Form 8-K BOK FINANCIAL CORP For: Jul 27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

Commission File No. 001-37811

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of Incorporation or Organization) | (IRS Employer Identification No.) | ||||||||||

| Bank of Oklahoma Tower | |||||||||||

| (Address of Principal Executive Offices) | (Zip Code) | ||||||||||

(918 ) 588-6000

(Registrant’s telephone number, including area code)

N/A

___________________________________________

(Former name or former address, if changes since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

INFORMATION TO BE INCLUDED IN THE REPORT

ITEM 2.02. Results of Operations and Financial Condition.

On July 27, 2022, BOK Financial Corporation (“BOK Financial”) issued a press release announcing its financial results for the three and six months ended June 30, 2022 (“Press Release”). The full text of the Press Release is attached as Exhibit 99.1(a) to this report and is incorporated herein by reference. On July 27, 2022, in connection with the issuance of the Press Release, BOK Financial released financial information related to the three and six months ended June 30, 2022 (“Financial Information”), which includes certain historical financial information relating to BOK Financial. The Financial Information is attached as Exhibit 99.1(b) to this report and is incorporated herein by reference.

ITEM 7.01. Regulation FD Disclosure.

On July 27, 2022, in connection with the issuance of the Press Release, BOK Financial released financial information related to the three and six months ended June 30, 2022 (“Financial Information”), which includes certain historical financial information relating to BOK Financial. The Financial Information is attached as Exhibit 99.2(a) to this report and is incorporated herein by reference.

ITEM 9.01. Financial Statements and Exhibits.

(d) Exhibits

99.1 Text of Press Release, dated July 27, 2022, titled "BOK Financial Corporation Reports Quarterly Earnings of $133 million or $1.96 Per Share in the Second Quarter" and Financial Information for the Three and Six Months Ended June 30, 2022.

99.2 Earnings conference call presentation, dated July 27, 2022 titled “Q2 Earnings Conference Call" for the Three and Six Months Ended June 30, 2022.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

BOK FINANCIAL CORPORATION

By: /s/ Steven E. Nell

Steven E. Nell

Executive Vice President

Chief Financial Officer

Date: July 27, 2022

Exhibit 99.1(a)

NASD: BOKF

BOK Financial Corporation Reports Quarterly Earnings of $133 million or $1.96 Per Share in the Second Quarter

| CEO Commentary | ||

Stacy Kymes, president and chief executive officer, stated, “The quarter represented strong earnings performance from across the company, demonstrating both our diversity and breadth. Loans are on a pace to exceed a 10 percent growth rate for the year, excluding the PPP program. While loan growth was exceptional, new loan commitments for the quarter grew at an even faster pace and broadly across our business region. Our net interest margin improved from the mix of earning assets and a balance sheet structure that is currently positioned to benefit from rising rates. Our trading businesses rebounded from the volatile first quarter. We had a strong quarter in commodity hedging and syndication activity as our market share in the energy space continues to expand. Despite market volatility and the resulting decrease in the value of assets under management and administration, our fiduciary fees increased. Transaction card revenues accelerated. We entered the year focused on growing top-line revenue and our team has responded, delivering those results across the board. While we understand these are unusual economic times, we are committed to prudent growth. The business profile of our geographic footprint remains exceptional and, when combined with BOKF's long-held credit discipline, will serve us well if the economy slows in future periods." | ||

Second Quarter 2022 Financial Highlights | ||

| (Unless indicated otherwise, all comparisons are to the prior quarter) | ||

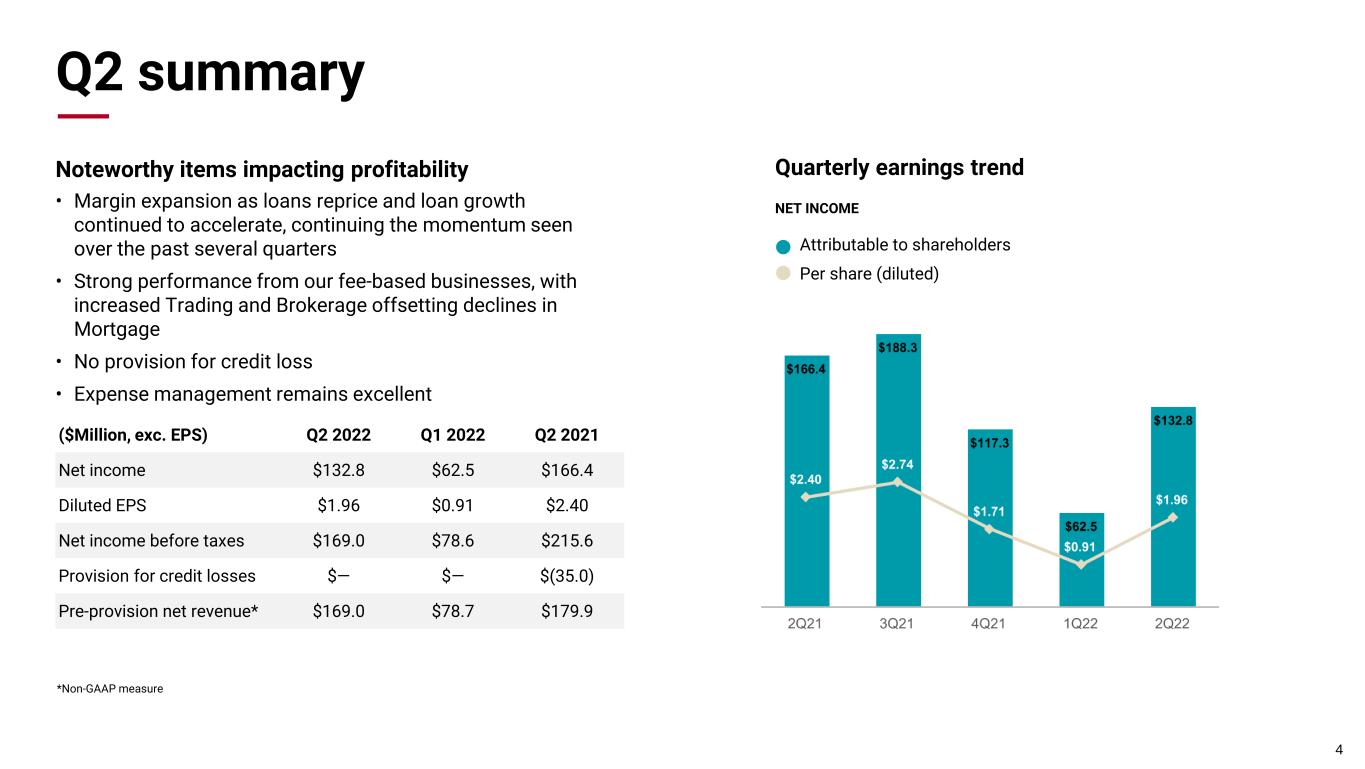

•Net income was $132.8 million or $1.96 per diluted share for the second quarter of 2022 and $62.5 million or $0.91 per diluted share for the first quarter of 2022.

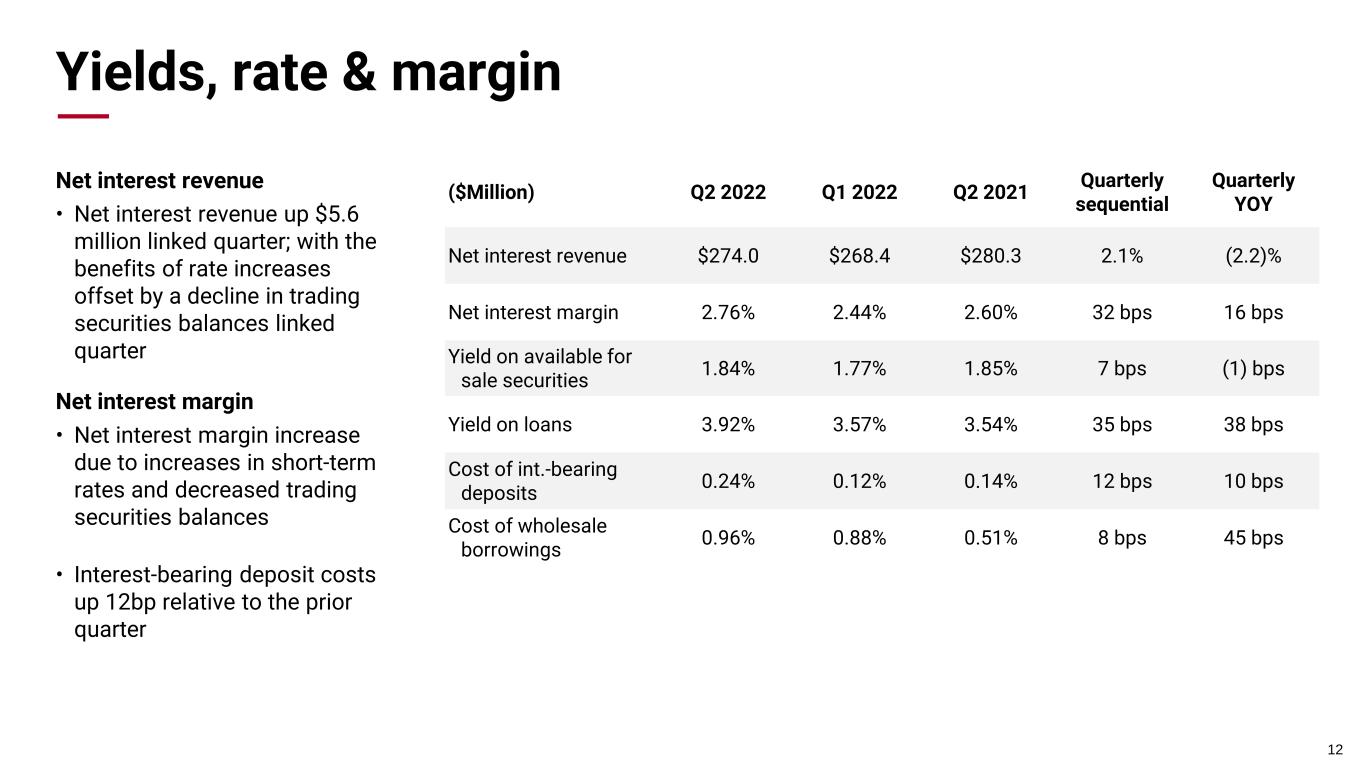

•Net interest revenue totaled $274.0 million, an increase of $5.6 million. Net interest margin was 2.76 percent compared to 2.44 percent. In response to rising inflation, the Federal Reserve has increased the federal funds rate 150 basis points since the beginning of 2022. The resulting impact on market interest rates has started to increase net interest margin.

•Fees and commissions revenue increased $75.7 million to $173.4 million. Brokerage and trading revenue increased $71.1 million following trading losses in the prior quarter. Revenue growth in all other fee-generating business activities was partially offset by a $5.3 million decrease in mortgage banking revenue.

•The net benefit of the changes in fair value of mortgage servicing rights and related economic hedges was $1.9 million for the second quarter of 2022 compared to a net cost of $8.4 million for the first quarter of 2022 due to reduced price sensitivity in the second quarter.

•Operating expense decreased $4.0 million to $273.7 million. Personnel expense decreased $4.3 million, primarily due to lower share-based compensation expense. Non-personnel expense was consistent with the prior quarter.

