Form 8-K Axos Financial, Inc. For: May 04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 4, 2021

Axos Financial, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-37709 | 33-0867444 | ||||||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification Number) | ||||||

9205 West Russell Road, STE 400, Las Vegas, NV 89148

(Address of principal executive offices) (zip code)

Registrant’s telephone number, including area code: (858) 649-2218

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common stock, $.01 par value | AX | New York Stock Exchange | ||||||

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

Axos Financial, Inc. (the “Registrant”), parent of Axos Bank, will use the presentation provided in the Exhibits at conferences and one-on-one meetings beginning on May 5, 2021 and during the next few weeks.

This Form 8-K and the information attached below shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), nor shall it be incorporated by reference into a filing under the Securities Act of 1933, as amended (“Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such a filing. The furnishing of the information in this report is not intended to, and does not, constitute a determination or admission by the Registrant that the information in this report is material or complete, or that investors should consider this information before making an investment decision with respect to any security of the Registrant or any of its affiliates. The information in the materials is presented as of May 4, 2021, and the Registrant does not assume any obligation to update such information in the future.

Safe Harbor Statement

Statements contained in the slide show presentation that state expectations or predictions about the future are forward-looking statements intended to be covered by the safe harbor provisions of the Securities Act and the Exchange Act. The Registrant’s actual results could differ materially from those projected in such forward-looking statements. Factors that could affect those results include “Risk Factors” and the other factors appearing in the documents that the Registrant has filed with the Securities and Exchange Commission.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit | Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Axos Financial, Inc. | ||||||||||||||

| Date: | May 4, 2021 | By: | /s/ Andrew J. Micheletti | |||||||||||

| Andrew J. Micheletti | ||||||||||||||

| EVP and Chief Financial Officer | ||||||||||||||

Axos Financial, Inc. Investor Presentation May 2021 NYSE: AX

Safe Harbor 1 This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). The words “believe,” “expect,” “anticipate,” “estimate,” “project,” or the negation thereof or similar expressions constitute forward-looking statements within the meaning of the Reform Act. These statements may include, but are not limited to, projections of revenues, income or loss, projected consummation of pending acquisitions, including the acquisition of E*TRADE Advisor Services, estimates of capital expenditures, plans for future operations, products or services, the effects of the COVID-19 pandemic, and financing needs or plans, as well as assumptions relating to these matters. Such statements involve risks, uncertainties and other factors that may cause actual results, performance or achievements of the Company and its subsidiaries to be materially different from any future results, performance For a discussion of these factors, we refer you to the Company's reports filed with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended June 30, 2020, Form 10-Q for the quarter ended March 31, 2021 and our last earnings press release. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the Company or by any other person or entity that the objectives and plans of the Company will be achieved. For all forward-looking statements, the Company claims the protection of the safe-harbor for forward-looking statements contained in the Reform Act. or achievements expressed or implied by such forward-looking statements.

Axos’ Business Model is Differentiated From Other Banks 2 Customer Acquisition Sales Servicing Distribution • Digital Marketing • Affinity and Distribution Partners • Data mining/target feeding direct marketing • Cross-selling • Automated fulfillment • Inbound call center sales • Outbound call center sales • Minimal outside sales • Significant inside sales • Self-service • Digital journey • Direct banker (call center) • Balance sheet • Whole loan sales options • Securitization Data Driven Insight Integrated Customer Experience Digital Marketing Digitally Enabled Operations Next-Gen Technology Core Digital Capabilities

Our Business Model is More Profitable Because Our Costs are Lower and Our Assets are Higher-Yielding 3 Axos1 (%) Banks Greater Than $10bn2 (%) Net interest income 4.27% 2.45% As % of average assets Salaries and benefits 0.98% 1.09% Premises, equipment and other non-interest expense 0.94% 1.26% Total non-interest expense 1.92% 2.35% Core business margin 2.35% 0.10% 1. For the three months ended 12/31/2021 – the most recent data on FDIC website “Statistics on Depository Institutions Report”. Axos Bank only, excludes Axos Financial, Inc. and non-bank subsidiaries to compare to FDIC data. Data retrieved 5/3/2021. 2. All Commercial Banks by asset size. FDIC reported for three months ended 12/31/2020. Total of 151 institutions >$10 billion. Data retrieved 5/4/2021.

