Form 8-K B. Riley Financial, Inc. For: Feb 10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 10, 2020

B. RILEY FINANCIAL, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-37503 | 27-0223495 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

21255 Burbank Boulevard, Suite 400

Woodland Hills, California 91367

818-884-3737

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.0001 per share | RILY | Nasdaq Global Market | ||

| Depositary Shares (each representing a 1/1000th interest in a 6.875% Series A Cumulative Perpetual Preferred Share, par value $0.0001 per share) | RILYP | Nasdaq Global Market | ||

| 7.25% Senior Notes due 2027 | RILYG | Nasdaq Global Market | ||

| 7.50% Senior Notes due 2027 | RILYZ | Nasdaq Global Market | ||

| 7.375% Senior Notes due 2023 | RILYH | Nasdaq Global Market | ||

| 6.875% Senior Notes due 2023 | RILYI | Nasdaq Global Market | ||

| 6.75% Senior Notes due 2024 | RILYO | Nasdaq Global Market | ||

| 6.50% Senior Notes due 2026 | RILYN | Nasdaq Global Market |

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure. |

On February 10, 2020, B. Riley Financial, Inc. (the “Company”) issued a press release announcing the commencement of its public offering of $50,000,000 aggregate principal amount of senior notes due 2025. The Company expects to grant the underwriters a 30-day option to purchase up to an additional $7,500,000 aggregate principal amount of senior notes in connection with the offering solely to cover overallotments. A copy of the press release is attached hereto as Exhibit 99.1.

In addition, in connection with the public offering, the Company will be making road show presentations to certain existing and potential securityholders of the Company. The road show materials are attached hereto as Exhibit 99.2.

This Current Report on Form 8-K (and the exhibits attached hereto) may contain “forward-looking” statements as defined by the Private Securities Litigation Reform Act of 1995 or by the U.S. Securities and Exchange Commission (the “SEC”) in its rules, regulations and releases. These statements include, but are not limited to, the Company’s plans, objectives, expectations and intentions regarding the performance of its business, the terms and conditions and timing of the senior notes offering, the intended use of proceeds of the senior notes offering and other non-historical statements. These statements can be identified by the use of words such as “believes,” “anticipates,” “expects,” “intends,” “plans,” “continues,” “estimates,” “predicts,” “projects,” “forecasts,” and similar expressions. All forward looking statements are based on management’s current expectations and beliefs only as of the date of this report and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those discussed in, or implied by, the forward-looking statements, including the risks identified and discussed from time to time in the Company’s reports filed with the SEC, including the Company’s most recent Annual Report on Form 10-K for the year ended December 31, 2018 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2019. Readers are strongly encouraged to review carefully the full cautionary statements described in these reports. Except as required by law, the Company undertakes no obligation to revise or update publicly any forward-looking statements to reflect events or circumstances after the date of this report, or to reflect the occurrence of unanticipated events or circumstances.

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

| 99.1 | ||

| 99.2 | Road Show Materials. |

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| February 10, 2020 | B. RILEY FINANCIAL, INC. | |||

| By: | /s/ Phillip J. Ahn | |||

| Name: | Phillip J. Ahn | |||

| Title: | Chief Financial Officer and Chief Operating Officer | |||

2

Exhibit 99.1

B. Riley Financial Announces Offering of $50 Million Senior Notes Due 2025

and “BBB+” Rating from Egan-Jones

LOS ANGELES — February 10, 2020 — B. Riley Financial, Inc. (NASDAQ: RILY) (“B. Riley” or the “Company”) today announced it has commenced an underwritten registered public offering of $50 million aggregate principal amount of senior notes due 2025, subject to market and certain other conditions. The Company expects to grant the underwriters a 30-day option to purchase additional senior notes in connection with the offering solely to cover overallotments.

B. Riley Financial and this issuance of notes both received an investment grade rating of BBB+ from Egan-Jones Ratings Company, an independent, unaffiliated rating agency.

The Company expects to use 20% of the net proceeds of this offering to redeem a portion of its existing 7.50% Senior Notes due 2027 (once these notes are subject to optional redemption, on or after May 31, 2020) and the remaining net proceeds for general corporate purposes, including funding future acquisitions and investments, repaying indebtedness, making capital expenditures and funding working capital.

B. Riley FBR, Ladenburg Thalmann, Incapital and William Blair & Company, LLC are acting as book-running managers for this offering. Boenning & Scattergood and Wedbush Securities are acting as co-managers.

The notes will be offered under the Company’s shelf registration statement on Form S-3, which was declared effective by the Securities and Exchange Commission (SEC). The offering of these notes will be made only by means of a prospectus supplement and accompanying base prospectus, which will be filed with the SEC.

Copies of the prospectus supplement and the accompanying base prospectus may be obtained on the SEC's website at www.sec.gov, or from the offices of B. Riley FBR at 1300 North 17th Street, Suite 1400, Arlington, VA 22209 or by calling (703) 312-9580 or by emailing [email protected].

This press release does not constitute an offer to sell or the solicitation of an offer to buy the notes, nor shall there be any sale of the notes in any jurisdiction in which such offer, solicitation or sale would not be permitted.

About B. Riley Financial (NASDAQ: RILY)

B. Riley Financial provides collaborative financial services tailored to fit the capital raising and business advisory needs of public and private companies and high-net-worth individuals. B. Riley operates through several wholly owned subsidiaries which offer complementary end-to-end capabilities spanning investment banking and institutional brokerage, private wealth and investment management, corporate advisory, restructuring, due diligence, forensic accounting and litigation support, appraisal and valuation, and auction and liquidation services. Certain registered affiliates of B. Riley originate and underwrite senior secured loans for asset-rich companies. The Company also makes proprietary investments in companies and assets with attractive return profiles.

Forward-Looking Statements

Statements in this press release that are not descriptions of historical facts are forward-looking statements that are based on management’s current expectations and assumptions and are subject to risks and uncertainties. If such risks or uncertainties materialize or such assumptions prove incorrect, our business, operating results, financial condition and stock price could be materially negatively affected. You should not place undue reliance on such forward-looking statements, which are based on the information currently available to us and speak only as of the date of this press release. Such forward looking statements include, but are not limited to, statements regarding the terms and conditions and timing of the senior notes offering and the intended use of proceeds. Because these forward-looking statements involve known and unknown risks and uncertainties, there are important factors that could cause actual results, events or developments to differ materially from those expressed or implied by these forward-looking statements. Factors that could cause actual results to differ include (without limitation) the possibility that the notes offering will not be consummated at the expected time, on the expected terms, or at all; and the Company’s financial performance; and those risks described from time to time in B. Riley Financial, Inc.’s periodic filings with the SEC, including, without limitation, the risks described in B. Riley Financial, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2018 under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Additional information is also set forth in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2019. These factors should be considered carefully, and readers are cautioned not to place undue reliance on such forward-looking statements. All information is current as of the date this press release is issued, and B. Riley Financial, Inc. undertakes no duty to update this information.

