Form 6-K VEON Ltd. For: May 14

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of May 2018

Commission File Number 1-34694

VEON Ltd.

(formerly VimpelCom Ltd.)

(Translation of registrant’s name into English)

The Rock Building, Claude Debussylaan 88, 1082 MD, Amsterdam, the Netherlands

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐.

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| VEON LTD. | ||

| (Registrant) | ||

Date: May 14, 2018

| By: | /s/ Scott Dresser | |

| Name: | Scott Dresser | |

| Title: | Group General Counsel |

Table of Contents

1 4 M A Y 2 0 1 8

V E O N R E P O R T S G O O D Q 1 2 0 1 8 R E S U L T S W I T H

F Y 2 0 1 8 T A R G E T S C O N F I R M E D

Table of Contents

Amsterdam (14 May 2018) – VEON Ltd. (NASDAQ: VEON, Euronext Amsterdam: VEON) a leading global provider of connectivity and internet services headquartered in Amsterdam and serving more than 240 million customers, today announces financial and operating results for the quarter ended 31 March 2018.

KEY DEVELOPMENTS

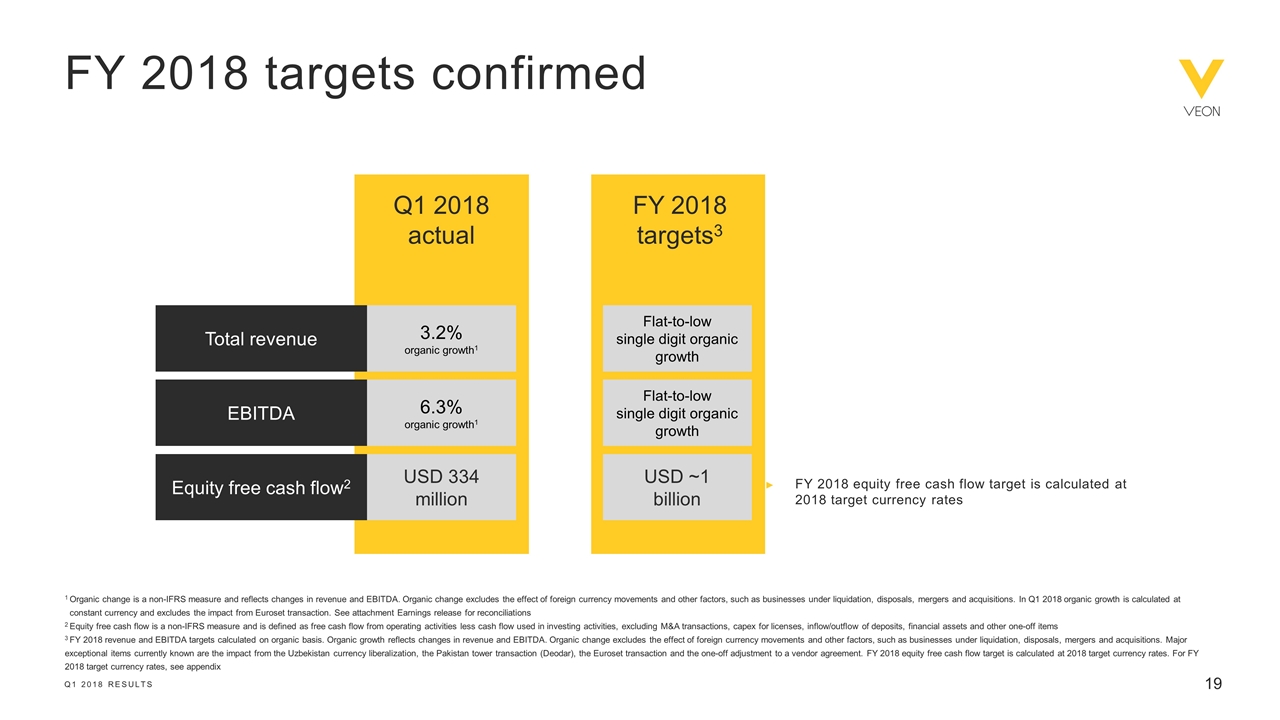

| ● | VEON reports good revenue and EBITDA organic1 growth in Q1 2018 |

| ● | USD 334 million in equity free cash flow2 excluding licenses |

| ● | Russia saw normalization in EBITDA, returning to trend. Pakistan, Ukraine and Uzbekistan continued their strong performance |

| ● | Kyivstar and Banglalink acquired spectrum and 4G/LTE licenses; VEON now launched 4G/LTE in all operating countries |

| ● | Euroset integration and rebranding into Beeline monobrand stores in Russia on track |

| ● | Ursula Burns appointed as Executive Chairman following departure of former CEO Jean-Yves Charlier |

| ● | VEON has withdrawn its Mandatory Tender Offer in relation to Global Telecom Holding |

| ● | Current best estimate for total Yarovaya law expenditures is RUB 45 billion over 5 years, of which approximately RUB 6 billion in FY 2018 |

| ● | VEON has completed sale of Laos operations; entered into an agreement to sell operations in Tajikistan |

| ● | FY 2018 guidance confirmed |

Q1 2018 KEY RESULTS3

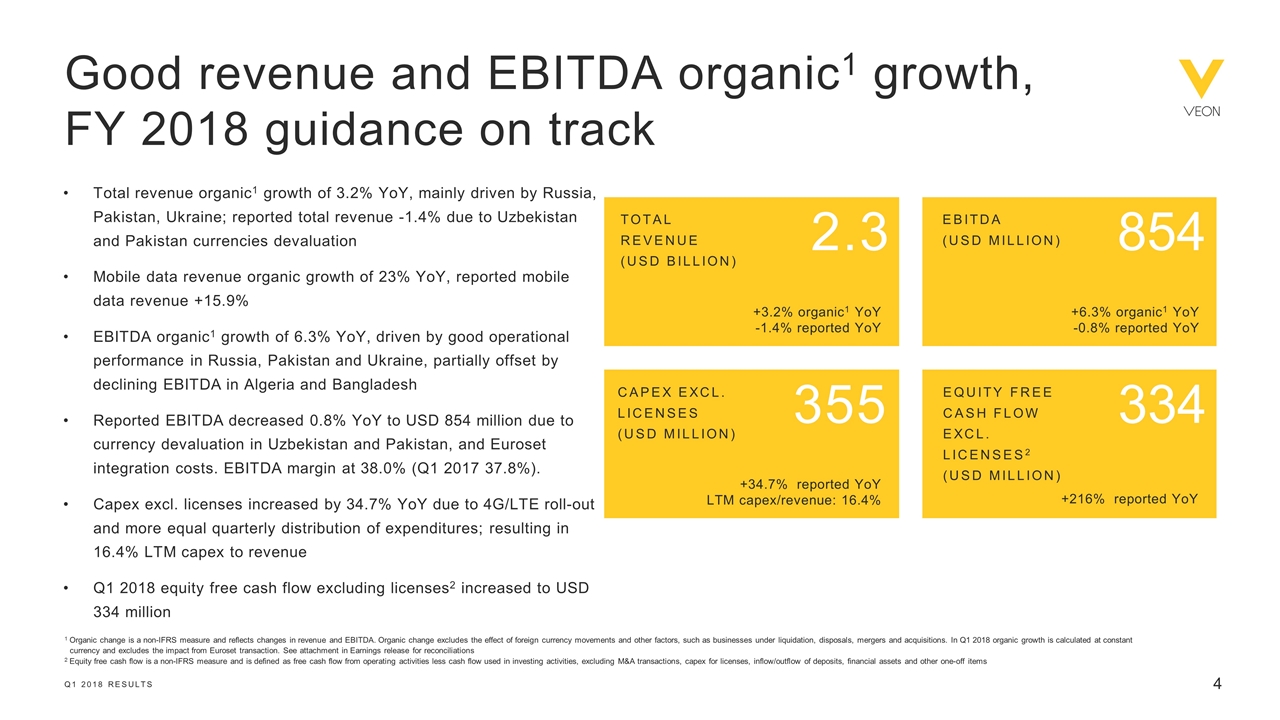

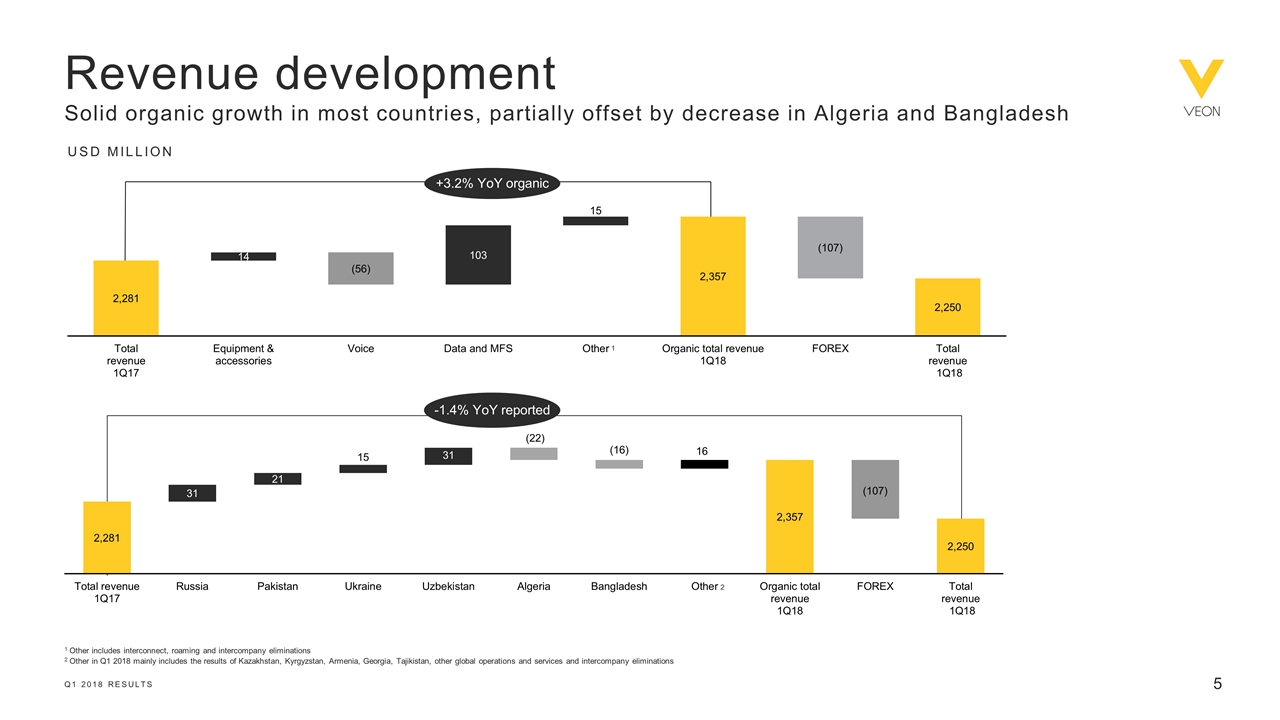

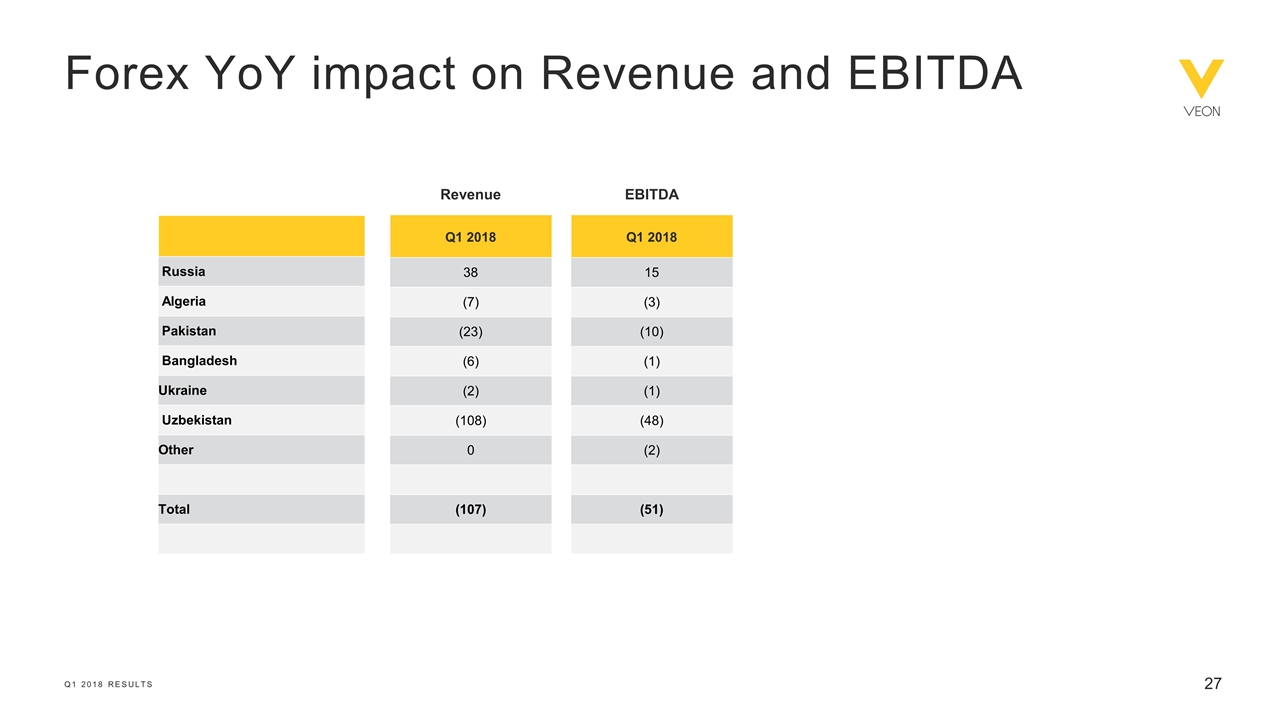

| ● | Total revenue decreased by 1.4% to USD 2,250 million, mainly due to the significant devaluation of the Uzbek and Pakistani currencies |

| ● | Total revenue grew organically1 by 3.2%, driven by Russia, Pakistan, Ukraine and Uzbekistan, partially offset by continued pressure in Algeria and Bangladesh |

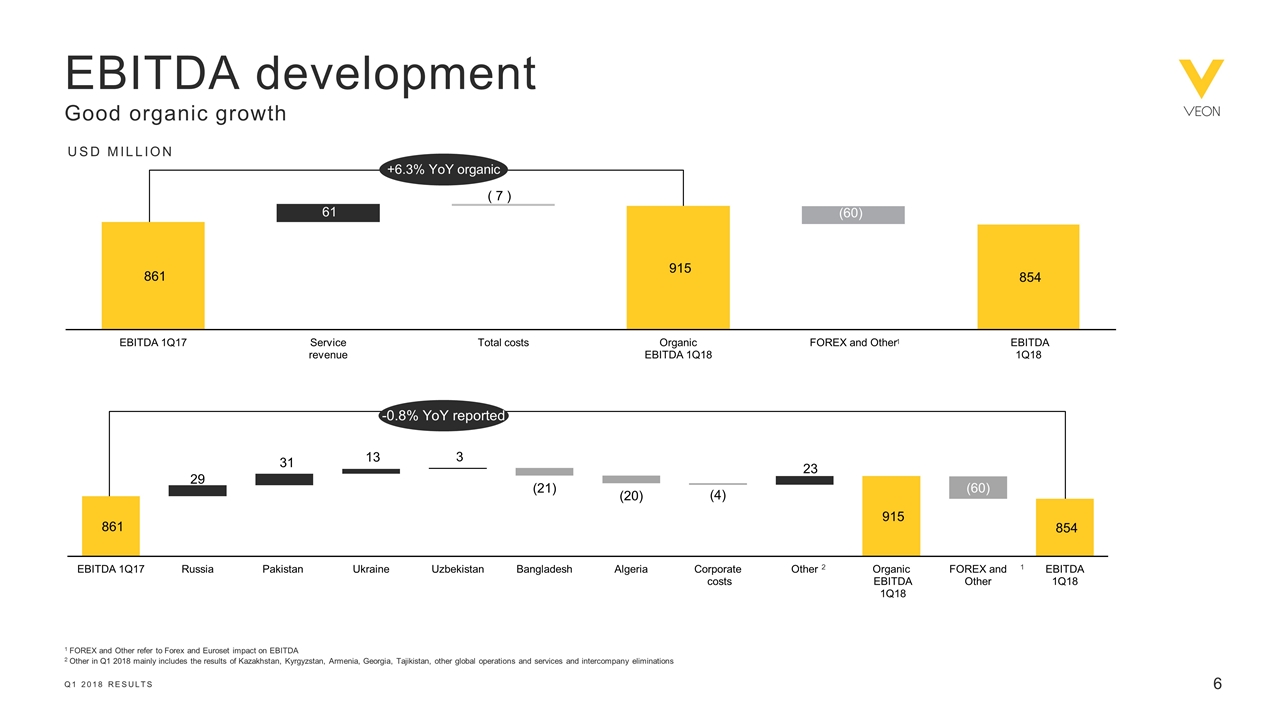

| ● | Reported EBITDA decreased 0.8% to USD 854 million, primarily due the significant devaluation of the Uzbek and Pakistani currencies, as well as Euroset integration costs |

| ● | EBITDA grew by 6.3% organically1, driven by good operational performance in Russia, Pakistan and Ukraine, partially offset by declining EBITDA in Algeria and Bangladesh |

| ● | EBITDA margin of 38.0%, up 0.2 percentage points year on year |

| ● | Equity free cash flow2 excluding licenses totalled USD 334 million in Q1 2018 |

