Form 8-K Adient plc For: Mar 29

Exhibit 99.1 Adient March 29, 2021 Lender Presentation Adient - PUBLICExhibit 99.1 Adient March 29, 2021 Lender Presentation Adient - PUBLIC

Important Information Adient has made statements in this document that are forward-looking and, therefore, are subject to risks and uncertainties. All statements in this document other than statements of historical fact are statements that are, or could be, deemed “forward- looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In this document, statements regarding Adient’s expectations for the strategic transactions in China, deleveraging transactions and the contemplated amendment and extension of the term loan credit agreement (collectively, the “Transactions”), timing, benefits and outcomes of the Transactions, as well as its future financial position, sales, costs, earnings, cash flows, other measures of results of operations, capital expenditures or debt levels and plans, objectives, market position, outlook, targets, guidance or goals are forward-looking statements. Words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “forecast,” “project” or “plan” or terms of similar meaning are also generally intended to identify forward-looking statements. Adient cautions that these statements are subject to numerous important risks, uncertainties, assumptions and other factors, some of which are beyond Adient’s control, that could cause Adient’s actual results to differ materially from those expressed or implied by such forward-looking statements, including, among others, risks related to: Adient’s ability to consummate the Transactions that may yield additional value for shareholders at all or on the same or different terms as those described herein, the timing, benefits and outcome of the Transactions, the effect of the announcement of the Transactions on Adient’s business relationships, operating results and business generally, the occurrence of any event, change or other circumstances that could give rise to the termination of the Transactions, the failure to satisfy conditions to consummation of the Transactions, including the receipt of regulatory approvals (and any conditions, limitations or restrictions placed on these approvals), risks that the Transactions disrupt current plans and operations, including potential disruptions with respect to our employees, vendors, clients and customers as well as management diversion or potential litigation, the effects of local and national economic, credit and capital market conditions on the economy in general, and other risks and uncertainties, the continued financial and operational impacts of and uncertainties relating to the COVID-19 pandemic on Adient and its customers, suppliers, joint venture partners and other parties, the ability of Adient to execute its turnaround plan, the ability of Adient to effectively launch new business at forecast and profitable levels, the ability of Adient to meet debt service requirements, the terms of financing, the impact of tax reform legislation through the Tax Cuts and Jobs Act and/or under the new U.S. presidential administration, uncertainties in U.S. administrative policy regarding trade agreements, tariffs and other international trade relations including as may be impacted by the change in U.S. presidential administration, general economic and business conditions, the strength of the U.S. or other economies, automotive vehicle production levels, mix and schedules, changes in consumer demand, work stoppages and similar events, global climate change and related emphasis on ESG matters by various stakeholders, energy and commodity prices, the availability of raw materials and component products, currency exchange rates and cancellation of or changes to commercial arrangements, and the ability of Adient to identify, recruit and retain key leadership. A detailed discussion of risks related to Adient’s business is included in the section entitled “Risk Factors” in Adient’s Annual Report on Form 10-K for the fiscal year ended September 30, 2020 filed with the U.S. Securities and Exchange Commission (the “SEC”) on November 30, 2020, Quarterly Report on Form 10-Q for the Quarterly Period ended December 31, 2020 filed with the SEC on February 5, 2021, and in subsequent reports filed with or furnished to the SEC, available at www.sec.gov. Potential investors, holders of notes and others should consider these factors in evaluating the forward-looking statements and should not place undue reliance on such statements. The forward-looking statements included in this document are made only as of the date of this document, unless otherwise specified, and, except as required by law, Adient assumes no obligation, and disclaims any obligation, to update such statements to reflect events or circumstances occurring after the date of this document. In addition, this document includes certain projections provided by Adient with respect to the anticipated future performance of Adient’s businesses. Such projections reflect various assumptions of Adient’s management concerning the future performance of Adient’s businesses, which may or may not prove to be correct. The actual results may vary from the anticipated results and such variations may be material. Adient does not undertake any obligation to update the projections to reflect events or circumstances or changes in expectations after the date of this document or to reflect the occurrence of subsequent events. No representations or warranties are made as to the accuracy or reasonableness of such assumptions or the projections based thereon. This document also contains non-GAAP financial information because Adient’s management believes it may assist investors in evaluating Adient’s on-going operations. Adient believes these non-GAAP disclosures provide important supplemental information to management and investors regarding financial and business trends relating to Adient’s financial condition and results of operations. Investors should not consider these non-GAAP measures as alternatives to the related GAAP measures.

- Transaction Summary Agenda - Business Overview and Update - Recent announcements - Key Financials 3 Adient - PUBLIC- Transaction Summary Agenda - Business Overview and Update - Recent announcements - Key Financials 3 Adient - PUBLIC

Transaction Adient Lender Presentation Summary 4 Adient - PUBLICTransaction Adient Lender Presentation Summary 4 Adient - PUBLIC

Transaction Summary Adient plc (“Adient” or the “Company”) (NYSE: ADNT) is a global leader in the automotive seating supply industry holding ~33% of the global market share with 202 manufacturing facilities in 32 countries in the Americas, Europe, Asia, and China For LTM period ending December 31, 2020, Adient generated Consolidated Revenue and Adjusted EBITDA of $12.6 billion and $754 million Current market capitalization of ~$3.9 billion The Company is opportunistically seeking to extend its existing Term Loan B and upsize by ~$200 million to $1,000 million Incremental proceeds, along with approximately $640 million of cash from the balance sheet will be used to refinance the 7% Senior First Lien Notes due 2026 and pay related fees and expenses th As announced on March 29 , 2021, $640 million of the outstanding 7% Senior First Lien Notes due 2026 were validly tendered by the early tender deadline at a price of $1,070.00 per $1,000.00; in addition, the Company intends to redeem $80 million of the 7% Senior First Lien Notes due 2026 at a price of 1,030.00 per $1,000.00 pursuant to the special call th rd feature before May 6 , 2021 and an additional $80 million before the end of Adient’s fiscal 3 quarter. Pro Forma Senior Secured Net Leverage and Total Net Leverage of 0.6x and 3.5x, respectively, based on LTM period ending December 31, 2020 Adj. EBITDA of $754 million As announced on March 12, 2021, the Company entered into various agreements with joint venture partner Yanfeng to end its YFAS joint venture, this will generate after-tax proceeds of ~$1.4B which are expected to be used, among other things, to repay debt during 2021 while driving net leverage down (target of 1.5x – 2.0x) 5 Adient - PUBLICTransaction Summary Adient plc (“Adient” or the “Company”) (NYSE: ADNT) is a global leader in the automotive seating supply industry holding ~33% of the global market share with 202 manufacturing facilities in 32 countries in the Americas, Europe, Asia, and China For LTM period ending December 31, 2020, Adient generated Consolidated Revenue and Adjusted EBITDA of $12.6 billion and $754 million Current market capitalization of ~$3.9 billion The Company is opportunistically seeking to extend its existing Term Loan B and upsize by ~$200 million to $1,000 million Incremental proceeds, along with approximately $640 million of cash from the balance sheet will be used to refinance the 7% Senior First Lien Notes due 2026 and pay related fees and expenses th As announced on March 29 , 2021, $640 million of the outstanding 7% Senior First Lien Notes due 2026 were validly tendered by the early tender deadline at a price of $1,070.00 per $1,000.00; in addition, the Company intends to redeem $80 million of the 7% Senior First Lien Notes due 2026 at a price of 1,030.00 per $1,000.00 pursuant to the special call th rd feature before May 6 , 2021 and an additional $80 million before the end of Adient’s fiscal 3 quarter. Pro Forma Senior Secured Net Leverage and Total Net Leverage of 0.6x and 3.5x, respectively, based on LTM period ending December 31, 2020 Adj. EBITDA of $754 million As announced on March 12, 2021, the Company entered into various agreements with joint venture partner Yanfeng to end its YFAS joint venture, this will generate after-tax proceeds of ~$1.4B which are expected to be used, among other things, to repay debt during 2021 while driving net leverage down (target of 1.5x – 2.0x) 5 Adient - PUBLIC

