Form 8-K Axos Financial, Inc. For: Sep 15

Exhibit 1.1

Underwriting Agreement

Execution Copy

$175,000,000

Axos Financial, Inc.

4.875% Fixed-to-Floating Rate Subordinated Notes due 2030

UNDERWRITING AGREEMENT

September 15, 2020

KEEFE, BRUYETTE & WOODS, INC.

787 Seventh Avenue, 4th Floor

New York, New York 10019

As representative of the Underwriters listed in Schedule A hereto

Ladies and Gentlemen:

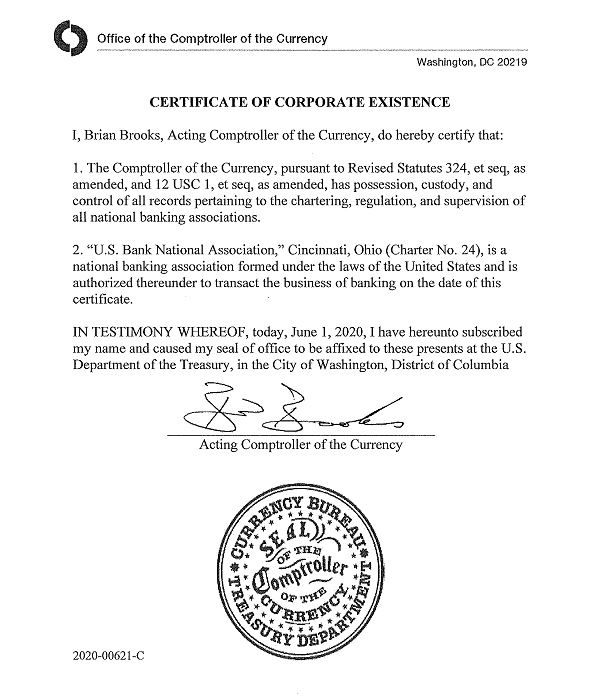

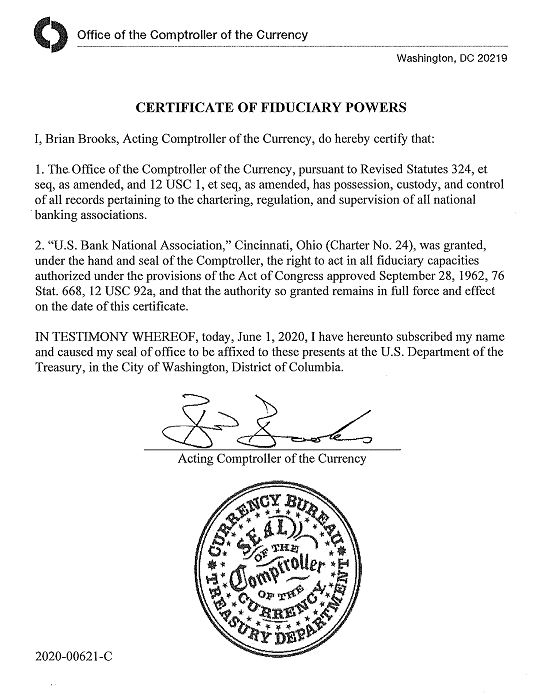

Axos Financial, Inc., a Delaware corporation (the “Company”), proposes to issue and sell to the several underwriters named in Schedule A hereto (the “Underwriters”) pursuant to the terms set forth herein (this “Agreement”) $175,000,000 aggregate principal amount of the Company’s 4.875% Fixed-to-Floating Rate Subordinated Notes due 2030 (the “Securities”). The Securities will be issued pursuant to an indenture, dated as of March 3, 2016 (the “Base Indenture”), between the Company and U.S. Bank, National Association, as trustee (the “Trustee”), as supplemented by a supplemental indenture thereto relating to the Securities, to be dated as of the Closing Time, between the Company and the Trustee (the “Supplemental Indenture” and, together with the Base Indenture, the “Indenture”). Keefe, Bruyette & Woods, Inc. (“KBW”) has agreed to act as representative of the several Underwriters (in such capacity, the “Representative”) in connection with the offering and sale of the Securities.

The Company has prepared and filed with the United States Securities and Exchange Commission (the “Commission”) an “automatic shelf registration statement,” as defined under Rule 405 (“Rule 405”) under the Securities Act of 1933, as amended (the “Securities Act”), on Form S-3 (File No. 333-223434) covering the public offering and sale from time to time of certain securities of the Company, including the Securities, under the Securities Act and the rules and regulations promulgated thereunder (the “Securities Act Regulations”), which automatic shelf registration statement became effective upon filing with the Commission under Rule 462(e) of the Securities Act Regulations (“Rule 462(e)”). Such registration statement, as of any time, means such registration statement as amended by any post-effective amendment thereto at such time, including the exhibits and any schedules thereto at such time, the documents incorporated or deemed to be incorporated by reference therein at such time pursuant to Item 12 of Form S-3 under the Securities Act and the documents otherwise deemed to be a part thereof as of such time pursuant to Rule 430B of the Securities Act Regulations (“Rule 430B”), is referred to herein as the “Registration Statement”;

1

provided, that the “Registration Statement” without reference to a time means such registration statement as amended by any post-effective amendment thereto as of the time of the first contract of sale for the Securities, which time shall be considered the “new effective date” of the Registration Statement with respect to the Securities within the meaning of Rule 430B(f)(2), including the exhibits and schedules thereto as of such time, the documents incorporated or deemed to be incorporated by reference therein at such time pursuant to Item 12 of Form S-3 under the Securities Act and the documents otherwise deemed to be a part thereof as of such time pursuant to Rule 430B. From and after the date and time of filing of any registration statement increasing the size of the offering pursuant to Rule 462(b) under the Securities Act Regulations (“Rule 462(b)” and such registration statement, a “Rule 462(b) Registration Statement”), the term “Registration Statement” shall include the Rule 462(b) Registration Statement. Each preliminary prospectus supplement and the base prospectus used in connection with the offering of the Securities, including the documents incorporated or deemed to be incorporated by reference therein pursuant to Item 12 of Form S-3 under the Securities Act immediately prior to the Applicable Time (as defined below), are collectively referred to herein as a “preliminary prospectus.” Promptly after execution and delivery of this Agreement, the Company will prepare and file a final prospectus supplement relating to the Securities in accordance with the provisions of Rule 424(b) of the Securities Act Regulations (“Rule 424(b)”). The final prospectus supplement and the base prospectus, in the form first furnished to the Underwriters for use in connection with the offering and sale of the Securities, including the documents incorporated or deemed to be incorporated by reference therein pursuant to Item 12 of Form S-3 under the Securities Act immediately prior to the Applicable Time (as defined below), are collectively referred to herein as the “Prospectus.” For purposes of this Agreement, all references to the Registration Statement, any preliminary prospectus, the Prospectus, any Issuer Free Writing Prospectus or any amendment or supplement thereto shall be deemed to include the copy filed with the Commission pursuant to its Electronic Data Gathering, Analysis and Retrieval system (or any successor system) (“EDGAR”).

As used in this Agreement:

“Applicable Time” means 3:35 p.m., New York City time, on September 15, 2020, or such other time as agreed by the Company and the Representative.

“Pricing Disclosure Package” means each Issuer General Use Free Writing Prospectus and the most recent preliminary prospectus furnished to the Underwriters for general distribution to investors prior to the Applicable Time, all considered together.

“Issuer Free Writing Prospectus” means (a) the “Term Sheet” (as defined below) and (b) any “issuer free writing prospectus,” as defined in Rule 433 of the Securities Act Regulations (“Rule 433”), including, without limitation, any “free writing prospectus” (as defined in Rule 405) relating to the Securities that is (i) required to be filed with the Commission by the Company, (ii) a “road show that is a written communication” within the meaning of Rule 433(d)(8)(i), whether or not required to be filed with the Commission, or (iii) exempt from filing with the Commission pursuant to Rule 433(d)(5)(i) because it contains a description of the Securities or of the offering thereof that does not reflect the final terms, in each case in the form filed or required to be filed with the Commission or, if not required to be filed, in the form retained in the Company’s records pursuant to Rule 433(g).