Investor Contact

Investor Relations

(310) 966-1444

Media Contact

Jo Anne McCusker

(646) 885-5425

Exhibit 99.2

NASDAQ:RILY February 2020 Investor Presentation

Title Text This presentation contains statements that are forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended that are based on management’s current expectations and assumptions and are subject to risks and uncertainties . These forward looking statements can often be identified by their use of words such as “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “forecast,” “intends,” “may,” “outlook,” “plans,” “potential,” “predicts,” “projects,” “should,” “target,” “will,” “would” or the negative of these terms or other comparable terminology . Such forward looking statements include, but are not limited to, expressed or implied statements regarding future financial performance and future dividends, the effects of our business model, the effects of our balance sheet on our ability to pursue business opportunities , statements regarding the terms and conditions and timing of the senior notes offering and the intended use of proceeds, the effects and anticipated benefits of our acquisitions and related actions, the strength of our business segments, assessments of future opportunities and performance, expectations regarding future transactions, and the financial impact, size and consistency of returns and timing thereof, expectations regarding market dynamics, as well as statements regarding the effect of investments in our business segments . Because these forward - looking statements involve known and unknown risks and uncertainties, there are important factors that could cause actual results, events or developments to differ materially from those expressed or implied by these forward - looking statements . Factors that could cause actual results to differ from those contained in the forward - looking statements include but are not limited to risks related to : volatility in our revenues and results of operations ; changing conditions in the financial markets ; our ability to generate sufficient revenues to achieve and maintain profitability ; the short term nature of our engagements ; the accuracy of our estimates and valuations of inventory or assets in “guarantee” based engagements ; competition in the asset management business ; potential losses related to our auction or liquidation engagements ; our dependence on communications, information and other systems and third parties ; potential losses related to purchase transactions in our auctions and liquidations business ; the potential loss of financial institution clients ; potential losses from or illiquidity of our proprietary investments ; changing economic and market conditions ; potential liability and harm to our reputation if we were to provide an inaccurate appraisal or valuation ; failure to successfully compete in any of our segments ; loss of key personnel ; our ability to borrow under our credit facilities or raise additional funds through offerings as necessary ; failure to comply with the terms of our credit agreements ; our ability to meet future capital requirements ; our ability to promptly and effectively integrate our business with that of magicJack ; and the diversion of management time on acquisition - related issues . Other factors that could adversely affect our operating results and cash flows include (without limitation) those risks described from time to time in B . Riley Financial, Inc . ’s periodic filings with the SEC, including, without limitation, the risks described in B . Riley Financial, Inc . ’s Annual Report on Form 10 - K for the year ended December 31 , 2018 under the captions "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations“ and our Quarterly Report on Form 10 - Q for the quarter ended September 30 , 2019 . These factors should be considered carefully and readers are cautioned not to place undue reliance on such forward - looking statements . All information is current as of the date this presentation is issued , and B . Riley Financial, Inc . undertakes no duty to update this information . Safe Harbor Statement 2

Title Text I. Transaction Summary & Credit Metrics II. B. Riley Financial at a Glance III. Segments Overview IV. Financial Overview V. Appendix 3 Table of Contents

I. Transaction Summary & Credit Metrics

Title Text 1. Actual offering size and pricing may differ materially from the figures shown; offering size and pricing to be determined by neg otiations between the Company and the underwriters. Transaction Summary Issuer B. Riley Financial, Inc. Security Senior Unsecured Notes Proposed Ticker / Exchange RILYM / Nasdaq Offering Size $50,000,000 (1 ) Notes Offered 2,000,000 (1 ) Overallotment Option 15% Par Value $25.00 Coupon 6.375% - 6.500% (1 ) Maturity The Notes will mature on February 28, 2025, unless redeemed prior to maturity. Call Feature: The Notes may be redeemed for cash in whole or in part at any time at the Issuer’s option (i) on or after February 28, 2021 and prior to February 28, 2022, at a price equal to $25.75 per note, plus accrued and unpaid interest to, but excluding, the date of redemption, (ii) on or after February 28, 2022 and prior to February 28, 2023, at a price equal to $25.50 per note, plus accrued and unpaid interest to, but excluding, the date of redemption, (iii) on or after February 28, 2023 and prior to February 29, 2024, at a price equal to $25.25 per note, plus accrued and unpaid interest to, but excluding, the date of redemption, and (iv) on or after February 29, 2024 and prior to maturity, at a price equal to 100% of their principal amount, plus accrued and unpaid interest to, but excluding, the date of redemption. In each case, redemption shall be upon notice not fewer than 30 days and not more than 60 days prior to the date fixed for redemption. Use of Proceeds The Issuer intends to use 20% of the net proceeds from this offering to redeem a portion of the principal amount of the Issuer’s 7.50% Senior Notes due 2027 (as soon as practical after the 7.50% Senior Notes are subject to optional redemption on or after May 31, 2020) with the remaining net proceeds available for general corporate purposes, including funding future acquisitions and investments, repaying indebtedness, making capital expenditures and funding working capital. Expected Pricing Date 2/10/2020 Bookrunning Managers B. Riley FBR, Ladenburg Thalmann, Incapital, and William Blair Co - Managers Boenning & Scattergood and Wedbush Securities 5

Title Text 6 Credit Metrics 1. Includes impact of the RILYP $57.5M Series A Preferred Stock offering. 2. Includes impact of the redemption of outstanding 7.50% Senior Notes due 2021. 3. Includes impact of proposed $ 50.0M Senior Unsecured Notes offering. Actual offering size, pricing, and fees incurred may differ materially from the figures show n; offering size and pricing to be determined by negotiations between the Company and the underwriters . 4. Excludes impact of (i) the Company's liquidation of Luxury retailer Barney's New York and (ii) the Company's $116.5M acquisi tio n of majority ownership in assets and intellectual property of 6 brands: Catherine Malandrino, English Laundry, Joan Vass, Kensie Girl, Limited Too and Nanette Lepore . 5. Includes approximately $326.6M in securities and other investments owned minus $29.1M in securities sold not yet purchased . 6. Includes $295.9M Loans Receivables at Cost minus $28.9M Loans Participation Sold . 7. Other equity investments and deposits reported in prepaid expenses and other assets. 8. Represents the principal amount of the 7.50% Senior Notes due 2021 which the Issuer redeemed in December 2019 . 9. Represents the principal amount of 7.50% Senior Unsecured Notes due 2027 which would be redeemed with 20% of the net transact ion proceeds and an issuance of $ 50.0M of New Senior Unsecured Notes . 10. Represents $50M principal amount of New Senior Unsecured Notes in connection with the transaction . 11. Excludes (i) operating lease liabilities, (ii) incremental sales of senior notes under our at the market sale program after 9 /30 /2019, and (iii) short term borrowings under our asset based credit facility with Wells Fargo after 9/30/2019 . 12. For a definition of Adjusted EBITDA and a reconciliation to GAAP financial measures, please see the Appendix . 13. Represents the LTM 9/30/2019 interest expense of the 7.50% Senior Notes due 2021 which the Issuer redeemed in December 2019 . 14. Pro forma adjustment to interest expense related to proposed note offering is calculated using a coupon rate of 6.50% for the new no tes and the associated redemption of certain 7.50% Senior Notes due 2027 . 15. Represents annual preferred dividends related to 6.875% Series A Cumulative Preferred Stock offering. Pro Forma Credit Statistics 9/30/2019 B. Riley October Offering December Redemption Pro Forma Pro Forma ($ in millions) Financial Adjustments (1) Adjustments (2) Adjustments - RILYM (3) Total (1)(2)(3)(4) Cash and Cash Equivalents 170.6$ 55.6$ (52.2)$ 38.1$ 212.1$ Due from Clearing Brokers 27.8 - - - 27.8 Marketable Securities, net (5) 297.5 - - - 297.5 Restricted Cash 0.5 - - - 0.5 Loans Receivable, net of Loans Participations Sold (6) 267.0 - - - 267.0 Other Equity Investments and Other (7) 81.2 - - - 81.2 Total Cash, Net Securities, and Other 844.6 55.6 (52.2) 38.1 886.2 Existing Senior Notes Payable - Bonds 701.3 - (52.2) (10.0) 639.1 New Senior Notes Payable - Bonds - - - 50.0 50.0 Term Loan 71.4 - - - 71.4 Notes Payable 1.2 - - - 1.2 Total Debt (11) 773.9 - (52.2) 40.0 761.7 Cash, Securities and Other Investments Owned, Net of Debt (11) 70.7$ 55.6$ -$ (1.9)$ 124.4$ Series A Preferred Stock - 57.5 - - 57.5 Cash, Securities and Other Investments Owned, Net of Debt + Preferred Stock (11) 70.7$ (1.9)$ -$ (1.9)$ 66.9$ LTM 9/30/2019 Revenue 588.9 - - - 588.9 LTM 9/30/2019 Adjusted EBITDA (12) 168.8 - - - 168.8 LTM 9/30/2019 Interest Expense 44.6 - (3.8) 2.9 43.6 LTM 9/30/2019 Preferred Dividends - 4.0 - - 4.0 Net Debt / LTM Adj. EBITDA (11)(12) -0.4x N/A N/A N/A -0.7x Total Debt / LTM Adj. EBITDA (11)(12) 4.6x N/A N/A N/A 4.5x LTM Adj. EBITDA / LTM Interest Expense (12) 3.8x N/A N/A N/A 3.9x LTM Adj. EBITDA / LTM Interest Expense + Preferred Dividends (12) 3.8x N/A N/A N/A 3.5x (8) (13) (15) (9) (10) (14)

