Form 8-K ASSOCIATED BANC-CORP For: Jul 22

Exhibit 99.1

| NEWS RELEASE Investor Contact: Ben McCarville, Vice President, Director of Investor Relations 920-491-7059 Media Contact: Jennifer Kaminski, Vice President, Public Relations Senior Manager 920-491-7576 | ||||

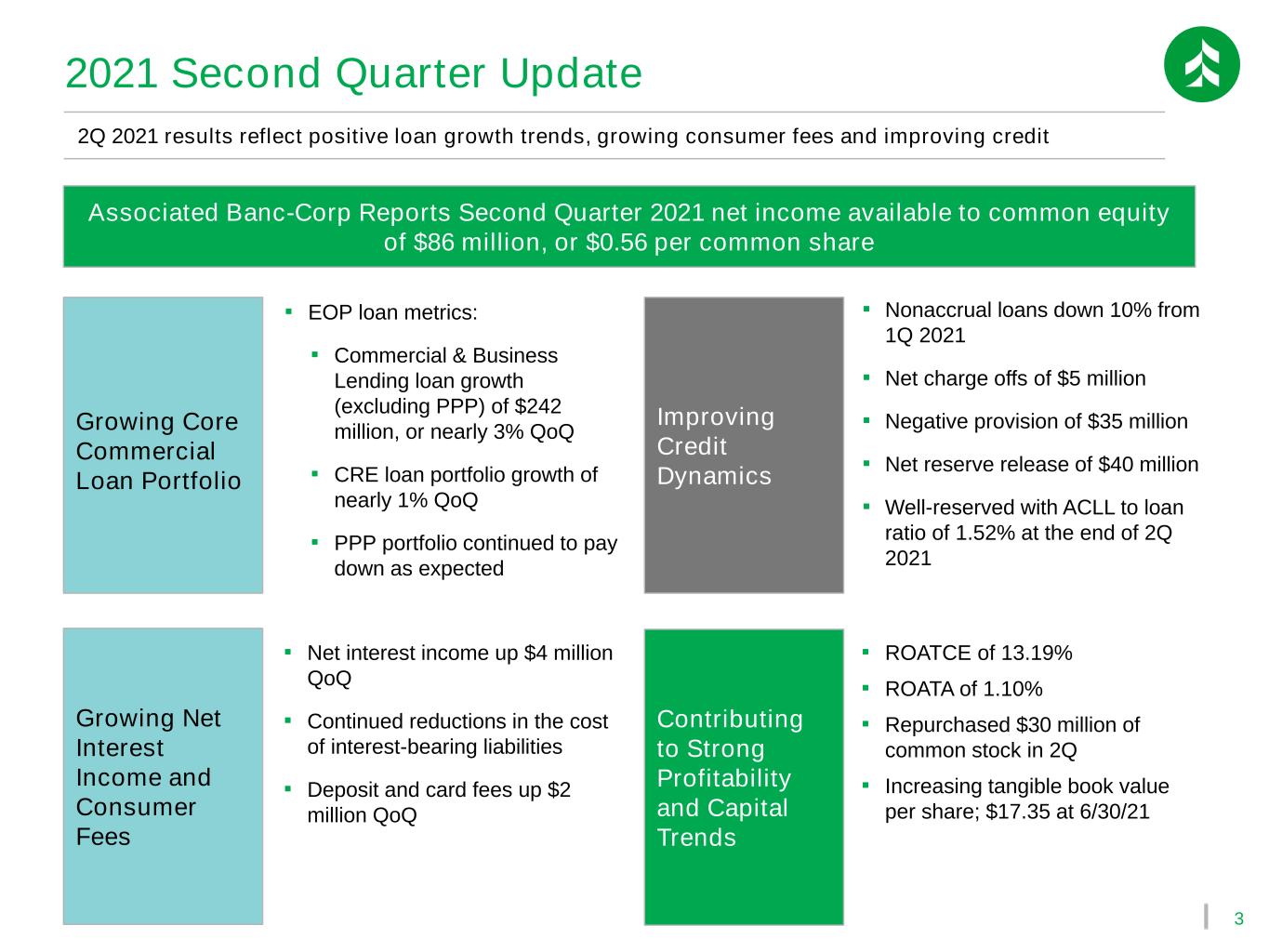

Associated Banc-Corp Reports Second Quarter 2021 Net Income Available to Common Equity of $86 million, or $0.56 Per Common Share.

Results driven by improving credit dynamics, growing net interest income and continued expense discipline.

GREEN BAY, Wis. -- July 22, 2021 -- Associated Banc-Corp (NYSE: ASB) ("Associated" or "Company") today reported net income available to common equity ("earnings") of $86 million, or $0.56 per common share, for the quarter ended June 30, 2021. These amounts compare to earnings of $145 million in the quarter ended June 30, 2020, or $0.94 per common share, including the net gain recognized on the sale of Associated Benefits and Risk Consulting (“ABRC”). Excluding the gain on ABRC, second quarter 2020 earnings per share were $0.26 per common share1. Second quarter 2021 results also compare to earnings of $89 million, or $0.58 per common share for the quarter ended March 31, 2021.

"Our second quarter results were driven by continuing improvement in our loan portfolios,” remarked President and CEO Andy Harmening. “Our credit metrics continued to improve, our C&I and CRE customers began to modestly borrow on their lines, and we saw accelerating PPP pay downs - all of which are indicators of an improving economic backdrop. We also saw signs of increased business and consumer confidence; evidenced by rising spending and payments activity. We remain optimistic about the unfolding recovery in our regional footprint and are proactively pursuing various initiatives to lean into the growth we expect to see in our markets. We look forward to updating investors on these initiatives, later this quarter."

Second Quarter 2021 Highlights (all comparisons to the first quarter of 2021)

•Period-end loans (excluding PPP) were up $216 million, to $23.5 billion

•Period-end deposits were down $413 million, to $27.3 billion

•Net interest income was up $4 million, to $180 million

•Fee-based revenue1 was up $2 million, to $53 million

•Noninterest expense was down $1 million, to $174 million

•Provision for credit losses was negative $35 million, compared to negative $23 million

•Net income available to common equity was down $3 million, to $86 million

•Earnings per common share were down $0.02, to $0.56

•Tangible book value per share was up $0.40, to $17.35

1This is a non-GAAP financial measure. Management believes these measures are meaningful because they reflect adjustments commonly made by management, investors, regulators, and analysts to evaluate the adequacy of earnings per common share, provide greater understanding of ongoing operations and enhance comparability of results with prior periods. See page 10 of the attached tables for a reconciliation of GAAP financial measures to non-GAAP financial measures.

Loans

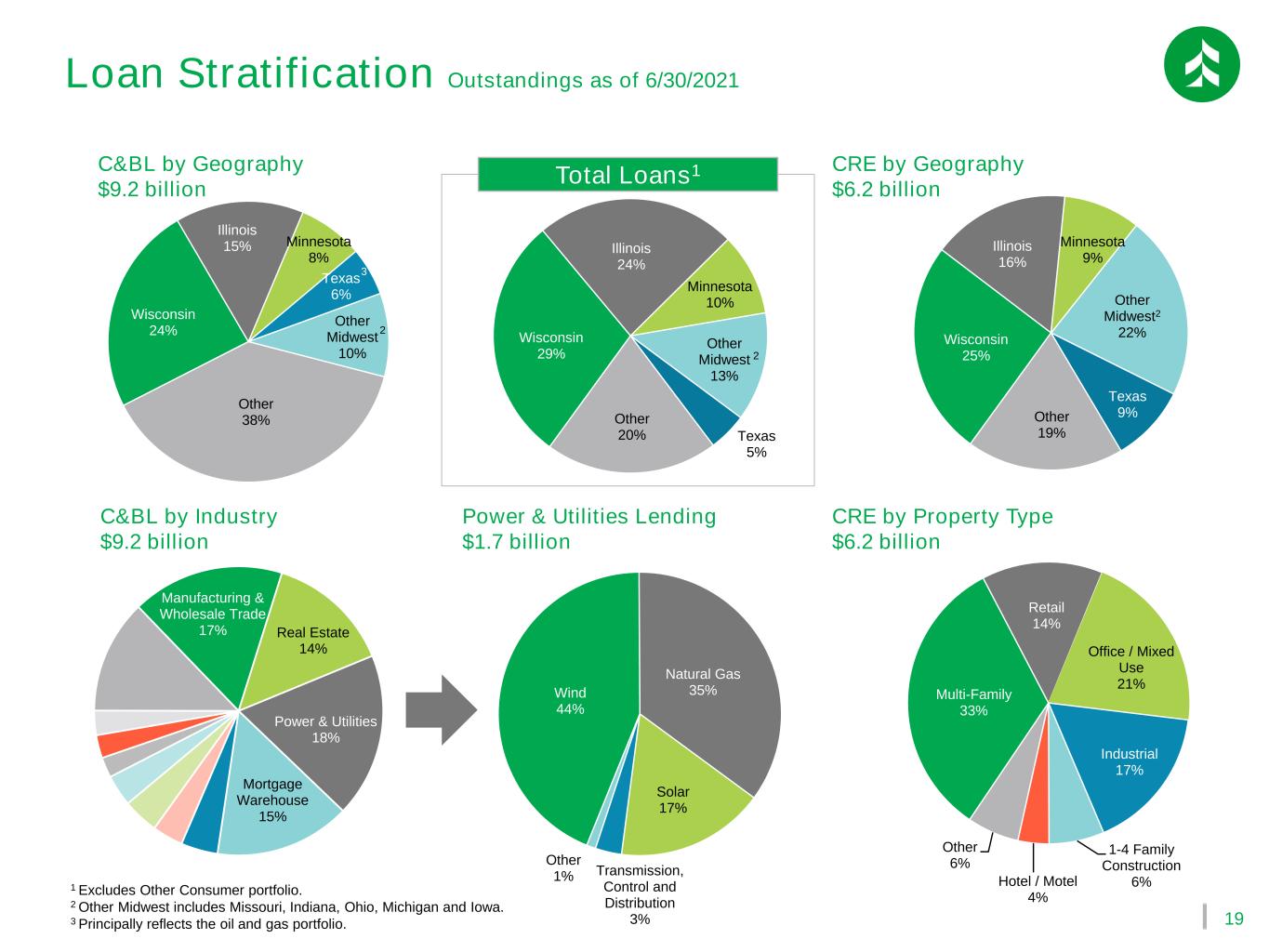

Second quarter 2021 average total loans of $24.1 billion were down 1%, or $365 million from the prior quarter and were down 4%, or $1.1 billion from the same period last year. Excluding PPP, average total loans of $23.4 billion were down 1%, or $259 million from the prior quarter and were down 4%, or $945 million from the same period last year. With respect to second quarter 2021 average balances by loan category:

•Commercial and business lending (excluding PPP) decreased $100 million from the prior quarter and decreased $755 million compared to the same period last year to $8.4 billion.

•Commercial real estate lending decreased $11 million from the prior quarter and increased $439 million from the same period last year to $6.2 billion.

•Consumer lending was $8.8 billion, down $148 million from the prior quarter and down $629 million from the same period last year.

•PPP loans decreased $105 million from the prior quarter and decreased $147 million from the same period last year to $701 million.

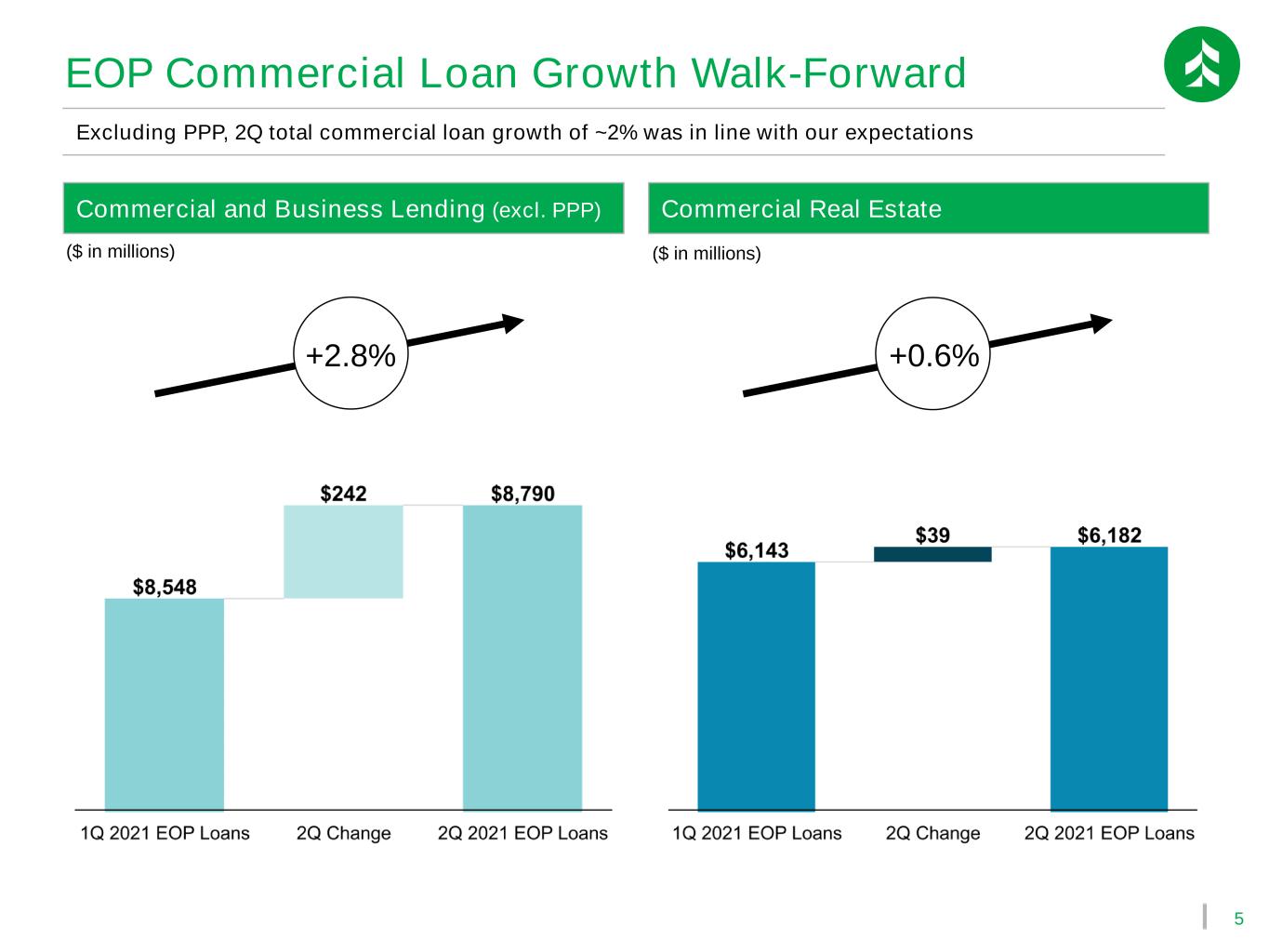

Second quarter 2021 period-end total loans of $23.9 billion were down 1%, or $215 million from the prior quarter and were down 4%, or $885 million from the same period last year. Excluding PPP, period-end total loans of $23.5 billion were up 1%, or $216 million from the prior quarter and were down 1%, or $279 million from the same period last year. With respect to second quarter 2021 period-end balances by loan category:

•Commercial and business lending (excluding PPP) increased $242 million from the prior quarter and decreased $93 million from the same period last year to $8.8 billion.

