Form 8-K Axos Financial, Inc. For: Apr 29

Axos Financial, Inc. Reports Fiscal Third Quarter 2021 Results

Net Interest Margin Improved to 3.96% from 3.94% in the Second Quarter of 2021

SAN DIEGO, CA – (BUSINESS WIRE) – April 29, 2021 – Axos Financial, Inc. (NYSE: AX) (“Axos”), parent company of Axos Bank (the “Bank”), today announced financial results for the third fiscal quarter ended March 31, 2021. Net income was $53.6 million, a decrease of 4.3% from $56.1 million for the quarter ended March 31, 2020. Earnings attributable to Axos’ common stockholders were $53.6 million or $0.89 per diluted share for the third quarter of fiscal 2021, a decrease of 4.2% from $56.0 million or $0.91 per diluted share for the third quarter ended March 31, 2020.

Adjusted earnings and adjusted earnings per diluted common share (“adjusted EPS”), non-GAAP measures, which excludes non-cash amortization expenses and non-recurring costs related to mergers and acquisitions, and other non-recurring costs decreased 3.9% to $55.4 million and decreased 2.1% to $0.92, respectively, for the quarter ended March 31, 2021 compared to $57.7 million and $0.94, respectively, for the quarter ended March 31, 2020.

Third Quarter Fiscal 2021 Financial Summary:

| Three Months Ended March 31 | |||||||||||||||||

| (Dollars in thousands, except per share data) | Q3 Fiscal 2021 | Q3 Fiscal 2020 | % Change | ||||||||||||||

| Net interest income | $ | 135,669 | $ | 148,616 | (8.7)% | ||||||||||||

| Non-interest income | $ | 23,887 | $ | 31,542 | (24.3)% | ||||||||||||

| Net income | $ | 53,645 | $ | 56,057 | (4.3)% | ||||||||||||

Adjusted earnings (Non-GAAP)1 | $ | 55,416 | $ | 57,652 | (3.9)% | ||||||||||||

| Net income attributable to common stockholders | $ | 53,645 | $ | 55,980 | (4.2)% | ||||||||||||

| Diluted EPS | $ | 0.89 | $ | 0.91 | (2.2)% | ||||||||||||

Adjusted EPS (Non-GAAP)1 | $ | 0.92 | $ | 0.94 | (2.1)% | ||||||||||||

1 See “Use of Non-GAAP Financial Measures” | |||||||||||||||||

For the nine months ended March 31, 2021, net income was a record $161.5 million, an increase of 16.9% over net income of $138.1 million for the nine months ended March 31, 2020. Earnings attributable to Axos’ common stockholders were $161.3 million or $2.67 per diluted share for the nine months ended March 31, 2021, an increase of 16.9% from $137.9 million or $2.23 per diluted share for the nine months ended March 31, 2020.

“Our fiscal third quarter 2021 results are a continuation of consistent progress in each of our businesses,” stated Greg Garrabrants, President and CEO of Axos. “Net interest margins showed further improvement, increasing by 2 basis points over linked quarter and 12 basis points for the banking business segment. Ending loan balances excluding mortgage warehouse were up 3.1% linked quarter, or 12.3% annualized, led by growth in commercial real estate and C&I lending. Excluding H&R Block-related fees in the prior year period, fee income improved 43.7% year-over-year due to strong growth in mortgage banking and broker-dealer fees. We will deploy some of our excess capital in the announced acquisition of E*TRADE Advisor Services. We are excited about adding a state-of-the-art technology platform, a seasoned team of custody experts, a new source of asset- and transaction-based fee income, and access to over $1 billion of low-cost deposits when the acquisition closes.”

Other Highlights

•Total assets grew to $14.8 billion, up $2.7 billion or 21.9% compared to March 31, 2020

•Net interest income decreased 8.7% year-over-year to $135.7 million; excluding net interest income from Refund Advance Loans in the quarter ended March 31, 2020, net interest income increased 17.3%

•Net interest margin increased 2 basis points to 3.96% for the three months ended March 31, 2021 compared to 3.94% for the three months ended December 31, 2020; net interest margin for the banking business segment increased 12 basis points to 4.23% for the three months ended March 31, 2021 compared to 4.11% for the three months ended December 31, 2020

•Efficiency ratio for the banking business segment was 42.33% for the three months ended March 31, 2021 compared to 40.45% for the three months ended December 31, 2020

•Net annualized charge-offs to average loans and leases of 3 basis points compared to 3 basis points for the March 31, 2020 period

•No loans were in forbearance or deferral at March 31, 2021

•Return on average common stockholders’ equity was 16.12% for the three months ended March 31, 2021

•Tier 1 leverage capital to adjusted average assets for Axos Bank was 9.56% compared to 8.72% for the three months ended March 31, 2020

•Book value increased $2.95 to $22.72 per share, up 14.9% from March 31, 2020

•Completed redemption of all $51.0 million issued and outstanding 6.25% fixed rate subordinated notes on March 31, 2021, which results in a cost savings of $3.2 million annually

Third Quarter Fiscal 2021 Income Statement Summary

During the quarter ended March 31, 2021, Axos earned $53.6 million or $0.89 per diluted share compared to $56.0 million, or $0.91 per diluted share for the quarter ended March 31, 2020. Net interest income decreased $12.9 million or 8.7% for the quarter ended March 31, 2021 compared to March 31, 2020, primarily due to interest income earned in the three months ended March 31, 2020 from seasonal tax products associated with H&R Block (“HRB”) that did not recur due to the termination of the HRB relationship.

The provision for credit losses was $2.7 million for the quarter ended March 31, 2021 compared to $28.5 million for the quarter ended March 31, 2020. The decrease in the provision was mainly attributable to the Company no longer originating tax product loans in the quarter ended March 31, 2021. An additional reason for the decrease from March 31, 2020 to March 31, 2021 was significant uncertainty of COVID-19’s impact on the economy in the March 31, 2020 period that has since cleared.

For the third quarter ended March 31, 2021, non-interest income was $23.9 million compared to $31.5 million for the three months ended March 31, 2020. The $7.6 million decrease was mainly the result of a decrease of $14.9 million in banking and service fees as a result of the non-recurrance of tax refund banking products related to the HRB relationship, partially offset by an increase of $6.1 million in mortgage banking income, and a $1.6 million increase in broker-dealer fee income.

Non-interest expense increased $9.0 million to $80.8 million for the three months ended March 31, 2021 compared to $71.8 million for the three months ended March 31, 2020. The increase was mainly the result of a $3.6 million increase in data processing to support operational growth, a $2.5 million increase in professional services, a $2.3 million increase to salary and payroll costs due to growth in Bank staffing, and a $1.1 million increase in broker-dealer clearing charges, partially offset by a decrease of $1.8 million to general and administrative expense.

Balance Sheet Summary

Axos’ total assets increased $976.0 million, or 7.0%, to $14.8 billion, at March 31, 2021, up from $13.9 billion at June 30, 2020. The increase in total assets was primarily due to an increase of $1.1 billion in net loans and leases held for investment, $0.3 billion in securities borrowed and $0.1 billion in broker-dealer and clearing receivables, partially offset by a decrease in cash and cash equivalents of $0.5 billion. Total liabilities increased to $13.5 billion from $12.6 billion, mainly due to a net increase of $0.4 billion in securities loaned, $0.3 billion in deposits, $0.1 billion in broker-dealer and clearing payables, and $0.1 billion in borrowings.