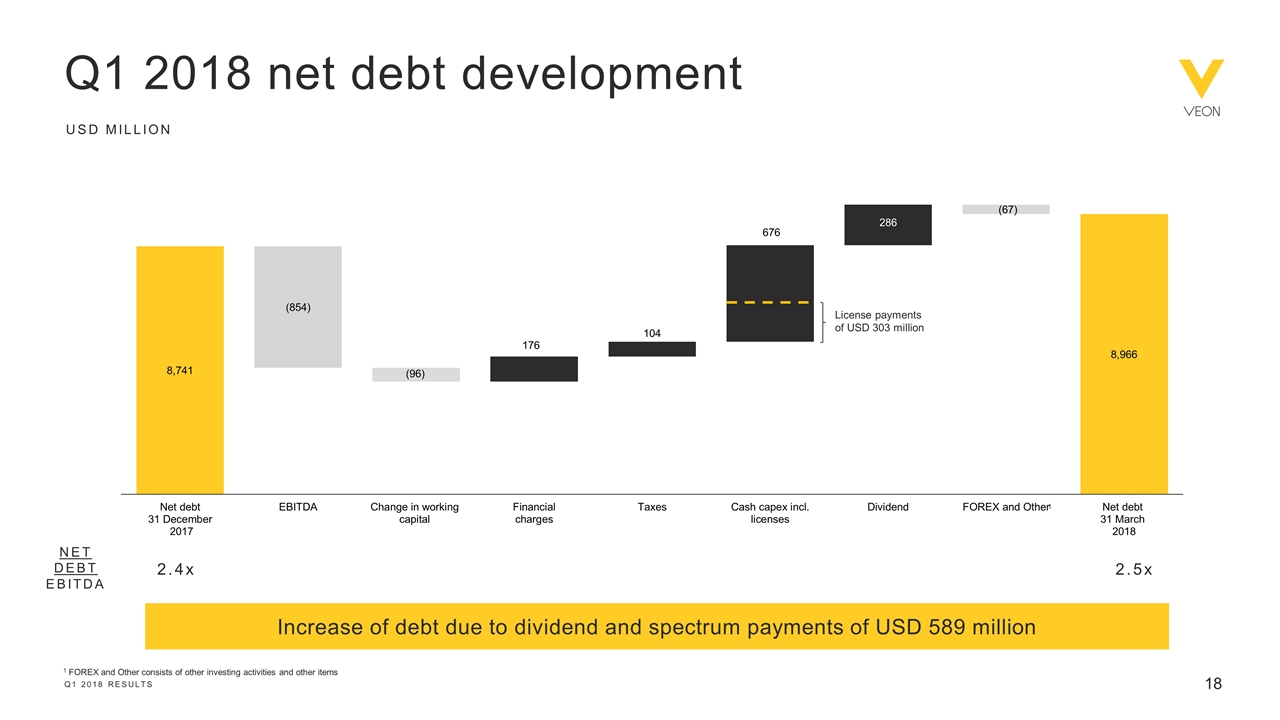

| ● | Net debt to LTM EBITDA at 2.5x, driven by spectrum investment and final dividend payment in Q1 2018 |

TROND WESTLIE, CHIEF FINANCIAL OFFICER, COMMENTS:

“The first quarter of 2018 saw VEON deliver good organic performance across its core markets. I am especially pleased to see a normalization in EBITDA performance in our largest market, Russia, following a more difficult fourth quarter. The company’s performance in Algeria and Bangladesh remains under pressure, but there is an indication that our turnaround plans for these markets are on track and are likely to show operational improvements towards the back end of the financial year. We have invested so that we now offer 4G/LTE in every one of our markets and we are on track to deliver on our 2018 outlook.”

| 1) | Organic change is a non-IFRS measure and reflects changes in revenue and EBITDA. Organic change excludes the effect of foreign currency movements and other factors, such as businesses under liquidation, disposals, mergers and acquisitions. In Q1 2018 organic growth is calculated at constant currency and excludes the impact from Euroset transaction. See Attachment C for reconciliations |

| 2) | Equity free cash flow is a non-IFRS measure and is defined as free cash flow from operating activities less cash flow used in investing activities, excluding M&A transactions, capex for licenses, inflow/outflow of deposits, financial assets and other one-off items. See attachment C for reconciliations |

| 3) | Key results compare to prior year results unless stated otherwise |

|

|

Q1 2018 2 |

Table of Contents

KEY RESULTS: CONSOLIDATED FINANCIAL AND OPERATING HIGHLIGHTS

| USD million |

1Q18 | 1Q17 | Reported YoY |

Organic YoY 1 |

||||||||||||

|

Total revenue, of which

|

2,250 | 2,281 | (1.4%) | 3.2 | % | |||||||||||

| mobile and fixed service revenue

|

2,156 | 2,202 | (2.1%) | 2.9 | % | |||||||||||

| mobile data revenue

|

505 | 436 | 15.9% | 23.0 | % | |||||||||||

| EBITDA

|

854 | 861 | (0.8%) | 6.3 | % | |||||||||||

| EBITDA margin (EBITDA/total revenue)

|

38.0% | 37.8% | 0.2p.p. | |||||||||||||

| Loss from continued operations

|

(82 | ) | (11 | ) | n.m. | |||||||||||

| Loss for the period attributable to VEON shareholders

|

(109 | ) | (5 | ) | n.m. | |||||||||||

| Equity free cash flow excl. licenses 2

|

334 | 106 | 215.7% | |||||||||||||

| Capital expenditures excl. licenses

|

355 | 264 | 34.7% | |||||||||||||

| LTM capex excl. licenses/revenue

|

16.4% | 18.6% | (2.2p.p. | ) | ||||||||||||

| Net debt

|

8,966 | 7,661 | 17.0% | |||||||||||||

| Net debt/LTM EBITDA

|

2.5 | 2.3 | ||||||||||||||

| Total mobile customer (millions, excluding Italy)

|

210 | 207 | 1.8% | |||||||||||||

| Total fixed-line broadband customers (millions, excluding Italy) |

3.6 | 3.4 | 5.9% | |||||||||||||

| 1) | Organic change is a non-IFRS measure and reflects changes in revenue and EBITDA. Organic change excludes the effect of foreign currency movements and other factors, such as businesses under liquidation, disposals, mergers and acquisitions. In Q1 2018 organic growth is calculated at constant currency and excludes the impact from Euroset transaction. See Attachment C for reconciliations |

| 2) | Equity free cash flow is a non-IFRS measure and is defined as free cash flow from operating activities less cash flow used in investing activities, excluding M&A transactions, capex for licenses, inflow/outflow of deposits, financial assets and other one-off items. See attachment C for reconciliations |

|

|

Q1 2018 3 |

Table of Contents

| CONTENTS | ||||

| 5 | ||||

| 6 | ||||

| 10 | ||||

| 18 | ||||

| 22 |

PRESENTATION OF FINANCIAL RESULTS

VEON’s results presented in this earnings release are based on IFRS and have not been audited.

Certain amounts and percentages that appear in this earnings release have been subject to rounding adjustments. As a result, certain numerical figures shown as totals, including those in tables, may not be an exact arithmetic aggregation of the figures that precede or follow them.

All non-IFRS measures disclosed in the document, i.e. EBITDA, EBITDA margin, EBIT, net debt, equity free cash flow, organic growth, capital expenditures excluding licenses, last twelve months (LTM) Capex excluding licenses/Revenue, are reconciled to the comparable IFRS measures in Attachment C.

VEON Ltd. owns a 50% share of the Wind Tre Joint Venture (with CK Hutchison owning the other 50%) and we account for this joint venture using the equity method as we do not have control. All information related to the Wind Tre Joint Venture is the sole responsibility of the Wind Tre Joint Venture’s management, and no such information contained herein, including, but not limited to, the Wind Tre Joint Venture’s financial and industry data, has been prepared by or on behalf of, or approved by, our management. For further information on the Wind Tre Joint Venture and its accounting treatment, see Note 6 to our audited consolidated financial statements included in our Annual Report on Form 20-F for the year ended 31 December 2017.

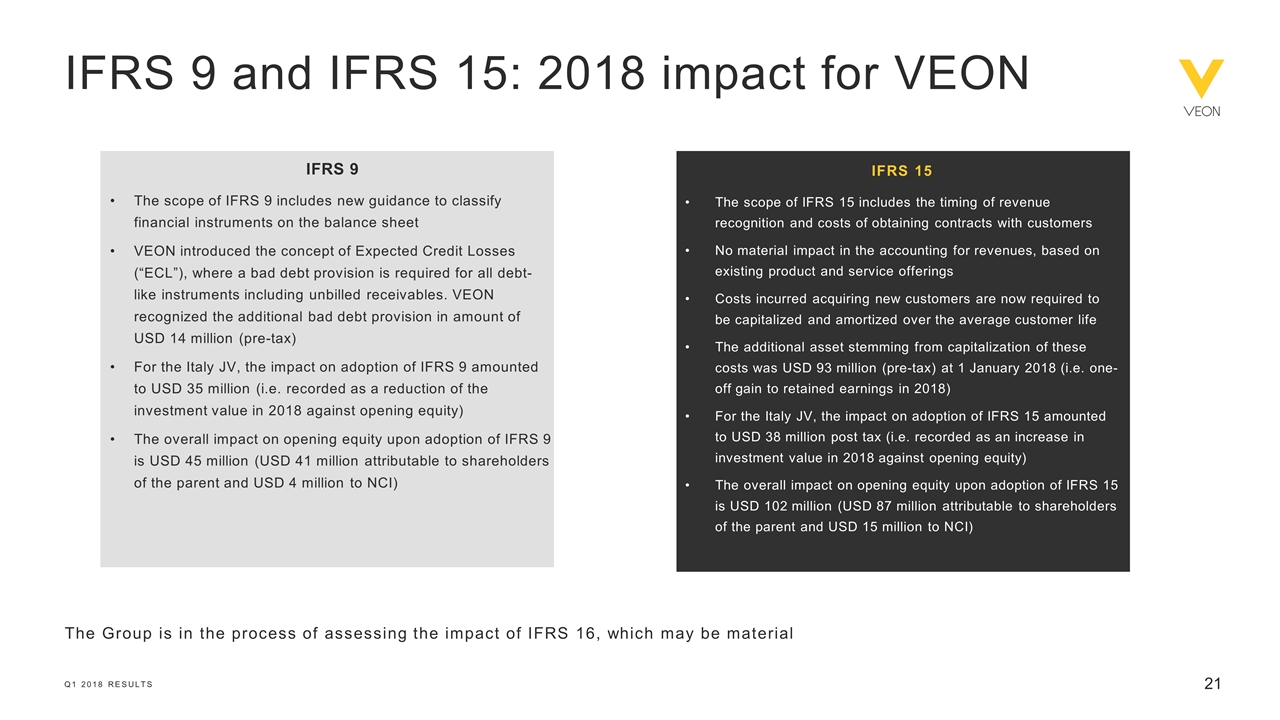

All comparisons are on a year on year basis unless otherwise stated.

IFRS 15 ‘Revenue from contracts with customers’ — VEON assessed the impact of IFRS 15. The scope of IFRS 15 includes the timing of revenue recognition and costs of obtaining contracts with customers. Under this standard, costs incurred acquiring new customers are now required to be capitalized and amortized over the average customer life. VEON has applied IFRS 15 with effect from 1 January 2018, using the modified retrospective approach. No material impact in the accounting for revenues, based on existing product and service offerings. The overall impact on opening equity upon adoption of IFRS 15 is USD 102 million (USD 87 million attributable to shareholders of the parent and USD 15 million to NCI).

IFRS 9 ‘Financial instruments’ — VEON assessed the impact of IFRS 9. The scope of IFRS 9 includes new guidance to classify financial instruments on the balance sheet. VEON introduced the concept of Expected Credit Losses (“ECL”), where a bad debt provision is required for all debt-like instruments including unbilled receivables. The overall impact on opening equity upon adoption of IFRS 9 is USD 45 million (USD 41 million attributable to shareholders of the parent and USD 4 million to NCI).

VEON has yet to assess the impact of IFRS 16 “Leases”, which may be material. The standard will be adopted in 2019.

|

|

Q1 2018 4 |

Table of Contents

APPOINTMENT OF URSULA BURNS AS EXECUTIVE CHAIRMAN AND DEPARTURE OF FORMER CEO JEAN-YVES CHARLIER

On 27 March 2018, VEON announced the appointment of Ursula Burns as Executive Chairman. Ms. Burns has served as Chairman of the VEON Supervisory Board since July 2017 and her appointment as Executive Chairman follows the resignation of former CEO Jean-Yves Charlier, who left the company after leading VEON for the past three years. VEON also announced that the Supervisory Board is undertaking a search for a new CEO, and once a replacement is named and installed, Ms. Burns will revert to her sole role as non-executive Chairman of the Board.

KYIVSTAR AND BANGLALINK ACQUIRED SPECTRUM AND 4G/LTE LICENSES; VEON NOW LAUNCHED 4G/LTE IN ALL OPERATING COUNTRIES

In February and March 2018, VEON’s subsidiary in Ukraine, Kyivstar, acquired spectrum in the 2600MHz and 1800MHz band suitable for 4G/LTE, for a total consideration of approximately USD 137 million. Following this acquisition, Kyivstar has the largest amount of contiguous spectrum in both the 1800MHz and 2600MHz bands, which will enable the company to increase the geographical coverage of its high-speed data network in Ukraine, further strengthening its position as the market leader in the country.

In February 2018, Banglalink was awarded technology neutral spectrum in the 1800 and 2100 MHz bands. The spectrum allows Banglalink to double its 3G network capacity. In parallel, Banglalink also acquired a 4G/LTE license, allowing the company to launch a high-speed data network. The total investment amounts to approximately USD 309 million for the spectrum, excluding VAT. The company paid approximately USD 35 million excluding VAT to convert its existing spectrum holding in 900 MHz and 1800 MHz into technology neutral spectrum and approximately USD 1 million excluding VAT to acquire the 4G/LTE license.

With the launch of 4G/LTE in Ukraine and Bangladesh during the first quarter of 2018, VEON is now offering 4G/LTE services in all of its operating countries.

YAROVAYA LAW INVESTMENTS

On 12 April 2018, the Russian Government adopted implementing regulation regarding data storage requirements under Federal Law No 374-FZ of 6 July 2016 (the “Yarovaya Law”). Telecom operators are required to store voice and SMS communications starting from 1 July 2018 and are required to store data communications from 1 October 2018. Data should be stored for up to 6 months. Discussions are still ongoing with competent authorities on how to practically implement this law. The current best estimate for total Yarovaya law expenditures is RUB 45 billion over 5 years, of which approximately RUB 6 billion in FY 2018.

GTH MANDATORY TENDER OFFER WITHDRAWAL

On 2 April 2018, VEON notified the Egyptian Financial Regulatory Authority (FRA) that, given the lapse of time and absence of approval, VEON was withdrawing the Mandatory Tender Offer (MTO) filed on 8 November 2017, and did not intend to proceed with another MTO at this time. VEON had submitted an application to the FRA seeking approval for a MTO for any and all shares of Global Telecom Holding S.A.E. not owned by VEON. Cash in the amount of USD 987 million, which was pledged as collateral for the MTO, has been released as of 31 March 2018.

TRANSACTION TO END EUROSET JOINT VENTURE COMPLETED, EUROSET INTEGRATION AND REBRANDING INTO BEELINE MONOBRAND STORES ON TRACK

VEON completed the transaction to end the Euroset joint venture on 22 February 2018 and commenced the planned nationwide integration of the stores under the single brand “Beeline” in line with the previously announced monobrand strategy. The Euroset integration is on track and at the end of April 2018, around 800 Euroset stores were integrated and rebranded into Beeline monobrand stores.