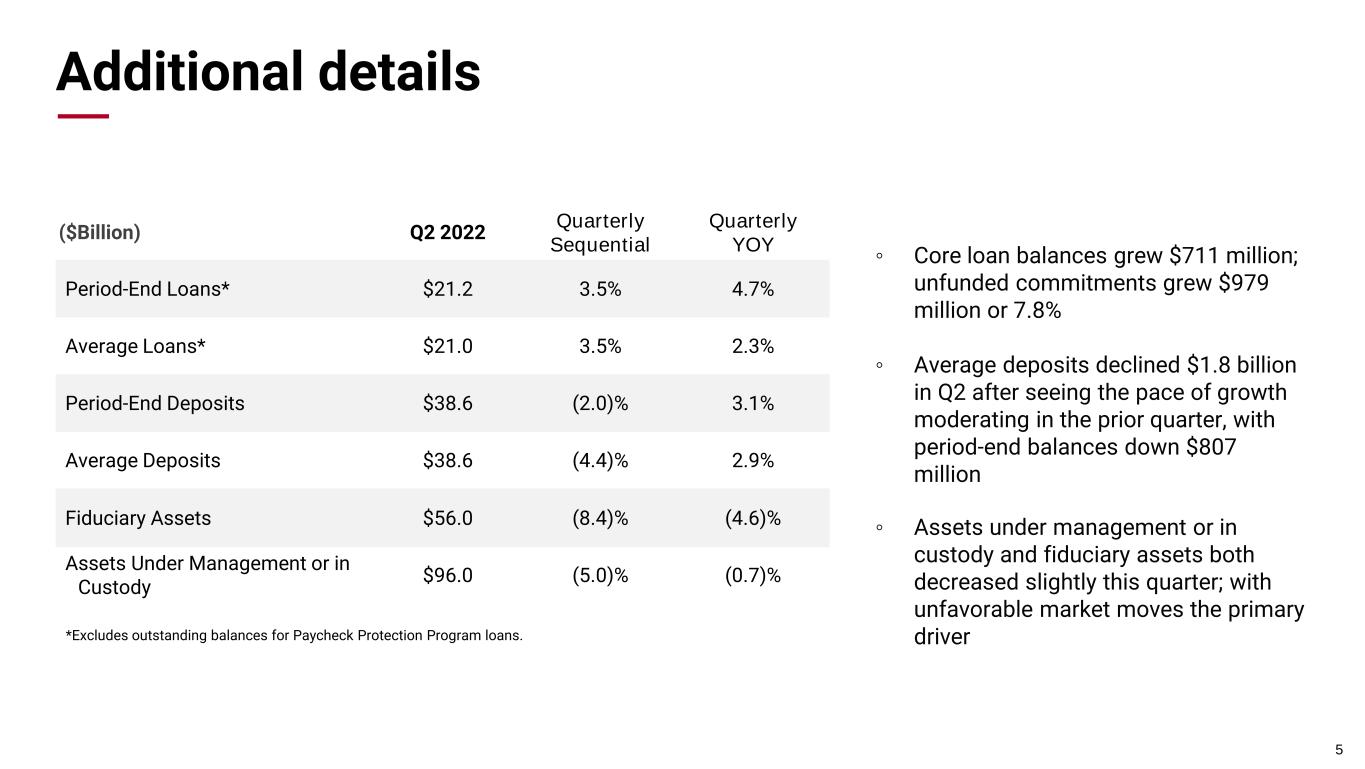

•Period-end loans increased $617 million to $21.3 billion at June 30, 2022. Commercial loans increased $696 million while period-end Paycheck Protection Program ("PPP") loans decreased $94 million to $43 million. In addition, unfunded loan commitments grew by $979 million. Average outstanding loan balances were $21.1 billion, a $594 million increase.

•No provision for expected credit losses was necessary for the second quarter of 2022, consistent with the prior quarter. An increase in required provision due to loan growth and changes in our economic outlook was offset by a sustained trend of improving credit quality metrics. The combined allowance for credit losses totaled $283 million or 1.33 percent of outstanding loans at June 30, 2022. The combined allowance for credit losses was $283 million or 1.37 percent of outstanding loans at March 31, 2022.

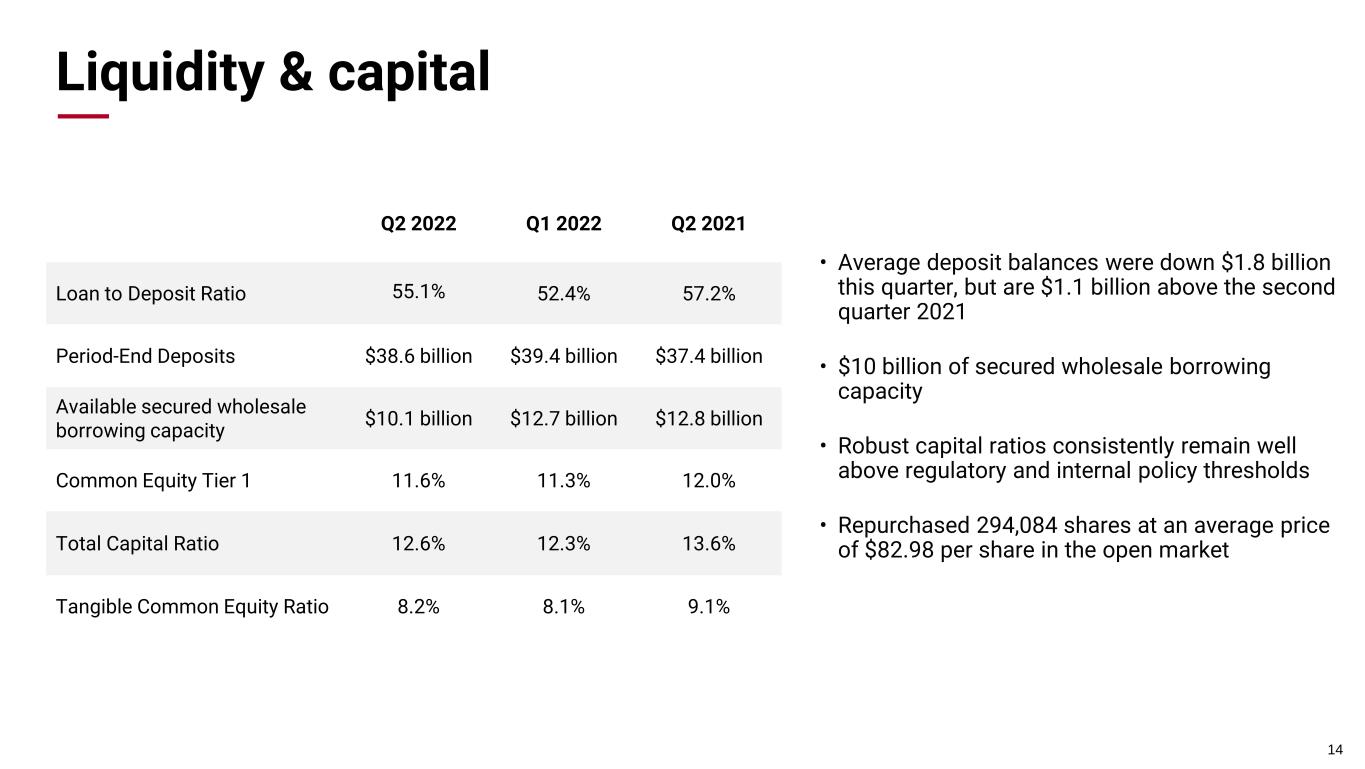

•Average deposits decreased $1.8 billion to $38.6 billion while period-end deposits decreased $807 million to $38.6 billion. Average interest-bearing deposits decreased $1.9 billion and average demand deposits grew $140 million.

1

•The company's common equity Tier 1 capital ratio was 11.61 percent at June 30, 2022. In addition, the company's Tier 1 capital ratio was 11.63 percent, total capital ratio was 12.59 percent, and leverage ratio was 9.12 percent at June 30, 2022. At March 31, 2022, the company's common equity Tier 1 capital ratio was 11.30 percent, Tier 1 capital ratio was 11.31 percent, total capital ratio was 12.25 percent, and leverage ratio was 8.47 percent.

•The company repurchased 294,084 shares of common stock at an average price of $82.98 a share in the second quarter of 2022.

Second Quarter 2022 Segment Highlights | ||

•Commercial Banking contributed $104.8 million to net income in the second quarter of 2022, an increase of $22.5 million. Combined net interest revenue and fee revenue increased $32.4 million due to loan growth, increased spreads on deposits sold to the Funds Management unit, and loan syndication fees. Net loans charged-off decreased $6.8 million. Transaction card revenue increased $2.7 million due to elevated transaction volumes in the second quarter. Personnel expense increased $3.3 million, primarily due to increased incentive compensation costs with growth in loans and syndication activity. The second quarter also included a $5.8 million write-down of a repossessed equity interest in a midstream energy entity. Average loans increased $640 million or 4 percent to $17.3 billion. Average deposits decreased $661 million or 3 percent.

•Consumer Banking contributed $1.2 million to net income in the second quarter of 2022 compared to a prior quarter net loss of $7.3 million. The net benefit of the changes in fair value of mortgage servicing rights and related economic hedges was $1.9 million for the second quarter of 2022 compared to a net cost of $8.4 million for the first quarter of 2022. Combined net interest revenue and fee revenue increased $2.7 million. Net interest revenue increased $6.6 million, primarily due to an increase in the spread on deposits sold to our Funds Management unit. Fees and commissions revenue decreased $3.9 million due to lower mortgage production volumes combined with narrowing margins. Operating expense increased $3.9 million due to a combination of increased business promotion expense and increased accruals for mortgage loan default servicing and loss mitigation costs. Average loans were relatively consistent with the previous quarter. Average deposits increased $130 million or 1 percent to $8.9 billion.

•Wealth Management contributed $27.3 million to net income in the second quarter of 2022 compared to a net loss of $4.5 million in the first quarter of 2022. Our diverse set of investment-focused businesses, which include trading in fixed income securities and other financial instruments and providing wealth management services to institutional and private wealth clients, produced total net interest and fee revenues of $124.5 million, an increase of $43.7 million. Total revenue from trading activities increased $47.4 million. Market disruptions during the first quarter of 2022 reduced demand for low-coupon, fixed-rate U.S. government agency residential mortgage-backed securities. These securities were fully sold during the second quarter. Growth in money market fund revenue, seasonal tax preparation fees and a reduction in fee waivers combined to increase fiduciary and asset management revenue $6.6 million. This increase was partially offset by a $3.2 million reduction in asset under management billable fees, consistent with market driven declines in assets under management. Operating expense increased $1.8 million, primarily due to increased volume-driven incentive compensation costs and a full quarter's impact of annual merit increases. Average loans increased $39 million or 2 percent to $2.2 billion. Average deposits decreased $1.1 billion or 12 percent to $8.5 billion as customers redeployed deposits into higher yielding alternatives. Assets under management were $96.0 billion, a decrease of $5.1 billion.

2

| Net Interest Revenue | ||||||||||||||

Net interest revenue was $274.0 million for the second quarter of 2022 compared to $268.4 million for the first quarter of 2022. Net interest margin was 2.76 percent compared to 2.44 percent. In response to rising inflation, the Federal Reserve has increased the federal funds rate 150 basis points since the beginning of 2022. The resulting impact on market interest rates has started to increase net interest margin as our earning assets reprice at a higher rate and faster pace than our interest-bearing liabilities.

Average earning assets decreased $4.4 billion. Average trading securities decreased $4.4 billion as we reduced our inventory of low-coupon mortgage-backed securities and repositioned the trading portfolio in response to rising mortgage interest rates. Average loan balances increased $594 million, largely due to growth in commercial loans, partially offset by a decrease in PPP loans. Average available for sale securities decreased $834 million while investment securities increased $416 million. We transferred $2.4 billion in U.S. government agency mortgage-backed securities from available for sale to investment securities late in the second quarter to limit the effect of future rate increases on the tangible common equity ratio. The transfer of securities did not significantly affect net interest revenue or net interest margin. Average interest bearing cash and cash equivalents decreased $207 million. Funds purchased and repurchase agreements decreased $780 million while other borrowings increased $153 million.

The yield on average earning assets was 2.96 percent, a 38 basis point increase. The loan portfolio yield increased 35 basis points to 3.92 percent. The yield on trading securities was up 29 basis points to 2.00 percent. The yield on the available for sale securities portfolio increased 7 basis points to 1.84 percent. The yield on investment securities decreased 272 basis points due to the transfer of securities from the available for sale portfolio to the investment portfolio. The yield on interest-bearing cash and cash equivalents increased 65 basis points.