2

“Issuer General Use Free Writing Prospectus” means any Issuer Free Writing Prospectus that is intended for general distribution to investors, as evidenced by its being specified in Schedule B hereto.

“Issuer Limited Use Free Writing Prospectus” means any Issuer Free Writing Prospectus that is not an Issuer General Use Free Writing Prospectus.

“Term Sheet” means a pricing term sheet substantially in the form of Schedule C hereto.

All references in this Agreement to financial statements and schedules and other information which is “contained,” “included” or “stated” (or other references of like import) in the Registration Statement, any preliminary prospectus or the Prospectus shall be deemed to include all such financial statements and schedules and other information incorporated or deemed to be incorporated by reference in the Registration Statement, any preliminary prospectus or the Prospectus, as the case may be, prior to the Applicable Time; and all references in this Agreement to amendments or supplements to the Registration Statement, any preliminary prospectus or the Prospectus shall be deemed to include the filing of any document under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations promulgated thereunder (the “Exchange Act Regulations”) incorporated or deemed to be incorporated by reference in the Registration Statement, such preliminary prospectus or the Prospectus, as the case may be, at or after the Applicable Time.

SECTION 1. Representations and Warranties.

(a) Representations and Warranties by the Company. The Company represents and warrants to each Underwriter at the date hereof, the Applicable Time and the Closing Time (as defined below), and agrees with each Underwriter, as follows:

(i) Compliance of the Registration Statement, the Prospectus and Incorporated Documents. The Company meets the requirements for use of Form S-3 under the Securities Act. The Registration Statement is an automatic shelf registration statement under Rule 405, and the offer and sale of the Securities is registered by the Company on such automatic shelf registration statement. Each of the Registration Statement and any post-effective amendment thereto has become effective under the Securities Act and the initial effective date of the Registration Statement is not more than three years before the date of this Agreement. No stop order suspending the effectiveness of the Registration Statement or any post-effective amendment thereto has been issued under the Securities Act, no notice of objection of the Commission to the use of the Registration Statement or any post-effective amendment thereto pursuant to Rule 401(g)(2) of the Securities Act Regulations (“Rule 401(g)(2)”) has been received by the Company, no order preventing or suspending the use of any preliminary prospectus or the Prospectus or any amendment or supplement thereto has been issued and no proceedings for any of those purposes have been instituted or are pending or, to the Company’s knowledge, contemplated. The Company has complied with each request (if any) from the Commission for additional information.

3

Each of the Registration Statement and any post-effective amendment thereto, at the time of its effectiveness, as of each deemed effective date with respect to the Underwriters pursuant to Rule 430B(f)(2), at the Closing Time complied and will comply in all material respects with the requirements of the Securities Act, the Securities Act Regulations, the Trust Indenture Act of 1939, as amended (the “Trust Indenture Act”), and the rules and regulations promulgated under the Trust Indenture Act. Each preliminary prospectus, the Prospectus and any amendment or supplement thereto, at the time each was filed or is hereafter filed with the Commission and at the Closing Time complied and will comply in all material respects with the requirements of the Securities Act and the Securities Act Regulations and are and will be identical to the electronically transmitted copies thereof filed with the Commission pursuant to EDGAR, except to the extent permitted by Regulation S-T.

The documents incorporated or deemed to be incorporated by reference in the Registration Statement, the Pricing Disclosure Package and the Prospectus, when they became effective or at the time they were or hereafter are filed with the Commission, complied and will comply in all material respects with the requirements of the Exchange Act and the Exchange Act Regulations.

(ii) Accurate Disclosure. Neither the Registration Statement nor any post-effective amendment thereto, at its effective time and at the Closing Time contained, contains or will contain an untrue statement of a material fact or omitted, omits or will omit to state a material fact required to be stated therein or necessary to make the statements therein not misleading. At the Applicable Time, neither (A) the Pricing Disclosure Package nor (B) any individual Issuer Limited Use Free Writing Prospectus, when considered together with the Pricing Disclosure Package, included, includes or will include an untrue statement of a material fact or omitted, omits or will omit to state a material fact necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading. Neither the Prospectus nor any amendment or supplement thereto, as of its issue date and at the Closing Time, included, includes or will include an untrue statement of a material fact or omitted, omits or will omit to state a material fact necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading. The documents incorporated or deemed to be incorporated by reference in the Registration Statement, the Pricing Disclosure Package and the Prospectus, at the time the Registration Statement became effective or when such incorporated documents were filed with the Commission, as the case may be, when read together with the other information in the Registration Statement, the Pricing Disclosure Package or the Prospectus, as the case may be, did not, does not and will not include an untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary to make the statements therein not misleading. There are no statutes, regulations, documents or contracts of a character required to be described in the Registration Statement, the Pricing Disclosure Package and the Prospectus, or to be filed as an exhibit to the Registration Statement, which are not described or filed as required. There are no business relationships or related person transactions involving the Company or any Subsidiary (as defined herein) or any other person required to be described in the Registration Statement, the Pricing Disclosure Package and the Prospectus that have not been described as required.

4

The representations and warranties in this subsection shall not apply to statements in or omissions from the Registration Statement or any amendment thereto or the Pricing Disclosure Package or the Prospectus or any amendment or supplement thereto made in reliance upon and in conformity with written information furnished to the Company by any Underwriter through the Representative expressly for use therein. For purposes of this Agreement, the only information so furnished shall be the information in the second and third sentences of the third paragraph, the third sentence under the subheading “No Public Trading Markets” and the first and sixth sentences in the first paragraph under the subheading “Stabilization,” each under the heading “Underwriting,” in each case, contained in the Registration Statement, the preliminary prospectus contained in the Pricing Disclosure Package and the Prospectus (collectively, the “Underwriter Information”).

(iii) Issuer Free Writing Prospectuses. No Issuer Free Writing Prospectus conflicts or will conflict with the information contained in the Registration Statement, any preliminary prospectus or the Prospectus, including any document incorporated by reference therein, that has not been superseded or modified. If, at any time prior to or as of the Closing Time and following issuance of an Issuer Free Writing Prospectus, there occurred or occurs an event or development as a result of which such Issuer Free Writing Prospectus conflicted or would conflict with the information then contained in the Registration Statement or as a result of which such Issuer Free Writing Prospectus, if republished immediately following such event or development, would include an untrue statement of a material fact or omitted or would omit to state a material fact necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading, (A) the Company has promptly notified or will promptly notify the Representatives thereof and (B) the Company has promptly amended or will promptly amend or supplement such Issuer Free Writing Prospectus to eliminate or correct such conflict, untrue statement or omission. Any offer that is a written communication relating to the Securities made prior to the initial filing of the Registration Statement by the Company or any person acting on its behalf (within the meaning, for this paragraph only, of paragraph (c) of Rule 163 of the Securities Act Regulations (“Rule 163”)) has been filed with the Commission in accordance with the exemption provided by Rule 163 and otherwise complied with the requirements of Rule 163, including, without limitation, the legending requirement, to qualify such offer for the exemption from Section 5(c) of the Securities Act provided by Rule 163.

(iv) Well-Known Seasoned Issuer. (A) At the original effectiveness of the Registration Statement, (B) at the time of the most recent amendment thereto for the purposes of complying with Section 10(a)(3) of the Securities Act (whether such amendment was by post-effective amendment, incorporated report filed pursuant to Section 13 or 15(d) of the Exchange Act or form of prospectus), (C) at the time the Company or any person acting on its behalf (within the meaning, for this clause only, of Rule 163(c)) made any offer relating to the Securities in reliance on the exemption of Rule 163 and (D) at the Applicable Time, the Company was and is a “well-known seasoned issuer,” as defined in Rule 405.

