Form 6-K VERMILION ENERGY INC. For: Mar 20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16

Under the Securities Exchange Act of 1934

For the month of March 2019

Commission File Number: 001-35829

Vermilion Energy Inc.

(Exact name of registrant as specified in its charter)

3500, 520 – 3rd Avenue S.W., Calgary, Alberta T2P 0R3

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

| Form 20-F ☐ | Form 40-F ☒ |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1).

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): _____

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

| Yes ☐ | No ☒ |

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

| Exhibit | Description | |

|---|---|---|

| 99.1 | Management Proxy Materials | |

| 99.2 | Instrument of Proxy | |

| 99.3 | Notice and Access Notification to Shareholders | |

| 99.4 | Notice of Meeting |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

VERMILION ENERGY INC.

| By: | /s/ Lars Glemser | |

| Title: | Lars Glemser, VP and Chief Financial Officer |

Date: March 20, 2019

Exhibit 99.1

FRONT COVER THEME

As illustrated by the front cover photo of our operations in Germany, Vermilion’s integration of sustainability throughout our business recognizes that we are part of a larger whole: the environments and communities in which we operate. We are therefore committed to conducting our activities in a manner that will protect the health and safety of both. This includes understanding our role in the evolving energy transition within the broader context of the United Nations Sustainable Development Goals (“SDGs”). We believe this approach, in which sustainability is embedded in our corporate strategy, supports Vermilion’s long-term economic viability while building a better future for our stakeholders through enhanced economic, environmental and community wellbeing.

ABOUT VERMILION

Vermilion is a publicly traded, widely held, international oil and gas producer. We are headquartered in Calgary, Alberta, Canada, with onshore and offshore operations around the world in countries noted for their stable, well-developed fiscal and regulatory policies regarding oil and gas exploration and development. Our core business involves the acquisition, exploration, development and optimization of hydrocarbon resources, with an emerging focus on developing renewable energy projects closely related to our core competencies.

VERMILION IS A DIVERSIFIED ENERGY PRODUCER WITH ASSETS IN THREE POLITICALLY STABLE REGIONS

TABLE OF CONTENTS

| Executive Summary | |

| Executive Summary | 1 |

| Business Highlights | 1 |

| Compensation Highlights | 4 |

| Independent Board with Significant Breadth and Depth | 6 |

| External Recognition | 7 |

| Letter to Shareholders | |

| Letter to Shareholders | 8 |

| Shareholder and Voting Information | |

| Invitation to Shareholders | 10 |

| General Information | 11 |

| Registered and Beneficial Shareholder Voting | 15 |

| General Voting Information | 16 |

| Annual Business | 17 |

| Special Business | 18 |

| Director Nominees and Compensation | |

| Director Nominee Biographies | 25 |

| Director Compensation | 30 |

| Equity Ownership | 34 |

| Corporate Governance | |

| Board Governance Policies and Highlights | 35 |

| Governance Philosophy | 37 |

| Board and Executive Diversity Policy | 37 |

| Nomination of Directors | 37 |

| Other Public Directorships | 38 |

| Directors Serving Together | 38 |

| Board Assessments | 38 |

| Skills and Experience | 39 |

| Continuing Education | 42 |

| Orientation | 42 |

| Independence and Board Committees | 42 |

| Expectations of Board Members | 43 |

| Meeting Attendance | 43 |

| Sessions without Management | 44 |

| Retirement Guideline | 44 |

| Terms of Reference | 44 |

| Code of Business Conduct and Ethics | 45 |

| Risk Oversight | 45 |

| Other Committees | 45 |

| Sustainability and Climate-Related Governance | 46 |

| Board and Committees | |

| Board and Committees | 49 |

| Board of Directors | 50 |

| Audit Committee | 52 |

| Governance and Human Resources Committee | 53 |

| Health, Safety and Environment Committee | 55 |

| Independent Reserves Committee | 55 |

| Sustainability Committee | 56 |

| Compensation Discussion and Analysis | |

| Compensation Practices and Highlights | 57 |

| Compensation Discussion and Analysis Overview | 59 |

| Strategy and Objectives | 59 |

| Compensation Program Design | 59 |

| Elements of Compensation | 61 |

| Peer Groups | 67 |

| Corporate Performance Results and Compensation Impact | |

| 2018 Performance – Corporate Scorecard Measures and Results | 71 |

| 2018 Strategic Plan Performance | 74 |

| 2019 Performance – Corporate Scorecard Changes | 77 |

| Executive Ownership Guidelines | 80 |

| Clawback Policy (Recoupment of Incentive Compensation) | 80 |

| Trading in Vermilion Securities | 81 |

| Anti-Hedging Policy | 81 |

| Succession Planning | 81 |

| President and Chief Executive Officer Review | 82 |

| Performance Graph | 82 |

| Cost of Management Ratios | 83 |

| 2018 Total Compensation Mix | 84 |

| Executive Compensation | |

| Named Executive Officers | 85 |

| 2018 Compensation Decisions | 88 |

| Summary Compensation Table | 91 |

| Termination and Change of Control Benefits | 94 |

| Schedules and Other Information | |

| Schedule “A” – Terms of Reference for the Board | A-1 |

| Schedule “B” – Summary of Vermilion Incentive Plan | B-1 |

| Schedule “C” – Summary of Five-Year Security-Based Compensation Arrangement | C-1 |

| Schedule “D” – Summary of Deferred Share Unit Plan | D-1 |

| Schedule “E” – Summary of Employee Bonus Plan | E-1 |

| Schedule “F” – Summary of Employee Share Savings Plan | F-1 |

| Schedule “G” – Advisory Statements | G-1 |

| Corporate Information | Inside back cover |

| Executive Summary |

EXECUTIVE SUMMARY

You can find the key highlights of our proxy statement and key results for 2018 in the next few pages. Please refer to the Strategic Highlights section starting on page 74 for full details of our 2018 performance.

Business Highlights

The commodity price environment remained volatile during 2018. In spite of this environment, 2018 was a successful year for Vermilion.

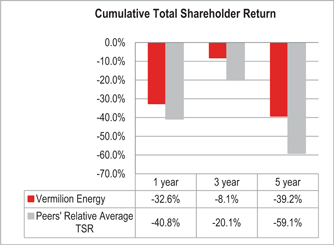

TOTAL SHAREHOLDER RETURN (“TSR”) OUTPERFORMANCE

| ü | In a highly volatile commodity price environment, Vermilion has continued to be a relatively defensive issue, producing better TSR results than our peer group for one, three and five-year cumulative TSR. |

FUND FLOWS FROM OPERATIONS1 (“FFO”)

| ü | Track record of FFO growth over the long-term despite a volatile commodity price environment. |

| ü | Reflecting our continuous improvement in capital efficiency, this production growth translated into free cash flow1 growth of 14%. |

ANNUAL PRODUCTION

| ü | Record annual average production of 87,270 boe/d in 2018, with Q4 2018 production in excess of 100,000 boe/d. |

| ü | Continued production per share (“PPS”) growth at significantly lower capital intensity. In 2018, PPS increased by 10%, marking our sixth straight year of PPS growth. Our compounded annual PPS growth rate over this time has been 8%. |

RESERVES

| ü | We have efficiently and consistently increased our reserves base over the past 16 years, featuring strategic acquisitions and conversions from our high-quality resource portfolio over the past several years. |

| ü | Since 2012, reserves per share have increased at an 11% compounded pace. |

Notes:

| 1. | See Advisory in Schedule “G”. |

| 2. | As evaluated by GLJ in a report dated February 7, 2019, with an effective date of December 31, 2018. See Advisory in Schedule “G”. |

Page 1 ■ Vermilion Energy Inc. ■ 2019 Management Proxy Circular

| Executive Summary |

RELIABLE AND GROWING DIVIDENDS

| ü | We have never cut our monthly dividend since inception of the dividend in 2003. |

| ü | We announced a 7% increase to the monthly dividend to $0.23 per share from $0.215 per share, effective with the April 2018 dividend paid on May 15, 2018. |

| ü | We have increased our dividend four times (2007, 2013, 2014 and 2018), paying a total of more than $3.3 billion of dividends since inception in 2003 to December 31, 2018. |