Funding costs were 0.31 percent, a 10 basis point increase. The cost of interest-bearing deposits increased 12 basis points to 0.24 percent. The cost of funds purchased and repurchase agreements decreased 42 basis points to 0.53 percent while the cost of other borrowings increased 63 basis points to 1.01 percent. The benefit to net interest margin from assets funded by non-interest liabilities was 11 basis points, an increase of 4 basis points.

| Operating Revenue | ||||||||||||||

Fees and commissions revenue totaled $173.4 million for the second quarter of 2022, a $75.7 million increase compared to the first quarter of 2022.

Brokerage and trading revenue increased $71.1 million to $44.0 million, rebounding from a net loss of $27.1 million. Trading revenue increased $66.0 million. Disruption in the fixed income markets related to uncertainty around rising inflation and interest rates adversely affected the value of trading securities during the first quarter of 2022. During the second quarter, we fully sold our inventory of low-coupon, U.S. government agency residential mortgage-backed securities. Trading activity in current-coupon instruments has returned to more normal levels. Investment banking revenue increased $4.2 million, largely due to the timing of commercial loan syndication activity.

3

Fiduciary and asset management revenue increased $3.4 million, primarily due to an increase in money market fund revenue, a reduction of fee waivers, and seasonal tax preparation fees. These increases were partially offset by a reduction in asset under management billable fees, consistent with market-driven declines in assets under management. We voluntarily waived certain administration fees on the Cavanal Hill money market funds in order to maintain positive yields during the low short-term interest rate environment.

Transaction card revenue increased $2.7 million and deposit service charges increased $1.5 million, both largely affected by changes in customer activity as transaction volumes recover from the pandemic.

Mortgage banking revenue decreased $5.3 million. Rapidly rising mortgage interest rates and continued inventory shortages have adversely affected both loan production volume and margins. Mortgage loan production volume, which includes funded loans and changes in unfunded commitments, decreased $102 million to $306 million. Competitive pricing pressure and a significant decrease in refinancing opportunities, down to 19 percent of total production, have reduced margins. Production revenue, which includes realized gains on loans sold and unrealized gains and losses on our mortgage commitment pipeline and related hedges, as a percentage of production volume, decreased 140 basis points to (0.16) percent.

Other gains and losses, net decreased $6.0 million, primarily related to a write-down of a repossessed equity interest in a midstream entity.

| Operating Expense | ||||||||||||||

Total operating expense was $273.7 million for the second quarter of 2022, a decrease of $4.0 million compared to the first quarter of 2022.

Personnel expense decreased $4.3 million. Deferred compensation expense, which is largely offset by a decrease in the value of related rabbi trust investments, decreased $4.8 million. Share-based incentive compensation expense decreased $3.9 million resulting from changes in vesting assumptions. Employee benefits expense decreased $2.4 million primarily due to a seasonal decrease in payroll taxes. These decreases were partially offset by an increase of $5.0 million in cash-based incentive compensation largely related to growing commercial activity and an increase of $1.8 million in regular compensation expense as we recognized a full quarter of expense related to annual merit increases.

Non-personnel expense was $118.7 million, consistent with the first quarter of 2022. Increases in mortgage banking expense, data processing and communications expense, and professional fees and services expense were offset by a decline in net occupancy and equipment expense and other expense.

| Loans, Deposits and Capital | ||||||||||||||

Loans

Outstanding loans were $21.3 billion at June 30, 2022, a $617 million increase compared to March 31, 2022 due to growth in commercial loans. Unfunded loan commitments also grew by $979 million during the second quarter.

Outstanding commercial loan balances increased $696 million, with growth in all categories.

4

Healthcare sector loan balances increased $255 million, totaling $3.7 billion or 17 percent of total loans. Our healthcare sector loans primarily consist of $3.0 billion of senior housing and care facilities, including independent living, assisted living and skilled nursing. Generally we loan to borrowers with a portfolio of multiple facilities, which serves to help diversify risks specific to a single facility.

Energy loan balances increased $195 million to $3.4 billion or 16 percent of total loans. The majority of this portfolio is first lien, senior secured, reserve-based lending to oil and gas producers, which we believe is the lowest risk form of energy lending. Approximately 72 percent of committed production loans are secured by properties primarily producing oil. The remaining 28 percent is secured by properties primarily producing natural gas. Unfunded energy loan commitments were $3.4 billion at June 30, 2022, an increase of $342 million over March 31, 2022.

General business loans increased $175 million to $3.1 billion or 14 percent of total loans. General business loans include $1.6 billion of wholesale/retail loans and $1.5 billion of loans from other commercial industries.

Services sector loan balances increased $70 million to $3.4 billion or 16 percent of total loans. Services loans consist of a large number of loans to a variety of businesses, including Native American tribal and state and local municipal government entities, Native American tribal casino operations, foundations and not-for-profit organizations, educational services and specialty trade contractors.

Commercial real estate loan balances increased $5.2 million and represent 19 percent of total loans. Loans secured by industrial facilities increased $42 million to $954 million while loans secured by retail facilities decreased $30 million to $637 million. Other changes include an increase of $11 million in multifamily residential loans, fully offset by a decrease in other real estate loans.

PPP loan balances decreased $94 million to $43 million, or less than 1 percent of the total loans balance.

Loans to individuals increased $10 million and represent 17 percent of total loans. Total residential mortgage loans increased $32 million while personal loans decreased $22 million.

Deposits

Period-end deposits totaled $38.6 billion at June 30, 2022, an $807 million decrease as customers begin to deploy cash resources following the savings trend during the pandemic. Interest-bearing transaction account balances decreased by $1.1 billion while demand deposits increased $478 million. Period-end Wealth Management deposits decreased $587 million, Commercial Banking deposits decreased $104 million, and Consumer Banking deposits declined by $138 million. Average deposits were $38.6 billion at June 30, 2022, a $1.8 billion decrease. Average interest-bearing transaction account balances decreased $1.7 billion, and average demand deposit account balances increased $140 million.

Capital

The company's common equity Tier 1 capital ratio was 11.61 percent at June 30, 2022. In addition, the company's Tier 1 capital ratio was 11.63 percent, total capital ratio was 12.59 percent, and leverage ratio was 9.12 percent at June 30, 2022. At the beginning of 2020, we elected to delay the regulatory capital impact of the transition of the allowance for credit losses from the incurred loss methodology to CECL for two years, followed by a three-year transition period. This election added 10 basis points to the company's common equity tier 1 capital ratio at June 30. At March 31, 2022, the company's common equity Tier 1 capital ratio was 11.30 percent, Tier 1 capital ratio was 11.31 percent, total capital ratio was 12.25 percent, and leverage ratio was 8.47 percent.

5

The company's tangible common equity ratio, a non-GAAP measure, was 8.16 percent at June 30, 2022 and 8.13 percent at March 31, 2022. The tangible common equity ratio is primarily based on total shareholders' equity, which includes unrealized gains and losses on available for sale securities. The company has elected to exclude unrealized gains and losses from available for sale securities from its calculation of Tier 1 capital for regulatory capital purposes, consistent with the treatment under the previous capital rules.

The company repurchased 294,084 shares of common stock at an average price of $82.98 a share in the second quarter of 2022. We view share buybacks opportunistically, but within the context of maintaining our strong capital position.

| Credit Quality | ||||||||||||||

Expected credit losses on assets carried at amortized cost are recognized over their projected lives based on models that measure the probability of default and loss given default over a 12-month reasonable and supportable forecast period. Our models incorporate base case, downside and upside macroeconomic variables such as real gross domestic product ("GDP") growth, civilian unemployment rates and West Texas Intermediate ("WTI") oil prices on a probability weighted basis.

No provision for credit losses was necessary for the second quarter of 2022. An increase in allowance related to our lending activities from the strong loan growth during the quarter and changes in our reasonable and supportable forecast, primarily related to the economic outlook from the Federal Reserve's actions to control inflation, were offset by the impact of a sustained trend of improving credit quality metrics.

Our base case reasonable and supportable forecast assumes inflation peaks in the third quarter of 2022 and begins to normalize thereafter. We expect the Russian-Ukraine conflict remains isolated and conditions improve in the fourth quarter of 2022. GDP is projected to increase by 1.4 percent over the next twelve months as labor force participants will continue to re-enter the job market to help meet record job openings. Inflation pressures cause modest declines in real household income compared to pre-pandemic levels, but is offset by a drawdown in savings. This results in below-trend GDP growth. Our forecasted civilian unemployment rate is 3.7 percent for the third quarter of 2022, increasing to 4.0 percent by the second quarter of 2023. Our base case also assumes the Federal Reserve increases federal funds rates at each meeting through June 2023, which results in a target range of 3.50 percent to 3.75 percent. WTI oil prices are projected to generally follow the NYMEX forward curve that existed at the end of June 2022, averaging $98.15 per barrel over the next twelve months.

The probability weighting of our base case reasonable and supportable forecast decreased to 55 percent in the second quarter of 2022 compared to 60 percent in the first quarter of 2022 as the level of uncertainty in economic forecasts continued to increase. Our downside case, probability weighted at 35 percent, assumes the Russia-Ukraine conflict persists through the second quarter of 2023, but does remain isolated. Additional surges in commodity prices and exacerbated supply chain dislocations create higher levels of inflation forcing the Federal Reserve to adopt a more aggressive monetary policy to combat the inflationary environment. This results in a federal funds target range of 4.50 percent to 4.75 percent. The United States economy is pushed into a recession, with a contraction in economic activity and a sharp increase in the unemployment rate from 4.2 percent in the third quarter of 2022 to 6.9 percent in the second quarter of 2023. In this scenario, real GDP is expected to contract 1.8 percent over the next four quarters. WTI oil prices are projected to average $105.36 per barrel over the next twelve months, peaking at $130.37 in the fourth quarter of 2022 and falling 39 percent over the following two quarters.

6

Nonperforming assets totaled $333 million or 1.56 percent of outstanding loans and repossessed assets at June 30, 2022, compared to $353 million or 1.70 percent at March 31, 2022. Nonperforming assets that are not guaranteed by U.S. government agencies totaled $118 million or 0.56 percent of outstanding loans and repossessed assets at June 30, 2022, compared to $132 million or 0.65 percent at March 31, 2022.

Nonaccruing loans were $114 million or 0.54 percent of outstanding loans at June 30, 2022. Nonaccruing commercial loans totaled $55 million or 0.40 percent of outstanding commercial loans. Nonaccruing commercial real estate loans totaled $11 million or 0.27 percent of outstanding commercial real estate loans. Nonaccruing loans to individuals totaled $49 million or 1.36 percent of outstanding loans to individuals.

Nonaccruing loans decreased $10 million compared to March 31, 2022, primarily related to nonaccruing commercial real estate, energy and services loans. New nonaccruing loans identified in the second quarter totaled $4.4 million, offset by $8.4 million in payments received, $4.0 million in foreclosures and $1.4 million in gross charge-offs.

Potential problem loans, which are defined as performing loans that, based on known information, cause management concern as to the borrowers' ability to continue to perform, totaled $131 million at June 30, 2022, down from $169 million at March 31. Potential problem energy loans decreased $36 million. Potential problem services loans increased $16 million, offset by a $14 million decrease in potential problem commercial real estate loans.

At June 30, 2022, the combined allowance for loan losses and accrual for off-balance sheet credit risk from unfunded loan commitments was $283 million or 1.33 percent of outstanding loans and 295 percent of nonaccruing loans. The allowance for loan losses totaled $241 million or 1.13 percent of outstanding loans and 251 percent of nonaccruing loans excluding residential mortgage loans guaranteed by U.S. government agencies.