(v) Company Not Ineligible Issuer. (A) At the time of filing the Registration Statement, any Rule 462(b) Registration Statement and any post-effective amendment thereto, (B) at the earliest time thereafter that the Company or another offering participant

5

made a bona fide offer (within the meaning of Rule 164(h)(2) of the Securities Act Regulations) of the Securities and (C) at the Applicable Time, the Company was not and is not an “ineligible issuer,” as defined in Rule 405. The Company has paid the registration fee for this offering pursuant to Rule 456(b)(1) under the Securities Act or will pay such fee within the time period required by such rule (without giving effect to the proviso therein) and in any event prior to the Closing Time.

(vi) Independent Accountants. BDO USA, LLP, the accounting firm that certified the financial statements and supporting schedules of the Company that are included in the Registration Statement, the Pricing Disclosure Package and the Prospectus, is (i) an independent public accountant as required by the Securities Act, the Securities Act Regulations, the Exchange Act, the Exchange Act Regulations and the Public Company Accounting Oversight Board (the “PCAOB”), (ii) a registered public accounting firm, as defined by the PCAOB, which has not had its registration superseded or revoked and which has not requested that such registration be withdrawn, and (iii) with respect to the Company, is not and has not been in violation of the auditor independence requirements of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) and the rules and regulations of the Commission.

(vii) Financial Statements; Non-GAAP Financial Measures. The financial statements of the Company and its consolidated Subsidiaries (as defined below) included in the Registration Statement, the Pricing Disclosure Package and the Prospectus, together with the related schedules and notes, comply in all material respects with the requirements of the Securities Act and present fairly the financial position of the Company and its consolidated Subsidiaries (as defined below). The financial statements of the Company and its consolidated Subsidiaries (as defined below) have been prepared in conformity with U.S. generally accepted accounting principles (“GAAP”) applied on a consistent basis throughout the periods involved, except as may be expressly stated in the related notes thereto. The supporting schedules, if any, present fairly in accordance with GAAP the information required to be stated therein. The selected financial data and the summary financial information included in the Registration Statement, the Pricing Disclosure Package and the Prospectus present fairly the information shown therein and have been compiled on a basis consistent with that of the audited financial statements included or incorporated by reference therein. Except as included therein, no historical or pro forma financial statements or supporting schedules are required to be included in the Registration Statement, any preliminary prospectus or the Prospectus. To the extent applicable, all disclosures contained in the Registration Statement, the Pricing Disclosure Package or the Prospectus, if any, regarding “non-GAAP financial measures” (as such term is defined by the rules and regulations of the Commission) comply with Regulation G under the Exchange Act and Item 10(e) of Regulation S-K under the Securities Act. The interactive data in eXtensible Business Reporting Language incorporated by reference in the Registration Statement, the Pricing Disclosure Package and the Prospectus is updated as necessary to comply with the requirements of the Securities Act and the Commission’s rules and guidelines applicable thereto and present fairly the information called for in all material respects.

6

(viii) No Material Adverse Change in Business. Since the respective dates as of which information is given in the Registration Statement, the Pricing Disclosure Package and the Prospectus, except as otherwise stated therein, (A) there has been no material adverse effect, or any development that could reasonably be expected to result in a material adverse effect, (i) on the general affairs, condition (financial or otherwise), business, properties, management, financial position, shareholders’ equity, assets, liabilities or results of operations, of the Company and its Subsidiaries considered as one enterprise, whether or not arising in the ordinary course of business or (ii) in the ability of the Company to perform its obligations under, and to consummate the transactions contemplated by, this Agreement (each of (i) and (ii) a “Material Adverse Effect”), (B) there has not been any change in the capital stock, short-term debt or long-term debt of the Company or any of the Subsidiaries, (C) there have been no transactions entered into by, and no obligations or liabilities, contingent or otherwise, incurred by the Company or any of the Subsidiaries, whether or not in the ordinary course of business, which are material to the Company and the Subsidiaries, considered as one enterprise, (D) the Company has not purchased any of its outstanding capital stock and other than regular quarterly distributions on the Company’s preferred stock there has been no dividend or distribution of any kind declared, paid or made by the Company on any class of its capital stock or (E) there has been no material loss or interference with the Company’s business from fire, explosion, flood or other calamity, whether or not covered by insurance, or from any labor dispute or court or governmental action, order or decree, in each case, otherwise than as set forth or contemplated in the Registration Statement, the Pricing Disclosure Package and the Prospectus.

(ix) Good Standing of the Company. The Company has been duly organized and is validly existing as a corporation in good standing under the laws of the State of Delaware and has corporate power and authority to own, lease and operate its properties and to conduct its business as described in the Registration Statement, the Pricing Disclosure Package and the Prospectus and to enter into and perform its obligations under this Agreement; and the Company is duly qualified as a foreign corporation to transact business and is in good standing in each other jurisdiction in which such qualification is required, whether by reason of the ownership or leasing of property or the conduct of business, except where the failure to so qualify or to be in good standing would not reasonably be expected to result in a Material Adverse Effect.

(x) Good Standing of Subsidiaries. Axos Bank (the “Bank”) is a federal savings bank chartered under the laws of the United States of America to transact business and the charter of the Bank is in full force and effect. The Bank is the only depositary institution subsidiary of the Company. Each subsidiary (as defined in Rule 405 under the Securities Act) of the Company (each, a “Subsidiary”) has been duly organized and is validly existing as a corporation or other organization in good standing under the laws of the jurisdiction of its incorporation, formation or organization, as applicable, has the requisite corporate or organizational power and authority to own, lease and operate its properties and to conduct its business as described in the Registration Statement, the Pricing Disclosure Package and the Prospectus and is duly qualified as a foreign corporation or other business entity to transact business and is in good standing in each jurisdiction in which such qualification is required,

7

whether by reason of the ownership or leasing of property or the conduct of business, except where the failure to so qualify or to be in good standing would not reasonably be expected to result in a Material Adverse Effect. Except as otherwise disclosed in the Registration Statement, the Pricing Disclosure Package and the Prospectus, all of the issued and outstanding capital stock or equity interests, as applicable, of each such Subsidiary has been duly authorized and validly issued, is fully paid and non-assessable and is owned by the Company, directly or through Subsidiaries, free and clear of any security interest, mortgage, pledge, lien, encumbrance, claim or equity; none of the outstanding shares of capital stock or equity interests of any Subsidiary was issued in violation of the preemptive or similar rights of any security holder of such Subsidiary arising by operation of law, or under the articles of incorporation, bylaws or other organizational documents of the Company or any Subsidiary or under any agreement to which the Company or any Subsidiary is a party. The only Subsidiaries of the Company are those listed on the organizational chart provided to the Representative and attached hereto as Schedule D hereto. The only Subsidiaries of the Company that constitute a “significant subsidiary” as defined in Rule 1-02 of Regulation S-X (the “Significant Subsidiaries”) are listed in Exhibit 21.1 to the Company’s Annual Report on Form 10-K for the year ended June 30, 2020. Except for the Subsidiaries, the Company does not own beneficially, directly or indirectly, more than five percent (5%) of any class of equity securities or similar interests in any corporation, business trust, association or similar organization, and is not, directly or indirectly, a partner in any partnership or party to any joint venture.

(xi) Capitalization. The authorized, issued and outstanding capital stock of the Company and consolidated long-term debt (i.e. a maturity greater than one year) as of June 30, 2020 is as set forth in the Registration Statement, the Pricing Disclosure Package and the Prospectus in the column entitled “Actual” under the caption “Capitalization” (except for subsequent issuances, if any, pursuant to this Agreement, pursuant to reservations, agreements or employee benefit plans referred to in the Registration Statement, the Pricing Disclosure Package and the Prospectus or pursuant to the exercise of convertible securities or options referred to in the Registration Statement, the Pricing Disclosure Package and the Prospectus). The shares of issued and outstanding capital stock of the Company have been duly authorized and validly issued and are fully paid and non-assessable; none of the outstanding shares of capital stock of the Company was issued in violation of the preemptive rights, rights of first refusal or other similar rights of any security holder of the Company arising by operation of law, or under the Charter or the Bylaws or under any agreement to which the Company or any Subsidiary is a party. There have been no long-term borrowings by the Company or its consolidated Subsidiaries since such date.

