Form 6-K WIPRO LTD For: Mar 05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of March 2021

Commission File Number 001-16139

Wipro Limited

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

Karnataka, India

(Jurisdiction of incorporation or organization)

Doddakannelli

Sarjapur Road

Bangalore, Karnataka 560035, India +91-80-2844-0011

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F

or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): Yes ☐ No ☒

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): Yes ☐ No ☒

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

DISCLOSURE OF ACQUISITION

Wipro Limited, a company organized under the laws of the Republic of India (the “Company”), hereby furnishes the Commission with the following information relating to the acquisition by the Company of Capco, a global technology and management consultancy providing digital, consulting and technology services to financial institutions in the Americas, Europe and Asia Pacific. The following information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

On March 4, 2021, the Company informed the securities exchanges in India on which its securities are listed and the New York Stock Exchange that the Company has signed an agreement to acquire Capco, and that the acquisition is subject to customary closing conditions and regulatory approvals and is expected to be completed during the quarter ending June 30, 2021. A copy of the letter to the securities exchanges is attached hereto as Item 99.1.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly organized.

| WIPRO LIMITED |

| /s/ Jatin Pravinchandra Dalal |

| Jatin Pravinchandra Dalal |

| Chief Financial Officer |

Dated: March 5, 2021

INDEX TO EXHIBITS

| Item |

||

| 99.1 | Letter to the Exchanges dated March 4, 2021. |

Exhibit 99.1

March 4, 2021

The Manager – Listing

BSE Limited

(BSE: 507685)

The Manager – Listing

National Stock Exchange of India Limited

(NSE: WIPRO)

The Market Operations

NYSE, New York

(NYSE: WIT)

Dear Sir/Madam,

Sub: Disclosure under Regulation 30 of SEBI Listing Regulations

Pursuant to Regulation 30(6) of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 and para 202.05 read with para 202.06 of the NYSE Listed Company Manual, please find attached the following:

| 1. | Press release and disclosure being issued by the Company |

| 2. | Schedule for the virtual Analyst/Investor Meeting to be held today |

| 3. | Investor presentation regarding the aforesaid announcement |

The details are also being made available on the Company’s website www.wipro.com.

This is for your information and records.

Thanking You,

For Wipro Limited

M Sanaulla Khan

Company Secretary

ENCL: as above

Registered Office: Wipro Limited T : +91 (80) 28440011 Doddakannelli F :+91 (80) 28440266 Sarjapur Road E : infoClwipro.com Bengaluru 560035 W : wipro.com India C :Ll32102KA1945PLC020800

Wipro to acquire Capco, a global management and technology consultancy to banking and financial services industry, for $ 1.45 billion

Wipro to be one of the largest providers of integrated, end-to-end consulting, digital, cloud and IT transformation services at scale

Bangalore, India, London, UK and New York, USA: March 4, 2021- Wipro Limited (NYSE: WIT, BSE: 507685, NSE: WIPRO), a leading global information technology, consulting and business process services company, today announced that it has signed an agreement to acquire Capco, a global management and technology consultancy providing digital, consulting and technology services to financial institutions in the Americas, Europe and the Asia Pacific.

London-headquartered Capco’s clients include many marquee names in the global financial services industry. Over the past 20 years, the company has worked closely with business leaders, including Boards and C-Suites in the banking, capital markets, wealth, asset management and insurance sectors and is widely acknowledged for its deep domain and consulting expertise, risk and regulatory offerings and thought leadership around key industry technology challenges and opportunities. In addition, Capco services clients in the energy and commodities trading sector.

Capco has an experienced executive team and over 5,000 world-class business and technology consultants based across more than 30 global locations supporting clients through their expert insights, entrepreneurial approach and focus on delivery excellence.

This acquisition will make Wipro one of the largest end-to-end global consulting, technology and transformation service providers to the banking and financial services industry. By combining Wipro’s capabilities in strategic design, digital transformation, cloud, cybersecurity, IT and operations services with Capco’s domain and consulting strength, clients will gain access to a partner who can deliver integrated, bespoke solutions to help fuel growth and achieve their transformation objectives.

Thierry Delaporte, CEO and Managing Director of Wipro Limited said, “We are very excited to welcome Capco’s admirable leadership team and employees, and global clients, to Wipro. Together, we can deliver high-end consulting and technology transformations, and operations offerings to our clients. Wipro and Capco share complimentary business models and core guiding values, and I am certain that our new Capco colleagues will be proud to call Wipro home.”

