Form 8-K 23andMe Holding Co. For: Jan 18

23andMe R&D Day January 18, 2022 Exhibit 99.1

Disclaimer Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the future performance of 23andMe’s businesses in consumer genetics and therapeutics and the growth and potential of its proprietary research platform. All statements, other than statements of historical fact, included or incorporated in this presentation, including statements regarding 23andMe’s strategy, financial position, funding for continued operations, cash reserves, projected costs, plans, and objectives of management, are forward-looking statements. The words "believes," "anticipates," "estimates," "plans," "expects," "intends," "may," "could," "should," "potential," "likely," "projects," "continue," "will," “schedule,” and "would" or, in each case, their negative or other variations or comparable terminology, are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are predictions based on 23andMe’s current expectations and projections about future events and various assumptions. 23andMe cannot guarantee that it will actually achieve the plans, intentions, or expectations disclosed in its forward-looking statements and you should not place undue reliance on 23andMe’s forward-looking statements. These forward-looking statements involve a number of risks, uncertainties (many of which are beyond the control of 23andMe), or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. The forward-looking statements contained herein are also 8-K filed with the Securities and Exchange Commission (“SEC”) on June 21, 2021 and in 23andMe’s Current Report on Form 10-Q filed with the SEC on November 10, 2021, as well as other filings made by 23andMe with the SEC from time to time. Investors are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date they are made. Except as required by law, 23andMe does not undertake any obligation to update or revise any forward-looking statements whether as a result of new information, future events, or otherwise. Intellectual Property All rights to the trademarks, copyrights, logos and other intellectual property listed herein belong to their respective owners 23andMe’s use thereof does not imply an affiliation with, or endorsement by the owners of such trademarks, copyrights, logos and other intellectual property. Solely for convenience, trademarks and trade names referred to in this Presentation may appear with the ® or ™ symbols, but such references are not intended to indicate, in any way, that such names and logos are trademarks or registered trademarks of 23andMe. Industry and Market Data This Presentation relies on and refers to certain information and statistics based on 23andMe’s management’s estimates, and/or obtained from third party sources which it believes to be reliable. 23andMe has not independently verified the accuracy or completeness of any such third party information.

Agenda Introduction -- Anne Wojcicki, CEO and Co-Founder 23andMe Therapeutics Therapeutics program overview – Kenneth Hillan, Head of Therapeutics Target discovery vision – Joe Arron, Chief Scientific Officer, Therapeutics Genetics-based target discovery – Adam Auton, VP of Human Genetics CD200R1 immuno-oncology program – Jennifer Low, Head of Therapeutics Development and Adrian Jubb, Sr. Clin. Dev. Fellow, Therapeutics CD96 immuno-oncology program – Jennifer Low, Head of Therapeutics Development Using genetics to inform clinical development – Jennifer Low, Head of Therapeutics Development Therapeutics program concluding remarks – Kenneth Hillan, Head of Therapeutics 23andMe Consumer Genetics-based primary care – Paul Johnson, VP, General Manager, Consumer The power of polygenic risk scores (PRS) for personalized health – Geoff Benton, Director, Product R&D Delivering a genetic-based primary care service – Davis Liu, Chief Clinical Officer Concluding Remarks – Anne Wojcicki, CEO and Co-Founder Q&A

Introduction Anne Wojcicki CEO and Co-Founder

Today’s News on 23andMe and GSK Collaboration GSK has elected to extend the exclusive target discovery period of the collaboration for a fifth year We will continue to discover and validate novel drug targets using 23andMe’s proprietary genetic and health survey database 23andMe will receive a one-time payment of $50 million 23andMe elects for royalty option on collaboration program targeting CD96 23andMe will be eligible to earn tiered worldwide royalties up to the low double digits The worldwide royalty option curtails 23andMe’s future investment in this program and provides 23andMe with a potentially high value revenue stream if the program is successful

Advanced a wholly owned immuno-oncology program into Phase 1 study Acquired Lemonaid Health to expand into Primary Care and Pharmacy Received FDA clearance for HOXB13 hereditary prostate cancer Released 14 new genetic health predisposition reports Reported on key genetic research findings on COVID-19, reproductive lifespan in women, depression, Parkinson’s disease, and more Added a new ancestry analysis, including additional insights into some customers’ indigenous genetic ancestry from North America and ancestral connections to 25 African ethnolinguistic groups FY2022 Highlights

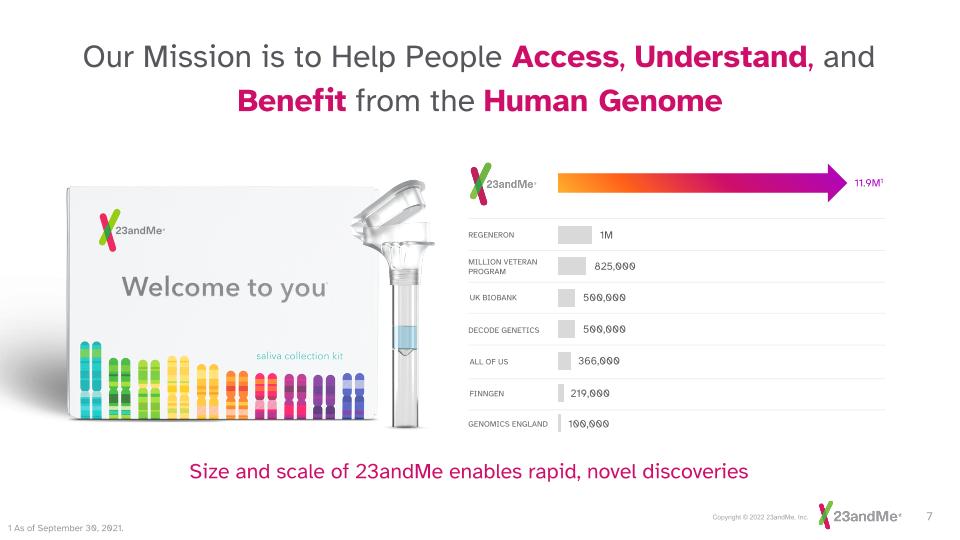

100,000 Our Mission is to Help People Access, Understand, and Benefit from the Human Genome 11.9M1 1M 825,000 500,000 366,000 219,000 500,000 REGENERON ALL OF US MILLION VETERAN PROGRAM FINNGEN UK BIOBANK DECODE GENETICS GENOMICS ENGLAND Size and scale of 23andMe enables rapid, novel discoveries 1 As of September 30, 2021.

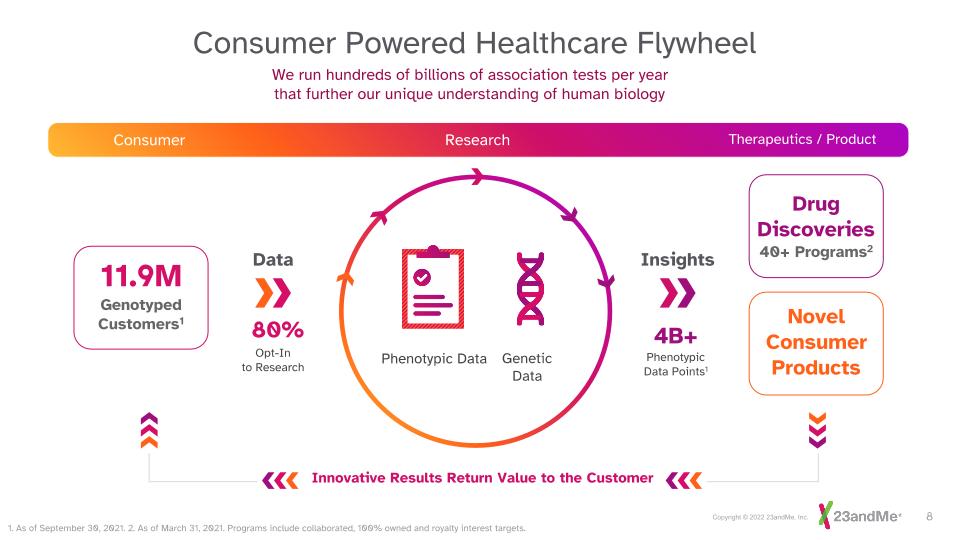

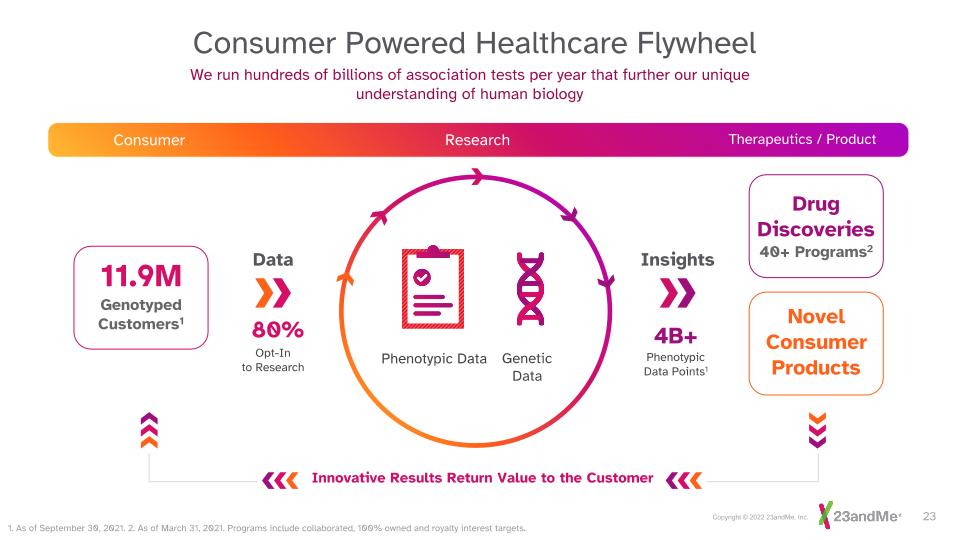

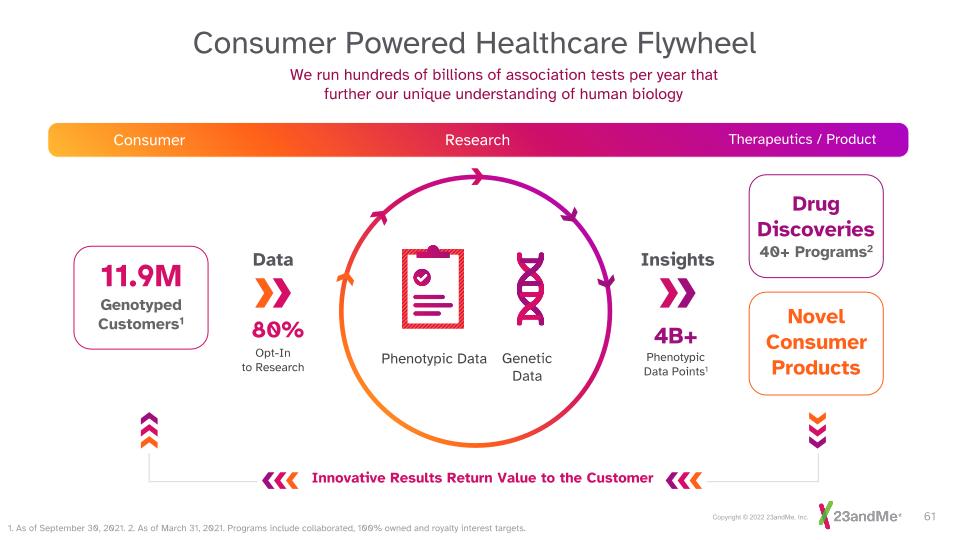

Novel Consumer Products Insights Drug Discoveries 40+ Programs2 Phenotypic Data Genetic Data 11.9M Genotyped Customers1 Innovative Results Return Value to the Customer We run hundreds of billions of association tests per year that further our unique understanding of human biology Consumer Powered Healthcare Flywheel Consumer Research Therapeutics / Product Data 80% Opt-In to Research 1. As of September 30, 2021. 2. As of March 31, 2021. Programs include collaborated, 100% owned and royalty interest targets. 4B+ Phenotypic Data Points1

What’s Coming: Next Generation Reports: Polygenic Risk Score reports that incorporate life-style factors to improve risk estimates Genetics-based Primary Care: Delivering personalized, prevention-oriented, genetics-based healthcare at scale by integrating Lemonaid Health’s digital health platform with 23andMe’s personal genetic services Advancing Therapeutics Pipeline: Advancing a pipeline of multiple clinical and research stage investigational programs addressing targets validated by human genetics

Therapeutics Program Overview Kenneth Hillan, M.B., Ch.B. Head of Therapeutics

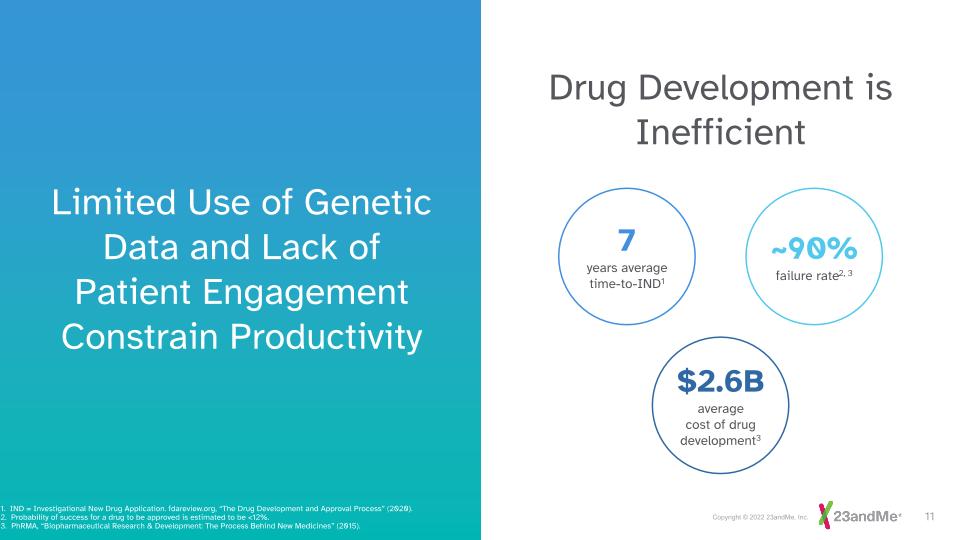

$2.6B average cost of drug development3 ~90% failure rate2, 3 7 years average time-to-IND1 Drug Development is Inefficient Limited Use of Genetic Data and Lack of Patient Engagement Constrain Productivity 1. IND = Investigational New Drug Application. fdareview.org, “The Drug Development and Approval Process” (2020). 2. Probability of success for a drug to be approved is estimated to be <12%. 3. PhRMA, “Biopharmaceutical Research & Development: The Process Behind New Medicines” (2015).

