Form 8-K American Outdoor Brands, For: Jul 15

INVESTOR PRESENTATION JULY 2021 NASDAQ: AOUT Exhibit 99.1

Certain statements contained in this presentation may be deemed to be forward-looking statements under federal securities laws, and we intend that such forward-looking statements be subject to the safe harbor created thereby. All statements other than statements of historical facts contained or incorporated herein by reference in this press release, including statements regarding our future operating results, future financial position, business strategy, objectives, goals, plans, prospects, markets, and plans and objectives for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “targets,” “contemplates,” “projects,” “predicts,” “may,” “might,” “plan,” “would,” “should,” “could,” “may,” “can,” “potential,” “continue,” “objective,” or the negative of those terms, or similar expressions intended to identify forward-looking statements. However, not all forward-looking statements contain these identifying words. We caution that these statements are qualified by important risks, uncertainties, and other factors that could cause actual results to differ materially from those reflected by such forward-looking statements. Such factors include, among others, the effects of the COVID-19 pandemic and related aftermath, including potential disruptions in our suppliers’ ability to source the raw materials necessary for the production of our products, disruptions and delays in the manufacture of our products, and difficulties encountered by retailers and other components of the distribution channel for our products including delivery of product stemming from port congestion and related transportation challenges; lower levels of consumer spending in general and specific to our products or product categories; our ability to introduce new products that are successful in the marketplace; interruptions of our arrangements with third-party contract manufacturers and freight carriers that disrupt our ability to fill our customers’ orders; increases in costs or decreases in availability of finished products, product components, and raw materials; our ability to maintain or strengthen our brand recognition and reputation; the ability to forecast demand for our products accurately; our ability to continue to expand our e-commerce business; our ability to compete in a highly competitive market; our dependence on large customers; our ability to attract and retain talent; an increase of emphasis on private label products by our customers; pricing pressures by our customers; our ability to collect our accounts receivable; the potential for product recalls, product liability, and other claims or lawsuits against us; our ability to protect our intellectual property; inventory levels, both internally and in the distribution channel, in excess of demand; our ability to identify acquisition candidates, to complete acquisitions of potential acquisition candidates, to integrate acquired businesses with our business, to achieve success with acquired companies, and to realize the benefits of acquisitions in a manner consistent with our expectations; the performance and security of our information systems; our ability to comply with any applicable foreign laws or regulations and the effect of increased protective tariffs; economic, social, political, legislative, and regulatory factors; the potential for increased regulation of firearms and firearms-related products; the effect of political pressures on firearm laws and regulations; the potential impact on our business and operations from the results of U.S. Presidential, Congressional, state, and local elections and the policies that may be implemented as a result thereof; our ability to realize the anticipated benefits of being a separate, public company; future investments for capital expenditures, liquidity and anticipated cash needs and availability; the potential for impairment charges; estimated amortization expense of intangible assets for future periods; actions of social activists that could, directly or indirectly, have an adverse effect on our business; disruptions caused by social unrest, including related protests or disturbances; our assessment of factors relating to the valuation of assets acquired and liabilities assumed in acquisitions, the timing for such evaluations, and the potential adjustment in such evaluations; and, other factors detailed from time to time in our reports filed with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the fiscal year ended April 30, 2021. LEGAL SAFE HARBOR American Outdoor Brands (NASDAQ: AOUT)

American outdoor brands Building authentic, lifestyle brands that help consumers make the most out of the moments that matter: Large, passion-driven industry ($30-35 billion)(a) Favorable macro trends (fishing, hunting, personal protection, shooting sports, camping, and hiking) Diverse portfolio of 20 early-stage consumer brands Innovative “Dock & Unlock”™ formula fuels brand growth Leverageable model drives profitability Strong balance sheet supports organic growth & acquisitions Estimated market size per AOUT management’s estimates. American Outdoor Brands (NASDAQ: AOUT)