Lance Levy, CEO of Capco said, “We are incredibly excited to join our new colleagues at Wipro. Together, we will offer bespoke transformational end-to-end solutions, now powered by innovative technology at scale, to create a new leading partner to the financial services industry. We look forward to leveraging the complementary capabilities and similar cultures of both companies to drive industry change and offer exciting opportunities for both our clients, and our people.”

The acquisition is subject to customary closing conditions and regulatory approvals and is expected to close in the quarter ending June 30, 2021.

About Wipro Limited

Wipro Limited (NYSE: WIT, BSE: 507685, NSE: WIPRO) is a leading global information technology, consulting and business process services company. We harness the power of cognitive computing, hyper-automation, robotics, cloud, analytics and emerging technologies to help our clients adapt to the digital world and make them successful. A company recognized globally for its comprehensive portfolio of services, strong commitment to sustainability and good corporate citizenship, we have over 190,000 dedicated employees serving clients across six continents. Together, we discover ideas and connect the dots to build a better and a bold new future.

About Capco

Capco is a global technology and management consultancy specializing in driving digital transformation in the financial services industry. With a growing client portfolio comprising of over 100 global organizations, Capco operates at the intersection of business and technology by combining innovative thinking with unrivalled industry knowledge to fast-track transformation initiatives for the banking and payments, capital markets, wealth and asset management, insurance, and the energy sector. Capco’s ingenuity is brought to life through its Innovation Labs, and award-winning Be Yourself at Work culture and diverse talent. To learn more, visit www.Capco.com or follow us on Twitter, Facebook, YouTube, LinkedIn Instagram, and Xing.

Wipro Media Contact:

Purnima Burman

Wipro Limited

purnima.burman@wipro.com

Capco Media Contact:

Tim Steele

Capco

tim.steele@capco.com

Forward-Looking Statements

The forward-looking statements contained herein represent Wipro’s beliefs regarding future events, many of which are by their nature, inherently uncertain and outside Wipro’s control. Such statements include, but are not limited to, statements regarding Wipro’s growth prospects, its future financial operating results, and its plans, expectations and intentions. Wipro cautions readers that the forward- looking statements contained herein are subject to risks and uncertainties that could cause actual results to differ materially from the results anticipated by such statements. Such risks and uncertainties include, but are not limited to, risks and uncertainties regarding fluctuations in our earnings, revenue and profits, our ability to generate and manage growth, complete proposed corporate actions, intense competition in IT services, our ability to maintain our cost advantage, wage increases in India, our ability to attract and retain highly skilled professionals, time and cost overruns on fixed-price, fixed-time frame contracts, client concentration, restrictions on immigration, our ability to manage our international operations, reduced demand for technology in our key focus areas, disruptions in telecommunication networks, our ability to successfully complete and integrate potential acquisitions, liability for damages on our service contracts, the success of the companies in which we make strategic investments, withdrawal of fiscal governmental incentives, political instability, war, legal restrictions on raising capital or acquiring companies outside India, unauthorized use of our intellectual property and general economic conditions affecting our business and industry. The conditions caused by the COVID-19 pandemic could decrease technology spending, adversely affect demand for our products, affect the

rate of customer spending and could adversely affect our customers’ ability or willingness to purchase our offerings, delay prospective customers’ purchasing decisions, adversely impact our ability to provide on-site consulting services and our inability to deliver our customers or delay the provisioning of our offerings, all of which could adversely affect our future sales, operating results and overall financial performance. Our operations may also be negatively affected by a range of external factors related to the COVID-19 pandemic that are not within our control. Additional risks that could affect our future operating results are more fully described in our filings with the United States Securities and Exchange Commission, including, but not limited to, Annual Reports on Form 20-F. These filings are available at www.sec.gov. We may, from time to time, make additional written and oral forward-looking statements, including statements contained in the company’s filings with the Securities and Exchange Commission and our reports to shareholders. We do not undertake to update any forward-looking statement that may be made from time to time by us or on our behalf.