CONSERVATIVE BALANCE SHEET

| ü | Ample liquidity to execute our business plan. |

COMMODITY MIX

| ü | Commodity and geographic diversification reduce volatility. |

Note:

| 1. | Company estimates as at February 22, 2019. FCF is a non-standardized measure (see Advisory in Schedule “G”) and excludes interest expense. FCF defined as FFO less E&D sustaining and growth capital expenditures. FCF estimate based on February 22, 2019 strip: Brent US$65.41/bbl; WTI US$57.86/bbl; LSB = WTI less US$3.48; TTF $8.40/mmbtu; AECO $1.60/mmbtu; CAD/USD 1.31; CAD/EUR 1.51 and CAD/AUD 0.94. Includes existing hedges. North American Gas, NGL, US and CEE have been excluded as those products and countries are estimated to produce not meaningful or negative FCF in 2019 at quoted strip. |

Vermilion Energy Inc. ■ 2019 Management Proxy Circular ■ Page 2

| Executive Summary |

VERMILION’S INTERNATIONAL ADVANTAGE

| ü | Focused in three core areas: Europe, North America and Australia, with stable, well-developed fiscal and regulatory regimes. |

| ü | Global asset portfolio provides commodity diversification and premium pricing. |

| ü | Diversified product portfolio reduces price correlation, increasing stability of our cash flows. |

| ü | Project diversification allows allocation of capital expenditures to the highest return commodity products and jurisdictions, increasing return on capital employed and producing more reliable growth. |

| ü | Greater selection of business development opportunities due to global reach. |

| Commodity Exposures | North American Natural Gas | European Natural Gas | WTI Crude Oil | Brent Crude Oil |

| Vermilion | ü | ü | ü | ü |

| North American Industry | ü | ü | ||

| International Industry | ü | ü |

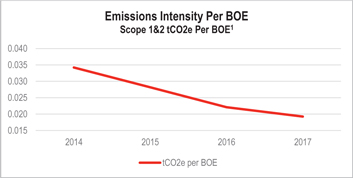

EMISSIONS INTENSITY PER BOE

| ü | Our emissions intensity provides an important benchmark, illustrating that we are decreasing greenhouse gas emissions in the production of each barrel of oil equivalent that we produce. |

Note:

| 1. | Greenhouse gas emissions: Scope 1 (Direct, from Vermilion-owned/controlled sources) and Scope 2 (Indirect, from purchased energy sources) in tonnes of carbon dioxide equivalent per barrel of oil equivalent. |

Page 3 ■ Vermilion Energy Inc. ■ 2019 Management Proxy Circular

| Executive Summary |

Compensation Highlights

Our executive compensation program is designed to reward performance in a simple and effective way. It reflects the size, scope, and success of Vermilion’s global business and the importance of our executive officers operating as a high-performing team, while focusing on key measures of profitability and the creation of shareholder value. Total compensation is targeted between median and top quartile, depending on Company and individual performance. A combination of superior individual and corporate performance results in above median compensation.

The 2018 Named Executive Officers (“NEOs”), who we also refer to as “executives” in this document, are the President and Chief Executive Officer, Vice President and Chief Financial Officer, Executive Vice President and Chief Operating Officer, Executive Vice President, People and Culture and Vice President, Business Development.

KEY FEATURES OF OUR EXECUTIVE COMPENSATION PROGRAM

In 2018, we completed an extensive revision of our corporate performance scorecard models, and we made changes to both our 2019 short-term and long-term incentive program scorecards (“STIP Scorecard” and “LTIP Scorecard”). We modified the respective scorecards to include a minimum of two operational and two return-based performance metrics for each one. Within our scorecards, we disclose the metrics, rationale for the metrics chosen, pre-established targets, achieved results, and the final overall score linked to our compensation program.

Vermilion Energy Inc. ■ 2019 Management Proxy Circular ■ Page 4

| Executive Summary |

PRESIDENT AND CHIEF EXECUTIVE OFFICER (“CEO”) VARIABLE PAY

| ü | 100% based on corporate performance. |

ADVISORY VOTE ON EXECUTIVE COMPENSATION

| ü | Holding 6th annual ‘Say on Pay’ vote. |

| ü | 2018 support of 86% and five-year average support of 95%. |

ANTI-HEDGING POLICY

| ü | Prohibits all directors and officers from engaging in any arrangements that are designed to hedge. |

CLAWBACK POLICY

| ü | Requires repayment of any incentive pay where executive(s) or officer(s) engage in intentional misconduct that causes financial restatement. |

ROBUST OWNERSHIP POLICY

| ü | Directors, 3 times annual retainer. |

| ü | CEO, 8 times base salary _ exceeds the industry average ownership requirements. |

| ü | CEO, post-retirement holding period of 2 times annual base salary for a period of 12 months. |

| ü | Executive Vice Presidents, 3 times base salary. |

| ü | Vice Presidents, 1 times base salary. |

EXECUTIVES VARIABLE PAY (OTHER THAN CEO)

| ü | Executive Vice Presidents based on 2/3 corporate and 1/3 individual performance. |

| ü | Vice Presidents based on 1/3 corporate performance and 2/3 individual performance. |

DOUBLE TRIGGER EXECUTIVE AGREEMENTS

| ü | CEO relinquished single trigger and moved to double trigger in 2018. |

| ü | All new executive agreements will be double trigger. |

| ü | Existing executive agreements are grandfathered with single trigger. |

COMPENSATION RISK

| ü | We focus on governance around our executive compensation: |

| ü | Stress-testing to provide possible payouts under various market conditions when we are seeking approval of compensation programs. |

| ü | Back-testing to determine whether amounts recommended for payout under our compensation programs are aligned with our initial expectations and overall corporate performance. |

Page 5 ■ Vermilion Energy Inc. ■ 2019 Management Proxy Circular

| Executive Summary |

Independent Board with Significant Breadth and Depth

| ü | Vermilion maintains a skills matrix to evaluate the skill set of the Board of Directors (“Board”) based on individual director self-assessments. |

| ü | In addition to the skills matrix summarized below, we have developed a sustainability-specific skills matrix to highlight the skills and experience that our Board members bring to managing environment, social and governance factors. |

| ü | Our Board members have significant relevant experience in all facets of our business. |

For full details on the Board skills matrix, including the sustainability skills matrix, see page 39.

SUSTAINABILITY COMMITTEE

| ü | In 2018, we have taken our commitment to being a leader in environmental, social and governance practices a step further, through the establishment of a Sustainability Committee by the Board to provide oversight with respect to sustainability policy and performance. |

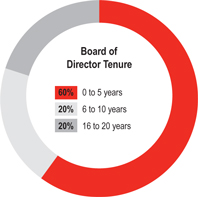

DIRECTOR NOMINEES TENURE

| ü | 60% of the Board has less than five years tenure. |

BOARD REFRESHMENT

| ü | We annually review the Board size and composition to ensure appropriate mix of backgrounds, skills and experience to guide the long-term strategy and ongoing business operations of the Company. |

| ü | In 2018, one appointment was approved: |

| ü | Ms. Carin Knickel – August 1, 2018. |

REPRESENTATION OF WOMEN

| ü | We recognize the importance of gender diversity. |

| ü | In 2018, we introduced a formal Board and Executive Diversity Policy relating to representation of women in our Board and executive officer level positions. |

| ü | We have launched a mentoring program, focused on helping high-potential female employees develop their management skills and prepare them for senior leadership roles in the future. |

Vermilion Energy Inc. ■ 2019 Management Proxy Circular ■ Page 6

| Executive Summary |

EXTERNAL RECOGNITION

BOARD GAMES

| ü | Recognized for excellence in governance practices as part of the Globe and Mail’s annual Board Games governance report. Vermilion’s governance practices resulted in a rank of 2nd amongst Canadian oil and gas companies in 2018 and within the top quartile of all companies in the S&P/TSX Composite Index. |

CANADIAN COALITION FOR GOOD GOVERNANCE

| ü | Recognized year-after-year for best practices for proxy disclosure in the area of corporate governance relating to disclosure on executive compensation, directors’ independence, benefits, and perquisites. |