II. B. Riley at a Glance

Title Text Company Overview Bryant Riley Chairman & Co - CEO ● Founded: 1997 ● Headquarters: Los Angeles, CA ● Employees: approx. 1,000 ● Major Offices: Los Angeles, New York, Metro D.C., San Francisco, Chicago, Boston, Houston, Dallas, Atlanta, Memphis, Miami, Ft. Lauderdale, West Palm Beach 8 Tom Kelleher Co - CEO Alan Forman EVP General Counsel Phil Ahn CFO & COO Kenny Young President Key Stats & Facts Key Executives * International operations in Germany, Australia and India Locations Dan Shribman Chief Investment Officer

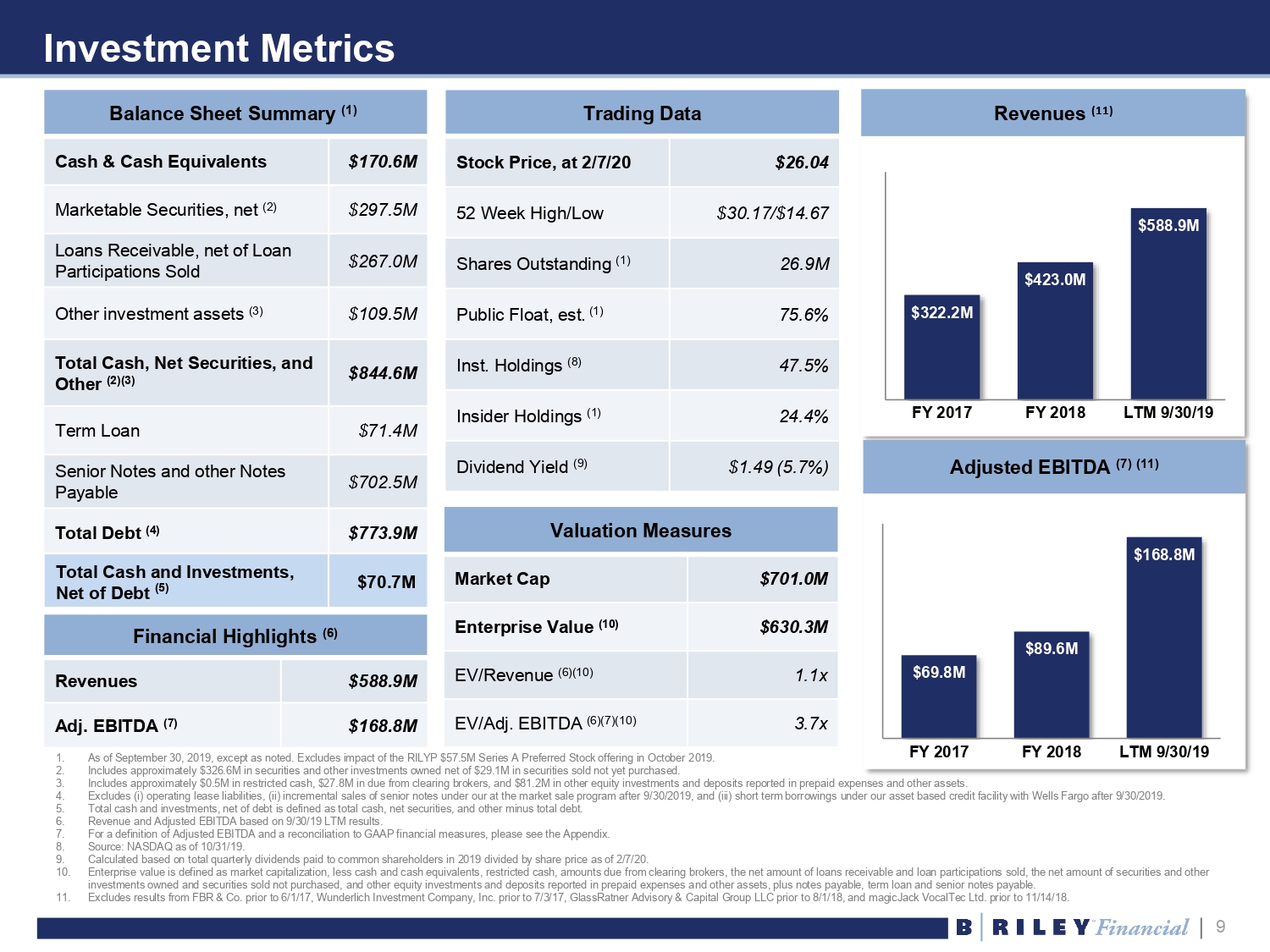

Title Text Investment Metrics 1. As of September 30, 2019, except as noted. Excludes impact of the RILYP $57.5M Series A Preferred Stock offering in October 2 019 . 2. Includes approximately $326.6M in securities and other investments owned net of $29.1M in securities sold not yet purchased. 3. Includes approximately $0.5M in restricted cash, $27.8M in due from clearing brokers, and $81.2M in other equity investments and deposits reported in prepaid expenses and other assets. 4. Excludes (i) operating lease liabilities, (ii) incremental sales of senior notes under our at the market sale program after 9 /30 /2019, and (iii) short term borrowings under our asset based credit facility with Wells Fargo after 9/30/2019. 5. Total cash and investments, net of debt is defined as total cash, net securities, and other minus total debt. 6. Revenue and Adjusted EBITDA based on 9/30/19 LTM results. 7. For a definition of Adjusted EBITDA and a reconciliation to GAAP financial measures, please see the Appendix. 8. Source: NASDAQ as of 10/31/19. 9. Calculated based on total quarterly dividends paid to common shareholders in 2019 divided by share price as of 2/7/20. 10. Enterprise value is defined as market capitalization, less cash and cash equivalents, restricted cash, amounts due from clearing brokers , t he net amount of loans receivable and loan participations sold, the net amount of securities and other investments owned and securities sold not purchased, and other equity investments and deposits reported in prepaid expenses a nd other assets, plus notes payable, term loan and senior notes payable. 11. Excludes results from FBR & Co. prior to 6/1/17, Wunderlich Investment Company, Inc. prior to 7/3/17, GlassRatner Advisory & Cap ital Group LLC prior to 8/1/18, and magicJack VocalTec Ltd. prior to 11/14/18. Trading Data Stock Price, at 2/7/20 $ 26.04 52 Week High/Low $30.17 /$14.67 Shares Outstanding (1) 26.9M Public Float, est. (1) 75.6% Inst. Holdings (8) 47.5% Insider Holdings (1) 24.4% Dividend Yield (9) $1.49 ( 5.7%) Balance Sheet Summary (1) Cash & Cash Equivalents $170.6M Marketable Securities, net (2) $297.5M Loans Receivable, net of Loan Participations Sold $267.0M Other investment assets (3) $109.5M Total Cash, Net Securities, and Other (2)(3) $844.6M Term Loan $71.4M Senior Notes and other Notes Payable $702.5M Total Debt (4) $773.9M Valuation Measures Market Cap $ 701.0M Enterprise Value (10) $ 630.3M EV/Revenue (6)(10) 1.1x EV/Adj. EBITDA (6)(7)(10) 3.7x Financial Highlights (6) Revenues $588.9M Adj. EBITDA (7) $168.8M Revenues (11) $322.2M $423.0M $588.9M FY 2017 FY 2018 LTM 9/30/19 Adjusted EBITDA (7) (11) $69.8M $89.6M $168.8M FY 2017 FY 2018 LTM 9/30/19 9 Total Cash and Investments, Net of Debt (5) $70.7M