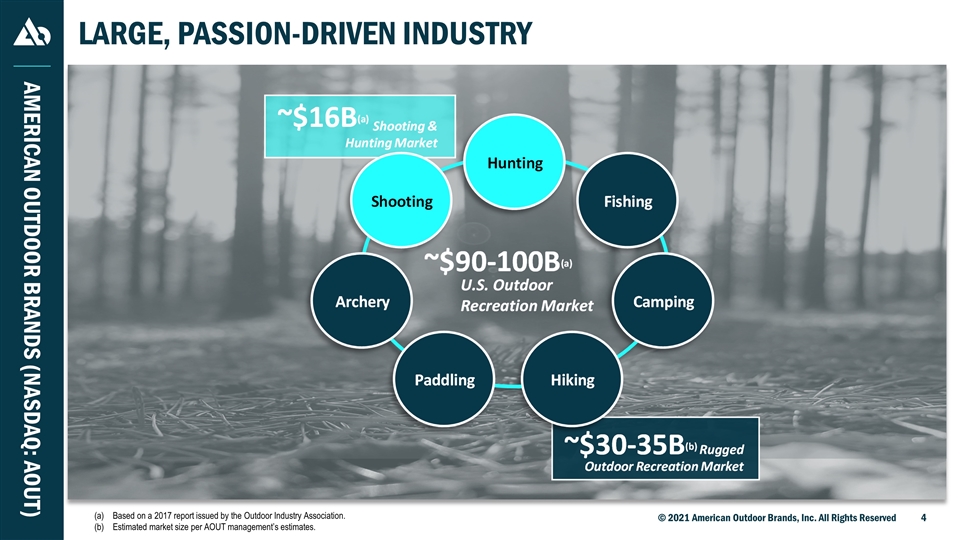

American Outdoor Brands (NASDAQ: AOUT) Large, passion-driven industry Based on a 2017 report issued by the Outdoor Industry Association. Estimated market size per AOUT management’s estimates.

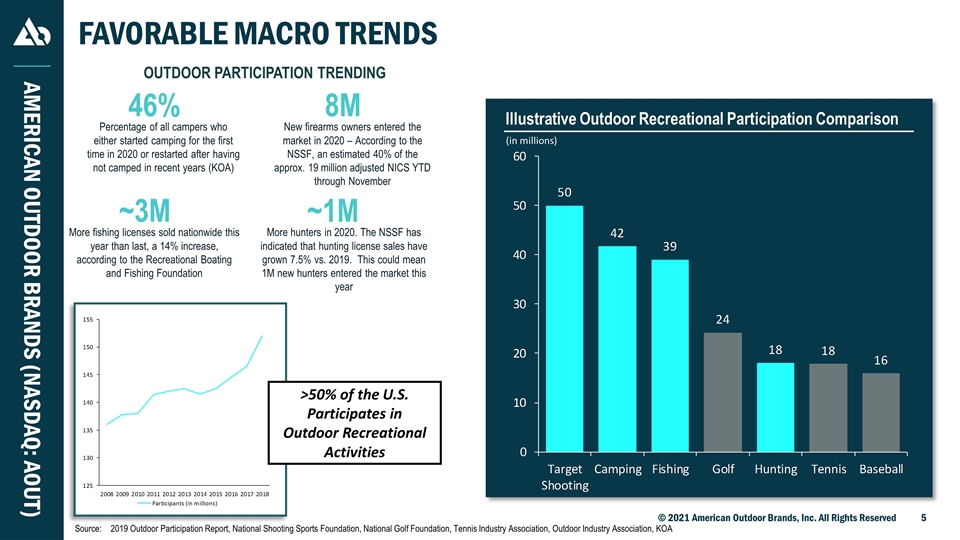

Illustrative Outdoor Recreational Participation Comparison Favorable Macro trends American Outdoor Brands (NASDAQ: AOUT) Outdoor Participation Trending Source:2019 Outdoor Participation Report, National Shooting Sports Foundation, National Golf Foundation, Tennis Industry Association, Outdoor Industry Association, KOA >50% of the U.S. Participates in Outdoor Recreational Activities (in millions) 46% Percentage of all campers who either started camping for the first time in 2020 or restarted after having not camped in recent years (KOA) 8M New firearms owners entered the market in 2020 – According to the NSSF, an estimated 40% of the approx. 19 million adjusted NICS YTD through November ~1M More hunters in 2020. The NSSF has indicated that hunting license sales have grown 7.5% vs. 2019. This could mean 1M new hunters entered the market this year ~3M More fishing licenses sold nationwide this year than last, a 14% increase, according to the Recreational Boating and Fishing Foundation