VEON HAS COMPLETED SALE OF LAOS OPERATIONS; ENTERED INTO AN AGREEMENT TO SELL OPERATIONS IN TAJIKISTAN

VEON has completed the sale of its 78% stake in Laos to the Government of the Lao People’s Democratic Republic. Furthermore, VEON has entered into an agreement to sell its 98% share in Tacom LLC, VEON’s operating subsidiary in Tajikistan, to ZET Mobile Limited. The transaction is subject to the satisfaction of certain conditions, including receipt of necessary regulatory approvals.

|

|

Q1 2018 5 |

Table of Contents

FINANCIALS BY COUNTRY

| USD million | 1Q18 | 1Q17 | Reported YoY |

Organic1 YoY |

||||||||||||||

| Total revenue |

2,250 | 2,281 | (1.4%) | 3.2% | ||||||||||||||

| Russia |

1,166 | 1,097 | 6.4% | 3.0% | ||||||||||||||

| Pakistan |

368 | 370 | (0.5%) | 5.7% | ||||||||||||||

| Algeria |

203 | 232 | (12.6%) | (9.3%) | ||||||||||||||

| Bangladesh |

129 | 151 | (14.5%) | (10.6%) | ||||||||||||||

| Ukraine |

156 | 143 | 9.2% | 10.1% | ||||||||||||||

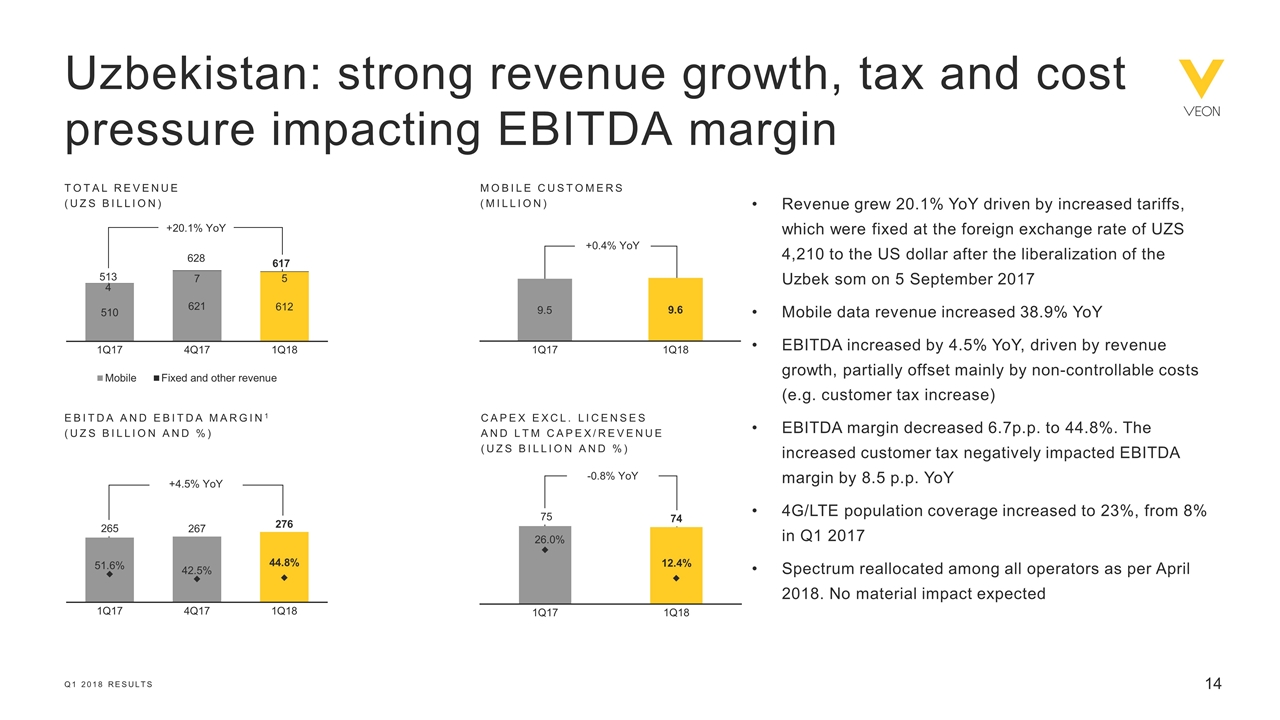

| Uzbekistan |

76 | 153 | (50.6%) | 20.1% | ||||||||||||||

| HQ |

||||||||||||||||||

| Other and eliminations |

152 | 135 | 11.9% | |||||||||||||||

| Service revenue |

2,156 | 2,202 | (2.1%) | 2.9% | ||||||||||||||

| Russia |

1,110 | 1,054 | 5.3% | 2.6% | ||||||||||||||

| Pakistan |

341 | 345 | (1.3%) | 4.9% | ||||||||||||||

| Algeria |

201 | 228 | (11.5%) | (8.2%) | ||||||||||||||

| Bangladesh |

125 | 147 | (15.0%) | (11.1%) | ||||||||||||||

| Ukraine |

156 | 142 | 9.2% | 10.1% | ||||||||||||||

| Uzbekistan |

76 | 153 | (50.7%) | 20.0% | ||||||||||||||

| HQ |

||||||||||||||||||

| Other and eliminations |

148 | 132 | 11.5% | |||||||||||||||

| EBITDA |

854 | 861 | (0.8%) | 6.3% | ||||||||||||||

| Russia |

443 | 409 | 8.3% | 7.4% | ||||||||||||||

| Pakistan |

175 | 154 | 13.0% | 20.1% | ||||||||||||||

| Algeria |

91 | 114 | (20.3%) | (17.3%) | ||||||||||||||

| Bangladesh |

47 | 69 | (32.9%) | (29.9%) | ||||||||||||||

| Ukraine |

89 | 77 | 15.6% | 16.4% | ||||||||||||||

| Uzbekistan |

34 | 79 | (57.0%) | 4.5% | ||||||||||||||

| HQ |

(80) | (76) | 5.3% | |||||||||||||||

| Other and eliminations |

55 | 35 | 58.4% | |||||||||||||||

| EBITDA margin |

38.0% | 37.8% | 0.2p.p. | |||||||||||||||

| 1) | Organic change is a non-IFRS measure and reflects changes in revenue and EBITDA. Organic change excludes the effect of foreign currency movements and other factors, such as businesses under liquidation, disposals, mergers and acquisitions. In Q1 2018 organic growth is calculated at constant currency and excludes the impact from Euroset transaction for the group. In Q1 2018 the organic change in Russia exclude the impact of Euroset and the impact of transit traffic revenue. Transit traffic revenue were partially centralized at VEON Wholesale Services. See Attachment C for reconciliations, including reconciliation for EBITDA |

Group reported revenue for Q1 2018 decreased by 1.4% year on year to USD 2.3 billion, primarily due to currency devaluation in Uzbekistan and Pakistan. Group revenue increased by 3.2% organically, driven by revenue growth in Russia, Pakistan, Ukraine and Uzbekistan, which was partially offset by continued pressure on revenue in Algeria and Bangladesh. The revenue trend was supported by good organic growth in mobile data revenue, increasing 23.0% for the quarter. Reported mobile data revenue increased by 15.9%. Mobile customers increased 1.8% to 210 million at the end of Q1 2018, primarily driven by growth in Pakistan, Bangladesh and Ukraine.

Group reported EBITDA decreased 0.8% to USD 854 million in Q1 2018, compared to USD 861 million in Q1 2017, due to the currency headwinds in Uzbekistan and Pakistan, as well as Euroset integration costs. EBITDA organically increased by 6.3%, driven by good operational performance in Russia, Pakistan, Ukraine and Uzbekistan, which was partially offset by EBITDA pressure in Algeria and Bangladesh. A more detailed explanation for these trends is provided in the following paragraphs.

For the discussion of each country’s individual performances below, all trends are expressed in local currency.

|

|

Q1 2018 6 |

Table of Contents

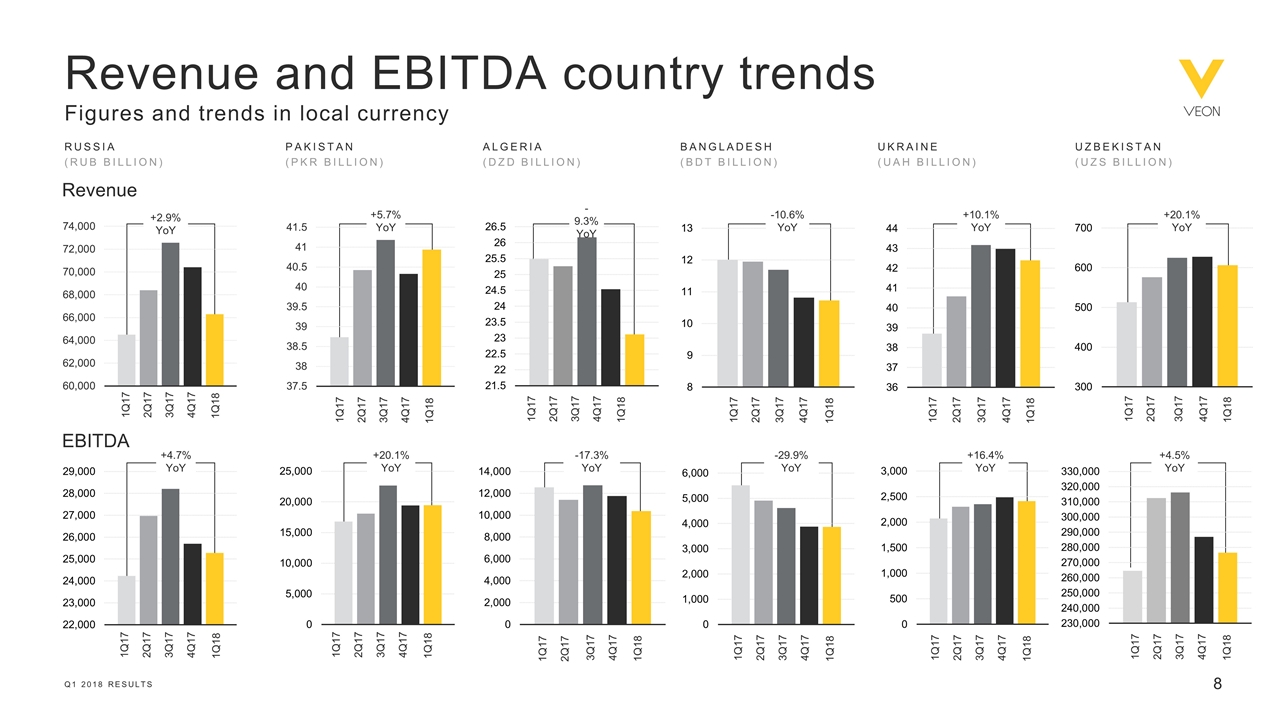

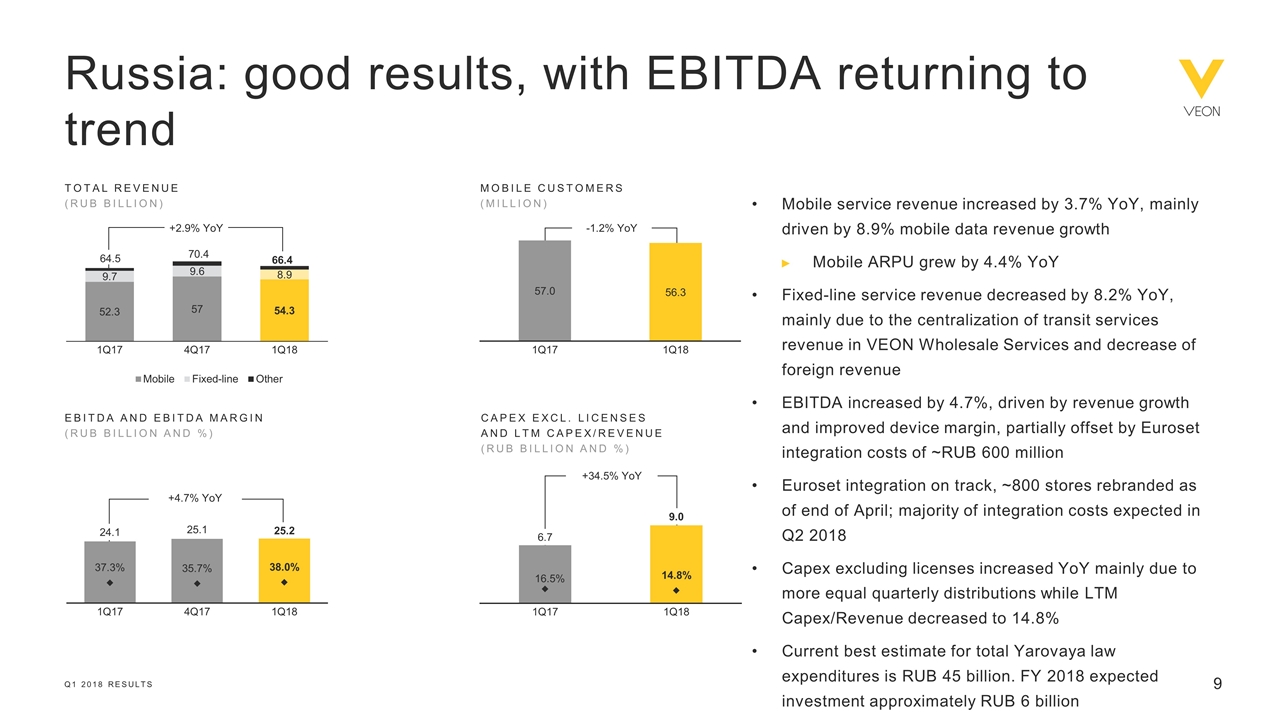

In Russia, total revenue in Q1 2018 increased by 2.9%, driven by an increase in mobile service revenue and sales of equipment and accessories. Mobile service revenue increased by 3.7%, driven by growth in mobile data, other value-added services and mobile financial services, thereby offsetting the decrease in voice revenue. Mobile ARPU continued its growth trajectory in Q1 2018, increasing by 4.4% year on year. Fixed-line service revenue decreased by 8.2%, showing an improvement in the revenue trend experienced in previous quarters. The decline was mainly due to a decrease in B2B revenue and a decrease in transit traffic revenue, which were partially centralized at VEON Wholesale Services, a Group division centrally managing arrangements of VEON Group companies with international carriers. EBITDA increased by 4.7% in Q1 2018, leading to an EBITDA margin of 38.0%, showing an improvement of 2.3 percentage points quarter on quarter, and 0.7 percentage points year on year. The year on year growth in EBITDA was driven by the revenue growth, which was partially offset by the Euroset integration costs in Q1 2018 of approximately RUB 600 million. Furthermore, the margin on devices improved as a result of growth in sales of high-margin devices through an increased number of Beeline monobrand stores. The Euroset integration is on track and at the end of April 2018, around 800 Euroset stores were integrated and rebranded into Beeline monobrand stores.

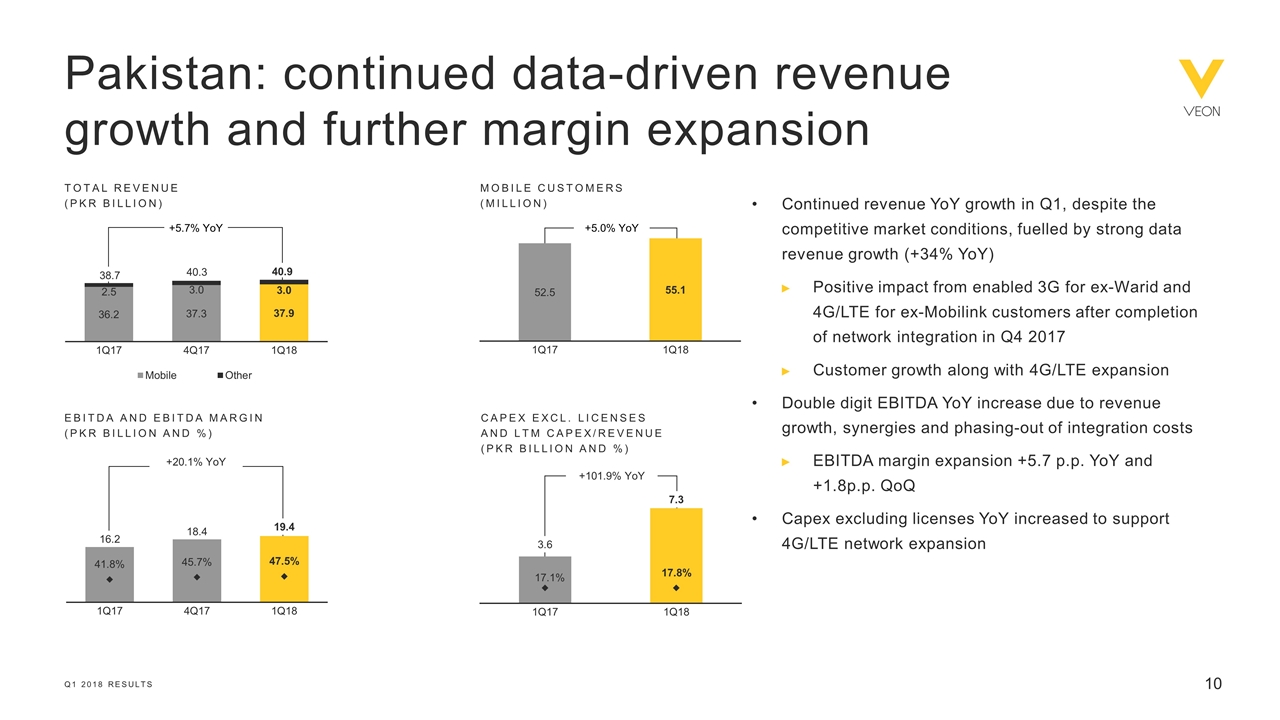

In Pakistan, total revenue grew 5.7% year on year, supported by an acceleration of mobile data revenue growth of 33.9%, driven by an increase in data customers through higher bundle penetration and continued data network expansion. After the completion of network integration in Q4 2017, Jazz is now able to offer 4G/LTE to all its customers and it continues to expand the network. EBITDA increased by 20.1%, driven by revenue growth, opex synergies and the phasing-out from Q1 2018 of merger integration costs, leading to an EBITDA margin of 47.5%, an increase of 5.7 percentage points year on year.