The Bank’s Tier 1 leverage capital to adjusted average assets ratio was 9.56% at March 31, 2021. At March 31, 2020, the Bank’s Tier 1 leverage capital to adjusted average assets ratio was 8.72%.

Conference Call

A conference call and webcast will be held on Thursday, April 29, 2021 at 5:00 PM Eastern / 2:00 PM Pacific. Analysts and investors may dial in and participate in the question/answer session. To access the call, please dial: 877-407-8293. The conference call will be webcast live and may be accessed at Axos’ website, http://www.axosfinancial.com. For those unable to listen to the live broadcast, a replay will be available until May 29, 2021, at Axos’ website and telephonically by dialing toll-free number 877-660-6853, passcode 13718242.

About Axos Financial, Inc. and Subsidiaries

The condensed consolidated financial statements include the accounts of Axos Financial, Inc. (“Axos”) and its wholly owned subsidiaries, Axos Bank (the “Bank”) and Axos Nevada Holding, LLC (the “Axos Nevada Holding” and collectively, the “Company”). Axos Nevada Holding wholly owns its subsidiary Axos Securities, LLC, which wholly owns subsidiaries Axos Clearing, LLC, a clearing broker dealer, Axos Invest, Inc., a registered investment advisor, and Axos Invest LLC, an introducing broker dealer. With approximately $14.8 billion in assets, Axos Bank provides consumer and business banking products through its low-cost distribution channels and affinity partners. Axos Clearing LLC and Axos Invest, Inc., provide comprehensive securities clearing services to introducing broker-dealers and registered investment advisor correspondents and digital investment advisory services to retail investors, respectively. Axos Financial, Inc.’s common stock is listed on the NYSE under the symbol “AX” and is a component of the Russell 2000® Index, the KBW Nasdaq Financial Technology Index, and the S&P SmallCap 600® Index. For more information on Axos Bank, please visit axosbank.com.

Segment Reporting

The Company operates through two segments: Banking Business and Securities Business. In order to reconcile the two segments to the consolidated totals, the Company includes parent-only activities and intercompany eliminations.

The following tables present the operating results of the segments:

| Three Months Ended March 31, 2021 | |||||||||||||||||||||||

| (Dollars in thousands) | Banking Business | Securities Business | Corporate/Eliminations | Axos Consolidated | |||||||||||||||||||

| Net interest income | $ | 135,092 | $ | 3,847 | $ | (3,270) | $ | 135,669 | |||||||||||||||

| Provision for credit losses | 2,700 | — | — | 2,700 | |||||||||||||||||||

| Non-interest income | 16,201 | 8,369 | (683) | 23,887 | |||||||||||||||||||

| Non-interest expense | 64,040 | 13,282 | 3,485 | 80,807 | |||||||||||||||||||

| Income before taxes | $ | 84,553 | $ | (1,066) | $ | (7,438) | $ | 76,049 | |||||||||||||||

| Three Months Ended March 31, 2020 | |||||||||||||||||||||||

| (Dollars in thousands) | Banking Business | Securities Business | Corporate/Eliminations | Axos Consolidated | |||||||||||||||||||

| Net interest income | $ | 145,372 | $ | 3,954 | $ | (710) | $ | 148,616 | |||||||||||||||

| Provision for credit losses | 28,500 | — | — | 28,500 | |||||||||||||||||||

| Non-interest income | 25,259 | 6,402 | (119) | 31,542 | |||||||||||||||||||

| Non-interest expense | 56,661 | 11,137 | 3,992 | 71,790 | |||||||||||||||||||

| Income before taxes | $ | 85,470 | $ | (781) | $ | (4,821) | $ | 79,868 | |||||||||||||||

| Nine Months Ended March 31, 2021 | |||||||||||||||||||||||

| (Dollars in thousands) | Banking Business | Securities Business | Corporate/Eliminations | Axos Consolidated | |||||||||||||||||||

| Net interest income | $ | 390,267 | $ | 13,002 | $ | (6,181) | $ | 397,088 | |||||||||||||||

| Provision for credit losses | 22,500 | — | — | 22,500 | |||||||||||||||||||

| Non-interest income | 68,708 | 20,725 | (973) | 88,460 | |||||||||||||||||||

| Non-interest expense | 187,733 | 35,946 | 8,971 | 232,650 | |||||||||||||||||||

| Income before taxes | $ | 248,742 | $ | (2,219) | $ | (16,125) | $ | 230,398 | |||||||||||||||

| Nine Months Ended March 31, 2020 | |||||||||||||||||||||||

| (Dollars in thousands) | Banking Business | Securities Business | Corporate/Eliminations | Axos Consolidated | |||||||||||||||||||

| Net interest income | $ | 350,184 | $ | 13,137 | $ | (2,982) | $ | 360,339 | |||||||||||||||

| Provision for credit losses | 35,700 | — | — | 35,700 | |||||||||||||||||||

| Non-interest income | 57,274 | 19,087 | (2,076) | 74,285 | |||||||||||||||||||

| Non-interest expense | 160,547 | 32,656 | 11,019 | 204,222 | |||||||||||||||||||

| Income before taxes | $ | 211,211 | $ | (432) | $ | (16,077) | $ | 194,702 | |||||||||||||||

Use of Non-GAAP Financial Measures

In addition to the results presented in accordance with GAAP, this report includes non-GAAP financial measures such as adjusted earnings, adjusted earnings per diluted common share, and tangible book value per common share. Non-GAAP financial measures have inherent limitations, may not be comparable to similarly titled measures used by other companies and are not audited. Readers should be aware of these limitations and should be cautious as to their reliance on such measures. Although we believe the non-GAAP financial measures disclosed in this report enhance investors’ understanding of our business and performance, these non-GAAP measures should not be considered in isolation, or as a substitute for GAAP basis financial measures.

We define “adjusted earnings”, a non-GAAP financial measure, as net income without the after-tax impact of non-recurring acquisition-related costs and other costs (unusual or non-recurring charges), as adjusted earnings, a non-GAAP financial measure. Adjusted earnings per diluted common share (“adjusted EPS”), a non-GAAP financial measure, is calculated by dividing non-GAAP adjusted earnings by the average number of diluted common shares outstanding during the period. We believe the non-GAAP measures of adjusted earnings and adjusted EPS provide useful information about the Bank’s operating performance. We believe excluding the non-recurring acquisition related costs and other (unusual or non-recurring) costs provides investors with an alternative understanding of Axos’ core business.

Below is a reconciliation of net income, the nearest compatible GAAP measure, to adjusted earnings and adjusted EPS (Non-GAAP) for the periods shown:

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||

| March 31, | March 31, | ||||||||||||||||||||||

| (Dollars in thousands, except per share amounts) | 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||

| Net income | $ | 53,645 | $ | 56,057 | $ | 161,452 | $ | 138,138 | |||||||||||||||

| Acquisition-related costs | 2,511 | 2,273 | 7,665 | 6,520 | |||||||||||||||||||

| Income taxes | (740) | (678) | (2,285) | (1,895) | |||||||||||||||||||

| Adjusted earnings (Non-GAAP) | $ | 55,416 | $ | 57,652 | $ | 166,832 | $ | 142,763 | |||||||||||||||

| Adjusted EPS (Non-GAAP) | $ | 0.92 | $ | 0.94 | $ | 2.76 | $ | 2.31 | |||||||||||||||

We define “tangible book value”, a non-GAAP financial measure, as book value adjusted for goodwill and other intangible assets. Tangible book value is calculated using common stockholders’ equity minus mortgage servicing rights, goodwill and other intangible assets. Tangible book value per common share, a non-GAAP financial measure, is calculated by dividing tangible book value by the common shares outstanding at the end of the period. We believe tangible book value per common share is useful in evaluating the Company’s capital strength, financial condition, and ability to manage potential losses.