Title Text Financial Summary 10 Historical Stock Performance (3) Revenues (1) $322.2M $423.0M $588.9M FY 2017 FY 2018 LTM 9/30/19 Adjusted EBITDA (1) (2) $69.8M $89.6M $168.8M FY 2017 FY 2018 LTM 9/30/19 1. Excludes results from FBR & Co. prior to 6/1/17, Wunderlich Investment Company, Inc. prior to 7/3/17, GlassRatner Advisory & Cap ital Group LLC prior to 8/1/18, and magicJack VocalTec Ltd. prior to 11/14/18. 2. For a definition of Adjusted EBITDA and a reconciliation to GAAP financial measures, please see the Appendix. 3. Source: Capital IQ for period from 1/1/19 to 12/31/19. 4. Final results for twelve months ended 12/31/19 could vary significantly as a result of the completion of our customary year - end closing, review, and audit procedures and other developments arising between now and the time our financial results for 2019 are finalized. Financial Results LTM 9/30/19 (2) Prelim. Est. FY2019 (2) (4) Actual Low High Net Income $55.7M $79.5M $81.5M Adjusted EBITDA $168.8M $205.1M $209.1M RILY S&P 500 28.71% 66.98% Jan-19 Mar-19 May-19 Jul-19 Sep-19 Nov-19

Title Text 11 Origin and Historical Timeline With over 20 years of continued growth, B. Riley has created a unique platform with diverse revenue streams and a full suite of end - to - end services and solutions for clients and partners

Title Text Trusted Advisors We offer a wide range of end - to - end business advisory and financial services solutions tailored to fit the needs of our clients through our diverse mix of complementary businesses Strategic Partners We partner with clients in providing senior - led services and financing to support the execution of mission - critical strategic growth objectives at any stage in the company life cycle Value Investors We leverage the deep investment, operational and industry expertise of our affiliated companies to source attractive opportunities that are proprietary to B. Riley Who We Are 12

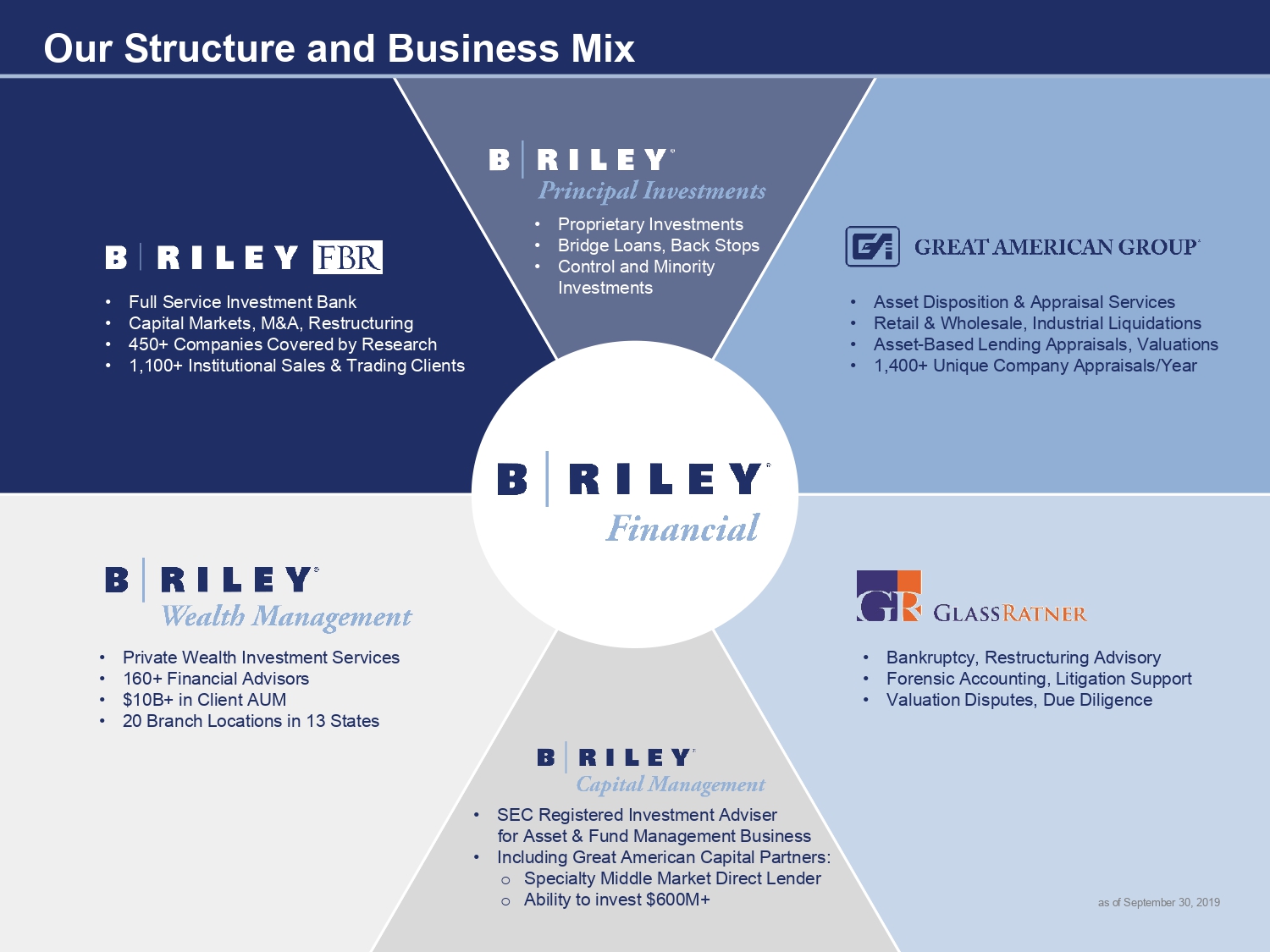

Title Text • Full Service Investment Bank • Capital Markets, M&A, Restructuring • 450+ Companies Covered by Research • 1,100 + Institutional Sales & Trading Clients • Asset Disposition & Appraisal Services • Retail & Wholesale, Industrial Liquidations • Asset - Based Lending Appraisals, Valuations • 1,400+ Unique Company Appraisals/Year • Bankruptcy, Restructuring Advisory • Forensic Accounting, Litigation Support • Valuation Disputes, Due Diligence • SEC Registered Investment Adviser for Asset & Fund Management Business • Including Great American Capital Partners: o Specialty Middle Market Direct Lender o Ability to invest $600M+ • Private Wealth Investment Services • 160+ Financial Advisors • $10B+ in Client AUM • 20 Branch Locations in 13 States • Proprietary Investments • Bridge Loans, Back Stops • Control and Minority Investments Our Structure and Business Mix as of September 30, 2019