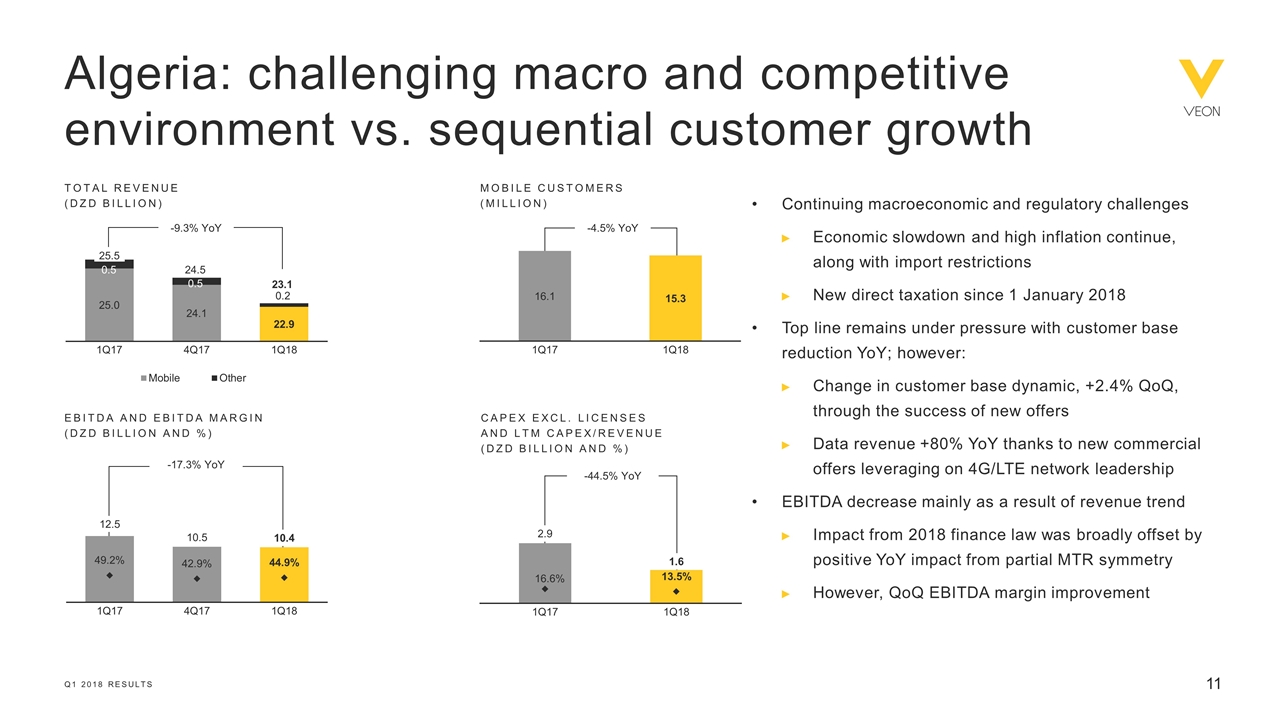

In Algeria, total revenue decreased by 9.3% year on year at a slightly lower declining pace compared to Q4 2017, as operational turnaround continued in Q1 2018. Price competition, in both voice and data, caused a continued reduction in ARPU and a year on year increase in churn. Data revenue growth was 79.7%, due to higher usage and a substantial increase in data customers as a result of the 3G and 4G/LTE network roll-out. This positive data revenue trend is also supported by the change towards a more aggressive data pricing strategy, through the launch of new offers which improved Djezzy’s share of gross adds and reversed the trend of net adds from negative to positive in Q1 2018. EBITDA decreased by 17.3% mainly due to the decline in revenue. EBITDA margin was 44.9% and the impact of the changes to direct taxes with effect from 1 January 2018 was broadly offset by the positive impact from the partial MTR symmetry, which is in place from 31 October 2017.

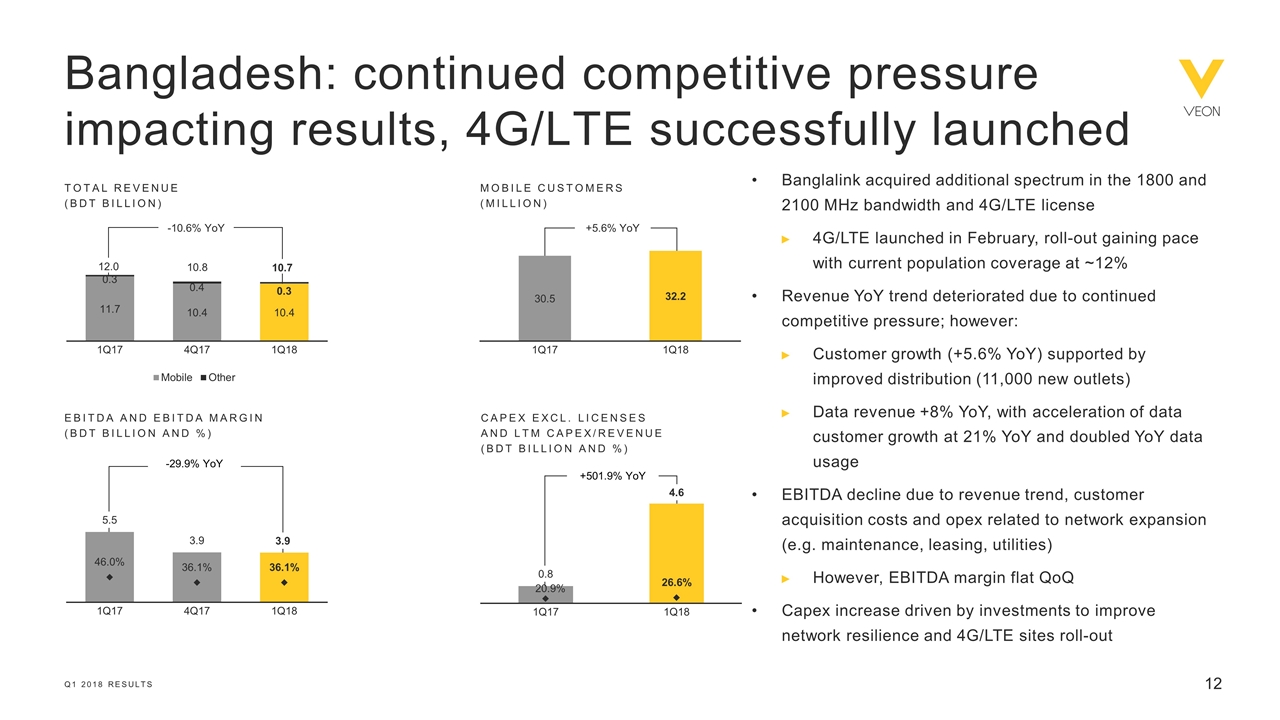

In Bangladesh, total revenue decreased by 10.6%, still mainly the result of the gap in 3G network coverage compared to the market leader. The market remains characterized by intense price competition especially in relation to data. The customer base grew by 5.6% year on year, despite continued competitive customer acquisition campaigns in the market. ARPU decreased year on year by 14.8%, as in Q4 2017, as a result of pricing pressure. Data revenue increased by 8.0% year on year, driven by increased smartphone penetration and 97.3% year on year data usage growth, along with 20.7% growth in active data users. EBITDA decreased by 29.9%, mainly as a result of revenue decline, increasing customer acquisition costs and network expenses (e.g. maintenance, leasing, utilities). The EBITDA margin was 36.1% in Q1 2018, which represents a year on year reduction of 9.9 percentage points.

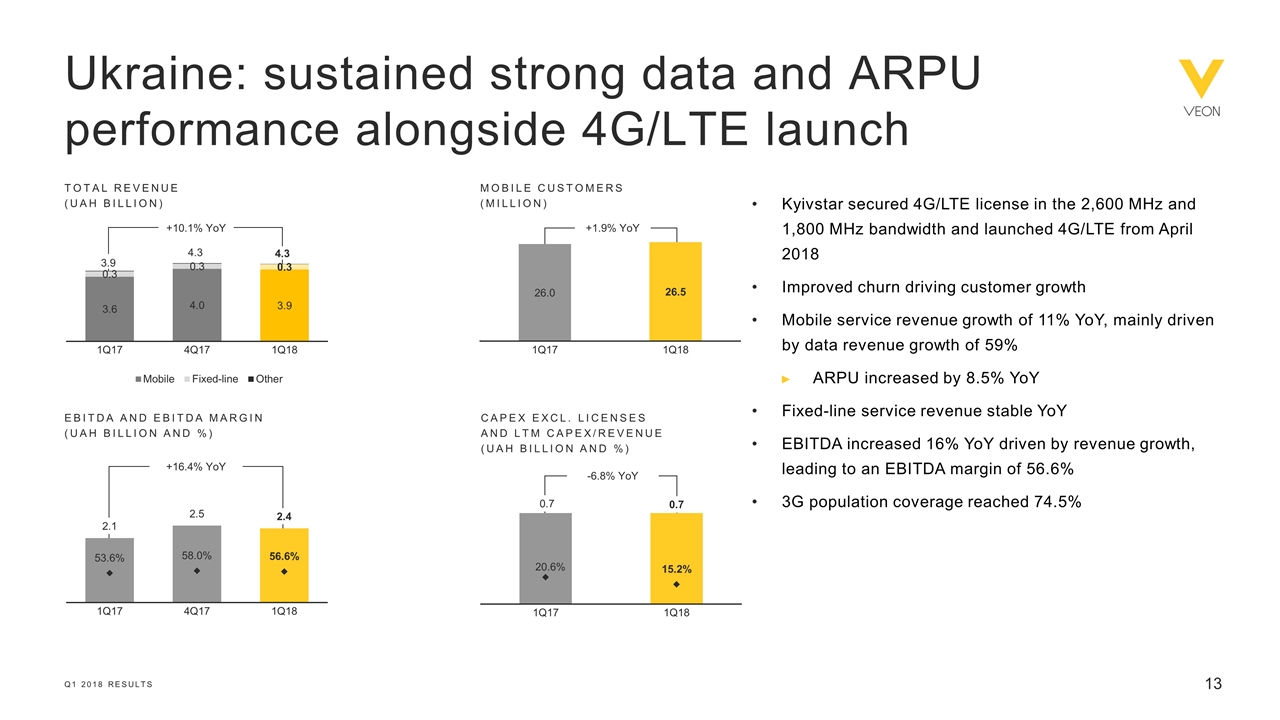

In Ukraine, total revenue increased by 10.1%, mainly driven by continued strong growth of mobile data revenue, which increased by 58.6% as a result of growing data usage, and successful marketing activities driven by the continued 3G network roll-out and data-centric tariffs. EBITDA increased by 16.4%, representing an EBITDA margin of 56.6%, driven by the revenue growth, partially offset by increased service costs and HR costs, while technology costs also increased as a result of the network expansion.

Uzbekistan continued to report strong revenue growth, as the company´s tariffs were fixed at the foreign exchange rate of UZS 4,210 to the US dollar after the liberalization of the Uzbek som on 5 September 2017, which is a higher level compared to the prior year. Total revenue increased by 20.1% and mobile service revenue increased by 20.0%, supported by successful marketing activities, increased revenues from interconnect services, value added services and mobile data. EBITDA increased by 4.5% and the EBITDA margin was 44.8% in Q1 2018. The revenue growth was partially offset by an increase in non-controllable costs, such as customer tax, content costs, frequency fees and the negative impact from the currency liberalization, while HR costs increased as well.

The HQ segment in Q1 2018 includes largely costs of VEON’s headquarters in Amsterdam and London, costs for digital, external costs for services and projects (e.g. M&A and legal costs). In Q1 2018, the amount increased by 5% year on year to USD 80 million mostly due to severance costs, partially offset by a release of a provision for long term management incentive plans. The Company is aiming to reduce corporate costs in FY 2018 by 20% year on year from approximately USD 430 million in FY 2017.

|

|

Q1 2018 7 |

Table of Contents

“Other” in Q1 2018 includes the results of Kazakhstan, Kyrgyzstan, Armenia, Georgia, Tajikistan, other global operations and services and intercompany eliminations.

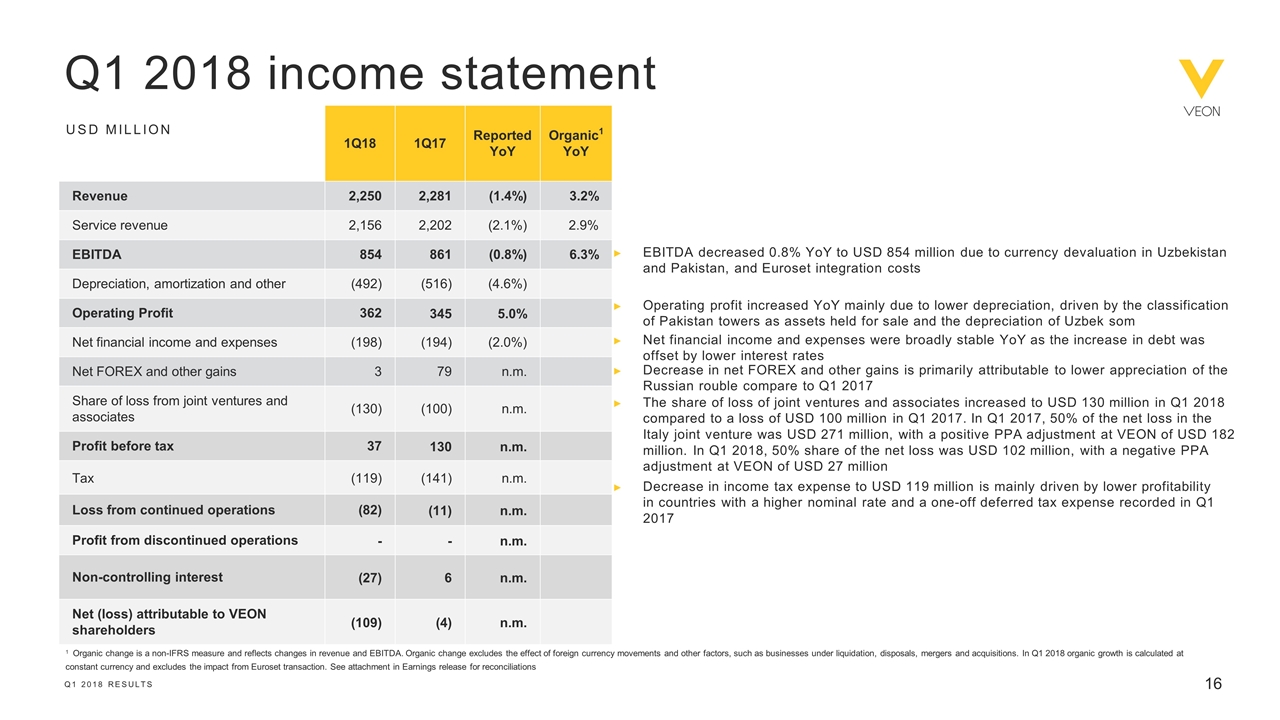

INCOME STATEMENT & CAPITAL EXPENDITURES

| USD million | 1Q18 | 1Q17 | Reported YoY |

|||||||||

| Total revenue |

2,250 | 2,281 | (1.4% | ) | ||||||||

| Service revenue |

2,156 | 2,202 | (2.1% | ) | ||||||||

| EBITDA |

854 | 861 | (0.8% | ) | ||||||||

| EBITDA margin |

38.0% | 37.8% | 0.2p.p. | |||||||||

| Depreciation, amortization, impairments and other |

(492 | ) | (516 | ) | 4.6% | |||||||

| EBIT (Operating Profit) |

362 | 345 | 5.0% | |||||||||

| Financial income and expenses |

(198 | ) | (193 | ) | (2.0% | ) | ||||||

| Net foreign exchange (loss)/gain and others |

3 | 79 | (96% | ) | ||||||||

| Share of (loss)/profit of joint ventures and associates |

(130 | ) | (101 | ) | (31.0% | ) | ||||||

| Profit before tax |

37 | 130 | (71.8%) | |||||||||

| Income tax expense |

(119 | ) | (141 | ) | (15.7% | ) | ||||||

| (Loss)/Profit from continued operations |

(82 | ) | (11 | ) | n.m. | |||||||

| (Loss)/Profit for the period attributable to VEON shareholders |

(109 | ) | (5 | ) | n.m. | |||||||

| 1Q18 | 1Q17 | Reported YoY |

||||||||||

| Capex |

774 | 268 | 188.7% | |||||||||

| Capex excl. licenses |

355 | 263 | 34.7% | |||||||||

| Capex excl. licenses/revenue |

15.8% | 11.6% | 4.2p.p. | |||||||||

| LTM capex excl. licenses/revenue |

16.4% | 18.6% | (2.2p.p. | ) | ||||||||

Q1 2018 ANALYSIS

EBIT increased by 5.0% to USD 362 million in Q1 2018, mainly due to lower depreciation, driven by the classification of Pakistan towers as assets held for sale in Q2 2017 and the depreciation of Uzbek som.