Below is a reconciliation of total stockholders’ equity to tangible book value per common share (Non-GAAP) as of the dates indicated:

| March 31, | |||||||||||

| (Dollars in thousands, except per share amounts) | 2021 | 2020 | |||||||||

| Total stockholders’ equity | $ | 1,345,650 | $ | 1,184,452 | |||||||

| Less: preferred stock | — | 5,063 | |||||||||

| Common stockholders’ equity | 1,345,650 | 1,179,389 | |||||||||

| Less: mortgage servicing rights, carried at fair value | 16,631 | 9,962 | |||||||||

| Less: goodwill and other intangible assets | 118,133 | 127,962 | |||||||||

| Tangible common stockholders’ equity (Non-GAAP) | $ | 1,210,886 | $ | 1,041,465 | |||||||

| Common shares outstanding at end of period | 59,237,765 | 59,653,192 | |||||||||

| Tangible book value per common share (Non-GAAP) | $ | 20.44 | $ | 17.46 | |||||||

Forward-Looking Safe Harbor Statement

This press release contains forward-looking statements that involve risks and uncertainties, including without limitation statements relating to Axos’ financial prospects and other projections of its performance and asset quality, Axos’ ability to continue to grow profitably and increase its business, satisfaction of the conditions to closing of the acquisition of E*TRADE Advisor Services and following closing, Axos’ ability to integrate E*TRADE Advisor Services and realize the benefits of the transaction, Axos’ ability to continue to diversify its lending and deposit franchises and the anticipated timing and financial performance of other offerings, initiatives, and acquisitions. These forward-looking statements are made on the basis of the views and assumptions of management regarding future events and performance as of the date of this press release. Actual results and the timing of events could differ materially from those expressed or implied in such forward-looking statements as a result of risks and uncertainties, including without limitation uncertainties surrounding the severity, duration, and effects of the COVID-19 pandemic, Axos’ ability to successfully integrate acquisitions and realize the anticipated benefits of the transactions, changes in the interest rate environment, inflation, government regulation, general economic conditions, conditions in the real estate markets in which we operate, risks associated with credit quality, the outcome and effects of pending class action litigation filed against the Company and other factors beyond our control. These and other risks and uncertainties detailed in Axos’ periodic reports filed with the Securities and Exchange Commission could cause actual results to differ materially from those expressed or implied in any forward-looking statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. All forward-looking statements are qualified in their entirety by this cautionary statement, and Axos undertakes no obligation to revise or update any forward-looking statements to reflect events or circumstances after the date of this press release.

Investor Relations Contact:

Johnny Lai, CFA

VP, Corporate Development & Investor Relations

858-649-2218

jlai@axosfinancial.com

The following tables set forth certain selected financial data concerning the periods indicated:

AXOS FINANCIAL, INC. AND SUBSIDIARIES

SELECTED CONSOLIDATED FINANCIAL INFORMATION

(Unaudited – dollars in thousands)

| March 31, 2021 | June 30, 2020 | March 31, 2020 | |||||||||||||||

| Selected Balance Sheet Data: | |||||||||||||||||

| Total assets | $ | 14,827,874 | $ | 13,851,900 | $ | 12,159,919 | |||||||||||

| Loans and leases—net of allowance for credit losses | 11,711,215 | 10,631,349 | 10,372,921 | ||||||||||||||

| Loans held for sale, carried at fair value | 61,500 | 51,995 | 40,236 | ||||||||||||||

| Loans held for sale, lower of cost or fair value | 13,371 | 44,565 | 29 | ||||||||||||||

| Allowance for credit losses - loans | 138,107 | 75,807 | 87,097 | ||||||||||||||

| Securities—trading | 254 | 105 | 919 | ||||||||||||||

| Securities—available-for-sale | 218,962 | 187,627 | 191,388 | ||||||||||||||

| Securities borrowed | 543,538 | 222,368 | 53,816 | ||||||||||||||

| Customer, broker-dealer and clearing receivables | 351,063 | 220,266 | 187,353 | ||||||||||||||

| Total deposits | 11,612,501 | 11,336,694 | 9,567,338 | ||||||||||||||

| Advances from the FHLB | 172,500 | 242,500 | 770,500 | ||||||||||||||

| Borrowings, subordinated notes and debentures | 365,753 | 235,789 | 76,285 | ||||||||||||||

| Securities loaned | 649,837 | 255,945 | 76,587 | ||||||||||||||

| Customer, broker-dealer and clearing payables | 483,677 | 347,614 | 318,100 | ||||||||||||||

| Total stockholders’ equity | 1,345,650 | 1,230,846 | 1,184,452 | ||||||||||||||

| Capital Ratios: | |||||||||||||||||

| Equity to assets at end of period | 9.08 | % | 8.89 | % | 9.74 | % | |||||||||||

| Axos Financial, Inc.: | |||||||||||||||||

| Tier 1 leverage (core) capital to adjusted average assets | 8.99 | % | 8.97 | % | 8.55 | % | |||||||||||

| Common equity tier 1 capital (to risk-weighted assets) | 10.86 | % | 11.22 | % | 11.34 | % | |||||||||||

| Tier 1 capital (to risk-weighted assets) | 10.86 | % | 11.27 | % | 11.39 | % | |||||||||||

| Total capital (to risk-weighted assets) | 13.32 | % | 12.64 | % | 12.96 | % | |||||||||||

| Axos Bank: | |||||||||||||||||

| Tier 1 leverage (core) capital to adjusted average assets | 9.56 | % | 9.25 | % | 8.72 | % | |||||||||||

| Common equity tier 1 capital (to risk-weighted assets) | 11.74 | % | 11.79 | % | 11.62 | % | |||||||||||

| Tier 1 capital (to risk-weighted assets) | 11.74 | % | 11.79 | % | 11.62 | % | |||||||||||

| Total capital (to risk-weighted assets) | 12.71 | % | 12.62 | % | 12.60 | % | |||||||||||

| Axos Clearing, LLC: | |||||||||||||||||

| Net capital | $ | 33,845 | $ | 34,022 | $ | 33,863 | |||||||||||

| Excess capital | $ | 26,338 | $ | 29,450 | $ | 30,341 | |||||||||||

| Net capital as a percentage of aggregate debit items | 9.02 | % | 14.88 | % | 19.23 | % | |||||||||||

| Net capital in excess of 5% aggregate debit items | $ | 15,077 | $ | 22,593 | $ | 25,057 | |||||||||||