Sources & Uses and Pro Forma Capitalization Sources & Uses Pro Forma Capitalization (1) ($ in millions) 12/31/2020 2021 Guidance ($ in millions) Sources of Funds Amount Pro Forma Capitalization Maturity Actual PF TLB/Tender PF China Trans. A&E Term Loan B $1,000 Cash & Cash Equivalents $1,820 $1,182 $1,182 Cash from Balance Sheet 638 ABL Revolver, incl. FILO ($1,250mm) 5/6/24 -- -- Total Sources $1,638 Term Loan B 5/6/24 788 -- Uses of Funds Amount A&E Term Loan B 7 years -- 1,000 1,000 9.000% Secured Notes 4/15/25 600 600 Repay Term Loan B $788 (2) 7.000% Secured Notes 5/15/26 800 -- Partially Redeem Senior Secured Notes due 2026 (10%) 160 Other Debt -- 11 11 Premium on Partial Special Redemption (@ 103.00) 5 Total Secured Debt $2,199 $1,611 Paydown Senior Secured Notes due 2026 640 European Investment Bank Loan 5/9/22 187 187 Tender Premium on Senior Secured Notes (@ 107.00) 45 3.500% Senior Notes (€1,000mm) 8/15/24 1,230 1,230 Total Uses $1,638 4.875% Senior Notes 8/15/26 797 797 (3) Total Debt $4,413 $3,825 ~$2.4bn Market Capitalization 3,939 3,939 Total Capitalization $8,352 $7,764 Operating Metrics (4) Adj. EBITDA $754 $754 $985 Credit Statistics Secured Debt / Adj. EBITDA 2.9x 2.1x TBD Note: Excludes transaction fees & expenses. (1) Assumes no change in cash or Term Loan B balance from pro forma 12/31/20 balance. Secured Net Debt / Adj. EBITDA 0.5x 0.6x TBD th (2) Assumes $80 million redeemed prior to May 6 , 2021, and an additional $80 million redeemed before the end of Adient’s fiscal third quarter. Total Debt / Adj. EBITDA 5.9x 5.1x ~2.4x (3) Reflects approximately $2.0 billion of debt paydown during calendar year 2021. Net Debt / Adj. EBITDA 3.4x 3.5x ~1.2x (4) Reflects midpoint of FY 2021E Adjusted EBITDA guidance ($1,050 million) adjusted for anticipated EBITDA impacts associated with sale of China JV (plus $90 million from consolidation, less $155 6 million from decrease in equity income). Adient - PUBLICSources & Uses and Pro Forma Capitalization Sources & Uses Pro Forma Capitalization (1) ($ in millions) 12/31/2020 2021 Guidance ($ in millions) Sources of Funds Amount Pro Forma Capitalization Maturity Actual PF TLB/Tender PF China Trans. A&E Term Loan B $1,000 Cash & Cash Equivalents $1,820 $1,182 $1,182 Cash from Balance Sheet 638 ABL Revolver, incl. FILO ($1,250mm) 5/6/24 -- -- Total Sources $1,638 Term Loan B 5/6/24 788 -- Uses of Funds Amount A&E Term Loan B 7 years -- 1,000 1,000 9.000% Secured Notes 4/15/25 600 600 Repay Term Loan B $788 (2) 7.000% Secured Notes 5/15/26 800 -- Partially Redeem Senior Secured Notes due 2026 (10%) 160 Other Debt -- 11 11 Premium on Partial Special Redemption (@ 103.00) 5 Total Secured Debt $2,199 $1,611 Paydown Senior Secured Notes due 2026 640 European Investment Bank Loan 5/9/22 187 187 Tender Premium on Senior Secured Notes (@ 107.00) 45 3.500% Senior Notes (€1,000mm) 8/15/24 1,230 1,230 Total Uses $1,638 4.875% Senior Notes 8/15/26 797 797 (3) Total Debt $4,413 $3,825 ~$2.4bn Market Capitalization 3,939 3,939 Total Capitalization $8,352 $7,764 Operating Metrics (4) Adj. EBITDA $754 $754 $985 Credit Statistics Secured Debt / Adj. EBITDA 2.9x 2.1x TBD Note: Excludes transaction fees & expenses. (1) Assumes no change in cash or Term Loan B balance from pro forma 12/31/20 balance. Secured Net Debt / Adj. EBITDA 0.5x 0.6x TBD th (2) Assumes $80 million redeemed prior to May 6 , 2021, and an additional $80 million redeemed before the end of Adient’s fiscal third quarter. Total Debt / Adj. EBITDA 5.9x 5.1x ~2.4x (3) Reflects approximately $2.0 billion of debt paydown during calendar year 2021. Net Debt / Adj. EBITDA 3.4x 3.5x ~1.2x (4) Reflects midpoint of FY 2021E Adjusted EBITDA guidance ($1,050 million) adjusted for anticipated EBITDA impacts associated with sale of China JV (plus $90 million from consolidation, less $155 6 million from decrease in equity income). Adient - PUBLIC

Summary of Terms – New Term Loan B Co-Borrowers: Adient US LLC and Adient Global Holdings S.à.r.l. (the “Co-Borrowers”) (same as existing Term Loan B) Facility: First Lien Term Loan B Guarantors: Same as existing Term Loan B Security: Same as existing Term Loan B Amount: $1,000 million Maturity: 7 years (2028) Pricing: L + 350 – 375 bps; locked until 12/31/21, thereafter subject to a 25 bps step-down (same as existing) LIBOR Floor: 0.00% (same as existing) OID: 99.5 Optional 101 soft call for 6 months Prepayments: Amortization: 1.00% per annum (same as existing Term Loan B) Financial Covenants: None (same as existing Term Loan B) Other Terms: Substantially the same as the existing Term Loan B 7 Adient - PUBLICSummary of Terms – New Term Loan B Co-Borrowers: Adient US LLC and Adient Global Holdings S.à.r.l. (the “Co-Borrowers”) (same as existing Term Loan B) Facility: First Lien Term Loan B Guarantors: Same as existing Term Loan B Security: Same as existing Term Loan B Amount: $1,000 million Maturity: 7 years (2028) Pricing: L + 350 – 375 bps; locked until 12/31/21, thereafter subject to a 25 bps step-down (same as existing) LIBOR Floor: 0.00% (same as existing) OID: 99.5 Optional 101 soft call for 6 months Prepayments: Amortization: 1.00% per annum (same as existing Term Loan B) Financial Covenants: None (same as existing Term Loan B) Other Terms: Substantially the same as the existing Term Loan B 7 Adient - PUBLIC

Indicative Execution Timeline March 2021 April 2021 Sun Mon Tue Wed Thu Fri Sat Sun Mon Tue Wed Thu Fri Sat 1 2 3 4 5 6 1 2 3 7 8 9 10 11 12 13 4 5 6 7 8 9 10 14 15 16 17 18 19 20 11 12 13 14 15 16 17 21 22 23 24 25 26 27 18 19 20 21 22 23 24 28 29 30 31 25 26 27 28 29 30 Market Holiday Key Syndication Date Date Event th March 29 , 2021 Lender Conference Call st April 1 , 2021 Term Loan B Lender Commitments Due (5PM ET) Thereafter Close & Fund Term Loan B 8 Adient - PUBLICIndicative Execution Timeline March 2021 April 2021 Sun Mon Tue Wed Thu Fri Sat Sun Mon Tue Wed Thu Fri Sat 1 2 3 4 5 6 1 2 3 7 8 9 10 11 12 13 4 5 6 7 8 9 10 14 15 16 17 18 19 20 11 12 13 14 15 16 17 21 22 23 24 25 26 27 18 19 20 21 22 23 24 28 29 30 31 25 26 27 28 29 30 Market Holiday Key Syndication Date Date Event th March 29 , 2021 Lender Conference Call st April 1 , 2021 Term Loan B Lender Commitments Due (5PM ET) Thereafter Close & Fund Term Loan B 8 Adient - PUBLIC

Business Overview Adient Lender Presentation and Update 9 Adient - PUBLICBusiness Overview Adient Lender Presentation and Update 9 Adient - PUBLIC

Adient is fundamental within the automotive industry Adient is a critical supplier in automotive seating, supplying approximately one out of every three automotive seats worldwide NYSE: ADNT FY20 Revenue Global market Revenue by share geography* ~$12.7B ~$7.6B Europe / Americas Consolidated Unconsolidated Lear Africa We supply Adient revenue seating revenue ~33 31% 26% % Strong and diversified ~19M revenue mix: Faurecia 7% 36% Passenger car ~35% seat systems Asia / China Truck ~22% per year Other Pacific Toyota CUV / SUV ~43% Boshoku Magna *Adient share includes non-consolidated revenue. Revenue by geography based on FY2020 (consolidated and non-consolidated). Source: External and management estimates 10 Adient - PUBLICAdient is fundamental within the automotive industry Adient is a critical supplier in automotive seating, supplying approximately one out of every three automotive seats worldwide NYSE: ADNT FY20 Revenue Global market Revenue by share geography* ~$12.7B ~$7.6B Europe / Americas Consolidated Unconsolidated Lear Africa We supply Adient revenue seating revenue ~33 31% 26% % Strong and diversified ~19M revenue mix: Faurecia 7% 36% Passenger car ~35% seat systems Asia / China Truck ~22% per year Other Pacific Toyota CUV / SUV ~43% Boshoku Magna *Adient share includes non-consolidated revenue. Revenue by geography based on FY2020 (consolidated and non-consolidated). Source: External and management estimates 10 Adient - PUBLIC