Profit before tax of USD 37 million, compared to a profit of USD 130 million in Q1 2017, was driven by a decrease in foreign exchange gain and an increase in the loss in joint venture and associates to USD 130 million. Net financial income and expenses were broadly stable year on year as the increase in debt was offset by lower interest rates during the quarter after the refinancing efforts in FY 2017. The decrease of net foreign exchange and other gains to USD 3 million was primarily attributable to lower appreciation of the Russian ruble. The share of loss of joint ventures and associates increased to USD 130 million in Q1 2018 compared to a loss of USD 101 million in Q1 2017. In Q1 2017, 50% of the net loss in the Italy joint venture was USD 271 million, with a positive PPA adjustment at VEON of USD 182 million. In Q1 2018, 50% share of the net loss in the Italy joint venture was USD 102 million, with a negative PPA adjustment at VEON of USD 27 million. Please refer to reconciliation table at attachment C.

The decrease in income tax expense to USD 119 million in Q1 2018 primarily attributable to lower profitability in countries with a higher nominal rate and a one-off deferred tax expense recorded in Q1 2017.

In Q1 2018, the company recorded a net loss for the period attributable to VEON´s shareholders of USD 109 million driven by the above-mentioned factors.

Capex increased to USD 774 million in Q1 2018, primarily due to spectrum purchases in Ukraine and Bangladesh, while Capex excluding licenses increased to USD 355 million, compared to USD 264 million in Q1 2017, driven by higher capex in Bangladesh and Ukraine to support 3G and 4G/LTE network expansion and equal quarterly distribution.

The LTM ratio of capex excluding licenses to revenue was 16.4% in Q1 2018.

|

|

Q1 2018 8 |

Table of Contents

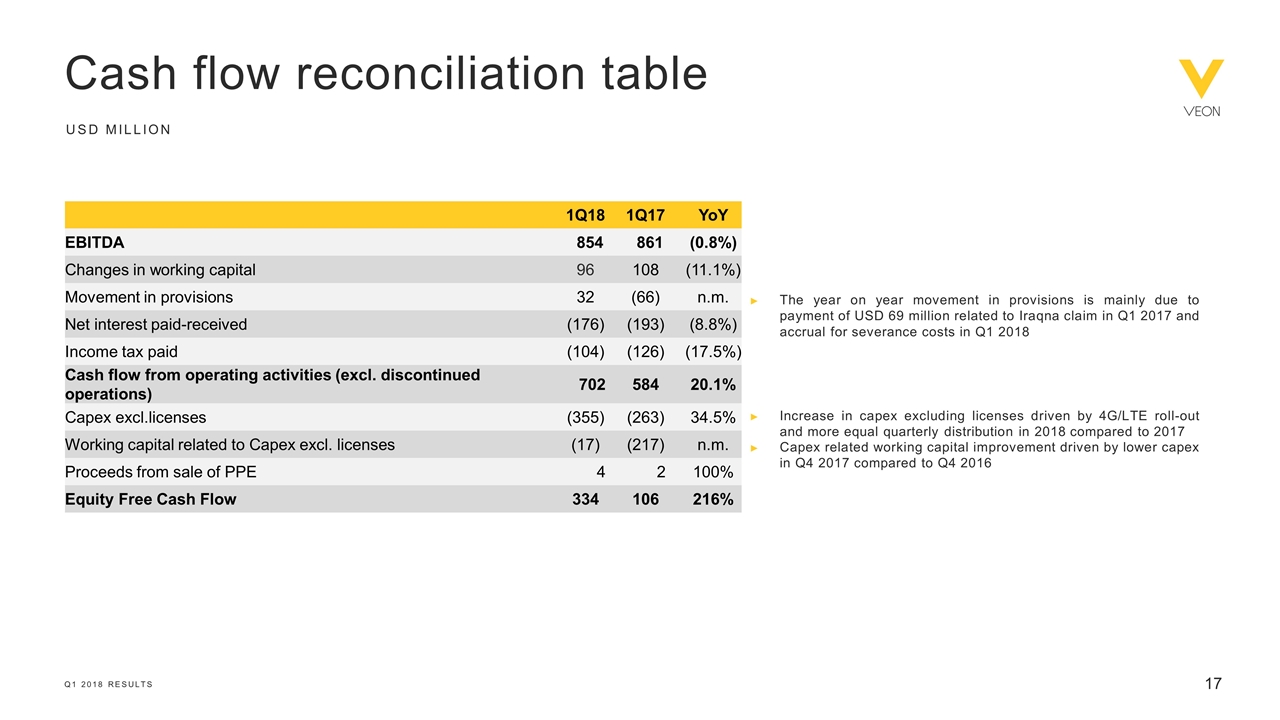

FINANCIAL POSITION & CASH FLOW

| USD million | 1Q18 | 4Q17 | QoQ | |||||||||

| Total assets |

18,750 | 19,521 | (4.0%) | |||||||||

| Shareholders’ equity |

4,018 | 4,352 | (7.7%) | |||||||||

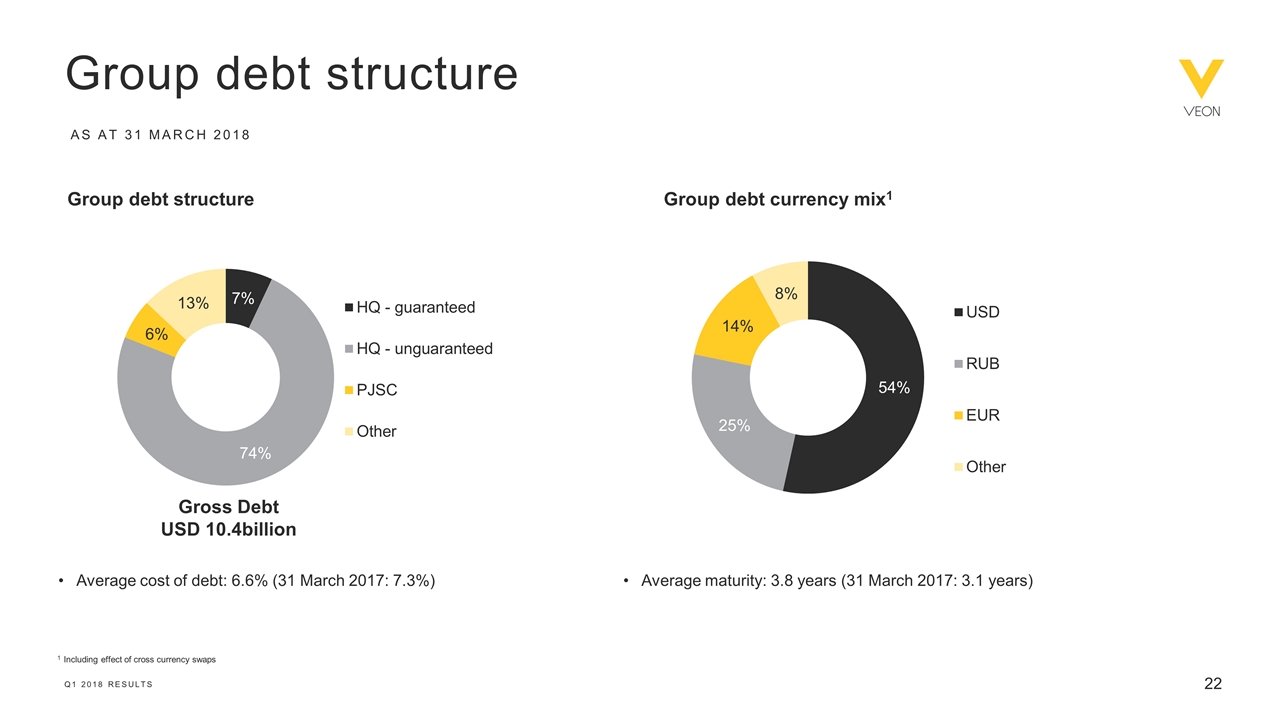

| Gross debt |

10,402 | 11,102 | (6.3%) | |||||||||

| Net debt |

8,966 | 8,741 | 2.6% | |||||||||

| Net debt/LTM EBITDA |

2.5 | 2.4 | ||||||||||

| USD million |

1Q18 |

1Q17 | YoY | |||||||||

| Net cash from/(used in) operating activities |

702 | 584 | 118 | |||||||||

| Net cash from/(used in) investing activities |

368 | (589) | 958 | |||||||||

| Net cash from/(used in) financing activities |

(1,001) | (746) | (255) | |||||||||

Total assets decreased compared to Q4 2017 mainly due to the repayment of certain borrowing and dividend payments, which was partially offset by the acquisition of new spectrum licenses in Ukraine and Bangladesh.