•Commercial real estate lending increased $39 million from the prior quarter and increased $299 million from the same period last year to $6.2 billion.

•Consumer lending was $8.6 billion, down $64 million from the prior quarter and down $485 million from the same period last year.

•PPP loans decreased by $431 million from the prior quarter and decreased $607 million from the same period last year to $405 million.

We continue to expect full-year commercial loan growth, excluding PPP, of 2% to 4% in 2021, driven by an expected 4% to 6% increase in CRE balances and an expected 1% to 2% increase in commercial and business lending outstandings.

Deposits

Second quarter 2021 average deposits of $27.5 billion were up 2%, or $666 million compared to the prior quarter and were up 5%, or $1.3 billion from the same period last year. With respect to second quarter 2021 average balances by deposit category:

•Noninterest-bearing demand deposits increased $403 million from the prior quarter and increased $1.1 billion from the same period last year to $8.1 billion.

•Savings increased $311 million from the prior quarter and increased $862 million from the same period last year to $4.1 billion.

•Interest-bearing demand deposits increased $166 million from the prior quarter and increased $434 million from the same period last year to $5.9 billion.

•Money market deposits increased $106 million from the prior quarter and increased $485 million from the same period last year to $7.0 billion.

•Network transaction deposits decreased $171 million from the prior quarter and decreased $636 million from the same period last year to $909 million.

•Time deposits decreased $149 million from the prior quarter and decreased $960 million from the same period last year to $1.5 billion.

Second quarter 2021 period-end deposits of $27.3 billion were down 1%, or $413 million compared to the prior quarter and were up 3%, or $713 million from the same period last year. Low-cost core deposits (interest-bearing demand, noninterest-bearing demand and savings) made up 66% of deposit balances as of June 30, 2021. With respect to second quarter 2021 period-end balances by deposit category:

•Noninterest-bearing demand deposits decreased $497 million from the prior quarter and increased $425 million from the same period last year to $8.0 billion.

•Savings increased $150 million from the prior quarter and increased $788 million from the same period last year to $4.2 billion.

•Interest-bearing demand deposits increased $221 million from the prior quarter and increased $122 million from the same period last year to $6.0 billion.

•Money market deposits decreased $198 million from the prior quarter and increased $155 million from the same period last year to $7.6 billion.

•Time deposits (excluding brokered CDs) decreased $89 million from the prior quarter and decreased $772 million from the same period last year to $1.5 billion.

•Network transaction deposits (included in money market and interest-bearing deposits) decreased $183 million from the prior quarter and decreased $625 million from the same period last year to $872 million.

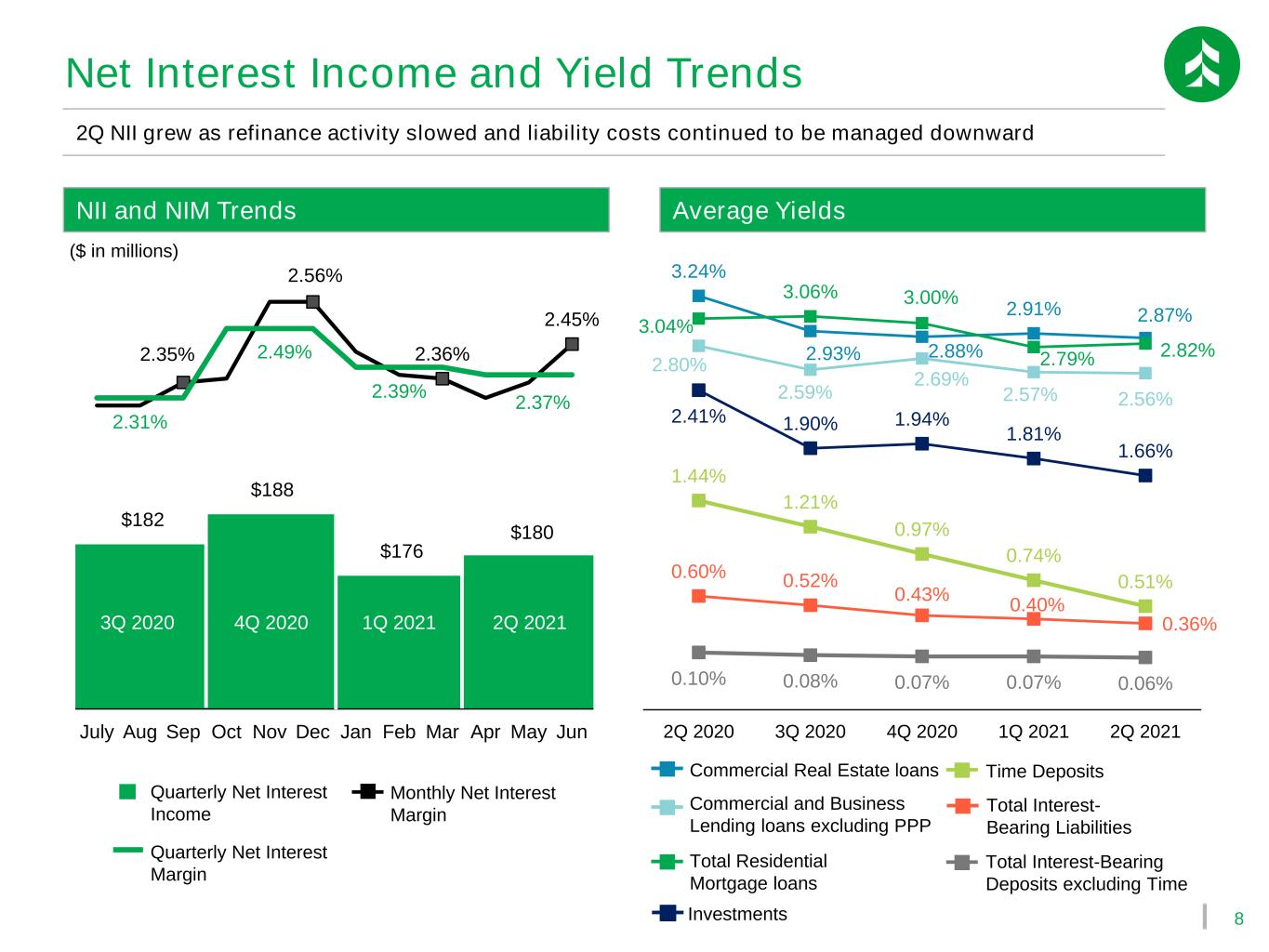

Net Interest Income and Net Interest Margin

Second quarter 2021 net interest income of $180 million was up 2%, or $4 million from the prior quarter and the net interest margin decreased 2 basis points from the prior quarter to 2.37%. Compared to the same period last year, net interest income decreased 5%, or $10 million, and the net interest margin decreased 12 basis points.

•The average yield on total loans for the second quarter of 2021 increased 2 basis points from the prior quarter and decreased 16 basis points from the same period last year to 2.90%.

•The average cost of total interest-bearing liabilities for the second quarter of 2021 decreased 4 basis points from the prior quarter and decreased 24 basis points from the same period last year to 0.36%.

•The net free funds benefit for the second quarter of 2021 decreased one basis point from the prior quarter and compressed 4 basis points compared to the same period last year to 0.11%.

We expect the full year margin for 2021 to be between 2.45% and 2.55%.

Noninterest Income

Second quarter 2021 total noninterest income of $73 million decreased $22 million from the prior quarter and decreased by $181 million from the same period last year, driven by the gain recognized last year on the sale of Associated Benefits and Risk Consulting in the second quarter of 2020 and the decrease in ABRC-related income.

With respect to second quarter 2021 noninterest income line items:

•Service charges and deposit account fees increased $1 million from the prior quarter and increased $4 million from the same period last year.

•Card-based fees increased $1 million from the prior quarter and increased $2 million from the same period last year.

•Mortgage Banking, net was $8 million for the second quarter, down $16 million from the prior quarter, driven by declining gain on sale margins and no additional mortgage servicing rights recoveries. Relative to the prior-year period, Mortgage Banking was down $4 million, principally due to lower gain on sale margins, offset by an $8 million MSR impairment in the prior-year period.

We expect noninterest income of between $315 million and $325 million in 2021.

Noninterest Expense

Second quarter 2021 total noninterest expense of $174 million decreased $1 million from the prior quarter and decreased $9 million compared to the same period last year.

With respect to second quarter 2021 noninterest expense line items:

•Personnel expense increased $3 million from the prior quarter and decreased $4 million from the same period last year.

•Other expense decreased $2 million from the prior quarter and $4 million from the same period last year.

We are withdrawing our prior 2021 total expense guidance. Total expense for 2021 will reflect incremental growth and efficiency initiatives which are under development and expected to be announced later in the third quarter. Before the impact of such initiatives, we expect total expense for 2021 would be approximately $695 million to $700 million.

Taxes

The second quarter 2021 tax expense was $22 million compared to $25 million of tax expense in the prior quarter and $51 million of tax expense in the same period last year. The effective tax rate for second quarter 2021 was 19.8% compared to an effective tax rate of 20.7% in the prior quarter and an effective tax rate of 25.6% in the same period last year, which was driven by the sale of ABRC.

We expect the annual 2021 tax rate to be between 19% and 21%, assuming no change in the corporate tax rate.

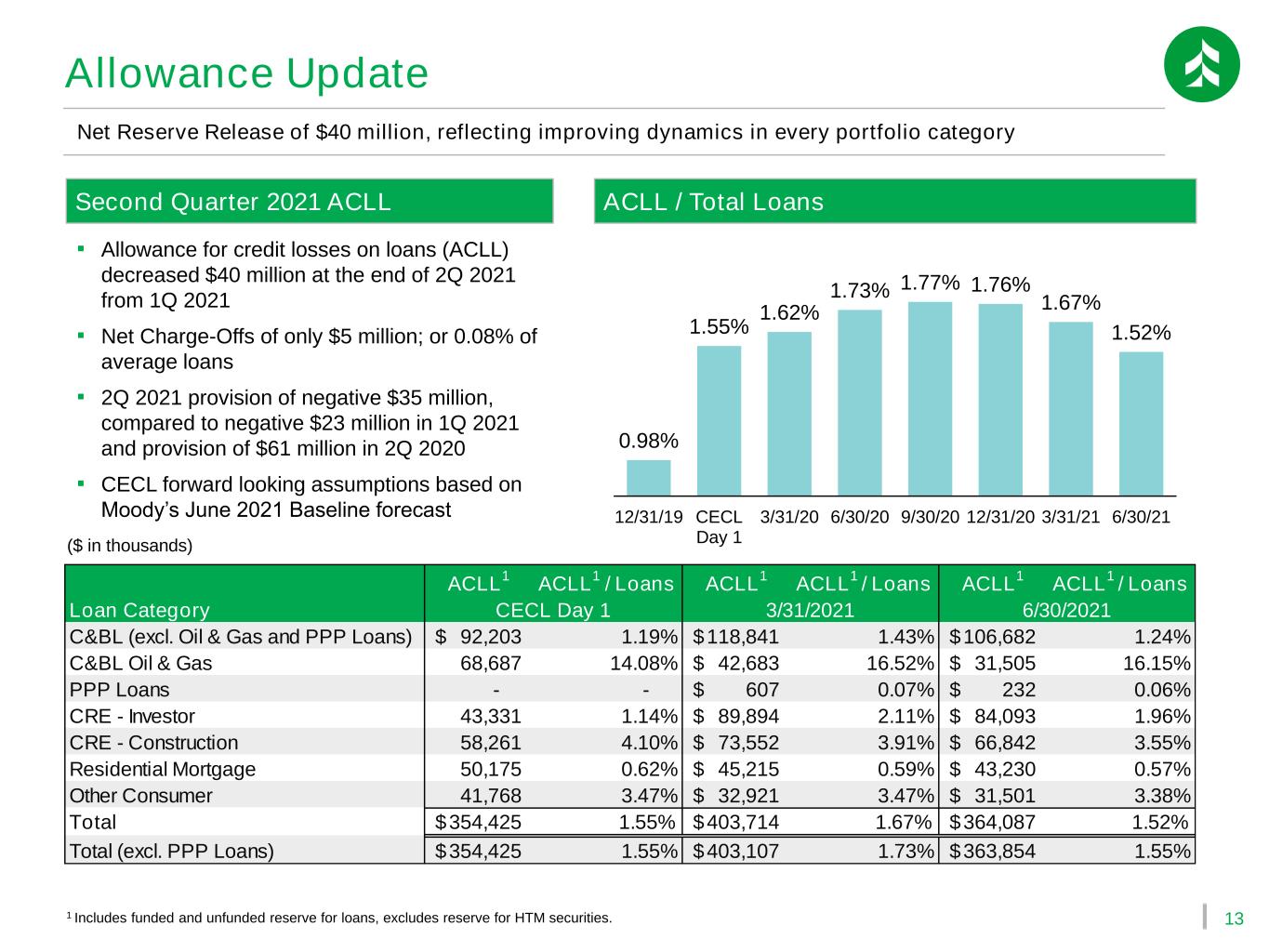

Credit

The second quarter 2021 provision for credit losses was negative $35 million, compared to a negative $23 million in the prior quarter and provision of $61 million in the same period last year.