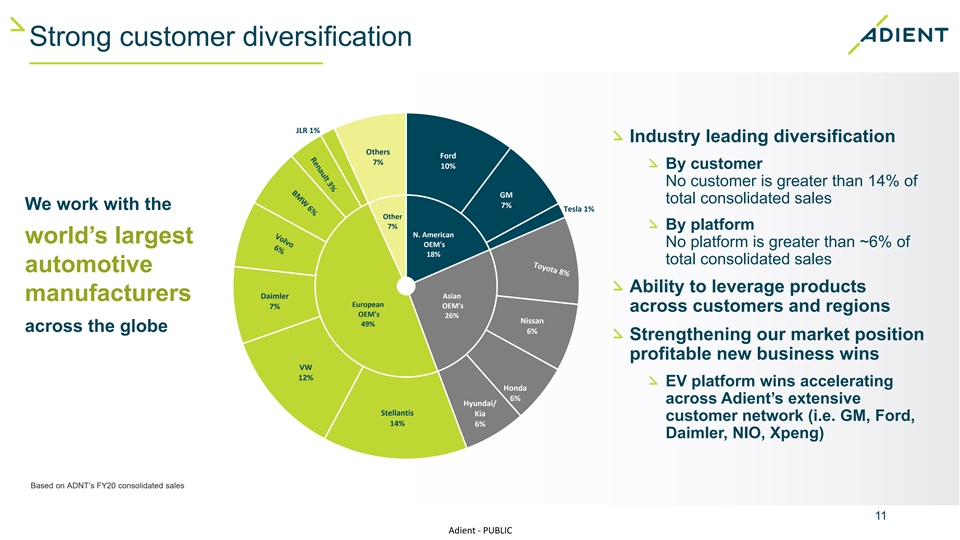

Strong customer diversification JLR 1% Industry leading diversification Others Ford 7% 10% By customer No customer is greater than 14% of GM total consolidated sales 7% We work with the Tesla 1% Other 7% By platform N. American world’s largest OEM's No platform is greater than ~6% of 18% total consolidated sales automotive Ability to leverage products Daimler Asian manufacturers European OEM's 7% across customers and regions OEM's 26% Nissan 49% across the globe 6% Strengthening our market position profitable new business wins VW 12% EV platform wins accelerating Honda 6% across Adient’s extensive Hyundai/ Stellantis Kia customer network (i.e. GM, Ford, 14% 6% Daimler, NIO, Xpeng) Based on ADNT’s FY20 consolidated sales 11 Adient - PUBLICStrong customer diversification JLR 1% Industry leading diversification Others Ford 7% 10% By customer No customer is greater than 14% of GM total consolidated sales 7% We work with the Tesla 1% Other 7% By platform N. American world’s largest OEM's No platform is greater than ~6% of 18% total consolidated sales automotive Ability to leverage products Daimler Asian manufacturers European OEM's 7% across customers and regions OEM's 26% Nissan 49% across the globe 6% Strengthening our market position profitable new business wins VW 12% EV platform wins accelerating Honda 6% across Adient’s extensive Hyundai/ Stellantis Kia customer network (i.e. GM, Ford, 14% 6% Daimler, NIO, Xpeng) Based on ADNT’s FY20 consolidated sales 11 Adient - PUBLIC

We delivered on our commitments in FY20… We are focused and resilient, executing plans to position Adient for long-term success. Successfully executed plans While managing through Driving long-term within our control. an unplanned obstacle stakeholder value by: Advanced the improvement phase of COVID-19 Pandemic Winning new and Adient’s turnaround plan through specific Executed immediate actions, replacement business focus areas: both structural and temporary, Launch management to protect the business long- Becoming customers’ Operational improvement term preferred supplier Cost reductions Executed actions to increase and protect Adient’s liquidity Commercial discipline Driving earnings Developed comprehensive growth With operations stabilized and steadily return to work guidelines to improving, executed various strategic ensure successful restart of actions: operations and to protect the Driving cash company’s employees and generation Portfolio adjustments — Announced customers and closed strategic transactions with JV Identified and executing partner Yanfeng, sale of Adient’s fabrics Strengthening the structural cost reductions to business, sale of RECARO Automotive balance sheet reduce the company’s Seating, and Adient Aerospace breakeven point deconsolidation Accelerated debt repayment 12 Adient - PUBLICWe delivered on our commitments in FY20… We are focused and resilient, executing plans to position Adient for long-term success. Successfully executed plans While managing through Driving long-term within our control. an unplanned obstacle stakeholder value by: Advanced the improvement phase of COVID-19 Pandemic Winning new and Adient’s turnaround plan through specific Executed immediate actions, replacement business focus areas: both structural and temporary, Launch management to protect the business long- Becoming customers’ Operational improvement term preferred supplier Cost reductions Executed actions to increase and protect Adient’s liquidity Commercial discipline Driving earnings Developed comprehensive growth With operations stabilized and steadily return to work guidelines to improving, executed various strategic ensure successful restart of actions: operations and to protect the Driving cash company’s employees and generation Portfolio adjustments — Announced customers and closed strategic transactions with JV Identified and executing partner Yanfeng, sale of Adient’s fabrics Strengthening the structural cost reductions to business, sale of RECARO Automotive balance sheet reduce the company’s Seating, and Adient Aerospace breakeven point deconsolidation Accelerated debt repayment 12 Adient - PUBLIC

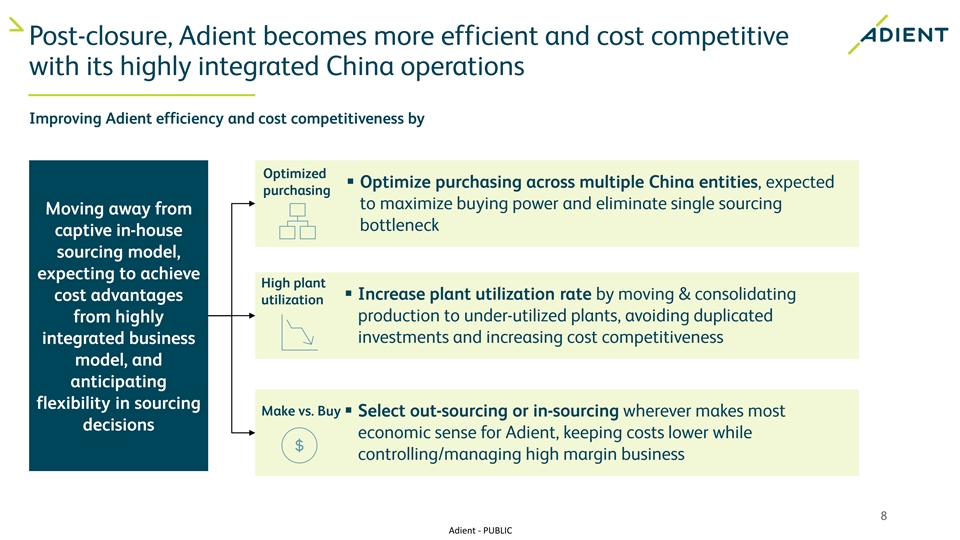

Building on our progress in FY21 — Launch, Operational & Cost Improvement Significant progress made throughout FY20; launch management will remain a focus area to ensure best-in-class performance Operational & Cost Improvement focus areas: Align manufacturing footprint to sales projections Continue to improve capacity utilization (i.e. grow trim and foam to fill open capacity) Purchasing performance - matched pairs between purchasing & business unit to enhance cooperation and strategic alignment; make vs. buy decisions, etc. Design for manufacturing – engage plant teams in early design phase to reduce labor costs and improve quality Increase use of automation (where feasible) across network Upgrade technology as needed for cost and quality improvement 13 Adient - PUBLICBuilding on our progress in FY21 — Launch, Operational & Cost Improvement Significant progress made throughout FY20; launch management will remain a focus area to ensure best-in-class performance Operational & Cost Improvement focus areas: Align manufacturing footprint to sales projections Continue to improve capacity utilization (i.e. grow trim and foam to fill open capacity) Purchasing performance - matched pairs between purchasing & business unit to enhance cooperation and strategic alignment; make vs. buy decisions, etc. Design for manufacturing – engage plant teams in early design phase to reduce labor costs and improve quality Increase use of automation (where feasible) across network Upgrade technology as needed for cost and quality improvement 13 Adient - PUBLIC