At March 31, 2022, the combined allowance for loan losses and accrual for off-balance sheet credit risk from unfunded loan commitments was $283 million or 1.37 percent of outstanding loans and 264 percent of nonaccruing loans. The allowance for loan losses was $246 million or 1.19 percent of outstanding loans and 230 percent of nonaccruing loans excluding residential mortgage loans guaranteed by U.S. government agencies.

Gross charge-offs were $1.4 million for the second quarter compared to $7.8 million for the first quarter of 2022. Recoveries totaled $2.2 million for the second quarter of 2022 and $1.8 million for the prior quarter leading to net recoveries of $799 thousand or 0.02 percent of average loans on an annualized basis and net charge-offs of $6.0 million or 0.12 percent of average loans on an annualized basis, respectively. Net charge-offs were 0.06 percent of average loans over the last four quarters.

7

| Securities and Derivatives | ||||||||||||||

The fair value of the available for sale securities portfolio totaled $10.2 billion at June 30, 2022, a $2.7 billion decrease compared to March 31, 2022. During the second quarter of 2022, certain U.S. government agency residential mortgage-backed securities were transferred from the available for sale portfolio to the investment securities portfolio. At the time of transfer, the fair value totaled $2.4 billion, amortized cost totaled $2.7 billion and the pretax unrealized loss totaled $268 million. At June 30, 2022, the available for sale securities portfolio consisted primarily of $4.9 billion of residential mortgage-backed securities fully backed by U.S. government agencies and $4.1 billion of commercial mortgage-backed securities fully backed by U.S. government agencies. At June 30, 2022, the available for sale securities portfolio had a net unrealized loss of $523 million compared to $547 million at March 31, 2022.

We hold an inventory of trading securities in support of sales to a variety of customers. At June 30, 2022, the trading securities portfolio totaled $2.9 billion compared to $4.9 billion at March 31, 2022. During the second quarter of 2022, we sold our low-coupon, fixed rate U.S. government agency residential mortgage-backed securities inventory.

The company also maintains a portfolio of residential mortgage-backed securities issued by U.S. government agencies and interest rate derivative contracts as an economic hedge of the changes in the fair value of our mortgage servicing rights. This portfolio of fair value option securities decreased $147 million to $38 million at June 30, 2022.

Derivative contracts are carried at fair value. At June 30, 2022, the net fair values of derivative contracts, before consideration of cash margin, reported as assets under our customer derivative programs totaled $2.0 billion compared to $2.4 billion at March 31, 2022. The aggregate net fair value of derivative contracts, before consideration of cash margin, held under these programs reported as liabilities totaled $2.0 billion at June 30, 2022 and $2.4 billion at March 31, 2022.

The net benefit of the changes in the fair value of mortgage servicing rights and related economic hedges was $1.9 million during the second quarter of 2022, including a $17.5 million increase in the fair value of mortgage servicing rights, $15.9 million decrease in the fair value of securities and derivative contracts held as an economic hedge, and $275 thousand of related net interest revenue. Three bulk mortgage servicing rights portfolios were acquired during the second quarter of 2022. These acquisitions added $3.5 billion in unpaid principal balance comprised of conventional, low note rate, strong performing loans.

8

| Conference Call and Webcast | ||||||||||||||

The company will hold a conference call at 9 a.m. Central time on Wednesday, July 27, 2022 to discuss the financial results with investors. The live audio webcast and presentation slides will be available on the company’s website at www.bokf.com. The conference call can also be accessed by dialing 1-201-689-8471. A conference call and webcast replay will also be available shortly after conclusion of the live call at www.bokf.com or by dialing 1-877-407-4018 and referencing conference ID # 13731240.

| About BOK Financial Corporation | ||||||||||||||

BOK Financial Corporation is a $45 billion regional financial services company headquartered in Tulsa, Oklahoma with $96 billion in assets under management and administration. The company's stock is publicly traded on NASDAQ under the Global Select market listings (BOKF). BOK Financial Corporation's holdings include BOKF, NA; BOK Financial Securities, Inc., BOK Financial Private Wealth, Inc. and BOK Financial Insurance, Inc. BOKF, NA's holdings include TransFund, Cavanal Hill Investment Management, Inc. and BOK Financial Asset Management, Inc. BOKF, NA operates banking divisions across eight states as: Bank of Albuquerque; Bank of Oklahoma; Bank of Texas; and BOK Financial in Arizona, Arkansas, Colorado, Kansas and Missouri; as well as having limited purpose offices in Nebraska, Wisconsin and Connecticut. Through its subsidiaries, BOK Financial Corporation provides commercial and consumer banking, brokerage trading, investment, trust and insurance services, mortgage origination and servicing, and an electronic funds transfer network. For more information, visit www.bokf.com.

The company will continue to evaluate critical assumptions and estimates, such as the appropriateness of the allowance for credit losses and asset impairment as of June 30, 2022 through the date its financial statements are filed with the Securities and Exchange Commission and will adjust amounts reported if necessary.

This news release contains forward-looking statements that are based on management's beliefs, assumptions, current expectations, estimates and projections about BOK Financial Corporation, the financial services industry, the economy generally and the expected or potential impact of the novel coronavirus (COVID-19) pandemic, and the related responses of the government, consumers, and others, on our business, financial condition and results of operations. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “plans,” “projects,” “will,” “intends,” variations of such words and similar expressions are intended to identify such forward-looking statements. Management judgments relating to and discussion of the provision and allowance for credit losses, allowance for uncertain tax positions, accruals for loss contingencies and valuation of mortgage servicing rights involve judgments as to expected events and are inherently forward-looking statements. Assessments that acquisitions and growth endeavors will be profitable are necessary statements of belief as to the outcome of future events based in part on information provided by others which BOK Financial has not independently verified. These various forward-looking statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions which are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may materially differ from what is expected, implied or forecasted in such forward-looking statements. Internal and external factors that might cause such a difference include, but are not limited to changes in government, consumer or business responses to, and ability to treat or prevent further outbreak of the COVID-19 pandemic, changes in commodity prices, interest rates and interest rate relationships, inflation, demand for products and services, the degree of competition by traditional and nontraditional competitors, changes in banking regulations, tax laws, prices, levies and assessments, the impact of technological advances, and trends in customer behavior as well as their ability to repay loans. BOK

9

Financial Corporation and its affiliates undertake no obligation to update, amend or clarify forward-looking statements, whether as a result of new information, future events, or otherwise.

10

Exhibit 99.1(b)

BALANCE SHEETS -- UNAUDITED

BOK FINANCIAL CORPORATION

(In thousands)

| June 30, 2022 | Mar. 31, 2022 | ||||||||||

| ASSETS | |||||||||||

| Cash and due from banks | $ | 1,313,563 | $ | 767,805 | |||||||

| Interest-bearing cash and cash equivalents | 723,787 | 599,976 | |||||||||

| Trading securities | 2,859,444 | 4,891,096 | |||||||||

| Investment securities, net of allowance | 2,637,345 | 183,824 | |||||||||

| Available for sale securities | 10,152,663 | 12,894,534 | |||||||||

| Fair value option securities | 37,927 | 185,003 | |||||||||

| Restricted equity securities | 95,130 | 77,389 | |||||||||

| Residential mortgage loans held for sale | 182,726 | 169,474 | |||||||||

| Loans: | |||||||||||

| Commercial | 13,578,697 | 12,883,189 | |||||||||

| Commercial real estate | 4,106,148 | 4,100,956 | |||||||||

| Paycheck protection program | 43,140 | 137,365 | |||||||||

| Loans to individuals | 3,563,163 | 3,552,919 | |||||||||

| Total loans | 21,291,148 | 20,674,429 | |||||||||

| Allowance for loan losses | (241,114) | (246,473) | |||||||||

| Loans, net of allowance | 21,050,034 | 20,427,956 | |||||||||

| Premises and equipment, net | 573,605 | 574,786 | |||||||||

| Receivables | 176,672 | 238,694 | |||||||||

| Goodwill | 1,044,749 | 1,044,749 | |||||||||

| Intangible assets, net | 83,744 | 87,761 | |||||||||

| Mortgage servicing rights | 270,312 | 209,563 | |||||||||

| Real estate and other repossessed assets, net | 22,221 | 24,492 | |||||||||

| Derivative contracts, net | 1,992,977 | 2,680,207 | |||||||||

| Cash surrender value of bank-owned life insurance | 409,937 | 407,763 | |||||||||

| Receivable on unsettled securities sales | 60,168 | 229,404 | |||||||||

| Other assets | 1,690,068 | 1,132,031 | |||||||||

| TOTAL ASSETS | $ | 45,377,072 | $ | 46,826,507 | |||||||

| LIABILITIES AND EQUITY | |||||||||||

| Deposits: | |||||||||||

| Demand | $ | 15,720,296 | $ | 15,242,341 | |||||||

| Interest-bearing transaction | 20,544,199 | 21,689,829 | |||||||||

| Savings | 984,824 | 979,365 | |||||||||

| Time | 1,369,599 | 1,514,416 | |||||||||

| Total deposits | 38,618,918 | 39,425,951 | |||||||||

| Funds purchased and repurchase agreements | 677,030 | 1,068,329 | |||||||||

| Other borrowings | 35,505 | 36,246 | |||||||||

| Subordinated debentures | 131,223 | 131,209 | |||||||||

| Accrued interest, taxes and expense | 211,419 | 238,048 | |||||||||

| Due on unsettled securities purchases | 297,352 | 81,016 | |||||||||

| Derivative contracts, net | 214,576 | 557,834 | |||||||||

| Other liabilities | 449,507 | 434,350 | |||||||||

| TOTAL LIABILITIES | 40,635,530 | 41,972,983 | |||||||||

| Shareholders' equity: | |||||||||||

| Capital, surplus and retained earnings | 5,339,967 | 5,267,408 | |||||||||

| Accumulated other comprehensive income (loss) | (602,628) | (417,826) | |||||||||

| TOTAL SHAREHOLDERS' EQUITY | 4,737,339 | 4,849,582 | |||||||||

| Non-controlling interests | 4,203 | 3,942 | |||||||||

| TOTAL EQUITY | 4,741,542 | 4,853,524 | |||||||||

| TOTAL LIABILITIES AND EQUITY | $ | 45,377,072 | $ | 46,826,507 | |||||||

11

AVERAGE BALANCE SHEETS -- UNAUDITED

BOK FINANCIAL CORPORATION

(in thousands)

| Three Months Ended | |||||||||||||||||||||||||||||

| June 30, 2022 | Mar. 31, 2022 | Dec. 31, 2021 | Sep. 30, 2021 | June 30, 2021 | |||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||

| Interest-bearing cash and cash equivalents | $ | 843,619 | $ | 1,050,409 | $ | 1,208,552 | $ | 682,788 | $ | 659,312 | |||||||||||||||||||

| Trading securities | 4,166,954 | 8,537,390 | 9,260,778 | 7,617,236 | 7,430,217 | ||||||||||||||||||||||||

| Investment securities, net of allowance | 610,983 | 195,198 | 213,188 | 218,117 | 221,401 | ||||||||||||||||||||||||

| Available for sale securities | 12,258,072 | 13,092,422 | 13,247,607 | 13,446,095 | 13,243,542 | ||||||||||||||||||||||||

| Fair value option securities | 54,832 | 75,539 | 46,458 | 56,307 | 64,864 | ||||||||||||||||||||||||

| Restricted equity securities | 167,732 | 164,484 | 137,874 | 245,485 | 208,692 | ||||||||||||||||||||||||

| Residential mortgage loans held for sale | 148,183 | 179,697 | 163,433 | 167,620 | 218,200 | ||||||||||||||||||||||||

| Loans: | |||||||||||||||||||||||||||||

| Commercial | 13,382,176 | 12,677,706 | 12,401,935 | 12,231,230 | 12,402,925 | ||||||||||||||||||||||||

| Commercial real estate | 4,061,129 | 4,059,148 | 3,838,336 | 4,218,190 | 4,395,848 | ||||||||||||||||||||||||

| Paycheck protection program | 90,312 | 210,110 | 404,261 | 792,728 | 1,668,047 | ||||||||||||||||||||||||

| Loans to individuals | 3,524,097 | 3,516,698 | 3,598,121 | 3,606,460 | 3,700,269 | ||||||||||||||||||||||||

| Total loans | 21,057,714 | 20,463,662 | 20,242,653 | 20,848,608 | 22,167,089 | ||||||||||||||||||||||||

| Allowance for loan losses | (246,064) | (254,191) | (271,794) | (306,125) | (345,269) | ||||||||||||||||||||||||

| Loans, net of allowance | 20,811,650 | 20,209,471 | 19,970,859 | 20,542,483 | 21,821,820 | ||||||||||||||||||||||||

| Total earning assets | 39,062,025 | 43,504,610 | 44,248,749 | 42,976,131 | 43,868,048 | ||||||||||||||||||||||||

| Cash and due from banks | 822,599 | 790,440 | 783,670 | 766,688 | 763,393 | ||||||||||||||||||||||||