Disclosure under regulation 30 of the Securities and Exchange Board of India (Listing

Obligations and Disclosure Requirements) Regulations, 2015

| Sr. No. |

Particulars |

Description | ||

| 1 | Target Name | The Capital Markets Company (“Capco”) group, through its holding companies Cardinal US Holdings, Inc. and Cardinal Foreign Holdings S.à.r.l., and it’s Indian subsidiary Capco Technologies Private Limited | ||

| 2 | Related party transaction | No | ||

| 3 | Industry of Target entity | Global management and technology consultancy providing digital, consulting and technology services to the global banking and financial services industry | ||

| 4 | Acquisition objectives | This acquisition will strengthen Wipro’s position as a consulting and IT services provider to the Banking, Financial Services and Insurance (BFSI) sector, provide access to marquee BFSI clients and create a large global financial services practice for Wipro with a strong consulting footprint. By combining Wipro’s capabilities in strategic design, domain & consulting, digital transformation, cloud, cybersecurity, data and IT services with Capco’s deep domain and consulting capabilities across banking, payments, capital markets, insurance, risk and regulatory offerings, the clients will have access to a trusted partner who can deliver integrated, bespoke solutions to fuel their growth and achieve their transformation objectives. | ||

| 5 | Government & regulatory Approval required |

Anti-trust approvals required under the competition laws of the United States of America, Germany, Canada, Brazil and Austria, and such other regulatory approvals as may be required. | ||

| 6 | Time period for completion | The transaction is expected to be completed during the quarter ending June 30, 2021, subject to requisite regulatory approvals and customary closing conditions. | ||

| 7 | Nature of consideration | Cash | ||

| 8 | Purchase consideration | US$ 1,450 Million (US Dollar One Thousand Four Hundred and Fifty Million), subject to customary closing adjustments as per terms of the purchase agreement | ||

| 9 | Shares acquired | 100% | ||

| 10 | Target Information | Founded in 1998 and headquartered in London, Capco is a leading global management and technology consultancy firm to the global banking and financial services industry. Capco has been working with Boards, C-Suites and business leaders for over 20 years across the banking, capital markets, wealth, asset management and insurance sectors. Capco works with more than 100 clients and has many long-standing relationships with the world’s leading financial institutions. Capco has over 5,000 consultants based in more than 30 global locations across 16 countries, supporting clients through their expert insights, entrepreneurial approach and focus on delivery excellence. Historical consolidated revenues (year ending 31 December) - 2020: $720 Mn; 2019: $693 Mn; 2018: $734 Mn | ||

FOR IMMEDIATE RELEASE

Conference Call to be conducted on Thursday,

March 4, 2021 at 7:00 PM IST

Wipro Limited invites you to participate in the conference call following the announcement regarding acquisition of “Capco”, on Thursday, March 04th, 2021, from 07:00 pm to 07:45 pm, Indian Standard Time

The audio from the conference call will be available online through a webcast and can be accessed at

https://links.ccwebcast.com/?EventId=WIPRO210304

Dial in details for the conference call are as below:

| Time |

7.00PM - IST* (8:30 AM-ET#) | |

|

Click here for the diamond pass link

Diamond Pass™ is a Premium Service that enables you to connect to your conference call without having to wait for an operator.

If you have a Diamond Pass™ click the above link to associate your pin and receive the access details for this conference, if you do not have a Diamond Pass™ please register through the link and you will receive your Diamond Pass™ for this conference. | ||

| Primary Access Toll Number | +91 22 6280 1120 +91 22 7115 8021 | |

| Local Access Available all over India |

+91-7045671221 | |

| US Toll Free Number US Standby Toll Number |

1 866 746 2133 1 323 386 8721 | |

| UK Toll Free Number UK Standby Toll Number |

0 808 101 1573 44 203 478 5524 | |

| No passcode Required | ||

| * | Indian Standard Time, # US Eastern Time |

Please dial any of the above numbers five to ten minutes ahead of schedule. The operator will provide instructions on asking questions before and during the call.

For Investor Relations please contact below:

| Investors Relations | Abhishek Kumar Jain +91 9845791363 |

Aparna C Iyer +91 9845540884 |

About Wipro Limited

Wipro Limited (NYSE: WIT, BSE: 507685, NSE: WIPRO) is a leading global information technology, consulting and business process services company. We harness the power of cognitive computing, hyper-automation, robotics, cloud, analytics and emerging technologies to help our clients adapt to the digital world and make them successful. A company recognized globally for its comprehensive portfolio of services, strong commitment to sustainability and good corporate citizenship, we have over 180,000 dedicated employees serving clients across six continents. Together, we discover ideas and connect the dots to build a better and a bold new future.