A strong start to FY21 We delivered strong Q1 results, … while looking to the future to ensure sustained, long-term driven by improved business success performance… In line with internal expectations, Focused on delivering world-class products and services to our customers; Q1 consolidated revenue of $3.8B, validated by external recognition, including, but not limited to: down $88M or 2% y-o-y (revenue • Hyundai Kia selected Adient as a Supplier of the Year 2020 honoree for impacted by prior year portfolio delivering several flawless launches and excellent quality and supply adjustments totaling ~$70M and chain management Adient specific launches) • Adient’s new “Floating Seat” (right) won a bronze 1 Q1 Adj.-EBITDA of $378M , up medal at the prestigious CLEPA Innovation Award $81M y-o-y; margin of 9.8%, up 228 ceremony bps y-o-y • Adient supplied seats for the winners of Cash and cash equivalents of the 2021 North American Utility and ~$1.8B at Dec. 31, 2020; total Truck of the Year — the Ford Mustang liquidity ~$2.8B at Dec. 31, 2020 Mach-E and Ford F-150, respectively 1 Gross debt and net debt totaled Adient issued its 2020 Sustainability Report — $4.4B and $2.5B, respectively at highlighting the company’s commitment to operating its Dec. 31, 2020 business in an environmentally responsible manner (more on slide 15) 1 Reference full earnings release issued Feb 5,2021 for non-GAAP to GAAP reconciliations 14 Adient - PUBLICA strong start to FY21 We delivered strong Q1 results, … while looking to the future to ensure sustained, long-term driven by improved business success performance… In line with internal expectations, Focused on delivering world-class products and services to our customers; Q1 consolidated revenue of $3.8B, validated by external recognition, including, but not limited to: down $88M or 2% y-o-y (revenue • Hyundai Kia selected Adient as a Supplier of the Year 2020 honoree for impacted by prior year portfolio delivering several flawless launches and excellent quality and supply adjustments totaling ~$70M and chain management Adient specific launches) • Adient’s new “Floating Seat” (right) won a bronze 1 Q1 Adj.-EBITDA of $378M , up medal at the prestigious CLEPA Innovation Award $81M y-o-y; margin of 9.8%, up 228 ceremony bps y-o-y • Adient supplied seats for the winners of Cash and cash equivalents of the 2021 North American Utility and ~$1.8B at Dec. 31, 2020; total Truck of the Year — the Ford Mustang liquidity ~$2.8B at Dec. 31, 2020 Mach-E and Ford F-150, respectively 1 Gross debt and net debt totaled Adient issued its 2020 Sustainability Report — $4.4B and $2.5B, respectively at highlighting the company’s commitment to operating its Dec. 31, 2020 business in an environmentally responsible manner (more on slide 15) 1 Reference full earnings release issued Feb 5,2021 for non-GAAP to GAAP reconciliations 14 Adient - PUBLIC

Adient Sustainability Adient’s 2020 sustainability report outlines the company’s key policies and actions regarding environmental responsibility, people and communities, governance and compliance, and more These policies and actions aim to ensure that Adient manages risks in these areas and achieves our environmental, social and governance goals From Adient President and CEO Doug Del Grosso: “At Adient, we believe that a commitment to positive environmental, social and governance-related business practices strengthens our company, increases our connection with our shareholders and helps us better serve our customers and the communities in which we operate. “We also see in these commitments additional ways of creating value for our shareholders, our employees, our customers and the wider world.” 15 Adient - PUBLICAdient Sustainability Adient’s 2020 sustainability report outlines the company’s key policies and actions regarding environmental responsibility, people and communities, governance and compliance, and more These policies and actions aim to ensure that Adient manages risks in these areas and achieves our environmental, social and governance goals From Adient President and CEO Doug Del Grosso: “At Adient, we believe that a commitment to positive environmental, social and governance-related business practices strengthens our company, increases our connection with our shareholders and helps us better serve our customers and the communities in which we operate. “We also see in these commitments additional ways of creating value for our shareholders, our employees, our customers and the wider world.” 15 Adient - PUBLIC

Strengthening our leading position Steady cadence of business wins 1 (replacement, new, conquest and alternative propulsion) expected to 2 strengthen Adient’s leading market position Recent program wins: 1 GM Future EV (new) 3 2 Peugeot 3008 (new) 3 Peugeot 5008 (new) 4 4 Lincoln Nautilus China (new) Not pictured: Chevrolet / Buick crossover (replacement) GMC crossover (new) 16 Adient - PUBLICStrengthening our leading position Steady cadence of business wins 1 (replacement, new, conquest and alternative propulsion) expected to 2 strengthen Adient’s leading market position Recent program wins: 1 GM Future EV (new) 3 2 Peugeot 3008 (new) 3 Peugeot 5008 (new) 4 4 Lincoln Nautilus China (new) Not pictured: Chevrolet / Buick crossover (replacement) GMC crossover (new) 16 Adient - PUBLIC

1 Launch status 2 Second F-150 manufacturing location (Riverside, MO) successfully underway VW ID 3 / 4 SUVe represents 1st SVW electric car 3 with MEB platform 4 Strong focus on process discipline around launch readiness underpinning Adient’s successful launch performance continues Recent and upcoming key launches: 5 1 Ford F-150 2 Jeep Wrangler 4xe 6 3 Acura MDX 4 Citroen C41 5 Honda City 7 6 VW ID3 and ID4 SUV 7 Mustang Mach-E 17 Adient - PUBLIC1 Launch status 2 Second F-150 manufacturing location (Riverside, MO) successfully underway VW ID 3 / 4 SUVe represents 1st SVW electric car 3 with MEB platform 4 Strong focus on process discipline around launch readiness underpinning Adient’s successful launch performance continues Recent and upcoming key launches: 5 1 Ford F-150 2 Jeep Wrangler 4xe 6 3 Acura MDX 4 Citroen C41 5 Honda City 7 6 VW ID3 and ID4 SUV 7 Mustang Mach-E 17 Adient - PUBLIC

Positioning the company for long-term success Focused on positioning the company for long-term, sustained success by executing actions within our control, while managing through “normal course” industry and macro headwinds. Advancing our strategic objectives to position Adient … …while managing through a variety of industry and for sustained success… macro headwinds Turnaround plan firmly rooted and accelerating Near-term production downtime and operating inefficiencies driven by supply Notable improvement achieved within the metals business – metals business chain disruptions now forecast to be FCF breakeven in FY21, one year ahead of plan semiconductor shortages Significant efficiencies achieved within operations (i.e. decrease in premium petrochemical supply constraints (impacting foam operations) freight, cost of poor quality, launch costs, etc.) Material economics — steel and chemicals Strengthening our market position with profitable new business wins Resurgence of COVID-19 EV platform wins accelerating across Adient’s extensive customer network Labor shortages (i.e. GM, Ford, Daimler, NIO, Xpeng) Premium freight (primarily driven by temporary supply chain disruptions) Deleveraging the balance sheet (debt pay down initiatives underway) Heavy launch cadence in the Americas Committed to positive environmental, social and governance-related business practices – 2020 Sustainability Report enhanced transparency 18 Adient - PUBLICPositioning the company for long-term success Focused on positioning the company for long-term, sustained success by executing actions within our control, while managing through “normal course” industry and macro headwinds. Advancing our strategic objectives to position Adient … …while managing through a variety of industry and for sustained success… macro headwinds Turnaround plan firmly rooted and accelerating Near-term production downtime and operating inefficiencies driven by supply Notable improvement achieved within the metals business – metals business chain disruptions now forecast to be FCF breakeven in FY21, one year ahead of plan semiconductor shortages Significant efficiencies achieved within operations (i.e. decrease in premium petrochemical supply constraints (impacting foam operations) freight, cost of poor quality, launch costs, etc.) Material economics — steel and chemicals Strengthening our market position with profitable new business wins Resurgence of COVID-19 EV platform wins accelerating across Adient’s extensive customer network Labor shortages (i.e. GM, Ford, Daimler, NIO, Xpeng) Premium freight (primarily driven by temporary supply chain disruptions) Deleveraging the balance sheet (debt pay down initiatives underway) Heavy launch cadence in the Americas Committed to positive environmental, social and governance-related business practices – 2020 Sustainability Report enhanced transparency 18 Adient - PUBLIC

Recent Adient Lender Presentation Announcements 19 Adient - PUBLICRecent Adient Lender Presentation Announcements 19 Adient - PUBLIC