Title Text Our Platform and Approach Illustrative Examples 14 Led restructuring and co - acquired rights to certain assets to facilitate pay - down of ABL and DIP credit facilities. Conducted store closing and real estate asset liquidation. Led restructuring and transformation into online - only retailer. Leveraging NOL for attractive investment yields. Assisting in acquiring licenses and paying dividends. Own approx. 30% Arranged $150M in secured financing and provided necessary liquidity needed to continue its operational transformation. ● We create end - to - end solutions for clients and partners through a mix of complementary businesses. ● Investing alongside our clients and partners creates opportunity to generate returns for our investors. ● We actively invest in opportunities which: o Create opportunities for service fee revenue o Generate yield and drive incremental returns o Offer growth, FCF and recurring revenue Proprietary Cross - Platform Opportunities Our unique platform provides proprietary investment and business opportunities ● Our diverse business mix provides us with: o In - house partnership opportunities o Competitive cross - selling advantage o Ability to develop differentiated solutions for our clients Business Opportunities Acted as sole book - running manager on upsized and fully underwritten equity offering. Retained approx. $15M of shares. Granted one board seat.

Title Text Our Platform and Approach (cont) Illustrative Examples 15 Acquisitions Majority Ownership Minority Ownership ● Self - sourced proprietary opportunities from our platform ● Leverages our platform’s core operational and investment expertise and industry knowledge ● Delivers financial improvements to maximize free cash flow ● Established brand investment platform ● Acquired majority ownership of six brands ● Significant investment in acquisition of Hurley ● Adds stable recurring revenue and cash flow Brand Investment Portfolio (new) Opportunistic investments are accretive and drive shareholder value ● Raised approximately $144M in special purpose acquisition company ● Focused on opportunistic deal flow created throughout the B. Riley platform B. Riley Principal Merger Corp. (NYSE:BRPM) Financing and Recaps

Title Text Shareholder Alignment Executives and board maintain significant ownership, strongly aligned with shareholders Insider 24% 16 1. As of September 30, 2019 638K+ 1.9M+ Management and Board Company Buybacks Insider Holdings (1) Shares Purchased since Q1 2018 (1) Insider Ownership ● 24 . 4 % of total shares held by Management and Directors ● 618 K+ shares purchased by Management and Board in open market since January 2018 Company Buybacks ● 1 . 9 M+ shares and warrants repurchased since Q 1 2018 o 1 . 2 M+ shares repurchased o 638 K+ warrants repurchased

Title Text Recent Developments 17 The ‘Retail Apocalypse’ May Last Two More Years Published October 5, 2019 Great American Group’s Scott Carpenter suggests as much as 30% of retail space “could cease to exist in its current form, as consumer buying trends shift increasingly online .“ B. Riley Establishes Brand Portfolio Published October 30, 2019 B . Riley has formed a brand investment portfolio which aligns with the Company's strategy of pursuing strong free cash flow investment opportunities to generate accretive recurring revenue . – News Release B. Riley Releases Guidance for Q4; Raises Guidance for FY 2019 Published January 22 , 2020 B . Riley expects to report FY 19 net income of $ 79 . 5 to $ 81 . 5 million and adj . EBITDA of $ 205 . 1 to $ 209 . 1 million, exceeding prior guidance for net income of $ 45 to $ 60 million and adj . EBITDA of $ 150 to $ 170 million . – News Release B. Riley to Repurchase 880,000 Shares Published January 22, 2020 B . Riley has agreed to repurchase 880 , 000 common shares in a block purchase from an existing stockholder as part of a privately negotiated transaction . – News Release B. Riley Forms New Real Estate Vertical Published February 4, 2020 B . Riley announced the formation of B . Riley Real Estate which specializes in maximizing value for distressed real estate . This new vertical complements the end - to - end capabilities offered by its investment banking, corporate valuation and consulting affiliates and aligns with its work in the retail sector . – News Release

III. Segment Overview

Title Text Segment Overview Diverse revenue streams with recurring revenue and episodic opportunities Capital Markets 64% Auction & Liquidation 13% Valuation & Appraisal 7% Principal Investments 16% Capital Markets 50% Auction & Liquidation 24% Valuation & Appraisal 7% Principal Investments 19% Q3 2019 Highlights ● New quarterly record, total revenues of $180.1M ● Strong performance by Capital Markets, Liquidation ● Steady contributions from Consulting, Appraisal and Wealth 19 Opportunities and Outlook ● Significant pipeline of proprietary opportunities for RILY ● Active retail liquidation environment driven by sector headwinds ● Addition of Brand Investment Platform offers accretive growth Revenue Mix (1) Segment Income Mix (1) 1. Based on LTM Sept. 30, 2019 results .

