICS") 2Q 1H 2018 2019 Change 2018 2019 Change Recurring fee revenues $334 $367 10% $667 $715 7% Event-driven fee revenues 97 48 (51)% 157 125 (20)% Distribution revenues 370 323 (13)% 705 664 (6)% Total revenues $802 $738 (8)% $1,529 $1,504 (2)% Earnings before income taxes $72 $37 (49)% $118 $96 (19)% Pre-tax margins 9.0% 5.0% 7.7% 6.4% Global Technology and Operations ("GTO") 2Q 1H 2018 2019 Change 2018 2019 Change Total revenues $228 $237 4% $443 $464 5% Earnings before income taxes $51 $47 (7)% $96 $94 (2)% Pre-tax margins 22.2% 20.0% 21.6% 20.2% Note: Amounts may not sum due to rounding 2019 | 13

Capital Allocation and Summary Balance Sheet $ in millions Select Uses of Cash in Summary Balance Sheet First Half 2019 as of December 31, 2018 Assets Cash and cash equivalents $ 250 Other assets 3,108 Total assets $ 3,358 Liabilities and Stockholders' Equity Total debt outstanding $ 1,194 Other liabilities 1,041 Total liabilities $ 2,235 Total stockholders' equity $ 1,123 Note: Amounts may not sum due to rounding (a) Purchases of Treasury stock, net of proceeds from exercise of stock options 2019 | 14

Fiscal Year 2019 Guidance - Reaffirmed Recurring fee revenue growth 5 - 7% Total revenue growth 3 - 5% Operating income margin - GAAP ~14.5% Adjusted Operating income margin - Non-GAAP ~16.5% Diluted earnings per share growth 12 - 16% Adjusted earnings per share growth - Non-GAAP 9 - 13% Free cash flow - Non-GAAP $565 - $615M Closed sales $185 - $225M Note: Fiscal year 2019 guidance includes $25 million of excess tax benefits related to stock-based compensation, down from $41 million in fiscal year 2018. 2019 | 15

3Q FY2019 Supplemental Guidance Q3 FY19 Growth vs Estimated Range ($'s in millions, except per share amounts) FY18 As Reported FY18 Pro Forma Recurring fee revenues $755 - $780M 18% - 22% 3% - 6% Total revenues $1,195 - $1,245M 11% - 16% (1)% - 3% Diluted earnings per share $1.25 - $1.41 39% - 57% Adjusted earnings per share - Non-GAAP $1.40 - $1.56 40% - 56% Note: For FY18 Pro Forma results refer to page 19 of the presentation 2019 | 16

Appendix 2019 | 17

Tax Act & ETB Impact 2018 2019 2018 2019 2018 2019 FY 2Q 2Q 1H 1H FY $ in millions Outlook Earnings before income taxes $103.5 $64.3 $177.8 $153.6 $561.0 Provision for income taxes (Excluding ETB and non-recurring gains & charges) $26.7 $15.2 $52.7 $34.8 $158.6 Net Tax Charges 16.1 — 16.1 — 15.4 — Excess Tax Benefits "ETB" (1.5) (0.8) (3.0) (7.9) (40.9) ~(25) Provision for income taxes (GAAP) $41.4 $14.4 $65.8 $27.0 $133.1 Tax Rates Tax Rate (Ex- ETB & non-recurring gains & charges) 25.8% 23.6% 29.6% 22.7% 28.3% ~24% Tax Rate (GAAP) 40.0% 22.4% 37.0% 17.6% 23.7% ~20% EPS Growth Diluted EPS 108% (19)% 79% 14% 32% Adjusted EPS 103% (29)% 76% 2% 34% Adjusted EPS (Ex- ETB) 97% (27)% 73% (1)% 23% Note: Amounts may not sum due to rounding 2019 | 18