4 Axos Financial’s Three Business Segments Provide the Foundation For Sustained Long-Term Growth Consumer Banking Commercial BankingSecurities › Diverse mix of asset, deposit, and fee income reduces risk and provides multiple growth opportunities in varying environments › Differentiated retail digital strategy from “online savings banks” or fin- tech competitors › Structural cost advantage vs. traditional banks › Differentiated distribution strategy › New business initiatives will generate incremental growth › Universal Digital Banking Platform and Enterprise Technology stack provide operating leverage opportunity › Technology synergies among business segments reduce overall cost of growth strategy Investment Thesis

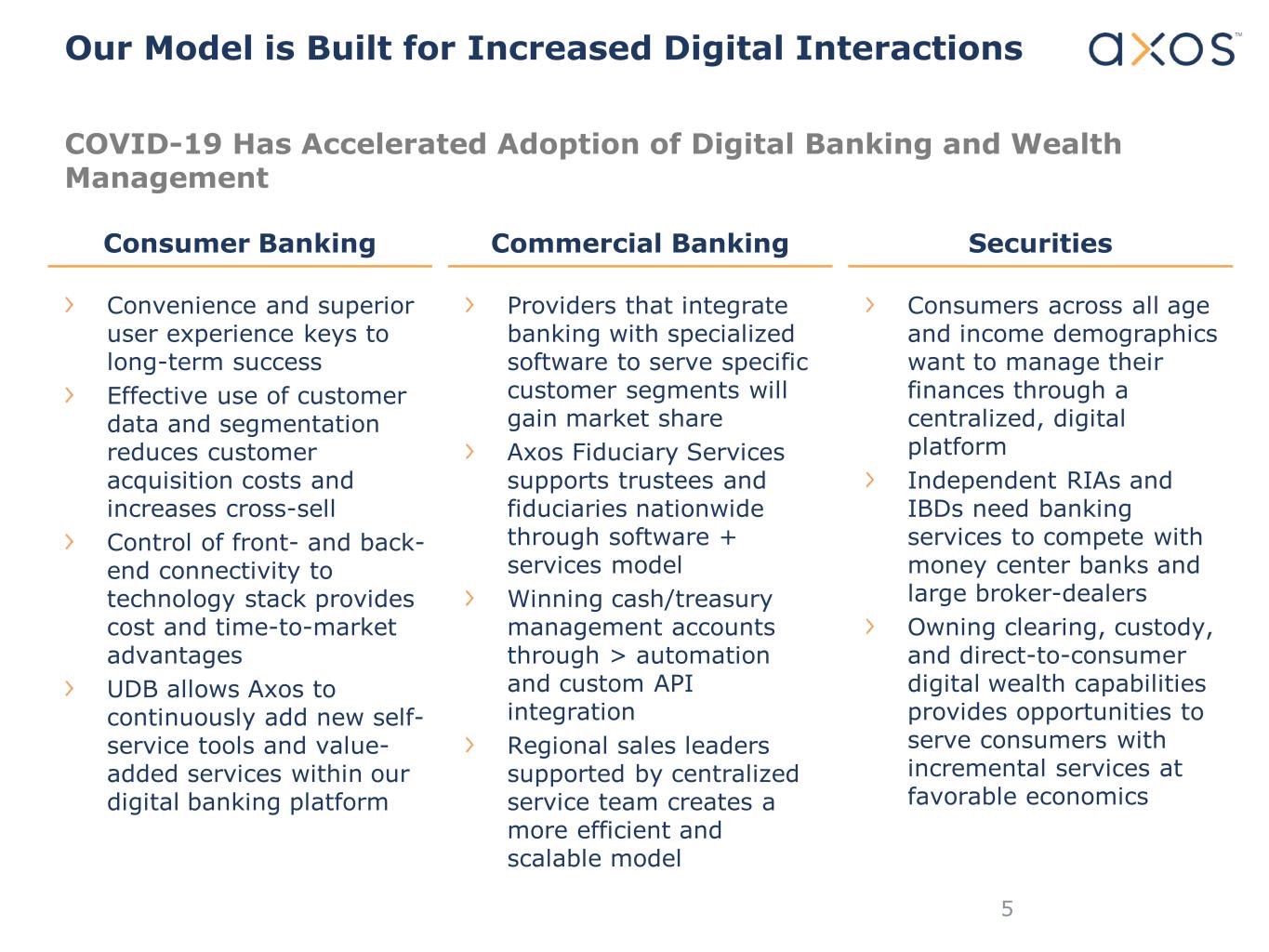

Convenience and superior user experience keys to long-term success Effective use of customer data and segmentation reduces customer acquisition costs and increases cross-sell Control of front- and back- end connectivity to technology stack provides cost and time-to-market advantages UDB allows Axos to continuously add new self- service tools and value- added services within our digital banking platform Consumer Banking Providers that integrate banking with specialized software to serve specific customer segments will gain market share Axos Fiduciary Services supports trustees and fiduciaries nationwide through software + services model Winning cash/treasury management accounts through > automation and custom API integration Regional sales leaders supported by centralized service team creates a more efficient and scalable model Commercial Banking Consumers across all age and income demographics want to manage their finances through a centralized, digital platform Independent RIAs and IBDs need banking services to compete with money center banks and large broker-dealers