AXOS FINANCIAL, INC. AND SUBSIDIARIES

SELECTED CONSOLIDATED FINANCIAL INFORMATION

(Unaudited – dollars in thousands, except per share data)

| At or for the Three Months Ended | At or for the Nine Months Ended | ||||||||||||||||||||||

| March 31, | March 31, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Selected Income Statement Data: | |||||||||||||||||||||||

| Interest and dividend income | $ | 155,674 | $ | 185,063 | $ | 460,942 | $ | 478,696 | |||||||||||||||

| Interest expense | 20,005 | 36,447 | 63,854 | 118,357 | |||||||||||||||||||

| Net interest income | 135,669 | 148,616 | 397,088 | 360,339 | |||||||||||||||||||

| Provision for credit losses | 2,700 | 28,500 | 22,500 | 35,700 | |||||||||||||||||||

| Net interest income after provision for credit losses | 132,969 | 120,116 | 374,588 | 324,639 | |||||||||||||||||||

| Non-interest income | 23,887 | 31,542 | 88,460 | 74,285 | |||||||||||||||||||

| Non-interest expense | 80,807 | 71,790 | 232,650 | 204,222 | |||||||||||||||||||

| Income before income tax expense | 76,049 | 79,868 | 230,398 | 194,702 | |||||||||||||||||||

| Income tax expense | 22,404 | 23,811 | 68,946 | 56,564 | |||||||||||||||||||

| Net income | $ | 53,645 | $ | 56,057 | $ | 161,452 | $ | 138,138 | |||||||||||||||

| Net income attributable to common stock | $ | 53,645 | $ | 55,980 | $ | 161,262 | $ | 137,906 | |||||||||||||||

| Per Common Share Data: | |||||||||||||||||||||||

| Net income: | |||||||||||||||||||||||

| Basic | $ | 0.91 | $ | 0.92 | $ | 2.72 | $ | 2.25 | |||||||||||||||

| Diluted | $ | 0.89 | $ | 0.91 | $ | 2.67 | $ | 2.23 | |||||||||||||||

Adjusted earnings (Non-GAAP) | $ | 0.92 | $ | 0.94 | $ | 2.76 | $ | 2.31 | |||||||||||||||

| Book value | $ | 22.72 | $ | 19.77 | $ | 22.72 | $ | 19.77 | |||||||||||||||

| Tangible book value (Non-GAAP) | $ | 20.44 | $ | 17.46 | $ | 20.44 | $ | 17.46 | |||||||||||||||

| Weighted average number of common shares outstanding: | |||||||||||||||||||||||

| Basic | 59,118,884 | 60,967,892 | 59,225,409 | 61,176,715 | |||||||||||||||||||

| Diluted | 60,482,733 | 61,523,513 | 60,453,220 | 61,811,845 | |||||||||||||||||||

| Common shares outstanding at end of period | 59,237,765 | 59,653,192 | 59,237,765 | 59,653,192 | |||||||||||||||||||

| Common shares issued at end of period | 67,902,239 | 67,084,817 | 67,902,239 | 67,084,817 | |||||||||||||||||||

| Performance Ratios and Other Data: | |||||||||||||||||||||||

| Loan and lease originations for investment | $ | 1,189,750 | $ | 2,596,420 | $ | 4,430,540 | $ | 5,493,338 | |||||||||||||||

| Loan originations for sale | $ | 418,618 | $ | 292,226 | $ | 1,349,683 | $ | 1,286,230 | |||||||||||||||

| Return on average assets | 1.52 | % | 1.79 | % | 1.55 | % | 1.56 | % | |||||||||||||||

| Return on average common stockholders’ equity | 16.12 | % | 18.65 | % | 16.90 | % | 15.99 | % | |||||||||||||||

Interest rate spread1 | 3.73 | % | 4.33 | % | 3.69 | % | 3.70 | % | |||||||||||||||

Net interest margin2 | 3.96 | % | 4.90 | % | 3.91 | % | 4.20 | % | |||||||||||||||

Net interest margin2 – Banking Business Segment only | 4.23 | % | 4.97 | % | 4.09 | % | 4.28 | % | |||||||||||||||

Efficiency ratio3 | 50.64 | % | 39.85 | % | 47.91 | % | 46.99 | % | |||||||||||||||

Efficiency ratio3 – Banking Business Segment only | 42.33 | % | 33.21 | % | 40.90 | % | 39.40 | % | |||||||||||||||

| Asset Quality Ratios: | |||||||||||||||||||||||

| Net annualized charge-offs to average loans and leases | 0.03 | % | 0.03 | % | 0.09 | % | 0.08 | % | |||||||||||||||

| Non-performing loans to total loans | 1.14 | % | 0.55 | % | 1.14 | % | 0.55 | % | |||||||||||||||

| Non-performing assets to total assets | 0.96 | % | 0.54 | % | 0.96 | % | 0.54 | % | |||||||||||||||

| Allowance for credit losses to total loans and leases held for investment at end of period | 1.16 | % | 0.83 | % | 1.16 | % | 0.83 | % | |||||||||||||||

| Allowance for credit losses to non-performing loans | 101.84 | % | 150.33 | % | 101.84 | % | 150.33 | % | |||||||||||||||

1. Interest rate spread represents the difference between the annualized weighted average yield on interest-earning assets and the annualized weighted average rate paid on interest-bearing liabilities.

2. Net interest margin represents annualized net interest income as a percentage of average interest-earning assets.

3. Efficiency ratio represents non-interest expense as a percentage of the aggregate of net interest income and non-interest income.

Axos Q3 2021 Earnings Supplement April 29, 2021 NYSE: AX

Safe Harbor 1 This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). The words “believe,” “expect,” “anticipate,” “estimate,” “project,” or the negation thereof or similar expressions constitute forward-looking statements within the meaning of the Reform Act. These statements may include, but are not limited to, projections of revenues, income or loss, projected consummation of pending acquisitions, including the acquisition of E*TRADE Advisor Services, estimates of capital expenditures, plans for future operations, products or services, the effects of the COVID-19 pandemic, and financing needs or plans, as well as assumptions relating to these matters. Such statements involve risks, uncertainties and other factors that may cause actual results, performance or achievements of the Company and its subsidiaries to be materially different from any future results, performance looking statements. For a discussion of these factors, we refer you to the Company's reports filed with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended June 30, 2020, Form 10-Q for the quarter ended March 31, 2021 and our last earnings press release. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the Company or by any other person or entity that the objectives and plans of the Company will be achieved. For all forward-looking statements, the Company claims the protection of the safe-harbor for forward-looking statements contained in the Reform Act. or achievements expressed or implied by such forward-

2 Net Loan Growth by Category for Third Quarter Ended March 31, 2021 Loans & Leases Single Family Mortgage & Warehouse Multifamily & SB Commercial Mortgage Commercial Real Estate Auto & Consumer Jumbo Mortgage Multifamily Small Balance Commercial Lender Finance RE SF Warehouse Lending SBLOC & Other Auto CRE Specialty Unsecured / OD Equipment Leasing Q3 FY21 $ Millions Other PPP Refund Advance & Other Q2 FY21 $3,931 968 1,963 461 2,911 132 121 266 58 125 10 ($137) ($217) 33 28 325 (3) (9) (3) - (2) Inc (Dec) $4,068 1,185 1,930 433 2,586 135 130 269 58 140 12 Commercial & Industrial Non-RE Lender Finance Non RE 523 510 13 387 293 94 $11,856 $11,749 $107 (15)

138.1136.4 100 110 120 130 140 150 1 2 3 4 6 5.7 5.7 0.4 Change in Allowance for Credit Losses (ACL) & Unfunded Loan Commitments Liability (UCL) ($ in millions) March 31, 2021 ACL + UCL $M December 31, 2020 ACL + UCL Gross Charge- offs Gross Recoveries Provision for Credit Losses (1.4) 2.7 3