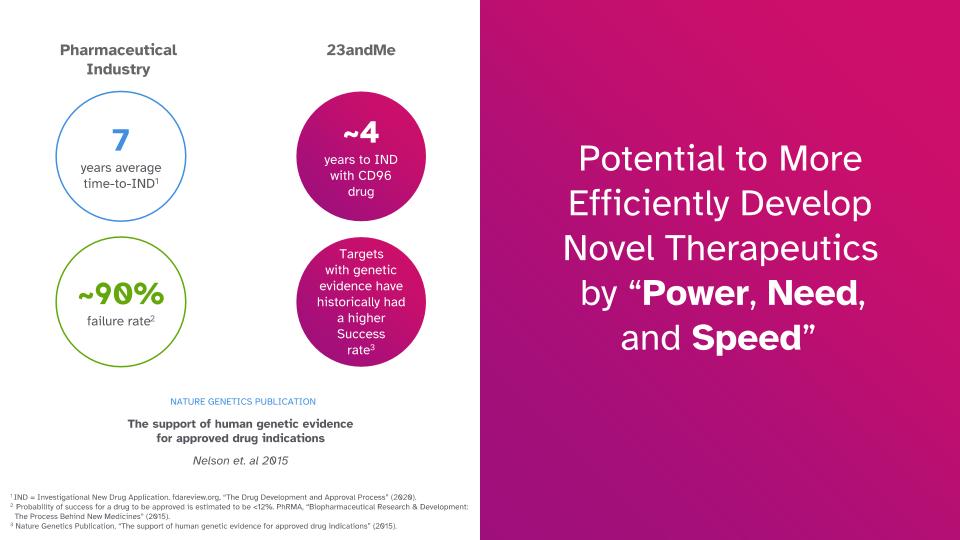

The support of human genetic evidence for approved drug indications Nelson et. al 2015 7 years average time-to-IND1 ~90% failure rate2 ~4 years to IND with CD96 drug Targets with genetic evidence have historically had a higher Success rate3 Potential to More Efficiently Develop Novel Therapeutics by “Power, Need, and Speed” NATURE GENETICS PUBLICATION 1 IND = Investigational New Drug Application. fdareview.org, “The Drug Development and Approval Process” (2020). 2 Probability of success for a drug to be approved is estimated to be <12%. PhRMA, “Biopharmaceutical Research & Development: The Process Behind New Medicines” (2015). 3 Nature Genetics Publication, “The support of human genetic evidence for approved drug indications” (2015). Pharmaceutical Industry 23andMe

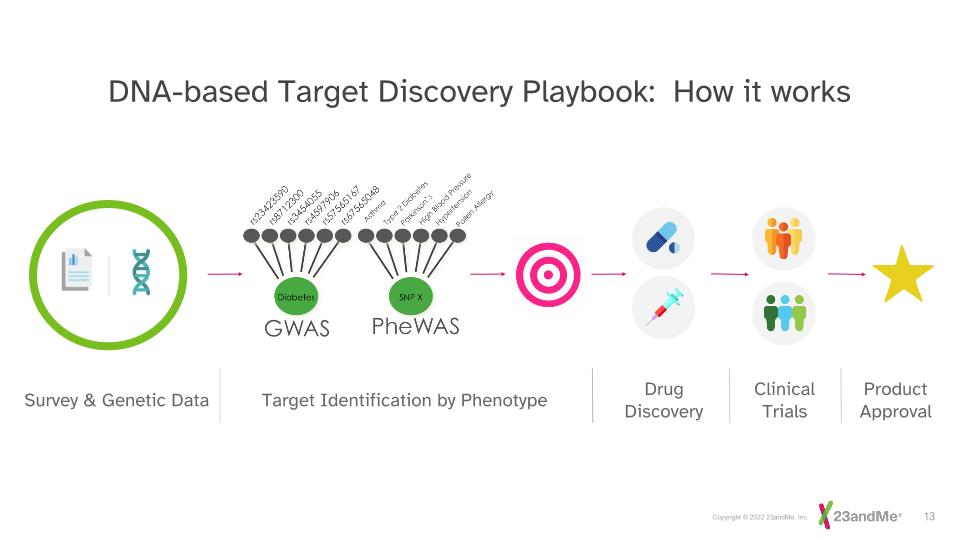

DNA-based Target Discovery Playbook: How it works Target Identification by Phenotype Drug Discovery Clinical Trials Product Approval Survey & Genetic Data

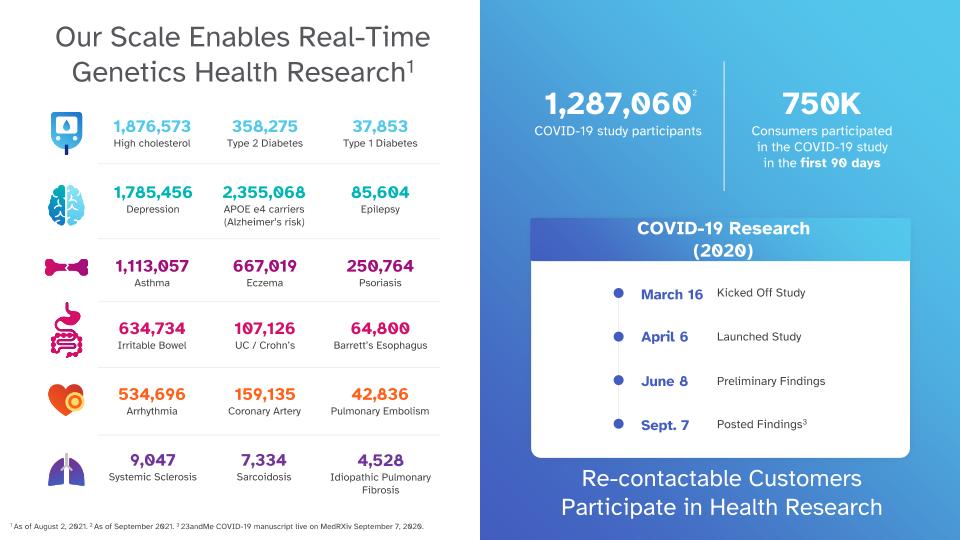

Our Scale Enables Real-Time Genetics Health Research1 COVID-19 Research (2020) March 16 April 6 June 8 Kicked Off Study Launched Study Preliminary Findings 750K Consumers participated in the COVID-19 study in the first 90 days 1,287,060 COVID-19 study participants Sept. 7 Posted Findings3 1,876,573 High cholesterol 358,275 Type 2 Diabetes 37,853 Type 1 Diabetes 2,355,068 APOE e4 carriers (Alzheimer’s risk) 1,785,456 Depression 85,604 Epilepsy 1,113,057 Asthma 667,019 Eczema 250,764 Psoriasis 634,734 Irritable Bowel 107,126 UC / Crohn’s 64,800 Barrett’s Esophagus 534,696 Arrhythmia 159,135 Coronary Artery 42,836 Pulmonary Embolism 4,528 Idiopathic Pulmonary Fibrosis 9,047 Systemic Sclerosis 7,334 Sarcoidosis 2 1 As of August 2, 2021. 2 As of September 2021. 3 23andMe COVID-19 manuscript live on MedRXiv September 7, 2020. Re-contactable Customers Participate in Health Research

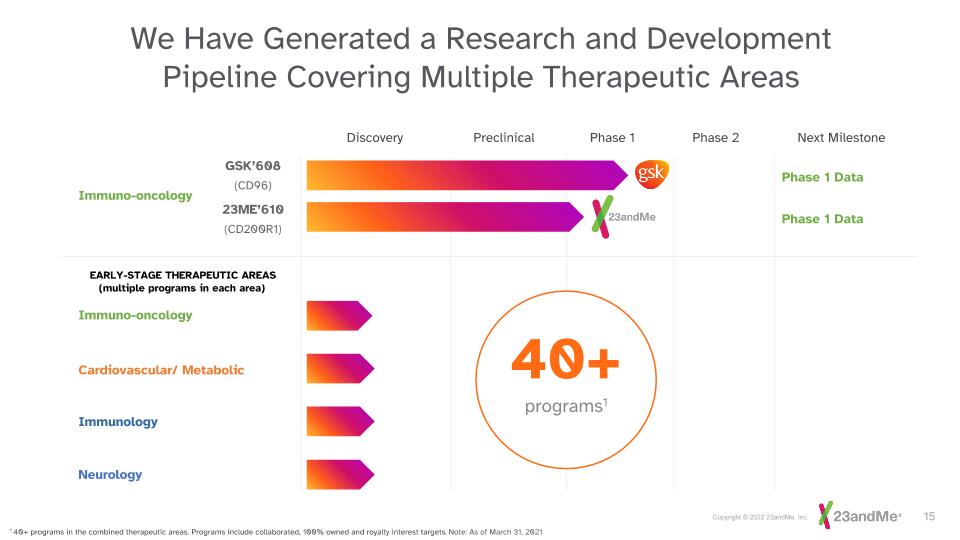

We Have Generated a Research and Development Pipeline Covering Multiple Therapeutic Areas 1 40+ programs in the combined therapeutic areas. Programs include collaborated, 100% owned and royalty interest targets. Note: As of March 31, 2021 Immunology Immuno-oncology Phase 1 Data Phase 1 Data Discovery Next Milestone Preclinical Phase 1 Phase 2 Cardiovascular/ Metabolic GSK’608 (CD96) 23ME’610 (CD200R1) Neurology Immuno-oncology EARLY-STAGE THERAPEUTIC AREAS (multiple programs in each area) 40+ programs1

Target Discovery Vison Joe Arron, M.D., Ph.D. Chief Scientific Officer, Therapeutics

MD/PhD Cornell and Rockefeller Postdoc Stanford Genentech 2006-2021 VP and Senior Fellow, Immunology Research Led target discovery for inflammatory, fibrotic, & ophthalmic diseases across >20 laboratories Developed forward & reverse translational strategies across multiple disease areas Contributed to >25 clinical programs from discovery through postmarketing Authored >75 peer-reviewed publications My Background

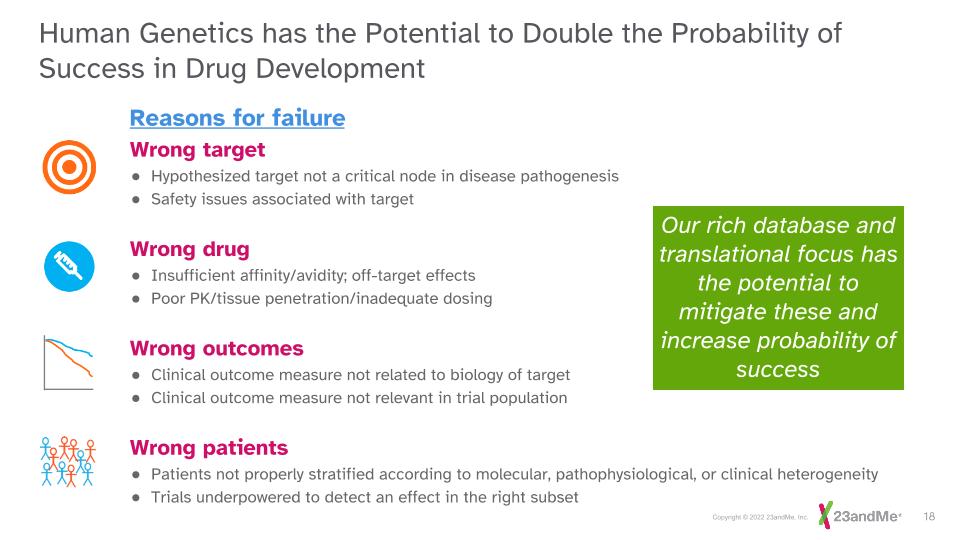

Reasons for failure Wrong target Hypothesized target not a critical node in disease pathogenesis Safety issues associated with target Wrong drug Insufficient affinity/avidity; off-target effects Poor PK/tissue penetration/inadequate dosing Wrong outcomes Clinical outcome measure not related to biology of target Clinical outcome measure not relevant in trial population Wrong patients Patients not properly stratified according to molecular, pathophysiological, or clinical heterogeneity Trials underpowered to detect an effect in the right subset Our rich database and translational focus has the potential to mitigate these and increase probability of success Human Genetics has the Potential to Double the Probability of Success in Drug Development

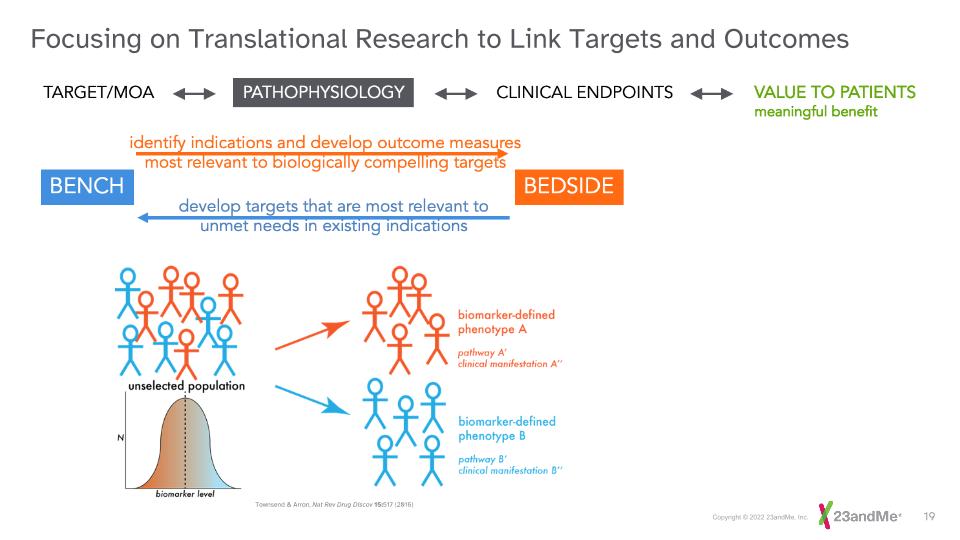

Townsend & Arron, Nat Rev Drug Discov 15:517 (2016) Focusing on Translational Research to Link Targets and Outcomes

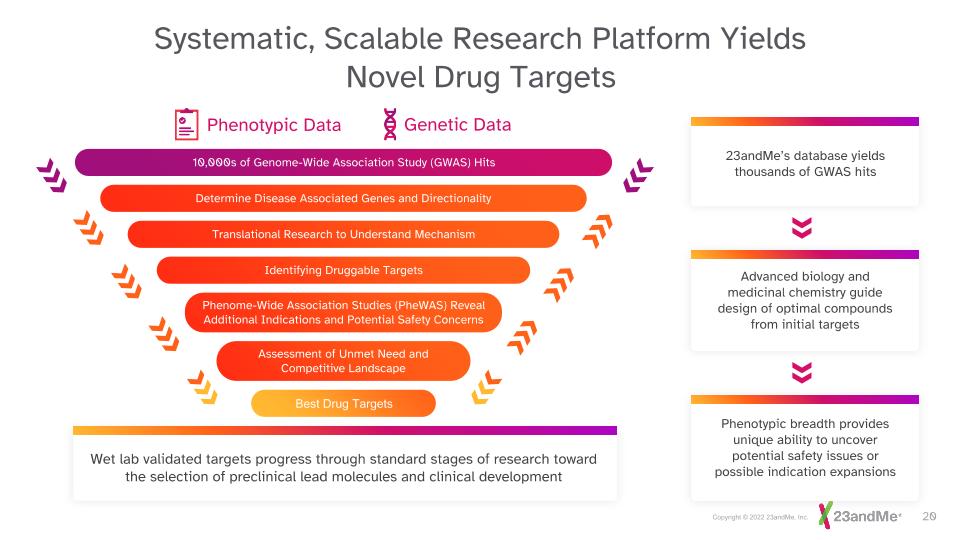

10,000s of Genome-Wide Association Study (GWAS) Hits Determine Disease Associated Genes and Directionality Translational Research to Understand Mechanism Identifying Druggable Targets Assessment of Unmet Need and Competitive Landscape Best Drug Targets Wet lab validated targets progress through standard stages of research toward the selection of preclinical lead molecules and clinical development Phenotypic Data 23andMe’s database yields thousands of GWAS hits Advanced biology and medicinal chemistry guide design of optimal compounds from initial targets Phenotypic breadth provides unique ability to uncover potential safety issues or possible indication expansions Phenome-Wide Association Studies (PheWAS) Reveal Additional Indications and Potential Safety Concerns Genetic Data Systematic, Scalable Research Platform Yields Novel Drug Targets