(xii) Authorization of Agreement. The Company has full right, power and authority to execute and deliver this Agreement and to perform its obligations hereunder; and all action required to be taken for the due and proper authorization, execution and delivery by it of this Agreement and the consummation by it of the transactions contemplated hereby has been duly and validly taken. This Agreement has been duly authorized, executed and delivered by the Company.

8

(xiii) Securities Offerings. All offers and sales of the Company’s capital stock and debt or other securities prior to the date hereof were made in compliance with or were the subject of an available exemption from the Securities Act and the Securities Act Regulations and all other applicable state and federal laws or regulations, or any actions under the Securities Act and the Securities Act Regulations or any state or federal laws or regulations in respect of any such offers or sales are effectively barred by effective waivers or statutes of limitation.

(xiv) Authorization, Validity and Enforceability of Indenture and Securities. The Indenture will be duly authorized, executed and delivered by the Company and, assuming the due authorization, execution and delivery of the Indenture by the Trustee, the Indenture will constitute a valid, legal and binding agreement of the Company enforceable against the Company in accordance with its terms, except to the extent that enforceability may be limited by (a) bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer or other similar laws now or hereafter in effect relating to creditors’ rights generally and (b) general principles of equity (regardless of whether enforceability is considered in a proceeding at law or in equity). The Indenture has been, and at the Closing Time will be, duly qualified under the Trust Indenture Act. The Securities to be purchased by the Underwriters from the Company have been duly authorized for issuance and sale to the Underwriters pursuant to this Agreement and, at Closing, will have been duly executed by the Company, and when authenticated and delivered by the Trustee in the manner provided for in the Indenture, and issued and delivered by the Company pursuant to this Agreement against payment of the consideration set forth herein, will constitute valid, legal and binding obligations of the Company, enforceable against the Company in accordance with their terms, except to the extent that enforceability may be limited by (a) bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer or other similar laws now or hereafter in effect relating to creditors’ rights generally and (b) general principles of equity (regardless of whether enforceability is considered in a proceeding at law or in equity). The Securities will be in the form contemplated by, and will be entitled to the benefits of, the Indenture. The description of the Indenture contained in the Registration Statement, the Pricing Disclosure Package and the Prospectus, insofar as they purport to constitute summaries of the terms of the Indenture, constitute accurate description of the terms of the Indenture in all material respects.

(xv) Registration Rights. There are no contracts, agreements or understandings granting any person registration rights or other similar rights to have any securities registered for resale pursuant to the Registration Statement or otherwise registered for resale or sold by the Company under the Securities Act by reason of filing of the Registration Statement with the Commission or by reason of the sale of the Securities by the Company pursuant to this Agreement.

(xvi) Summaries of Legal Matters. The statements set forth in the Registration Statement, the Pricing Disclosure Package and the Prospectus under the captions “Description of Subordinated Notes” and “Certain ERISA Considerations” and under the captions “Regulation” and “Legal Proceedings” in the Company’s Annual Report on Form 10-K for the year ended June 30, 2020, insofar as they purport to describe legal matters or provisions of the laws and regulations or documents referred to therein, are accurate, complete and fair

9

in all material respects; and the statements set forth in the Pricing Disclosure Package and the Prospectus under the caption “Material U.S. Federal Income Tax Considerations”, insofar as they purport to summarize certain federal income tax laws of the United States, constitute a fair summary of the principal U.S. federal income tax consequences of an investment in the Securities in all material respects.

(xvii) Absence of Defaults and Conflicts. The Company is not in violation of its Certificate of Incorporation, as amended (the “Charter”), or Bylaws, as amended (the “Bylaws”); none of the Subsidiaries is in violation of its charter, bylaws or other organizational documents and neither the Company nor any of its Subsidiaries is in default in the performance or observance of any obligation, agreement, covenant or condition contained in any contract, indenture, mortgage, deed of trust, loan or credit agreement, note, lease or other agreement or instrument to which the Company or any of its Subsidiaries is a party or by which it or any of them may be bound, or to which any of the property or assets of the Company or any Subsidiary is subject (collectively, “Agreements and Instruments”), or in violation of any law or statute or any judgment, order, rule or regulation of any court or arbitrator or governmental or regulatory authority, except for such violations or defaults that would not, singly or in the aggregate, reasonably be expected to result in a Material Adverse Effect; and the execution, delivery and performance of this Agreement and the Indenture and the consummation of the transactions contemplated herein and therein, and in the Registration Statement (including the issuance and sale of the Securities and the use of the proceeds from the sale of the Securities as described in the Prospectus under the caption “Use of Proceeds”) and compliance by the Company with its obligations hereunder have been duly authorized by all necessary corporate action and do not and will not, whether with or without the giving of notice or passage of time or both, conflict with or constitute a breach of, or default or Repayment Event (as defined below) under, or result in the creation or imposition of any lien, charge or encumbrance upon any property or assets of the Company or any Subsidiary pursuant to, the Agreements and Instruments (except for such conflicts, breaches or defaults or liens, charges or encumbrances that would not, singly or in the aggregate, reasonably be expected to result in a Material Adverse Effect); nor will such action result in any violation of the provisions of the Charter or Bylaws of the Company or the charter, bylaws or other organizational document of any Subsidiary; nor will such action result in any violation of any applicable law, statute, rule, regulation, judgment, order, writ or decree of any government, government instrumentality or court, domestic or foreign, having jurisdiction over the Company or any Subsidiary or any of their assets, properties or operations (except for such violations that would not, singly or in the aggregate, reasonably be expected to result in a Material Adverse Effect). As used herein, a “Repayment Event” means any event or condition which gives the holder of any note, debenture or other evidence of indebtedness (or any person acting on such holder’s behalf) the right to require the repurchase, redemption or repayment of all or a portion of such indebtedness by the Company or any Subsidiary.

(xviii) New York Stock Exchange Compliance. The Company is in compliance in all material respects with the requirements of the New York Stock Exchange (“NYSE”) for continued listing of the Company’s common stock, $0.01 par value per share (the

10

“Common Stock”), thereon. The Company has taken no action designed to, or likely to have the effect of, terminating the registration of the Common Stock under the Exchange Act or the listing of the Common Stock on the NYSE, nor has the Company received any notification that the Commission or the NYSE is contemplating terminating such registration or listing. The transactions contemplated by this Agreement will not contravene the rules or regulations of the NYSE.

(xix) Absence of Labor Dispute. No labor dispute with the employees of the Company or any Subsidiary exists or, to the knowledge of the Company, is imminent. The Company is not aware of any existing or imminent labor disturbance by the employees of any of its or any Subsidiary’s principal suppliers, vendors, customers or contractors, which, in either case, could, singly or in the aggregate, reasonably be expected to result in a Material Adverse Effect. Neither the Company nor any of the Significant Subsidiaries is engaged in any unfair labor practice; except for matters which would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect, (A) there is (1) no unfair labor practice complaint pending or, to the Company’s knowledge, threatened against the Company or any of the Significant Subsidiaries before the National Labor Relations Board or any similar domestic or foreign body, and no grievance or arbitration proceeding arising out of or under collective bargaining agreements is pending or, to the Company’s knowledge, threatened, (2) no strike, labor dispute, slowdown or stoppage pending or, to the Company’s knowledge, threatened against the Company or any of the Significant Subsidiaries and (3) no union representation dispute currently existing concerning the employees of the Company or any of the Significant Subsidiaries, (B) to the Company’s knowledge, no union organizing activities are currently taking place concerning the employees of the Company or any of the Significant Subsidiaries and (C) there has been no violation of any federal, state, local or foreign law relating to discrimination in the hiring, promotion or pay of employees, any applicable wage or hour laws or any provision of the Employee Retirement Income Security Act of 1974, as amended, and the regulations and published interpretations thereunder (collectively, “ERISA”) or any similar domestic or foreign law or the rules and regulations promulgated thereunder concerning the employees of the Company or any of the Significant Subsidiaries.