Owning clearing, custody, and direct-to-consumer digital wealth capabilities provides opportunities to serve consumers with incremental services at favorable economics Securities Our Model is Built for Increased Digital Interactions COVID-19 Has Accelerated Adoption of Digital Banking and Wealth Management 5

Fiscal 2021 Third Quarter Highlights Compared with Fiscal 2020 Third Quarter 6 12,160 14,828 0 5,000 10,000 15,000 20,000 Q3 2020 Q3 2021 $ Millions Asset Growth 56.0 53.6 0 50 100 Q3 2020 Q3 2021 $ Millions Net Income 9,567 11,613 0 5,000 10,000 15,000 Q3 2020 Q3 2021 $ Millions Deposit Growth 0.91 0.89 0.00 0.20 0.40 0.60 0.80 1.00 Q3 2020 Q3 2021 $ Diluted EPS Diluted EPS Return on Equity = 16.65%* Return on Assets = 1.57%* 21.9% 21.4% -2.1% -3.9%57.6* 55.4* 0.94* 0.92* * Adjusted earnings and adjusted earnings per diluted common share, non-GAAP measures, exclude non-cash amortization expenses and non-recurring costs related to mergers and acquisitions, and other non-recurring costs. Without adjusted earnings, ROE was 16.12% and ROA was 1.52% based on GAAP earnings.

Fiscal 2020 Highlights Compared with Fiscal 2019 7 11,220 13,852 0 5,000 10,000 15,000 FY 2019 FY 2020 $ Millions Asset Growth 155.1 183.4 0 100 200 FY 2019 FY 2020 $ Millions Net Income 8,983 11,337 0 5,000 10,000 15,000 FY 2019 FY 2020 $ Millions Deposit Growth 2.48 2.98 0.00 0.50 1.00 1.50 2.00 2.50 3.00 FY 2019 FY 2020 $ Diluted EPS Diluted EPS Return on Equity = 16.21%* Return on Assets = 1.59%* 23.5% 26.2% 12.7% 10.8%172.0* 190.5* 2.75* 3.10* * Adjusted earnings and adjusted earnings per diluted common share, non-GAAP measures, which excludes non-cash amortization expenses and non- recurring costs related to mergers and acquisitions, and other non-recurring costs. Without adjusted earnings, ROE was 15.65% and ROA was 1.53% based on GAAP earnings.