With respect to second quarter 2021 credit quality:

•Potential problem loans of $196 million were down $68 million, or 26%, from the prior quarter and down $111 million, or 36%, from the same period last year.

•Nonaccrual loans of $147 million were down $16 million, or 10%, from the prior quarter and down $24 million, or 14% from the same period last year. The nonaccrual loans to total loans ratio was 0.61% in the second quarter, down from 0.68% in the prior quarter and down from 0.69% in the same period last year.

•Net charge offs of $5 million were down 3% from the prior quarter and down $22 million, or 83%, from the same period last year.

•The allowance for credit losses on loans (ACLL) of $364 million was down $40 million from the prior quarter and down $64 million compared to the same period last year. The ACLL to total loans ratio was 1.52% in the second quarter, down from 1.67% in the prior quarter and down from 1.73% in the same period last year.

We continue to experience positive credit trends due to economic conditions and expect our provision to adjust with changes to risk grade, other indications of credit quality, and loan volume.

Capital

The Company’s capital position remains strong, with a CET1 capital ratio of 10.7% at June 30, 2021. The Company’s capital ratios continue to be in excess of the Basel III “well-capitalized” regulatory benchmarks on a fully phased in basis.

SECOND QUARTER 2021 EARNINGS RELEASE CONFERENCE CALL

The Company will host a conference call for investors and analysts at 4:00 p.m. Central Time (CT) today, July 22, 2021. Interested parties can access the live webcast of the call through the Investor Relations section of the Company's website, http://investor.associatedbank.com. Parties may also dial into the call at 877-407-8037 (domestic) or 201-689-8037 (international) and request the Associated Banc-Corp second quarter 2021 earnings call. The second quarter 2021 financial tables with an accompanying slide presentation will be available on the Company's website just prior to the call. An audio archive of the webcast will be available on the Company's website approximately fifteen minutes after the call is over.

ABOUT ASSOCIATED BANC-CORP

Associated Banc-Corp (NYSE: ASB) has total assets of $34 billion and is Wisconsin's largest bank holding company. Headquartered in Green Bay, Wisconsin, Associated is a leading Midwest banking franchise, offering a full range of financial products and services from more than 220 banking locations serving more than 120 communities throughout Wisconsin, Illinois and Minnesota, and commercial financial services in Indiana, Michigan, Missouri, Ohio and Texas. Associated Bank, N.A. is an Equal Housing Lender, Equal Opportunity Lender and Member FDIC. More information about Associated Banc-Corp is available at www.associatedbank.com.

FORWARD-LOOKING STATEMENTS

Statements made in this document which are not purely historical are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding management’s plans, objectives, or goals for future operations, products or services, and forecasts of its revenues, earnings, or other measures of performance. Such forward-looking statements may be identified by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “estimate,” “should,” “will,” “intend,” "target," “outlook,” "guidance," or similar expressions. Forward-looking statements are based on current management expectations and, by their nature, are subject to risks and uncertainties. Actual results may differ materially from those contained in the forward-looking statements. Factors which may cause actual results to differ materially from those contained in such forward-looking statements include those identified in the Company’s most recent Form 10-K and subsequent SEC filings. Such factors are incorporated herein by reference.

NON-GAAP FINANCIAL MEASURES

This press release and related materials may contain references to measures which are not defined in generally accepted accounting principles (“GAAP”). Information concerning these non-GAAP financial measures can be found in the financial tables. Management believes these measures are meaningful because they reflect adjustments commonly made by management, investors, regulators, and analysts to evaluate the adequacy of earnings per common share, provide a greater understanding of ongoing operations and enhance comparability of results with prior periods.

# # #

| Associated Banc-Corp Consolidated Balance Sheets (Unaudited) | |||||||||||||||||||||||

| ($ in thousands) | June 30, 2021 | March 31, 2021 | Seql Qtr $ Change | December 31, 2020 | September 30, 2020 | June 30, 2020 | Comp Qtr $ Change | ||||||||||||||||

| Assets | |||||||||||||||||||||||

| Cash and due from banks | $ | 406,994 | $ | 356,285 | $ | 50,709 | $ | 416,154 | $ | 401,151 | $ | 443,500 | $ | (36,506) | |||||||||

| Interest-bearing deposits in other financial institutions | 1,340,385 | 1,590,494 | (250,109) | 298,759 | 712,416 | 1,569,006 | (228,621) | ||||||||||||||||

| Federal funds sold and securities purchased under agreements to resell | 25,000 | — | 25,000 | 1,135 | 95 | 185 | 24,815 | ||||||||||||||||

| Investment securities available for sale, at fair value | 3,323,346 | 3,356,949 | (33,603) | 3,085,441 | 3,258,360 | 3,149,773 | 173,573 | ||||||||||||||||

| Investment securities held to maturity, net, at amortized cost | 1,799,834 | 1,857,087 | (57,253) | 1,878,938 | 1,990,870 | 2,077,225 | (277,391) | ||||||||||||||||

| Equity securities | 17,144 | 15,673 | 1,471 | 15,106 | 15,090 | 15,091 | 2,053 | ||||||||||||||||

| Federal Home Loan Bank and Federal Reserve Bank stocks, at cost | 168,281 | 168,281 | — | 168,280 | 168,280 | 206,281 | (38,000) | ||||||||||||||||

| Residential loans held for sale | 160,547 | 153,151 | 7,396 | 129,158 | 130,139 | 196,673 | (36,126) | ||||||||||||||||

| Commercial loans held for sale | — | — | — | — | 19,360 | 3,565 | (3,565) | ||||||||||||||||

| Loans | 23,947,536 | 24,162,328 | (214,792) | 24,451,724 | 25,003,753 | 24,832,671 | (885,135) | ||||||||||||||||

| Allowance for loan losses | (318,811) | (352,938) | 34,127 | (383,702) | (384,711) | (363,803) | 44,992 | ||||||||||||||||

| Loans, net | 23,628,725 | 23,809,389 | (180,664) | 24,068,022 | 24,619,041 | 24,468,868 | (840,143) | ||||||||||||||||

| Tax credit and other investments | 294,220 | 303,701 | (9,481) | 297,232 | 314,066 | 303,132 | (8,912) | ||||||||||||||||

| Premises and equipment, net | 398,050 | 398,671 | (621) | 418,914 | 422,222 | 434,042 | (35,992) | ||||||||||||||||

| Bank and corporate owned life insurance | 682,709 | 680,831 | 1,878 | 679,647 | 679,257 | 676,196 | 6,513 | ||||||||||||||||

| Goodwill | 1,104,992 | 1,104,992 | — | 1,109,300 | 1,107,902 | 1,107,902 | (2,910) | ||||||||||||||||

| Other intangible assets, net | 62,498 | 64,701 | (2,203) | 68,254 | 70,507 | 72,759 | (10,261) | ||||||||||||||||

| Mortgage servicing rights, net | 48,335 | 49,500 | (1,165) | 41,961 | 45,261 | 49,403 | (1,068) | ||||||||||||||||

| Interest receivable | 81,797 | 86,466 | (4,669) | 90,263 | 91,612 | 87,097 | (5,300) | ||||||||||||||||

| Other assets | 609,766 | 579,084 | 30,682 | 653,219 | 653,117 | 640,765 | (30,999) | ||||||||||||||||

| Total assets | $ | 34,152,625 | $ | 34,575,255 | $ | (422,630) | $ | 33,419,783 | $ | 34,698,746 | $ | 35,501,464 | $ | (1,348,839) | |||||||||

| Liabilities and stockholders’ equity | |||||||||||||||||||||||

| Noninterest-bearing demand deposits | $ | 7,999,143 | $ | 8,496,194 | $ | (497,051) | $ | 7,661,728 | $ | 7,489,048 | $ | 7,573,942 | $ | 425,201 | |||||||||

| Interest-bearing deposits | 19,265,157 | 19,180,972 | 84,185 | 18,820,753 | 19,223,500 | 18,977,502 | 287,655 | ||||||||||||||||

| Total deposits | 27,264,299 | 27,677,166 | (412,867) | 26,482,481 | 26,712,547 | 26,551,444 | 712,855 | ||||||||||||||||

| Federal funds purchased and securities sold under agreements to repurchase | 170,419 | 138,507 | 31,912 | 192,971 | 155,329 | 142,293 | 28,126 | ||||||||||||||||

| Commercial paper | 55,785 | 51,171 | 4,614 | 59,346 | 50,987 | 39,535 | 16,250 | ||||||||||||||||

| PPPLF | — | — | — | — | 1,022,217 | 1,009,760 | (1,009,760) | ||||||||||||||||

| FHLB advances | 1,619,826 | 1,629,966 | (10,140) | 1,632,723 | 1,706,763 | 2,657,016 | (1,037,190) | ||||||||||||||||

| Other long-term funding | 549,024 | 549,729 | (705) | 549,465 | 549,201 | 548,937 | 87 | ||||||||||||||||

| Allowance for unfunded commitments | 45,276 | 50,776 | (5,500) | 47,776 | 57,276 | 64,776 | (19,500) | ||||||||||||||||

| Accrued expenses and other liabilities | 337,942 | 350,160 | (12,218) | 364,088 | 398,991 | 463,245 | (125,303) | ||||||||||||||||

| Total liabilities | 30,042,573 | 30,447,474 | (404,901) | 29,328,850 | 30,653,313 | 31,477,007 | (1,434,434) | ||||||||||||||||

| Stockholders’ equity | |||||||||||||||||||||||

| Preferred equity | 290,200 | 353,512 | (63,312) | 353,512 | 353,637 | 353,846 | (63,646) | ||||||||||||||||

| Common equity | 3,819,852 | 3,774,268 | 45,584 | 3,737,421 | 3,691,796 | 3,670,612 | 149,240 | ||||||||||||||||

| Total stockholders’ equity | 4,110,052 | 4,127,780 | (17,728) | 4,090,933 | 4,045,433 | 4,024,457 | 85,595 | ||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 34,152,625 | $ | 34,575,255 | $ | (422,630) | $ | 33,419,783 | $ | 34,698,746 | $ | 35,501,464 | $ | (1,348,839) | |||||||||

Numbers may not sum due to rounding.

1

| Associated Banc-Corp Consolidated Statements of Income (Unaudited) | Comp Qtr | YTD | YTD | Comp YTD | ||||||||||||||||||||||

| ($ in thousands, except per share data) | 2Q21 | 2Q20 | $ Change | % Change | Jun 2021 | Jun 2020 | $ Change | % Change | ||||||||||||||||||

| Interest income | ||||||||||||||||||||||||||

| Interest and fees on loans | $ | 174,228 | $ | 191,895 | $ | (17,667) | (9) | % | $ | 348,277 | $ | 416,681 | $ | (68,404) | (16) | % | ||||||||||

| Interest and dividends on investment securities | ||||||||||||||||||||||||||

| Taxable | 8,840 | 16,103 | (7,263) | (45) | % | 15,855 | 36,375 | (20,520) | (56) | % | ||||||||||||||||

| Tax-exempt | 14,366 | 14,616 | (250) | (2) | % | 28,528 | 29,498 | (970) | (3) | % | ||||||||||||||||

| Other interest | 1,826 | 2,231 | (405) | (18) | % | 3,521 | 5,535 | (2,014) | (36) | % | ||||||||||||||||

| Total interest income | 199,260 | 224,845 | (25,585) | (11) | % | 396,180 | 488,090 | (91,910) | (19) | % | ||||||||||||||||

| Interest expense | ||||||||||||||||||||||||||

| Interest on deposits | 4,609 | 13,178 | (8,569) | (65) | % | 10,519 | 49,844 | (39,325) | (79) | % | ||||||||||||||||

| Interest on federal funds purchased and securities sold under agreements to repurchase | 30 | 51 | (21) | (41) | % | 55 | 420 | (365) | (87) | % | ||||||||||||||||

| Interest on other short-term funding | 7 | 5 | 2 | 40 | % | 13 | 40 | (27) | (68) | % | ||||||||||||||||

| Interest on PPPLF | — | 676 | (676) | (100) | % | — | 676 | (676) | (100) | % | ||||||||||||||||

| Interest on FHLB Advances | 9,524 | 15,470 | (5,946) | (38) | % | 19,017 | 33,096 | (14,079) | (43) | % | ||||||||||||||||

| Interest on long-term funding | 5,575 | 5,593 | (18) | — | % | 11,160 | 11,200 | (40) | — | % | ||||||||||||||||

| Total interest expense | 19,745 | 34,973 | (15,228) | (44) | % | 40,764 | 95,276 | (54,512) | (57) | % | ||||||||||||||||

| Net interest income | 179,515 | 189,872 | (10,357) | (5) | % | 355,416 | 392,814 | (37,398) | (10) | % | ||||||||||||||||

| Provision for credit losses | (35,004) | 61,000 | (96,004) | N/M | (58,009) | 114,001 | (172,010) | N/M | ||||||||||||||||||

| Net interest income after provision for credit losses | 214,519 | 128,872 | 85,647 | 66 | % | 413,425 | 278,813 | 134,612 | 48 | % | ||||||||||||||||

| Noninterest income | ||||||||||||||||||||||||||

| Wealth management fees | 22,706 | 20,916 | 1,790 | 9 | % | 45,120 | 41,732 | 3,388 | 8 | % | ||||||||||||||||

| Service charges and deposit account fees | 15,549 | 11,484 | 4,065 | 35 | % | 30,404 | 26,706 | 3,698 | 14 | % | ||||||||||||||||

| Card-based fees | 10,982 | 8,893 | 2,089 | 23 | % | 20,725 | 18,490 | 2,235 | 12 | % | ||||||||||||||||

| Other fee-based revenue | 4,244 | 4,774 | (530) | (11) | % | 8,840 | 9,272 | (432) | (5) | % | ||||||||||||||||