(xx) Absence of Proceedings. There is no action, suit, proceeding, inquiry or investigation before or brought by any court or governmental agency or body, domestic or foreign, now pending, or, to the knowledge of the Company, threatened, against or affecting the Company or any Subsidiary, which is required to be disclosed in the Registration Statement (other than as disclosed therein), or which, if determined adversely to the Company or any Subsidiary, individually or in the aggregate, could reasonably be expected to result in a Material Adverse Effect, or which could reasonably be expected to materially and adversely affect the properties or assets thereof, nor, to the Company’s knowledge, is there any basis for any such action, suit, inquiry, proceeding or investigation; the aggregate of all pending legal or governmental proceedings to which the Company or any Subsidiary is a party or of which any of their respective property or assets is the subject which are not described in the Registration Statement, including ordinary routine litigation incidental to the business, if

11

determined adversely to the Company or any Subsidiary, individually or in the aggregate, could not reasonably be expected to result in a Material Adverse Effect.

(xxi) Home Owners’ Loan Act. The Company has been duly registered as, and meets in all material respects the applicable requirements for qualification as, a savings and loan holding company under the applicable provisions of the Home Owners’ Loan Act, as amended, and has elected to be treated as a financial holding company by the Board of Governors of the Federal Reserve System. The activities of the Subsidiaries are permitted of subsidiaries of a financial holding company under applicable law and the rules and regulations of the Federal Reserve set forth in Title 12 of the Code of Federal Regulations.

(xxii) Compliance with Bank Regulatory Authorities. The Company and each of its Subsidiaries are in compliance in all material respects with all applicable laws, rules and regulations (including, without limitation, all applicable regulations and orders) of, or agreements with, the Board of Governors of the Federal Reserve System, the Office of the Comptroller of the Currency (the “OCC”), the Federal Deposit Insurance Corporation, the Consumer Financial Protection Bureau (the “CFPB”), and any other federal or state bank regulatory authority with jurisdiction over the Company or its Subsidiaries, as applicable (collectively, the “Bank Regulatory Authorities”), the Equal Credit Opportunity Act, the Fair Housing Act, the Truth in Lending Act, the Community Reinvestment Act (the “CRA”), the Home Mortgage Disclosure Act, the Bank Secrecy Act and Title III of the USA Patriot Act, to the extent such laws or regulations apply to the Company or the Bank, as applicable. The Company and the Bank have no knowledge of any facts and circumstances, and have no reason to believe that any facts or circumstances exist, that could reasonably be expected to cause the Bank (A) to be deemed not to be in satisfactory compliance with the CRA and the regulations promulgated thereunder or to be assigned a CRA rating by federal or state banking regulators of lower than “satisfactory,” or (B) to be deemed to be operating in violation, in any material respect, of the Bank Secrecy Act of 1970 as amended by the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (or otherwise known as the “Currency and Foreign Transactions Reporting Act”), the USA Patriot Act (or otherwise known as “Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001”) or any order issued with respect to the Anti-Money Laundering Laws (as defined below). As of June 30, 2020, each of the Company and the Bank met or exceeded the standards necessary to be considered “well capitalized” under the FDIC’s regulatory framework for prompt corrective action. The Bank has a Community Reinvestment Act rating of at least “Satisfactory.” The Bank has been duly chartered, is validly existing under the laws of the United States of America and holds the requisite authority to do business as a federal savings bank with banking powers under the laws of the United States of America. The Bank is the only depository institution subsidiary of the Company and the Bank is a member in good standing of the Federal Home Loan Bank System. The activities of the Bank are permitted under the laws and regulations of the United States and the OCC. Since June 30, 2015, the Company, the Bank and each of its subsidiaries have filed all material reports, registrations and statements, together with any required amendments thereto, that it was required to file with the Federal Reserve, the FDIC, the OCC, and any

12

other applicable federal or state banking authorities. All such reports and statements filed with any such regulatory body or authority are collectively referred to herein as the “Company Reports.” As of their respective dates, the Company Reports complied as to form in all material respects with all the rules and regulations promulgated by the Federal Reserve, the OCC and any other applicable federal or state banking authorities, as the case may be. Except as disclosed in the Registration Statement, the Pricing Disclosure Package and the Prospectus, none of the Company, the Bank nor any of their respective subsidiaries is a party or subject to any formal or informal agreement, memorandum of understanding, consent decree, directive, cease-and-desist order, order of prohibition or suspension, written commitment, supervisory agreement or other written statement as described under 12 U.S.C. 1818(u) with, or order issued by, or has adopted any board resolutions at the request of, the Federal Reserve, the FDIC, the OCC, the CFPB or any other bank regulatory authority that restricts materially the conduct of its business, or in any manner relates to its capital adequacy, its credit policies or its management, nor have any of them been advised by any Bank Regulatory Authority that it is contemplating issuing or requesting (or is considering the appropriateness of issuing or requesting) any such order, decree, agreement, memorandum of understanding, extraordinary supervisory letter, commitment letter or similar submission, or any such board resolutions or that imposes any restrictions or requirements not generally applicable to bank holding companies or commercial banks. There is no unresolved violation, criticism or exception by any Bank Regulatory Authority with respect to any examination of the Company, the Bank or any of the Company’s other Subsidiaries, which would reasonably be expected to result in a Material Adverse Effect.

(xxiii) Accuracy of Exhibits. There are no contracts or documents which are required to be described in the Registration Statement, the Pricing Disclosure Package, the Prospectus or the documents incorporated by reference therein or to be filed as exhibits thereto which have not been so described and filed as required.

(xxiv) Absence of Further Requirements. No filing with, or authorization, approval, consent, license, order, registration, qualification or decree of, any court or governmental agency or body is necessary or required for the performance by the Company of its obligations under this Agreement in connection with the offering, issuance or sale of the Securities or the consummation of the transactions contemplated in this Agreement prior to the Closing Time, except such as have been already obtained or as may be required under the Securities Act, the Securities Act Regulations, the rules of the NYSE, the securities laws of any state or non-U.S. jurisdiction or the rules of the Financial Industry Regulatory Authority, Inc. (“FINRA”). All of the information provided to the Underwriters or to counsel for the Underwriters by the Company, its counsel, its officers and directors and the holders of any securities (debt or equity) or options to acquire any securities of the Company in connection with the offering of the Securities is true, complete, correct and compliant with FINRA’s rules, and any letters, filings or other supplemental information provided to FINRA pursuant to FINRA Rules or National Association of Securities Dealers Conduct Rules are true, complete and correct.

(xxv) Possession of Licenses and Permits. The Company and its Subsidiaries possess such permits, licenses, approvals, registrations, memberships, consents and other

13

authorizations (collectively, “Governmental Licenses”) issued by the appropriate federal, state, local or foreign regulatory agencies or bodies necessary to conduct the business now operated by them; the Company and its Subsidiaries are in compliance with the terms and conditions of all such Governmental Licenses, except where the failure to so comply would not, singly or in the aggregate, reasonably be expected to have a Material Adverse Effect and no event has occurred that allows, or after notice or lapse of time would allow, revocation or termination of any such Governmental License or result in any other material impairment of the rights of any such Governmental License; all of the Governmental Licenses are valid and in full force and effect; and neither the Company nor any of its Subsidiaries has received any notice of proceedings relating to the revocation or modification of any such Governmental Licenses. Neither the Company nor any of its Subsidiaries has failed to file with applicable regulatory authorities any material statement, report, information or form required by any applicable law, regulation or order, all such filings were in material compliance with applicable laws when filed and no material deficiencies have been asserted by any regulatory commission, agency or authority with respect to any such filings or submissions.