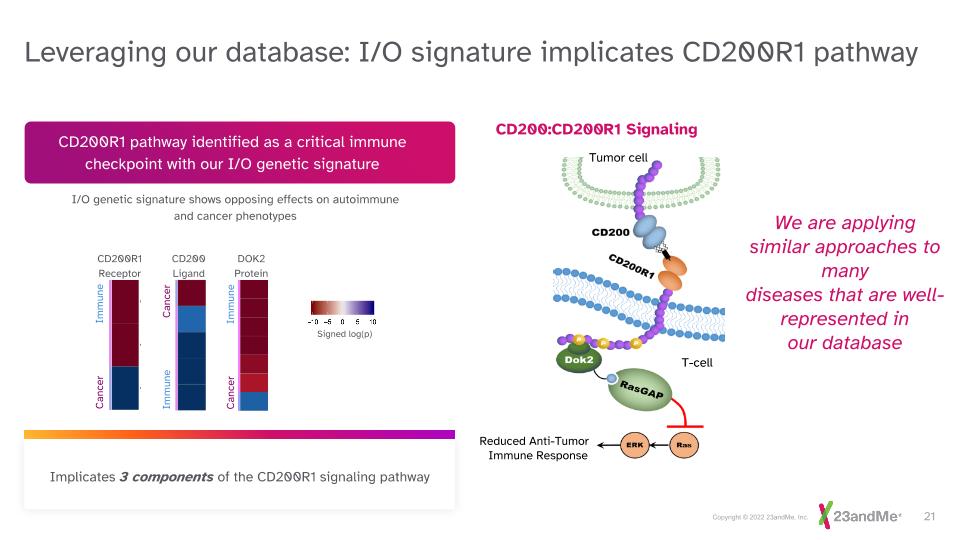

Leveraging our database: I/O signature implicates CD200R1 pathway Implicates 3 components of the CD200R1 signaling pathway Immune Immune Cancer Cancer CD200 Ligand CD200R1 Receptor DOK2 Protein Signed log(p) Cancer Immune CD200R1 pathway identified as a critical immune checkpoint with our I/O genetic signature I/O genetic signature shows opposing effects on autoimmune and cancer phenotypes We are applying similar approaches to many diseases that are well-represented in our database Reduced Anti-Tumor Immune Response CD200:CD200R1 Signaling T-cell Tumor cell

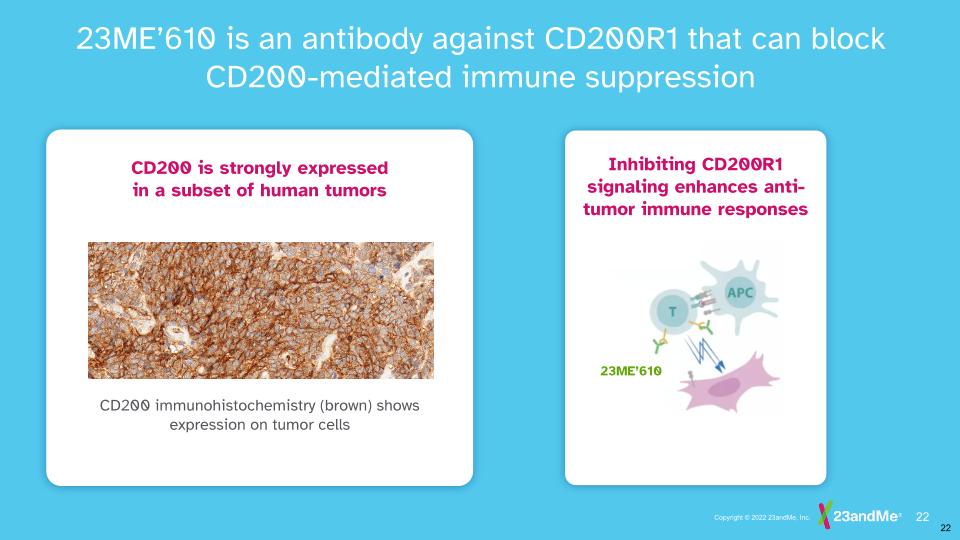

23ME’610 is an antibody against CD200R1 that can block CD200-mediated immune suppression Inhibiting CD200R1 signaling enhances anti-tumor immune responses CD200 immunohistochemistry (brown) shows expression on tumor cells CD200 is strongly expressed in a subset of human tumors 23ME’610

Novel Consumer Products Insights Drug Discoveries 40+ Programs2 Phenotypic Data Genetic Data 11.9M Genotyped Customers1 Innovative Results Return Value to the Customer We run hundreds of billions of association tests per year that further our unique understanding of human biology Consumer Powered Healthcare Flywheel Consumer Research Therapeutics / Product Data 80% Opt-In to Research 1. As of September 30, 2021. 2. As of March 31, 2021. Programs include collaborated, 100% owned and royalty interest targets. 4B+ Phenotypic Data Points1

Genetics-based Target Discovery Adam Auton, Ph.D. Vice President, Human Genetics

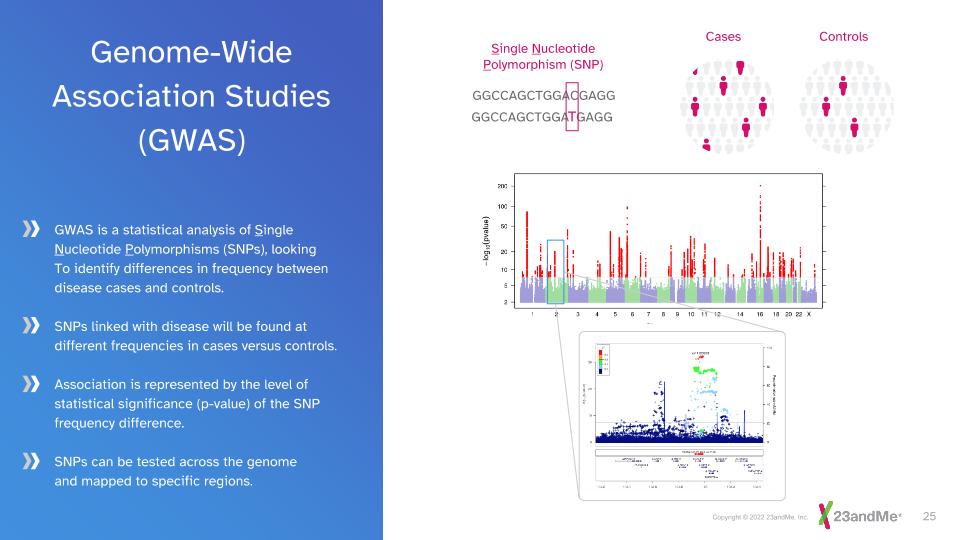

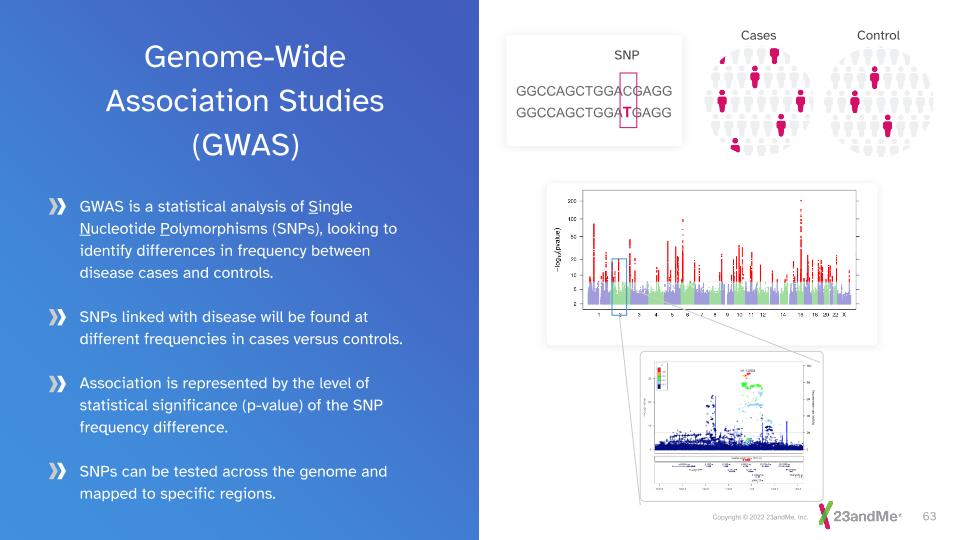

GWAS is a statistical analysis of Single Nucleotide Polymorphisms (SNPs), looking To identify differences in frequency between disease cases and controls. SNPs linked with disease will be found at different frequencies in cases versus controls. Association is represented by the level of statistical significance (p-value) of the SNP frequency difference. SNPs can be tested across the genome and mapped to specific regions. Genome-Wide Association Studies (GWAS) Cases Controls GGCCAGCTGGACGAGG GGCCAGCTGGATGAGG Single Nucleotide Polymorphism (SNP)

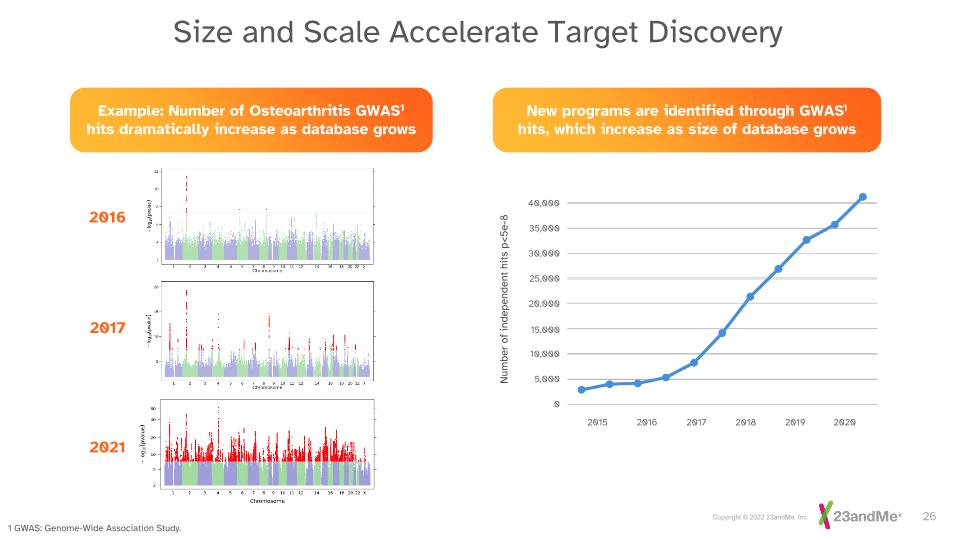

Number of independent hits p<5e-8 2015 2016 2017 2018 2019 2020 10,000 5,000 0 15,000 20,000 25,000 30,000 35,000 40,000 Example: Number of Osteoarthritis GWAS1 hits dramatically increase as database grows 2016 2017 2021 New programs are identified through GWAS1 hits, which increase as size of database grows 1 GWAS: Genome-Wide Association Study. Size and Scale Accelerate Target Discovery

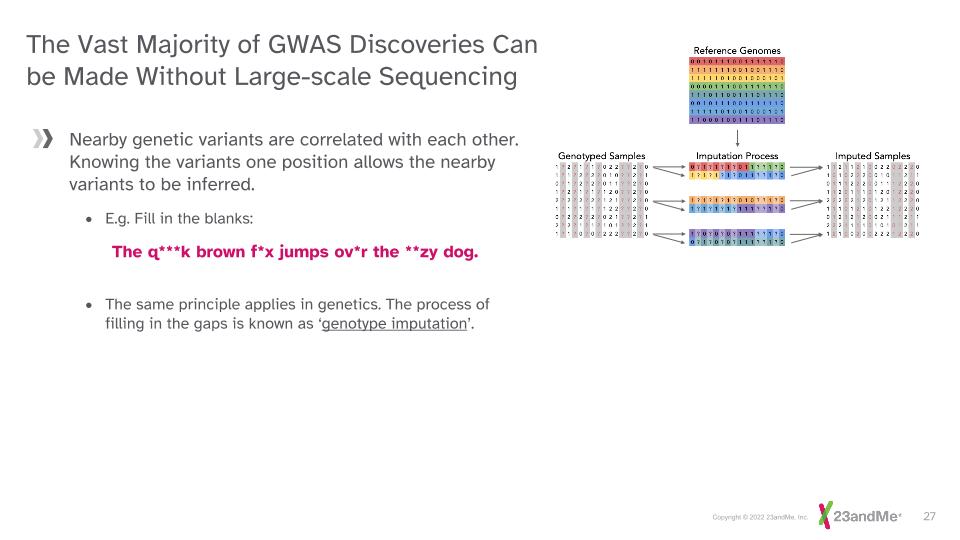

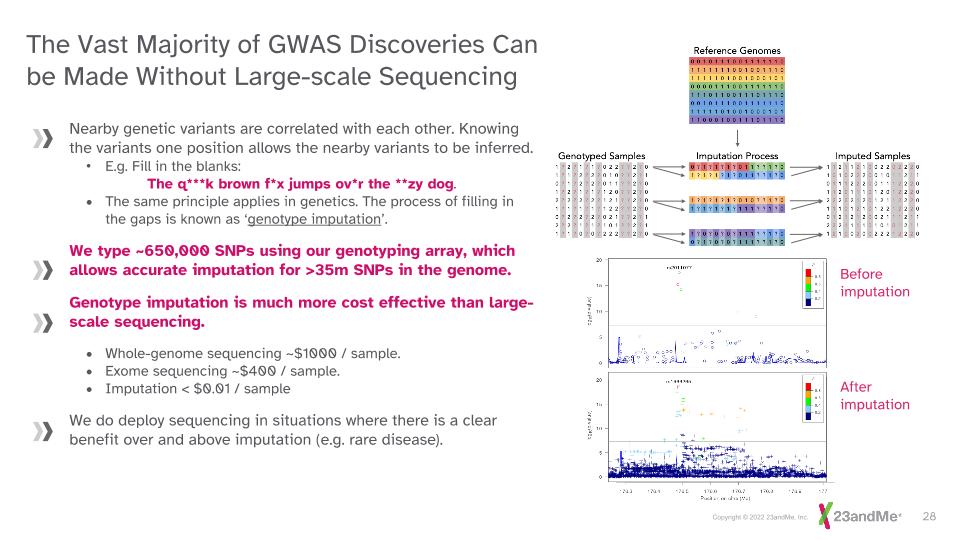

Nearby genetic variants are correlated with each other. Knowing the variants one position allows the nearby variants to be inferred. E.g. Fill in the blanks: The q***k brown f*x jumps ov*r the **zy dog. The same principle applies in genetics. The process of filling in the gaps is known as ‘genotype imputation’. The Vast Majority of GWAS Discoveries Can be Made Without Large-scale Sequencing

Nearby genetic variants are correlated with each other. Knowing the variants one position allows the nearby variants to be inferred. E.g. Fill in the blanks: The q***k brown f*x jumps ov*r the **zy dog. The same principle applies in genetics. The process of filling in the gaps is known as ‘genotype imputation’. We type ~650,000 SNPs using our genotyping array, which allows accurate imputation for >35m SNPs in the genome. Genotype imputation is much more cost effective than large-scale sequencing. Whole-genome sequencing ~$1000 / sample. Exome sequencing ~$400 / sample. Imputation < $0.01 / sample We do deploy sequencing in situations where there is a clear benefit over and above imputation (e.g. rare disease). Before imputation After imputation The Vast Majority of GWAS Discoveries Can be Made Without Large-scale Sequencing