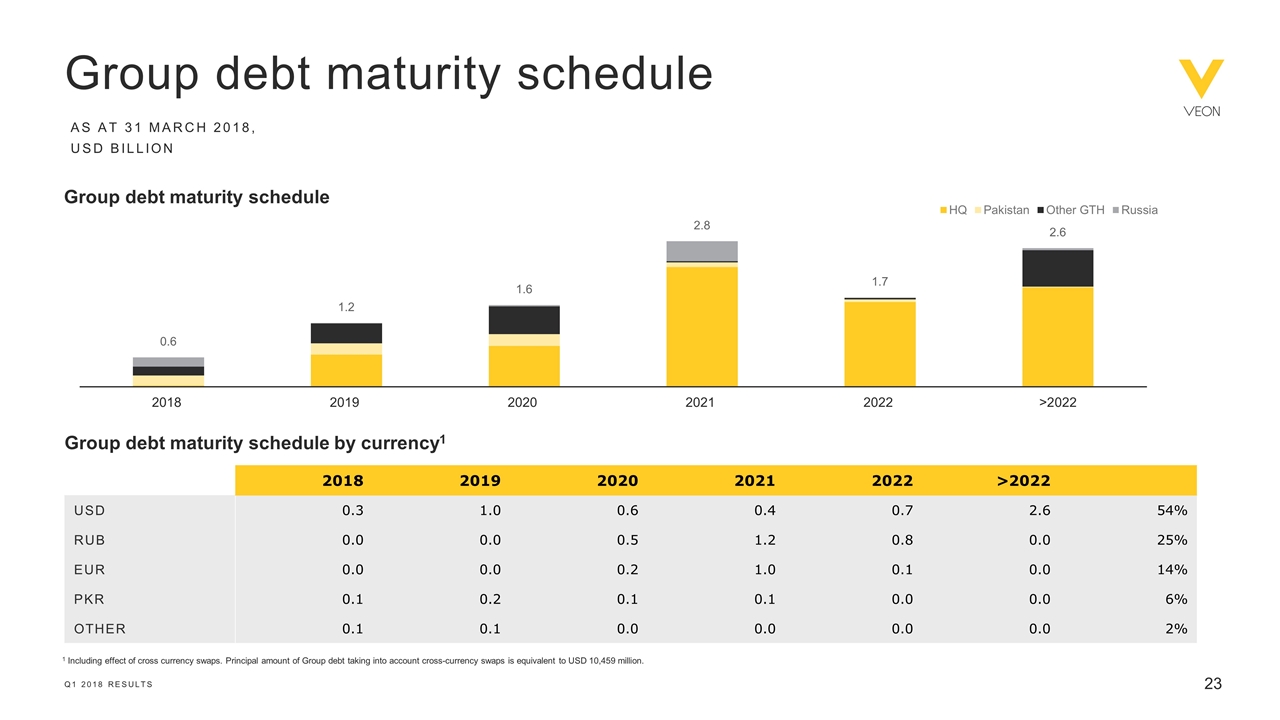

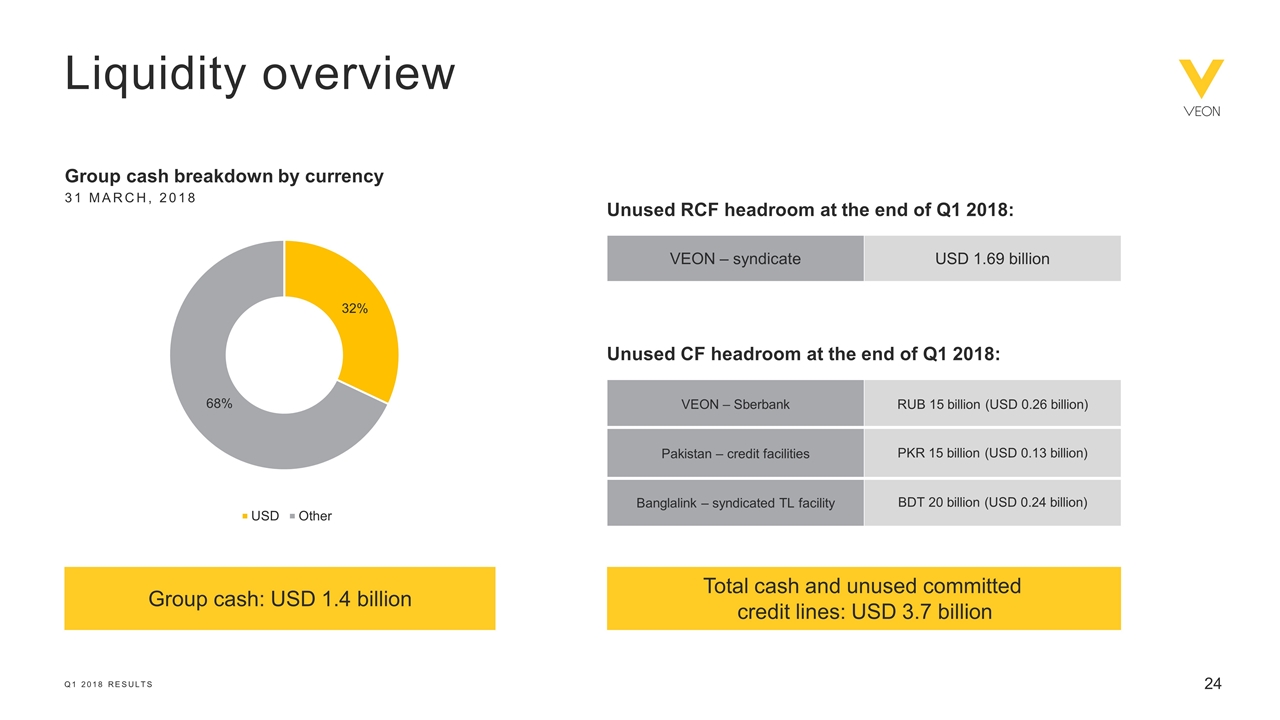

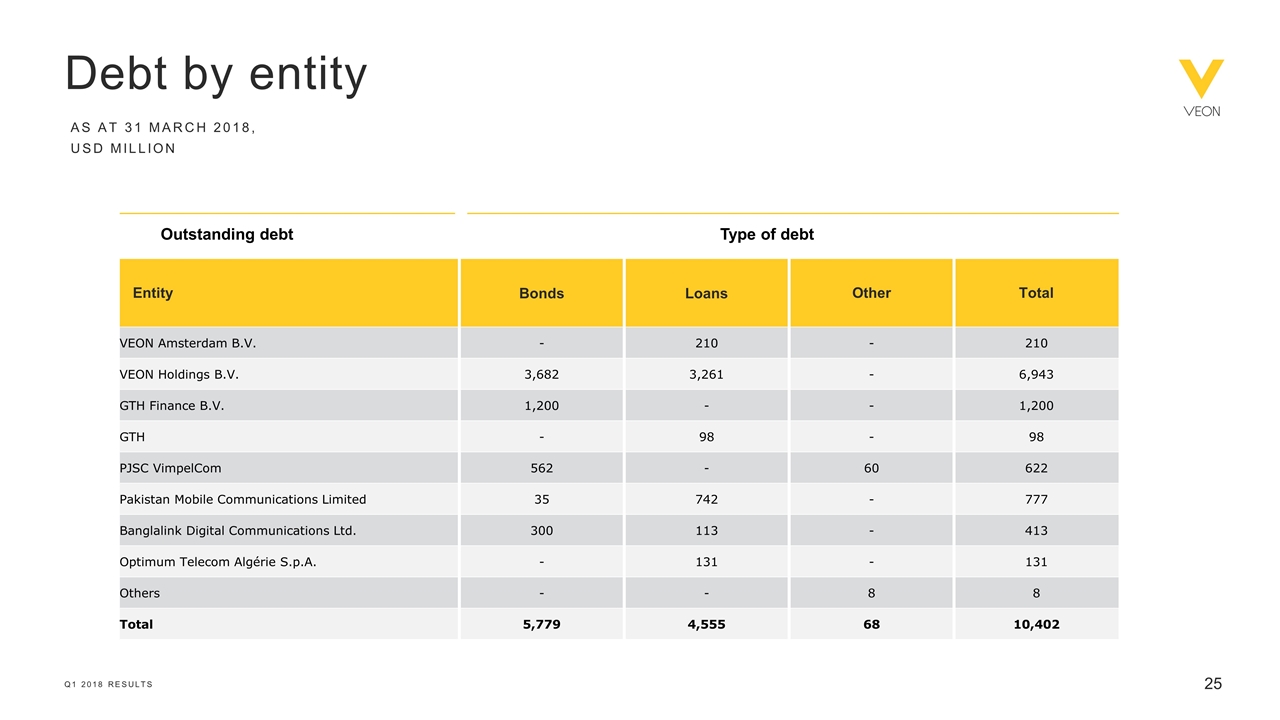

Gross debt decreased USD 700 million quarter on quarter mainly due to the scheduled repayment of HQ loans and bonds, as well as the prepayment of a PJSC VimpelCom guaranteed HQ loan, partially offset by a drawdown under the new Bangladesh syndication loan. Net debt in Q1 2018 was impacted by spectrum investments and the final dividend payment to VEON shareholders; net debt/LTM EBITDA ratio in Q1 2018 was 2.5x.

Net cash from operating activities increased by USD 118 million year on year in Q1 2018, driven by higher cash flow from continuing operations as a result of significant improvements in working capital and a decrease in net interest and taxes paid. In Q1 2018, VEON received USD 40 million cash related to a one-off adjustment to a vendor agreement, while cash flow from operating activities in Q1 2017 was negatively impacted by the payment made in order to settle the Iraqna litigation in an amount of USD 69 million.

Net cash flow used in investing activities increased year on year by USD 958 million, driven by the withdrawal of the MTO, which resulted in the release of cash collateral in the above-mentioned amount.

Net cash used in financing activities decreased by USD 255 million year on year in Q1 2018, mainly due to the repayment of indebtedness.

|

|

Q1 2018 9 |

Table of Contents

| ● | Russia |

| ● | Pakistan |

| ● | Algeria |

| ● | Bangladesh |

| ● | Ukraine |

| ● | Uzbekistan |

| ● | Italy |

RUSSIA

| RUB million | 1Q18 | 1Q17 | YoY | |||||||||

| Total revenue |

66,351 | 64,507 | 2.9% | |||||||||

| Mobile service revenue |

54,282 | 52,348 | 3.7% | |||||||||

| Fixed-line service revenue |

8,867 | 9,660 | (8.2%) | |||||||||

| EBITDA |

25,204 | 24,070 | 4.7% | |||||||||

| EBITDA margin |

38.0% | 37.3% | 0.7p.p. | |||||||||

| Capex excl. licenses |

9,007 | 6,695 | 34.5% | |||||||||

| LTM Capex excl. licenses /revenue |

14.8% | 16.5% | (1.7p.p.) | |||||||||

| Mobile | ||||||||||||

| Total revenue |

57,452 | 54,822 | 4.8% | |||||||||

| - of which mobile data |

15,138 | 13,903 | 8.9% | |||||||||

| Customers (mln) |

56.3 | 57.0 | (1.2%) | |||||||||

| - of which data users (mln) |

36.7 | 36.4 | 0.7% | |||||||||

| ARPU (RUB) |

315 | 302 | 4.4% | |||||||||

| MOU (min) |

307 | 324 | (5.1%) | |||||||||

| Data usage (MB/user) |

3,234 | 2,565 | 26.1% | |||||||||

| Fixed-line1 |

||||||||||||

| Total revenue |

8,899 | 9,685 | (8.1%) | |||||||||

| Broadband revenue |

2,560 | 2,650 | (3.4%) | |||||||||

| Broadband customers (mln) |

2.3 | 2.2 | 3.3% | |||||||||

| Broadband ARPU (RUB) |

377 | 403 | (6.5%) | |||||||||

Beeline reported good results in Q1 2018, showing strong quarter on quarter improvements in EBITDA performance compared to Q4 2017, which was impacted by non-recurring costs. The company expects the macro-economic and market conditions to remain challenging in Russia, as a result of the recent weakening of the ruble.

Total revenue in Q1 2018 increased by 2.9% year on year to RUB 66.4 billion, driven by an increase in mobile service revenue and sales of equipment and accessories, which was partially attributable to the additional monobrand stores following the Euroset integration and rebranding from 26 February 2018. Mobile service revenue increased by 3.7% to RUB 54.3 billion, driven by growth in mobile data, other value-added services and mobile financial services, offsetting the decrease in voice revenue. Mobile ARPU continued its growth trajectory in Q1 2018, increasing by 4.4% year on year.

Mobile data revenue continued to grow, increasing by 8.9% to RUB 15.1 billion, as a result of an increased penetration of integrated bundles and smartphones, resulting in data traffic growth. Mobile data ARPU showed continued improvement, growing by 6.3%, driven by successful upselling activities and continued efforts to simplify tariff plans, while being supported by increased penetration of bundled propositions in the customer base.

Beeline’s mobile customer base decreased 1.2% year on year to 56.3 million customers, driven by a reduction in sales from alternative distribution channels, as Beeline is focusing on monobrand distribution.

|

|

Q1 2018 10 |

Table of Contents

Fixed-line service revenue decreased by 8.1% to RUB 8.9 billion, showing an improvement in the declining trend compared to previous quarters. The decline was mainly due to a decrease of foreign revenue and a decrease of RUB 341 million in transit traffic revenue, which was partially centralized at VEON Wholesale Services, a Group division centrally managing arrangements of VEON Group companies with international carriers. The centralization of the international interconnect and transit traffic services revenues will continue in the remainder of this year and the expected maximum impact on revenue for Russia is USD 43 million, while the expected maximum impact on EBITDA is USD 7 million in FY 2018. Beeline continues its initiatives to turnaround the fixed-line segment by modernizing and expanding its fixed-line network, improving service quality and providing superior offers, such as the FMC proposition. In the consumer segment, the broadband base grew by 3.3% year on year to 2.3 million broadband customers, mostly driven by FMC customer base growth of 47% year on year to 925 thousand. This represents a 42% FMC customer penetration in the broadband customer base, supporting improvements in broadband customer churn and ARPU upsell.

EBITDA increased by 4.7% to RUB 25.2 billion, leading to an EBITDA margin of 38.0%, showing an improvement of 2.3 percentage points quarter on quarter, and 0.7 percentage points year on year. The year on year growth in EBITDA was driven by the revenue growth, partially offset by the Euroset integration costs in Q1 2018 of approximately RUB 600 million. Furthermore, the margin on devices improved as a result of growth in sales of high-margin devices by the increased number of Beeline monobrand stores. The Euroset integration is on track and at the end of April 2018, around 800 Euroset stores were integrated and rebranded into Beeline monobrand stores. Beeline expects continued negative impact on EBITDA of approximately RUB 3 billion in FY 2018 due to the integration and rebranding costs for the Euroset stores into Beeline monobrand stores. Additionally, Beeline expects EBITDA margin pressure driven by the changing revenue mix, following the integration and rebranding of the Euroset stores. To mitigate this effect, Beeline plans to decrease its expenditures on alternative sales channels.

The Euroset integration is an important milestone in executing on Beeline´s monobrand strategy. After the rebranding and integration of the Euroset stores, Beeline expects a positive effect on revenue going forward and, from 2019, on EBITDA, driven by device sales acceleration and channel-mix improvement. SIM sales in channels with high churn will be reduced, expectedly resulting in reduction in customer acquisition costs.

Beeline has increased its focus on the B2B segment, improving its proposition with more customized offers and solutions to both small and large enterprises. As a result, mobile service revenue in the B2B segment showed growth in a stagnating market, growing by 8.0% year on year. Overall, B2B revenue contributed RUB 12.1 billion to revenue.

Capex excluding licenses increased by 34.5% year on year during the quarter, mainly as a result of equal quarterly distributions. Beeline continues to invest in network development to ensure it has high-tech and up to date network infrastructure that is ready to integrate new technologies. The LTM capex excluding licenses to revenue ratio for Q1 2018 was 14.8%. On 12 April 2018, the Russian Government adopted regulation regarding data storage requirements under Federal Law No 374-FZ of 6 July 2016 (the “Yarovaya Law”). Telecom operators are required to store voice and SMS communications starting from 1 July 2018 and are required to store data communications from 1 October 2018. Data should be stored for up to six months. Discussions are still ongoing with competent authorities on how to practically implement this law. The current best estimate for total Yarovaya law expenditures is RUB 45 billion over 5 years, of which approximately RUB 6 billion in FY 2018.

|

|

Q1 2018 11 |

Table of Contents

PAKISTAN

| PKR billion | 1Q18 | 1Q17 | YoY | |||||||||||

| Total revenue |

40.9 | 38.7 | 5.7% | |||||||||||

| Mobile service revenue |

37.9 | 36.2 | 4.9% | |||||||||||

| of which mobile data |

7.0 | 5.2 | 33.9% | |||||||||||

| EBITDA |

19.4 | 16.2 | 20.1% | |||||||||||

| EBITDA margin |

47.5% | 41.8% | 5.7p.p. | |||||||||||

| Capex excl. licenses |

7.3 | 3.6 | 101.9% | |||||||||||

| LTM capex excl. licenses/revenue |

17.8% | 17.1% | 0.7p.p. | |||||||||||

| Mobile |

||||||||||||||

| Customers (mln) |

55.1 | 52.5 | 5.0% | |||||||||||

| - of which data users (mln) |

30.5 | 26.3 | 15.9% | |||||||||||

| ARPU (PKR) |

232.2 | 231.1 | 0.5% | |||||||||||

| MOU (min) |

538 | 515 | 4.4% | |||||||||||

| Data usage (MB/user)

|

|

821

|

|

|

465

|

|

|

76.4%

|

| |||||

Jazz continued to show growth of both revenue and customers despite competitive market conditions. Revenue growth of 5.7% year on year was supported by an acceleration of mobile data revenue growth of 33.9% year on year, driven by an increase in data customers due to higher bundle penetration and continued data network expansion. After the completion of network integration in Q4 2017, Jazz is now able to offer 4G/LTE to all its customers and it continues to expand its network.

The customer base increased by 5.0% year on year driven by gross additions as a result of simplifying prices and more efficient distribution channel management. Jazz sees data and voice monetization among its key priorities, underpinned by the aim to offer the best network in terms of both quality of service and coverage.

EBITDA increased by 20.1%, driven by revenue growth, opex synergies and the phasing-out from Q1 2018 of merger integration costs, leading to an EBITDA margin of 47.5%, an increase of 5.7 percentage points year on year, also progressing by 1.8 percentage points quarter on quarter.

Capex excluding licenses increased to PKR 7.3 billion in Q1 2018, mainly due to the 4G/LTE network expansion, while the LTM capex excluding licenses to revenue ratio was 17.8%. At the end of the Q1 2018, 3G was offered in more than 360 cities while 4G/LTE was offered in over 70 cities (defined as cities with at least three base stations). At the end of Q1 2018, population coverage of 3G and 4G/LTE networks was 52% and 28% respectively.

|

|

Q1 2018 12 |

Table of Contents

ALGERIA

| DZD billion | 1Q18 | 1Q17 | YoY | |||||||||

| Total revenue |

23.1 | 25.5 | (9.3%) | |||||||||

| Mobile service revenue |

23.0 | 25.0 | (8.2%) | |||||||||

| of which mobile data |

5.0 | 2.8 | 79.7% | |||||||||

| EBITDA |

10.4 | 12.5 | (17.3%) | |||||||||

| EBITDA margin |

44.9% | 49.2% | (4.4p.p.) | |||||||||

| Capex excl. licenses |

1.6 | 2.9 | (44.5%) | |||||||||

| LTM capex excl. licenses/revenue |

13.5% | 16.6% | (3.2p.p.) | |||||||||

| Mobile |

||||||||||||

| Customers (mln) |

15.3 | 16.1 | (4.5%) | |||||||||

| - of which mobile data customers (mln) |

8.0 | 7.1 | 13.4% | |||||||||

| ARPU (DZD) |

504 | 513 | (1.8%) | |||||||||

| MOU (min) |

437 | 365 | 19.8% | |||||||||

| Data usage (MB/user) |

|

1,065

|

|

|

573

|

|

|

85.7%

|

| |||

Djezzy’s operational performance continued to be impacted in Q1 2018 by strong competition, a challenging regulatory and macro-economic environment which remains characterized by inflationary pressures and import restrictions on certain goods. The new Finance Law, effective from January 2018, imposed new direct taxation consisting of a 0.5% tax on revenue and a 0.5% tax on recharge transfer between operators and distributors. As a result of new taxation, Djezzy EBITDA was negatively impacted in Q1 2018 by approximately DZD 176 million. This impact on EBITDA was broadly offset by the positive impact from the partial MTR symmetry, which is in place from 31 October 2017.

Revenue decreased by 9.3% year on year, a slightly lower declining pace compared to Q4 2017, as operational turnaround continued in Q1 2018. Price competition, in both voice and data, caused a continued reduction in ARPU and a year on year increase in churn. Djezzy’s Q1 2018 service revenue was DZD 23.0 billion, an 8.2% decline, while data revenue growth was 79.7%, due to higher usage and a substantial increase in data customers as a result of the 3G and 4G/LTE network roll-out. This data revenue growth is also supported by the change towards a more aggressive data pricing strategy, through the launch of new offers which improved Djezzy’s share of gross adds and reversed the trend of net adds from negative to positive in Q1 2018.

The customer base in Algeria decreased by 4.5% to 15.3 million year on year, due to continued competitive pressures in the market. However, in the same period, the customer base grew by over 2% quarter on quarter driven by positive uptake of new offers. ARPU declined by 1.8% year on year, a lower decrease compared to Q4 2017, primarily driven by continued and intense price competition.

In Q1 2018, EBITDA decreased by 17.3% year on year, mainly due to the decline in revenues. EBITDA margin was 44.9%, improving by 2 percentage points quarter on quarter.

At the end of Q1 2018, the company’s 4G/LTE services covered 28 wilayas and more than 25.3% of the country’s population, while the 3G network covered all 48 wilayas and more than 75% of population. In Q1 2018 capex excluding licenses was DZD 1.6 billion, with a LTM capex excluding licenses to revenue ratio of 13.5%.

|

|

Q1 2018 13 |

Table of Contents

BANGLADESH

| BDT billion | 1Q18 | 1Q17 | YoY | |||||||||

| Total revenue |

10.7 | 12.0 | (10.6%) | |||||||||

| Mobile service revenue |

10.4 | 11.7 | (11.1%) | |||||||||

| of which mobile data |

1.6 | 1.5 | 8.0% | |||||||||

| EBITDA |

3.9 | 5.5 | (29.9%) | |||||||||

| EBITDA margin |

36.1% | 46.0% | (9.9p.p.) | |||||||||

| Capex excl. licenses |

4.6 | 0.8 | 501.9% | |||||||||

| LTM capex excl. licenses/revenue |

26.6% | 20.9% | 5.7p.p. | |||||||||

| Mobile |

||||||||||||

| Customers (mln) |

32.2 | 30.5 | 5.6% | |||||||||

| - of which mobile data customers (mln) |

18.1 | 15.0 | 20.7% | |||||||||

| ARPU (BDT) |

109 | 128 | (14.8%) | |||||||||

| MOU (min) |

272 | 305 | (11.1%) | |||||||||

| Data usage (MB/user)

|

|

600

|

|

|

304

|

|

|

97.3%

|

| |||

In Bangladesh, Q1 2018 results continue to be affected by intense competition with a specific focus on customer acquisition, and also by costs related to the network expansion, after the recent acquisition of additional spectrum and 4G/LTE licence. During Q1 2018, Banglalink continued to focus on acquiring customers in a competitive market. The network availability, deteriorated by the severe weather conditions in 2017, has significantly improved in Q1 2018.