Capital markets, net | 5,696 | 6,910 | (1,214) | (18) | % | 13,814 | 14,845 | (1,031) | (7) | % | ||||||||||||||||

| Mortgage banking, net | 8,128 | 12,263 | (4,135) | (34) | % | 32,054 | 18,407 | 13,647 | 74 | % | ||||||||||||||||

| Bank and corporate owned life insurance | 3,088 | 3,625 | (537) | (15) | % | 5,791 | 6,719 | (928) | (14) | % | ||||||||||||||||

| Insurance commissions and fees | 86 | 22,430 | (22,344) | (100) | % | 161 | 45,038 | (44,877) | (100) | % | ||||||||||||||||

Asset gains (losses), net(a) | (14) | 157,361 | (157,375) | N/M | 4,796 | 157,284 | (152,488) | (97) | % | |||||||||||||||||

| Investment securities gains (losses), net | 24 | 3,096 | (3,072) | (99) | % | (16) | 9,214 | (9,230) | N/M | |||||||||||||||||

Gains (losses) on sale of branches, net(b) | 36 | — | 36 | N/M | 1,038 | — | 1,038 | N/M | ||||||||||||||||||

Other | 2,918 | 2,737 | 181 | 7 | % | 6,059 | 5,090 | 969 | 19 | % | ||||||||||||||||

| Total noninterest income | 73,443 | 254,490 | (181,047) | (71) | % | 168,786 | 352,796 | (184,010) | (52) | % | ||||||||||||||||

| Noninterest expense | ||||||||||||||||||||||||||

| Personnel | 106,994 | 111,350 | (4,356) | (4) | % | 211,020 | 225,551 | (14,531) | (6) | % | ||||||||||||||||

| Technology | 20,236 | 21,174 | (938) | (4) | % | 40,975 | 41,973 | (998) | (2) | % | ||||||||||||||||

| Occupancy | 14,679 | 14,464 | 215 | 1 | % | 30,835 | 30,532 | 303 | 1 | % | ||||||||||||||||

| Business development and advertising | 4,970 | 3,556 | 1,414 | 40 | % | 9,366 | 9,382 | (16) | — | % | ||||||||||||||||

| Equipment | 5,481 | 5,312 | 169 | 3 | % | 10,999 | 10,751 | 248 | 2 | % | ||||||||||||||||

| Legal and professional | 6,661 | 5,058 | 1,603 | 32 | % | 13,191 | 10,217 | 2,974 | 29 | % | ||||||||||||||||

| Loan and foreclosure costs | 2,671 | 3,605 | (934) | (26) | % | 4,891 | 6,725 | (1,834) | (27) | % | ||||||||||||||||

| FDIC assessment | 3,600 | 5,250 | (1,650) | (31) | % | 8,350 | 10,750 | (2,400) | (22) | % | ||||||||||||||||

| Other intangible amortization | 2,203 | 2,872 | (669) | (23) | % | 4,439 | 5,686 | (1,247) | (22) | % | ||||||||||||||||

| Other | 6,979 | 10,766 | (3,787) | (35) | % | 15,755 | 24,030 | (8,275) | (34) | % | ||||||||||||||||

| Total noninterest expense | 174,475 | 183,407 | (8,932) | (5) | % | 349,821 | 375,598 | (25,777) | (7) | % | ||||||||||||||||

| Income (loss) before income taxes | 113,487 | 199,955 | (86,468) | (43) | % | 232,389 | 256,012 | (23,623) | (9) | % | ||||||||||||||||

| Income tax expense (benefit) | 22,480 | 51,238 | (28,758) | (56) | % | 47,082 | 61,457 | (14,375) | (23) | % | ||||||||||||||||

| Net income | 91,007 | 148,718 | (57,711) | (39) | % | 185,307 | 194,555 | (9,248) | (5) | % | ||||||||||||||||

| Preferred stock dividends | 4,875 | 4,144 | 731 | 18 | % | 10,082 | 7,945 | 2,137 | 27 | % | ||||||||||||||||

| Net income available to common equity | $ | 86,131 | $ | 144,573 | $ | (58,442) | (40) | % | $ | 175,226 | $ | 186,611 | $ | (11,385) | (6) | % | ||||||||||

| Earnings per common share | ||||||||||||||||||||||||||

| Basic | $ | 0.56 | $ | 0.94 | $ | (0.38) | (40) | % | $ | 1.14 | $ | 1.21 | $ | (0.07) | (6) | % | ||||||||||

| Diluted | $ | 0.56 | $ | 0.94 | $ | (0.38) | (40) | % | $ | 1.13 | $ | 1.20 | $ | (0.07) | (6) | % | ||||||||||

| Average common shares outstanding | ||||||||||||||||||||||||||

| Basic | 152,042 | 152,393 | (351) | — | % | 152,198 | 153,547 | (1,349) | (1) | % | ||||||||||||||||

| Diluted | 153,381 | 153,150 | 231 | — | % | 153,473 | 154,360 | (887) | (1) | % | ||||||||||||||||

N/M = Not meaningful

Numbers may not sum due to rounding.

(a) 2Q20 and YTD 2020 include a gain of $163 million from the sale of Associated Benefits & Risk Consulting.

(b) Includes the deposit premium on the sale of branches net of miscellaneous costs to sell.

2

| Associated Banc-Corp Consolidated Statements of Income (Unaudited) - Quarterly Trend | |||||||||||||||||||||||||||||

| ($ in thousands, except per share data) | Seql Qtr | Comp Qtr | |||||||||||||||||||||||||||

| 2Q21 | 1Q21 | $ Change | % Change | 4Q20 | 3Q20 | 2Q20 | $ Change | % Change | |||||||||||||||||||||

| Interest income | |||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 174,228 | $ | 174,049 | $ | 179 | — | % | $ | 185,934 | $ | 182,625 | $ | 191,895 | $ | (17,667) | (9) | % | |||||||||||

| Interest and dividends on investment securities | |||||||||||||||||||||||||||||

| Taxable | 8,840 | 7,014 | 1,826 | 26 | % | 9,746 | 13,689 | 16,103 | (7,263) | (45) | % | ||||||||||||||||||

| Tax-exempt | 14,366 | 14,162 | 204 | 1 | % | 14,296 | 14,523 | 14,616 | (250) | (2) | % | ||||||||||||||||||

| Other interest | 1,826 | 1,694 | 132 | 8 | % | 1,699 | 2,238 | 2,231 | (405) | (18) | % | ||||||||||||||||||

| Total interest income | 199,260 | 196,920 | 2,340 | 1 | % | 211,675 | 213,075 | 224,845 | (25,585) | (11) | % | ||||||||||||||||||

| Interest expense | |||||||||||||||||||||||||||||

| Interest on deposits | 4,609 | 5,909 | (1,300) | (22) | % | 7,762 | 10,033 | 13,178 | (8,569) | (65) | % | ||||||||||||||||||

| Interest on federal funds purchased and securities sold under agreements to repurchase | 30 | 26 | 4 | 15 | % | 32 | 34 | 51 | (21) | (41) | % | ||||||||||||||||||

| Interest on other short-term funding | 7 | 6 | 1 | 17 | % | 5 | 5 | 5 | 2 | 40 | % | ||||||||||||||||||

| Interest on PPPLF | — | — | — | N/M | 410 | 899 | 676 | (676) | (100) | ||||||||||||||||||||

| Interest on FHLB Advances | 9,524 | 9,493 | 31 | — | % | 9,888 | 14,375 | 15,470 | (5,946) | (38) | % | ||||||||||||||||||

| Interest on long-term funding | 5,575 | 5,585 | (10) | — | % | 5,585 | 5,580 | 5,593 | (18) | — | % | ||||||||||||||||||

| Total interest expense | 19,745 | 21,018 | (1,273) | (6) | % | 23,682 | 30,925 | 34,973 | (15,228) | (44) | % | ||||||||||||||||||

| Net interest income | 179,515 | 175,902 | 3,613 | 2 | % | 187,993 | 182,150 | 189,872 | (10,357) | (5) | % | ||||||||||||||||||

| Provision for credit losses | (35,004) | (23,004) | (12,000) | 52 | % | 16,997 | 43,009 | 61,000 | (96,004) | N/M | |||||||||||||||||||

| Net interest income after provision for credit losses | 214,519 | 198,906 | 15,613 | 8 | % | 170,996 | 139,141 | 128,872 | 85,647 | 66 | % | ||||||||||||||||||

| Noninterest income | |||||||||||||||||||||||||||||

| Wealth management fees | 22,706 | 22,414 | 292 | 1 | % | 22,073 | 21,152 | 20,916 | 1,790 | 9 | % | ||||||||||||||||||

| Service charges and deposit account fees | 15,549 | 14,855 | 694 | 5 | % | 15,318 | 14,283 | 11,484 | 4,065 | 35 | % | ||||||||||||||||||

| Card-based fees | 10,982 | 9,743 | 1,239 | 13 | % | 9,848 | 10,195 | 8,893 | 2,089 | 23 | % | ||||||||||||||||||

| Other fee-based revenue | 4,244 | 4,596 | (352) | (8) | % | 4,998 | 4,968 | 4,774 | (530) | (11) | % | ||||||||||||||||||

| Capital markets, net | 5,696 | 8,118 | (2,422) | (30) | % | 5,898 | 7,222 | 6,910 | (1,214) | (18) | % | ||||||||||||||||||

| Mortgage banking, net | 8,128 | 23,925 | (15,797) | (66) | % | 14,537 | 12,636 | 12,263 | (4,135) | (34) | % | ||||||||||||||||||

| Bank and corporate owned life insurance | 3,088 | 2,702 | 386 | 14 | % | 3,978 | 3,074 | 3,625 | (537) | (15) | % | ||||||||||||||||||

| Insurance commissions and fees | 86 | 76 | 10 | 13 | % | 92 | 114 | 22,430 | (22,344) | (100) | % | ||||||||||||||||||

Asset gains (losses), net(a) | (14) | 4,809 | (4,823) | N/M | (1,356) | (339) | 157,361 | (157,375) | N/M | ||||||||||||||||||||

| Investment securities gains (losses), net | 24 | (39) | 63 | N/M | — | 7 | 3,096 | (3,072) | (99) | % | |||||||||||||||||||

Gains on sale of branches, net(b) | 36 | 1,002 | (966) | (96) | % | 7,449 | — | — | 36 | N/M | |||||||||||||||||||

| Other | 2,918 | 3,141 | (223) | (7) | % | 2,879 | 2,232 | 2,737 | 181 | 7 | % | ||||||||||||||||||

| Total noninterest income | 73,443 | 95,343 | (21,900) | (23) | % | 85,714 | 75,545 | 254,490 | (181,047) | (71) | % | ||||||||||||||||||

| Noninterest expense | |||||||||||||||||||||||||||||

| Personnel | 106,994 | 104,026 | 2,968 | 3 | % | 98,033 | 108,567 | 111,350 | (4,356) | (4) | % | ||||||||||||||||||

| Technology | 20,236 | 20,740 | (504) | (2) | % | 19,574 | 19,666 | 21,174 | (938) | (4) | % | ||||||||||||||||||

| Occupancy | 14,679 | 16,156 | (1,477) | (9) | % | 15,678 | 17,854 | 14,464 | 215 | 1 | % | ||||||||||||||||||

| Business development and advertising | 4,970 | 4,395 | 575 | 13 | % | 5,421 | 3,626 | 3,556 | 1,414 | 40 | % | ||||||||||||||||||

| Equipment | 5,481 | 5,518 | (37) | (1) | % | 5,555 | 5,399 | 5,312 | 169 | 3 | % | ||||||||||||||||||

| Legal and professional | 6,661 | 6,530 | 131 | 2 | % | 5,737 | 5,591 | 5,058 | 1,603 | 32 | % | ||||||||||||||||||

| Loan and foreclosure costs | 2,671 | 2,220 | 451 | 20 | % | 3,758 | 2,118 | 3,605 | (934) | (26) | % | ||||||||||||||||||

| FDIC assessment | 3,600 | 4,750 | (1,150) | (24) | % | 5,700 | 3,900 | 5,250 | (1,650) | (31) | % | ||||||||||||||||||

| Other intangible amortization | 2,203 | 2,236 | (33) | (1) | % | 2,253 | 2,253 | 2,872 | (669) | (23) | % | ||||||||||||||||||

| Loss on prepayments of FHLB advances | — | — | — | N/M | — | 44,650 | — | — | N/M | ||||||||||||||||||||

| Other | 6,979 | 8,775 | (1,796) | (20) | % | 11,141 | 13,963 | 10,766 | (3,787) | (35) | % | ||||||||||||||||||

| Total noninterest expense | 174,475 | 175,347 | (872) | — | % | 172,850 | 227,587 | 183,407 | (8,932) | (5) | % | ||||||||||||||||||

| Income (loss) before income taxes | 113,487 | 118,903 | (5,416) | (5) | % | 83,860 | (12,900) | 199,955 | (86,468) | (43) | % | ||||||||||||||||||

| Income tax expense (benefit) | 22,480 | 24,602 | (2,122) | (9) | % | 16,858 | (58,114) | 51,238 | (28,758) | (56) | % | ||||||||||||||||||

| Net income | 91,007 | 94,301 | (3,294) | (3) | % | 67,002 | 45,214 | 148,718 | (57,711) | (39) | % | ||||||||||||||||||

| Preferred stock dividends | 4,875 | 5,207 | (332) | (6) | % | 5,207 | 5,207 | 4,144 | 731 | 18 | % | ||||||||||||||||||

| Net income available to common equity | $ | 86,131 | $ | 89,094 | $ | (2,963) | (3) | % | $ | 61,795 | $ | 40,007 | $ | 144,573 | $ | (58,442) | (40) | % | |||||||||||

| Earnings per common share | |||||||||||||||||||||||||||||

| Basic | $ | 0.56 | $ | 0.58 | $ | (0.02) | (3) | % | $ | 0.40 | $ | 0.26 | $ | 0.94 | $ | (0.38) | (40) | % | |||||||||||

| Diluted | $ | 0.56 | $ | 0.58 | $ | (0.02) | (3) | % | $ | 0.40 | $ | 0.26 | $ | 0.94 | $ | (0.38) | (40) | % | |||||||||||

| Average common shares outstanding | |||||||||||||||||||||||||||||

| Basic | 152,042 | 152,355 | (313) | — | % | 152,497 | 152,440 | 152,393 | (351) | — | % | ||||||||||||||||||

| Diluted | 153,381 | 153,688 | (307) | — | % | 153,262 | 153,194 | 153,150 | 231 | — | % | ||||||||||||||||||

N/M = Not meaningful

Numbers may not sum due to rounding.