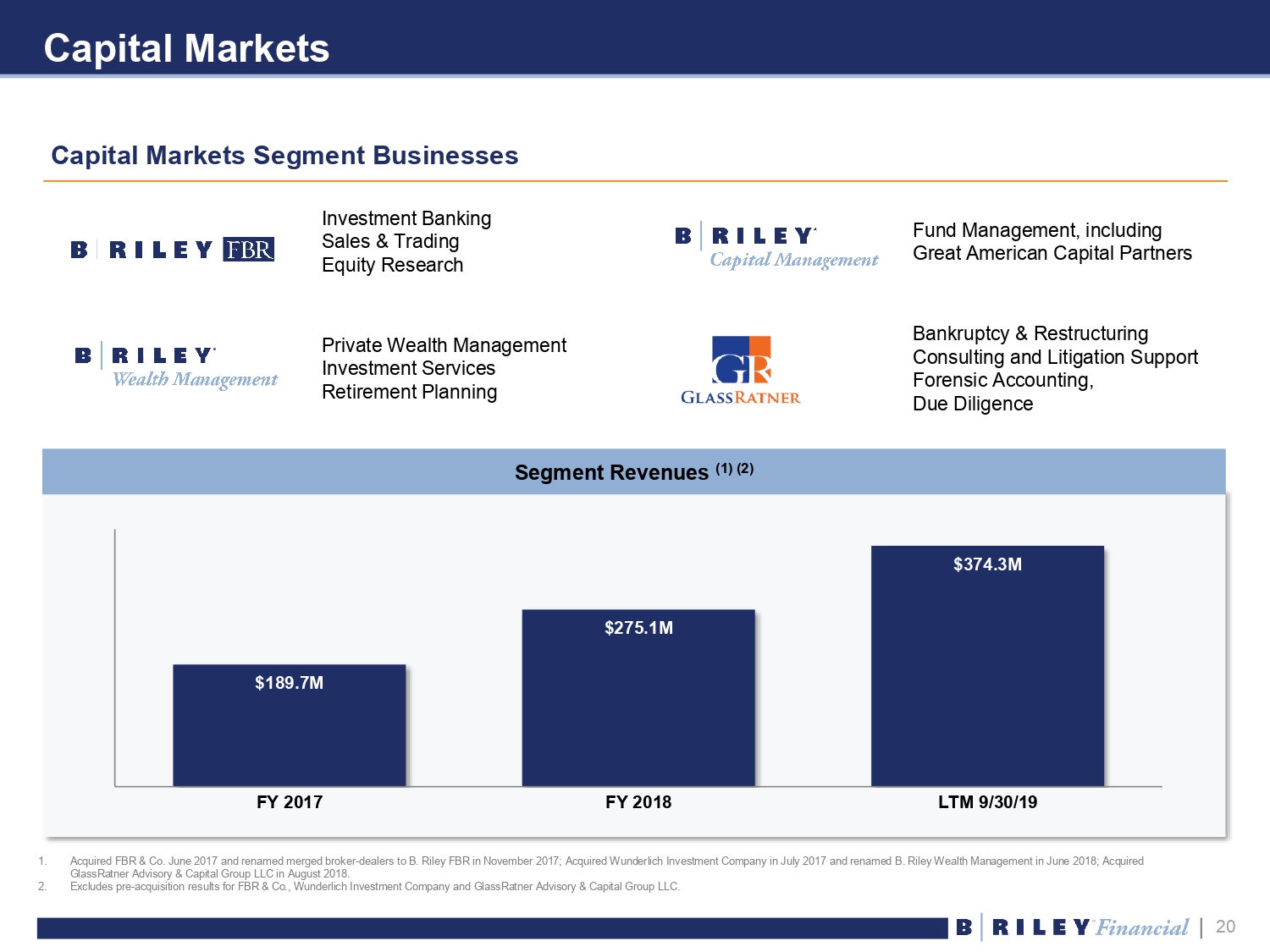

Title Text Capital Markets 1. Acquired FBR & Co. June 2017 and renamed merged broker - dealers to B. Riley FBR in November 2017; Acquired Wunderlich Investment Company in July 2017 and renamed B. Riley Wealth Management in June 2018; Acquired GlassRatner Advisory & Capital Group LLC in August 2018. 2. Excludes pre - acquisition results for FBR & Co., Wunderlich Investment Company and GlassRatner Advisory & Capital Group LLC. Investment Banking Sales & Trading Equity Research Fund Management, including Great American Capital Partners Private Wealth Management Investment Services Retirement Planning Bankruptcy & Restructuring Consulting and Litigation Support Forensic Accounting, Due Diligence Segment Revenues (1) (2) $189.7M $275.1M $374.3M FY 2017 FY 2018 LTM 9/30/19 20 Capital Markets Segment Businesses

Title Text Capital Markets (cont) Recent Transactions ● Offers corporate finance, M&A, restructuring, equity research, sales & trading ● Dominates pre - public private placements (144A) ● Consistently recognized for stock picking ● Sources, structures, prices and allocates own transactions ● 80+ investment banking professionals 21 Institutional Brokerage and Research Sales and Trading Research ● 80+ sales and trading professionals ● Market - maker in 500+ equity securities ● 1,100 + institutional investors covered ● 45+ research professionals ● 450+ companies covered ● ~$600M median market cap 1. Source : Dealogic . Information presented for illustration purposes only and does not represent a recommendation, solicitation or offer to buy or sell any security . Past performance is not indicative of future performance . 2. Source : Dealogic . Apportioned credit to all bookrunning managers ; Rank Eligible transactions only, US and Bermuda Issuers – Market Caps < $ 1 billion – All Industries – 1 / 1 / 2012 – 12 / 31 / 2018 – Initial Common Stock Offerings . Includes deals transacted at predecessor firms and may not be indicative of future capabilities . 3. Source : StarMine rankings as of 9 / 30 / 2018 . Overall coverage includes only companies with a rating & domiciled in the U . S . Does not include Closed End Funds . 4. Source : Dealogic . Apportioned credit to all book - running managers ; Rank Eligible transactions only, US and Bermuda Issuers – Market Caps < $ 1 . 5 Billion – All industries – 12 / 31 / 2008 – 12 / 31 / 2018 – Initial Common Stock Offerings . #1 Bookrunner – 144A equity offerings (1) #2 Leading small - cap research coverage (3) #2 Lead bookrunner – Initial equity offerings for issuers < $1 Billion (2) Top 5 bookrunner – Initial common stock offerings for U.S. small - caps (4) Small and mid - cap focused investment bank with leading equity offering franchise Accolades SPAC IPO August 2019 $253,000,000 Units Initial Public Offering Sole B ookrunner August 2019 $581,000,000 Sell - Side Advisor h as been acquired by M&A Restructuring August 2019 Financial Advisor completes merger with CMPO September 2019 $55,200,000 Global Ship Lease Common Stock Follow - On Sole Bookrunner as of September 30, 2019

Title Text $10B+ Assets under administration 33,000 (2) Active client accounts 160+ Financial advisors 20 Office locations Capital Markets (cont) 1. As of September 30, 2019. 2. Figure shown is an approximation and does not reflect actual number of Active Client Accounts. Enhanced distribution through large network of HNW, family office and traditional accounts ● Advises on over $10 billion in client assets ● Provides comprehensive financial management and investment services to individuals, families, corporations and non - profits ● Benefits from B. Riley infrastructure, deals syndicate and ancillary investment offerings 22 Corporations ● Financial planning ● Retirement income ● Estate planning ● Qualified plan and 401(K) advisory services ● Investment banking and directed share programs ● Business lending resources through 3rd party institutions Individuals Key Statistics (1) ● Risk management and insurance ● Trust management

Title Text Capital Markets (cont) Direct Lending ● General partner for direct lending funds with ability to invest $600M+ (1) ● Provides financing to asset - rich companies seeking capital in addition to traditional debt ● Underwriting analysis based on net recovery from liquidation of assets ● Leverages Great American Group’s cross - industry expertise in asset liquidation and appraisal values Our platform provides opportunity and insight for our fund management businesses 1. As of September 30, 2019 23 Alternatives Credit ● Emerging manager platform and internal funds ● Provides discretionary fixed income investment management services ● Focused on identifying and acquiring undervalued securities in the non - investment grade corporate debt market

Title Text Capital Markets (cont) 24 Nationally recognized bankruptcy and litigation advisor ● Complements B. Riley’s core financial restructuring capabilities ● Strong referral network among prominent law firms, financial institutions ● International reach via BTG Global Advisory network throughout Europe, Asia, Australia, South Africa, Canada and Brazil Recent Accolades 2019 (1) ● #1 Overall Expert Witness ● #1 Forensic Accounting Firm ● #1 Litigation Valuation Firm ● Cross Border Special Situation M&A Deal of the Year 2018 (2) ● Best End to End Litigation Consulting Firm ● Best Expert Witness Provider ● Valuation Service Provider of the Year ● Refinancing Deal of the Year Bankruptcy and restructuring advisory Forensic accounting and litigation support Corporate finance and valuation Real estate advisory services Core Services 1. Source: ALM’s Daily Report , “Best of 2019” and Global M&A Network , “Turnaround Atlas Awards” (2019) 2. Source: Corporate Counsel , “Best Of” Awards (2018); National Law Journal, “Best Of” Awards (2018); and Global M&A Network , “Turnaround Atlas Awards” (2018)

Title Text Auction & Liquidation Leading provider of large - scale retail liquidations ● Highly profitable, cyclical business with robust store closing project pipeline ● Leverages balance sheet to develop creative deal structures ● Global resources in Europe, Canada and Australia 25 $47.4M $55.0M $77.0M FY 2017 FY 2018 LTM 9/30/19 Annual Liquidation Revenue Illustrative Clients $13B+ total value of assets liquidated since 2013 6,800+ completed store closings since 2013

Title Text 1,275 1,350 1,475 FY 2016 FY 2017 FY 2018 Annual Completed Appraisals (1) Appraisal & Valuation One of the largest appraisal practices in the U.S. ● 1,400+ valuation appraisals annually primarily supporting asset based loans ● High recurring business rate among financial institution clients ● Provides opportunities and expertise for GACP direct lending fund 26 Annual Appraisal Revenues Illustrative Clients $31.7M $33.3M $38.7M FY 2016 FY 2017 FY 2018 1. Figures shown are approximations and do not reflect actual number of completed appraisals.