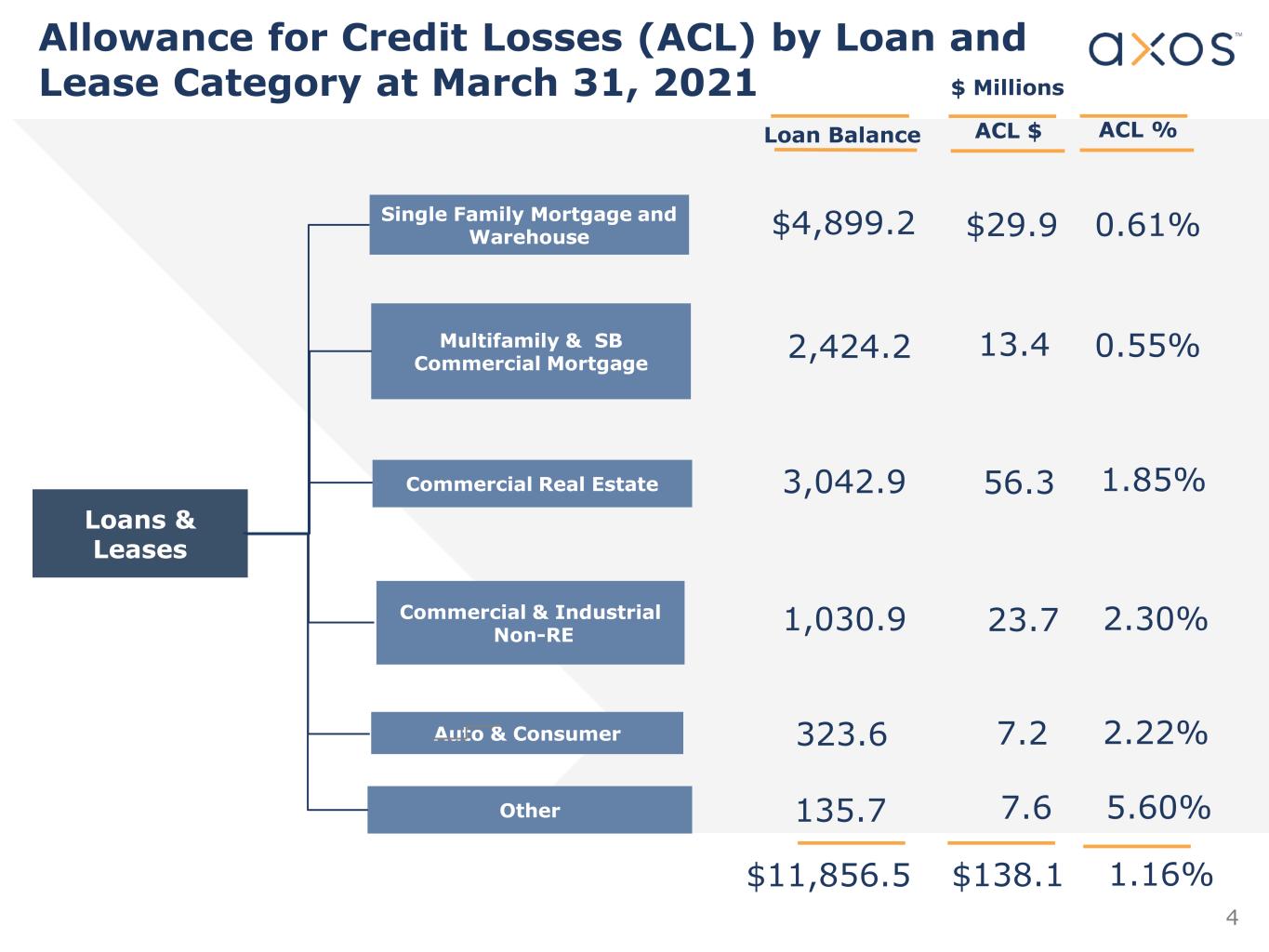

4 Allowance for Credit Losses (ACL) by Loan and Lease Category at March 31, 2021 Loans & Leases Single Family Mortgage and Warehouse Multifamily & SB Commercial Mortgage Commercial Real Estate Auto & Consumer Loan Balance $ Millions Other ACL $ $4,899.2 2,424.2 3,042.9 323.6 135.7 ACL % Commercial & Industrial Non-RE 1,030.9 $11,856.5 13.4 56.3 7.2 7.6 23.7 $29.9 $138.1 1.16% 1.85% 0.55% 0.61% 5.60% 2.22% 2.30%

Credit Quality No Loans in Forbearance and Decreasing NPAs 5 12/31/2020 Loans O/S Loans in Forbearance or Deferral % NPAs % Single Family-Mortgage & Warehouse $5,252.8 $0.0 0.00% $117.2 2.23% Multifamily and Commercial Mortgage $2,363.0 $0.0 0.00% $32.1 1.36% Commercial Real Estate $2,720.9 $0.0 0.00% $16.6 0.61% Commercial & Industrial - Non-RE $933.1 $0.0 0.00% $3.0 0.32% Auto & Consumer $327.3 $0.0 0.00% $0.4 0.11% Other $151.5 $0.0 0.00% $0.0 0.00% Total $11,748.6 $0.0 0.00% $169.3 1.44% 3/31/2021 Loans O/S Loans in Forbearance or Deferral % NPAs % Single Family-Mortgage & Warehouse $4,899.2 $0.0 0.00% $85.0 1.74% Multifamily and Commercial Mortgage $2,424.2 $0.0 0.00% $30.8 1.27% Commercial Real Estate $3,042.9 $0.0 0.00% $16.4 0.54% Commercial & Industrial - Non-RE $1,030.9 $0.0 0.00% $3.0 0.29% Auto & Consumer $323.6 $0.0 0.00% $0.4 0.12% Other $135.7 $0.0 0.00% $0.0 0.00% Total $11,856.5 $0.0 0.00% $135.6 1.14% Change from 12/31/20 to 3/31/21 Loans O/S Loans in Forbearance or Deferral NPAs Single Family-Mortgage & Warehouse -$353.6 $0.0 -$32.2 Multifamily and Commercial Mortgage $61.2 $0.0 -$1.2 Commercial Real Estate $322.0 $0.0 -$0.2 Commercial & Industrial - Non-RE $97.8 $0.0 $0.0 Auto & Consumer -$3.7 $0.0 $0.0 Other -$15.8 $0.0 $0.0 Total $107.9 $0.0 -$33.6