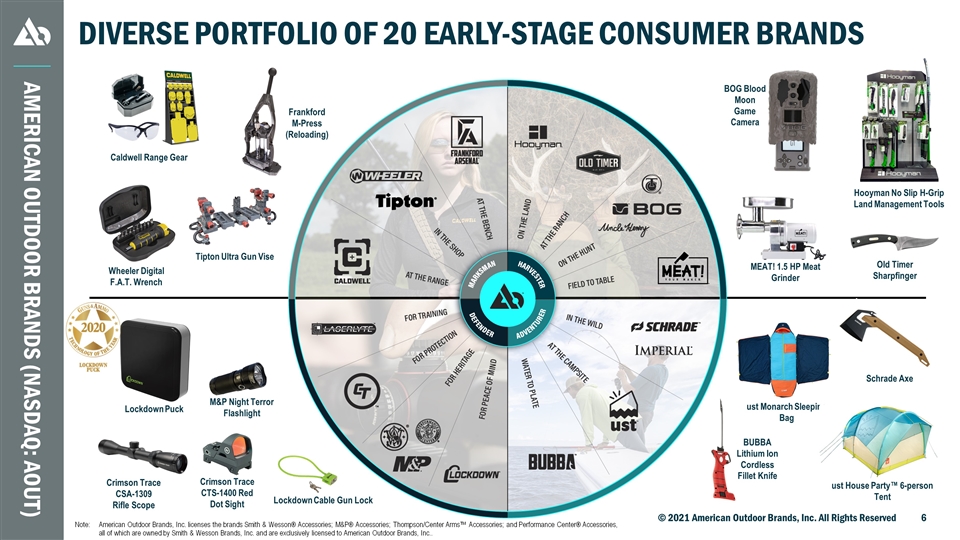

Diverse portfolio of 20 early-stage consumer brands Caldwell Range Gear Wheeler Digital F.A.T. Wrench Frankford M-Press (Reloading) BOG Blood Moon Game Camera MEAT! 1.5 HP Meat Grinder Hooyman No Slip H-Grip Land Management Tools Old Timer Sharpfinger BUBBA Lithium Ion Cordless Fillet Knife ust House Party™ 6-person Tent Lockdown Puck Crimson Trace CSA-1309 Rifle Scope Crimson Trace CTS-1400 Red Dot Sight ust Monarch Sleeping Bag Schrade Axe Lockdown Cable Gun Lock M&P Night Terror Flashlight Tipton Ultra Gun Vise American Outdoor Brands (NASDAQ: AOUT) Note:American Outdoor Brands, Inc. licenses the brands Smith & Wesson® Accessories; M&P® Accessories; Thompson/Center Arms™ Accessories; and Performance Center® Accessories, all of which are owned by Smith & Wesson Brands, Inc. and are exclusively licensed to American Outdoor Brands, Inc..

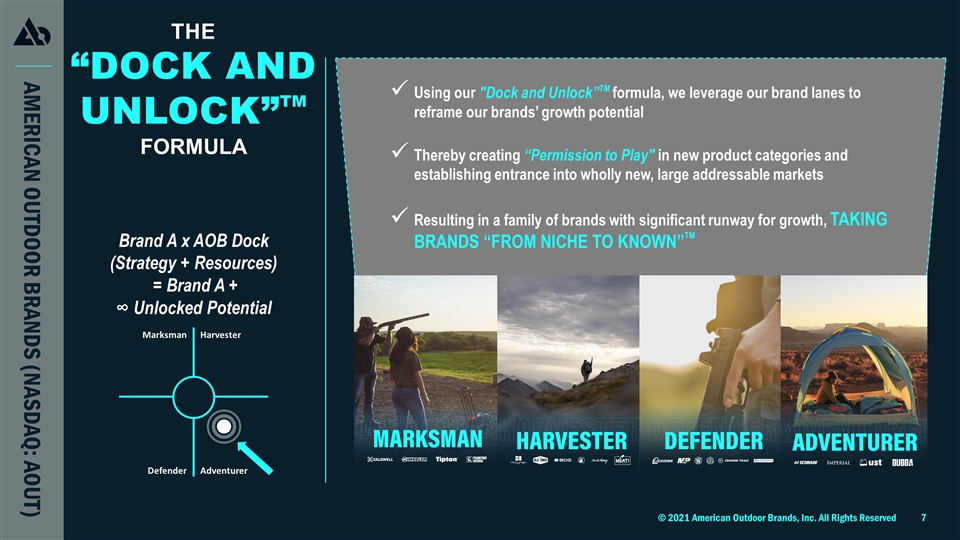

Brand A x AOB Dock (Strategy + Resources) = Brand A + ∞ Unlocked Potential THE “DOCK AND UNLOCK”TM FORMULA Adventurer Harvester Marksman Defender American Outdoor Brands (NASDAQ: AOUT) Using our "Dock and Unlock”TM formula, we leverage our brand lanes to reframe our brands’ growth potential Thereby creating “Permission to Play" in new product categories and establishing entrance into wholly new, large addressable markets Resulting in a family of brands with significant runway for growth, TAKING BRANDS “FROM NICHE TO KNOWN”TM