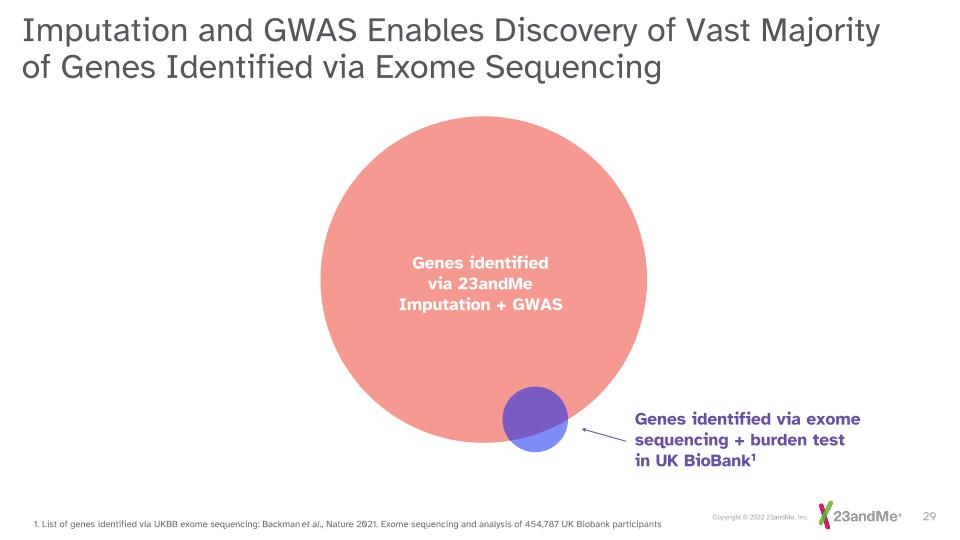

Imputation and GWAS Enables Discovery of Vast Majority of Genes Identified via Exome Sequencing Genes identified via 23andMe Imputation + GWAS Genes identified via exome sequencing + burden test in UK BioBank1 1. List of genes identified via UKBB exome sequencing: Backman et al., Nature 2021. Exome sequencing and analysis of 454,787 UK Biobank participants

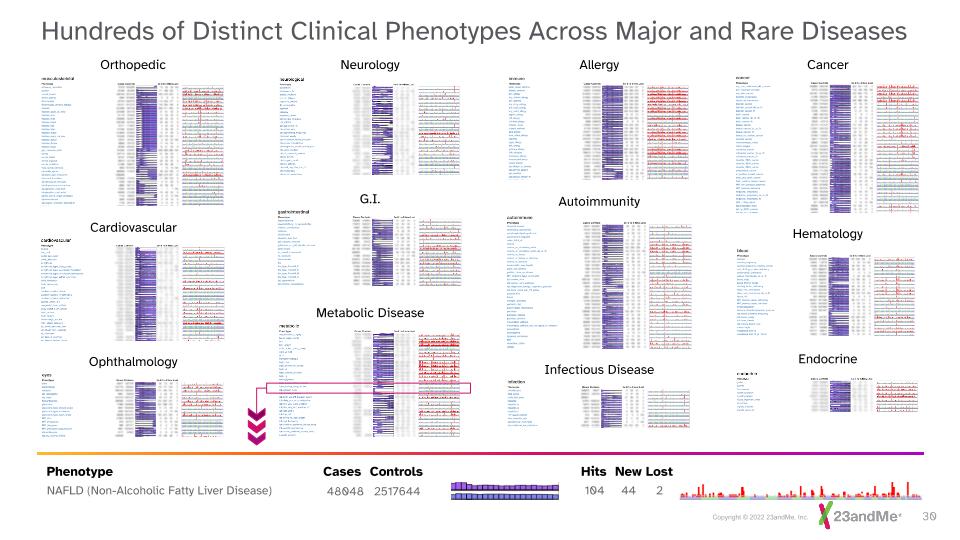

Cancer Endocrine Hematology Autoimmunity Allergy Infectious Disease Cardiovascular Orthopedic Ophthalmology Neurology G.I. Metabolic Disease NAFLD (Non-Alcoholic Fatty Liver Disease) Hundreds of Distinct Clinical Phenotypes Across Major and Rare Diseases Phenotype Cases Controls Hits New Lost 48048 2517644 104 44 2

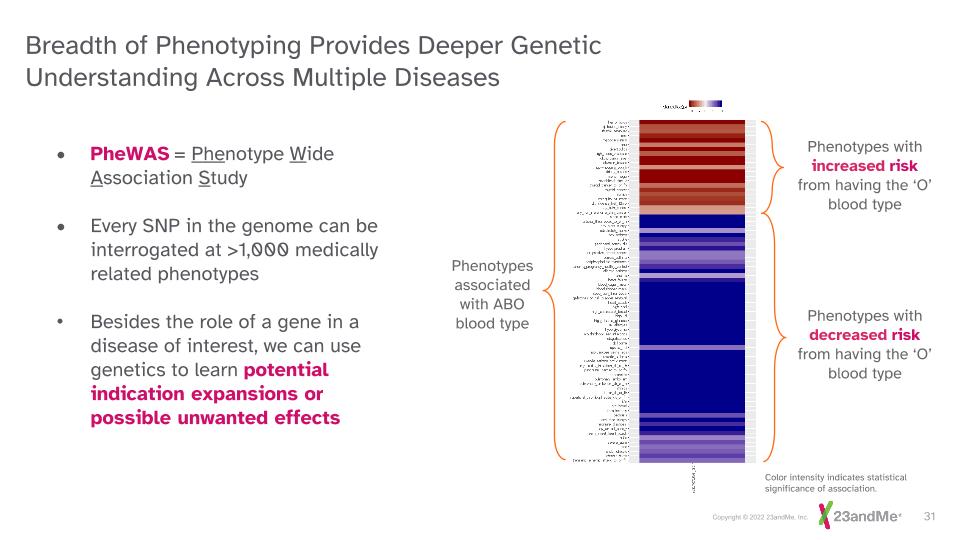

PheWAS = Phenotype Wide Association Study Every SNP in the genome can be interrogated at >1,000 medically related phenotypes Besides the role of a gene in a disease of interest, we can use genetics to learn potential indication expansions or possible unwanted effects Phenotypes associated with ABO blood type Color intensity indicates statistical significance of association. Phenotypes with increased risk from having the ‘O’ blood type Phenotypes with decreased risk from having the ‘O’ blood type Breadth of Phenotyping Provides Deeper Genetic Understanding Across Multiple Diseases

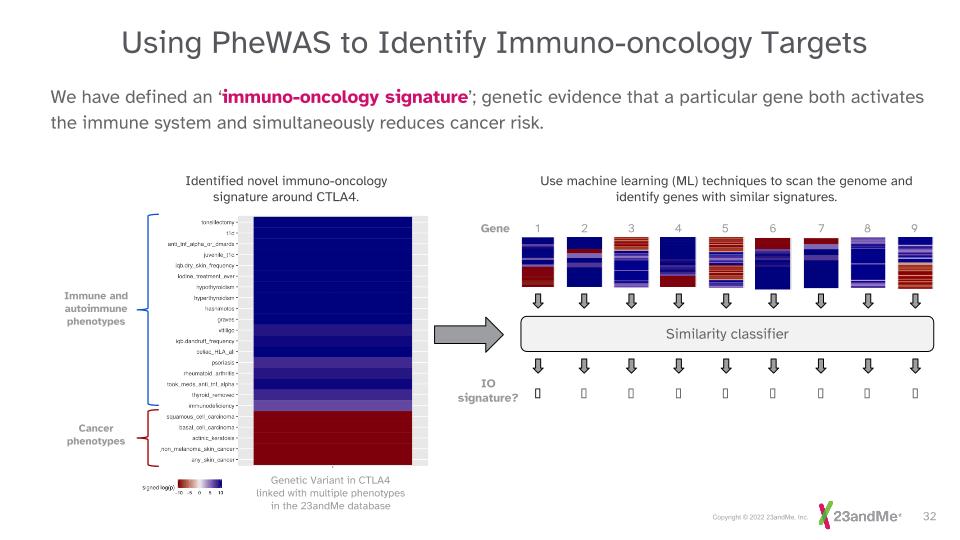

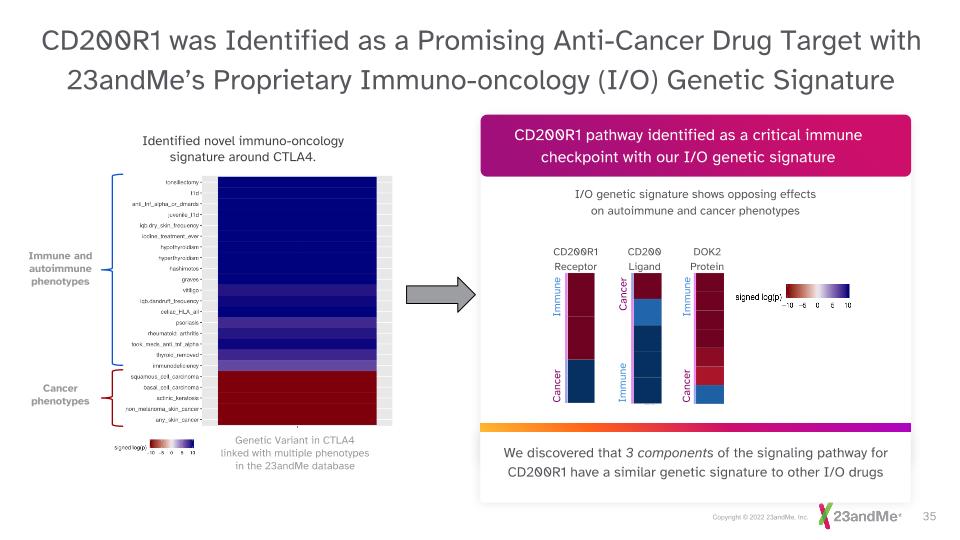

Using PheWAS to Identify Immuno-oncology Targets We have defined an ‘immuno-oncology signature’; genetic evidence that a particular gene both activates the immune system and simultaneously reduces cancer risk. Genetic Variant in CTLA4 linked with multiple phenotypes in the 23andMe database Immune and autoimmune phenotypes Cancer phenotypes Use machine learning (ML) techniques to scan the genome and identify genes with similar signatures. Gene 1 2 3 4 5 6 7 8 9 Similarity classifier IO signature? ❌ ❌ ❌ ✅ ❌ ❌ ❌ ❌ ❌ Identified novel immuno-oncology signature around CTLA4.

23ME-00610 (P006): A Novel Immuno-oncology Antibody Targeting CD200R1 Jennifer Low, M.D., PhD Head of Therapeutics Development, and Adrian Jubb, M.B., Ch.B., Ph.D. Senior Clinical Development Fellow

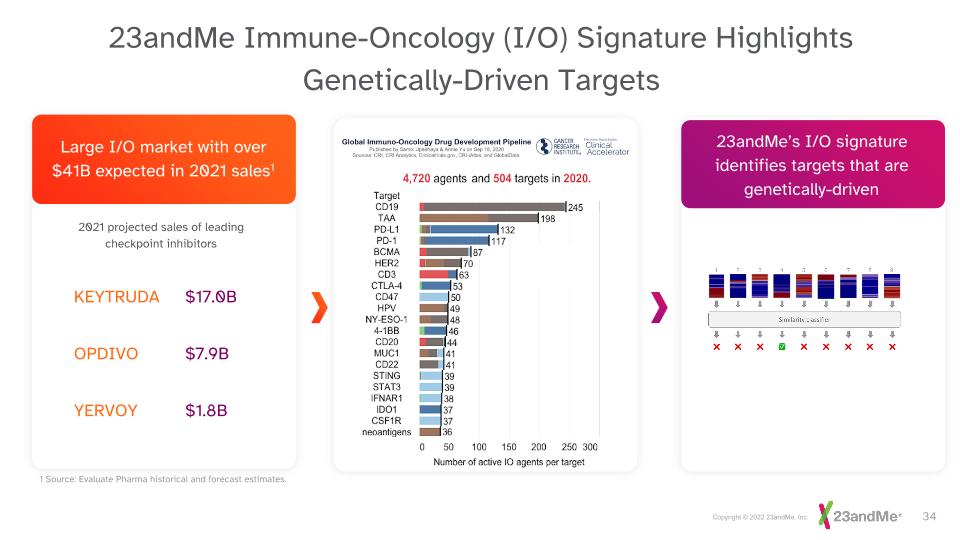

Large I/O market with over $41B expected in 2021 sales1 23andMe Immune-Oncology (I/O) Signature Highlights Genetically-Driven Targets Large I/O market with over $41B expected in 2021 sales1 2021 projected sales of leading checkpoint inhibitors $17.0B KEYTRUDA $7.9B OPDIVO $1.8B YERVOY Large I/O market with over $41B expected in 2021 sales1 23andMe’s I/O signature identifies targets that are genetically-driven 1 Source: Evaluate Pharma historical and forecast estimates.

CD200R1 pathway identified as a critical immune checkpoint with our I/O genetic signature I/O genetic signature shows opposing effects on autoimmune and cancer phenotypes CD200R1 was Identified as a Promising Anti-Cancer Drug Target with 23andMe’s Proprietary Immuno-oncology (I/O) Genetic Signature We discovered that 3 components of the signaling pathway for CD200R1 have a similar genetic signature to other I/O drugs CD200R1 Receptor Immune Immune Cancer Cancer CD200 Ligand DOK2 Protein Genetic Variant in CTLA4 linked with multiple phenotypes in the 23andMe database Immune and autoimmune phenotypes Cancer phenotypes Identified novel immuno-oncology signature around CTLA4. Cancer Immune

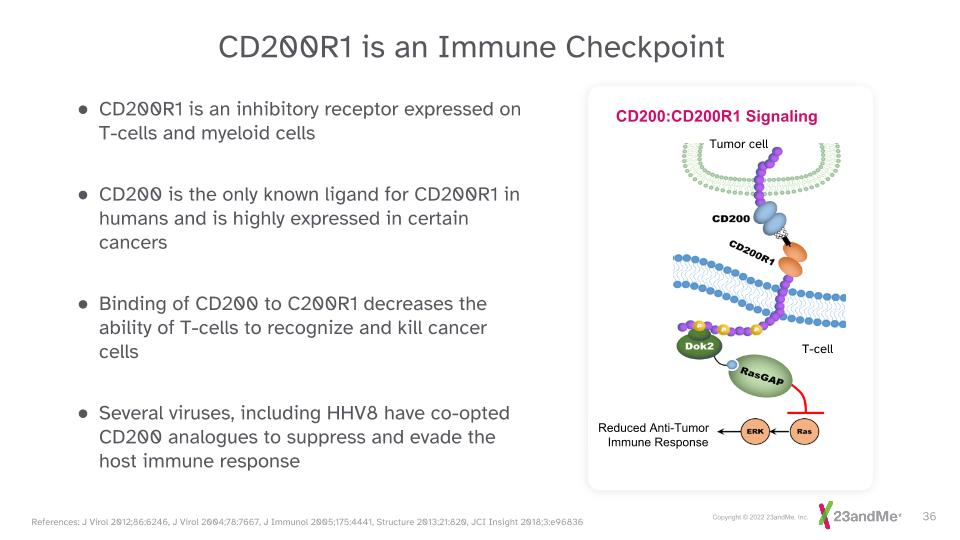

CD200R1 is an Immune Checkpoint References: J Virol 2012;86:6246, J Virol 2004;78:7667, J Immunol 2005;175:4441, Structure 2013;21:820, JCI Insight 2018;3:e96836 CD200R1 is an inhibitory receptor expressed on T-cells and myeloid cells CD200 is the only known ligand for CD200R1 in humans and is highly expressed in certain cancers Binding of CD200 to C200R1 decreases the ability of T-cells to recognize and kill cancer cells Several viruses, including HHV8 have co-opted CD200 analogues to suppress and evade the host immune response Reduced Anti-Tumor Immune Response CD200:CD200R1 Signaling T-cell Tumor cell