Pro Forma Accounting Change Impact to FY 2018 Total Revenues 2018 $ in millions Q1 Q2 Q3 Q4 FY Revenues As Reported Recurring Fee Revenues $ 547.8 $ 562.4 $ 638.6 $ 861.5 $ 2,610.4 Event-Driven Fee Revenues 59.3 97.3 66.5 60.7 283.9 Distribution Revenues 334.2 370.4 385.4 422.9 1,512.9 FX (16.5) (17.4) (18.6) (24.8) (77.3) Total Revenues $ 924.8 $ 1,012.8 $ 1,071.9 $ 1,320.4 $ 4,329.9 Revenue Adjustments from Revenue Accounting Change Recurring Fee Revenues $ (3.3) $ 3.5 $ 97.8 $ (97.5) $ 0.4 Event-Driven Fee Revenues 43.9 (47.3) 2.1 (1.0) (2.2) Distribution Revenues 18.5 (21.4) 36.4 (24.0) 9.6 FX — — — — — Total Revenues $ 59.1 $ (65.2) $ 136.3 $ (122.5) $ 7.7 Revenues (As Adjusted) Recurring Fee Revenues $ 544.5 $ 565.9 $ 736.4 $ 764.0 $ 2,610.8 Event-Driven Fee Revenues 103.2 50.0 68.6 59.7 281.6 Distribution Revenues 352.8 349.0 421.8 399.0 1,522.5 FX (16.5) (17.4) (18.6) (24.8) (77.3) Total Revenues $ 983.9 $ 947.6 $ 1,208.2 $ 1,197.9 $ 4,337.6 Note: Amounts may not sum due to rounding 2019 | 19

Pro Forma Accounting Change Impact to FY 2018 Recurring Revenues 2018 $ in millions Q1 Q2 Q3 Q4 FY Recurring Fee Revenues As Reported ICS $ 332.9 $ 334.4 $ 403.5 $ 628.0 $ 1,698.9 GTO 214.9 228.0 235.2 233.5 911.6 Total Recurring Fee Revenues $ 547.8 $ 562.4 $ 638.6 $ 861.5 $ 2,610.4 % of FY Recurring Fee Revenue 21.0% 21.5% 24.5% 33.0% 100.0% Recurring Fee Revenue Adjustments from Revenue Accounting Change ICS $ (1.1) $ 3.1 $ 96.9 $ (97.7) $ 1.3 GTO (2.3) 0.4 0.8 0.2 (0.9) Total Recurring Fee Revenues $ (3.3) $ 3.5 $ 97.8 $ (97.5) $ 0.4 Recurring Fee Revenues (As Adjusted) ICS $ 331.8 $ 337.5 $ 500.4 $ 530.4 $ 1,700.1 GTO 212.6 228.4 236.0 233.7 910.7 Total Recurring Fee Revenues $ 544.5 $ 565.9 $ 736.4 $ 764.0 $ 2,610.8 % of FY Recurring Fee Revenue 20.9% 21.7% 28.2% 29.3% 100.0% Note: Amounts may not sum due to rounding 2019 | 20