Building a Bold Tomorrow Wipro Limited announces acquisition of Capco

Forward looking statements The forward-looking statements contained herein represent Wipro’s beliefs regarding future events, many of which are by their nature, inherently uncertain and outside Wipro’s control. Such statements include, but are not limited to, statements regarding Wipro’s growth prospects, its future financial operating results, and its plans, expectations and intentions. Wipro cautions readers that the forward-looking statements contained herein are subject to risks and uncertainties that could cause actual results to differ materially from the results anticipated by such statements. Such risks and uncertainties include, but are not limited to, risks and uncertainties regarding fluctuations in our earnings, revenue and profits, our ability to generate and manage growth, complete proposed corporate actions, intense competition in IT services, our ability to maintain our cost advantage, wage increases in India, our ability to attract and retain highly skilled professionals, time and cost overruns on fixed-price, fixed-time frame contracts, client concentration, restrictions on immigration, our ability to manage our international operations, reduced demand for technology in our key focus areas, disruptions in telecommunication networks, our ability to successfully complete and integrate potential acquisitions, liability for damages on our service contracts, the success of the companies in which we make strategic investments, withdrawal of fiscal governmental incentives, political instability, war, legal restrictions on raising capital or acquiring companies outside India, unauthorized use of our intellectual property and general economic conditions affecting our business and industry. Additional risks that could affect our future operating results are more fully described in our filings with the United States Securities and Exchange Commission, including, but not limited to, Annual Reports on Form 20-F. These filings are available at www.sec.gov. We may, from time to time, make additional written and oral forward-looking statements, including statements contained in the company’s filings with the Securities and Exchange Commission and our reports to shareholders. We do not undertake to update any forward-looking statement that may be made from time to time by us or on our behalf. Building a Bold Tomorrow © confidential 2

Wipro Limited announces acquisition of Capco overview On March 4, 2021, Wipro signed a definitive sale and purchase agreement to acquire Capco, a provider of end-to-end management consulting services and digital transformation solutions serving global financial institutions in the US, Europe and Asia Pacific. financing Transaction to be financed through internal cash and debt transaction time lines The acquisition is subject to regulatory approvals and is expected to close in the quarter ending June 30, 2021. key transaction terms • Transaction consideration $1450M to be paid in cash • Revenue: CY20 over $700M • Revenue by Geo: 55% North America • 41% Europe • 4% Asia • 5,000+ employees across the globe including US, UK, France, Germany, Poland, Slovakia, Austria, Poland, Switzerland, Brazil, India, Singapore, Malaysia and Hong Kong. integration imperatives • Given its strong brand recall, Capco to operate as a separate unit (Capco – A Wipro Company) • Complimentary business models and sector alignment • Similar value systems & client centricity • Opens up a plethora of opportunities for the leadership of both entities Building a Bold Tomorrow © confidential 3

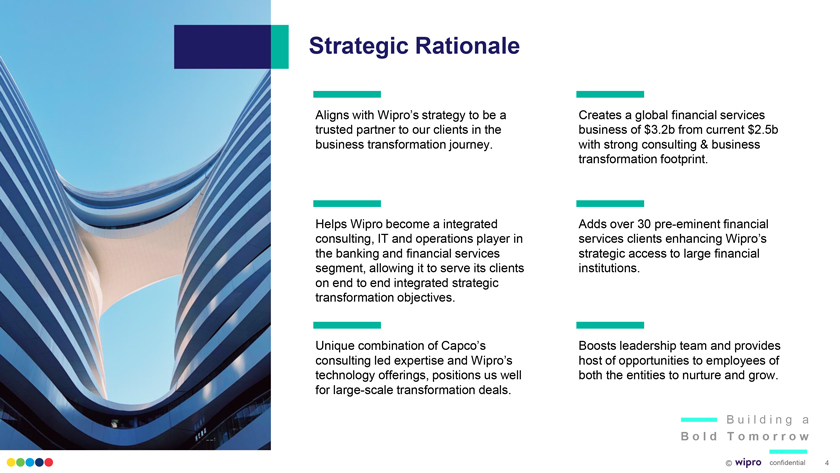

Strategic Rationale Aligns with Wipro’s strategy to be a trusted partner to our clients in the business transformation journey. Helps Wipro become a integrated consulting, IT and operations player in the banking and financial services segment, allowing it to serve its clients on end to end integrated strategic transformation objectives. Unique combination of Capco’s consulting led expertise and Wipro’s technology offerings, positions us well for large-scale transformation deals. Creates a global financial services business of $3.2b from current $2.5b with strong consulting & business transformation footprint. Adds over 30 pre-eminent financial services clients enhancing Wipro’s strategic access to large financial institutions. Boosts leadership team and provides host of opportunities to employees of both the entities to nurture and grow. Building a Bold Tomorrow © confidential 4