Derivative contracts, net | 3,051,429 | 2,126,282 | 1,441,869 | 1,501,736 | 1,022,137 | ||||||||||||||||||||||||

Cash surrender value of bank-owned life insurance | 408,489 | 406,379 | 404,149 | 401,926 | 401,760 | ||||||||||||||||||||||||

| Receivable on unsettled securities sales | 457,165 | 375,616 | 585,901 | 632,539 | 716,700 | ||||||||||||||||||||||||

| Other assets | 3,486,691 | 3,357,747 | 3,139,718 | 3,220,129 | 3,424,884 | ||||||||||||||||||||||||

| TOTAL ASSETS | $ | 47,288,398 | $ | 50,561,074 | $ | 50,604,056 | $ | 49,499,149 | $ | 50,196,922 | |||||||||||||||||||

| LIABILITIES AND EQUITY | |||||||||||||||||||||||||||||

| Deposits: | |||||||||||||||||||||||||||||

| Demand | $ | 15,202,597 | $ | 15,062,282 | $ | 14,818,841 | $ | 13,670,656 | $ | 13,189,954 | |||||||||||||||||||

| Interest-bearing transaction | 21,037,294 | 22,763,479 | 22,326,401 | 21,435,736 | 21,491,145 | ||||||||||||||||||||||||

| Savings | 981,493 | 947,407 | 909,131 | 888,011 | 872,618 | ||||||||||||||||||||||||

| Time | 1,373,036 | 1,589,039 | 1,747,715 | 1,839,983 | 1,936,510 | ||||||||||||||||||||||||

| Total deposits | 38,594,420 | 40,362,207 | 39,802,088 | 37,834,386 | 37,490,227 | ||||||||||||||||||||||||

Funds purchased and repurchase agreements | 1,224,134 | 2,004,466 | 2,893,128 | 1,448,800 | 1,790,490 | ||||||||||||||||||||||||

| Other borrowings | 1,301,358 | 1,148,440 | 880,837 | 2,546,083 | 3,608,369 | ||||||||||||||||||||||||

| Subordinated debentures | 131,219 | 131,228 | 131,224 | 214,654 | 276,034 | ||||||||||||||||||||||||

| Derivative contracts, net | 535,574 | 682,435 | 320,757 | 434,334 | 366,202 | ||||||||||||||||||||||||

| Due on unsettled securities purchases | 380,332 | 519,097 | 629,642 | 957,538 | 701,495 | ||||||||||||||||||||||||

| Other liabilities | 389,031 | 565,350 | 578,091 | 619,913 | 634,460 | ||||||||||||||||||||||||

| TOTAL LIABILITIES | 42,556,068 | 45,413,223 | 45,235,767 | 44,055,708 | 44,867,277 | ||||||||||||||||||||||||

| Total equity | 4,732,330 | 5,147,851 | 5,368,289 | 5,443,441 | 5,329,645 | ||||||||||||||||||||||||

| TOTAL LIABILITIES AND EQUITY | $ | 47,288,398 | $ | 50,561,074 | $ | 50,604,056 | $ | 49,499,149 | $ | 50,196,922 | |||||||||||||||||||

12

STATEMENTS OF EARNINGS -- UNAUDITED

BOK FINANCIAL CORPORATION

(in thousands, except per share data)

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||

| June 30, | June 30, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Interest revenue | $ | 294,247 | $ | 295,893 | $ | 577,346 | $ | 594,132 | |||||||||||||||

| Interest expense | 20,229 | 15,584 | 34,917 | 33,403 | |||||||||||||||||||

| Net interest revenue | 274,018 | 280,309 | 542,429 | 560,729 | |||||||||||||||||||

| Provision for credit losses | — | (35,000) | — | (60,000) | |||||||||||||||||||

Net interest revenue after provision for credit losses | 274,018 | 315,309 | 542,429 | 620,729 | |||||||||||||||||||

| Other operating revenue: | |||||||||||||||||||||||

| Brokerage and trading revenue | 44,043 | 29,408 | 16,964 | 50,190 | |||||||||||||||||||

| Transaction card revenue | 26,940 | 24,923 | 51,156 | 47,353 | |||||||||||||||||||

| Fiduciary and asset management revenue | 49,838 | 44,832 | 96,237 | 86,154 | |||||||||||||||||||

| Deposit service charges and fees | 28,500 | 25,861 | 55,504 | 50,070 | |||||||||||||||||||

| Mortgage banking revenue | 11,368 | 21,219 | 28,018 | 58,332 | |||||||||||||||||||

| Other revenue | 12,684 | 23,172 | 23,129 | 39,468 | |||||||||||||||||||

| Total fees and commissions | 173,373 | 169,415 | 271,008 | 331,567 | |||||||||||||||||||

| Other gains (losses), net | (7,639) | 16,449 | (9,283) | 26,570 | |||||||||||||||||||

| Gain (loss) on derivatives, net | (13,569) | 18,820 | (60,550) | (8,830) | |||||||||||||||||||

| Loss on fair value option securities, net | (2,221) | (1,627) | (13,422) | (3,537) | |||||||||||||||||||

| Change in fair value of mortgage servicing rights | 17,485 | (13,041) | 66,595 | 20,833 | |||||||||||||||||||

| Gain on available for sale securities, net | 1,188 | 1,430 | 2,125 | 1,897 | |||||||||||||||||||

| Total other operating revenue | 168,617 | 191,446 | 256,473 | 368,500 | |||||||||||||||||||

| Other operating expense: | |||||||||||||||||||||||

| Personnel | 154,923 | 172,035 | 314,151 | 345,045 | |||||||||||||||||||

| Business promotion | 6,325 | 2,744 | 12,838 | 4,898 | |||||||||||||||||||

| Charitable contributions to BOKF Foundation | — | — | — | 4,000 | |||||||||||||||||||

| Professional fees and services | 12,475 | 12,361 | 23,888 | 24,341 | |||||||||||||||||||

| Net occupancy and equipment | 27,489 | 26,633 | 58,344 | 53,295 | |||||||||||||||||||

| Insurance | 4,728 | 3,660 | 9,011 | 8,280 | |||||||||||||||||||

| Data processing and communications | 41,280 | 36,418 | 81,116 | 73,885 | |||||||||||||||||||

| Printing, postage and supplies | 3,929 | 4,285 | 7,618 | 7,725 | |||||||||||||||||||

| Amortization of intangible assets | 4,049 | 4,578 | 8,013 | 9,385 | |||||||||||||||||||

| Mortgage banking costs | 9,437 | 11,126 | 17,314 | 25,069 | |||||||||||||||||||

| Other expense | 9,020 | 17,312 | 18,980 | 31,013 | |||||||||||||||||||

| Total other operating expense | 273,655 | 291,152 | 551,273 | 586,936 | |||||||||||||||||||

| Net income before taxes | 168,980 | 215,603 | 247,629 | 402,293 | |||||||||||||||||||

| Federal and state income taxes | 36,122 | 48,496 | 52,319 | 90,878 | |||||||||||||||||||

| Net income | 132,858 | 167,107 | 195,310 | 311,415 | |||||||||||||||||||

| Net loss attributable to non-controlling interests | 12 | 686 | (24) | (1,066) | |||||||||||||||||||

Net income attributable to BOK Financial Corporation shareholders | $ | 132,846 | $ | 166,421 | $ | 195,334 | $ | 312,481 | |||||||||||||||

| Average shares outstanding: | |||||||||||||||||||||||

| Basic | 67,453,748 | 68,815,666 | 67,616,396 | 68,975,743 | |||||||||||||||||||

| Diluted | 67,455,172 | 68,817,442 | 67,617,834 | 68,978,798 | |||||||||||||||||||

| Net income per share: | |||||||||||||||||||||||

| Basic | $ | 1.96 | $ | 2.40 | $ | 2.87 | $ | 4.50 | |||||||||||||||

| Diluted | $ | 1.96 | $ | 2.40 | $ | 2.87 | $ | 4.50 | |||||||||||||||

13

FINANCIAL HIGHLIGHTS -- UNAUDITED

BOK FINANCIAL CORPORATION

(in thousands, except ratio and share data)

| Three Months Ended | |||||||||||||||||||||||||||||

| June 30, 2022 | Mar. 31, 2022 | Dec. 31, 2021 | Sep. 30, 2021 | June 30, 2021 | |||||||||||||||||||||||||

| Capital: | |||||||||||||||||||||||||||||

| Period-end shareholders' equity | $ | 4,737,339 | $ | 4,849,582 | $ | 5,363,732 | $ | 5,388,973 | $ | 5,332,977 | |||||||||||||||||||

| Risk weighted assets | $ | 36,792,067 | $ | 37,160,258 | $ | 34,575,277 | $ | 33,916,456 | $ | 33,824,860 | |||||||||||||||||||

| Risk-based capital ratios: | |||||||||||||||||||||||||||||

| Common equity tier 1 | 11.61 | % | 11.30 | % | 12.24 | % | 12.26 | % | 11.95 | % | |||||||||||||||||||

| Tier 1 | 11.63 | % | 11.31 | % | 12.25 | % | 12.29 | % | 12.01 | % | |||||||||||||||||||

| Total capital | 12.59 | % | 12.25 | % | 13.29 | % | 13.38 | % | 13.61 | % | |||||||||||||||||||

| Leverage ratio | 9.12 | % | 8.47 | % | 8.55 | % | 8.77 | % | 8.58 | % | |||||||||||||||||||

Tangible common equity ratio1 | 8.16 | % | 8.13 | % | 8.61 | % | 9.28 | % | 9.09 | % | |||||||||||||||||||

| Common stock: | |||||||||||||||||||||||||||||

| Book value per share | $ | 69.87 | $ | 71.21 | $ | 78.34 | $ | 78.56 | $ | 77.20 | |||||||||||||||||||

| Tangible book value per share | $ | 53.22 | $ | 54.58 | $ | 61.74 | $ | 61.93 | $ | 60.50 | |||||||||||||||||||

| Market value per share: | |||||||||||||||||||||||||||||

| High | $ | 94.76 | $ | 119.59 | $ | 110.21 | $ | 92.97 | $ | 93.00 | |||||||||||||||||||

| Low | $ | 74.03 | $ | 93.76 | $ | 89.01 | $ | 77.20 | $ | 83.59 | |||||||||||||||||||

| Cash dividends paid | $ | 35,892 | $ | 36,093 | $ | 36,256 | $ | 35,725 | $ | 35,925 | |||||||||||||||||||

| Dividend payout ratio | 27.02 | % | 57.76 | % | 30.90 | % | 18.97 | % | 21.59 | % | |||||||||||||||||||

| Shares outstanding, net | 67,806,005 | 68,104,043 | 68,467,772 | 68,596,764 | 69,078,458 | ||||||||||||||||||||||||

| Stock buy-back program: | |||||||||||||||||||||||||||||

| Shares repurchased | 294,084 | 475,877 | 128,522 | 478,141 | 492,994 | ||||||||||||||||||||||||

| Amount | $ | 24,404 | $ | 48,074 | $ | 13,426 | $ | 40,644 | $ | 43,797 | |||||||||||||||||||

| Average price per share | $ | 82.98 | $ | 101.02 | $ | 104.46 | $ | 85.00 | $ | 88.84 | |||||||||||||||||||