Diluted EPS and Book Value Per Share Have Been Consistently Strong 8 Book Value Per Share (FY)Diluted EPS (FY) 1.34 1.87 2.10 2.37 2.48 2.98 0.0 0.5 1.0 1.5 2.0 2.5 3.0 2018 $ per share 20172015 2016 2020 17% CAGR 2019 8.51 10.73 13.05 15.24 17.47 20.56 0 5 10 15 20 25 19% CAGR 2018 $ per share 20172015 2016 20202019 *Adjusted earnings and adjusted earnings per diluted common share, non-GAAP measures, which excludes non-cash amortization expenses and non-recurring costs related to mergers and acquisitions, and other non-recurring costs. Without adjusted earnings, Diluted EPS was $2.48 and $2.98 for FY19 and FY20, respectively, based on GAAP earnings. 3.10* 2.75*

9 3.91% 3.95% 4.11% 4.07% 4.12% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% FY2016 FY2017 FY2018 FY2019 FY2020 Net Interest Margin Has Been Stable/Rising Through a Variety of Interest Rate Cycles Axos NIM - reported Fed Funds Stable Net Interest Margin

Axos is a Top Quartile Performer Versus Bank Peer Group 10 Axos Bank Peer Group Percentile ROAA 1.81% 1.16% 81% Return on equity 19.01% 10.68% 83% G&A 1.98% 2.40% 29% Efficiency ratio 42.31% 64.47% 8% Source: Uniform Bank Performance Report (UBPR) as of 3/31/21; data retrieved 5/3/21. Note: Peer group is all savings banks (101) with assets greater than $1 billion for quarter ended 3/31/21. The 83% on ROE means that the Bank outperformed 83% of all banks. The 29% G&A ranking means that only 29% of banks spend less on G&A than Axos. Peer group includes savings banks greater than $1 billion.

11 Net Loan Growth by Category for Third Quarter Ended March 31, 2021 Loans & Leases Single Family Mortgage & Warehouse Multifamily & SB Commercial Mortgage Commercial Real Estate Auto & Consumer Jumbo Mortgage Multifamily Small Balance Commercial Lender Finance RE SF Warehouse Lending SBLOC & Other Auto CRE Specialty Unsecured / OD Equipment Leasing Q3 FY21 $ Millions Other PPP Refund Advance & Other Q2 FY21 $3,931 968 1,963 461 2,911 132 121 266 58 125 10 ($137) ($217) 33 28 325 (3) (9) (3) - (2) Inc (Dec) $4,068 1,185 1,930 433 2,586 135 130 269 58 140 12 Commercial & Industrial Non-RE Lender Finance Non RE 523 510 13 387 293 94 $11,856 $11,749 $107 (15)

12 Our Asset Growth has been Driven by Strong and Profitable Organic Loan Production Net Loan Portfolio – End of Last Five Quarters ($ in Thousands) Multifamily Single family 54% 55% 56% 57% 58% 58% Average Loan to Value $10,372,921 $10,631,349 $10,925,450 $11,609,584 $11,711,215 $- $2,000,000 $4,000,000 $6,000,000 $8,000,000 $10,000,000 $12,000,000 $14,000,000 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 56% 58% 55% 57%

138.1136.4 100 110 120 130 140 150 1 2 3 4 6 5.7 5.7 0.4 Change in Allowance for Credit Losses (ACL) & Unfunded Loan Commitments Liability (UCL) ($ in millions) March 31, 2021 ACL + UCL $M December 31, 2020 ACL + UCL Gross Charge- offs Gross Recoveries Provision for Credit Losses (1.4) 2.7 13