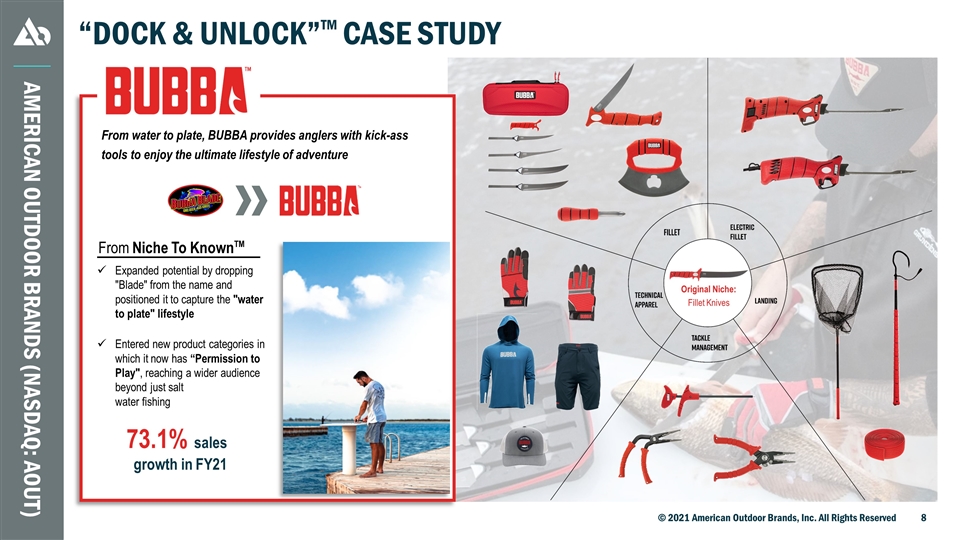

Original Niche: Fillet Knives “DOCK & UNLOCK”TM CASE STUDY American Outdoor Brands (NASDAQ: AOUT) From water to plate, BUBBA provides anglers with kick-ass tools to enjoy the ultimate lifestyle of adventure From Niche To KnownTM Expanded potential by dropping "Blade" from the name and positioned it to capture the "water to plate" lifestyle Entered new product categories in which it now has “Permission to Play", reaching a wider audience beyond just salt water fishing 73.1% sales growth in FY21

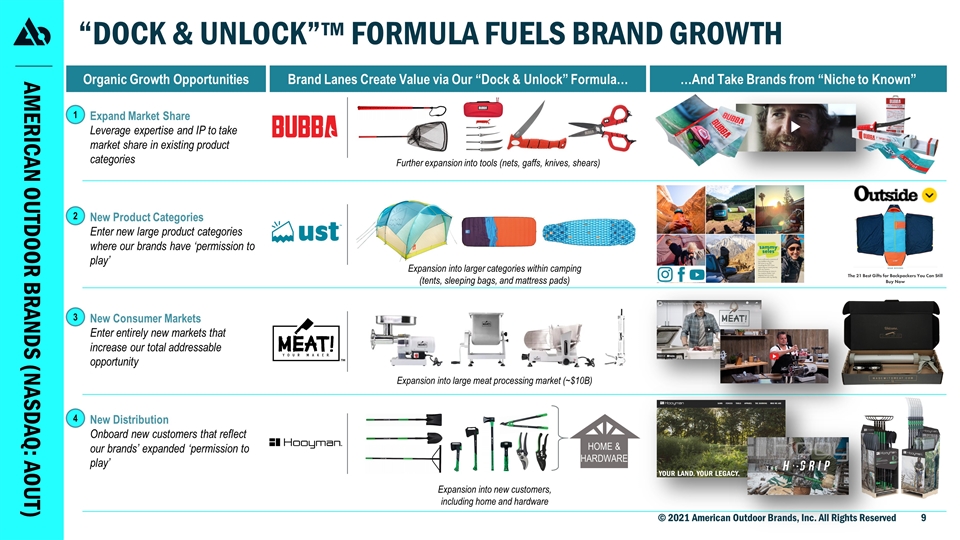

“Dock & Unlock”™ formula fuels brand growth Expand Market Share Leverage expertise and IP to take market share in existing product categories New Product Categories Enter new large product categories where our brands have ‘permission to play’ New Consumer Markets Enter entirely new markets that increase our total addressable opportunity New Distribution Onboard new customers that reflect our brands’ expanded ‘permission to play’ Organic Growth Opportunities Brand Lanes Create Value via Our “Dock & Unlock” Formula… …And Take Brands from “Niche to Known” 1 4 3 2 Further expansion into tools (nets, gaffs, knives, shears) Expansion into larger categories within camping (tents, sleeping bags, and mattress pads) Expansion into large meat processing market (~$10B) Expansion into new customers, including home and hardware HOME & HARDWARE American Outdoor Brands (NASDAQ: AOUT)