Performance ratios (quarter annualized): | |||||||||||||||||||||||||||||

| Return on average assets | 1.13 | % | 0.50 | % | 0.92 | % | 1.51 | % | 1.33 | % | |||||||||||||||||||

| Return on average equity | 11.27 | % | 4.93 | % | 8.68 | % | 13.78 | % | 12.58 | % | |||||||||||||||||||

| Net interest margin | 2.76 | % | 2.44 | % | 2.52 | % | 2.66 | % | 2.60 | % | |||||||||||||||||||

| Efficiency ratio | 60.65 | % | 75.07 | % | 70.14 | % | 61.23 | % | 64.20 | % | |||||||||||||||||||

| Reconciliation of non-GAAP measures: | |||||||||||||||||||||||||||||

1 Tangible common equity ratio: | |||||||||||||||||||||||||||||

| Total shareholders' equity | $ | 4,737,339 | $ | 4,849,582 | $ | 5,363,732 | $ | 5,388,973 | $ | 5,332,977 | |||||||||||||||||||

Less: Goodwill and intangible assets, net | 1,128,493 | 1,132,510 | 1,136,527 | 1,140,935 | 1,153,785 | ||||||||||||||||||||||||

| Tangible common equity | $ | 3,608,846 | $ | 3,717,072 | $ | 4,227,205 | $ | 4,248,038 | $ | 4,179,192 | |||||||||||||||||||

| Total assets | $ | 45,377,072 | $ | 46,826,507 | $ | 50,249,431 | $ | 46,923,409 | $ | 47,154,375 | |||||||||||||||||||

Less: Goodwill and intangible assets, net | 1,128,493 | 1,132,510 | 1,136,527 | 1,140,935 | 1,153,785 | ||||||||||||||||||||||||

| Tangible assets | $ | 44,248,579 | $ | 45,693,997 | $ | 49,112,904 | $ | 45,782,474 | $ | 46,000,590 | |||||||||||||||||||

| Tangible common equity ratio | 8.16 | % | 8.13 | % | 8.61 | % | 9.28 | % | 9.09 | % | |||||||||||||||||||

14

| Three Months Ended | |||||||||||||||||||||||||||||

| June 30, 2022 | Mar. 31, 2022 | Dec. 31, 2021 | Sep. 30, 2021 | June 30, 2021 | |||||||||||||||||||||||||

| Pre-provision net revenue: | |||||||||||||||||||||||||||||

| Net income before taxes | $ | 168,980 | $ | 78,649 | $ | 152,025 | $ | 241,782 | $ | 215,603 | |||||||||||||||||||

| Provision for expected credit losses | — | — | (17,000) | (23,000) | (35,000) | ||||||||||||||||||||||||

| Net income (loss) attributable to non-controlling interests | 12 | (36) | (129) | (601) | 686 | ||||||||||||||||||||||||

| Pre-provision net revenue | $ | 168,968 | $ | 78,685 | $ | 135,154 | $ | 219,383 | $ | 179,917 | |||||||||||||||||||

| Other data: | |||||||||||||||||||||||||||||

| Tax equivalent interest | $ | 2,040 | $ | 1,973 | $ | 2,104 | $ | 2,217 | $ | 2,320 | |||||||||||||||||||

| Net unrealized gain (loss) on available for sale securities | $ | (522,812) | $ | (546,598) | $ | 93,381 | $ | 221,487 | $ | 297,267 | |||||||||||||||||||

| Mortgage banking: | |||||||||||||||||||||||||||||

| Mortgage production revenue | $ | (504) | $ | 5,055 | $ | 10,018 | $ | 15,403 | $ | 10,004 | |||||||||||||||||||

| Mortgage loans funded for sale | $ | 360,237 | $ | 418,866 | $ | 568,507 | $ | 652,336 | $ | 754,893 | |||||||||||||||||||

Add: current period-end outstanding commitments | 106,004 | 160,260 | 171,412 | 239,066 | 276,154 | ||||||||||||||||||||||||

Less: prior period end outstanding commitments | 160,260 | 171,412 | 239,066 | 276,154 | 387,465 | ||||||||||||||||||||||||

Total mortgage production volume | $ | 305,981 | $ | 407,714 | $ | 500,853 | $ | 615,248 | $ | 643,582 | |||||||||||||||||||

Mortgage loan refinances to mortgage loans funded for sale | 19 | % | 45 | % | 51 | % | 48 | % | 48 | % | |||||||||||||||||||

| Realized margin on funded mortgage loans | 0.88 | % | 1.64 | % | 2.34 | % | 2.48 | % | 2.75 | % | |||||||||||||||||||

| Production revenue as a percentage of production volume | (0.16) | % | 1.24 | % | 2.00 | % | 2.50 | % | 1.55 | % | |||||||||||||||||||

| Mortgage servicing revenue | $ | 11,872 | $ | 11,595 | $ | 11,260 | $ | 10,883 | $ | 11,215 | |||||||||||||||||||

Average outstanding principal balance of mortgage loans serviced for others | 17,336,596 | 16,155,329 | 15,930,480 | 14,899,306 | 15,065,173 | ||||||||||||||||||||||||

| Average mortgage servicing revenue rates | 0.27 | % | 0.29 | % | 0.28 | % | 0.29 | % | 0.30 | % | |||||||||||||||||||

Gain (loss) on mortgage servicing rights, net of economic hedge: | |||||||||||||||||||||||||||||

Gain (loss) on mortgage hedge derivative contracts, net | $ | (13,639) | $ | (46,694) | $ | (4,862) | $ | (5,829) | $ | 18,764 | |||||||||||||||||||

Gain (loss) on fair value option securities, net | (2,221) | (11,201) | 1,418 | (120) | (1,627) | ||||||||||||||||||||||||

Gain (loss) on economic hedge of mortgage servicing rights | (15,860) | (57,895) | (3,444) | (5,949) | 17,137 | ||||||||||||||||||||||||

Gain (loss) on changes in fair value of mortgage servicing rights | 17,485 | 49,110 | 7,859 | 12,945 | (13,041) | ||||||||||||||||||||||||

| Gain (loss) on changes in fair value of mortgage servicing rights, net of economic hedges, included in other operating revenue | 1,625 | (8,785) | 4,415 | 6,996 | 4,096 | ||||||||||||||||||||||||

Net interest revenue on fair value option securities2 | 275 | 383 | 259 | 286 | 341 | ||||||||||||||||||||||||

| Total economic benefit (cost) of changes in the fair value of mortgage servicing rights, net of economic hedges | $ | 1,900 | $ | (8,402) | $ | 4,674 | $ | 7,282 | $ | 4,437 | |||||||||||||||||||

2 Actual interest earned on fair value option securities less internal transfer-priced cost of funds.

15

QUARTERLY EARNINGS TREND -- UNAUDITED

BOK FINANCIAL CORPORATION

(in thousands, except ratio and per share data)

| Three Months Ended | |||||||||||||||||||||||||||||

| June 30, 2022 | Mar. 31, 2022 | Dec. 31, 2021 | Sep. 30, 2021 | June 30, 2021 | |||||||||||||||||||||||||

| Interest revenue | $ | 294,247 | $ | 283,099 | $ | 292,334 | $ | 293,463 | $ | 295,893 | |||||||||||||||||||

| Interest expense | 20,229 | 14,688 | 15,257 | 13,236 | 15,584 | ||||||||||||||||||||||||

| Net interest revenue | 274,018 | 268,411 | 277,077 | 280,227 | 280,309 | ||||||||||||||||||||||||

| Provision for credit losses | — | — | (17,000) | (23,000) | (35,000) | ||||||||||||||||||||||||

Net interest revenue after provision for credit losses | 274,018 | 268,411 | 294,077 | 303,227 | 315,309 | ||||||||||||||||||||||||

| Other operating revenue: | |||||||||||||||||||||||||||||

| Brokerage and trading revenue | 44,043 | (27,079) | 14,869 | 47,930 | 29,408 | ||||||||||||||||||||||||

| Transaction card revenue | 26,940 | 24,216 | 24,998 | 24,632 | 24,923 | ||||||||||||||||||||||||

| Fiduciary and asset management revenue | 49,838 | 46,399 | 46,872 | 45,248 | 44,832 | ||||||||||||||||||||||||

| Deposit service charges and fees | 28,500 | 27,004 | 26,718 | 27,429 | 25,861 | ||||||||||||||||||||||||

| Mortgage banking revenue | 11,368 | 16,650 | 21,278 | 26,286 | 21,219 | ||||||||||||||||||||||||

| Other revenue | 12,684 | 10,445 | 11,586 | 18,896 | 23,172 | ||||||||||||||||||||||||

| Total fees and commissions | 173,373 | 97,635 | 146,321 | 190,421 | 169,415 | ||||||||||||||||||||||||

| Other gains (losses), net | (7,639) | (1,644) | 6,081 | 31,091 | 16,449 | ||||||||||||||||||||||||

| Gain (loss) on derivatives, net | (13,569) | (46,981) | (4,788) | (5,760) | 18,820 | ||||||||||||||||||||||||

Gain (loss) on fair value option securities, net | (2,221) | (11,201) | 1,418 | (120) | (1,627) | ||||||||||||||||||||||||

Change in fair value of mortgage servicing rights | 17,485 | 49,110 | 7,859 | 12,945 | (13,041) | ||||||||||||||||||||||||

| Gain on available for sale securities, net | 1,188 | 937 | 552 | 1,255 | 1,430 | ||||||||||||||||||||||||

| Total other operating revenue | 168,617 | 87,856 | 157,443 | 229,832 | 191,446 | ||||||||||||||||||||||||

| Other operating expense: | |||||||||||||||||||||||||||||

| Personnel | 154,923 | 159,228 | 174,474 | 175,863 | 172,035 | ||||||||||||||||||||||||

| Business promotion | 6,325 | 6,513 | 6,452 | 4,939 | 2,744 | ||||||||||||||||||||||||

Charitable contributions to BOKF Foundation | — | — | 5,000 | — | — | ||||||||||||||||||||||||

| Professional fees and services | 12,475 | 11,413 | 14,129 | 12,436 | 12,361 | ||||||||||||||||||||||||

| Net occupancy and equipment | 27,489 | 30,855 | 26,897 | 28,395 | 26,633 | ||||||||||||||||||||||||

| Insurance | 4,728 | 4,283 | 3,889 | 3,712 | 3,660 | ||||||||||||||||||||||||

Data processing and communications | 41,280 | 39,836 | 39,358 | 38,371 | 36,418 | ||||||||||||||||||||||||

| Printing, postage and supplies | 3,929 | 3,689 | 2,935 | 3,558 | 4,285 | ||||||||||||||||||||||||

Amortization of intangible assets | 4,049 | 3,964 | 4,438 | 4,488 | 4,578 | ||||||||||||||||||||||||

| Mortgage banking costs | 9,437 | 7,877 | 8,667 | 8,962 | 11,126 | ||||||||||||||||||||||||

| Other expense | 9,020 | 9,960 | 13,256 | 10,553 | 17,312 | ||||||||||||||||||||||||

| Total other operating expense | 273,655 | 277,618 | 299,495 | 291,277 | 291,152 | ||||||||||||||||||||||||

| Net income before taxes | 168,980 | 78,649 | 152,025 | 241,782 | 215,603 | ||||||||||||||||||||||||

| Federal and state income taxes | 36,122 | 16,197 | 34,836 | 54,061 | 48,496 | ||||||||||||||||||||||||

| Net income | 132,858 | 62,452 | 117,189 | 187,721 | 167,107 | ||||||||||||||||||||||||

Net income (loss) attributable to non-controlling interests | 12 | (36) | (129) | (601) | 686 | ||||||||||||||||||||||||