Title Text Principal Investments ● Operationally - focused, control equity investments which leverage B. Riley’s expertise and resources Strong cash - flow companies generating attractive returns 1. Includes results from United Online, Inc. since Q3 2016, and results from magicJack VocalTec Ltd. since Q4 2018. 27 ● Acquired July 2016 ● Internet access and online advertising produce high gross margins; predictable subscriber attrition ● Low overhead from successful execution of cost synergies ● Highly profitable business generating significant cash flows ● Acquired November 2018 ● VoIP cloud technology and services communications provider ● Offers operational synergies with United Online Cumulative Segment Income (1) $9.2M $28.7M $48.2M $72.5M 2016 2017 2018 as of 9/30/19 United Online magicJack

IV. Financial Overview

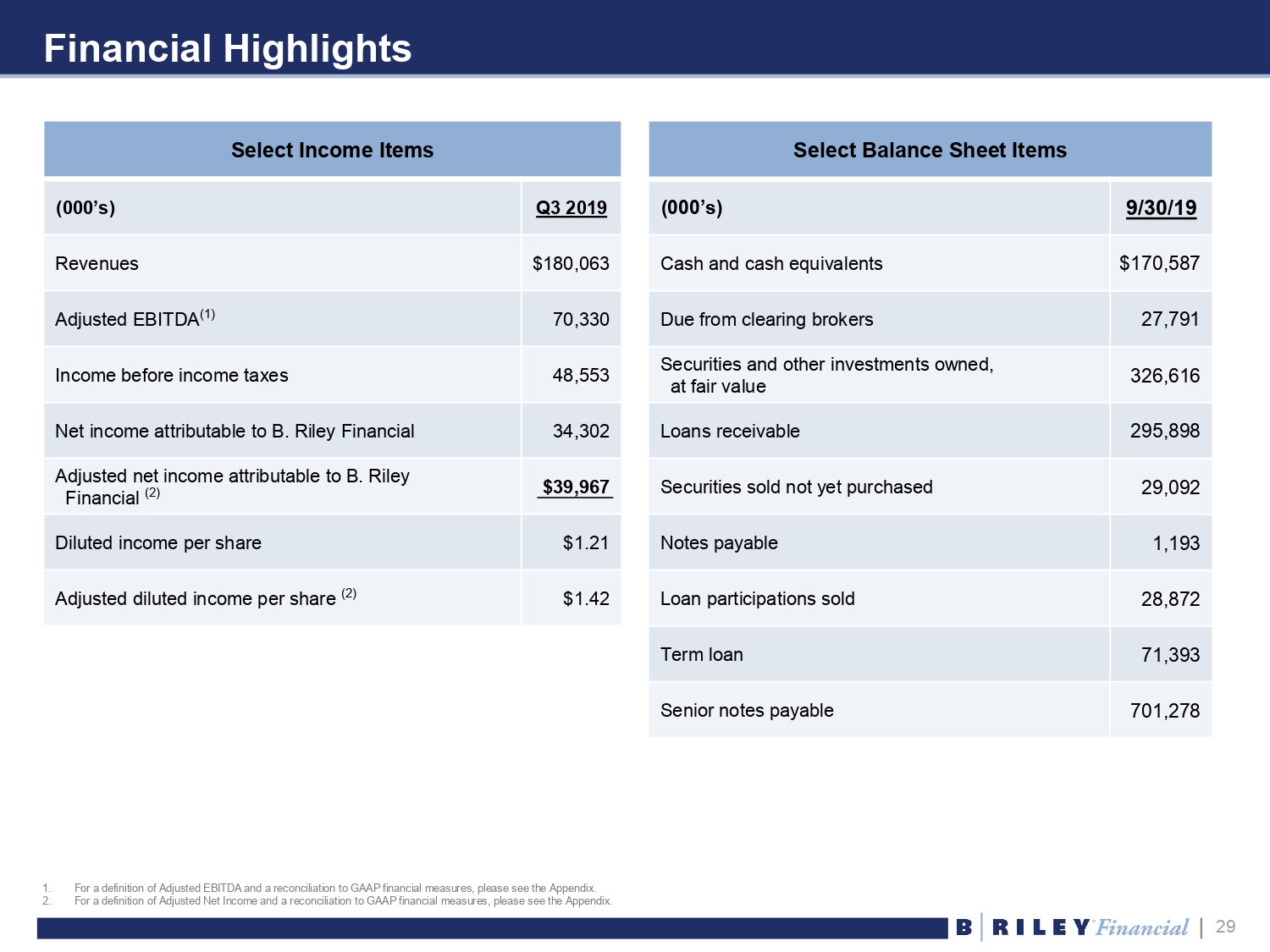

Title Text Financial Highlights Select Income Items (000’s) Q3 2019 Revenues $180,063 Adjusted EBITDA (1) 70,330 Income before income taxes 48,553 Net income attributable to B. Riley Financial 34,302 Adjusted net income attributable to B. Riley Financial (2) $39,967 Diluted income per share $1.21 Adjusted diluted income per share (2) $1.42 Select Balance Sheet Items (000’s) 9/30/19 Cash and cash equivalents $170,587 Due from clearing brokers 27,791 Securities and other investments owned, at fair value 326,616 Loans receivable 295,898 Securities sold not yet purchased 29,092 Notes payable 1,193 Loan participations sold 28,872 Term loan 71,393 Senior notes payable 701,278 1. For a definition of Adjusted EBITDA and a reconciliation to GAAP financial measures, please see the Appendix. 2. For a definition of Adjusted Net Income and a reconciliation to GAAP financial measures, please see the Appendix. 29

Title Text Financial Highlights (cont.) Cash and Net Investments (000’s) 9/30/19 Cash and cash equivalents $170,587 Restricted cash 471 Due from clearing brokers 27,791 Loans receivables, net of loan participations sold 267,026 Marketable securities, net (1) 297,524 Other equity investments and deposits (2) 81,194 Total Cash, Net Securities, and Other $844,593 Debt (000’s) 9/30/19 Senior notes payable $701,278 Term loan 71,393 Notes payable 1,193 Total Debt $773,864 Total Cash and Investments, Net of Debt (3) $70,729 Total cash and investment, net of debt of $70.7M as of September 30, 2019 30 1. Includes approximately $326.6M in securities and other investments owned net of $29.1M in securities sold not yet purchased. 2. Other equity investments and deposits reported in prepaid expenses and other assets. 3. Defined as total cash, net securities, and other minus total debt.