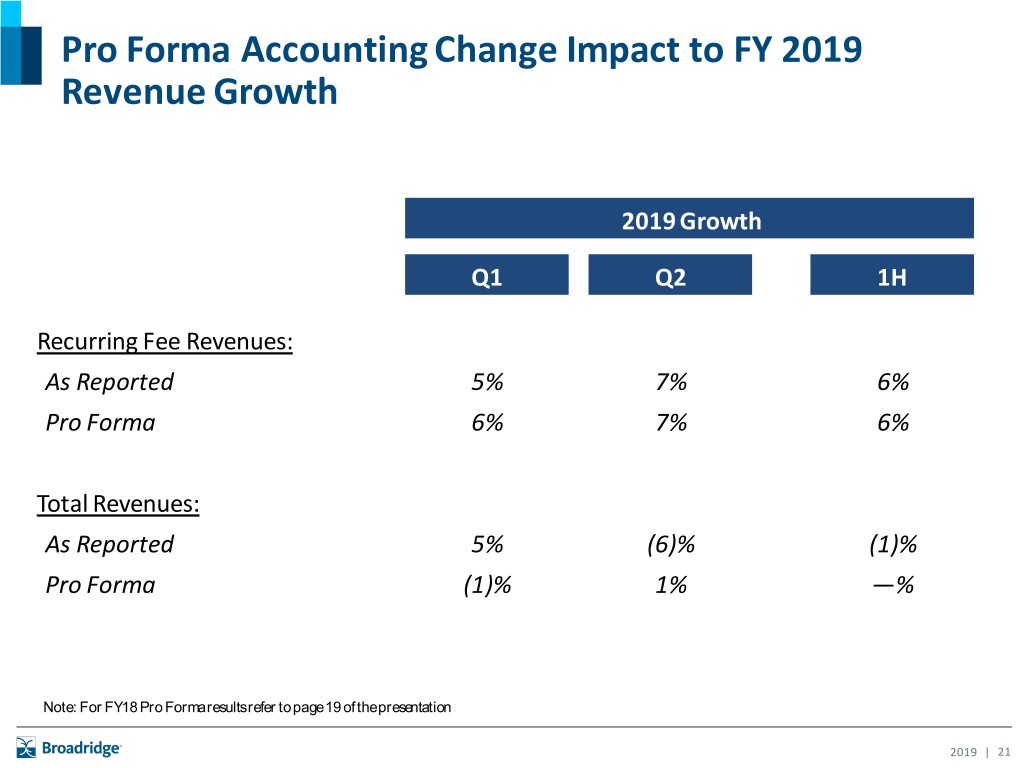

Pro Forma Accounting Change Impact to FY 2019 Revenue Growth 2019 Growth Q1 Q2 1H Recurring Fee Revenues: As Reported 5% 7% 6% Pro Forma 6% 7% 6% Total Revenues: As Reported 5% (6)% (1)% Pro Forma (1)% 1% —% Note: For FY18 Pro Forma results refer to page 19 of the presentation 2019 | 21

Supplemental Reporting Detail - Product Line Reporting1 $ in millions Q1FY18 Q2FY18 Q3FY18 Q4FY18 FY 2018 Q1FY19 Q2 FY19 YTD FY19 Investor Communication Solutions ("ICS") Equity proxy $ 30.0 $ 33.6 $ 45.1 $ 298.1 $ 406.8 $ 31.0 $ 41.7 $ 72.7 Mutual fund & ETF interims 49.2 46.9 67.0 58.3 221.4 57.8 60.7 118.5 Customer communications & fulfillment 181.5 187.3 210.7 180.6 760.1 174.9 182.6 357.5 Other ICS 72.2 66.5 80.7 91.1 310.6 83.8 82.1 165.9 Total ICS recurring fee revenues $ 332.9 $ 334.4 $ 403.5 $ 628.0 $ 1,698.9 $ 347.4 $ 367.2 $ 714.6 Equity & other $ 30.8 $ 28.8 $ 39.9 $ 34.9 $ 134.4 $ 24.1 $ 19.5 $ 43.6 Mutual funds 28.5 68.6 26.6 25.8 149.4 52.8 28.6 81.4 Total Event-driven fee revenues $ 59.3 $ 97.3 $ 66.5 $ 60.7 $ 283.9 $ 76.9 $ 48.1 $ 125.1 Distribution 334.2 370.4 385.4 422.9 1,512.9 341.4 322.9 664.2 Total ICS revenues $ 726.4 $ 802.2 $ 855.3 $ 1,111.7 $ 3,495.6 $ 765.8 $ 738.1 $ 1,503.9 Global Technology & Operations ("GTO") Equities & other $ 179.0 $ 189.4 $ 195.9 $ 193.0 $ 757.2 $ 187.7 $ 196.5 $ 384.2 Fixed income 35.9 38.5 39.3 40.5 154.3 40.0 40.1 80.1 Total GTO recurring fee revenues $ 214.9 $ 228.0 $ 235.2 $ 233.5 $ 911.6 $ 227.7 $ 236.6 $ 464.3 Foreign currency exchange (16.5) (17.4) (18.6) (24.8) (77.3) (20.7) (21.4) (42.0) Total revenues $ 924.8 $ 1,012.8 $ 1,071.9 $ 1,320.4 $ 4,329.9 $ 972.8 $ 953.4 $ 1,926.2 Revenues by Type Recurring fee revenues $ 547.8 $ 562.4 $ 638.6 $ 861.5 $ 2,610.4 $ 575.2 $ 603.8 $ 1,179.0 Event-driven fee revenues 59.3 97.3 66.5 60.7 283.9 76.9 48.1 125.1 Distribution revenues 334.2 370.4 385.4 422.9 1,512.9 341.4 322.9 664.2 Foreign currency exchange (16.5) (17.4) (18.6) (24.8) (77.3) (20.7) (21.4) (42.0) Total revenues $ 924.8 $ 1,012.8 $ 1,071.9 $ 1,320.4 $ 4,329.9 $ 972.8 $ 953.4 $ 1,926.2 1 Fiscal 2018 results have not been restated for the revenue accounting change. Note: Amounts may not sum due to rounding 2019 | 22