ISS GOVERNANCE QUALITYSCORE

| ü | In 2018, recognized for excellence in managing governance risk with decile scores of “1” for Environmental practices, “2” for Social practices and “3” for Governance practices. A decile score of “1” indicates lower governance risk, while a “10” indicates higher governance risk. Institutional Shareholder Services (“ISS”) QualityScore is a scoring solution supported by data on environmental, social and governance practices, designed to help institutional investors identify risks within portfolio companies. |

GREAT PLACE TO WORK® INSTITUTE

| ü | Recognized as a Best WorkplaceTM in Canada, the Netherlands and Germany. In Canada, Vermilion is the only energy company on a Best WorkplaceTM list (small, medium or large). This recognition is a positive reflection of Vermilion’s strong corporate culture. |

CORPORATE KNIGHTS 2018 FUTURE 40

| ü | Vermilion has earned recognition on the Corporate Knights Future 40 Responsible Corporate Leaders in Canada listing every year since the list’s inception in 2014. In 2018, we ranked 11th, and were the highest rated oil and gas company on the list. |

CDP DRIVING SUSTAINABLE ECONOMIES

| ü | Vermilion was named to the CDP Climate Leadership Level (A-) for the second consecutive year in 2018. We were the only Canadian oil and gas company to achieve this level, which places us among the top two percent of companies in North America and the top five percent globally. |

FM-FSI COMPETITION FOR BEST SUSTAINABILITY REPORT

| ü | The Montreal-based Finance and Sustainability Initiative selected Vermilion as a finalist for the FM-FSI Competition for Best Sustainability Report in the Non-Renewable Resources – Oil and Gas category for 2018. |

MSCI’S GOVERNANCE METRICS REPORT

| ü | In 2018, Vermilion's MSCI Environment, Social and Governance (“ESG”) rating remained at A, marking the second consecutive year Vermilion has scored at a high level, and our Governance Metrics score ranked in the top decile globally. This recognition reflects our continued focus on achieving robust shareholder returns combined with environmental, social and governance performance. |

ROBECOSAM

| ü | Vermilion received a top quartile ranking in 2018 for our industry sector in RobecoSAM’s annual Corporate Sustainability Assessment (“CSA”). The CSA analyzes sustainability performance across economic, environmental, governance and social criteria, and is the basis of the Dow Jones Sustainability Indices. |

Page 7 ■ Vermilion Energy Inc. ■ 2019 Management Proxy Circular

| Letter to Shareholders |

Letter to Shareholders

Founded in 1994, and now recognized as a premier operator both onshore and offshore, Vermilion has been delivering outstanding financial and operational performance for 25 years. This is made possible by the efforts of more than 1,000 staff (employees and contractors) located across our global operations. In 2018, we continued to be recognized by Great Place to Work® Institute as a Best WorkplaceTM in Canada, the Netherlands and Germany.

Vermilion’s operations are focused in three core regions – North America, Europe and Australia – providing diversified commodity exposure and breadth of opportunity. Our international asset base provides the high margins, low base production decline rates and strong capital efficiencies necessary to support our self-funded growth-and-income business model. We have developed an inventory of conventional and semi-conventional projects which we manage at a growth rate appropriate to our asset base and business model. We continue to increase our portfolio of development and exploration opportunities, as evidenced by our increasing reserves and resources.1

We aim to deliver annual organic production growth along with reliable and increasing dividends to our shareholders, while maintaining debt ratios that are below sector averages. Vermilion continues to produce favourable results on all of these key measures. Since 2003, we have increased our dividend four times, most recently in April 2018, and have never reduced our dividend. Cumulatively, we have paid out over $3.3 billion in dividends, exceeding our entire equity issuance since Vermilion’s inception.

We continuously evaluate opportunities to augment our organic growth targets with accretive acquisitions that are subject to disciplined evaluation criteria, to ensure they add long-term value for our shareholders. The principles underlying our business model have allowed us to repeatedly weather commodity price instability, enabling the delivery of dependable returns to our shareholders. Vermilion has generated a compound annualized total return2 of 28.0% since our inception in 1994.

In 2018, we conducted our most active drilling program in our history, while holding Exploration and Development (“E&D”) capital investment below the level from five years earlier, a time when our production rate was less than half of what it is today. We also completed four acquisitions within our existing core areas last year, making this our most active year in terms of both organic and M&A activity. As a result, we delivered record annual production of 87,270 boe/d, representing a year-over-year increase of 28%, or 10% on a per share basis. We achieved a significant operational milestone in Q4 2018 as our production exceeded 100,000 boe/d for the first time in our history. Similarly, we increased our proved plus probable reserves by 63% to 488.1 mmboe1, reflecting a year-over-year increase of 31% on a per share basis.

Looking forward, we estimate that cash dividends will constitute approximately $400 million in 2019. Our capital budget of $530 million for 2019 is designed to deliver a production range of 101,000 to 106,000 boe/d, resulting in year-over-year production per share growth of 8%. At current differentials and using the current commodity strip for Brent, WTI and European natural gas, we estimate that we will be more than self-funded for our dividends and capital program for 2019, with excess cash generation earmarked for further debt reduction.

Our 2018 acquisitions added high netback, low decline and free cash flow3 generating producing assets while also significantly expanding our future project inventory. We are very disciplined in our M&A approach and apply a rigorous strategic framework, comprehensive technical evaluation methodology, and consistent decision criteria for any assets that we consider in our three operating regions. We were able to opportunistically conclude the Spartan acquisition, a Saskatchewan/Manitoba waterflood purchase, and a Powder River Basin stacked zone land and production acquisition, along with the consolidation of additional working interests in Corrib. These important acquisitions enhanced our margins, reduced risk in our operating and financial profiles, expanded our development project inventory, increased our operating control, and diversified our asset base away from Alberta’s particularly challenged product pricing. As a result of our organic and acquisition activities, we generated a Return on Capital Employed (“ROCE”)3 of 9% in 2018, compared to our five-year average ROCE of 4%.

At Vermilion, we have always been committed to the priorities of health and safety, the environment, and economic prosperity – in that order. Nothing is more important to us than the safety of our communities and those who work with us, and the protection of our natural surroundings. And while our communities rely on us to conduct business responsibly, we believe in reaching beyond conscientious operation, ensuring that our investors, staff, partners and communities share in our success.

Vermilion Energy Inc. ■ 2019 Management Proxy Circular ■ Page 8

| Letter to Shareholders |

Over the past decade, Vermilion has consciously pursued the integration of environmental and social sustainability into our business strategy, beginning in 2008 with our use of recycled geothermal energy in our Parentis greenhouse project. We continue to expand our recycled geothermal projects, now supplying heat to social housing projects in France and soon to agricultural centers in Netherlands. We are proud of our demonstrated record of enhanced energy efficiency and flared gas reductions in our oil and gas operations, reducing absolute emissions while increasing energy production for the third consecutive year. We are honoured to be a central contributor to these economic and social success stories, which positively impact several interconnected United Nations Sustainable Development Goals: SDG 7 on Affordable and Clean Energy, SDG 8 on Decent Work and Economic Growth, SDG 10 on Industry, Innovation and Infrastructure, and SDG 13 on Climate Change.

Our strategy – in which we prioritize people and the environment – is aligned with many of the Task Force on Climate-related Financial Disclosures’ (TCFD) recommendations for managing climate risks and opportunities in terms of governance, strategy, risk management and measurement. In 2018, for the second consecutive year, we were named to Climate Leadership Level (A-) by the CDP (formerly named the Carbon Disclosure Project). This year, we have taken our commitment to being a leader in environmental, social and governance practices a step further, through the establishment of a Sustainability Committee by the Board to provide oversight with respect to sustainability policy and performance.

Vermilion’s strong record of leadership in Strategic Community Investment continued in 2018, as we established our second company-wide community investment program. This aligns with our strategy to create shared value between the Company and our communities, assessing where our financial investments and our employees’ volunteer time best align with community needs. Following the successful launch of our Global Emergency Responder Program in 2017, which focuses on safety, we established the Global Environmental Stewardship Program. Our initial investments will leverage our operational focus on protecting the environment by supporting land conservation (Canada, United States and the Netherlands), environmental work experience for underemployed individuals (France), and volunteer reforestation (Croatia). We implement all of these programs with a deep respect for the non-profit organizations with which we partner, recognizing that our mutual contributions to SDG 17, on Partnerships, strengthen our communities in ways that would not be possible if we were operating alone.