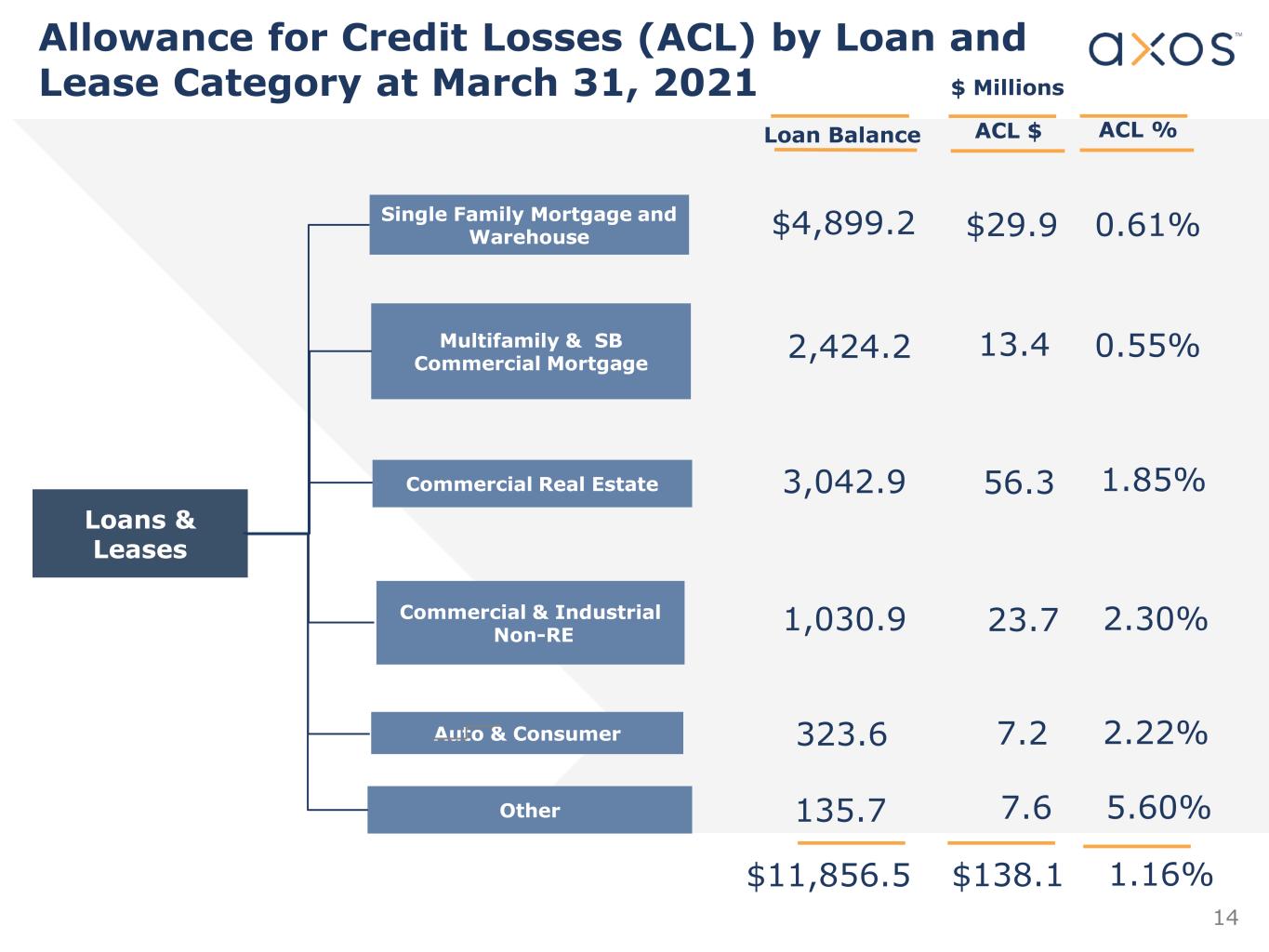

14 Allowance for Credit Losses (ACL) by Loan and Lease Category at March 31, 2021 Loans & Leases Single Family Mortgage and Warehouse Multifamily & SB Commercial Mortgage Commercial Real Estate Auto & Consumer Loan Balance $ Millions Other ACL $ $4,899.2 2,424.2 3,042.9 323.6 135.7 ACL % Commercial & Industrial Non-RE 1,030.9 $11,856.5 13.4 56.3 7.2 7.6 23.7 $29.9 $138.1 1.16% 1.85% 0.55% 0.61% 5.60% 2.22% 2.30%