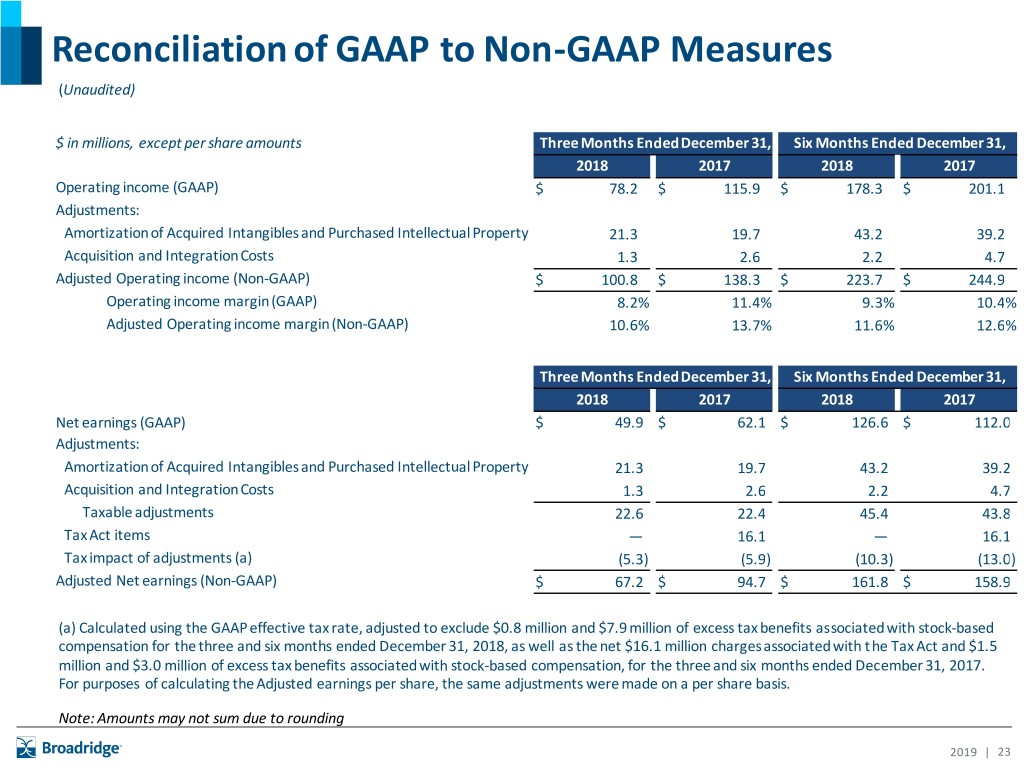

Reconciliation of GAAP to Non-GAAP Measures (Unaudited) $ in millions, except per share amounts Three Months Ended December 31, Six Months Ended December 31, 2018 2017 2018 2017 Operating income (GAAP) $ 78.2 $ 115.9 $ 178.3 $ 201.1 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 21.3 19.7 43.2 39.2 Acquisition and Integration Costs 1.3 2.6 2.2 4.7 Adjusted Operating income (Non-GAAP) $ 100.8 $ 138.3 $ 223.7 $ 244.9 Operating income margin (GAAP) 8.2% 11.4% 9.3% 10.4% Adjusted Operating income margin (Non-GAAP) 10.6% 13.7% 11.6% 12.6% Three Months Ended December 31, Six Months Ended December 31, 2018 2017 2018 2017 Net earnings (GAAP) $ 49.9 $ 62.1 $ 126.6 $ 112.0 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 21.3 19.7 43.2 39.2 Acquisition and Integration Costs 1.3 2.6 2.2 4.7 Taxable adjustments 22.6 22.4 45.4 43.8 Tax Act items — 16.1 — 16.1 Tax impact of adjustments (a) (5.3) (5.9) (10.3) (13.0) Adjusted Net earnings (Non-GAAP) $ 67.2 $ 94.7 $ 161.8 $ 158.9 (a) Calculated using the GAAP effective tax rate, adjusted to exclude $0.8 million and $7.9 million of excess tax benefits associated with stock-based compensation for the three and six months ended December 31, 2018, as well as the net $16.1 million charges associated with the Tax Act and $1.5 million and $3.0 million of excess tax benefits associated with stock-based compensation, for the three and six months ended December 31, 2017. For purposes of calculating the Adjusted earnings per share, the same adjustments were made on a per share basis. Note: Amounts may not sum due to rounding 2019 | 23