The achievements of our Company would not be possible without the dedication, creativity and hard work of our staff, and the strong leadership of our Board of Directors. Our staff and Board work collaboratively to assess and adapt to today’s multi-faceted challenges to our industry, and to devise the corporate strategy that will continue our long-term record of success in the face of these new challenges. Vermilion is determined to stay at the forefront of economic, social and environmental success.

On behalf of Vermilion’s Board of Directors, we appreciate your continued support as we approach a quarter century of operational, market and ESG outperformance. Thank you for your interest and investment in Vermilion.

| (“Lorenzo Donadeo”) | (“Anthony Marino”) |

| Lorenzo Donadeo | Anthony Marino |

| Chair of the Board | President and Chief Executive Officer |

Notes:

| 1. | Based on reserves as evaluated by GLJ Petroleum Consultants Ltd. in a report dated February 7, 2019 with an effective date of December 31, 2018. |

| 2. | Annualized total returns are calculated to December 31, 2018. |

| 3. | Non-GAAP Financial Measure. See Advisory in Schedule “G.” |

Page 9 ■ Vermilion Energy Inc. ■ 2019 Management Proxy Circular

| Shareholder and Voting Information |

Invitation to Shareholders

Dear Vermilion Shareholder,

It is our pleasure to invite you to attend our annual general meeting to be held on Thursday, April 25, 2019 at 3:00 pm MDT (“Meeting”) in the Ballroom of the Metropolitan Centre, in Calgary, Alberta. At the Meeting you will hear about our 2018 performance and our future plans. You will also vote on the items of business and have the opportunity to meet management, members of the Board and other shareholders.

Please take some time to read this Notice of Meeting, Proxy Statement and Information Circular (“Circular”). It contains important information about the Meeting, voting, director nominees, our governance practices, and our director and executive compensation. It will help you to understand the Board’s role and responsibilities and explains our compensation in detail.

We appreciate your confidence in Vermilion and look forward to seeing you at the Meeting.

| Notice of Meeting: | |

| Date and Time: | Thursday, April 25, 2019 at 3:00 pm MDT |

| Place: | Ballroom, Metropolitan Centre, 333 – 4th Avenue SW, Calgary, Alberta |

| Your Right to Vote: | You have the right to vote if you were a Vermilion shareholder on March 11, 2019 |

| Meeting Matters: | 1. receiving our financial statements and the respective auditors’ report for the year ended December 31, 2018; |

| 2. fixing the number of directors to be elected at the Meeting at 10 directors; | |

| 3. electing the directors for the next year; | |

| 4. appointing Deloitte LLP as auditors; | |

| 5. approving the adoption of, and unallocated entitlements under, the Deferred Share Unit Plan governing the issuance of deferred share units of the Company to non-employee directors and certain service providers of the Company; | |

| 6. approving unallocated entitlements under, and amendments to, the Vermilion Incentive Plan; | |

| 7. approving unallocated entitlements under, and amendments to, Vermilion’s Employee Bonus Plan; | |

| 8. approving unallocated entitlements under, and amendments to, Vermilion’s Employee Share Savings Plan; | |

| 9. approving unallocated entitlements under, and amendments to, Five-Year Security-Based Compensation Arrangement; and | |

| 10. advisory vote on Vermilion’s approach to executive compensation as set forth in this Circular. |

The Circular explains your voting options (starting on page15) and gives you more information about the items that will be covered at the Meeting.

Sincerely,

(“Lorenzo Donadeo”)

Lorenzo Donadeo

Chair of the Board

Vermilion Energy Inc. ■ 2019 Management Proxy Circular ■ Page 10

| Shareholder and Voting Information |

General Information

Vermilion

Vermilion Energy Inc. is an international energy producer that seeks to create value through the acquisition, exploration, development and optimization of producing properties in North America, Europe and Australia. Our business model emphasizes organic production growth augmented with value-adding acquisitions, along with providing reliable and increasing dividends to investors. Vermilion is targeting growth in production primarily through the exploitation of light oil and liquids-rich natural gas conventional resource plays in Canada and the United States, the exploration and development of high impact natural gas opportunities in the Netherlands, Germany and Central and Eastern Europe, and oil drilling and workover programs in France and Australia. Vermilion holds a 20% operated interest in the Corrib gas field in Ireland. Vermilion operates approximately 90% of its production on a worldwide basis. Vermilion pays a monthly dividend of Canadian $0.23 per share, which provides a current yield of approximately 8.0%.

Through the rest of this Circular we refer to Vermilion Energy Inc. as “we”, “our”, “Vermilion” and/or the “Company”.

We use the following abbreviations for the names of the committees in tables:

| ñ | AC = Audit |

| ñ | GHR = Governance and Human Resources |

| ñ | HSE = Health, Safety and Environment |

| ñ | IR = Independent Reserves |

| ñ | SC = Sustainability |

Canada Business Unit

Vermilion’s Canadian production is primarily focused in the West Pembina region of West Central Alberta and in southeast Saskatchewan and Manitoba. Vermilion's main targets in West Pembina are the condensate-rich Mannville and Cardium light oil plays, while our light oil targets in southeast Saskatchewan and Manitoba are primarily the Mississippian Midale, Frobisher/Alida and Ratcliffe formations. West Pembina is the Company's main NGL producing area.

Australia Business Unit

In 2005, Vermilion acquired a 60% operated interest in the Wandoo offshore oil field and related production assets, located on Western Australia's northwest shelf. In 2007, Vermilion acquired the remaining 40% interest in the asset. Production occurs from 20 well bores and five lateral sidetrack wells that are tied into two platforms, Wandoo 'A' and Wandoo 'B'.

France Business Unit

Vermilion entered France in 1997 and has completed three subsequent acquisitions. The Company is the largest oil producer in the country and represents approximately three-quarters of domestic oil production. Vermilion predominately produces oil in France and the Company's oil is priced with reference to Dated Brent.

Vermilion's main producing areas in France are located in the Aquitaine Basin southwest of Bordeaux, and in the Paris Basin, located just east of Paris. The two major fields in the Paris Basin area are Champotran and Chaunoy, and the two major fields in the Aquitaine Basin are Parentis and Cazaux.

Netherlands Business Unit

Vermilion entered the Netherlands in 2004 and is the country's second largest onshore natural gas producer (excluding state-owned energy company EBN). Vermilion's natural gas production in the Netherlands is priced off of the TTF index.

Germany Business Unit

Vermilion entered Germany in 2014 with the acquisition of a 25% non-operated interest in natural gas producing assets. In December 2016, Vermilion completed an acquisition of oil and gas producing properties that provided Vermilion with its first operated position in the country. We hold a significant undeveloped land position in Germany as a result of a farm-in agreement the Company entered into in 2015. Our natural gas production in Germany is priced with reference to the NCG and GPL indices which are both highly correlated to the TTF benchmark, and our oil production is priced with reference to Dated Brent.

Ireland Business Unit

Vermilion acquired an 18.5% non-operating interest in the offshore Corrib gas field located off the northwest coast of Ireland in 2009. The asset is comprised of six offshore subsea wells, an onshore natural gas processing facility and offshore and onshore pipeline segments.

In July 2017, Vermilion and Canada Pension Plan Investment Board ("CPPIB") announced a strategic partnership in Corrib, whereby CPPIB acquired Shell E&P Ireland Limited’s 45% interest in Corrib. At closing, we assumed operatorship of Corrib, and CPPIB transferred a 1.5% working interest to Vermilion, bringing our ownership interest in Corrib to 20%. The acquisition has an effective date of January 1, 2017 and closed in December 2018.

United States Business Unit

Vermilion entered the United States in 2014 in the East Finn oil field of northeastern Wyoming and expanded its position through the 2018 acquisition of mineral land and producing assets in the Hilight oil field located approximately 40 miles northwest of the existing assets. All of our working interest ownership in Wyoming is Company operated.