Revenue in Q1 2018 decreased by 10.6% year on year, while Banglalink’s service revenue decreased by 11.1% year on year to BDT 10.4 billion. The decline in service revenue was still mainly the result of the gap in 3G network coverage compared to the market leader. The market remains characterized by intense price competition especially in relation to data. The customer base grew by 5.6% year on year, despite continued competitive customer acquisition campaigns in the market, supported by improved distribution. ARPU decreased year on year by 14.8%, a trend similar to Q4 2017, as a result of pricing pressure. Data revenue increased by 8.0% year on year, driven by increased smartphone penetration and 97.3% year on year data usage growth, along with 20.7% growth in active data users.

Banglalink’s EBITDA in Q1 2018 decreased by 29.9% to BDT 3.9 billion, mainly as a result of revenue decline, increasing customer acquisition costs and network expansion related expenses (e.g. maintenance, leasing, utilities). The EBITDA margin was 36.1% in Q1 2018, which represents a year on year reduction of 9.9 percentage points.

In Q1 2018, capex excluding licenses significantly increased year on year to BDT 4.6 billion, with an LTM capex excluding licenses to revenue ratio of 26.6%. Banglalink continues to invest in efficient, high-speed data networks aiming to substantially improve its 3G network coverage (approximately 70% of the population at the end of Q1 2018) and availability. The 4G/LTE service has been launched in mid-February and at the end of Q1 2018 23 districts towns were covered, with a population coverage of approximately 12%.

|

|

Q1 2018 14 |

Table of Contents

UKRAINE

| UAH million | 1Q18 | 1Q17 | YoY | |||||||||

| Total revenue |

4,263 | 3,871 | 10.1% | |||||||||

| Mobile service revenue |

3,949 | 3,560 | 10.9% | |||||||||

| Fixed-line service revenue |

295 | 295 | 0.1% | |||||||||

| EBITDA |

2,412 | 2,073 | 16.4% | |||||||||

| EBITDA margin |

56.6% | 53.6% | 3.0p.p. | |||||||||

| Capex excl. licenses |

687 | 737 | (6.8%) | |||||||||

| LTM capex excl. licenses/revenue |

15.2% | 20.6% | (5.4p.p.) | |||||||||

| Mobile |

||||||||||||

| Total operating revenue |

3,968 | 3,576 | 11.0% | |||||||||

| - of which mobile data |

1,341 | 845 | 58.6% | |||||||||

| Customers (mln) |

26.5 | 26.0 | 1.9% | |||||||||

| - of which data customers (mln) |

12.9 | 11.3 | 13.7% | |||||||||

| ARPU (UAH) |

49 | 45 | 8.5% | |||||||||

| MOU (min) |

586 | 574 | 2.1% | |||||||||

| Data usage (MB/user) |

1,543 | 699 | 120.7% | |||||||||

| Fixed-line |

||||||||||||

| Total operating revenue |

295 | 295 | 0.1% | |||||||||

| Broadband revenue |

181 | 170 | 6.1% | |||||||||

| Broadband customers (mln) |

0.8 | 0.8 | 2.7% | |||||||||

| Broadband ARPU (UAH) |

72 | 69 | 4.3% | |||||||||

Kyivstar secured 4G/LTE license and spectrum in the 2,600 MHz and 1,800 MHz bandwidth in Q1 2018 and launched 4G/LTE from April 2018. Following this spectrum acquisition, Kyivstar is well positioned in both the 1800MHz and 2600MHz bands, which will enable the company to increase the geographical coverage of its high-speed data network in Ukraine, further strengthening its position as market leader in the country.

Kyivstar sustained strong performance in the first quarter, as total revenue increased by 10.1% year on year to UAH 4.3 billion. Mobile service revenue grew by 10.9% to UAH 3.9 billion and fixed line revenue was stable year on year. The growth in mobile service revenue was mainly driven by continued strong growth of mobile data revenue, which increased by 58.6% as a result of growing data usage and successful marketing activities, driven by the continued 3G network roll-out and data-centric tariffs. As a result, data consumption per user more than doubled in Q1 2018 compared to the same quarter in the previous year.

Kyivstar´s mobile customer base increased by 1.9% to 26.5 million, supported by lower churn, while mobile ARPU continued to increase by 8.5% year on year to UAH 49.

Fixed-line service revenue was stable year on year at UAH 295 million. Uptake for Kyivstar’s FMC proposition, launched in 2017 is strong. The fixed broadband customer base increased by 2.7% year on year to 840 thousand and fixed broadband ARPU increased by 4.3% year on year to UAH 72.

EBITDA increased by 16.4% to UAH 2.4 billion in Q1 2018, representing an EBITDA margin of 56.6%, driven by the revenue growth, partially offset by increased service costs and HR costs, while technology costs also increased as a result of the network expansion.

Q1 2018 capex excluding licenses was UAH 687 million with an LTM capex excluding licenses to revenue ratio of 15.2%, as Kyivstar continued to roll out its 3G network, reaching a population coverage of 74%, up from 65% in the same quarter last year.

|

|

Q1 2018 15 |

Table of Contents

UZBEKISTAN

| UZS bln | 1Q18 | 1Q17 | YoY | |||||||||

| Total revenue |

617 | 513 | 20.1% | |||||||||

| Mobile service revenue |

612 | 510 | 20.0% | |||||||||

| - of which mobile data |

186 | 134 | 38.9% | |||||||||

| Fixed-line service revenue |

4.2 | 3.4 | 24.1% | |||||||||

| EBITDA |

276 | 265 | 4.5% | |||||||||

| EBITDA margin |

44.8% | 51.6% | (6.7p.p.) | |||||||||

| Capex excl. licenses |

74 | 75 | (0.8%) | |||||||||

| LTM Capex excl. licenses/revenue |

12.4% | 26.0% | (13.6p.p.) | |||||||||

| Mobile |

||||||||||||

| Customers (mln) |

9.6 | 9.5 | 0.4% | |||||||||

| - of which mobile data customers (mln) |

5.2 | 4.6 | 11.2% | |||||||||

| ARPU (UZS) |

21,152 | 17,767 | 19.1% | |||||||||

| MOU (min) |

546 | 545 | 0.1% | |||||||||

| Data usage (MB/user)

|

754 | 350 | 115.3% | |||||||||

Unitel continued to report strong revenue growth, as the company´s tariffs were fixed at the foreign exchange rate of UZS 4,210 to the US dollar after the liberalization of the Uzbek som on 5 September 2017, which is a higher level compared to the prior year. Total revenue increased by 20.1% and mobile service revenue increased by 20.0% to UZS 612 billion, supported by successful marketing activities, increased revenues from interconnect services, value added services and mobile data. Mobile data traffic more than doubled and mobile data revenue increased by 38.9% year on year during the first quarter, driven by the continued high-speed data network roll-out, increased smartphone penetration and the launch of new bundled offerings. The overall customer base increased by 0.4% to 9.6 million during the first quarter.

EBITDA increased by 4.5% to UZS 276 billion and the EBITDA margin was 44.8% in Q1 2018. The revenue growth was partially offset by an increase in non-controllable costs, such as customer tax, content costs, frequency fees and the negative impact from the currency liberalization, while HR costs increased as well as a result of insourcing maintenance activities. Customer costs increased in total by UZS 52.1 billion as a result of a doubling in customer tax to UZS 4,000 per customer per month from 1 January 2018. Adjusting for this negative customer tax effect, EBITDA growth would have been 18.9% and EBITDA margin for Q1 2018 would have been 8.5 percentage points higher, at 53.2%.

Capex excluding licenses totalled UZS 74.4 billion and the Q1 2018 LTM capex excluding licenses to revenue ratio was 12.4%. The company continued to invest in its high-speed data networks, improving the 4G/LTE coverage to 23% and increasing the number of nationwide 3G sites by 32% year on year. Further improvements to the high-speed data networks will continue to be a priority for Unitel in 2018.

The Republican Radiofrequencies Council in Uzbekistan redistributed radio frequencies in Uzbekistan in April 2018. This resulted in a reallocation of Unitel’s radio frequencies to other cellular communications providers in the market. The Company prepared the network for this conversion and expects no material impact.

The cash and deposits balances as of the end of Q1 2018 in Uzbekistan are USD 166 million in Uzbek som. In the first quarter VEON’s subsidiary PJSC VimpelCom successfully repatriated a net amount of approximately USD 20 million from Uzbekistan and an additional USD 20 million in April 2018. The repatriation of cash was executed at the market rate and the Company aims to repatriate excess cash in the remainder of FY 2018.

|

|

Q1 2018 16 |

Table of Contents

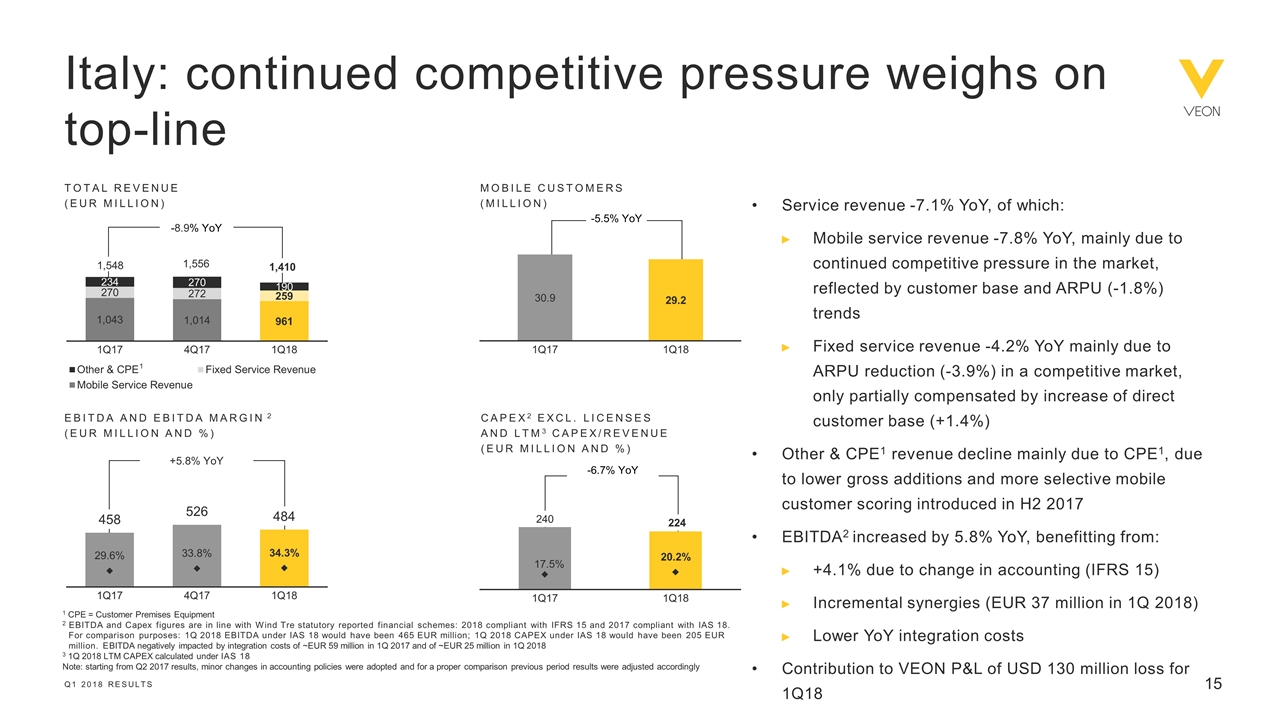

ITALY JOINT VENTURE

| EUR million | 1Q18 | 1Q17 | YoY | |||||||||

| Total revenue |

1,410 | 1,548 | (8.9%) | |||||||||

| Mobile service revenue |

961 | 1,043 | (7.8%) | |||||||||

| Fixed-line service revenue |

259 | 270 | (4.2%) | |||||||||

| EBITDA1 |

484 | 458 | 5.8% | |||||||||

| EBITDA margin1 |

34.3% | 29.6% | 4.7p.p. | |||||||||

| Capex excl. licenses1 |

224 | 240 | (6.7%) | |||||||||

| LTM capex excl. licenses/revenue2 |

20.2% | 17.5% | 2.8p.p. | |||||||||

| Mobile |

||||||||||||

| Total revenue |

1,115 | 1,253 | (11.0%) | |||||||||

| - of which mobile data |

357 | 352 | 1.1% | |||||||||

| Customers (mln) |

29.2 | 30.9 | (5.5%) | |||||||||

| - of which data customers (mln) |

19.3 | 19.5 | (1.4%) | |||||||||

| ARPU (EUR) |

10.8 | 11.0 | (1.8%) | |||||||||

| MOU (min) |

284 | 264 | 7.5% | |||||||||

| Fixed-line |

||||||||||||

| Total revenue |

294 | 295 | (0.1%) | |||||||||

| Total voice customers (mln) |

2.70 | 2.72 | (0.7%) | |||||||||

| ARPU (EUR) |

27.0 | 28.1 | (3.9%) | |||||||||

| Broadband customers (mln) |

2.39 | 2.35 | 1.7% | |||||||||

| Broadband ARPU (EUR) |

20.6 | 21.8 | (5.1%) | |||||||||

Notes: EBITDA negatively impacted by integration costs of approximately EUR 59 million in Q1 2017 and of approximately EUR 25 million in Q1 2018

Wind Tre has different accounting policies for presenting amortization of capitalized costs of obtaining contracts with customers in accordance IFRS 15. VEON’s policy is to present this expense within “Selling, general and administrative expenses” in profit or loss, whilst Wind Tre presents this expense within the “Amortization” line item in profit or loss.

1 EBITDA and Capex are in line with Wind Tre statutory reported financial schemes: 2018 compliant with IFRS 15 and 2017 compliant with IAS 18. For comparison purposes: Q1 2018 EBITDA under IAS 18 would have been EUR 465 million; Q1 2018 Capex under IAS 18 would have been EUR 205 million

2 LTM capex/revenue under IAS 18

Wind Tre’s total revenue in Q1 2018 decreased by 8.9% to EUR 1.4 billion, primarily driven by a 7.8% decline in mobile service revenue and lower CPE (“Customer Premises Equipment”) mainly related to mobile handsets. The mobile service revenue decline was primarily due to continuing aggressive competition in the market, which impacted both customer base (-5.5%) at 29.2 million and ARPU. The mobile handset revenue decline was primarily due to lower volume of gross additions and a more selective mobile customer scoring starting from H2 2017.

Mobile data revenue increased 1.1% year on year, driven by growth in both data ARPU (+0.9%) and data usage (+51% to approximately 4.4 GB per customer per month), more than offsetting the slight decline in data customer base (-1.4%). In Q1 2018, mobile ARPU slightly declined to EUR 10.8, a 1.8% year on year erosion, all attributable to the voice component.

Fixed-line service revenue declined by 4.2% year on year, due to ARPU dilution only partially offset by the increases in direct and broadband customers of 1.4% and 1.7% respectively, driven by the increased demand for fibre connections. In Q1 2018, the fixed-line direct customer base and the broadband customer base reached 2.5 million and 2.4 million respectively. The highly competitive market in 2017 has impacted Q1 2018, in particular fixed and broadband ARPU, which both slightly decreased year on year.

Q1 2018 EBITDA increased by 5.8% year on year to EUR 484 million; 4.1% of the year on year growth is explained by change in accounting (IFRS 15), while the remaining part of the growth is driven by the combination of incremental synergies (EUR 37 million in Q1) and lower integration costs in Q1 2018 vs Q1 2017, more than offsetting the top line decrease. EBITDA margin increased 4.7 percentage points to 34.3%.

Capex in the quarter was EUR 224 million and was primarily focused on modernizing and merging the former Wind and Tre networks as well as expanding capacity and coverage of 4G/LTE.