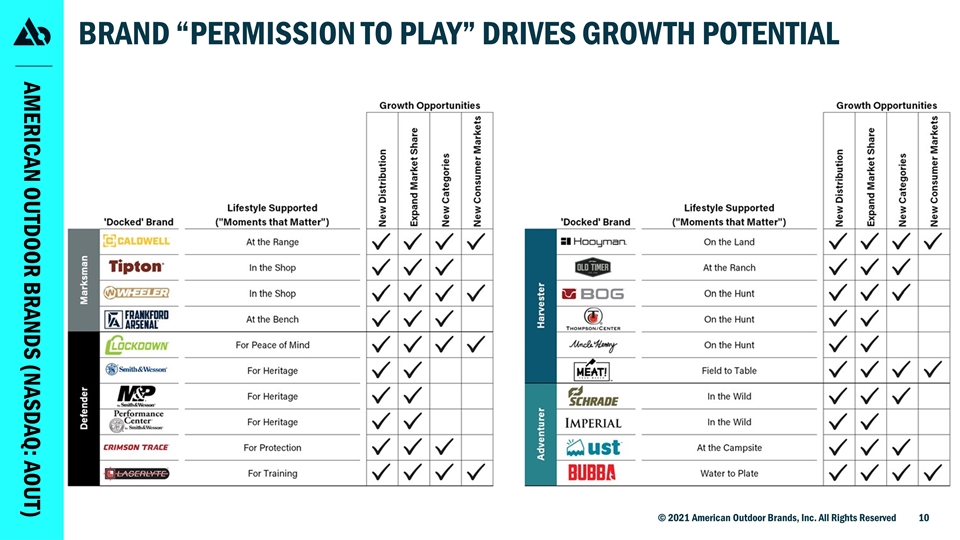

Brand “permission to play” drives growth potential American Outdoor Brands (NASDAQ: AOUT)

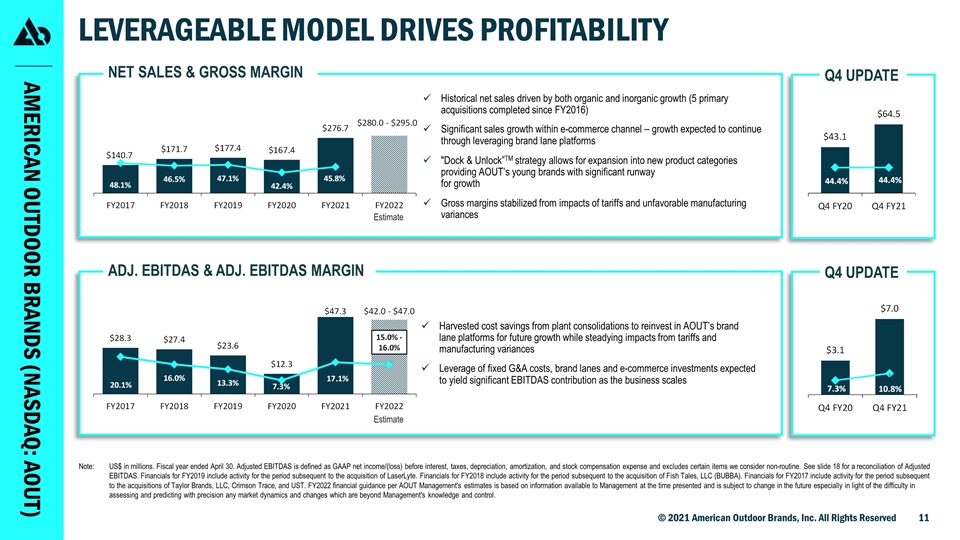

American Outdoor Brands (NASDAQ: AOUT) Leverageable model drives profitability net sales & Gross Margin Adj. EBITDAS & adj. ebitdas Margin Historical net sales driven by both organic and inorganic growth (5 primary acquisitions completed since FY2016) Significant sales growth within e-commerce channel – growth expected to continue through leveraging brand lane platforms "Dock & Unlock”TM strategy allows for expansion into new product categories providing AOUT’s young brands with significant runway for growth Gross margins stabilized from impacts of tariffs and unfavorable manufacturing variances Note:US$ in millions. Fiscal year ended April 30. Adjusted EBITDAS is defined as GAAP net income/(loss) before interest, taxes, depreciation, amortization, and stock compensation expense and excludes certain items we consider non-routine. See slide 18 for a reconciliation of Adjusted EBITDAS. Financials for FY2019 include activity for the period subsequent to the acquisition of LaserLyte. Financials for FY2018 include activity for the period subsequent to the acquisition of Fish Tales, LLC (BUBBA). Financials for FY2017 include activity for the period subsequent to the acquisitions of Taylor Brands, LLC, Crimson Trace, and UST. FY2022 financial guidance per AOUT Management's estimates is based on information available to Management at the time presented and is subject to change in the future especially in light of the difficulty in assessing and predicting with precision any market dynamics and changes which are beyond Management's knowledge and control. Harvested cost savings from plant consolidations to reinvest in AOUT’s brand lane platforms for future growth while steadying impacts from tariffs and manufacturing variances Leverage of fixed G&A costs, brand lanes and e-commerce investments expected to yield significant EBITDAS contribution as the business scales Estimate Estimate Q4 Update Q4 Update 7.9%