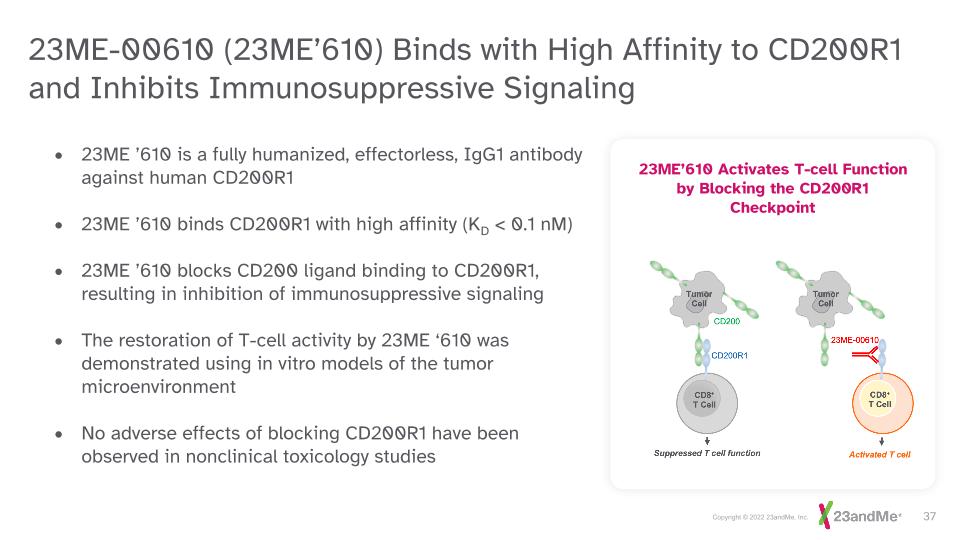

23ME-00610 (23ME’610) Binds with High Affinity to CD200R1 and Inhibits Immunosuppressive Signaling 23ME ’610 is a fully humanized, effectorless, IgG1 antibody against human CD200R1 23ME ’610 binds CD200R1 with high affinity (KD < 0.1 nM) 23ME ’610 blocks CD200 ligand binding to CD200R1, resulting in inhibition of immunosuppressive signaling The restoration of T-cell activity by 23ME ‘610 was demonstrated using in vitro models of the tumor microenvironment No adverse effects of blocking CD200R1 have been observed in nonclinical toxicology studies 23ME’610 Activates T-cell Function by Blocking the CD200R1 Checkpoint

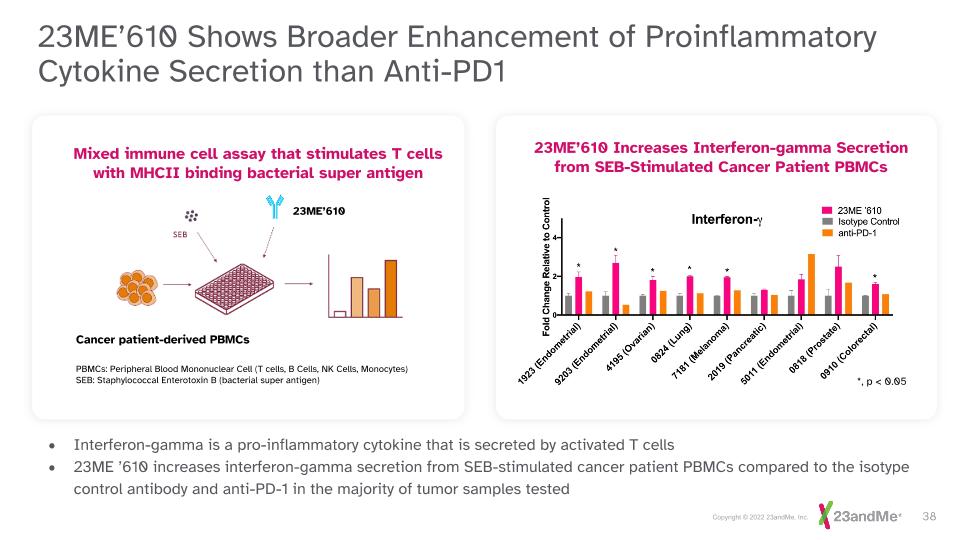

23ME’610 Shows Broader Enhancement of Proinflammatory Cytokine Secretion than Anti-PD1 23ME’610 Increases Interferon-gamma Secretion from SEB-Stimulated Cancer Patient PBMCs *, p < 0.05 Interferon-gamma is a pro-inflammatory cytokine that is secreted by activated T cells 23ME ’610 increases interferon-gamma secretion from SEB-stimulated cancer patient PBMCs compared to the isotype control antibody and anti-PD-1 in the majority of tumor samples tested Cancer patient-derived PBMCs 23ME’610 PBMCs: Peripheral Blood Mononuclear Cell (T cells, B Cells, NK Cells, Monocytes) SEB: Staphylococcal Enterotoxin B (bacterial super antigen) Mixed immune cell assay that stimulates T cells with MHCII binding bacterial super antigen

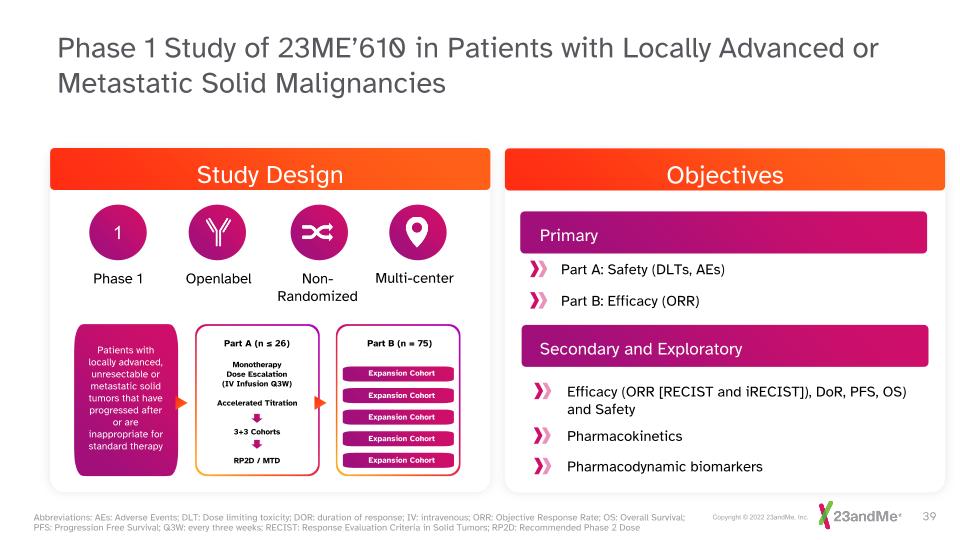

Genetics-Based Primary Care Phase 1 Study of 23ME’610 in Patients with Locally Advanced or Metastatic Solid Malignancies Abbreviations: AEs: Adverse Events; DLT: Dose limiting toxicity; DOR: duration of response; IV: intravenous; ORR: Objective Response Rate; OS: Overall Survival; PFS: Progression Free Survival; Q3W: every three weeks; RECIST: Response Evaluation Criteria in Solid Tumors; RP2D: Recommended Phase 2 Dose Study Design 1 Phase 1 Openlabel Non- Randomized Multi-center Objectives Genetics-Based Primary Care Patients with locally advanced, unresectable or metastatic solid tumors that have progressed after or are inappropriate for standard therapy Monotherapy Dose Escalation (IV Infusion Q3W) Accelerated Titration 3+3 Cohorts RP2D / MTD Part A (n ≤ 26) Part B (n = 75) Expansion Cohort Expansion Cohort Expansion Cohort Expansion Cohort Expansion Cohort Primary Secondary and Exploratory Part A: Safety (DLTs, AEs) Part B: Efficacy (ORR) Efficacy (ORR [RECIST and iRECIST]), DoR, PFS, OS) and Safety Pharmacokinetics Pharmacodynamic biomarkers

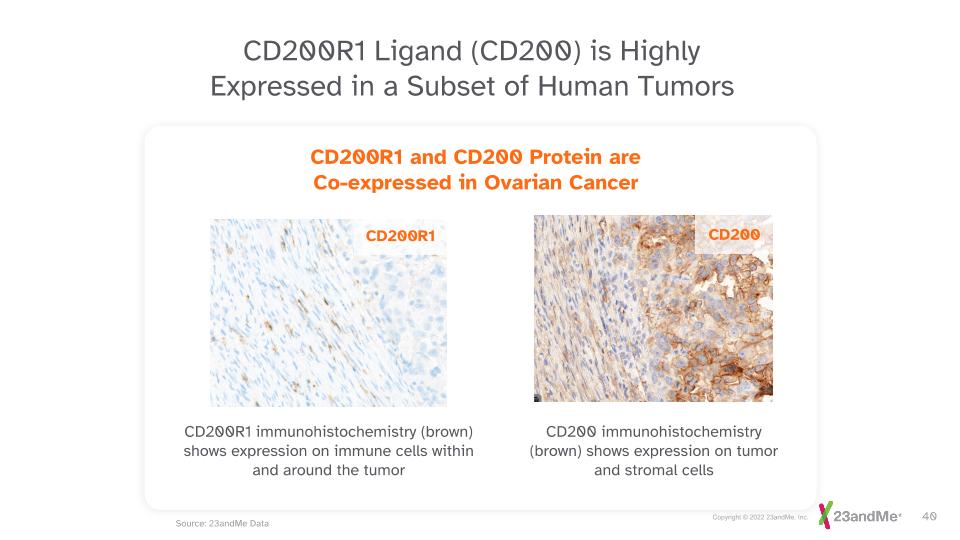

CD200R1 Ligand (CD200) is Highly Expressed in a Subset of Human Tumors Source: 23andMe Data CD200R1 and CD200 Protein are Co-expressed in Ovarian Cancer CD200R1 immunohistochemistry (brown) shows expression on immune cells within and around the tumor CD200R1 CD200 CD200 immunohistochemistry (brown) shows expression on tumor and stromal cells

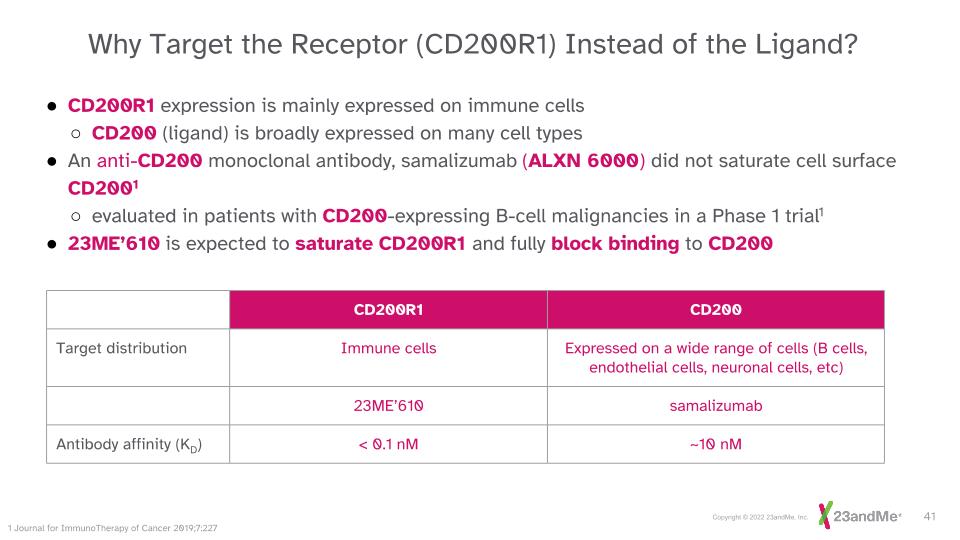

CD200R1 expression is mainly expressed on immune cells CD200 (ligand) is broadly expressed on many cell types An anti-CD200 monoclonal antibody, samalizumab (ALXN 6000) did not saturate cell surface CD2001 evaluated in patients with CD200-expressing B-cell malignancies in a Phase 1 trial1 23ME’610 is expected to saturate CD200R1 and fully block binding to CD200 CD200R1 CD200 Target distribution Immune cells Expressed on a wide range of cells (B cells, endothelial cells, neuronal cells, etc) 23ME’610 samalizumab Antibody affinity (KD) < 0.1 nM ~10 nM Why Target the Receptor (CD200R1) Instead of the Ligand? 1 Journal for ImmunoTherapy of Cancer 2019;7:227

23ME '610 Targeting CD200R1: A Genetically- Validated Approach to Anti-Cancer Therapy 23andMe’s I/O signature highlights potential targets with genetic evidence of importance CD200R1 is an immune checkpoint with a clearly defined I/O signature in three components of the pathway CD200R1 ligand is highly expressed in a subset of human cancers 23ME ‘610 is a potent monoclonal antibody against CD200R1 that has the potential to restore T-cell killing of cancer cells The Phase 1 study of 23ME ‘610 in patients with advanced solid malignancies has been initiated and the first patient was dosed in January 2022

CD96 Program: First Clinical-stage Immuno-oncology Antibody Targeting CD96 Jennifer Low, M.D., Ph.D. Head of Therapeutics Development Strategic Collaboration with

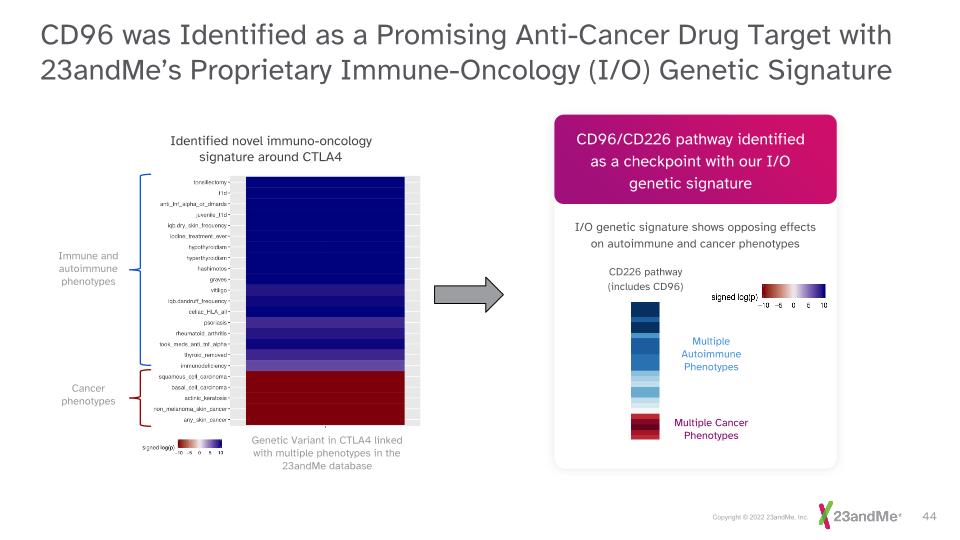

Multiple Cancer Phenotypes Multiple Autoimmune Phenotypes CD96/CD226 pathway identified as a checkpoint with our I/O genetic signature I/O genetic signature shows opposing effects on autoimmune and cancer phenotypes CD96 was Identified as a Promising Anti-Cancer Drug Target with 23andMe’s Proprietary Immune-Oncology (I/O) Genetic Signature CD226 pathway (includes CD96) Genetic Variant in CTLA4 linked with multiple phenotypes in the 23andMe database Immune and autoimmune phenotypes Cancer phenotypes Identified novel immuno-oncology signature around CTLA4

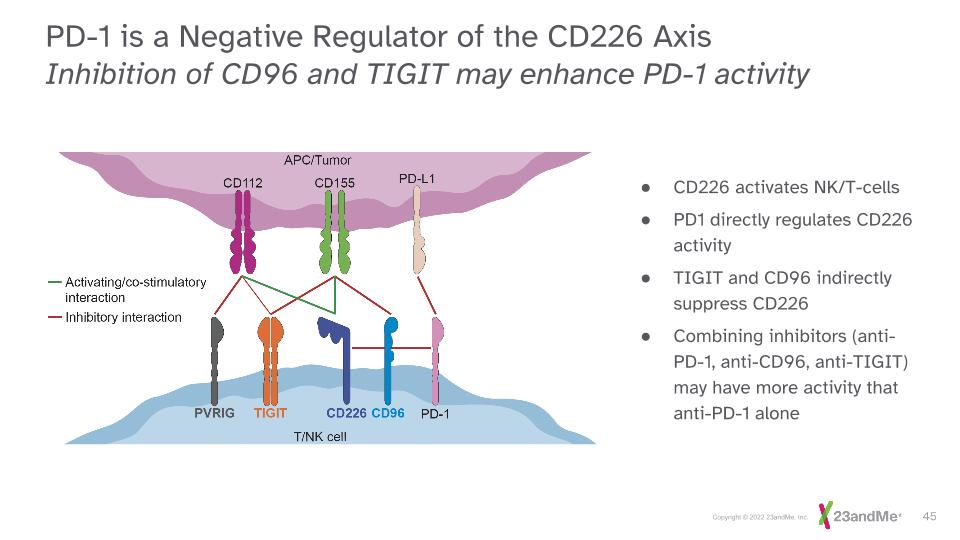

PD-1 is a Negative Regulator of the CD226 Axis Inhibition of CD96 and TIGIT may enhance PD-1 activity CD226 activates NK/T-cells PD1 directly regulates CD226 activity TIGIT and CD96 indirectly suppress CD226 Combining inhibitors (anti-PD-1, anti-CD96, anti-TIGIT) may have more activity that anti-PD-1 alone