E*TRADE Advisor Services Acquisition 6

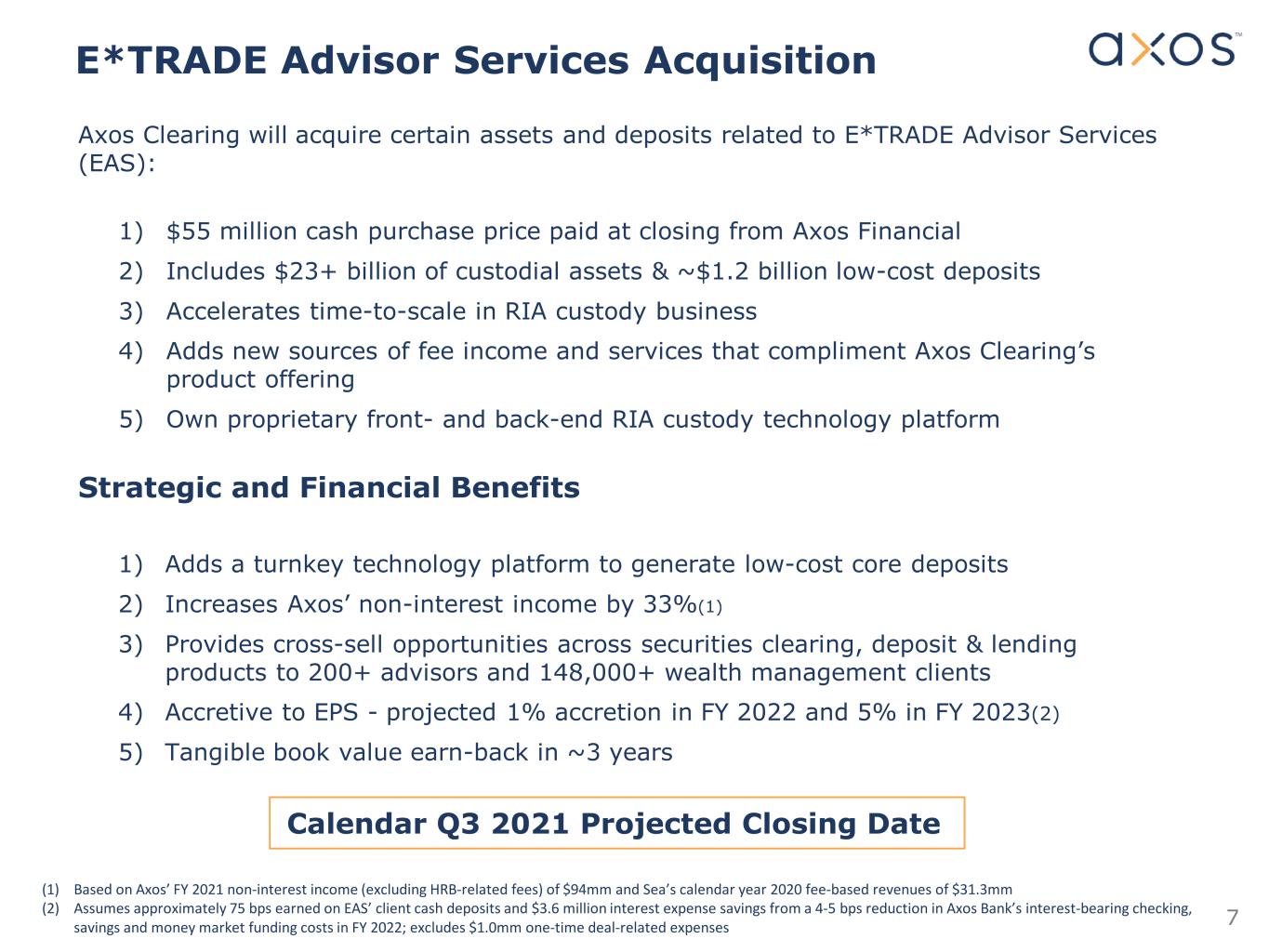

7 E*TRADE Advisor Services Acquisition Axos Clearing will acquire certain assets and deposits related to E*TRADE Advisor Services (EAS): 1) $55 million cash purchase price paid at closing from Axos Financial 2) Includes $23+ billion of custodial assets & ~$1.2 billion low-cost deposits 3) Accelerates time-to-scale in RIA custody business 4) Adds new sources of fee income and services that compliment Axos Clearing’s product offering 5) Own proprietary front- and back-end RIA custody technology platform Strategic and Financial Benefits 1) Adds a turnkey technology platform to generate low-cost core deposits 2) Increases Axos’ non-interest income by 33%(1) 3) Provides cross-sell opportunities across securities clearing, deposit & lending products to 200+ advisors and 148,000+ wealth management clients 4) Accretive to EPS - projected 1% accretion in FY 2022 and 5% in FY 2023(2) 5) Tangible book value earn-back in ~3 years Calendar Q3 2021 Projected Closing Date (1) Based on Axos’ FY 2021 non-interest income (excluding HRB-related fees) of $94mm and Sea’s calendar year 2020 fee-based revenues of $31.3mm (2) Assumes approximately 75 bps earned on EAS’ client cash deposits and $3.6 million interest expense savings from a 4-5 bps reduction in Axos Bank’s interest-bearing checking, savings and money market funding costs in FY 2022; excludes $1.0mm one-time deal-related expenses