(a) 2Q20 includes a gain of $163 million from the sale of Associated Benefits & Risk Consulting.

(b) Includes the deposit premium on the sale of branches net of miscellaneous costs to sell

3

| Associated Banc-Corp Selected Quarterly Information | |||||||||||||||||||||||

| ($ in millions except per share data and COVID-19 loan forbearances; shares repurchased and outstanding in thousands) | YTD Jun 2021 | YTD Jun 2020 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | ||||||||||||||||

| Per common share data | |||||||||||||||||||||||

| Dividends | $ | 0.36 | $ | 0.36 | $ | 0.18 | $ | 0.18 | $ | 0.18 | $ | 0.18 | $ | 0.18 | |||||||||

| Market value: | |||||||||||||||||||||||

| High | 23.33 | 21.94 | 23.33 | 23.14 | 17.17 | 14.25 | 17.03 | ||||||||||||||||

| Low | 17.20 | 10.85 | 20.36 | 17.20 | 12.68 | 11.86 | 11.48 | ||||||||||||||||

| Close | 20.48 | 21.34 | 17.05 | 12.62 | 13.68 | ||||||||||||||||||

| Book value | 24.99 | 24.56 | 24.34 | 24.04 | 23.89 | ||||||||||||||||||

| Tangible book value / share | 17.35 | 16.95 | 16.67 | 16.37 | 16.21 | ||||||||||||||||||

| Performance ratios (annualized) | |||||||||||||||||||||||

| Return on average assets | 1.10 | % | 1.16 | % | 1.06 | % | 1.14 | % | 0.78 | % | 0.51 | % | 1.72 | % | |||||||||

| Noninterest expense / average assets | 2.07 | % | 2.24 | % | 2.04 | % | 2.11 | % | 2.02 | % | 2.55 | % | 2.12 | % | |||||||||

| Effective tax rate | 20.26 | % | 24.01 | % | 19.81 | % | 20.69 | % | 20.10 | % | N/M | 25.62 | % | ||||||||||

Dividend payout ratio(a) | 31.58 | % | 29.75 | % | 32.14 | % | 31.03 | % | 45.00 | % | 69.23 | % | 19.15 | % | |||||||||

| Net interest margin | 2.38 | % | 2.66 | % | 2.37 | % | 2.39 | % | 2.49 | % | 2.31 | % | 2.49 | % | |||||||||

| Selected trend information | |||||||||||||||||||||||

Average full time equivalent employees(b) | 4,005 | 4,666 | 3,990 | 4,020 | 4,134 | 4,374 | 4,701 | ||||||||||||||||

| Branch count | 224 | 227 | 228 | 249 | 249 | ||||||||||||||||||

Assets under management, at market value(c) | $ | 13,141 | $ | 12,553 | $ | 13,314 | $ | 12,195 | $ | 11,755 | |||||||||||||

| Mortgage loans originated for sale during period | $ | 889 | $ | 861 | $ | 477 | $ | 413 | $ | 323 | $ | 458 | $ | 550 | |||||||||

| Mortgage loan settlements during period | $ | 885 | $ | 1,022 | $ | 484 | $ | 400 | $ | 339 | $ | 599 | $ | 725 | |||||||||

| Mortgage portfolio loans transferred to held for sale during period | $ | — | $ | 200 | $ | — | $ | — | $ | — | $ | 70 | $ | — | |||||||||

| Mortgage portfolio serviced for others | $ | 7,150 | $ | 7,313 | $ | 7,744 | $ | 8,219 | $ | 8,454 | |||||||||||||

| Mortgage servicing rights, net / mortgage portfolio serviced for others | 0.68 | % | 0.68 | % | 0.54 | % | 0.55 | % | 0.58 | % | |||||||||||||

Shares repurchased during period(d) | 2,280 | 4,264 | 1,314 | 966 | — | — | — | ||||||||||||||||

| Shares outstanding, end of period | 152,865 | 153,685 | 153,540 | 153,552 | 153,616 | ||||||||||||||||||

| Paycheck Protection Program fees, net | |||||||||||||||||||||||

| Deferred fees, beginning of period | $ | 12 | $ | — | $ | 18 | $ | 12 | $ | 21 | $ | 24 | $ | — | |||||||||

| Fees received | 18 | 27 | 6 | 12 | — | 1 | 27 | ||||||||||||||||

| Fees recognized | (15) | (3) | (8) | (7) | (9) | (4) | (3) | ||||||||||||||||

| Deferred fees, end of period | $ | 15 | $ | 24 | $ | 15 | $ | 18 | $ | 12 | $ | 21 | $ | 24 | |||||||||

| COVID-19 impacted loans in forbearances ($ in thousands) | |||||||||||||||||||||||

| Total commercial | 15,185 | 17,636 | 30,744 | 310,377 | 863,090 | ||||||||||||||||||

| Total consumer | 4,376 | 19,724 | 47,835 | 375,794 | 724,921 | ||||||||||||||||||

| Total COVID-19 impacted loans in forbearance | $ | 19,561 | $ | 37,360 | $ | 78,579 | $ | 686,171 | $ | 1,588,011 | |||||||||||||

| Selected quarterly ratios | |||||||||||||||||||||||

| Loans / deposits | 87.83 | % | 87.30 | % | 92.33 | % | 93.60 | % | 93.53 | % | |||||||||||||

| Stockholders’ equity / assets | 12.03 | % | 11.94 | % | 12.24 | % | 11.66 | % | 11.34 | % | |||||||||||||

Risk-based capital(e)(f) | |||||||||||||||||||||||

| Total risk-weighted assets | $ | 26,073 | $ | 25,640 | $ | 25,903 | $ | 26,142 | $ | 25,864 | |||||||||||||

| Common equity Tier 1 | $ | 2,790 | $ | 2,759 | $ | 2,706 | $ | 2,672 | $ | 2,651 | |||||||||||||

| Common equity Tier 1 capital ratio | 10.70 | % | 10.76 | % | 10.45 | % | 10.22 | % | 10.25 | % | |||||||||||||

| Tier 1 capital ratio | 11.81 | % | 12.14 | % | 11.81 | % | 11.57 | % | 11.62 | % | |||||||||||||

| Total capital ratio | 14.02 | % | 14.36 | % | 14.02 | % | 13.78 | % | 13.83 | % | |||||||||||||

| Tier 1 leverage ratio | 9.23 | % | 9.53 | % | 9.37 | % | 9.02 | % | 9.08 | % | |||||||||||||

| Mortgage banking, net | |||||||||||||||||||||||

Mortgage servicing fees, net(g) | $ | (2) | $ | 1 | $ | — | $ | (1) | $ | (1) | $ | (1) | $ | (1) | |||||||||

| Gains (losses) and fair value adjustments on loans held for sale | 23 | 31 | 9 | 15 | 15 | 15 | 21 | ||||||||||||||||

| Fair value adjustment on portfolio loans transferred to held for sale | — | 3 | — | — | — | 1 | — | ||||||||||||||||

| Mortgage servicing rights (impairment) recovery | 10 | (17) | — | 11 | 1 | (1) | (8) | ||||||||||||||||

| Mortgage banking, net | $ | 32 | $ | 18 | $ | 8 | $ | 24 | $ | 15 | $ | 13 | $ | 12 | |||||||||

N/M = Not meaningful

Numbers may not sum due to rounding.

(a)Ratio is based upon basic earnings per common share.

(b)Average full time equivalent employees without overtime.

(c)Excludes assets held in brokerage accounts.

(d)Does not include repurchases related to tax withholding on equity compensation.

(e)The Federal Reserve establishes regulatory capital requirements, including well-capitalized standards for the Corporation. The regulatory capital requirements effective for the Corporation follow Basel III, subject to certain transition provisions.

(f)June 30, 2021 data is estimated.

(g)Includes mortgage origination and servicing fees, net of mortgage servicing rights amortization.

4

| Associated Banc-Corp Selected Asset Quality Information | |||||||||||||||||||||||||||||

| ($ in thousands) | Jun 30, 2021 | Mar 31, 2021 | Seql Qtr % Change | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Comp Qtr % Change | ||||||||||||||||||||||

| Allowance for loan losses | |||||||||||||||||||||||||||||

| Balance at beginning of period | $ | 352,938 | $ | 383,702 | (8) | % | $ | 384,711 | $ | 363,803 | $337,793 | 4 | % | ||||||||||||||||

| Provision for loan losses | (29,500) | (26,000) | 13 | % | 26,500 | 50,500 | 52,500 | N/M | |||||||||||||||||||||

| Charge offs | (7,681) | (13,174) | (42) | % | (30,315) | (34,079) | (28,351) | (73) | % | ||||||||||||||||||||

| Recoveries | 3,054 | 8,410 | (64) | % | 2,805 | 4,488 | 1,861 | 64 | % | ||||||||||||||||||||

| Net charge offs | (4,628) | (4,764) | (3) | % | (27,510) | (29,592) | (26,490) | (83) | % | ||||||||||||||||||||

| Balance at end of period | $ | 318,811 | $ | 352,938 | (10) | % | $ | 383,702 | $ | 384,711 | $ | 363,803 | (12) | % | |||||||||||||||

| Allowance for unfunded commitments | |||||||||||||||||||||||||||||

| Balance at beginning of period | $ | 50,776 | $ | 47,776 | 6 | % | $ | 57,276 | $ | 64,776 | $ | 56,276 | (10) | % | |||||||||||||||

| Provision for unfunded commitments | (5,500) | 3,000 | N/M | (9,500) | (7,500) | 8,500 | N/M | ||||||||||||||||||||||

| Balance at end of period | $ | 45,276 | $ | 50,776 | (11) | % | $ | 47,776 | $ | 57,276 | $ | 64,776 | (30) | % | |||||||||||||||

| Allowance for credit losses on loans (ACLL) | $ | 364,087 | $ | 403,714 | (10) | % | $ | 431,478 | $ | 441,988 | $ | 428,579 | (15) | % | |||||||||||||||

| Provision for credit losses on loans | $ | (35,000) | $ | (23,000) | 52 | % | $ | 17,000 | $ | 43,000 | $ | 61,000 | N/M | ||||||||||||||||

| ($ in thousands) | Jun 30, 2021 | Mar 31, 2021 | Seql Qtr % Change | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Comp Qtr % Change | ||||||||||||||||||||||

| Net (charge offs) recoveries | |||||||||||||||||||||||||||||

| PPP Loans | $ | — | $ | — | N/M | $ | — | $ | — | $ | — | N/M | |||||||||||||||||

| Commercial and industrial | 1,333 | 1,367 | (2) | % | (8,514) | (24,834) | (24,919) | N/M | |||||||||||||||||||||

| Commercial real estate—owner occupied | 5 | 4 | 25 | % | 143 | (416) | 1 | N/M | |||||||||||||||||||||

| Commercial and business lending | 1,338 | 1,370 | (2) | % | (8,371) | (25,249) | (24,919) | N/M | |||||||||||||||||||||

| Commercial real estate—investor | (5,589) | (5,886) | (5) | % | (18,696) | (3,609) | 28 | N/M | |||||||||||||||||||||

| Real estate construction | 23 | 29 | (21) | % | 43 | (21) | (3) | N/M | |||||||||||||||||||||

| Commercial real estate lending | (5,566) | (5,857) | (5) | % | (18,653) | (3,630) | 25 | N/M | |||||||||||||||||||||

| Total commercial | (4,228) | (4,487) | (6) | % | (27,024) | (28,879) | (24,893) | (83) | % | ||||||||||||||||||||

| Residential mortgage | (223) | (109) | 105 | % | (162) | (79) | (215) | 4 | % | ||||||||||||||||||||

| Home equity | 337 | 344 | (2) | % | 335 | 156 | (303) | N/M | |||||||||||||||||||||

| Other consumer | (514) | (511) | 1 | % | (659) | (790) | (1,078) | (52) | % | ||||||||||||||||||||

| Total consumer | (400) | (277) | 44 | % | (486) | (712) | (1,596) | (75) | % | ||||||||||||||||||||

| Total net (charge offs) recoveries | $ | (4,628) | $ | (4,764) | (3) | % | $ | (27,510) | $ | (29,592) | $ | (26,490) | (83) | % | |||||||||||||||

| (In basis points) | Jun 30, 2021 | Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | ||||||||||||||||||||||||