15 3.3 3.6 4.2 5.9 6.9 6.8 1.4 1.4 1.6 1.5 1.6 0 1 2 3 4 5 6 7 8 Loan Origination Growth 15.6% 11.2% 34.7% › Organic growth in existing business lines • Multifamily geographic expansion • Agency and jumbo mortgage channel expansion • Small Balance Commercial Real Estate expansion • Large Balance Commercial / Specialty Real Estate expansion › Additional C&I verticals/product expansion › Retail auto lending launch › RIA M&A and succession lending Annual growth rate Fiscal Year Loan Originations Future Plans 14.3% 5-yr CAGR 5.0 4.3 1.0 7.5 8.4 5.6 $ Billions 2015 2016 2017 2018 2019 2020 Loans for investmentLoans for sale 12.3% 0% 8.4

16 Diversified Deposit Businesses Key Elements Deposit Consumer direct Distribution Partners Fiduciary Services ‹ Full service digital banking, wealth management, and securities trading* Small business banking ‹ Exclusive relationships with significant brands, groups, or employers ‹ Exclusive relationships with brokers and financial planners through Axos Clearing and Axos Advisor ‹ Business banking with simple suite of cash management services ‹ Serves 40% of U.S. Chapter 7 bankruptcy trustees in exclusive relationship ‹ Software allows servicing of SEC receivers and non- chapter 7 cases Specialty deposits ‹ Fiduciary services for trustees ‹ 1031 exchange firms ‹ Title and escrow companies ‹ HOA and property management Commercial/ Treasury Management ‹ Full-service treasury/cash management ‹ Team enhancements and geographic expansion ‹ Bank and securities cross-sell Axos Securities ‹ Broker-dealer client cash ‹ Broker-dealer reserve accounts *Fiscal Q4 2021 Expected Launch

17 Deposit Growth in Checking, Business, and Savings Was Achieved While Transforming the Mix of Deposits 19% Checking and other demand deposits 31% Savings Time deposits 50% Checking and other demand deposits Savings Time deposits June 30, 2013 March 31, 2021 Checking Growth (6/2013 – 3/2021) = 1,518% Savings Growth (6/2013 – 3/2021) = 422% 100% of Deposits = $2.1 billion 100% of Deposits = $11.6 billion Savings – IRA 29% 14% 2% 55%%

18 Axos Customer Base and Deposit Volume is Well Distributed Throughout the United States Axos Deposits Have National Reach With Customers in Every State Average Deposit Balance Number of Accounts

19 Commercial Loans and Deposits 4 years of growth •Product Expansion •Repeating Client Relationships •Reputation for Reliable Execution •Service to Specialty Verticals •Technology and Application Integration •Reposition as Commercial Banker Loan Growth Drivers Deposit Growth Drivers Spot Balance ($BN’s)

20 Core Deposit Growth Was Sufficiently Strong To Grow Overall Deposits While Changing The Deposit Mix Deposit Growth Future Plans › Enhanced digital marketing automation integrated to outbound sales group › Products and technology integration targeted to specific industry groups › Creation of differentiated consumer and business banking platform › Enhanced focus on customer service and user experience › Leverage existing and create new distribution partnerships to allow for reduced acquisition cost and leverage of external brands 4,452 6,044 6,900 7,985 8,983 11,337 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 10,000 11,000 12,000 $ Millions 2020 20.6% 5-yr CAGR 20192018201720162015 % CDs1 18% 17% 12% 25% % Borrowings2 15% 12% 9% 6% 26% 6% 1 as a % of total deposits 2 as a % of total liabilities 20% 4%