Net income attributable to BOK Financial Corporation shareholders | $ | 132,846 | $ | 62,488 | $ | 117,318 | $ | 188,322 | $ | 166,421 | |||||||||||||||||||

| Average shares outstanding: | |||||||||||||||||||||||||||||

| Basic | 67,453,748 | 67,812,400 | 68,069,160 | 68,359,125 | 68,815,666 | ||||||||||||||||||||||||

| Diluted | 67,455,172 | 67,813,851 | 68,070,910 | 68,360,871 | 68,817,442 | ||||||||||||||||||||||||

| Net income per share: | |||||||||||||||||||||||||||||

| Basic | $ | 1.96 | $ | 0.91 | $ | 1.71 | $ | 2.74 | $ | 2.40 | |||||||||||||||||||

| Diluted | $ | 1.96 | $ | 0.91 | $ | 1.71 | $ | 2.74 | $ | 2.40 | |||||||||||||||||||

16

LOANS TREND -- UNAUDITED

BOK FINANCIAL CORPORATION

(In thousands)

| June 30, 2022 | Mar. 31, 2022 | Dec. 31, 2021 | Sep. 30, 2021 | June 30, 2021 | ||||||||||||||||||||||||||||

| Commercial: | ||||||||||||||||||||||||||||||||

| Healthcare | $ | 3,696,963 | $ | 3,441,732 | $ | 3,414,940 | $ | 3,347,641 | $ | 3,381,261 | ||||||||||||||||||||||

| Services | 3,421,493 | 3,351,495 | 3,367,193 | 3,323,422 | 3,389,756 | |||||||||||||||||||||||||||

| Energy | 3,393,072 | 3,197,667 | 3,006,884 | 2,814,059 | 3,011,331 | |||||||||||||||||||||||||||

| General business | 3,067,169 | 2,892,295 | 2,717,448 | 2,690,018 | 2,690,559 | |||||||||||||||||||||||||||

| Total commercial | 13,578,697 | 12,883,189 | 12,506,465 | 12,175,140 | 12,472,907 | |||||||||||||||||||||||||||

| Commercial real estate: | ||||||||||||||||||||||||||||||||

| Office | 1,100,115 | 1,097,516 | 1,040,963 | 1,030,755 | 1,073,346 | |||||||||||||||||||||||||||

| Industrial | 953,626 | 911,928 | 766,125 | 890,316 | 824,577 | |||||||||||||||||||||||||||

| Multifamily | 878,565 | 867,288 | 786,404 | 875,586 | 964,824 | |||||||||||||||||||||||||||

| Retail | 637,304 | 667,561 | 679,917 | 766,402 | 784,445 | |||||||||||||||||||||||||||

Residential construction and land development | 111,575 | 120,506 | 120,016 | 118,416 | 128,939 | |||||||||||||||||||||||||||

| Other commercial real estate | 424,963 | 436,157 | 437,900 | 435,417 | 470,861 | |||||||||||||||||||||||||||

| Total commercial real estate | 4,106,148 | 4,100,956 | 3,831,325 | 4,116,892 | 4,246,992 | |||||||||||||||||||||||||||

| Paycheck protection program | 43,140 | 137,365 | 276,341 | 536,052 | 1,121,583 | |||||||||||||||||||||||||||

| Loans to individuals: | ||||||||||||||||||||||||||||||||

| Residential mortgage | 1,784,729 | 1,723,506 | 1,722,170 | 1,747,243 | 1,772,627 | |||||||||||||||||||||||||||

| Residential mortgages guaranteed by U.S. government agencies | 293,838 | 322,581 | 354,173 | 376,986 | 413,806 | |||||||||||||||||||||||||||

| Personal | 1,484,596 | 1,506,832 | 1,515,206 | 1,395,623 | 1,388,534 | |||||||||||||||||||||||||||

| Total loans to individuals | 3,563,163 | 3,552,919 | 3,591,549 | 3,519,852 | 3,574,967 | |||||||||||||||||||||||||||

| Total | $ | 21,291,148 | $ | 20,674,429 | $ | 20,205,680 | $ | 20,347,936 | $ | 21,416,449 | ||||||||||||||||||||||

17

LOANS MANAGED BY PRINCIPAL MARKET AREA -- UNAUDITED

BOK FINANCIAL CORPORATION

(in thousands)

| June 30, 2022 | Mar. 31, 2022 | Dec. 31, 2021 | Sep. 30, 2021 | June 30, 2021 | |||||||||||||||||||||||||

| Texas: | |||||||||||||||||||||||||||||

| Commercial | $ | 6,631,658 | $ | 6,254,883 | $ | 6,068,700 | $ | 5,815,562 | $ | 5,690,901 | |||||||||||||||||||

| Commercial real estate | 1,339,452 | 1,345,105 | 1,253,439 | 1,383,871 | 1,403,751 | ||||||||||||||||||||||||

| Paycheck protection program | 14,040 | 31,242 | 81,654 | 115,623 | 342,933 | ||||||||||||||||||||||||

| Loans to individuals | 934,856 | 957,320 | 942,982 | 901,121 | 885,619 | ||||||||||||||||||||||||

| Total Texas | 8,920,006 | 8,588,550 | 8,346,775 | 8,216,177 | 8,323,204 | ||||||||||||||||||||||||

| Oklahoma: | |||||||||||||||||||||||||||||

| Commercial | 3,125,764 | 2,883,663 | 2,633,014 | 2,590,887 | 2,840,560 | ||||||||||||||||||||||||

| Commercial real estate | 576,458 | 552,310 | 546,021 | 552,184 | 552,673 | ||||||||||||||||||||||||

| Paycheck protection program | 13,329 | 52,867 | 69,817 | 192,474 | 242,880 | ||||||||||||||||||||||||

| Loans to individuals | 1,982,247 | 1,977,886 | 2,024,404 | 2,014,099 | 2,063,419 | ||||||||||||||||||||||||

| Total Oklahoma | 5,697,798 | 5,466,726 | 5,273,256 | 5,349,644 | 5,699,532 | ||||||||||||||||||||||||

| Colorado: | |||||||||||||||||||||||||||||

| Commercial | 2,074,455 | 1,977,773 | 1,936,149 | 1,874,613 | 1,904,182 | ||||||||||||||||||||||||

| Commercial real estate | 473,231 | 480,740 | 470,937 | 526,653 | 656,521 | ||||||||||||||||||||||||

| Paycheck protection program | 8,233 | 28,584 | 82,781 | 140,470 | 299,712 | ||||||||||||||||||||||||

| Loans to individuals | 234,105 | 236,125 | 256,533 | 249,298 | 262,796 | ||||||||||||||||||||||||

| Total Colorado | 2,790,024 | 2,723,222 | 2,746,400 | 2,791,034 | 3,123,211 | ||||||||||||||||||||||||

| Arizona: | |||||||||||||||||||||||||||||

| Commercial | 1,080,228 | 1,074,551 | 1,130,798 | 1,194,801 | 1,239,270 | ||||||||||||||||||||||||

| Commercial real estate | 766,767 | 719,970 | 674,309 | 734,174 | 705,497 | ||||||||||||||||||||||||

| Paycheck protection program | 5,173 | 11,644 | 21,594 | 42,815 | 104,946 | ||||||||||||||||||||||||

| Loans to individuals | 212,870 | 190,746 | 186,528 | 182,506 | 178,481 | ||||||||||||||||||||||||

| Total Arizona | 2,065,038 | 1,996,911 | 2,013,229 | 2,154,296 | 2,228,194 | ||||||||||||||||||||||||

| Kansas/Missouri: | |||||||||||||||||||||||||||||

| Commercial | 338,337 | 334,371 | 338,697 | 336,414 | 388,291 | ||||||||||||||||||||||||

| Commercial real estate | 458,157 | 436,740 | 382,761 | 408,001 | 406,055 | ||||||||||||||||||||||||

| Paycheck protection program | 573 | 2,595 | 4,718 | 6,920 | 41,954 | ||||||||||||||||||||||||

| Loans to individuals | 125,584 | 121,247 | 110,889 | 100,920 | 103,092 | ||||||||||||||||||||||||

| Total Kansas/Missouri | 922,651 | 894,953 | 837,065 | 852,255 | 939,392 | ||||||||||||||||||||||||

| New Mexico: | |||||||||||||||||||||||||||||

| Commercial | 252,033 | 262,533 | 306,964 | 287,695 | 304,804 | ||||||||||||||||||||||||

| Commercial real estate | 431,606 | 504,632 | 442,128 | 437,302 | 437,996 | ||||||||||||||||||||||||

| Paycheck protection program | 1,792 | 9,713 | 13,510 | 31,444 | 86,716 | ||||||||||||||||||||||||

| Loans to individuals | 67,026 | 63,299 | 63,930 | 66,651 | 68,177 | ||||||||||||||||||||||||

| Total New Mexico | 752,457 | 840,177 | 826,532 | 823,092 | 897,693 | ||||||||||||||||||||||||

| Arkansas: | |||||||||||||||||||||||||||||

| Commercial | 76,222 | 95,415 | 92,143 | 75,168 | 104,899 | ||||||||||||||||||||||||

| Commercial real estate | 60,477 | 61,459 | 61,730 | 74,707 | 84,499 | ||||||||||||||||||||||||

| Paycheck protection program | — | 720 | 2,267 | 6,306 | 2,442 | ||||||||||||||||||||||||

| Loans to individuals | 6,475 | 6,296 | 6,283 | 5,257 | 13,383 | ||||||||||||||||||||||||

| Total Arkansas | 143,174 | 163,890 | 162,423 | 161,438 | 205,223 | ||||||||||||||||||||||||

| TOTAL BOK FINANCIAL | $ | 21,291,148 | $ | 20,674,429 | $ | 20,205,680 | $ | 20,347,936 | $ | 21,416,449 | |||||||||||||||||||

Loans attributed to a principal market may not always represent the location of the borrower or the collateral.

18

DEPOSITS BY PRINCIPAL MARKET AREA -- UNAUDITED

BOK FINANCIAL CORPORATION

(in thousands)

| June 30, 2022 | Mar. 31, 2022 | Dec. 31, 2021 | Sep. 30, 2021 | June 30, 2021 | |||||||||||||||||||||||||

| Oklahoma: | |||||||||||||||||||||||||||||

| Demand | $ | 5,422,593 | $ | 5,205,806 | $ | 5,433,405 | $ | 5,080,162 | $ | 4,985,542 | |||||||||||||||||||

| Interest-bearing: | |||||||||||||||||||||||||||||

| Transaction | 10,240,378 | 11,410,709 | 12,689,367 | 11,692,679 | 12,065,844 | ||||||||||||||||||||||||

| Savings | 561,413 | 558,634 | 521,439 | 510,906 | 500,344 | ||||||||||||||||||||||||

| Time | 678,127 | 817,744 | 978,822 | 1,039,866 | 1,139,980 | ||||||||||||||||||||||||

| Total interest-bearing | 11,479,918 | 12,787,087 | 14,189,628 | 13,243,451 | 13,706,168 | ||||||||||||||||||||||||

| Total Oklahoma | 16,902,511 | 17,992,893 | 19,623,033 | 18,323,613 | 18,691,710 | ||||||||||||||||||||||||

| Texas: | |||||||||||||||||||||||||||||

| Demand | 4,670,535 | 4,552,001 | 4,552,983 | 3,987,503 | 3,752,790 | ||||||||||||||||||||||||

| Interest-bearing: | |||||||||||||||||||||||||||||

| Transaction | 5,344,326 | 4,963,118 | 5,345,461 | 4,985,465 | 4,335,113 | ||||||||||||||||||||||||

| Savings | 183,708 | 182,536 | 178,458 | 165,043 | 160,805 | ||||||||||||||||||||||||

| Time | 333,038 | 329,931 | 337,559 | 337,389 | 346,577 | ||||||||||||||||||||||||