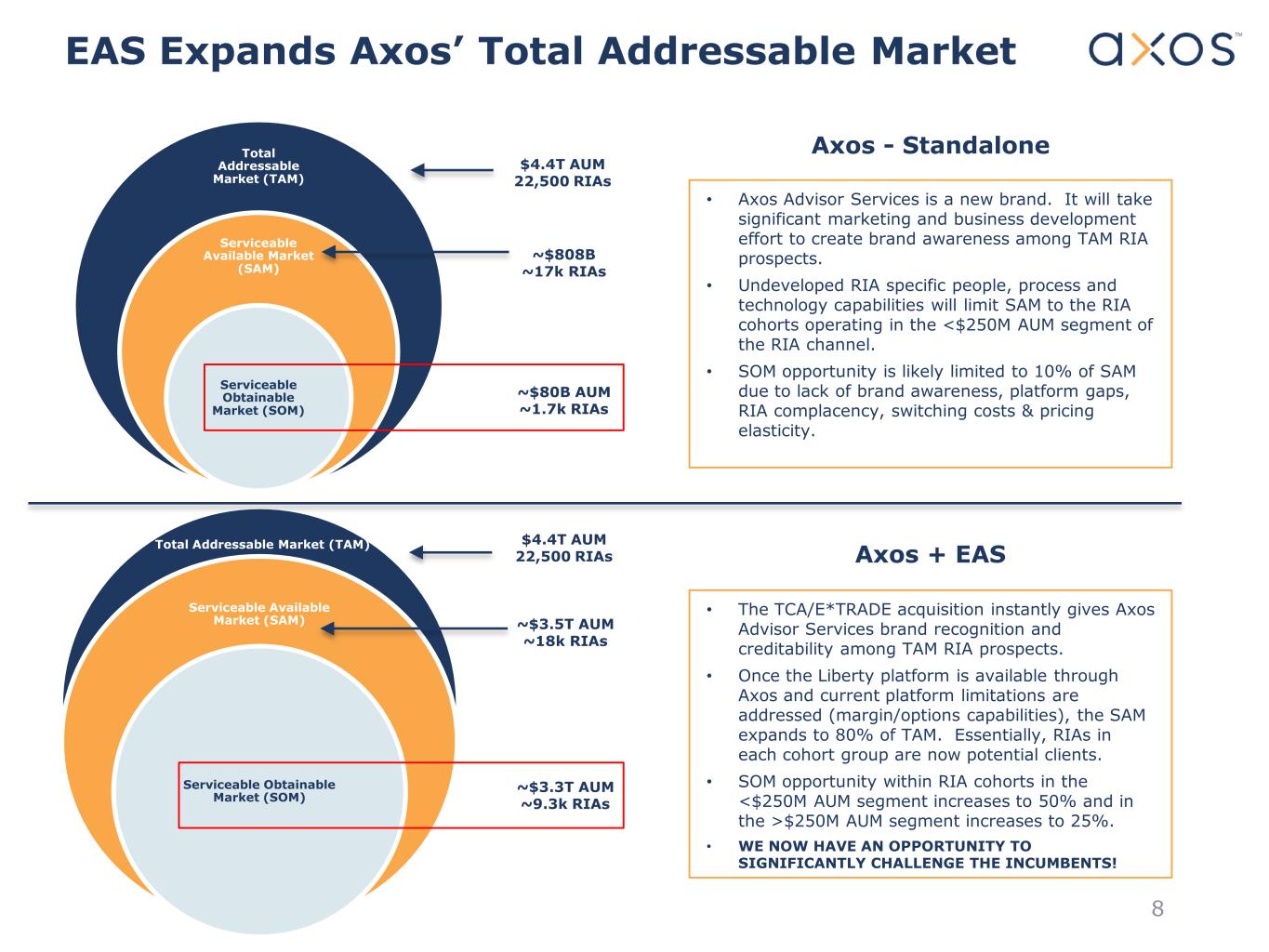

EAS Expands Axos’ Total Addressable Market 8 Total Addressable Market (TAM) Serviceable Available Market (SAM) Serviceable Obtainable Market (SOM) Serviceable Available Market (SAM) Serviceable Obtainable Market (SOM) Axos - Standalone Axos + EAS • Axos Advisor Services is a new brand. It will take significant marketing and business development effort to create brand awareness among TAM RIA prospects. • Undeveloped RIA specific people, process and technology capabilities will limit SAM to the RIA cohorts operating in the <$250M AUM segment of the RIA channel. • SOM opportunity is likely limited to 10% of SAM due to lack of brand awareness, platform gaps, RIA complacency, switching costs & pricing elasticity. • The TCA/E*TRADE acquisition instantly gives Axos Advisor Services brand recognition and creditability among TAM RIA prospects. • Once the Liberty platform is available through Axos and current platform limitations are addressed (margin/options capabilities), the SAM expands to 80% of TAM. Essentially, RIAs in each cohort group are now potential clients. • SOM opportunity within RIA cohorts in the <$250M AUM segment increases to 50% and in the >$250M AUM segment increases to 25%. • WE NOW HAVE AN OPPORTUNITY TO SIGNIFICANTLY CHALLENGE THE INCUMBENTS! $4.4T AUM 22,500 RIAs ~$808B ~17k RIAs ~$80B AUM ~1.7k RIAs $4.4T AUM 22,500 RIAs ~$3.5T AUM ~18k RIAs ~$3.3T AUM ~9.3k RIAs Total Addressable Market (TAM)

Adds a Scalable Technology Platform E*TRADE Advisor Services Platform Overview Liberty Integrated Platform Dedicated Strategic Business Consultant Dedicated Client Service Advocate Supported by High-Touch, Best-In-Class Client Service Helping Advisors Drive Efficiencies so They Can Focus on Building and Sustaining Long-Term Client Relationships Liberty Platform Liberty Custody Web-based Highly scalable and secure Mobile capabilities Asset-based pricing APIs to 3rd party value – added CRM, planning, compliance, aggregation and other tools RIA client white labelled client portal, statements and mobile app • Prospecting • Proposal • Conversion • Onboarding • UMA • Rebalancing • Omnibus trading • Tax harvesting • Fractional shares • 3rd party investment managers • Diverse strategies • Fee billing • Mobile enabled • Investor portal • Performance • Statements • Private-labeling • Custom branding No lending of client securities FDIC insurance for up to $250K Supports alternative / non-tradeable assets Portfolio Management & Trading Managed Investment Solutions Growth Tools Operational Tools Reporting + Analytics Helping advisors drive efficiencie so they can focus on bui di g and sustaining their long-term client relationships Dedicated operations team Access to executive management team, trainers, business consultants, technology experts, and onboarding teams 9

10 Leveraging Bank’s existing digital platforms provides a truly differentiated client experience for Independent RIAs. Enhances Axos’ Securities Strategic Vision Clients Universal Enrollment Platform Universal Digital Bank Platform Onboard Clients Faster “Single-Pane” Rich Banking and Securities features Independent RIAs Self-Directed Trading Introducing Broker-Dealers

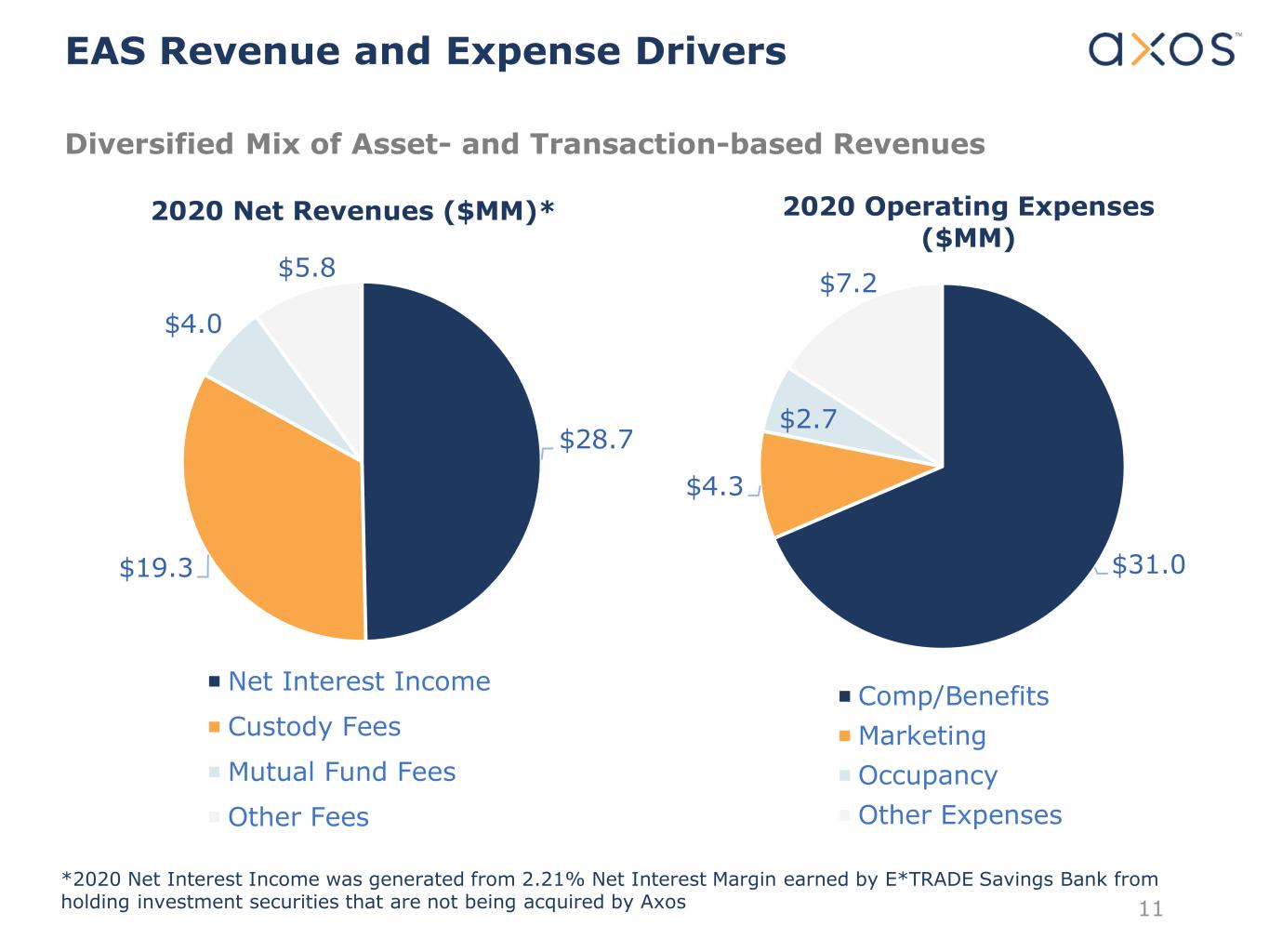

$28.7 $19.3 $4.0 $5.8 2020 Net Revenues ($MM)* Net Interest Income Custody Fees Mutual Fund Fees Other Fees EAS Revenue and Expense Drivers Diversified Mix of Asset- and Transaction-based Revenues 11 $31.0 $4.3 $2.7 $7.2 2020 Operating Expenses ($MM) Comp/Benefits Marketing Occupancy Other Expenses *2020 Net Interest Income was generated from 2.21% Net Interest Margin earned by E*TRADE Savings Bank from holding investment securities that are not being acquired by Axos