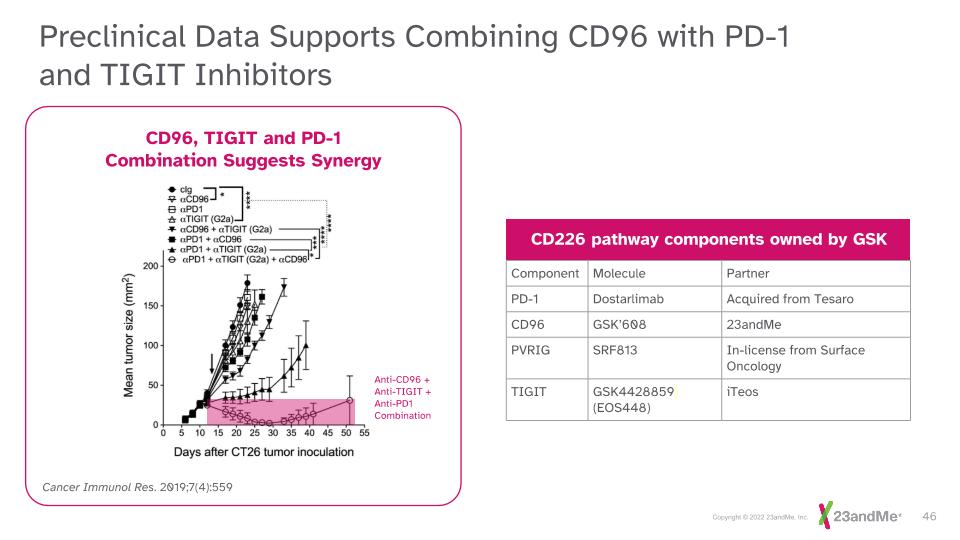

CD96, TIGIT and PD-1 Combination Suggests Synergy Cancer Immunol Res. 2019;7(4):559 Component Molecule Partner PD-1 Dostarlimab Acquired from Tesaro CD96 GSK’608 23andMe PVRIG SRF813 In-license from Surface Oncology TIGIT GSK4428859 (EOS448) iTeos Preclinical Data Supports Combining CD96 with PD-1 and TIGIT Inhibitors CD226 pathway components owned by GSK Anti-CD96 + Anti-TIGIT + Anti-PD1 Combination

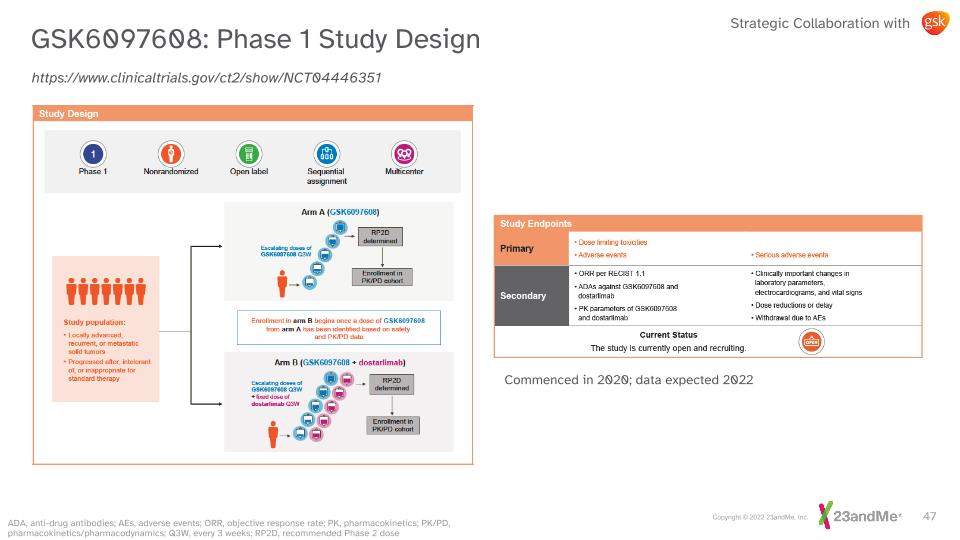

GSK6097608: Phase 1 Study Design https://www.clinicaltrials.gov/ct2/show/NCT04446351 Commenced in 2020; data expected 2022 ADA, anti-drug antibodies; AEs, adverse events; ORR, objective response rate; PK, pharmacokinetics; PK/PD, pharmacokinetics/pharmacodynamics; Q3W, every 3 weeks; RP2D, recommended Phase 2 dose Strategic Collaboration with

The 23andMe immuno-oncology signature has highlighted the importance of the CD226 pathway which includes CD96 and TIGIT Combining components of the CD226 pathway may be more efficacious than inhibiting single components, but will require complex clinical trials GSK has the relevant agents to target the CD226 axis The Phase 1 clinical trial with GSK’608 (anti-CD96) and dostarlimab is ongoing (conducted by GSK) Data is expected in 2022 CD96 is Part of the Genetically-validated CD226 Axis and is Progressing in Clinical Development

Using Genetics to Inform Clinical Development Jennifer Low, M.D., Ph.D. Head of Therapeutics Development

What if we could use genetics to predict immune function and immune response to I/O agents?

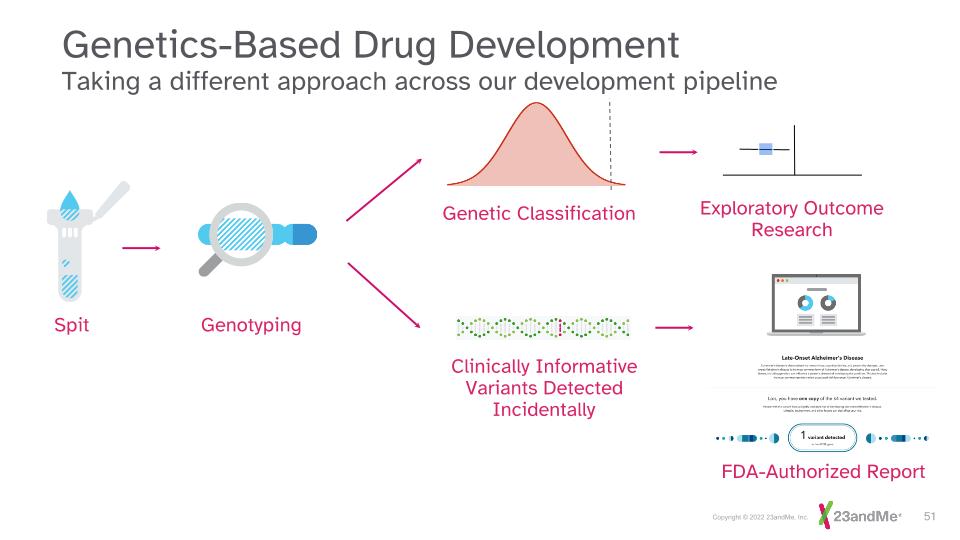

Genetics-Based Drug Development Taking a different approach across our development pipeline Spit Genotyping Genetic Classification Exploratory Outcome Research Clinically Informative Variants Detected Incidentally FDA-Authorized Report

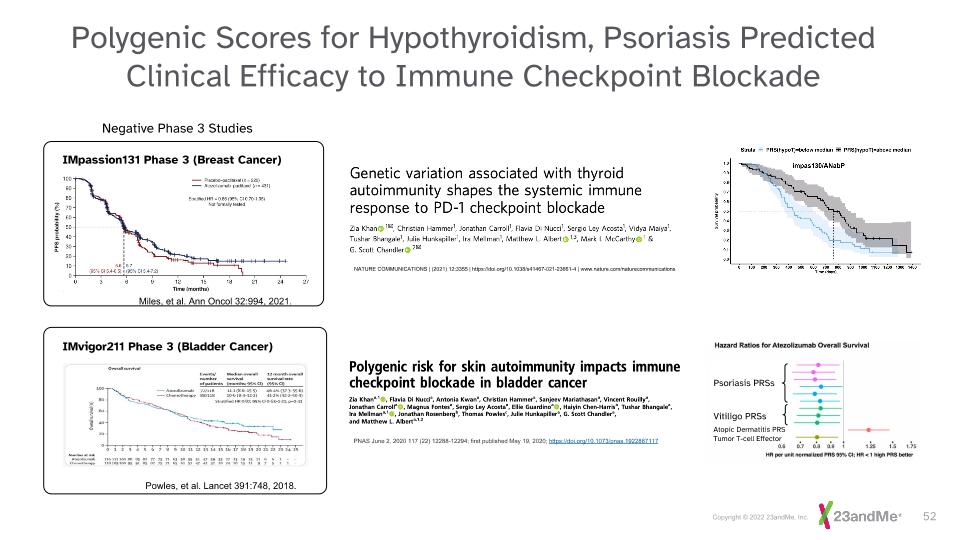

Powles, et al. Lancet 391:748, 2018. IMvigor211 Phase 3 (Bladder Cancer) Miles, et al. Ann Oncol 32:994, 2021. IMpassion131 Phase 3 (Breast Cancer) Psoriasis PRSs Vitiligo PRSs Atopic Dermatitis PRS Tumor T-cell Effector Polygenic Scores for Hypothyroidism, Psoriasis Predicted Clinical Efficacy to Immune Checkpoint Blockade NATURE COMMUNICATIONS | (2021) 12:3355 | https://doi.org/10.1038/s41467-021-23661-4 | www.nature.com/naturecommunications PNAS June 2, 2020 117 (22) 12288-12294; first published May 19, 2020; https://doi.org/10.1073/pnas.1922867117 Negative Phase 3 Studies

Polygenic Scores May Predict Safety and Efficacy 23andMe is incorporating clinical genotyping into our clinical trials Use of polygenic scores could enable more efficient clinical development and improve the probability of success Developing drugs in genetically-defined patient populations may differentiate products based on better outcomes and improved benefit-risk profiles Providing the right drugs to the right patients

Executive Summary - Therapeutics 23andMe has generated a research and development pipeline covering multiple therapeutic areas in indications of high unmet medical need To date, more than 40 programs have been generated from the database as part of our collaboration with GSK GSK has extended their exclusive target discovery period of their collaboration with 23andMe for an additional fifth year 23andMe advanced a novel immuno-oncology antibody targeting CD200R1, 23ME-00610, into the clinic 23andMe has taken a royalty option on immuno-oncology antibody collaboration program targeting CD96 into later stages of development Managing our therapeutic portfolio investments based on scientific data to optimize investment, mitigate risk and maximize potential future returns

Genetics-Based Primary Care Paul Johnson Vice President, General Manager, Consumer

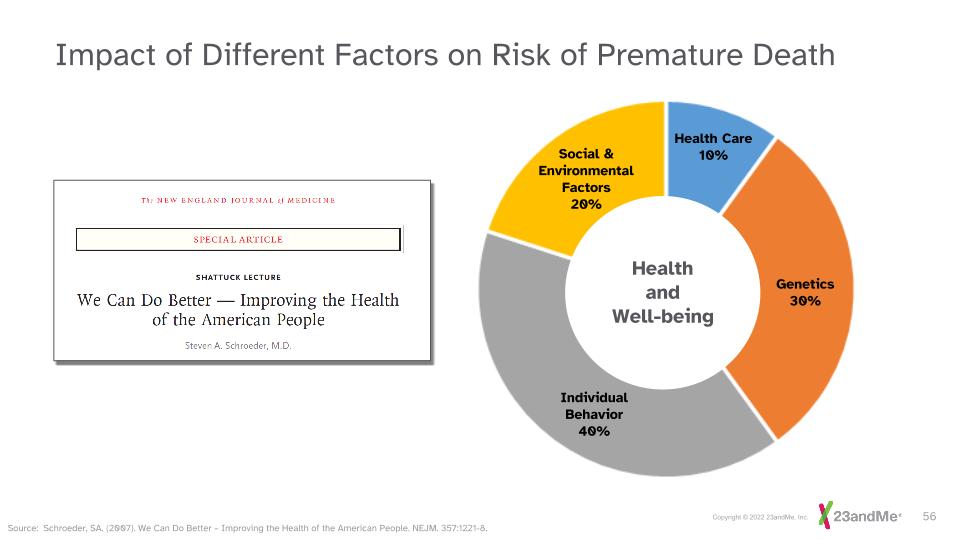

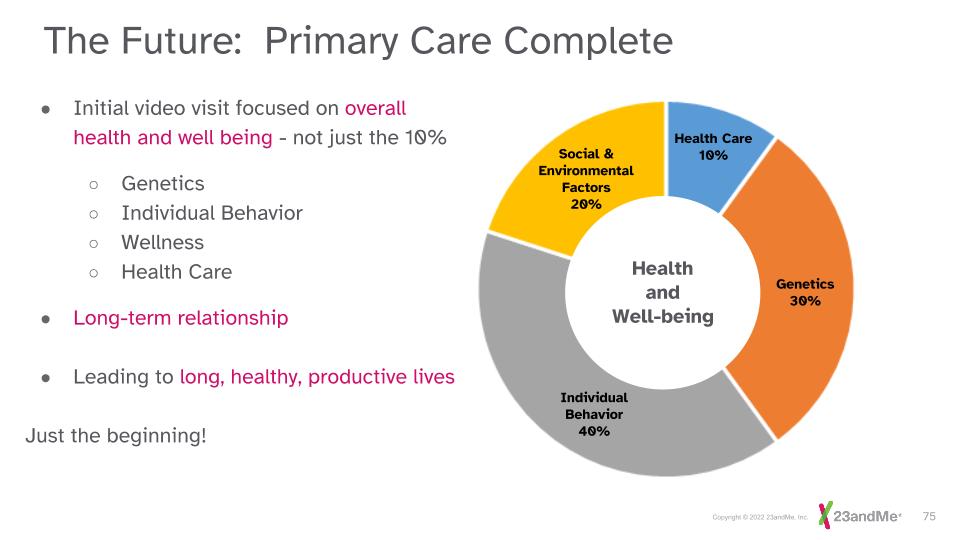

Impact of Different Factors on Risk of Premature Death Health and Well-being Health Care 10% Genetics 30% Individual Behavior 40% Social & Environmental Factors 20% Source: Schroeder, SA. (2007). We Can Do Better – Improving the Health of the American People. NEJM. 357:1221-8.