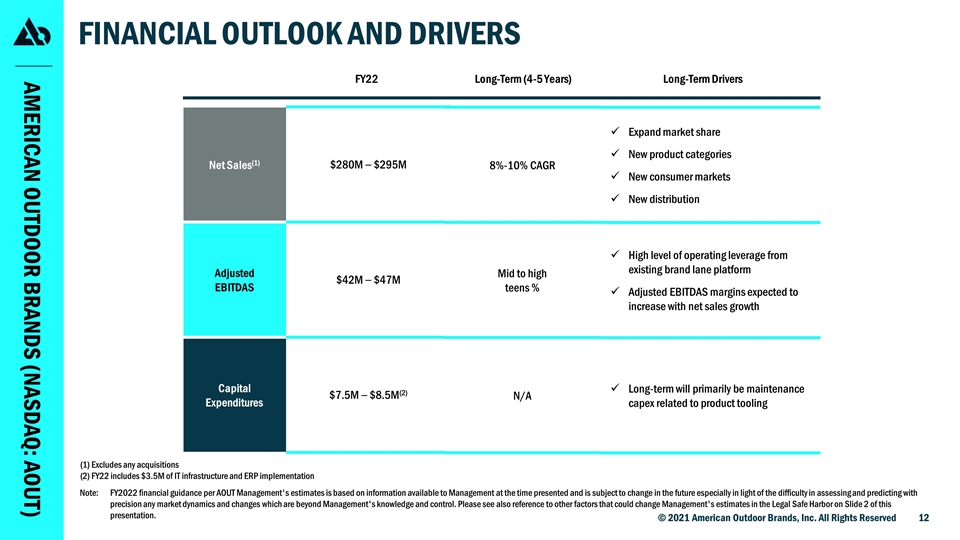

American Outdoor Brands (NASDAQ: AOUT) Financial Outlook and Drivers Net Sales(1) $280M – $295M Adjusted EBITDAS $42M – $47M Capital Expenditures $7.5M – $8.5M(2) Expand market share New product categories New consumer markets New distribution High level of operating leverage from existing brand lane platform Adjusted EBITDAS margins expected to increase with net sales growth Long-term will primarily be maintenance capex related to product tooling Long-Term Drivers Note:FY2022 financial guidance per AOUT Management's estimates is based on information available to Management at the time presented and is subject to change in the future especially in light of the difficulty in assessing and predicting with precision any market dynamics and changes which are beyond Management's knowledge and control. Please see also reference to other factors that could change Management's estimates in the Legal Safe Harbor on Slide 2 of this presentation. (1) Excludes any acquisitions (2) FY22 includes $3.5M of IT infrastructure and ERP implementation FY22 Long-Term (4-5 Years) 8%-10% CAGR Mid to high teens % N/A

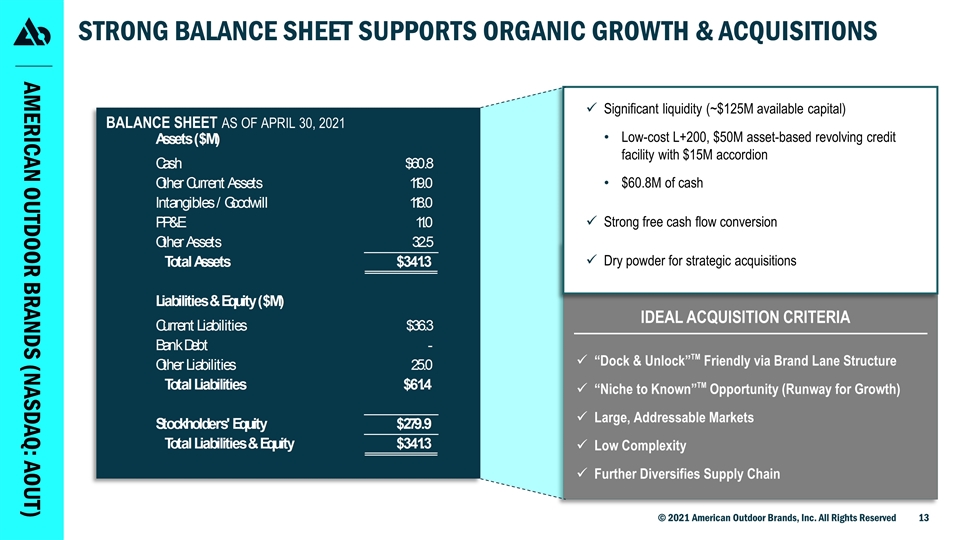

balance sheet As of APRIL 30, 2021 American Outdoor Brands (NASDAQ: AOUT) Strong balance sheet supports organic growth & acquisitions Significant liquidity (~$125M available capital) Low-cost L+200, $50M asset-based revolving credit facility with $15M accordion $60.8M of cash Strong free cash flow conversion Dry powder for strategic acquisitions IDEAL ACQUISITION CRITERIA “Dock & Unlock”TM Friendly via Brand Lane Structure “Niche to Known”TM Opportunity (Runway for Growth) Large, Addressable Markets Low Complexity Further Diversifies Supply Chain

Appendix Follows

Experienced Leadership BRIAN D. MURPHY President & Chief Executive Officer 15+ years experience Lead execution of AOUT’s “Dock & Unlock”TM strategy as part of expansion into new outdoor product categories and markets Experienced leader with ability to motivate teams, build and run business operations, and apply transactional and industry experience Significant M&A and financial experience with publicly traded companies H. ANDREW FULMER, CPA Chief Financial Officer 25+ years experience Extensive financial experience with the company, and played key role in the development and execution of the company’s long-term acquisition strategy Led the company’s strategic planning process and developed procedures for acquisition-related financial modeling, due diligence, internal controls, and integration American Outdoor Brands (NASDAQ: AOUT)