21 Diversified Fee / Non-Interest Income *Excludes investment securities gains and losses Fee Income Mortgage Banking Deposit/ Service Fees Agency Jumbo Structured Settlement Other Cash/Treasury Management Consumer Deposit Multifamily Payments Tax Prepayment Fee Prepaid 16% 6% % Fee Income FY 2020* 20% Gain on Sale – Other 7% % Fee Income Fiscal Q3 2021* 38% 1% 19% 6% Broker-Dealer 22%33% 3% 29%

22 Axos Securities Overview Axos Clearing Securities Clearing & Custody Axos Invest Digital Wealth & Personal Financial Management Axos Trading¹ Self-Directing Trading A xo s S ec ur iti es 62 IBDs 110,000 Clients 24,000 Clients Expected Launch Fiscal Q4 2021 Consumer Banking Consumer Deposit Accounts ODL/Margin Accounts Jumbo Single Family Mortgage Loans Commercial Banking Securities-Backed Lines of Credit Cash Management Commercial Property Refinancing Digital Solutions Universal Digital Platform Account Opening Platform Access to ~135,000 Clients ¹ Target “go-live” Fiscal Q4 2021 Monetizing synergies by integrating Banking products and services to Securities customers, RIAs, and IBDs .

23 Securities Strategy Leveraging Bank’s existing digital platforms allows for a unique integrated and flexible Banking and Securities product features End Clients Universal Enrollment Platform Universal Digital Bank Platform Onboard Clients Faster “Single-Pane” Rich Banking and Securities features Independent RIAs Introducing Broker-Dealers Self-Directed Trading

Fee Compression for Active and Passive Investment Managers Advisors are Leaving Wirehouses to Become Independent Advisors Aging Advisor Population Is Driving Consolidation and Succession Planning Digitization of Wealth Management Secular Industry Trends Provide Opportunities for Axos • RIAs need to reduce costs and streamline back-office ops • Automation frees up > time/resources for client interactions • Axos to provide bundled securities clearing, custody and banking services • Target small and medium-sized RIAs and IBDs that large custodians do not serve well • Axos to provide succession-based and M&A financing to RIAs and IBDs • Nation-wide footprint and industry focus are competitive advantages • Axos will offer direct-to-consumer and private label robo-advisory solutions to individuals and independent RIAs 24

Business Segment Overview – Axos Invest Free financial digital advisor that helps clients achieve their goals by automating the financial planning process. Provides premium packages for clients who want additional value beyond our core services. High Conversion Rates – Platform has been able to sustain 20% conversion rate with low client attrition. Low Acquisition Costs– Compared to industry standards, historic acquisition costs have sub – $50/per client (funded account). Sticky Accounts – Clients trust our advice with 49% following our recommendations within first week. Do-It-Yourself Mass Market Core Services Customer Served Customer Behavior 24,000+ sticky customer accounts with opportunities to cross-sell banking and premium services 25

26 49% OF RECOMMENDATIONS COMPLETED IN 1 WEEK INTEGRATED FINANCIAL PRODUCTS SEEK GUIDANCE Our recommendation engine already has the capability to integrate a wide variety of financial offerings: savings, credit, purchases, and more $54,829.19 Value $550.00 Weekly New Home New Car Retirem ent + = Monetize Clients by Leveraging Data and Personalization at Key Event-Driven Decision Points

27 Key Goals of Universal Digital Bank Personalization Self-Service Facilitate Partnerships Customizable Experience Cross-Sell › Artificial intelligence and big data credit models enable quick credit decisions › Customized product recommendations based upon analytical determination of need › Provide holistic and interactive and intuitive design experience › Integrate online experience with other channels › Easy integration of third-party features (e.g., biometrics) › Access to value added tools (e.g., robo-advisory, automated savings features) either proprietary or third party › Enable creative customer acquisition partners › Eventual artificial intelligence tools assist sale of banking products such as deposits, loans, and mortgages › Products optimized by channel, recipient and journey › Self service saves time and cost (e.g., activate and de-activate debit-card in platform, send wires via self-service) › Increase chances of offering right product at the right time and place › Personalization is the right antidote for too much choice, too much content, and not enough time