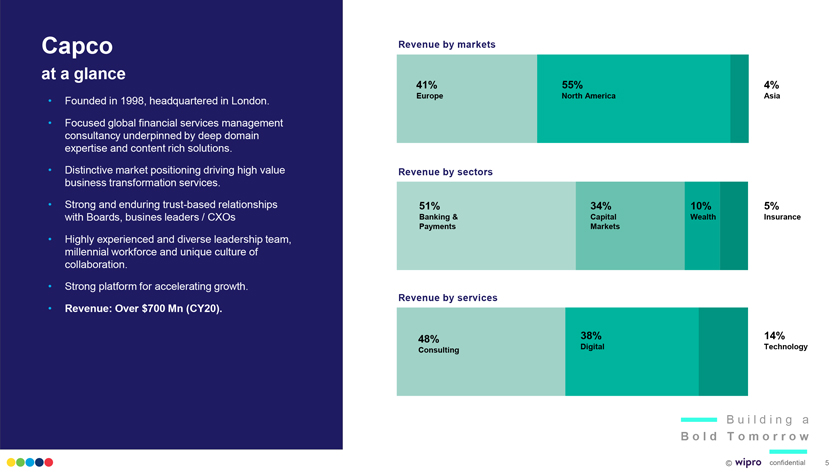

Capco at a glance • Founded in 1998, headquartered in London. • Focused global financial services management consultancy underpinned by deep domain expertise and content rich solutions. • Distinctive market positioning driving high value business transformation services. • Strong and enduring trust-based relationships with Boards, busines leaders / CXOs • Highly experienced and diverse leadership team, millennial workforce and unique culture of collaboration. • Strong platform for accelerating growth. • Revenue: Over $700 Mn (CY20). Revenue by markets 41% 55% 4% Europe North America Asia Revenue by sectors 51% 34% 10% 5% Banking & Capital Wealth Insurance Payments Markets Revenue by services 48% 38% 14% Consulting Digital Technology Building a Bold Tomorrow © confidential 5

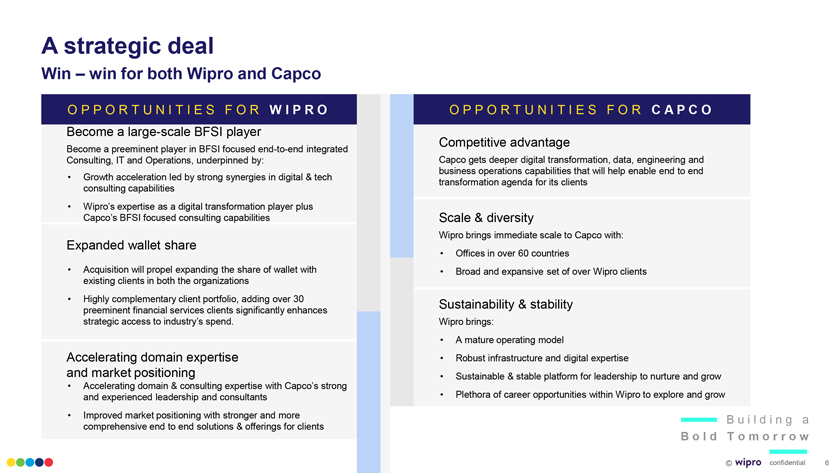

A strategic deal Win – win for both Wipro and Capco OPPORTUNITIES FOR WIPRO Become a large-scale BFSI player Become a preeminent player in BFSI focused end-to-end integrated Consulting, IT and Operations, underpinned by: • Growth acceleration led by strong synergies in digital & tech consulting capabilities • Wipro’s expertise as a digital transformation player plus Capco’s BFSI focused consulting capabilities Expanded wallet share • Acquisition will propel expanding the share of wallet with existing clients in both the organizations • Highly complementary client portfolio, adding over 30 preeminent financial services clients significantly enhances strategic access to industry’s spend. Accelerating domain expertise and market positioning • Accelerating domain & consulting expertise with Capco’s strong and experienced leadership and consultants • Improved market positioning with stronger and more comprehensive end to end solutions & offerings for clients OPPORTUNITIES FOR CAPCO Competitive advantage Capco gets deeper digital transformation, data, engineering and business operations capabilities that will help enable end to end transformation agenda for its clients Scale & diversity Wipro brings immediate scale to Capco with: • Offices in over 60 countries • Broad and expansive set of over Wipro clients Sustainability & stability Wipro brings: • A mature operating model • Robust infrastructure and digital expertise • Sustainable & stable platform for leadership to nurture and grow • Plethora of career opportunities within Wipro to explore and grow Building a Bold Tomorrow © confidential 6