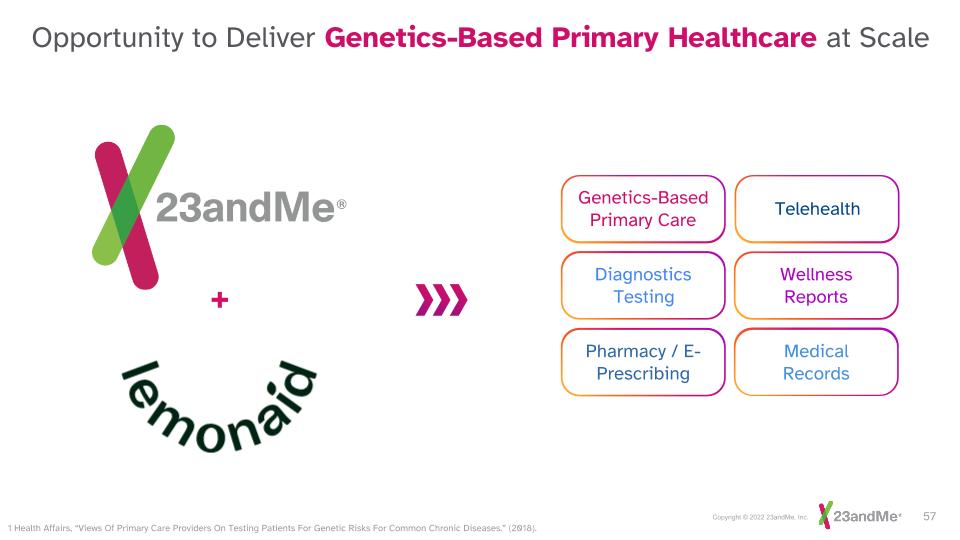

Opportunity to Deliver Genetics-Based Primary Healthcare at Scale Genetics-Based Primary Care Genetics-Based Primary Care Genetics-Based Primary Care Telehealth Wellness Reports Telehealth Pharmacy / E-Prescribing Pharmacy / E-Prescribing Medical Records Diagnostics Testing Medical Records Diagnostics Testing + 1 Health Affairs, “Views Of Primary Care Providers On Testing Patients For Genetic Risks For Common Chronic Diseases.” (2018).

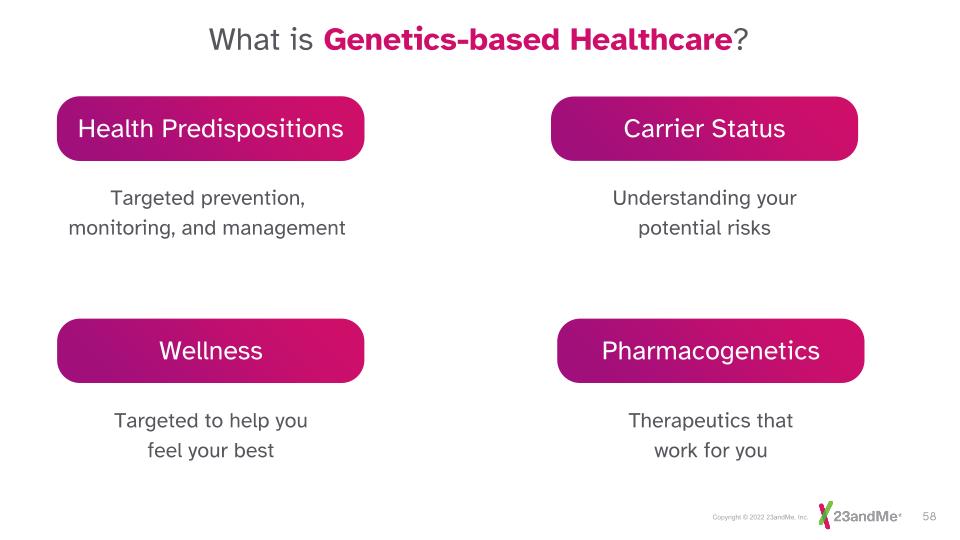

Pharmacogenetics Carrier Status Wellness Health Predispositions Therapeutics that work for you Targeted prevention, monitoring, and management Understanding your potential risks Targeted to help you feel your best What is Genetics-based Healthcare?

Personalized Healthcare at Scale Acquiring Lemonaid Health positions us to Provide personalized healthcare at scale Become a trusted holistic wellness and healthcare brand Create a fully integrated offering across 23andMe with accessible, affordable healthcare, driving strategic differentiation Healthcare based on a patient’s wellness, choices, and genetics

The Power of Polygenic Risk Scores (PRS) for Personalized Healthcare Geoff Benton, Ph.D. Director, Product R&D

Novel Consumer Products Insights Drug Discoveries 40+ Programs2 Phenotypic Data Genetic Data 11.9M Genotyped Customers1 Innovative Results Return Value to the Customer We run hundreds of billions of association tests per year that further our unique understanding of human biology Consumer Powered Healthcare Flywheel Consumer Research Therapeutics / Product Data 80% Opt-In to Research 1. As of September 30, 2021. 2. As of March 31, 2021. Programs include collaborated, 100% owned and royalty interest targets. 4B+ Phenotypic Data Points1

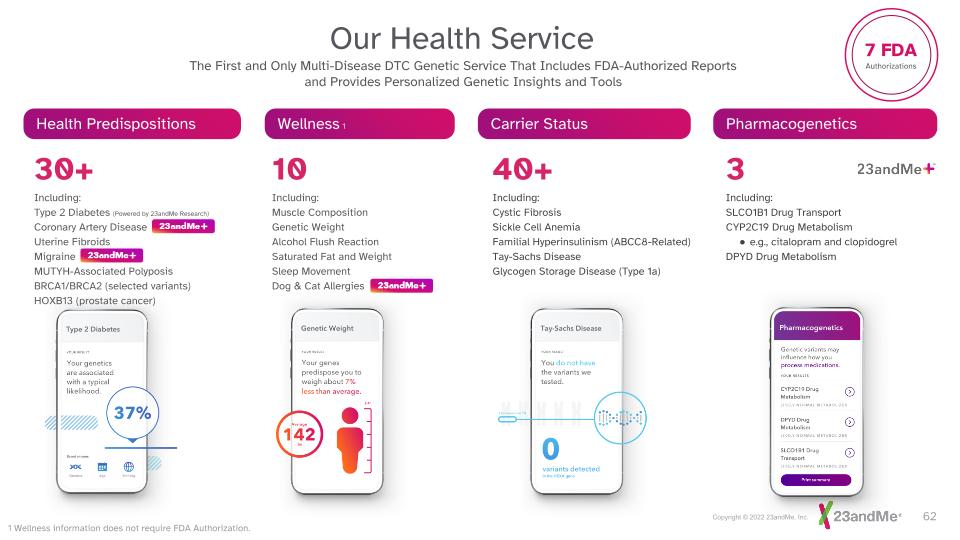

Pharmacogenetics Carrier Status Wellness 30+ Including: Type 2 Diabetes (Powered by 23andMe Research) Coronary Artery Disease Uterine Fibroids Migraine MUTYH-Associated Polyposis BRCA1/BRCA2 (selected variants) HOXB13 (prostate cancer) Health Predispositions 10 Including: Muscle Composition Genetic Weight Alcohol Flush Reaction Saturated Fat and Weight Sleep Movement Dog & Cat Allergies 40+ Including: Cystic Fibrosis Sickle Cell Anemia Familial Hyperinsulinism (ABCC8-Related) Tay-Sachs Disease Glycogen Storage Disease (Type 1a) 3 Including: SLCO1B1 Drug Transport CYP2C19 Drug Metabolism e.g., citalopram and clopidogrel DPYD Drug Metabolism 7 FDA Authorizations 1 1 Wellness information does not require FDA Authorization. Our Health Service The First and Only Multi-Disease DTC Genetic Service That Includes FDA-Authorized Reports and Provides Personalized Genetic Insights and Tools

GWAS is a statistical analysis of Single Nucleotide Polymorphisms (SNPs), looking to identify differences in frequency between disease cases and controls. SNPs linked with disease will be found at different frequencies in cases versus controls. Association is represented by the level of statistical significance (p-value) of the SNP frequency difference. SNPs can be tested across the genome and mapped to specific regions. Genome-Wide Association Studies (GWAS) GGCCAGCTGGACGAGG GGCCAGCTGGATGAGG SNP Cases Controls

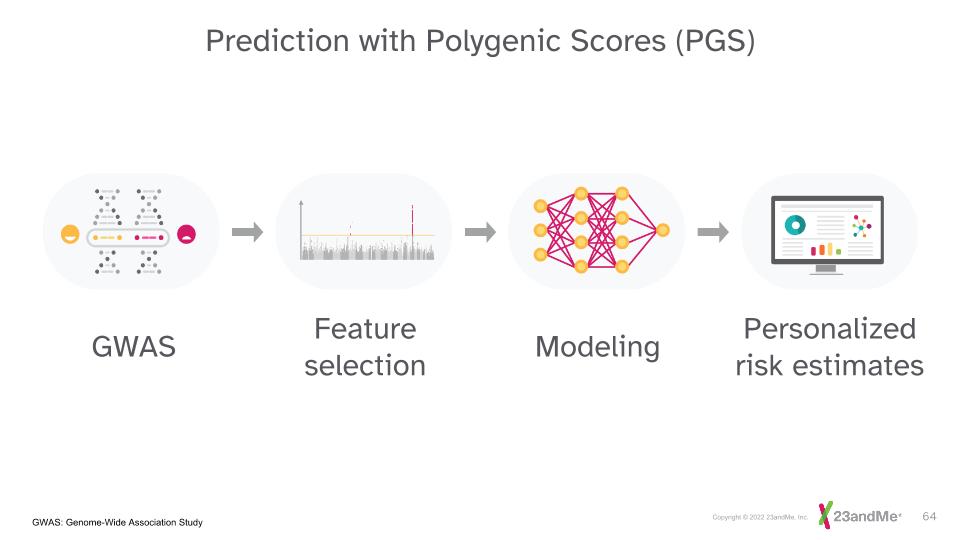

GWAS Feature selection Modeling Personalized risk estimates Prediction with Polygenic Scores (PGS) GWAS: Genome-Wide Association Study

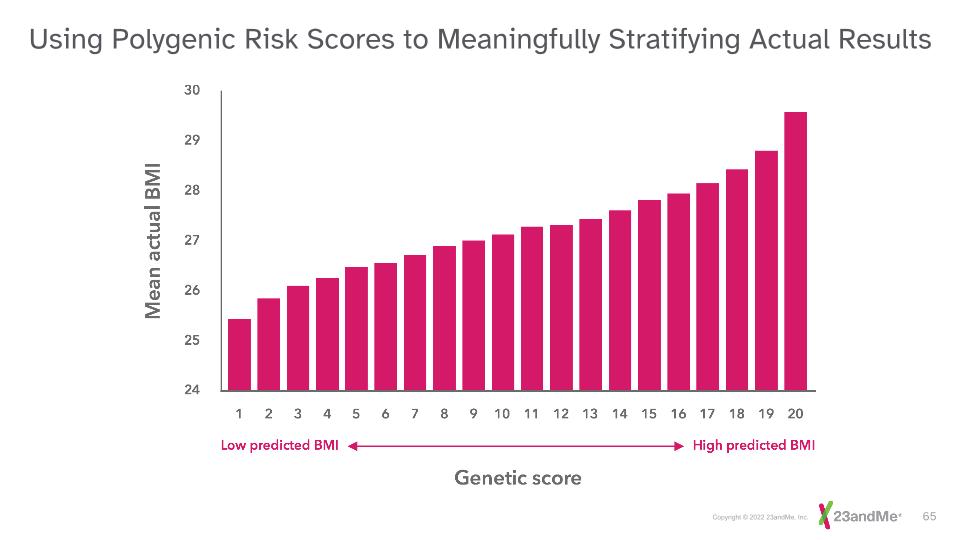

Using Polygenic Risk Scores to Meaningfully Stratifying Actual Results

Personalized Risk Report

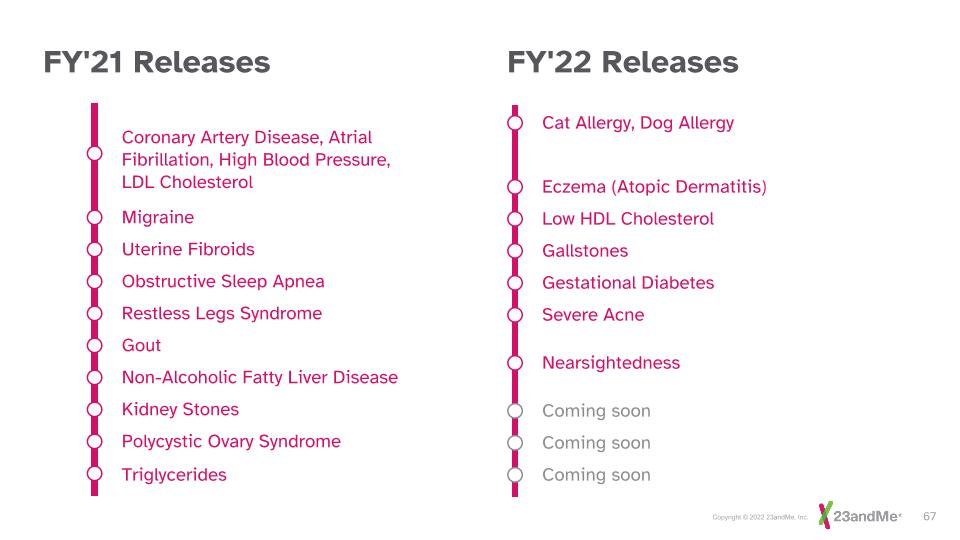

FY'21 Releases Migraine Low HDL Cholesterol Gallstones Gestational Diabetes Severe Acne Nearsightedness Coming soon Coming soon Coming soon Cat Allergy, Dog Allergy Eczema (Atopic Dermatitis) Triglycerides Obstructive Sleep Apnea Restless Legs Syndrome Gout Uterine Fibroids Non-Alcoholic Fatty Liver Disease Polycystic Ovary Syndrome Kidney Stones Coronary Artery Disease, Atrial Fibrillation, High Blood Pressure, LDL Cholesterol FY'22 Releases

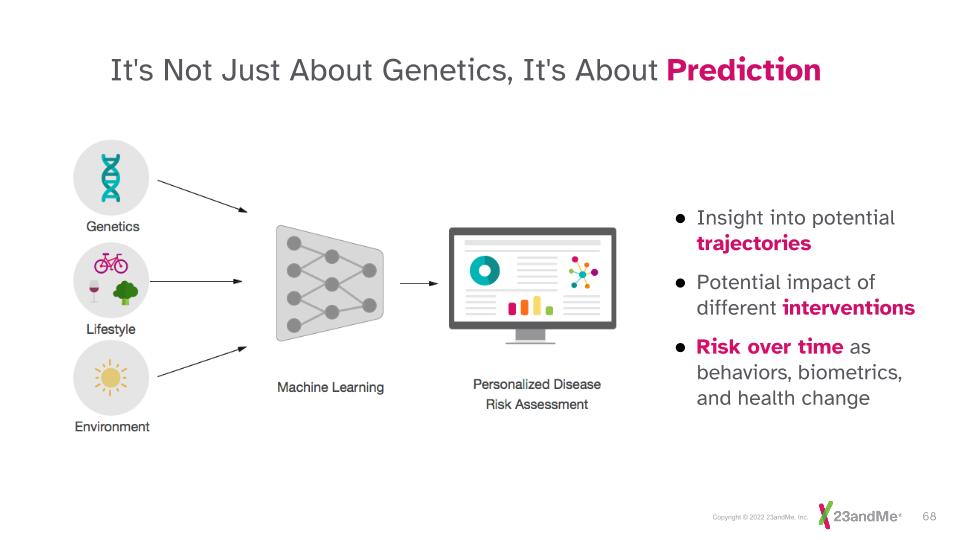

It's Not Just About Genetics, It's About Prediction Insight into potential trajectories Potential impact of different interventions Risk over time as behaviors, biometrics, and health change