Webs ites O nline Banking Mobile AppEnrollment Personalization Solution Will Increase Consumer Engagement and Lifetime Value Goal is to present customers with customized and relevant offers at the right time via the right channel Establish a central hub for customer information needed to identify + prioritize relevant opportunities Target unknown prospects and lookalikes Present relevant personalized content across digital properties Contact customers via marketing automation solutions 28

As We Fully Digitize All Front-End Customer Interactions, Operational Efficiency Gains Also Become Possible Online Banking Customer Interaction Customer Self Service Operational Efficiency • Provide compelling customer value proposition to use online banking • Employ intelligent, personalized, automated campaigns to develop customer confidence in our messages • Utilize multiple channels to deliver information that reflects customer preferences • Expand digital channels and leverage omnichannel AI Hub across multiple channels, to streamline interactions ̶ Easy to use self help via intelligent, automated platforms such as conversational.ai to make it easy to get what’s wanted, when it’s wanted, anytime, anywhere ̶ Customer seamlessly switches from one channel to another e.g. IVR, Chatbot, Facebook Messenger, etc. • Customer centric operational efficiencies reduce cost, while accelerating delivery of customer requests • Efficiencies are delivered using tools such as our robotic process automation platform, or low code platform to automate high volume, repetitive processes 29

30 Holistic Credit Risk Management What We Do Loan Life Cycle Utilize a holistic credit-risk management framework to manage and monitor credit quality at each stage of the loan life cycle, and leverage specialized Credit Tools to optimize monitoring and reporting capabilities Set Appetite Originations Portfolio Management Reporting Special Assets Credit Monitoring & Oversight Axos Credit Objectives Establish Credit Framework and Culture Safe Growth Monitor Assets Throughout Life Cycle Data-Driven Decision Making Mitigate Problem Loans Example of Credit Tools • Board of Directors • Annual Strategic Plan • Corporate Governance • Policies & Approval Authorities Credit Tools list is a sampling and is not purported to be comprehensive.

Credit Quality No Loans in Forbearance and Decreasing NPA 31

32 Asset Quality Built to Withstand Economic Cycles Note I: Company uses a June 30 fiscal year-end. Note II: The Company partnered with H&R Block Bank (HRB) to provide HRB branded financial services products. The partnership was terminated July 1, 2020. *As of March 31, 2021, NPAs / Assets was 0.96% and NCOs / Avg. Assets was 0.07%.

Axos Advisors Consumer Direct Small Business Banking Specialty Commercial Deposits Axos Fiduciary Services Commercial Cash/Treasury Management Prepaid Consumer Debit Cards Consumer and Commercial Deposits Non-Interest-Bearing Deposits Axos Clearing - $472 million FHLB - $2.8 billion Federal Reserve Discount Window - $2.3 billion Tier 1 Capital: 11.74% (Bank) Tier 1 Leverage: 9.56% (Bank) Total Capital: 13.32 % (Holdco) TCE/TA: 8.24% (Holdco) Tangible Book Value/Share: $20.44 Off Balance Sheet Funding* Strong Capital Ratios* Diversified Funding and Liquidity Strong Profitability and Liquidity Support Organic Growth 33*As of 3/31/21

34 Greg Garrabrants, President and CEO Andy Micheletti, EVP/CFO [email protected] www.axosfinancial.com Johnny Lai, VP Corporate Development and Investor Relations Phone: 858.649.2218 Mobile: 858.245.1442 [email protected] Contact Information

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Axos Bank Named to the 2024 Forbes America’s Best Banks

- Vareto Introduces First Multiplayer Platform In Enterprise Planning Category

- TradeSun Announces an Agreement With Wells Fargo

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share