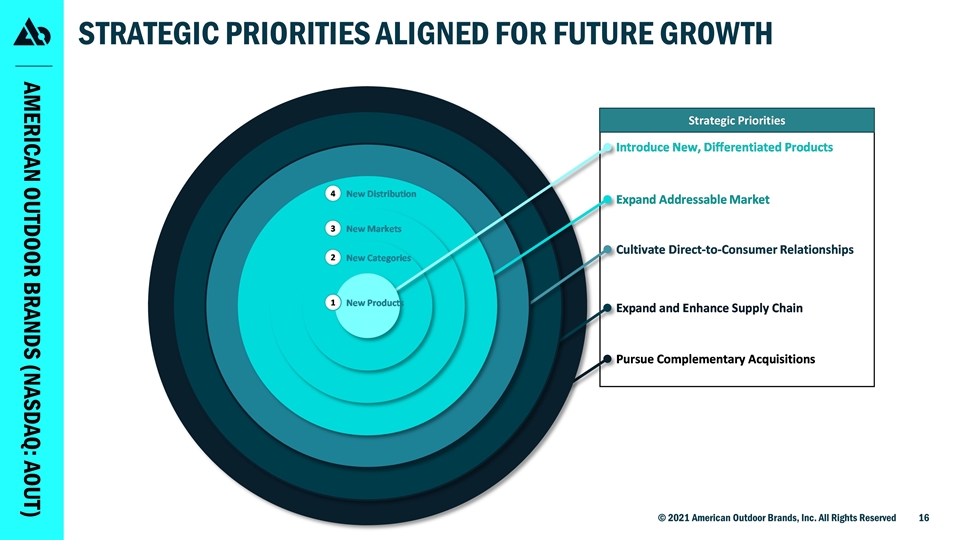

Strategic Priorities aligned for Future Growth American Outdoor Brands (NASDAQ: AOUT)

American Outdoor Brands (NASDAQ: AOUT) In this presentation, certain non-GAAP financial measures, including “non-GAAP net income,” “non-GAAP income per share diluted,” “Adjusted EBITDAS,” and “free cash flow” are presented. A reconciliation of these and other non-GAAP financial measures are contained at the end of this press release. A reconciliation of projected non-GAAP income per share diluted and free cash flow are contained under the “Outlook” section of this press release. From time-to-time, the Company considers and uses these non-GAAP financial measures as supplemental measures of operating performance in order to provide the reader with an improved understanding of underlying performance trends. The Company believes it is useful for itself and the reader to review, as applicable, both (1) GAAP measures that include (i) amortization of acquired intangible assets, (ii) stock compensation, (iii) transition costs, (iv) COVID-19 expenses, (v) goodwill impairment, (vi) product recall, (vii) the tax effect of non-GAAP adjustments, (viii) interest expense, (ix) income tax expense/(benefit), (x) depreciation and amortization, and (xi) related party interest income; and (2) the non-GAAP measures that exclude such information. The Company presents these non-GAAP measures because it considers them an important supplemental measure of its performance and believes the disclosure of such measures provides useful information to investors regarding the Company’s financial condition and results of operations. The Company’s definition of these adjusted financial measures may differ from similarly named measures used by others. The Company believes these measures facilitate operating performance comparisons from period to period by eliminating potential differences caused by the existence and timing of certain expense items that would not otherwise be apparent on a GAAP basis. These non-GAAP measures have limitations as an analytical tool and should not be considered in isolation or as a substitute for the Company's GAAP measures. The principal limitations of these measures are that they do not reflect the Company's actual expenses and may thus have the effect of inflating its financial measures on a GAAP basis. Non-GAAP Financial Measures