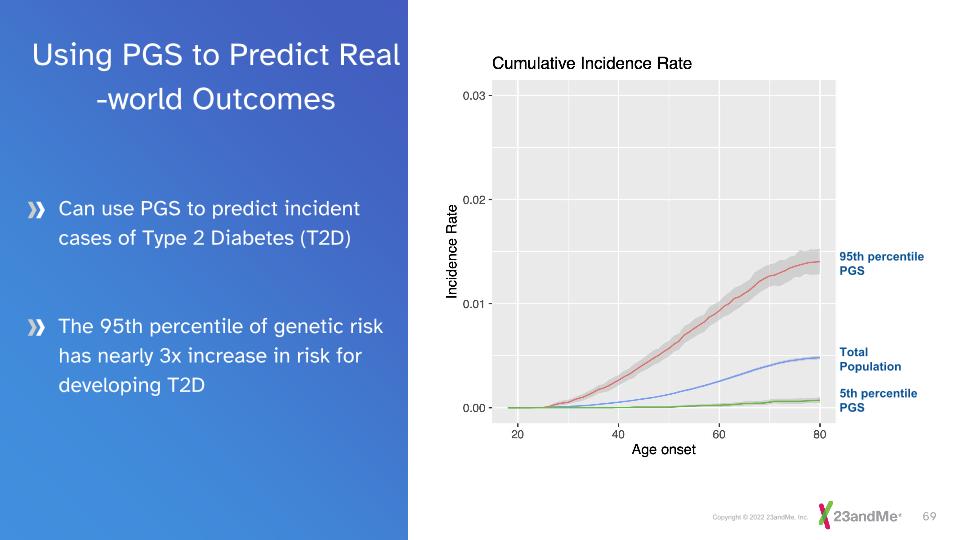

Can use PGS to predict incident cases of Type 2 Diabetes (T2D) The 95th percentile of genetic risk has nearly 3x increase in risk for developing T2D Using PGS to Predict Real-world Outcomes Total Population 5th percentile PGS 95th percentile PGS

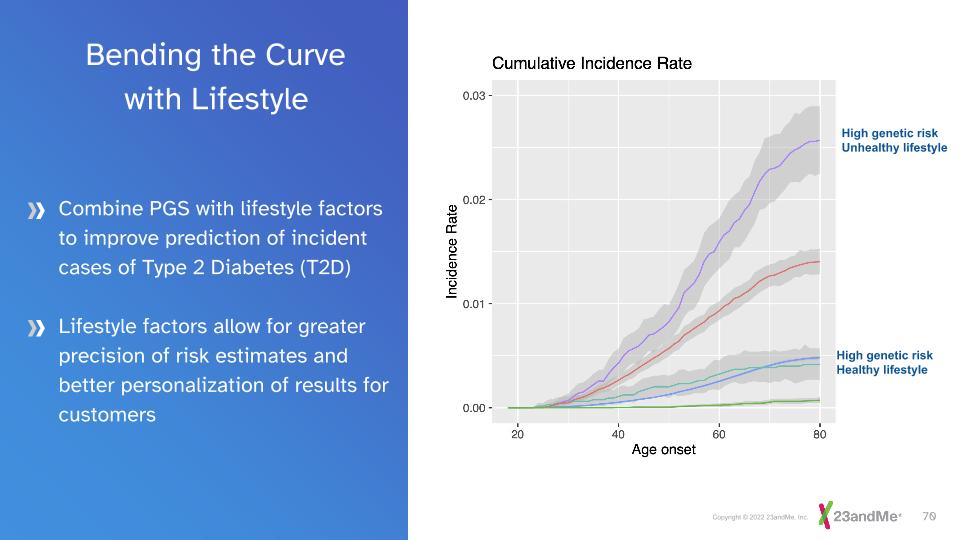

Bending the Curve with Lifestyle Combine PGS with lifestyle factors to improve prediction of incident cases of Type 2 Diabetes (T2D) Lifestyle factors allow for greater precision of risk estimates and better personalization of results for customers High genetic risk Healthy lifestyle High genetic risk Unhealthy lifestyle

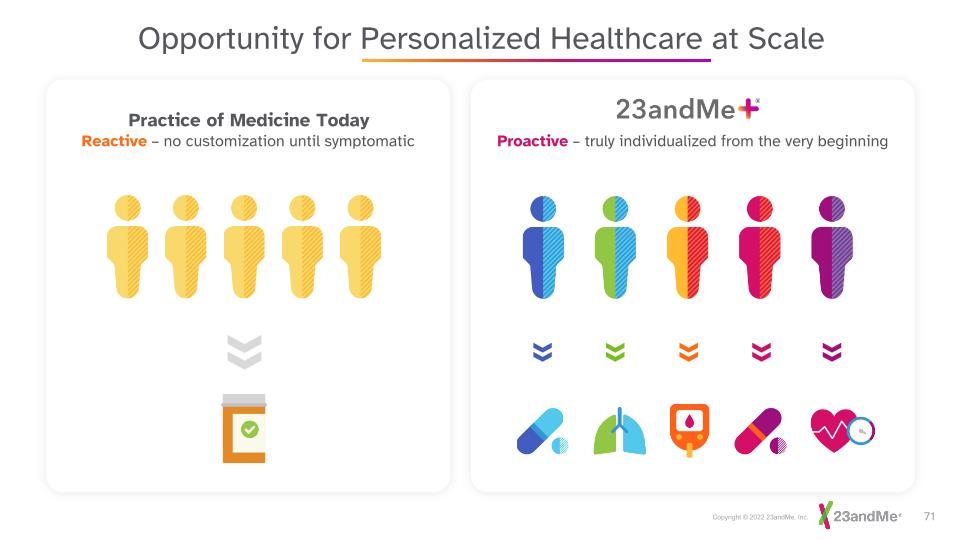

Opportunity for Personalized Healthcare at Scale Practice of Medicine Today Reactive – no customization until symptomatic Proactive – truly individualized from the very beginning

Delivering a Genetics-based Primary Care Service Davis Liu, M.D. Chief Clinical Officer

Online doctor visits Cutting out the doctor waiting room – with fully integrated w-2 core clinical team Mail order pharmacy Cutting out the retail pharmacy – owned and controlled mail order pharmacy All connected using an algorithm-driven proprietary technology platform Broad range of services Building the online healthcare brand with the biggest impact Lemonaid Health is Fully Integrated with a Broad Service Offering

The Future: Primary Care Complete Will be matched with a doctor who is attuned to genetics, wellness goals, interests, and medical conditions. Lemonaid Health clinician

Health and Well-being Health Care 10% Genetics 30% Individual Behavior 40% Social & Environmental Factors 20% Initial video visit focused on overall health and well being - not just the 10% Genetics Individual Behavior Wellness Health Care Long-term relationship Leading to long, healthy, productive lives Just the beginning! The Future: Primary Care Complete

Concluding Remarks Anne Wojcicki CEO and Co-Founder

Future of 23andMe Continuing to be world leader in direct-to-consumer personal genetic health services, growing annually Pioneering a genetics-based primary care service that empowers individuals to be proactive with their health Developing a pipeline of over 40 clinical and research stage programs addressing targets validated by human genetics Leveraging strong balance sheet to support investment in therapeutics portfolio and strategic initiatives in DTC personal health services

Q&A

Exhibit 99.2

23andMe Announces Extension of GSK Collaboration and Update on Joint Immuno-oncology Program

GSK extends exclusive target discovery period of collaboration for a fifth year to discover and validate novel drug targets using 23andMe’s proprietary genetic and health survey database

23andMe elects for royalty option as GSK advances immuno-oncology antibody

collaboration program targeting CD96 into development

Company will discuss at its R&D Day event today at 8:00 a.m. Pacific Time

SUNNYVALE, CA - January 18, 2022 - 23andMe Holding Co. (Nasdaq: ME) (“23andMe”), a leading consumer genetics and therapeutics company, today provided an update on its collaboration with GlaxoSmithKline plc (“GSK”). GSK has elected to exercise its option to extend the exclusive target discovery period of the ongoing collaboration with 23andMe for an additional year to July 2023. 23andMe will receive a one-time payment of $50 million to extend the period. In addition, 23andMe has elected to take a royalty option on its joint immuno-oncology antibody collaboration program with GSK targeting CD96 (GSK6097608, a.k.a. GSK’608), currently in Phase 1 studies. GSK will be solely responsible for GSK’608’s subsequent development in later-stage clinical trials, including full development costs moving forward.

“The collaboration with GSK has been very productive. In less than four years, under this collaboration, we have identified over 40 therapeutic programs and have advanced an immuno- oncology antibody targeting CD96 into clinical development,” said Kenneth Hillan, Head of Therapeutics at 23andMe. “GSK’s decision to extend the exclusive target discovery period of our collaboration for an additional year demonstrates the enthusiasm for our collaboration and the value our database provides for identifying targets and advancing new medicines based on human genetics.”

“Our collaboration with 23andMe continues to exceed expectations, with more than 40 genetically validated drug discovery programs in the GSK portfolio that were initiated under the collaboration,” said John Lepore, SVP and Head of Research at GSK. “Evidence shows that genetically validated drug targets have at least double the probability of success in becoming medicines; today more than 70% of our targets in research have genetic validation. Working with 23andMe for an additional year will continue to strengthen the quality and breadth of our pipeline and reinforce GSK’s long-term focus on human genetics, the immune system and advanced technologies to discover and develop transformational new medicines for patients.”

“The CD96 program is a prime example of the potential value we bring to drug discovery and development. Through our genetic validation and based on the Phase 1a data, we are hopeful that targeting CD96 will have the potential to provide cancer patients with a new medicine in the fight against cancer,” states Hillan. “We believe GSK is in the best position to move this program forward because of its leading portfolio of antibodies targeting the CD96 axis, and their ability to conduct the complex clinical studies of combination therapies that the development plan will require. This decision also allows 23andMe to strategically invest capital and resources into advancing our diverse portfolio of therapeutic programs.”

23andMe’s Therapeutics team was established in 2015 with the goal to improve the way drug discovery is currently conducted by starting with human genetic information. With approximately 12 million genotyped customers, of which approximately 80 percent consent to research, 23andMe has the world’s largest set of genotypic information paired with billions of phenotypic data points contributed by engaged research participants.

About the GSK and 23andMe Collaboration

In July 2018, GSK and 23andMe entered into a collaboration which included an initial four-year exclusive target discovery period, with GSK having the option to extend that period for a fifth year. In order to jointly discover novel targets for drug development, 23andMe performs proprietary statistical analysis in-house using de-identified data from 23andMe’s consenting research participants. Together 23andMe and GSK review the summary results that can be used to progress new medicines into development. GSK and 23andMe collaborate, using their combined resources, to identify new targets and prioritize them based on the strength of the biological hypothesis, possibility to find a medicine, and clinical opportunity and progress programs to generate lead compounds, perform preclinical research and progress into clinical development.

For joint projects, program costs and profits in relevant territories (US, UK and EU) are split (50% / 50%), with each company having certain rights to opt-out of further funding or reduce its funding share for any joint collaboration program at certain defined development milestones. The company that opts out of the cost/profit split is eligible to receive a worldwide royalty, or in the case of reduced funding, an adjusted percentage of profits or royalty outside the relevant territories, if the program is successfully commercialized.

Additionally, GSK made a $300M equity investment in 23andMe, Inc. in 2018.

About the CD96 Program

The CD96 program is an immuno-oncology therapeutic mAb targeting CD96 called GSK’608. CD96 sequesters a shared ligand, CD155, away from the costimulatory receptor, CD226, effectively attenuating T and NK cell antitumor immune responses. By blocking CD96, GSK’608 may allow activation of CD226 and enhance anti-tumor immunity through T and NK cells.

GSK’608 is now being dosed in combination with GSK’s PD-1 blocking drug, dostarlimab, in a Phase 1 clinical trial. Additional studies will potentially also involve combinations with other anticancer treatments, such as anti-TIGIT and anti-PVRIG drugs.

Prior to taking the worldwide royalty election, the CD96 program was advanced under a 50/50 cost share and a profit share arrangement between 23andMe and GSK in the shared territories of US, UK and EU with a tiered royalty for other territories. With the worldwide royalty option, 23andMe will be eligible to earn tiered worldwide royalties up to the low double digits if GSK’608 is successfully brought to market. This option allows 23andMe to retain economic upside if GSK’608 is successfully brought to market but will no longer be contributing to the development costs as the program advances into later, larger and more complex clinical studies. This allows 23andMe to invest further in its advancing pipeline of therapeutic programs, largely identified under the GSK collaboration. In addition, if GSK’608 is successful in achieving market authorization, 23andMe will not be required to contribute to marketing and commercialization costs.

R&D Day Event Information

To discuss the GSK collaboration updates and other developments from its Therapeutics and Consumer groups in more detail, the company is hosting a virtual R&D Day event today from 8:00 a.m. to 11:30 am Pacific Time. The webcast event can be accessed at https://investors.23andme.com/news-events/events-presentations. A webcast replay will be available at the same address for a limited time within 24 hours after the event.

About 23andMe

23andMe, headquartered in Sunnyvale, CA, is a leading consumer genetics and therapeutics company. Founded in 2006, the company’s mission is to help people access, understand, and benefit from the human genome. 23andMe has pioneered direct access to genetic information as the only company with multiple FDA authorizations for genetic health risk reports. The company has created the world’s largest crowdsourced platform for genetic research, with 80 percent of its customers electing to participate. The 23andMe research platform has generated more than 180 publications on the genetic underpinnings of a wide range of diseases, conditions, and traits. The platform also powers the 23andMe Therapeutics group, currently pursuing drug discovery programs rooted in human genetics across a spectrum of disease areas, including oncology, respiratory, and cardiovascular diseases, in addition to other therapeutic areas. More information is available at www.23andMe.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, without limitation, statements regarding opportunities related to and the benefits of 23andMe’s collaboration with GSK, the discovery and the potential of genetically validated targets, and the development and commercialization of therapeutic programs. All statements, other than statements of historical fact, included or incorporated in this press release. The words "believes," "anticipates," "estimates," "plans," "expects," "intends," "may," "could," "should," "potential," "likely," "projects," “predicts,” "continue," "will," “schedule,” and "would" or, in each case, their negative or other variations or comparable terminology, are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are predictions based on 23andMe’s current expectations and projections about future events and various assumptions. 23andMe cannot guarantee that it will actually achieve the plans, intentions, or expectations disclosed in its forward-looking statements and you should not place undue reliance on 23andMe’s forward-looking statements. These forward-looking statements involve a number of risks, uncertainties (many of which are beyond the control of 23andMe), or other assumptions that may cause actual results or performance to differ materially from those expressed or implied by these forward-looking statements, including, without limitation: (i) whether 23andMe’s cash resources will be sufficient to fund the further development of therapeutic programs pursuant to the collaboration agreement with GSK or otherwise; (ii) whether results obtained in preclinical studies and clinical trials will be indicative of the results that will be generated in future clinical trials; (iii) whether any of the therapeutic programs will advance into or through the clinical trial process when anticipated or at all or warrant submission for regulatory approval; (iv) whether any such therapeutic programs will receive approval from the U.S. Food and Drug Administration or equivalent foreign regulatory agencies; (v) whether, if any such therapeutic programs receive approval, they will be successfully distributed and marketed; (vi) whether the collaboration with GSK will continue to be productive or will ultimately be successful in developing new medicines; (vii) collaborators’ ability to successfully complete clinical development of, obtain regulatory approval for, and commercialize any therapeutic programs; and (viii) the impact of public health crises, including the coronavirus (COVID-19) pandemic. The forward-looking statements contained herein are also subject to other risks and uncertainties that are described in 23andMe’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2021 filed with the Securities and Exchange Commission (“SEC”) on November 10, 2021 and in the reports subsequently filed by 23andMe with the SEC. The statements made herein are made as of the date of this press release and, except as may be required by law, 23andMe undertakes no obligation to update them, whether as a result of new information, developments, or otherwise.

Contacts

Investor Relations Contact: [email protected]

Media Contact: [email protected]

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- 23andMe (ME) CEO Wojcicki considering taking company private - 13D

- AXSOME ALERT: Bragar Eagel & Squire, P.C. is Investigating Axsome Therapeutics, Inc. on Behalf of Long-Term Stockholders and Encourages Investors to Contact the Firm

- Oracle to Invest More Than $8 Billion in Cloud Computing and AI in Japan

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share