| Net charge offs to average loans (annualized) | |||||||||||||||||||||||||||||

| PPP Loans | — | — | — | — | — | ||||||||||||||||||||||||

| Commercial and industrial | 7 | 7 | (45) | (126) | (121) | ||||||||||||||||||||||||

| Commercial real estate—owner occupied | — | — | 6 | (18) | — | ||||||||||||||||||||||||

| Commercial and business lending | 6 | 6 | (35) | (103) | (100) | ||||||||||||||||||||||||

| Commercial real estate—investor | (52) | (55) | (173) | (34) | — | ||||||||||||||||||||||||

| Real estate construction | 1 | 1 | 1 | — | — | ||||||||||||||||||||||||

| Commercial real estate lending | (36) | (38) | (121) | (24) | — | ||||||||||||||||||||||||

| Total commercial | (11) | (12) | (69) | (73) | (64) | ||||||||||||||||||||||||

| Residential mortgage | (1) | (1) | (1) | — | (1) | ||||||||||||||||||||||||

| Home equity | 21 | 21 | 18 | 8 | (15) | ||||||||||||||||||||||||

| Other consumer | (69) | (68) | (83) | (98) | (128) | ||||||||||||||||||||||||

| Total consumer | (2) | (1) | (2) | (3) | (7) | ||||||||||||||||||||||||

| Total net charge offs | (8) | (8) | (44) | (47) | (42) | ||||||||||||||||||||||||

| ($ in thousands) | Jun 30, 2021 | Mar 31, 2021 | Seql Qtr % Change | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Comp Qtr % Change | ||||||||||||||||||||||

| Credit Quality | |||||||||||||||||||||||||||||

| Nonaccrual loans | $ | 147,135 | $ | 163,292 | (10) | % | $ | 210,854 | $ | 231,590 | $ | 171,607 | (14) | % | |||||||||||||||

| Other real estate owned (OREO) | 24,000 | 24,588 | (2) | % | 14,269 | 18,983 | 20,264 | 18 | % | ||||||||||||||||||||

| Other nonperforming assets | — | — | N/M | — | 909 | 909 | (100) | % | |||||||||||||||||||||

| Total nonperforming assets | $ | 171,135 | $ | 187,880 | (9) | % | $ | 225,123 | $ | 251,481 | $ | 192,780 | (11) | % | |||||||||||||||

| Loans 90 or more days past due and still accruing | $ | 1,302 | $ | 1,675 | (22) | % | $ | 1,598 | $ | 1,854 | $ | 1,466 | (11) | % | |||||||||||||||

| Allowance for credit losses on loans to total loans | 1.52 | % | 1.67 | % | 1.76 | % | 1.77 | % | 1.73 | % | |||||||||||||||||||

| Allowance for credit losses on loans to nonaccrual loans | 247.45 | % | 247.23 | % | 204.63 | % | 190.85 | % | 249.74 | % | |||||||||||||||||||

| Nonaccrual loans to total loans | 0.61 | % | 0.68 | % | 0.86 | % | 0.93 | % | 0.69 | % | |||||||||||||||||||

| Nonperforming assets to total loans plus OREO | 0.71 | % | 0.78 | % | 0.92 | % | 1.01 | % | 0.78 | % | |||||||||||||||||||

| Nonperforming assets to total assets | 0.50 | % | 0.54 | % | 0.67 | % | 0.72 | % | 0.54 | % | |||||||||||||||||||

| Year-to-date net charge offs to year-to-date average loans (annualized) | 0.08 | % | 0.08 | % | 0.41 | % | 0.40 | % | 0.36 | % | |||||||||||||||||||

N/M = Not meaningful

5

| Associated Banc-Corp Selected Asset Quality Information (continued) | |||||||||||||||||||||||||||||

| (In thousands) | Jun 30, 2021 | Mar 31, 2021 | Seql Qtr % Change | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Comp Qtr % Change | ||||||||||||||||||||||

| Nonaccrual loans | |||||||||||||||||||||||||||||

| Commercial and industrial | $ | 18,380 | $ | 33,192 | (45) | % | $ | 61,859 | $ | 105,899 | $ | 80,239 | (77) | % | |||||||||||||||

| Commercial real estate—owner occupied | 7 | 7 | — | % | 1,058 | 2,043 | 1,932 | (100) | % | ||||||||||||||||||||

| Commercial and business lending | 18,387 | 33,200 | (45) | % | 62,917 | 107,941 | 82,171 | (78) | % | ||||||||||||||||||||

| Commercial real estate—investor | 63,003 | 58,485 | 8 | % | 78,220 | 50,458 | 11,172 | N/M | |||||||||||||||||||||

| Real estate construction | 247 | 327 | (24) | % | 353 | 392 | 503 | (51) | % | ||||||||||||||||||||

| Commercial real estate lending | 63,250 | 58,813 | 8 | % | 78,573 | 50,850 | 11,675 | N/M | |||||||||||||||||||||

| Total commercial | 81,637 | 92,012 | (11) | % | 141,490 | 158,792 | 93,846 | (13) | % | ||||||||||||||||||||

| Residential mortgage | 56,795 | 61,256 | (7) | % | 59,337 | 62,331 | 66,656 | (15) | % | ||||||||||||||||||||

| Home equity | 8,517 | 9,792 | (13) | % | 9,888 | 10,277 | 10,829 | (21) | % | ||||||||||||||||||||

| Other consumer | 186 | 231 | (19) | % | 140 | 190 | 276 | (33) | % | ||||||||||||||||||||

| Total consumer | 65,498 | 71,280 | (8) | % | 69,364 | 72,798 | 77,761 | (16) | % | ||||||||||||||||||||

| Total nonaccrual loans | $ | 147,135 | $ | 163,292 | (10) | % | $ | 210,854 | $ | 231,590 | $ | 171,607 | (14) | % | |||||||||||||||

| Jun 30, 2021 | Mar 31, 2021 | Seql Qtr % Change | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Comp Qtr % Change | |||||||||||||||||||||||

Restructured loans (accruing)(a) | |||||||||||||||||||||||||||||

| Commercial and industrial | $ | 11,569 | $ | 11,985 | (3) | % | $ | 12,713 | $ | 16,002 | $ | 16,321 | (29) | % | |||||||||||||||

| Commercial real estate—owner occupied | 1,225 | 1,488 | (18) | % | 1,711 | 1,389 | 1,441 | (15) | % | ||||||||||||||||||||

| Commercial and business lending | 12,794 | 13,473 | (5) | % | 14,424 | 17,391 | 17,762 | (28) | % | ||||||||||||||||||||

| Commercial real estate—investor | 13,306 | 13,627 | (2) | % | 26,435 | 635 | 114 | N/M | |||||||||||||||||||||

| Real estate construction | 253 | 256 | (1) | % | 260 | 382 | 313 | (19) | % | ||||||||||||||||||||

| Commercial real estate lending | 13,559 | 13,884 | (2) | % | 26,695 | 1,016 | 427 | N/M | |||||||||||||||||||||

| Total commercial | 26,353 | 27,356 | (4) | % | 41,119 | 18,407 | 18,189 | 45 | % | ||||||||||||||||||||

| Residential mortgage | 12,227 | 10,462 | 17 | % | 7,825 | 5,378 | 4,178 | 193 | % | ||||||||||||||||||||

| Home equity | 2,451 | 1,929 | 27 | % | 1,957 | 1,889 | 1,717 | 43 | % | ||||||||||||||||||||

| Other consumer | 904 | 1,073 | (16) | % | 1,191 | 1,218 | 1,219 | (26) | % | ||||||||||||||||||||

| Total consumer | 15,582 | 13,464 | 16 | % | 10,973 | 8,485 | 7,114 | 119 | % | ||||||||||||||||||||

| Total restructured loans (accruing) | $ | 41,935 | $ | 40,820 | 3 | % | $ | 52,092 | $ | 26,891 | $ | 25,303 | 66 | % | |||||||||||||||

| Nonaccrual restructured loans (included in nonaccrual loans) | $ | 17,237 | $ | 17,624 | (2) | % | $ | 20,190 | $ | 23,844 | $ | 25,362 | (32) | % | |||||||||||||||

| Jun 30, 2021 | Mar 31, 2021 | Seql Qtr % Change | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Comp Qtr % Change | |||||||||||||||||||||||

| Accruing Loans 30-89 Days Past Due | |||||||||||||||||||||||||||||

| Commercial and industrial | $ | 258 | $ | 526 | (51) | % | $ | 6,119 | $ | 298 | $ | 716 | (64) | % | |||||||||||||||

| Commercial real estate—owner occupied | 47 | — | N/M | 373 | 870 | 199 | (76) | % | |||||||||||||||||||||

| Commercial and business lending | 306 | 526 | (42) | % | 6,492 | 1,167 | 916 | (67) | % | ||||||||||||||||||||

| Commercial real estate—investor | 391 | 5,999 | (93) | % | 12,793 | 409 | 13,874 | (97) | % | ||||||||||||||||||||

| Real estate construction | 117 | 977 | (88) | % | 991 | 111 | 385 | (70) | % | ||||||||||||||||||||

| Commercial real estate lending | 509 | 6,976 | (93) | % | 13,784 | 520 | 14,260 | (96) | % | ||||||||||||||||||||

| Total commercial | 814 | 7,502 | (89) | % | 20,276 | 1,687 | 15,175 | (95) | % | ||||||||||||||||||||

| Residential mortgage | 5,015 | 3,973 | 26 | % | 10,385 | 6,185 | 3,023 | 66 | % | ||||||||||||||||||||

| Home equity | 2,472 | 2,352 | 5 | % | 4,802 | 5,609 | 3,108 | (20) | % | ||||||||||||||||||||

| Other consumer | 1,075 | 1,270 | (15) | % | 1,599 | 1,351 | 1,482 | (27) | % | ||||||||||||||||||||

| Total consumer | 8,562 | 7,594 | 13 | % | 16,786 | 13,144 | 7,613 | 12 | % | ||||||||||||||||||||

| Total accruing loans 30-89 days past due | $ | 9,376 | $ | 15,097 | (38) | % | $ | 37,062 | $ | 14,831 | $ | 22,788 | (59) | % | |||||||||||||||

| Jun 30, 2021 | Mar 31, 2021 | Seql Qtr % Change | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Comp Qtr % Change | |||||||||||||||||||||||

| Potential Problem Loans | |||||||||||||||||||||||||||||

PPP Loans(b) | $ | 8,695 | $ | 22,398 | (61) | % | $ | 18,002 | $ | 19,161 | $ | 19,161 | (55) | % | |||||||||||||||

| Commercial and industrial | 77,064 | 122,143 | (37) | % | 121,487 | 144,159 | 176,270 | (56) | % | ||||||||||||||||||||

| Commercial real estate—owner occupied | 17,828 | 15,965 | 12 | % | 26,179 | 22,808 | 15,919 | 12 | % | ||||||||||||||||||||

| Commercial and business lending | 103,587 | 160,506 | (35) | % | 165,668 | 186,129 | 211,350 | (51) | % | ||||||||||||||||||||

| Commercial real estate—investor | 71,613 | 85,752 | (16) | % | 91,396 | 100,459 | 88,237 | (19) | % | ||||||||||||||||||||

| Real estate construction | 16,465 | 13,977 | 18 | % | 19,046 | 2,178 | 2,170 | N/M | |||||||||||||||||||||

| Commercial real estate lending | 88,078 | 99,728 | (12) | % | 110,442 | 102,637 | 90,407 | (3) | % | ||||||||||||||||||||

| Total commercial | 191,665 | 260,234 | (26) | % | 276,111 | 288,766 | 301,758 | (36) | % | ||||||||||||||||||||

| Residential mortgage | 3,024 | 2,524 | 20 | % | 3,749 | 2,396 | 3,157 | (4) | % | ||||||||||||||||||||

| Home equity | 1,558 | 1,729 | (10) | % | 2,068 | 1,632 | 1,921 | (19) | % | ||||||||||||||||||||

| Total consumer | 4,583 | 4,254 | 8 | % | 5,817 | 4,028 | 5,078 | (10) | % | ||||||||||||||||||||

| Total potential problem loans | $ | 196,248 | $ | 264,488 | (26) | % | $ | 281,928 | $ | 292,794 | $ | 306,836 | (36) | % | |||||||||||||||

N/M = Not meaningful

Numbers may not sum due to rounding.

(a) Does not include any restructured loans related to the COVID-19 pandemic in accordance with Section 4013 of the CARES Act.

(b) The Corporation's policy is to assign risk ratings at the borrower level. PPP loans are 100% guaranteed by the SBA and therefore the Corporation considers these loans to have a risk profile similar to pass rated loans.