(xxvi) Title to Property. The Company and its Subsidiaries have good and marketable title in fee simple to all real property owned by the Company and its Subsidiaries and good title to all other properties owned by them, in each case, free and clear of all mortgages, pledges, liens, security interests, claims, restrictions or encumbrances of any kind except such as (A) are described in the Registration Statement, the Pricing Disclosure Package and the Prospectus or (B) do not materially affect the value of such property and do not interfere with the use made and proposed to be made of such property by the Company or any Subsidiary. All of the leases and subleases under which the Company or any of its Subsidiaries holds properties described in the Registration Statement, the Pricing Disclosure Package and the Prospectus, are in full force and effect and are held under valid, subsisting and enforceable leases, and neither the Company nor any Subsidiary has any notice of any material claim of any sort that has been asserted by anyone adverse to the rights of the Company or any Subsidiary under any of the leases or subleases mentioned above, or affecting or questioning the rights of the Company or such Subsidiary to the continued possession of the leased or subleased premises under any such lease or sublease.

(xxvii) Possession of Intellectual Property. The Company and its Subsidiaries own or possess, or can acquire on reasonable terms, adequate patents, patent rights, licenses, inventions, copyrights, know-how (including trade secrets and other unpatented and/or unpatentable proprietary or confidential information, systems or procedures and excluding generally commercially available “off the shelf” software programs licensed pursuant to shrink wrap or “click and accept” licenses), systems, technology, trademarks, service marks, trade names or other intellectual property (collectively, “Intellectual Property”) necessary to carry on the business now operated by them. Neither the Company nor any of its Subsidiaries has received any notice or is otherwise aware of any infringement or misappropriation of or conflict with asserted rights of others with respect to any of its Intellectual Property or of any facts or circumstances which would reasonably be expected to render any such Intellectual Property invalid or inadequate to protect the interest of the Company or any of its Subsidiaries therein.

14

(xxviii) Environmental Laws. Except as described in the Registration Statement and except as would not, singly or in the aggregate, reasonably be expected to result in a Material Adverse Effect, (A) neither the Company nor any of its Subsidiaries is in violation of any federal, state, local or foreign statute, law, rule, regulation, ordinance, code, policy or rule of common law or any judicial or administrative interpretation thereof, including any judicial or administrative order, consent, decree or judgment, relating to pollution or protection of human health, the environment (including, without limitation, ambient air, surface water, groundwater, land surface or subsurface strata) or wildlife, including, without limitation, laws and regulations relating to the release or threatened release of chemicals, pollutants, contaminants, wastes, toxic substances, hazardous substances, petroleum or petroleum products, asbestos-containing materials or mold (collectively, “Hazardous Materials”) or to the manufacture, processing, distribution, use, treatment, storage, disposal, transport or handling of Hazardous Materials (collectively, “Environmental Laws”), (B) the Company and its Subsidiaries have all permits, authorizations and approvals required under any applicable Environmental Laws and are each in compliance with their requirements, (C) there are no pending or, to the Company’s knowledge, threatened administrative, regulatory or judicial actions, suits, demands, demand letters, claims, liens, notices of noncompliance or violation, investigation or proceedings relating to any Environmental Law against the Company or any of its Subsidiaries, (D) there are no events or circumstances that could reasonably be expected to result in forming the basis of an order for clean-up or remediation, or an action, suit or proceeding by any private party or governmental body or agency, against or affecting the Company or any of its Subsidiaries relating to Hazardous Materials or any Environmental Laws, and (E) none of the Company or any of its Subsidiaries anticipate material capital expenditures relating to Environmental Laws.

(xxix) ERISA. Each employee benefit plan, within the meaning of Section 3(3) of ERISA, that is maintained, administered or contributed to by the Company or any Subsidiary or any member of the Company’s “control group” (within the meaning of Section 414 of the Internal Revenue Code of 1986, as amended (the “Code”) for employees or former employees of the Company and its affiliates (“Plan”) has been maintained in material compliance with its terms and the requirements of any applicable statutes, orders, rules and regulations, including but not limited to ERISA and the Code. No “prohibited transaction,” within the meaning of Section 406 of ERISA or Section 4975 of the Code has occurred with respect to any such Plan excluding transactions effected pursuant to a statutory or administrative exemption. No “reportable event” (as defined under ERISA) has occurred or is reasonably expected to occur with respect to any “employee benefit plan” established or maintained by the Company, the Subsidiaries or any of their ERISA Affiliates. No “employee benefit plan” (as defined under ERISA) established or maintained by the Company, the Subsidiaries or any of their ERISA Affiliates, if such employee benefit plan were terminated, could have any “amount of unfunded benefit liabilities” (as defined under ERISA). Neither the Company, the Subsidiaries nor any of their ERISA Affiliates has incurred or reasonably expects to incur any liability under (A) Title IV of ERISA with respect to termination of, or withdrawal from, any “employee benefit plan,” or (B) Sections 412, 4971, 4975 or 4980B of the Code. Each employee benefit plan established or maintained by the Company, the

15

Subsidiaries or any of their ERISA Affiliates that is intended to be qualified under Section 401(a) of the Code is so qualified and nothing has occurred, whether by action or failure to act, which could cause the loss of such qualification. With respect to each Plan subject to Title IV of ERISA, the minimum funding standard of Section 302 of ERISA or Section 412 of the Code, as applicable, has been satisfied (without taking into account any waiver thereof or extension of any amortization period) and is reasonably expected to be satisfied in the future (without taking into account any waiver thereof or extension of any amortization period) and the fair market value of the assets under each Plan exceeds the present value of all benefits accrued under such Plan (determined based on those assumptions used to fund such Plan). There is no pending audit or investigation by the Internal Revenue Service, the U.S. Department of Labor, the Pension Benefit Guaranty Corporation or any other governmental agency or any foreign agency.

(xxx) Internal Control Over Financial Reporting. The Company and each of its Subsidiaries maintain a system of internal control over financial reporting (as such term is defined in Rule 13a-15(f) of the Exchange Act Regulations) that complies with the requirements of the Exchange Act and the Exchange Act Regulations and has been designed by, or under the supervision of, the Company’s principal executive officer and principal financial officer to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. The Company and the Subsidiaries maintain internal accounting controls sufficient to provide reasonable assurance that (A) transactions are executed in accordance with management’s general or specific authorizations; (B) transactions are recorded as necessary to permit preparation of financial statements in conformity with GAAP and to maintain asset accountability; (C) access to assets is permitted only in accordance with management’s general or specific authorization; and (D) the recorded accountability for assets is compared with the existing assets at reasonable intervals and appropriate action is taken with respect to any differences; and (E) the interactive data in eXtensible Business Reporting Language included or incorporated by reference in the Registration Statement is accurate and fairly presents the information called for in all material respects and has been prepared in accordance with the Commission’s rules and guidelines applicable thereto. The systems of internal control over financial reporting of the Company and its Subsidiaries are overseen by the Audit Committee of the Board of Directors of the Company in accordance with NYSE rules and regulations. Except as described in the Registration Statement, the Pricing Disclosure Package and the Prospectus, since the end of the Company’s most recent audited fiscal year, (i) there has been no material weakness in the Company’s internal control over financial reporting (whether or not remediated), (ii) there has been no change in the Company’s internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, the Company’s internal control over financial reporting, and (iii) the Company has not been advised of (A) any significant deficiencies in the design or operation of internal controls that could adversely affect the ability of the Company or any Subsidiary to record, process, summarize and report financial data, or any material weakness in internal controls, or (Bb) any fraud, whether or not material, that involves management or other employees who have a significant role in the internal controls of the Company and each of the Subsidiaries.