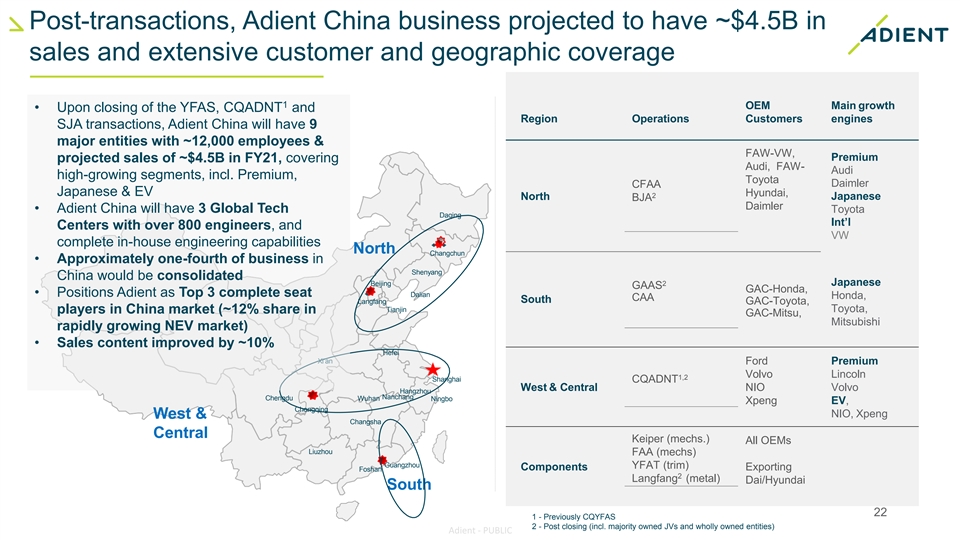

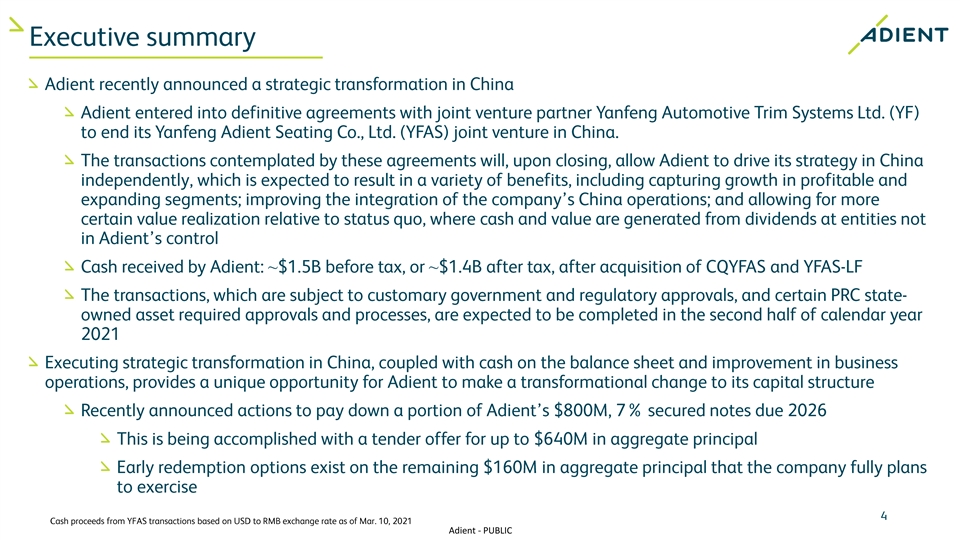

Executive summary Adient recently announced a strategic transformation in China Adient entered into definitive agreements with joint venture partner Yanfeng Automotive Trim Systems Ltd. (YF) to end its Yanfeng Adient Seating Co., Ltd. (YFAS) joint venture in China. The transactions contemplated by these agreements will, upon closing, allow Adient to drive its strategy in China independently, which is expected to result in a variety of benefits, including capturing growth in profitable and expanding segments; improving the integration of the company’s China operations; and allowing for more certain value realization relative to status quo, where cash and value are generated from dividends at entities not in Adient’s control Cash received by Adient: ~$1.5B before tax, or ~$1.4B after tax, after acquisition of CQYFAS and YFAS-LF The transactions, which are subject to customary government and regulatory approvals, and certain PRC state-owned asset required approvals and processes, are expected to be completed in the second half of calendar year 2021 Executing strategic transformation in China, coupled with cash on the balance sheet and improvement in business operations, provides a unique opportunity for Adient to make a transformational change to its capital structure and makes progress towards its net leverage goal of around 1.5x – 2.0x Recently announced $640M tender offer to pay down a portion of Adient’s $800M, 7% secured notes due 2026 Early redemption options exist on the remaining $160M in aggregate principal, that the company fully plans to exercise in the near term 20 Cash proceeds from YFAS transactions based on USD to RMB exchange rate as of Mar. 10, 2021 Adient - PUBLICExecutive summary Adient recently announced a strategic transformation in China Adient entered into definitive agreements with joint venture partner Yanfeng Automotive Trim Systems Ltd. (YF) to end its Yanfeng Adient Seating Co., Ltd. (YFAS) joint venture in China. The transactions contemplated by these agreements will, upon closing, allow Adient to drive its strategy in China independently, which is expected to result in a variety of benefits, including capturing growth in profitable and expanding segments; improving the integration of the company’s China operations; and allowing for more certain value realization relative to status quo, where cash and value are generated from dividends at entities not in Adient’s control Cash received by Adient: ~$1.5B before tax, or ~$1.4B after tax, after acquisition of CQYFAS and YFAS-LF The transactions, which are subject to customary government and regulatory approvals, and certain PRC state-owned asset required approvals and processes, are expected to be completed in the second half of calendar year 2021 Executing strategic transformation in China, coupled with cash on the balance sheet and improvement in business operations, provides a unique opportunity for Adient to make a transformational change to its capital structure and makes progress towards its net leverage goal of around 1.5x – 2.0x Recently announced $640M tender offer to pay down a portion of Adient’s $800M, 7% secured notes due 2026 Early redemption options exist on the remaining $160M in aggregate principal, that the company fully plans to exercise in the near term 20 Cash proceeds from YFAS transactions based on USD to RMB exchange rate as of Mar. 10, 2021 Adient - PUBLIC

Rationale Aligns with China auto industry trend in post-JV era Global manufacturers such as Tesla, VW, BMW have moved towards majority-owned business model and away from JV model after China abolished its JV requirements in 2018 with OEMs Similar trend taking place with leading Chinese manufacturers Enables Adient to drive strategy in China independently and opportunity to capture growth in profitable and expanding segments (Japanese manufacturers, luxury, EVs, etc.) Improves integration of Adient China operation – potential to achieve significant synergies across multiple locations Will provide more certain value realization relative to status quo where cash and value is generated from dividends at entities not in Adient’s control Monetizes significant value that has accumulated at the JV without jeopardizing future opportunities for growth The transaction is consistent with other strategic actions the company has completed recently to further its portfolio optimization strategy, which includes focusing on Adient’s profitable, large-volume core seating business 21 Adient - PUBLIC SJA YFAS transaction transactionRationale Aligns with China auto industry trend in post-JV era Global manufacturers such as Tesla, VW, BMW have moved towards majority-owned business model and away from JV model after China abolished its JV requirements in 2018 with OEMs Similar trend taking place with leading Chinese manufacturers Enables Adient to drive strategy in China independently and opportunity to capture growth in profitable and expanding segments (Japanese manufacturers, luxury, EVs, etc.) Improves integration of Adient China operation – potential to achieve significant synergies across multiple locations Will provide more certain value realization relative to status quo where cash and value is generated from dividends at entities not in Adient’s control Monetizes significant value that has accumulated at the JV without jeopardizing future opportunities for growth The transaction is consistent with other strategic actions the company has completed recently to further its portfolio optimization strategy, which includes focusing on Adient’s profitable, large-volume core seating business 21 Adient - PUBLIC SJA YFAS transaction transaction