6

| Associated Banc-Corp Net Interest Income Analysis - Fully Tax-Equivalent Basis - Sequential and Comparable Quarter | |||||||||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||

| June 30, 2021 | March 31, 2021 | June 30, 2020 | |||||||||||||||||||||||||||||||||

| ($ in thousands) | Average Balance | Interest Income /Expense | Average Yield /Rate | Average Balance | Interest Income /Expense | Average Yield /Rate | Average Balance | Interest Income /Expense | Average Yield /Rate | ||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||

| Earning assets | |||||||||||||||||||||||||||||||||||

Loans (a) (b) (c) | |||||||||||||||||||||||||||||||||||

| Commercial PPP lending | $ | 701,440 | $ | 10,048 | 5.75 | % | $ | 806,699 | $ | 8,900 | 4.47 | % | $ | 848,761 | $ | 4,841 | 2.29 | % | |||||||||||||||||

| Commercial and business lending (excl PPP loans) | 8,437,624 | 53,886 | 2.56 | % | 8,537,301 | 54,091 | 2.57 | % | 9,192,910 | 64,097 | 2.80 | % | |||||||||||||||||||||||

| Commercial real estate lending | 6,159,728 | 44,139 | 2.87 | % | 6,171,202 | 44,315 | 2.91 | % | 5,720,262 | 46,057 | 3.24 | % | |||||||||||||||||||||||

| Total commercial | 15,298,792 | 108,073 | 2.83 | % | 15,515,202 | 107,307 | 2.80 | % | 15,761,933 | 114,995 | 2.93 | % | |||||||||||||||||||||||

| Residential mortgage | 7,861,139 | 55,337 | 2.82 | % | 7,962,691 | 55,504 | 2.79 | % | 8,271,757 | 62,860 | 3.04 | % | |||||||||||||||||||||||

| Retail | 938,682 | 11,197 | 4.78 | % | 985,456 | 11,630 | 4.75 | % | 1,157,116 | 14,368 | 4.98 | % | |||||||||||||||||||||||

| Total loans | 24,098,614 | 174,607 | 2.90 | % | 24,463,349 | 174,442 | 2.88 | % | 25,190,806 | 192,223 | 3.06 | % | |||||||||||||||||||||||

| Investment securities | |||||||||||||||||||||||||||||||||||

| Taxable | 3,220,825 | 8,840 | 1.10 | % | 2,976,469 | 7,014 | 0.94 | % | 3,129,113 | 16,103 | 2.06 | % | |||||||||||||||||||||||

Tax-exempt(a) | 1,953,696 | 18,101 | 3.71 | % | 1,900,346 | 17,844 | 3.76 | % | 1,922,392 | 18,270 | 3.80 | % | |||||||||||||||||||||||

| Other short-term investments | 1,766,615 | 1,826 | 0.41 | % | 991,844 | 1,694 | 0.69 | % | 1,016,976 | 2,231 | 0.88 | % | |||||||||||||||||||||||

| Investments and other | 6,941,135 | 28,767 | 1.66 | % | 5,868,659 | 26,553 | 1.81 | % | 6,068,481 | 36,604 | 2.41 | % | |||||||||||||||||||||||

| Total earning assets | 31,039,749 | $ | 203,375 | 2.62 | % | 30,332,008 | $ | 200,994 | 2.67 | % | 31,259,287 | $ | 228,826 | 2.94 | % | ||||||||||||||||||||

| Other assets, net | 3,339,898 | 3,352,135 | 3,586,656 | ||||||||||||||||||||||||||||||||

| Total assets | $ | 34,379,647 | $ | 33,684,143 | $ | 34,845,943 | |||||||||||||||||||||||||||||

| Liabilities and stockholders' equity | |||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities | |||||||||||||||||||||||||||||||||||

| Interest-bearing deposits | |||||||||||||||||||||||||||||||||||

| Savings | $ | 4,121,553 | $ | 357 | 0.03 | % | $ | 3,810,321 | $ | 332 | 0.04 | % | $ | 3,260,040 | $ | 429 | 0.05 | % | |||||||||||||||||

| Interest-bearing demand | 5,879,173 | 1,057 | 0.07 | % | 5,713,270 | 1,178 | 0.08 | % | 5,445,267 | 1,442 | 0.11 | % | |||||||||||||||||||||||

| Money market | 6,981,482 | 1,023 | 0.06 | % | 6,875,730 | 1,059 | 0.06 | % | 6,496,841 | 1,902 | 0.12 | % | |||||||||||||||||||||||

| Network transaction deposits | 908,869 | 264 | 0.12 | % | 1,080,109 | 327 | 0.12 | % | 1,544,737 | 539 | 0.14 | % | |||||||||||||||||||||||

| Time deposits | 1,509,705 | 1,909 | 0.51 | % | 1,658,568 | 3,014 | 0.74 | % | 2,469,899 | 8,866 | 1.44 | % | |||||||||||||||||||||||

| Total interest-bearing deposits | 19,400,781 | 4,609 | 0.10 | % | 19,137,998 | 5,909 | 0.13 | % | 19,216,785 | 13,178 | 0.28 | % | |||||||||||||||||||||||

| Federal funds purchased and securities sold under agreements to repurchase | 157,619 | 30 | 0.08 | % | 136,144 | 26 | 0.08 | % | 204,548 | 51 | 0.10 | % | |||||||||||||||||||||||

| Commercial Paper | 55,209 | 7 | 0.05 | % | 42,774 | 6 | 0.05 | % | 37,526 | 5 | 0.05 | % | |||||||||||||||||||||||

| PPPLF | — | — | — | % | — | — | — | % | 774,500 | 676 | 0.35 | % | |||||||||||||||||||||||

| FHLB advances | 1,620,397 | 9,524 | 2.36 | % | 1,631,895 | 9,493 | 2.36 | % | 2,810,867 | 15,470 | 2.21 | % | |||||||||||||||||||||||

| Long-term funding | 549,222 | 5,575 | 4.06 | % | 549,585 | 5,585 | 4.07 | % | 548,757 | 5,593 | 4.08 | % | |||||||||||||||||||||||

| Total short and long-term funding | 2,382,446 | 15,136 | 2.55 | % | 2,360,397 | 15,109 | 2.58 | % | 4,376,199 | 21,795 | 2.00 | % | |||||||||||||||||||||||

| Total interest-bearing liabilities | 21,783,227 | $ | 19,745 | 0.36 | % | 21,498,395 | $ | 21,018 | 0.40 | % | 23,592,983 | $ | 34,973 | 0.60 | % | ||||||||||||||||||||

| Noninterest-bearing demand deposits | 8,069,851 | 7,666,561 | 6,926,401 | ||||||||||||||||||||||||||||||||

| Other liabilities | 395,950 | 415,195 | 480,041 | ||||||||||||||||||||||||||||||||

| Stockholders’ equity | 4,130,618 | 4,103,991 | 3,846,517 | ||||||||||||||||||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 34,379,647 | $ | 33,684,143 | $ | 34,845,943 | |||||||||||||||||||||||||||||

| Interest rate spread | 2.26 | % | 2.27 | % | 2.34 | % | |||||||||||||||||||||||||||||

| Net free funds | 0.11 | % | 0.12 | % | 0.15 | % | |||||||||||||||||||||||||||||

| Fully tax-equivalent net interest income and net interest margin ("NIM") | $ | 183,629 | 2.37 | % | $ | 179,976 | 2.39 | % | $ | 193,853 | 2.49 | % | |||||||||||||||||||||||

| Fully tax-equivalent adjustment | 4,115 | 4,074 | 3,981 | ||||||||||||||||||||||||||||||||

| Net interest income | $ | 179,515 | $ | 175,902 | $ | 189,872 | |||||||||||||||||||||||||||||

Numbers may not sum due to rounding.

(a)The yield on tax-exempt loans and securities is computed on a fully tax-equivalent basis using a tax rate of 21% and is net of the effects of certain disallowed interest deductions.

(b)Nonaccrual loans and loans held for sale have been included in the average balances.

(c)Interest income includes amortization of net deferred loan origination costs and net accreted purchase loan discount.

7

| Associated Banc-Corp Net Interest Income Analysis - Fully Tax-Equivalent Basis - Year Over Year | ||||||||||||||||||||||||||||||||||||||

| Six Months Ended June 30, | ||||||||||||||||||||||||||||||||||||||

| 2021 | 2020 | |||||||||||||||||||||||||||||||||||||

| ($ in thousands) | Average Balance | Interest Income /Expense | Average Yield / Rate | Average Balance | Interest Income /Expense | Average Yield / Rate | ||||||||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||||||||

| Earning assets | ||||||||||||||||||||||||||||||||||||||

Loans (a) (b) (c) | ||||||||||||||||||||||||||||||||||||||

| Commercial PPP lending | $ | 753,778 | $ | 18,949 | 5.07 | % | $ | 424,380 | $ | 4,841 | 2.29 | % | ||||||||||||||||||||||||||

| Commercial and business lending (excl PPP loans) | 8,487,187 | 107,977 | 2.56 | % | 8,786,511 | 144,314 | 3.30 | % | ||||||||||||||||||||||||||||||

| Commercial real estate lending | 6,165,433 | 88,455 | 2.89 | % | 5,524,915 | 103,556 | 3.77 | % | ||||||||||||||||||||||||||||||

| Total commercial | 15,406,399 | 215,380 | 2.82 | % | 14,735,807 | 252,711 | 3.45 | % | ||||||||||||||||||||||||||||||

Residential mortgage | 7,911,635 | 110,841 | 2.80 | % | 8,338,054 | 132,821 | 3.19 | % | ||||||||||||||||||||||||||||||

| Retail | 961,940 | 22,827 | 4.76 | % | 1,175,851 | 31,841 | 5.43 | % | ||||||||||||||||||||||||||||||

| Total loans | 24,279,974 | 349,049 | 2.89 | % | 24,249,712 | 417,372 | 3.45 | % | ||||||||||||||||||||||||||||||

| Investment securities | ||||||||||||||||||||||||||||||||||||||

| Taxable | 3,099,322 | 15,855 | 1.02 | % | 3,294,669 | 36,375 | 2.21 | % | ||||||||||||||||||||||||||||||

Tax-exempt (a) | 1,927,169 | 35,945 | 3.73 | % | 1,948,320 | 36,873 | 3.79 | % | ||||||||||||||||||||||||||||||

| Other short-term investments | 1,381,370 | 3,521 | 0.51 | % | 745,290 | 5,535 | 1.49 | % | ||||||||||||||||||||||||||||||

| Investments and other | 6,407,860 | 55,320 | 1.73 | % | 5,988,278 | 78,783 | 2.63 | % | ||||||||||||||||||||||||||||||

| Total earning assets | 30,687,834 | $ | 404,369 | 2.65 | % | 30,237,990 | $ | 496,155 | 3.29 | % | ||||||||||||||||||||||||||||

| Other assets, net | 3,345,982 | 3,473,484 | ||||||||||||||||||||||||||||||||||||

| Total assets | $ | 34,033,816 | $ | 33,711,474 | ||||||||||||||||||||||||||||||||||

| Liabilities and stockholders' equity | ||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities | ||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits | ||||||||||||||||||||||||||||||||||||||

| Savings | $ | 3,966,797 | $ | 689 | 0.04 | % | $ | 3,064,440 | $ | 2,228 | 0.15 | % | ||||||||||||||||||||||||||

| Interest-bearing demand | 5,796,680 | 2,234 | 0.08 | % | 5,376,249 | 10,197 | 0.38 | % | ||||||||||||||||||||||||||||||

| Money market | 6,928,898 | 2,082 | 0.06 | % | 6,517,749 | 12,708 | 0.39 | % | ||||||||||||||||||||||||||||||

| Network transaction deposits | 994,016 | 591 | 0.12 | % | 1,489,433 | 5,141 | 0.69 | % | ||||||||||||||||||||||||||||||

| Time deposits | 1,583,725 | 4,923 | 0.63 | % | 2,553,065 | 19,569 | 1.54 | % | ||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 19,270,116 | 10,519 | 0.11 | % | 19,000,936 | 49,844 | 0.53 | % | ||||||||||||||||||||||||||||||

| Federal funds purchased and securities sold under agreements to repurchase | 146,941 | 55 | 0.08 | % | 199,477 | 420 | 0.42 | % | ||||||||||||||||||||||||||||||

| Commercial Paper | 49,026 | 13 | 0.05 | % | 35,904 | 30 | 0.17 | % | ||||||||||||||||||||||||||||||

| PPPLF | — | — | — | % | 387,250 | 676 | 0.35 | % | ||||||||||||||||||||||||||||||

| Other short-term funding | — | — | — | % | 8,498 | 11 | 0.25 | % | ||||||||||||||||||||||||||||||

| FHLB advances | 1,626,114 | 19,017 | 2.36 | % | 3,021,433 | 33,096 | 2.20 | % | ||||||||||||||||||||||||||||||

| Long-term funding | 549,402 | 11,160 | 4.06 | % | 549,111 | 11,200 | 4.08 | % | ||||||||||||||||||||||||||||||

| Total short and long-term funding | 2,371,483 | 30,245 | 2.56 | % | 4,201,674 | 45,432 | 2.17 | % | ||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 21,641,598 | $ | 40,764 | 0.38 | % | 23,202,610 | $ | 95,276 | 0.83 | % | ||||||||||||||||||||||||||||

| Noninterest-bearing demand deposits | 7,869,320 | 6,216,631 | ||||||||||||||||||||||||||||||||||||

| Other liabilities | 405,519 | 448,074 | ||||||||||||||||||||||||||||||||||||

| Stockholders’ equity | 4,117,378 | 3,844,158 | ||||||||||||||||||||||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 34,033,816 | $ | 33,711,474 | ||||||||||||||||||||||||||||||||||

| Interest rate spread | 2.27 | % | 2.46 | % | ||||||||||||||||||||||||||||||||||

| Net free funds | 0.11 | % | 0.20 | % | ||||||||||||||||||||||||||||||||||

| Fully tax-equivalent net interest income and net interest margin ("NIM") | $ | 363,605 | 2.38 | % | $ | 400,879 | 2.66 | % | ||||||||||||||||||||||||||||||

| Fully tax-equivalent adjustment | 8,189 | 8,066 | ||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 355,416 | $ | 392,814 | ||||||||||||||||||||||||||||||||||

Numbers may not sum due to rounding.

(a)The yield on tax-exempt loans and securities is computed on a fully tax-equivalent basis using a tax rate of 21% and is net of the effects of certain disallowed interest deductions.

(b)Nonaccrual loans and loans held for sale have been included in the average balances.

(c)Interest income includes amortization of net deferred loan origination costs and net accreted purchase loan discount.