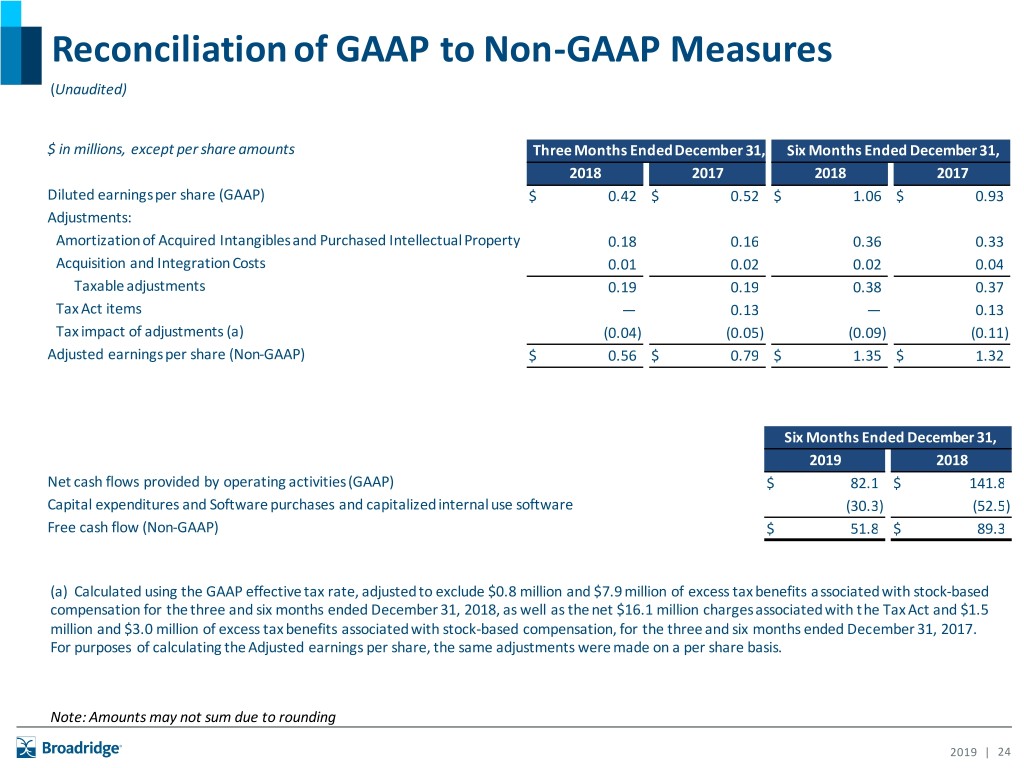

Reconciliation of GAAP to Non-GAAP Measures (Unaudited) $ in millions, except per share amounts Three Months Ended December 31, Six Months Ended December 31, 2018 2017 2018 2017 Diluted earnings per share (GAAP) $ 0.42 $ 0.52 $ 1.06 $ 0.93 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 0.18 0.16 0.36 0.33 Acquisition and Integration Costs 0.01 0.02 0.02 0.04 Taxable adjustments 0.19 0.19 0.38 0.37 Tax Act items — 0.13 — 0.13 Tax impact of adjustments (a) (0.04) (0.05) (0.09) (0.11) Adjusted earnings per share (Non-GAAP) $ 0.56 $ 0.79 $ 1.35 $ 1.32 Six Months Ended December 31, 2019 2018 Net cash flows provided by operating activities (GAAP) $ 82.1 $ 141.8 Capital expenditures and Software purchases and capitalized internal use software (30.3) (52.5) Free cash flow (Non-GAAP) $ 51.8 $ 89.3 (a) Calculated using the GAAP effective tax rate, adjusted to exclude $0.8 million and $7.9 million of excess tax benefits associated with stock-based compensation for the three and six months ended December 31, 2018, as well as the net $16.1 million charges associated with the Tax Act and $1.5 million and $3.0 million of excess tax benefits associated with stock-based compensation, for the three and six months ended December 31, 2017. For purposes of calculating the Adjusted earnings per share, the same adjustments were made on a per share basis. Note: Amounts may not sum due to rounding 2019 | 24