Title Text Financial Highlights (cont.) Cumulative dividend payout of $3.53 per share from December 2014 through November 2019 Historical Common Stock Dividends Paid (per share) (1) Cumulative Common Stock Dividend Payout (per share) (1) $0.35 $0.63 $1.30 $2.04 $3.53 2015 2016 2017 2018 2019 $0.32 $0.28 $0.67 $0.74 $1.49 2015 2016 2017 2018 2019 Regular Dividends Paid Special Dividends Paid 31 1. There can be no assurance that we will continue to generate sufficient cash to pay dividends or that we will pay dividends in fu ture periods. Further, the issuance of preferred stock may reduce or eliminate our ability to make common stock dividends.

V. Appendix

Title Text Historical Financial Results for B. Riley Financial 1. Excludes FBR & Co. results prior to 6/1/17, Wunderlich Investment Company, Inc. results prior to 7/3/17, and GlassRatner Advi sor y & Capital Group LLC results prior to 8/1/18. 2. Excludes magicJack VocalTec Ltd. results prior to 11/14/18. 3. Adjusted EBITDA: earnings before interest expense, interest income, provision for or benefit from income taxes, depreciation and amortization, share - based payments, fair value adjustments, litigation settlement, insurance settlement recovery, transactions - related costs, and restructuring costs. 33 B. Riley Financial Segment Financial Results (000’s) FY 2017 FY 2018 9/30/19 LTM Q4 2018 Q1 2019 Q2 2019 Q3 2019 Revenues: Capital Markets (1) $189,723 $275,066 $374,254 $60,609 $85,301 $94,248 $134,096 Auction and Liquidation 47,379 54,986 $77,037 10,126 20,709 34,916 11,286 Valuation and Appraisal 33,331 38,705 $40,465 11,322 8,583 9,742 10,818 Principal Investments - UOL and MJ (2) 51,743 54,234 $97,150 19,974 27,535 25,778 23,863 Total Revenue 322,176 422,991 588,906 102,031 142,128 164,684 180,063 Segment Operating Income (Loss): Capital Markets (1) 15,931 10,152 $78,112 (12,544) 13,861 24,393 52,402 Auction and Liquidation 11,186 27,013 $37,552 2,267 11,504 17,828 5,953 Valuation and Appraisal 9,713 11,097 $10,950 3,399 1,363 2,737 3,451 Principal Investments - UOL and MJ (2) 19,503 19,448 $30,102 5,732 7,929 7,779 8,662 Total Segment Income (Loss) 56,333 67,710 156,716 (1,146) 34,657 52,737 70,468 Corporate and Other Expenses (27,489) (22,326) ($34,166) (5,388) (9,679) (8,482) (10,617) Adjusted EBITDA (3) $69,783 $89,631 $168,813 $11,197 $34,430 $52,856 $70,330

Title Text Non - GAAP Financial Measures 1. Excludes FBR & Co. results prior to 6/1/17, Wunderlich Investment Company, Inc. results prior to 7/3/17, GlassRatner Advisory & Capital Group LLC results prior to 8/1/18, and magicJack VocalTec Ltd. results prior to 11/14/18. 2. FY 2017 includes $9.0M fair value adjustment. 3. In addition to restructuring costs, FY 2017 includes $6.0M insurance settlement recovery, and Q4 and FY 2018 include $0.5M li tig ation settlement. 34 B. Riley Financial Adjusted EBITDA Reconciliation (1) (000’s) FY 2017 FY 2018 9/30/19 LTM Q4 2018 Q1 2019 Q2 2019 Q3 2019 Net Income (Loss) $11,556 $15,509 $55,677 ($8,805) $8,023 $22,157 $34,302 Provision for (Benefit from) Income Taxes 8,510 4,903 23,293 (3,509) 3,104 9,289 14,409 Interest Expense, net 7,962 32,067 42,678 8,877 10,133 11,257 12,411 Depreciation and Amortization 11,140 13,809 18,258 4,041 4,913 4,831 4,473 Share-based Compensation and Fair Value Adjustment (2) 16,950 11,596 13,562 3,286 2,614 2,934 4,728 Transaction-Related Costs 7,291 2,741 6,887 548 5,496 836 7 Restructuring Costs and Other (3) 6,374 9,006 8,458 6,759 147 1,552 - Total Adjustments 58,227 74,122 113,136 20,002 26,407 30,699 36,028 Adjusted EBITDA $69,783 $89,631 $168,813 $11,197 $34,430 $52,856 $70,330

Title Text Non - GAAP Financial Measures 1. Excludes FBR & Co. results prior to 6/1/17, Wunderlich Investment Company, Inc. results prior to 7/3/17, GlassRatner Advisory & Capital Group LLC results prior to 8/1/18, and magicJack VocalTec Ltd. results prior to 11/14/18. 2. FY 2017 includes $9.0M fair value adjustment. 3. In addition to restructuring costs, FY 2017 includes $6.0M insurance settlement recovery, and Q4 and FY 2018 include $0.5M li tig ation settlement. 35 B. Riley Financial Adjusted Net Income Reconciliation (1) (000’s) FY 2017 FY 2018 9/30/19 LTM Q4 2018 Q1 2019 Q2 2019 Q3 2019 Net Income (Loss) $11,556 $15,509 $55,677 ($8,805) $8,023 $22,157 $34,302 Amortization of Intangible Assets 7,422 9,133 12,765 2,734 3,377 3,344 3,310 Share-based Compensation and Fair Value Adjustment (2) 16,950 11,596 13,562 3,286 2,614 2,934 4,728 Transaction-Related Costs 7,291 2,741 6,887 548 5,496 836 7 Restructuring Costs and Other (3) 6,374 9,006 8,458 6,759 147 1,552 - Income Tax Effect of Adjusting Entries (15,741) (9,209) (11,983) (3,798) (3,245) (2,560) (2,380) Tax Benefit from Tax Election to Treat Acquisition of UOL as a Taxable Business Combination (8,389) - - - - - - Tax Expense from New Tax Legislation Change - Reduction in Federal Rate from 35% to 21% 13,051 - - - - - - Total Adjustments 26,958 23,267 29,689 9,529 8,389 6,106 5,665 Adjusted Net Income $38,514 $38,776 $85,366 $724 $16,412 $28,263 $39,967

Title Text Non - GAAP Financial Measures 36 1. Final results for twelve months ended 12/31/19 could vary significantly as a result of the completion of our customary year - end closing, review, and audit procedures and other developments arising between now and the time our financial results for 2019 are finalized. B. Riley Financial Adjusted EBITDA Reconciliation (000’s) Low High Net Income attributable to B. Riley Financial, Inc. $79,482 $81,482 Provision for Income Taxes 34,302 35,302 Interest Expense 50,130 50,130 Interest Income (1,529) (1,529) Share-based payments 15,676 16,176 Depreciation and Amortization 19,017 19,517 Transaction-Related Costs 6,339 6,339 Restructuring Expense 1,699 1,699 Total EBITDA Adjustments 125,634 127,634 Adjusted EBITDA $205,116 $209,116 Preliminary Estimates for FY 2019 (1)

For more information, please visit www.brileyfin.com

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- B. Riley Financial (RILY) Files 10-K

- B. Riley Financial (RILY) touching day low of $27, giving back half the day's gains

- Atlantic Coast Recycling Unveils State-of-the-Art Recycling Facility; Capital Investment Led by B. Riley Financial

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

B. RileySign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share