Page 11 ■ Vermilion Energy Inc. ■ 2019 Management Proxy Circular

| Shareholder and Voting Information |

Central and Eastern Europe ("CEE") Business Unit

Vermilion established a CEE Business Unit in 2014 with a head office in Budapest, Hungary. The CEE Business Unit is responsible for business development in CEE, including managing the exploration and development opportunities associated with the Company's land holdings in Hungary, Slovakia and Croatia. We drilled our first well (1.0 net) in CEE in the South Battonya license of Hungary in Q1 2018.

Common Shares Outstanding

At the close of business on March 1, 2019, there were 152,894,656 Common Shares outstanding. Our Common Shares trade under the symbol VET on the Toronto Stock Exchange (“TSX”) and on the New York Stock Exchange (“NYSE”).

Owners of 10% or

More of the Common Shares

To the knowledge of the directors and executives, no person or company owns or controls more than 10% of our Common Shares.

Interests in Meeting Business and Material Transactions

None of Vermilion, our directors and officers, any nominee for election as a director or anyone associated or affiliated with any of the above has a material interest in any item of business at the Meeting. A material interest is one that could reasonably interfere with the ability to make independent decisions.

No insider of Vermilion has or had, during 2018, a material interest in a material transaction or proposed material transaction affecting Vermilion.

Indebtedness

We do not make loans to our directors or executives. As a result, there are no loans outstanding to any of them.

Annual Report and

Other Documents

We file our

Annual Report and Annual Information Form with Canadian and U.S. securities regulators. Financial information is provided in our

comparative annual financial statements and Management’s Discussion and Analysis for the most recently completed fiscal

year. A copy of the Annual Report, including our annual financial statements, notes and Management’s Discussion and Analysis,

the Annual Information Form and this Circular will be provided on request to registered and beneficial shareholders. You can also

obtain copies by accessing our public filings at www.sedar.com, www.sec.gov or www.vermilionenergy.com.

If you prefer, you can address a written or an email request for documents to:

|

Vermilion

Energy Inc. 3500, 520 – 3rd Avenue SW Calgary, Alberta T2P 0R3 Attention: Cathy Arcuri |

|

[email protected] |

Dividend Reinvestment Plan

Under the Premium Dividend™ and Dividend Reinvestment Plan (the “Plan”), eligible shareholders who elect to participate in the Dividend Reinvestment Component can reinvest their dividends in Common Shares at the Average Market Price (with no broker commissions or trading costs).

Participation in the Plan, which is explained in greater detail in the complete Plan document available on Vermilion’s corporate website at www.vermilionenergy.com (under the heading “Investor Relations” subheading “DRIP”), is subject to eligibility restrictions, applicable withholding taxes, prorating as provided for in the Plan, and other limitations on the availability of Common Shares to be issued or purchased in certain events. Participation in the Plan is available to Canadian residents and non-U.S. resident foreign shareholders who meet certain eligibility criteria as set forth in the complete Plan. U.S. resident shareholders are not currently permitted to participate in the Plan due to the requirement, under U.S. securities regulations, to maintain a continuous shelf registration for issuance of new equity to U.S. shareholders. At this time, Vermilion has not put in place the required shelf registration due to the high cost of establishing and maintaining such a shelf registration.

For more information on our Premium Dividend™ and Dividend Reinvestment Plan, defined meanings for capitalized terms above, eligibility restrictions, and enrollment information and forms among other details, please refer to the complete copy of the Premium DividendTM and Dividend Reinvestment Plan document as well as a related series of Questions and Answers available on Vermilion’s website at www.vermilionenergy.com (under the heading “Invest With Us” subheading “Dividends”) or contact our plan agent, Computershare Trust Company of Canada (“Computershare”):

|

1.800.564.6253 (toll free) |

|

www.computershare.com |

|

[email protected] |

Vermilion Energy Inc. ■ 2019 Management Proxy Circular ■ Page 12

| Shareholder and Voting Information |

Communicating with the Board

You may write to the Board or any member or members of the Board in care of:

|

Vermilion

Energy Inc. 3500, 520 – 3rd Avenue SW Calgary, Alberta T2P 0R3 Attention: Cathy Arcuri |

You may also communicate online with our Board as a group:

|

[email protected] |

If an interested party wishes to communicate directly with the Chair of the Board, the Lead Director or the Company's independent directors as a group regarding any matter, such party can communicate his or her concerns anonymously or confidentially by postal mail. Any submissions should be marked confidential and addressed to: the Chair of the Board, the Lead Director or independent directors, as the case may be, at the above address.

Communications are distributed to the Board, or to any individual directors as appropriate, depending on the facts and circumstances outlined in the communication. In that regard, the Board has requested that certain items which are unrelated to the duties and responsibilities of the Board should be excluded from distribution, such as questions about day-to-day functions and operations and items that are commercial in nature (e.g. advertising).

Engaging Shareholders

The Company and our Board believe in the importance of regular and open dialogue with our stakeholders in accordance with the Company’s Disclosure Policy. To that end, our Board, executives and investor relations representatives engage with both institutional and retail shareholders and investors, sell-side research and sales representatives, government officials and other interested stakeholders across all regions and throughout the year:

| ñ | through both formal and informal in-person meetings with investors across North America, Europe and Asia; |

| ñ | through participation in industry-based institutional and retail conferences and expositions; |

| ñ | through conducting of executive tours of our facilities and operations and the hosting of open houses for stakeholders in the communities in which we operate; |

| ñ | through the hosting of quarterly earnings calls with open question and answer sessions that are accessible both by phone or via webcast; |

| ñ | through our regulatory filings and the issuance of news releases; |

| ñ | through regular media interviews on business news networks; |

| ñ | by maintaining an external corporate website with detailed consolidated and segmented corporate and investor information (www.vermilionenergy.com); |

| ñ | participated in 29 conferences and 16 roadshows in 2018, resulting in over 480 meetings including 410 institutional meetings, 32 sell-side meetings and 41 retail presentations; |

| ñ | hosted an investor day in Toronto on November 27, 2018 with 131 live participants and 104 viewings of the archived webcast; |

| ñ | by providing an investor relations email address and phone number and responding in a timely manner to all inquiries received from interested stakeholders; |

| ñ | by holding an annual general meeting in-person, during which shareholders are provided an opportunity to ask questions to the Board and the executive following completion of the formal business of the Meeting; and |

| ñ | by providing avenues to communicate directly with the Board or any member, as set out above. |

In 2018, in addition to the ongoing quarterly and annual shareholder engagements listed above, we engaged with ISS and Glass Lewis to better understand their policies and guidelines in preparation for the 2019 Circular.

Page 13 ■ Vermilion Energy Inc. ■ 2019 Management Proxy Circular

| Shareholder and Voting Information |

Sustainability

Approach

As a responsible oil and gas producer, we consistently seek to deliver long-term shareholder value by operating in an economically, environmentally and socially sustainable manner that is recognized as a model in our industry.

Vermilion understands

our stakeholders’ expectations that we deliver strong financial results in a responsible and ethical way. As a result, we

align our strategic priorities in the following order:

| ñ | the safety and health of our staff and those involved directly or indirectly in our operations; |

| ñ | our responsibility to protect the environment. We follow the Precautionary Principle introduced in 1992 by the United Nations "Rio Declaration on Environment and Development" by using environmental risk as part of our development decision criteria, and by continually seeking improved environmental performance in our operations; and |

| ñ | economic success through a focus on operational excellence across our business, which includes technical and process excellence, efficiency, expertise, stakeholder relations, and respectful and fair treatment of staff, contractors, partners and suppliers. |

Reflecting these priorities, we have positioned Vermilion purposefully within the energy transition. Predictions differ about the manner and speed of the transition, but our own scenario analyses are clear that Vermilion can best contribute by focusing on producing energy safely and responsibly, and also reliably and cost-effectively. We also believe those stakeholders who are concerned about sustainability, including investors, governments, regulators, communities and citizens, should turn to best-in-class operators such as Vermilion to ensure our assets in oil and gas are strategic resources that can be deployed in the service of the energy transition and, indeed, of the framework for the planet’s health and wellbeing represented by the SDGs.

To support our strategy, we regularly communicate with our stakeholders, including via our sustainability reporting. In 2018, following a review of recommendations from the Task Force on Climate-related Financial Disclosures and the Sustainability Accounting Standards Board, we adopted a wider approach to reporting, including within this document and in our Management’s Discussion and Analysis.