Reconciliation of GAAP to Non-GAAP Measures Fiscal Years Ended June 30, 2018 2017 2016 2015 2014 Diluted earnings per share (GAAP) $ 3.56 $ 2.70 $ 2.53 $ 2.32 $ 2.12 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 0.68 0.60 0.26 0.20 0.18 Acquisition and Integration Costs 0.07 0.16 0.04 0.04 0.02 Gain on Sale of Securities (0.05) — — — — Taxable Adjustments 0.70 0.76 0.30 0.24 0.20 Tax Act items 0.13 — — — — MAL investment gain (a) — (0.08) — — — Tax impact of adjustments (b) (0.20) (0.26) (0.10) (0.08) (0.07) Adjusted earnings per share (Non-GAAP) $ 4.19 $ 3.13 $ 2.73 $ 2.47 $ 2.25 (a) Represents a non-cash, nontaxable gain on investment. (b) Calculated using the GAAP effective tax rate, adjusted to exclude the net $15.4 million charges associated with the Tax Act, as well as $40.9 million of excess tax benefits associated with stock-based compensation for the fiscal year ended June 30, 2018. For purposes of calculating Adjusted earnings per share, the same adjustments were made on a per share basis. Note: Amounts may not sum due to rounding 2019 | 25

Reconciliation of GAAP to Non-GAAP Measures - Third Quarter and FY19 Guidance (Unaudited) (Dollars in millions, except per share amounts) Third Quarter FY19 Adjusted Earnings Per Share (1) Diluted earnings per share (GAAP) $1.25 - $1.41 Adjusted earnings per share (Non-GAAP) $1.40 - $1.56 FY19 Adjusted Earnings Per Share Growth Rate (1) Diluted earnings per share (GAAP) 12% - 16% Adjusted earnings per share (Non-GAAP) 9% - 13% FY19 Adjusted Operating Income Margin (2) Operating income margin % (GAAP) ~14.5% Adjusted Operating income margin % (Non-GAAP) ~16.5% Free Cash Flow Net cash flows provided by operating activities (GAAP) $660 - $730 million Capital expenditures and Software purchases and capitalized internal use software (95) - (115) million Free cash flow (Non-GAAP) $565 - $615 million (1) Adjusted earnings per share growth (Non-GAAP) is adjusted to exclude the projected impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, and Acquisition and Integration Costs, and is calculated using diluted shares outstanding. Fiscal year 2019 Non -GAAP Adjusted earnings per share guidance estimates exclude Amortization of Acquired Intangibles and Purchased Intellectual Property, and Acquisition and Integration Costs, net of taxes, of approximately $0.60 per share. For the third quarter of Fiscal Year 2019, the guidance excludes Amortization of Acquired Intangibles and Purchased Intellectual Property, andAcquisition and Integration Costs, net of taxes, of approximately $0.15 per share. (2) Adjusted Operating income margin (Non-GAAP) is adjusted to exclude the projected impact of Amortization of Acquired Intangi bles and Purchased Intellectual Property, and Acquisition and Integration Costs. Fiscal year 2019 Non-GAAP Adjusted Operating income margin guidance estimates exclude Amortization of Acquired Intangibles and Purchased Intellectual Property, and Acquisition and Integration Costs of approximately $94 million. 2019 | 26

Broadridge Investor Relations W. Edings Thibault Investor Relations Tel: 516-472-5129 Email: [email protected] 2019 | 27

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- SBI SECURITIES Selects Broadridge's Post-trade Solution for its Equities Brokerage Services in the UK

- Relevate Power Announces Rebranding and Launches Equity Raise to Accelerate M&A Growth

- Alaska Energy Metals Files Amended NI 43-101 Technical Report for the Eureka Deposit, Nikolai Nickel Project, Alaska, USA

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share