At the end of April 2018 approximately 6.5 thousand transmission sites were modernized and the cities of Trieste, Bologna, Agrigento, Milano and Alessandria were completed. The network modernization resulted in a sensible network performance improvement in these cities, leading to an overall improvement of the customer experience.

|

|

Q1 2018 17 |

Table of Contents

On 14 May 2018, VEON will also host a conference call by senior management at 9:30 CEST (8:30 BST) on the same day, which will be made available through following dial-in numbers. The call and slide presentation may be accessed at http://www.veon.com

9:30 CEST investor and analyst conference call

US call-in number: +1 (929) 477 0448

Confirmation Code: 2181209

International call-in number: 44 (0) 330 336 9105

Confirmation Code: 2181209

The conference call replay and the slide presentation webcast will be available until 21 May 2018.

The slide presentation will also be available for download on VEON’s website.

Investor and analyst call replay

US Replay Number: +1 719 457 0820

Confirmation Code: 2181209

UK Replay Number: 0800 101 1153

Confirmation Code: 2181209

| CONTACT INFORMATION

|

||

| INVESTOR RELATIONS Richard James |

MEDIA AND PUBLIC RELATIONS Maria Piskunenko |

|

|

Q1 2018 18 |

Table of Contents

DISCLAIMER

This press release contains “forward-looking statements”, as the phrase is defined in Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. These forward-looking statements may be identified by words such as “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “seek,” “believe,” “estimate,” “predict,” “potential,” “continue,” “contemplate,” “possible” and other similar words. Forward-looking statements include statements relating to, among other things, VEON’s plans to implement its strategic priorities, including with respect to its transformation plan, among others; anticipated performance and guidance for 2018, including VEON’s ability to generate sufficient cash flow; future market developments and trends; operational and network development and network investment, including expectations regarding the roll-out and benefits of 3G/4G/LTE networks, as applicable; the effect of the acquisition of additional spectrum on customer experience; and VEON’s ability to realize its targets and strategic initiatives in its various countries of operation. The forward-looking statements included in this press release are based on management’s best assessment of VEON’s strategic and financial position and of future market conditions, trends and other potential developments. These discussions involve risks and uncertainties. The actual outcome may differ materially from these statements as a result of demand for and market acceptance of VEON’s products and services; continued volatility in the economies in VEON’s markets; unforeseen developments from competition; governmental regulation of the telecommunications industries; general political uncertainties in VEON’s markets; government investigations or other regulatory actions; litigation or disputes with third parties or other negative developments regarding such parties; failure to realize the expected benefits of the Italy Joint Venture due to, among other things, the parties’ inability to successfully implement integration strategies or otherwise realize the anticipated synergies; risks associated with data protection or cyber security, other risks beyond the parties’ control or a failure to meet expectations regarding various strategic priorities, the effect of foreign currency fluctuations, increased competition in the markets in which VEON operates and the effect of consumer taxes on the purchasing activities of consumers of VEON´s services. Certain other factors that could cause actual results to differ materially from those discussed in any forward-looking statements include the risk factors described in VEON’s Annual Report on Form 20-F for the year ended December 31, 2017 filed with the U.S. Securities and Exchange Commission (the “SEC”) and other public filings made by VEON with the SEC. Other unknown or unpredictable factors also could harm our future results. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Under no circumstances should the inclusion of such forward-looking statements in this press release be regarded as a representation or warranty by us or any other person with respect to the achievement of results set out in such statements or that the underlying assumptions used will in fact be the case. Therefore, you are cautioned not to place undue reliance on these forward-looking statements. The forward-looking statements speak only as of the date hereof. We cannot assure you that any projected results or events will be achieved. Except to the extent required by law, we disclaim any obligation to update or revise any of these forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made, or to reflect the occurrence of unanticipated events. Non-IFRS measures are reconciled to comparable IFRS measures in VEON Ltd.’s earnings release published on its website on the date hereof. Furthermore, elements of this press release contain or may contain, “inside information” as defined under the Market Abuse Regulation (EU) No. 596/2014.

VEON Ltd. owns a 50% share of the Italy Joint Venture (with CK Hutchison owning the other 50%) and we account for this JV using the equity method as we do not have control. All information related to the Italy Joint Venture is the sole responsibility of the Italy Joint Venture’s management, and no information contained herein, including, but not limited to, the Italy Joint Venture’s financial and industry data, has been prepared by or on behalf of, or approved by, our management. As a result of this, we do not provide any reconciliations for non-IFRS measures for the Wind Tre Joint Venture. For further information on the Italy Joint Venture and its accounting treatment, see “Explanatory Note—Presentation of Financial Information of the Italy Joint Venture” included in our Annual Report on Form 20-F for the year ended 31 December 2017 and notes 5, 14 and 25 to our audited consolidated financial statements filed therewith.

|

|

Q1 2018 19 |

Table of Contents

All non-IFRS measures disclosed further in this press release (including, without limitation, EBITDA, EBITDA margin, EBT, net debt, equity free cash flow, organic growth, capital expenditures excluding licenses and LTM (last twelve months) capex excluding licenses/revenue) are reconciled to comparable IFRS measures in VEON Ltd.’s earnings release published on its website on the date hereof. In addition, we present certain information on a forward-looking basis (including, without limitation, the expected impact on revenue, EBITDA and equity free cash flow from the consolidation of the Euroset stores after completing the transaction ending the Euroset joint venture). We are not able to, without unreasonable efforts, provide a full reconciliation to IFRS due to potentially high variability, complexity and low visibility as to the items that would be excluded from the comparable IFRS measure in the relevant future period, including, but not limited to, depreciation and amortization, impairment loss, loss on disposal of non-current assets, financial income and expenses, foreign currency exchange losses and gains, income tax expense and performance transformation costs, cash and cash equivalents, long - term and short-term deposits, interest accrued related to financial liabilities, other unamortized adjustments to financial liabilities, derivatives, and other financial liabilities.

|

|

Q1 2018 20 |

Table of Contents

ABOUT VEON

VEON is a NASDAQ and Euronext Amsterdam-listed global provider of connectivity and internet services, with the ambition to lead the personal internet revolution for over 240 million customers it currently serves, and many others in the years to come.

Follow us:

on Twitter @veondigital

on Twitter @veondigital

visit our blog @ blog.veon.com

visit our blog @ blog.veon.com

go to our website @ http://www.veon.com

go to our website @ http://www.veon.com

| Attachment A |

Customers | 22 | ||||

| Attachment B |

Definitions | 22 | ||||

| Attachment C |

Reconciliation tables | 24 | ||||

| Average rates and target rates of functional currencies to USD | ||||||

For more information on financial and operating data for specific countries, please refer to the supplementary file Factbook1Q2018.xls on VEON’s website at http://veon.com/Investor-relations/Reports--results/Results/.

|

|

Q1 2018 21 |

Table of Contents

| Mobile | Fixed-line broadband | |||||||||||||||||||||||||||

| million | 1Q18 | 1Q17 | YoY | 1Q18 | 1Q17 | YoY | ||||||||||||||||||||||

| Russia |

56.3 | 57.0 | (1.2%) | 2.3 | 2.2 | 3.3% | ||||||||||||||||||||||

| Pakistan |

55.1 | 52.5 | 5.0% | |||||||||||||||||||||||||

| Algeria |

15.3 | 16.1 | (4.5%) | |||||||||||||||||||||||||

| Bangladesh |

32.2 | 30.5 | 5.6% | |||||||||||||||||||||||||

| Ukraine |

26.5 | 26.0 | 1.9% | 0.8 | 0.8 | 0.9% | ||||||||||||||||||||||

| Uzbekistan |

9.6 | 9.5 | 0.4% | |||||||||||||||||||||||||

| Other |

15.5 | 15.2 | 1.8% | 0.5 | 0.4 | 8.4% | ||||||||||||||||||||||

| Total consolidated |

210.5 | 206.8 | 1.8% | 3.6 | 3.4 | 5.9% | ||||||||||||||||||||||

| Italy |

29.2 | 30.9 | (5.5%) | 2.4 | 2.4 | 1.7% | ||||||||||||||||||||||

| Total |

239.7 | 237.7 | 0.8% | 6.0 | 5.8 | 3.4% | ||||||||||||||||||||||

ATTACHMENT B: DEFINITIONS

ARPU (Average Revenue per User) measures the monthly average revenue per mobile user. We generally calculate mobile ARPU by dividing our mobile service revenue during the relevant period, including data revenue, roaming revenue, MFS and interconnect revenue, but excluding revenue from connection fees, sales of handsets and accessories and other non-service revenue, by the average number of our mobile customers during the period and dividing by the number of months in that period. Wind Tre defines mobile ARPU as the measure of the sum of the mobile revenue in the period divided by the average number of mobile customers in the period (the average of each month’s average number of mobile customers (calculated as the average of the total number of mobile customers at the beginning of the month and the total number of mobile customers at the end of the month) divided by the number of months in that period.

Mobile data customers are mobile customers who have engaged in revenue generating activity during the three months prior to the measurement date as a result of activities including USB modem Internet access using 2.5G/3G/4G/HSPA+ technologies. Wind Tre measures mobile data customers based on the number of active contracts signed and includes customers who have performed at least one mobile Internet event during the previous month. For Algeria, mobile data customers are 3G customers who have performed at least one mobile data event on the 3G network during the previous four months.

Capital expenditures (capex) are purchases of new equipment, new construction, upgrades, licenses, software, other long-lived assets and related reasonable costs incurred prior to intended use of the non-current asset, accounted at the earliest event of advance payment or delivery. Long-lived assets acquired in business combinations are not included in capital expenditures.

Capital expenditures (capex) excluding licenses is calculated as capex, excluding purchases of new spectrum licenses.

EBIT or Operating Profit is calculated as EBITDA plus depreciation, amortization and impairment loss. Our management uses EBIT as a supplemental performance measure and believes that it provides useful information of earnings of the Company before making accruals for financial income and expenses and net foreign exchange (loss)/gain and others. Reconciliation of EBIT to net income attributable to VEON Ltd., the most directly comparable IFRS financial measure, is presented in the reconciliation tables section in Attachment C below.

Adjusted EBITDA (called EBITDA in this document) is a non-IFRS financial measure. VEON calculates Adjusted EBITDA as (loss)/profit before tax before depreciation, amortization, loss from disposal of non-current assets and impairment loss and includes certain non-operating losses and gains mainly represented by litigation provisions for all of its segments except for Russia. Our Adjusted EBITDA may be used to evaluate our performance against other telecommunications companies that provide EBITDA.

Additionally, a limitation of EBITDA’s use as a performance measure is that it does not reflect the periodic costs of certain capitalized tangible and intangible assets used in generating revenue or the need to replace capital equipment over time. Reconciliation of EBITDA to net income attributable to VEON Ltd., the most directly comparable IFRS financial measure, is presented in the reconciliation tables section in Attachment C below.

EBITDA margin is calculated as EBITDA divided by total revenue, expressed as a percentage.

Gross Debt is calculated as the sum of long term notional debt and short-term notional debt.

|

|

Q1 2018 22 |

Table of Contents

Equity free cash flow is a non-IFRS measure and is defined as free cash flow from operating activities less cash flow used in investing activities, excluding M&A transactions, capex for licenses, inflow/outflow of deposits, financial assets and other one-off items. Reconciliation to the most directly comparable IFRS financial measure, is presented in the reconciliation tables section in Attachment C below.

An FMC customer is a customer on a 1 month Active Broadband Connection subscribing to a converged bundle consisting of at least fixed internet subscription and at least 1 mobile SIM

Households passed are households located within buildings, in which indoor installation of all the FTTB equipment necessary to install terminal residential equipment has been completed.

MFS (Mobile financial services) is a variety of innovative services, such as mobile commerce or m-commerce, that use a mobile phone as the primary payment user interface and allow mobile customers to conduct money transfers to pay for items such as goods at an online store, utility payments, fines and state fees, loan repayments, domestic and international remittances, mobile insurance and tickets for air and rail travel, all via their mobile phone.

Mobile customers are generally customers in the registered customer base as at a given measurement date who engaged in a revenue generating activity at any time during the three months prior to such measurement date. Such activity includes any outgoing calls, customer fee accruals, debits related to service, outgoing SMS and MMS, data transmission and receipt sessions, but does not include incoming calls, SMS and MMS or abandoned calls. Our total number of mobile customers also includes customers using mobile internet service via USB modems and fixed-mobile convergence (“FMC”)

Net debt is a non-IFRS financial measure and is calculated as the sum of interest bearing long-term notional debt and short-term notional debt minus cash and cash equivalents, long-term and short-term deposits. The Company believes that net debt provides useful information to investors because it shows the amount of notional debt outstanding to be paid after using available cash and cash equivalents and long-term and short-term deposits. Net debt should not be considered in isolation as an alternative to long-term debt and short-term debt, or any other measure of the Company financial position.

Net foreign exchange (loss)/gain and others represents the sum of Net foreign exchange (loss)/gain, VEON’s share in net (loss)/gain of associates and Other (expense)/income (primarily (losses)/gains from derivative instruments) and is adjusted for certain non-operating losses and gains mainly represented by litigation provisions.

NPS (Net Promoter Score) is the methodology VEON uses to measure customer satisfaction.

Organic growth in revenue and EBITDA are non-IFRS financial measures that reflect changes in Revenue and EBITDA, excluding foreign currency movements and other factors, such as businesses under liquidation, disposals, mergers and acquisitions.

Reportable segments: the Company identified Russia, Pakistan, Algeria, Bangladesh, Ukraine, Uzbekistan and HQ based on the business activities in different geographical areas

Total revenue in this section is fully comparable with Total Operating revenue in MD&A section below.

|

|

Q1 2018 23 |

Table of Contents

ATTACHMENT C: RECONCILIATION TABLES

RECONCILIATION OF CONSOLIDATED EBITDA

| USD mln | 1Q18 | 1Q17 | ||||||||

| Unaudited |

||||||||||

| EBITDA |

854 | 861 | ||||||||

| Depreciation |

(346 | ) | (390 | ) | ||||||

| Amortization |

(126 | ) | (122 | ) | ||||||

| Impairment loss |

(3 | ) | 3 | |||||||

| Loss on disposals of non-current assets |

(17 | ) | (7 | ) | ||||||

| Operating profit |

362 | 345 | ||||||||

| Financial Income and Expenses |

(198 | ) | (193 | ) | ||||||

| - including finance income |

19 | 22 | ||||||||

| - including finance costs |

(217 | ) | (215 | ) | ||||||

| Net foreign exchange (loss)/gain and others |

(127 | ) | (21 | ) | ||||||

| - including Other non-operating (losses)/gains |

(9 | ) | (36 | ) | ||||||

| - including Shares of loss of associates and joint ventures |

(130 | ) | (101 | ) | ||||||

| - including Net foreign exchange gain |

12 | 115 | ||||||||

| Profit before tax |

37 | 130 | ||||||||

| Income tax expense |

(119 | ) | (141 | ) | ||||||

| (Loss)/Profit for the period |

(82 | ) | (11 | ) | ||||||

| Less profit attributable to non-controlling interest |

(27 | ) | 6 | |||||||

| (Loss) for the year attributable to the owners of the parent |

(109 | ) | (4 | ) | ||||||

| RECONCILIATION OF CAPEX | ||||||||||

| USD mln unaudited | 1Q18 | 1Q17 | ||||||||

| Cash paid for purchase of property, plant and equipment and intangible assets |

676 | 487 | ||||||||

| Net difference between timing of recognition and payments for purchase of property, plant and equipment and intangible assets |

99 | (218 | ) | |||||||

| Capital expenditures |

774 | 268 | ||||||||

| Less capital expenditures in licenses and other |

(419 | ) | (5 | ) | ||||||

| Capital expenditures excl. licenses |

355 | 264 | ||||||||

RECONCILIATION OF ORGANIC AND REPORTED GROWTH RATES

| 1Q18 vs 1Q17 | ||||||||||||||||||||||||||||||

| Total Revenue | EBITDA | |||||||||||||||||||||||||||||

| Organic | Forex & other1 | Reported | Organic | Forex & other1 | Reported | |||||||||||||||||||||||||

| Russia |

3.0% | 3.4% | 6.4% | 7.4% | 0.9% | 8.3% | ||||||||||||||||||||||||

| Pakistan |

5.7% | (6.2%) | (0.5%) | 20.1% | (7.1%) | 13.0% | ||||||||||||||||||||||||

| Algeria |

(9.3%) | (3.3%) | (12.6%) | (17.3%) | (3.0%) | (20.3%) | ||||||||||||||||||||||||

| Bangladesh |

(10.6%) | (3.8%) | (14.5%) | (29.9%) | (3.0%) | (32.9%) | ||||||||||||||||||||||||

| Ukraine |

10.1% | (0.9%) | 9.2% | 16.4% | (0.8%) | 15.6% | ||||||||||||||||||||||||

| Uzbekistan |

20.1% | (70.8%) | (50.6%) | 4.5% | (61.5%) | (57.0%) | ||||||||||||||||||||||||

| Total |

3.2% | (4.6%) | (1.4%) | 6.3% | (7.1%) | (0.8%) | ||||||||||||||||||||||||