For more information, please see references to sustainability throughout this document, including Corporate Governance on page 46, and the Sustainability Committee on page 56. For additional context, our Sustainability Report can be found on our website at www.vermilionenergy.com (under the heading “Our Responsibility”).

Vermilion Energy Inc. ■ 2019 Management Proxy Circular ■ Page 14

| Shareholder and Voting Information |

Registered Shareholder Voting

You are a registered holder if your shares are in your name and you have a physical certificate in your possession.

Voting Options

|

In person at the Meeting (see below) |

|

By proxy (see below) |

|

By telephone (see enclosed proxy form) |

|

By internet (see enclosed proxy form) |

|

By smartphone (see enclosed proxy form) |

Voting in Person

If you plan to attend the Meeting and want to vote your shares in person, do not complete or return the enclosed proxy. Your vote will be taken and counted at the Meeting. Please register with Computershare when you arrive at the Meeting.

Voting by Proxy

Whether or not you attend the Meeting, you can appoint someone else to attend and vote as your proxy holder. Use the enclosed proxy form to do this. The people named in the enclosed proxy are members of management. You have the right to choose another person to be your proxy holder by printing that person’s name in the space provided. Then complete the rest of the proxy, sign it and return it. Your votes can only be counted if the person you appointed attends the Meeting and votes on your behalf. If you have voted by proxy, you may not vote in person at the Meeting, unless you properly revoke your proxy.

Return your completed proxy in the envelope provided so that it arrives by 3:00 pm MDT on April 23, 2019 or if the Meeting is adjourned, at least 48 hours (excluding weekends and holidays) before the time set for the Meeting to resume.

Revoking your Proxy

You may revoke your proxy at any time before it is acted on. Deliver a written statement that you want to revoke your proxy to our Corporate Secretary on or before April 24, 2019 (or the last business day before the Meeting if it is adjourned or postponed), or to the Chair of the Meeting on April 25, 2019.

| BENEFICIAL SHAREHOLDER VOTING | |

| You are a beneficial holder if your shares are held in the name of a nominee, such as a bank, trust company, securities broker, trustee or other institution. | |

| Voting Options | |

|

In person at the Meeting (see below) |

|

By voting instruction form (see below) |

|

By telephone (see enclosed voting instruction form) |

|

By internet (see enclosed voting instruction form) |

|

By smartphone (see enclosed voting instruction form) |

| Voting in Person | |

| If you plan to attend the Meeting and wish to vote your shares in person, insert your own name in the space on the enclosed form. Then follow the signing and return instructions provided by your nominee. Your vote will be taken and counted at the Meeting, so do not indicate your votes on the form. Please register with Computershare when you arrive at the Meeting, to ensure that your vote will be counted. | |

| Voting by Proxy | |

| You can vote your shares by completing the Voting Information Form (“VIF”) following the instructions provided on the VIF or you can appoint someone else to attend and vote as your proxy holder. Use the enclosed form to do this. The people named in the enclosed form are members of management. You have the right to choose another person to be your proxy by printing that person’s name in the space provided. Then complete the rest of the form, sign it and return it. Your votes can only be counted if the person you appointed attends the Meeting and votes on your behalf. If you have voted on the form, neither you nor your proxy holder may vote in person at the Meeting, unless you properly revoke your proxy. | |

| Return your completed form in the envelope provided so that it arrives by 3:00 pm MDT on April 23, 2019 or if the Meeting is adjourned, at least 72 hours (excluding weekends and holidays) before the time set for the Meeting to resume. | |

| Revoking your Proxy | |

| You may revoke your proxy before it is acted on. Follow the procedures provided by your nominee. Your nominee must receive your request to revoke your instructions before 3:00 pm MDT on April 23, 2019. This will give your nominee time to submit the revocation to us. | |

Page 15 ■ Vermilion Energy Inc. ■ 2019 Management Proxy Circular

| Shareholder and Voting Information |

General Voting Information

Notice-and-Access Notification

The Company has elected to use the “notice-and-access” provisions under National Instrument 54-101 Communications with Beneficial Owners of Securities of a Reporting Issuer (“Notice-and-Access Provisions”) for the Meeting. The Notice-and-Access Provisions are rules developed by the Canadian Securities Administrators that reduce the volume of materials that must be physically mailed to shareholders by allowing a reporting issuer to post an Information Circular in respect of a meeting of its shareholders and related materials online. The Company has also elected to use procedures known as ‘stratification’ in relation to its use of the Notice-and-Access Provisions. Stratification occurs when a reporting issuer using the Notice-and-Access Provisions provides a paper copy of an Information Circular and, if applicable, a paper copy of financial statements and related Management’s Discussion and Analysis (“Financial Information”), to some shareholders together with a notice of a shareholder meeting.

In relation

to the Meeting, registered shareholders and beneficial shareholders who have requested to receive a paper copy will receive a

paper copy of the Circular and a form of proxy whereas all other beneficial shareholders will receive a voting instruction form

and a Notice-and-Access Notification which will include a link to the Circular and the 2018 Annual Report (“Meeting Materials”).

Non-objecting beneficial owners (“NOBOs”) of Common Shares will have their Meeting Materials delivered directly by

the Company with the assistance of Broadridge, and the Company intends to pay for intermediaries to deliver proxy-related materials

to objecting beneficial owners of Common Shares. Contact information is obtained in accordance with applicable securities regulatory

requirements. By choosing to send Meeting Materials to NOBOs directly, the Company has assumed responsibility for (i) delivering

these materials, and (ii) executing proper voting instructions. Beneficial owners are asked to please return their voting instructions

as specified in the request for voting instructions.

A paper copy of the financial information in respect of the most recent financial year of the Company will be mailed to registered shareholders as well as to those beneficial shareholders who have previously requested to receive them.

Interactive Proxy

We are pleased to continue to provide our shareholders with an interactive format for reviewing our Circular. This online platform makes it easy for shareholders to access the content within an intuitive and easy-to-navigate framework. Presenting content online is a cost-effective and environmentally friendly alternative to printing.

To access our interactive format, please visit our website at www.vermilionenergy.com (under the heading “Invest With Us” subheading “Annual General Meeting”).

Date of Information

This information contained in this Circular is as of March 1, 2019, unless otherwise noted.

Mailing of Circular

The Meeting Materials and Notice-and-Access Notification will be mailed on March 20, 2019 to shareholders of record on March 11, 2019.

Request for Proxies

Our management is requesting your proxies for this Meeting and is paying for the costs incurred. No director of Vermilion has informed management in writing that he/she intends to oppose any action intended to be taken by management at the Meeting.

We will provide Meeting Materials to Broadridge and other intermediaries and request that those materials be forwarded promptly to our beneficial shareholders.

Record Date

The record date for the Meeting is March 11, 2019. If you held shares on that date, you are entitled to receive notice of, attend and vote at the Meeting. You may be entitled to vote your shares if you bought shares from a registered shareholder and notify our transfer agent at least 10 days before the Meeting that you want to vote at the Meeting.

Voting Securities and Votes

Vermilion’s only voting securities are its Common Shares. Each Common Share entitles the holder to one vote at the Meeting.

Vermilion Energy Inc. ■ 2019 Management Proxy Circular ■ Page 16

| Shareholder and Voting Information |

Voting Instructions

If you specify how you want to vote on your proxy form or voting direction, your proxy holder has to vote that way. If you do not indicate how you want to vote, your proxy holder will decide for you.

If you appoint Anthony W. Marino or Lars W. Glemser, the management members set out in the enclosed proxy or voting direction, and do not specify how you want to vote, your shares will be voted as follows:

| Matter | Voted |

| Fixing the number of directors to be elected at the Meeting at 10 directors | FOR |

| Electing management nominees as directors | FOR |

| Appointing Deloitte LLP as auditors | FOR |

| Approving the adoption of, and unallocated entitlements under, the Deferred Share Unit Plan | FOR |

| Approving unallocated entitlements under, and amendments to, the Vermilion Incentive Plan | FOR |

| Approving unallocated entitlements under, and amendments to, Vermilion’s Employee Bonus Plan | FOR |

| Approving unallocated entitlements under, and amendments to, Vermilion’s Employee Share Savings Plan | FOR |

| Approving unallocated entitlements under, and amendments to, Five-Year Security-Based Compensation Arrangement | FOR |

| Advisory vote on executive compensation | FOR |

Quorum

We can only conduct business at the Meeting if we have a quorum – where at least two people attend the Meeting in person and hold or represent by proxy at least 25% of the total outstanding Common Shares.