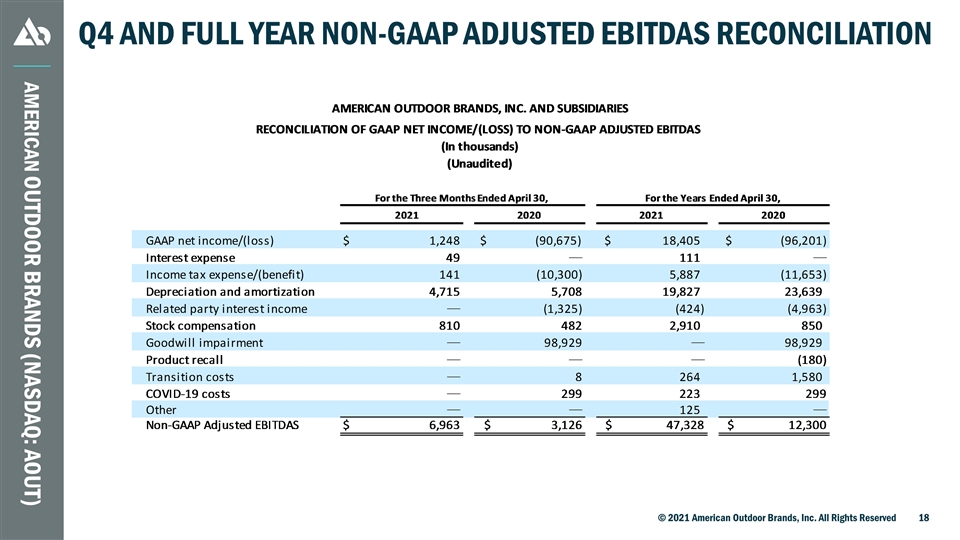

American Outdoor Brands (NASDAQ: AOUT) Q4 and full year non-gaap adjusted ebitdas reconciliation

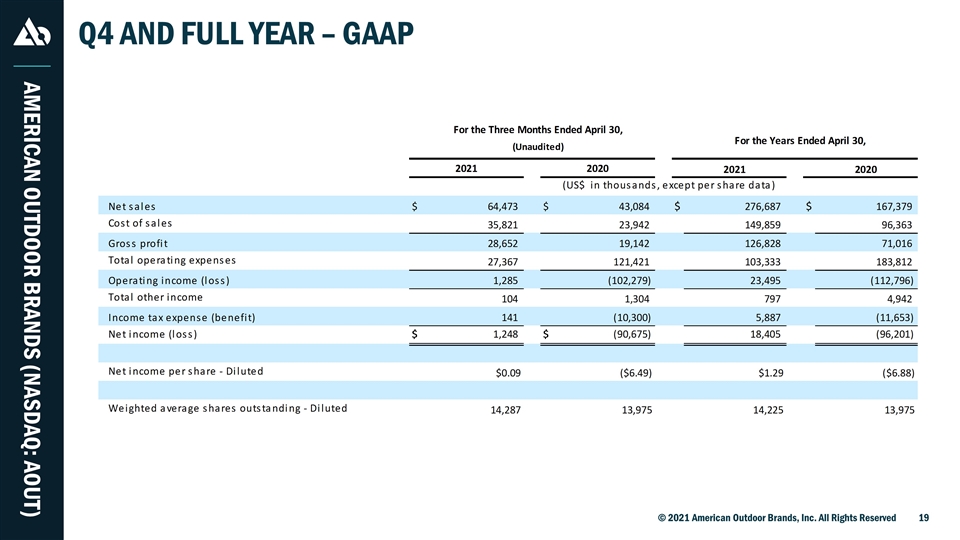

Q4 and full year – gaap American Outdoor Brands (NASDAQ: AOUT)

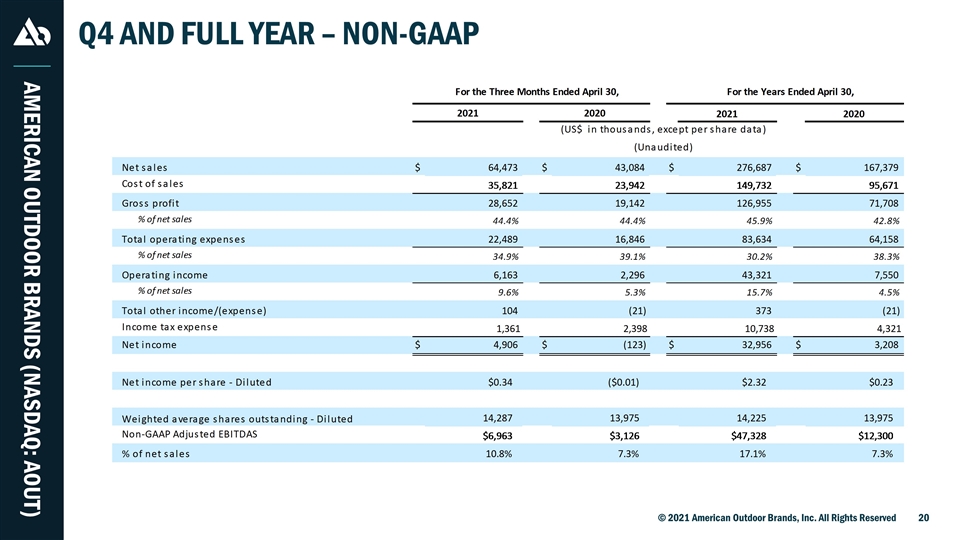

Q4 and full year – non-GAAP American Outdoor Brands (NASDAQ: AOUT)

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Leading Industry Publication: Black & Veatch Remains Among Global Critical Infrastructure Leaders as Sustainability, Decarbonization Solutions Drive Growth

- Biophytis Announces Transfer of ADSs to OTC Market

- Blackstone Credit and Insurance appoints Dan Leiter as Head of International

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share