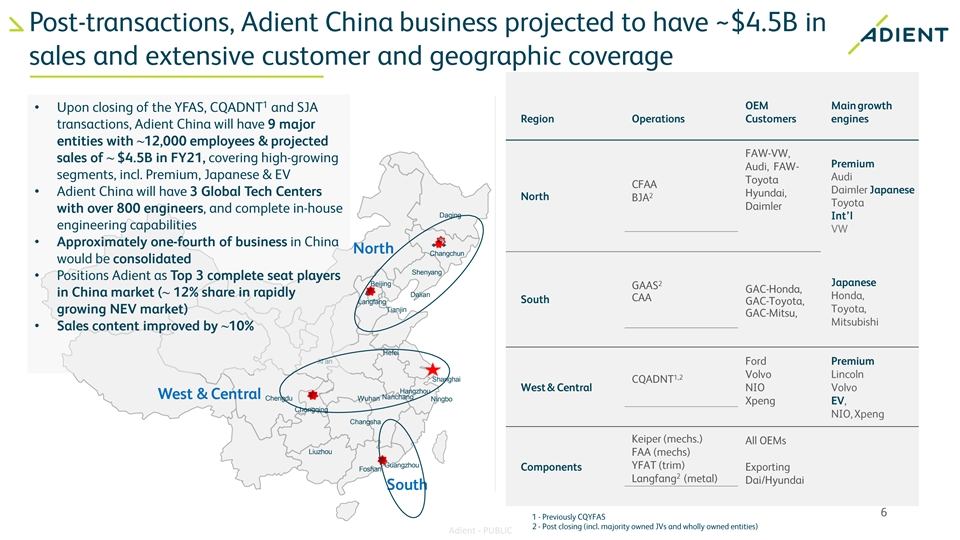

Post-transactions, Adient China business projected to have ~$4.5B in sales and extensive customer and geographic coverage 1 OEM Main growth • Upon closing of the YFAS, CQADNT and Region Operations Customers engines SJA transactions, Adient China will have 9 major entities with ~12,000 employees & FAW-VW, Premium projected sales of ~$4.5B in FY21, covering Audi, FAW- Audi high-growing segments, incl. Premium, Toyota Daimler CFAA Japanese & EV Hyundai, 2 North Japanese BJA Daimler • Adient China will have 3 Global Tech Toyota Daqing Int’l Centers with over 800 engineers, and VW complete in-house engineering capabilities North Changchun • Approximately one-fourth of business in Shenyang China would be consolidated Beijing 2 Japanese GAAS GAC-Honda, • Positions Adient as Top 3 complete seat Dalian Honda, CAA South Langfang GAC-Toyota, Tianjin Toyota, players in China market (~12% share in GAC-Mitsu, Mitsubishi rapidly growing NEV market) • Sales content improved by ~10% Hefei Xi’an Ford Premium Volvo Lincoln 1,2 Shanghai CQADNT West & Central NIO Volvo Hangzhou Nanchang Chengdu Wuhan Ningbo Xpeng EV, Chongqing NIO, Xpeng West & Changsha Central Keiper (mechs.) All OEMs Liuzhou FAA (mechs) Guangzhou YFAT (trim) Components Exporting Foshan 2 Langfang (metal) Dai/Hyundai South 22 1 - Previously CQYFAS 2 - Post closing (incl. majority owned JVs and wholly owned entities) Adient - PUBLICPost-transactions, Adient China business projected to have ~$4.5B in sales and extensive customer and geographic coverage 1 OEM Main growth • Upon closing of the YFAS, CQADNT and Region Operations Customers engines SJA transactions, Adient China will have 9 major entities with ~12,000 employees & FAW-VW, Premium projected sales of ~$4.5B in FY21, covering Audi, FAW- Audi high-growing segments, incl. Premium, Toyota Daimler CFAA Japanese & EV Hyundai, 2 North Japanese BJA Daimler • Adient China will have 3 Global Tech Toyota Daqing Int’l Centers with over 800 engineers, and VW complete in-house engineering capabilities North Changchun • Approximately one-fourth of business in Shenyang China would be consolidated Beijing 2 Japanese GAAS GAC-Honda, • Positions Adient as Top 3 complete seat Dalian Honda, CAA South Langfang GAC-Toyota, Tianjin Toyota, players in China market (~12% share in GAC-Mitsu, Mitsubishi rapidly growing NEV market) • Sales content improved by ~10% Hefei Xi’an Ford Premium Volvo Lincoln 1,2 Shanghai CQADNT West & Central NIO Volvo Hangzhou Nanchang Chengdu Wuhan Ningbo Xpeng EV, Chongqing NIO, Xpeng West & Changsha Central Keiper (mechs.) All OEMs Liuzhou FAA (mechs) Guangzhou YFAT (trim) Components Exporting Foshan 2 Langfang (metal) Dai/Hyundai South 22 1 - Previously CQYFAS 2 - Post closing (incl. majority owned JVs and wholly owned entities) Adient - PUBLIC

Use of proceeds / pro forma Adient Use of proceeds Adient intends to use the anticipated after-tax proceeds of ~$1.4B for: Transformational change Debt repayment (consistent with the company’s near-term capital allocation plans), in Adient’s future earnings Ability to fund Boxun’s put right, if exercised (~$125M), and other corporate purposes profile and balance sheet (EPS and Net Income 2 accretive) Pro forma Adient (post closings, ----- 1 compared to the company’s current FY21 outlook) Significant opportunity to Consolidated sales expected to increase annually by ~$700M - $800M pay down debt in FY21, Unconsolidated sales expected to decline annually by ~$3.5B - $4.0B beginning with the recent Consolidated EBITDA expected to increase annually by ~$90M - $100M tender offer Equity income expected to decline annually by ~$155M Net leverage target between 1.5x – 2.0x (dependent on level of debt repayment and other uses of proceeds) 1 – FY21 outlook provided with Adient’s Q1FY21 earnings results released on Feb. 5, 2021 2 – Post closing and assuming approximately $2B of debt paydown by December 2021, annual interest expense estimated at ~$100M (vs. guidance of $235M in FY21) and cash taxes increasing by ~$10M 23 Cash proceeds from YFAS transactions based on USD to RMB exchange rate as of Mar. 10, 2021 Adient - PUBLICUse of proceeds / pro forma Adient Use of proceeds Adient intends to use the anticipated after-tax proceeds of ~$1.4B for: Transformational change Debt repayment (consistent with the company’s near-term capital allocation plans), in Adient’s future earnings Ability to fund Boxun’s put right, if exercised (~$125M), and other corporate purposes profile and balance sheet (EPS and Net Income 2 accretive) Pro forma Adient (post closings, ----- 1 compared to the company’s current FY21 outlook) Significant opportunity to Consolidated sales expected to increase annually by ~$700M - $800M pay down debt in FY21, Unconsolidated sales expected to decline annually by ~$3.5B - $4.0B beginning with the recent Consolidated EBITDA expected to increase annually by ~$90M - $100M tender offer Equity income expected to decline annually by ~$155M Net leverage target between 1.5x – 2.0x (dependent on level of debt repayment and other uses of proceeds) 1 – FY21 outlook provided with Adient’s Q1FY21 earnings results released on Feb. 5, 2021 2 – Post closing and assuming approximately $2B of debt paydown by December 2021, annual interest expense estimated at ~$100M (vs. guidance of $235M in FY21) and cash taxes increasing by ~$10M 23 Cash proceeds from YFAS transactions based on USD to RMB exchange rate as of Mar. 10, 2021 Adient - PUBLIC

Adient - Unequaled global capabilities Global locations manufacturing facilities 194 Europe countries 32 North America Asia Global employees Africa 90,000 South America ~3,500 engineers 8 major tech centers Unequaled global capability in JIT and all critical components; trim, Based on management estimates - post closing of China strategic transformation (including consolidated and foam, structures and mechanisms unconsolidated entities) 24 Adient - PUBLICAdient - Unequaled global capabilities Global locations manufacturing facilities 194 Europe countries 32 North America Asia Global employees Africa 90,000 South America ~3,500 engineers 8 major tech centers Unequaled global capability in JIT and all critical components; trim, Based on management estimates - post closing of China strategic transformation (including consolidated and foam, structures and mechanisms unconsolidated entities) 24 Adient - PUBLIC

Adient Lender Key Financials Presentation 25 Adient - PUBLICAdient Lender Key Financials Presentation 25 Adient - PUBLIC

FY 2021 Q1 key financials 1 As Reported As Adjusted $ millions, except per share data Q1 FY21 Q1 FY20 Q1 FY21 Q1 FY20 B/(W) Consolidated $ 3,848 $ 3,936 $ 3,848 $ 3,936 -2% Revenue EBIT $ 282 $ (42) $ 295 $ 218 35% Margin 7.3% * 7.7% 5.5% 27% EBITDA N/A N/A $ 378 $ 297 Margin 9.8% 7.5% Memo: Equity Income 2 excluding Interiors up y-o-y Memo: Equity Income -13% $ 97 $ (113) $ 94 $ 108 (FY21 $94M vs FY20 $91M) Tax Expense (Benefit) $ 52 $ 54 $ 51 $ 56 ETR 23.1% * 21.5% 32.6% Net Income (Loss) $ 150 $ (167) $ 162 $ 90 80% 78% EPS Diluted $ 1.58 $ (1.78) $ 1.71 $ 0.96 1 - Reference full earnings release issued Feb 5,2021 for non-GAAP to GAAP reconciliations 2 – Equity income included in EBIT & EBITDA NM - Measure not meaningful 26 Adient - PUBLICFY 2021 Q1 key financials 1 As Reported As Adjusted $ millions, except per share data Q1 FY21 Q1 FY20 Q1 FY21 Q1 FY20 B/(W) Consolidated $ 3,848 $ 3,936 $ 3,848 $ 3,936 -2% Revenue EBIT $ 282 $ (42) $ 295 $ 218 35% Margin 7.3% * 7.7% 5.5% 27% EBITDA N/A N/A $ 378 $ 297 Margin 9.8% 7.5% Memo: Equity Income 2 excluding Interiors up y-o-y Memo: Equity Income -13% $ 97 $ (113) $ 94 $ 108 (FY21 $94M vs FY20 $91M) Tax Expense (Benefit) $ 52 $ 54 $ 51 $ 56 ETR 23.1% * 21.5% 32.6% Net Income (Loss) $ 150 $ (167) $ 162 $ 90 80% 78% EPS Diluted $ 1.58 $ (1.78) $ 1.71 $ 0.96 1 - Reference full earnings release issued Feb 5,2021 for non-GAAP to GAAP reconciliations 2 – Equity income included in EBIT & EBITDA NM - Measure not meaningful 26 Adient - PUBLIC