Amendments or Other Business

If amendments or other business are properly brought up at the Meeting, you (or your proxy holder, if you are voting by proxy) can vote as you see fit. We are not aware of any changes to the current business or new business to be considered at the Meeting.

Vote Counting and Confidentiality

Votes by proxy are counted by Computershare. Your vote is confidential, unless you clearly intend to communicate your vote to management or as needed to comply with legal requirements.

Voting Questions

You can contact Computershare directly by:

|

9th

Floor, 100 University Avenue Toronto, Ontario, Canada M5J 2Y1 |

|

1.800.564.6253 (toll free) |

|

[email protected] |

Annual BUSINESS

Financial Statements

The consolidated financial statements as at and for the year ended December 31, 2018 and the respective auditor’s report are included in the 2018 Annual Report which will be available at the Meeting. The Annual Report is also filed on SEDAR at www.sedar.com, and on the EDGAR section of the Securities and Exchange Commission (“SEC”) website at www.sec.gov, and is available on Vermilion’s website at www.vermilionenergy.com. Additional copies are available, free of charge, upon request by shareholders.

Fixing the Number of Directors of Vermilion

The articles of Vermilion provide for a minimum of one director and a maximum of 15 directors. The by-laws of Vermilion provide that the number of directors shall be fixed from time-to-time by the shareholders. At the Meeting, it is proposed that the number of directors of Vermilion to be elected to hold office until the next annual meeting or until their successors are elected or appointed be fixed at 10. Unless otherwise directed, it is the intention of management to vote proxies in favour of fixing the number of directors to be elected at 10.

Election of Directors

Each director will hold office until the close of the next annual general meeting or until his/her successor is duly appointed or elected. Director nominees are:

| Lorenzo Donadeo | Dr. Timothy R. Marchant |

| Larry J. Macdonald | Anthony W. Marino |

| Carin A. Knickel | Robert B. Michaleski |

| Stephen P. Larke | William B. Roby |

| Loren M. Leiker | Catherine L. Williams |

We feel these nominees are well qualified to be directors of Vermilion and each one has confirmed that he/she is eligible and willing to serve if elected (see pages 25 to 29 for more information on the nominees). As Mr. Macdonald has reached the age of 70, and the GHR Committee oversees nominations, it has been recommended and approved by the Board that he remains for an additional term, as his skill set and expertise in international oil and gas exploration, production and operations are critical to the Board and Vermilion’s growth and strategic plan. Our Board retirement guideline can be found on page 44.

If a nominee

is not available to serve at the time of the Meeting (and we are not aware of any reason that would occur), the people named in

the enclosed proxy will vote for a substitute if one is chosen by the Board.

We recommend that you vote FOR these appointments. The people named in the enclosed proxy will vote FOR these nominations unless you tell them to withhold your vote.

Page 17 ■ Vermilion Energy Inc. ■ 2019 Management Proxy Circular

| Shareholder and Voting Information |

Majority Voting Policy

The Board adopted a Majority Voting Policy because we believe it reflects good corporate governance. Unless there is a contested election, a director who receives more “withhold” than “for” votes will offer to resign. The GHR Committee will then review the matter and recommend to the Board whether to accept the resignation. The director will not participate in any deliberations on the matter. Following deliberations, the Board will publicly announce its decision within 90 days of the particular annual general meeting. We expect to accept the resignation unless there are exceptional circumstances that warrant the director continuing on the Board. A copy of the policy is available on our website at www.vermilionenergy.com (under the heading “About Us” subheading “Governance”).

Appointment of Auditors

The Audit Committee recommends appointing Deloitte LLP as auditors of Vermilion for 2019. Deloitte LLP were first appointed as Vermilion’s auditors in 2000. In accordance with certain regulatory standards and as a means of ensuring the independence and integrity of the audit, lead partners on the audit are rotated every five years, including partners responsible for Vermilion’s material international subsidiaries.

We recommend that you vote FOR this appointment. The people named in the enclosed proxy will vote FOR the appointment of Deloitte LLP as auditors unless you tell them to withhold your vote.

Special Business

Security-Based Compensation Arrangements – Unallocated Entitlements

Vermilion has five security-based compensation arrangements: (i) the Vermilion Incentive Plan (“VIP”); (ii) the Employee Bonus Plan (“Bonus Plan”); (iii) the Employee Share Savings Plan (“Savings Plan”); (iv) the Five-Year Security-Based Compensation Arrangement (“Compensation Arrangement”); and (v) the Deferred Share Unit Plan (“DSU Plan”), which has been approved and adopted by the Board and is subject to shareholder approval at the Meeting. In this document the VIP and the Compensation Arrangement are referred to as “LTIP”. The features of each of these plans are described in more detail below.

Since the number of Common Shares issuable under the security-based compensation arrangements is based on a fixed percentage rather than a fixed maximum number of shares, the TSX requires a majority of the Board and shareholders to approve, every three years, all unallocated entitlements under the security-based compensation arrangements. In this Circular, unallocated entitlements refer to awards not granted and represent the balance between the reserve under each plan and the number of awards issued and outstanding.

In preparation for the 2019 approval and in connection with the adoption of the DSU Plan, Vermilion reviewed the share reserves

under its security-based compensation arrangements and determined that it is preferable to amend each of the security-based compensation arrangements to decrease the rolling reserve of the number of Common Shares issuable under all of the security-based compensation arrangements to 3.5% of the total number of issued and outstanding Common Shares (a decrease from the current 3.8% reserve), calculated on an undiluted basis, and to increase the maximum number of Common Shares that may be issued or granted in any calendar year pursuant to each of the Bonus Plan and Savings Plan to 500,000 from 300,000 Common Shares and pursuant to the Compensation Arrangement to 500,000 from 100,000 Common Shares. The maximum number of Common Shares that may be issued pursuant to the DSU Plan is 300,000 Common Shares. Vermilion considers the decrease of the rolling reserve for all of Vermilion’s security-based compensation arrangements from 3.8% to 3.5% of the issued and outstanding Common Shares, as prudent stewardship for shareholders.

If the proposed amendments are approved, the rolling reserve will be reduced to 3.5% (from 3.8%) of the total number of issued and outstanding Common Shares from time-to-time and the maximum number of Common Shares that may be issued or granted in any calendar year pursuant to each of the Bonus Plan, Savings Plan and the Compensation Arrangement will be limited to 500,000 Common Shares, and the DSU Plan will be limited to 300,000 Common Shares.

| Plan Category | # of Shares as at March 1, 2019 |

Annual Maximum Issuance per Plan |

| Total Shares Issued and Outstanding | 152,894,656 | n/a |

| 3.5% Rolling Reserve | 5,351,313 | n/a |

|

VIP Awards (issued and outstanding) |

1,867,630 | n/a |

|

Compensation Arrangement (issued and outstanding) |

36,845 | |

| Total Share Awards (VIP and Compensation Arrangement issued and outstanding) |

1,904,475 | n/a |

|

Unallocated Entitlements (available for future issuance) |

3,446,8381,2,3 | n/a |

| ñ Vermilion Incentive Plan | n/a | |

| ñ Savings Plan | 500,000 | |

| ñ Bonus Plan | 500,000 | |

| ñ Compensation Arrangement | 500,000 | |

| ñ DSU Plan4 | 300,000 |

| Notes: |

| 1. | Unallocated awards available for future issuance is based on one rolling reserve for all of Vermilion’s security-based compensation arrangements of 3.5% less VIP and Compensation Arrangement awards and DSUs issued and outstanding. As at March 1, 2019, no DSUs were issued; the first DSU grant will be March 31, 2019. |