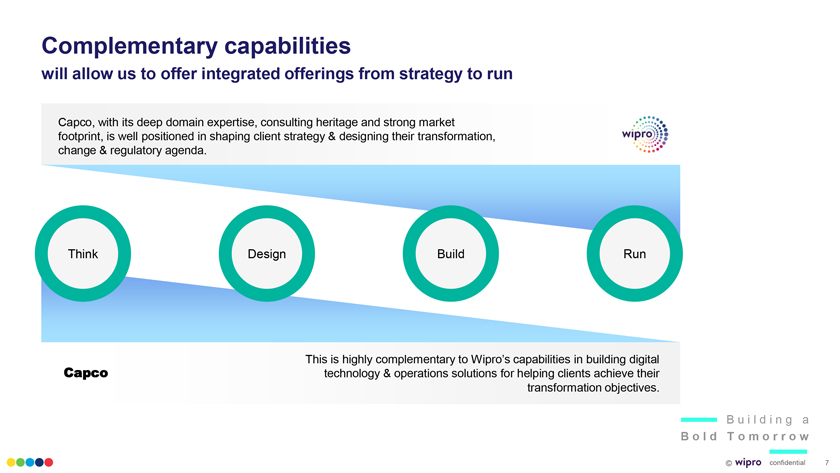

Complementary capabilities will allow us to offer integrated offerings from strategy to run Capco, with its deep domain expertise, consulting heritage and strong market footprint, is well positioned in shaping client strategy & designing their transformation, change & regulatory agenda. Think Design Build Run Capco This is highly complementary to Wipro’s capabilities in building digital technology & operations solutions for helping clients achieve their transformation objectives. Building a Bold Tomorrow © confidential 7

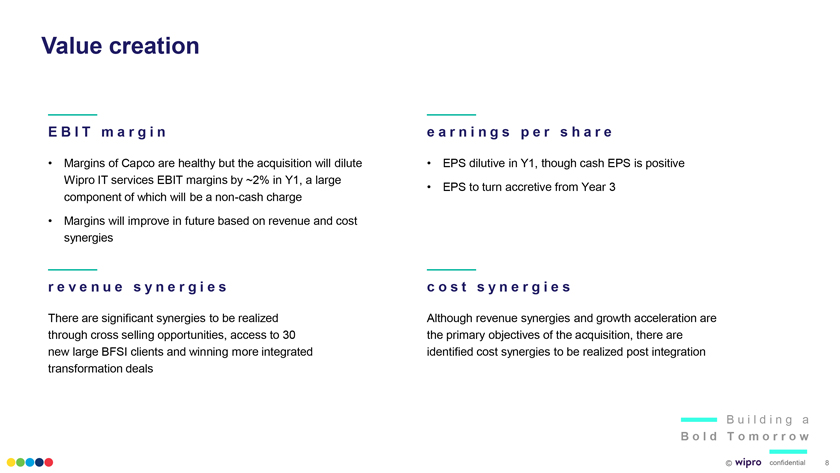

Value creation E B I T margin • Margins of Capco are healthy but the acquisition will dilute Wipro IT services EBIT margins by ~2% in Y1, a large component of which will be a non-cash charge • Margins will improve in future based on revenue and cost synergies revenue synergies There are significant synergies to be realized through cross selling opportunities, access to 30 new large BFSI clients and winning more integrated transformation deals earnings per share • EPS dilutive in Y1, though cash EPS is positive • EPS to turn accretive from Year 3 cost synergies Although revenue synergies and growth acceleration are the primary objectives of the acquisition, there are identified cost synergies to be realized post integration Building a Bold Tomorrow © confidential 8

The acquisition will create one of the world’s preeminent integrated consulting, technology & operations service providers offering end-to -end transformative outcomes to banks & financial institutions Building a Bold Tomorrow © confidential 9

Strong alignment between our values • Be passionate about clients’ success • Treat each person with respect • Be global and responsible • Unyielding integrity in everything we do • Respect • Commitment • Integrity • Knowledge • Excellence Public

Thank You Building a Bold Tomorrow © confidential 11

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Wipro Ltd. (WIT) PT Lowered to $4.75 at Jefferies

- Proactive Service Focus: Optimizing Power Business Environment

- Hempacco Receives Notification of Deficiency from Nasdaq

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share