8

| Associated Banc-Corp Loan and Deposit Composition | ||||||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | ||||||||||||||||||||||||||||||||||||||||||||

| Period end loan composition | Jun 30, 2021 | Mar 31, 2021 | Seql Qtr % Change | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Comp Qtr % Change | |||||||||||||||||||||||||||||||||||||

| PPP Loans | $ | 405,482 | $ | 836,566 | (52) | % | $ | 767,757 | $ | 1,022,217 | $ | 1,012,033 | (60) | % | ||||||||||||||||||||||||||||||

| Commercial and industrial | 7,909,119 | 7,664,501 | 3 | % | 7,701,422 | 7,933,404 | 7,968,709 | (1) | % | |||||||||||||||||||||||||||||||||||

| Commercial real estate—owner occupied | 880,755 | 883,237 | — | % | 900,912 | 904,997 | 914,385 | (4) | % | |||||||||||||||||||||||||||||||||||

| Commercial and business lending | 9,195,355 | 9,384,303 | (2) | % | 9,370,091 | 9,860,618 | 9,895,127 | (7) | % | |||||||||||||||||||||||||||||||||||

| Commercial real estate—investor | 4,300,651 | 4,260,706 | 1 | % | 4,342,584 | 4,320,926 | 4,174,125 | 3 | % | |||||||||||||||||||||||||||||||||||

| Real estate construction | 1,880,897 | 1,882,299 | — | % | 1,840,417 | 1,859,609 | 1,708,189 | 10 | % | |||||||||||||||||||||||||||||||||||

| Commercial real estate lending | 6,181,549 | 6,143,004 | 1 | % | 6,183,001 | 6,180,536 | 5,882,314 | 5 | % | |||||||||||||||||||||||||||||||||||

| Total commercial | 15,376,904 | 15,527,307 | (1) | % | 15,553,091 | 16,041,154 | 15,777,441 | (3) | % | |||||||||||||||||||||||||||||||||||

| Residential mortgage | 7,638,372 | 7,685,218 | (1) | % | 7,878,324 | 7,885,523 | 7,933,518 | (4) | % | |||||||||||||||||||||||||||||||||||

| Home equity | 631,783 | 651,647 | (3) | % | 707,255 | 761,593 | 795,671 | (21) | % | |||||||||||||||||||||||||||||||||||

| Other consumer | 300,477 | 298,156 | 1 | % | 313,054 | 315,483 | 326,040 | (8) | % | |||||||||||||||||||||||||||||||||||

| Total consumer | 8,570,632 | 8,635,020 | (1) | % | 8,898,632 | 8,962,599 | 9,055,230 | (5) | % | |||||||||||||||||||||||||||||||||||

| Total loans | $ | 23,947,536 | $ | 24,162,328 | (1) | % | $ | 24,451,724 | $ | 25,003,753 | $ | 24,832,671 | (4) | % | ||||||||||||||||||||||||||||||

| Period end deposit and customer funding composition | Jun 30, 2021 | Mar 31, 2021 | Seql Qtr % Change | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Comp Qtr % Change | |||||||||||||||||||||||||||||||||||||

| Noninterest-bearing demand | $ | 7,999,143 | $ | 8,496,194 | (6) | % | $ | 7,661,728 | $ | 7,489,048 | $ | 7,573,942 | 6 | % | ||||||||||||||||||||||||||||||

| Savings | 4,182,651 | 4,032,830 | 4 | % | 3,650,085 | 3,529,423 | 3,394,930 | 23 | % | |||||||||||||||||||||||||||||||||||

| Interest-bearing demand | 5,969,285 | 5,748,353 | 4 | % | 6,090,869 | 5,979,449 | 5,847,349 | 2 | % | |||||||||||||||||||||||||||||||||||

| Money market | 7,640,825 | 7,838,437 | (3) | % | 7,322,769 | 7,687,775 | 7,486,319 | 2 | % | |||||||||||||||||||||||||||||||||||

| Time deposits (excluding brokered CDs) | 1,472,395 | 1,561,352 | (6) | % | 1,757,030 | 2,026,852 | 2,244,680 | (34) | % | |||||||||||||||||||||||||||||||||||

| Brokered CDs | — | — | N/M | — | — | 4,225 | (100) | % | ||||||||||||||||||||||||||||||||||||

| Total deposits | 27,264,299 | 27,677,166 | (1) | % | 26,482,481 | 26,712,547 | 26,551,444 | 3 | % | |||||||||||||||||||||||||||||||||||

Customer funding(a) | 226,160 | 182,228 | 24 | % | 245,247 | 198,741 | 178,398 | 27 | % | |||||||||||||||||||||||||||||||||||

| Total deposits and customer funding | $ | 27,490,459 | $ | 27,859,394 | (1) | % | $ | 26,727,727 | $ | 26,911,289 | $ | 26,729,842 | 3 | % | ||||||||||||||||||||||||||||||

Network transaction deposits(b) | $ | 871,603 | $ | 1,054,634 | (17) | % | $ | 1,197,093 | $ | 1,390,778 | $ | 1,496,958 | (42) | % | ||||||||||||||||||||||||||||||

| Net deposits and customer funding (Total deposits and customer funding, excluding Brokered CDs and network transaction deposits) | $ | 26,618,856 | $ | 26,804,761 | (1) | % | $ | 25,530,634 | $ | 25,520,511 | $ | 25,228,660 | 6 | % | ||||||||||||||||||||||||||||||

| Quarter average loan composition | Jun 30, 2021 | Mar 31, 2021 | Seql Qtr % Change | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Comp Qtr % Change | |||||||||||||||||||||||||||||||||||||

| PPP Loans | $ | 701,440 | $ | 806,699 | (13) | % | $ | 929,859 | $ | 1,019,808 | $ | 848,761 | (17) | % | ||||||||||||||||||||||||||||||

| Commercial and industrial | 7,558,878 | 7,631,274 | (1) | % | 7,609,185 | 7,844,209 | 8,263,270 | (9) | % | |||||||||||||||||||||||||||||||||||

| Commercial real estate—owner occupied | 878,746 | 906,027 | (3) | % | 904,565 | 906,874 | 929,640 | (5) | % | |||||||||||||||||||||||||||||||||||

| Commercial and business lending | 9,139,064 | 9,344,000 | (2) | % | 9,443,609 | 9,770,891 | 10,041,671 | (9) | % | |||||||||||||||||||||||||||||||||||

| Commercial real estate—investor | 4,321,109 | 4,303,365 | — | % | 4,289,703 | 4,255,473 | 4,113,895 | 5 | % | |||||||||||||||||||||||||||||||||||

| Real estate construction | 1,838,619 | 1,867,836 | (2) | % | 1,867,919 | 1,776,835 | 1,606,367 | 14 | % | |||||||||||||||||||||||||||||||||||

| Commercial real estate lending | 6,159,728 | 6,171,202 | — | % | 6,157,622 | 6,032,308 | 5,720,262 | 8 | % | |||||||||||||||||||||||||||||||||||

| Total commercial | 15,298,792 | 15,515,202 | (1) | % | 15,601,230 | 15,803,199 | 15,761,933 | (3) | % | |||||||||||||||||||||||||||||||||||

| Residential mortgage | 7,861,139 | 7,962,691 | (1) | % | 8,029,585 | 8,058,283 | 8,271,757 | (5) | % | |||||||||||||||||||||||||||||||||||

| Home equity | 641,438 | 680,738 | (6) | % | 736,059 | 780,202 | 819,680 | (22) | % | |||||||||||||||||||||||||||||||||||

| Other consumer | 297,245 | 304,718 | (2) | % | 314,963 | 321,387 | 337,436 | (12) | % | |||||||||||||||||||||||||||||||||||

| Total consumer | 8,799,822 | 8,948,147 | (2) | % | 9,080,607 | 9,159,872 | 9,428,873 | (7) | % | |||||||||||||||||||||||||||||||||||

Total loans(c) | $ | 24,098,614 | $ | 24,463,349 | (1) | % | $ | 24,681,837 | $ | 24,963,071 | $ | 25,190,806 | (4) | % | ||||||||||||||||||||||||||||||

| Quarter average deposit composition | Jun 30, 2021 | Mar 31, 2021 | Seql Qtr % Change | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Comp Qtr % Change | |||||||||||||||||||||||||||||||||||||

| Noninterest-bearing demand | $ | 8,069,851 | $ | 7,666,561 | 5 | % | $ | 7,677,003 | $ | 7,412,186 | $ | 6,926,401 | 17 | % | ||||||||||||||||||||||||||||||

| Savings | 4,121,553 | 3,810,321 | 8 | % | 3,628,458 | 3,462,942 | 3,260,040 | 26 | % | |||||||||||||||||||||||||||||||||||

| Interest-bearing demand | 5,879,173 | 5,713,270 | 3 | % | 5,739,983 | 5,835,597 | 5,445,267 | 8 | % | |||||||||||||||||||||||||||||||||||

| Money market | 6,981,482 | 6,875,730 | 2 | % | 6,539,583 | 6,464,784 | 6,496,841 | 7 | % | |||||||||||||||||||||||||||||||||||

| Network transaction deposits | 908,869 | 1,080,109 | (16) | % | 1,265,748 | 1,528,199 | 1,544,737 | (41) | % | |||||||||||||||||||||||||||||||||||

| Time deposits | 1,509,705 | 1,658,568 | (9) | % | 1,888,074 | 2,135,870 | 2,469,899 | (39) | % | |||||||||||||||||||||||||||||||||||

| Total deposits | $ | 27,470,633 | $ | 26,804,559 | 2 | % | $ | 26,738,850 | $ | 26,839,578 | $ | 26,143,186 | 5 | % | ||||||||||||||||||||||||||||||

N/M = Not meaningful

Numbers may not sum due to rounding.

(a)Includes repurchase agreements and commercial paper.

(b)Included above in interest-bearing demand and money market.

(c)Nonaccrual loans and loans held for sale have been included in the average balances.

9

| Associated Banc-Corp Non-GAAP Financial Measures Reconciliation | YTD | YTD | |||||||||||||||||||||

| ($ in millions, except per share data) | Jun 2021 | Jun 2020 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | ||||||||||||||||

Tangible common equity reconciliation(a) | |||||||||||||||||||||||

| Common equity | $ | 3,820 | $ | 3,774 | $ | 3,737 | $ | 3,692 | $ | 3,671 | |||||||||||||

| Goodwill and other intangible assets, net | (1,167) | (1,170) | (1,178) | (1,178) | (1,181) | ||||||||||||||||||

| Tangible common equity | $ | 2,652 | $ | 2,605 | $ | 2,560 | $ | 2,513 | $ | 2,490 | |||||||||||||

Tangible assets reconciliation(a) | |||||||||||||||||||||||

| Total assets | $ | 34,153 | $ | 34,575 | $ | 33,420 | $ | 34,699 | $ | 35,501 | |||||||||||||

| Goodwill and other intangible assets, net | (1,167) | (1,170) | (1,178) | (1,178) | (1,181) | ||||||||||||||||||

| Tangible assets | $ | 32,985 | $ | 33,406 | $ | 32,242 | $ | 33,520 | $ | 34,321 | |||||||||||||

Average tangible common equity and average common equity tier 1 reconciliation(a) | |||||||||||||||||||||||

| Common equity | $ | 3,769 | $ | 3,576 | $ | 3,788 | $ | 3,750 | $ | 3,700 | $ | 3,681 | $ | 3,566 | |||||||||

| Goodwill and other intangible assets, net | (1,172) | (1,277) | (1,169) | (1,175) | (1,178) | (1,180) | (1,281) | ||||||||||||||||

| Tangible common equity | 2,598 | 2,299 | 2,619 | 2,576 | 2,522 | 2,501 | 2,285 | ||||||||||||||||

| Modified CECL transitional amount | 111 | 109 | 106 | 116 | 123 | 120 | 115 | ||||||||||||||||

| Accumulated other comprehensive loss (income) | (4) | 9 | (3) | (5) | (4) | (4) | 8 | ||||||||||||||||

| Deferred tax assets (liabilities), net | 40 | 46 | 40 | 41 | 42 | 42 | 45 | ||||||||||||||||

| Average common equity tier 1 | $ | 2,745 | $ | 2,462 | $ | 2,762 | $ | 2,727 | $ | 2,683 | $ | 2,660 | $ | 2,453 | |||||||||

Average tangible assets reconciliation(a) | |||||||||||||||||||||||

| Total assets | $ | 34,034 | $ | 33,711 | $ | 34,380 | $ | 33,684 | $ | 34,076 | $ | 35,550 | $ | 34,846 | |||||||||

| Goodwill and other intangible assets, net | (1,172) | (1,277) | (1,169) | (1,175) | (1,178) | (1,180) | (1,281) | ||||||||||||||||

| Tangible assets | $ | 32,862 | $ | 32,435 | $ | 33,211 | $ | 32,510 | $ | 32,898 | $ | 34,371 | $ | 33,565 | |||||||||

Selected trend information(b) | |||||||||||||||||||||||

| Wealth management fees | $ | 45 | $ | 42 | $ | 23 | $ | 22 | $ | 22 | $ | 21 | $ | 21 | |||||||||

| Service charges and deposit account fees | 30 | 27 | 16 | 15 | 15 | 14 | 11 | ||||||||||||||||

| Card-based fees | 21 | 18 | 11 | 10 | 10 | 10 | 9 | ||||||||||||||||

| Other fee-based revenue | 9 | 9 | 4 | 5 | 5 | 5 | 5 | ||||||||||||||||

| Fee-based revenue | 105 | 96 | 53 | 52 | 52 | 51 | 46 | ||||||||||||||||

| Other | 64 | 257 | 20 | 44 | 33 | 25 | 208 | ||||||||||||||||

| Total noninterest income | $ | 169 | $ | 353 | $ | 73 | $ | 95 | $ | 86 | $ | 76 | $ | 254 | |||||||||

Pre-tax pre-provision income(c) | |||||||||||||||||||||||

| Income before income taxes | $ | 232 | $ | 256 | $ | 113 | $ | 119 | $ | 84 | $ | (13) | $ | 200 | |||||||||

| Provision for credit losses | (58) | 114 | (35) | (23) | 17 | 43 | 61 | ||||||||||||||||