Regional Performance Q1 2021 Revenue 1 (consolidated sales y-o-y growth by region) Consolidated and unconsolidated sales Q1 Q1 IHS Production $ in Millions Consolidated sales Americas -5.2% 0.4% EMEA 2.7% 1.6% $3,936 $67 $3,848 Asia -5.2% 4.3% $(73) $(82) 7.2% Note: China 5.9% -10.5% Note: Asia excl. China 2.0% > Adient sales impacted by recent portfolio adjustments, and Adient specific launches ‒ Americas sales primarily impacted by F-150 launch and Tesla in-sourcing ‒ Asia excluding China impacted by lower production in Thailand and Japan Q1FY20 FX Portfolio Volume/Pricing Q1FY21 adjustments 1 – Growth rates at constant foreign exchange, and adjusted for portfolio changes (Americas ~$10M RECARO, Unconsolidated seating sales EMEA ~$37M Fabrics & ~$12M RECARO, Asia ~$14M RECARO) $2,634 M > China unconsolidated seating up 13% y-o-y (ex. FX), versus production up $2,265 M Year-over- 6% year growth ‒ Adient’s favorable exposure to premium OEMs, Japanese OEMs, and the ~16% premium EV market in China helped drive outperformance vs the market ~11% excl. FX ‒ China sales continuing to progress in a positive direction Q1 FY20 Q1 FY21 27 Adient - PUBLIC unconsolidated consolidatedRegional Performance Q1 2021 Revenue 1 (consolidated sales y-o-y growth by region) Consolidated and unconsolidated sales Q1 Q1 IHS Production $ in Millions Consolidated sales Americas -5.2% 0.4% EMEA 2.7% 1.6% $3,936 $67 $3,848 Asia -5.2% 4.3% $(73) $(82) 7.2% Note: China 5.9% -10.5% Note: Asia excl. China 2.0% > Adient sales impacted by recent portfolio adjustments, and Adient specific launches ‒ Americas sales primarily impacted by F-150 launch and Tesla in-sourcing ‒ Asia excluding China impacted by lower production in Thailand and Japan Q1FY20 FX Portfolio Volume/Pricing Q1FY21 adjustments 1 – Growth rates at constant foreign exchange, and adjusted for portfolio changes (Americas ~$10M RECARO, Unconsolidated seating sales EMEA ~$37M Fabrics & ~$12M RECARO, Asia ~$14M RECARO) $2,634 M > China unconsolidated seating up 13% y-o-y (ex. FX), versus production up $2,265 M Year-over- 6% year growth ‒ Adient’s favorable exposure to premium OEMs, Japanese OEMs, and the ~16% premium EV market in China helped drive outperformance vs the market ~11% excl. FX ‒ China sales continuing to progress in a positive direction Q1 FY20 Q1 FY21 27 Adient - PUBLIC unconsolidated consolidated

1 Q1 FY21 Adjusted-EBITDA $32 $86 $(21) $(9) $(7) $ in millions $378 > Q1FY21 Adj.-EBITDA of $378M, up $81M $297 y-o-y. Key drivers of the y-o-y increase: ‒ Improved business performance, which included: Q1FY20 Improved SG&A Equity Vol / Mix FX / other Q1FY21 • Various “normal course” commercial Business Income Performance settlements • Improved operating performance, $38 $4 $378 including lower labor & overhead, $65 freight, launch and ops waste $(26) ‒ Lower SG&A costs primarily driven by $297 9.8% improved performance and divestiture of certain non-core businesses (RECARO and Fabrics) 7.5% > The positive benefits were partially offset by lower equity income, driven by the absence of Interiors equity income resulting from the YFAI divestiture, the impact of lower volumes & mix in Asia and increasing commodity costs > The Metals business in Americas and Q1FY20 EMEA Americas Asia Corporate Q1FY21 EMEA continued to make significant Note: Corporate includes central costs that are not allocated back to the operations, currently including executive offices, communications, finance, corporate development, and legal improvements y-o-y 1 28 Reference full earnings release issued Feb 5,2021 for non-GAAP to GAAP reconciliations Adient - PUBLIC1 Q1 FY21 Adjusted-EBITDA $32 $86 $(21) $(9) $(7) $ in millions $378 > Q1FY21 Adj.-EBITDA of $378M, up $81M $297 y-o-y. Key drivers of the y-o-y increase: ‒ Improved business performance, which included: Q1FY20 Improved SG&A Equity Vol / Mix FX / other Q1FY21 • Various “normal course” commercial Business Income Performance settlements • Improved operating performance, $38 $4 $378 including lower labor & overhead, $65 freight, launch and ops waste $(26) ‒ Lower SG&A costs primarily driven by $297 9.8% improved performance and divestiture of certain non-core businesses (RECARO and Fabrics) 7.5% > The positive benefits were partially offset by lower equity income, driven by the absence of Interiors equity income resulting from the YFAI divestiture, the impact of lower volumes & mix in Asia and increasing commodity costs > The Metals business in Americas and Q1FY20 EMEA Americas Asia Corporate Q1FY21 EMEA continued to make significant Note: Corporate includes central costs that are not allocated back to the operations, currently including executive offices, communications, finance, corporate development, and legal improvements y-o-y 1 28 Reference full earnings release issued Feb 5,2021 for non-GAAP to GAAP reconciliations Adient - PUBLIC

1 Building on a positive trend Memo: $’s millions EBITDA margin Sales Adjusted EBITDA excl. Equity Income $3,936 $297 Q1 4.80% $3,511 $211 Q2 > Adient’s strong start to 5.72% FY21 is building on the Significant COVID impact Q3 $1,626 $(122) momentum established in FY20 Q4 $3,597 $287 5.53% > Successful execution of $3,848 $378 Q1 7.38% the turnaround plan driving operational and B / (W) Prior Year financial improvements EBITDA Margin excl. Sales Adjusted EBITDA Equity Income (bps) > Four out of five quarters Q1 FY20 $(222) $121 257 of significant y-o-y Q2 FY20 $(717) $20 270 earnings improvement Significant COVID impact Q3 FY20 $(2,593) $(327) despite lower revenue Q4 FY20 $(324) $72 194 Q1 FY21 $(88) $81 258 29 1 Reference full earnings release issued Feb 5,2021 for non-GAAP to GAAP reconciliations Adient - PUBLIC FY21 FY201 Building on a positive trend Memo: $’s millions EBITDA margin Sales Adjusted EBITDA excl. Equity Income $3,936 $297 Q1 4.80% $3,511 $211 Q2 > Adient’s strong start to 5.72% FY21 is building on the Significant COVID impact Q3 $1,626 $(122) momentum established in FY20 Q4 $3,597 $287 5.53% > Successful execution of $3,848 $378 Q1 7.38% the turnaround plan driving operational and B / (W) Prior Year financial improvements EBITDA Margin excl. Sales Adjusted EBITDA Equity Income (bps) > Four out of five quarters Q1 FY20 $(222) $121 257 of significant y-o-y Q2 FY20 $(717) $20 270 earnings improvement Significant COVID impact Q3 FY20 $(2,593) $(327) despite lower revenue Q4 FY20 $(324) $72 194 Q1 FY21 $(88) $81 258 29 1 Reference full earnings release issued Feb 5,2021 for non-GAAP to GAAP reconciliations Adient - PUBLIC FY21 FY20