12 Long-Term Revenue and Expense Synergies Axos Custody Axos Invest Axos Clearing Revenue Synergies* Cost Synergies* Axos Securities: • Margin Loans • Securities Lending • Fixed Income Trading • Order Flow • White-label Robo Advisor Axos Consumer Banking: • White-label Banking • Auto Lending • Mortgage Lending • Unsecured Lending Axos Business Banking: • Small Business Banking • RIA Lending Axos Securities: • Self-Clearing • Regulatory/Compliance • Client Acquisition Costs • Customer Service • IT Infrastructure/Dev Axos Consumer Banking: • Deposit Servicing Costs • Client Acquisition Costs Axos Business Banking: • Client Acquisition Costs *Not included in EPS accretion or tangible book value earn-back analysis

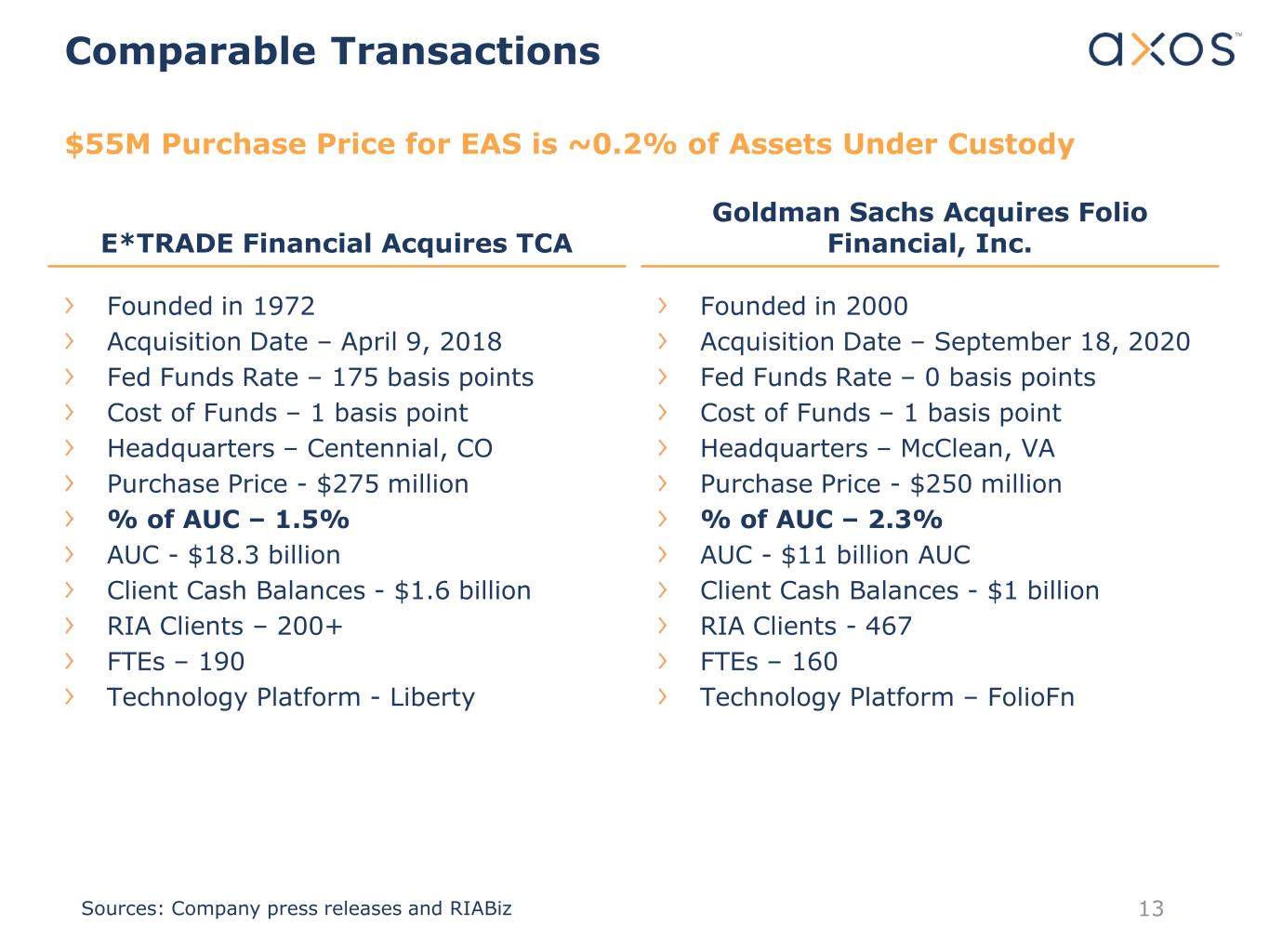

Founded in 1972 Acquisition Date – April 9, 2018 Fed Funds Rate – 175 basis points Cost of Funds – 1 basis point Headquarters – Centennial, CO Purchase Price - $275 million % of AUC – 1.5% AUC - $18.3 billion Client Cash Balances - $1.6 billion RIA Clients – 200+ FTEs – 190 Technology Platform - Liberty Founded in 2000 Acquisition Date – September 18, 2020 Fed Funds Rate – 0 basis points Cost of Funds – 1 basis point Headquarters – McClean, VA Purchase Price - $250 million % of AUC – 2.3% AUC - $11 billion AUC Client Cash Balances - $1 billion RIA Clients - 467 FTEs – 160 Technology Platform – FolioFn E*TRADE Financial Acquires TCA Goldman Sachs Acquires Folio Financial, Inc. Comparable Transactions $55M Purchase Price for EAS is ~0.2% of Assets Under Custody 13Sources: Company press releases and RIABiz

14 Transaction Milestones Regulatory •Asset Purchase from E*TRADE Savings Bank •EAS business will be broker-dealer compliant at closing •FINRA approval required prior to closing Operations •RIA custody business will be headquartered in Centennial, CO •Axos and Seller will sign Transition Services Agreement for support services post-closing •Vendor consolidation will occur during calendar 2021 Tech & Deposits •Client sweep deposits will transition to Axos Bank or other bank partners at closing with no incremental net growth in balance sheet ex-organic loan growth •Technology, trademarks and RIA and client contracts will be transferred to Axos Clearing Financials •EPS accretion and tangible book value earn-back projections do not include incremental revenue or operating cost synergies from Axos Clearing or Axos Bank •$1.0 million one-time deal-related expenses

15 Greg Garrabrants, President and CEO Andy Micheletti, EVP/CFO [email protected] www.axosfinancial.com Johnny Lai, VP Corporate Development and Investor Relations Phone: 858.649.2218 Mobile: 858.245.1442 [email protected] Contact Information

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Kura Oncology to Report First Quarter 2024 Financial Results

- Plato Gold Reports on 2023 Year-End Results

- Form 8.3 - [SPIRENT COMMUNICATIONS PLC] - 24 04 2024 - (CGAML)

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share