16

(xxxi) Disclosure Controls and Procedures. The Company and its Subsidiaries employ disclosure controls and procedures (as such term is defined in Rule 13a-15(e) of the Exchange Act Regulations), which (A) are designed to ensure that information required to be disclosed by the Company in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the Commission’s rules and forms and that material information relating to the Company and its Subsidiaries is made known to the Company’s principal executive officer and principal financial officer by others within the Company and its Subsidiaries to allow timely decisions regarding disclosure, (B) have been evaluated by management of the Company for effectiveness as of the end of the Company’s most recent fiscal quarter, and (C) were then effective in all material respects to perform the functions for which they were established. Based on the evaluation of the Company’s and each Subsidiary’s disclosure controls and procedures described above, the Company is not aware of (1) any significant deficiency in the design or operation of internal controls which would reasonably be expected to adversely affect the Company’s or its Subsidiaries’ ability to record, process, summarize and report financial data or any material weakness in internal controls or (2) any fraud, whether or not material, that involves management or other employees who have a significant role in the Company’s or its Subsidiaries’ internal controls. Since the most recent evaluation of the Company’s disclosure controls and procedures described above, there have been no changes in internal controls or in other factors that could significantly and materially affect internal controls. The Company does not reasonably expect within the next 90 days to publicly disclose or report to the Audit Committee or the Board of Directors a material weakness, change in internal control over financial reporting or fraud involving management or other employees who have a significant role in internal control over financial reporting, any violation of, or failure to comply with, the Sarbanes-Oxley Act or the Exchange Act, or any matter related to internal control over financial reporting which, if determined adversely, would result in a Material Adverse Effect.

(xxxii) Compliance with the Sarbanes-Oxley Act. There is and has been no failure on the part of the Company or any of the Company’s directors or officers, in their capacities as such, to comply in all material respects with any provision of the Sarbanes-Oxley Act and the rules and regulations promulgated in connection therewith, including Section 402 related to loans and Sections 302 and 906 related to certifications.

(xxxiii) Pending Procedures and Examinations. The Registration Statement is not the subject of a pending proceeding or examination under Section 8(d) or 8(e) of the Securities Act, and the Company is not the subject of a pending proceeding under Section 8A of the Securities Act in connection with the offering of the Securities.

(xxxiv) Payment of Taxes. All United States federal income tax returns of the Company and the Subsidiaries required by law to be filed have been timely filed and all taxes shown by such returns or otherwise assessed, which are due and payable, have been paid, except assessments against which have been or will be promptly contested in good faith and as to which adequate reserves have been provided in the Company’s financials in accordance with GAAP. The Company and the Subsidiaries have filed all other tax returns that are required to have been filed by them pursuant to applicable foreign, state, local or other law, except

17

insofar as the failure to file such returns, individually or in the aggregate, would not reasonably be expected to result in a Material Adverse Effect, and have paid all taxes due pursuant to such returns or pursuant to any assessment received by the Company or any Subsidiary except for such taxes, if any, as are being contested in good faith and as to which adequate reserves have been provided. The charges, accruals and reserves on the books of the Company and the Subsidiaries in respect of any income and corporation tax liability for any years not finally determined are adequate to meet any assessments or re-assessments for additional income tax for any years not finally determined. Except as otherwise disclosed in the Registration Statement, the Pricing Disclosure Package and the Prospectus, there is no material tax deficiency that has been or would reasonably be expected to be asserted against the Company or any of its Subsidiaries or any of their respective properties or assets.

(xxxv) Insurance. The Company and each Subsidiary is insured by insurers of recognized financial responsibility against such losses and risks and in such amounts as are prudent and customary in the businesses in which they are engaged including, but not limited to, policies covering real and personal property owned or leased by the Company and each Subsidiary against theft, damage, destruction, and acts of vandalism; neither the Company nor any of its Subsidiaries has been refused any insurance coverage sought or applied for; and the Company has no reason to believe that it or any Subsidiary will not be able to renew their existing insurance coverage as and when such coverage expires or to obtain similar coverage from similar insurers as may be necessary to continue its business at a cost that would not have a Material Adverse Effect. All such insurance is fully in force as of the date hereof.

(xxxvi) Investment Company Act. The Company is not, and upon the issuance and sale of the Securities as herein contemplated and the application of the net proceeds therefrom as described in the Registration Statement, the Pricing Disclosure Package and the Prospectus will not be, an “investment company” or an entity “controlled” by an “investment company” as such terms are defined in the Investment Company Act of 1940, as amended (the “Investment Company Act”).

(xxxvii) Absence of Manipulation. Neither the Company nor any of the Subsidiaries, nor any affiliates of the Company or its Subsidiaries, has taken, directly, or indirectly, and neither the Company nor any of the Subsidiaries, nor any affiliates of the Company or its Subsidiaries, will take, directly or indirectly, any action designed to cause or result in, or which constitutes or could reasonably be expected to constitute, the stabilization or manipulation of the price of any security of the Company or any “reference security” (as defined in Rule 100 of Regulation M under the Exchange Act) to facilitate the sale or resale of the Securities or otherwise, and has taken no action which would directly or indirectly violate Regulation M under the Exchange Act.

(xxxviii) Foreign Corrupt Practices Act. None of the Company, any of its Subsidiaries or, to the best knowledge of the Company, any director, officer, agent or employee of the Company or any of its Subsidiaries, any of the respective affiliates of the Company or any of its Subsidiaries or any other person acting on behalf of the Company or any of its Subsidiaries or their respective affiliates has (A) used any corporate funds for any unlawful

18

contribution, gift, entertainment or other unlawful expense relating to political activity; (B) made or taken an act in furtherance of an offer, payment, promise or authorization of any direct or indirect unlawful payment or giving of money, property, gifts or anything else of value, directly or indirectly, to any foreign or domestic government official (including any officer or employee of a government or government-owned or controlled entity or of a public international organization, or any person acting in an official capacity for or on behalf of any of the foregoing, or any political party or party official or candidate for public office) from corporate funds; (C) violated or is in violation of any provision of the Foreign Corrupt Practices Act of 1977, as amended (the “FCPA”), or any applicable law or regulations implementing the Organisation for Economic Co-operation and Development Convention on Combating Bribery of Foreign Public Officials in International Business Transactions, or committed an offense under the Bribery Act 2010 of the United Kingdom, or any other applicable anti-bribery or anti-corruption statute or regulation; or (D) made, offered, agreed, requested or taken an act in furtherance of any unlawful bribe, rebate, payoff, influence payment, kickback or other unlawful payment or benefit in violation of any applicable law, rule or regulation. The Company and its Subsidiaries and their respective affiliates have conducted their businesses in compliance with the FCPA and all other applicable anti-bribery and anti-corruption laws and have instituted and maintain policies and procedures designed to ensure, and which are reasonably expected to continue to ensure, continued compliance therewith.

(xxxix) Anti-Money Laundering Laws. The operations of the Company and its Subsidiaries and, to the best knowledge of the Company, their respective affiliates, are and have been conducted at all times in compliance with applicable financial recordkeeping and reporting requirements of the Currency and Foreign Transactions Reporting Act of 1970, as amended, and the applicable anti-money laundering statutes of all jurisdictions where the Company and its Subsidiaries and their respective affiliates conduct business, the rules and regulations thereunder and any related or similar rules, regulations or guidelines, issued, administered or enforced by any governmental agency or body (collectively, the “Anti-Money Laundering Laws”); and no action, suit or proceeding by or before any court, governmental agency or body involving the Company or any of its Subsidiaries with respect to the Anti-Money Laundering Laws is pending or, to the best knowledge of the Company, threatened. The Company and its Subsidiaries and, to the knowledge of the Company, their respective affiliates, have conducted their businesses in compliance with applicable anti-corruption laws and have instituted and maintain and will continue to maintain policies and procedures designed to promote and achieve compliance with such laws.