Cash flow & total liquidity (1) Free Cash Flow Cash & liquidity position (in $ millions) Q1 FY21 Q1 FY20 Total liquidity of ~$2.8B at Dec. Adjusted-EBITDA $ 378 $ 297 31, 2020, comprised of cash on (+/-) Net Equity in Earnings (93) (107) hand of ~$1,820M and ~$1,000M (-) Restructuring (55) (20) of undrawn capacity under the (+/-) Net Customer Tooling (8) 6 revolving line of credit (+/-) Trade Working Capital (Net AR/AP + Inventory) 250 202 (+/-) Accrued Compensation (19) (61) Adient’s strong cash balance and (-) Interest paid (66) (49) liquidity at the end of Q1FY21 (-) Taxes paid (12) (29) should provide protection against (-) Non-income related taxes (VAT) (67) (1) near-term macro uncertainties and (+/-) Commercial settlements (9) 19 enable significant opportunities for (+/-) Other (68) (18) debt reduction as the company Operating Cash flow $ 231 $ 239 progresses through FY21 (2) (-) CapEx (71) (91) Free Cash flow $ 160 $ 148 1 – Free cash flow defined as operating cash flow less CapEx 2 - CapEx by segment for the quarter: Americas $36M, EMEA $31M, Asia $4M 30 Adient - PUBLICCash flow & total liquidity (1) Free Cash Flow Cash & liquidity position (in $ millions) Q1 FY21 Q1 FY20 Total liquidity of ~$2.8B at Dec. Adjusted-EBITDA $ 378 $ 297 31, 2020, comprised of cash on (+/-) Net Equity in Earnings (93) (107) hand of ~$1,820M and ~$1,000M (-) Restructuring (55) (20) of undrawn capacity under the (+/-) Net Customer Tooling (8) 6 revolving line of credit (+/-) Trade Working Capital (Net AR/AP + Inventory) 250 202 (+/-) Accrued Compensation (19) (61) Adient’s strong cash balance and (-) Interest paid (66) (49) liquidity at the end of Q1FY21 (-) Taxes paid (12) (29) should provide protection against (-) Non-income related taxes (VAT) (67) (1) near-term macro uncertainties and (+/-) Commercial settlements (9) 19 enable significant opportunities for (+/-) Other (68) (18) debt reduction as the company Operating Cash flow $ 231 $ 239 progresses through FY21 (2) (-) CapEx (71) (91) Free Cash flow $ 160 $ 148 1 – Free cash flow defined as operating cash flow less CapEx 2 - CapEx by segment for the quarter: Americas $36M, EMEA $31M, Asia $4M 30 Adient - PUBLIC

1 Net leverage trend Net Leverage Ratio 7.00 Spike in net leverage driven April 2020 - 6.00 by COVID-19’s Issued significant $600m 9% impact on Q3 Senior Note Improving operational / 5.00 EBITDA financial performance, lessening impact from 4.00 COVID-19 and recently announced / executed 3.00 portfolio changes COVID- driving Adient’s net 19 2.00 leverage down impact Anticipated Operational operational difficulties had (target of 1.5x – 2.0x) improvements, a significant 1.00 executed portfolio impact on change proceeds, EBITDA deleveraging 0.00 Sep-17 Jan-18 May-18 Sep-18 Jan-19 May-19 Sep-19 Jan-20 May-20 Sep-20 Jan-21 May-21 Sep-21 Jan-22 May-22 Sep-22 1 Net leverage defined as total debt, less cash / LTM Adj. EBITDA 31 Adient - PUBLIC1 Net leverage trend Net Leverage Ratio 7.00 Spike in net leverage driven April 2020 - 6.00 by COVID-19’s Issued significant $600m 9% impact on Q3 Senior Note Improving operational / 5.00 EBITDA financial performance, lessening impact from 4.00 COVID-19 and recently announced / executed 3.00 portfolio changes COVID- driving Adient’s net 19 2.00 leverage down impact Anticipated Operational operational difficulties had (target of 1.5x – 2.0x) improvements, a significant 1.00 executed portfolio impact on change proceeds, EBITDA deleveraging 0.00 Sep-17 Jan-18 May-18 Sep-18 Jan-19 May-19 Sep-19 Jan-20 May-20 Sep-20 Jan-21 May-21 Sep-21 Jan-22 May-22 Sep-22 1 Net leverage defined as total debt, less cash / LTM Adj. EBITDA 31 Adient - PUBLIC

FY21 Outlook – key financial metrics Outlook FY21 Q1 Actual Key takeaways Consolidated ~ $14.6B – $15.0B $3.8B FY21 guidance reaffirmed sales Consolidated sales trending towards the upper end of the range – driven primarily by FX movements, and to ~ $1,000M – $1,100M $378M Adj.-EBITDA a lesser extent volume & mix. Elevated risk of production disruptions in the near-term given supply chain disruptions (semiconductors). Equity income ~ $250M $94M (incl. in Adj. EBITDA) Adj. EBITDA forecasted to range between $1.0B and $1.1B as rising material costs is expected to have a greater impact on Adj. EBITDA as FY21 progresses. ~ $235M $60M Interest expense In addition, “normal course” commercial settlements that benefited Q1 are not expected to have the same impact in Q2, Q3, or Q4 (timing benefits H1 FY21). ~ $85M $12M Cash tax Equity income (incl. in Adj. EBITDA) continues to track on plan and follow normal seasonality (strong Q1, ~ $320 - $340M $71M CapEx significant drop expected in Q2 related to the Chinese New Year, followed by expected improvement in Q3 and Q4) Free cash flow ~ $0M - $100M $160M (operating cash flow ~$160M - $260M excl. special items impacting FY21 (e.g. elevated less CapEx) restructuring and deferred non-income tax payments) Guidance did not reflect recently announced strategic transformation in China, see page 23 for impact to this guidance 32 Reconciliations of non-GAAP measures related to FY2021 guidance have not been provided due to the Adient - PUBLIC unreasonable efforts it would take to provide such reconciliationsFY21 Outlook – key financial metrics Outlook FY21 Q1 Actual Key takeaways Consolidated ~ $14.6B – $15.0B $3.8B FY21 guidance reaffirmed sales Consolidated sales trending towards the upper end of the range – driven primarily by FX movements, and to ~ $1,000M – $1,100M $378M Adj.-EBITDA a lesser extent volume & mix. Elevated risk of production disruptions in the near-term given supply chain disruptions (semiconductors). Equity income ~ $250M $94M (incl. in Adj. EBITDA) Adj. EBITDA forecasted to range between $1.0B and $1.1B as rising material costs is expected to have a greater impact on Adj. EBITDA as FY21 progresses. ~ $235M $60M Interest expense In addition, “normal course” commercial settlements that benefited Q1 are not expected to have the same impact in Q2, Q3, or Q4 (timing benefits H1 FY21). ~ $85M $12M Cash tax Equity income (incl. in Adj. EBITDA) continues to track on plan and follow normal seasonality (strong Q1, ~ $320 - $340M $71M CapEx significant drop expected in Q2 related to the Chinese New Year, followed by expected improvement in Q3 and Q4) Free cash flow ~ $0M - $100M $160M (operating cash flow ~$160M - $260M excl. special items impacting FY21 (e.g. elevated less CapEx) restructuring and deferred non-income tax payments) Guidance did not reflect recently announced strategic transformation in China, see page 23 for impact to this guidance 32 Reconciliations of non-GAAP measures related to FY2021 guidance have not been provided due to the Adient - PUBLIC unreasonable efforts it would take to provide such reconciliations

Questions? Title / Date / Public-Internal-Confidential-Restricted Adient - PUBLICQuestions? Title / Date / Public-Internal-Confidential-Restricted Adient - PUBLIC

Exhibit 99.2 Adient - PUBLICExhibit 99.2 Adient - PUBLIC

Adient - PUBLICAdient - PUBLIC

Adient - PUBLICAdient - PUBLIC

~ ~ Adient - PUBLIC~ ~ Adient - PUBLIC

Adient - PUBLICAdient - PUBLIC

• ~ ~ • Daqing • Changchun Shenyang • Beijing ~ Dalian Langfang Tianjin • ~ Hefei Xi’an Shanghai Hangzhou Nanchang Chengdu Wuhan Ningbo Chongqing Changsha Liuzhou Guangzhou Foshan Adient - PUBLIC• ~ ~ • Daqing • Changchun Shenyang • Beijing ~ Dalian Langfang Tianjin • ~ Hefei Xi’an Shanghai Hangzhou Nanchang Chengdu Wuhan Ningbo Chongqing Changsha Liuzhou Guangzhou Foshan Adient - PUBLIC

• • • • • • • • Adient - PUBLIC• • • • • • • • Adient - PUBLIC

▪ ▪ ▪ Adient - PUBLIC▪ ▪ ▪ Adient - PUBLIC

~ ~ ~ ~ ~ ~ Adient - PUBLIC~ ~ ~ ~ ~ ~ Adient - PUBLIC

10 Adient - PUBLIC10 Adient - PUBLIC

Adient - PUBLICAdient - PUBLIC

Adient - PUBLICAdient - PUBLIC

Title / Date / Public-Internal-Confidential-Restricted Adient - PUBLICTitle / Date / Public-Internal-Confidential-Restricted Adient - PUBLIC

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Adient (ADNT) Announces Restructuring, Job Cuts in Europe, Sees $125M Q2 Charge

- RLAB: M2MMA Welcomes Legendary Triathlete Chris McCormack to Advisory Board

- American Rebel CEO Andy Ross to introduce American Rebel Beer at the Inaugural Music Habitat Nashville Festival

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share