| Total interest-bearing | 5,861,072 | 5,475,585 | 5,861,478 | 5,487,897 | 4,842,495 | ||||||||||||||||||||||||

| Total Texas | 10,531,607 | 10,027,586 | 10,414,461 | 9,475,400 | 8,595,285 | ||||||||||||||||||||||||

| Colorado: | |||||||||||||||||||||||||||||

| Demand | 2,799,798 | 2,673,352 | 2,526,855 | 2,158,596 | 1,991,343 | ||||||||||||||||||||||||

| Interest-bearing: | |||||||||||||||||||||||||||||

| Transaction | 2,277,563 | 2,387,304 | 2,334,371 | 2,337,354 | 2,159,819 | ||||||||||||||||||||||||

| Savings | 82,976 | 81,762 | 78,636 | 79,873 | 73,990 | ||||||||||||||||||||||||

| Time | 160,795 | 165,401 | 174,351 | 184,002 | 193,787 | ||||||||||||||||||||||||

| Total interest-bearing | 2,521,334 | 2,634,467 | 2,587,358 | 2,601,229 | 2,427,596 | ||||||||||||||||||||||||

| Total Colorado | 5,321,132 | 5,307,819 | 5,114,213 | 4,759,825 | 4,418,939 | ||||||||||||||||||||||||

| New Mexico: | |||||||||||||||||||||||||||||

| Demand | 1,347,600 | 1,271,264 | 1,196,057 | 1,222,895 | 1,197,412 | ||||||||||||||||||||||||

| Interest-bearing: | |||||||||||||||||||||||||||||

| Transaction | 845,442 | 888,257 | 858,394 | 837,630 | 723,757 | ||||||||||||||||||||||||

| Savings | 115,660 | 115,457 | 107,963 | 107,615 | 105,837 | ||||||||||||||||||||||||

| Time | 148,532 | 156,140 | 163,871 | 168,879 | 174,665 | ||||||||||||||||||||||||

| Total interest-bearing | 1,109,634 | 1,159,854 | 1,130,228 | 1,114,124 | 1,004,259 | ||||||||||||||||||||||||

| Total New Mexico | 2,457,234 | 2,431,118 | 2,326,285 | 2,337,019 | 2,201,671 | ||||||||||||||||||||||||

| Arizona: | |||||||||||||||||||||||||||||

| Demand | 901,543 | 947,775 | 934,282 | 1,110,884 | 943,511 | ||||||||||||||||||||||||

| Interest-bearing: | |||||||||||||||||||||||||||||

| Transaction | 792,269 | 810,896 | 834,491 | 784,614 | 820,901 | ||||||||||||||||||||||||

| Savings | 17,999 | 18,122 | 16,182 | 16,468 | 13,496 | ||||||||||||||||||||||||

| Time | 28,774 | 27,259 | 31,274 | 30,862 | 30,012 | ||||||||||||||||||||||||

| Total interest-bearing | 839,042 | 856,277 | 881,947 | 831,944 | 864,409 | ||||||||||||||||||||||||

| Total Arizona | 1,740,585 | 1,804,052 | 1,816,229 | 1,942,828 | 1,807,920 | ||||||||||||||||||||||||

19

| June 30, 2022 | Mar. 31, 2022 | Dec. 31, 2021 | Sep. 30, 2021 | June 30, 2021 | |||||||||||||||||||||||||

| Kansas/Missouri: | |||||||||||||||||||||||||||||

| Demand | 537,143 | 553,345 | 658,342 | 488,595 | 463,339 | ||||||||||||||||||||||||

| Interest-bearing: | |||||||||||||||||||||||||||||

| Transaction | 913,921 | 1,107,525 | 1,086,946 | 965,757 | 978,160 | ||||||||||||||||||||||||

| Savings | 19,943 | 19,589 | 18,844 | 17,303 | 17,539 | ||||||||||||||||||||||||

| Time | 13,962 | 11,527 | 12,255 | 13,040 | 13,509 | ||||||||||||||||||||||||

| Total interest-bearing | 947,826 | 1,138,641 | 1,118,045 | 996,100 | 1,009,208 | ||||||||||||||||||||||||

| Total Kansas/Missouri | 1,484,969 | 1,691,986 | 1,776,387 | 1,484,695 | 1,472,547 | ||||||||||||||||||||||||

| Arkansas: | |||||||||||||||||||||||||||||

| Demand | 41,084 | 38,798 | 42,499 | 41,594 | 46,472 | ||||||||||||||||||||||||

| Interest-bearing: | |||||||||||||||||||||||||||||

| Transaction | 130,300 | 122,020 | 119,543 | 149,611 | 195,125 | ||||||||||||||||||||||||

| Savings | 3,125 | 3,265 | 3,213 | 3,289 | 3,445 | ||||||||||||||||||||||||

| Time | 6,371 | 6,414 | 6,196 | 6,677 | 6,819 | ||||||||||||||||||||||||

| Total interest-bearing | 139,796 | 131,699 | 128,952 | 159,577 | 205,389 | ||||||||||||||||||||||||

| Total Arkansas | 180,880 | 170,497 | 171,451 | 201,171 | 251,861 | ||||||||||||||||||||||||

| TOTAL BOK FINANCIAL | $ | 38,618,918 | $ | 39,425,951 | $ | 41,242,059 | $ | 38,524,551 | $ | 37,439,933 | |||||||||||||||||||

20

NET INTEREST MARGIN TREND -- UNAUDITED

BOK FINANCIAL CORPORATION

| Three Months Ended | |||||||||||||||||||||||||||||

| June 30, 2022 | Mar. 31, 2022 | Dec. 31, 2021 | Sep. 30, 2021 | June 30, 2021 | |||||||||||||||||||||||||

| TAX-EQUIVALENT ASSETS YIELDS | |||||||||||||||||||||||||||||

| Interest-bearing cash and cash equivalents | 0.83 | % | 0.18 | % | 0.16 | % | 0.14 | % | 0.10 | % | |||||||||||||||||||

| Trading securities | 2.00 | % | 1.71 | % | 1.89 | % | 2.04 | % | 1.95 | % | |||||||||||||||||||

| Investment securities, net of allowance | 2.35 | % | 5.07 | % | 4.99 | % | 5.02 | % | 5.01 | % | |||||||||||||||||||

| Available for sale securities | 1.84 | % | 1.77 | % | 1.72 | % | 1.80 | % | 1.85 | % | |||||||||||||||||||

| Fair value option securities | 2.92 | % | 2.81 | % | 2.71 | % | 2.62 | % | 2.60 | % | |||||||||||||||||||

| Restricted equity securities | 3.30 | % | 2.69 | % | 2.98 | % | 2.55 | % | 3.36 | % | |||||||||||||||||||

| Residential mortgage loans held for sale | 4.22 | % | 3.11 | % | 3.06 | % | 3.06 | % | 2.91 | % | |||||||||||||||||||

| Loans | 3.92 | % | 3.57 | % | 3.70 | % | 3.68 | % | 3.54 | % | |||||||||||||||||||

| Allowance for loan losses | |||||||||||||||||||||||||||||

| Loans, net of allowance | 3.96 | % | 3.61 | % | 3.75 | % | 3.73 | % | 3.60 | % | |||||||||||||||||||

| Total tax-equivalent yield on earning assets | 2.96 | % | 2.58 | % | 2.66 | % | 2.78 | % | 2.75 | % | |||||||||||||||||||

| COST OF INTEREST-BEARING LIABILITIES | |||||||||||||||||||||||||||||

| Interest-bearing deposits: | |||||||||||||||||||||||||||||

| Interest-bearing transaction | 0.22 | % | 0.10 | % | 0.09 | % | 0.09 | % | 0.10 | % | |||||||||||||||||||

| Savings | 0.03 | % | 0.03 | % | 0.04 | % | 0.04 | % | 0.04 | % | |||||||||||||||||||

| Time | 0.68 | % | 0.56 | % | 0.53 | % | 0.55 | % | 0.58 | % | |||||||||||||||||||

| Total interest-bearing deposits | 0.24 | % | 0.12 | % | 0.12 | % | 0.13 | % | 0.14 | % | |||||||||||||||||||

| Funds purchased and repurchase agreements | 0.53 | % | 0.95 | % | 0.73 | % | 0.20 | % | 0.16 | % | |||||||||||||||||||

| Other borrowings | 1.01 | % | 0.38 | % | 0.49 | % | 0.37 | % | 0.34 | % | |||||||||||||||||||

| Subordinated debt | 4.50 | % | 4.02 | % | 4.02 | % | 4.63 | % | 4.87 | % | |||||||||||||||||||

| Total cost of interest-bearing liabilities | 0.31 | % | 0.21 | % | 0.21 | % | 0.19 | % | 0.21 | % | |||||||||||||||||||

| Tax-equivalent net interest revenue spread | 2.65 | % | 2.37 | % | 2.45 | % | 2.59 | % | 2.54 | % | |||||||||||||||||||

Effect of noninterest-bearing funding sources and other | 0.11 | % | 0.07 | % | 0.07 | % | 0.07 | % | 0.06 | % | |||||||||||||||||||

| Tax-equivalent net interest margin | 2.76 | % | 2.44 | % | 2.52 | % | 2.66 | % | 2.60 | % | |||||||||||||||||||

Yield calculations are shown on a tax equivalent basis at the statutory federal and state rates for the periods presented. The yield calculations exclude security trades that have been recorded on trade date with no corresponding interest income and the unrealized gains and losses. The yield calculation also includes average loan balances for which the accrual of interest has been discontinued and are net of unearned income. Yield/rate calculations are generally based on the conventions that determine how interest income and expense is accrued.

21

CREDIT QUALITY INDICATORS -- UNAUDITED

BOK FINANCIAL CORPORATION

(in thousands, except ratios)

| Three Months Ended | |||||||||||||||||||||||||||||

| June 30, 2022 | Mar. 31, 2022 | Dec. 31, 2021 | Sep. 30, 2021 | June 30, 2021 | |||||||||||||||||||||||||

| Nonperforming assets: | |||||||||||||||||||||||||||||

| Nonaccruing loans: | |||||||||||||||||||||||||||||

| Commercial: | |||||||||||||||||||||||||||||

| Energy | $ | 20,924 | $ | 24,976 | $ | 31,091 | $ | 45,500 | $ | 70,341 | |||||||||||||||||||

| Services | 15,259 | 16,535 | 17,170 | 25,714 | 29,913 | ||||||||||||||||||||||||

| Healthcare | 14,886 | 15,076 | 15,762 | 509 | 527 | ||||||||||||||||||||||||

| General business | 3,539 | 3,750 | 10,081 | 8,951 | 11,823 | ||||||||||||||||||||||||

| Total commercial | 54,608 | 60,337 | 74,104 | 80,674 | 112,604 | ||||||||||||||||||||||||

| Commercial real estate | 10,939 | 15,989 | 14,262 | 21,223 | 26,123 | ||||||||||||||||||||||||

| Loans to individuals: | |||||||||||||||||||||||||||||

| Permanent mortgage | 30,460 | 30,757 | 31,574 | 30,674 | 31,473 | ||||||||||||||||||||||||

Permanent mortgage guaranteed by U.S. government agencies | 18,000 | 16,992 | 13,861 | 9,188 | 9,207 | ||||||||||||||||||||||||

| Personal | 132 | 171 | 258 | 188 | 229 | ||||||||||||||||||||||||

| Total loans to individuals | 48,592 | 47,920 | 45,693 | 40,050 | 40,909 | ||||||||||||||||||||||||

| Total nonaccruing loans | $ | 114,139 | $ | 124,246 | $ | 134,059 | $ | 141,947 | $ | 179,636 | |||||||||||||||||||

Accruing renegotiated loans guaranteed by U.S. government agencies | 196,420 | 204,121 | 210,618 | 178,554 | 171,324 | ||||||||||||||||||||||||

| Real estate and other repossessed assets | 22,221 | 24,492 | 24,589 | 28,770 | 57,337 | ||||||||||||||||||||||||