Vermilion Energy Inc. ■ 2019 Management Proxy Circular ■ Page 18

| Shareholder and Voting Information |

| 2. | If the annual maximum number of Common Shares available for issuance under each of the Savings Plan, Bonus Plan and the Compensation Arrangement is increased to 500,000 Common Shares under each plan, and such maximum number of Common Shares are issued under each plan and under the DSU Plan (assuming the DSU Plan is approved by the shareholders at the Meeting), 1,646,838 unallocated share awards will remain available for future issuance under the VIP. If the amendment to increase the annual maximum number of Common Shares available for issuance under each of the Savings Plan, the Bonus Plan and the Compensation Arrangement is not approved by shareholders at the Meeting and the DSU Plan is not approved by the shareholders at the Meeting, 2,446,838 unallocated share awards will remain available for future issuance under the VIP (assuming the amendment to reduce the rolling reserve to 3.5% is approved). |

| 3. | Total unallocated entitlements available for future issuance based on our current rolling reserve of 3.8% is 3,905,522. If the amendment to decrease the rolling reserve from 3.8% to 3.5% is not approved by shareholders at the Meeting, 3,905,522 unallocated entitlements will remain available for future issuance. |

| 4. | The grant of DSUs on March 31, 2019 with an aggregate value of $447,589 (estimated 13,202 Common Shares using a $33.90 share price as at March 1, 2019) will reduce the annual maximum number of 300,000 Common Shares available for issuance under the DSU. |

Assuming upon vesting all awards are settled in Common Shares issued from treasury, as of March 1, 2019: (i) 1,867,630 share awards were issued and outstanding under the VIP (equal to approximately 1.22% of our issued and outstanding Common Shares); (ii) 36,845 share awards were issued and outstanding under the Compensation Arrangement (equal to approximately 0.02% of our issued and outstanding Common Shares); and (iii) no awards were issued and outstanding under either the Savings Plan, the Bonus Plan, or the DSU Plan. As each of the security-based compensation arrangements is subject to the same 3.5% “rolling reserve” limit, 3,446,838 unallocated entitlements (equal to approximately 2.25% of our issued and outstanding Common Shares) remain available for future issuance under the security-based compensation arrangements. If the amendment to decrease the reserve from 3.8% to 3.5% is not approved by shareholders at the Meeting, 3,905,522 unallocated entitlements (equal to approximately 2.55% of our issued and outstanding Common Shares) would remain available for future issuance under the security-based compensation arrangements.

At the Meeting, shareholders will be asked to approve the unallocated entitlements under our security-based compensation arrangements. If approved, we will again be required to seek shareholder approval of unallocated entitlements under our security-based compensation arrangements by no later than the annual meeting of shareholders held in 2022.

If shareholder approval of the unallocated entitlements is not obtained at the Meeting, the existing 1,867,630 share awards will vest and be settled in accordance with the VIP, the existing 36,545 share awards will vest and be settled in accordance with the Compensation Arrangement and the remaining 3,446,838 unallocated entitlements (3,905,522 unallocated entitlements in case of the 3.8% reserve) will not be permitted to be settled with Common Shares issued from treasury until shareholder approval is obtained. If shareholders do not approve the unallocated entitlements, awards will be settled in cash or with Common Shares purchased on the secondary market (or a combination thereof).

Summaries of all five plans are included in the Schedules to this Circular and a full copy of each plan can be found on SEDAR at www.sedar.com under Vermilion’s profile (filed March 20, 2019 under “Other Securityholders Documents”). In consideration of the environment and savings associated with reduced printing, shipping and mailing costs, we have not included copies of the plans in this Circular.

Deferred Share Unit Plan

Approval of Deferred Share Unit Plan

The DSU Plan was recently approved by the Board with an effective date of January 1, 2019. The principal purposes of the DSU Plan are to: (i) align our director compensation structure with the best governance practice; (ii) strengthen the ability of the Company and its affiliates to retain qualified non-employee directors and other specified non-employee service providers which the Company and its affiliates require; (iii) provide a competitive long-term incentive program to attract qualified non-employee directors and other specified non-employee service providers which the Company and its affiliates require; and (iv) promote a proprietary interest in the Company through share ownership thereby aligning the interests of non-employee directors and other specified non-employee service providers with shareholders. A summary of the DSU Plan is set forth in Schedule "D" of this Circular and a full copy of the plan is available on SEDAR at www.sedar.com under Vermilion’s profile (filed on March 20, 2019 under “Other Securityholders Documents”).

The DSU Plan provides for grants of deferred share units (“DSUs”) to Designated Participants (as defined in the DSU Plan).

A non-employee director Designated Participant is required to elect (in respect of each calendar year) the amount of the aggregate annual retainer or fee to be received in the form of DSUs, cash, Common Shares purchased on the secondary market, or a combination thereof, subject to requirements imposed by the Board to receive a specified minimum value of his or her annual retainer in the form of DSUs. In accordance with our Share Ownership Policy, non-employee directors are subject to a mandatory 50% DSU election until their ownership requirements are met, and to a 25% mandatory DSU election after the ownership requirements are met. Our Board amended the DSU Plan on February 27, 2019 such that a Designated Participant may also elect (in respect of each calendar year) to receive any meeting fees, including any Board Chair fees, committee Chair fees, Board committee member fees and Board meeting fees, in the form of DSUs, cash, Common Shares purchased on the secondary market, or a combination thereof. The meeting fees are not subject to a mandatory DSU election.

Page 19 ■ Vermilion Energy Inc. ■ 2019 Management Proxy Circular

| Shareholder and Voting Information |

The grant date with respect to a DSU will be the last day of each calendar quarter in a particular calendar year except in the case of the last calendar quarter where the grant date with respect to a DSU will be December 15. The first grant of DSUs will be on March 31, 2019. DSUs granted under the DSU Plan are to be settled at the election of the Board in cash, Common Shares issued from treasury (subject to shareholder approval of the DSU Plan at the Meeting and of unallocated entitlements thereunder every three years thereafter), or, at the election of the Board, or a combination of cash and Common Shares.

Vermilion believes DSUs and the DSU Plan aligns the interests of the Board of Directors with those of our shareholders, as it provides an effective retention mechanism in the competitive international environment in which the Company operates, and continues to reflect the Company’s prudent use of its cash resources while managing all Vermilion’s compensation arrangements with the 3.5% “rolling reserve”.

The DSU Plan constitutes a security-based compensation arrangement, which under TSX rules require approval (when instituted) by a majority of the Board and shareholders.

At the Meeting, shareholders will be asked to approve the DSU Plan and all unallocated entitlements under the DSU plan. Under the DSU Plan, the number of Common Shares reserved for issuance is subject to the same ‘rolling reserve’ limit applicable to entitlements under all other Vermilion security-based compensation arrangements (being the VIP, the Bonus Plan, the Savings Plan and the Compensation Arrangement) of 3.5% (assuming the amendments described above are approved) of the total number of issued and outstanding Common Shares, calculated on an undiluted basis, and will also be subject to an annual maximum of 300,000 Common Shares that may be issued or granted under the DSU Plan.

As of the date of this Circular, DSUs with an aggregate value of $447,589 (estimated 13,202 shares using a $33.90 share price as at March 1, 2019, represents 0.01% of total issued and outstanding Common Shares) are to be granted to Designated Participants on March 31, 2019 (subject to shareholder approval of the DSU Plan). If DSUs are settled with Common Shares issued from treasury, the number of underlying Common Shares to be issued will be determined based on the applicable five-day weighted average trading price of the Common Shares on the applicable exchange (being the TSX or the NYSE). If shareholders do not approve the DSU Plan, the DSUs granted will be settled with Common Shares purchased on the secondary market, a cash amount equal to the aggregate fair market value of Common Shares (as at the Redemption Date) or a combination thereof, but will not be settled with Common Shares issued from treasury.

Our Board has approved the DSU Plan as amended. At the Meeting the following ordinary resolution will be placed before shareholders for consideration and approval:

RESOLVED THAT:

| 1. | The DSU Plan, substantially as described in the Management Proxy Circular of Vermilion dated March 1, 2019, be and is hereby approved. |

| 2. | The DSUs with an aggregate value of $447,589 (estimated 13,202 shares using a $33.90 share price as at March 1, 2019, represents 0.01% of total issued and outstanding Common Shares), to be granted to Designated Participants on March 31, 2019 subject to shareholder ratification, be and are hereby ratified. |