(xl) OFAC. None of the Company, any of the Subsidiaries or nor, to the knowledge of the Company after due inquiry, any officer or director of either the Company or any Subsidiary, any agent, employee, affiliate or person acting on behalf of the Company or any of the Subsidiaries is or has been (A) engaged in any services (including financial services), transfers of goods, software, or technology, or any other business activity related to (i) Cuba, Iran, North Korea, Sudan, Syria, the Crimea region of Ukraine claimed by Russia or any other country or territory that is, or whose government is, the subject of Sanctions that broadly prohibit dealings with that country or territory (collectively, “Sanctioned Countries”

19

and each, a “Sanctioned Country”), (ii) the government of any Sanctioned Country, (iii) any person, entity or organization located in, resident in, formed under the laws of, or owned or controlled by the government of, any Sanctioned Country, or (iv) any person, entity or organization made subject of any sanctions administered or enforced by the United States Government, including, without limitation, the list of Specially Designated Nationals (“SDN List”) of the Office of Foreign Assets Control of the U.S. Treasury Department (“OFAC”), or by the United Nations Security Council, the European Union, Her Majesty’s Treasury, or other relevant sanctions authority (collectively, “Sanctions”) and the Company will not directly or indirectly use the proceeds of the offering of the Securities, or lend, contribute or otherwise make available such proceeds to any Subsidiary, or any joint venture partner or other person or entity, for the purpose of financing the activities of or business with any person, or in any country or territory, that currently is the subject or target of any U.S. sanctions administered by OFAC or in any other manner that will result in a violation by any person (including any person participating in the transaction whether as underwriter, advisor, investor or otherwise) of U.S. sanctions administered by OFAC; (B) engaged in any transfers of goods, technologies or services (including financial services) that may assist the governments of Sanctioned Countries or facilitate money laundering or other activities proscribed by United States laws, rules or regulations; (C) is a person, entity or organization currently the subject of any Sanctions; or (D) located, organized or resident in any Sanctioned Country.

(xli) Relationship. No relationship, direct or indirect, exists between or among the Company or any of its Subsidiaries, on the one hand, and the directors, officers, shareholders, customers or suppliers of the Company or any of its Subsidiaries, on the other, that is required by the Securities Act or Securities Act Regulations to be described in the Registration Statement and/or the Prospectus and that is not so described.

(xlii) Lending Relationship. Except as disclosed in the Registration Statement, the Pricing Disclosure Package and the Prospectus, the Company (A) does not have any material lending or other relationship with any bank or lending affiliate of any Underwriter and (B) does not intend to use any of the proceeds from the sale of the Securities to repay any outstanding debt owed to any affiliate of any Underwriter.

(xliii) No Restrictions on Subsidiaries. Except in each case as otherwise disclosed in the Registration Statement, the Pricing Disclosure Package and the Prospectus, no Subsidiary of the Company is currently prohibited, directly or indirectly, under any agreement or other instrument to which it is a party or is subject, from paying any dividends to the Company, from making any other distribution on such Subsidiary’s capital stock, from repaying to the Company any loans or advances to such Subsidiary from the Company or from transferring any of such Subsidiary’s properties or assets to the Company or any other Subsidiary of the Company.

(xliv) Statistical and Market-Related Data. The statistical and market-related data contained in the Registration Statement, the Pricing Disclosure Package and the Prospectus comply in all material respects with the requirements of Commission Industry Guide 3 (where applicable) and are based on or derived from sources which the Company

20

believes are reliable and accurate, and the Company has obtained the written consent to the use of such data from such sources to the extent required.

(xlv) Distribution of Offering Material By the Company. The Company has not distributed and will not distribute, prior to the later of the Closing Time and the completion of the Underwriters’ distribution of the Securities, any offering material in connection with the offering and sale of the Securities other than the Registration Statement, the preliminary prospectus contained in the Pricing Disclosure Package, the Prospectus, any Issuer Free Writing Prospectus reviewed and consented to by the Representative and included in Schedule B hereto or any electronic road show or other written communications reviewed and consented to by the Representative and listed on Schedule B hereto (each a, “Company Additional Written Communication”). Each such Company Additional Written Communication, when taken together with the Pricing Disclosure Package, did not, and at the Closing Time will not, contain any untrue statement of a material fact or omit to state a material fact necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading. The preceding sentence does not apply to statements in or omissions from the Company Additional Written Communication based upon and in conformity with written information furnished to the Company by any Underwriter through the Representative specifically for use therein, it being understood and agreed that the only such information furnished by any Underwriter through the Representative consists of the Underwriter Information.

(xlvi) Forward-Looking Statements. Each financial or operational projection or other “forward-looking statement” (as defined by Section 27A of the Securities Act or Section 21E of the Exchange Act) contained in the Registration Statement, the Pricing Disclosure Package and the Prospectus (A) was so included by the Company in good faith and with reasonable basis after due consideration by the Company of the underlying assumptions, estimates and other applicable facts and circumstances and (B) is accompanied by meaningful cautionary statements identifying those factors that could cause actual results to differ materially from those in such forward-looking statement. No such statement was made with the knowledge of an executive officer or director of the Company that it was false or misleading.

(xlvii) No Fees or Advisory Rights. Other than as contemplated by this Agreement, there is no broker, finder or other party that is entitled to receive from the Company or any Subsidiary any brokerage or finder’s fee or any other fee, commission or payment as a result of the transactions contemplated by this Agreement. No person has the right to act as a financial advisor to the Company in connection with the offer and sale of the Securities.

(xlviii) Deposit Insurance. The deposit accounts of the Bank are insured by the FDIC up to applicable legal limits, the Bank has paid all premiums and assessments required by the FDIC and the regulations thereunder, and no proceeding for the termination or revocation of such insurance is pending or, to the knowledge of the Company, threatened.

21

(xlix) Derivative Instruments. Any and all material swaps, caps, floors, futures, forward contracts, option agreements (other than options issued under the Company’s shareholder-approved benefit plans) and other derivative financial instruments, contracts or arrangements, whether entered into for the account of the Company or one of its Subsidiaries or for the account of a customer of the Company or one of its Subsidiaries, were entered into in the ordinary course of business and in accordance with applicable laws, rules, regulations and policies of all applicable regulatory agencies and with counterparties believed by the Company to be financially responsible. The Company and each of its Subsidiaries have duly performed in all material respects all of their obligations thereunder to the extent that such obligations to perform have accrued, and there are no breaches, violations or defaults or allegations or assertions of such by any party thereunder except as would not, singly or in the aggregate, reasonably be expected to have a Material Adverse Effect.

(l) Termination of Contracts. Except as would not have a Material Adverse Effect, (A) neither the Company nor any Significant Subsidiary has sent or received any communication regarding termination of, or intent not to renew, any of the contracts or agreements referred to or described in the Registration Statement, the Pricing Disclosure Package and Prospectus, or referred to or described in, or filed as an exhibit to, the Registration Statement, the Pricing Disclosure Package and Prospectus, and no such termination or non-renewal has been threatened by the Company or any Significant Subsidiary or, to the Company’s knowledge, any other party to any such contract or agreement; and (B) there are no contracts or documents of the Company or any of the Significant Subsidiaries that are required to be described in the Registration Statement, the Pricing Disclosure Package and the Prospectus or to be filed as exhibits thereto by the Securities Act or by the rules and regulations of the Commission thereunder that have not been so described and filed.

(li) Off-Balance Sheet Transactions. There is no transaction, arrangement or other relationship between the Company or any of its Subsidiaries and an unconsolidated or other off-balance sheet entity which is required to be disclosed in the Registration Statement, the Pricing Disclosure Package and the Prospectus (other than as disclosed therein).

(lii) Margin Rules. The application of the proceeds received by the Company from the issuance, sale and delivery of the Securities as described in the Registration Statement, the Pricing Disclosure Package and the Prospectus will not violate Regulation T, U or X of the Federal Reserve or any other regulation of the Federal Reserve.